Devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the December and January reports.

Contents

- Ampere Analysis: Epic Games became the leader in MAU on consoles in December

- PlayStation sales in Japan in 2023 are the best in 14 years

- Dragon Quest Monsters: The Dark Prince became the leader of Japanese charts in December 2023

- Sensor Tower: State of the South Korean Mobile Gaming Market in the H2 2023

- StreamElements & Rainmaker.gg - State of the Game Streaming Market in December 2023

- data.ai: Genshin Impact became the fastest game in history to earn $5B on mobile devices

- TIGA: British game studios express cautious optimism about the 2024

- AppMagic: Top Mobile Games by Revenue & Downloads in January 2024

- AppsFlyer: Benchmark on Game uninstalls on Android in October-November 2023

- Game sales Round-up (17.01.2024 - 06.02.2024)

- Lurkit: Top 500 games in streaming in 2023

- Griffin Gaming Partners & Rendered.VC - Game Development Trends in 2023

- Drake Star Partners: Gaming Investments in 2023

- GSD & GfK: Game Sales dropped in January 2024 in the UK

- GameDiscoverCo: Where Steam and PlayStation audiences are in 2024

- Sensor Tower: IP in Games Landscape Report

- GSD & GfK: PC/console game sales in Europe in January 2024 decreased by 7%

- Famitsu: Like a Dragon: Infinite Wealth became the best-selling game of the month in Japan in January

- Helldivers 2 is the most successful release of PlayStation Studios on PC in terms of CCU, but Destiny 2 numbers are still higher

- InvestGame: Gaming Investments in 2023

- Game sales Round-up (07.02.2024 - 20.02.2024)

- Apptica: The State of the Mobile Gaming Market and Advertising in 2023

- Steam: 2023 Results

- Epic Games Store: Results of 2023

- Newzoo: Palworld in January 2024

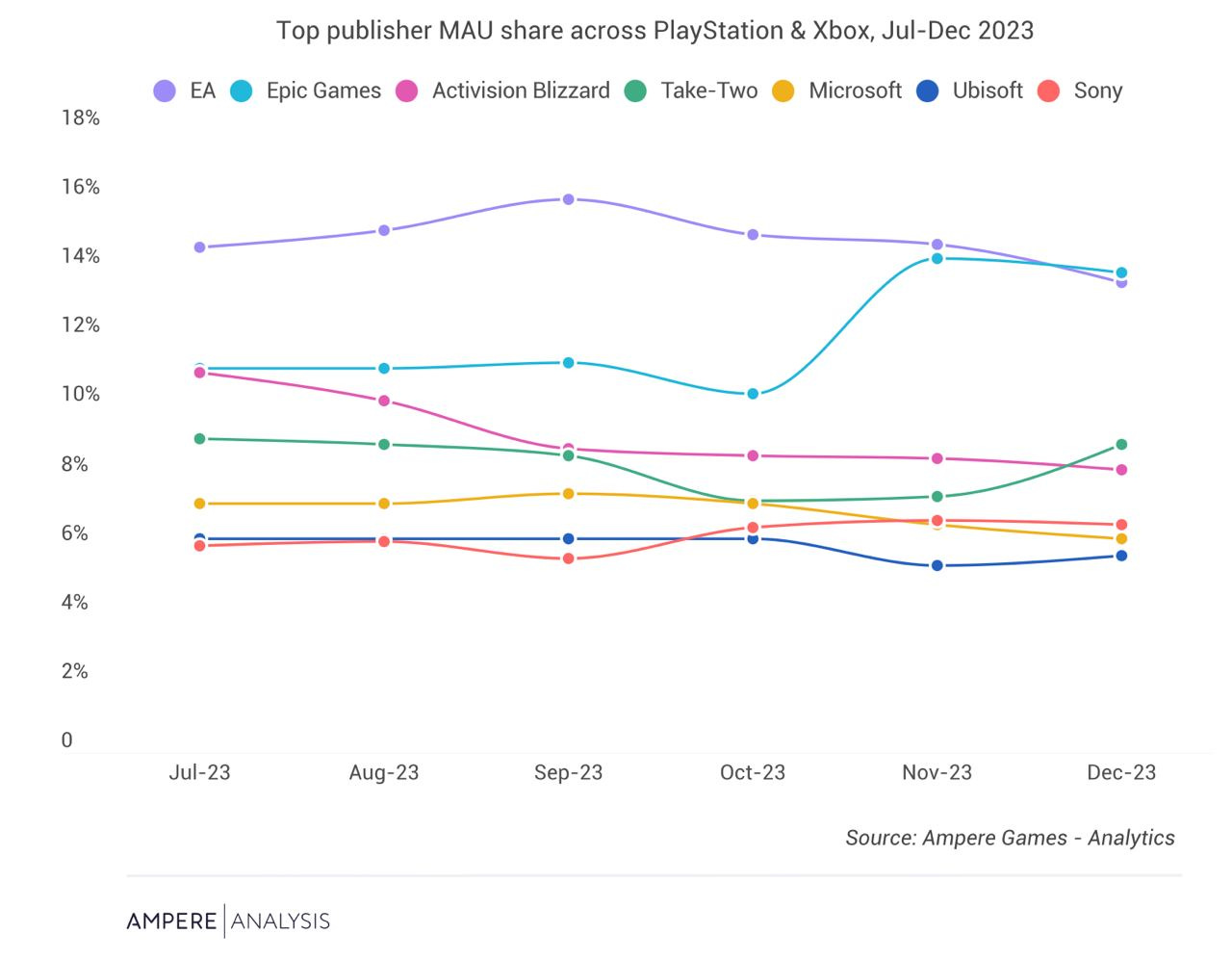

Ampere Analysis: Epic Games became the leader in MAU on consoles in December

-

13.9% of the entire monthly audience of PlayStation and Xbox played Fortnite in December. This is more than all EA games (13.6% of the audience), Take-Two (8.9%), or Activision Blizzard (8.2%).

-

In November 2023, the total number of hours spent by players in Fortnite increased by 146%. And in December, the figure rose by an additional 9% - to more than 1.6 billion hours.

-

Judging by MAU, Microsoft with Activision Blizzard is the largest publisher on consoles in the world. In December, 14.4% of console players played their games.

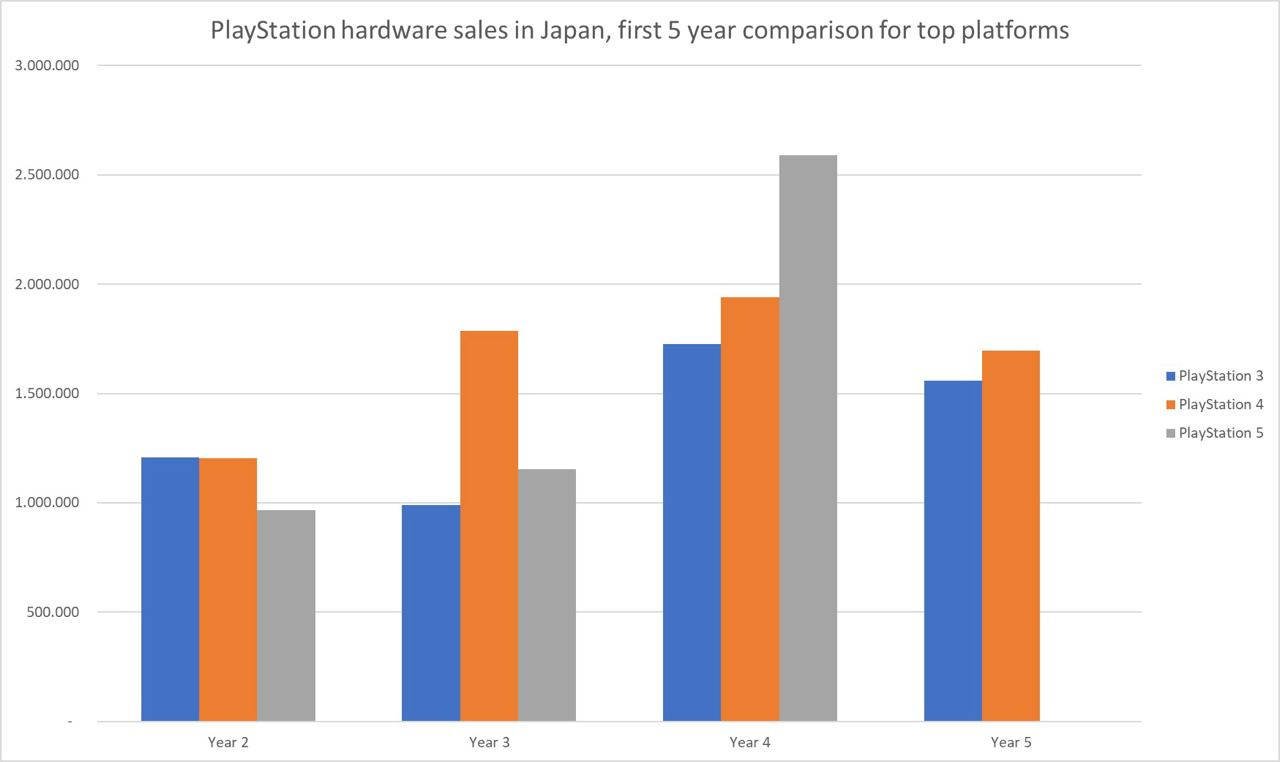

PlayStation sales in Japan in 2023 are the best in 14 years

- In 2023, 2.58 million PlayStation 5 units were sold. The last time there were more sales was in 2010 when the PlayStation Portable sold 2.88 million copies.

-

2023 ranks as the 12th most successful year for PlayStation systems (out of 25). Sony's major success occurred in 1997 when the first PlayStation was sold 4.45 million times.

- In its fourth year on the market, PS5 managed to surpass PlayStation 4 in Japan in annual sales. However, the cumulative sales of PS4 are still higher (5.8 M over 4 years compared to 4.95M for PS5).

-

On the other hand, all these achievements pale in comparison to Nintendo. In 2023, Nintendo Switch was the best-selling console in Japan, and all of the top 10 best-selling games in the country were for this console. In the last 19 years, only once has a Nintendo console not been at the top of the chart (precisely in 2010).

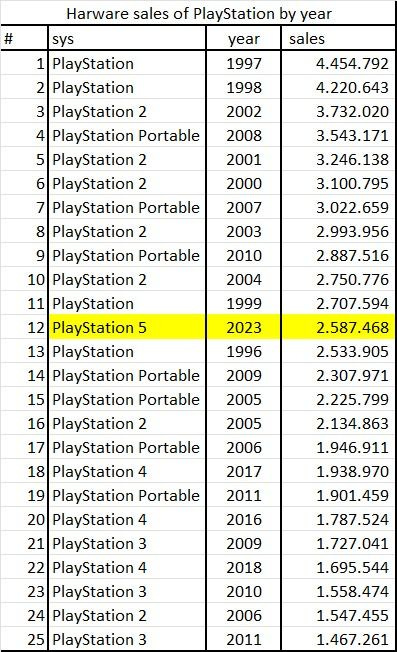

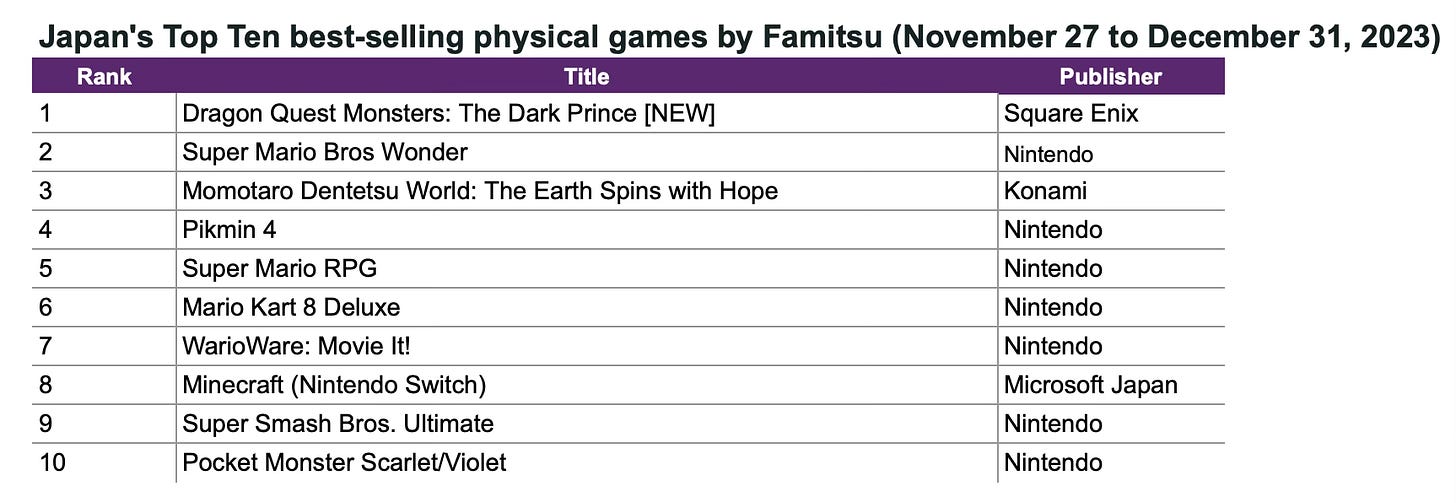

Dragon Quest Monsters: The Dark Prince became the leader of Japanese charts in December 2023

Famitsu only takes into account the sales of physical copies of games.

Game Sales

-

In the first month after its launch, Dragon Quest Monsters: The Dark Prince sold 510.5 thousand copies in Japan.

-

In second place is Super Mario Bros. Wonder (460.7 thousand copies); in third place is Momotaro Dentetsu World (382.7 thousand copies).

- Baldur’s Gate III entered the sales charts in Japan for the first time in December. The game secured the 24th position with 25.9 thousand copies sold.

-

Nintendo holds 39.9% of all physical game sales in the country. Following are Square Enix (16.1%) and Konami (12%).

Hardware Sales

-

Nintendo Switch is the best-selling console of the month (435 thousand systems).

-

PlayStation 5 sold 177.7 thousand consoles; Xbox Series S|X sold 7.3 thousand units.

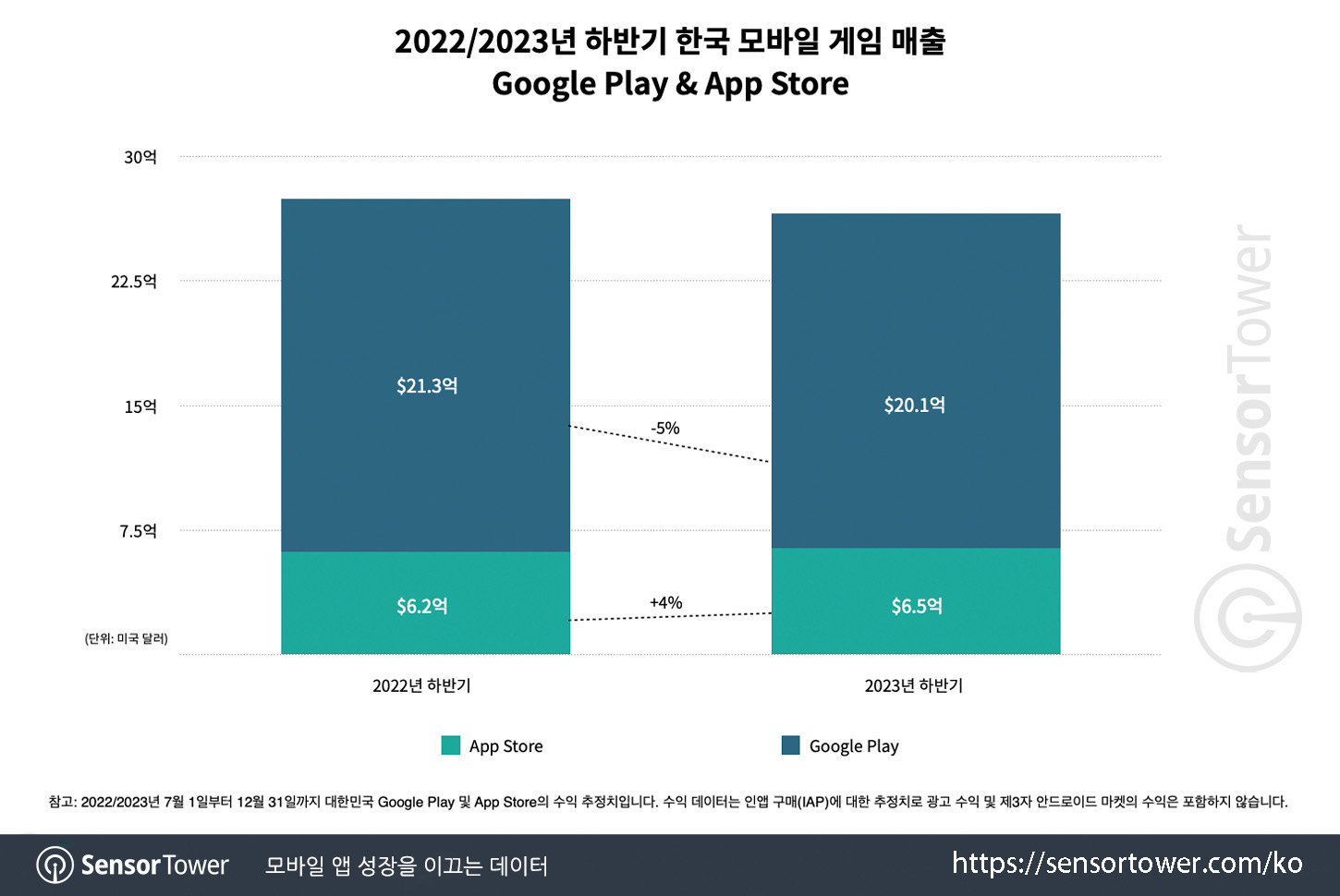

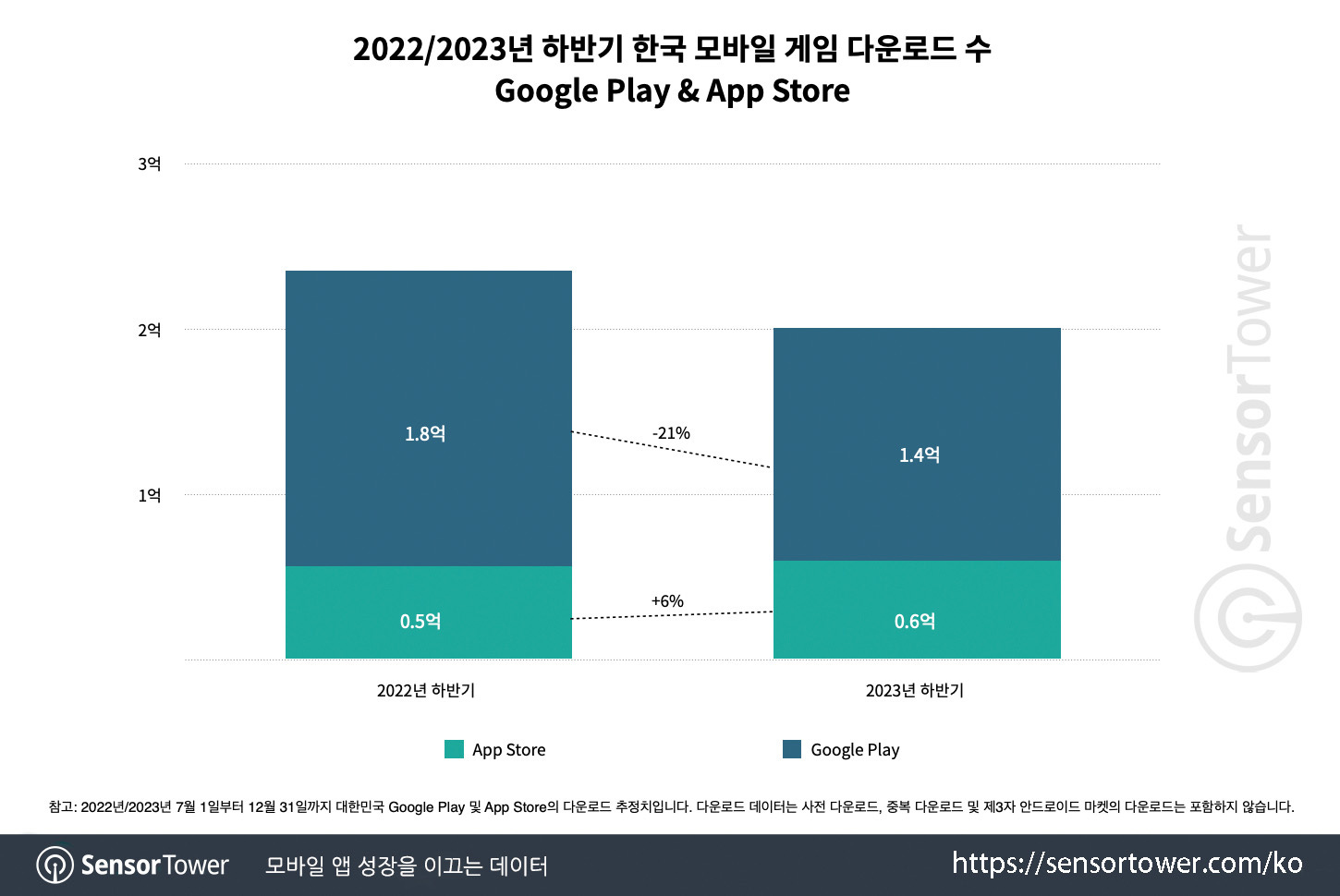

Sensor Tower: State of the South Korean Mobile Gaming Market in the H2 2023

Overall numbers

-

According to Sensor Tower, mobile revenue in South Korea in the second half of 2023 amounted to $2.66 billion - 3% less than the same period the previous year ($2.75 billion).

-

However, the trend is positive. The difference between the first halves of 2022 and 2023 is 16% (the market was higher in 2022).

-

In the second half of 2023, revenue from mobile games on the App Store grew by 4%. The decline is attributed to a 5% decrease on Google Play.

- The number of downloads in the second half of 2023 dropped by 15% compared to 2022 - from 235 million to 200 million.

-

Once again, the App Store showed a growth of 6%; Google Play plummeted by 21%.

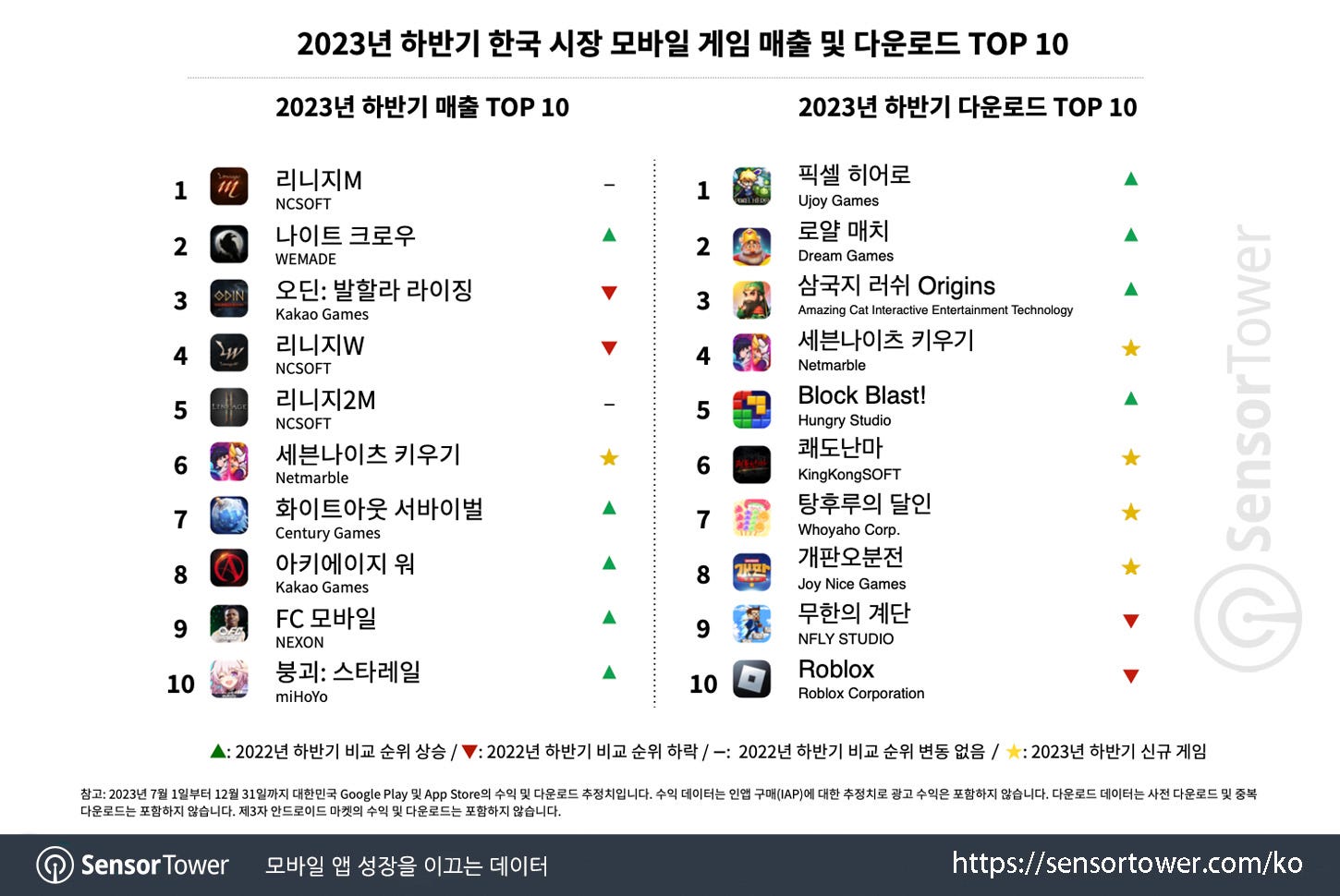

Top Games by Revenue and Downloads

- Three games from the Lineage series are at the top by revenue. Lineage M is in the first position; Lineage W is in the fourth position; Lineage 2M is in the fifth position.

-

Night Crows, released in April 2023, took the second position by revenue.

-

MMORPGs continue to dominate the Korean charts, but Raising Seven Knights; Whiteout Survival, and EA Sports FC Mobile add diversity.

Top Mobile Games by Growth Dynamics

- Raising Seven Knights - Netmarble's Idle RPG - leads in South Korea in terms of revenue and download growth dynamics.

Idle RPGs are getting hot not only in South Korea. Amount of new titles in this genre is big, and many of them are getting to the top.

-

Tower of God: A New World, also a game from Netmarble, performs well. The project is in the fifth position in terms of sales growth dynamics.

-

Royal Match - in the 7th position in South Korea. The game earned $36 million in the country in the second half of 2023.

Publisher Rankings

- NCSoft - the highest-earning publisher in South Korea, thanks to the Lineage series.

-

WEMADE jumped from the 15th position to the 5th position, thanks to the success of Night Crows.

-

In the top 10 in South Korea, there are a total of 4 foreign publishers. These are miHoYo, Century Games (a newcomer), Tencent, and 37GAMES.

Devtodev is committed to supporting the growth of gaming companies by providing free access to all functions of the analytics platform for projects with MAU up to 10K. Explore the free demo or schedule a tour with our manager.

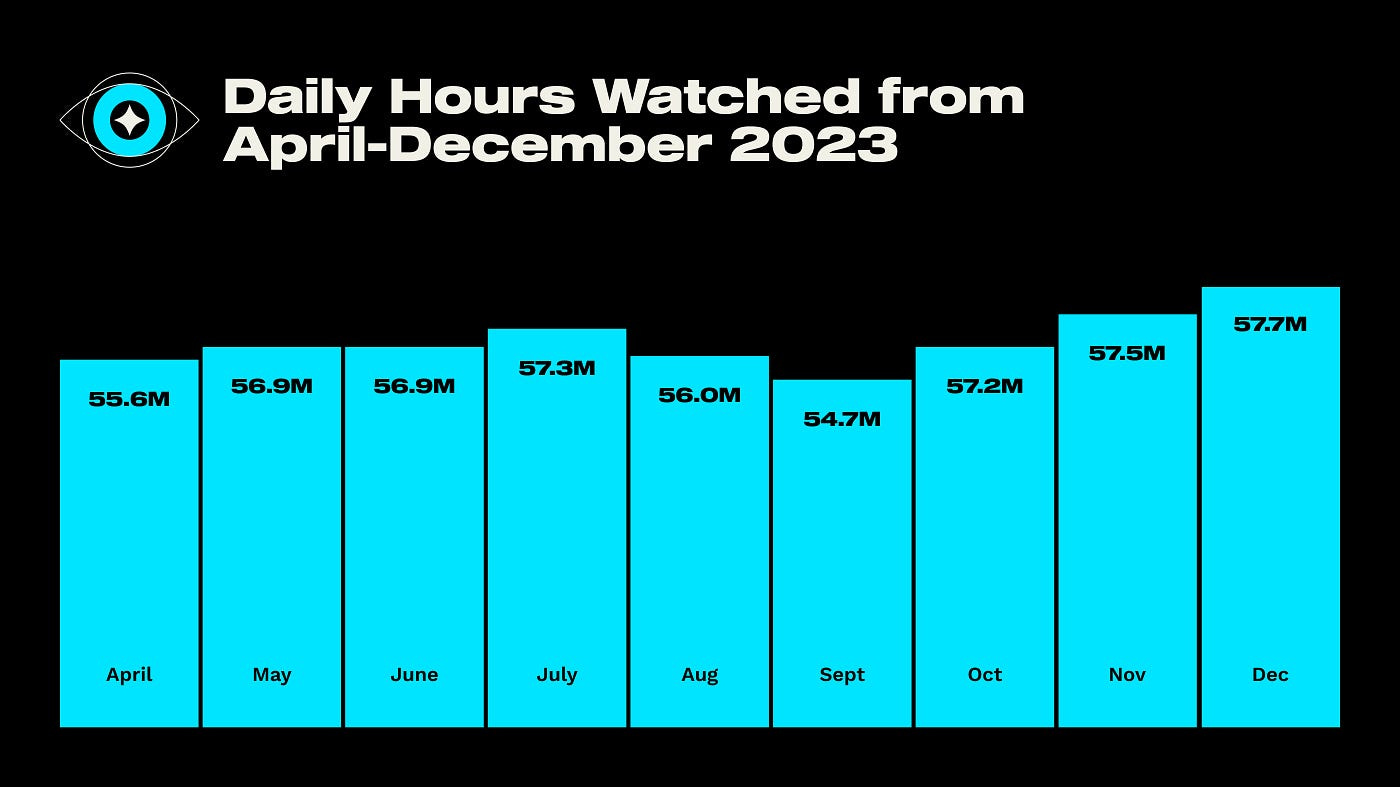

StreamElements & Rainmaker.gg - State of the Game Streaming Market in December 2023

-

Twitch had a mostly stable year in 2023, with a 3% increase in the number of hours watched in Q4.

-

The average daily hours on Twitch in December reached 57.7 million hours, marking the highest figure since April 2023.

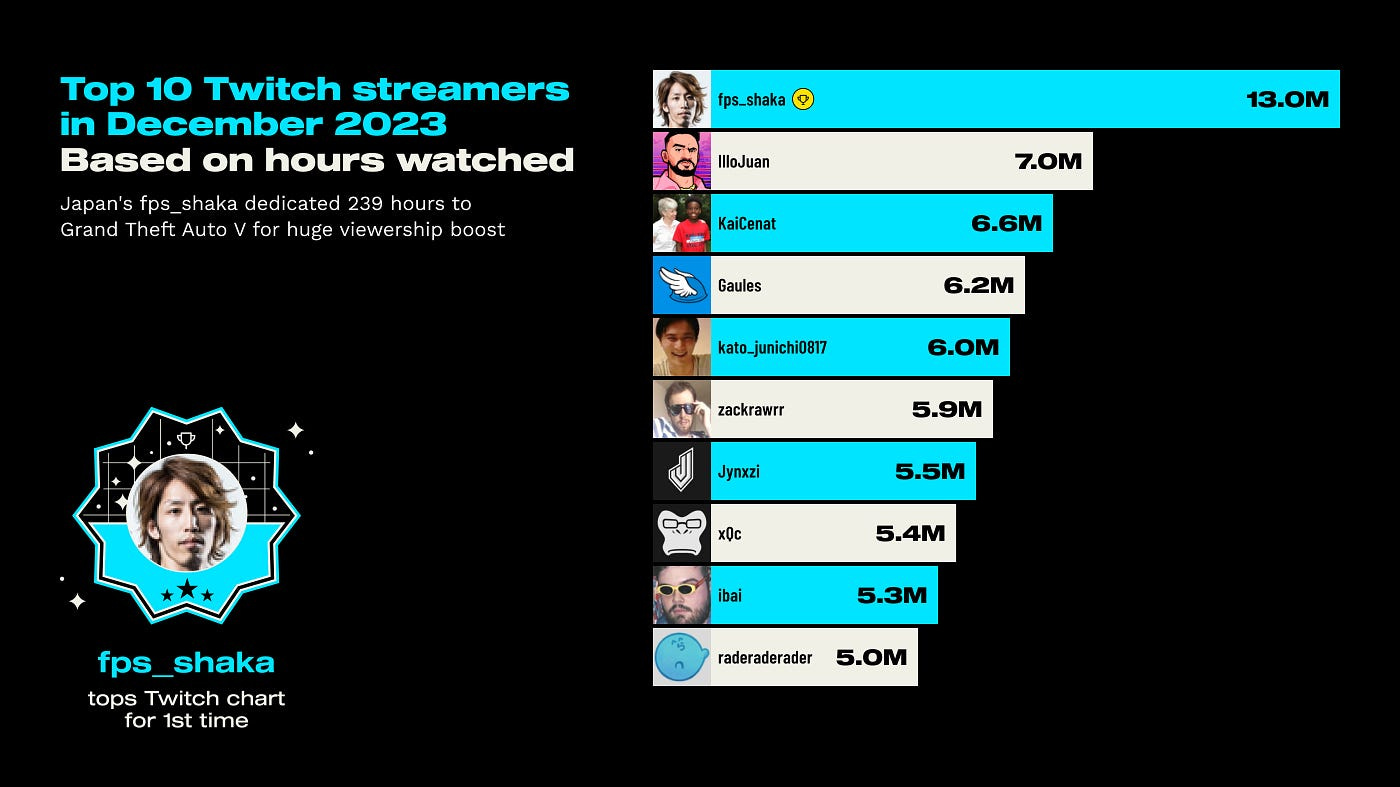

💬 Co-founder of StreamElements, Or Perry, notes: "One notable takeaway is that streaming cutbacks from top talent who now share time on other platforms did not significantly impact viewership. This has also opened the door for other stars to take the throne, such as Japan’s fps_shaka landing top streamer for the first time. One avenue for Twitch to accelerate its growth is to encourage its creators to multi-stream, given the existing broader gaming audience".

-

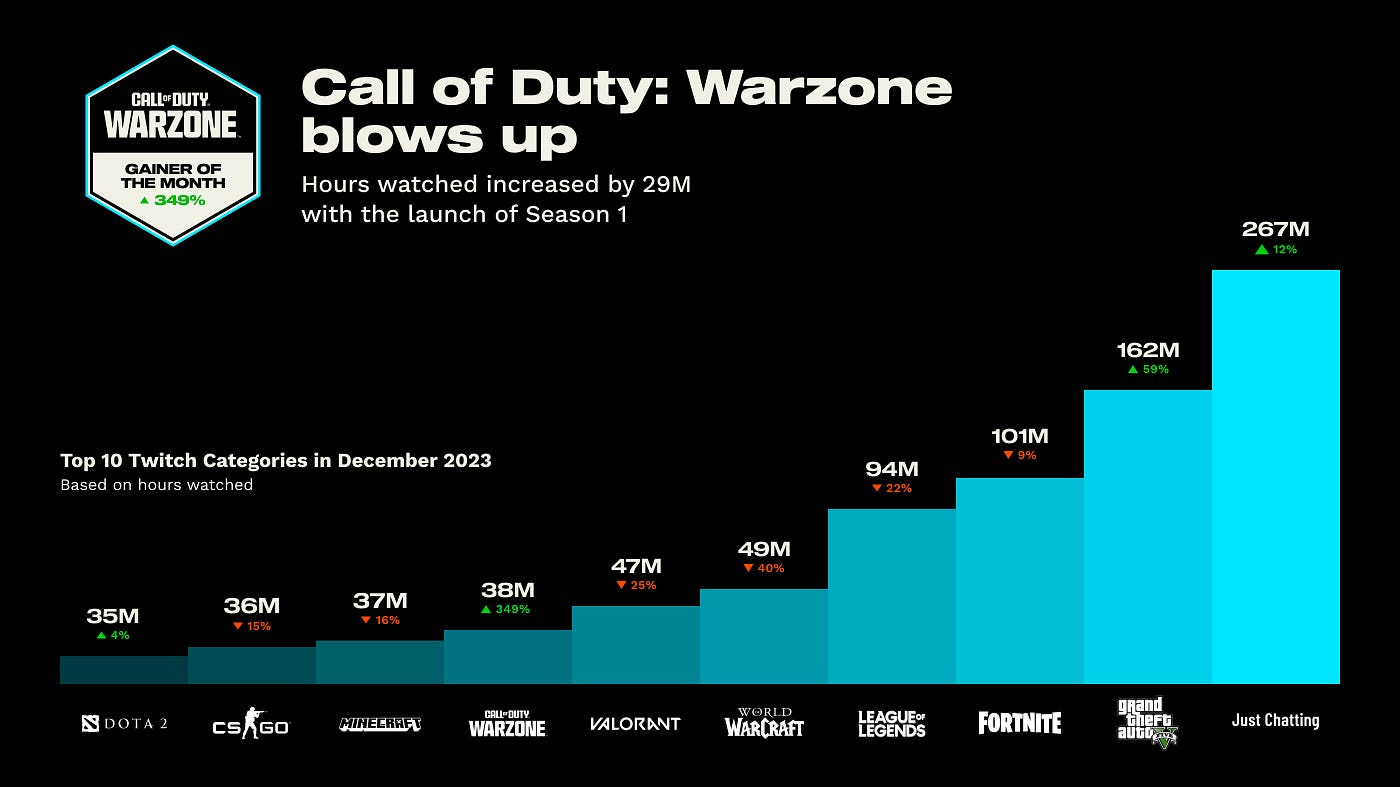

Grand Theft Auto V (162 million hours, +59% MoM), Fortnite (101 million hours, -9% MoM), and League of Legends (94 million hours, -22% MoM) were the leaders on Twitch in December 2023.

-

Call of Duty: Warzone experienced significant growth - a 349% increase, thanks to the release of Season 1. The game garnered 38 million hours of views in December.

-

fps_shaka - the top streamer in December on Twitch. The Japanese-speaking streamer has never claimed the top spot before. He streamed Grand Theft Auto V the most, totaling 239 hours.

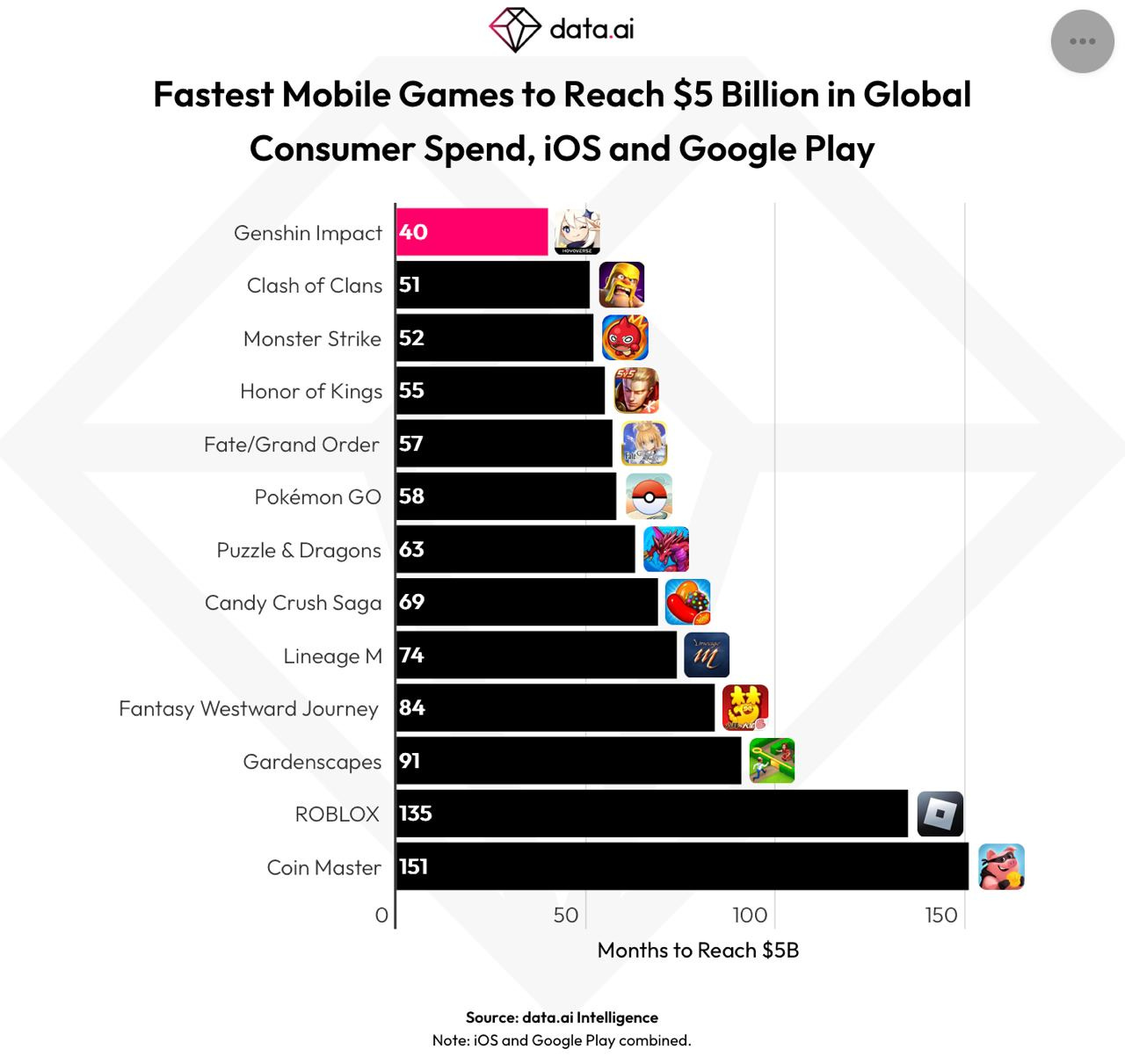

data.ai: Genshin Impact became the fastest game in history to earn $5B on mobile devices

-

It took the game 40 months to achieve this milestone since its release in September 2020. The previous record was held by Clash of Clans (51 months).

-

It's important to note that the calculation does not include Chinese Android stores, so the actual figure is even higher. Genshin Impact earned nearly $1.5 billion on iOS alone in China, accounting for 30% of its revenue.

-

In Japan, Genshin Impact earned $1.06 billion (21% of total revenue); in the United States, it earned $903 million (18%).

-

Currently, there are only 13 games worldwide that have crossed the $5 billion revenue mark. Before Genshin Impact, Gardenscapes achieved this milestone, taking the game 91 months.

TIGA: British game studios express cautious optimism about the 2024

Hiring situation

-

73% of surveyed businesses plan to increase their workforce in 2024 (compared to 75% in 2023).

-

21% plan to maintain the same staffing levels.

-

6% of respondents plan layoffs.

-

33% of surveyed businesses state that a shortage of qualified employees is the main hindrance to company growth in 2024.

Business Investments

These are investments related to R&D, employee training, and the development of new projects.

-

44% of businesses are more optimistic about these costs than in 2023.

-

36% do not anticipate significant changes by 2023.

-

19% of respondents believe that the situation with internal investments will worsen.

Results

-

70% responded that their companies feel "good" or "very good," compared to 75% the previous year.

-

27% of businesses feel the same as the previous year.

-

3% reported that the situation is either bad or very bad.

Expectations

-

However, 46% of respondents note that they are optimistic about the coming year (compared to 40% the previous year).

-

54% expect an increase in net profit in the next 12 months.

-

But optimism about market conditions has fallen from 66% in 2023 to 46%.

Costs and Prices

-

77% of businesses expect an increase in spending on personnel and equipment this year, compared to 86% in the previous year.

-

35% of businesses plan to shift some of these expenses to customers; 56% do not plan to change pricing policies.

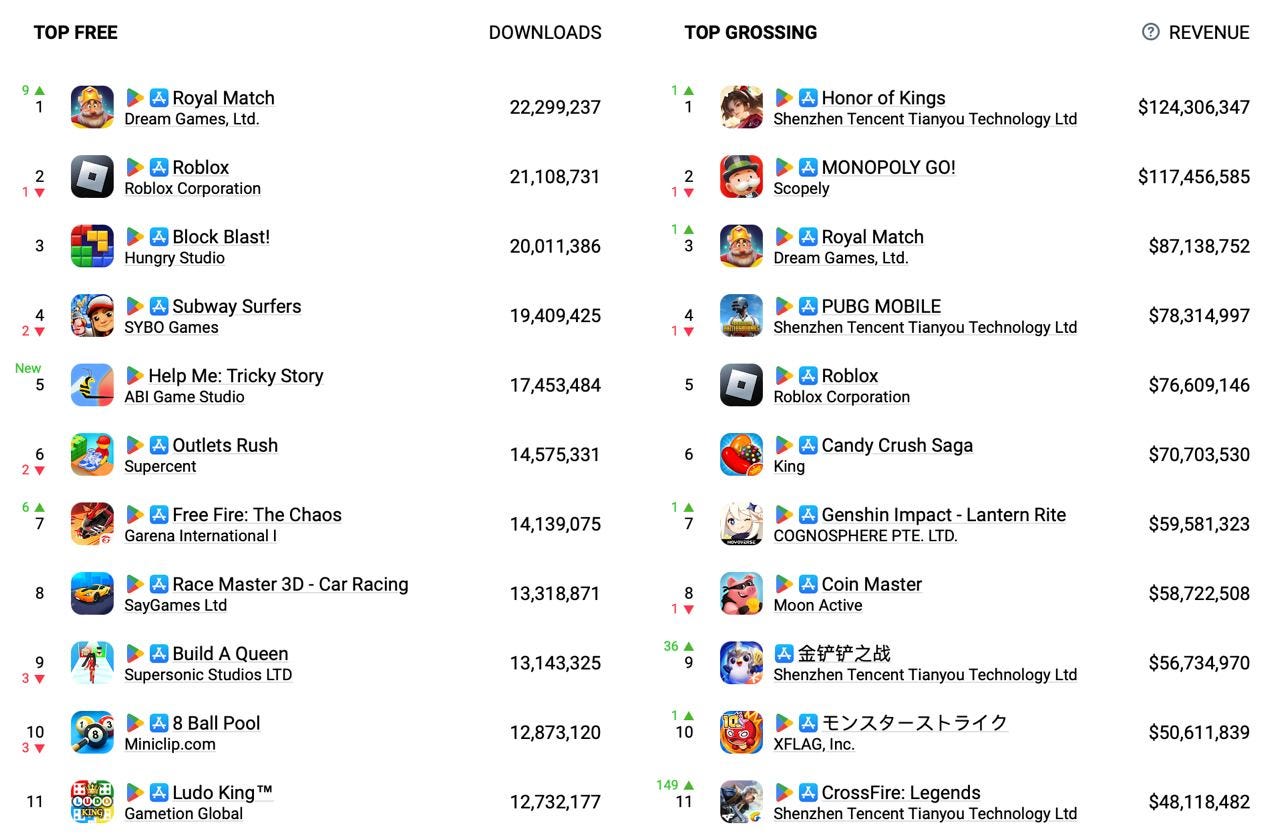

AppMagic: Top Mobile Games by Revenue & Downloads in January 2024

AppMagic provides data on revenue net of store fees and taxes.

Revenue

-

Honor of Kings returned to the top of the chart and earned $120.2 million. MONOPOLY GO! took the second spot with $113.8 million. The game experienced a slight decline after reaching peak values in January.

-

Teamfight Tactics (specifically the Chinese version - Battle of the Golden Spatula) showed explosive growth in January. The project earned $55 million in China on iOS alone, up from $17.9 million in December 2023.

-

CrossFire: Legends claimed the 11th spot on the charts with $46.8M in revenue, 98% of which came from Chinese iOS. The dynamics are interesting - the game had $5.5 million in revenue in December 2023, marking an 8.5-fold increase.

Downloads

-

Royal Match became the most downloaded game of the month with 21.6 million installations. The game jumped nine positions in January.

-

Roblox (20.6 million), Block Blast! (19.5 million), Subway Surfers (18.9 million) secured the second to fourth positions.

-

Help Me: Tricky Story - a new game in the charts with 17.1 million downloads (5th place). This is a Brain puzzle from the Vietnamese studio ABI Game Studio. The company's previous hits include an app with prank sounds (farting, haircut machine, etc.), a weapon sound simulator, and a social title based on the Squid Games.

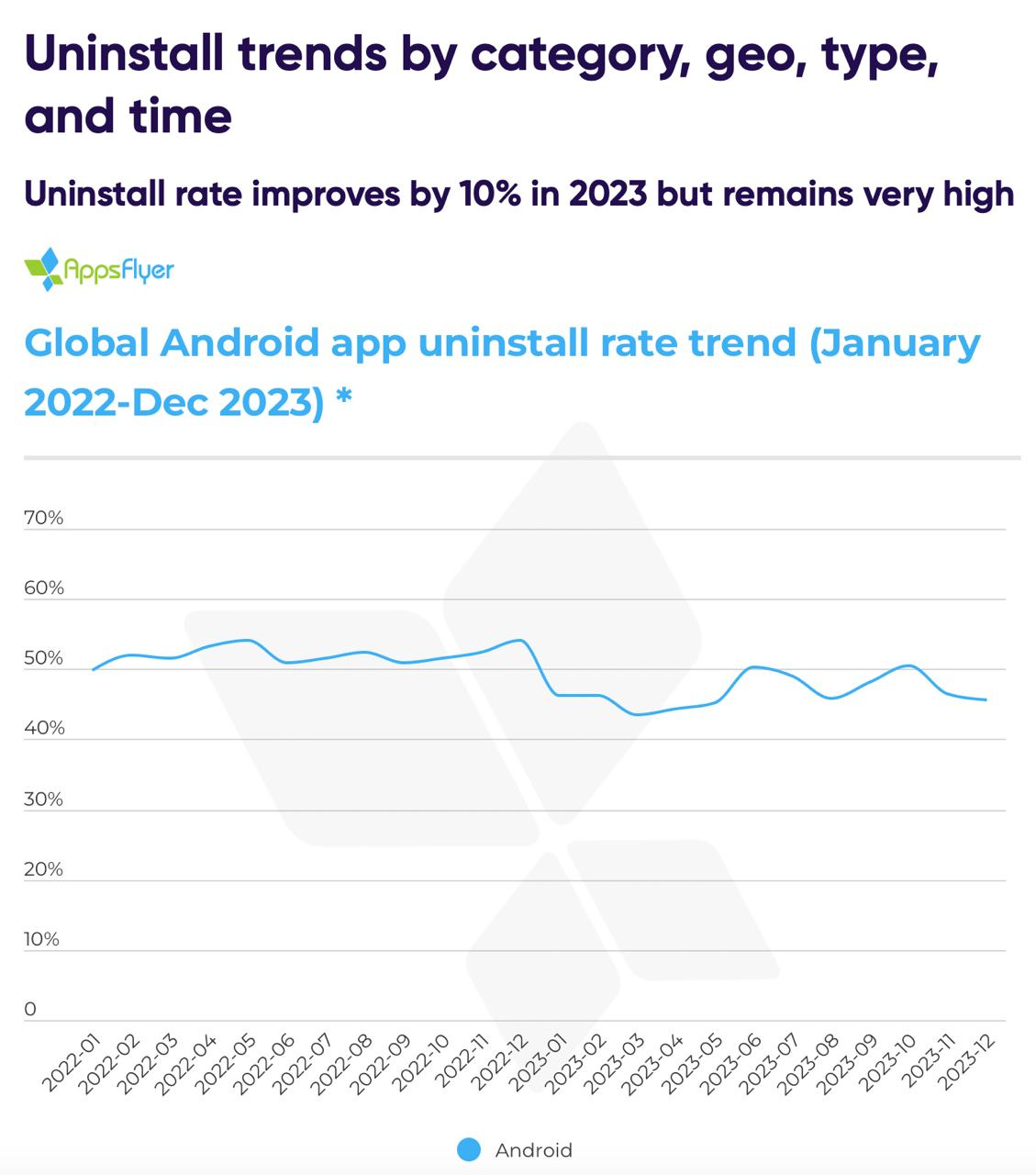

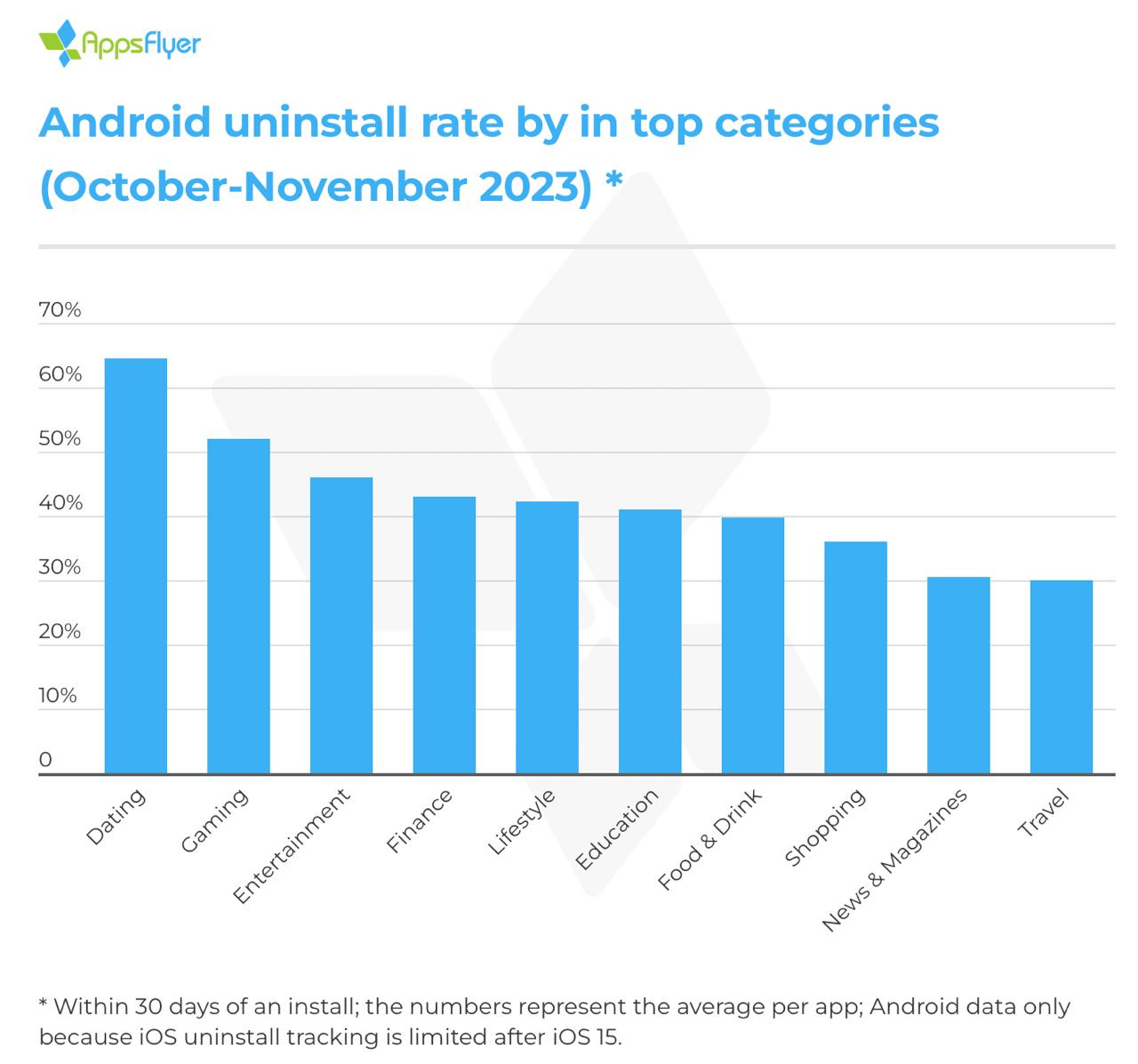

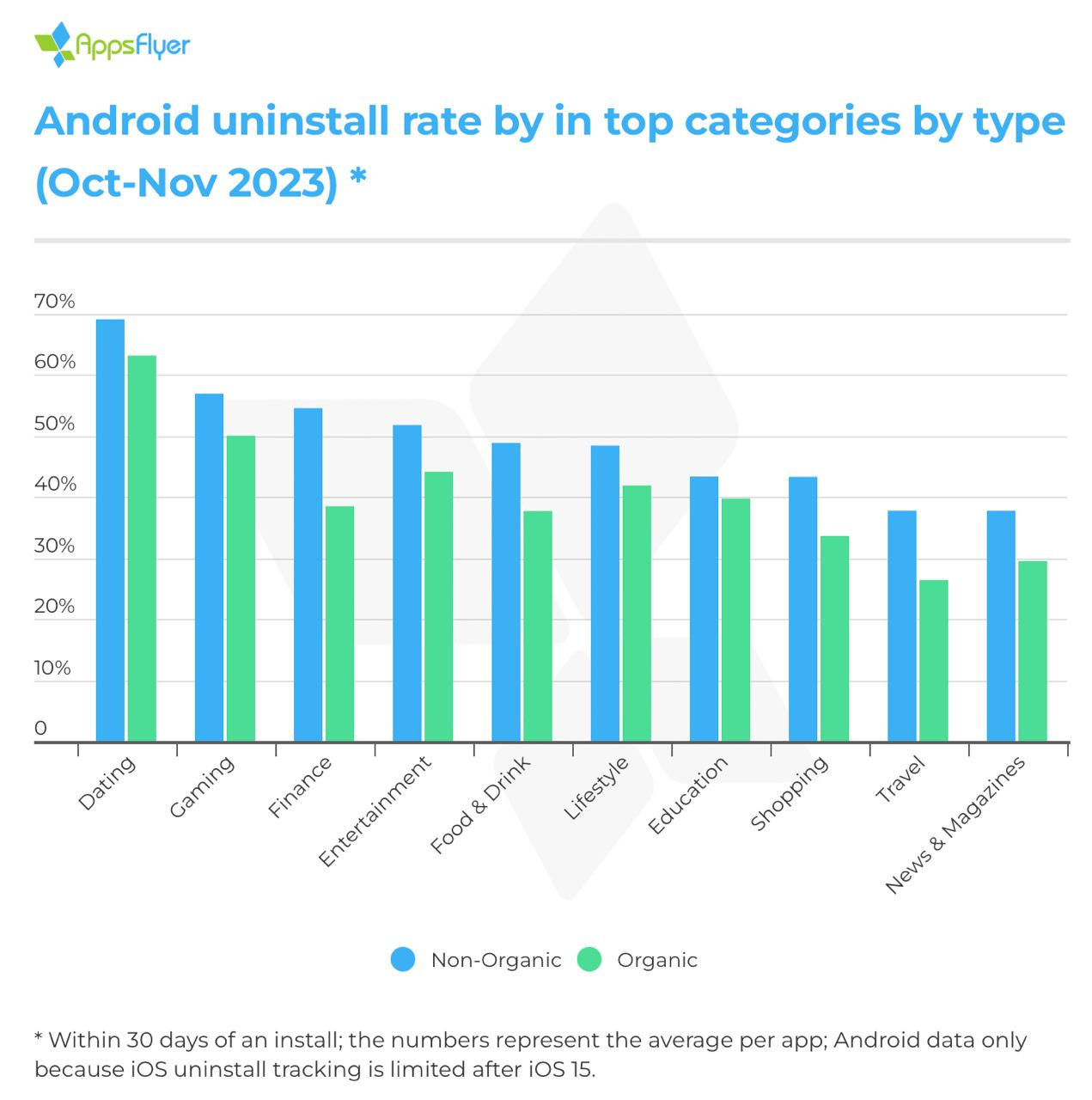

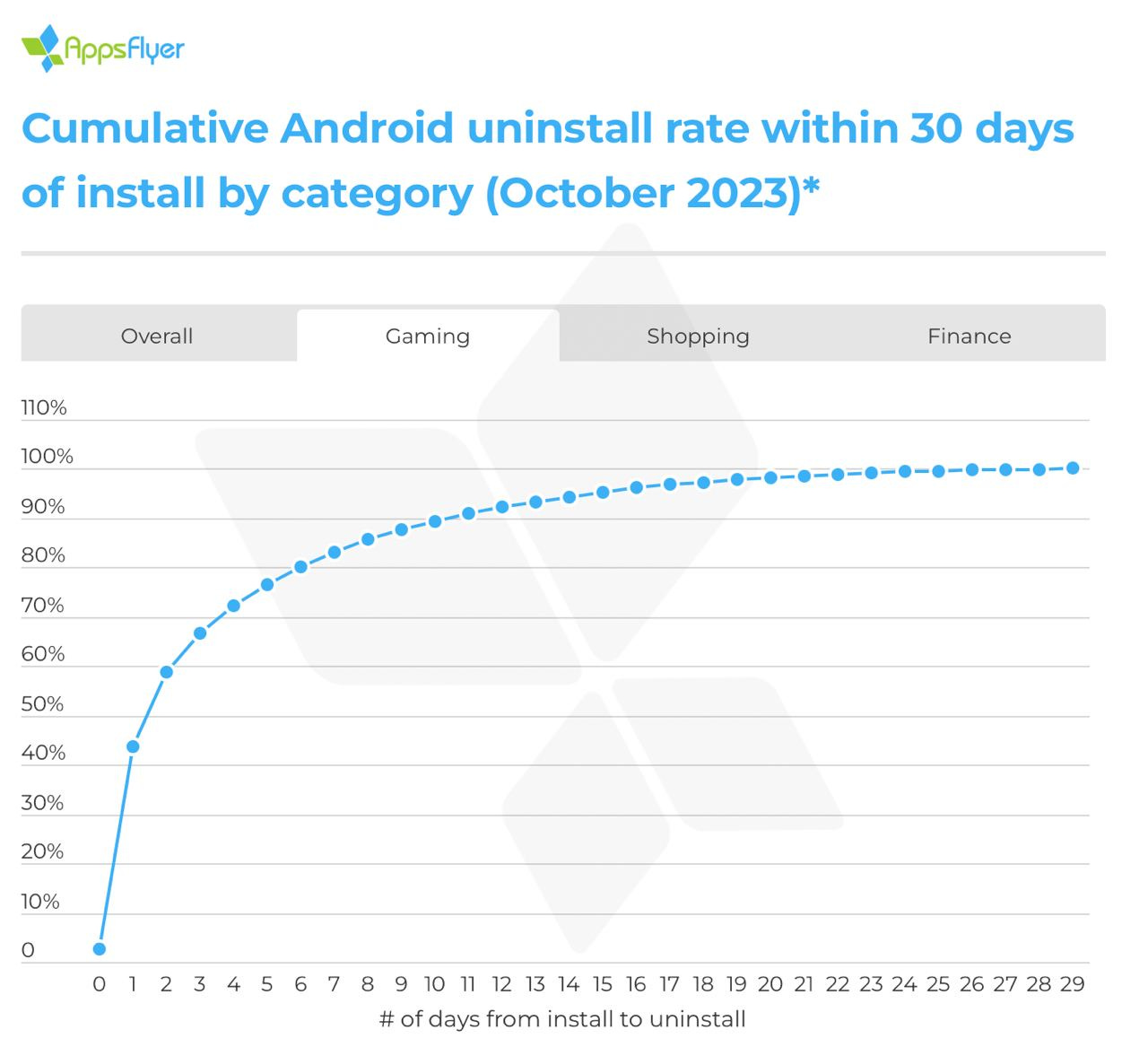

AppsFlyer: Benchmark on Game uninstalls on Android in October-November 2023

The figures are presented only for Android, as with the release of iOS 15, accurately tracking changes on iOS has become impossible.

-

According to AppsFlyer, every second app is uninstalled from mobile devices within 30 days of installation.

-

The situation is the worst for dating apps (64.6% of users uninstall them within 30 days) and games (52% of users uninstall the game within 30 days).

-

Paying users uninstall games more frequently (56.96% within the first month); organic users uninstall less often (50.06% within the first month).

-

In developing countries, the number of apps uninstalls is on average 20% higher than in developed countries.

-

AppsFlyer studied data from October 2023 on uninstallations of gaming apps. 43.54% of uninstalls occur on the first day of installing the game. Most likely, user expectations did not align with reality. 90.9% of uninstalls occur within the first 11 days. Afterward, uninstalls accumulate steadily.

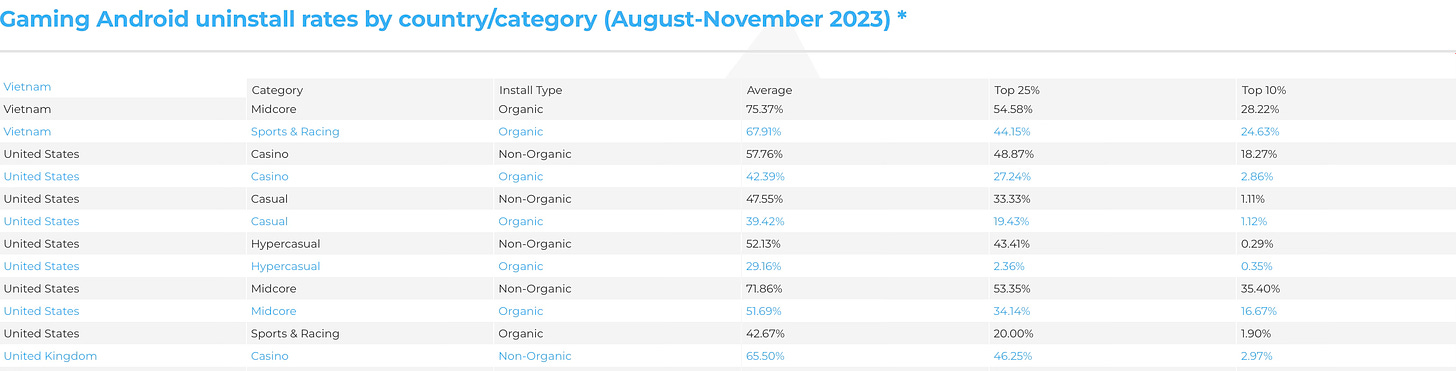

Benchmark for the USA

-

Considering paid traffic, casual games in the USA, on average, have 47.55% of users uninstalling within the first 30 days. However, for the top 10% of projects in this regard, uninstalls are dramatically lower - only 1.11%.

The figure looks suspiciously low. Without additional information, I would approach it skeptically.

-

With mid-core projects, it's a bit more challenging. Looking at organic users, 51.69% uninstall the game within the first 30 days. However, for the top 10% of projects, this figure is three times lower - 16.67%.

Here, the figure seems more plausible.

Game sales Round-up (17.01.2024 - 06.02.2024)

-

19 million people played Palworld within 13 days of release. 12 million bought the game on Steam; 7 million are Xbox owners. Console sales are difficult to calculate because the game was distributed for free on Xbox Game Pass. The game became the largest launch in Microsoft's subscription service by a third-party developer.

-

Street Fighter 6 surpassed the mark of 3 million copies sold within 7 months of release. It took 3 days to reach the first million. The total series sales are over 52 million copies.

-

Video Game Chronicle reports that sales of Mario + Rabbids: Sparks of Hope are at 3 million copies. Earlier, there were talks that the game hadn’t met sales expectations. Ubisoft stated that the game was rushed to release.

-

Mobile game Whiteout Survival earned over $400 million in 11 months. 33% of revenue is from the US; 20% is from South Korea.

-

Lethal Company likely surpassed 10 million copies sold. The solo developer earned $113.9 million before deductions and taxes. There is now one more millionaire in the world.

-

eFootball by Konami has been downloaded over 700 million times.

-

The Grand Theft Auto trilogy on Netflix for mobile devices has been downloaded over 22 million times. GTA: San Andreas - 13.6 million downloads; GTA Vice City - 4.6 million; GTA III - 3.7 million. Netflix is very satisfied with the achievement and stated that this launch brought them subscribers specifically for games for the first time. The company will monitor their behavior.

-

Enshrouded was bought over a million times within 4 days of release. It's another Survival project with crafting. The game had 160 thousand concurrent players in the first weekend.

-

Sales of Ubisoft's latest games have appeared online. Rumors suggest Prince of Persia: The Lost Crown - 300 thousand players ($15 million revenue); Avatar: Frontiers of Pandora - 1.9 million players ($133 million revenue); Assassin’s Creed Mirage - 5 million players ($250 million revenue). This is a leakage, so it should be approached skeptically.

-

World of Tanks has earned over $7 billion. Over 350 million people have registered in the game over time. Chris Chang, franchise director, shared this on his LinkedIn profile.

-

Resident Evil 4: Remake reached 6.48 million copies sold by the end of 2023. It's the best-selling game in the series' history.

-

Farming Simulator 22 calmly reached its 6 million copies sold. Cool.

-

SEGA officially announced that Like a Dragon: Infinite Wealth sold 1 million copies in the first week of release. This is a record for the series.

-

Satisfactory sold 5.5 million copies in 5 years of "early access." Developers promise to release the full version this year.

-

Honkai: Star Rail has reached 100 million downloads. In honor of this, the developers even announced support for Apple Vision Pro. By the way, the game has been updated to version 2.0.

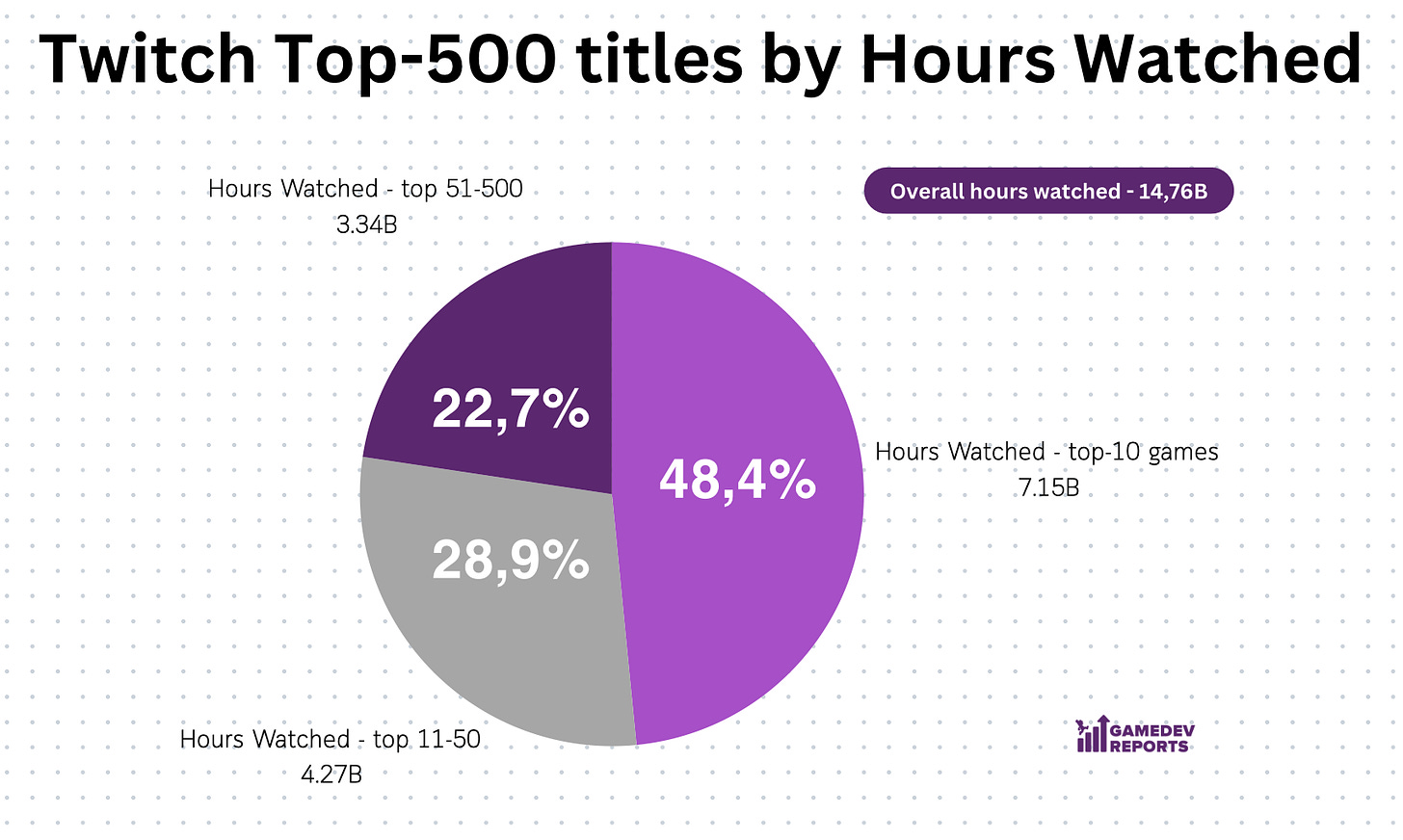

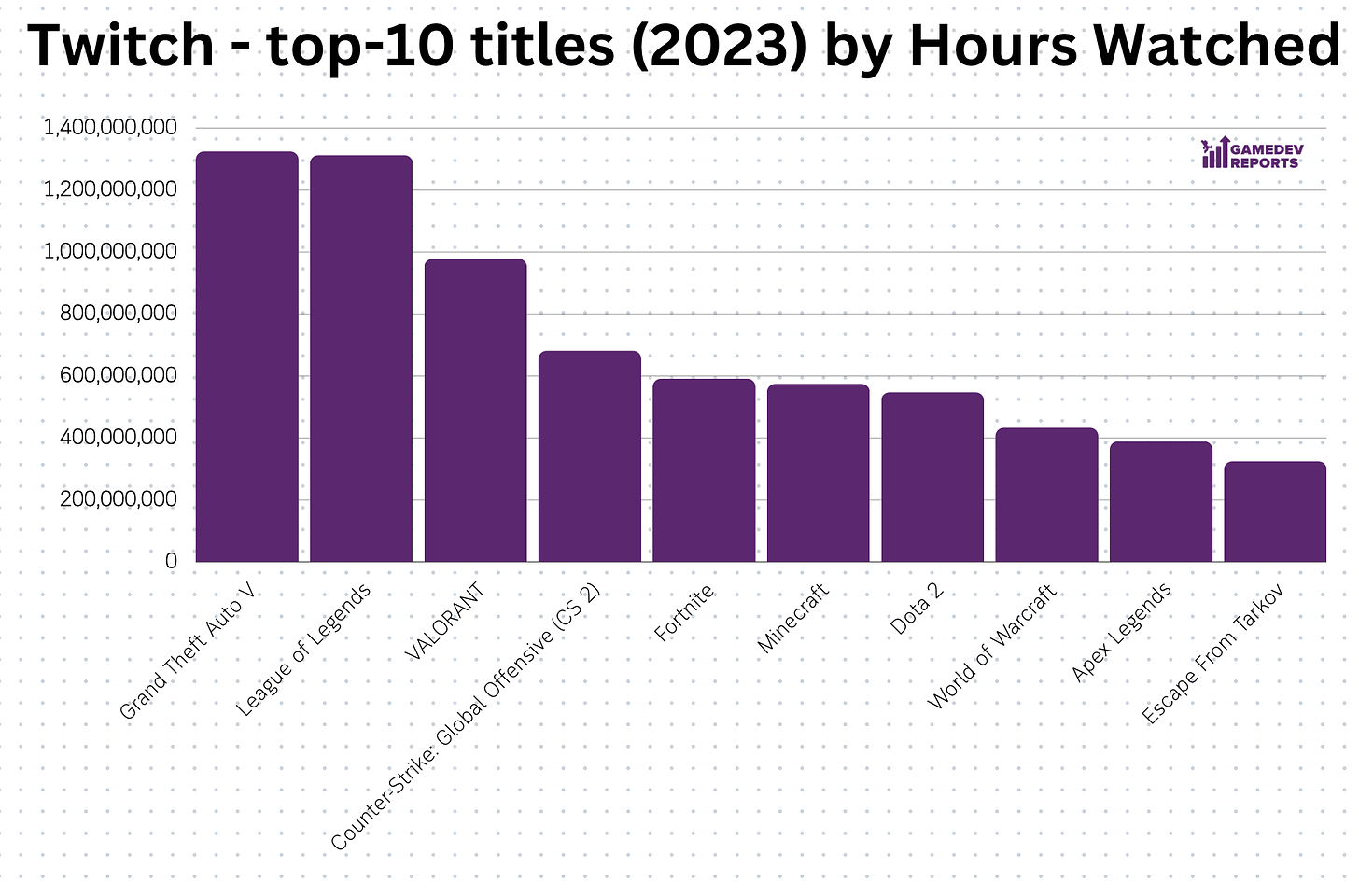

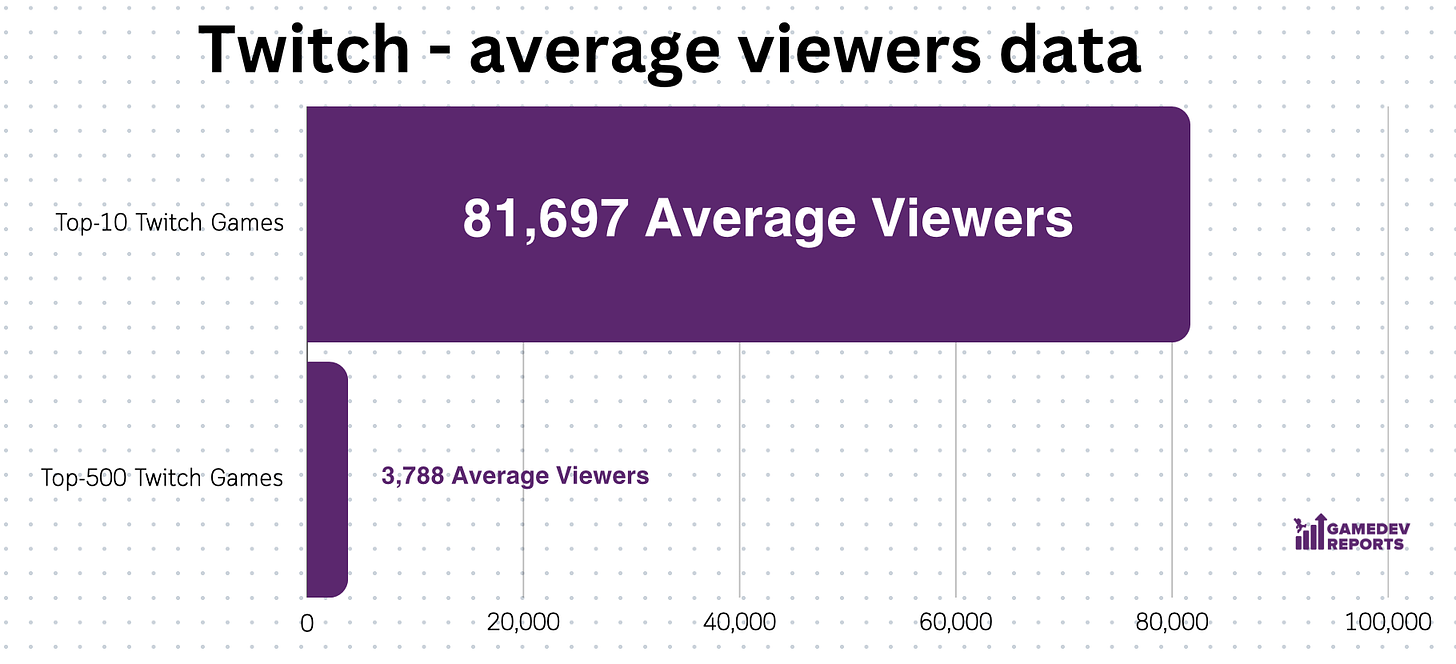

Lurkit: Top 500 games in streaming in 2023

Data is presented based on Twitch, as the primary gaming streaming platform in the world.

-

Grand Theft Auto V (1.324 billion hours watched) and League of Legends (1.312 billion hours watched) - the leaders of the streaming market in 2023.

-

In the top 10 by hours watched, there isn't a single game younger than 2020; the newest is Valorant unless considering CS2 as a 2023 release.

-

Diablo IV, among all games released in 2023, has the highest number of hours watched by people. The game occupies the 13th position.

-

Considering the entire top 500 on Twitch, the top 10 games account for 48.4% of all hours watched. Looking at the top 50, they collectively account for 77.3% of all hours watched. This means that games ranked from 51 to 500 collectively receive only 22.7% of viewer attention.

-

On average, the top 10 games on Twitch have 81,697 viewers, while the entire top 500 have 3,788. That's a stark difference.

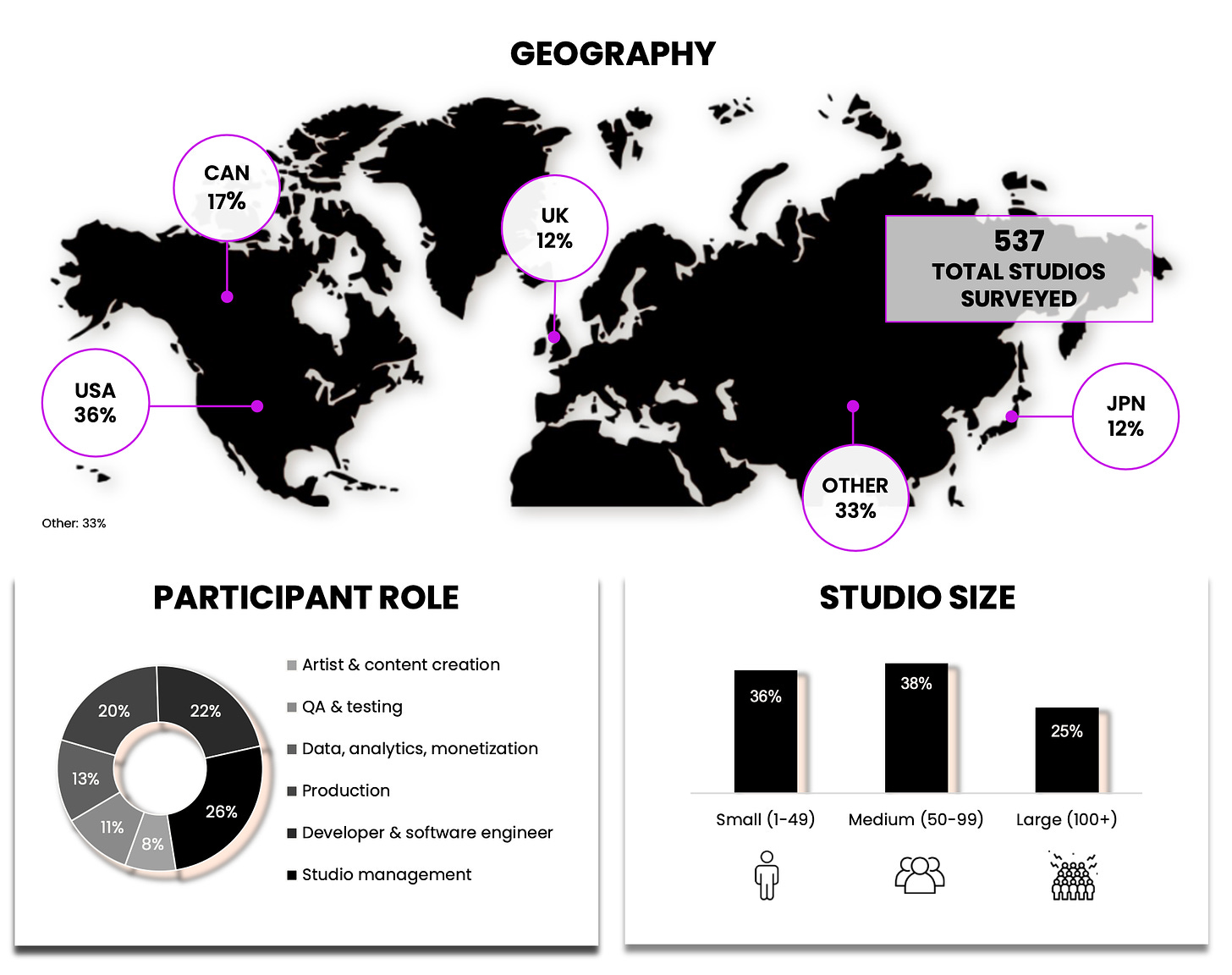

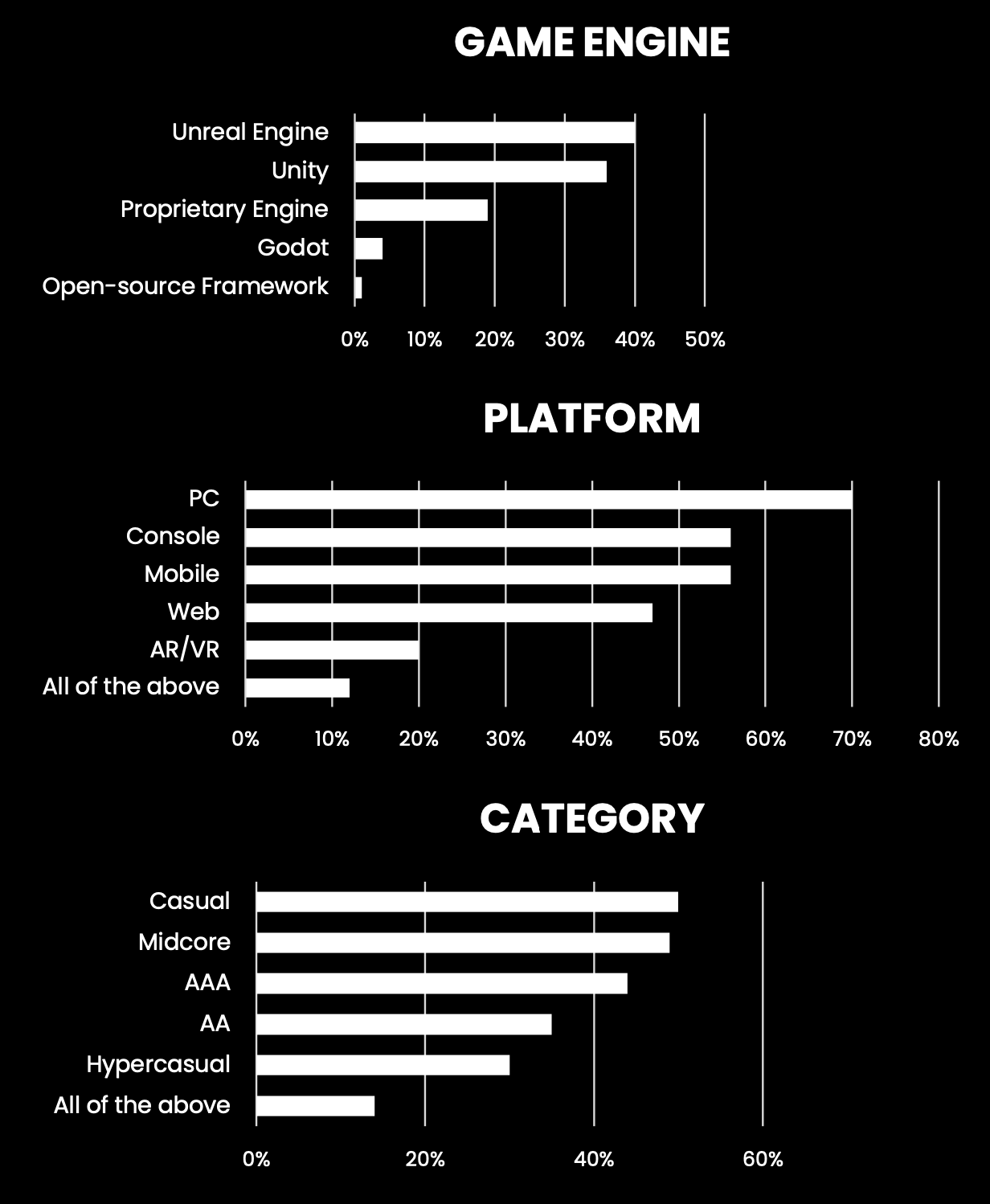

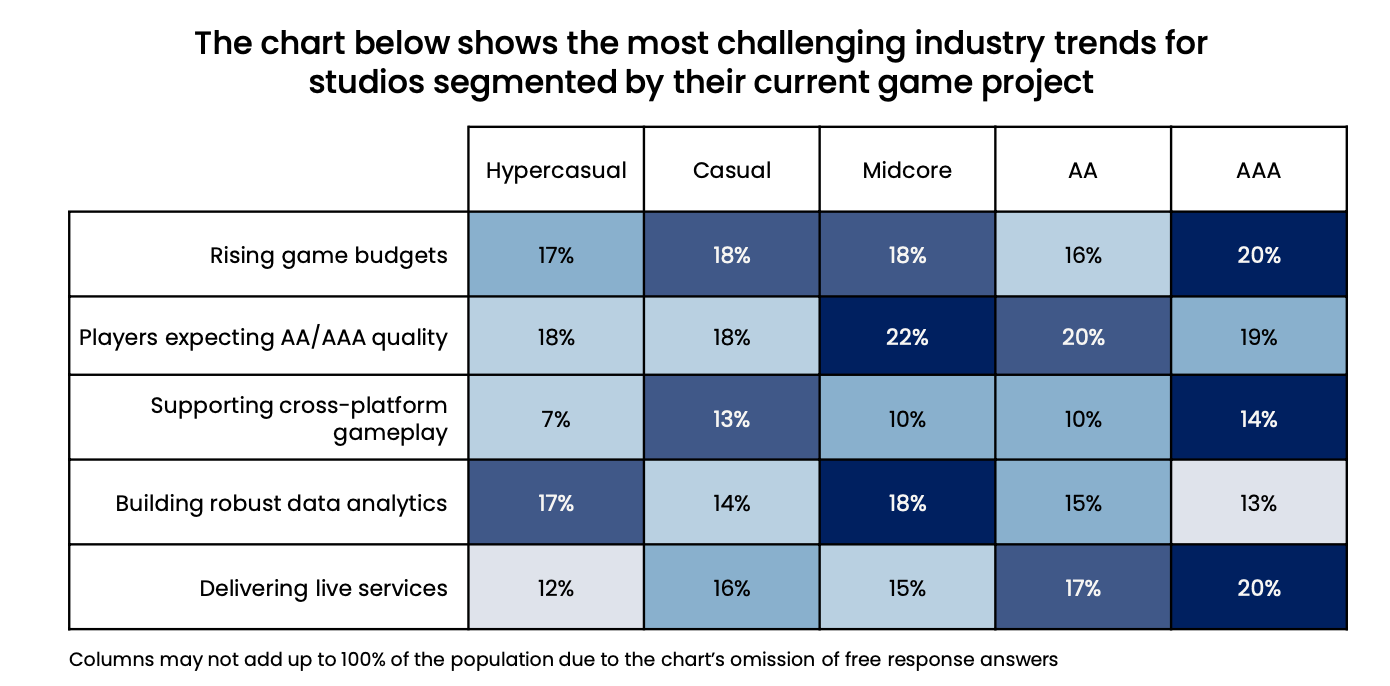

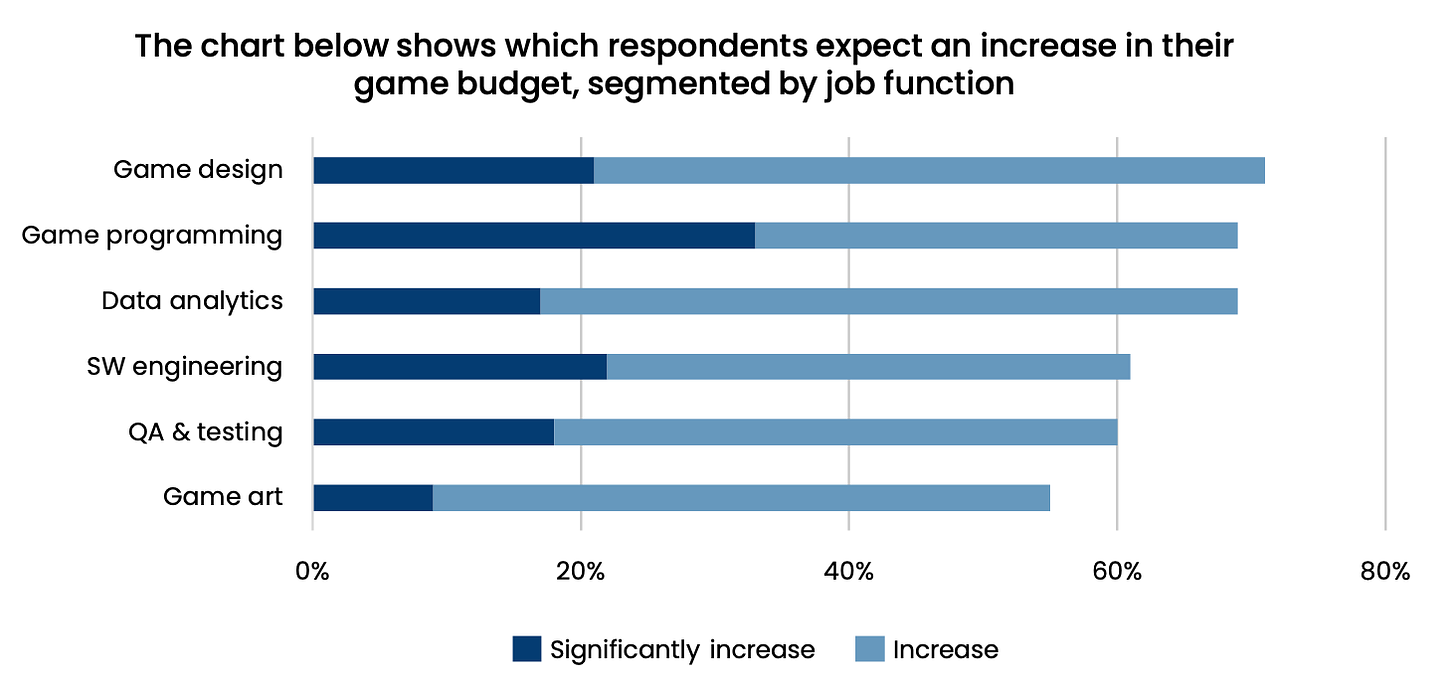

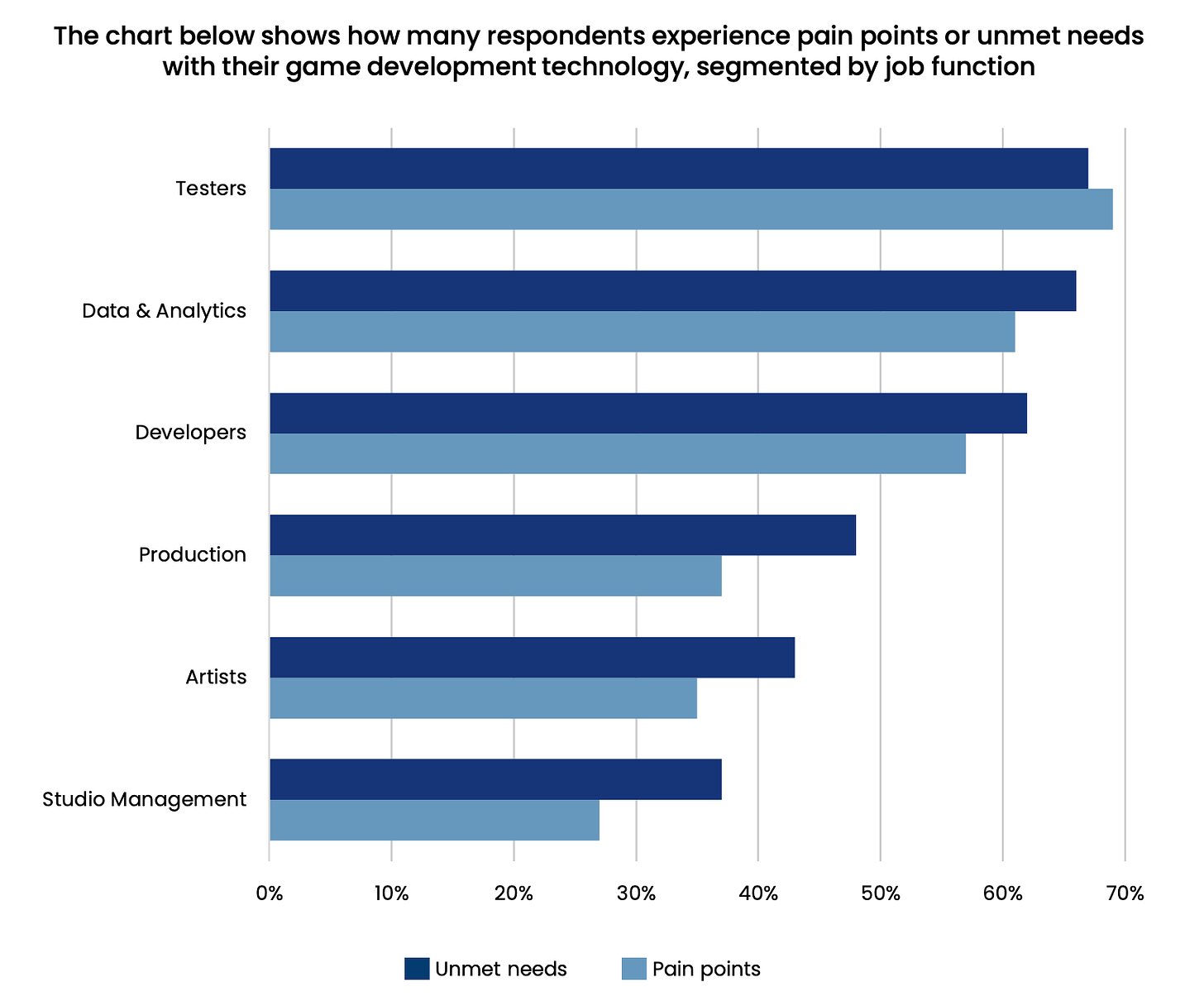

Griffin Gaming Partners & Rendered.VC - Game Development Trends in 2023

537 studios from different countries participated in the survey. Businesses of various sizes were surveyed; among the respondents were management, developers, analysts, and professionals from other fields.

40% of respondents develop games on Unreal Engine; 36% on Unity; 19% on their own engine. 70% develop games for PC; 56% for consoles and mobile devices; 48% for web platforms.

General trends

-

77% of studios reported that development costs continue to rise.

-

According to developers' perceptions, costs for programmers, game designers, QA, and testing are increasing the most.

-

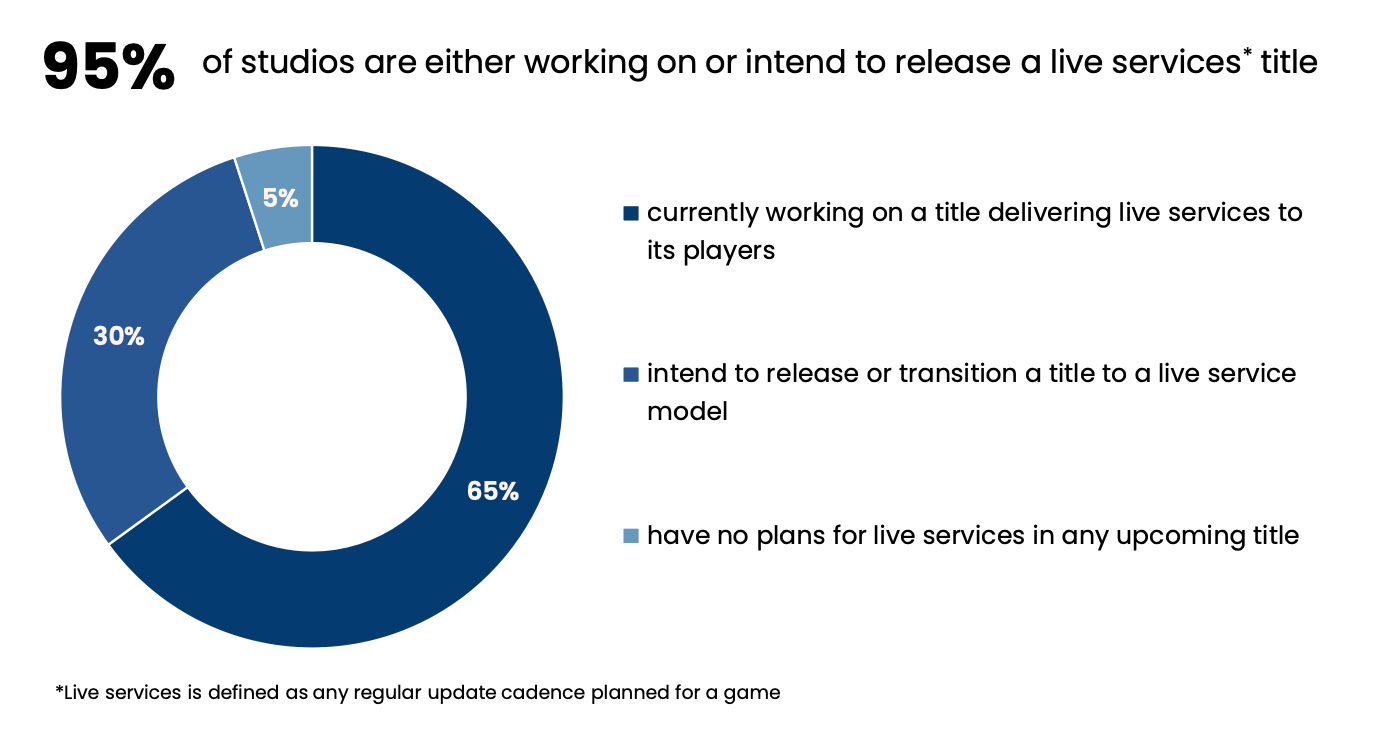

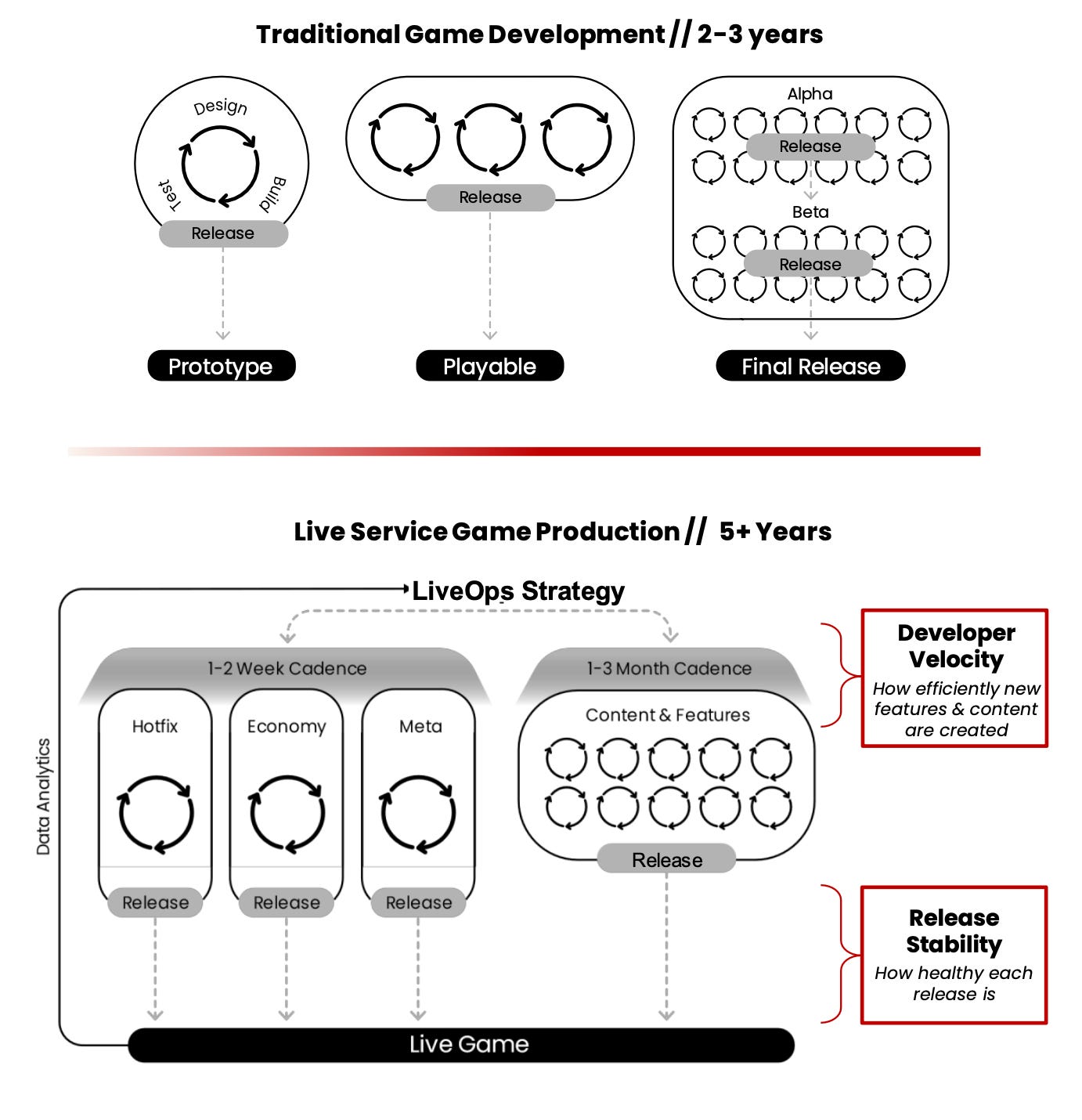

65% of developers are working on projects that will receive regular updates after release. 30% are considering this.

-

88% of studios actively consider new technologies to improve their workflow.

Development Trends

-

Development costs are rising due to increasing complexity and demands of games. 74% of artists are confident that the production of 3D art is becoming more expensive. Additionally, there are numerous issues related to file management, libraries, and collaborative work.

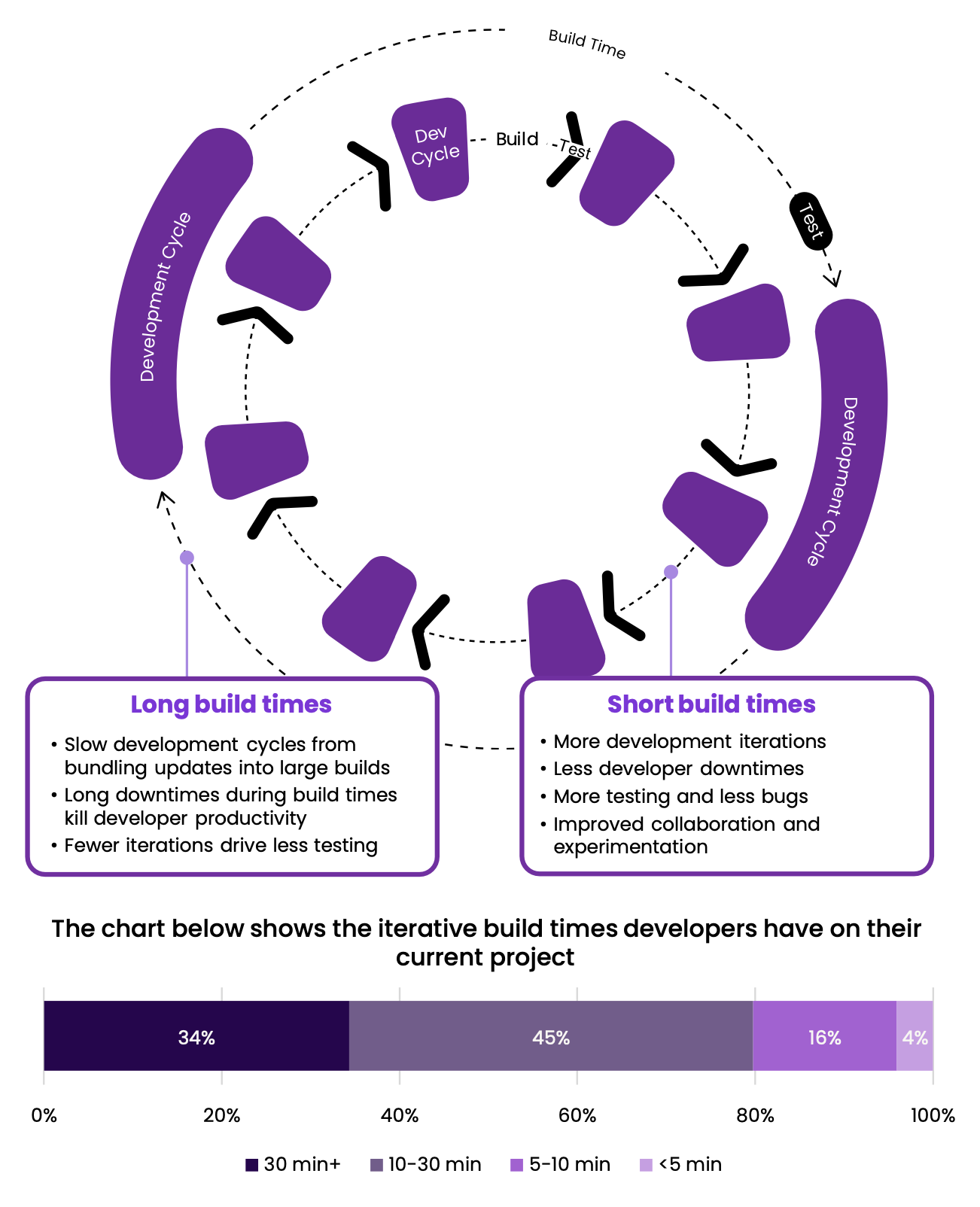

-

79% of developers face long build times - over 10 minutes. This slows down all processes within the team. Teams would like to see a faster and more iterative process.

-

Testing is becoming increasingly difficult, especially noticeable in large projects and games with complex operations.

-

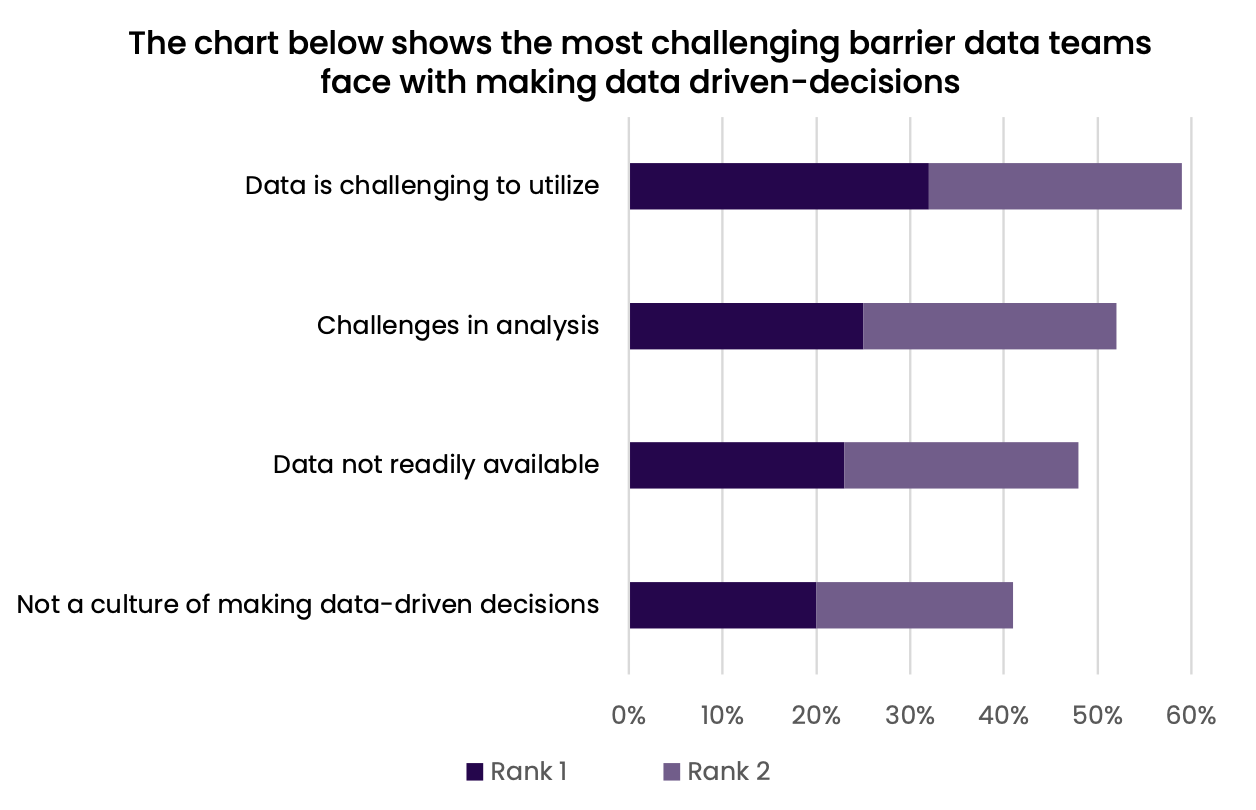

32% of teams encounter problems working with analytics. The issue is not just collecting data but working with it - gathering useful numbers and interpreting them correctly is challenging.

-

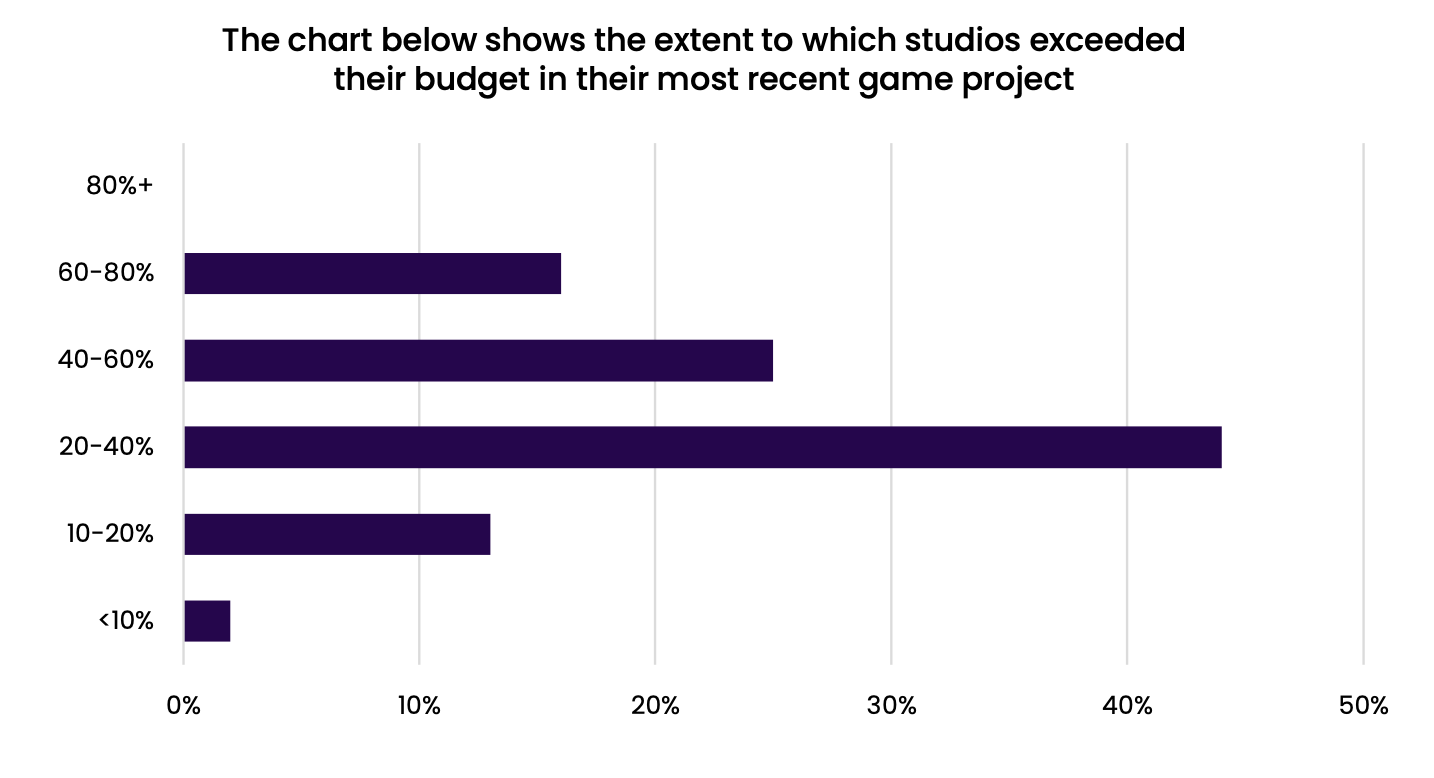

Most teams have significant budget planning issues. 44% of studios increased their initial budget by 20-40%. 25% increased it by 40-60%. 16% of studios had to increase the budget by 60-80%. For 13% of teams, the increase is minor - by 10-20%. And only 2% saw budget growth of less than 10%.

-

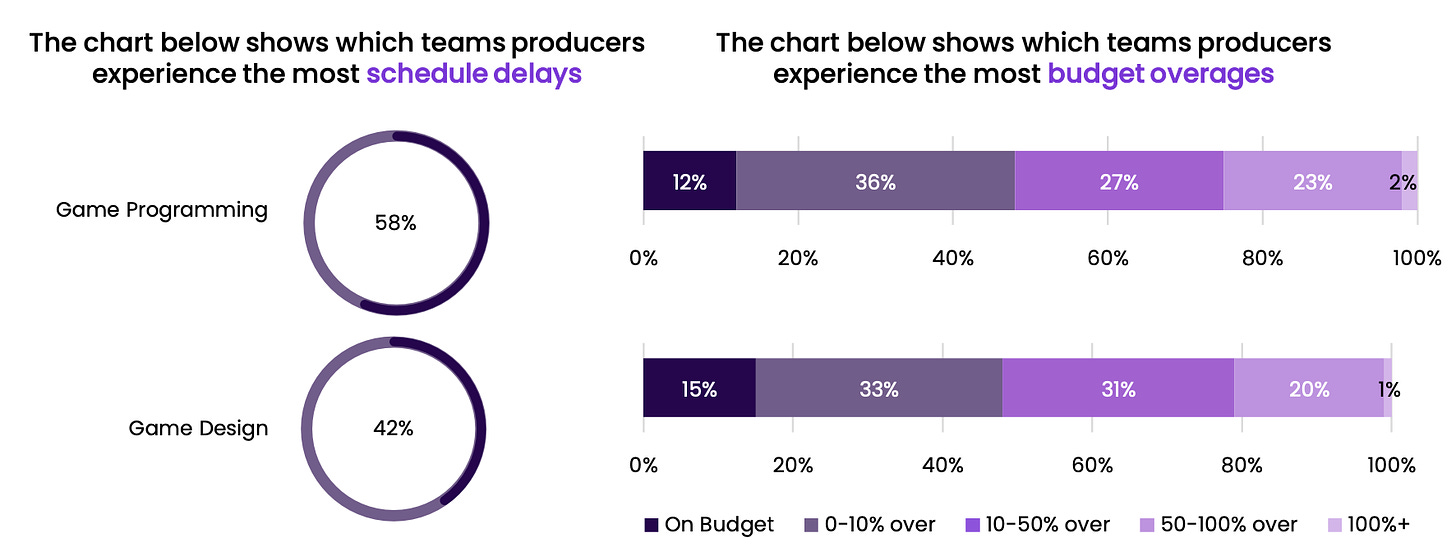

One of the sources of budget problems is incorrect deadlines. In the case of programmers, only 12% deliver tasks on time; among game designers, it's 15%.

-

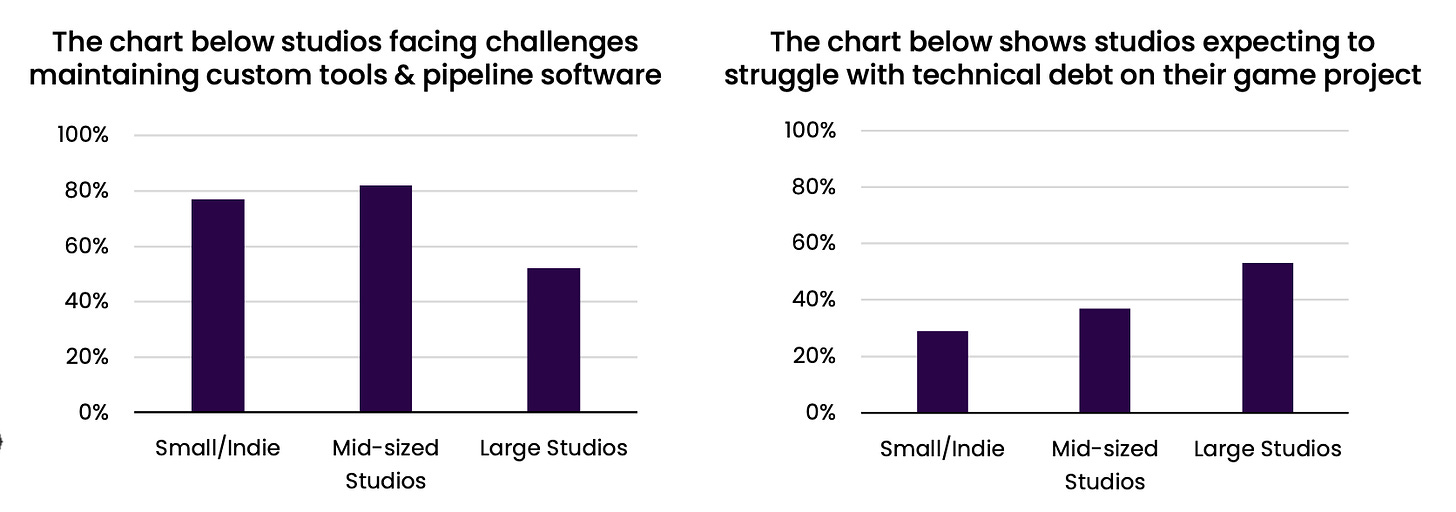

The problem of technical legacy is most common in large studios. Over 55% of large companies suffer from it.

Product Processes

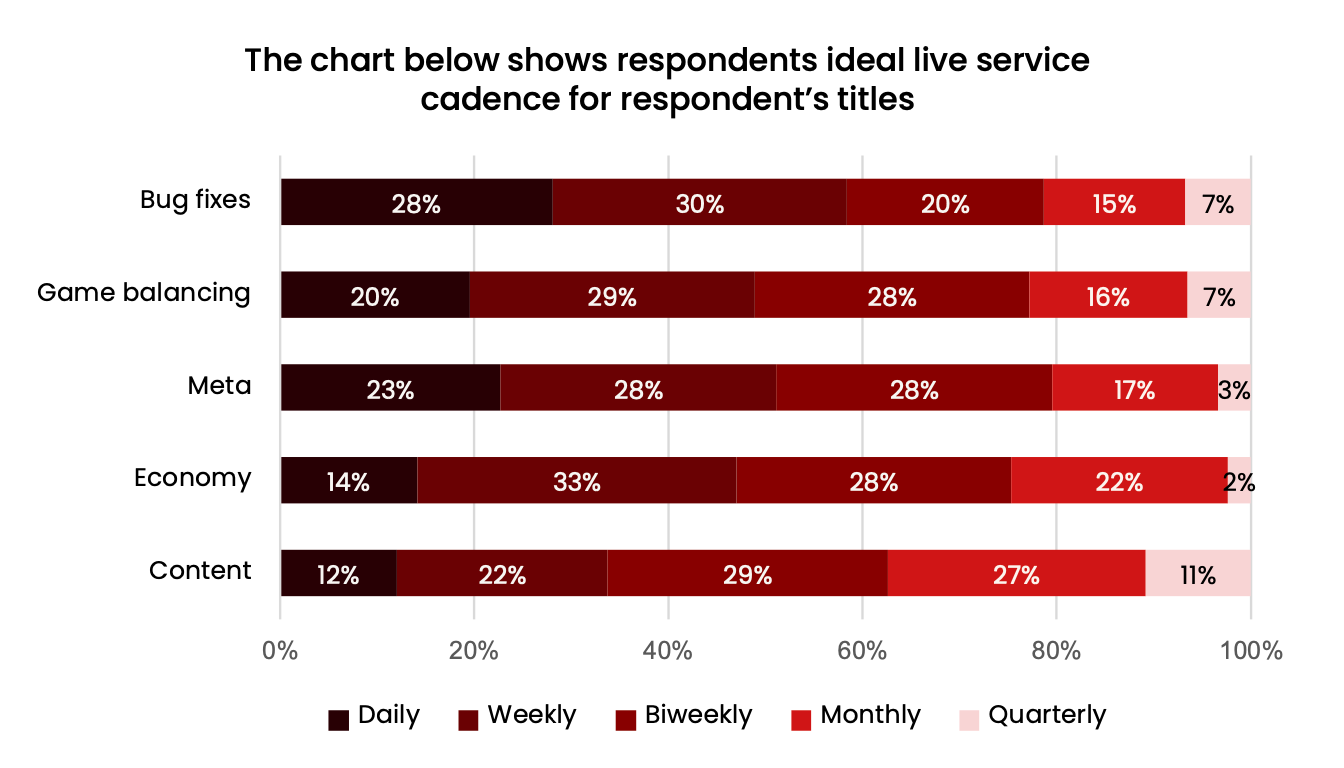

56% of producers would like to release game updates on a weekly or biweekly basis.

-

68% of producers believe their product pipelines are not suitable for service games. The problem is that developing a game and supporting it are two different development approaches.

-

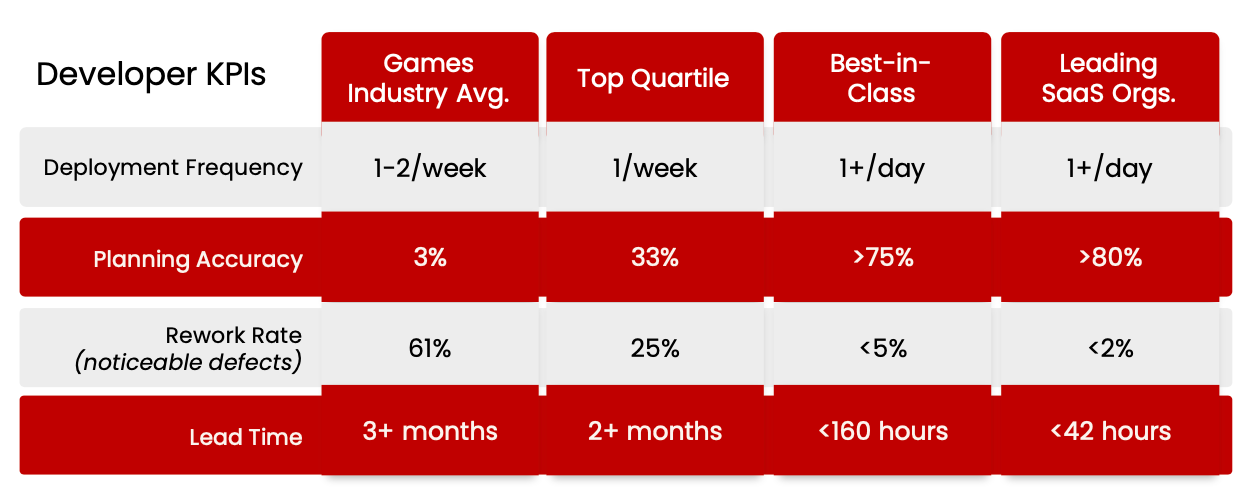

For leaders in service games, updates are released almost daily (compared to 1-2 times a week on average in the market); planning accuracy is above 75% (compared to 3% on average in the market); significant errors are below 5% (compared to 61% on average in the market).

-

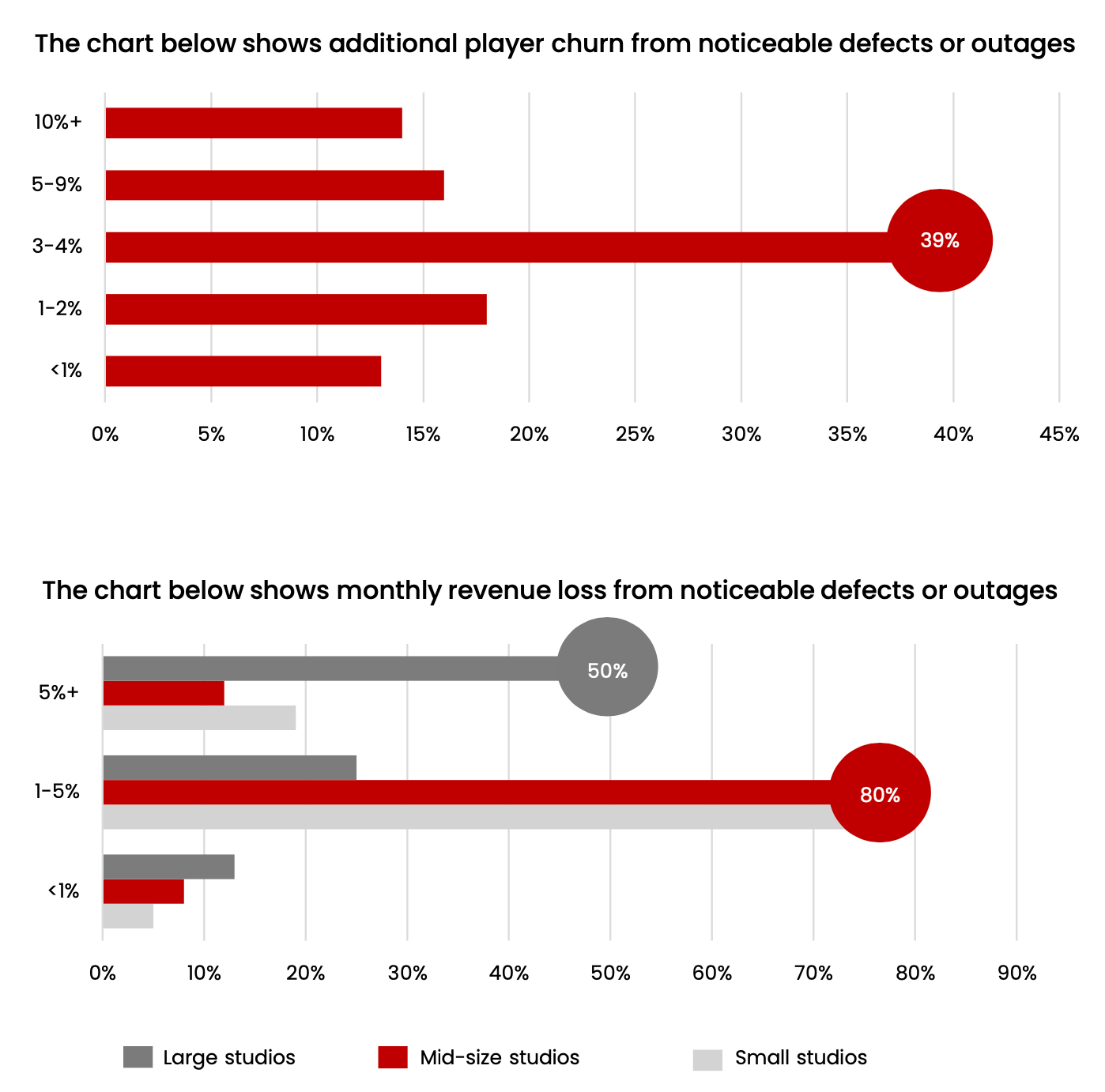

Bugs or technical unavailability of the game affect audience and revenue. For half of large companies, technical problems lead to a revenue decrease of 5% or more. For 14% of studios, user churn increases by more than 10%.

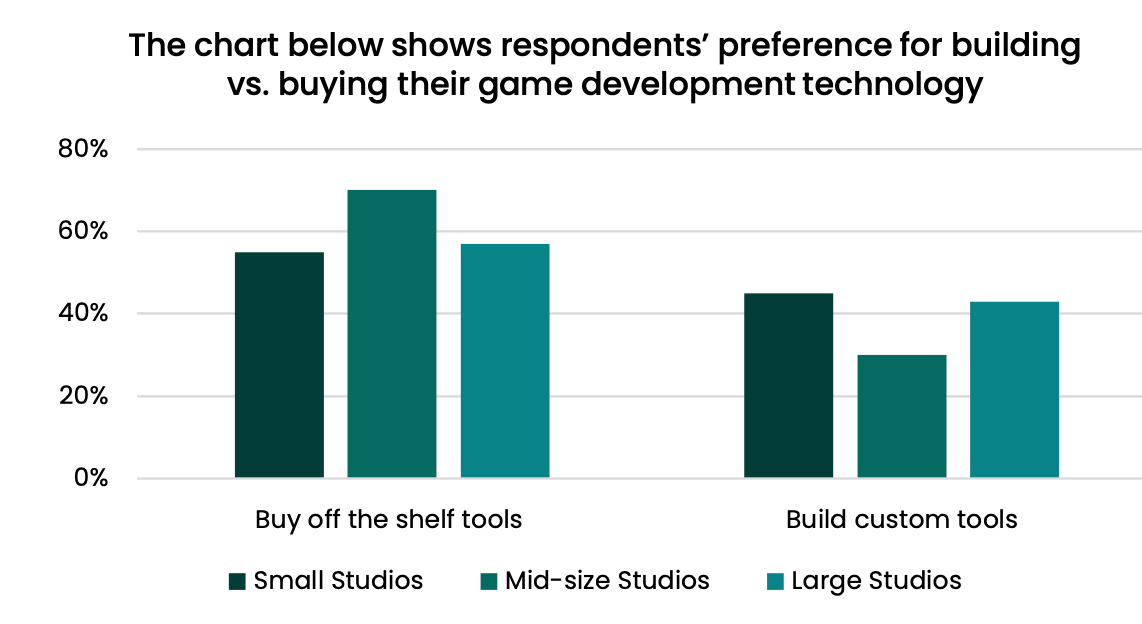

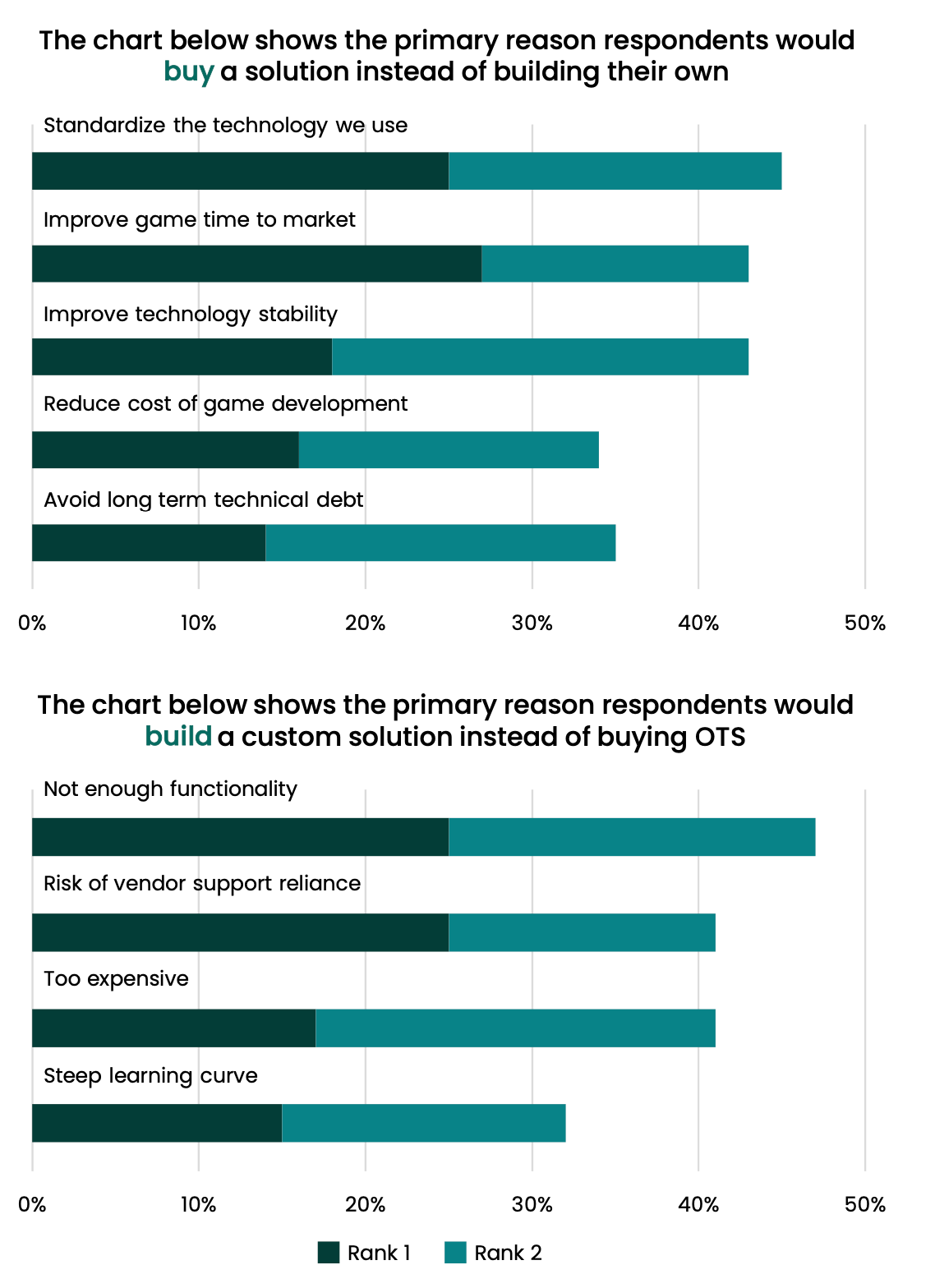

Tech Development Trends

-

65% of studios plan to use more off-the-shelf solutions rather than building their own.

However, the trend is unclear as there is no comparison with previous years.

-

One of the main tasks of studios at the moment is standardizing the technical stack and reducing time-to-market. In addition, large companies express interest in quality technical support and support for old products. Among the main reasons for creating custom solutions are the lack of functionality in market solutions, risks of vendor dependence, and price.

-

94% of studios plan to increase their use of cloud infrastructure.

-

52% of artists believe that within 2 years AI will be able to produce the same result as the average artist can now.

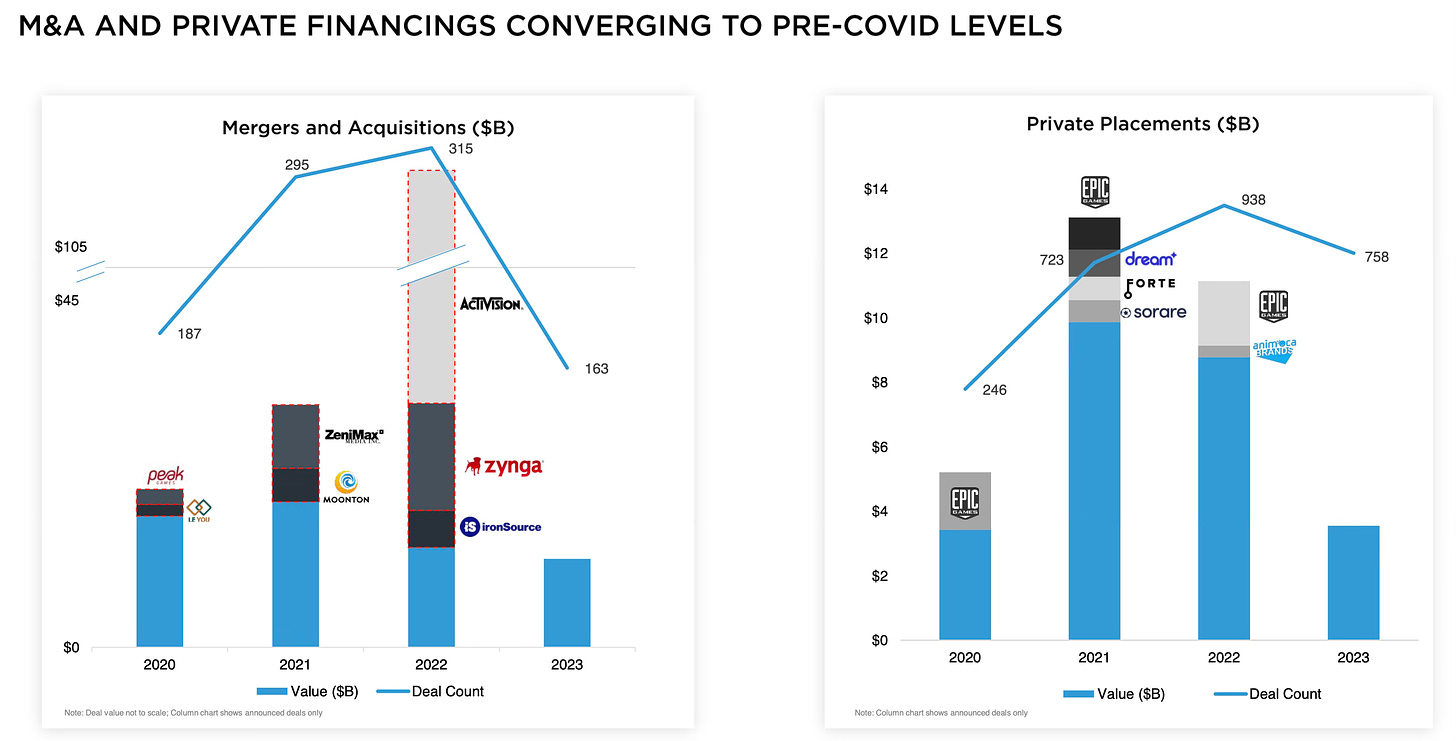

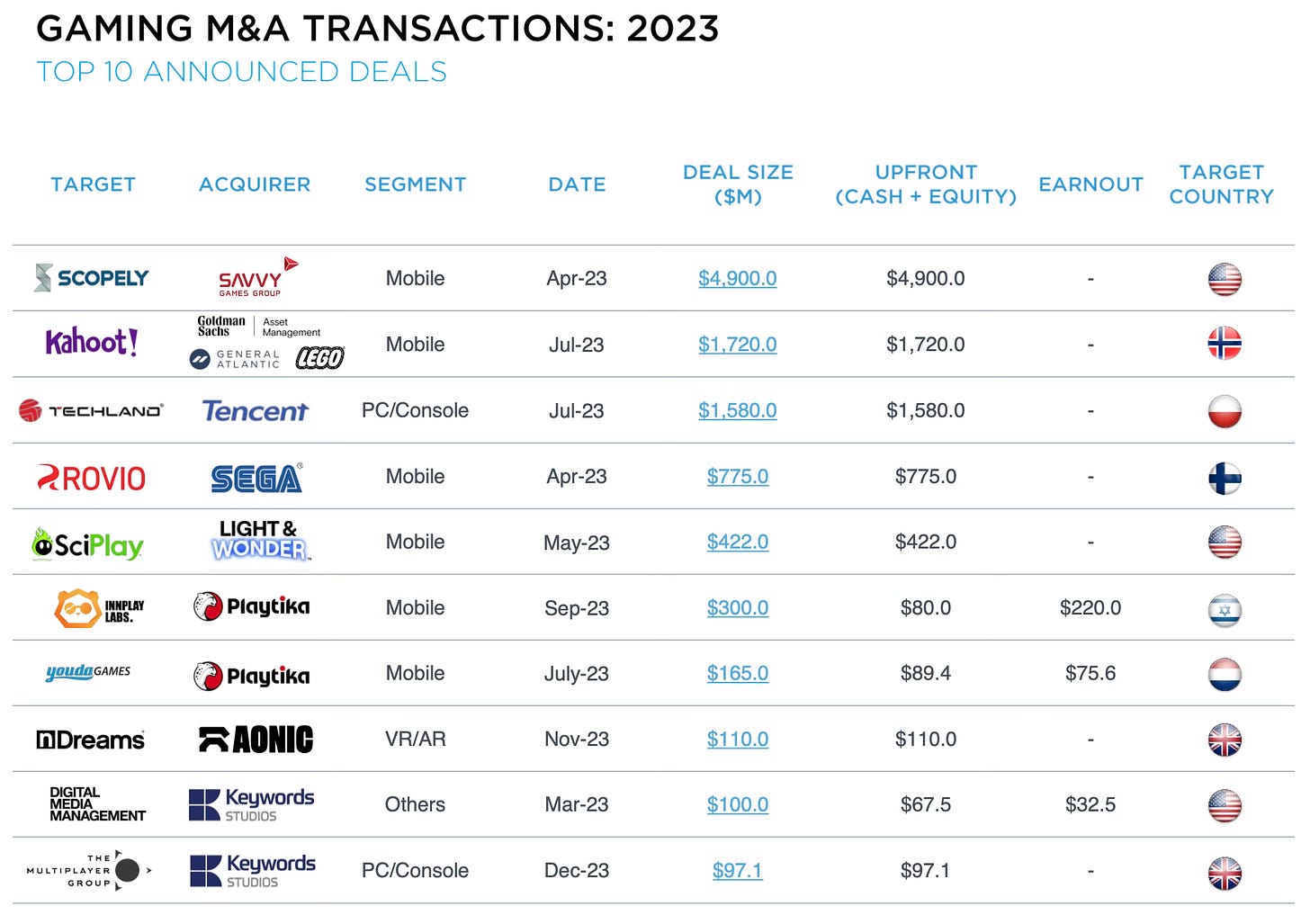

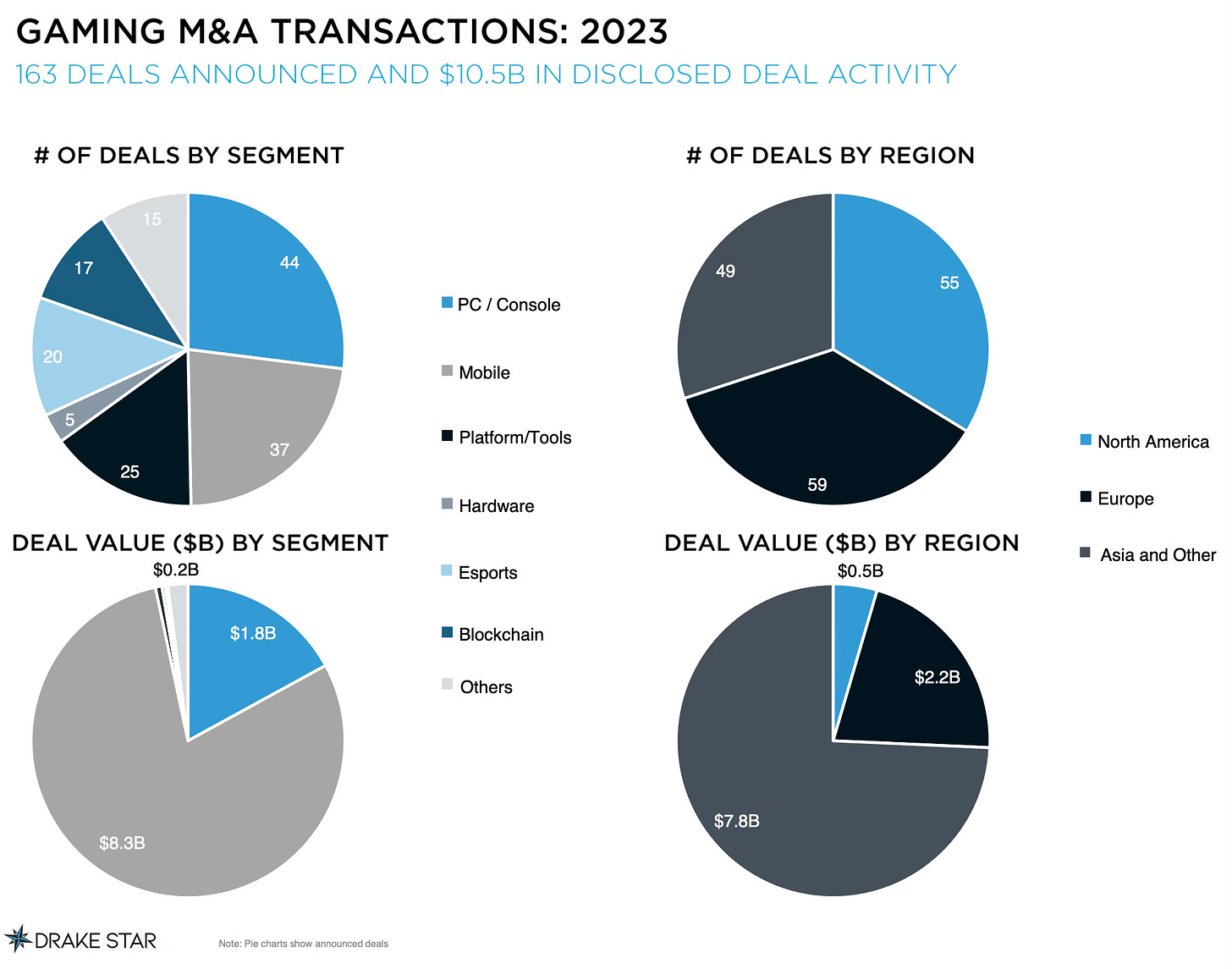

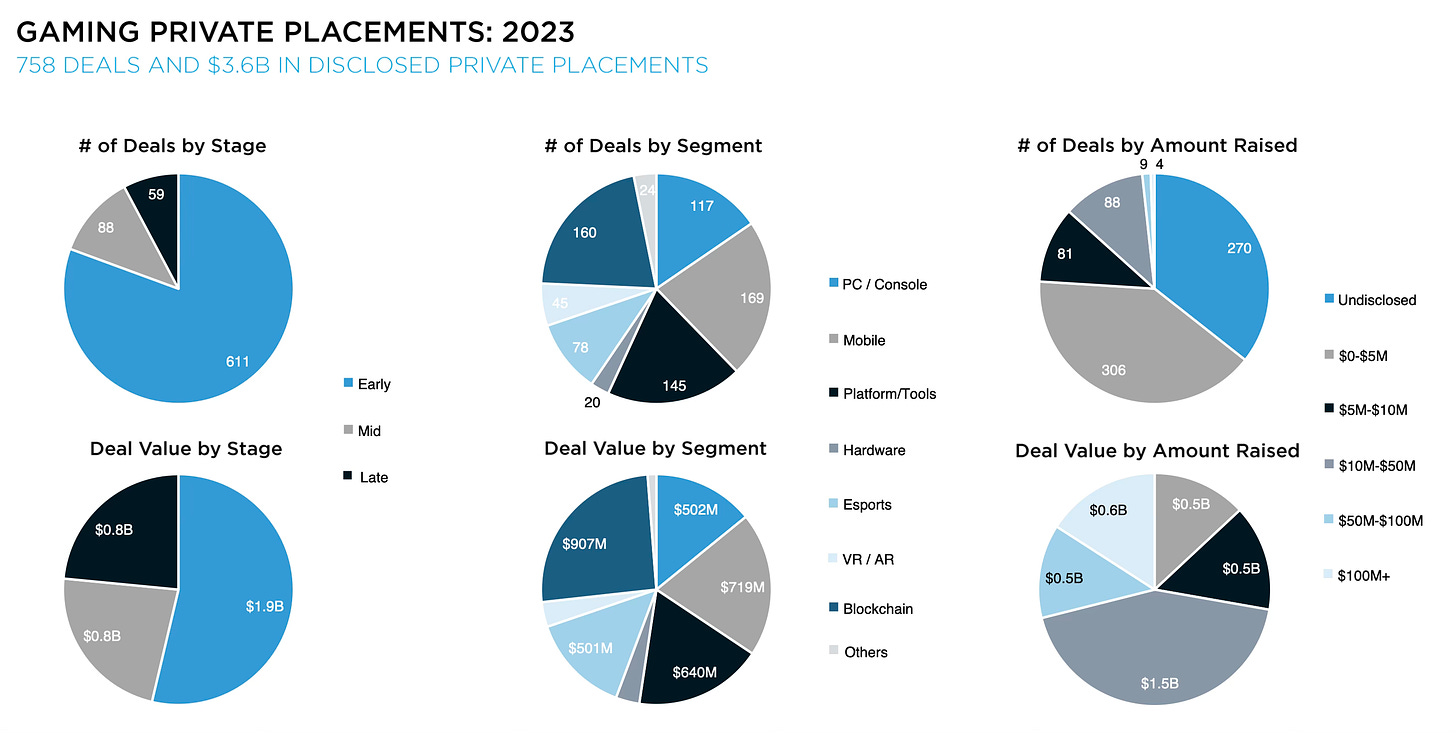

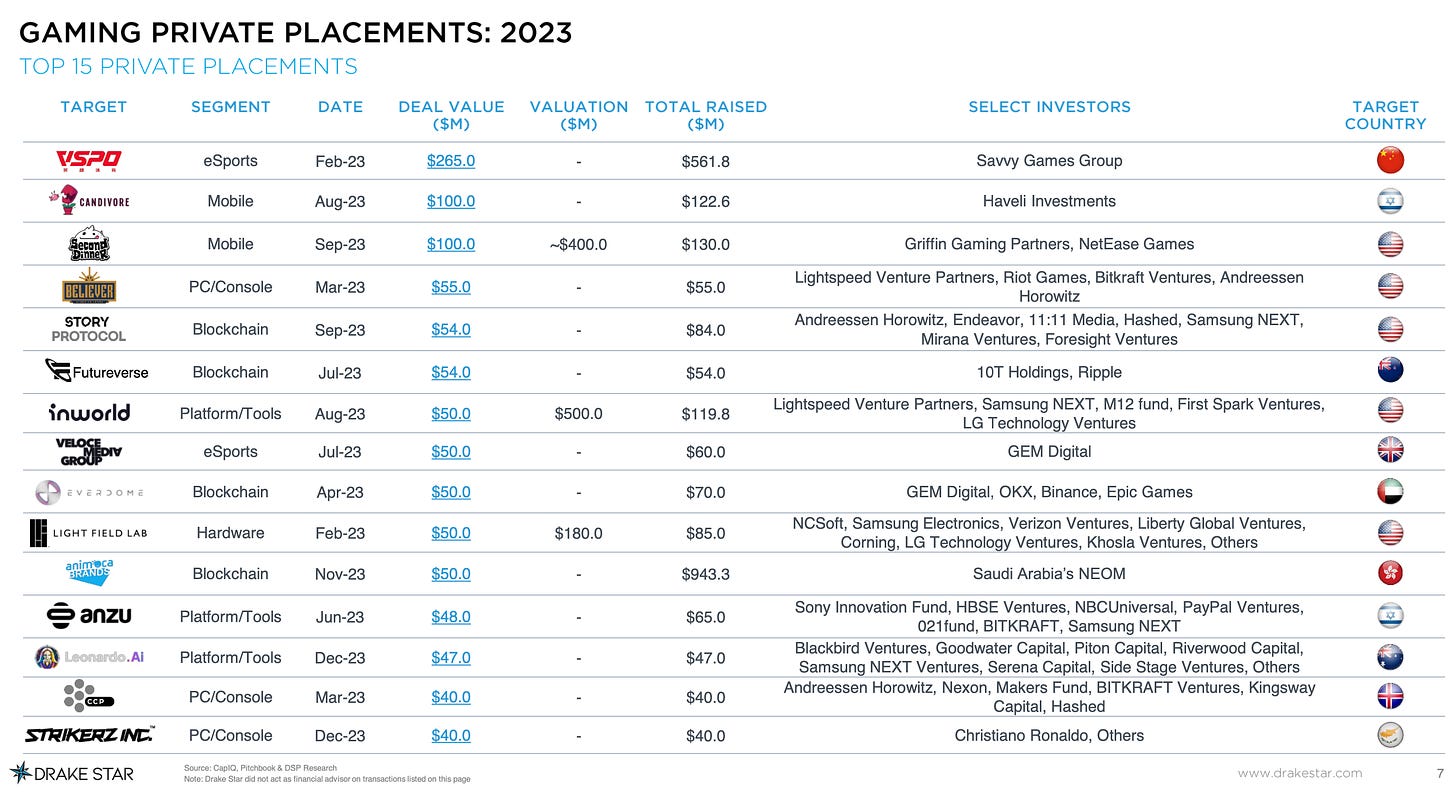

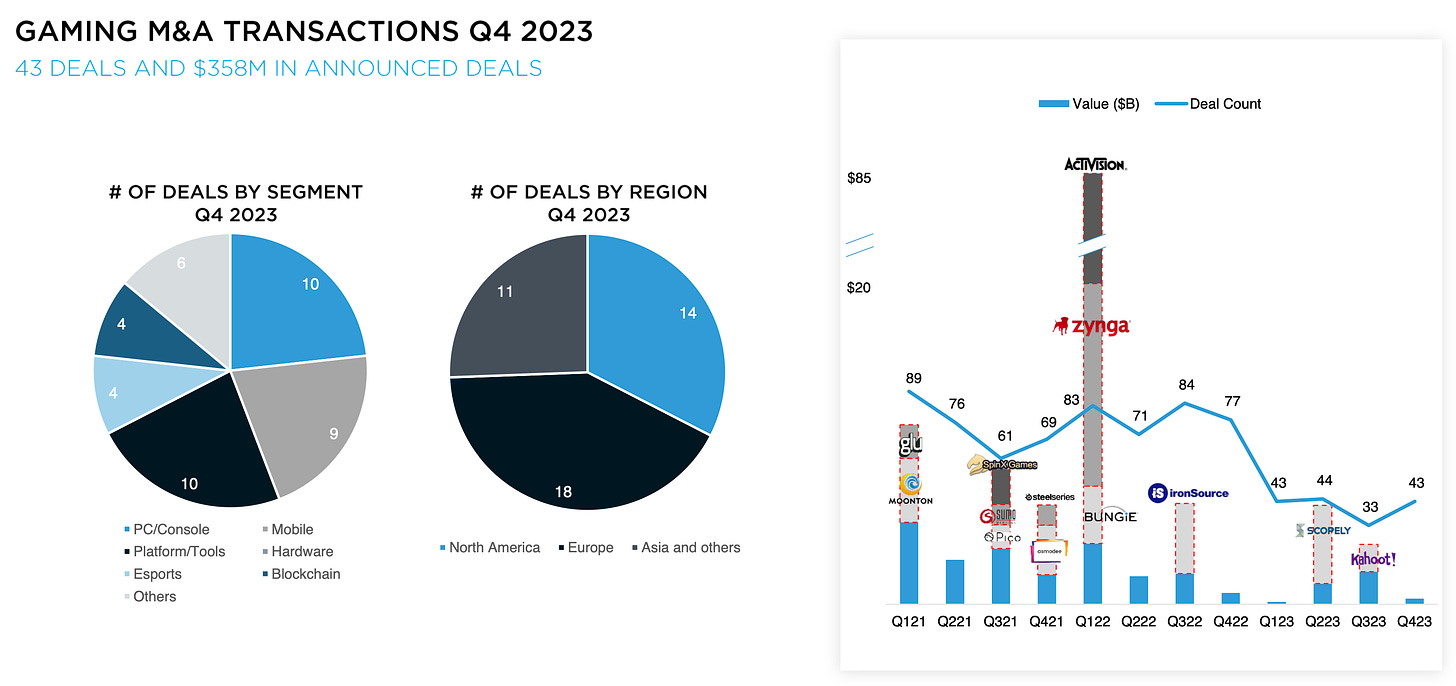

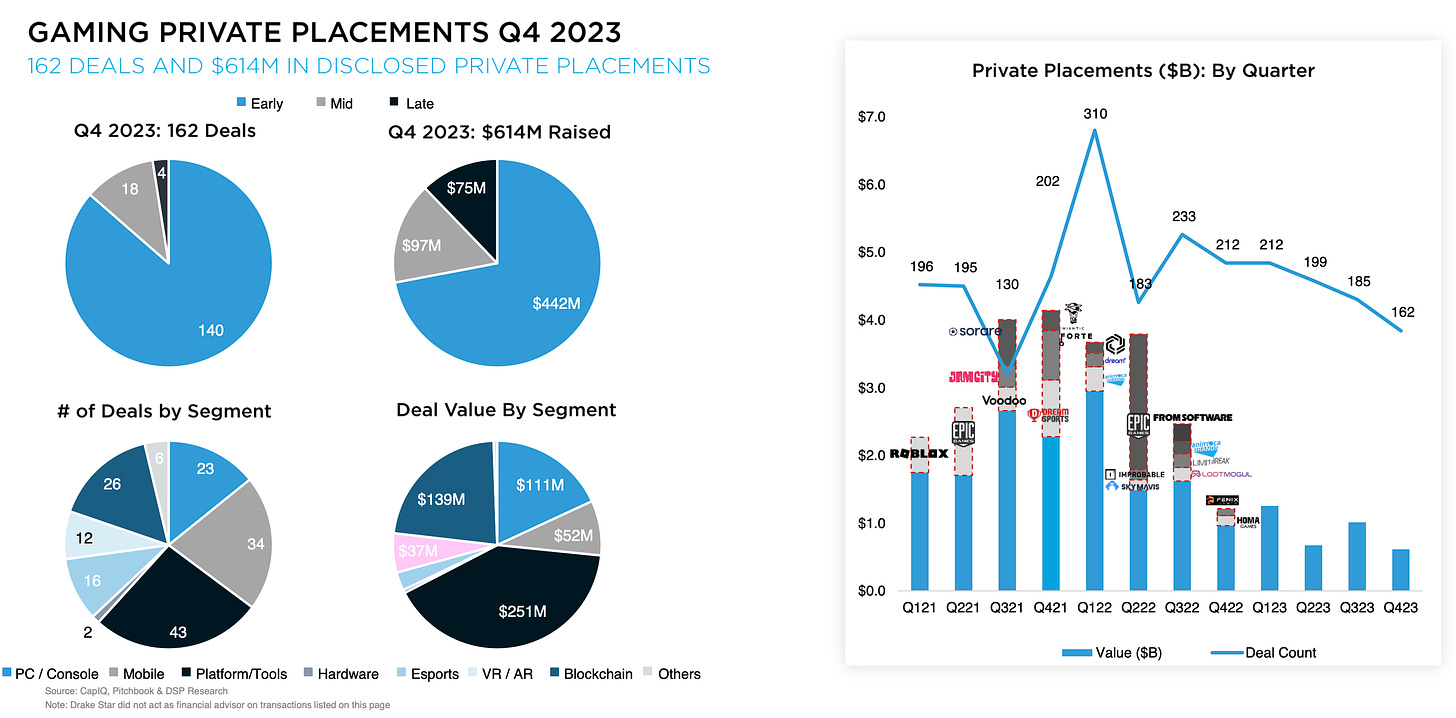

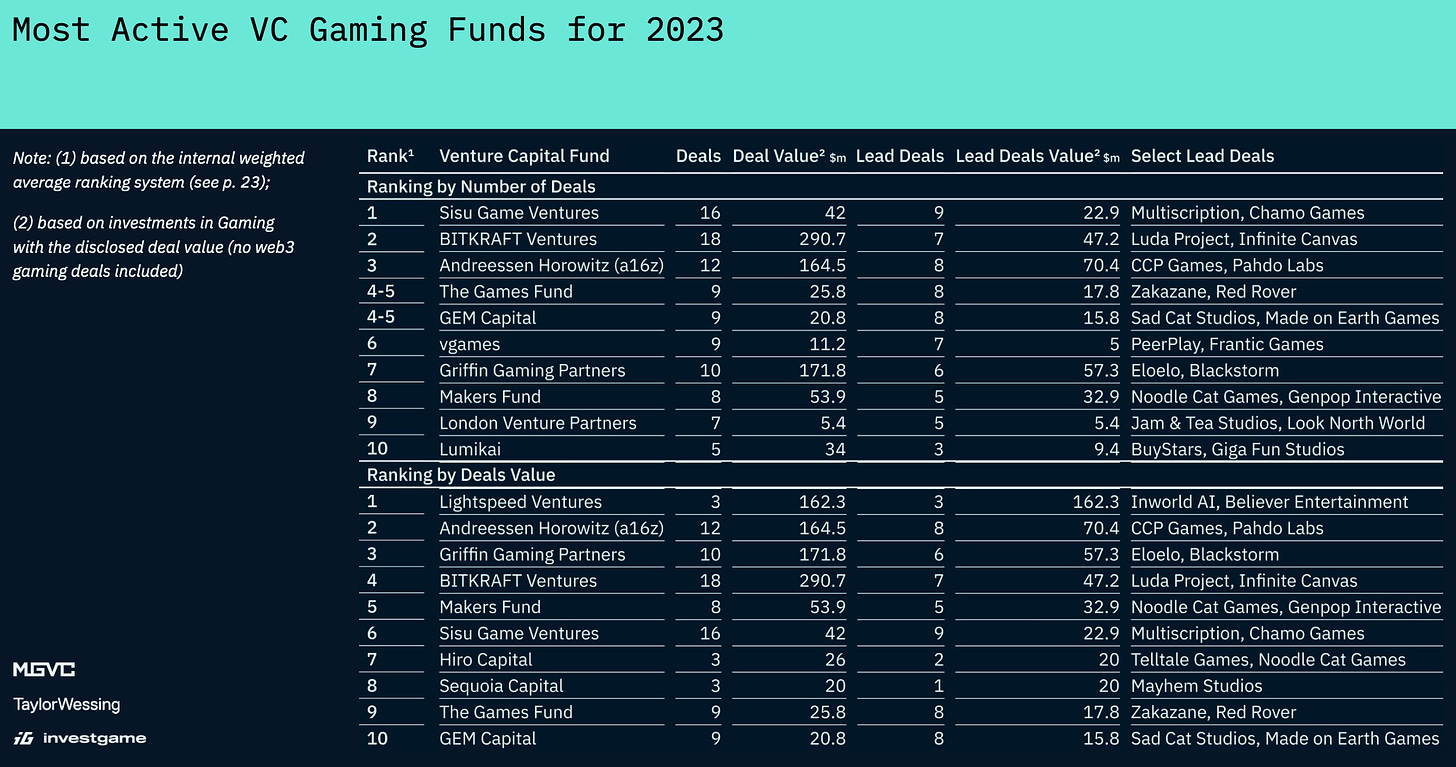

Drake Star Partners: Gaming Investments in 2023

2023 Results

-

The total deal value in 2023 amounted to $86 billion. However, if we exclude the Activision-Blizzard acquisition, the deal size amounted to $20 billion - similar to pre-pandemic times.

-

In 2023, there were 163 merger and acquisition deals with a total value of $10.5 billion. The leader was Savvy Games Group with a deal with Scopely ($4.9B). Also notable were deals between the Goldman Sachs consortium and Kahoot ($1.7B); Tencent and Techland ($1.6B).

-

There were 44 M&A deals for PC/consoles; 37 for mobile; and 25 for platforms. Business activity, overall, returned to pre-COVID levels.

-

In terms of VC investments, over 750 deals were made totaling $3.5 billion. In 2020, there were similar deals totaling $3.4 billion, excluding the Epic Games round. Most investments were in mobile companies (168), followed by blockchain companies (159) and platforms (143). Among the most notable transactions were VSPO ($265 million), Candivore ($100 million), and Second Dinner ($100 million).

-

Bitkraft, a16z, Play Ventures, and Griffin Gaming were the most active VC funds in gaming deals.

Q4 2023 Results

-

There were 43 announced M&A deals in the fourth quarter. There were 33 in the previous quarter. The most notable deals were between Aonic and nDreams; Keywords and The Multiplayer Group; MTG and Snowprint; Devolver Digital and System Era.

-

In the fourth quarter, there were 162 VC deals, at pre-COVID levels. The most notable were at Animoca Brands ($50 million), Leonardo.AI ($47 million), Strikerz ($40 million), and ON ($25 million). Over 85% of the money went to seed and early stages. Investors still fear late-stage investment rounds.

-

Drake Star Partners notes a 13% increase in the valuations of public companies. There was also a significant public offering - Singapore's Grand Centrex Limited (GCL) went public on NASDAQ through SPAC with a valuation of $1.2 billion.

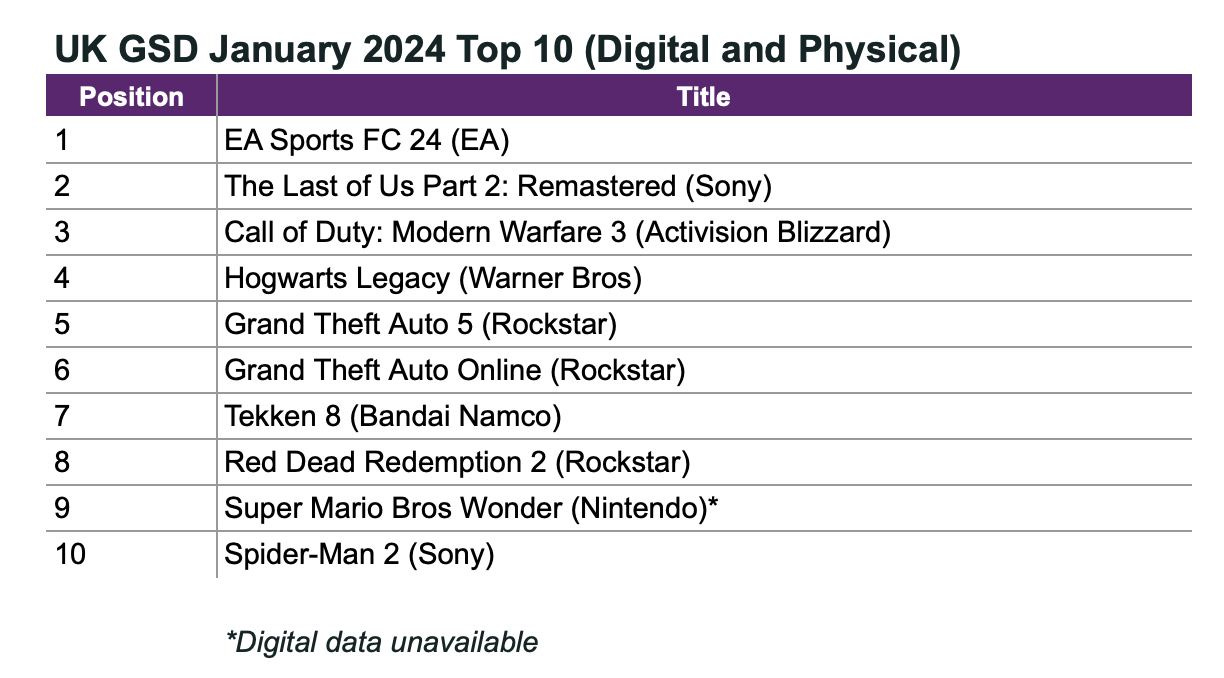

GSD & GfK: Game Sales dropped in January 2024 in the UK

Analytical platforms report only actual sales figures obtained directly from partners. Major publishers, such as Nintendo, do not share sales information for digital copies, for example. The mobile segment is also not taken into account.

Game Sales

-

2.47 million copies of games were sold in the country in January 2024. This is 3% less than the previous year.

-

EA Sports FC 24 was the best-selling game of the month. Interestingly, the results for January are better for the project than for FIFA 23.

-

The Last of Us: Part II - Remastered took second place in the charts. The game sold 2.5 times better in 2 weeks than The Last of Us: Part I. However, it is not entirely clear whether upgrades from the PS4 version were counted or not.

-

Tekken 8 debuted at 7th place. The game sold a third better than last year's Street Fighter 6 in a similar period. Interestingly, most of Street Fighter 6's sales are digital, while Tekken 8's are physical.

There is also no Palworld data because the developer & publisher don’t share the information with GSD. So, in reality, the market might be on a plateau instead of a decline. Or not.

-

Prince of Persia: The Lost Crown debuted at 15th place; Like a Dragon: Infinite Wealth - at 23rd position.

Hardware Sales

-

111 thousand consoles were sold in the UK in January 2024. This is 19% less than last year.

-

PlayStation 5 sales dropped by 17; Nintendo Switch - by 31%; Xbox Series S|X - by 7%.

Considering that last year was the first when PS5 and Xbox Series S|X fully normalized supply chains, the trend may continue throughout the year, as pent-up demand was realized in 2023.

-

687 thousand accessories were sold in January 2024, which is 10% more than the previous year. The best-selling accessories are controllers for PlayStation and Xbox.

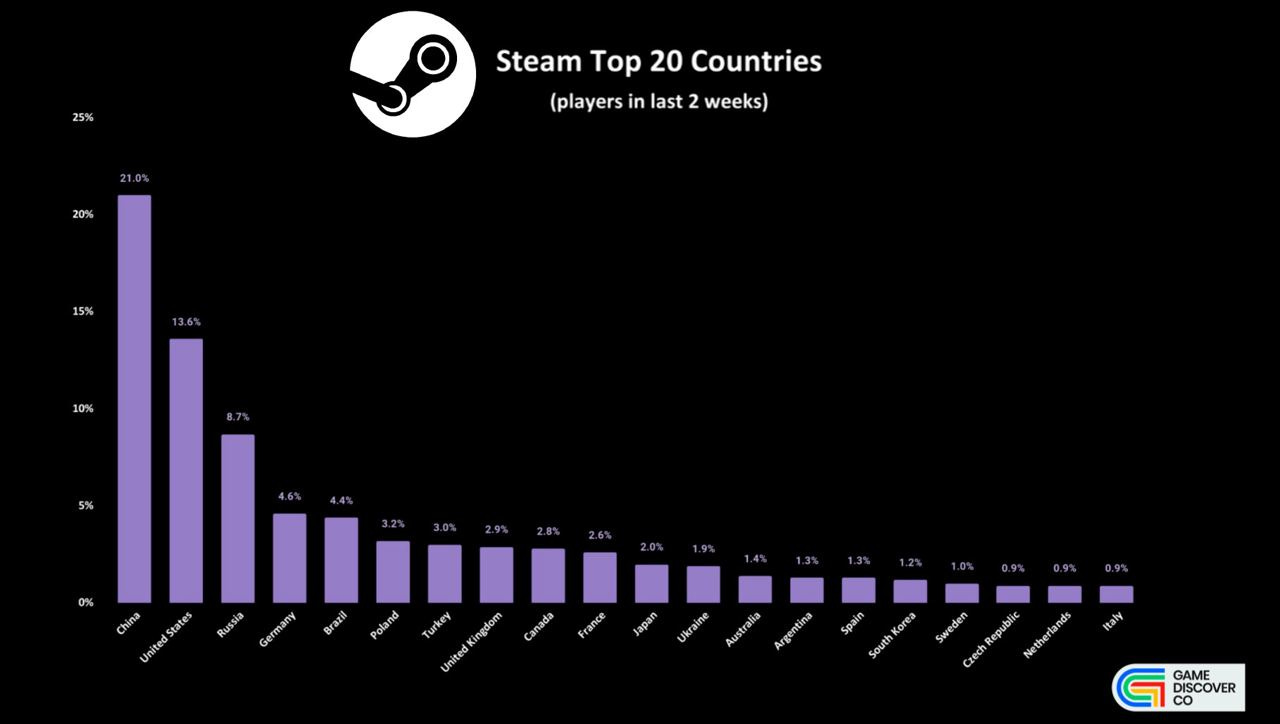

GameDiscoverCo: Where Steam and PlayStation audiences are in 2024

Simon Carless from GameDiscoverCo decided to track from which countries people played on Steam and PlayStation over the last 2 weeks (from January 16, 2024, to January 30, 2024).

There is a hypothesis that this figure more realistically reflects the distribution of the active audience by country and excludes those who play occasionally.

Steam Statistics

-

21% of the audience on Steam is from China. This is 71% more than in the study that examined all players on the platform.

These figures could have been influenced by the release of Palworld, 36.4% of which audience is from China.

-

The second largest audience is from the USA (13.6%); in third place is Russia (8.7%).

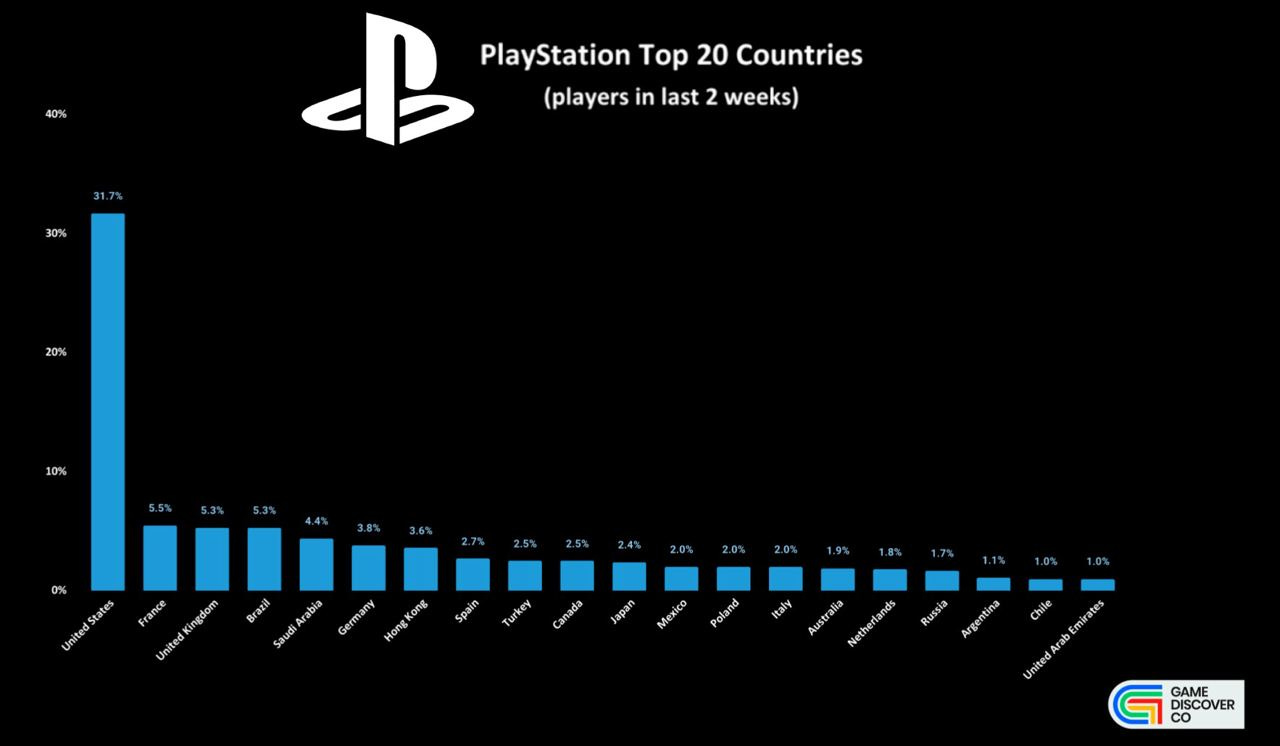

PlayStation Statistics

-

31.7% of the audience on PlayStation over the past two weeks is from the USA.

-

Following are France (5.5%), the United Kingdom (5.3%), and surprisingly, Brazil (5.3%).

-

There is also a large audience in Hong Kong (3.6% of the total - possibly due to "gray" shipments of consoles to China) and Turkey (2.52% of the total audience - most likely due to the overflow of the audience from Russia).

-

It is also interesting that Arab countries account for 5.4% of the entire PlayStation audience. The value of the region for Sony is increasing.

Sensor Tower: IP in Games Landscape Report

Overview

-

Mobile games based on IP earned $16 billion in 2023 from in-game purchases.

-

$5 billion of this amount came from gaming IPs (Pokemon GO; Call of Duty); $2 billion from anime and manga (Uma Musume Pretty Derby); $1.1 billion from sports franchises (EA Sports FC Mobile); $1 billion from board games (Monopoly); $400 million from comics (Marvel or DC); $320 million from television IPs (Star Trek).

-

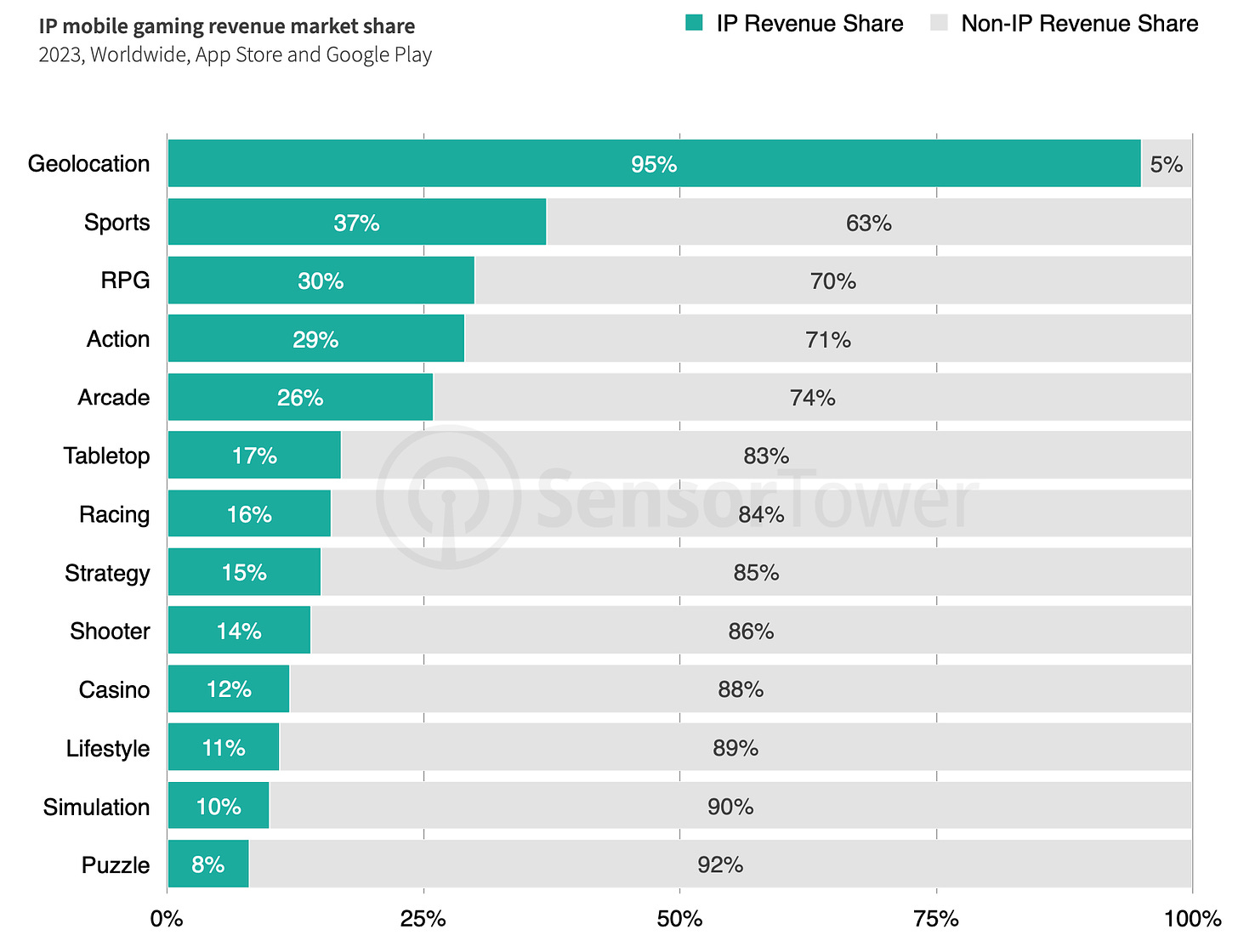

In geolocation-based projects, the share of IP games is 95%. In sports projects - 37%; in RPGs - 30%; in action games - 29%; in arcades - 26%. IAP revenue for 2023 was considered. Less saturation in board games (17%); racing (16%); strategies (15%); shooters (14%).

-

All major launches on PC and consoles in 2023 in the USA were either series continuations or IP games.

Successes of 2023

-

MONOPOLY GO! - the highest-earning mobile game in the world based on IP.

-

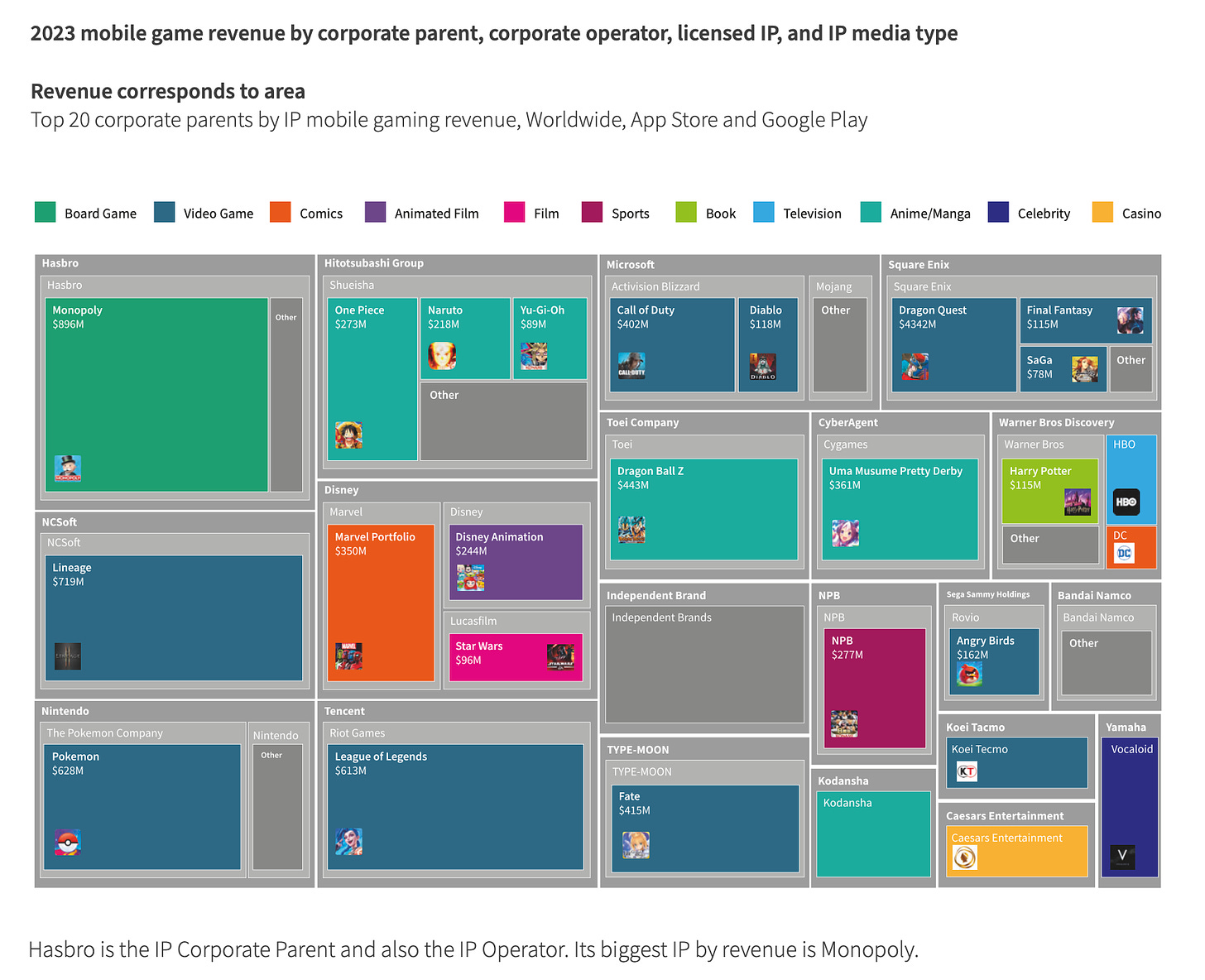

Hasbro - the highest-earning IP holder in the mobile market. According to Sensor Tower, Monopoly GO! earned $896 million net. Following were NCSoft (Lineage - $719 million); Nintendo (Pokemon - $628 million and other IPs); Hiotsubashi Group (One Piece - $273 million; Naruto - $218 million; Yu-Gi-Oh - $89 million); Disney (Marvel - $350 million; Disney animated films - $244 million; Star Wars - $96 million).

-

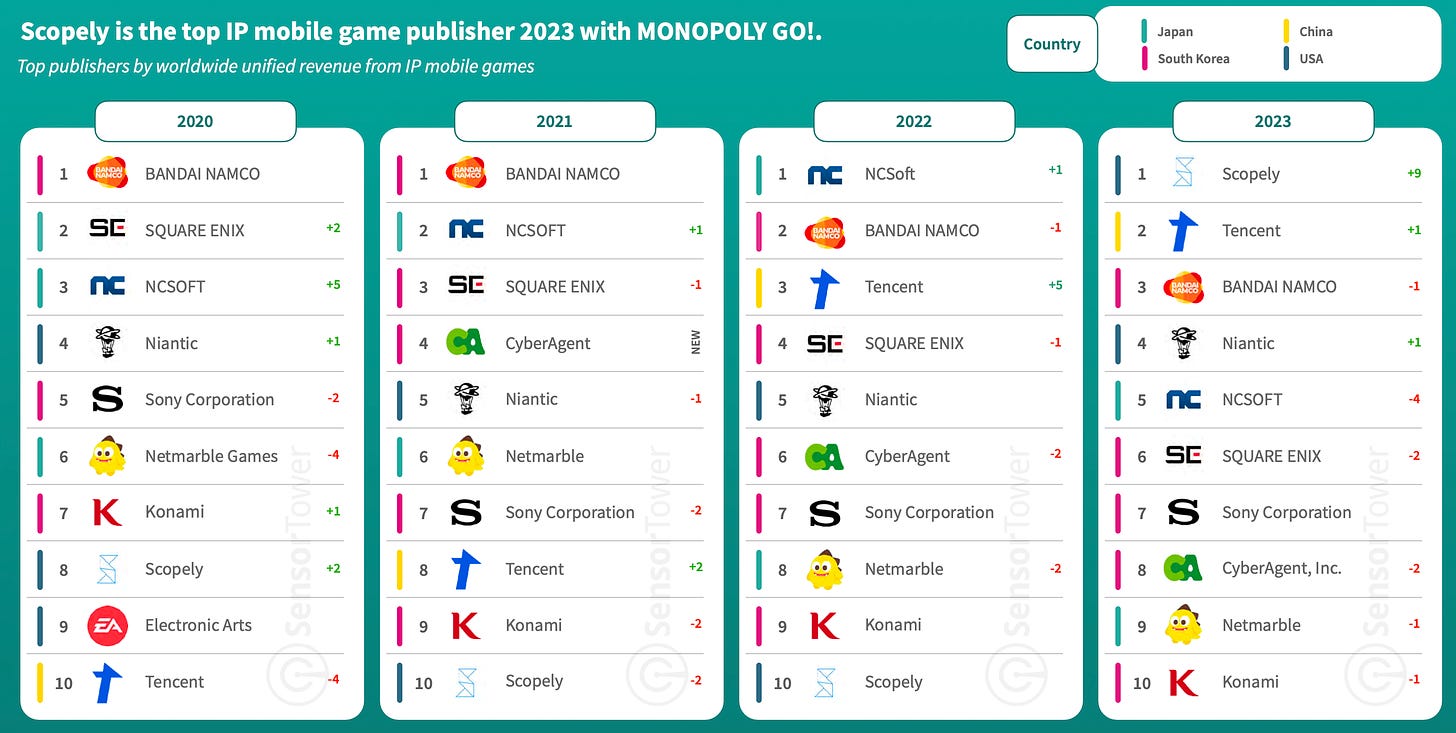

Thanks to the success of MONOPOLY GO!, Scopely became the largest revenue publisher of IP games. In 2020-2021, BANDAI NAMCO led due to Dragon Ball Z; in 2022, NCSoft took first place (Lineage).

IP Revenue by Genre and Country

-

RPGs account for 36% of all revenue from licensed IPs.

-

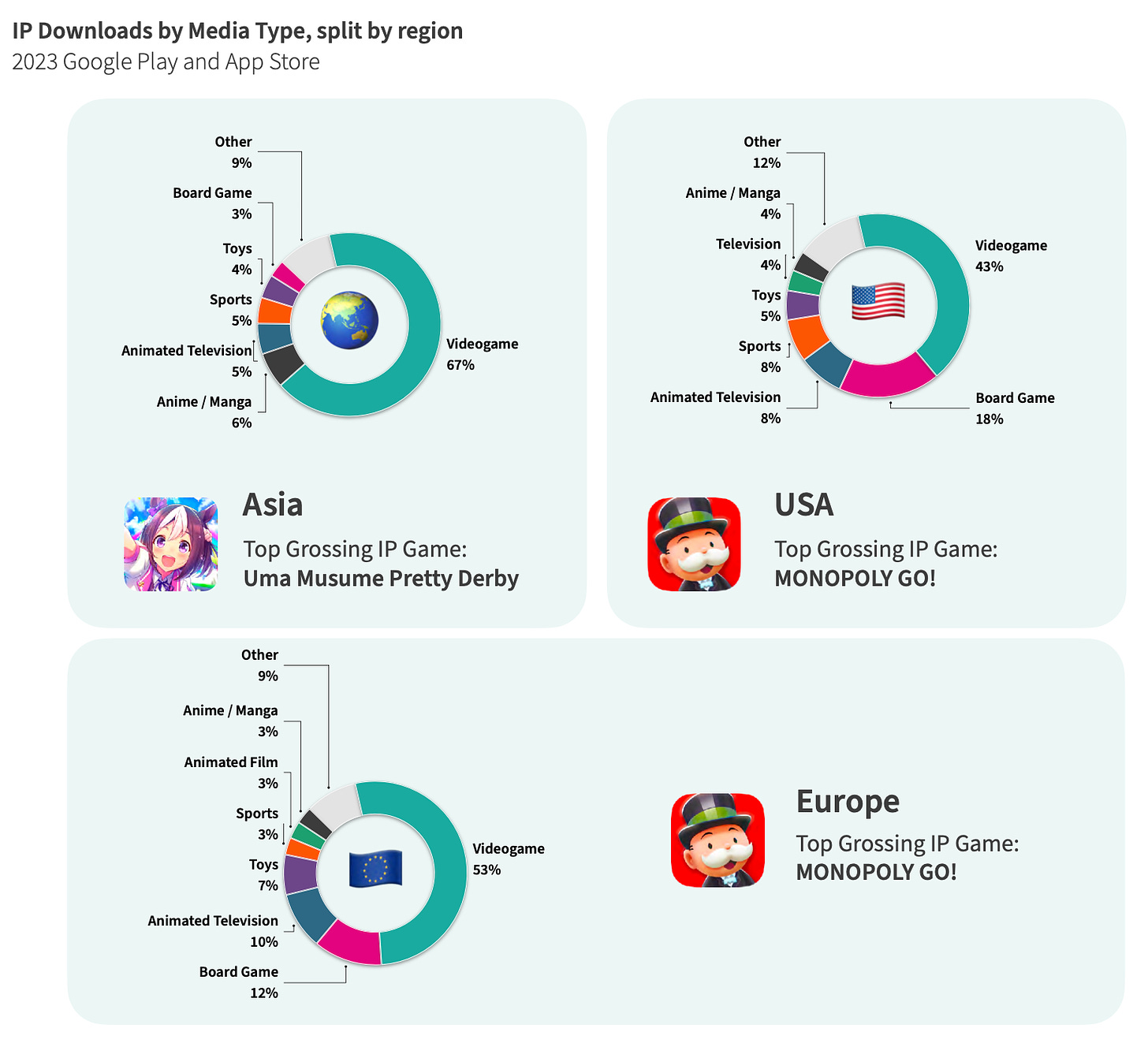

IP projects are most popular in Asia. This region accounts for 70% of all game downloads for licensed IPs.

-

In European countries, gaming IPs dominate revenue. Only France stands out - 31% of revenue from licensed games in this region comes from anime projects.

-

RPGs are the most popular (and profitable) genre for gaming or anime licensed projects.

-

The USA and Asia are the main regions for sports IP projects. Surprisingly, 37% of the audience for EA Sports FC is from South Korea; 20% from China; 10% from the USA. Germany and the UK, with their football culture, make up only 3%.

Hogwarts Legacy Case

-

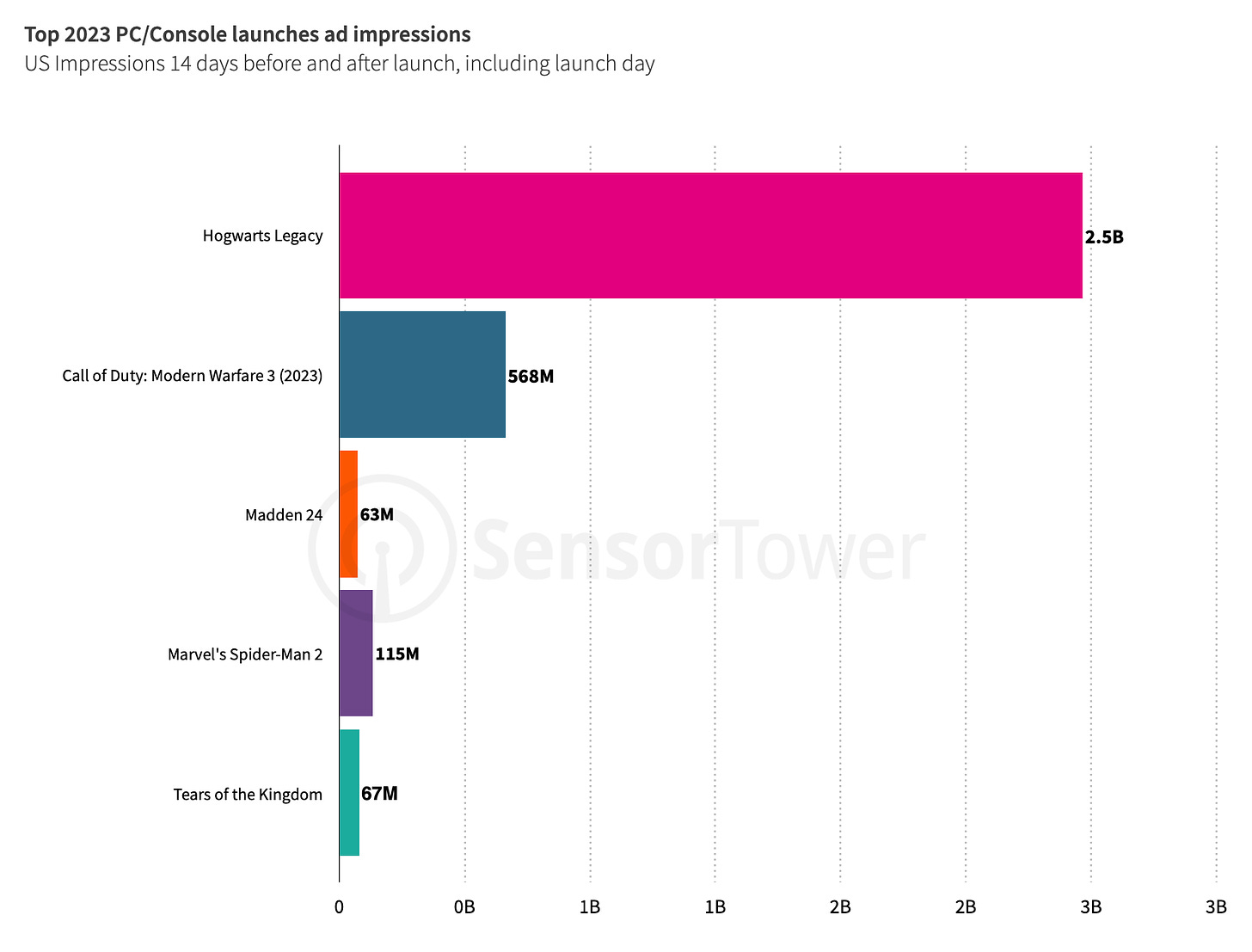

Hogwarts Legacy surpassed its closest competitor (Call of Duty: Modern Warfare 3) by 5 times in terms of advertising coverage in the first 2 weeks after launch in the USA.

-

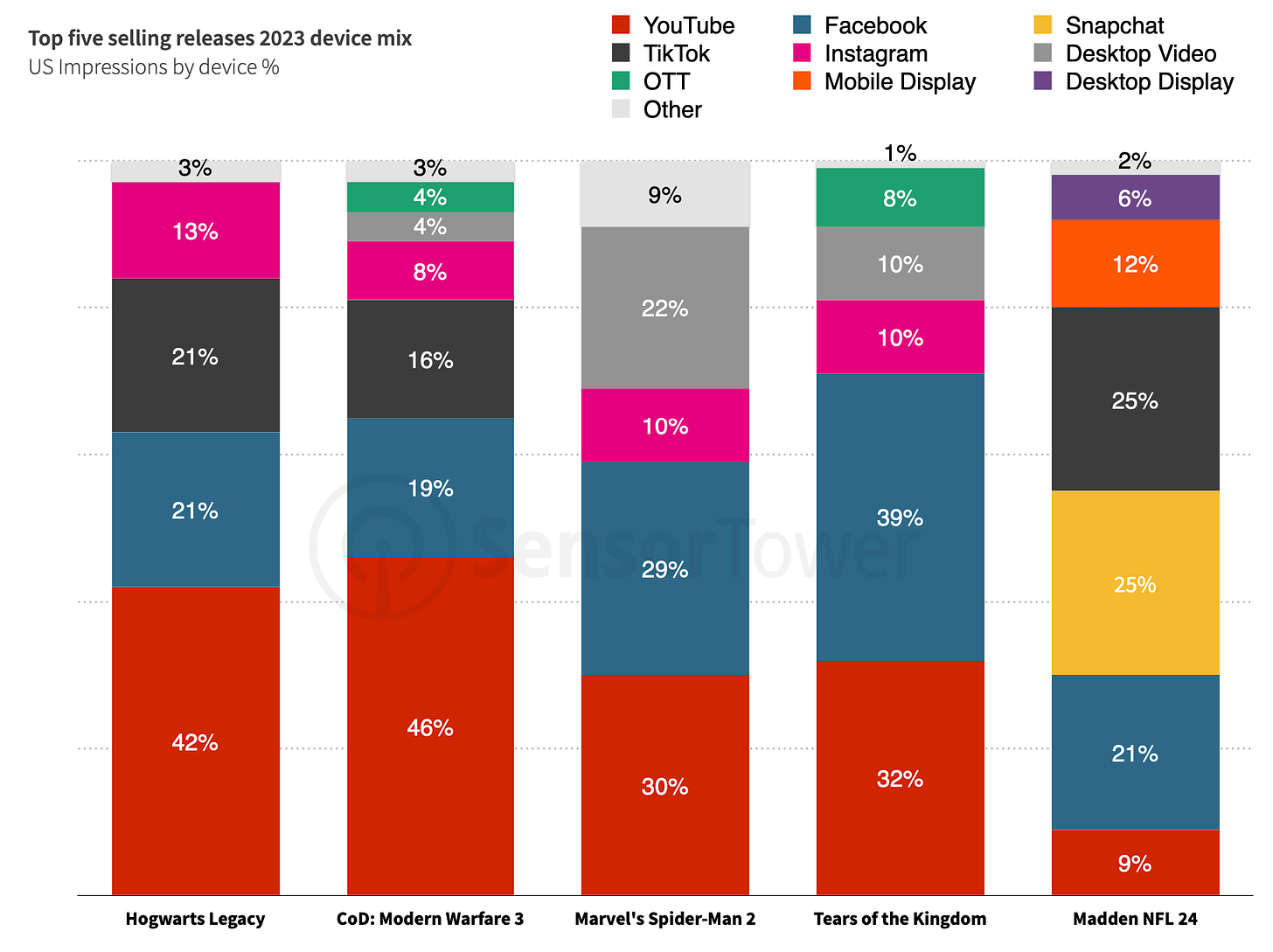

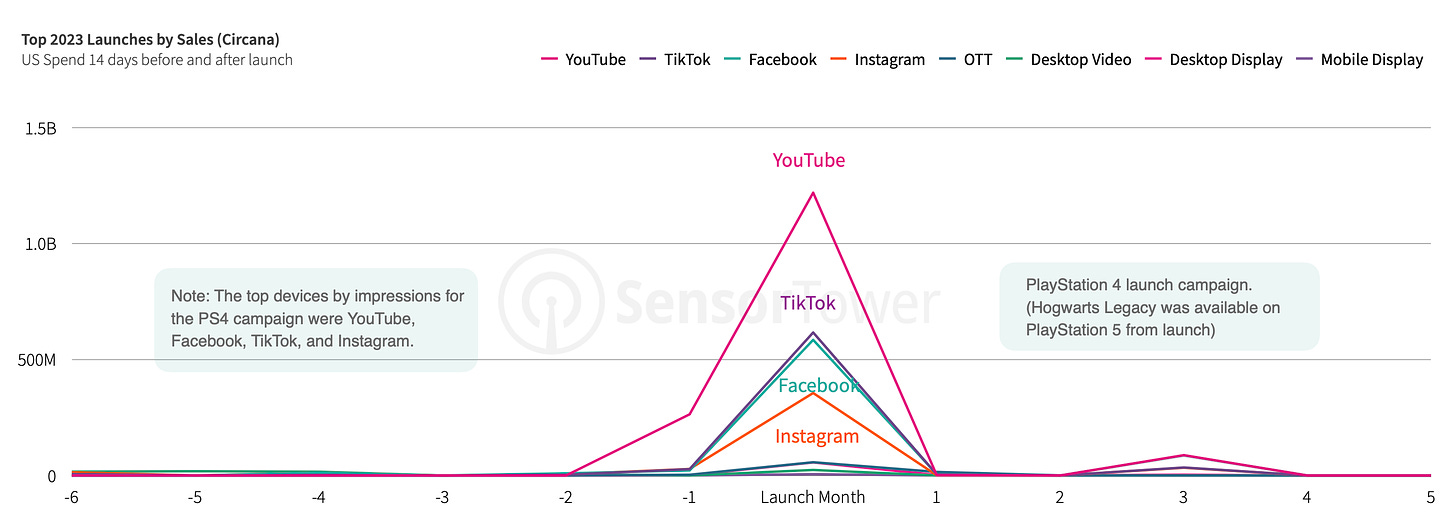

YouTube is a priority channel for PC/console games, which Hogwarts Legacy actively utilized.

-

Despite being available on PC and Xbox Series S|X, all advertising was exclusively branded for PlayStation.

-

The advertising campaign for Hogwarts Legacy was entirely focused on the first month after release. There was then a small activation upon the game's release on PlayStation 4 and Xbox One.

-

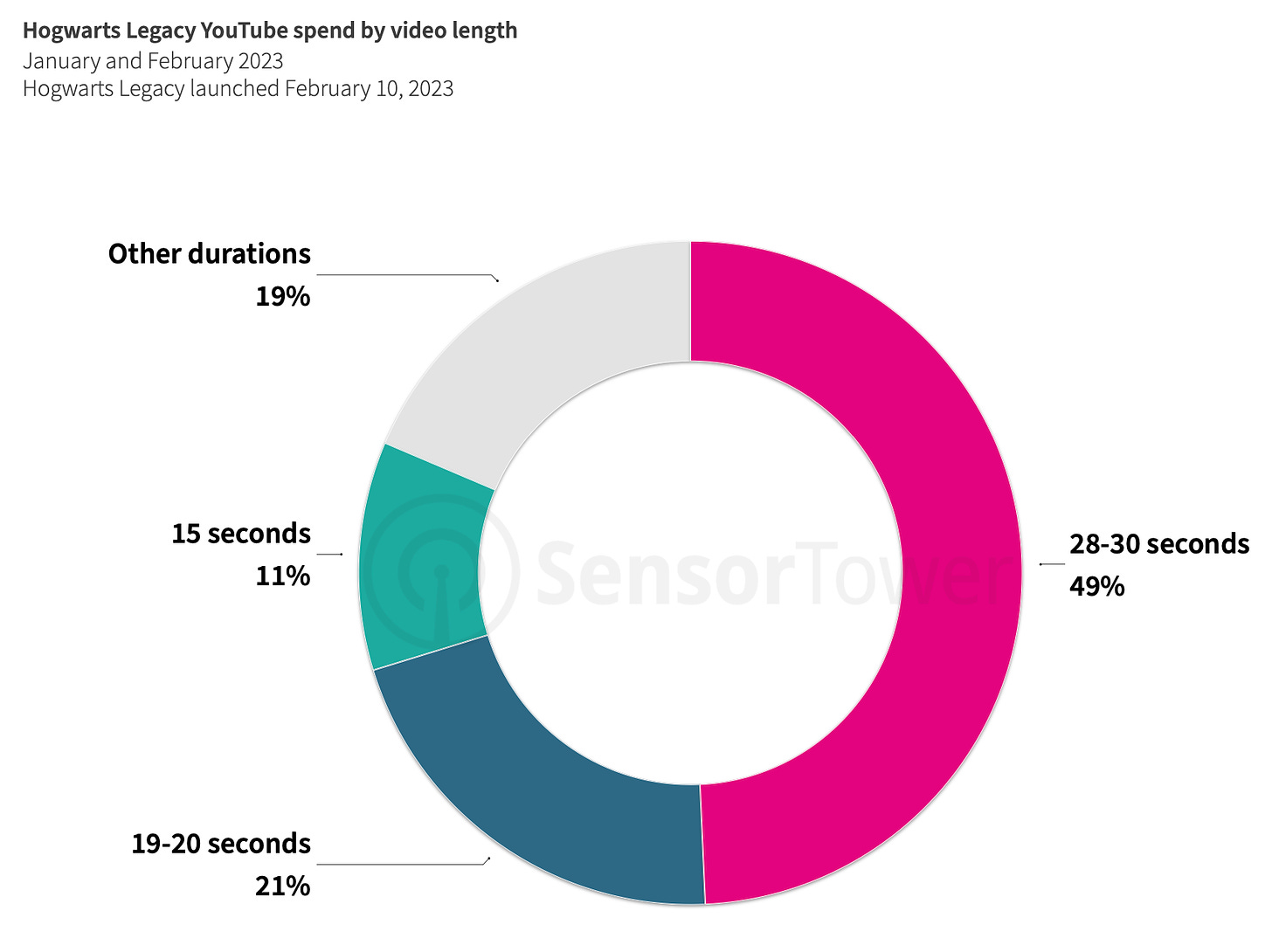

49% of the project's advertising budget was spent on 30-second videos.

IP Collaborations in Games

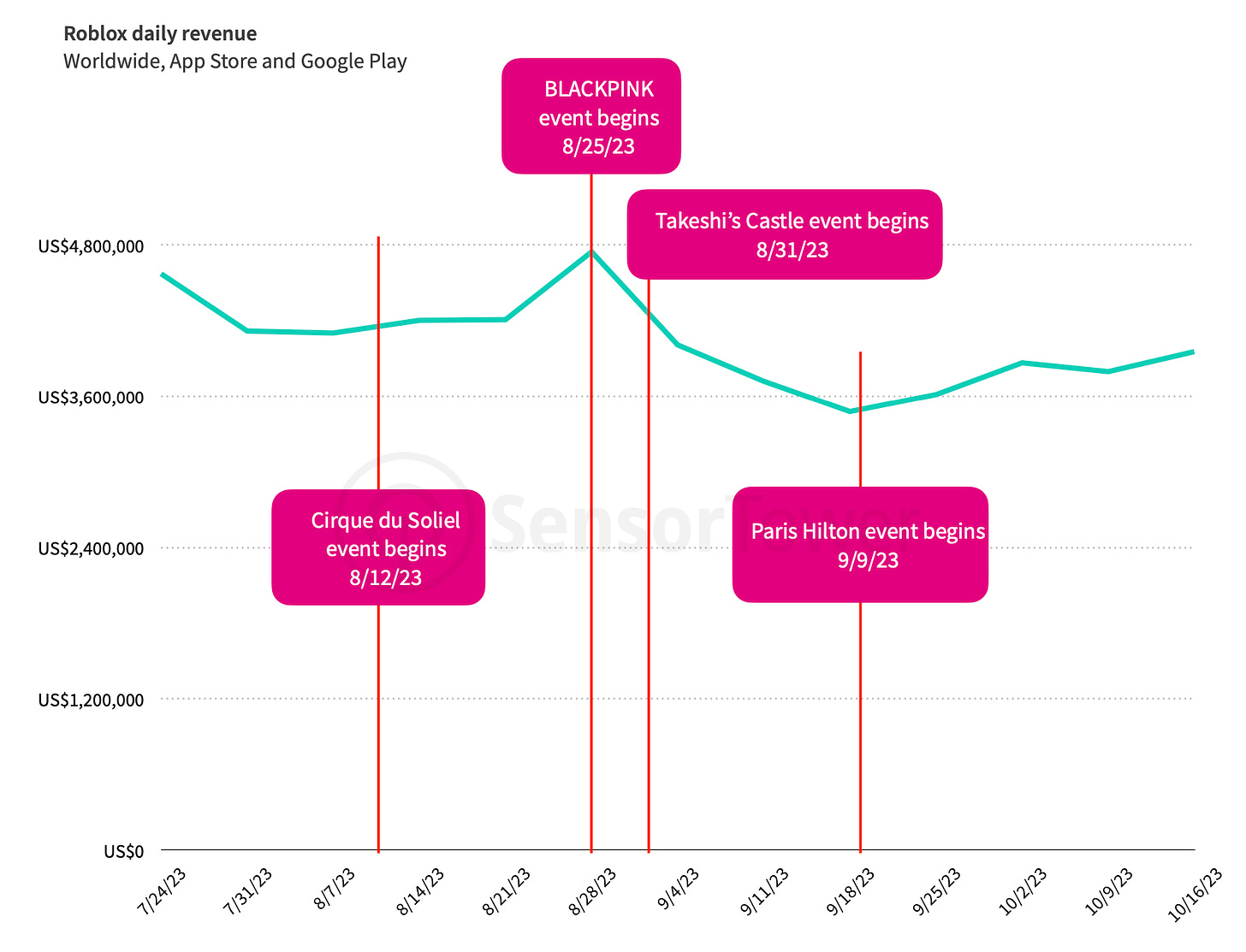

-

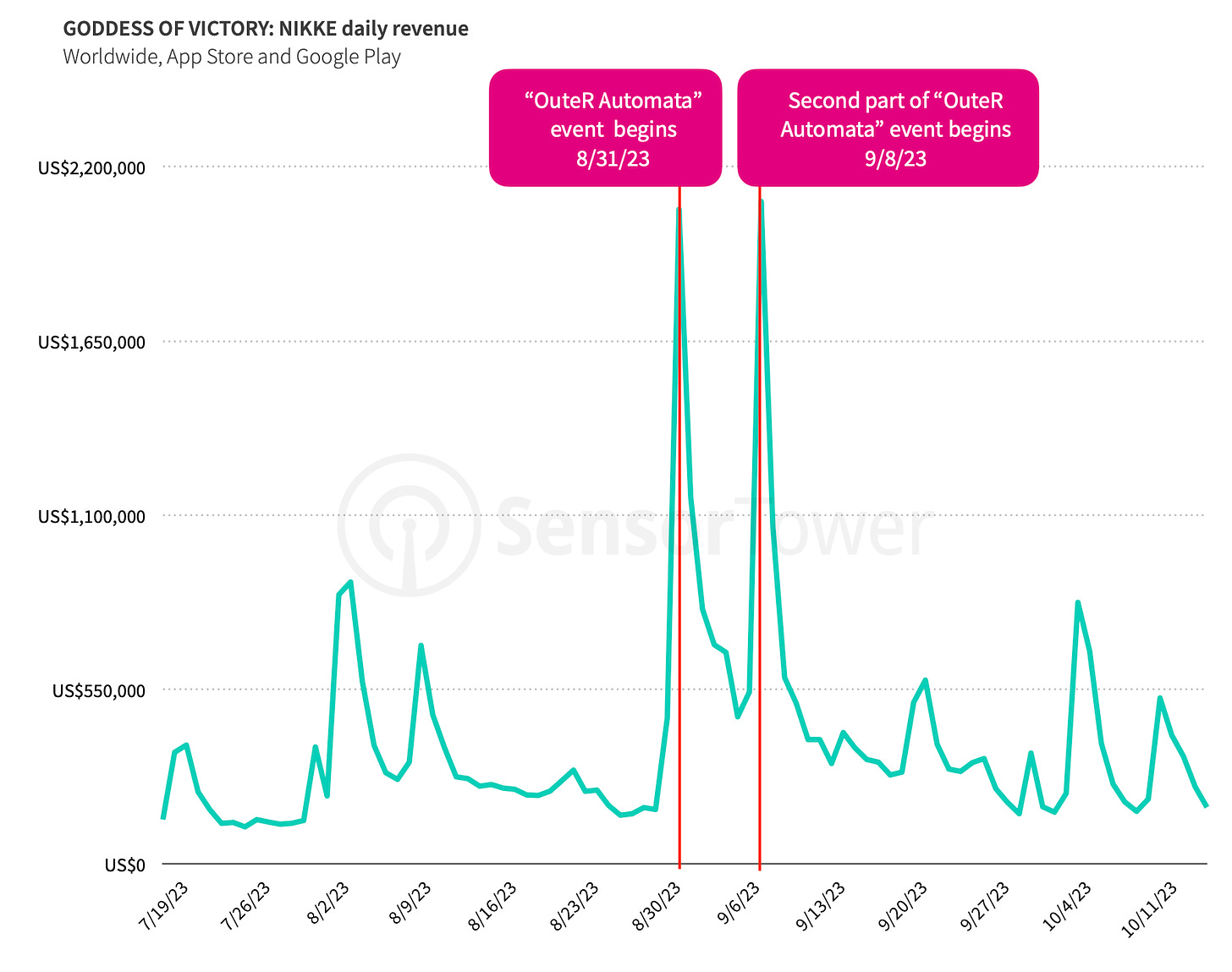

In August-September 2023, for example, Roblox held four events in a month. With Cirque du Soleil, K-Pop group BLACKPINK; Japanese show Takeshi’s Castle, and Paris Hilton. These events did not have a significant impact on revenue.

-

Another example is the collaboration Goddess of Victory: Nikke with NieR: Automata. Distributed over two stages, the event increased the project's daily revenue almost 10 times.

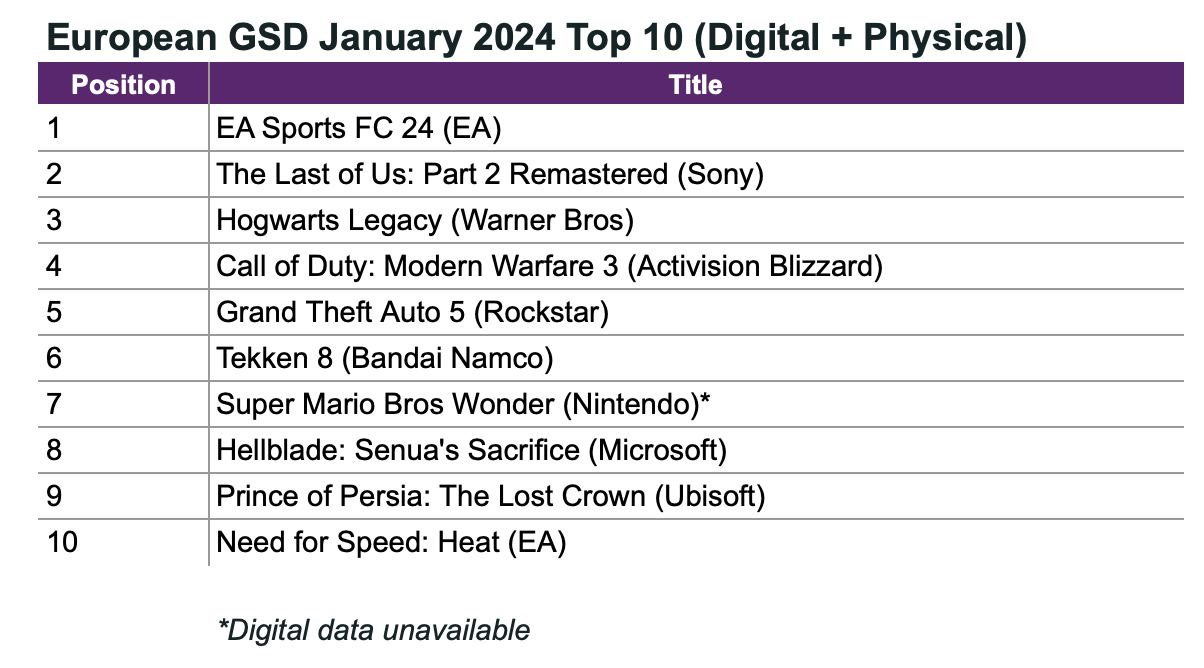

GSD & GfK: PC/console game sales in Europe in January 2024 decreased by 7%

Analytical platforms report only actual sales figures obtained directly from partners. Nintendo, for example, does not share information on digital copy sales. The mobile segment is also not taken into account.

Game Sales

-

12.14 million copies of games were sold in Europe in January 2024. This is 7.3% less than the previous year.

-

EA Sports FC 24 was the best-selling game of the month in the region. Sales were almost equivalent to FIFA 23 results in January 2023.

-

The Last of Us: Part II Remastered became the best-selling new release of the month (second place). Sales for the first 2 weeks were 2.5 times higher than The Last of Us: Part I. However, this does not mean that Sony earned more - upgrading from the PS4 version was possible for €10.

-

Tekken 8 debuted at 7th place on the chart. The game sells 80% better than Street Fighter 6.

-

Hellblade: Senua’s Sacrifice suddenly entered the chart at 8th place. The game received a significant discount on Steam.

Palworld is not on the list because developers do not share data with GSD.

Hardware Sales

-

475 thousand consoles were sold in Europe in January 2024. This is 1.4% less than the previous year. And the figures, as before, do not include Germany and the United Kingdom.

-

PlayStation 5 is the top-selling system in the region. Unlike in the UK, sales did not decline in Europe.

-

However, Nintendo Switch experienced a significant decline in sales. The console is approaching its 7th birthday, and it is expected that a new console will be released later this year.

-

Sales of Xbox Series S|X slightly declined compared to the previous year.

-

European players bought 1.8 million accessories in January. This is 1.4% less than in January 2023.

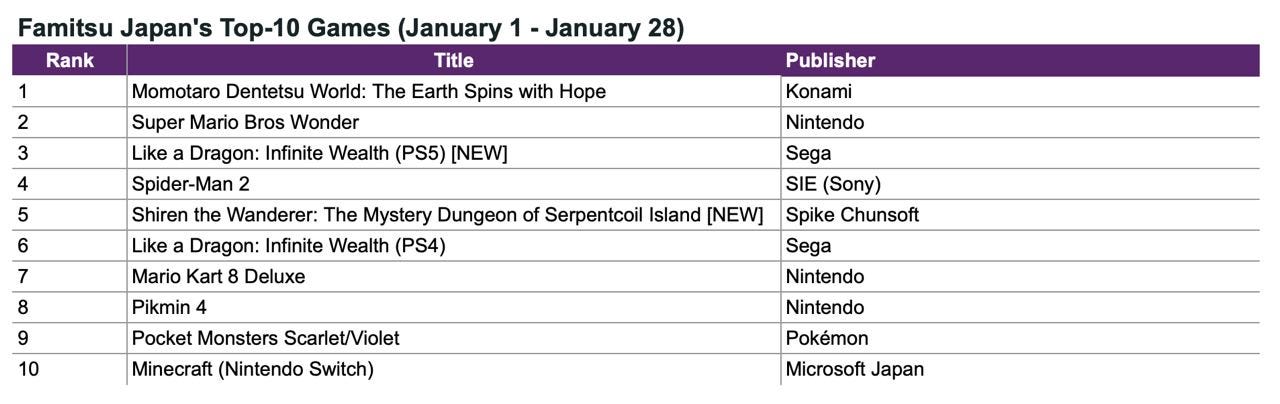

Famitsu: Like a Dragon: Infinite Wealth became the best-selling game of the month in Japan in January

Famitsu only takes into account physical sales.

Game Sales

-

Physical sales of Momotaro Dentetsu World: The Earth Spins with Hope amounted to just over 153 thousand copies, formally placing the game at the top of the physical charts.

-

However, Like a Dragon: Infinite Wealth, released on January 26, sold 103 thousand physical copies on PS5 and 77.1 thousand on PS4. If it weren't for Famitsu's chart peculiarities, the game would have topped the sales chart.

-

Super Mario Bros. Wonder, in second place, sold 151.5 thousand physical copies.

-

Marvel’s Spider-Man 2 is also performing well with 98.1 thousand copies sold.

-

In January, Nintendo held 34.1% of the physical gaming market; SEGA - 12.3%; Konami - 10.2%.

Hardware Sales

-

Nintendo Switch remains the clear leader in sales. 241.2 thousand systems were sold in January, with the majority of sales attributed to the OLED version.

-

PlayStation 5 comes in second in sales with 185.4 thousand systems sold.

-

Xbox Series S|X sold 7.6 thousand consoles in January.

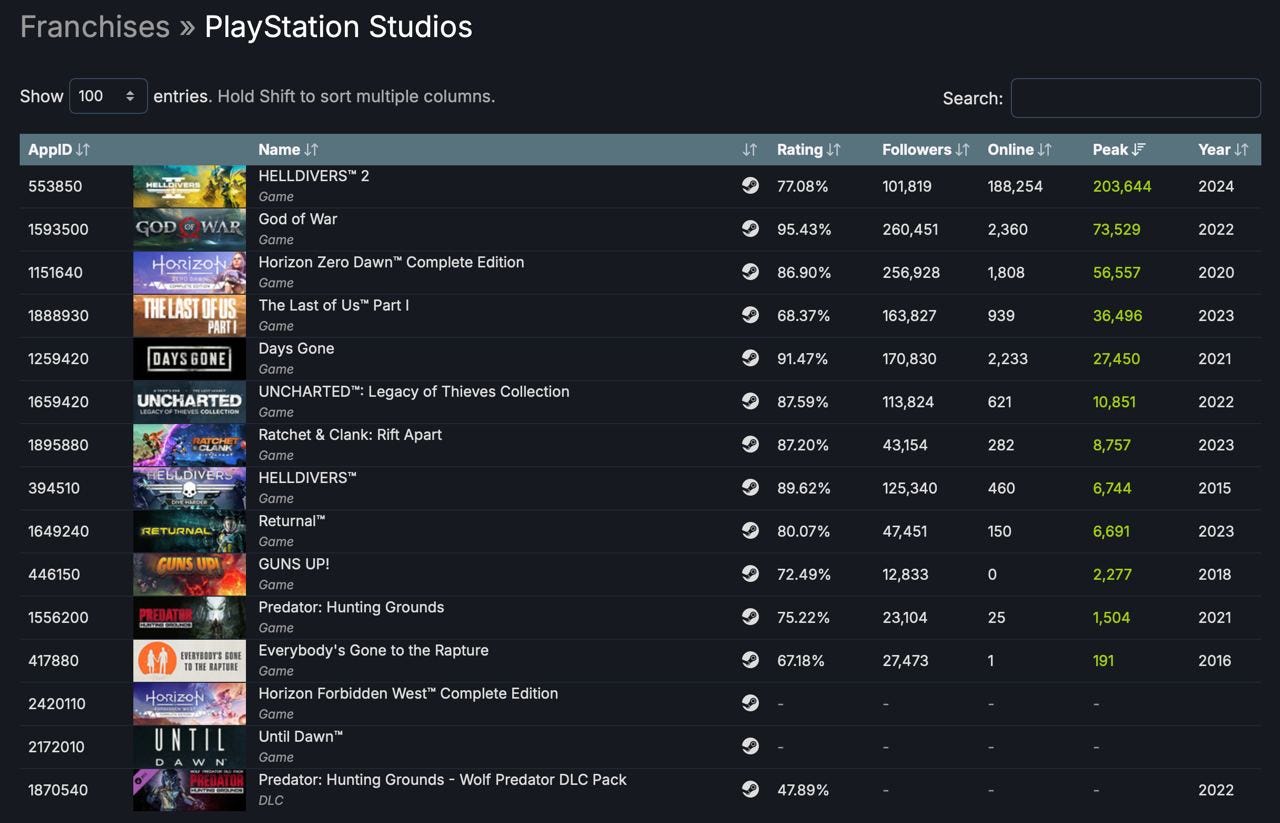

Helldivers 2 is the most successful release of PlayStation Studios on PC in terms of CCU, but Destiny 2 numbers are still higher

-

Currently, the peak CCU for Helldivers 2 stands at 203.6 thousand users.

-

The previous record for PlayStation Studios belonged to God of War, which had over 73 thousand users playing simultaneously.

Of course, it's worth considering the genre specificity here. All previous Sony releases on the platform are geared towards single-player gameplay.

-

Meanwhile, the peak CCU for Destiny 2 on Steam, which is now also in Sony's portfolio, is 316.7 thousand. This was set in March 2023.

-

The peak CCU for the first Helldivers was 6.7 thousand people. In terms of this metric, the sequel's results are more than 30 times higher.

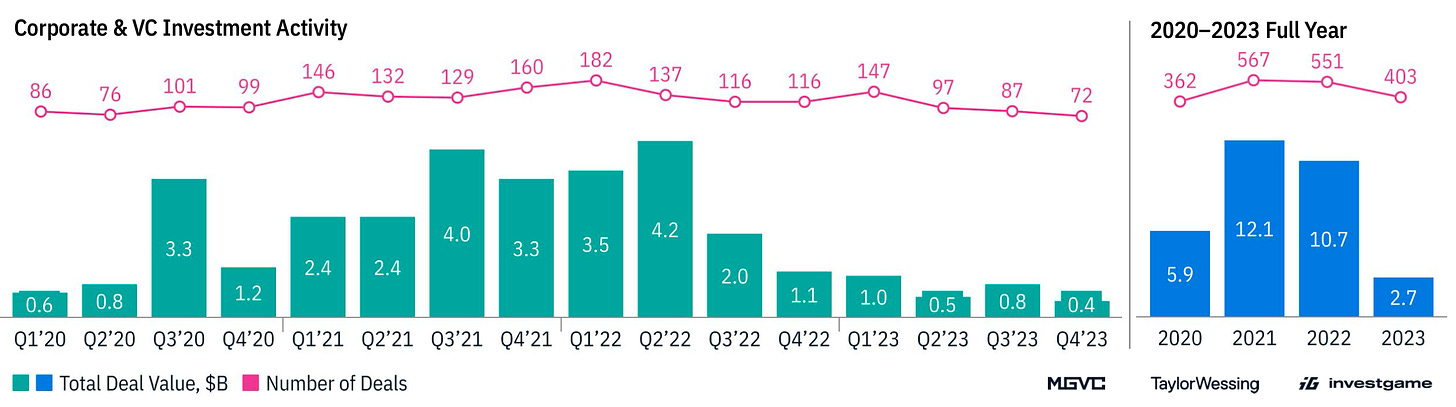

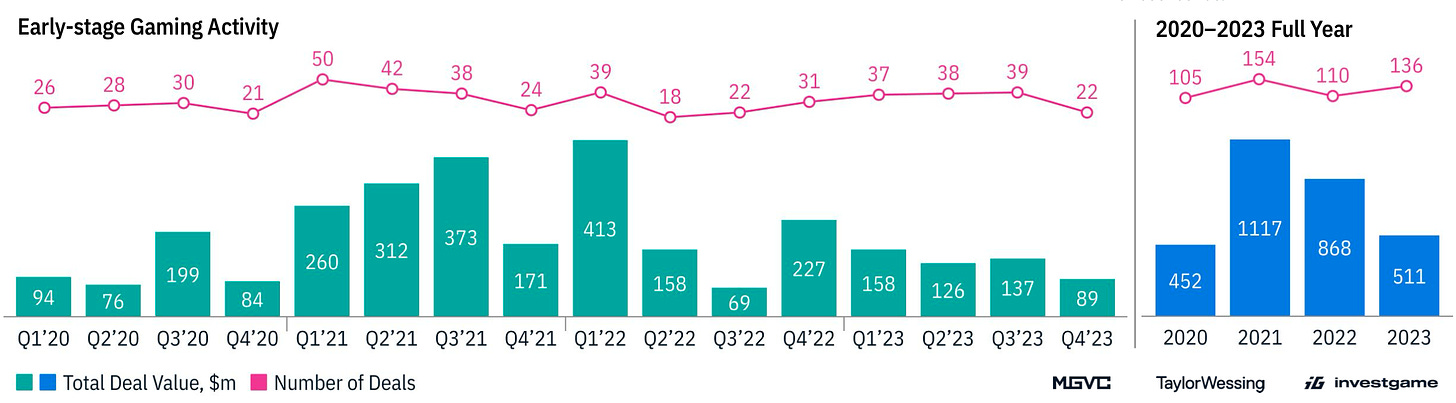

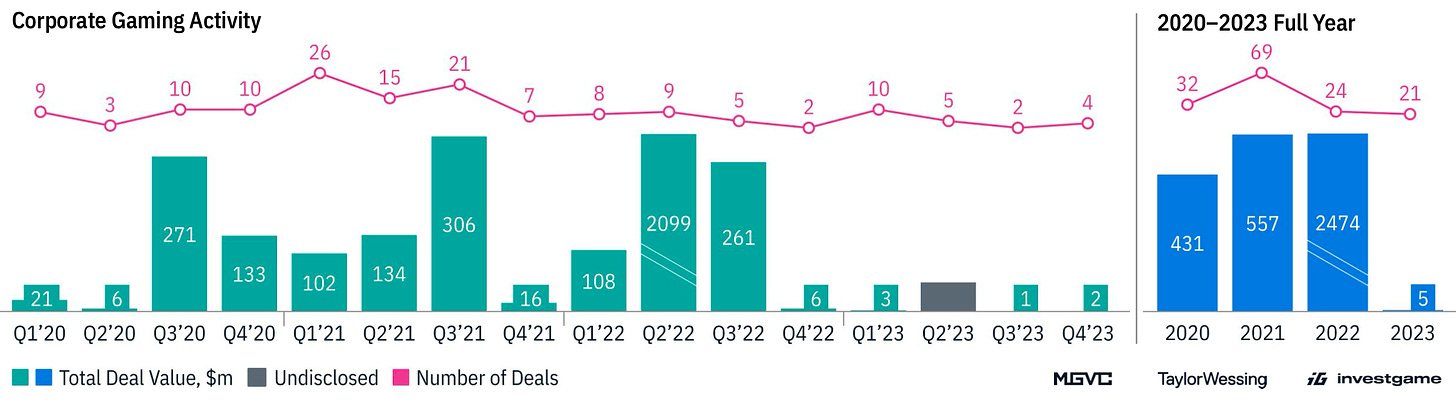

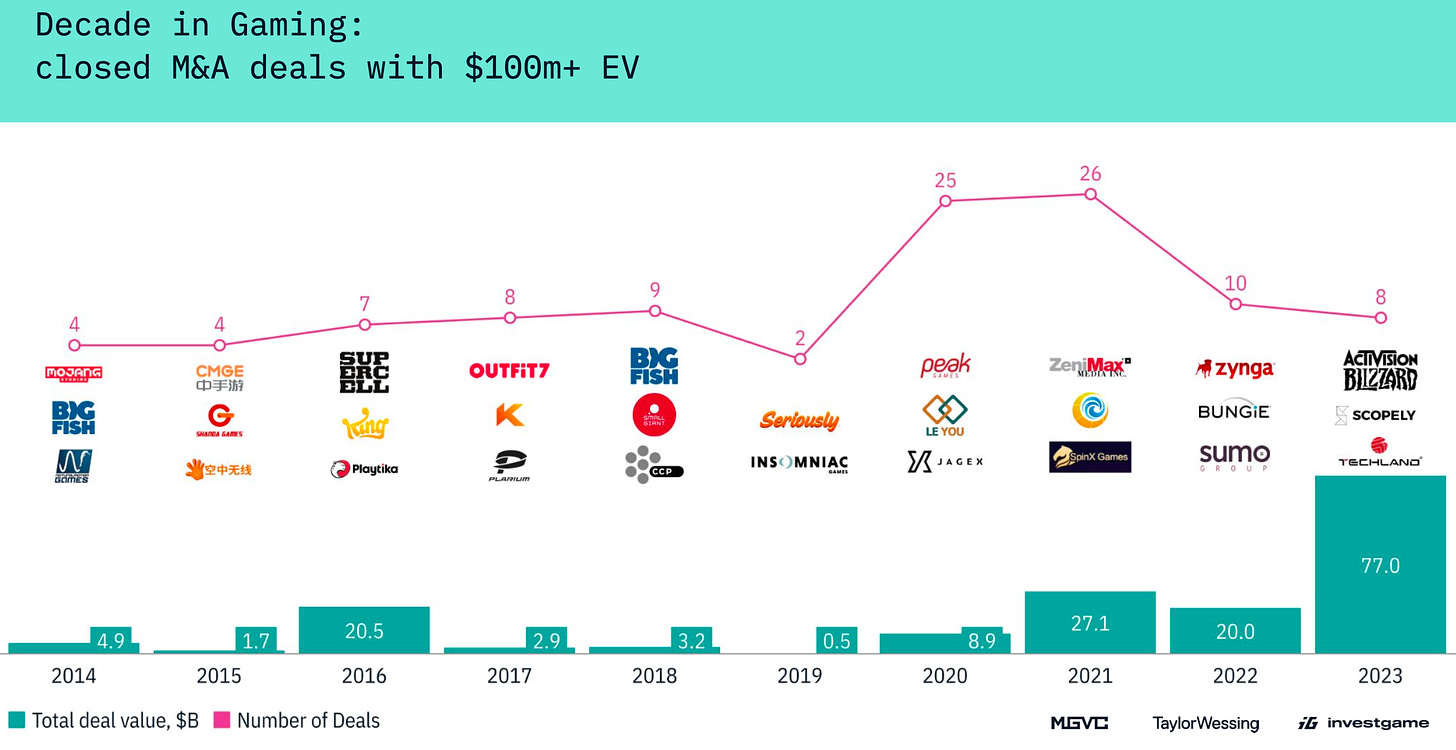

InvestGame: Gaming Investments in 2023

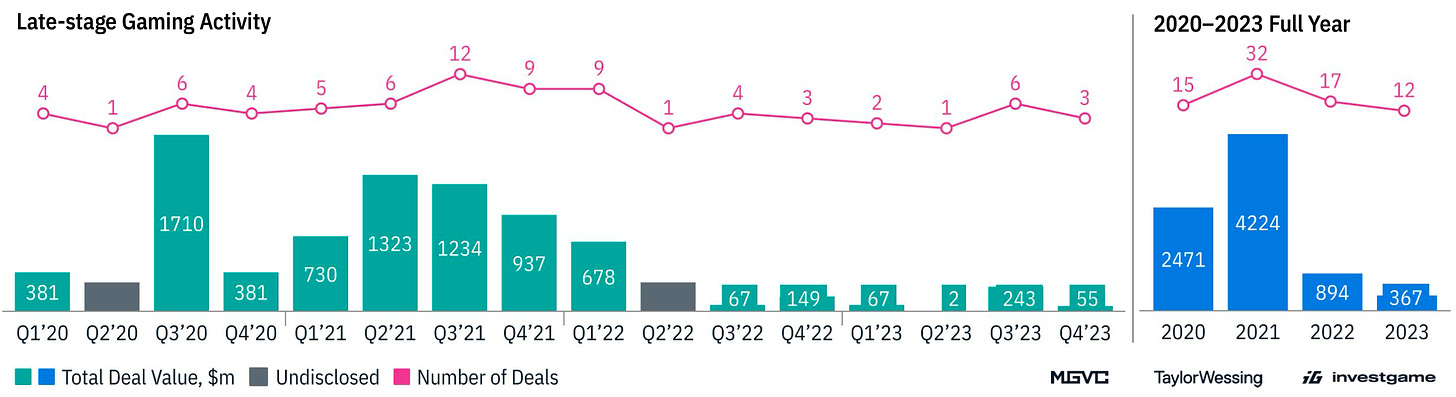

Private Investments

-

In 2023, 403 deals were made totaling $2.7 billion. This marks a 4-fold decrease in volume compared to the previous year and a 36% decrease in the number of deals.

-

Speaking specifically about developers and publishers, in 2023, there were 136 deals (+23.6% compared to 2022) in the early stages totaling $511 million (-70% compared to 2022).

-

In later rounds, there were 12 deals in 2023 (30% less than in 2022) totaling $367 million (2.4 times less than in 2022). This also covers only deals with developers and publishers.

-

Moreover, in January 2024 alone, two major deals occurred - a $1.5 billion transaction between Disney and Epic Games; and a $110 million round for Build a Rocket Boy.

-

InvestGame experts note that in 2024, we may see an increase in deals in later rounds, as well as the closure of companies that received investments in 2020-2022 (companies that fail to show results and/or cannot attract additional funding due to high valuations from previous rounds).

-

Corporate investment funds are more inclined to engage in joint deals with VC funds, which helps reduce financial risks.

-

The USA, Western Europe, Asia, and the MENAT region are the most active markets in terms of VC deals.

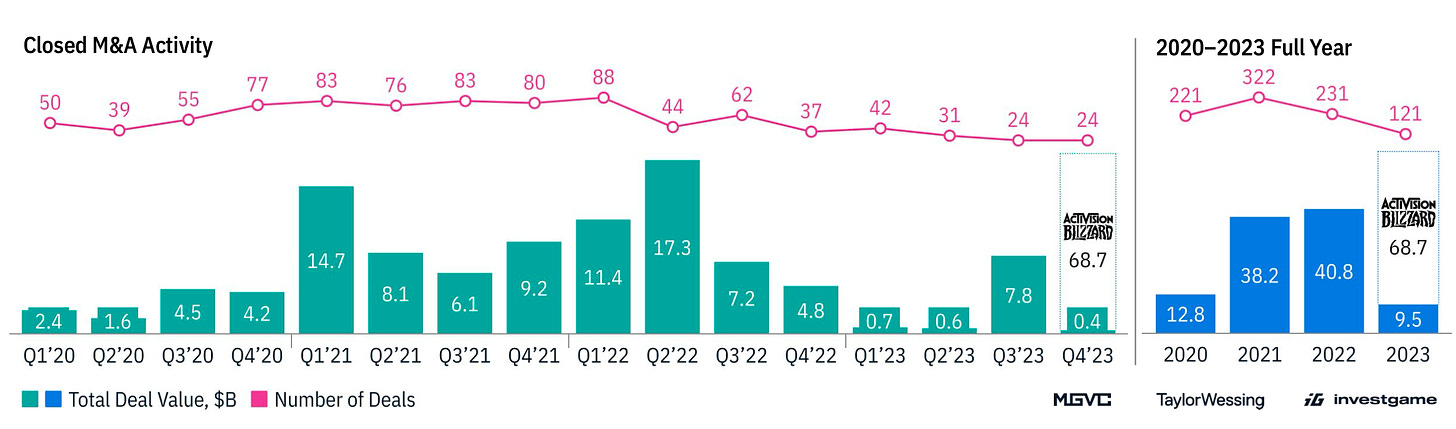

M&A

-

Taking into account the Microsoft and Activision Blizzard deal, the volume of M&A deals in 2023 amounted to $78.2 billion. This is almost twice the amount in 2022 ($40.8 billion). Excluding this deal, there were M&A transactions worth $9.5 billion in 2023, 4.3 times less than the previous year. The number of deals dropped from 231 in 2022 to 121 in 2023.

-

InvestGame's forecast for 2024 is an increase in business M&A activity. For instance, a deal has already occurred between CVC and Haveli to acquire Jagex.

-

Overall, large companies ended 2023 confidently, setting an optimistic tone. However, recession risks, platform regulations, and state interventions (such as laws on loot boxes) could impede growth.

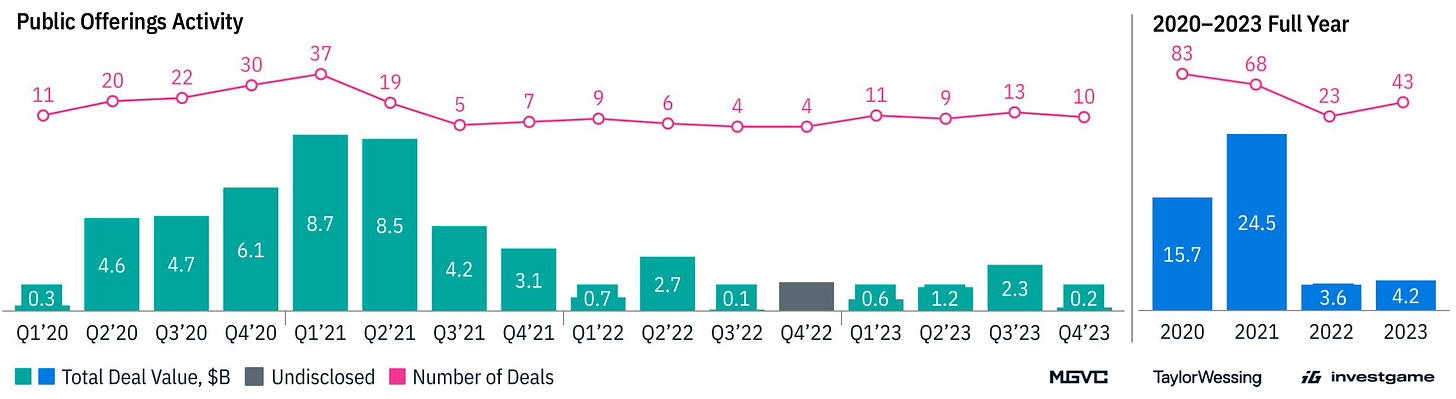

Public Offerings

-

In 2020-2021, the gaming market witnessed a boom in public offerings amid active industry growth. However, in 2022, the situation changed drastically due to macroeconomic crises and corrections. Only 23 companies conducted public offerings, raising a total of $3.6 billion (almost 7 times less than in 2021).

-

Signs of improvement appeared in 2023. There were 43 public offerings (almost double the previous year) totaling $4.2 billion (+16% compared to 2022).

-

InvestGame believes that companies are increasingly considering public offerings. There's likely pent-up demand that could materialize if the industry situation improves.

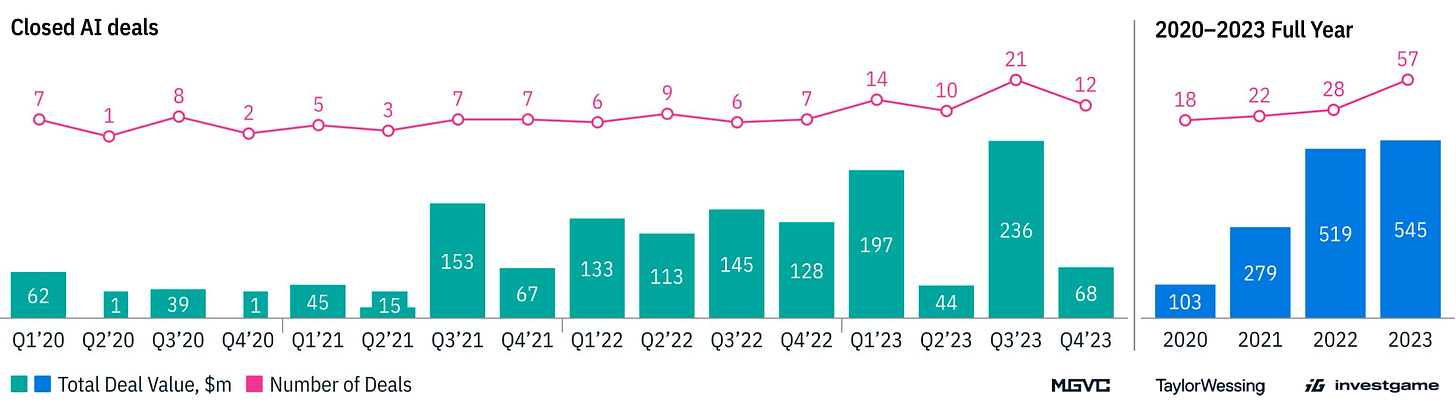

AI Investments

-

Since 2020, there hasn't been a single quarter without deals with companies specializing in AI. However, the number of deals in 2023 doubled - 57 compared to 28 in 2022. Yet, the total investment volume hardly increased - $545 million in 2023 compared to $519 million in 2022. This refers specifically to AI solutions for games.

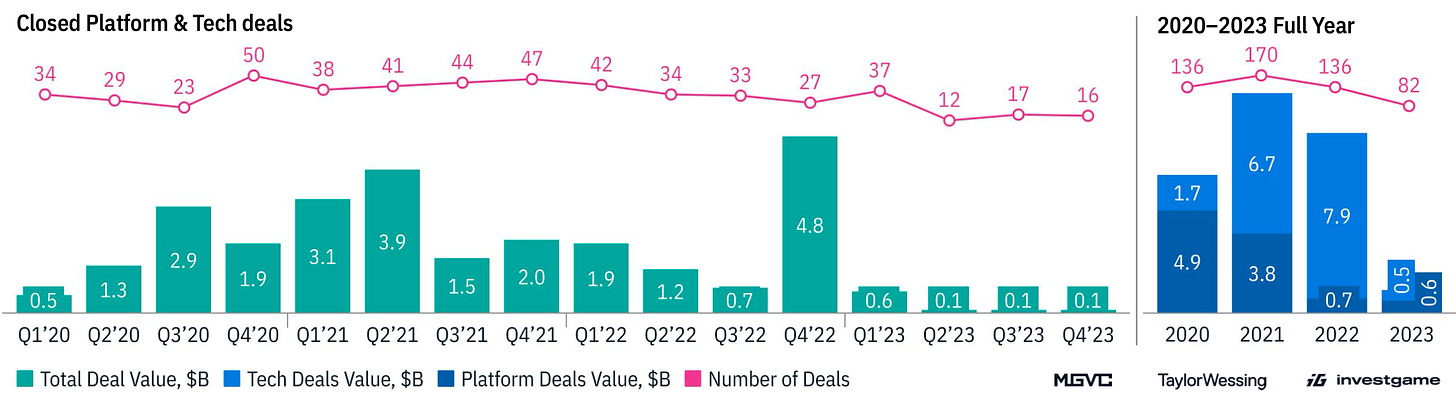

Investments in Platforms and Technologies

-

The number of deals in technological and platform solutions plummeted by 40% in 2023 to 82. Investments in platforms remained roughly the same ($0.6 billion compared to $0.7 billion in 2022), while investments in technological solutions plummeted 16 times from $7.9 billion in 2022 to $0.5 billion in 2023.

-

It's worth noting that the Unity merger with ironSource ($4.4 billion) occurred in 2022.

-

InvestGame analysts believe that the consolidation of the technical gaming market is nearing its end.

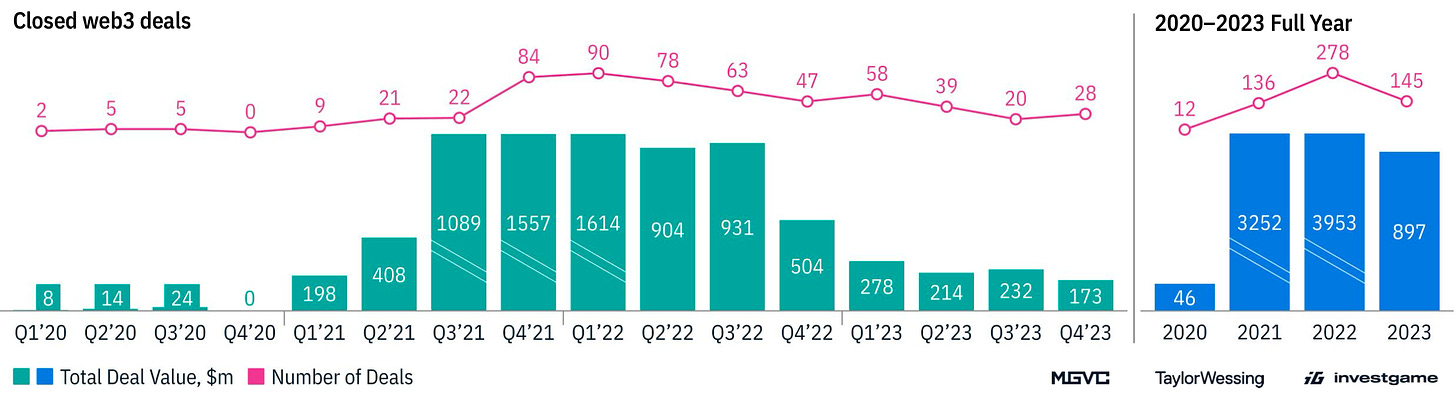

Blockchain Investments

-

The number of deals nearly halved from 278 in 2022 to 145 in 2023. The investment volume dropped almost 4.5 times from $3.95 billion in 2022 to $0.9 billion in 2023.

-

Nevertheless, InvestGame notes a positive trend. The market in 2023 is significantly higher than in 2020. Overall, the gaming Web3 market is becoming niche, with fewer developers, investors, and smaller checks.

Esports Investments

-

The number of investments in esports decreased by 20% in 2023 (37 deals). The investment volume dropped by 4.8 times to $471 million.

-

Despite esports existing for a long time, companies still struggle to establish an effective business model for fully monetizing their audience.

Game sales Round-up (07.02.2024 - 20.02.2024)

-

Chrome Valley Customs has earned $40 million since its release in June 2023. Space Ape expects the game to become the highest-earning in their portfolio. Previously, the studio released Beatstar ($120 million in 2 years).

-

Persona 3 Reload sold a million copies in a week. It's the fastest-selling game in Atlus' history.

-

Helldivers 2 is doing great. On February 11th, developers reported the first million copies sold, and on February 19th, the game reached a peak online of 411 thousand players on Steam alone.

-

Silent Hill: The Short Message has been downloaded over 2 million times. However, both critics and players received the project reservedly.

-

Kingdom Come: Deliverance has reached 6 million copies sold. It took 2 weeks for the first million and just over a year and a half for the sixth.

-

Granblue Fantasy: Relink surpassed 1 million copies in 11 days. Interestingly, the peak online at launch for a fairly niche project was 114 thousand people.

-

Marvel’s Spider-Man 2 reached 10 million sales in less than 4 months since release. The first 5 million were sold in a few weeks; total franchise sales exceeded 50 million copies.

-

Bandai Namco Entertainment is pleased with the results of Tekken 8 - the game sold 2 million copies in less than 3 weeks. The company reports that sales of the new installment are better than those of previous entries in the series.

-

Metro Exodus has entered the club of projects that have sold over 10 million copies. In 2022, there were reports of 6 million sales - impressive growth.

-

Alan Wake II sold 1.3 million copies. It's the fastest-selling game from Remedy; in the first couple of months, it outsold Control by 50% in 4 months. "You have no idea how difficult it is to make a game that will be bought a million times," Remedy said. We believe them.

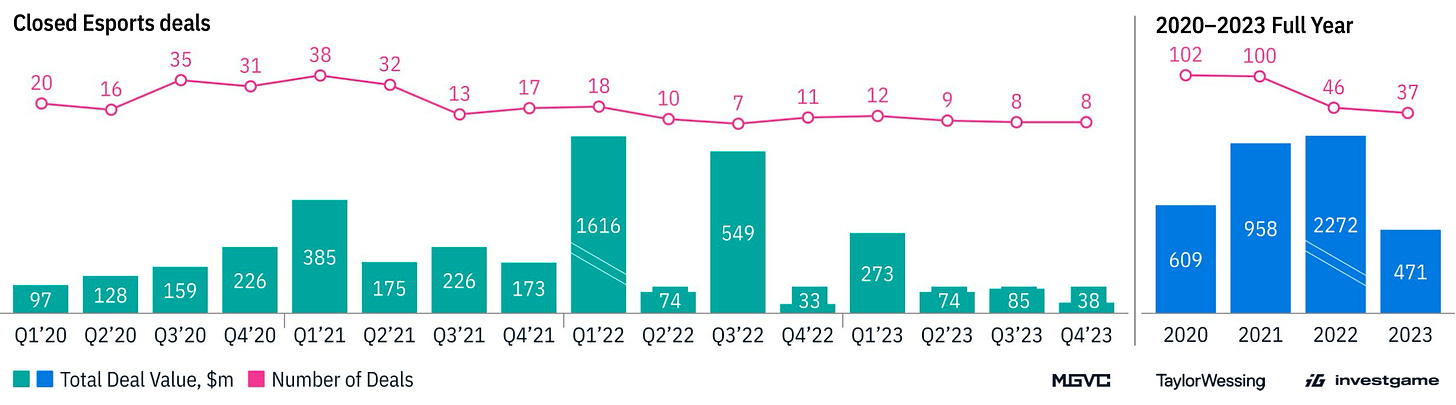

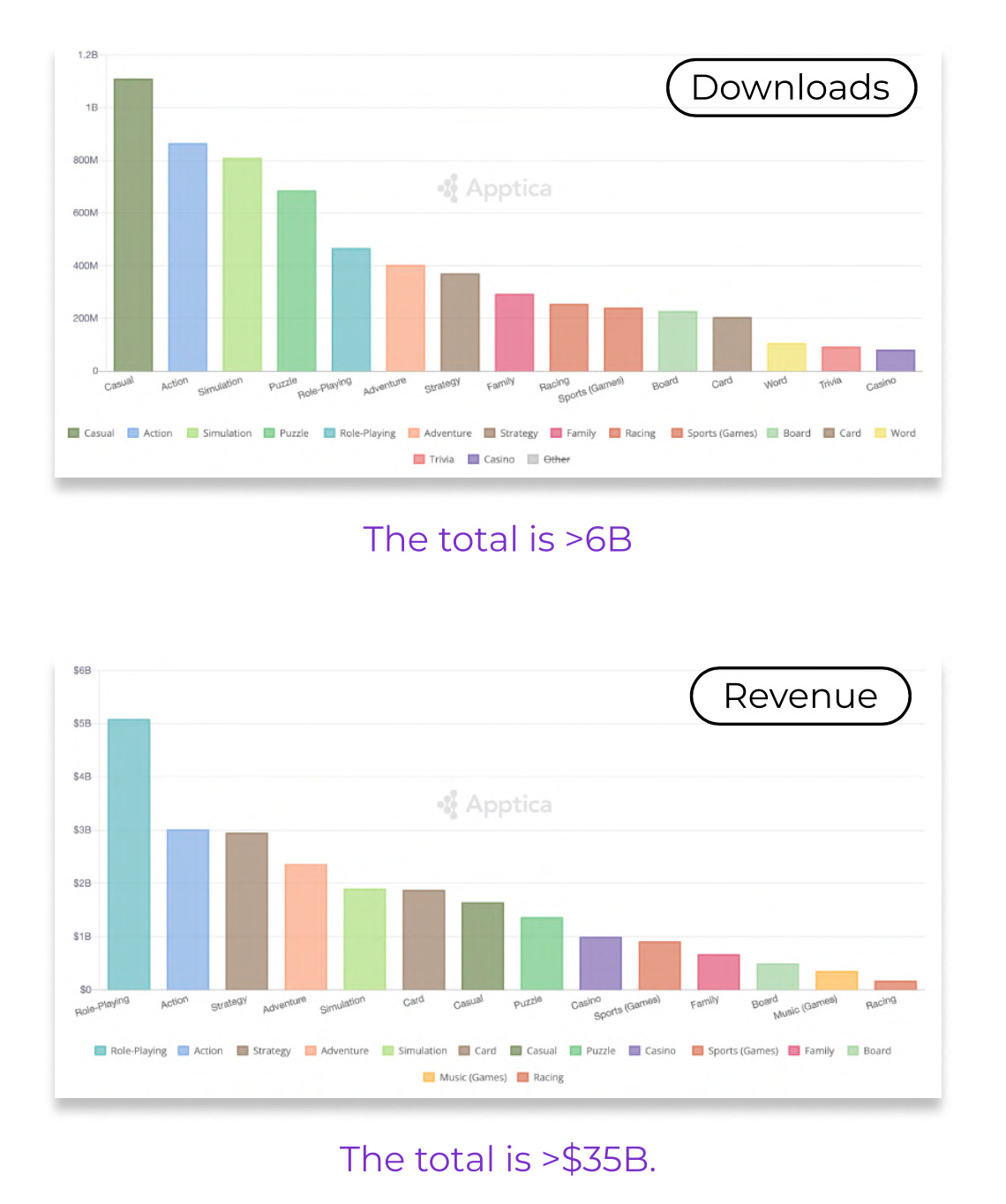

Apptica: The State of the Mobile Gaming Market and Advertising in 2023

The company collected data on 37 countries from January 1 to December 31, 2023. Only the App Store and Google Play were taken into account. All revenue - Gross.

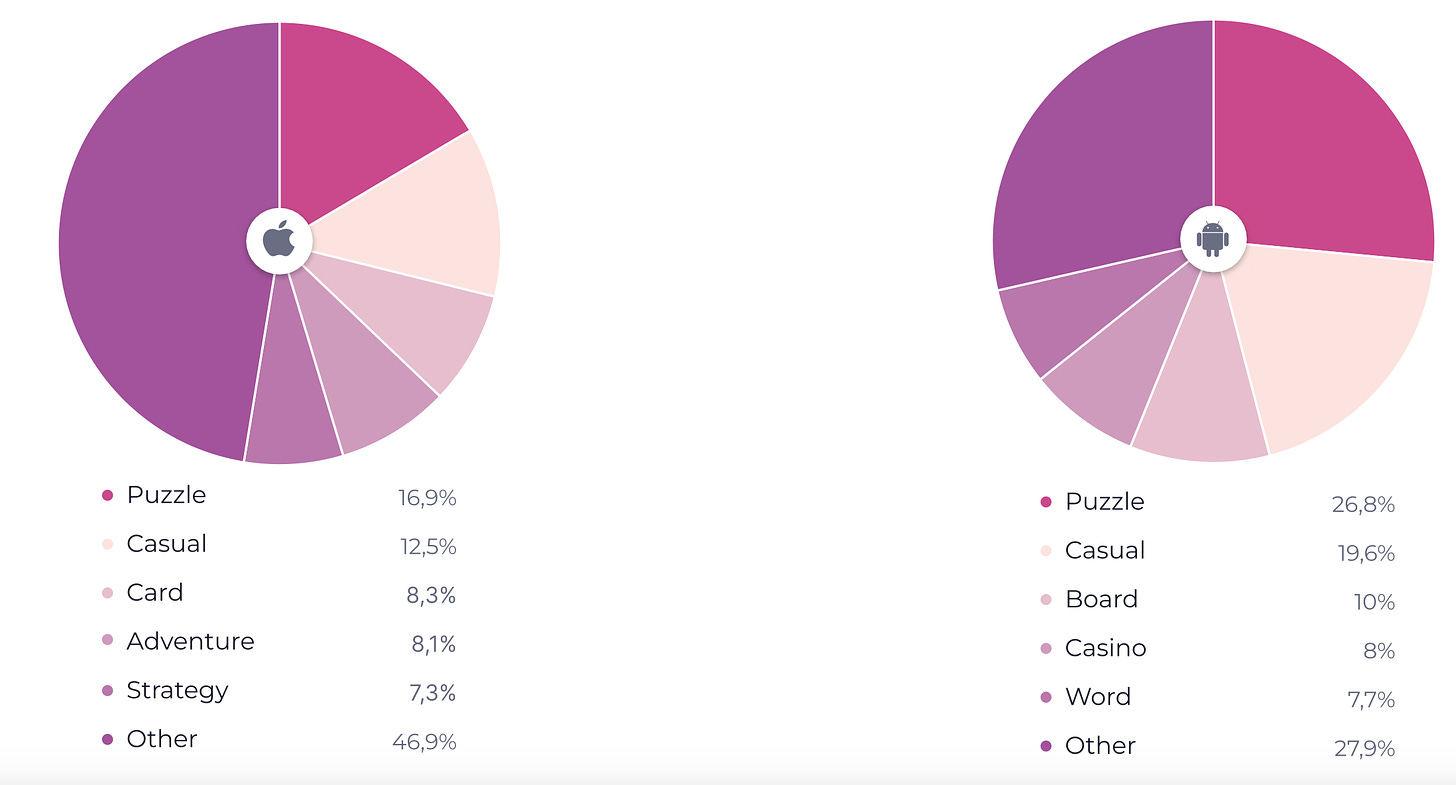

iOS Games

-

Downloads on iOS in 2023 decreased by 9.75%, with a total of just over 6 billion downloads. Casual projects, action, and Simulation genres are leaders.

-

Revenue from iOS games in 2023 was just over $35 billion (-6.7% from the previous year). The RPG genre saw the sharpest decline, by 12%, but it still remains the largest.

Android Games

-

The total number of downloads on Android in 2023 was over 51 billion. Puzzle games saw the strongest growth (+5.25%), Simulation genre (+5%), card games (+4.8%). Leaders in decline were RPGs (-12%), arcade games (-10%), and strategies (-8%).

-

Apptica counted the total revenue from Android games in 2023 at $20 billion.

Retention in Games

-

On average, Retention on Android is lower by 5-7 percentage points.

-

Casino games are leaders on iOS in R1 - 40.6%. This genre also leads in R30 on Android (9.1%) and iOS (13.6%). RPG games also show good figures in R1.

-

The average Retention for 1 day in games is 32.4%; for 30 days - 6.6%.

Downloads Leaders

-

Subway Surfers (225.4 million downloads); Candy Crush Saga (199 million) and Roblox (195 million) - leaders on Android in terms of downloads.

-

The situation is significantly different on iOS. Eggy Party (45.9 million downloads) is in first place, followed by MONOPOLY GO! (44.2 million), and Royal Match (42.8 million).

Eggy Party is not on the Android charts because Apptica does not take alternative stores in China into account.

Revenue Leaders

-

Coin Master ($425.9 million), MONOPOLY GO! ($415 million), and Candy Crush Saga ($369 million) - revenue leaders on Android.

-

Honor of Kings ($1.5 billion), Game for Peace, the Chinese version of PUBG Mobile ($611.5 million), MONOPOLY GO! ($609 million) - revenue leaders on iOS.

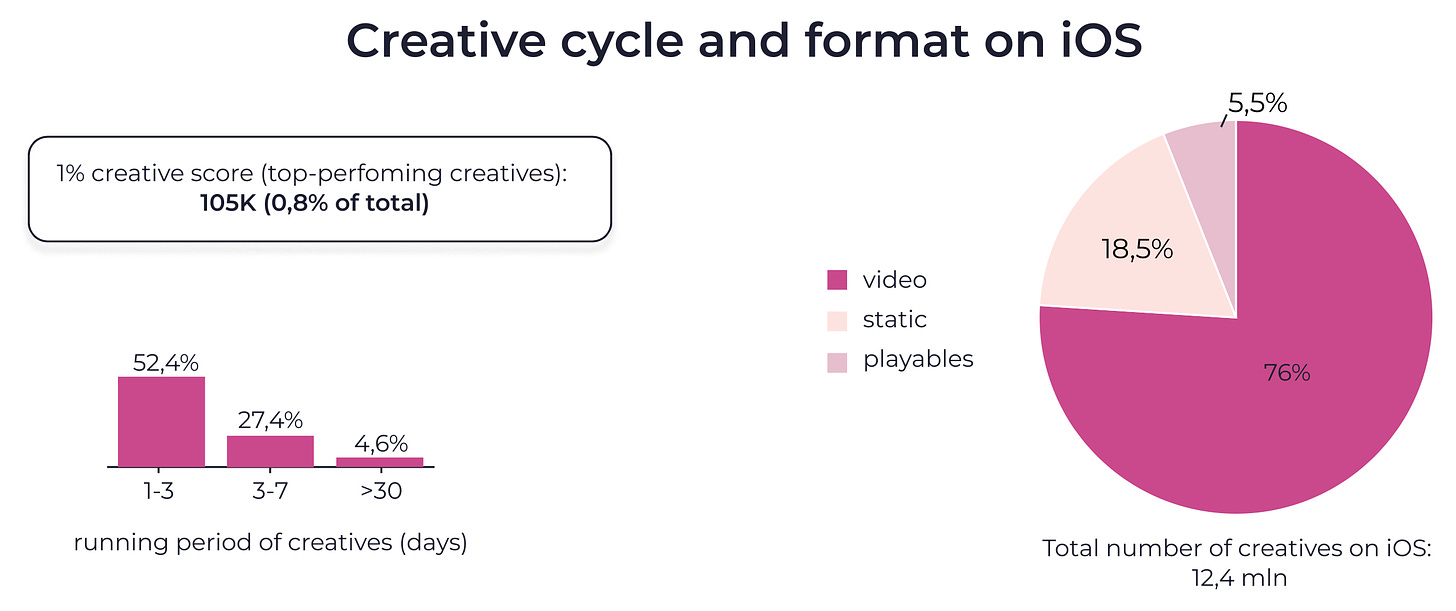

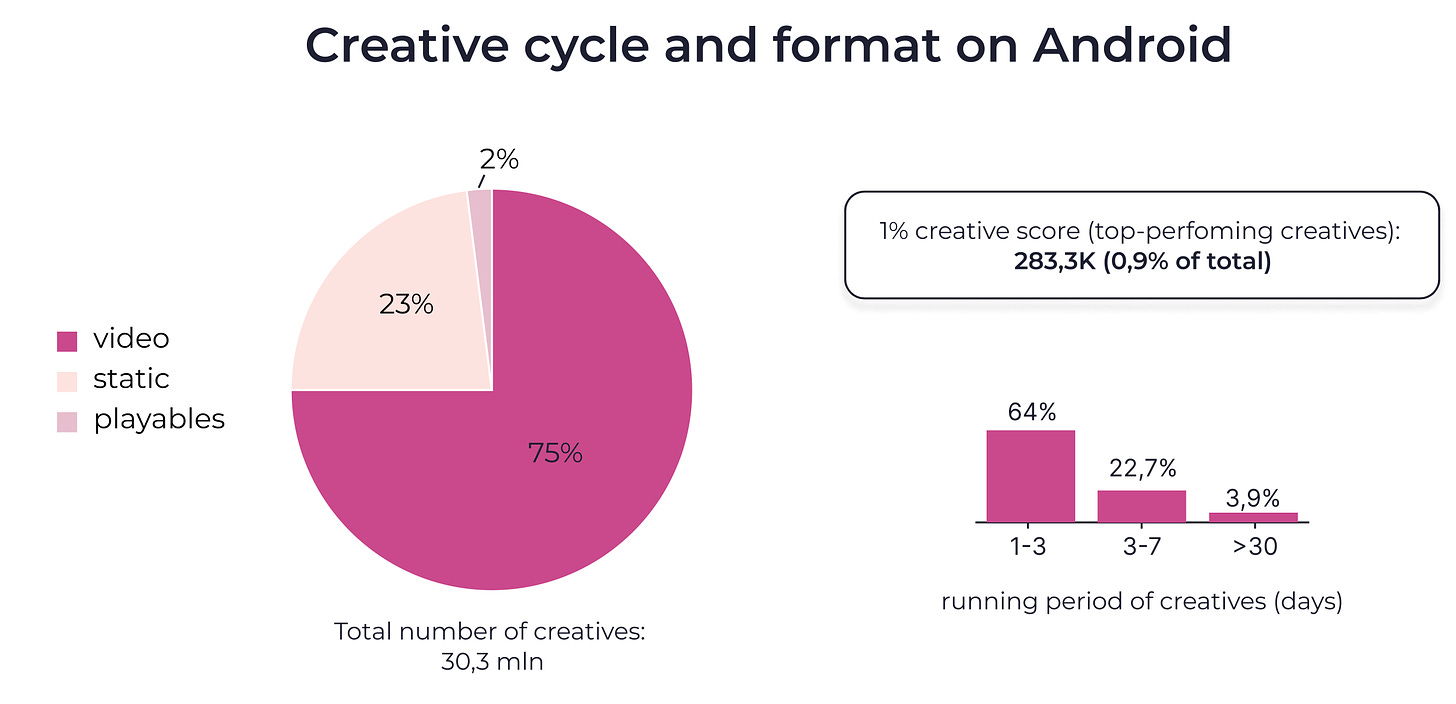

Advertising Market

-

According to Apptica's estimate, there are currently 109.8 thousand advertisers on the mobile market (-8.5% YoY). Of these, 53% are gaming advertisers.

-

Playrix is the most active advertiser on both iOS and Android.

-

The most mobile traffic is purchased for casual projects. For example, a quarter of all puzzle games on Android.

-

76% of all creatives on iOS are videos; 18.5% are static images; 5.5% are playables.

-

On iOS, only 4.6% of creatives last more than 30 days. The majority - 52.4% - last no more than 1-3 days.

-

In the case of Android, 75% of all creatives are videos; 23% are static; 2% are playables.

-

On Android, 3.9% of creatives last more than 30 days. 64% stop performing within the first 3 days.

-

It is noted that the popularity of UGC and influencers in advertising is growing. However, the use of misleads has decreased. In 2024, experts expect more AI-generated creatives.

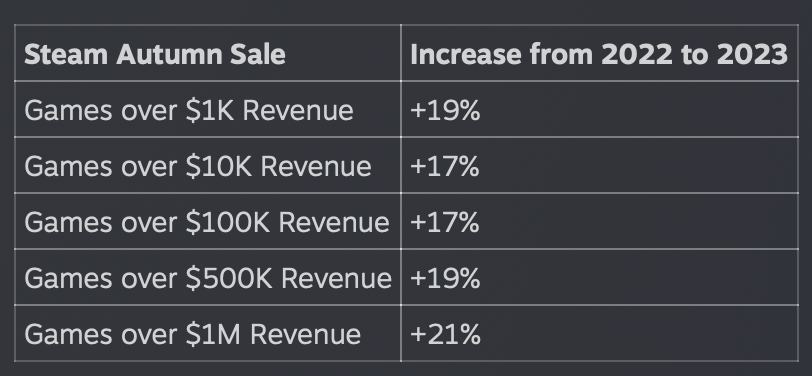

Steam: 2023 Results

The company primarily focused on product updates, but there were several interesting figures.

-

More than 500 games on Steam earned over $3 million in 2023. This is twice as many as in 2018.

-

The company is proud that a quarter of the projects in the tops were released by developers whose games had not been released on Steam before.

However, this does not mean that the teams did not have such experience before.

-

Steam surpassed the 33 million CCU mark for the first time. Moreover, in 2024, the record has already been broken.

-

The company is very satisfied with its sales. For example, during the autumn sale of games earning over $1 million, there were 21% more than in 2022. Sales at such events are generally increasing.

-

Steam also notes that people actively use gift cards - both physical and digital. From December 20 to December 31, 2023, physical cards worth $80 million were activated.

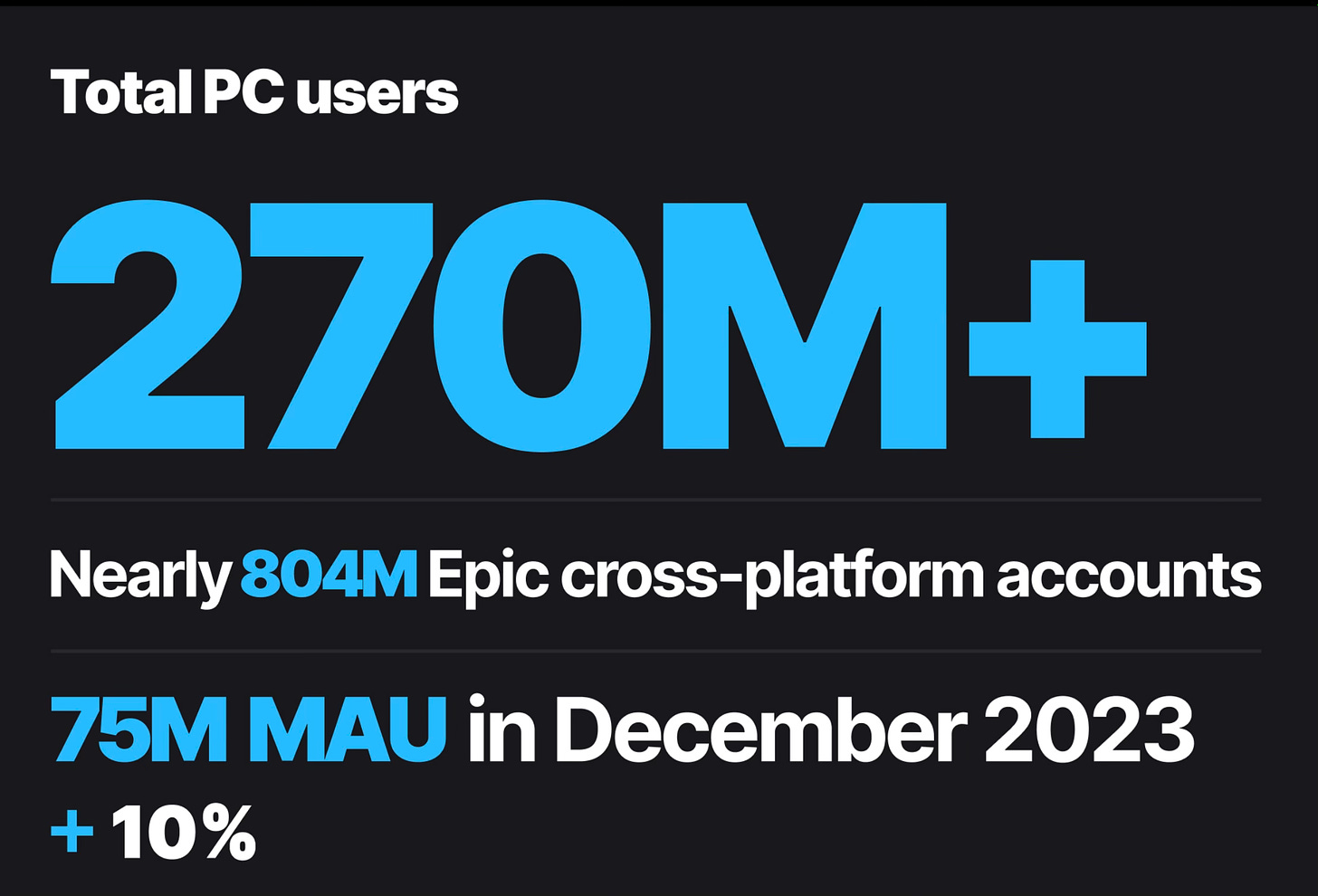

Epic Games Store: Results of 2023

-

The number of EGS users has grown to 270 million - 40 million more than last year.

-

The total number of accounts in the Epic ecosystem reached 804 million.

-

The peak DAU on the platform in 2023 was 36.1 million users. MAU reached 75 million - last year it was 68 million.

-

In 2023, more than 1300 games were released on the Epic Games Store, bringing the total number to 2900 projects.

-

Users spent $310 million on games from third-party developers (-13% YoY). $950 million was spent on games from Epic Games (+16% YoY).

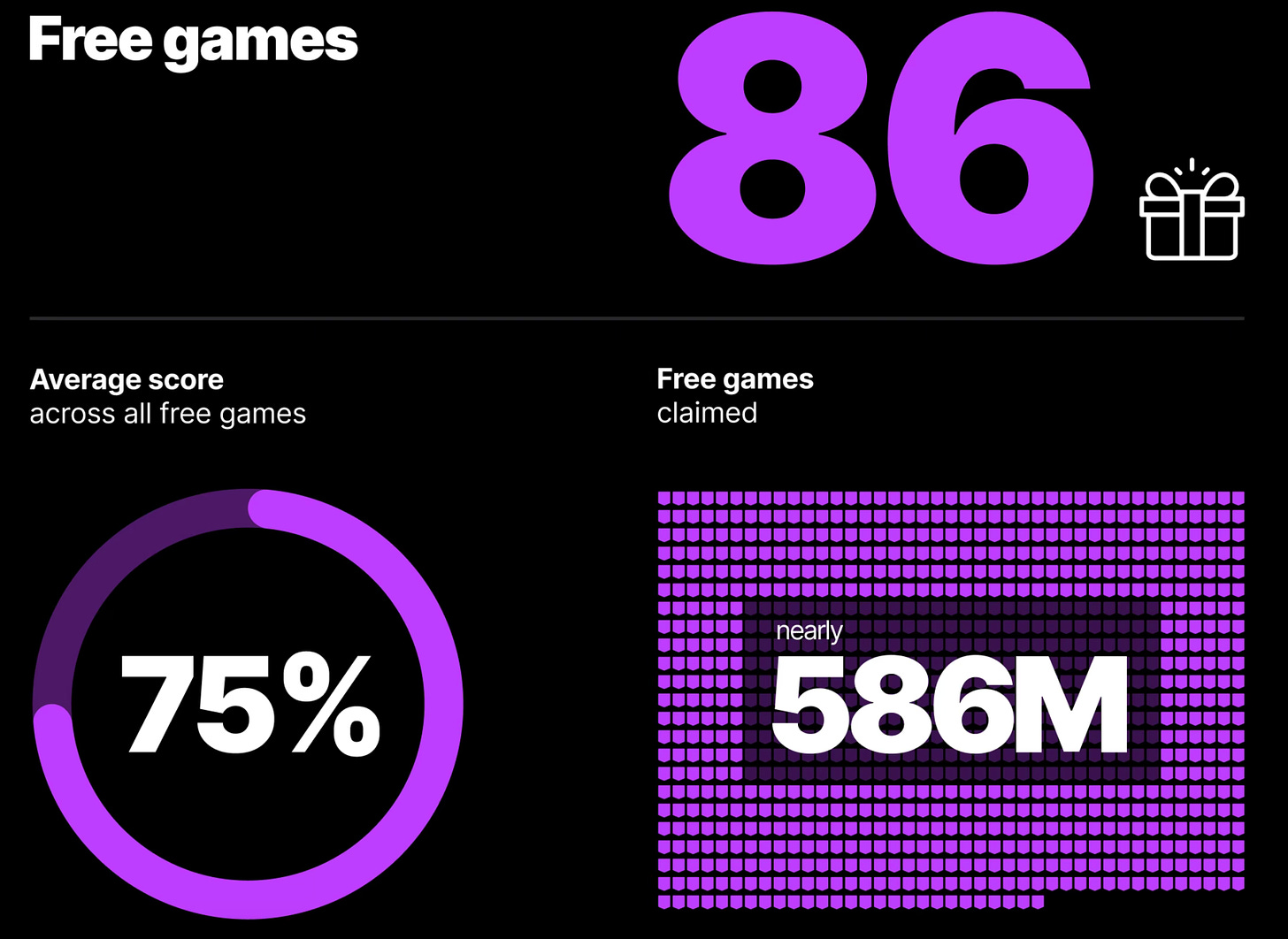

-

The company gave away 86 games in 2023 through the Free Games program. Their total retail value was $2055 with an average Metacritic score of 75. In 2023, users claimed 586 million copies of free games.

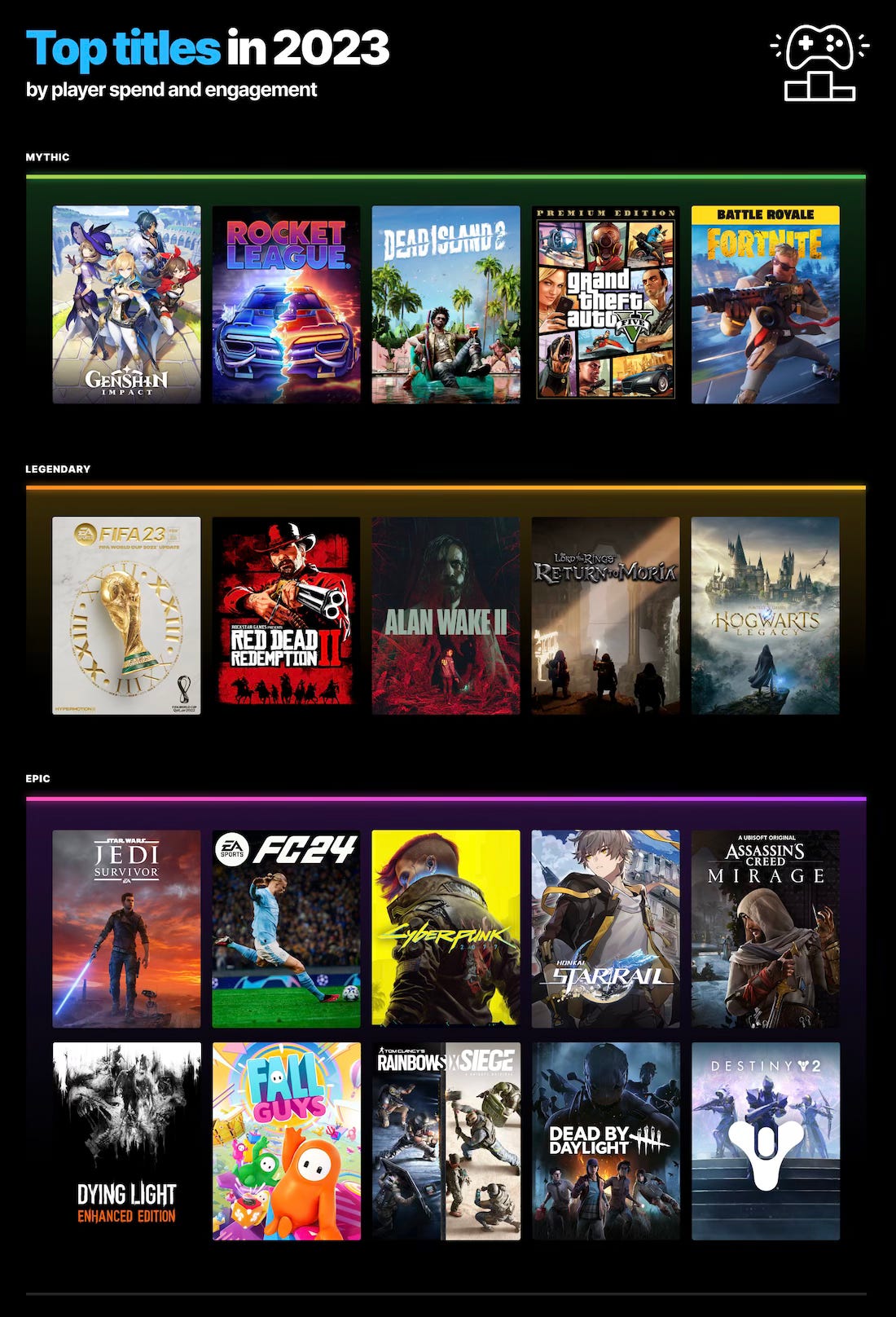

-

Genshin Impact, Rocket League, Dead Island 2, Grand Theft Auto V, and Fortnite were the most successful projects on the platform in 2023.

-

In 2024, the company promises to add preload for pre-orders; subscription support; dynamic bundles. And also - launch on iOS in Europe.

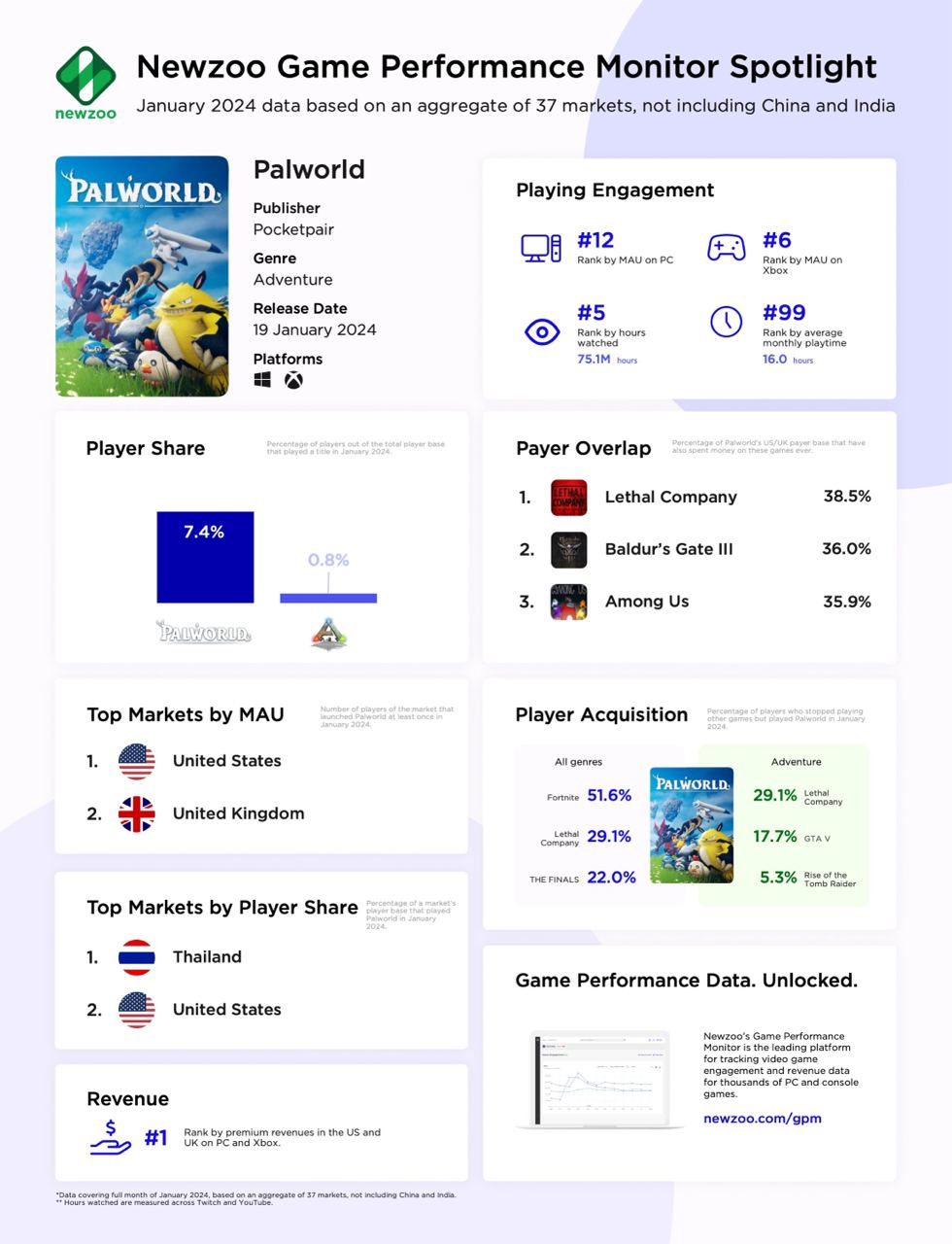

Newzoo: Palworld in January 2024

The game was released on January 19, 2024. Within the first 13 days, the game was purchased by more than 12 million people. Newzoo considers 37 countries excluding China in its report.

-

In January 2024, Palworld became the 11th game by MAU on PC and Xbox. Among adventure games, it ranks second.

-

7.4% of the gaming audience on PC and consoles played Palworld. On average, they spent 16 hours in the game.

-

Palworld was watched for over 75 million hours on Twitch and YouTube. It ranks second among adventure games and fifth among all games.

-

Palworld became the best-selling paid game in the USA and the UK. 38.5% of those who bought the game also purchased Lethal Company.

-

29.1% of those who stopped playing Lethal Company in January 2024 switched to Palworld. Additionally, 51.6% of those who stopped playing Fortnite and 22% of The Finals audience joined the game.

-

The USA and the UK are the main markets by MAU for Palworld. If we consider the percentage coverage of countries, the leaders are the USA and Thailand.

Tune in next month for more updates!

In the meantime, you can take a look at our free demo to better understand how devtodev helps game projects grow and increase revenue.