devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the April and May reports.

Contents

- Mini-games in WeChat have 400M+ MAU

- Sensor Tower: FIFA Mobile reached $1B in revenue; South Korea is the largest mobile FIFA market

- KOCCA: In 2022 the South Korean gaming market revenue was $16.4B

- StreamElements & Rainmaker.gg: State of game streaming market in May 2023

- Capcom world sales reached 500M copies

- Circana: The US gaming market grew in May thanks to The Legend of Zelda: Tears of the Kingdom

- The Last of Us: Part II & Horizon Forbidden West development cost Sony more than $200M each

- Sony: Call of Duty franchise brought PlayStation $800M in the US in 2021

- Unity: Mobile Games Monetization in 2023 Report

- Newzoo: How consumers engage with video games in 2023

- PwC: The US gaming market revenue in 2022 grew only by 2.4%

- Famitsu: The Legend of Zelda: Tears of the Kingdom sold 1.5M retail copies in May in Japan

- Newzoo: 10 best-selling games on PC and Consoles in the US and UK in 2023 (January - May)

- data.ai: Diablo Immortal earned $525M in the first year on mobile

- Sensor Tower: Honkai: Star Rail earned more than Genshin Impact in May outside of China on Mobile

- GSD: Game sales in Europe in May 2023 increased by 33%

- The GameDiscoverCo: Genshin Impact on PlayStation has 400k DAU

- Diablo IV is the most successful launch in Blizzard Entertainment's history

- Sensor Tower: PUBG Mobile earned $10B

- Circana: Game subscriptions revenue growth in the US almost stopped

- AppMagic: Genshin Impact in May 2023 showed the worst revenue on Mobile since the launch

- The GameDiscoverCo: Rating of games from E3 2023 shows replacements

- AppMagic: Top Mobile Games of May 2023 by Revenue and Downloads

- Newzoo: Transmedia in games: trends, success factors, market insights

- GSD: The Legend of Zelda: Tears of the Kingdom dominated the UK market in May

- Street Fighter 6 reached 1M copies in 4 days

- Newzoo: DLCs effect in PC and Console titles

- Niko Partners: Chinese Gaming market in 2022 surged to $45.5M; the Chinese PC market is gigantic

- InvestGame: Gaming Investment Deals Report - Q1 2023

- Newzoo adjusted the Gaming market size in 20

- AppMagic: Honkai: Star Rail earned $132.3M in the first month on Mobile

- Neogames: The Finnish Game Industry in 2022

- Nintendo: The Legend of Zelda: Tears of the Kingdom sales exceeded 10M copies in the first 3 days

- GTA V sales reached 180M copies

- Sony: PlayStation VR 2 tapped 600k copies in the first 6 weeks

- StreamElements & Stream Charts: New streaming platform Kick Report

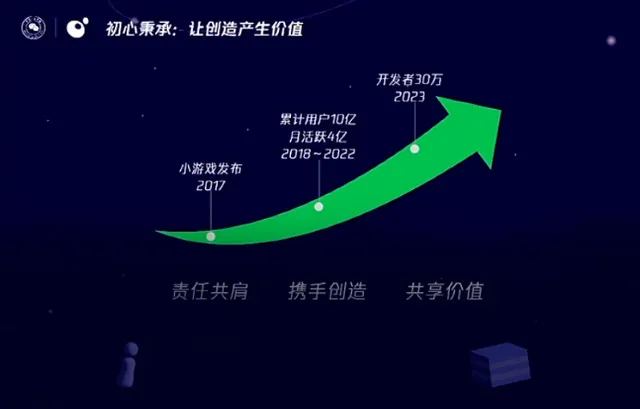

Mini-games in WeChat have 400M+ MAU

- The overall number of users on the platform exceeded 1B people.

- Currently, more than 300k teams are working on games on WeChat. More than half of them are teams of 30 people or less.

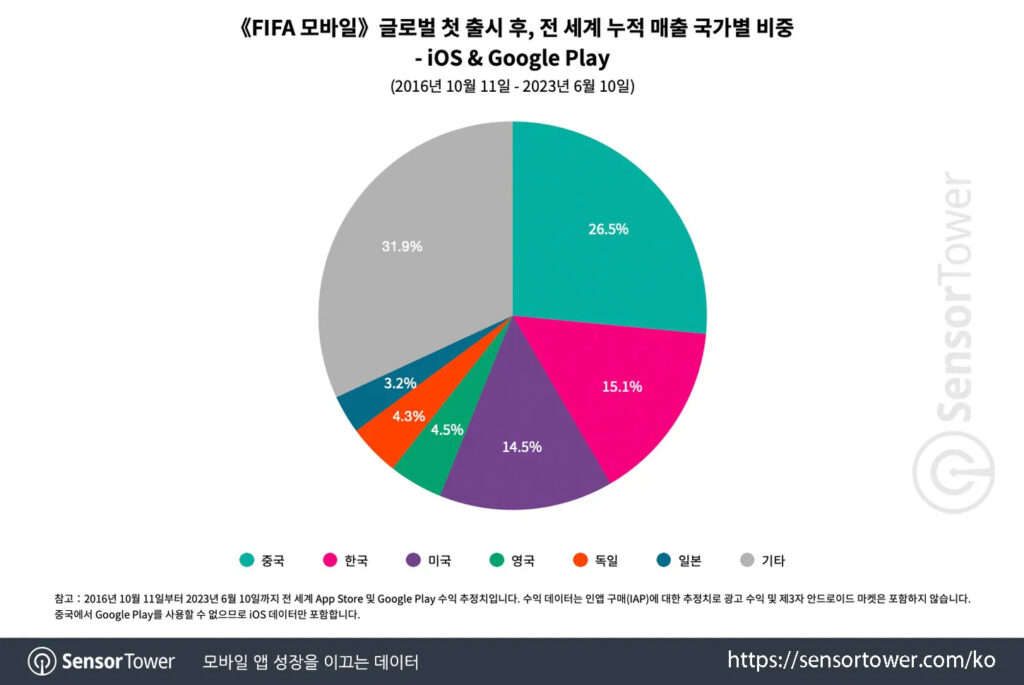

Sensor Tower: FIFA Mobile reached $1B in revenue; South Korea is the largest mobile FIFA market

- FIFA Mobile was going to the first billion since October 2016. 26.5% of revenue was coming from China; 15.1% - from South Korea; 14.5% from the US; 4.5% from the UK; 4.3% from Germany, and 3.2% from Japan.

- It’s worth noting that FIFA Mobile was launched only on the South Korean market in June 2020. Despite this, the country made a significant contribution to the overall sales. South Korea generated 22.1% of overall revenue since the game was released in the country.

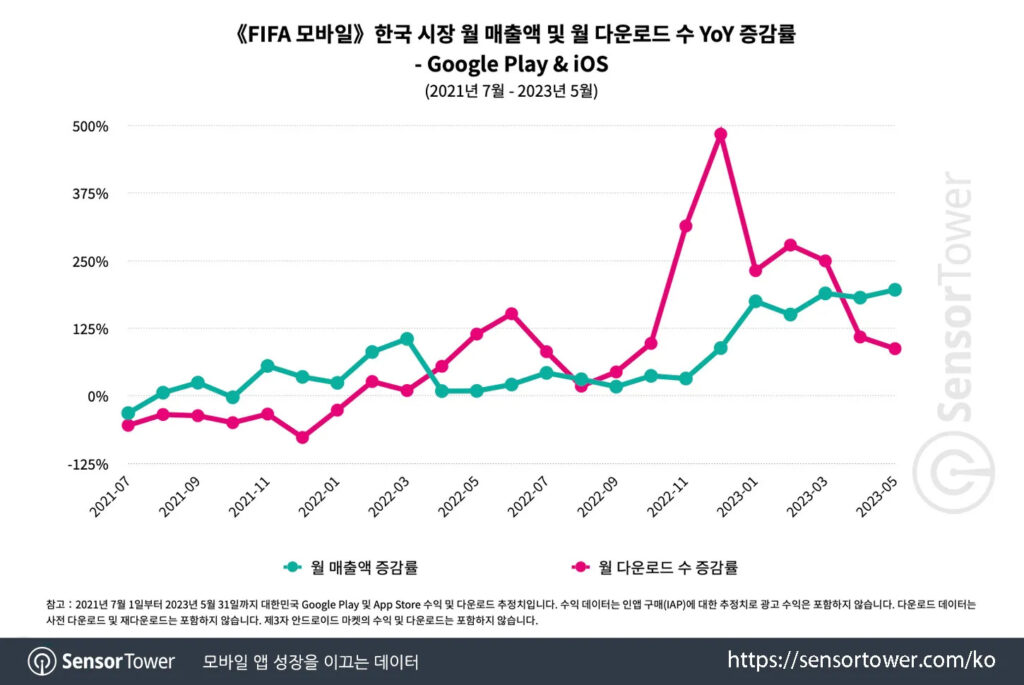

- FIFA Mobile downloads on the Korean market are growing. The vast spikes happened during the World Cup 2022 in Qatar.

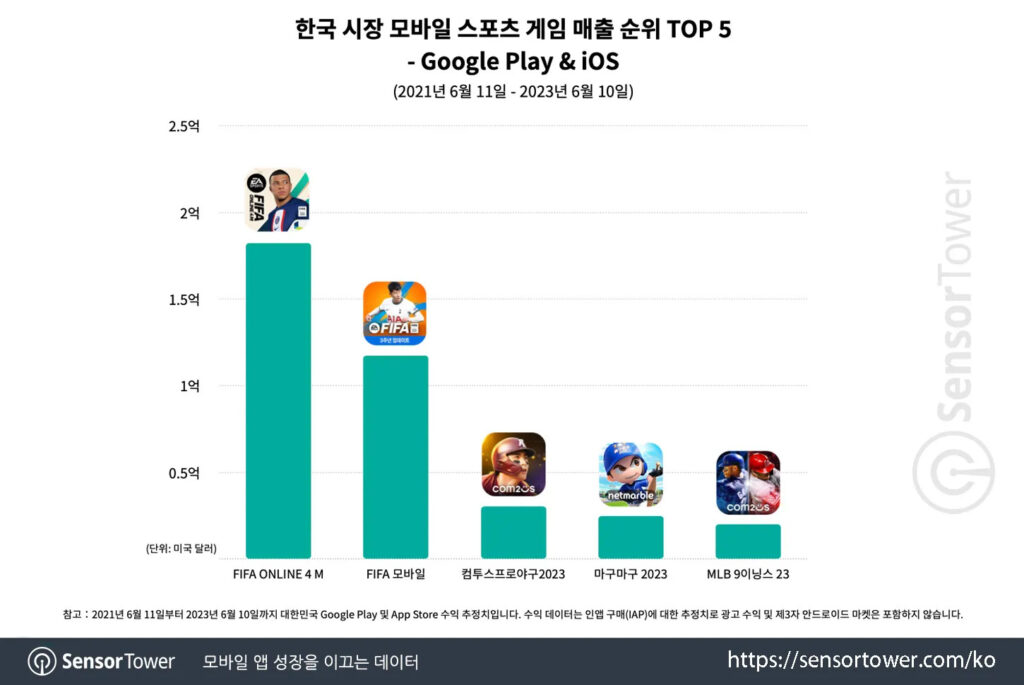

- Along with FIFA Mobile, the market also has FIFA Online 4M. In the South Korean market, both games are operated by Nexon; their cumulative sales reached $530M. This makes South Korea the largest market for mobile FIFA in the world.

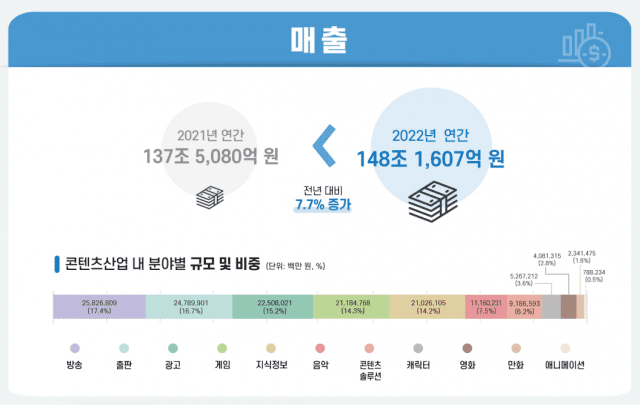

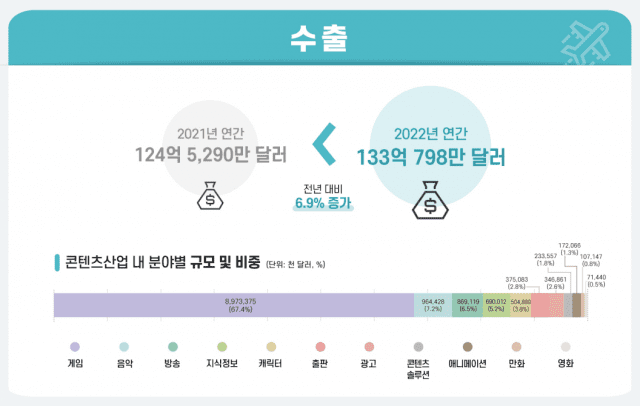

KOCCA: In 2022, the South Korean gaming market revenue was $16.4B

- It’s only 0.9% more than in 2021. Modest growth analysts are connecting with the economic recession and the cancellation of pandemic restrictions.

- South Korean companies earned overseas $8.97B. It’s 67.4% of the overall revenue of all creative industries in the country, including films, music, etc.

- 81.6k people worked in South Korean gaming companies at the end of 2022. It’s 225 people less than in 2021.

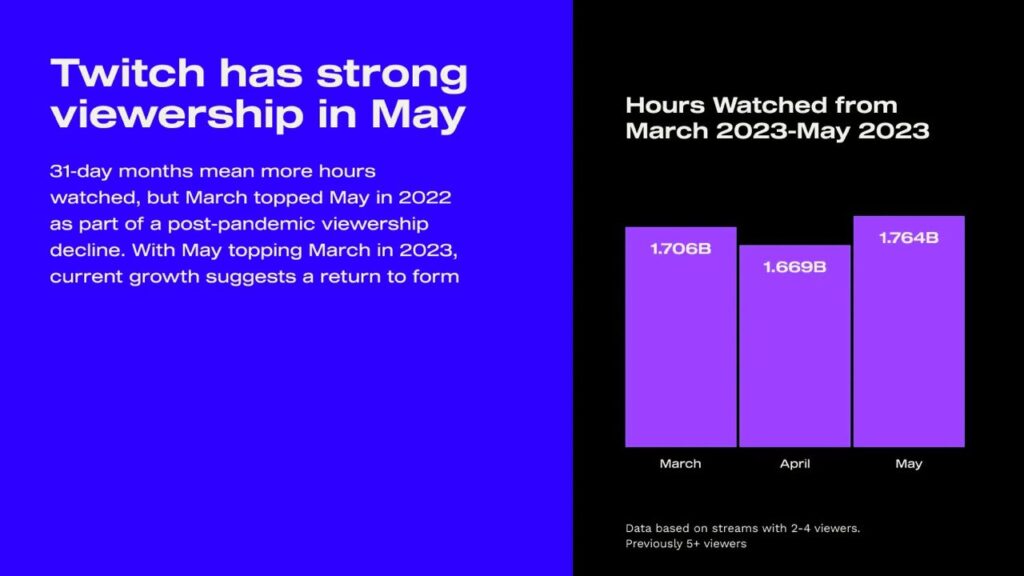

StreamElements & Rainmaker.gg: State of game streaming market in May 2023

- The number of views on Twitch in May 2023 reached 1.764B hours. Analysts highlighted that the streaming market returned to growth.

- The Legend of Zelda: Tears of the Kingdom reached the #10 place in the chart.

- League of Legends (124M hours), Valorant (102M hours), and GTA V (94M hours) are the most popular games among viewers.

- Gaming content accounts for about 76% of all views on streaming platforms. It’s the same as in 2022, meaning audience preferences are stable.

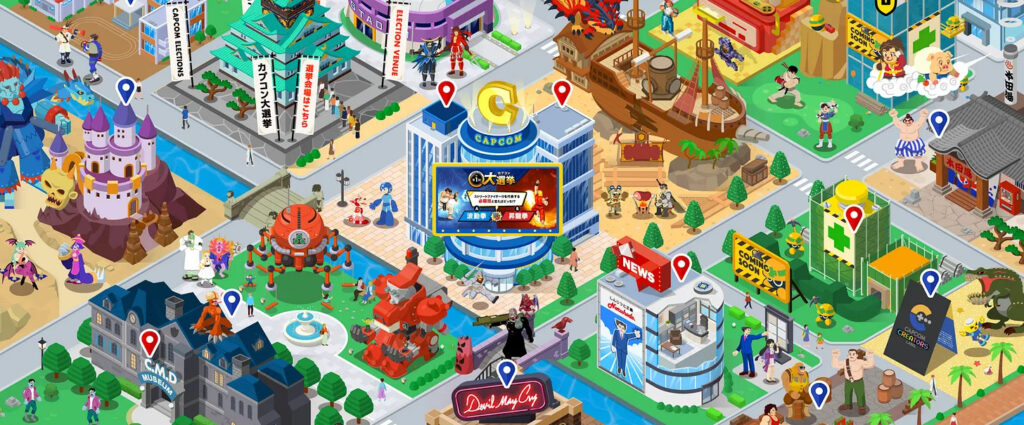

Capcom world sales reached 500M copies

- Resident Evil has an overall sale of 142M copies. The latest Resident Evil 4 Remake already reached 4M units.

- Monster Hunter games were bought 92M times. The series launched in 2004.

- Iconic (but niche) Street Fighter has 49M overall sales; the first game was released in 1987. Street Fighter 6 reached the first million copies in a week before release.

- Capcom released 307 titles in 230 countries within its 40 years of history.

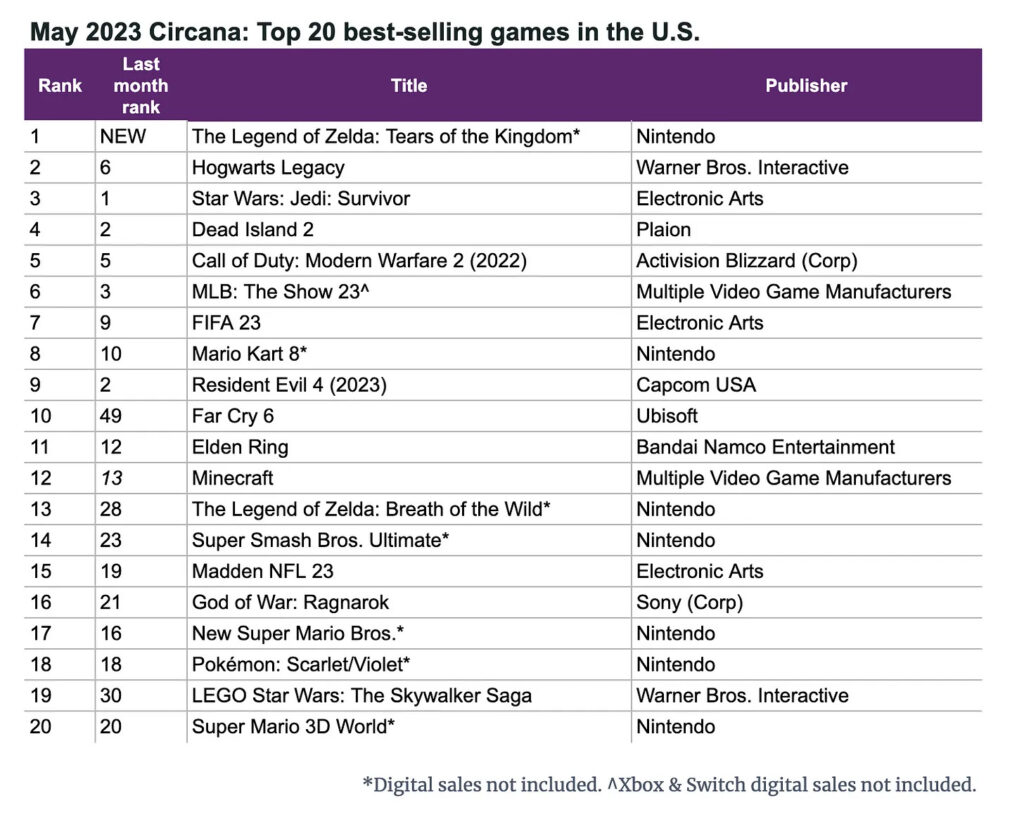

Circana: The US gaming market grew in May thanks to The Legend of Zelda: Tears of the Kingdom

- American users spent $4B in May on games. It’s 12% higher than a year before.

Games

- Software sales reached $3.6B with a 9% YoY growth.

- The Legend of Zelda: Tears of the Kingdom took a solid first place in sales. However, Nintendo is not sharing digital sales.

- Hogwarts Legacy and Star Wars Jedi: Survivor are the second and third games by sale.

Hardware and accessories

- Hardware sales increased by 56% YoY and reached $338M. It’s a 15 years record.

- The last time people spent more on gaming hardware ($427M) was in 2008.

- Nintendo Switch is the month leader by dollar sales. The console also set a historical record in this term in May.

- Accessory sales increased by 14% YoY to $159M. DualSense is a leader.

The Last of Us: Part II & Horizon Forbidden West development cost Sony more than $200M each

Numbers were published after documents from the FTC Microsoft-AB hearing went live.

- The Last of Us: Part II development cost $220M. At peak, more than 200 people worked on the title.

- Horizon Forbidden West had a budget of $212M. The number of employees was reaching 300 people.

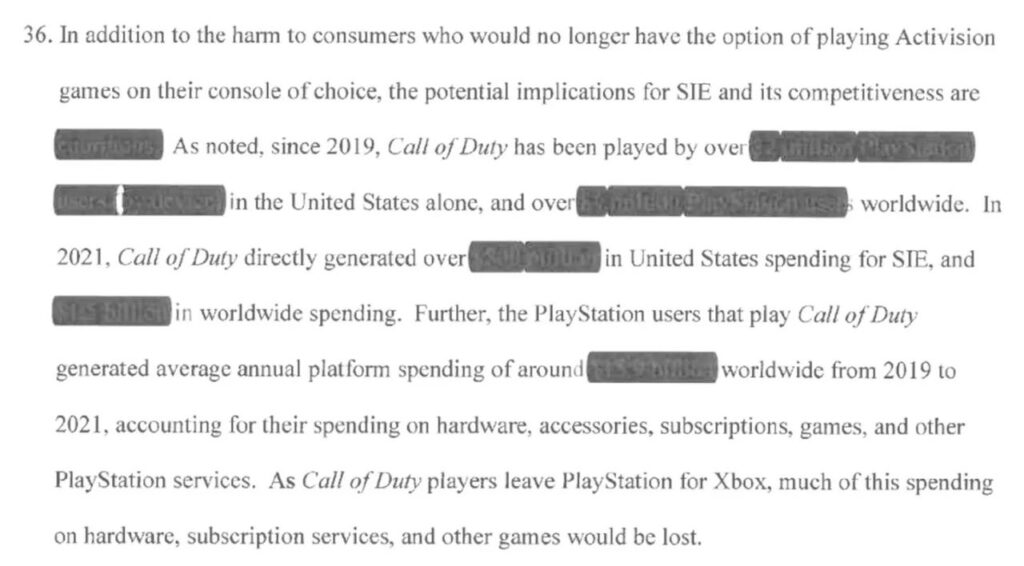

Sony: Call of Duty franchise brought PlayStation $800M in the US in 2021

Poorly scanned documents from the FTC hearings provided more data on the PlayStation business.

- Sony claims that the direct revenue from the Call of Duty series on PlayStation in 2021 was $1.5B. The US was responsible for $800M of this amount.

- If we count users who played Call of Duty, revenue from them is somewhere between $13.9B and $15.9B.

- Sony still has exclusive marketing rights for one Call of Duty game that will launch in 2023.

- 43M users have played Call of Duty games on PlayStation in the US since 2019. It’s two-thirds of the overall audience in the region.

- About a million US PlayStation users are playing only Call of Duty.

- In 2021 internal games from PlayStation studios brought 14% of all sales (but this number might be false, as it’s not visible in the document.

- Sony’s margin from third-party sales on the platform is around 10%.

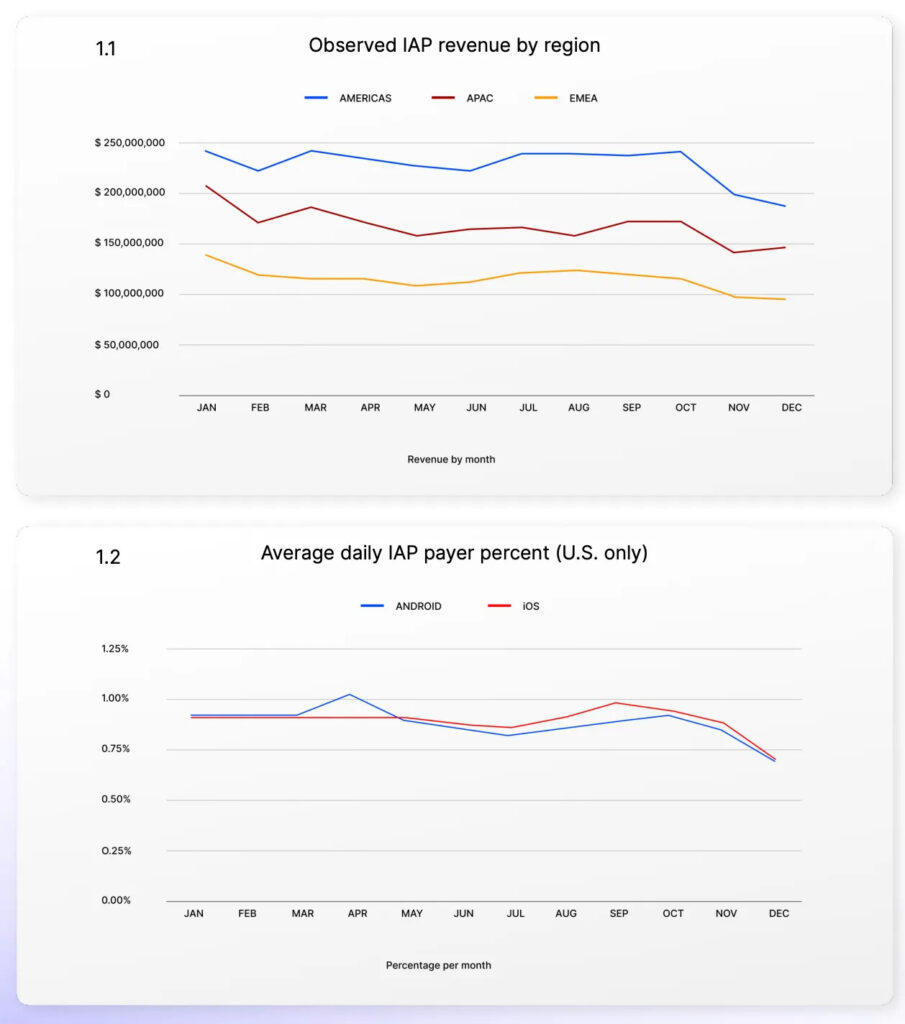

Unity: Mobile Games Monetization in 2023 Report

In-App Purchases

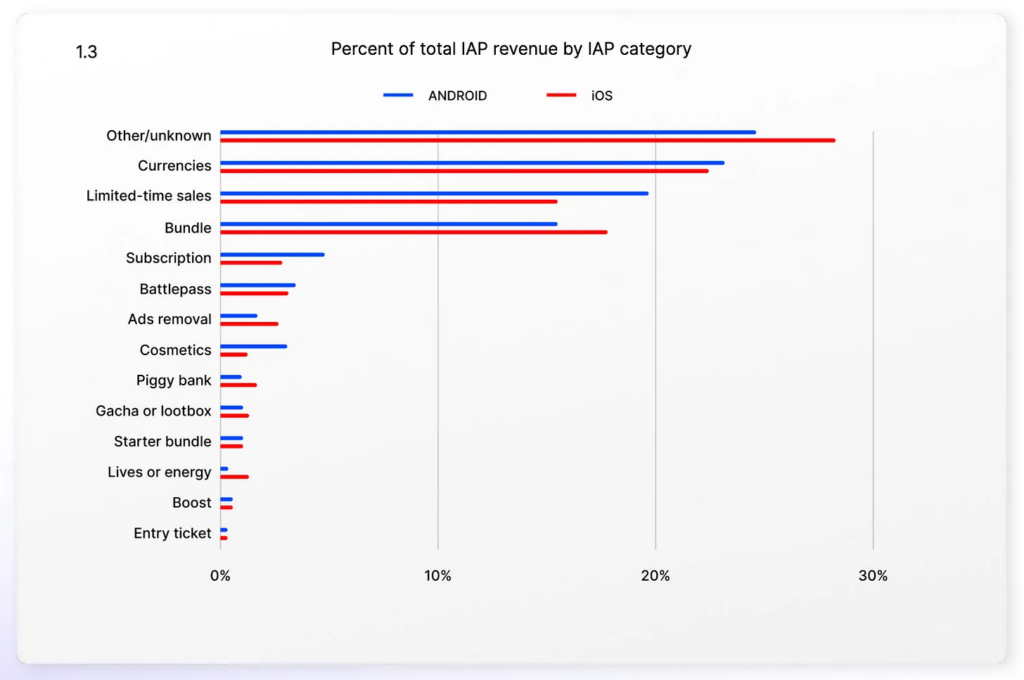

- Currency sales are generating 22% (iOS) or 23% (Android) of all IAP. Limited-time offers are responsible for 15% (iOS) or 20% (Android) of revenue. Bundles are taking 18% (iOS) or 15% (Android) of revenue share. This means that more than 55% of IAP revenue is generated by mentioned three types of IAPs.

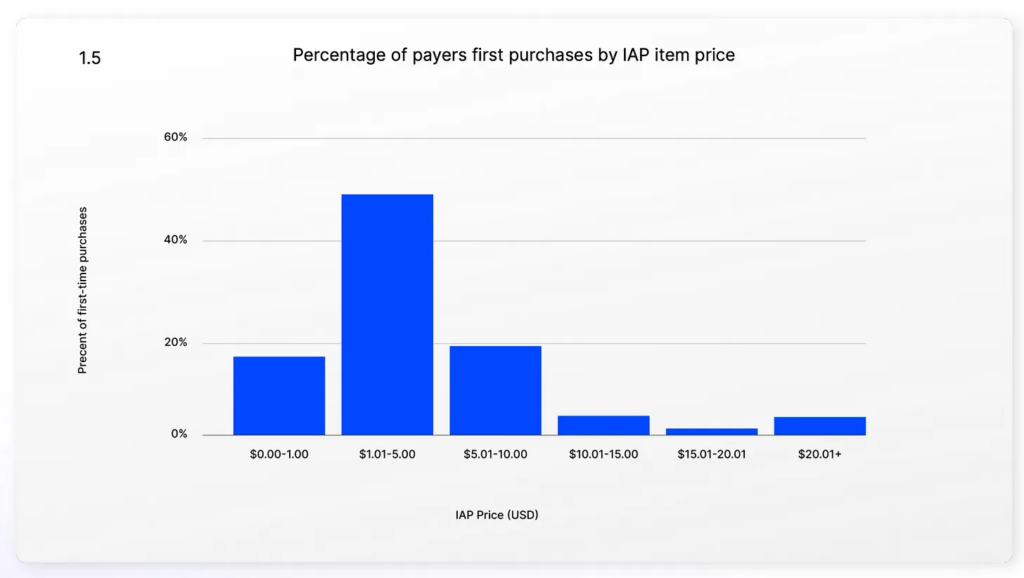

- In 50% of cases, the first purchase of the user is between $1.01 to $5.

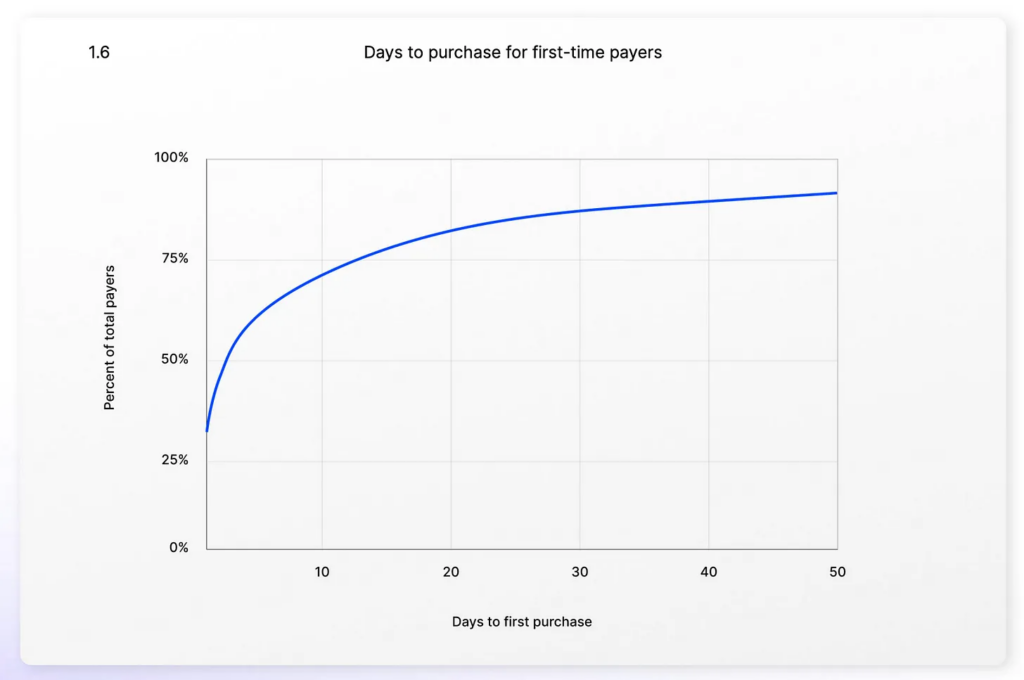

- 77% of paying users are spending money in the first two weeks. If the user hasn’t converted during this period, it makes sense to implement additional monetization methods to it.

Ad monetization

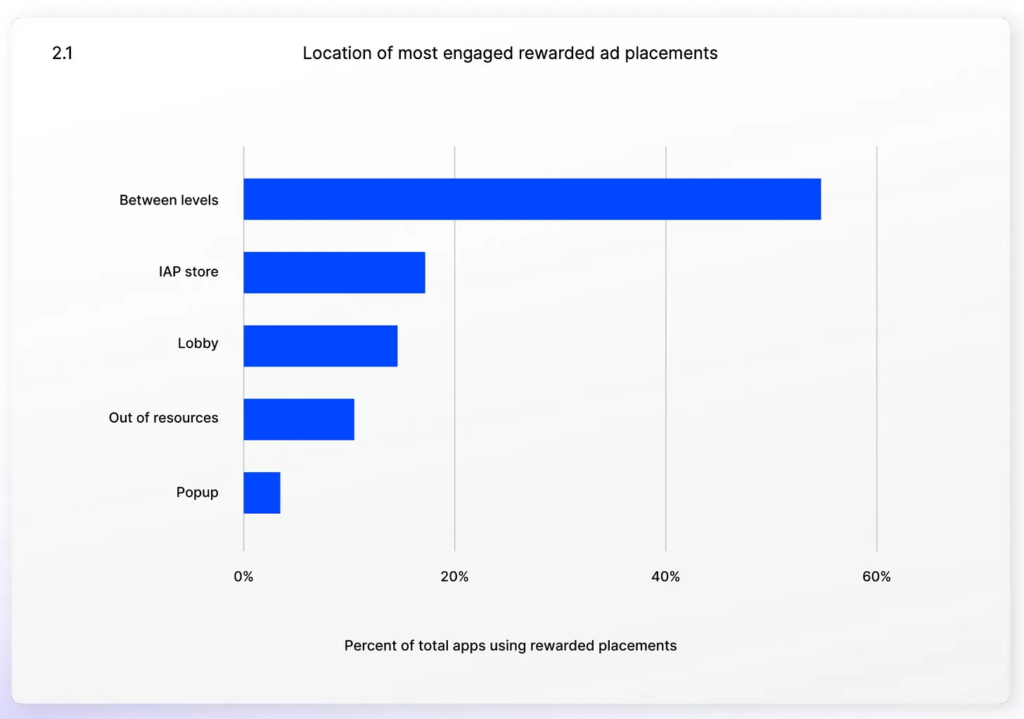

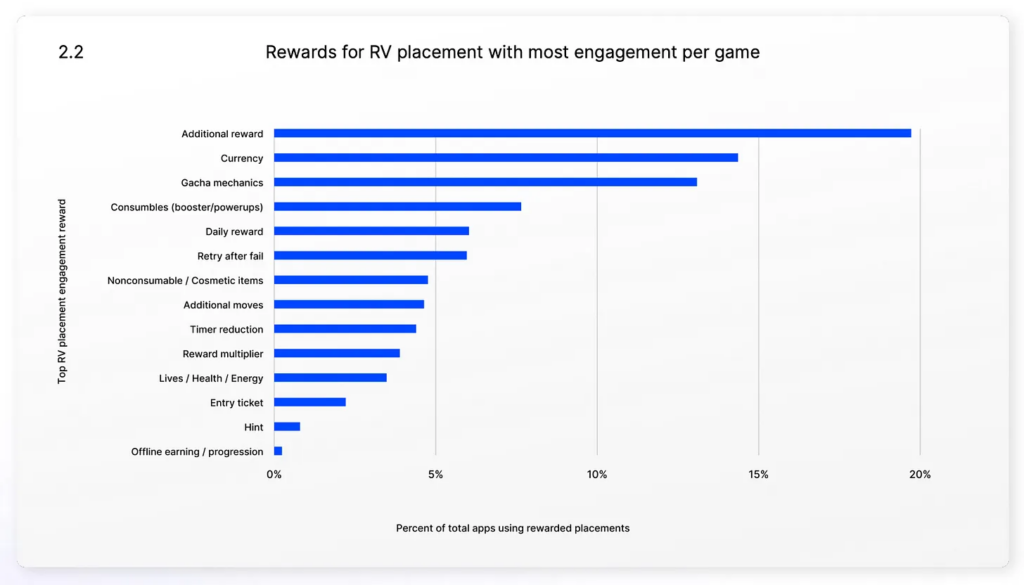

- In more than 55% of games, Rewarded Ads are placed between levels. That’s the most popular placement.

- People do want to get an additional reward (in 20% of cases), currency (14%), and gacha (13%) for watching ads.

Offerwalls

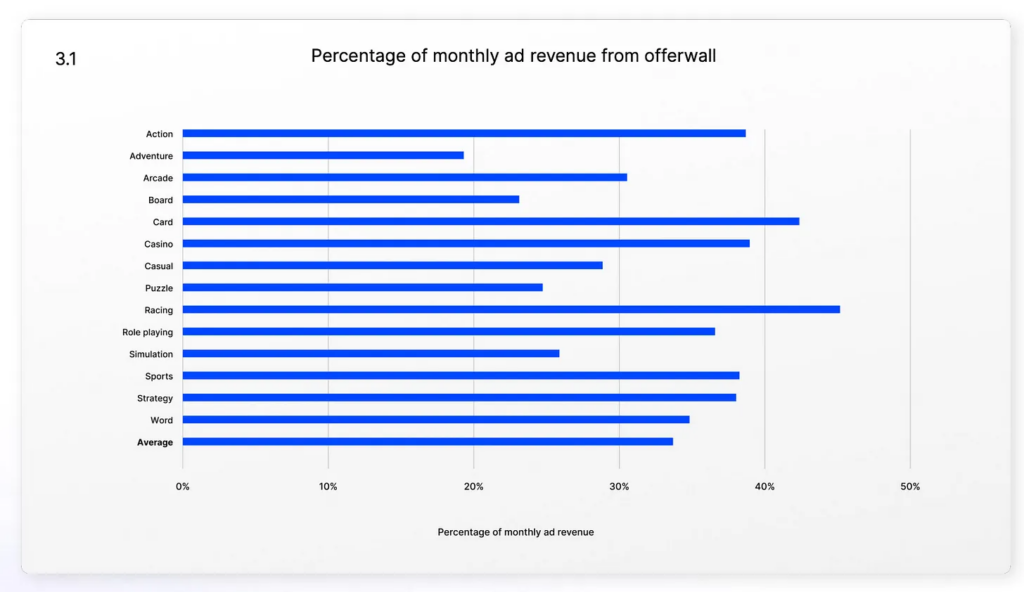

- On average, offerwalls generate 33% of ad revenue.

- The publisher earns $4.68 for each user that is doing tasks in the offerwall. And $0.27 for each who enters the offerwall section.

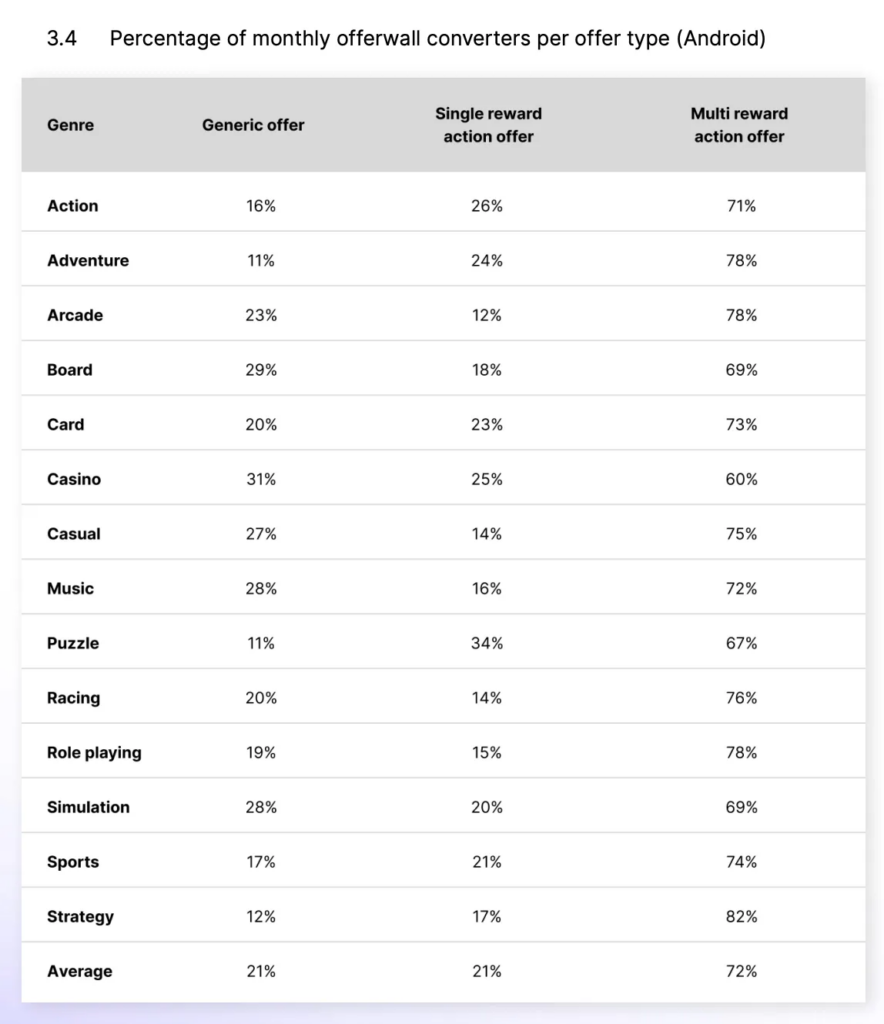

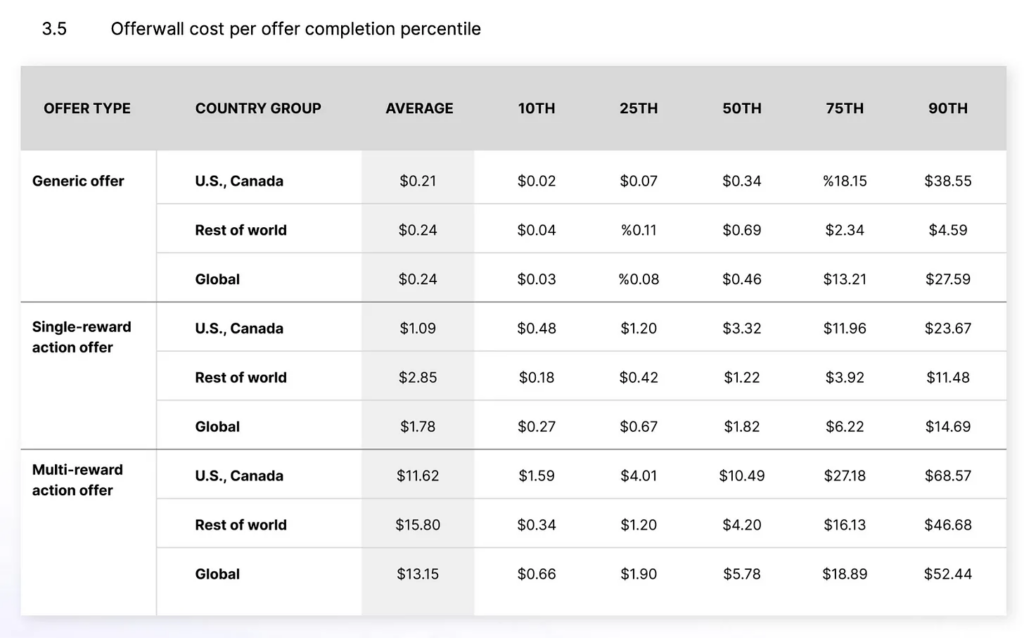

- Offers with multiple rewards are working 3 times better than offers with a single reward.

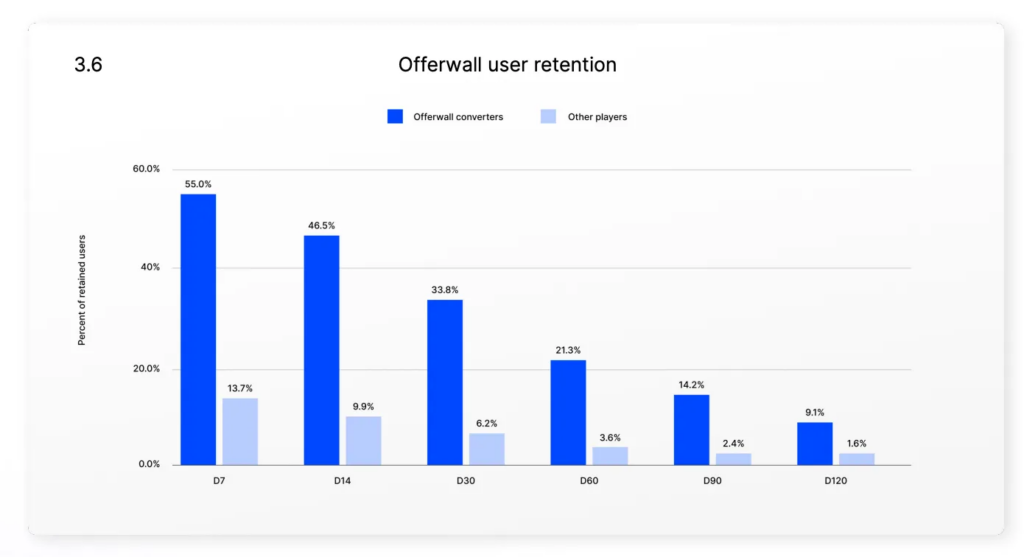

- Users, who are using the offerwall, are showing 5x better Retention from D7 to D120 compared to the normal users.

Unity: Mobile Games Monetization in 2023 Report

Newzoo: How consumers engage with video games in 2023

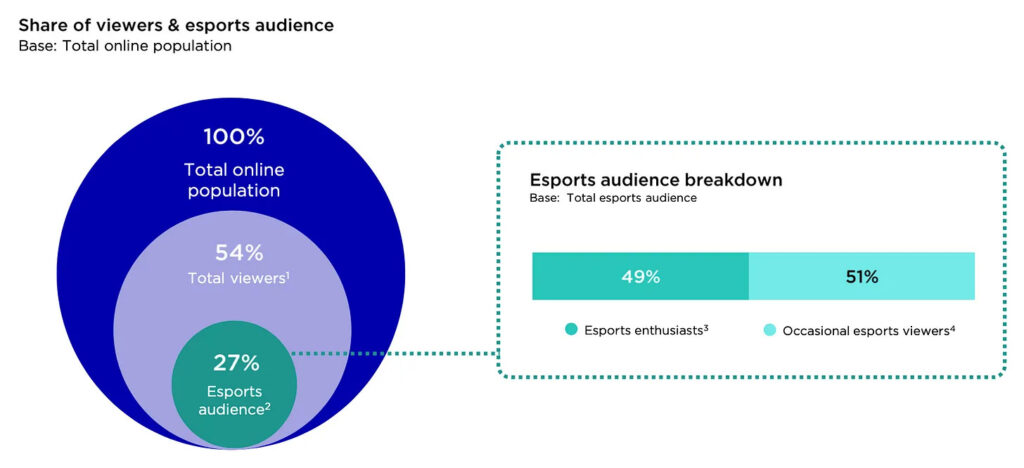

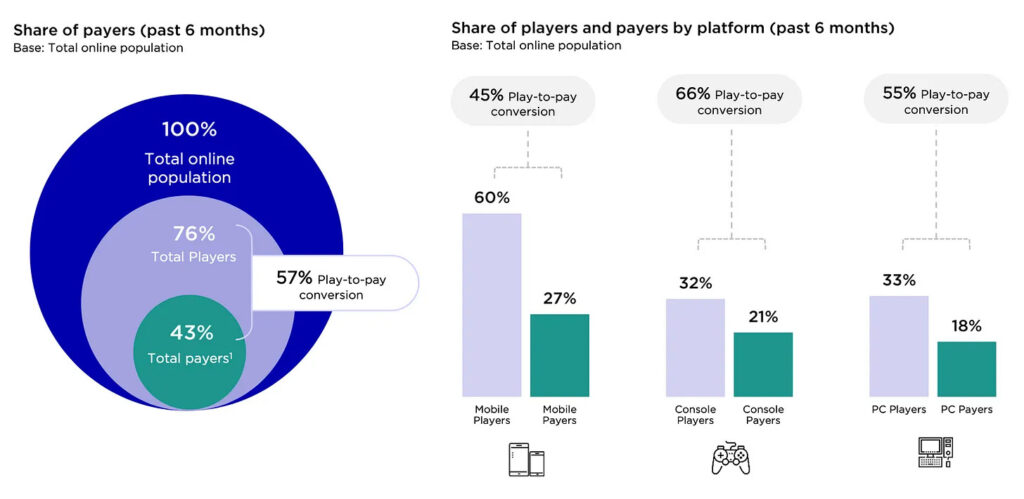

74.3 thousand people from 36 different countries participated in the study. It was performed from February to May 2023.

Overall behavior

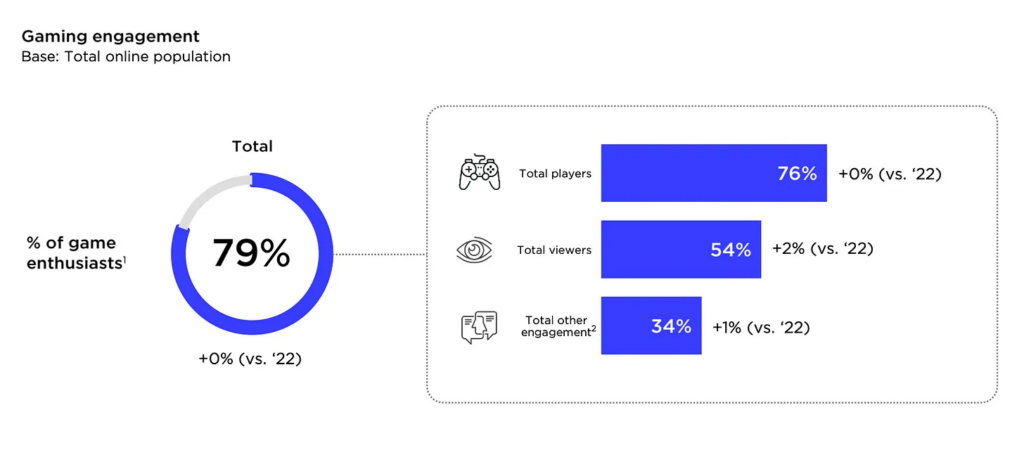

- 79% of the online population is interacting with video games - playing, watching, and discussing.

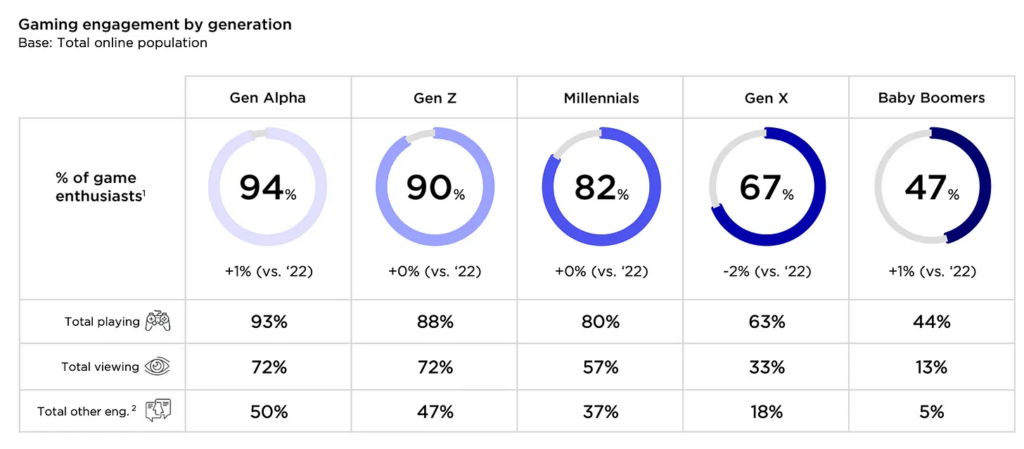

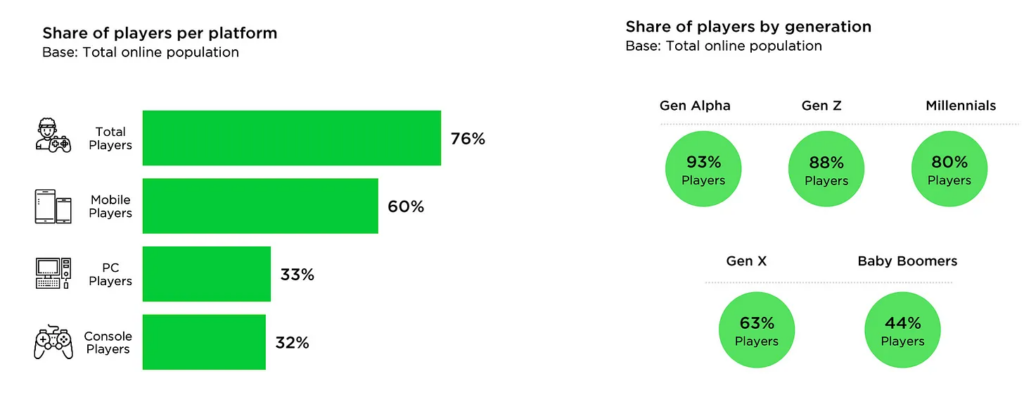

- The younger - the larger percentage is. Across the generation alpha, 94% of the population is interacting with games. Among baby boomers - only 47%.

- Three out of four people online are playing games. Mobile devices attracted 60% of players; PC - 33%; consoles - another 33%.

- 54% of the online population watched game content. 27% watched eSports events.

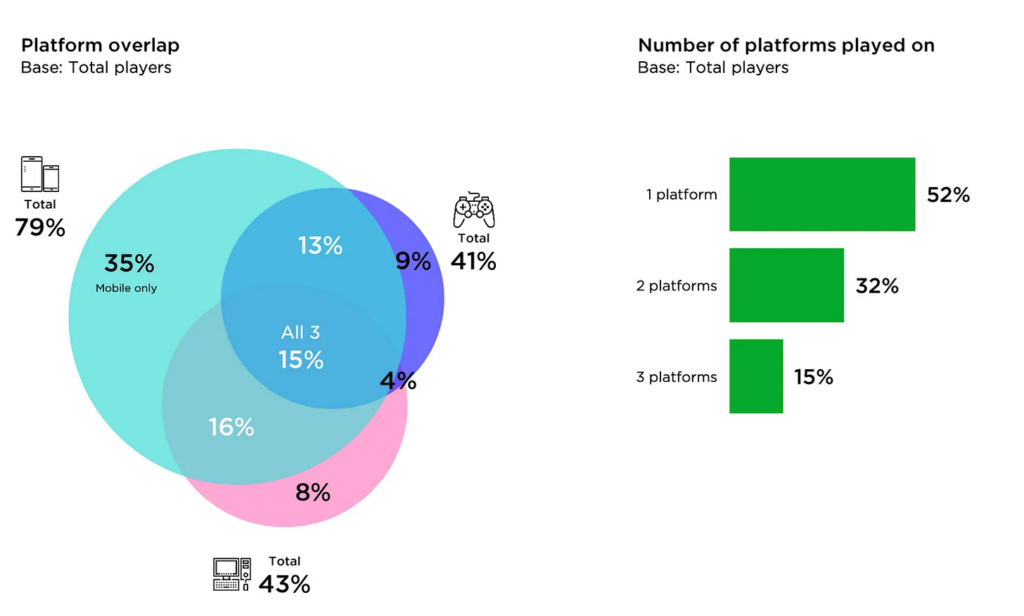

Cross-platform

- 52% of users are playing on one platform. 32% on two. 15% on three.

- 35% of users are playing only on a mobile. It’s much more than those who are playing only on consoles (9%) and only on PC (8%).

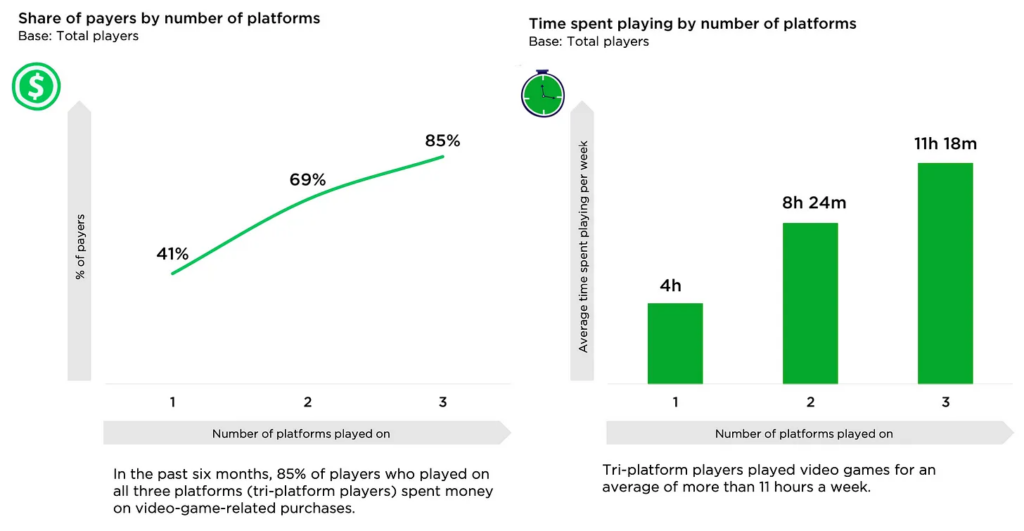

- There is a direct correlation between the probability of payment and the number of platforms on which the user is playing. If the platform is 1, the conversion rate is 41%. If two - 69%. If three - 85%.

- The same correlation might have seemed in the time consumption. Users with 1 platform spend about 4 hours per week on games. With 2 platforms - 8 hours 24 minutes. With 3 - 11 hours 18 minutes.

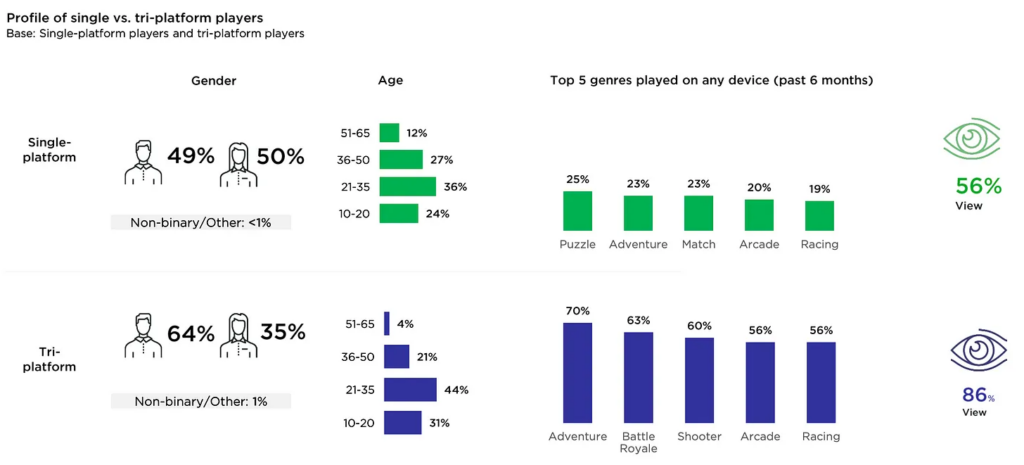

- Multiplatform players tend to be male (64%). They’re choosing more hardcore genres than those who are playing on one platform. They’re also more likely to watch the gaming content.

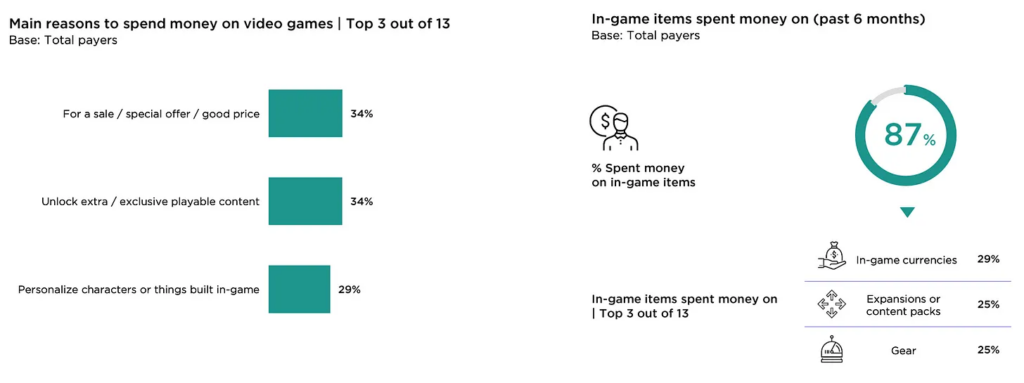

Spending

- 57% of players are paying in games.

- Conversion to the payer on mobile devices is the lowest - 45%. The PC is next with a 55% conversion. Consoles are leaders with a 66% conversion to the payer.

- The main reasons for buying something are sales (34%), an opportunity to unlock more content (34%), and customization (29%).

- 87% of the money in the last half a year was spent on in-game currency (29%), content updates (25%), and equipment (25%).

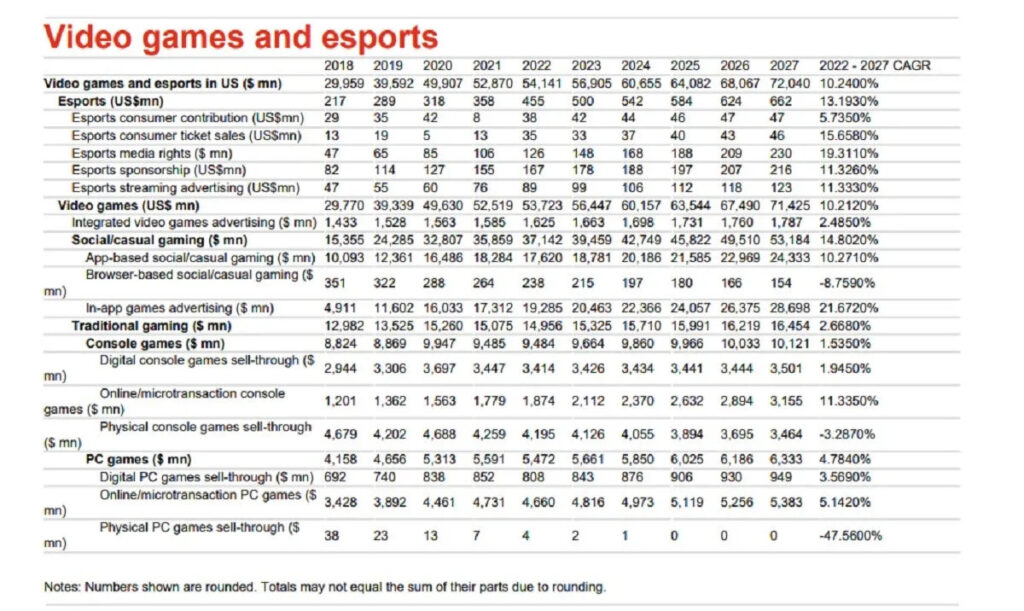

Brands

- 50% of players are discovering new brands while playing.

- 47% tend to buy a brand that was in their favorite title.

- 42% bought an item or a service that was advertised by a favorite streamer.

- Gamers have overall more positive attitudes toward brands than those who are not playing games.

Newzoo Global Gamer Study 2023 (pdf)

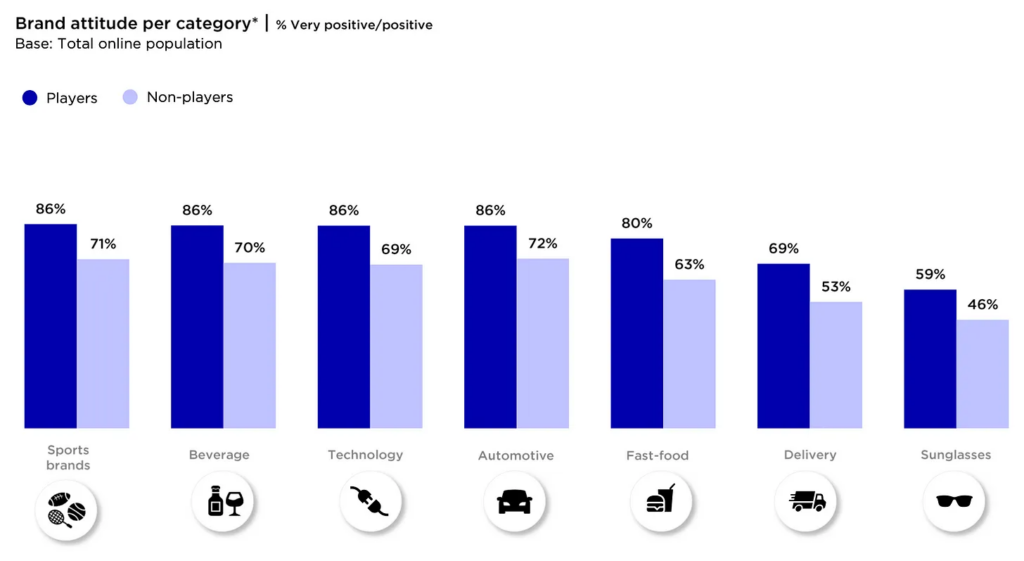

PwC: The US gaming market revenue in 2022 grew only by 2.4%

State in 2022

- $54.1B the US gaming market (including eSports) generated in 2022.

- The increase in revenue was 2.4%. This is the slowest growth in the last 5 years.

Expectations

- PwC analysts suggest that in 2023 the gaming market will grow by 5.1% to $56.9B.

- By 2027 the gaming market is forecasted to grow to $72B with a 10.24% CAGR from 2018 to 2027.

Verticals revenue

- The eSports industry in the US in 2022 generated $455M. It’s 0.85% of the overall gaming industry value.

- Social/casual games (I assume that mobile games are included) have the largest share in the overall revenue - 68.5% ($37.1B).

- In-app advertising ($19.3B) on mobile surpassed the IAP revenue ($17.6B) in 2022.

- PC/Console verticals are responsible for 27.5% of the overall gaming industry in the US ($14.95B). This segment dropped in 2022 by 0.8%.

- Console vertical generated $9.5B in revenue in 2022 (no changes to 2021). PC - $5.8B (-2.2% YoY).

- Analysts are skeptical about the console market's ability to grow. They forecast that in 2027 this segment will be only 6.7% larger than in 2022.

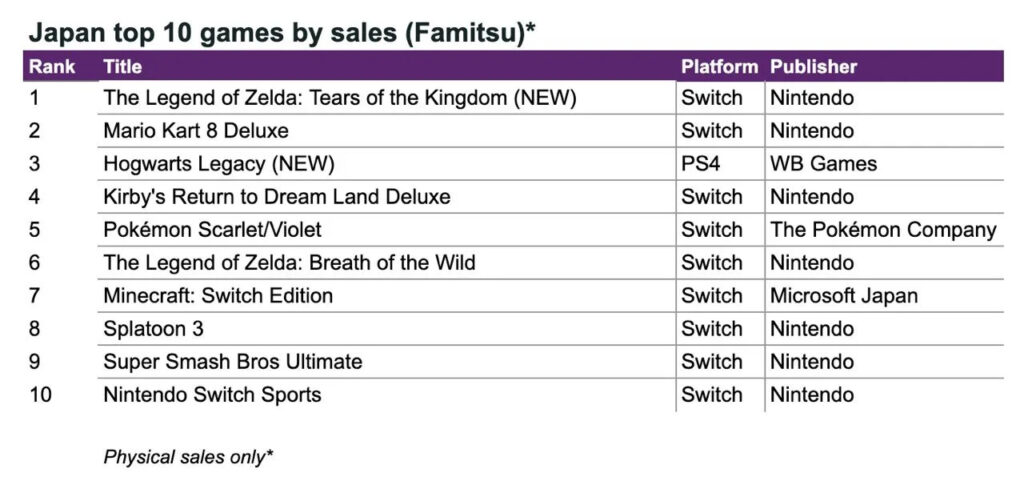

Famitsu: The Legend of Zelda: Tears of the Kingdom sold 1.5M retail copies in May in Japan

Famitsu is tracking only physical copies sales.

Games

- Gamers bought 1.1M copies of The Legend of Zelda: Tears of the Kingdom in the first three days of sales. It’s almost 4 times more than Breath of the Wild had.

- Mario Kart 8 Deluxe (47k copies) is second in sales. Hogwarts Legacy (43k copies) is third.

- Nintendo holds 8 places in the top 10 chart of best-selling games in Japan. That’s what domination looks like.

Consoles

- Nintendo Switch OLED was responsible for 52.8% of all hardware sales in Japan in May. About 274k consoles have been sold. If we count all Switch sales, the number will increase to 345k in May.

- PlayStation 5 is second by sales with 145k sold copies (28% of the overall amount in May).

Newzoo: 10 best-selling games on PC and Consoles in the US and UK in 2023 (January - May)

- Hogwarts Legacy is first with a big margin. Moreover, game sales increased in May compared to the previous month, connected to the game's release on PlayStation 4 and Xbox One.

- The Legend of Zelda: Tears of the Kingdom is already second. It outperformed the previous installment, Breath of the Wild, by far. However, it’s unlikely that it’ll surpass Hogwarts Legacy because of the audience's limitations.

- Star Wars Jedi: Survivor is the third game by sales in mentioned markets. It means that 2 out of 3 games at the top are based on books or films IP.

- 3 out of 10 games in the top 10 are remakes or remasters. We’re speaking of Resident Evil 4, Dead Space, and Metroid Prime: Remastered.

- MLB The Show 2023 and WWE 2K23 are the most popular sports games. FIFA 23 hasn’t reached the top as the US market is significantly larger than the UK one. If EU sales are counted, the situation will be different.

- Sons of the Forest is 8 by overall sales. It’s a large success for the studio with less than 25 people, and it released its title on Steam only. The previous title - The Forest - had more than 5M copies sold.

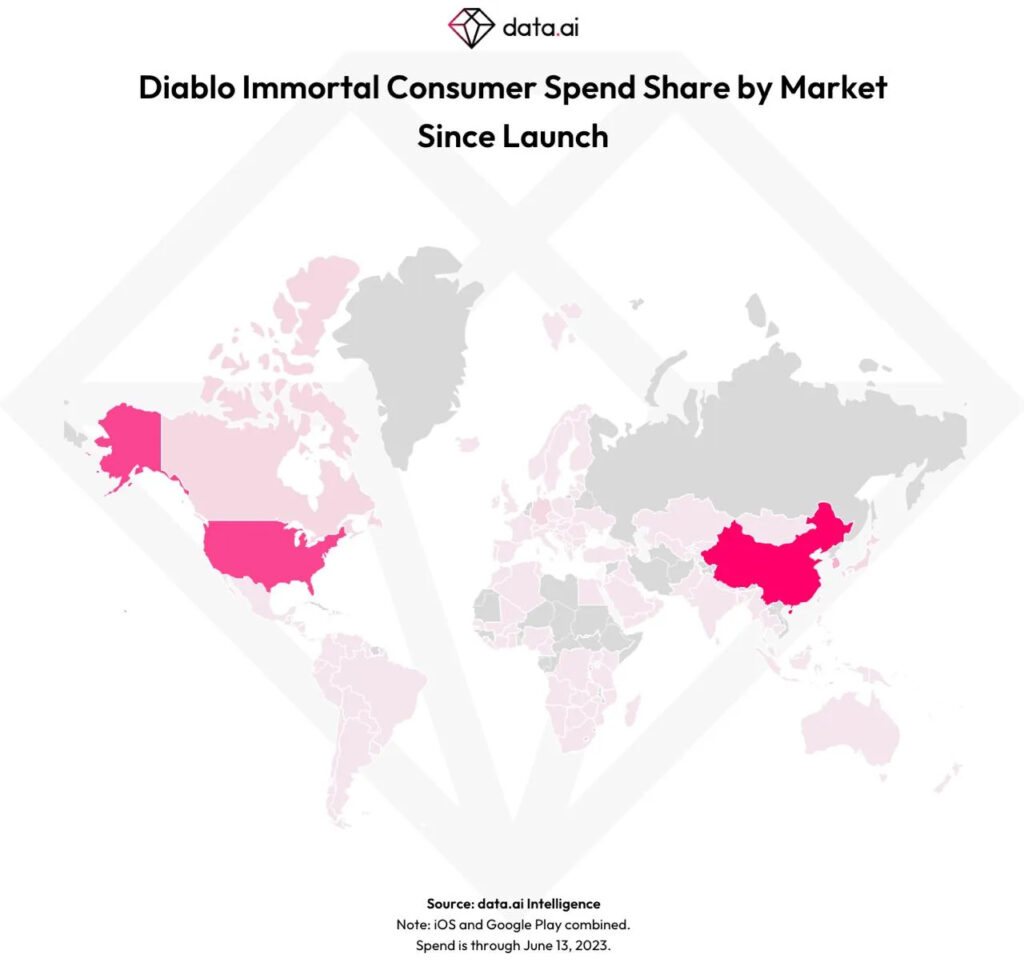

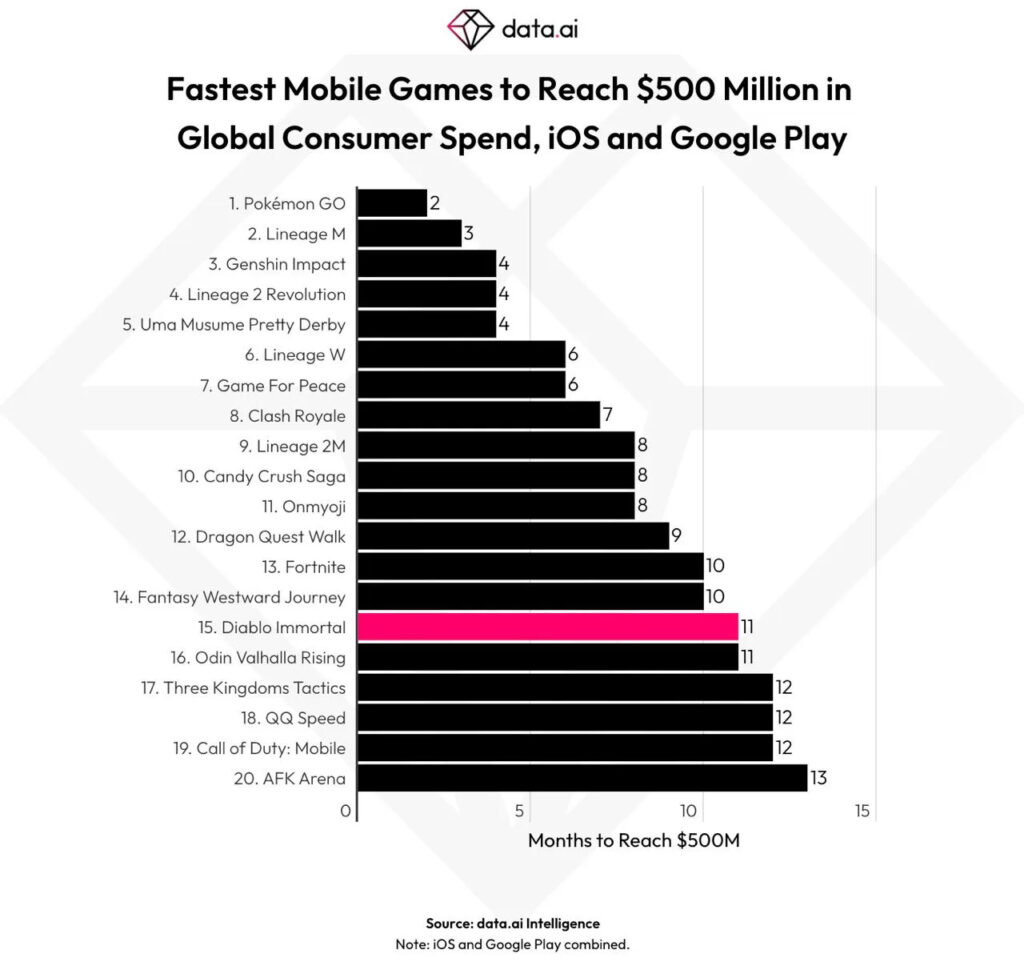

data.ai: Diablo Immortal earned $525M in the first year on mobile

- The revenue number doesn’t include 3rd-party Android stores in China and PC purchases.

- 36.8% of revenue has been earned in China. The second market for the game is the US (24.4%).

- The game was downloaded 22M times.

- By revenue growth, Diablo Immortal is in the top-15 mobile games. Pokemon GO, Candy Crush Saga, and Genshin Impact are making a company.

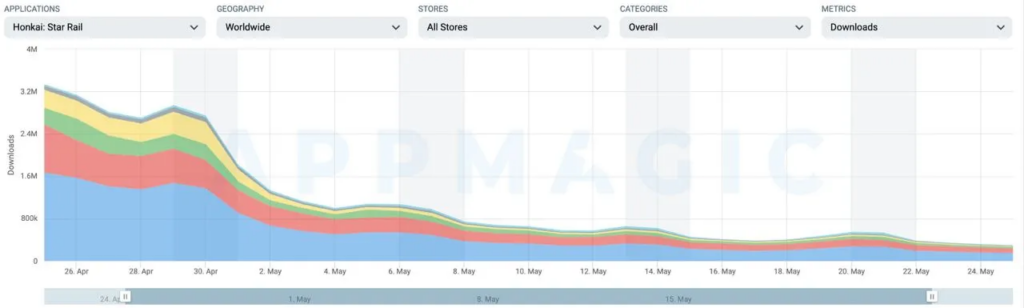

Sensor Tower: Honkai: Star Rail earned more than Genshin Impact in May outside of China on Mobile

- Honkai: Star Rail's success

- Honkai: Star Rail revenue increased 3.7x times according to April. Okay, that happened majorly because the game's release happened on the 26th of April.

- 38% of overall revenue came from Japan (the top market for the title), and the US is responsible for 21%.

- An update with Jing Yuan released on May 17 significantly increased HonkaI: Star Rail's performance.

Other titles

- Whiteout Survival is growing firmly, with a revenue increase of 29%. The game is #5 in the top chart by revenue.

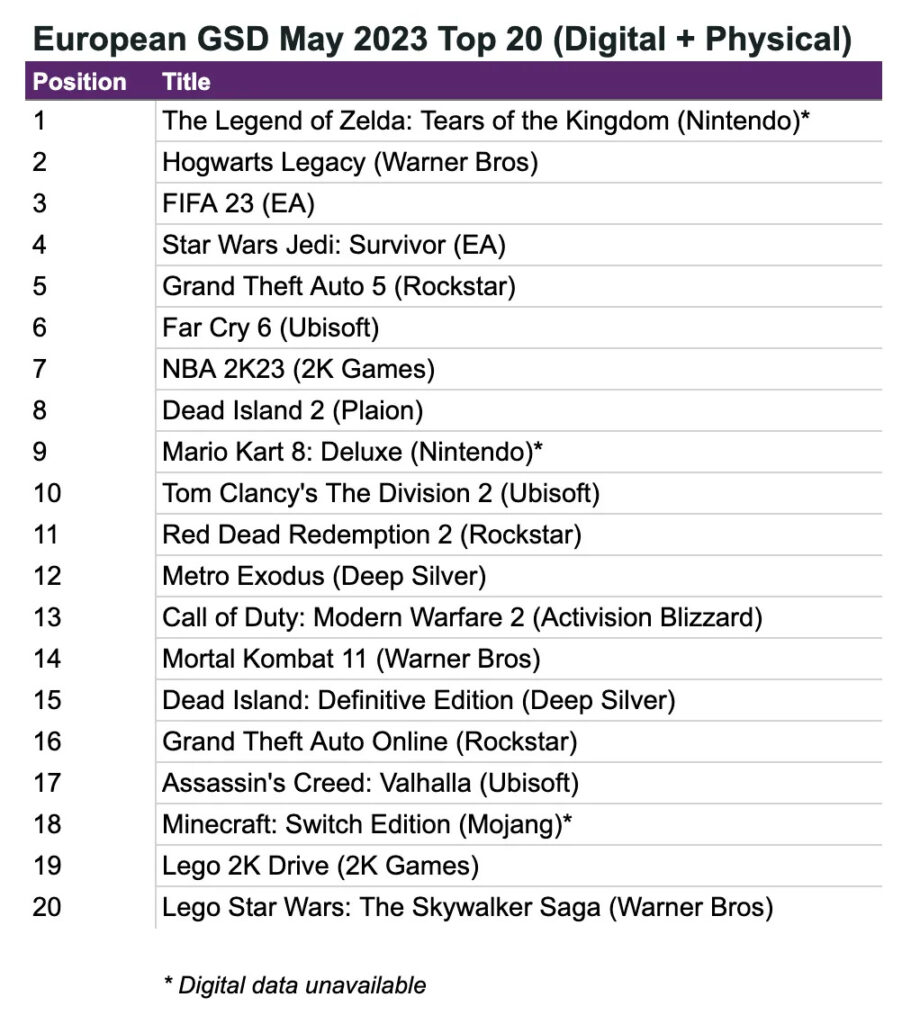

GSD: Game sales in Europe in May 2023 increased by 33%

GSD is reporting only the fact sales numbers were received from partners. There are partners (like Nintendo) who are not sharing the digital sales numbers, which might affect the overall picture.

Games

- 10.6M game copies were sold in Europe in May this year. It’s 33% more than in May 2022.

- The Legend of Zelda: Tears of the Kingdom was the main growth driver. Its sales are 2.5x higher than Hogwarts Legacy’s, which was the second.

- After 3 weeks of sales, The Legend of Zelda: Tears of the Kingdom is losing only to FIFA 23 and Hogwarts Legacy in terms of overall sales numbers (without digital sales). If we compare retail sales only, the game is already #1 in Europe.

- Hogwarts Legacy sales increased by 321% to the previous month thanks to the release on PlayStation 4 and Xbox One. 71.5% of the game sales in May came from the PS4; 11.7% - from Xbox One.

- The only new game in the top 20 by sales in May was LEGO 2K Drive.

Hardware and accessories

-

429k consoles were sold in Europe in May, 40% more than a year before. Numbers are without Germany and the UK.

- Nintendo Switch outperformed PS5 in sales in May. Amid The Legend of Zelda: Tears of the Kingdom release, sales went up by 39% compared to the previous year.

- PlayStation 5 sales increased by 81% compared with May 2022.

- Xbox Series S|X is not feeling great. Console sales decreased by 16% compared to the previous year.

- 1.3M accessories have been sold in May (+30% YoY). DualSense continues to lead.

The GameDiscoverCo: Genshin Impact on PlayStation has 400k DAU

- The monthly audience of the title on PlayStation consoles is about 2.1M people.

- miHoYo is currently working on the PlayStation release of its new title - Honkai: Star Rail.

Diablo IV is the most successful launch in Blizzard Entertainment's history

- The game earned $666M in the first 5 days of sales.

- The company also set a record for pre-sales on both PC and Consoles.

- In the first 5 days, players spent more than 276M hours in the game. It’s been more than 30 thousand years.

- Diablo IV is the most popular game among all Blizzard Entertainment titles by the number of hours watched on Twitch in the first 10 days.

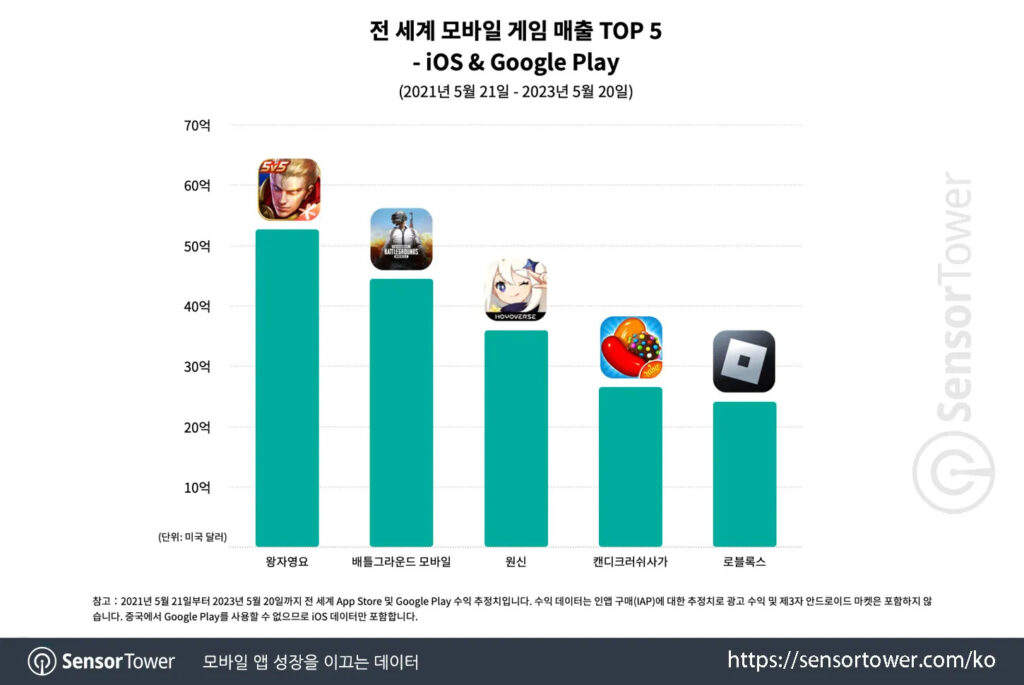

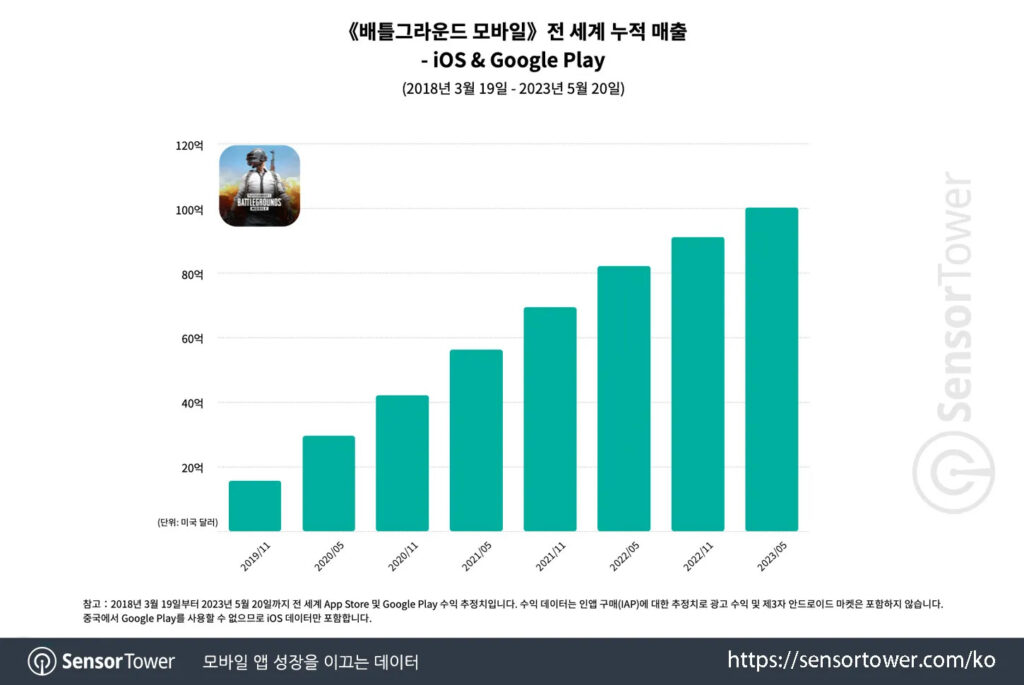

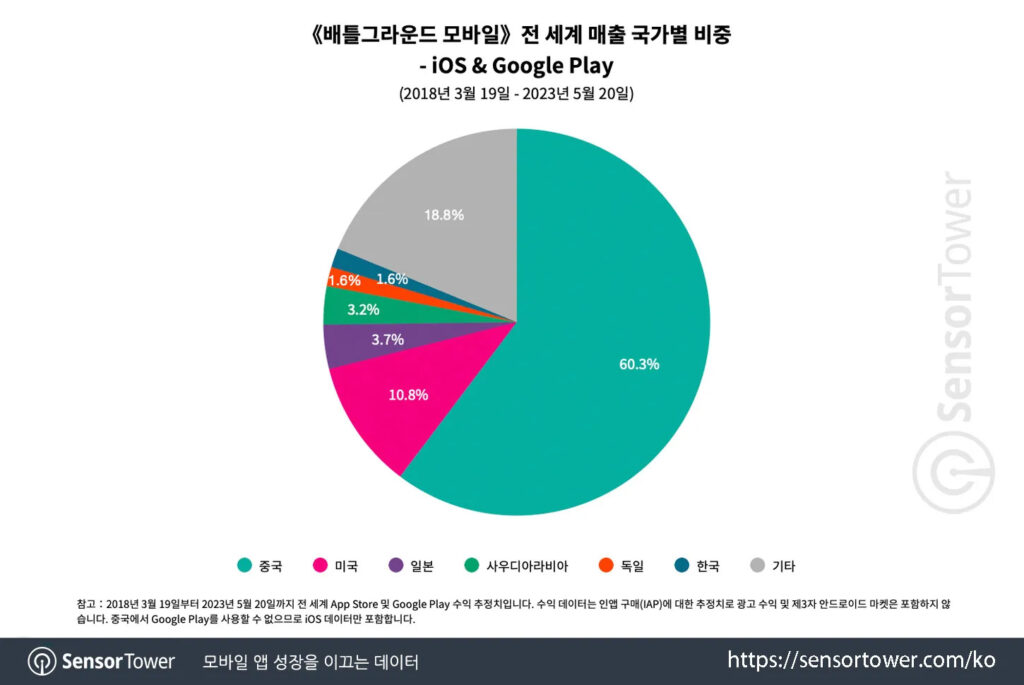

Sensor Tower: PUBG Mobile earned $10B

- Only Honor of Kings received more revenue worldwide.

- The last billion PUBG Mobile earned in half a year. The report of $9B revenue was released in December 2022.

- 60.3% of PUBG Mobile’s revenue came from China. The US is responsible for 10.7%; Japan - for 3.7%.

- The majority of downloads are from India (21.8% of the overall amount). China (14.3%) and the US (5.9%) are next.

Circana: Game subscriptions revenue growth in the US almost stopped

- The revenue from gaming subscriptions in April 2023 was just 2% higher than a year before.

- Mat Piscatella, the executive director of Circana, is connecting it with problems of finding a new audience willing to pay.

- Mat also claims that traditional game releases in 2023 showed a great performance, especially strong digital sales.

- His words are supported by Sony reports. The number of PS Plus subscribers is stagnating at a level of 46-47M users in the last two years.

Microsoft last time reported about 25M Xbox Game Pass subscribers in January 2022. In October 2022, in the UK court, Sony told about 29M subscribers of the service.

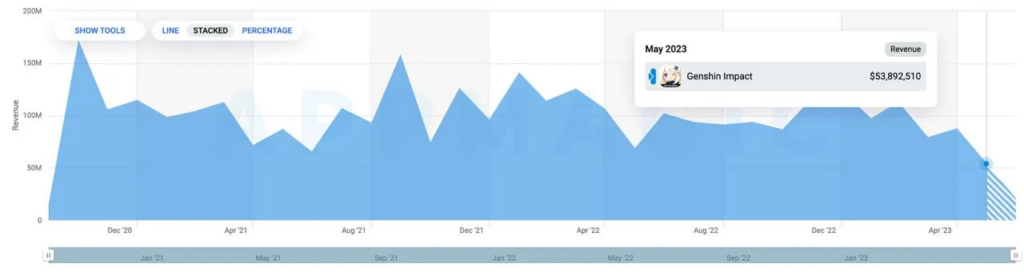

AppMagic: Genshin Impact in May 2023 showed the worst revenue on Mobile since the launch

- Based on AppMagic data, the game earned $53.9M in May 2023. It’s the lowest number since the release.

- The previous anti-record was set in June 2021 - the game earned $65.6M back then.

AppMagic also launched their podcast with a first guest - Daniel Ahmad. They discussed trends, which genres grew despite the market decline, and how studios can benefit from the current macroeconomic situation.

- The drop in revenue might’ve happened due to two reasons. The first is the underperformance of the Baizhu banner, which made only $1.9M in China on iOS, while the previous banner made $8M. The second is the release of Honkai: Star Rail, which might’ve attracted some of the audience.

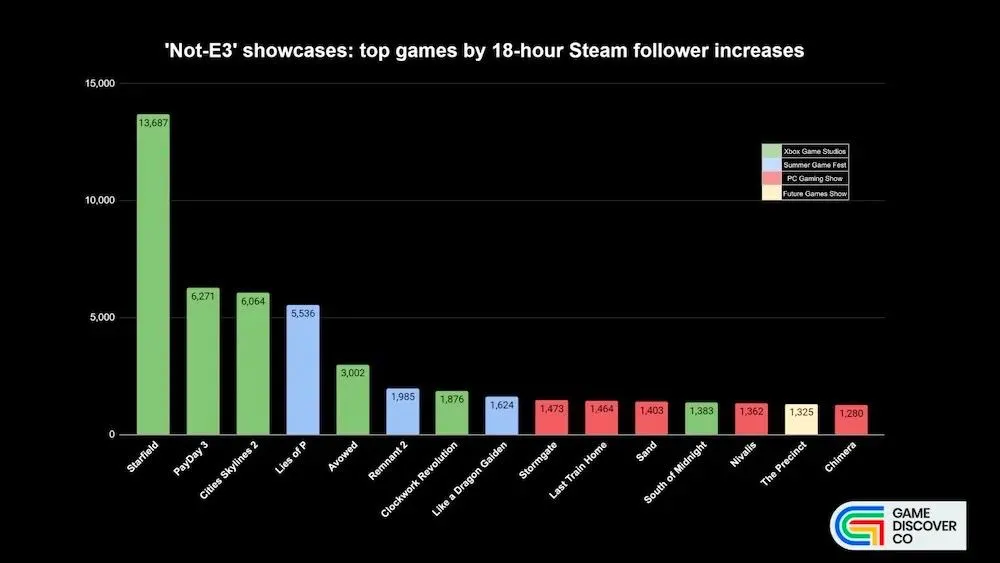

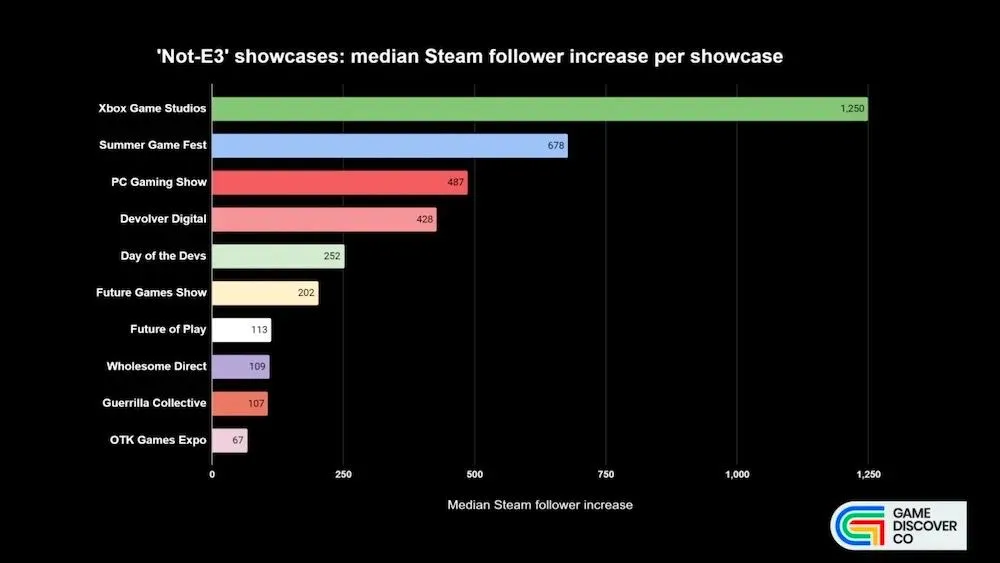

The GameDiscoverCo: Rating of games from E3 2023 shows replacements

Rating by number of increased Steam followers

- Starfield, PayDay 3, and Cities Skylines 2 are leaders by the number of subscribers growth after recent shows.

- If we’ll check the median increase, Xbox Show is leading by efficiency (+1,250 followers on median), Summer Game Fest is second (+678 followers), and PC Gaming Show is third (+487 followers).

It’s important to mention that some titles - like PlayStation exclusives - are unavailable on Steam.

Rating by media coverage

- Starfield was presented at the Xbox show and is the leader among all games, with 1,106 articles across different media outlets.

- Cyberpunk 2077: The Phantom Liberty is second (600 articles), and Marvel’s Spider-Man 2 is third (550 articles).

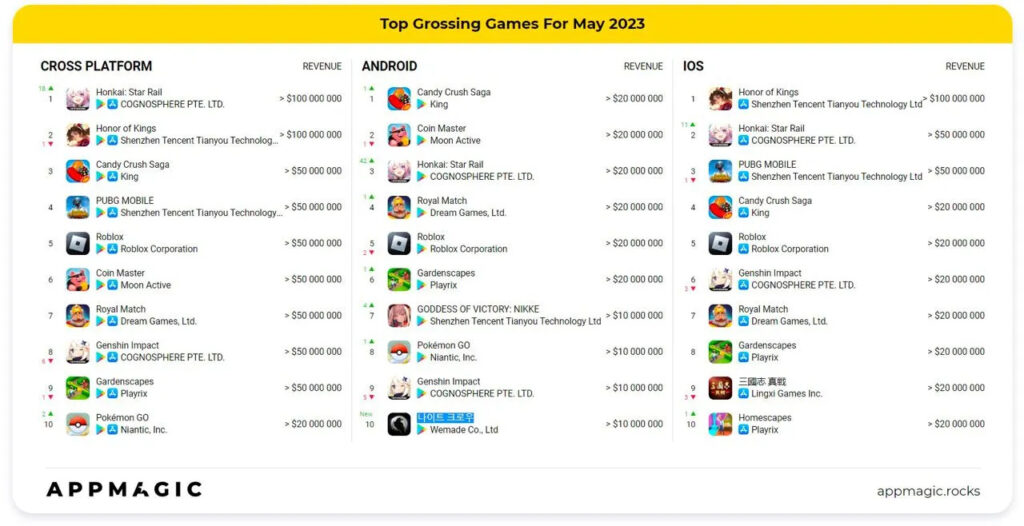

AppMagic: Top Mobile Games of May 2023 by Revenue and Downloads

Revenue

- Honkai: Star Rail is the top-grossing game of the month, with $116.6M in revenue.

- The Honor of Kings is in unusual second place. The last time it happened was in December 2022, when Genshin Impact took the lead.

- Night Crows is the new title in the top 10 of Android revenue. This is the MMORPG from Wemade, which is currently launched only in South Korea. In May, the game earned $23.1M.

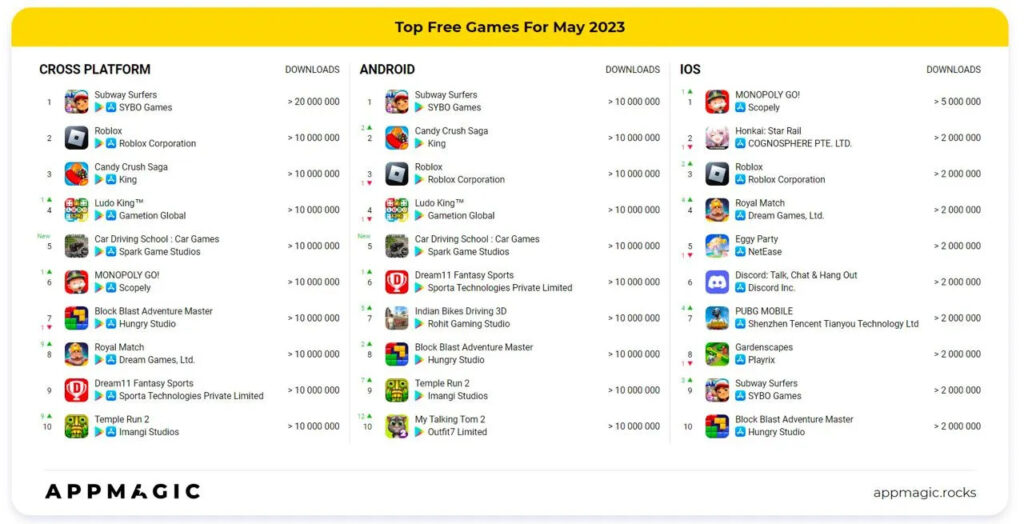

Downloads

- Subway Surfers, Roblox, and Candy Crush Saga are world leaders in downloads.

- The only newcomer in the downloads chart is Car Driving School: Car Games. The game from Pakistan-based Spark Game Studios has been downloaded 15.1M times. Considering the release date in September 2019, this is a wonder.

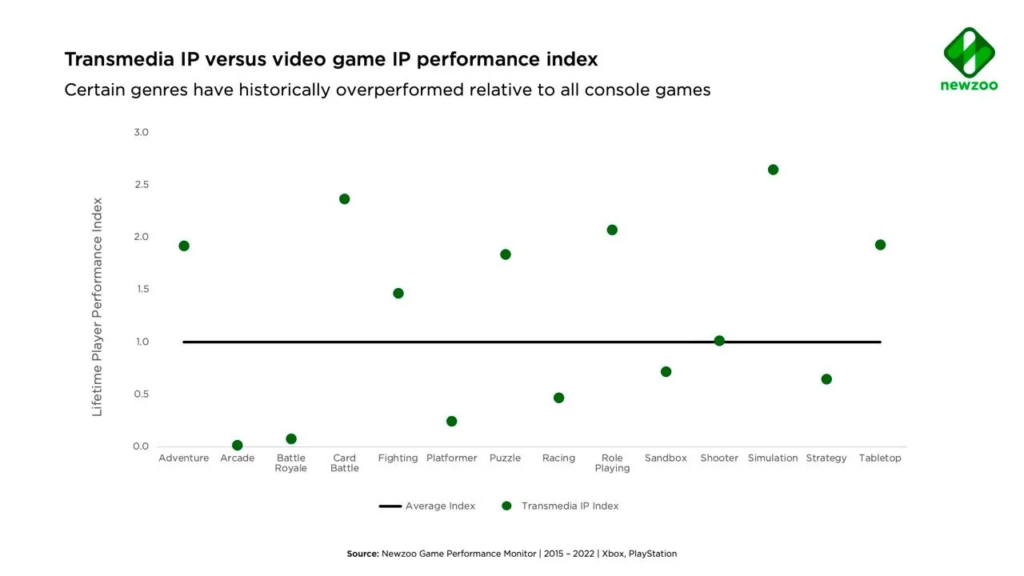

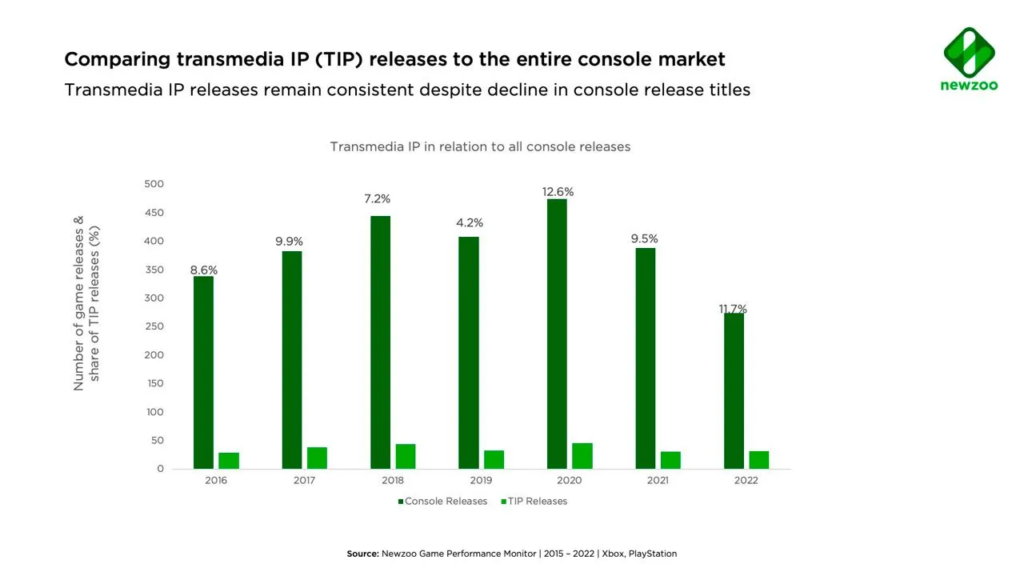

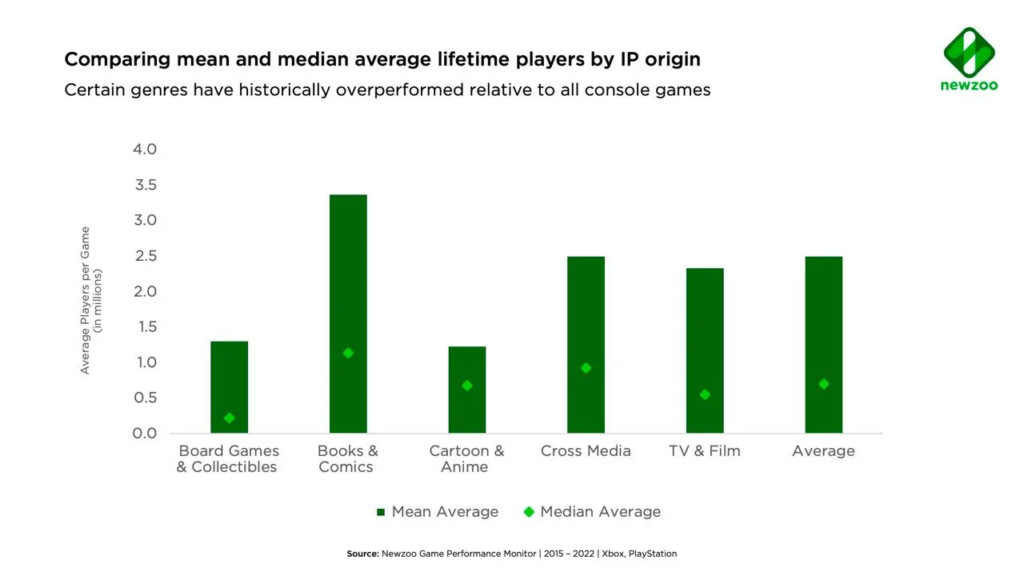

Newzoo: Transmedia in games: trends, success factors, market insights

General trends

- About 10% of all console releases since 2016 were based on IPs. Since the pandemic, the share of IP-based games increased due to the smaller number of non-IP releases. IP-based titles tend to have better retention than non-IP games.

- Most IP-based games are made in 4 genres: adventures, fighting, RPG, and shooters.

History

- The first attempt to make an IP-based game happened in 1982. E.T. the Extra-Terrestrial release on Atari 2600 was such a big disaster that the next try was only in 1988 with Dr. Jekyll and Mr. Hyde.

IP-based games market status

- Despite the view that the number of IP-based games is increasing, its amount has been consistent since 2016 - from 180 to 228 releases per year. In 2022 there was even a decline, with 150 IP-based games being released.

- On the console market, there are 30-40 IP-based releases per year.

- The share of IP-based games from the overall amount of titles in Steam, App Store, and Google Play is below 2%.

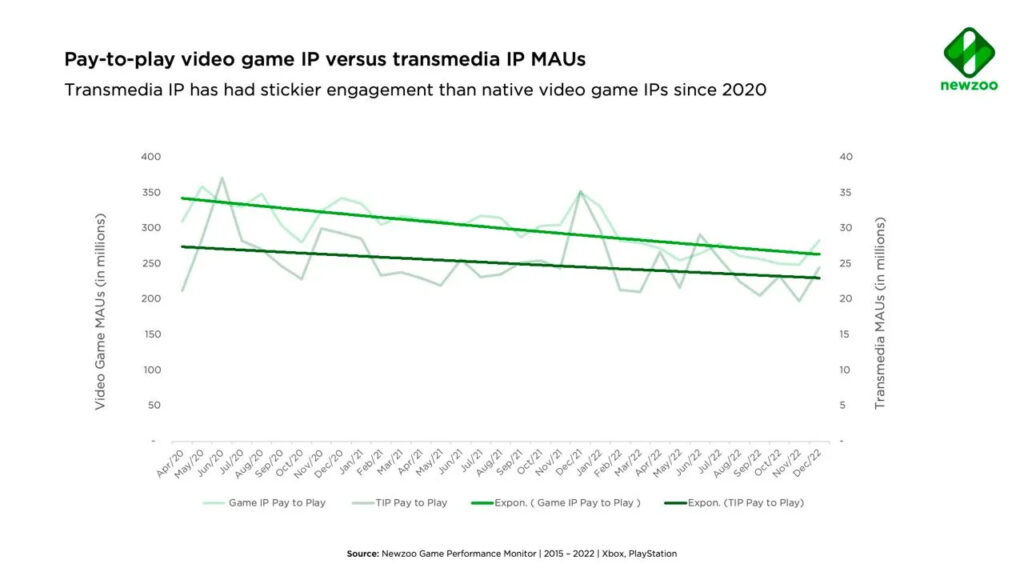

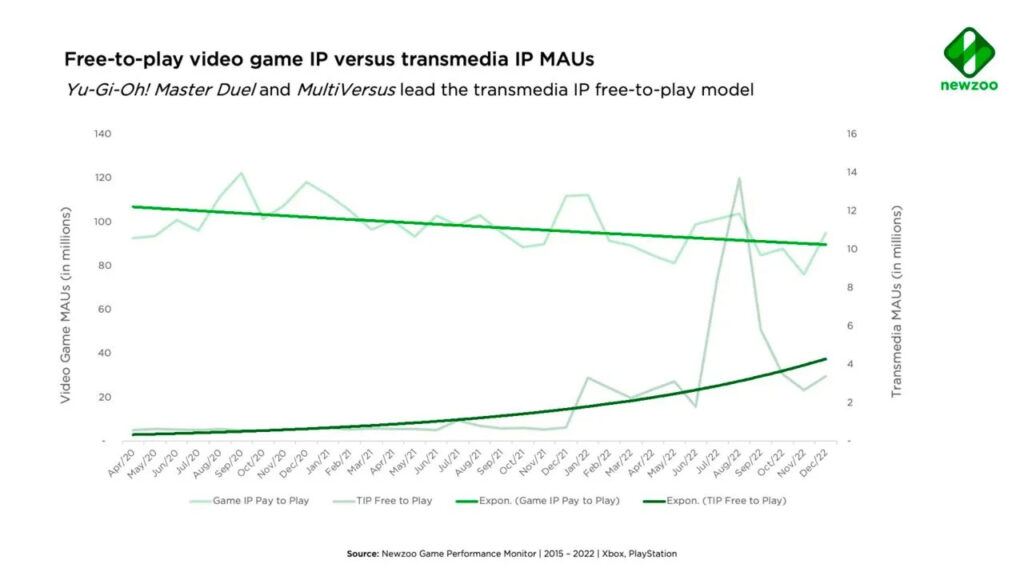

IP games retention

- As of April 2023, the average IP-based title has 2.5M gamers’ lifetime, while non-IP-based titles have only 1.4M players.

- IP-based titles have been working with the retention of Premium titles since 2020.

- IP-based F2P games are not only better in terms of retention compared to non-IP titles; they even managed to increase the MAU from 2 to 4 million in 2022. Games without transmedia IPs were declining by MAU the whole year.

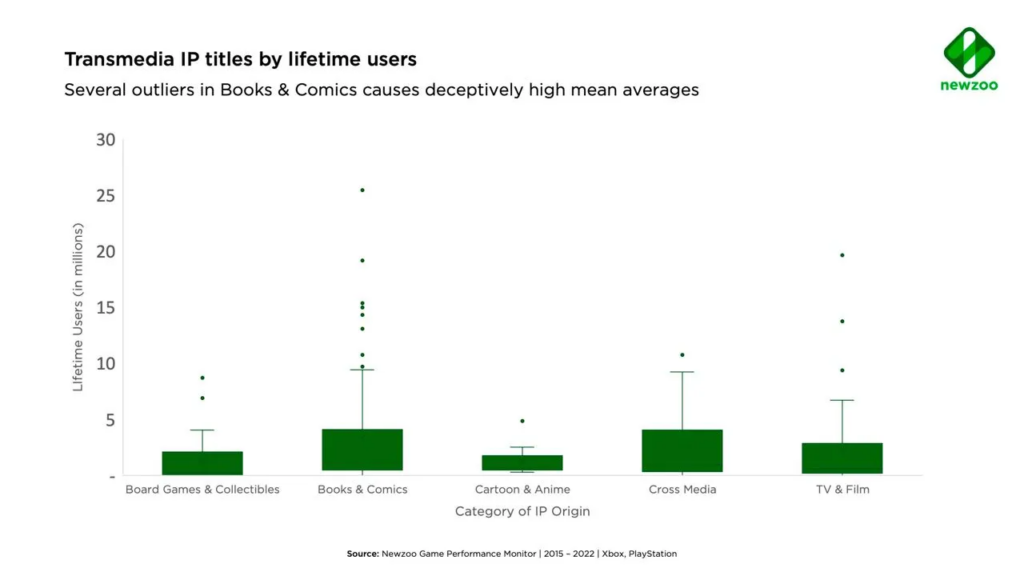

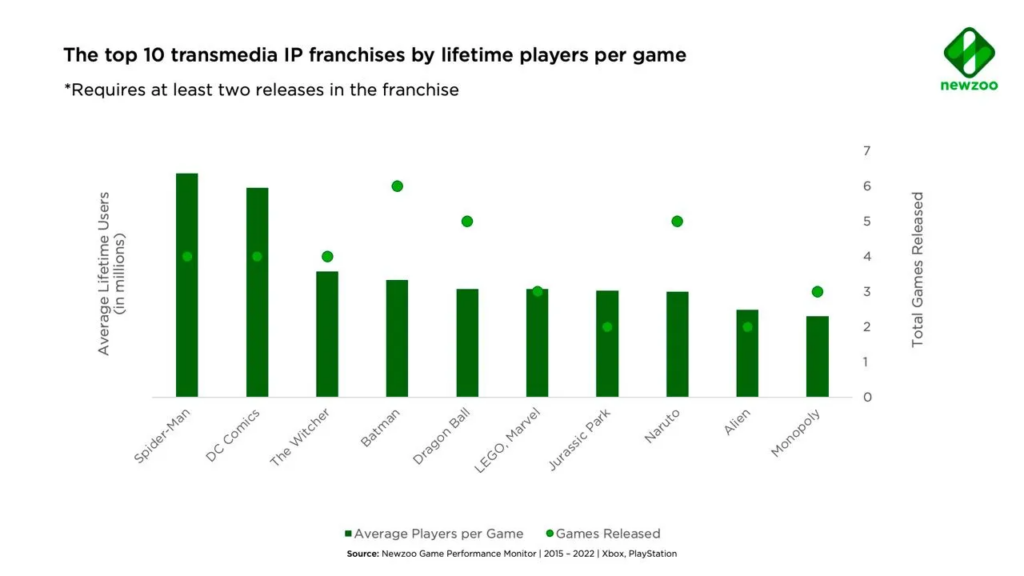

Most popular IP

- Games based on comics or books IPs are considered the most popular. But even in this case, out of 88 analyzed games, only 9 had more than 10M users. 51 titles haven’t surpassed the million threshold.

- Top-10 most successful IPs based on the number of users are Spider-Man, DC Comics, The Witcher, Batman, Dragon Ball, LEGO Marvel, Jurassic Park, Naruto, Alien, and Monopoly.

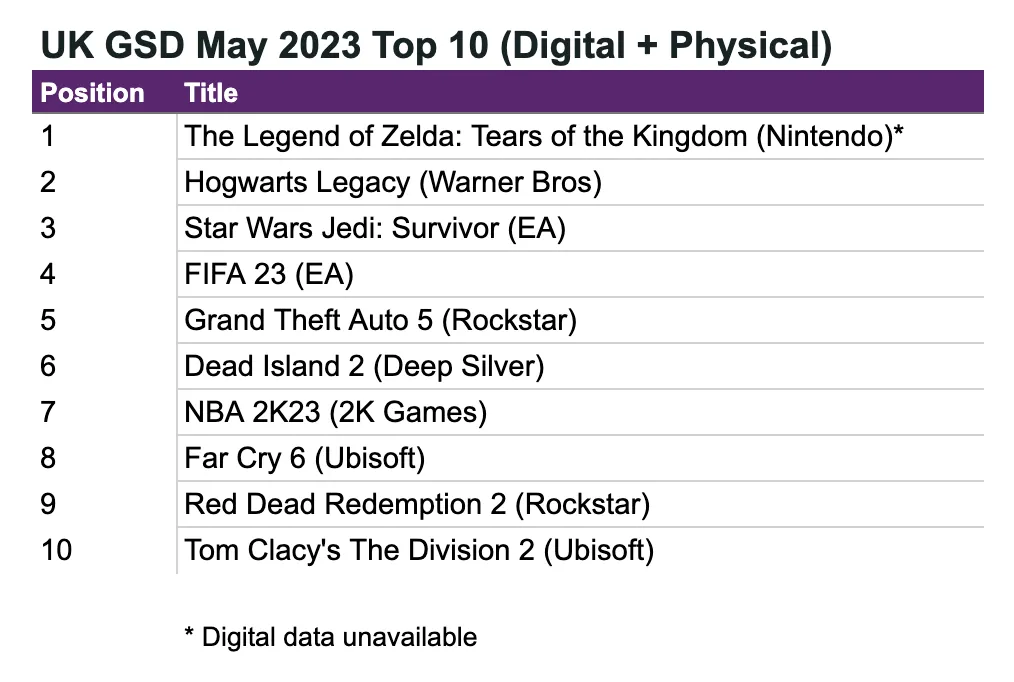

GSD: The Legend of Zelda: Tears of the Kingdom dominated the UK market in May

Games

- The Legend of Zelda: Tears of the Kingdom reached #1 on the chart even without the digital sales numbers, which Nintendo is not sharing.

- The Legend of Zelda: Tears of the Kingdom is the largest launch in the series’ history in the UK. Overall game sales are now behind only Twilight Princess and Breath of the Wild.

- Amid the success of a new Nintendo exclusive, game sales increased by 30% YoY to 2.17M copies.

- Hogwarts Legacy launched on past-gen consoles. In May, 53% of sales came from PS4 and 24% from Xbox One.

Hardware

- 96k game consoles were sold in the UK in May. It’s 10% lower than last year; and a 14% drop to April.

- Nintendo Switch, which sales increased by 28% YoY, took first place by sales from PlayStation 5.

- 35% of all Nintendo Switch sales in May came from the OLED-version bundle with The Legend of Zelda: Tears of the Kingdom

- PlayStation 5 sales decreased by 23% from the previous month. May was the first month of 2023 when console sales dropped below 2022.

- Xbox Series S|X experienced a decline of 10% YoY.

- At the end of May, overall console sales in 2023 increased by 16.6% compared to the previous year. The growth is led by PlayStation 5 (+81% YoY). Nintendo Switch declined by 8%; Xbox Series S|X - by 19%.

- 441.2k accessories were sold in May - a 5% drop from the previous year. DualSense is still a leader but had a great competition with Nintendo Switch Pro Controller.

Street Fighter 6 reached 1M copies in 4 days

- Overall, series sales surpassed 50M copies.

- Street Fighter V had 7M copies sold at the end of 2022.

- Capcom is planning to reach 10M copies with Street Fighter 6.

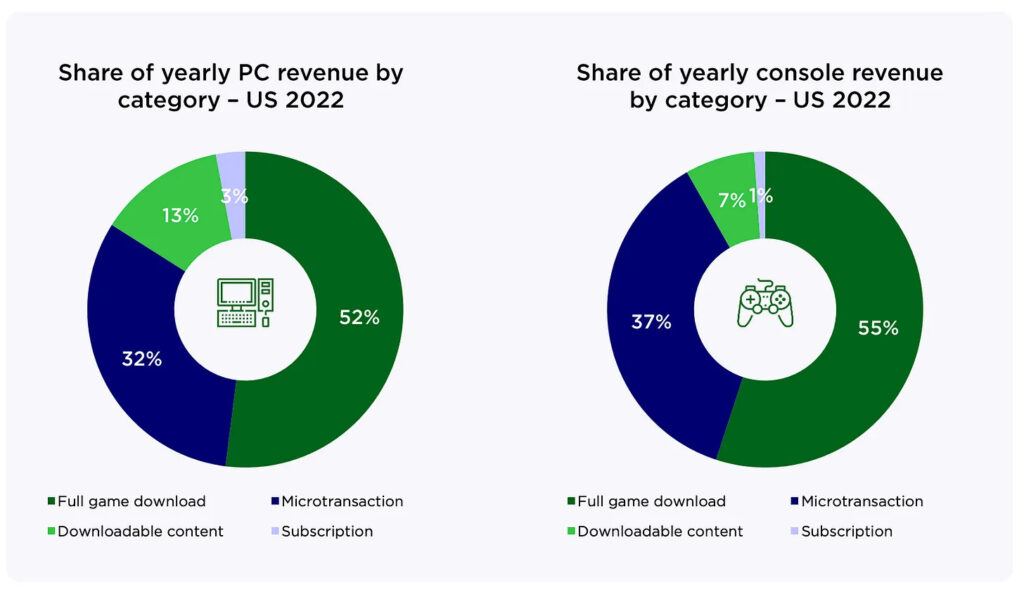

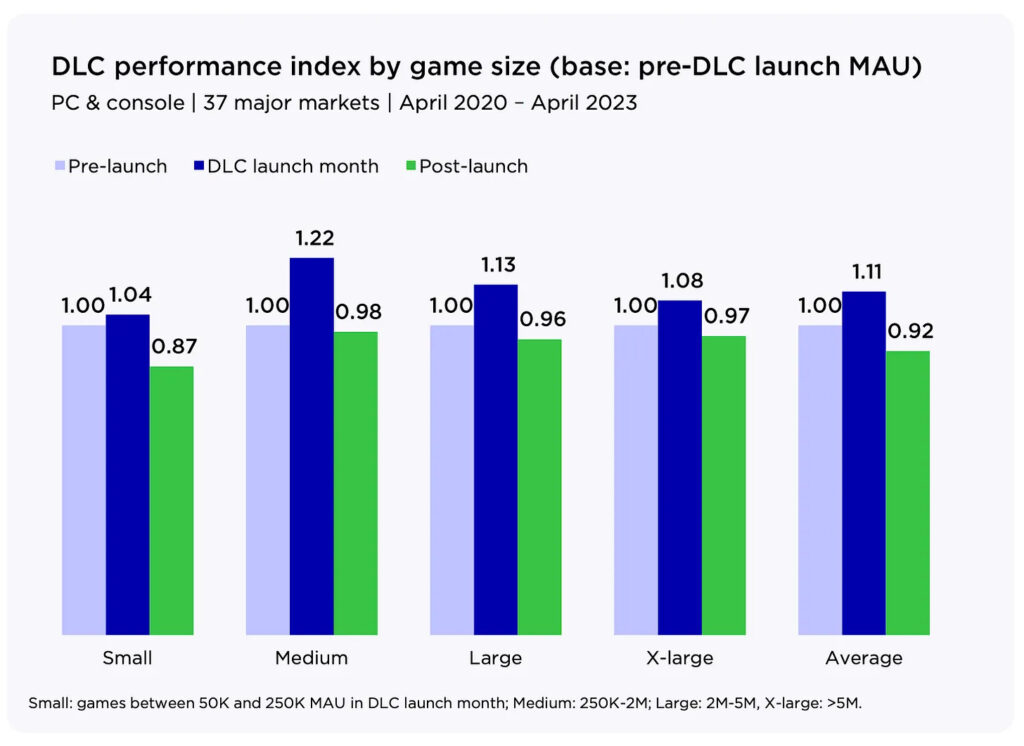

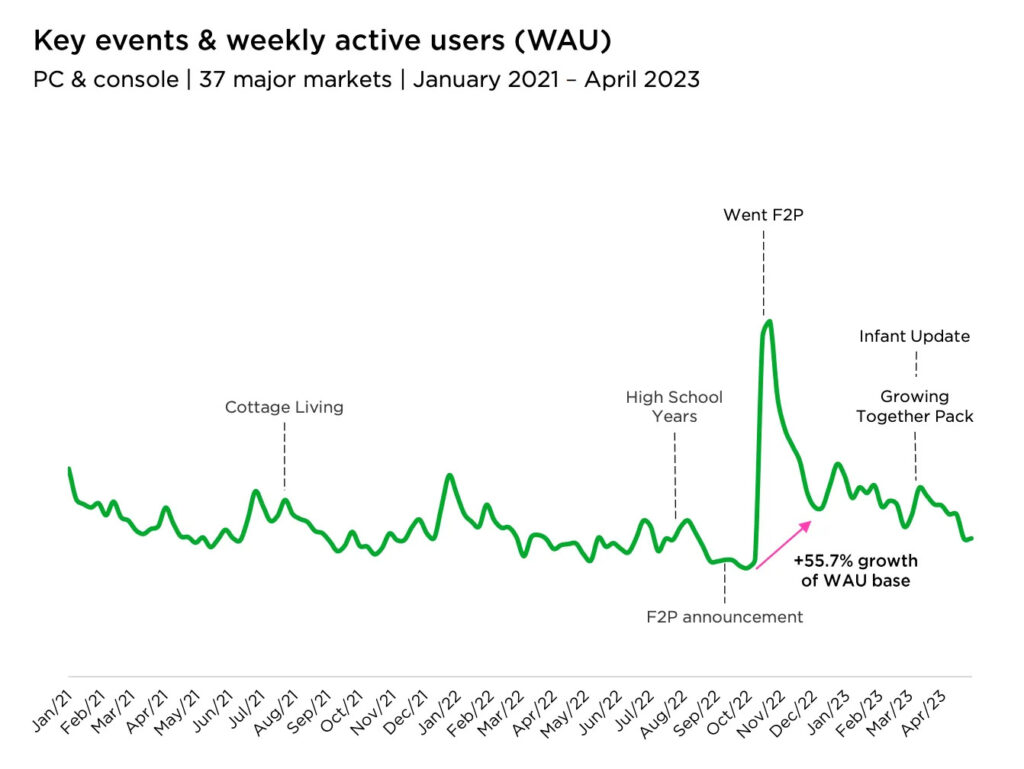

Newzoo: DLCs effect in PC and Console titles

Newzoo analyzed more than 1,600 DLCs released from April 2020 to April 2023.

General conclusions

- DLCs are responsible for 13% of all PC revenue and 7% of console revenue in 2022 in the US.

- On average, DLCs increase MAU by 11% on PC and consoles. However, the following month after the release, there was a decline from 2% to 13%, depending on the game size.

- Games of medium size (from 250k to 2M MAU at the moment of DLC release) are benefitting the most from new content - an increase by MAU is reaching 22%.

- Strategy games are in first place by MAU growth after the DLC release (+30.5%). RPG (+21.1%) and Simulation (+19.6%) are next.

The Sims 4 case study

- At the end of 2022, EA announced The Sims 4 transition to the F2P model. After a spike (+189% WAU), WAU stabilized at +56% to the paid version numbers.

- EA launched the free Infant Update in March 2023, and two days after - paid Growing Together update. A combination of free and paid releases made Growing Together the most successful DLC in The Sims 4 history, with WAU up by 16.7%.

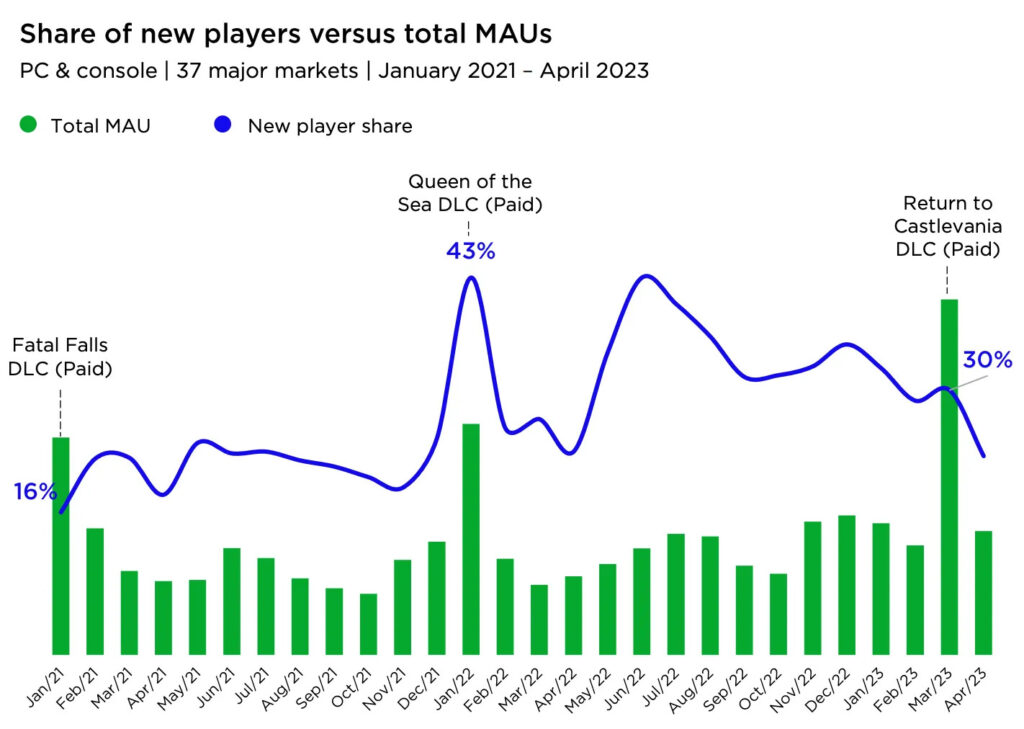

Dead Cells case study

- The average MAU growth in the new DLC launches (company released 3) is 156%.

- The most successful DLC is “Return to Castlevania” - in March 2023, it boosted the MAU by 225%.

- The share of new users in the MAU in months of DLC release varies from 16% to 43%.

- Despite the large MAU growth, 87% of users haven’t returned to play the DLC.

Newzoo DLC Content Report 2023 Final (pdf)

Niko Partners: Chinese Gaming market in 2022 surged to $45.5M; the Chinese PC market is gigantic

Chinese Gaming Market

- Despite the 2.4% decline, China is still the largest market in the world, according to Niko Partners.

- China is responsible for 31.7% of worldwide gaming industry revenue and 33.4% of PC segment revenue.

- Mobile games generate 66% of Chinese gaming market revenue, 31% - from PC games, and 3% - from consoles.

- By 2027 it’s expected that the market will reach $57B. The number of gamers will increase to 730M.

- Niko Partners assume that in 2023 1,000 local developers and 100 foreign developers will receive the ISBN.

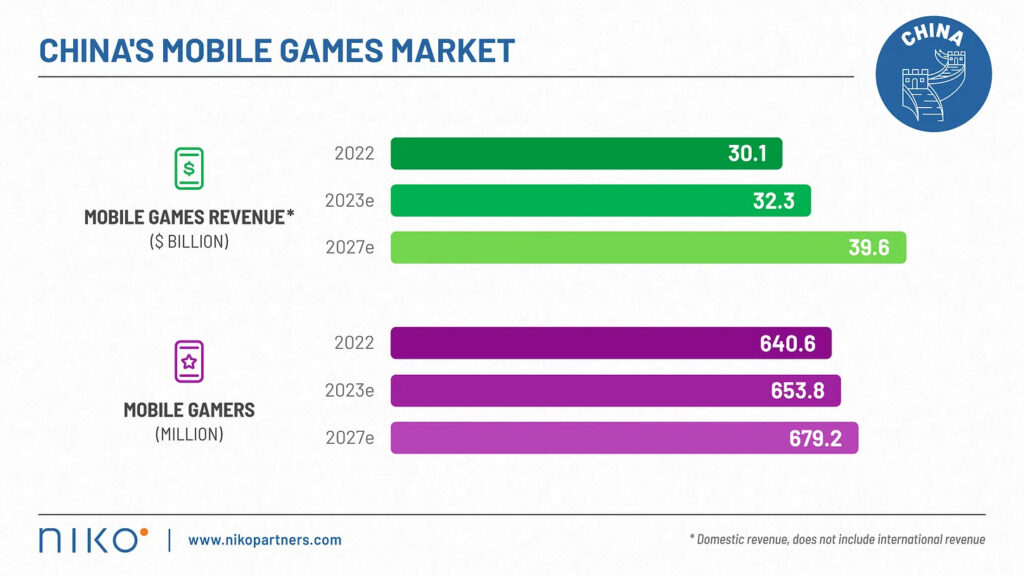

Chinese Mobile Gaming market

- The volume of the Chinese mobile gaming market in 2022 was $30.1B. In 2023 according to analysts, it will grow to $32.3B and to $39.6B in 2027.

- 640.6M mobile gamers were in China in 2022. By 2027 this amount will increase to 679.2M.

Chinese gaming companies

- Chinese gaming companies are responsible for 39% of worldwide PC revenue (including the Chinese market).

- Chinese gaming companies’ revenue in the West on PC increased by 22% in 2022. Niko Partners expects that their CAGR by 2027 will be 13.8%.

- Tencent and NetEase are responsible for 61% of local PC revenue in 2022. Despite the large percentage, it’s lower than in 2021.

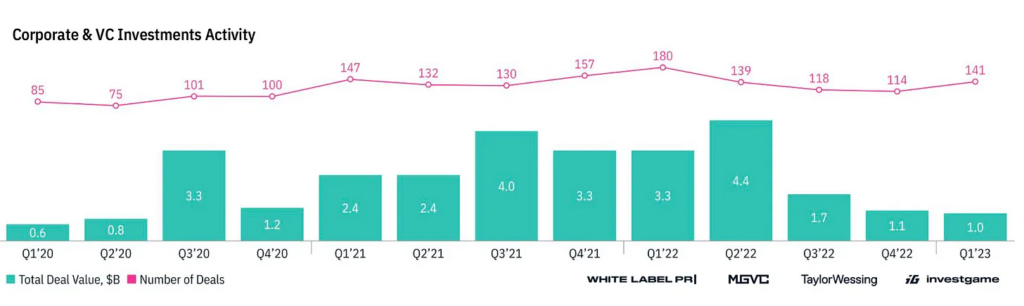

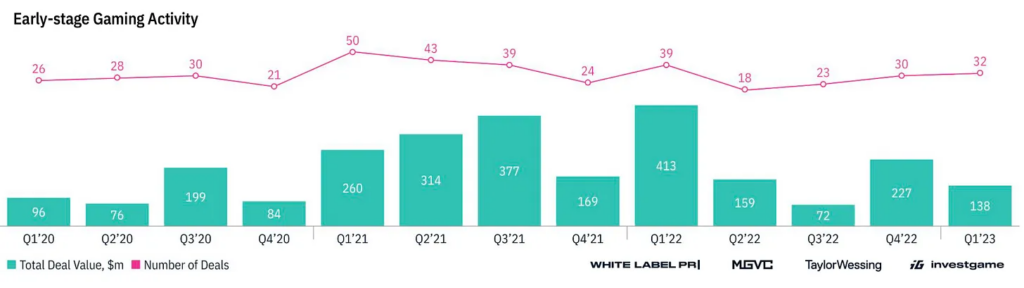

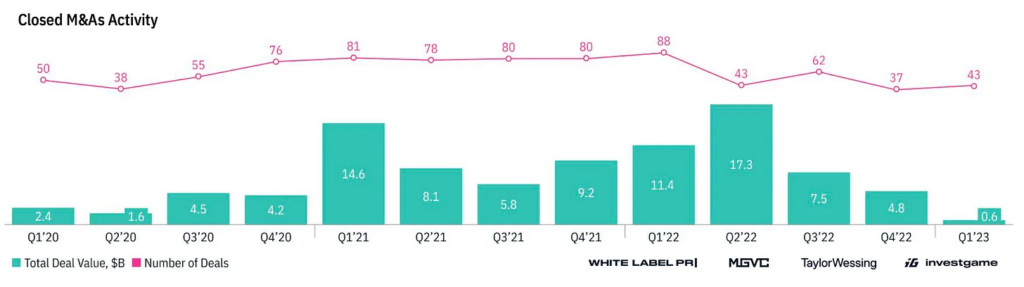

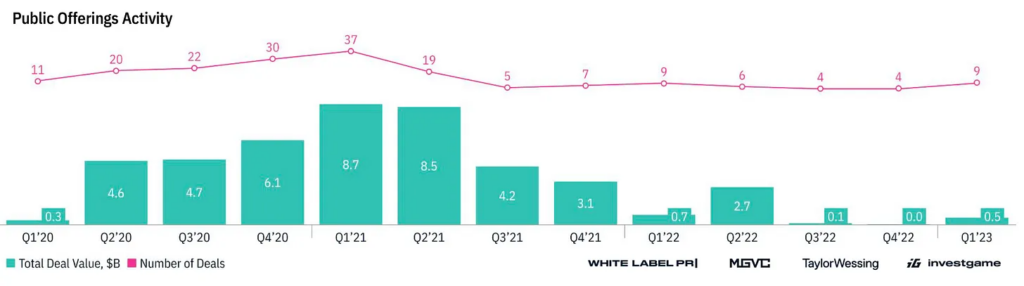

InvestGame: Gaming Investment Deals Report - Q1 2023

- The market is cooling off after the outstanding performance of 2021 and 2022.

Private investments

- The number of private investments increased compared to the previous two quarters. But the overall size of investments decreased - in Q1’23, it was about $1B.

- The majority of deals in Q1’23 have been in the early stages. The largest rounds of the quarter are VSPO ($265M), Believer ($55M), and CCP Games ($40M).

- Of all deals (141), 32 were in product companies in the early stages.

- Two product companies in Q1 ’23 received a later-stage investment - CCP Games and Carry1st.

Corporate investments

- 10 corporate deals happened in Q1’23. The majority of them are of undisclosed amount.

M&A

- In Q1’23, the M&A activity was minor. The number of deals was twice less than a year before.

- The overall size of deals was $0.6B. However, the second quarter will be more prominent - we already know about Savvy Games Group x Scopely and SEGA x Rovio deals.

Public offerings

- 9 public offerings happened in Q1’23 with an overall sum of $0.5B.

- InvestGame experts are sure that the situation won’t be better anytime soon.

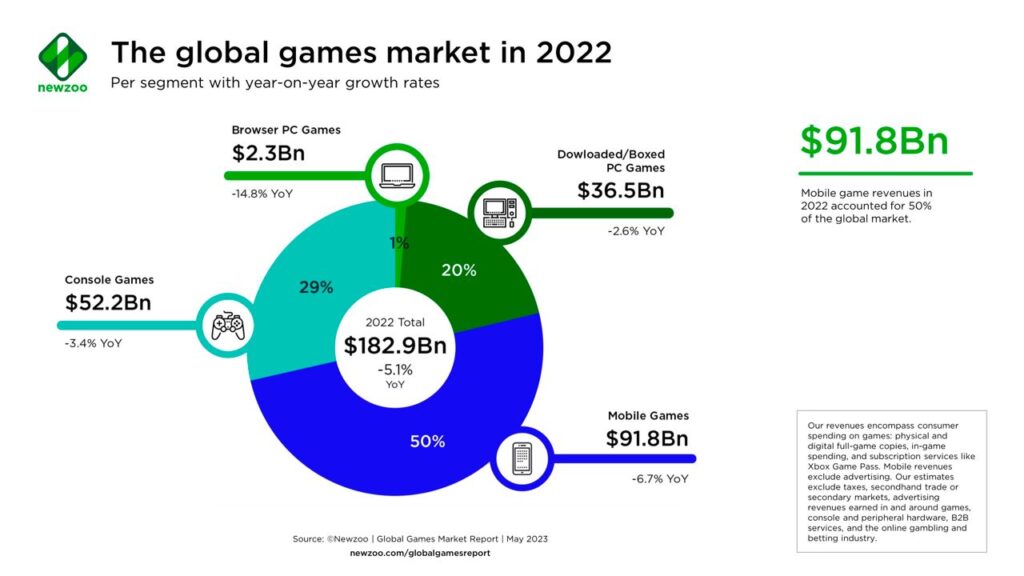

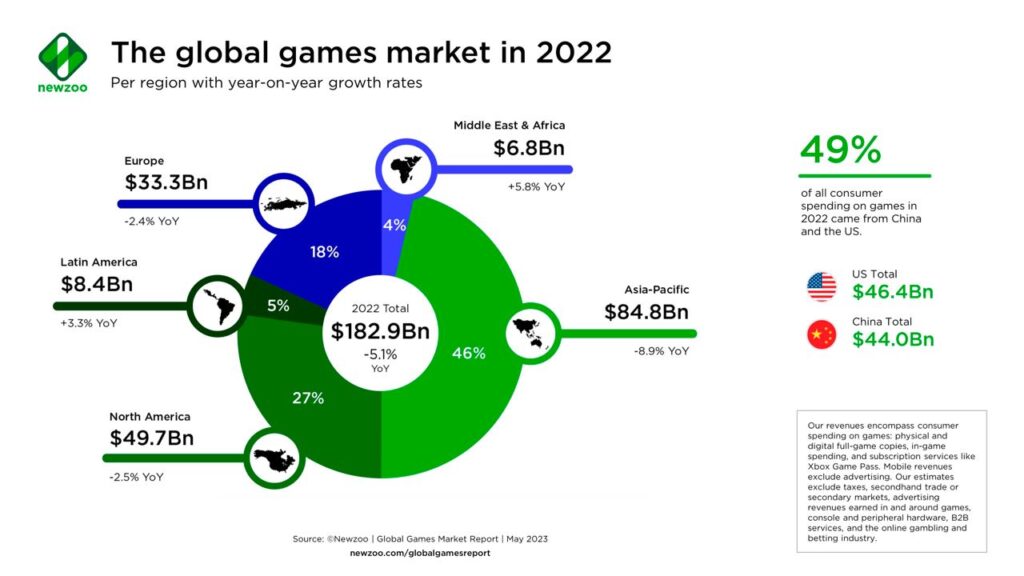

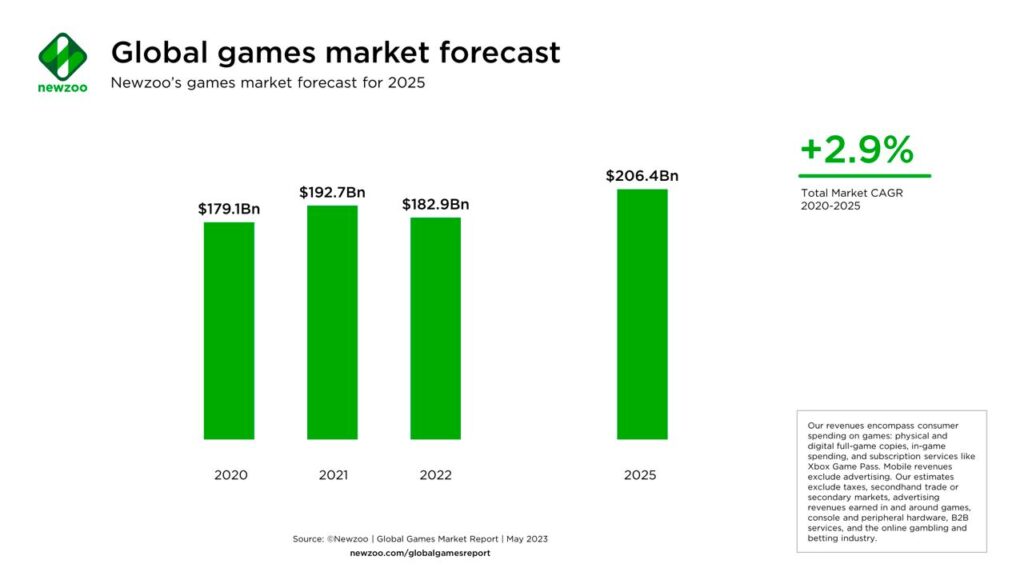

Newzoo adjusted the Gaming market size in 2022 - it's dropped worse than expected

- The gaming market in 2022 was $182.9B - a 5.1% decline to 2021. The previous estimation was at $184.4B.

- Mobile gaming is responsible for 50% of overall revenue. The PC browser market experienced the largest decline - by 14.8% YoY.

- However, Newzoo analytics do forecast that in 2025 the market will reach $206.4B with a 2.9% CAGR.

- China and the US are 49% of the worldwide gaming market. The only regions with a positive dynamic in 2022 were MENA ($6.8B size - +5.8% YoY growth) and LATAM ($8.4B size - +3.3% YoY growth).

AppMagic: Honkai: Star Rail earned $132.3M in the first month on Mobile

- China is responsible for 34% of the revenue; Japan got 26%; the US generated 15%.

- The game has been downloaded 17.6M times, which resulted in an RpD of $6.48.

- Honkai: Star Rail launched slightly worse than Genshin Impact, which had $176.4M of revenue and 21M of downloads.

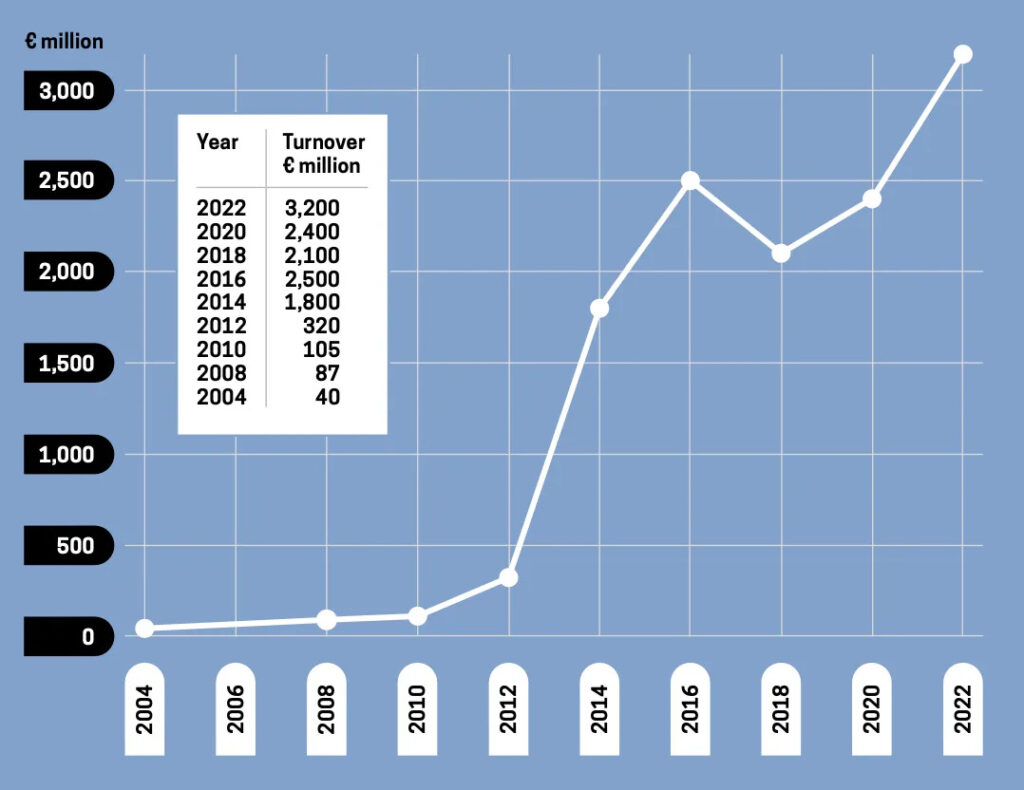

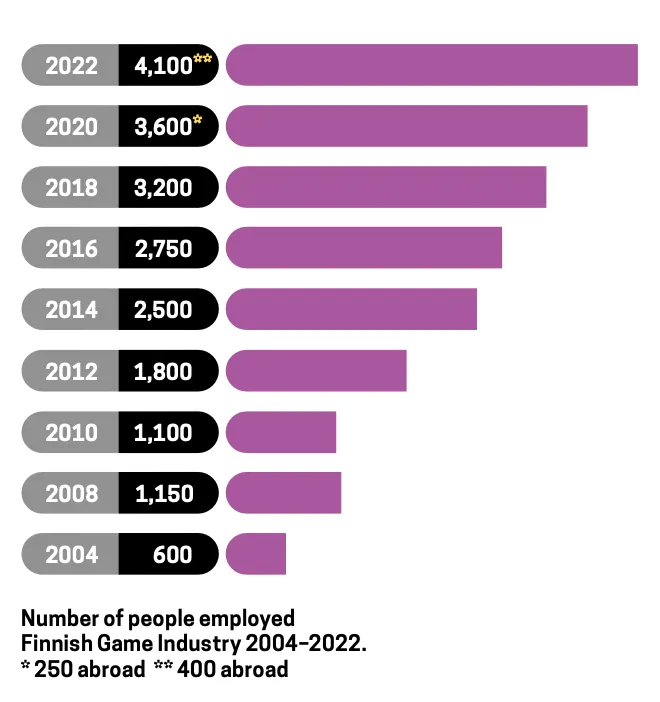

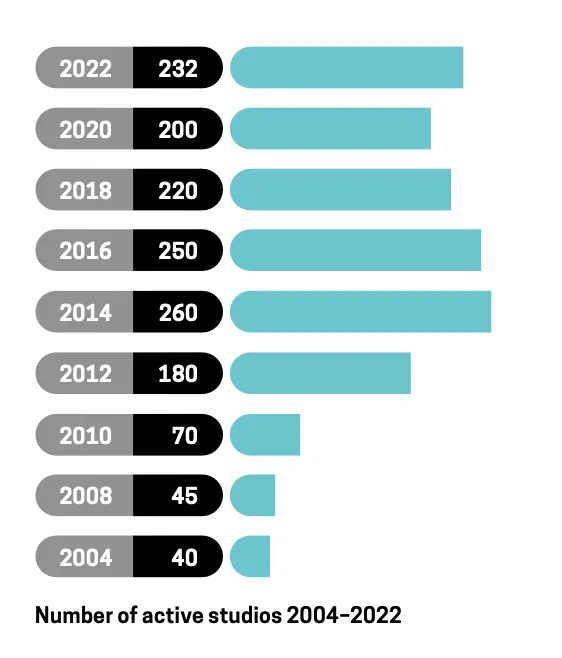

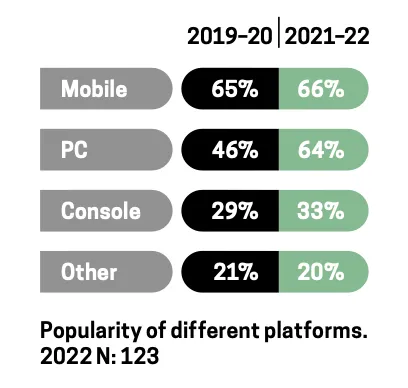

Neogames: The Finnish Game Industry in 2022

- Finnish companies’ turnover in 2022 reached €3.2M. There are 5 companies in the country now with annual revenue of €100M+.

- 4100 people were working in the Finnish gaming industry by the end of 2022. Growth of 500 people compared to 2020.

- 650 gaming studios have been open in Finland since 1995. 232 of them are now actively developing new games.

- The median number of employees in Finnish gaming companies is 10 people.

- About 35% of Finnish game industry employees are working remotely.

- Finnish gaming studios expressed a growing interest in PCs over the last two years. In 2019-2020, the number of developers for this platform was about 46%; in 2021-2022, it reached 64%. 59% of gaming studios in Finland work on titles for two or more platforms.

The Game Industry of Finland 2022 report (pdf)

Nintendo: The Legend of Zelda: Tears of the Kingdom sales exceeded 10M copies in the first 3 days

- That’s the fastest-selling title in The Legend of Zelda series.

- Japanese players bought 2.24M copies of the title while the North and Latin American gamers bought 4M copies of the game cumulatively.

- The Legend of Zelda: Tears of the Kingdom is sharing the first position now with the Pokémon Scarlet and Violet.

GTA V sales reached 180M copies

Take-Two, in the financial report of 2022, uncovered its leading series sales.

- GTA V sales exceeded 180M copies. Series now has 400M+ copies sold.

- Red Dead Redemption II reached the 53M copies sold mark. The whole series has 75M.

- NBA 2K sold 135M copies.

- Borderlands series sales are 80M copies.

- Games from Sid Meier’s Civilization series have been bought 67M times.

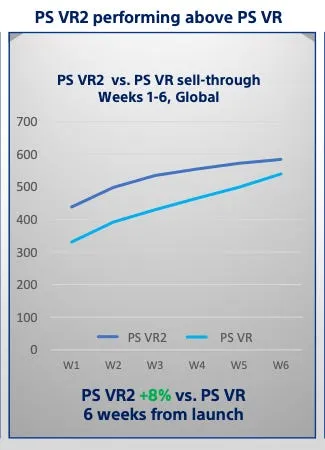

Sony: PlayStation VR 2 tapped 600k copies in the first 6 weeks

- PS VR 2 starting sales (first 6 weeks) are 8% higher than the original PS VR had.

- However, the sales dynamic of the first PS VR was better - it had stable sales after the first-week push, while PS VR 2 sales slowed down after 3-4 weeks.

- Sony plans to increase investments in the new IP development for PS VR 2.

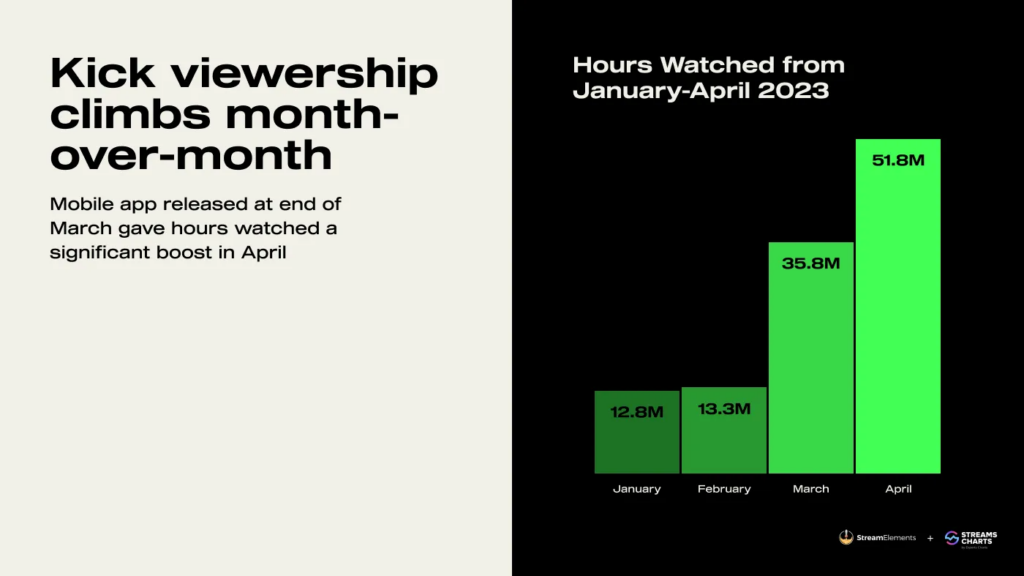

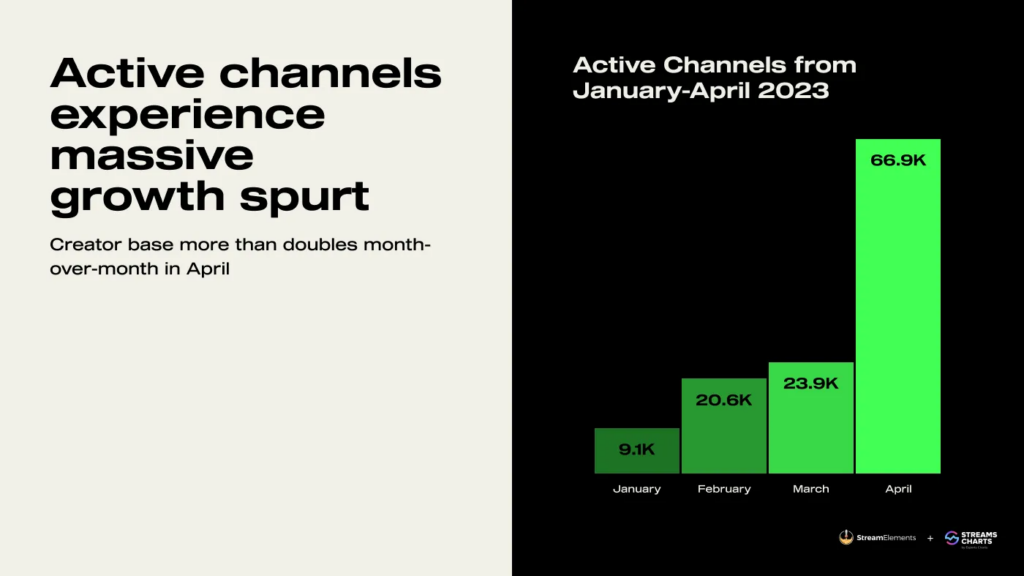

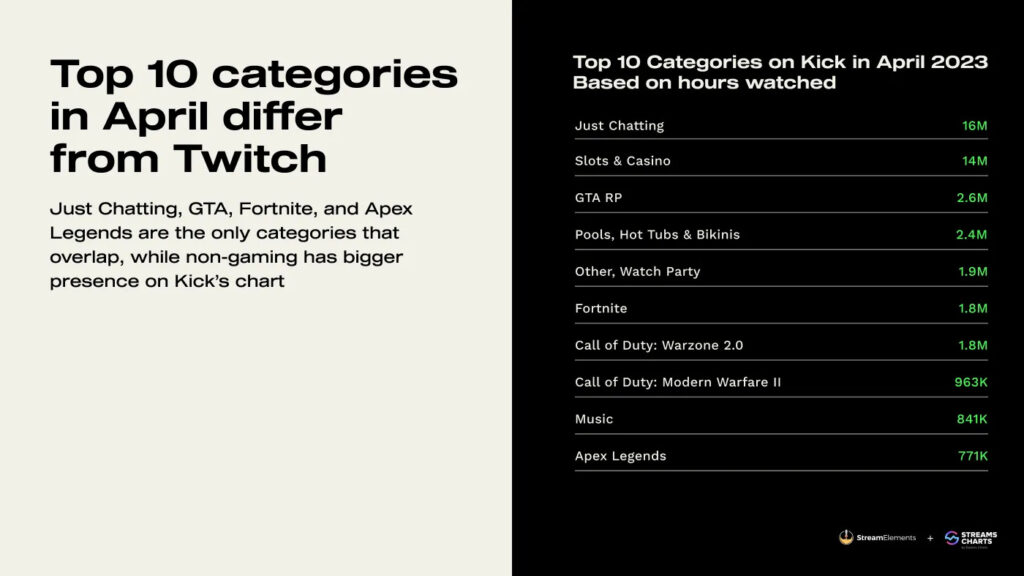

StreamElements & Stream Charts: New streaming platform Kick Report

Kick is a recently launched competitor to Twitch, YouTube Live, and Facebook Live. The platform is currently in the beta stage, and the main difference is in increased payments to content creators.

- In April 2023, the number of hours watched on platforms reached 51.8M. The increase to the previous year was about 44%.

- Amount of active channels increased from 23.9k in March 2023 to 66.9k in April 2023.

- Chatting and slots (casino) streams are gathering the majority of hours watched on the platform. However, games took half of the chart with GTA RP (2.6M hours); Fortnite (1.8M hours); Call of Duty: Warzone 2.0 (1.8M hours); Call of Duty: Modern Warfare II (963k hours), Apex Legends (771k hours) being on top 10.

Tune in next month for more updates!