devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the September and October reports.

Contents

- dataspelsbranschen: Sweden Gaming Industry in 2023

- Sensor Tower: The Japanese Mobile Market in 2023

- Unity: Toxicity in Multiplayer Games Report 2023

- Circana: In September 2023, 22% of all gamers in the USA on PC and consoles played Minecraft at least once

- AppMagic: Marvel Snap earned more than $116M on mobile devices in the first year

- The audience of EA Sports FC 24 reached 14.5 million players in the first month

- Omdia: Gaming subscriptions will grow to $22 billion by 2027

- Sensor Tower: The Mobile Gaming Market in South Korea in 2023

- SNJV: The State of the French Gaming Industry in 2023

- Drake Star: The State of the Video Game Investment Market in Q3 2023

- Mistplay: North American players’ behavior in Mobile Games in 2023

- Sony: Over 46.6M PS5 units are sold worldwide

- Newzoo: IP & Brand Collaborations in Games in 2023

- Axios: 2023 is already a record year for games with 90+ ratings on Metacritic

- Editorial: Warcraft Rumble earned $6 million in the first week

- AppMagic: Top Mobile Games of October 2023 by Revenue and Downloads

- Lumikai & Google: The Indian Gaming Market in 2023 and Forecast until 2027

- Newzoo: The Gaming Industry in 2023

- Circana: The American gaming market in October 2023 fell by 5%

- Famitsu: Super Mario Bros. Wonder became the leader of the Japanese chart in October 2023

- InvestGame: Gaming Market investment activity in Q3 2023

- Monopoly GO: $1 Billion Later

- GfK & GSD: The UK gaming market in October 2023 experienced a significant decline

- Roblox: Trends in Digital Fashion and Beauty in 2023

- GSD: Game sales in Europe slightly decreased in October 2023

- SuperScale: 83% of launched mobile games die within 3 years

- BFI UK: 51.9% of all British game developers work in companies owned by foreign entities

- StreamElements & Rainmaker.gg: The State of the Streaming Market in September and October 2023

dataspelsbranschen: Sweden Gaming Industry in 2023

The report covers the results of Swedish companies for the financial year 2022.

-

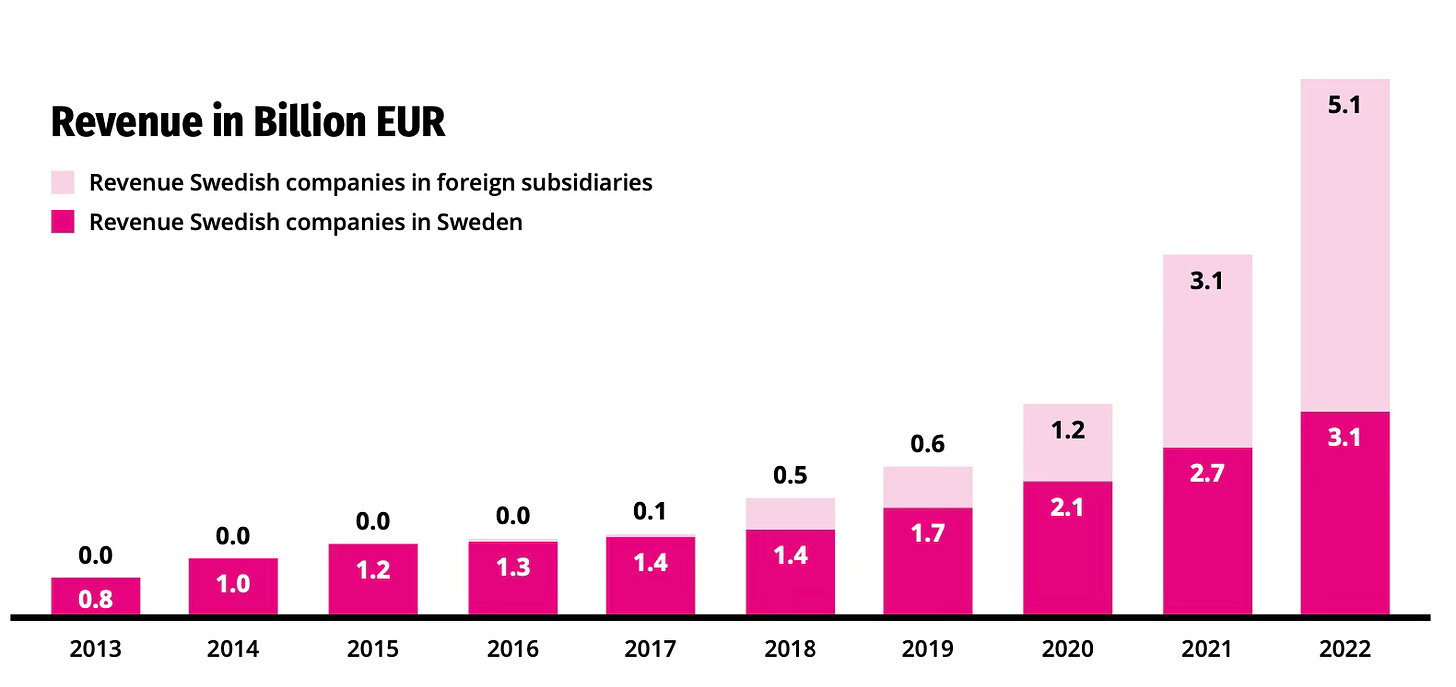

The revenue of the Swedish gaming industry increased to €3.1 billion. This is 13% more than the previous year.

-

When considering foreign subsidiaries, the revenue of the Swedish industry is €8.1 billion (+40% compared to the previous year).

-

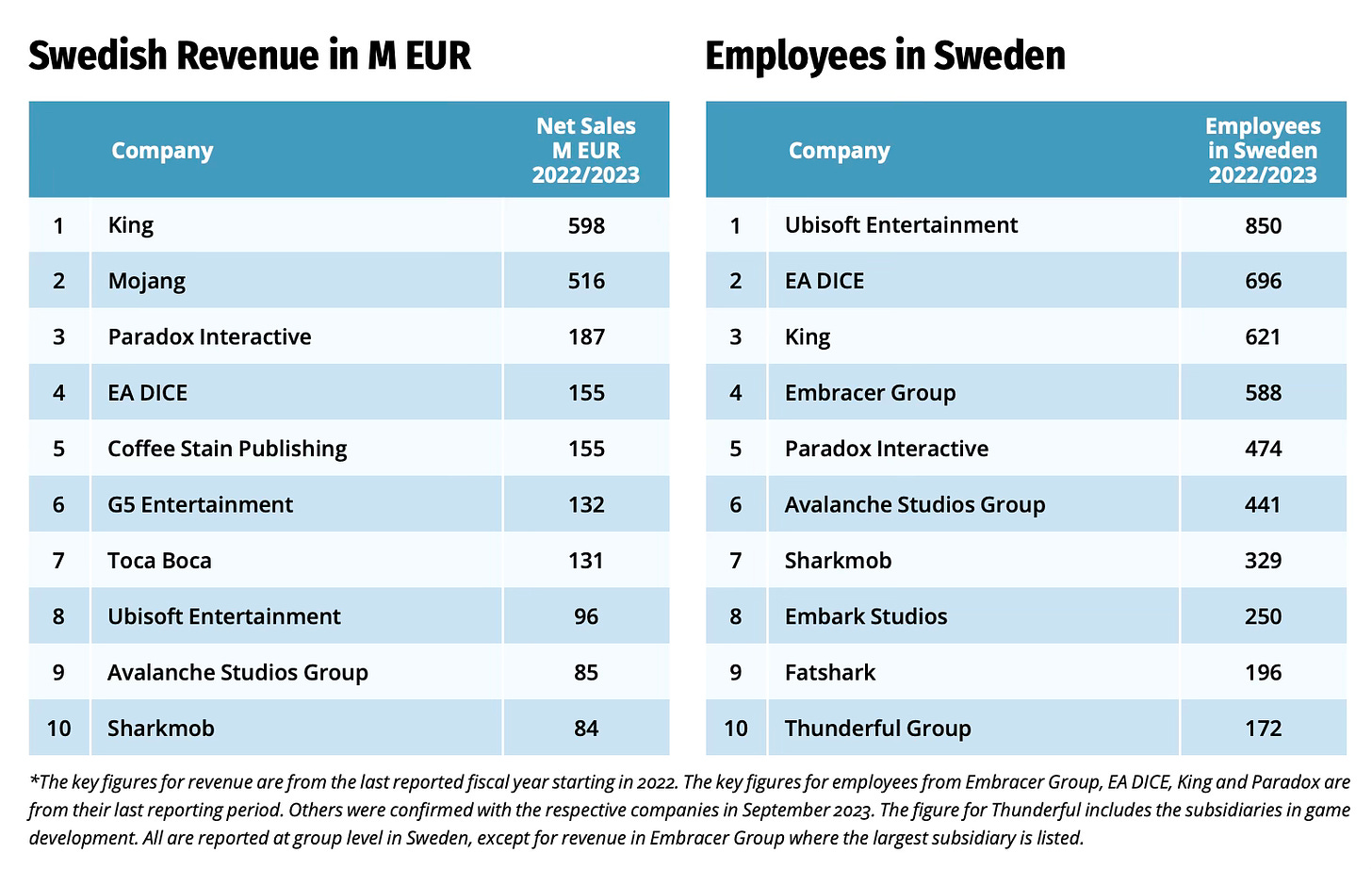

The largest Swedish companies in terms of revenue are King (€598 million), Mojang (€516 million), and Paradox Interactive (€187 million).

-

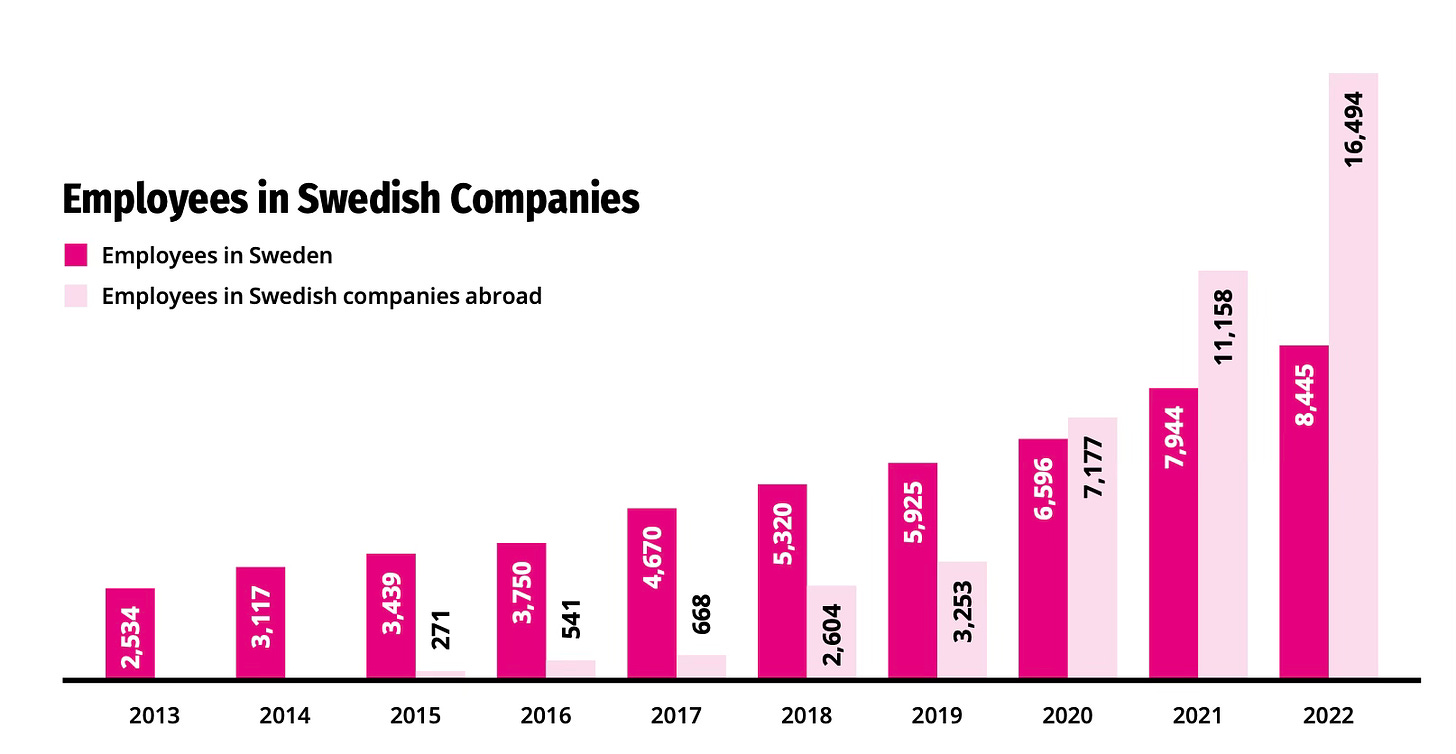

In Swedish companies, there were 8,445 employees in the country and 16,494 employees in foreign branches at the end of the 2022 financial year. In Sweden, 501 people were hired in 2022, a 6% increase compared to 2021.

-

Ubisoft Entertainment (850 people), EA DICE (696 people), and King (621 people) have the most employees in Sweden.

-

44% of the new employees are female. Their total number in the workforce is slightly more than 23%.

-

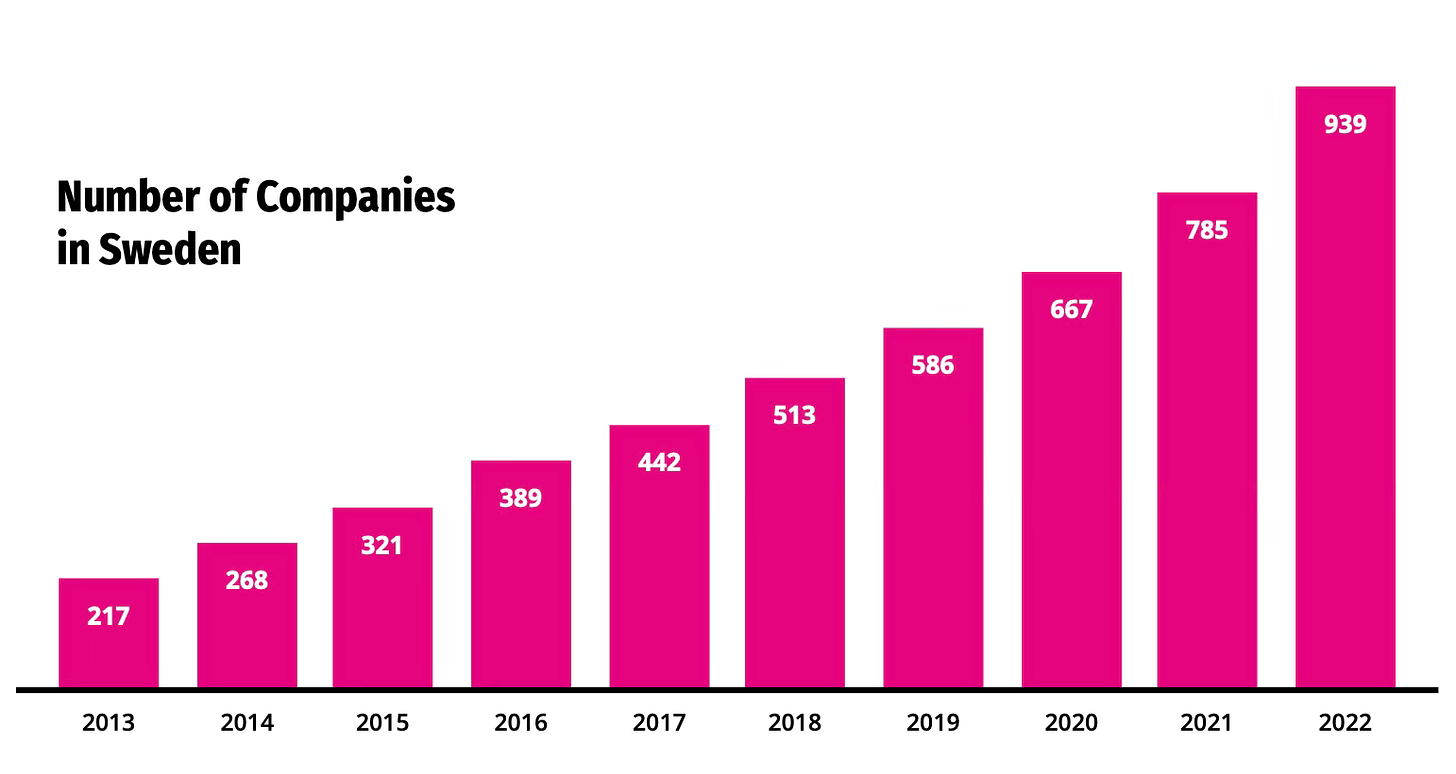

In Sweden, 104 companies started in 2022. By the end of the year, there were 939 active companies in the country, which is 20% more than at the beginning.

-

Only 14% of active companies have more than 10 employees.

-

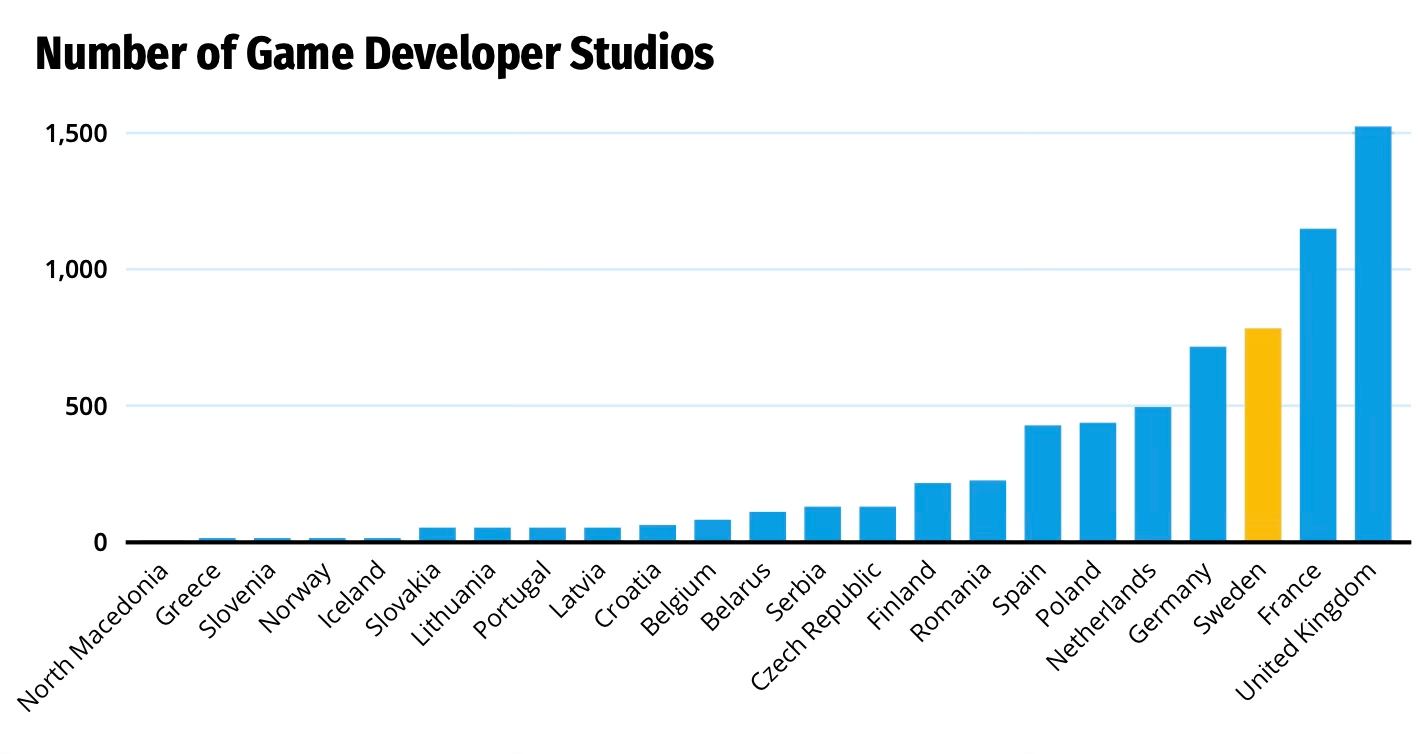

Sweden is the third country in Europe in terms of the number of gaming studios, following France and the United Kingdom. It is the fourth in terms of revenue.

-

In 2022, there were 31 investment deals, six of which were larger than €100 million.

-

The ten most profitable Swedish gaming companies paid €250 million in corporate taxes.

-

The ten largest employers paid €113 million to the state in salary deductions.

-

23 Swedish companies are listed on the local stock exchange. Their total revenue in 2022 exceeded €5.7 billion.

Sensor Tower: The Japanese Mobile Market in 2023

Market

-

During the first half of 2023, Japanese users spent over $6.8 billion on games, slightly more than during the same period the previous year.

-

It is predicted that the total revenue for 2023 will reach $14 billion. The record was set in 2021 at $17.8 billion.

Revenue

-

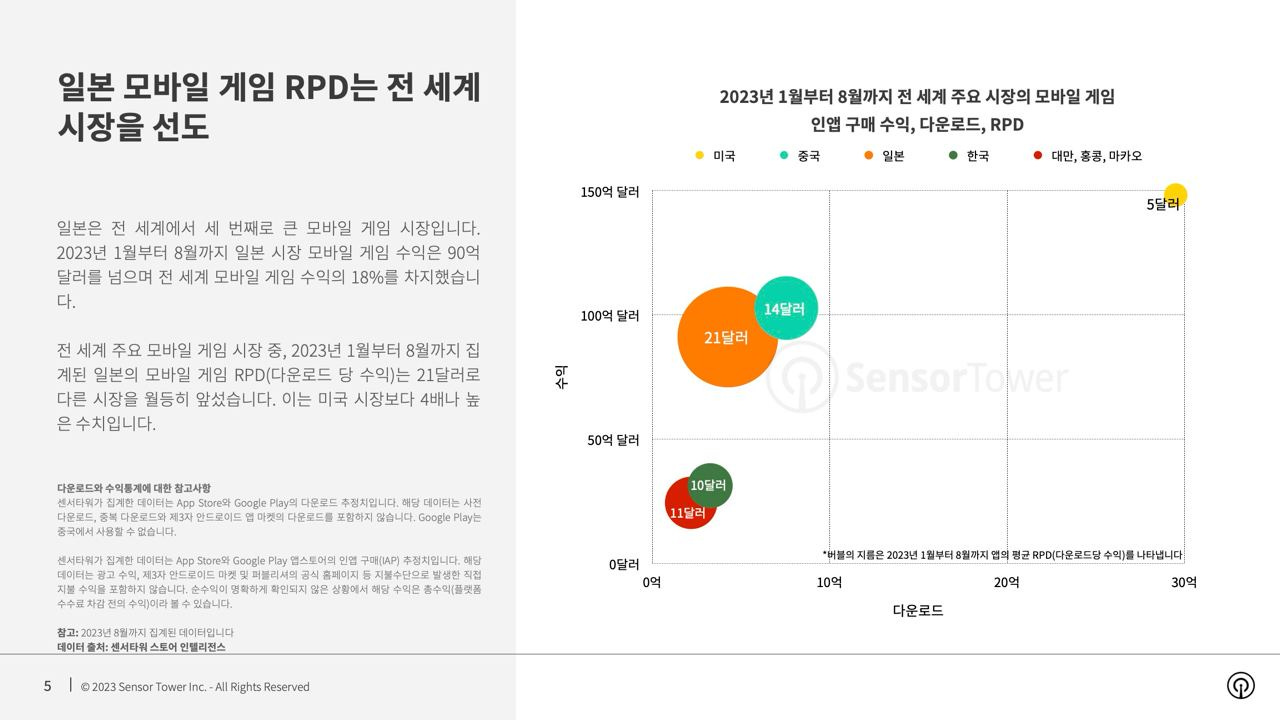

From January to August of this year, the Japanese mobile gaming market's revenue has already exceeded $9 billion, making it the third-largest market in the world, accounting for 18% of the total revenue.

-

The Revenue per Download (RPD) for the Japanese mobile market is $21, the highest on the planet, four times higher than in the United States.

Downloads

-

In 2020, the number of downloads in Japan reached a historical high of around 800 million. After that, they declined for two years. From January to August 2023, a growing trend in downloads can be observed again, with the number of downloads surpassing 420 million. By the end of the year, it is expected to reach 620 million game installations.

Genres and Games

-

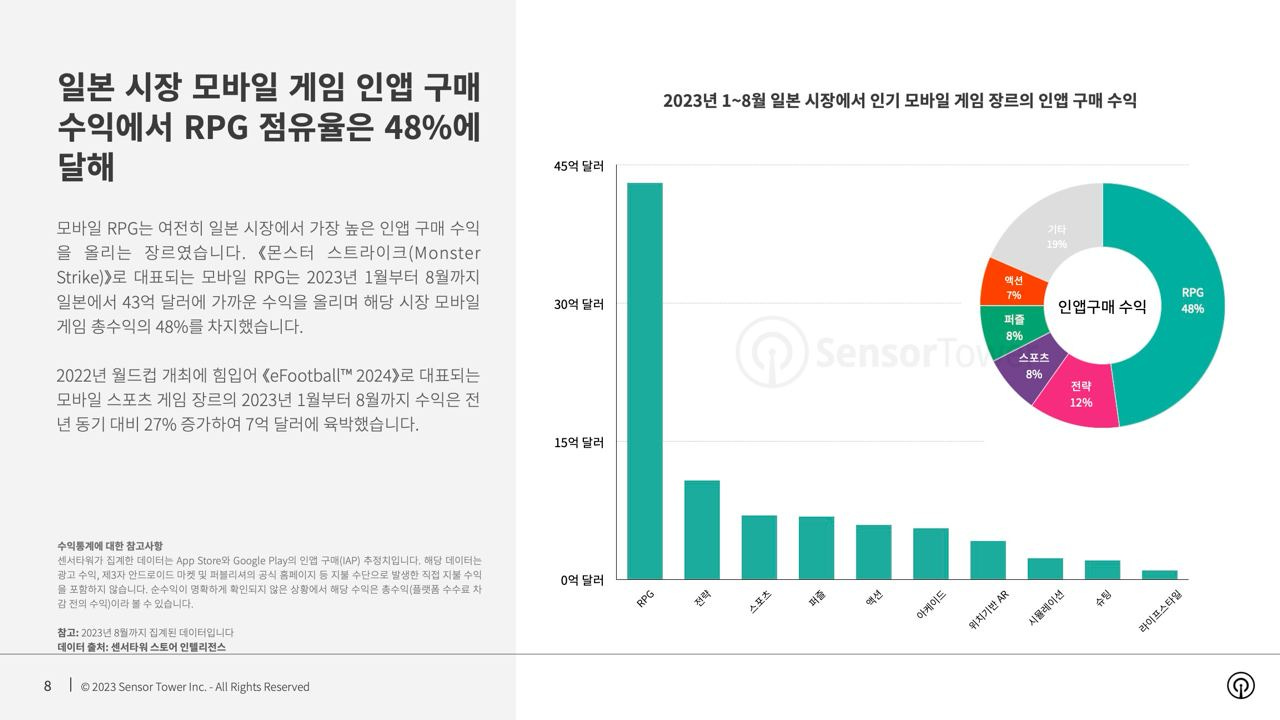

RPGs make up 48% of the revenue structure. From January to August, games of this genre earned $4.3 billion in Japan.

-

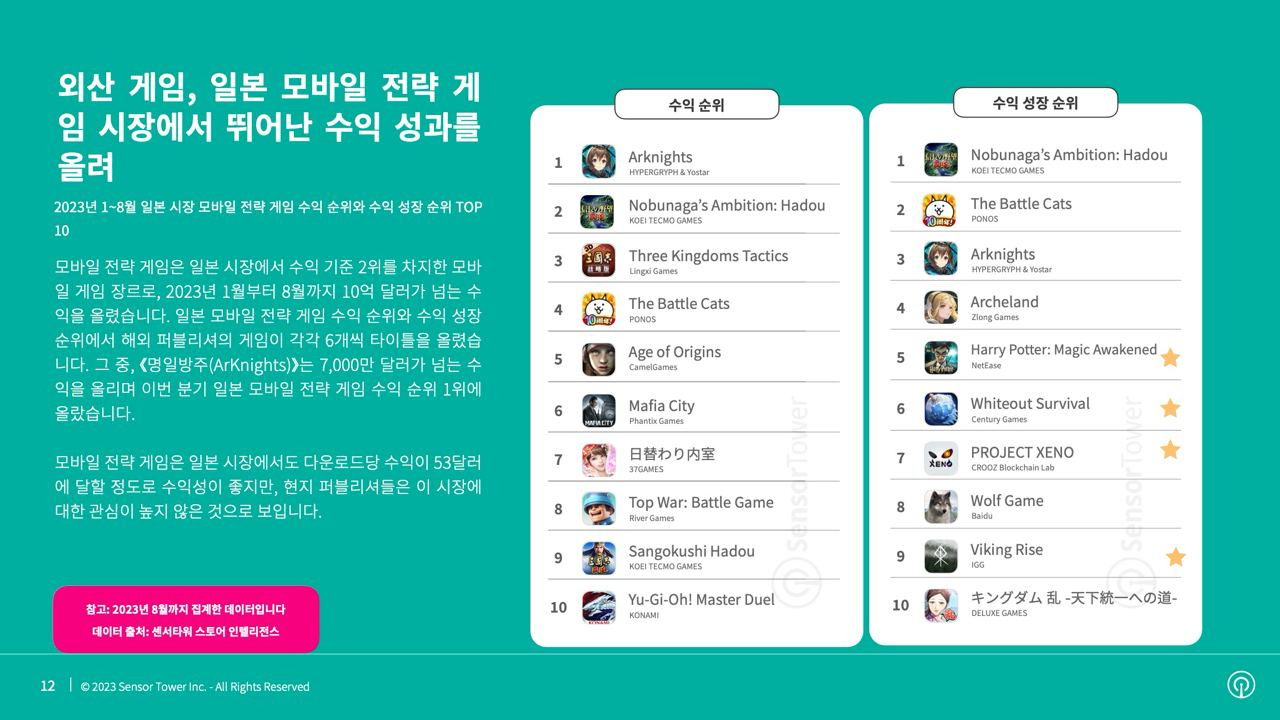

Mobile strategies are the second-highest revenue genre in Japan, earning over $1 billion from January to August.

-

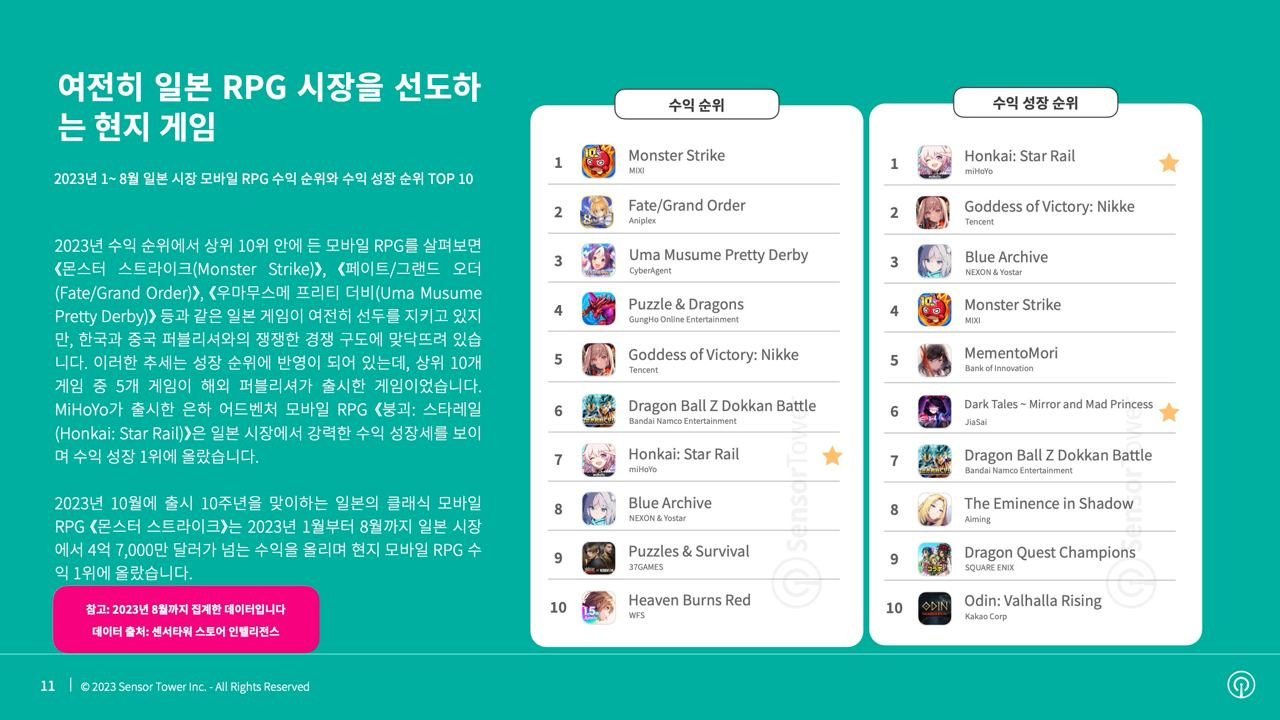

Foreign developers actively compete in the Japanese market. In the top 10 games this year, 5 out of 10 were released by non-Japanese companies. Korean and Chinese companies are vying for market share.

Expansion into Foreign Markets

-

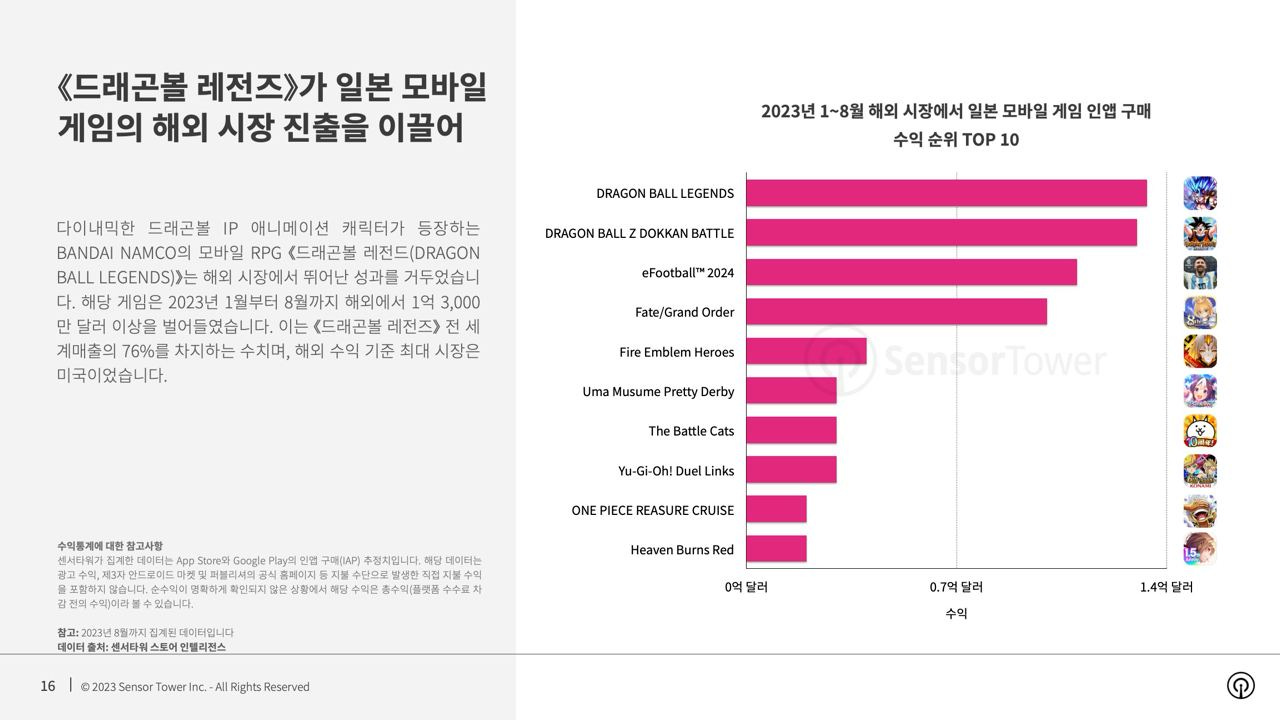

Dragon Ball Legends and Dragon Ball Z Dokkan Battle are the two most successful games from Japanese developers in Western markets. Together, they earned more than $250 million abroad from January to August this year.

-

The company KAYAC deserves attention, as its hyper-casual games have become noticeable beyond Japan.

Unity: Toxicity in Multiplayer Games Report 2023

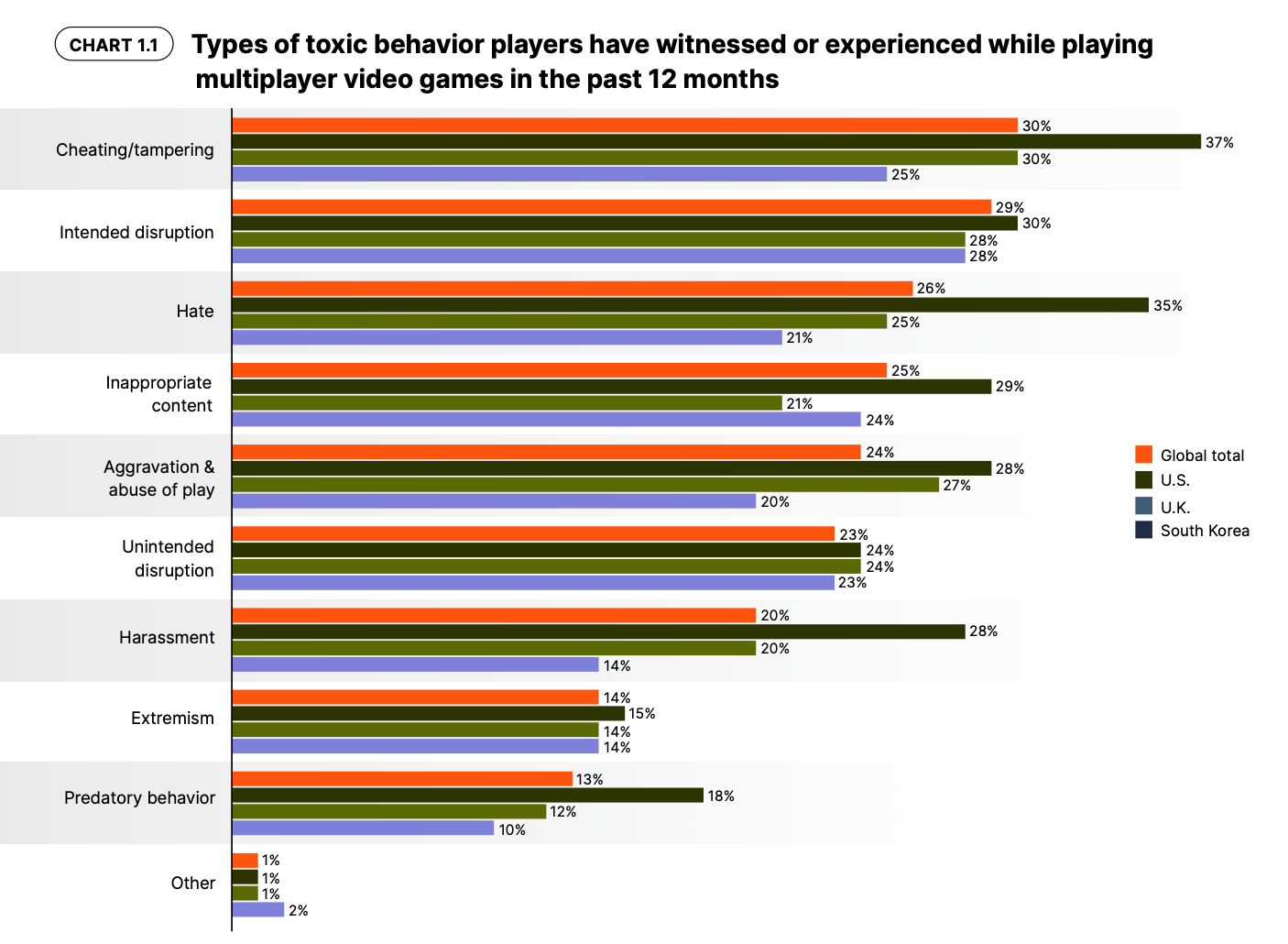

Data was collected in the United States, the United Kingdom, and South Korea. 2522 players and 407 developers were surveyed.

-

The proportion of players encountering toxic behavior increased from 68% in 2021 to 74% in 2023.

-

The most common forms of toxic behavior are cheating (30%), deliberate attempts to disrupt the gameplay of others (29%), hatred towards other players (28%), unacceptable content (25%), and abuse of game mechanics (24%).

-

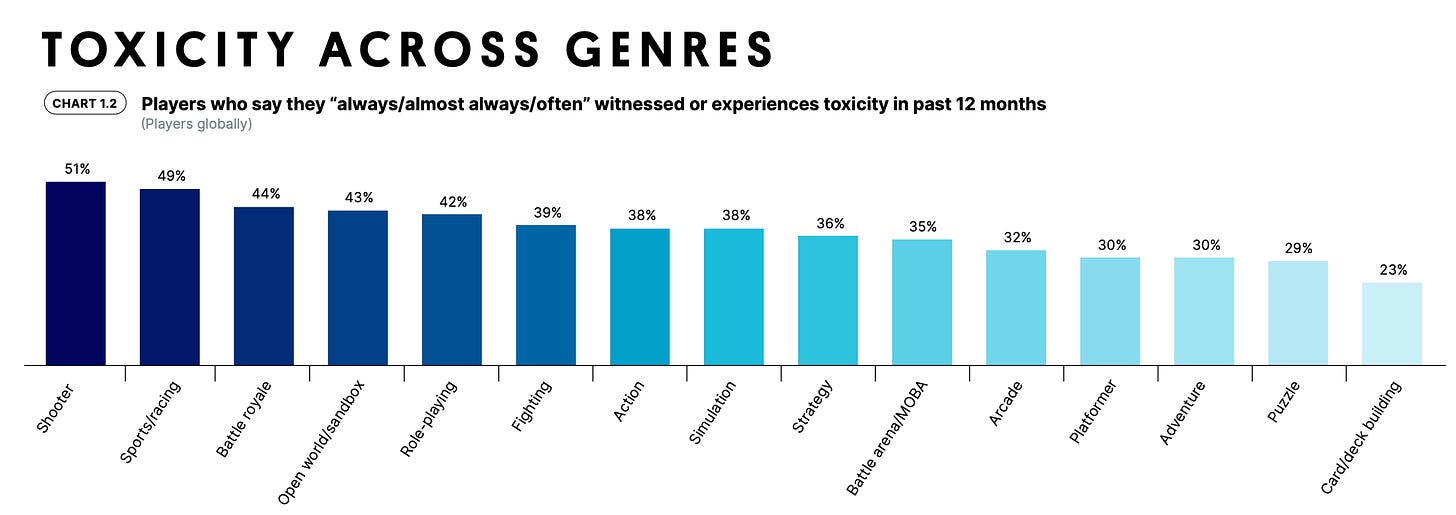

The most toxic players are found in shooters, racing games, and Battle Royale games. The least toxic players are in adventure games, puzzles, and card projects.

-

Half of users regularly encounter toxic players.

-

Developers more frequently than ordinary players report an increase in toxicity.

-

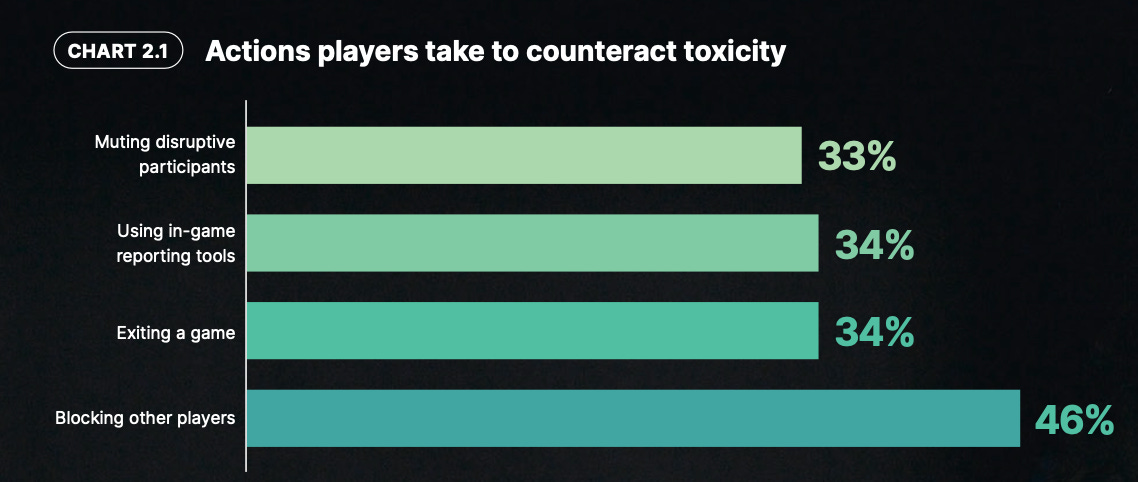

In 2023, 96% of users reacted to toxic behavior. They block such users, leave the game, and submit reports. In 2021, only 66% took active measures.

-

67% of players stated that they quit the game if they encounter toxic behavior.

-

74% of players mentioned that they wouldn't start playing a game known for its toxic audience.

-

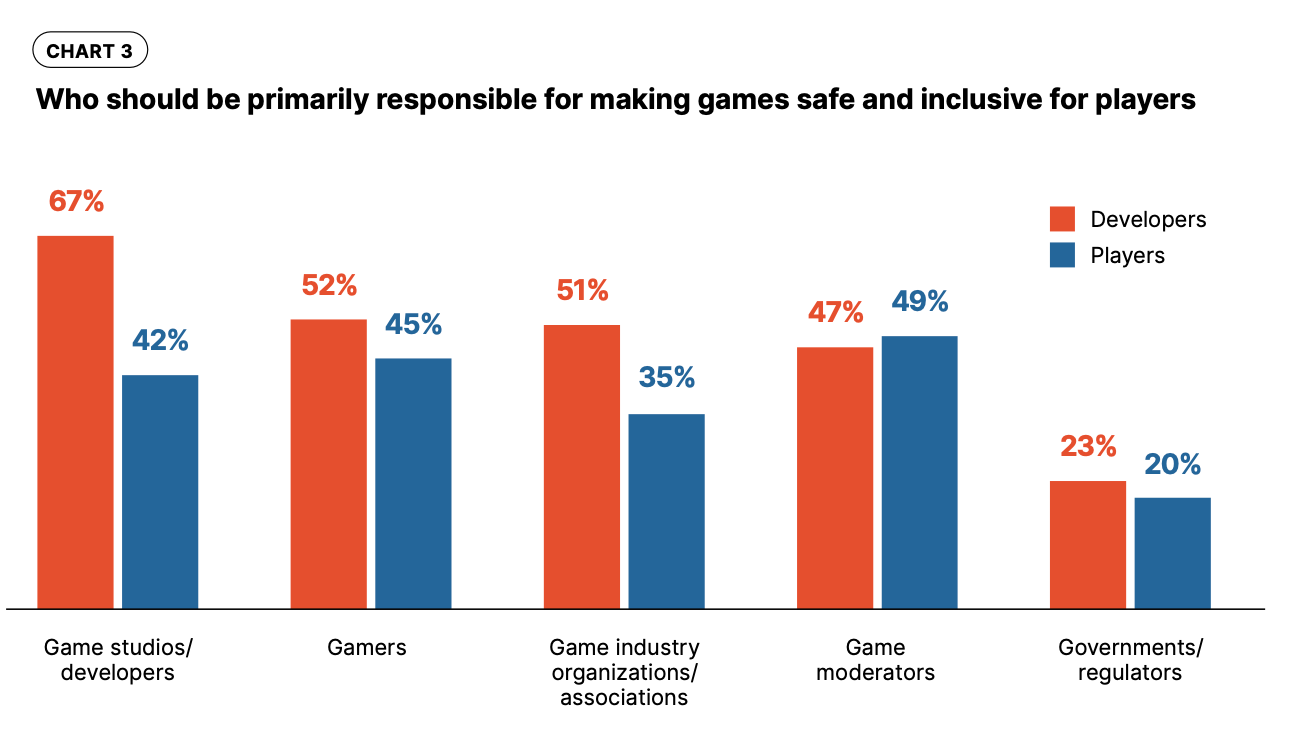

Players believe that moderators and game studios are responsible for a healthy in-game environment.

-

81% of players believe that user protection from toxic behavior should become a priority for game studios.

Circana: In September 2023, 22% of all gamers in the USA on PC and consoles played Minecraft at least once

-

This is the highest figure in the entire history of observations among all PC/console projects.

-

In October, Mojang reported 300 million copies of the game sold.

-

52% of the audience are male, and 48% are female.

-

49% of this audience also played Roblox. More than 40% played Fortnite and/or Grand Theft Auto V.

-

88% of those who played regularly watch YouTube.

-

35% of the audience plays on PC, consoles, and mobile devices.

AppMagic: Marvel Snap earned more than $116M on mobile devices in the first year

All figures are after taxes and third-party commissions.

-

The revenue leaders are the United States ($71 million), the United Kingdom ($4.9 million), Canada ($4.3 million), South Korea ($4.18 million), and Italy ($3.7 million).

-

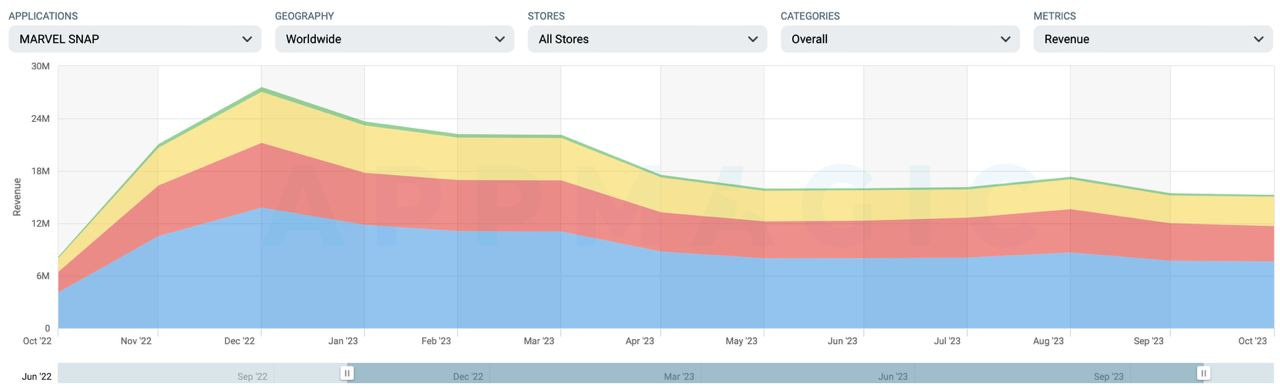

In December 2022, the game set a revenue record of $13.8 million. The revenue has now stabilized at $8-9 million per month.

-

The project's cumulative RpD (Revenue per Download) in the first year is $4.95. For Yu-Gi-Oh! Duel Links, for example, this figure is almost twice as high at $9.11. Hearthstone also has higher figures at $8.54.

👉 Many have noted the unobtrusive monetization in Marvel Snap at its launch. There is an excellent article on this topic on Deconstructor of Fun.

-

At the moment, the game has been downloaded more than 23.7 million times.

-

5.5 million downloads are from the United States; 2.6 million are from Brazil; 1.7 million are from Indonesia; 1.1 million are from Italy; and 1.06 million are from the United Kingdom.

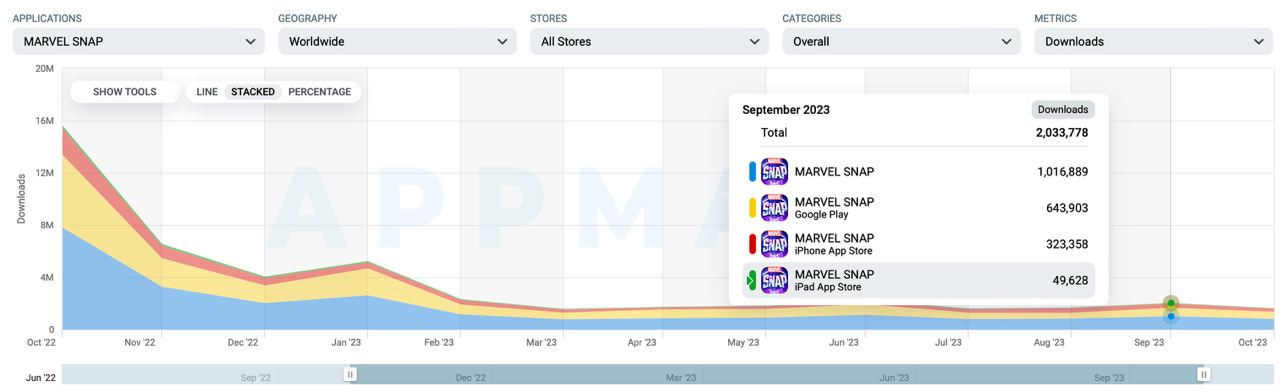

-

The peak in downloads occurred in October 2022, with 7.8 million downloads. Currently, the game is being installed by 1.5-2 million users monthly.

The audience of EA Sports FC 24 reached 14.5 million players in the first month

-

This number of players was achieved on PC and consoles. EA notes that the numbers in terms of attracting a new audience are in the double digits.

-

The launch of FC Mobile set a record for the football franchise. Over 2 million users installed the game on the first day, over 5 million within the first 3 days, and over 11 million within the first 10 days.

-

Based on the results of September (the game was released on September 29), EA Sports FC 24 became the 14th best-selling game of the year.

💬 EA speaks positively about the launch results after parting ways with FIFA. The company expects that EA Sports FC 24 will show a slight increase in sales compared to FIFA 23.

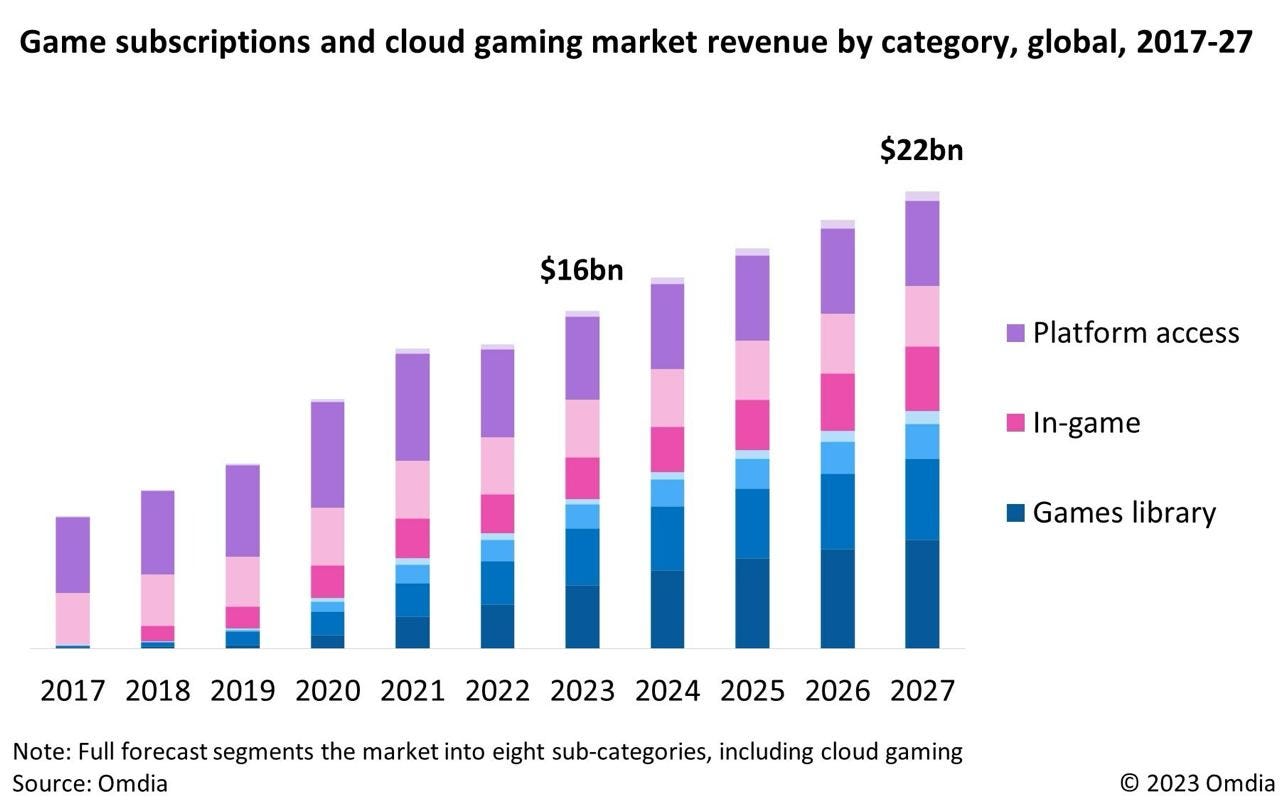

Omdia: Gaming subscriptions will grow to $22 billion by 2027

-

It is expected that by 2027, subscription services will account for 11.6% of the total gaming industry revenue.

-

The number of paying subscribers is projected to increase to 217 million by 2027, according to Omdia's forecasts, with 175 million by the end of 2023.

-

By the end of 2023, the revenue generated by subscription services will amount to $16 billion.

Omdia includes several types of offerings in subscription services:

-

Game library services (Xbox Game Pass, Netflix, advanced versions of PlayStation Plus subscriptions) are expected to account for 44% of total revenue in 2023 ($7.3 billion).

-

In-game subscriptions make up 30% of total revenue ($4.8 billion).

-

Subscriptions for access to platform functionality (online gaming) contribute 26% of total revenue ($4.3 billion).

-

Services offering cloud gaming are projected to earn $3.6 billion in 2023, with this figure increasing to $6.4 billion by 2027. Growth will be driven by subscriptions like Xbox Game Pass Ultimate and PlayStation Plus Premium.

-

The average annual growth rate of subscription services will be 6.58%.

-

Currently, Microsoft and Sony are the leaders in the subscription business, with a combined total of 51 million paying users.

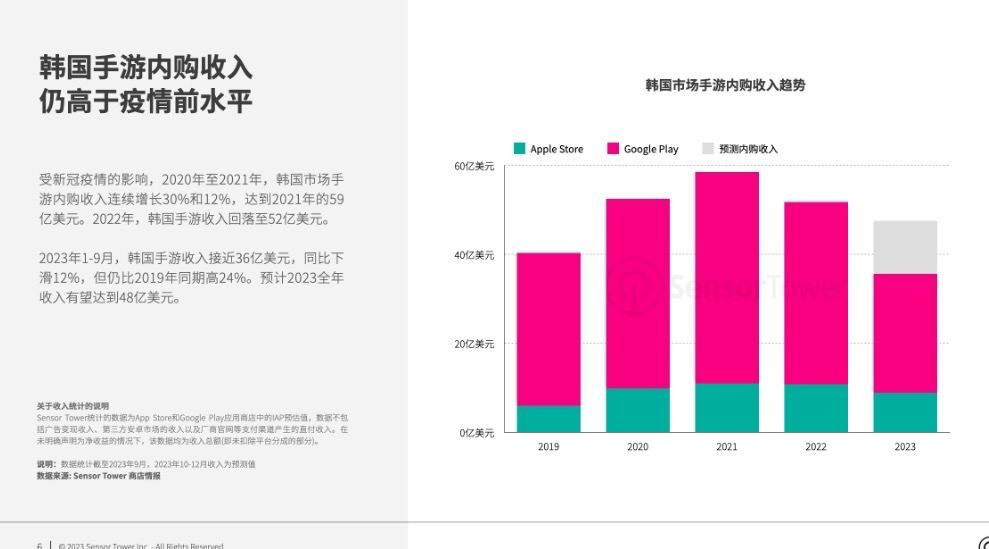

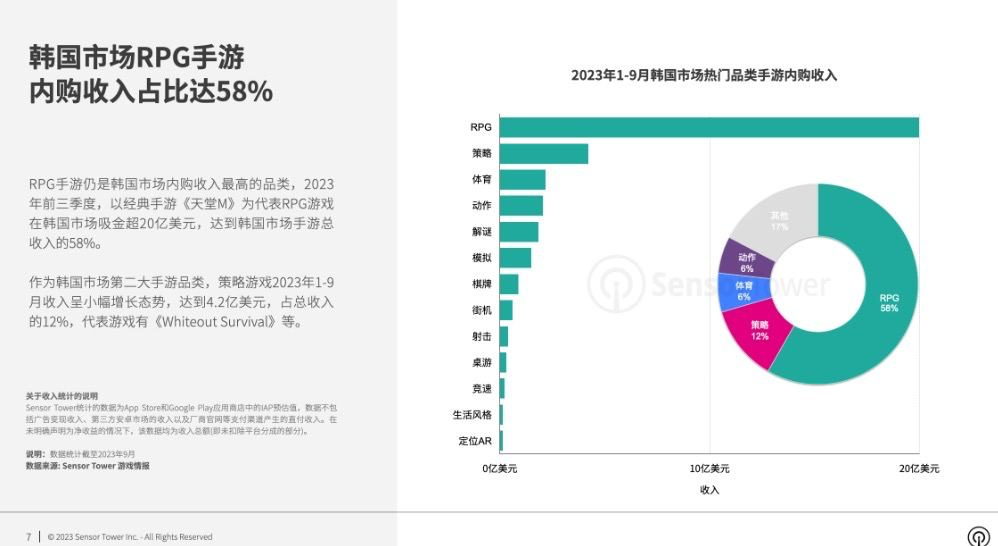

Sensor Tower: The Mobile Gaming Market in South Korea in 2023

-

The total volume of the mobile gaming market in South Korea in 2023 will reach $4.8 billion. 42% of this amount will be earned by foreign companies, mostly from China.

-

From January to September of this year, the mobile revenue of the South Korean market amounted to $3.6 billion. This is 24% more than in the same period in 2019.

-

The highest revenue the South Korean market reached was in 2021 - $5.9 billion.

Key Genres

-

RPG is the main genre in South Korea. In 2023, it accounted for more than 58% of the total revenue ($2 billion).

-

Strategy games are in second place with $420 million (12% of the total).

Most Successful Games

-

From January to September 2023, Lineage M earned the most, almost $300 million.

-

The fastest-growing in terms of revenue is Night Crows - $130 million, a new MMORPG by Wemade.

Results of South Korean companies on global markets

-

Blue Archive by Nexon ($190 million), DoubleDown Casino Vegas Slots by DoubleUCasino, and Jackpot World by Netmarble Games are the most profitable games from South Korean developers in international markets.

-

Netmarble Games invested over $40 million in promoting Jackpot World in just the first 3 quarters of 2023.

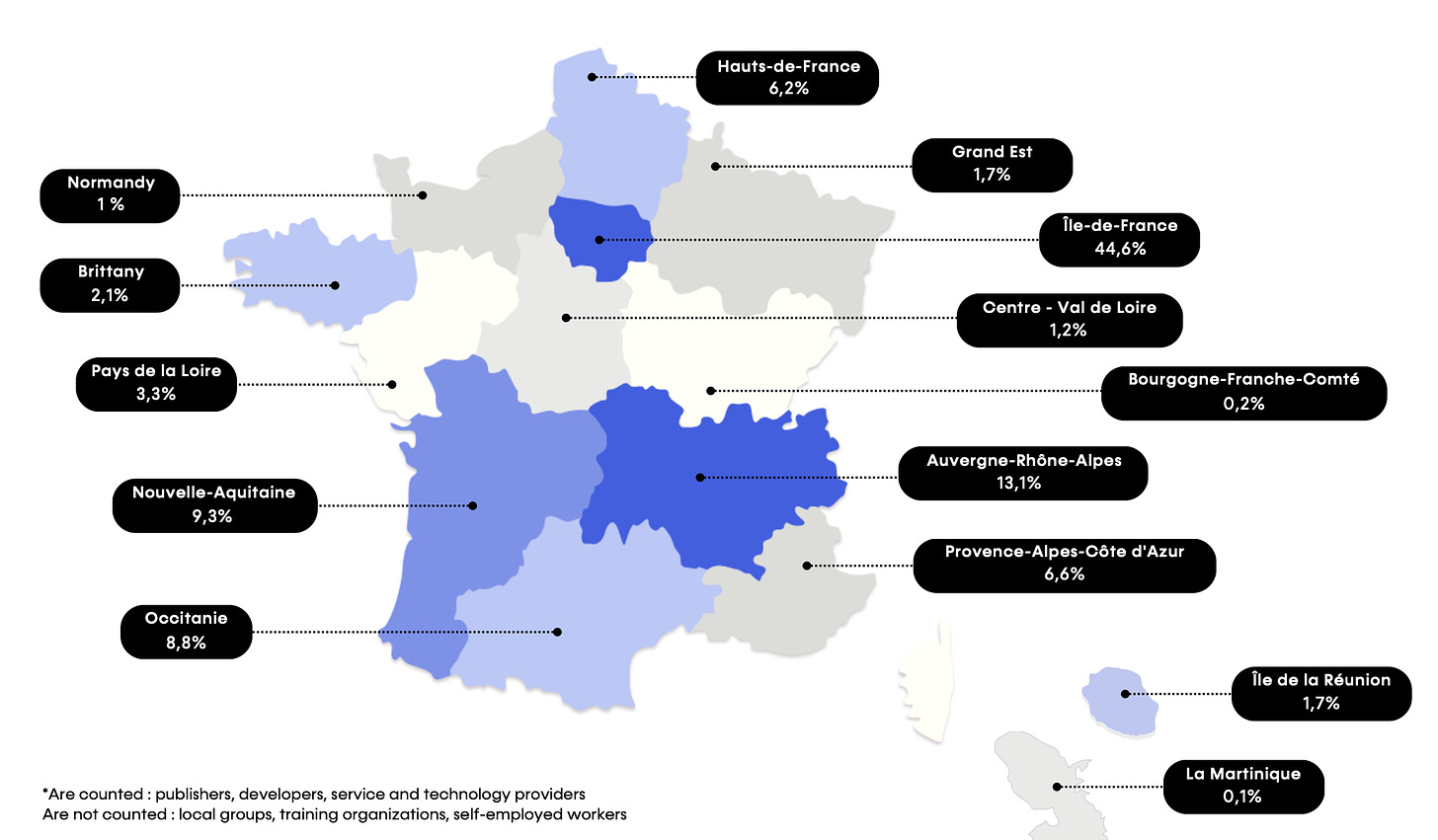

SNJV: The State of the French Gaming Industry in 2023

The survey was conducted from February 28, 2023, to June 26, 2023. It involved 577 French gaming companies and mainly covered the results of 2022.

-

In France in 2022, there were over 1,000 gaming companies, of which 580 were game developers.

-

In France, 1,257 new games are being developed, with 854 of them being new IPs (intellectual properties).

-

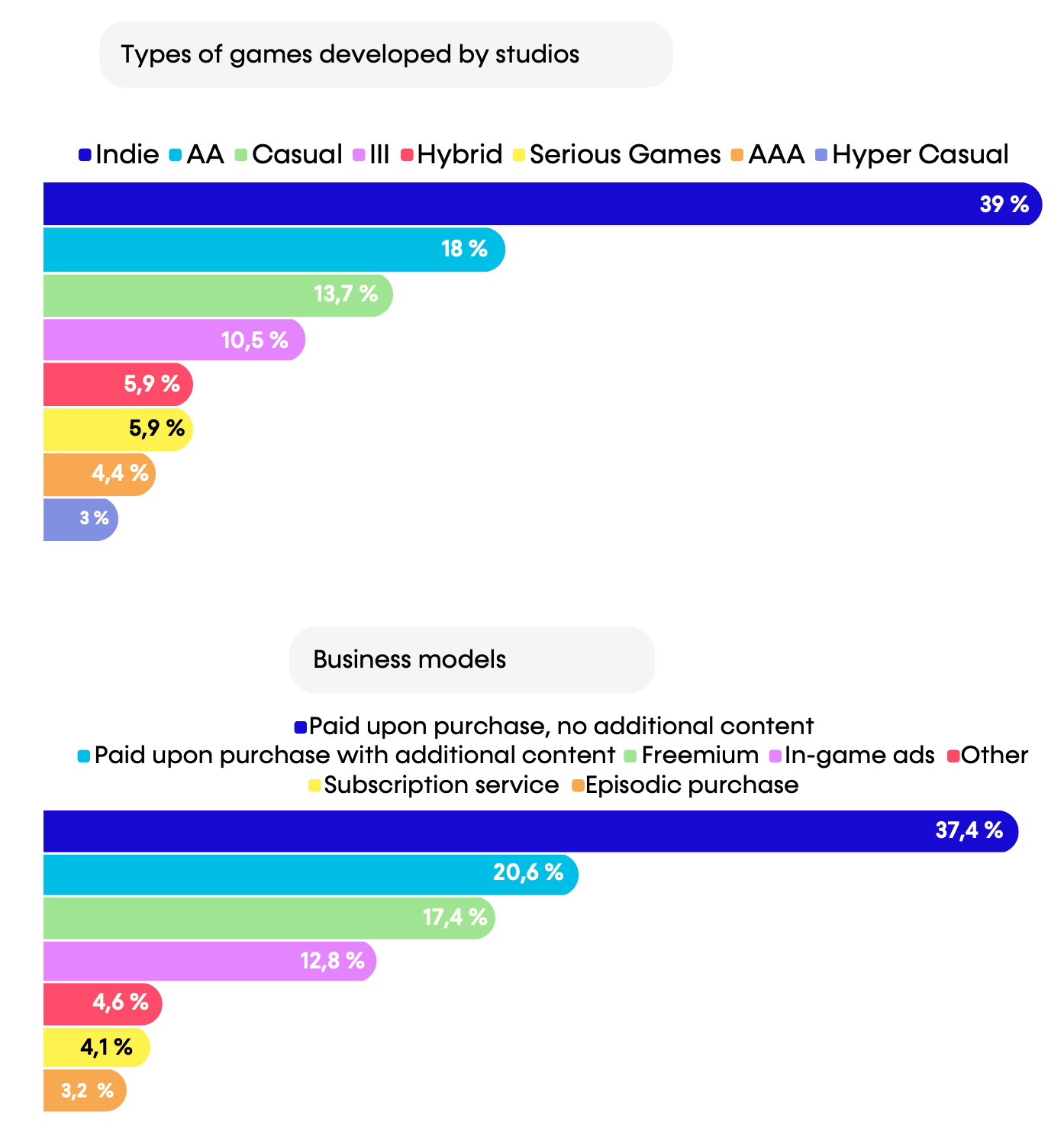

39% of games in development are indie projects, and 4.4% are large-budget AAA games.

-

37.4% of games are planned to be distributed using the B2P (Buy to Play) model without in-game payments. Another 20.6% will use the B2P model with in-game payments.

-

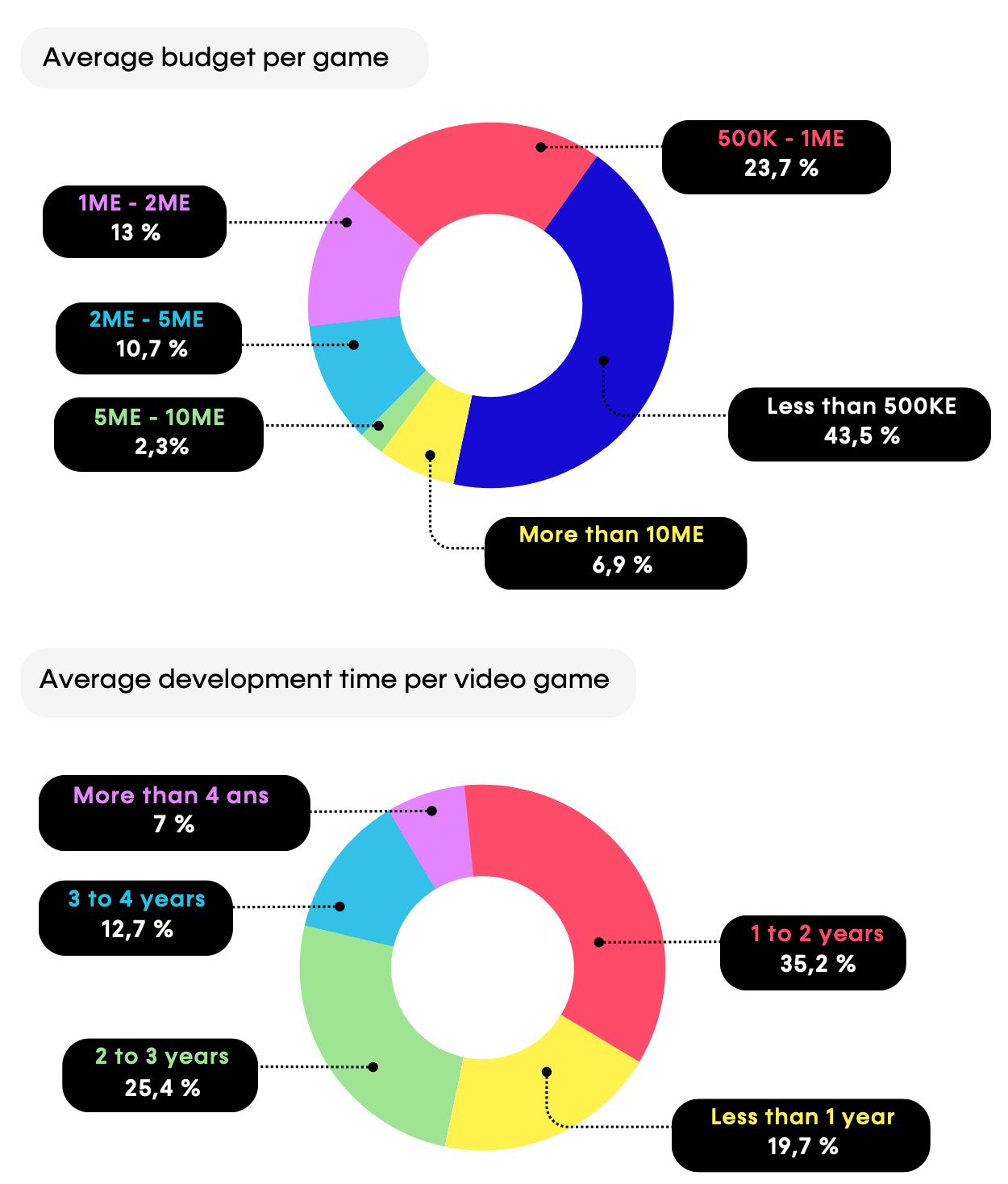

67.2% of games in development have a budget of less than €1 million, while 6.9% have budgets exceeding €10 million.

-

7% of developers take more than 4 years to create a game, while the majority (60.6%) complete their games in 1 to 3 years.

Hiring

-

In 2023, between 400 and 600 new job vacancies will be opened in French game studios. 24% of the current workforce in companies are women.

-

52% of studios plan to hire in 2023, 40% want to retain their employees, and 7.5% plan layoffs.

-

33% of French companies have implemented a full remote workday, and 47.5% offer a hybrid work model.

Financial Situation

-

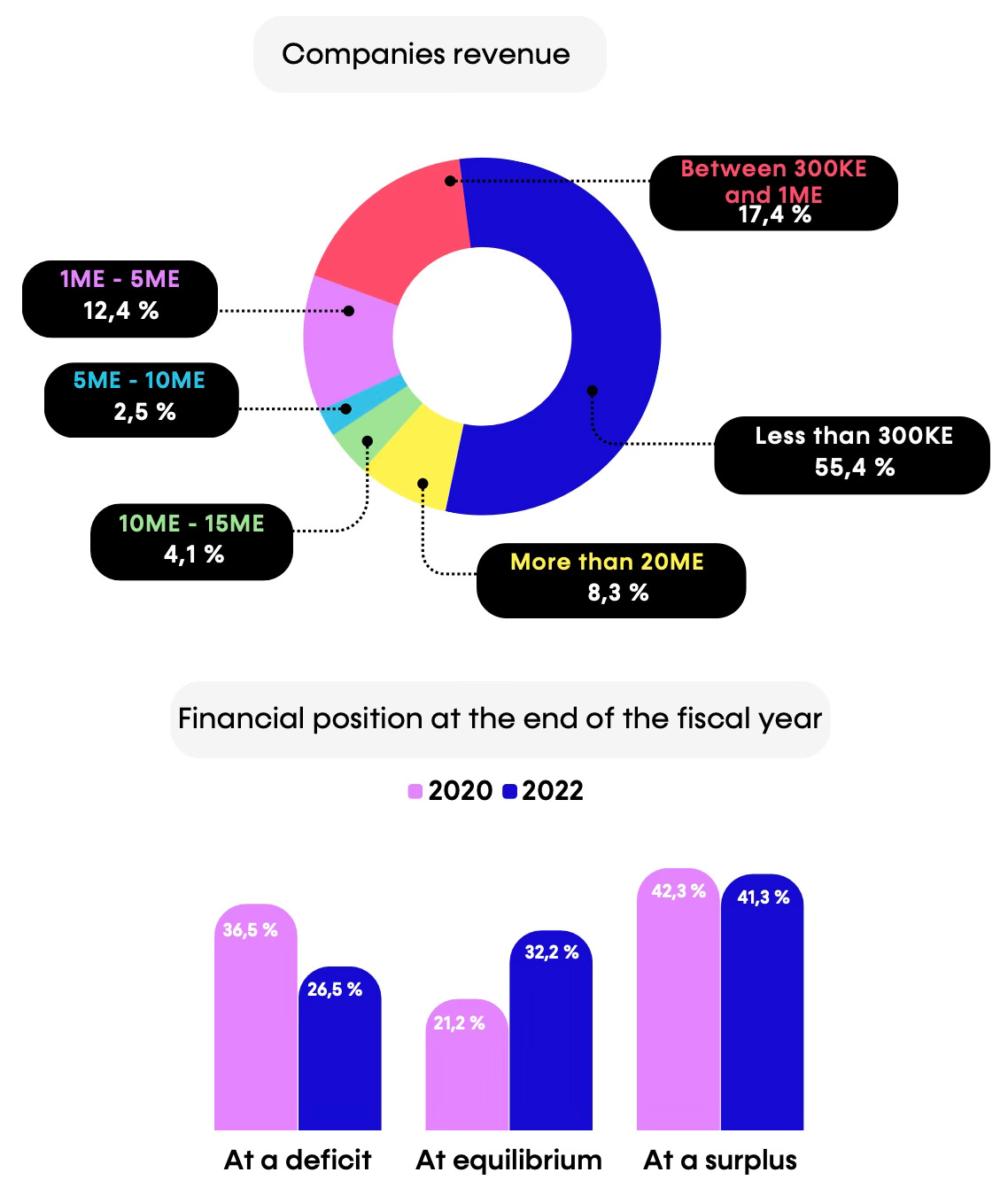

27% of studios have crossed the €1 million mark in annual revenue.

-

8.3% of French studios have earned more than €20 million, while the majority (55%) earn less than €300,000 per year.

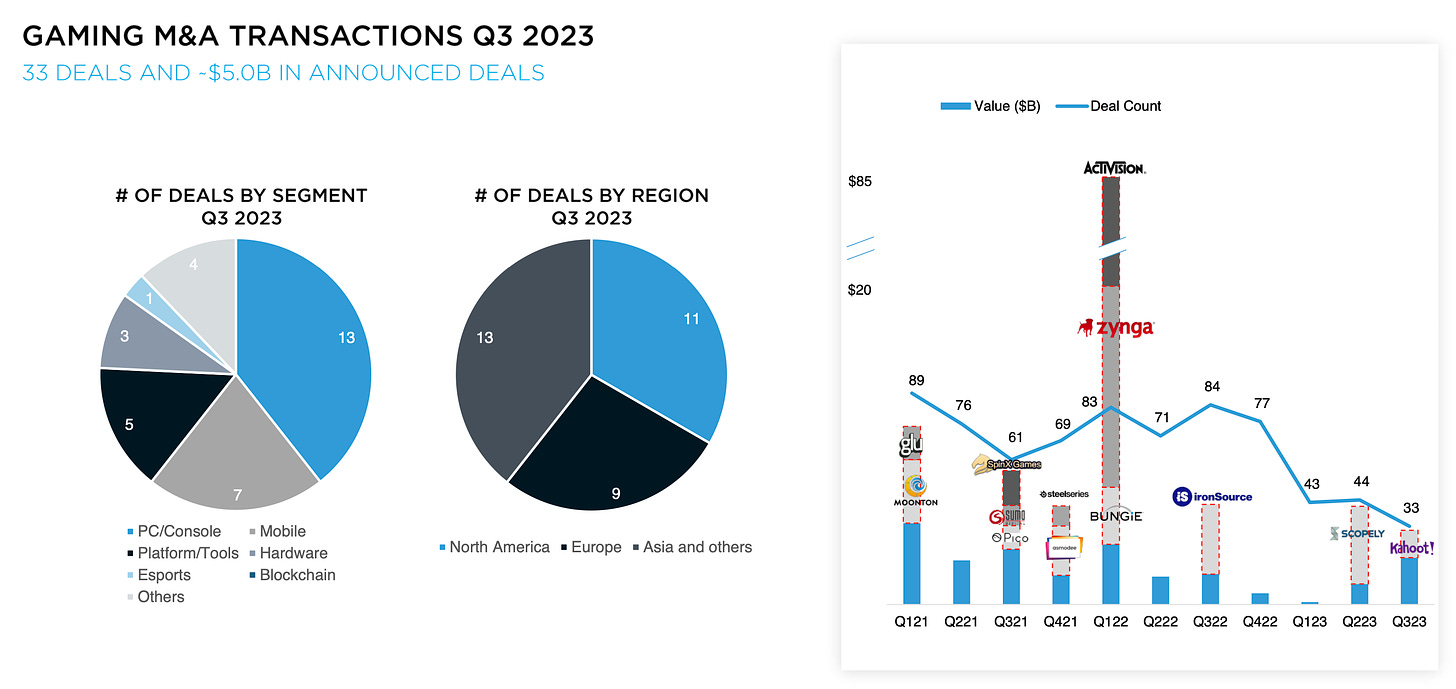

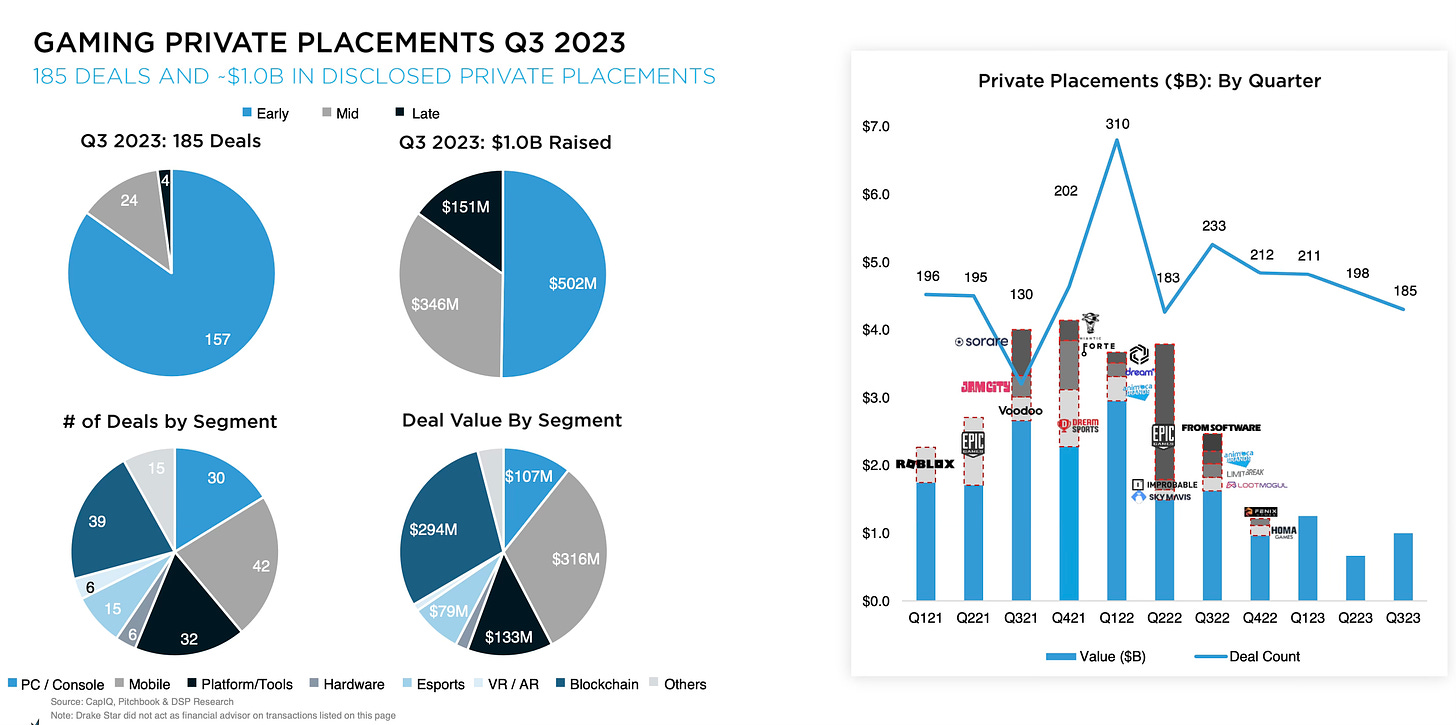

Drake Star: The State of the Video Game Investment Market in Q3 2023

-

In the third quarter, 33 M&A deals were announced with a total value of $5 billion. One such deal, worth $1.72 billion, was the acquisition of Kahoot!, an interactive learning platform. This deal has an indirect connection to games.

-

Among other significant deals, Playtika acquired Youda Games and Innplay Labs for $465 million; Tencent acquired Techland and Visual Arts; Sumo Group acquired Midoki; Supercell acquired a majority stake in Ultimate Studio; Capcom acquired Swordcanes Studio.

-

In the third quarter, private investments decreased to 185, with a total transaction volume of $1 billion.

-

In terms of the number of transactions, this is the lowest figure since the second quarter of 2022. In terms of volume, the only lower quarter in the last 2.5 years was the second quarter of 2023.

-

Among the most notable deals of this quarter are a $100 million investment in Candivore by Haveli Investments; a $90 million investment in Second Dinner by Griffin Gaming Partners and NetEase; and a $54 million investment in Story Protocol by a conglomerate of investors led by Andreessen Horowitz.

-

Bitkraft, Andreessen Horowitz, and Play Ventures are the most prominent funds of 2023 at the moment.

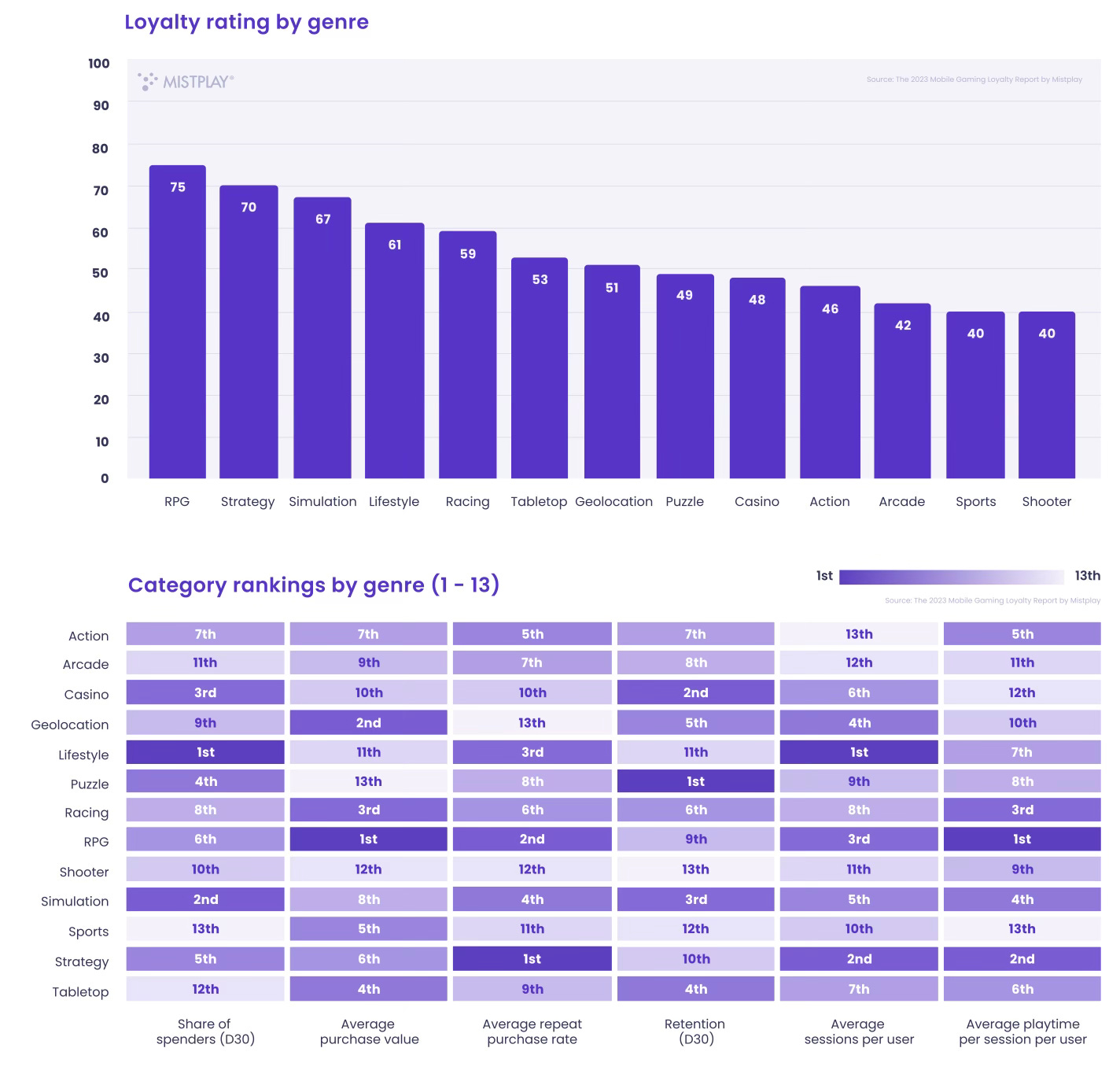

Mistplay: North American players’ behavior in Mobile Games in 2023

The Mistplay Loyalty Index is based on several monetization indicators (the share of paying users in 30 days; average spending; average frequency of repeat purchases) and engagement (30-day retention; average number of sessions per user; average session duration).

The survey involved more than 3,000 mobile gamers aged 18 and older from the USA and Canada. The survey was conducted among Mistplay users in the third quarter of 2023.

Genre Overview

-

RPG, strategy, and simulation games have the most loyal audience. RPG games lead in average spending and average session duration.

-

Lifestyle projects have the highest number of paying users in 30 days. Strategies have the highest repeat purchase rate among all genres. RPGs, as mentioned earlier, lead in average spending.

-

Puzzle games are the strongest genre in D30 retention; RPGs lead in the average number of sessions per user; Lifestyle projects lead in average session duration.

User Interaction with Advertising and Game Installation

-

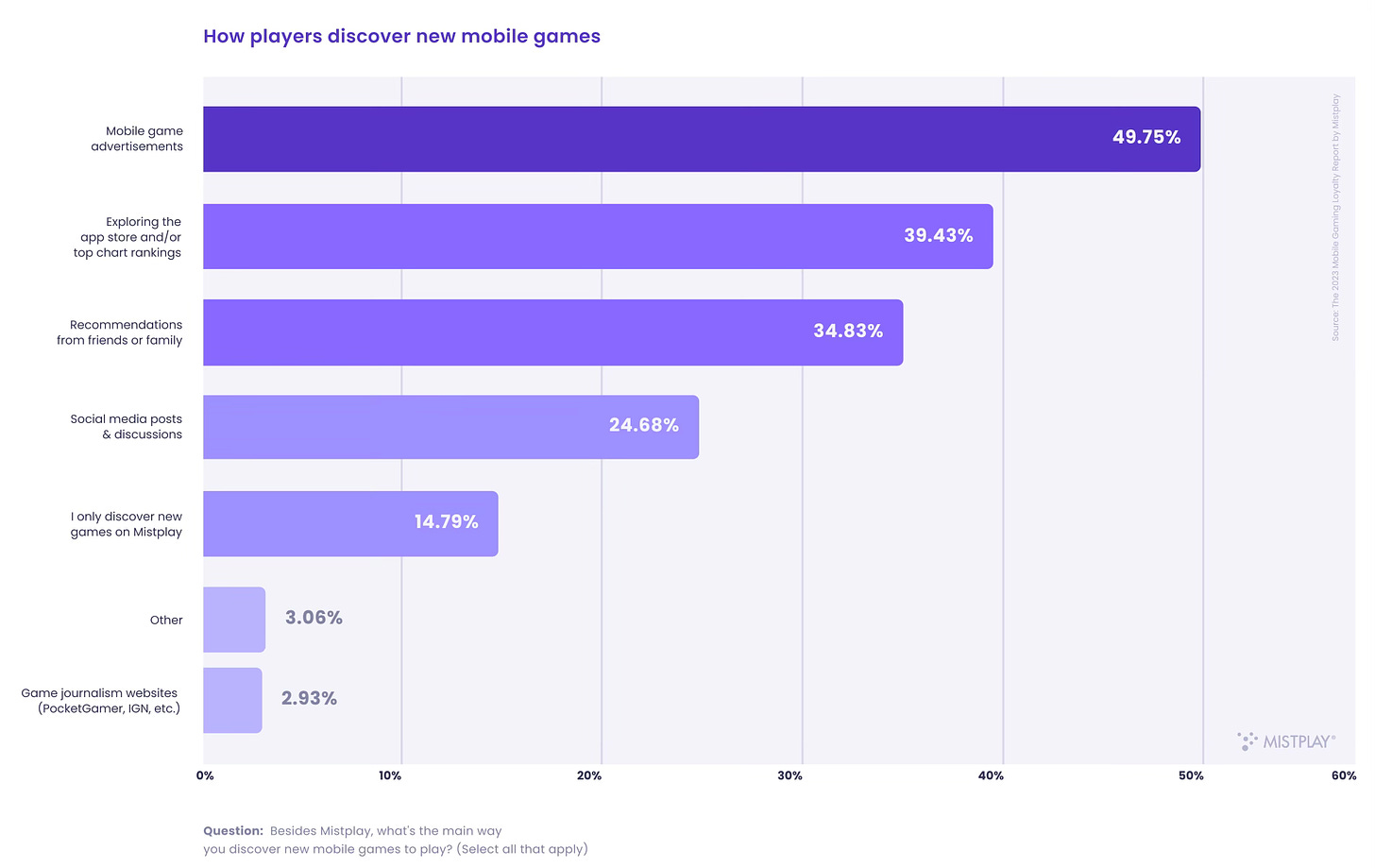

49.75% of users discover new games through advertising; 39.43% find them through app stores and top charts; 34.83% rely on recommendations from friends.

-

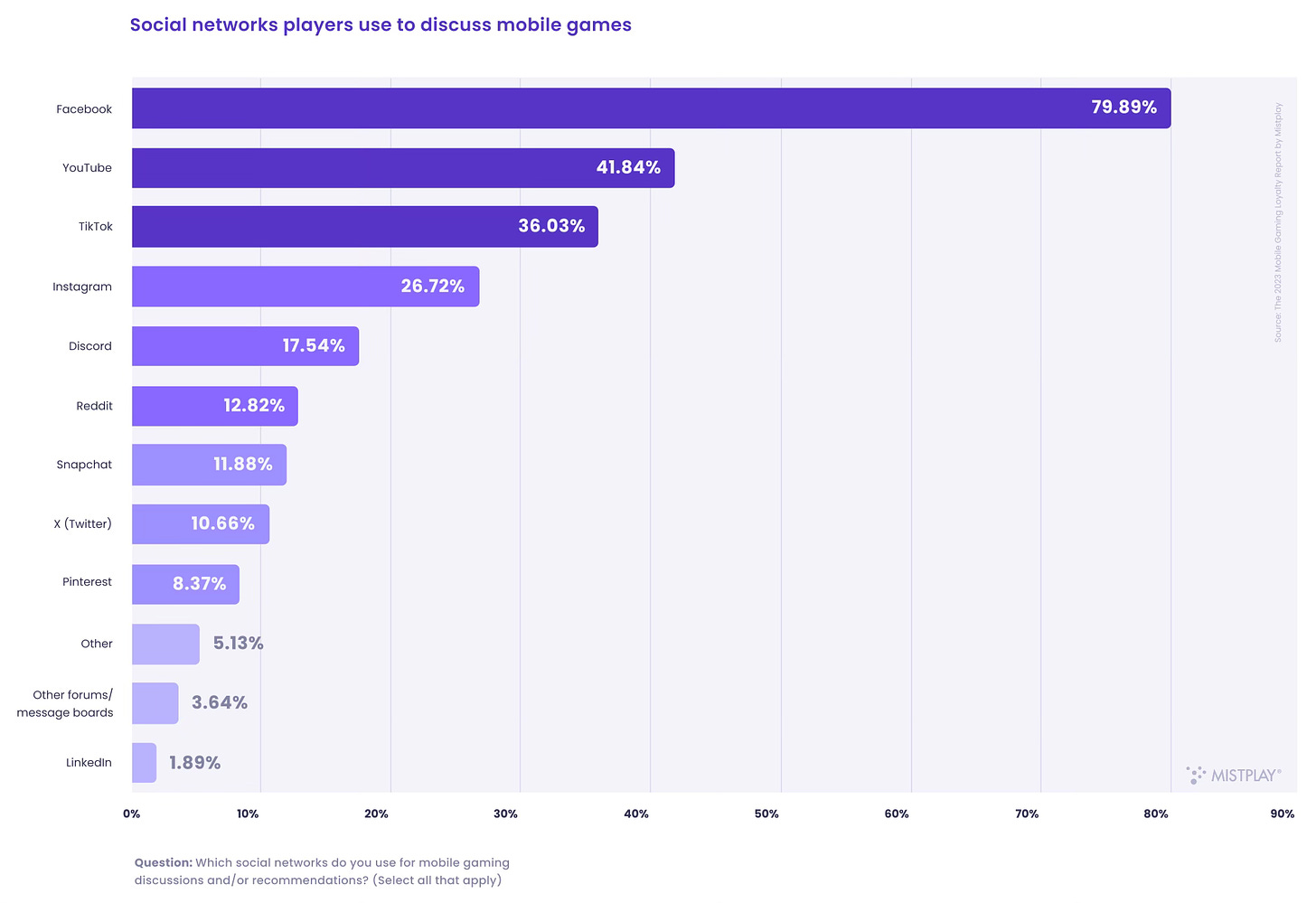

Facebook (79.89%), YouTube (41.84%), and TikTok (36.03%) are the main platforms where players discuss mobile games.

-

36.7% of players do not interact with advertising at all, preferring to ignore it or hide it.

-

68.3% of users are willing to install a new game after seeing an ad within the first few weeks. 21.7% fundamentally do not install games they see in ads.

-

44.6% of the audience is satisfied with a 3-star app rating. 29.95% do not install apps with a rating below 4 stars; 6.36% only want to see a 5-star rating.

User Motivation

-

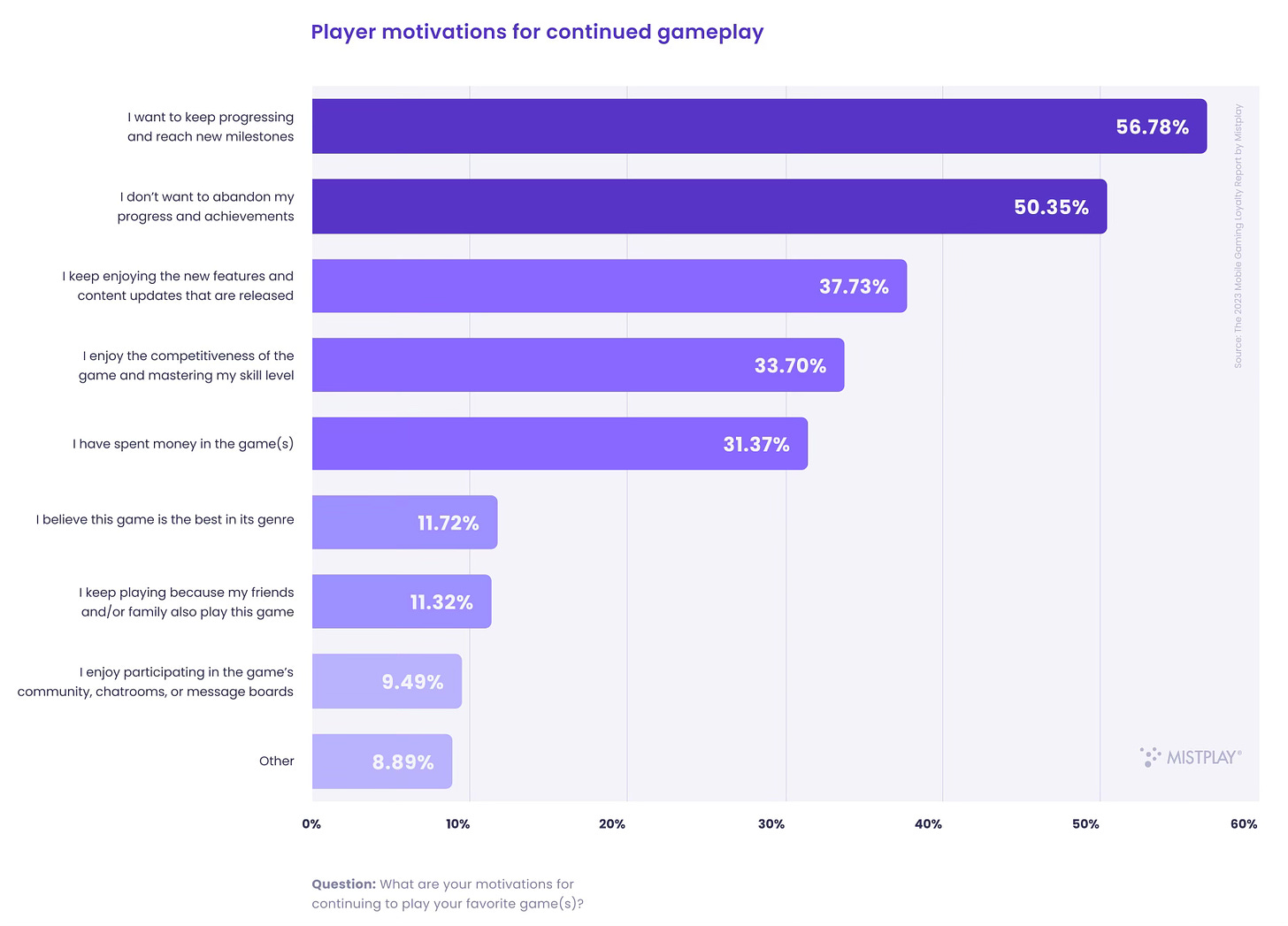

56.78% of players continue playing for progress and achieving new results; 50.35% do not want to lose their accumulated progress and achievements; 37.73% like new updates and content.

-

On the other hand, 59.75% of users stop playing because the game becomes "pay to win"; 55.18% quit due to bugs or errors; 54.55% do not feel a sense of progress.

-

25.64% of people will not leave the game if there is a bad update, knowing that the issue will be fixed. On the contrary, 4.7% will stop playing immediately. The majority, around 70%, is willing to give the game from 1-3 days to 2 months to fix issues.

-

The publisher's name is important to players. On a scale from 1 to 5, only 6.39% of players chose a rating of 1 or 2, which means that survey participants are unlikely to try games from the same publisher.

Player Purchasing Preferences

-

92.8% of the paying audience simultaneously makes purchases in 1-4 projects. 53% spend on only one game per week.

-

61.96% of users spend money to achieve new progress; 30.71% for rare or unique content; and 29.27% to play without ads.

-

59.55% of players prefer bundles with a larger number of items; 45.95% prefer one-time profitable offers; and 28.64% want to buy in-game currency to spend as they see fit.

Sony: Over 46.6M PS5 units are sold worldwide

Sony reported on the second financial quarter of 2023 and shared some new figures.

-

Over 46.6 million PlayStation 5 units have been sold worldwide. 4.9 million of them were sold from July to September of this year.

-

The company predicts that the sales momentum will only accelerate with the release of the Slim version of the PS5 and PlayStation Portal. The maximum target is to sell 25 million PlayStation 5 units in this fiscal year. Currently, the PS5 is performing 25% better than the year when the PS4 sold 20 million consoles.

-

During the second financial quarter of 2023 (July-September), 67.6 million games for PS4 and PS5 were sold. This is 7.5% more than in the same period in 2022.

-

4.7 million copies sold were games from Sony's studios, which accounts for 7% of the total.

-

Sales of Marvel’s Spider-Man 2 exceeded 5 million copies. The game achieved this milestone in just 11 days. Only God of War: Ragnarok reached this mark faster (5 days). God of War (2018) took 31 days to reach it, and Ghost of Tsushima took 118 days.

-

MAU on PlayStation platforms reached 107 million in September, which is 5 million more than in September of the previous year. On the other hand, this is 1 million MAU less than in the peak month of the first financial quarter of 2023. But such comparisons should consider seasonality.

-

Sony noted that it has halved its plan to release game services. By March 2026, there should be 6 of them, not 12 as previously planned. The company has decided to focus on quality rather than quantity.

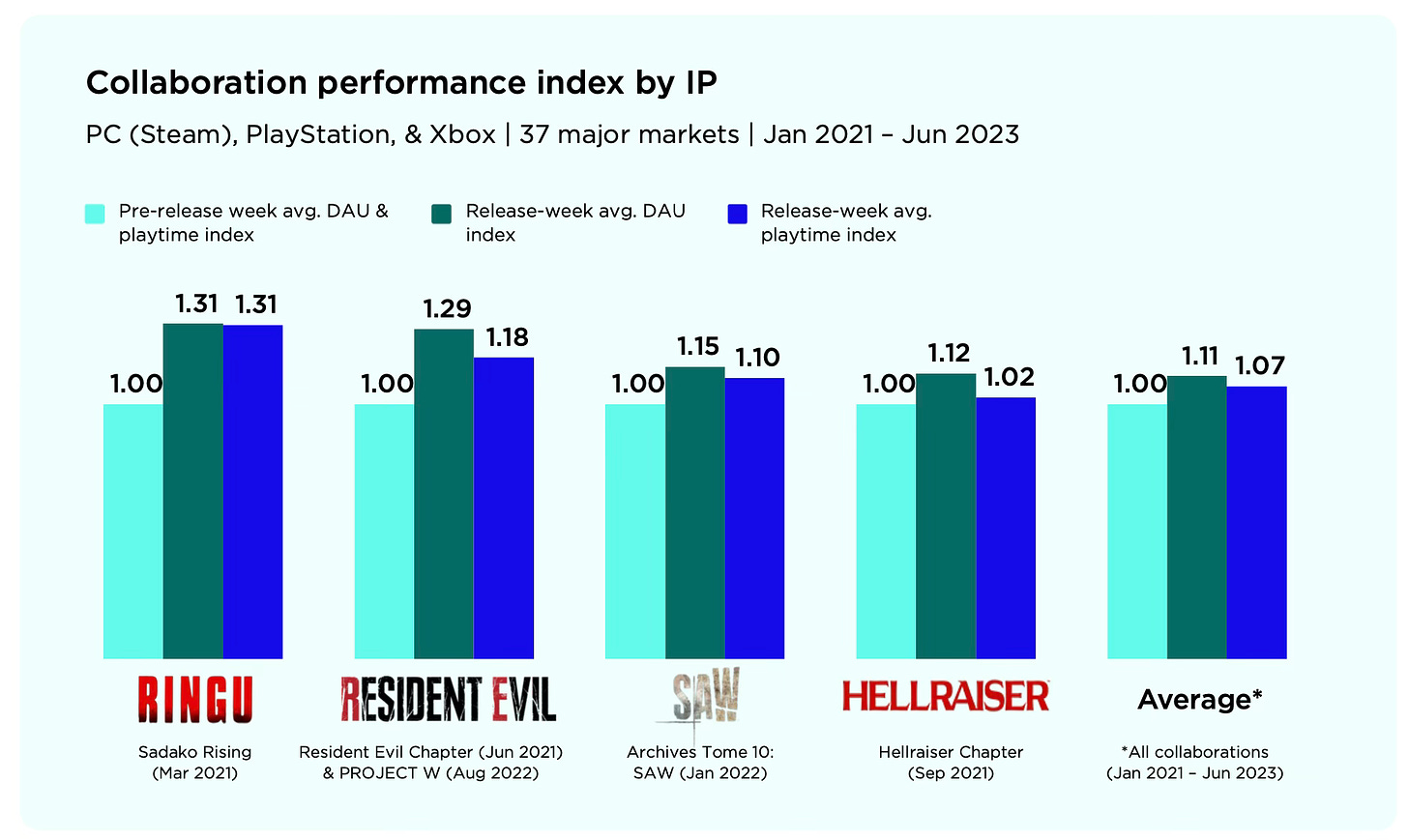

Newzoo: IP & Brand Collaborations in Games in 2023

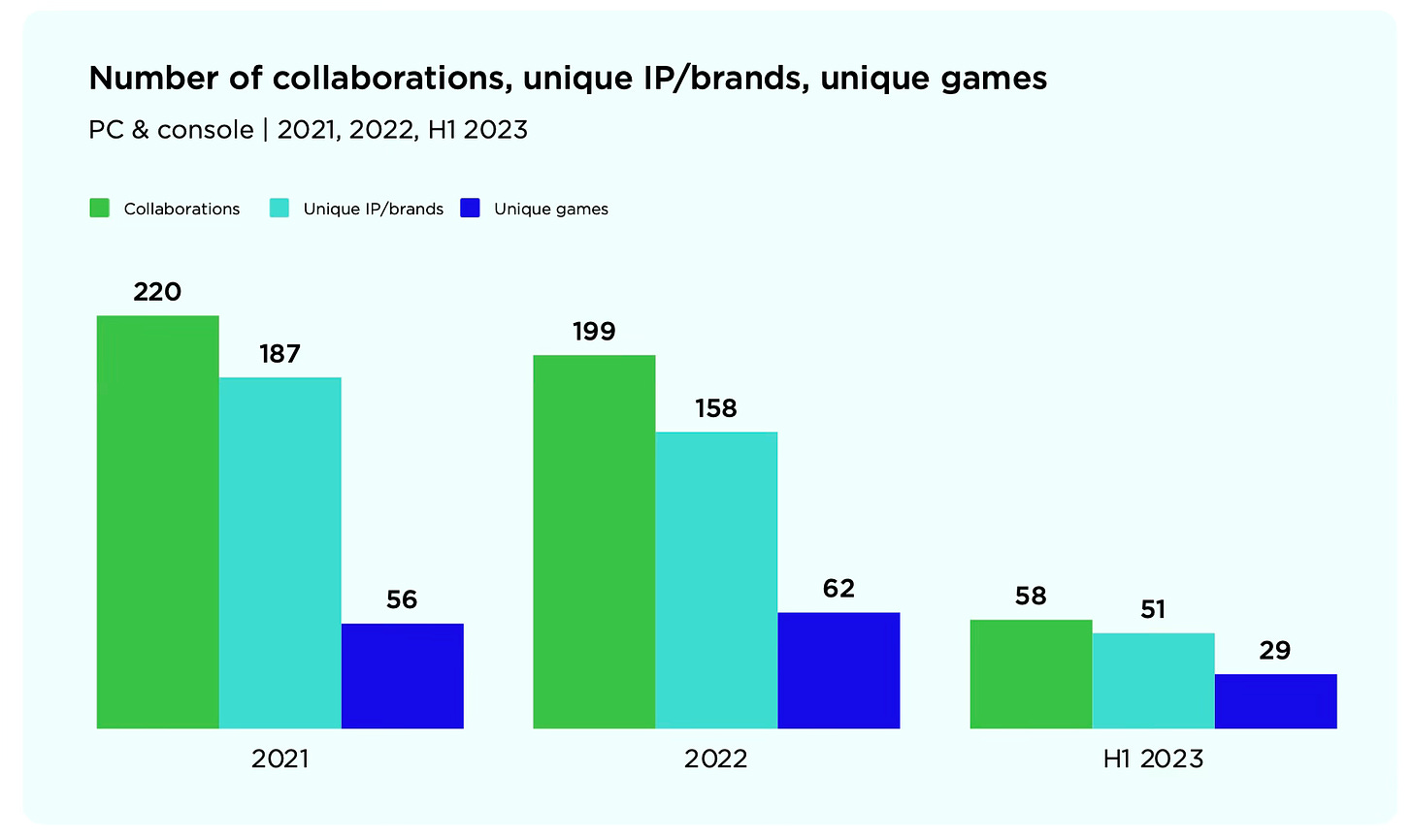

The company examined 477 integrations from January 2021 to June 2023 as part of its research.

-

The number of collaborations and joint projects has been decreasing since 2021, attributed to the deteriorating situation in the gaming market.

-

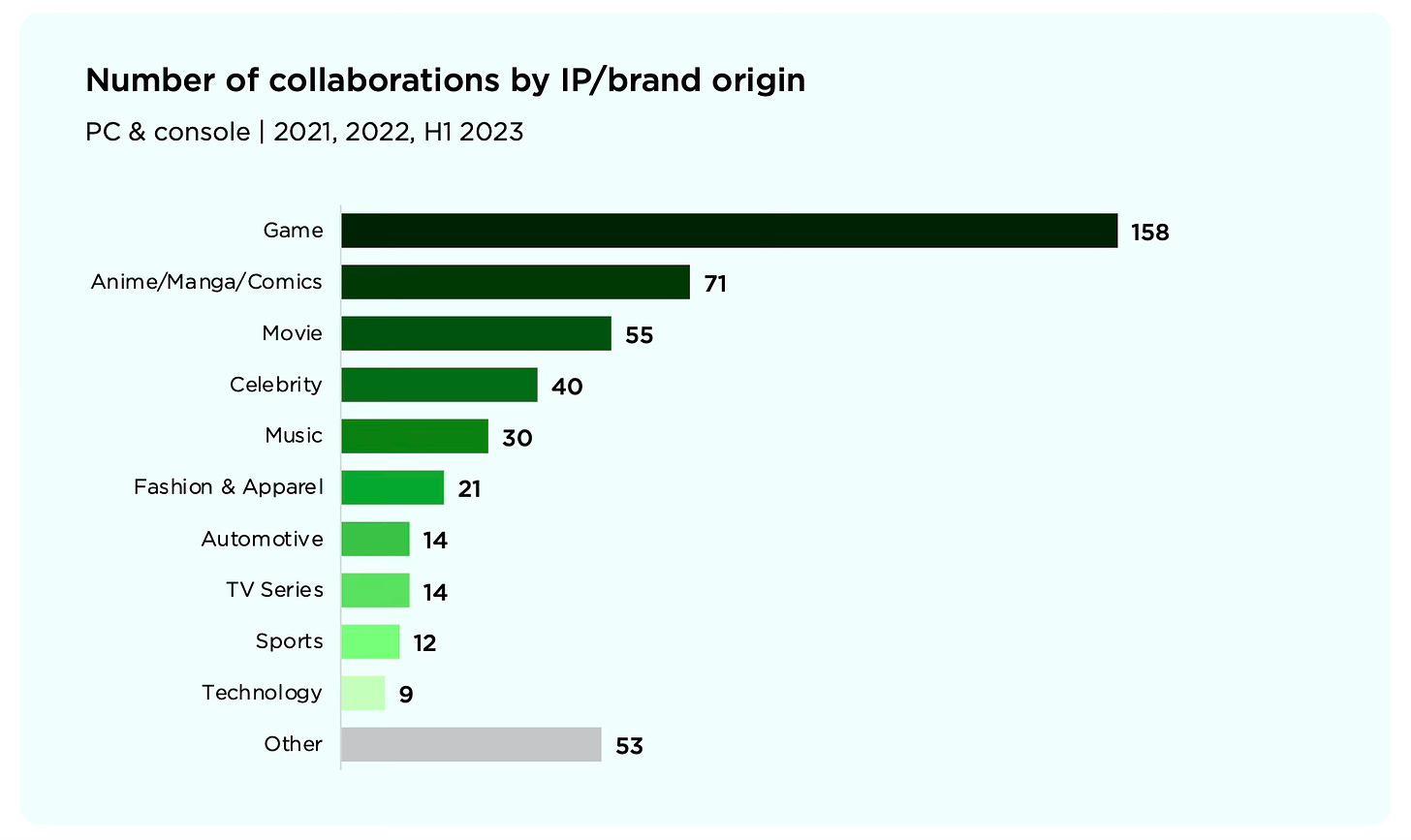

158 out of 477 integrations were between gaming IPs. In second place were anime (manga) with 71 cases, followed by movies with 55 cases.

-

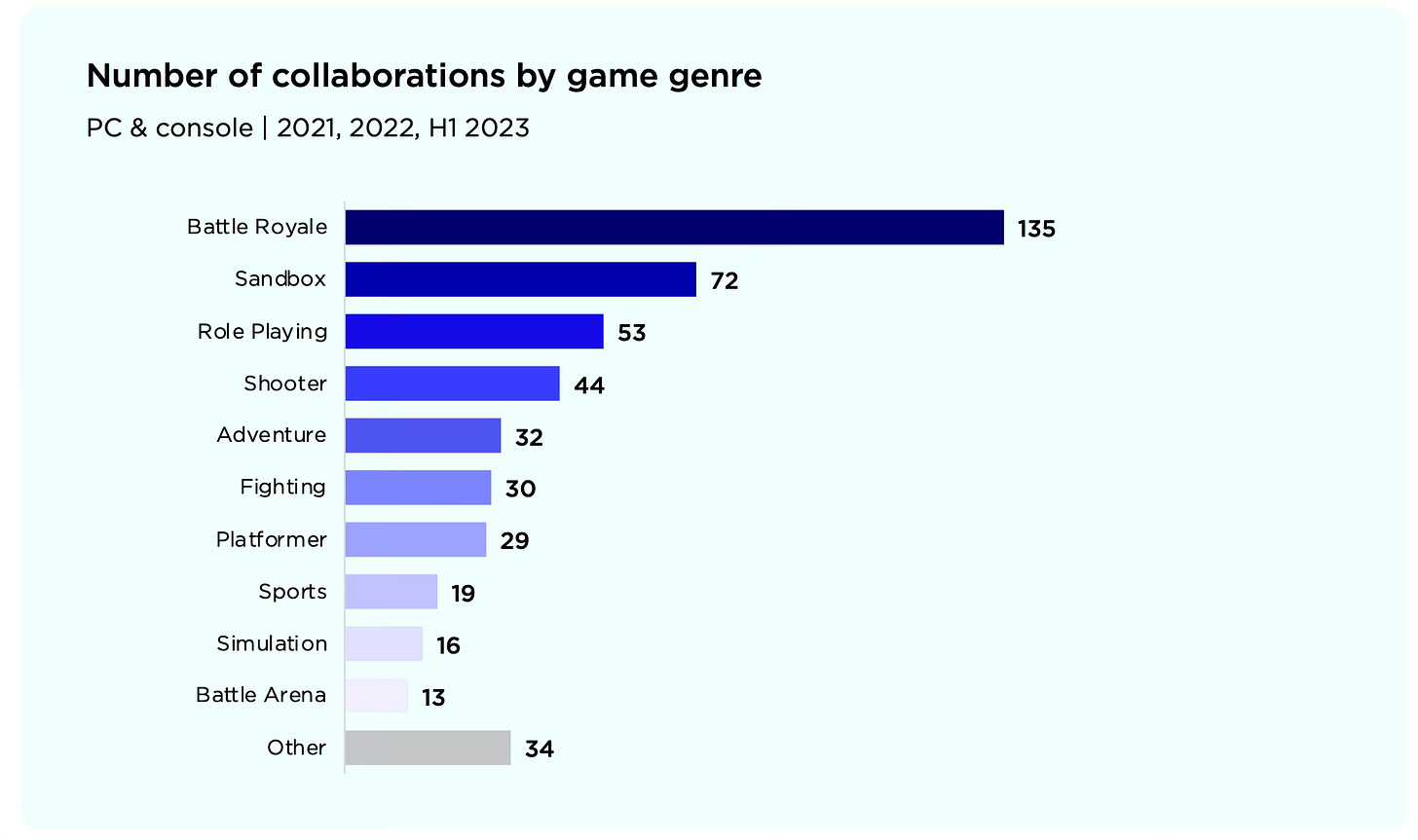

Battle Royale is the most popular genre for collaborations, accounting for 135 out of the 477 cases studied. Sandbox games rank second with 72 collaborations, and RPGs are third with 53.

-

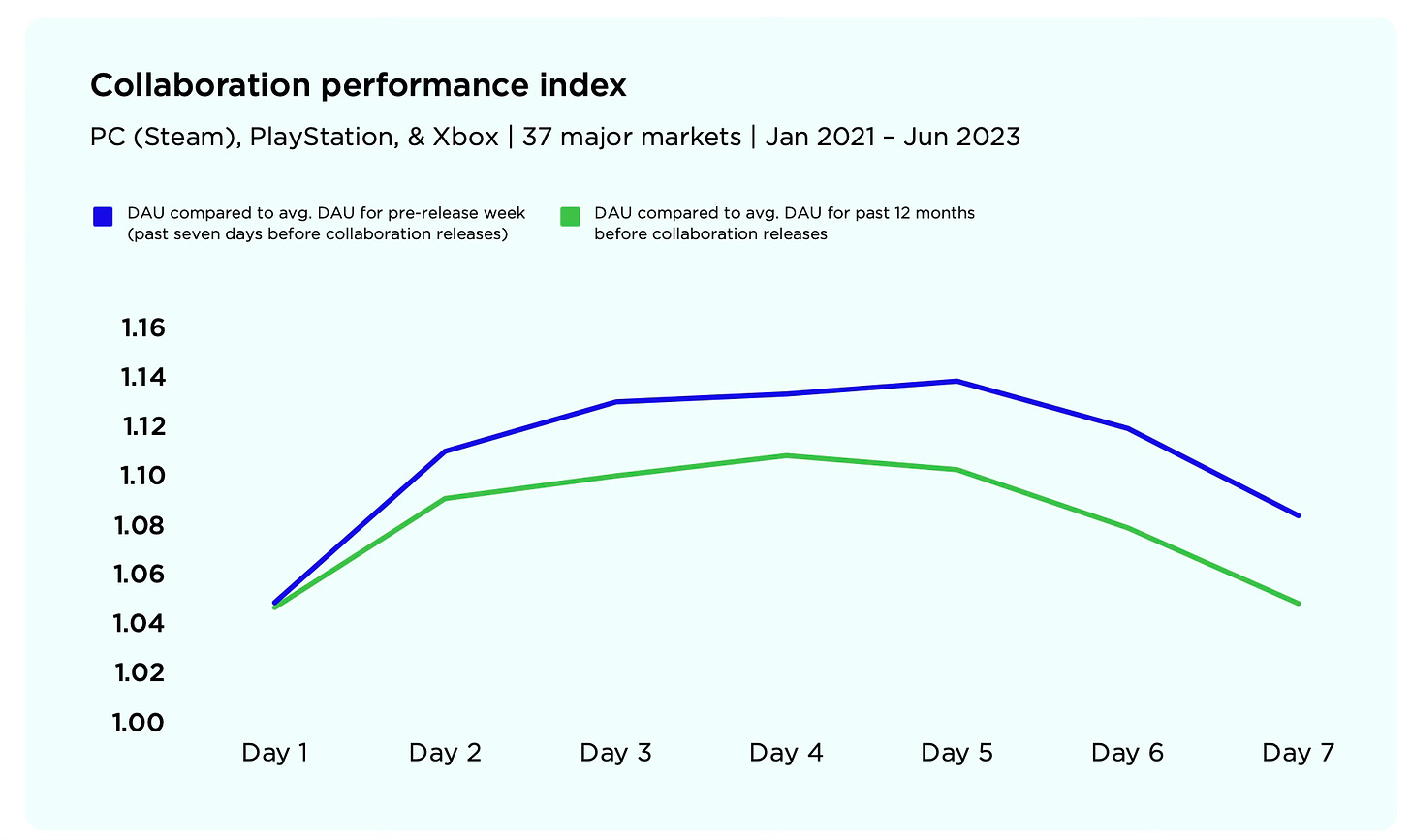

The average growth in Daily Active Users (DAU) during the first 7 days after collaboration is 11%, peaking on the 4th or 5th day after release. However, Newzoo does not assess the monetization results.

-

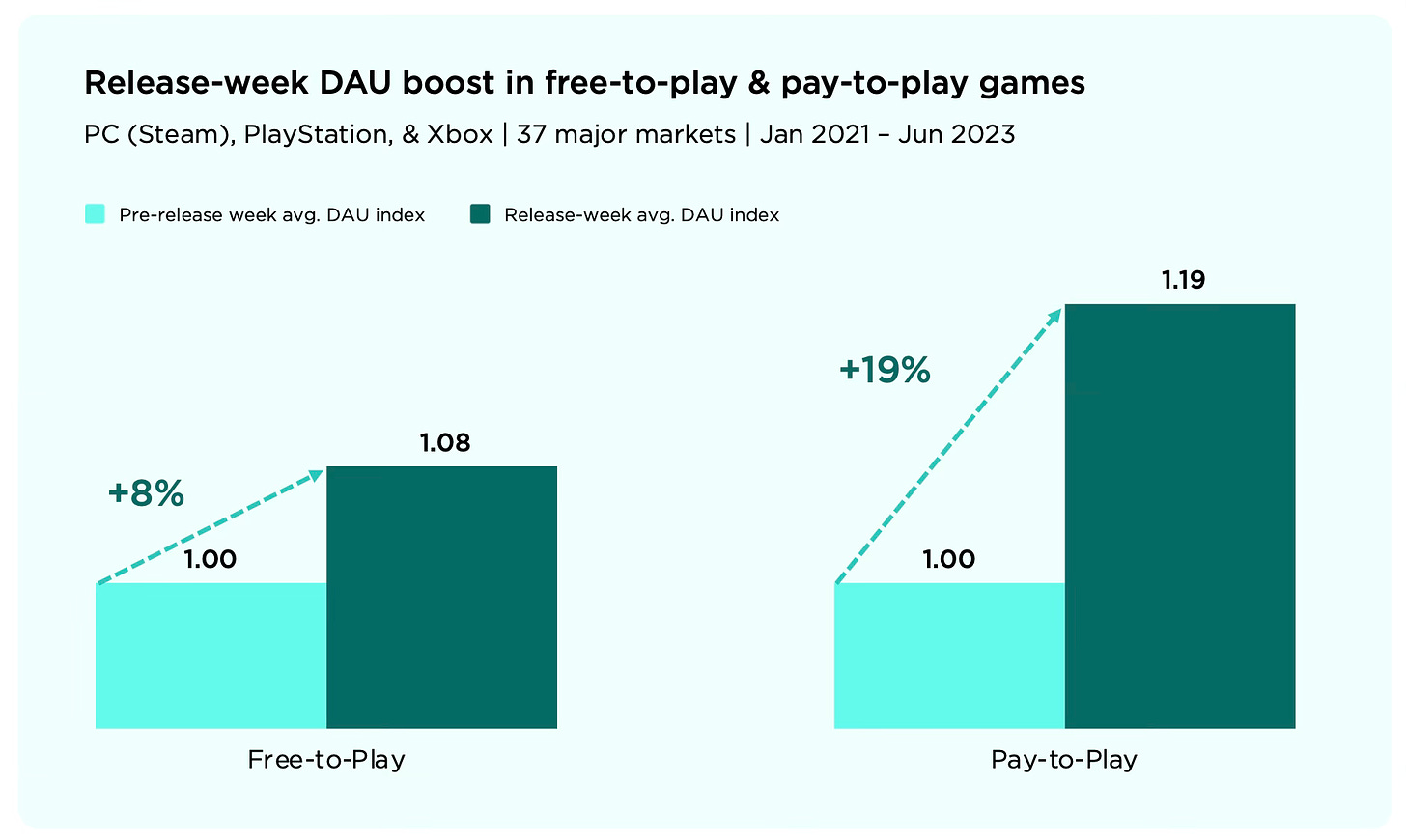

The effect is more noticeable for games distributed under the buy-to-play model, with a 19% increase in DAU. Free-to-play projects experience an 8% growth.

Case Study: Dead by Daylight

The game developer successfully collaborates with various popular horror franchises.

-

The most successful collaboration was with the movie "The Ring." DAU and average time in the game increased by 31% in the first week.

-

In second place was the collaboration with Resident Evil. DAU increased by 29%, and game time increased by 18% in the first week.

- The average growth in DAU for all collaborations is 11%, and the growth in time spent is 7%.

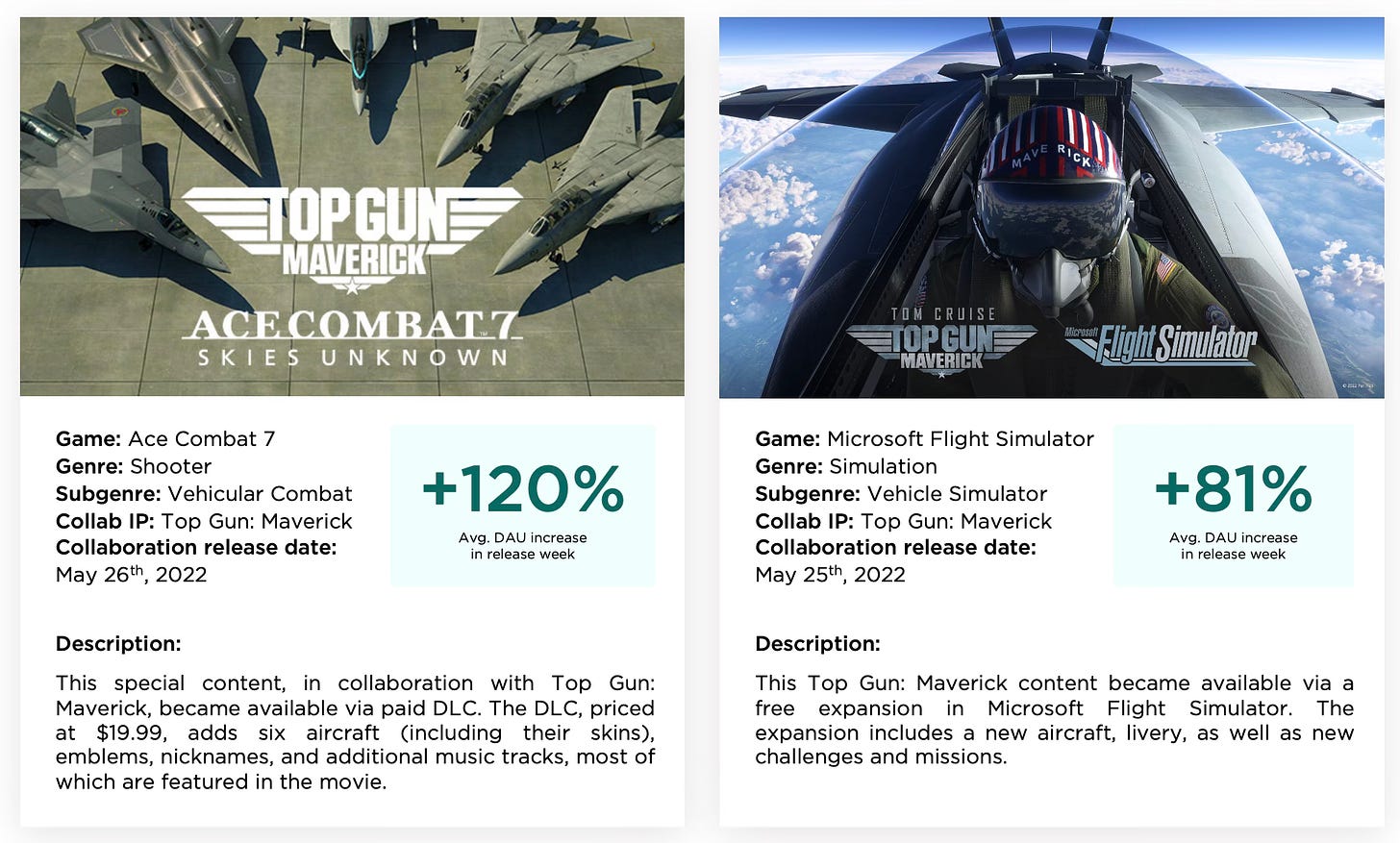

Case Study: Top Gun Maverick

Two collaborations with games were announced for the movie release - Ace Combat 7: Skies Unknown and Microsoft Flight Simulator.

-

In the case of Ace Combat 7: Skies Unknown, a paid DLC priced at $19.99 was released. It added 6 new combat vehicles, emblems, music, and other in-game items. DAU of the game increased by 120% in the week after the release.

-

In the case of Microsoft Flight Simulator, a free add-on was released, including an aircraft, cosmetic items, new trials, and missions. The DAU growth in the week after the release was 81%.

❗️ It is important to note that Newzoo looks at collaborations in terms of audience growth. However, in reality, the goal of collaborations is not only to expand the potential audience but also to maximize the conversion of the existing audience into payments. Key success markers for collaborations should include a combination of engagement and monetization metrics.

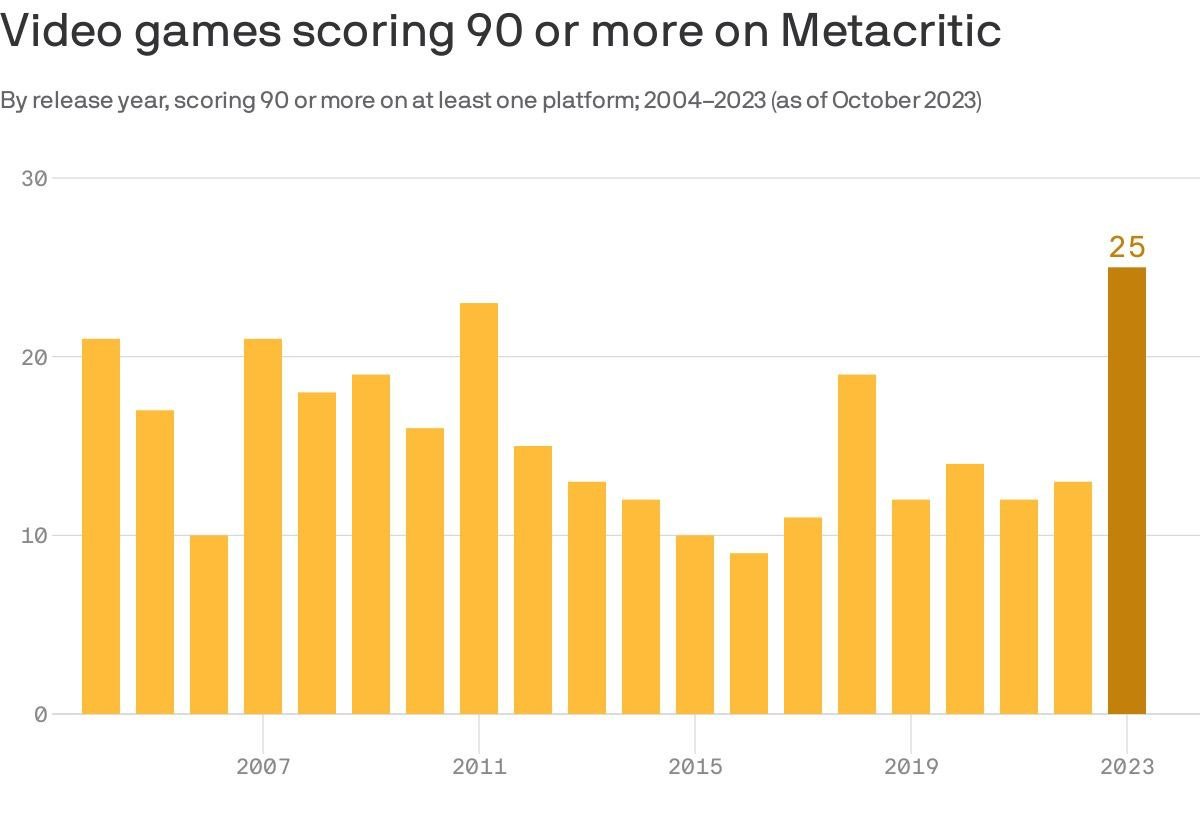

Axios: 2023 is already a record year for games with 90+ ratings on Metacritic

-

As of the end of October 2023, there have been 25 games with a rating above 90 on Metacritic. The most notable projects include The Legend of Zelda: Tears of the Kingdom, Baldur’s Gate III, and the remake of Resident Evil 4.

-

The industry has come closest to these results in 2011 when 23 games with a rating above 90 were released.

- In 2023, many projects came close to reaching the required rating. These include the remake of Dead Space (89 points), the indie project Pizza Tower (89 points), Armored Core VI: Fires of Rubicon (88 points), and Hi-Fi Rush (87 points).

So, if you've found yourself thinking that 2023 is one of the best years for the gaming industry in terms of games, there is now statistical confirmation for that. Ironically, it's in this year that game studios have actively carried out layoffs.

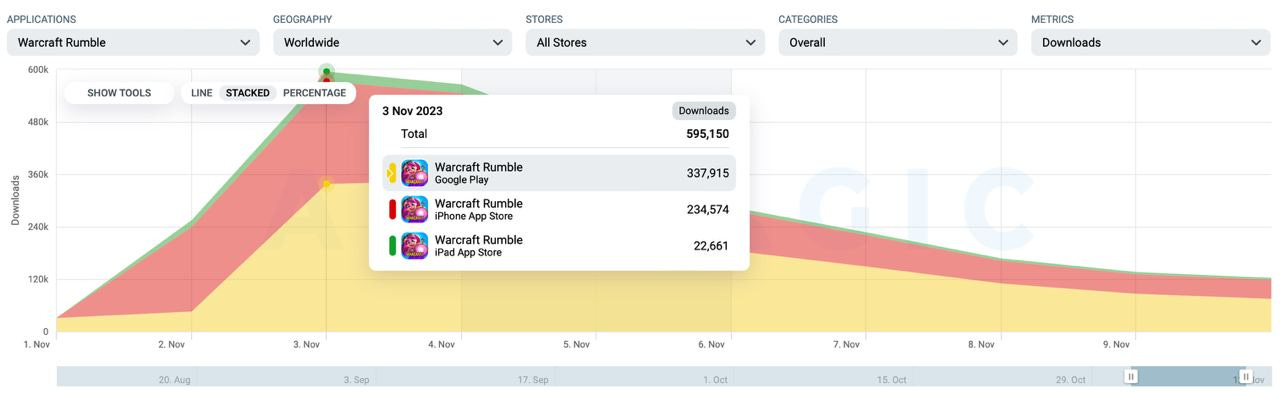

Editorial: Warcraft Rumble earned $6 million in the first week

AppMagic provides net revenue data - after the store commissions and taxes.

-

According to AppMagic, the game earned $6 million in the first week after release. Similar data is provided by data.ai - $5.68 million.

-

Currently, the total revenue of the project is $7.8 million - the game reached $900 thousand per day over the weekend. The game is steadily growing in revenue.

-

59% of the project's revenue came from iOS; 41% - from Google Play.

-

The majority of revenue - 44% - comes from the United States. Germany (10%), Taiwan (6%), South Korea (6%), and France (5%) follow.

-

The game was downloaded 2.8 million times in the first week. The peak was on the release day (November 3) - the game received almost 600 thousand installs.

-

Downloads are decreasing - currently, the game is downloaded by about 100 thousand users per day.

-

The cumulative RpD of the project is currently $2.61. But it's still too early to conclude; the game has not had enough time to demonstrate its medium- and long-term mechanics.

Comparison with the launch of Clash Royale

-

Supercell's game earned $27.1 million in the first week after release (March 2, 2016 - March 9, 2016). This is almost 5 times better than Warcraft Rumble.

-

The number of downloads was 8 times higher - Clash Royale was downloaded 22.7 million times in the first week.

-

Currently, Clash Royale's RpD is $4.88. This is twice as high as Warcraft Rumble, but the data is collected for the entire existence of the project. Therefore, Blizzard Entertainment's game still has time to catch up.

💭 It's quite possible that the Clash brand from Supercell is stronger on mobile devices than Warcraft. This can be indirectly inferred from the initial results of the two games.

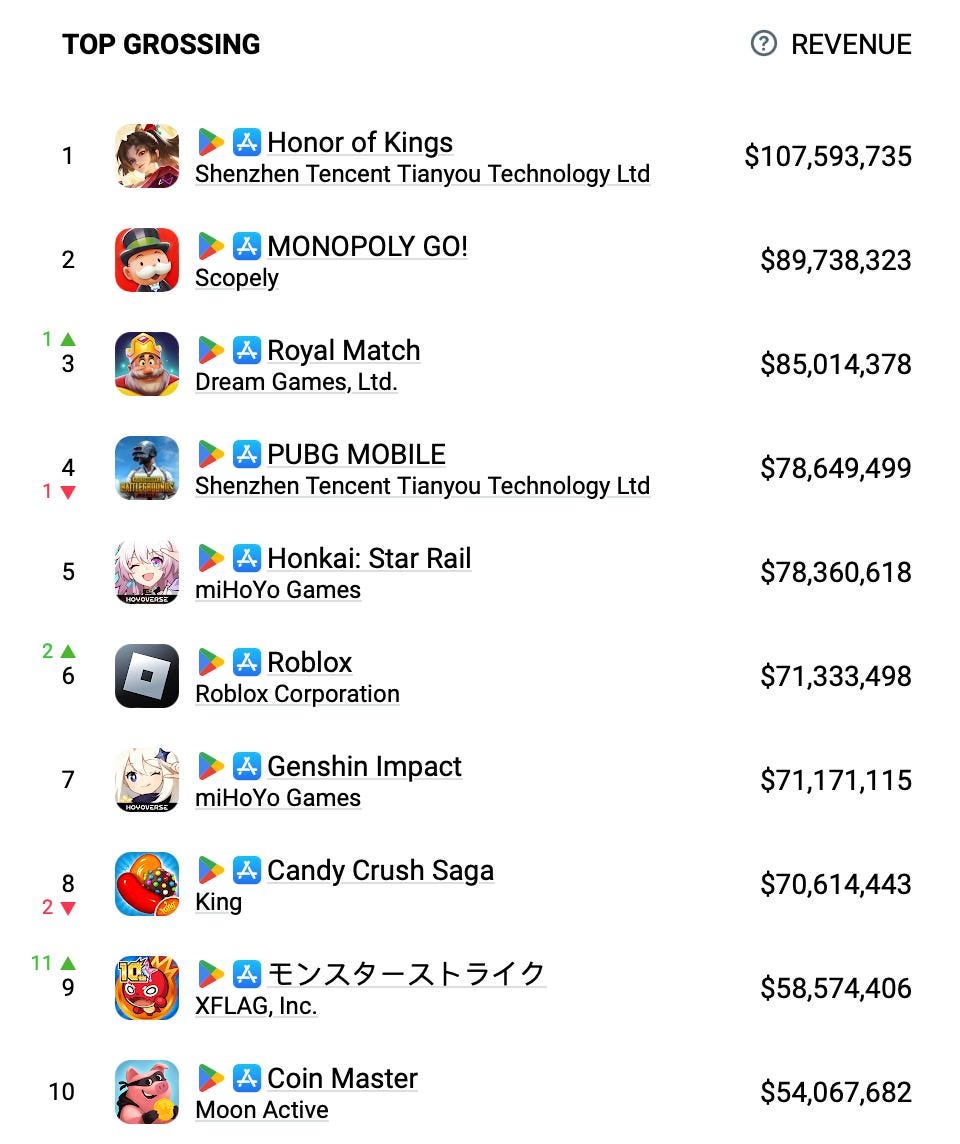

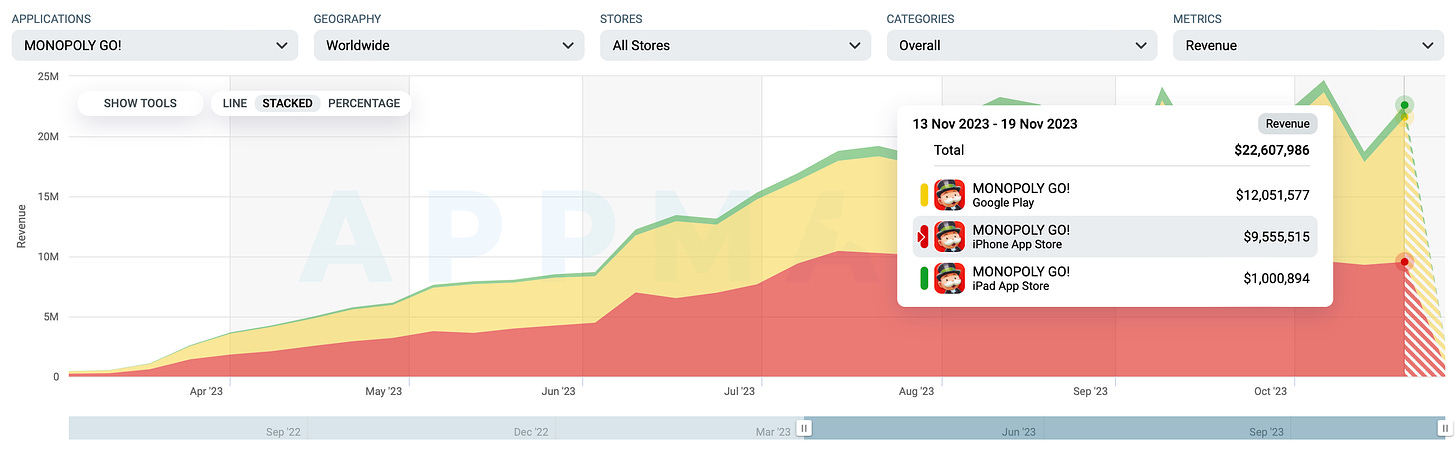

AppMagic: Top Mobile Games of October 2023 by Revenue and Downloads

AppMagic provides revenue data net of store fees and taxes.

Revenue

-

Honor of Kings - the leader. In October, the game earned nearly $108 million, excluding alternative stores.

-

MONOPOLY GO! holds the second position. In October, the game earned $89.7 million, and the project's monthly revenue continues to grow.

-

Monster Strike returned to the top 10 in the 9th position. The game earned $58.6 million in October, with 98% of the revenue coming from Japan.

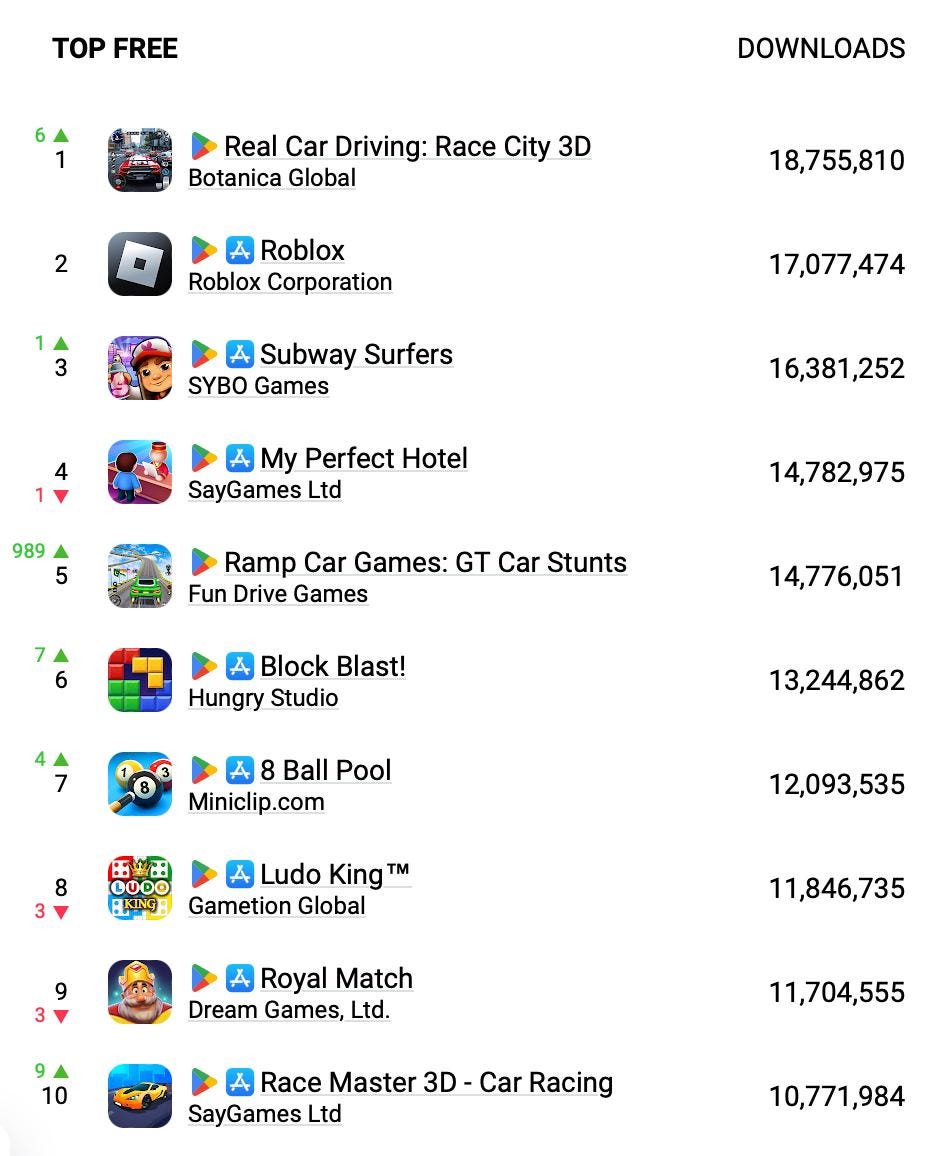

Downloads

-

Real Car Driving: Race City 3D became the most downloaded game of the month with 18.8 million installations.

-

In second place is Roblox (17 million downloads), and in third place is Subway Surfers (16.4 million installations).

-

Among the newcomers on the chart is only Ramp Car Games: GT Car Stunts from Fun Drive Games. The game was downloaded 14.8 million times in October.

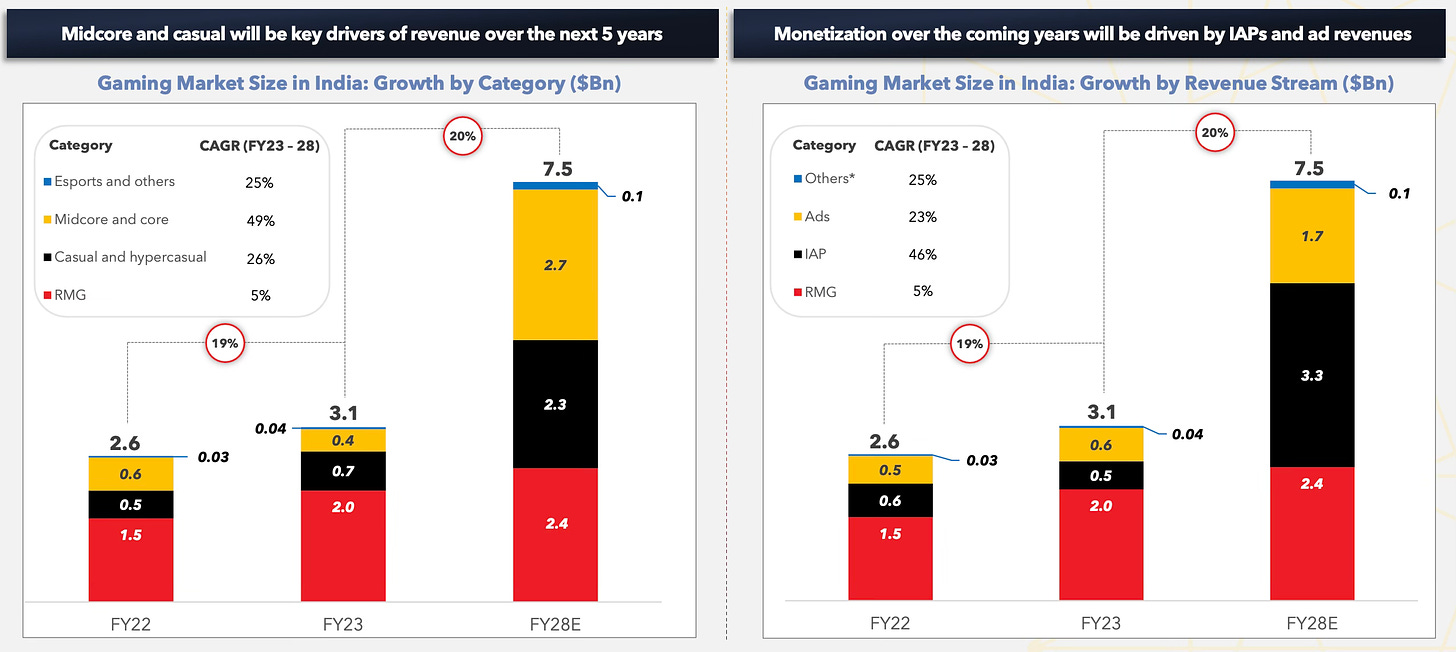

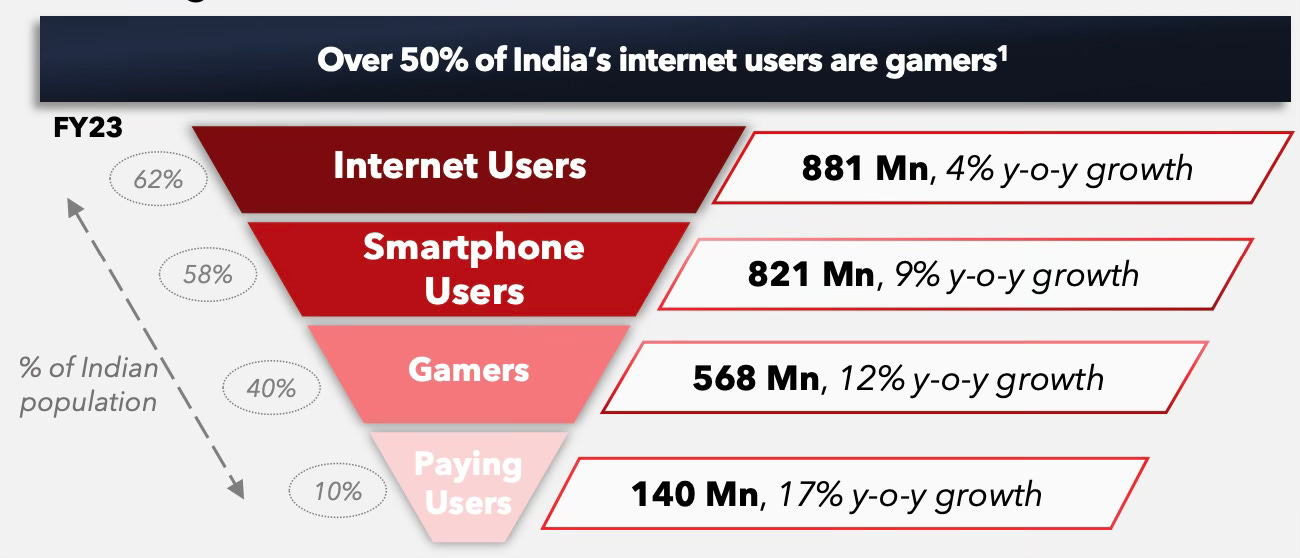

Lumikai & Google: The Indian Gaming Market in 2023 and Forecast until 2027

-

The size of the Indian gaming market in 2023 will reach $3.1 billion. Mobile games account for only $1.1 billion, with the remaining volume taken up by Real Money Gaming (RMG) games.

❗️ In October, India announced a 28% tax on deposits in RMG games, impacting the entire industry.

-

Therefore, Lumikai and Google forecast a very restrained annual growth of 5% for the entire segment until 2028.

-

However, mobile games are expected to show explosive growth. The growth of the casual games segment is projected to increase from $0.7 billion in 2023 to $2.3 billion in 2028 (26% average annual growth rate). In the case of mid-core and hardcore projects, growth is expected from $0.4 billion to $2.7 billion in 2028 (49% average annual growth rate).

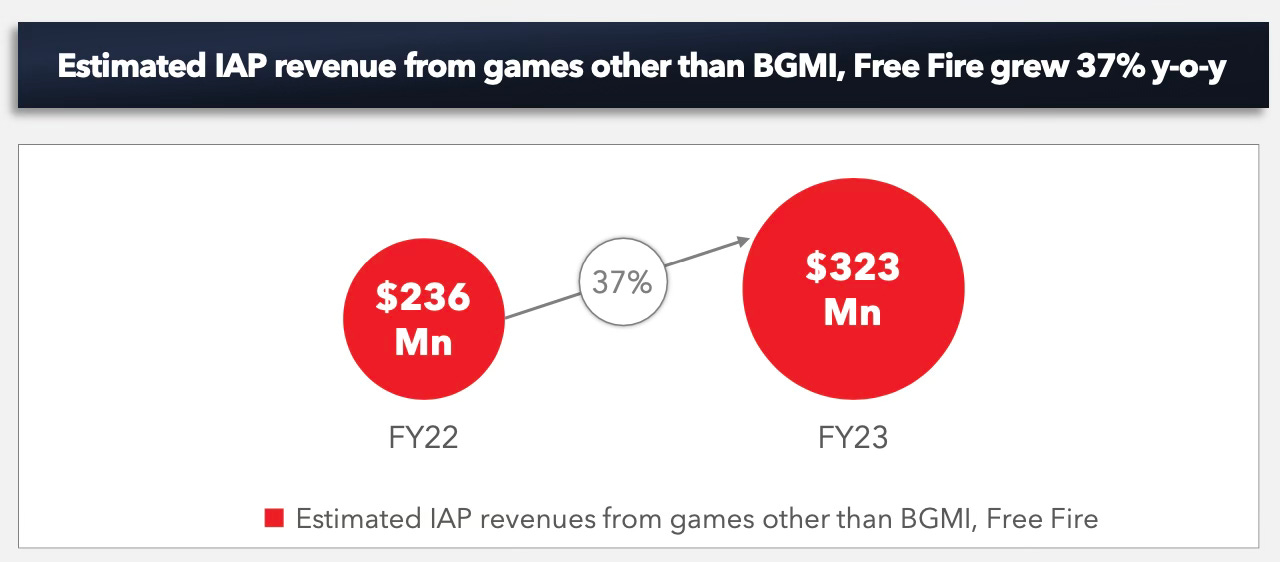

-

Interestingly, the growth of in-game payments beyond Battlegrounds Mobile India and Garena: Free Fire was separately calculated. In 2023, players spent $323 million on in-game purchases in other games, with a 37% growth compared to 2022.

❗️ If the data in the report is consistent, the two largest Battle Royale games in India account for approximately $180 million in revenue annually.

-

Lumikai and Google believe that the volume of in-game transactions in India will grow nearly sevenfold in five years, and advertising revenue will triple.

-

Currently, India has 568 million players, of which only 140 million are paying players. On average, they spend 10-12 hours per week on games.

-

59% of players are male, and 41% are female.

-

The majority of players (50%) are young people aged 18 to 30.

-

The number of players in India from non-major (by Indian standards) cities is growing. In 2023, they account for 66% of the entire audience.

-

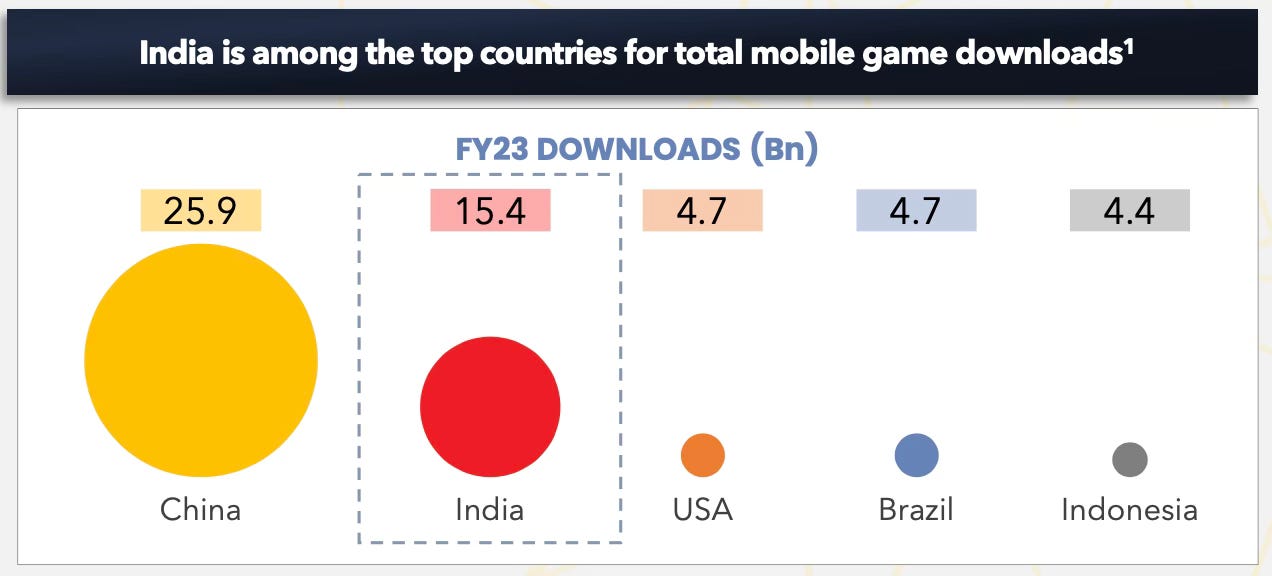

India is the second-largest market after China in terms of game downloads (15.4 billion per year).

-

Lumikai and Google note that in 2023, the average annual ARPPU (Average Revenue Per Paying User) for a user from India is $19.2. In 2019, this indicator was $2.

Newzoo: The Gaming Industry in 2023

The user research is based on a survey of more than 74,000 people from 36 countries around the world aged 10 to 65. Revenue data does not include taxes, advertising, and "hardware" sales.

Revenue

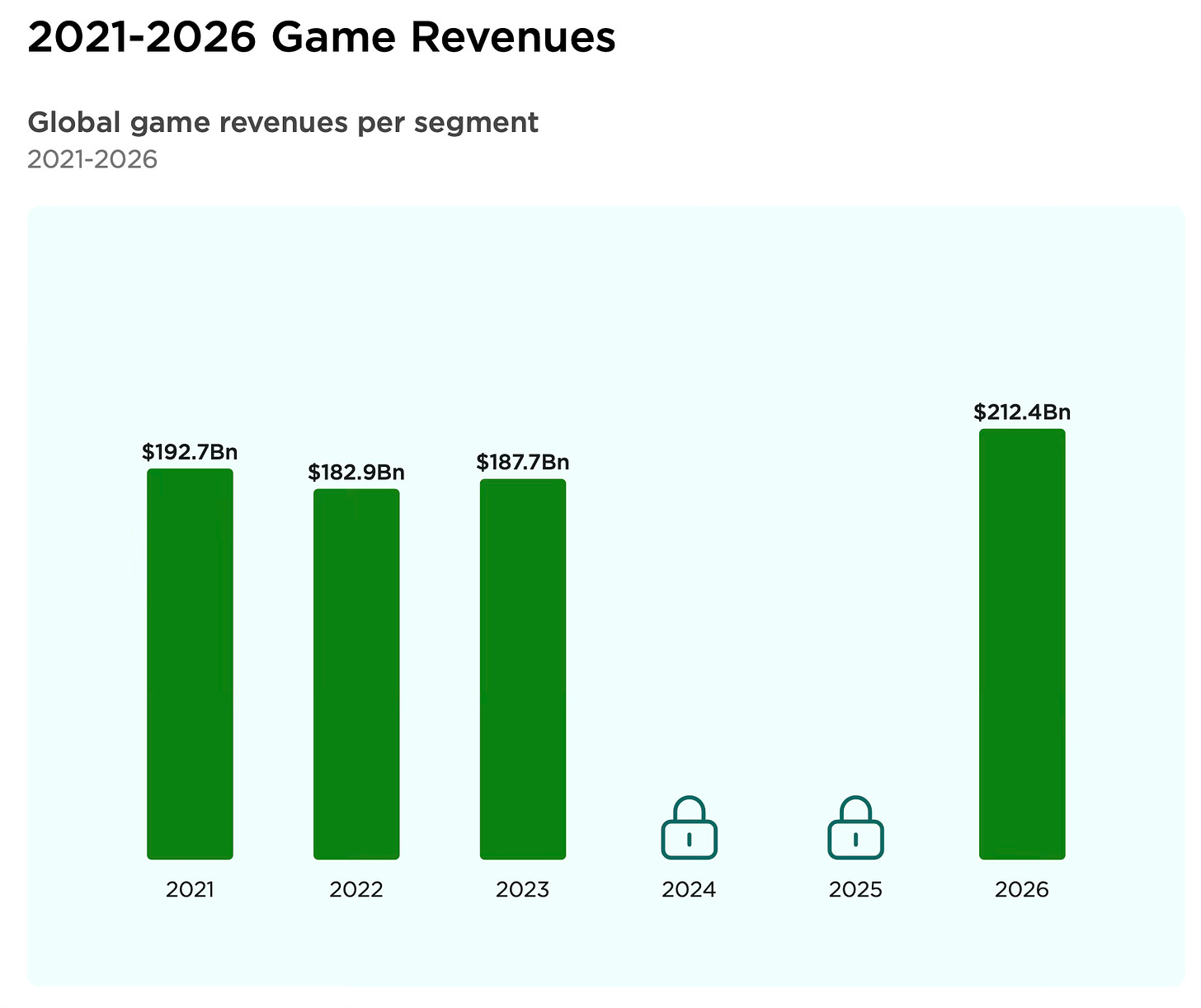

-

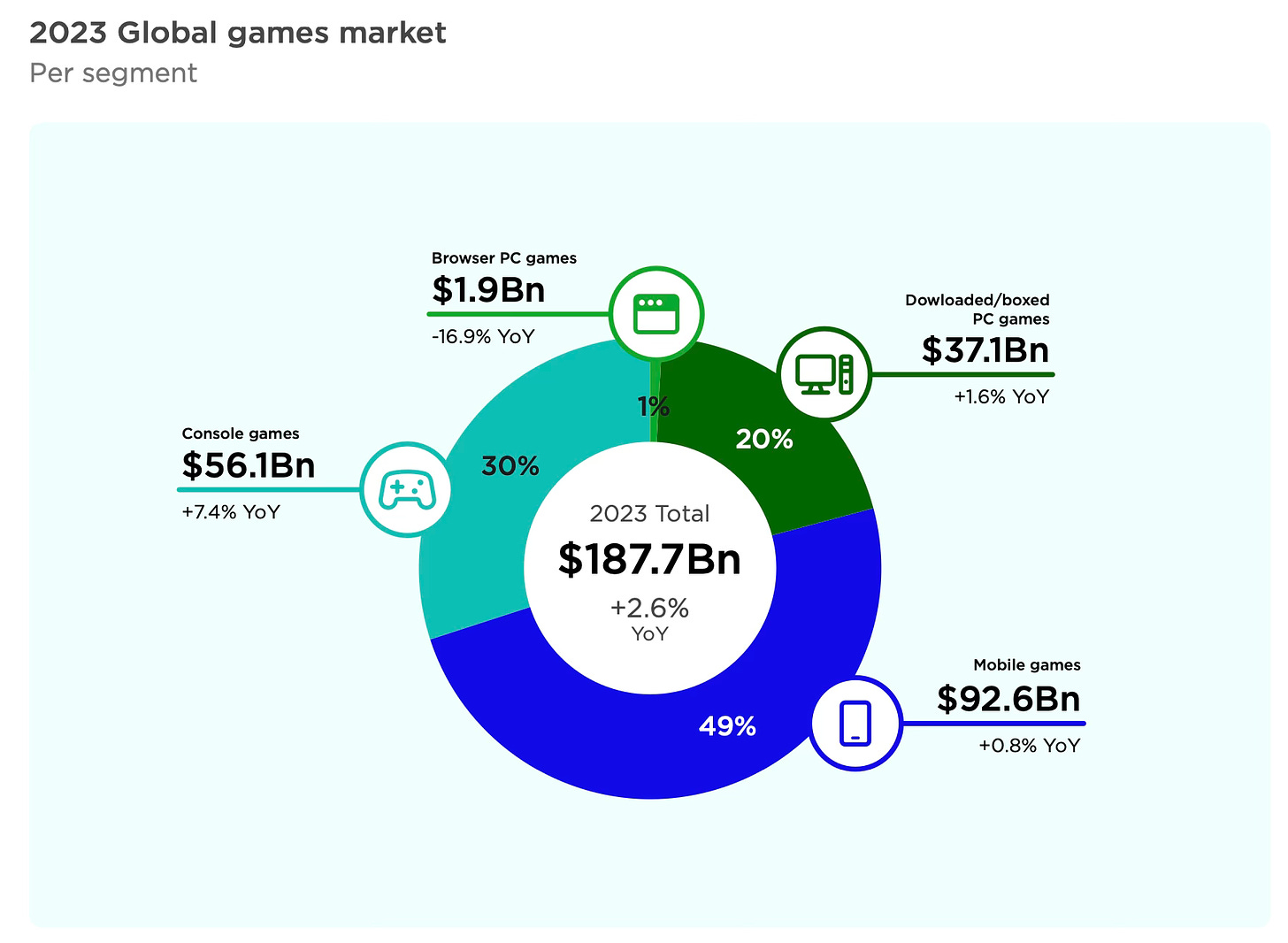

By the end of 2023, the gaming market will grow by 2.6% and reach $187.7 billion.

-

$92.6 billion (49%) - revenue of the mobile market. Newzoo believes that the growth of this segment will be limited due to platform policies regarding user data. By the end of 2023, it will grow by 0.8%.

-

The console market grew the most, by 7.4%, reaching $56.1 billion. Newzoo analysts note that this segment in 2022 underperformed in revenue due to delays in major releases and a shortage of consoles.

-

PC segment revenue by the end of 2023 will reach $37.1 billion. This is 1.6% more than the previous year. Browser PC games continue to decline rapidly, by 16.9% per year. The volume of this segment in 2023 will be $1.9 billion.

-

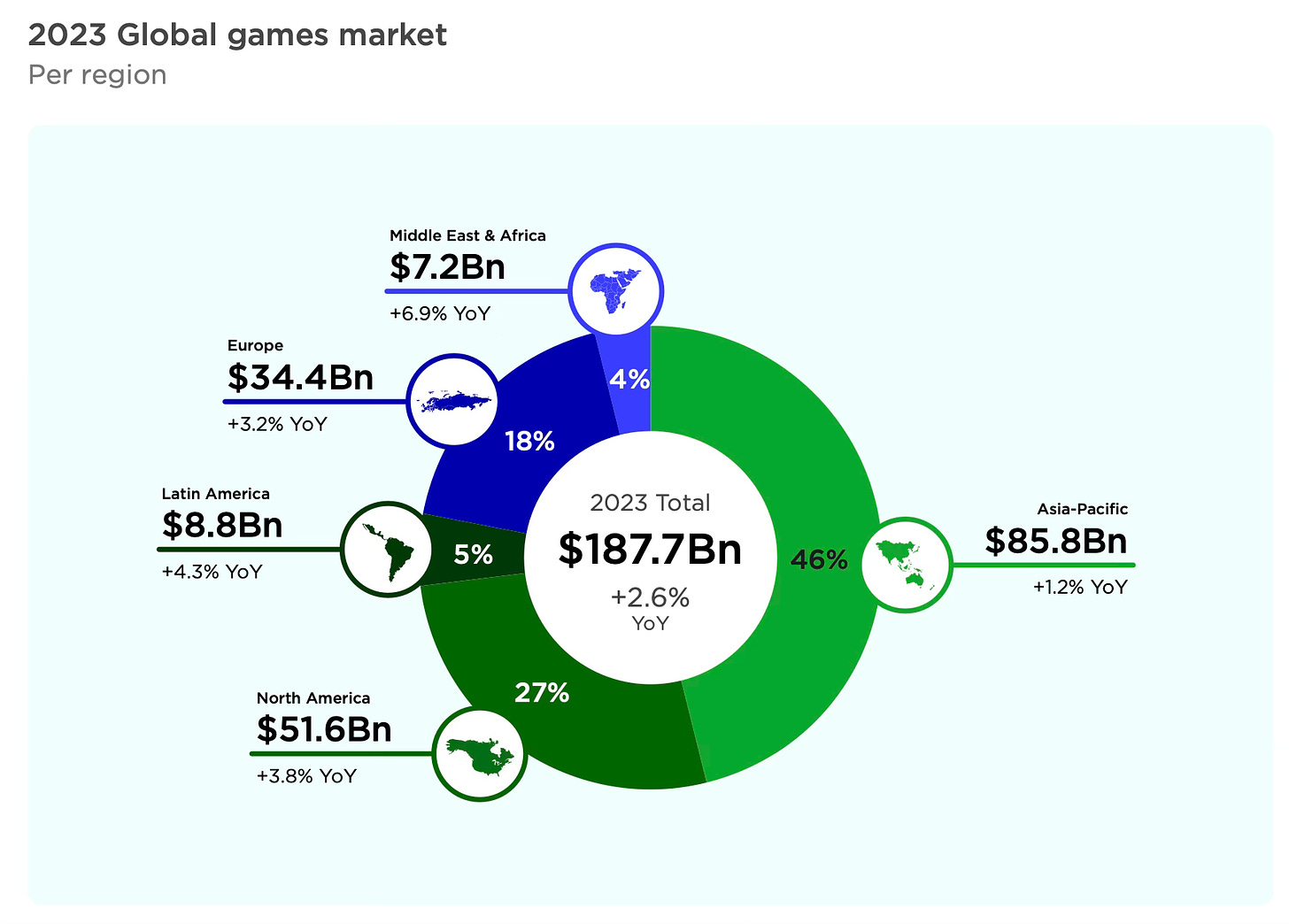

46% of gaming revenue ($85.5 billion) is concentrated in the Asia-Pacific region. 27% ($51.6 billion) in North America. 18% ($34.4 billion) in Europe. 5% ($8.8 billion) in Latin America. 4% ($7.2 billion) in the Middle East and Africa. This region is growing the fastest - by 6.9% per year.

-

Newzoo believes that the gaming market has stabilized after the pandemic growth and subsequent correction. By the end of 2026, the market volume will reach $212.4 billion.

Users

-

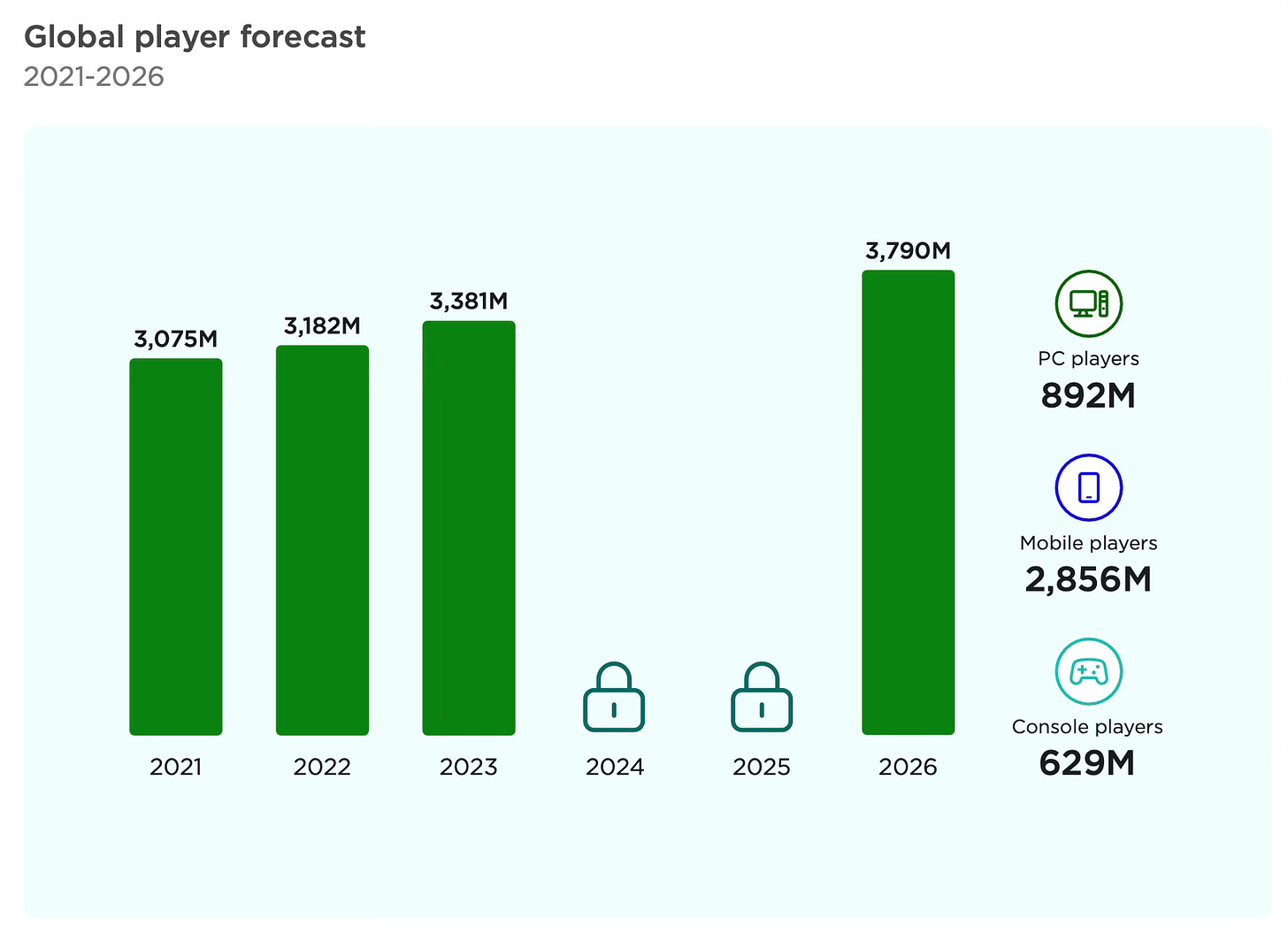

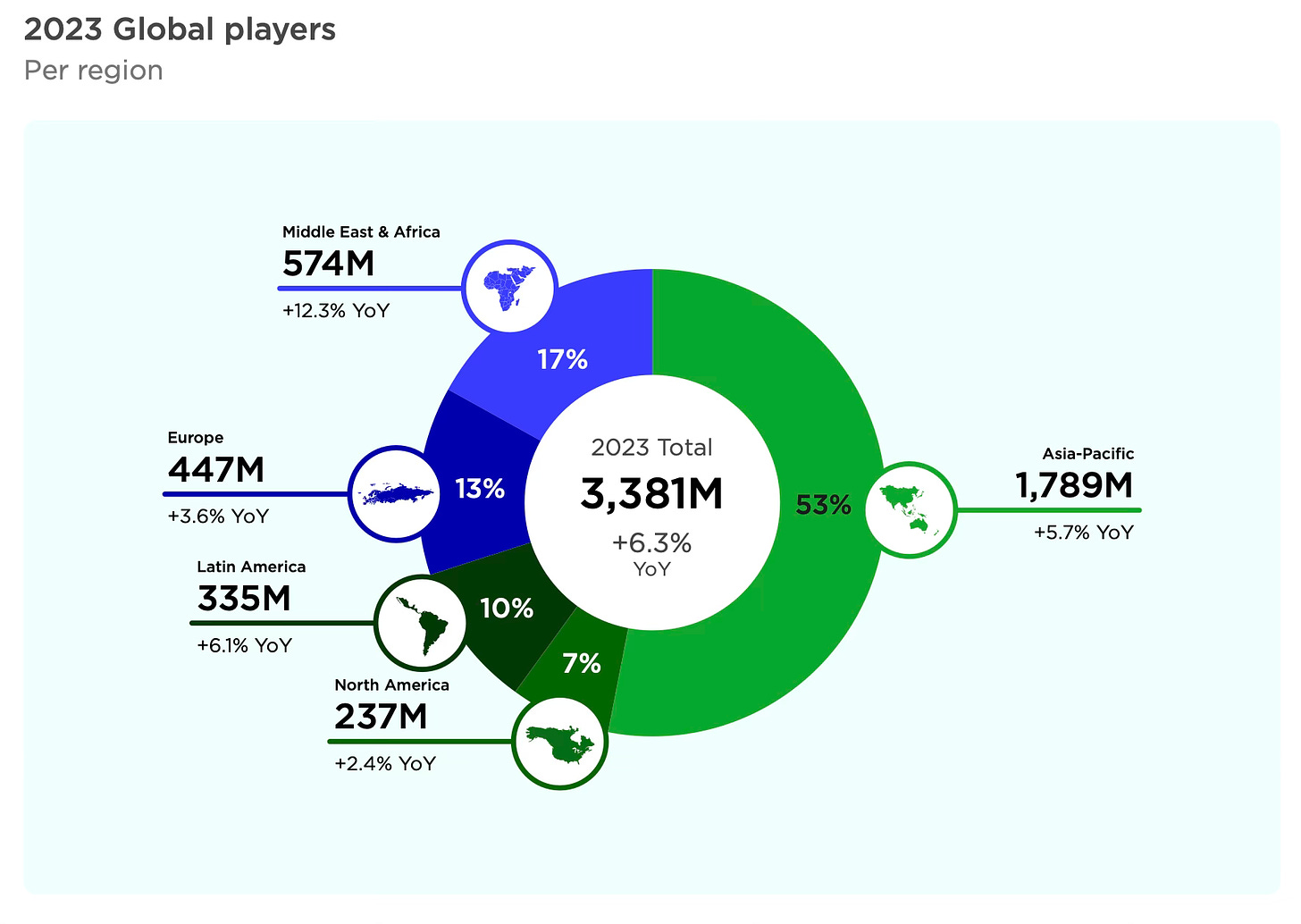

The number of gamers worldwide will reach 3.38 billion. This is 6.3% more than the previous year.

-

2.856 billion gamers play on mobile devices; 892 million on PC; 629 million on consoles.

-

53% of the entire gaming audience is concentrated in the Asia-Pacific region. 17% in the Middle East and Africa (also the fastest-growing region in terms of users - +12.3% per year). 13% in Europe; 10% in Latin America; 7% in North America.

-

The number of paying gamers by the end of 2023 will grow by 7.3% to 1.47 billion. The average annual growth rate from 2021 to 2026 is expected to be 4.7%, and by the end of 2026, there will be 1.66 billion paying gamers.

Companies

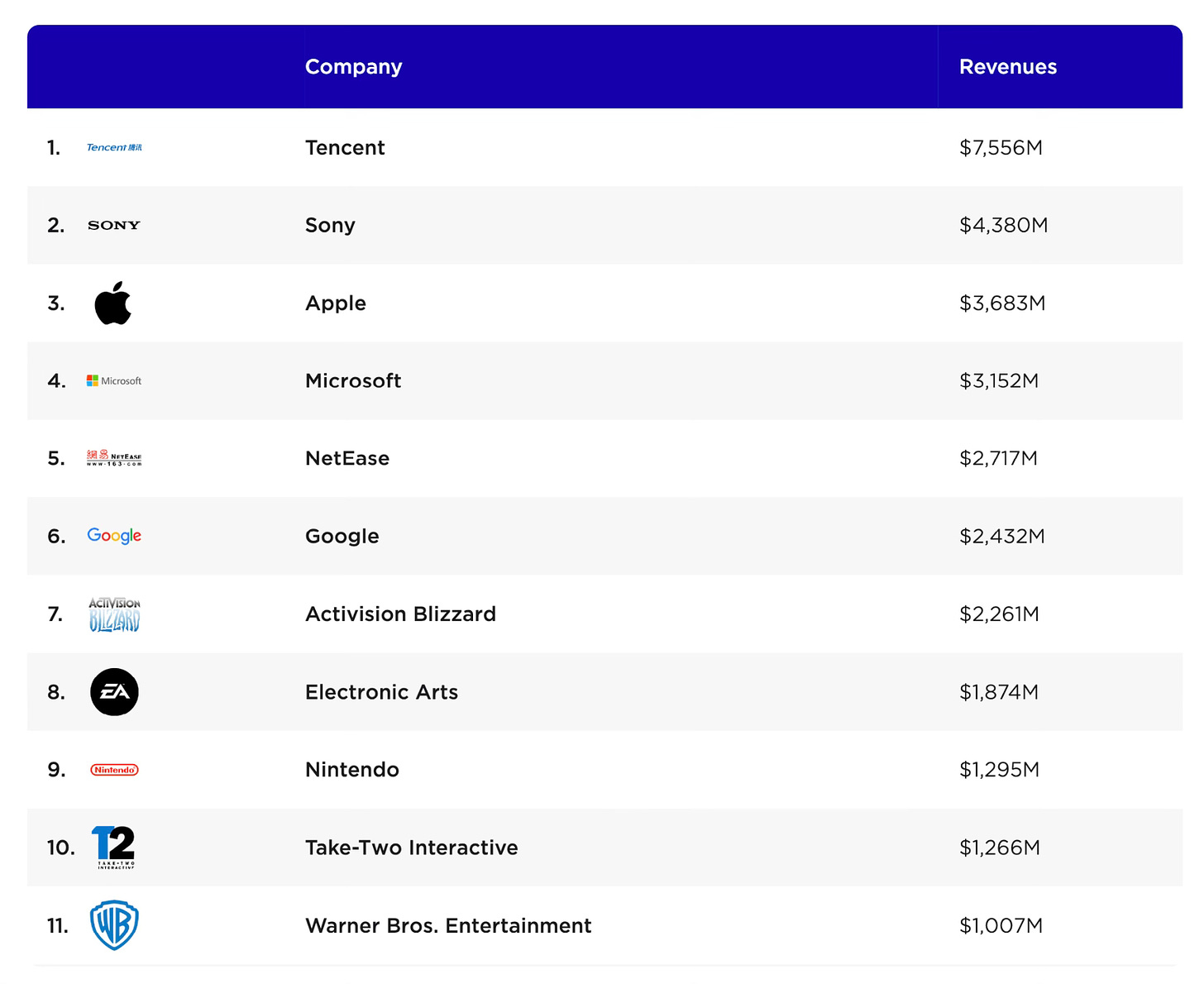

-

Tencent - the largest public company by gaming revenue. In 2023, it will earn $7.556 billion.

-

The combined revenue of Microsoft and Activision Blizzard will be $5.413 billion. This makes Microsoft the second company in the world by gaming revenue. Sony will have $4.38 billion in 2023.

Cloud Gaming

-

In 2023, the number of paying users will be around 43.1 million. By 2025, this number is expected to almost double - to 80.4 million.

Trends

-

The boom in live-service games continues. But it's very difficult for new players to get started.

-

AI is changing approaches to development in the gaming industry.

-

Complementary gaming devices are becoming increasingly popular. Newzoo includes Steam Deck and Nintendo Switch in this category.

-

Mobile game studios continue to adapt to changing platform regulations.

-

User-generated content (UGC), the creative economy, and opinion leaders become a crucial part of the success of games and studios.

-

Apple enters VR; Meta still believes in the direction. There is growth.

-

Development of the gaming market in Saudi Arabia (thanks to Savvy Games Group). Strengthening positions of developers from China and Japan.

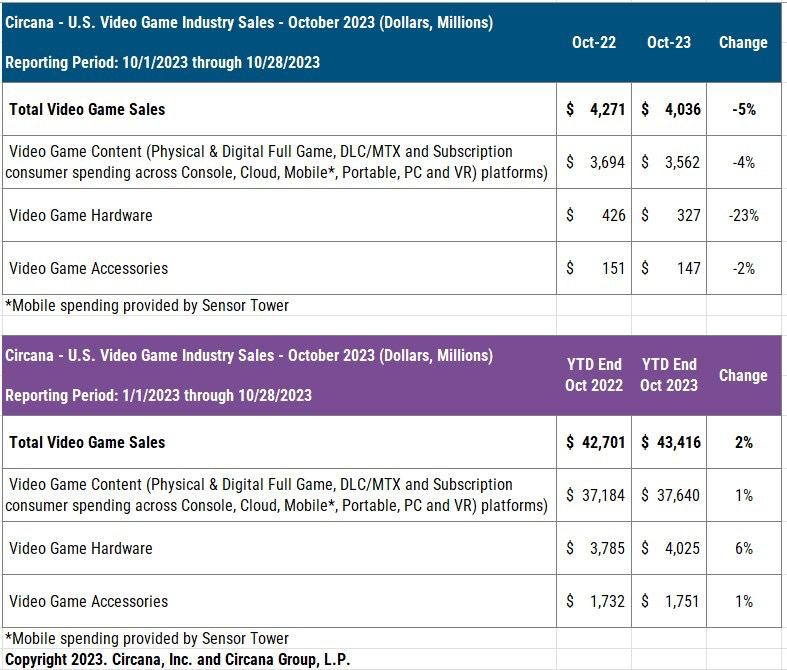

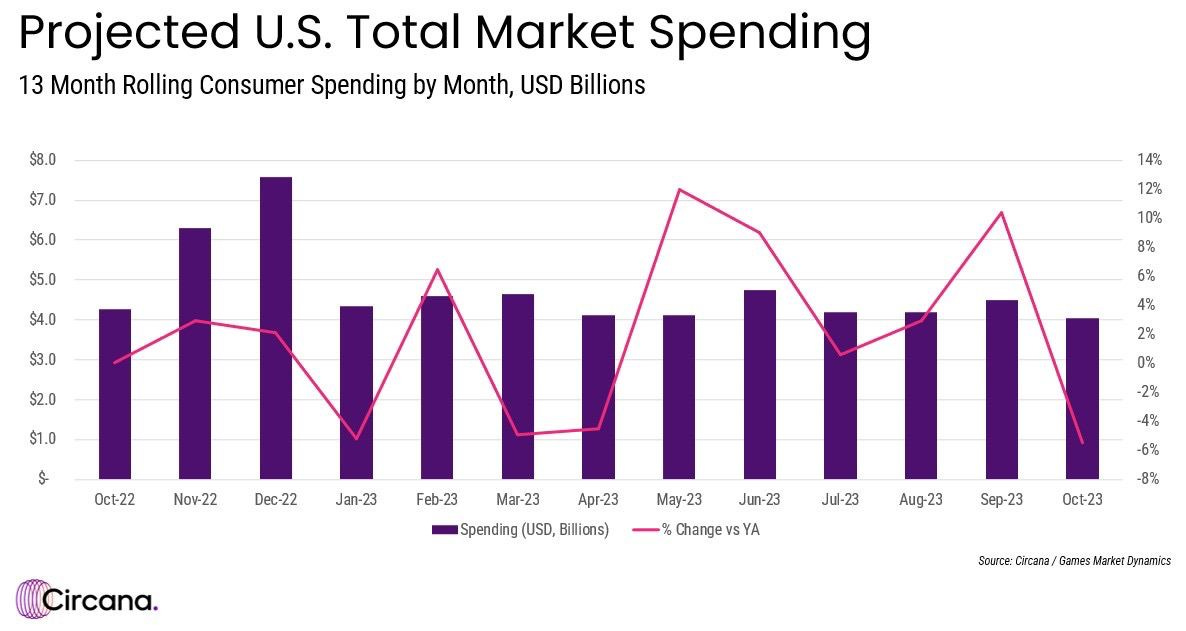

Circana: The American gaming market in October 2023 fell by 5%

-

In October, the total revenue of the gaming market amounted to $4.036 billion. This is 5% less than the previous year.

-

Sales of gaming hardware dropped the most, by 23%, to $327 million.

-

PlayStation 5 remains the best-selling system both in terms of units sold and in dollar terms.

-

Content sales decreased by 4% to $3.562 billion. However, this is partially because the release of Call of Duty last year took place at the end of September, and a large share of sales fell in October. This year, the new installment started on November 8.

-

Accessory sales fell by 2% to $147 million.

-

As of the end of October, the volume of the American market is $43.4 billion. This is 2% more than the same period last year.

-

Marvel’s Spider-Man 2, Super Mario Bros. Wonder, and Assassin’s Creed: Mirage became the best-selling games in October on PC and consoles.

-

Hogwarts Legacy remains the most successful game of the year. Marvel’s Spider-Man 2 rose to the 4th position in American sales in 2023.

-

Spending on mobile games in the USA in October grew by 2.1%. MONOPOLY GO!, Royal Match, and Roblox are the top 3 games by revenue.

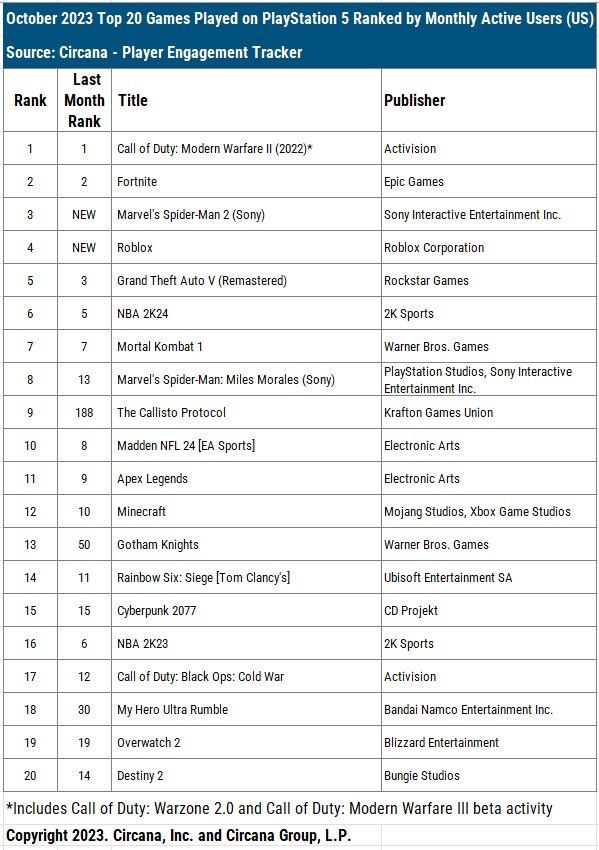

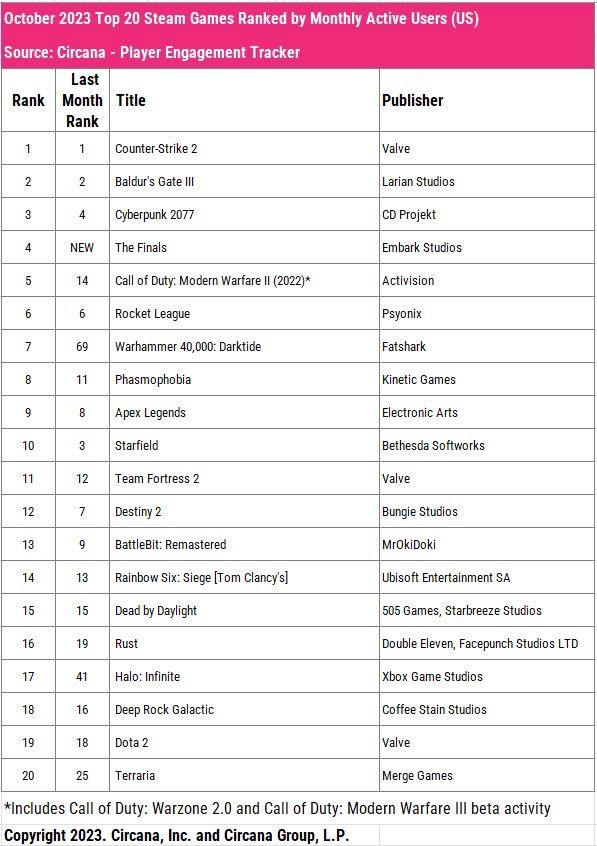

Most popular games on platforms

-

Call of Duty: Modern Warfare II (Call of Duty: Warzone 2.0); Fortnite and Marvel’s Spider-Man 2 - leaders in MAU on PlayStation platforms in October. Roblox immediately started from the 4th position.

-

Call of Duty: Modern Warfare II (Call of Duty: Warzone 2.0); Fortnite and GTA V - the largest games by MAU on Xbox.

-

Counter-Strike 2; Baldur’s Gate III, and Cyberpunk 2077 - leaders in MAU on Steam. The Finals beta was in 4th place.

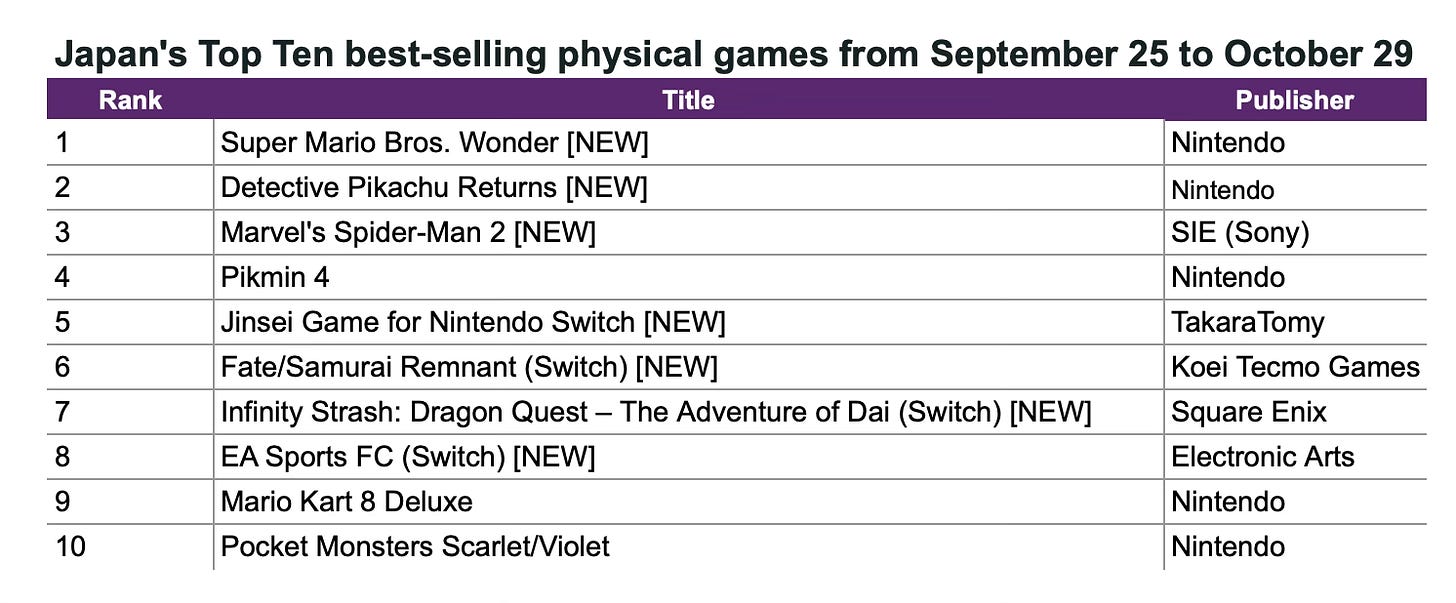

Famitsu: Super Mario Bros. Wonder became the leader of the Japanese chart in October 2023

Famitsu only collects data on physical sales.

Games

-

Super Mario Bros. Wonder, released on October 20, sold 801 thousand copies in just 11 days in Japan. This excludes digital sales.

-

In second place is Detective Pikachu Returns with 110 thousand copies.

-

A PlayStation 5 game entered the top 3 of the chart for the first time in a long time. Marvel’s Spider-Man 2 had an excellent start in Japan, with over 90 thousand copies sold monthly.

-

Physical game sales in Japan in October increased by 25% compared to the previous year, reaching $91 million. Last month, there were 7 new entries in the top 10.

Consoles

-

Nintendo Switch (with the most popular version being Switch OLED) accounted for 60% of all console sales in October.

-

PlayStation 5 had a 22% market share in October.

-

Hardware sales in Japan in October increased by 15% compared to the previous year, reaching $115 million. However, this is the lowest figure in the last six months.

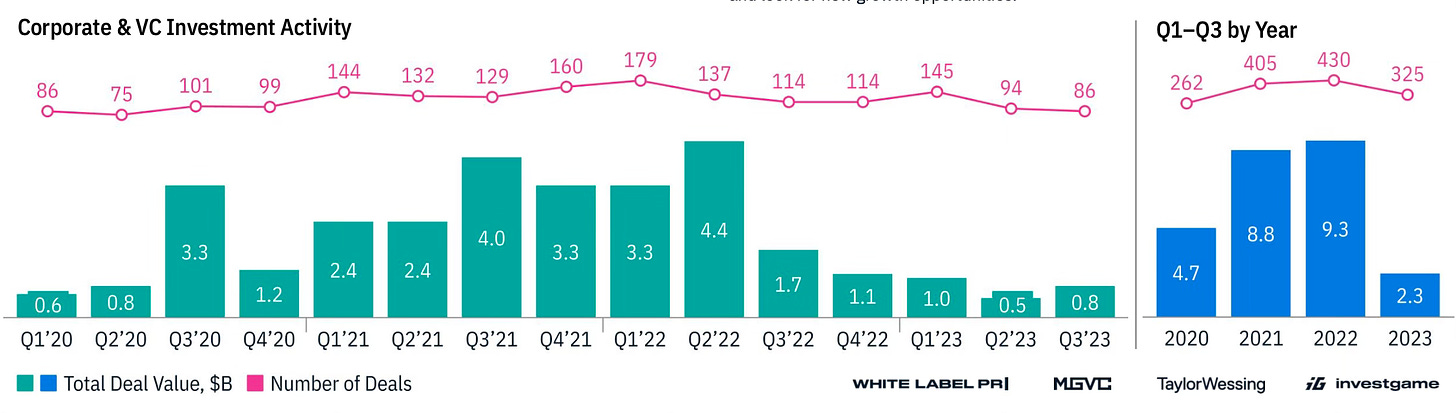

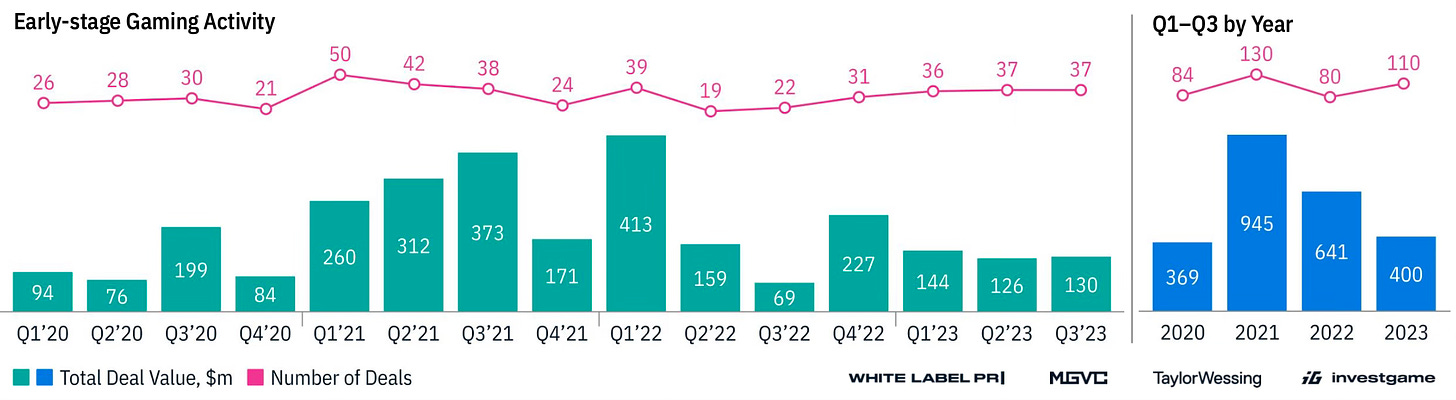

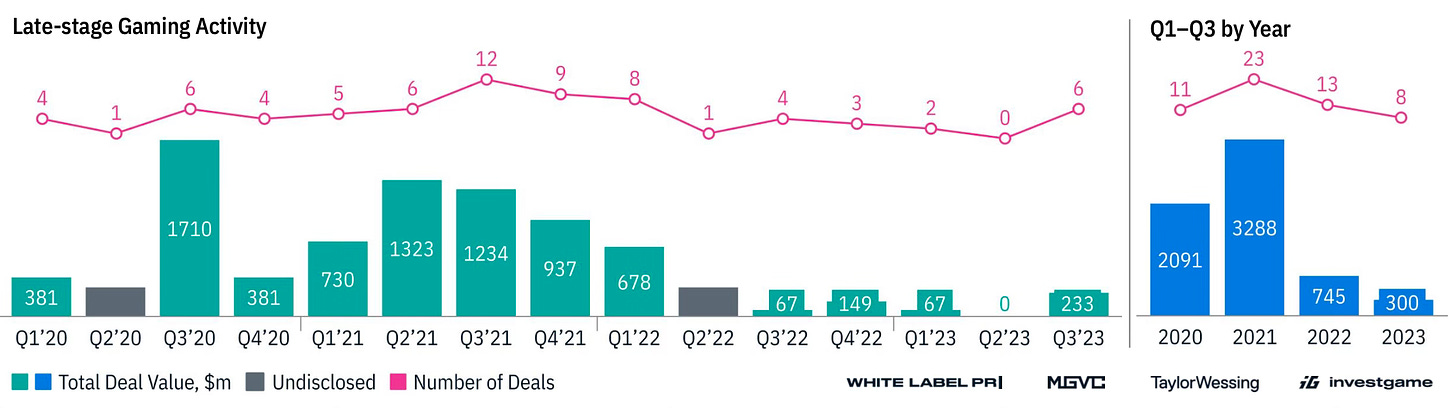

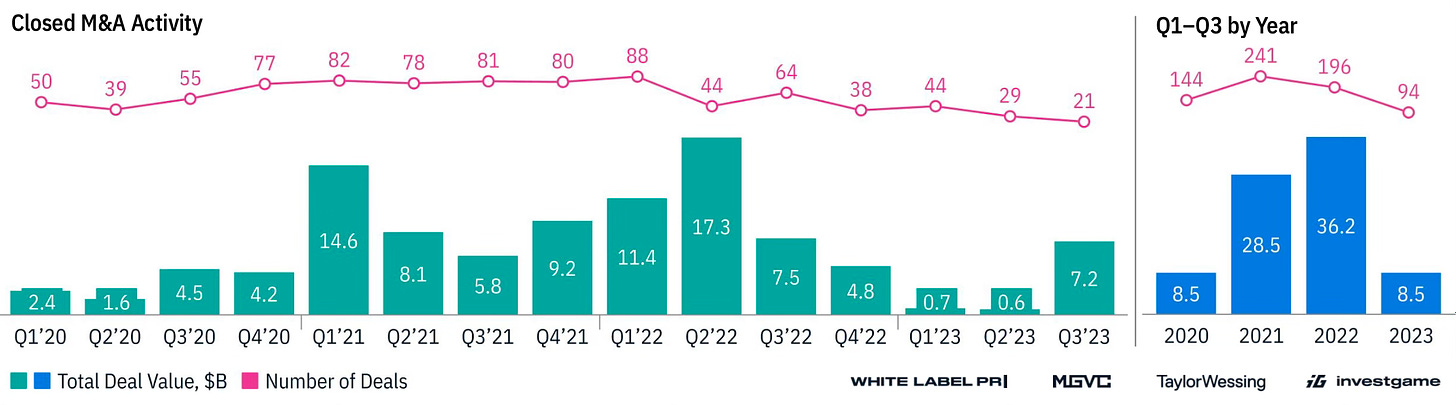

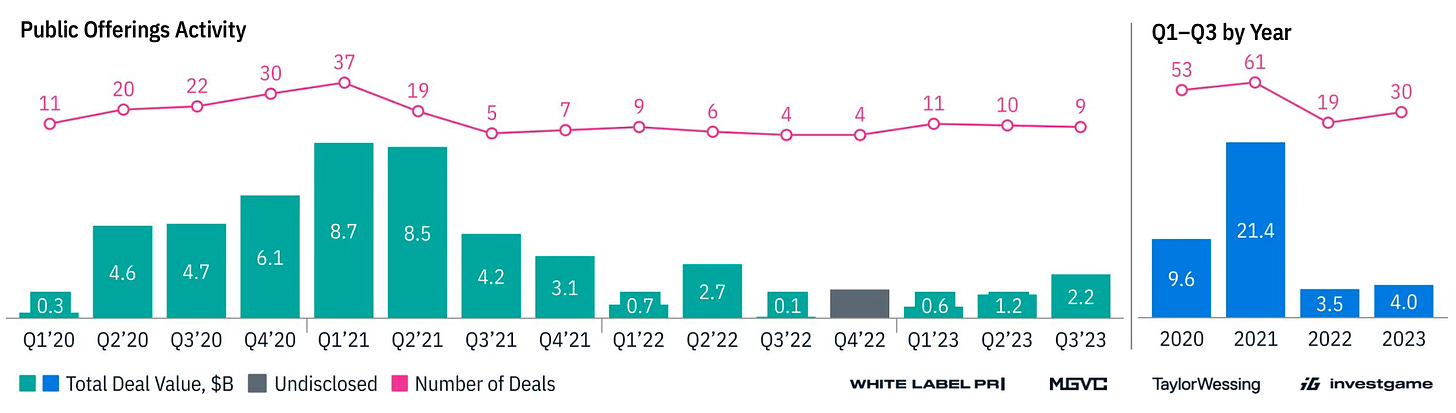

InvestGame: Gaming Market investment activity in Q3 2023

-

This year, at the current moment, has the lowest business activity in the last 3 years.

Private Investments

-

By the end of the first three quarters of 2023, the volume of private capital raised amounted to $2.3 billion. This is 4 times less than the average in 2021-2022.

-

The number of deals also decreased by 23%.

-

Early-stage deals were less affected by the crisis. In the first 3 quarters of this year, there were 110 deals (compared to 80 in 2022) - totaling $400 million (compared to $6.41 billion in 2022).

-

It became more challenging at later stages, with fewer follow-up rounds due to unclear exit prospects. In the first 3 quarters, there were 8 deals (compared to 13 in 2022) totaling $300 million (compared to $745 million in 2022).

-

Despite the negative picture, business activity has returned to pre-COVID levels. There is hope for future growth.

M&A

-

In the first three quarters of 2023, the total volume of M&A deals amounted to $8.5 billion. This is 3.8 times less than the average in 2021-2022.

-

Three deals contributed more than 75% of the total volume - the acquisition of Scopely ($4.9 billion), Rovio ($0.8 billion), and Techland (amount undisclosed).

-

The deal between Microsoft and Activision Blizzard for $68.7 billion, which closed in October (4th quarter), is not included in the statistics.

Public Offerings

-

Excluding the $1.5 billion debt refinancing of AppLovin, the volume of public offerings in the first three quarters of 2023 fell by 29%.

-

High interest rates, the poor performance of companies that went public, low valuations, and the crisis make public offerings unpopular options for companies.

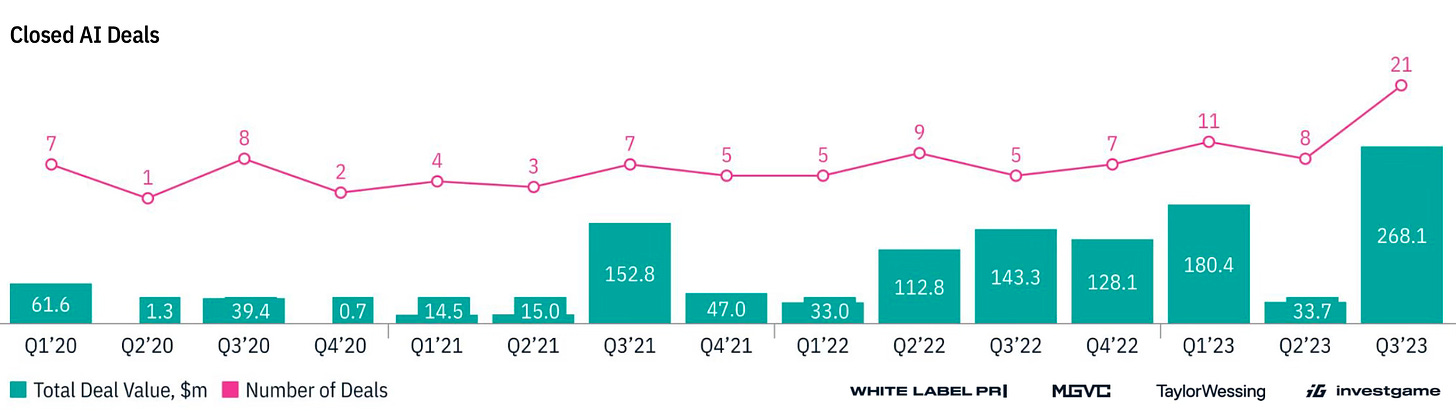

Investments in AI

-

In the third quarter of 2023, there was a significant increase in investments in AI startups. 21 deals were made totaling $268.1 million - more than the first half of this year.

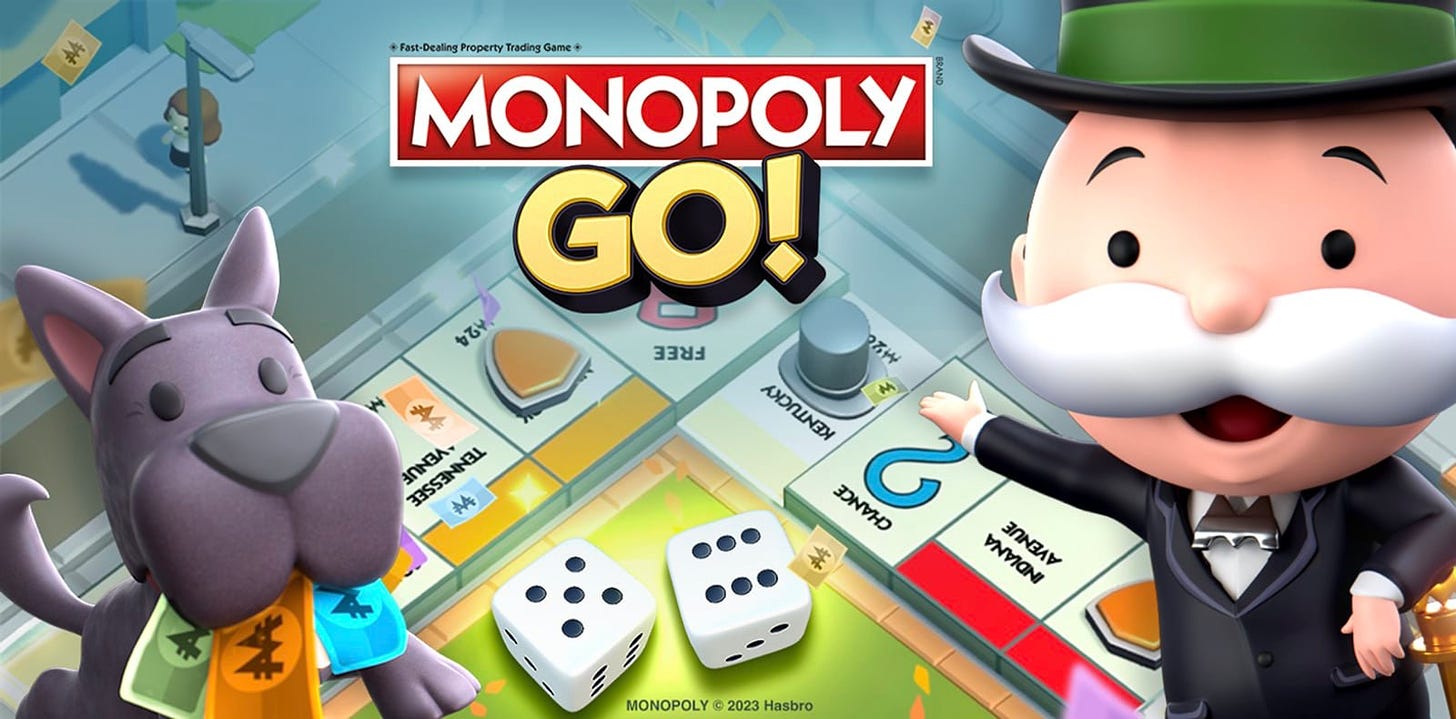

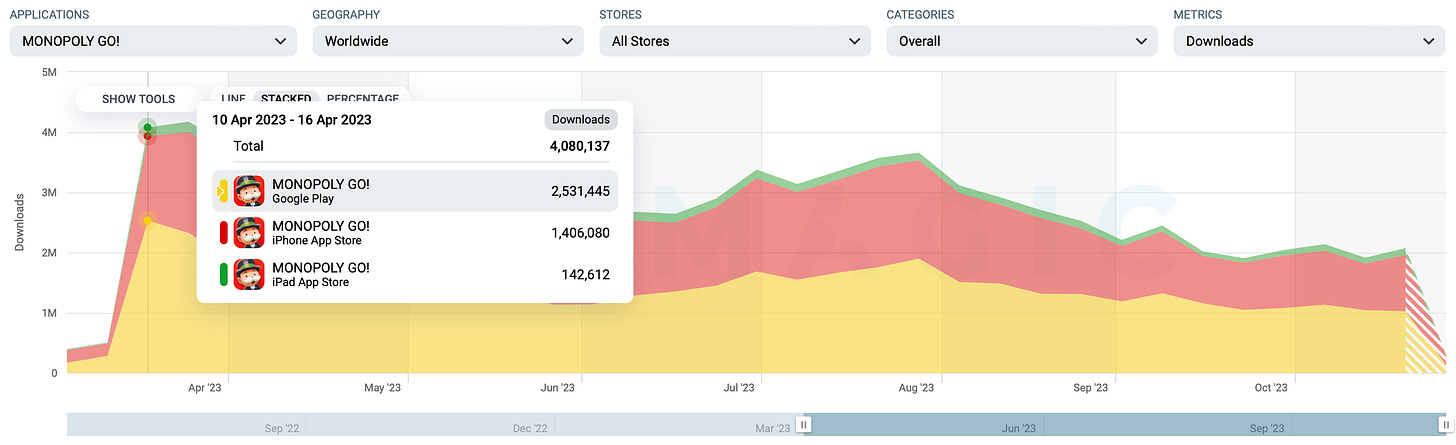

Monopoly GO: $1 Billion Later

Scopely has announced that MONOPOLY GO! has generated over $1 billion and has become the largest mobile launch of 2023. Let's look at the data and compare it with Dice Dreams.

-

MONOPOLY GO! also reached the milestone of 100 million installations on Sunday.

Revenue and Downloads

-

AppMagic recorded $446 million in revenue after taxes and commissions. In this case, the analytical service accounted for 3/4 of the revenue, around $745 million Gross. In terms of downloads, there are 94 million users.

Revenue - net of store commissions (30%) and taxes.

-

At data.ai, revenue figures are slightly more accurate - $513 million after taxes and commissions, roughly $855 million Gross.

-

The revenue growth trend for the game has significantly slowed down. Most likely, the game has passed the stage of rapid growth. Scopely reports that the project currently earns $200 million in monthly revenue.

-

70% of the project's total revenue comes from the United States, 5% from the United Kingdom, and 3% each from Germany, Australia, Canada, and France.

-

Downloads are distributed somewhat differently. The U.S. accounts for 32% of the total volume, followed by Italy (7%), Malaysia (5%), Italy (5%), and the United Kingdom (5%).

-

Scopely actively supports the game through the UA. On average, there are 1.3 free users per paying user.

In-game Users

-

D1 Retention on both platforms is around 50%; D7 is 21-24% (slightly higher on Google Play); D30 is 12-15%. Analytical services often omit these metrics, so they should be treated with skepticism.

-

Men and women in the game are equally split - 50% each.

-

Players over 45 years old make up 45% of the entire audience. The combination of mechanics and a familiar IP worked well.

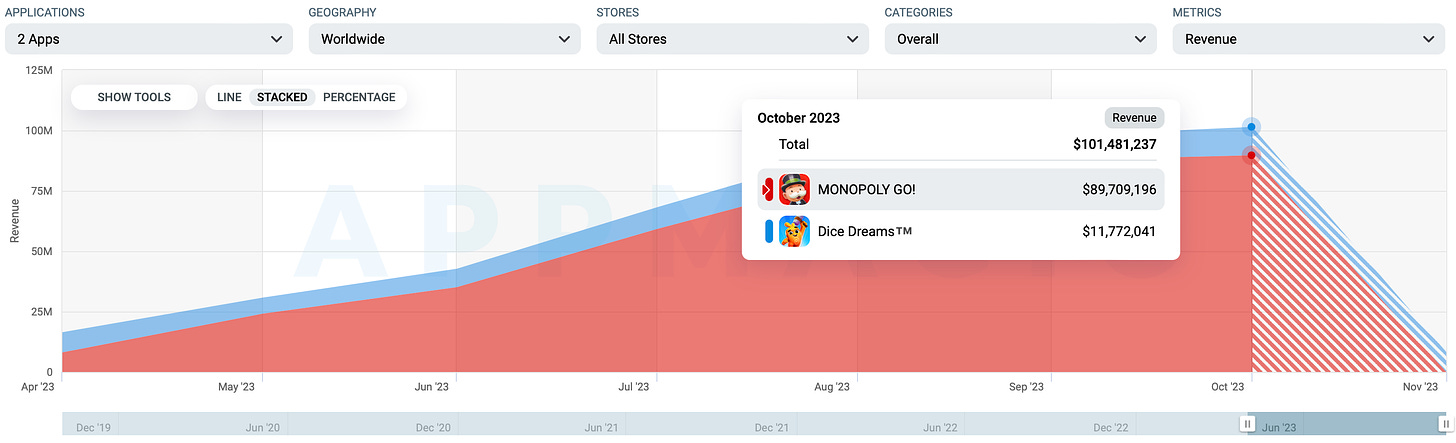

What about Dice Dreams?

Monopoly GO! is often compared to Dice Dreams. Let's see how both projects fare in comparison.

-

The total revenue of Dice Dreams is currently at $160 million (after deducting taxes and store commissions) - roughly $266 million Gross. The game's monthly revenue (after deducting taxes and commissions) is currently at $11.7 million - the project is growing quite actively. However, in terms of revenue volume, Dice Dreams is not a competitor to Monopoly GO!

-

The revenue distribution by countries for Dice Dreams and Monopoly GO! is similar. The majority is in the U.S., followed by the UK, Canada, and European countries.

-

Over its lifetime (Dice Dreams was launched in mid-2020), the game has been downloaded 30 million times. The game has much lower acquisition volumes compared to Monopoly GO!, although the k-factor (the ratio between paying and organic users) is similar.

-

In Dice Dreams, the audience aged 25 to 44 dominates, accounting for almost 56%. It can be assumed that this demographic is less engaged and tends to spend less compared to older players.

The games are very similar to each other, and despite a significant time advantage, Dice Dreams is far behind the competitors. Several factors played a role:

-

A perfect synergy between IP and mechanics in Monopoly GO! Users know what to expect from the game even before launch, and it lives up to expectations.

-

Scopely's marketing expertise and the ability to operate with significantly larger budgets than Superplay.

-

Stronger monetization. Revenue per Download (RpD) for Monopoly GO! is already higher than for Dice Dreams, even though the project is not yet a year old. Perhaps this is due to the different audiences that the projects have managed to capture.

-

Product quality - especially the feel of the dice and rewards - is higher in Monopoly GO! However, this is very subjective.

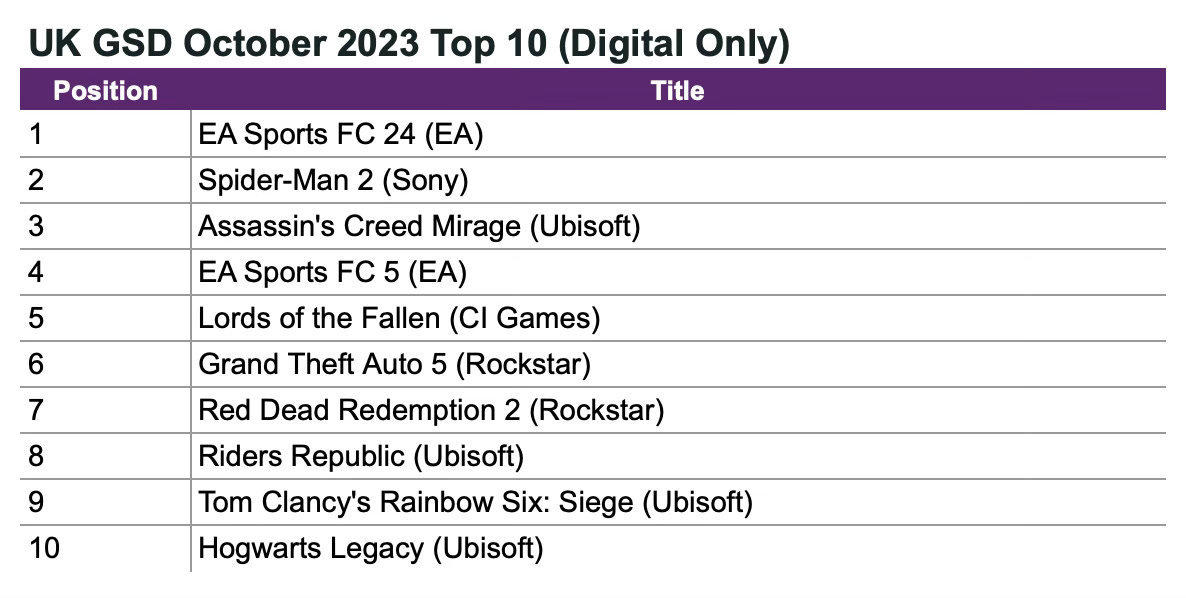

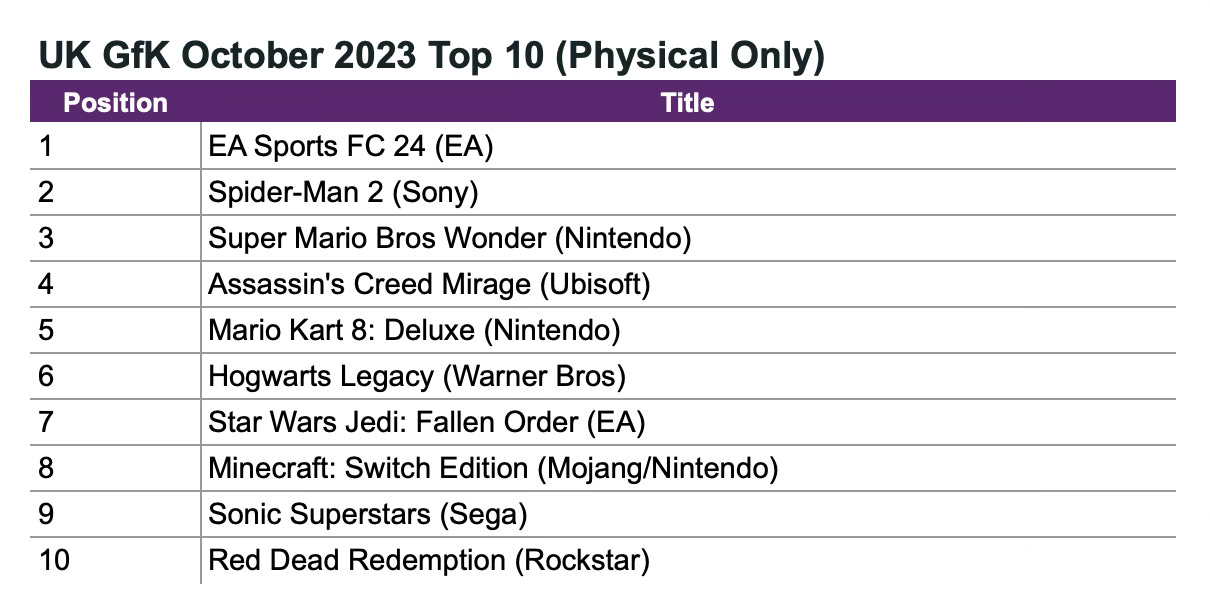

GfK & GSD: The UK gaming market in October 2023 experienced a significant decline

GSD & GfK reports only on the actual sales figures obtained directly from partners. Major publishers, such as Nintendo, do not share information on the sales of digital copies, for example.

Software Sales

-

Digital sales in the UK fell by 24%, with 1.6 million digital copies sold. However, physical versions saw a slight increase of 8% to 1.08 million.

-

The sharp decline in sales is attributed to the fact that Call of Duty was released in October last year, while this year, a new installment in the series is set to launch in November.

-

EA Sports FC 24 launched 16% worse than FIFA 23.

-

Marvel’s Spider-Man 2 from Sony became the best-selling new game of the month. However, sales in the UK were 9% weaker than the first part but 94% better than Marvel’s Spider-Man: Miles Morales.

-

Compared to God of War Ragnarok, sales in the first two weeks of Marvel’s Spider-Man 2 were 2% higher. This is notable, considering that GoW: Ragnarok was available on PS4 and PS5.

-

Assassin’s Creed Mirage launched 58% worse than Assassin’s Creed Valhalla. First-month sales were nearly identical to the results of Assassin’s Creed Odyssey, released in 2018.

Hardware Sales

-

In October, 176 thousand gaming devices were sold in the UK, a 10% decrease from the previous month.

-

PS5 sales decreased by 4% compared to the previous month; 56% of all sales were attributed to the EA Sports FC 24 bundle.

-

Xbox Series S|X sales plummeted by 33%. The previous month saw an increase in console sales due to Starfield.

-

Nintendo Switch performed well. In October, console sales grew by 15% thanks to the release of Super Mario Bros. Wonder.

-

PlayStation 5 accounted for 51% of all console sales in the country over the last six months. Nintendo Switch had 25%, and Microsoft consoles had 23%.

-

In October, almost 584 thousand accessories were sold, a 15% decrease compared to the previous year.

Roblox: Trends in Digital Fashion and Beauty in 2023

The report explores the behavior of Generation Z in the world of Roblox. Data on in-game behavior was collected from January 1st to September 30th. The survey involved 1545 individuals aged 14 to 26 living in the United States and the United Kingdom.

-

56% of Generation Z respondents stated that the appearance of their avatar is more important to them than their real-life appearance. Last year, this figure was 42%.

-

84% noted that digital fashion is something important to them. The majority believes that its importance has grown over the past year.

![]()

-

In 2023, users purchased 1.6 billion digital items for avatars. This is a 15% increase compared to the previous year. The number of avatar modifications increased by 38% to 165 billion times.

![]()

-

54% of Generation Z individuals mentioned that their real-life style is heavily inspired by the style of avatars in games.

![]()

-

84% of respondents stated that the likelihood of purchasing a branded item in real life increases after they have tried on that item on their digital avatar.

-

52% of Generation Z individuals are willing to spend up to $10 per month on digital fashion items; 19% are willing to spend up to $20, and 18% are willing to spend from $50 to $100 each month.

-

Users note that people in metaverses are less prone to judgment. Therefore, they strive to make their avatars unique and express themselves. People are less concerned about what others will think of them.

![]()

GSD: Game sales in Europe slightly decreased in October 2023

GSD reports only actual sales figures obtained directly from partners. Major publishers, for example, Nintendo, do not share information on digital copy sales.

Game Sales

* No digital data is available for Nintendo

-

By the end of October 2023, 10.21 million game copies were sold in Europe. This is 2.3% less than in October of the previous year. This is linked to the release of Call of Duty being moved to November this year.

-

EA Sports FC 24 became the best-selling game of the month by a significant margin. However, its sales are 10% lower than FIFA 23.

-

Assassin’s Creed Mirage managed to surpass Marvel’s Spider-Man 2 in sales, taking the second spot (though the game was on sale for 15 days longer). Meanwhile, sales of the new Assassin’s Creed installment are 49% worse than Assassin’s Creed Valhalla, but 22% better than AC: Odyssey, and 6% better than AC Origins.

-

In the first two weeks, Marvel’s Spider-Man 2 in Europe started 30% better than the first part and almost three times better than Marvel’s Spider-Man: Miles Morales.

-

Compared with God of War: Ragnarok, sales of Marvel’s Spider-Man 2 are 28% lower. But if you exclude copies for PS4, Marvel’s Spider-Man 2 sells 8% better after the first two weeks.

Hardware Sales

-

In total, 481 thousand consoles were sold in Europe in October. This is 16% more than in September.

-

PlayStation 5 - the best-selling console of October. Sales increased by 143% compared to the previous year and by 11% compared to the previous month.

-

Nintendo Switch - in second place; October sales dropped by 20% compared to the previous year. But they increased by 10% compared to September.

-

Xbox Series S|X is not doing well in Europe. Console sales in October plummeted by 52% compared to the previous year. And by 20% compared to September.

-

1.14 million accessories were sold in Europe in October. This is 3.6% less than last year.

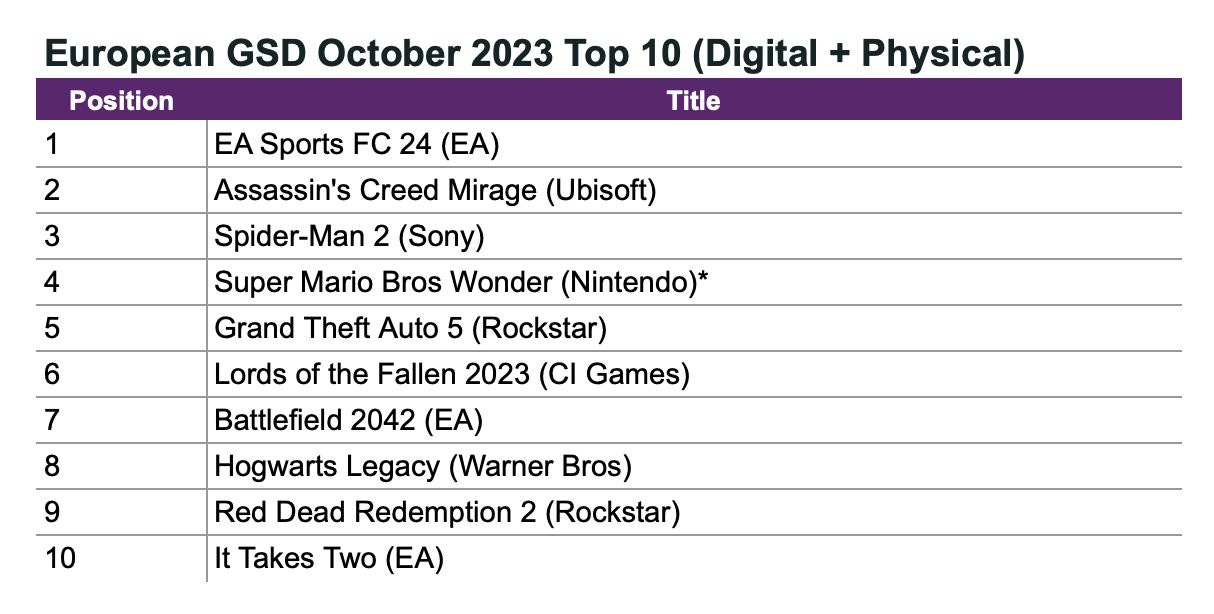

SuperScale: 83% of launched mobile games die within 3 years

The company published a report in which it surveyed 504 mobile developers from the USA and the UK. There is not much positivity in it.

Overall Picture

-

43% of games do not reach the release stage. 25% of those surveyed noted that the closure of an unreleased game significantly demotivates them.

-

83% of launched games close within 3 years. Only 5% are supported for more than 7 years. Most developers noted that they would prefer to work on new games.

-

In 76% of cases, the revenue peak occurs in the first year after release. In 4% - in the second.

-

38% of developers do not release regular updates for their games. This partially explains the above figures. Many developers simply do not know how to manage their games.

-

34% of developers believe that success lies in new releases; 30% are confident that success lies in managing current games. The remaining developers do not fully understand what to do in the current market situation.

Situation in Studios

-

32% of studios have conducted layoffs. Developers of puzzles and Match 3 games are the least affected.

-

24% are on the verge of bankruptcy. Most of them work on hyper-casual projects.

-

29% have cut UA budgets.

-

40% of studios have become open to outsourcing development. For many, this is now a survival question.

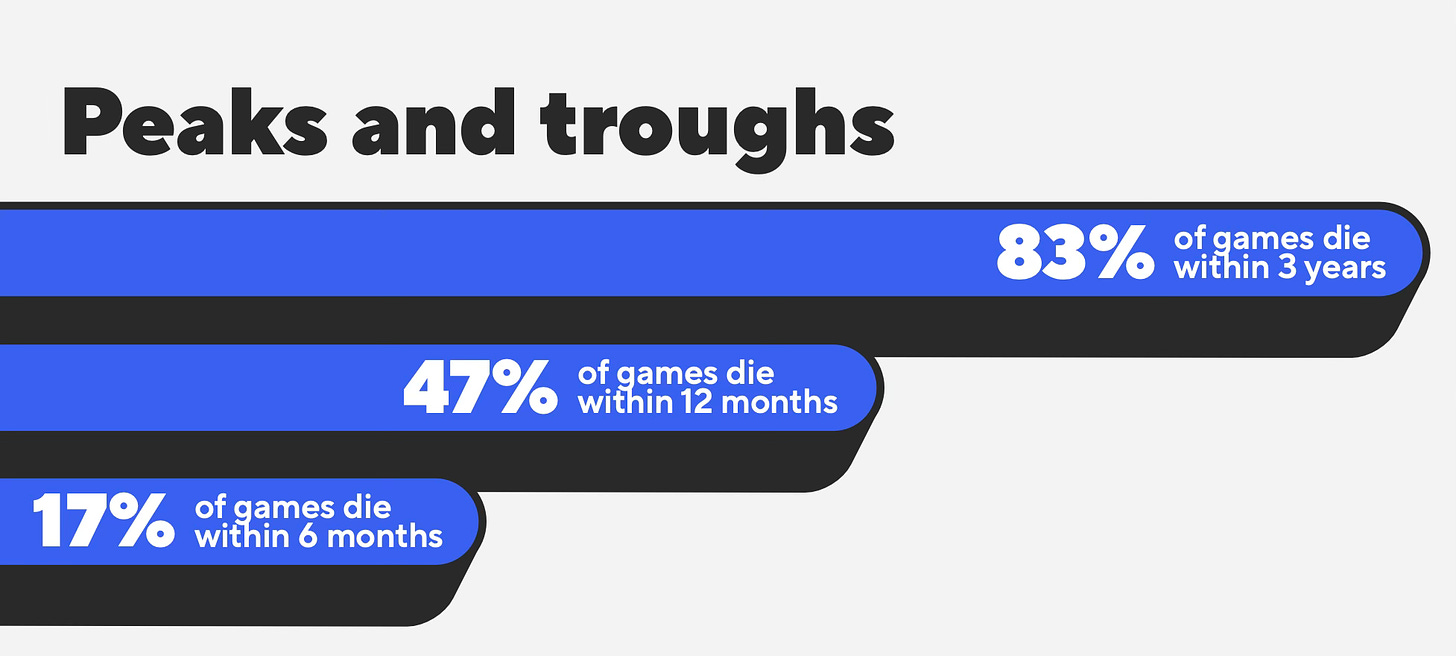

Monetization and UA

-

62% of developers actively use LiveOps in their major projects. 37% update games every week; 48% every month; and 14% hold special events.

-

Google (54%); TikTok (39%); and Meta (31%) are the most successful advertising networks, according to developers.

-

26% of developers do not consider either LTV or ROAS (Return on Ad Spend). Another 32% only look at the horizon for six months. Only 5% try to predict what the ROAS will be beyond a year.

BFI UK: 51.9% of all British game developers work in companies owned by foreign entities

BFI UK studied the history of M&A transactions in the UK gaming market and assessed its impact on the industry. The figures are current as of the end of April 2023.

-

From 1993 to 2022, 118 transactions were completed, involving the acquisition of British studios. In 105 cases, the asset was a company, the majority of whose business is based in the UK.

-

49% of the transactions were carried out by companies headquartered in the USA; 15% were with HQs in China; 10% in Sweden.

-

The volume of transactions sharply increased from 2018 to 2021. During this period, 41 transactions occurred (39% of the number of "truly British" transactions).

-

In 2020 and 2021, the most money was spent (or earned - depending on the perspective), $2 billion and $2.7 billion, respectively. The largest deals were with Codemasters, Sumo Group, and Playdemic.

-

The majority of buyers are actively involved in the gaming industry. Publishers accounted for 56% of all transactions.

-

Acquiring talented teams and strong IPs are the two main motivators for deals during this period, according to BFI UK.

-

Deals brought access to capital and marketing expertise. This is a positive outcome.

-

On the downside, studios lost autonomy (which may negatively impact innovation), and some revenue flowed out of the UK.

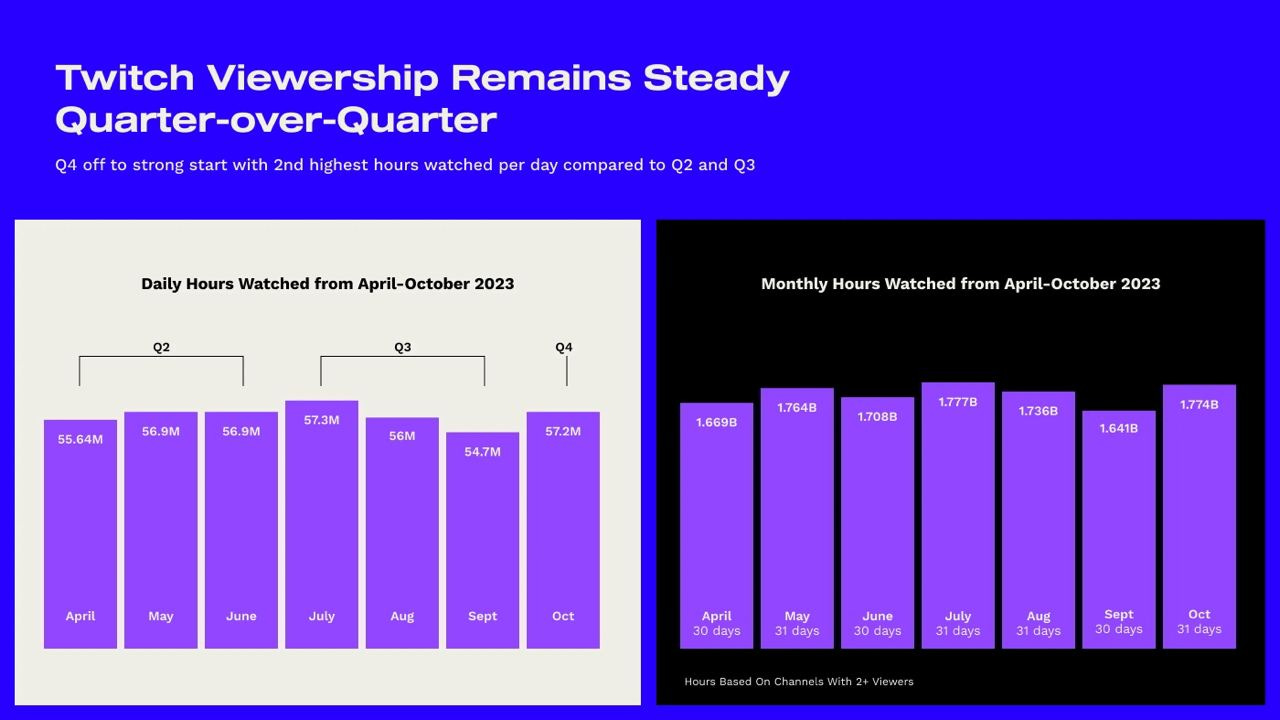

StreamElements & Rainmaker.gg: The State of the Streaming Market in September and October 2023

-

Twitch, in terms of hours watched, replicated its second-quarter results in the third quarter.

-

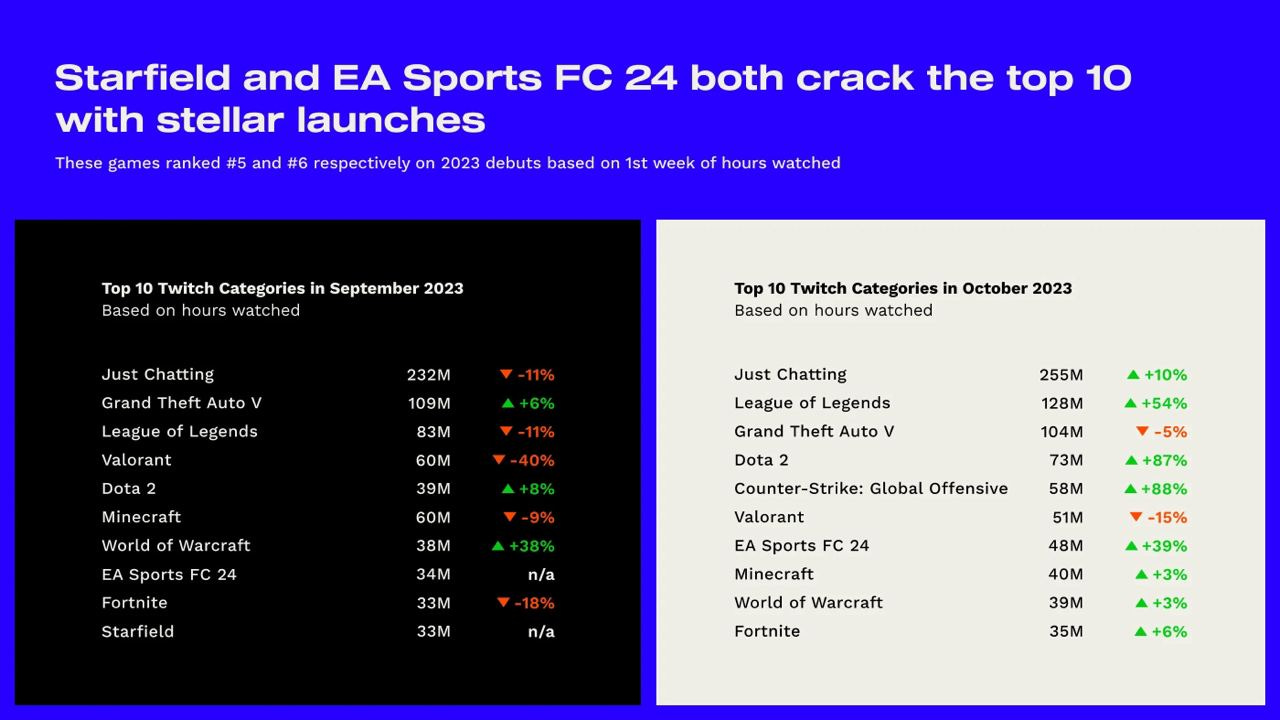

October became the second-highest month in terms of views this year, attributed to tournaments for League of Legends and DOTA 2, as well as the release of Counter-Strike 2.

-

EA Sports FC 24 and Starfield entered the top 10 in terms of hours watched in September and October.

-

Throughout 2023, despite the abundance of new releases, only 7 new projects made it into the top 10.

-

Traditional viewership leaders include League of Legends, Grand Theft Auto V, DOTA 2, and Valorant.

Tune in next month for more updates!