devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the September and October reports.

Table of Content

- Adikteev: Payers behavior in Mobile midcore & hardcore games

- SocialPeta: Mobile Game Marketing in Q3 2022

- Statista: Pokemon Go Live delivered an additional $300M+ to the cities where it happened

- GSD: Call of Duty: Modern Warfare 2 almost outsell Call of Duty: Vanguard in 2 weeks in Europe

- GfK: God of War Ragnarok physical launch sales in the UK beat Call of Duty: Modern Warfare II

- Newzoo: The Gaming Market will decline by 4.3% in 2022

- inMobi & Tenjin: Ad Monetization in Games report (October 2022)

- Newzoo: VR Gaming Market in 2022

- Google: Puzzle games on Mobile Devices in 2022

- Newzoo: Chinese Gaming Market Regulations in 2022

- Time2Play: Canadian mobile gamers habits in 2022

- Call of Duty: Modern Warfare II earned $1B in 10 days

- KantanGames: Japanese PC gaming market doubled in the last 3 years

- AppMagic: Top mobile games in October 2022 by Revenue and Downloads

- Huawei AppGallery reached 580M MAU

- Sensor Tower: Top Mobile games in Southeast Asia by Downloads in September 2022

- Sensor Tower: Top Mobile games by Revenue in Southeast Asia in September 2022

- GSD: PC & Console gaming market in the UK grew in October 2022

- Newzoo: ARPU & ARPPU on PC & Consoles at the US market in 2022

- StreamElements & Stream Charts: Streaming Market Status in September 2022

- Sonic The Hedgehog series surpassed 1.5B in sales

- Niko Partners: Top-10 Asian markets and Female gamers in Asia

- Call of Duty: Modern Warfare 2 (2022) showed the best launch in the series' history

- Adjust & Liftoff: Mobile gaming trends in Japan in 2022

- Niko Partners: The Chinese gaming market will decline in 2022 for the first time in 20 years

- Superjoost: Top-10 companies by revenue in the gaming industry in 2021

- Newzoo: Fortnite helped Xbox Cloud Gaming to twice the audience this year

Adikteev: Payers behavior in Mobile midcore & hardcore games

-

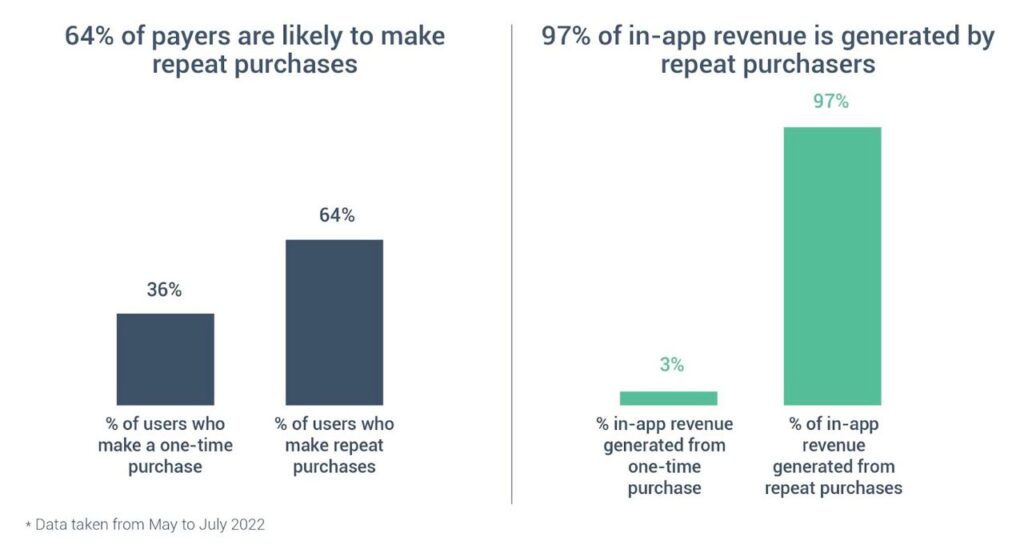

97% of midcore and hardcore titles’ in-app revenue is based on repeated purchases.

-

There are 64% of paying users are making repeated purchases. And 36% are paying only once - they’re responsible for only 3% of the revenue.

-

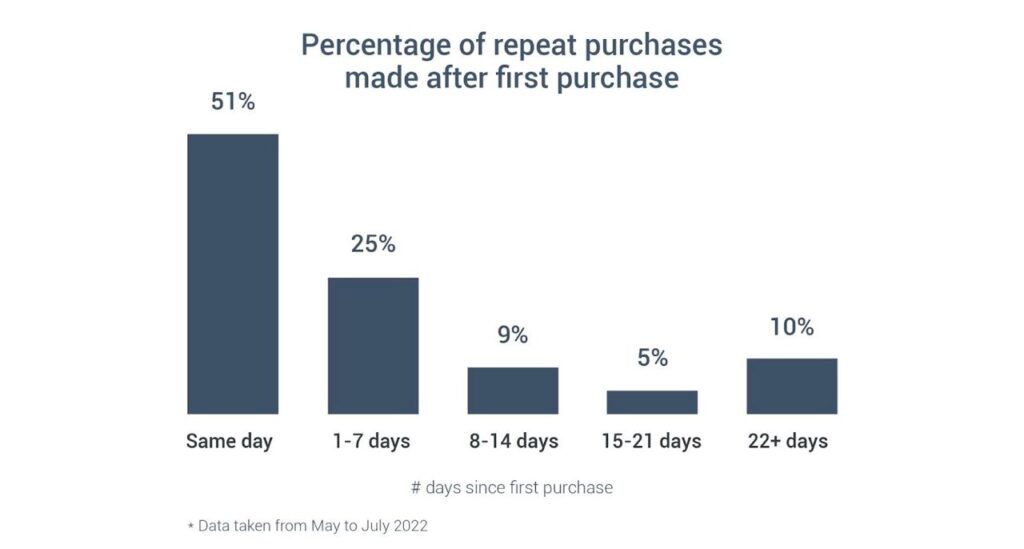

51% of payers are making repeated purchases on the same day. 25% - in the first week, 9% - during the second week, and 5% - during the third week. 10% of payers are converting into repeated purchases further.

-

The sooner the payer makes the second purchase, the higher the probability he will convert into the third. The probability of a such event in the first week is 77%.

SocialPeta: Mobile Game Marketing in Q3 2022

-

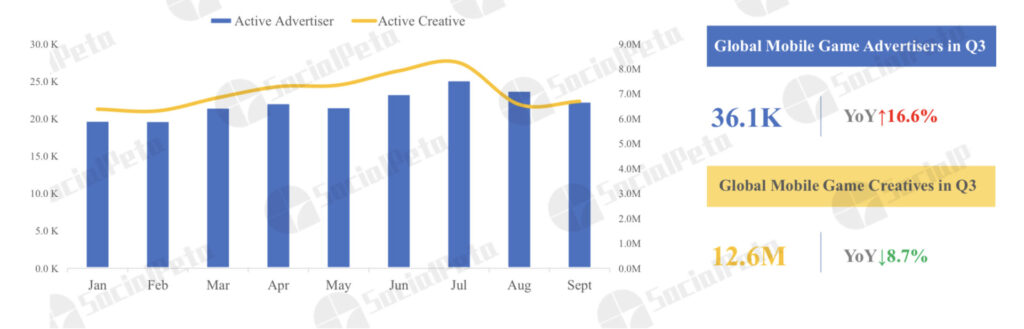

The number of advertisers in Q3 2022 reached 36.1k 0 it’s 16.6% more than a year before.

-

The number of creatives in the same quarter reached 12.6M. Here is a decline of 8.7% compared to the previous year.

-

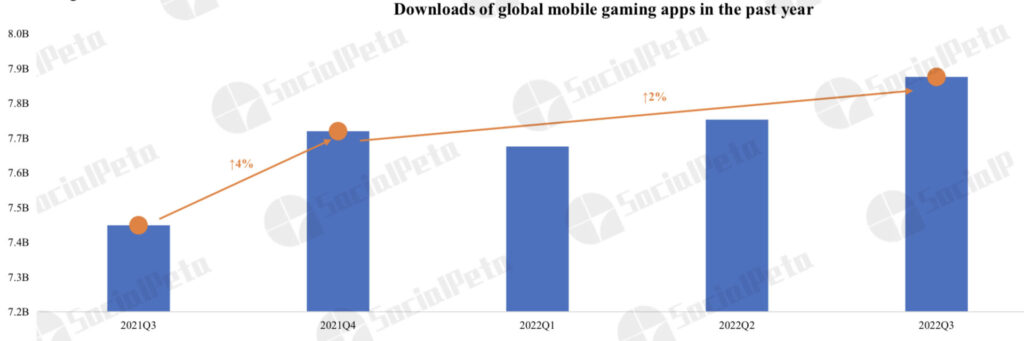

During the whole of 2022, there was a negative downloads trend, but Q3 2022 managed to break it. The number of downloads in Q3 2022 was 2% more than in Q4 2021.

-

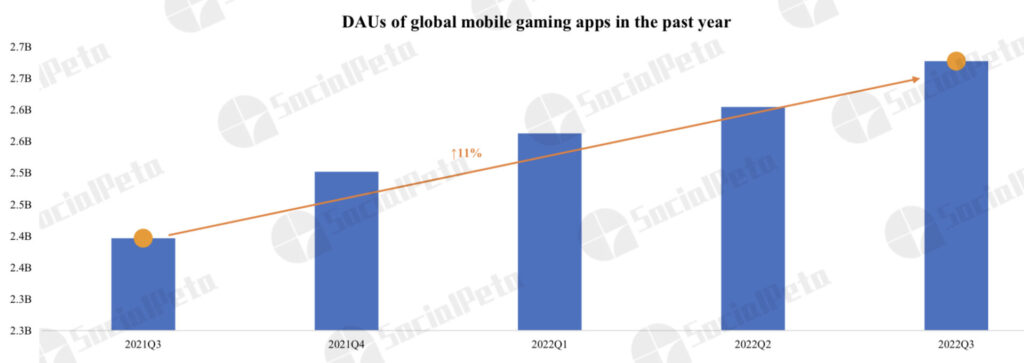

DAU in games increased by 11% per year. SocialPeta analytics are sure that users started to prefer old games to new ones more often.

-

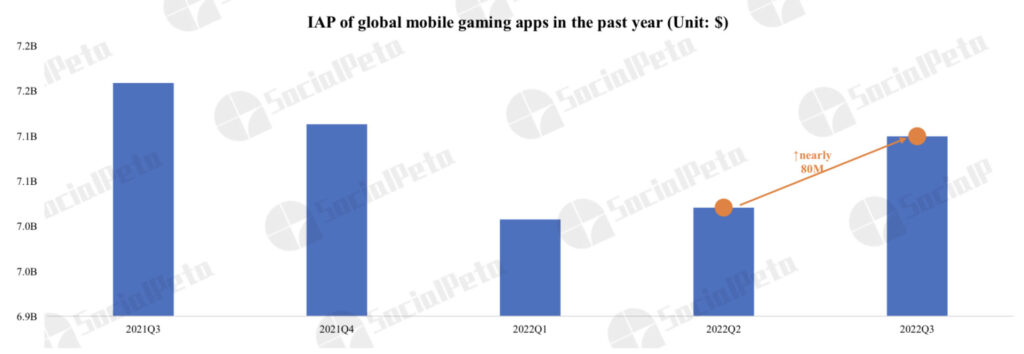

IAP revenue in 2022 decreased a lot compared to 2021. However, it’s recovering, and the dynamics in Q3 2022 were quite good.

-

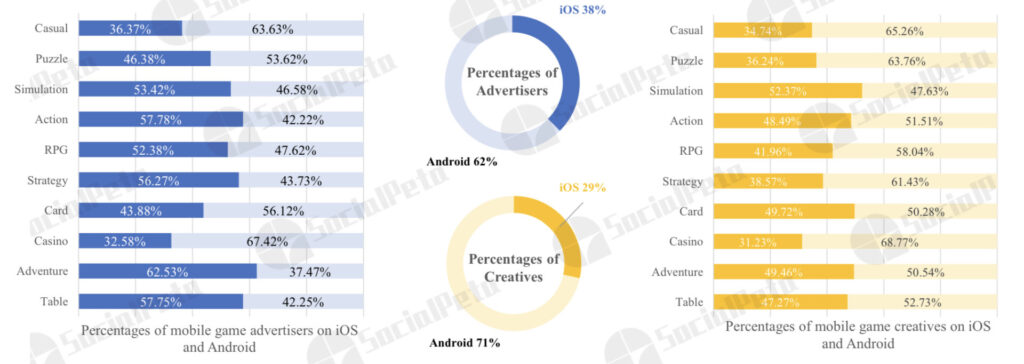

The number of casual games advertisers is increasing (+1,5%). RPG advertisers, the opposite, decreased by 1.85%.

-

The number of creatives for puzzle games increased (+1,53%). For action games (-1,73%) and RPGs (-1,62%) decreased.

-

The majority of advertisers are in the casual genre (7.2 thousand), puzzles (4 thousand), and simulation games (3.2 thousand).

-

Strategy (524 per advertiser), casino (385 per advertiser), and RPG (381 per advertiser) games are getting more creatives than any other genre.

-

62% of advertisers are on Android. The same platform is responsible for 71% of all creatives.

-

83.6% of all creatives are video. 12% are images.

The report is 109 pages with a deep overview of creatives and the market situation.

SocialPeta-Q3-2022-Mobile-Game-MarketingDownload

Statista: Pokemon Go Live delivered an additional $300M+ to the cities where it happened

-

Based on analytics data, Pokemon Go Live motivated 150 thousand of people to travel to new cities. They’ve spent there $309M.

-

Pokemon Go Live based on economic impact can be compared with Super Bowl LVI ($234-477M). The women’s UEFA Euro 2022 brought the economy $60M.

-

85% of Pokemon Go Live participants spent around $650. The average player walked 10.2km during the event.

-

Seattle benefitted the most from Pokemon Go Live. The event delivered an additional $155M to the city. It welcomed 58 thousand trainers and each spent $816.

GSD: Call of Duty: Modern Warfare 2 almost outsell Call of Duty: Vanguard in 2 weeks in Europe

-

11,9M games were sold in Europe in October. Call of Duty: Modern Warfare 2 is the leader.

-

Games sales increased by 1.5% compared to October 2021. 57.5% of sales are digital. Physical copies sales decreased by 13%.

-

Starting sales of Call of Duty: Modern Warfare II outperformed by 125% the launch of Call of Duty: Vanguard. The game already became the third by sales this year just behind the FIFA 23 and Elden Ring. Moreover, it almost reached the lifetime sales of Call of Duty: Vanguard in Europe.

-

Almost 368k consoles were sold in Europe in October. That’s without the UK and Germany.

-

PlayStation 5 became the top-selling system of October 2022. It’s the first month since September 2021 when the Nintendo console was not the first.

-

Xbox Series sales increased by 26% compared to the previous year.

-

1.18M accessories have been sold in October. It’s 13% less than last year.

GfK: God of War Ragnarok physical launch sales in the UK beat Call of Duty: Modern Warfare II

That’s only about physical sales.

-

God of War Ragnarok showed the second-best results in the year by physical copies sales in the UK. FIFA 23 is first.

-

82% of the game sales came from the PS5 version. 12% of this amount were PS5 bundles with God of War Ragnarok.

-

God of War Ragnarok's release helped PS5 to set the record for weekly sales in the UK in 2022.

-

God of War Ragnarok showed the best launch in the series' history. The game sold 51% better in the first week than the God of War (2018).

-

In a week after the release, the game managed to become the third in the whole franchise by sales.

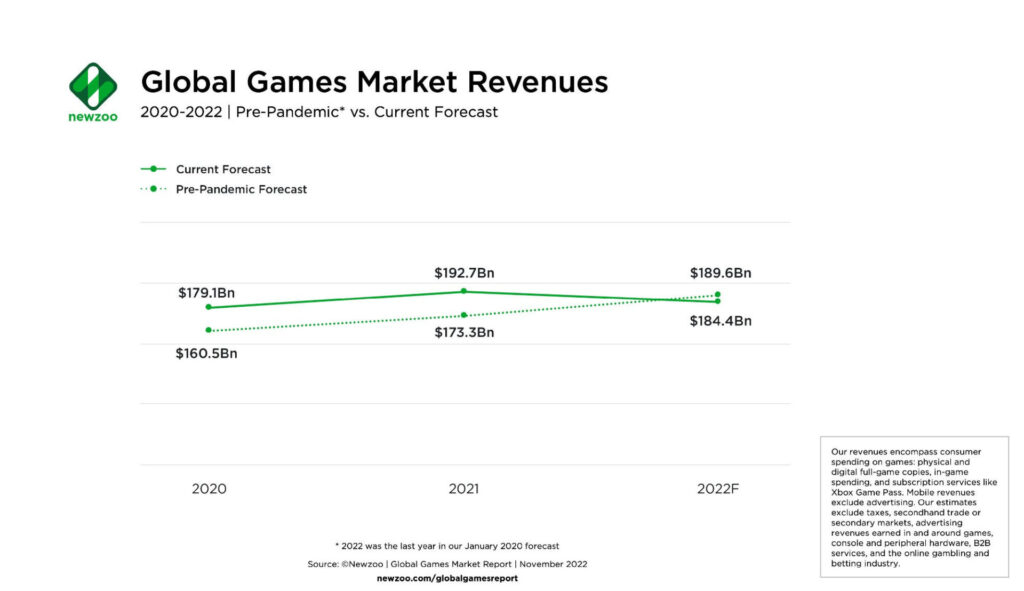

Newzoo: The Gaming Market will decline by 4.3% in 2022

-

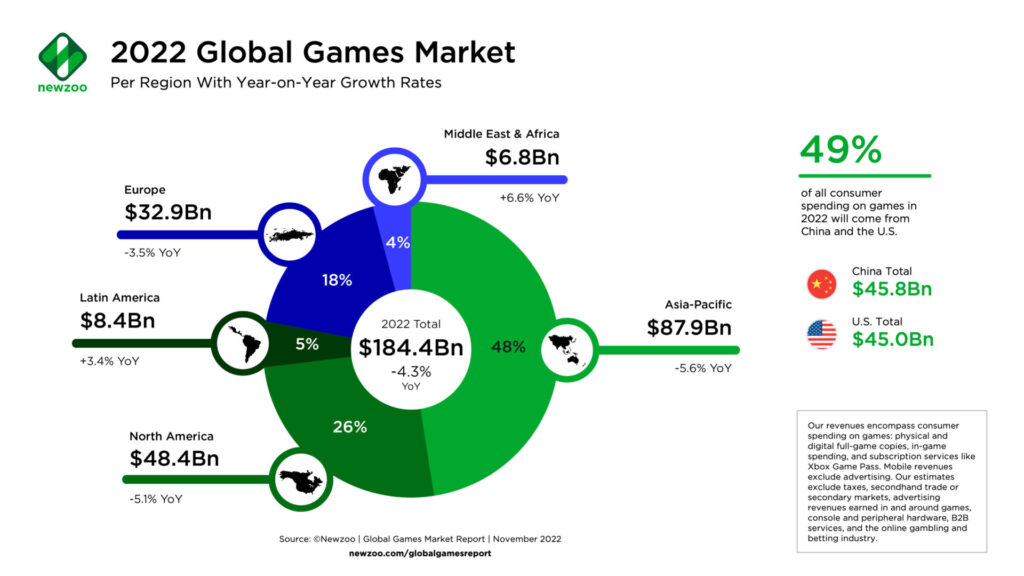

The overall game market valuation will be $184.4B. The decline will happen for the first time in 15 years of research.

-

However, there are no reasons to panic. Newzoo analytics are positive that it’s not the trend, but just the correction after explosive growth in 2020 & 2021.

-

Newzoo's forecast in 2020 was close to the current market valuation. But the growth dynamic was completely different.

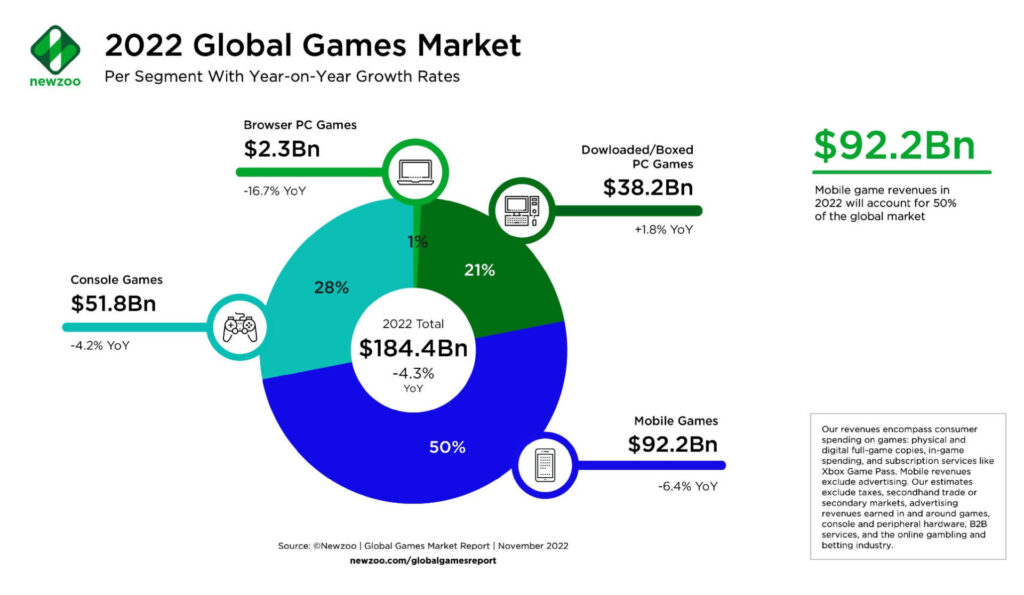

Platforms

-

The PC market will reach $40.5B in 2020 with a 0,5% YoY growth. Browser games continue to fall with -16,7% YoY to $2.3B.

-

The mobile market in 2022 will reach $92.2B. The decline is significant - 6.4% YoY. And there are several reasons for it: IDFA, economic problems in many countries, and pressure from other forms of entertainment available after dropping many COVID restraints.

-

The console market will experience a drop of 4.2% from the previous year to $51.8B.

Markets

-

The Chinese gaming market is still the largest with $45.8B. The US market is about $45B. Those two countries are responsible for 49% of the overall gaming market.

-

Asia-Pacific region remains the largest by revenue in 2022 ($87.9B) but will drop by 5.6%.

-

North America (-5,1% YoY) and Europe (-3,5%) revenues will drop too.

-

Middle-East and African regions will grow by 6.6% to $6.8B. The same will happen with Latin America - +3,4% YoY to $8.4B.

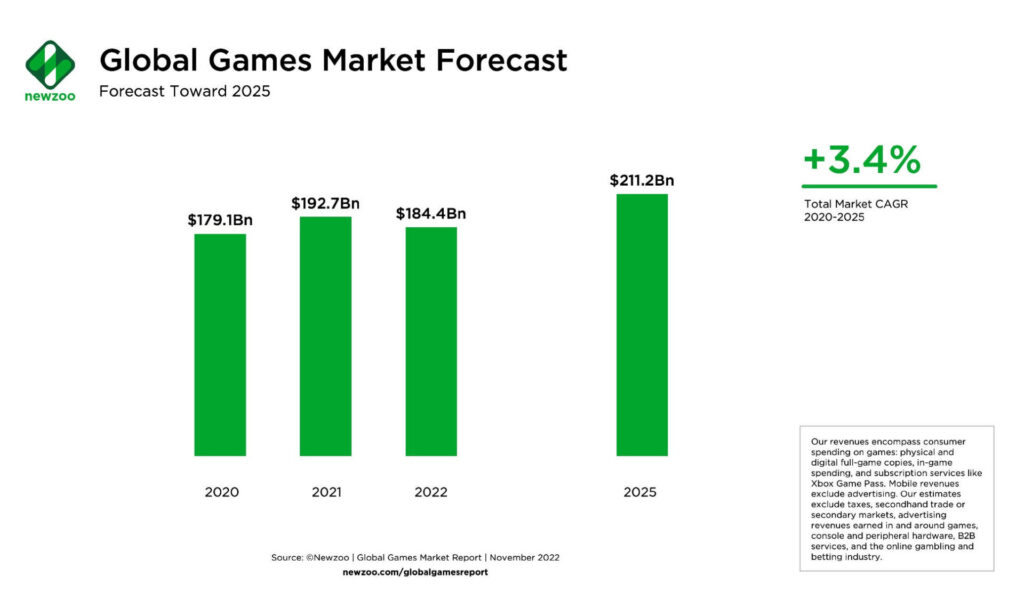

Future

-

Newzoo analytics are quite positive about the future. They are sure that the market will grow to $211.2B in 2025 and will show a CAGR of 3.4%.

-

The number of gamers will increase from 3.198B in 2022 to 3.534B in 2025.

2022_Newzoo_Free_Global_Games_Market_Report-1Download

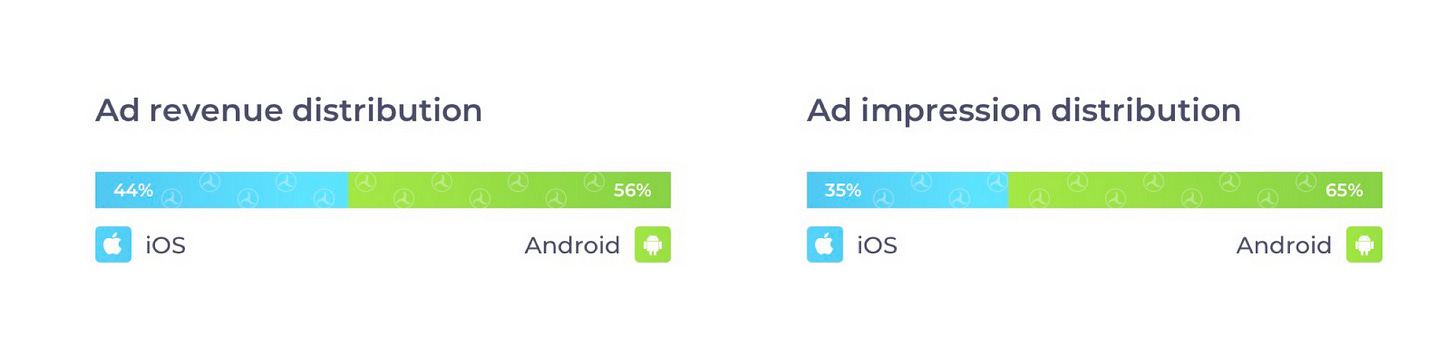

inMobi & Tenjin: Ad Monetization in Games report (October 2022)

-

Android is responsible for 56% of ads revenue and 65% of impressions.

-

In October 2022 compared to the previous month eCPM on Android became lower by 2%, ad revenue increased by 5% and ad impressions jumped by 9%.

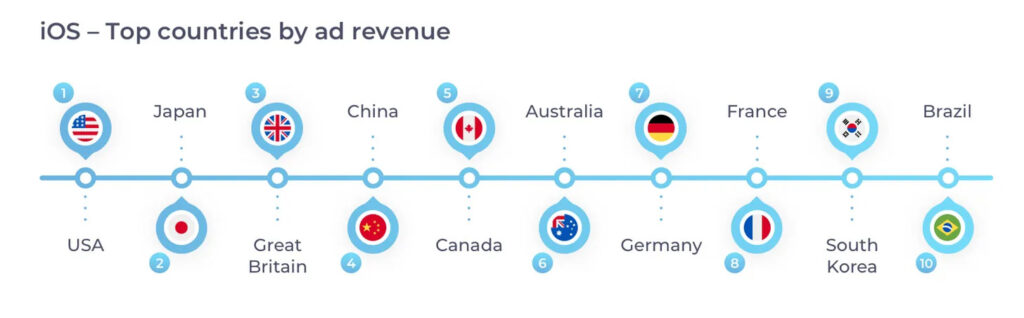

iOS

-

The US, Japan, the UK, China & Canada are leaders in ad revenue on iOS.

-

80% of iOS revenue came from banners. Interstitials (8%) and video ads (7%) are next.

-

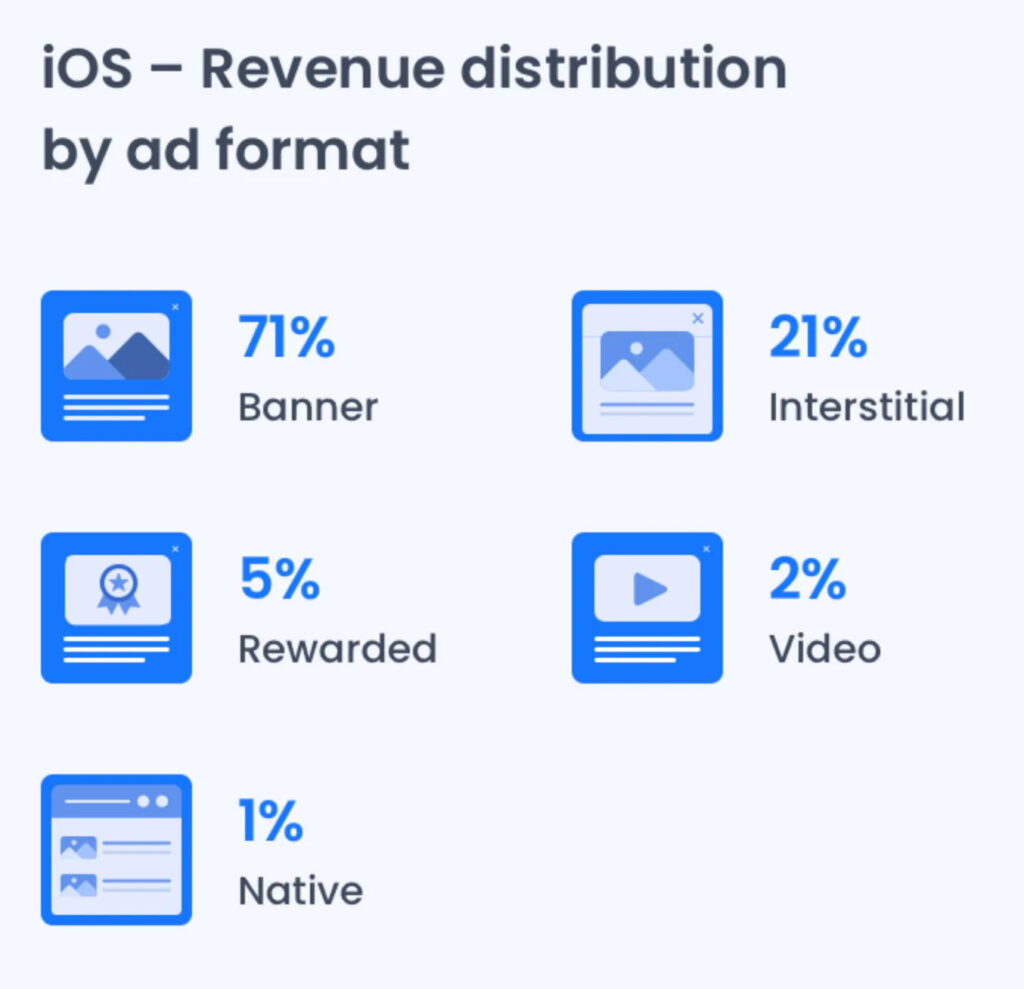

71% of ad revenue on iOS came from banners, 21% - from interstitials, and 5% - from Rewarded Video.

Android

-

The US, Japan, Brazil, the UK, and Germany are the top countries by ad revenue on Android.

-

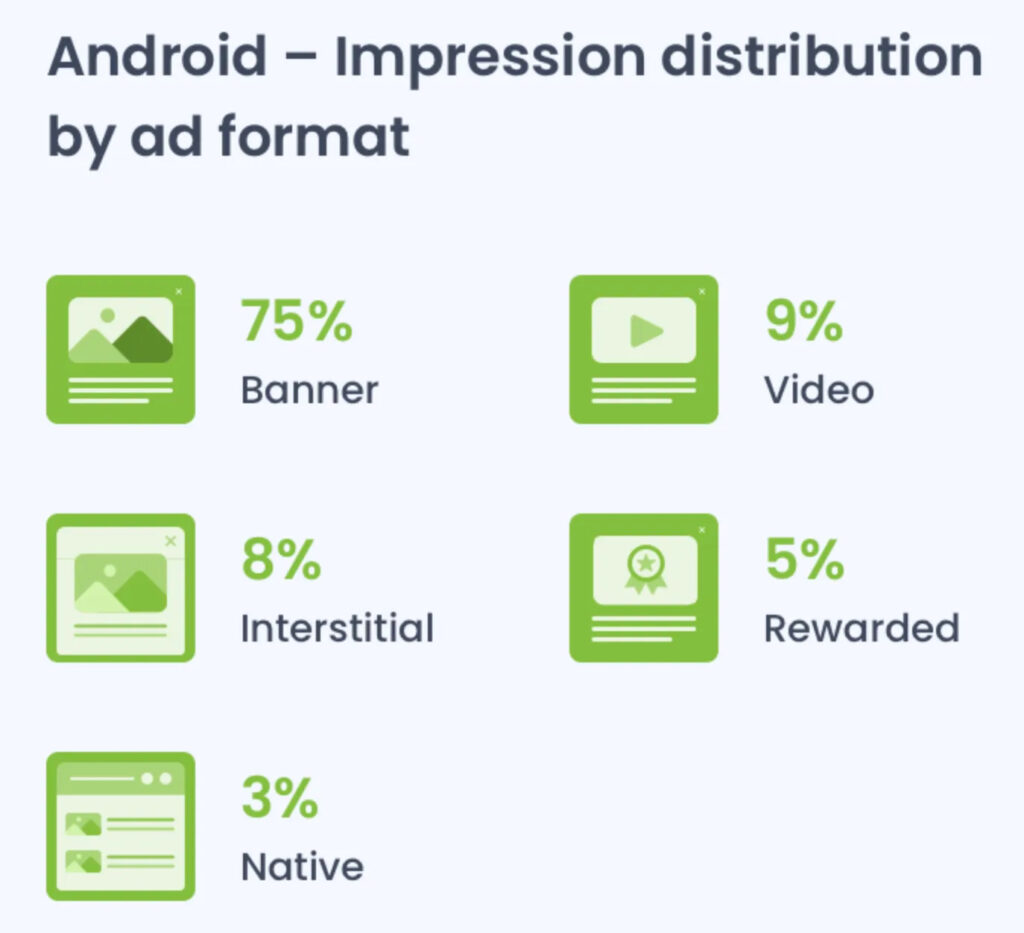

75% of impressions on Android are from banners, 9% from video, and 8% from interstitials.

-

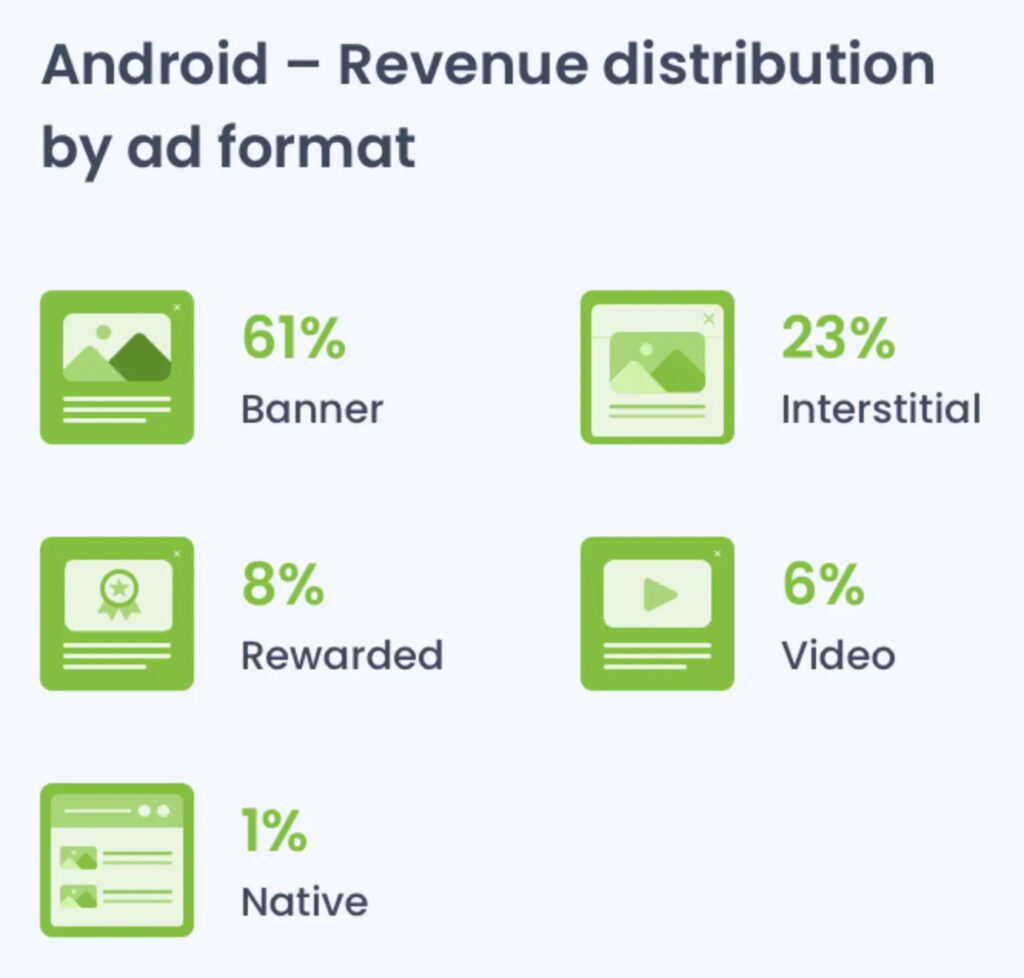

Android ad revenue is as follows: 61% - banners, 23% - interstitials, 8% - rewarded video.

Newzoo: VR Gaming Market in 2022

-

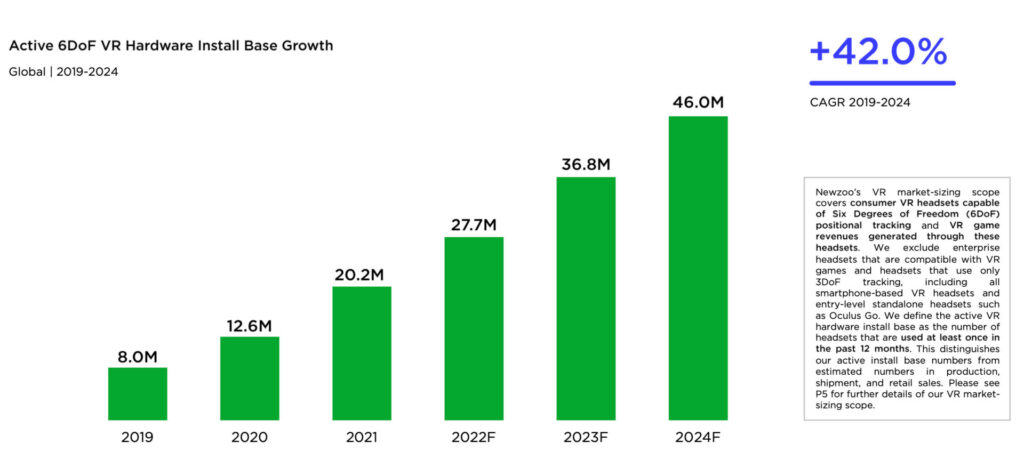

There will be 27.7M VR devices in the world by the end of 2022. It’s a solid growth from 8M in 2019. By 2024 there will be 46M devices, based on Newzoo analytics assumptions.

-

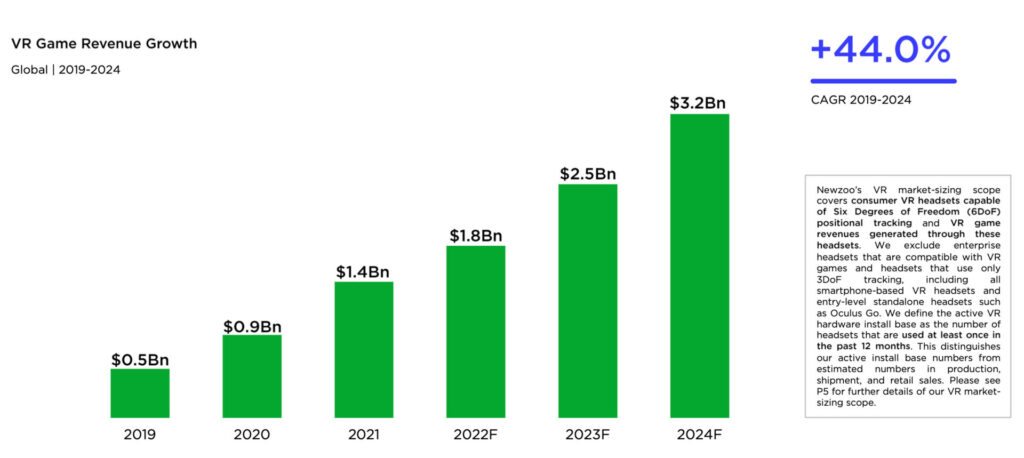

VR games revenue in 2022 will reach $1.8B. By 2024 it is forecasted to reach $3.2B.

-

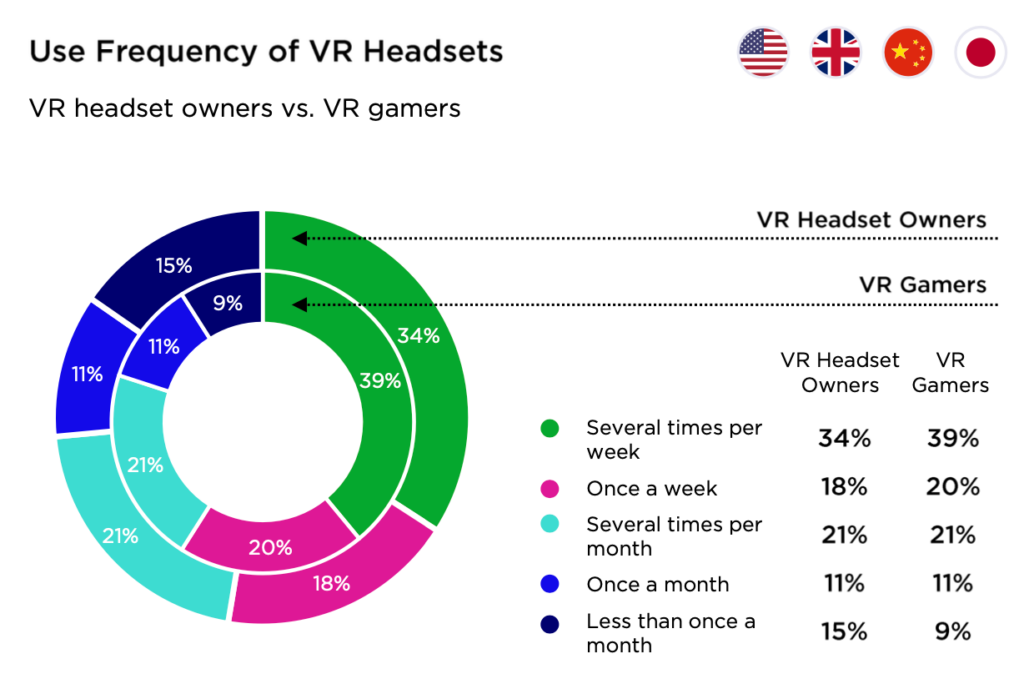

39% of VR gamers are using the headset multiple times per week. The majority (61%) do it once a week or less often.

-

VR gamer is predominately male (63%) in the age of 21 to 35 years (43%) and high income (43%).

-

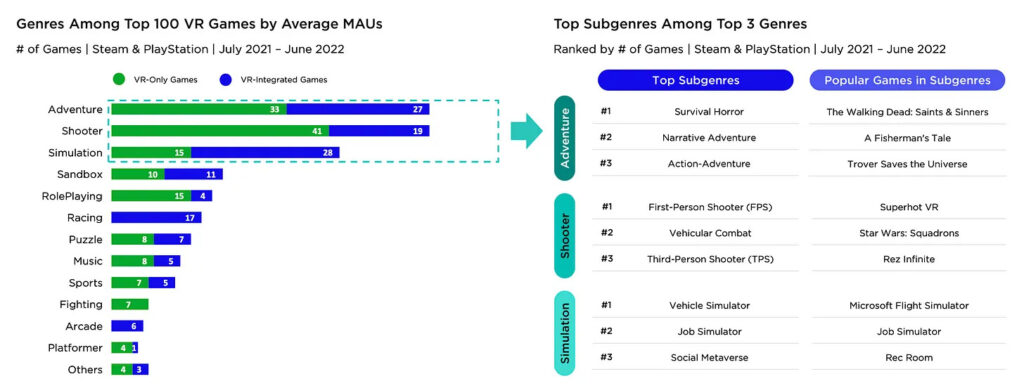

Adventure games, shooters, and simulators are the most popular genres in VR.

Newzoo: VR Gaming Market in 2022Download

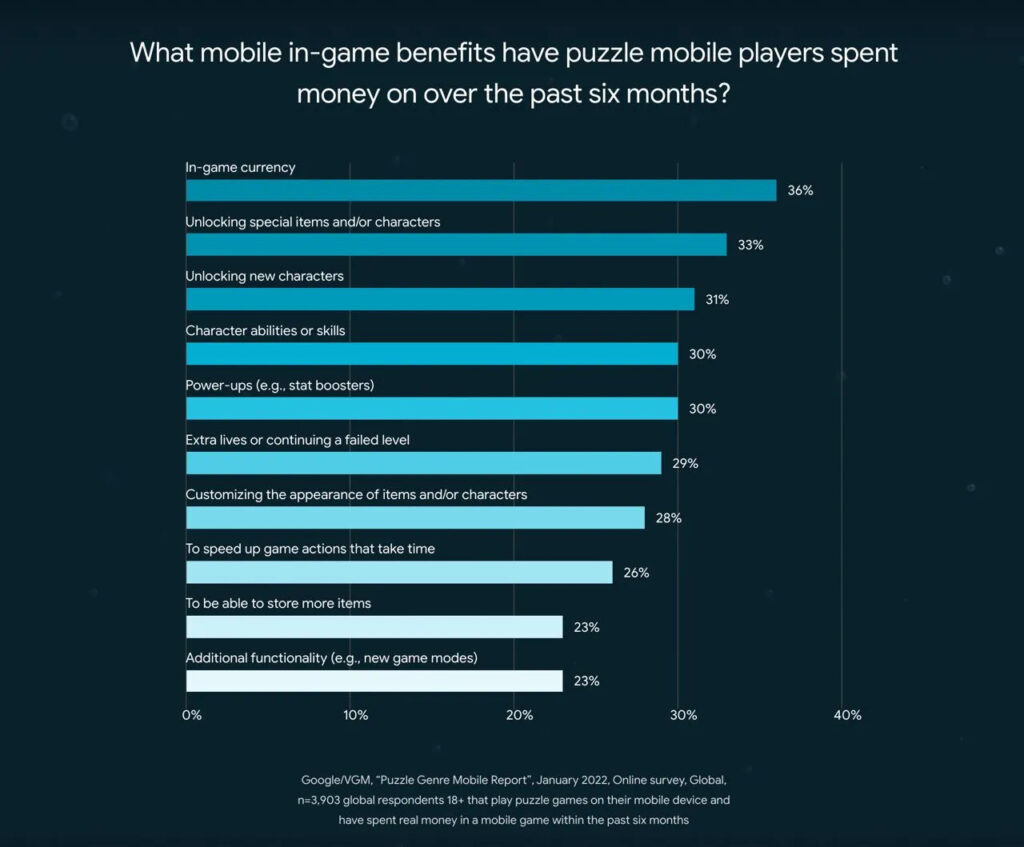

Google: Puzzle games on Mobile Devices in 2022

Google names Match-3, Hidden Object, and other games that can be found in the relevant category of Google Play as Puzzles.

-

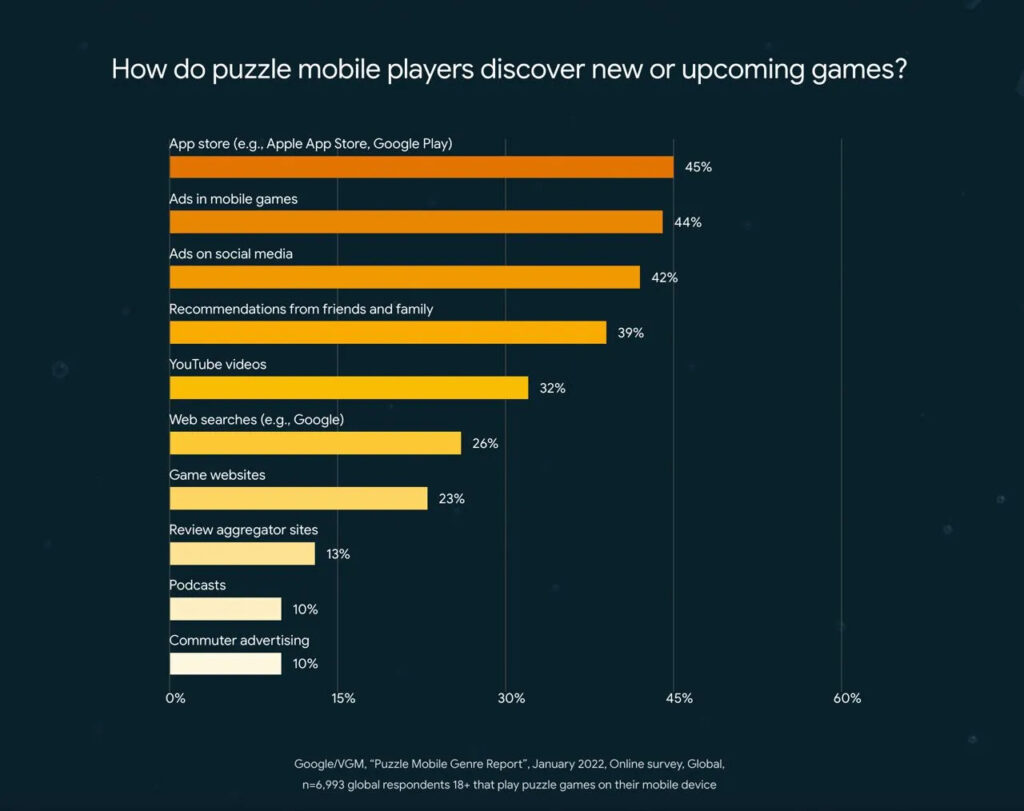

Puzzle gamers learn about new games through App Store (45%), in-game ads (44%), social network ads (42%), recommendations (39%), and YouTube videos (32%).

-

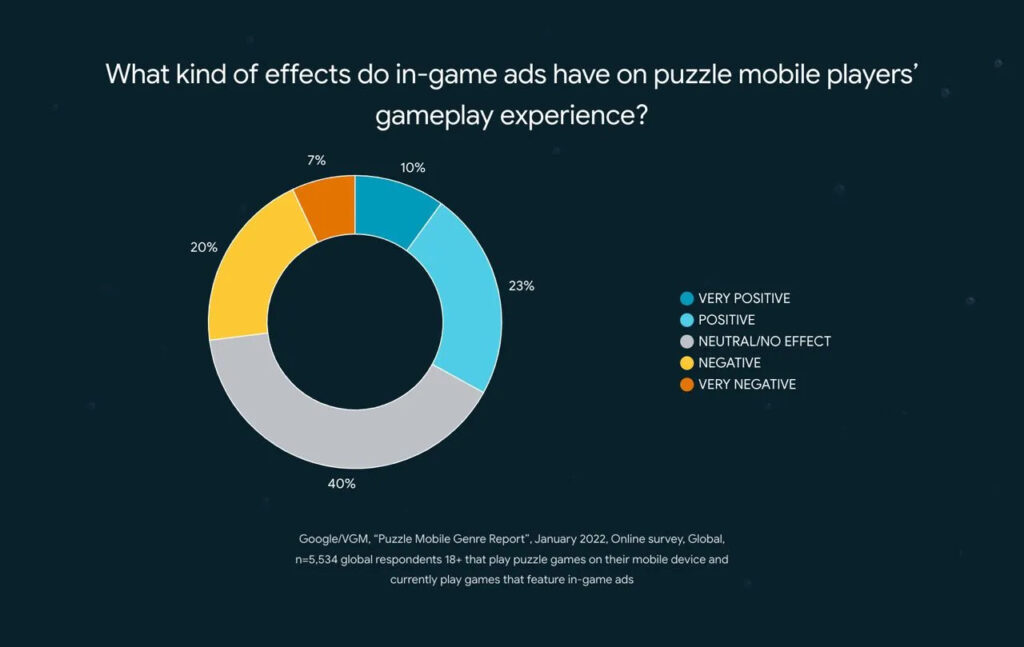

73% of puzzle lovers do not think that ads have a negative effect on gameplay.

-

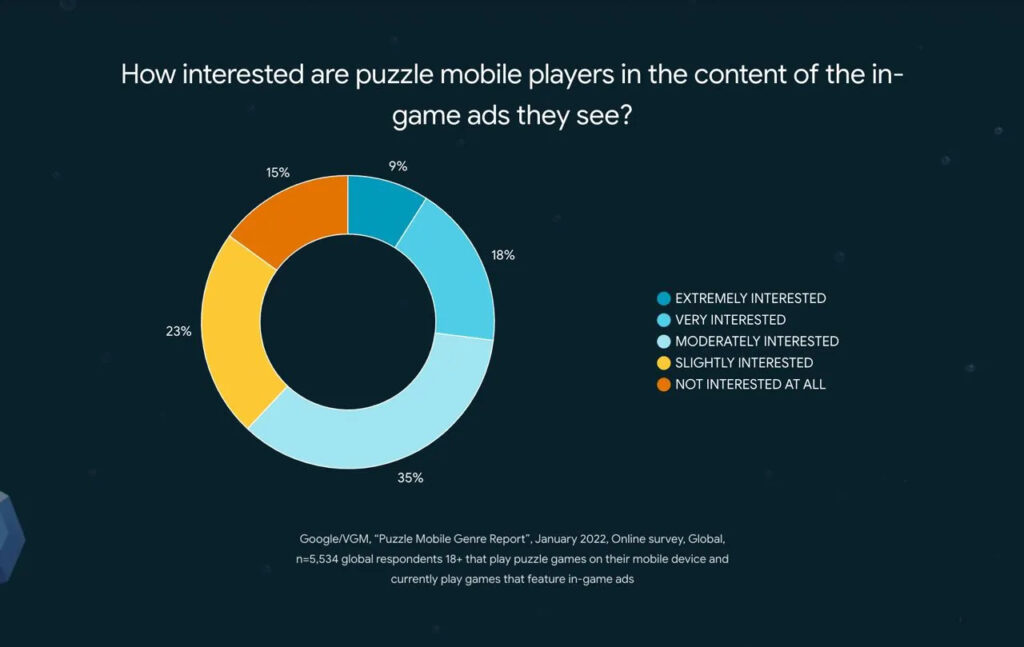

62% of users are interested in the ads that are shown.

-

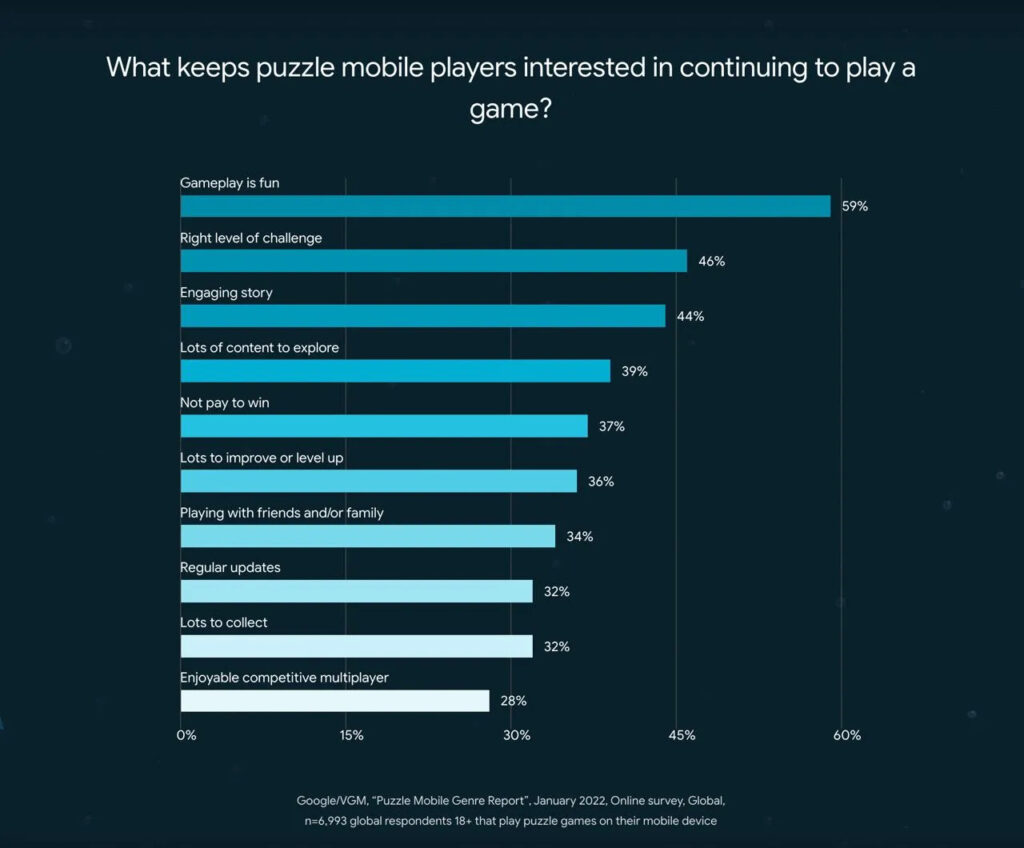

Google highlighted an obvious thing. The main engaging factor in games is exciting gameplay. The right challenge level (46%) and engaging story (44%) are next.

-

The top-3 reasons why puzzle gamers stop playing games are non-interesting gameplay (45%), a lot of ads (43%), and a lot of bugs & glitches (40%).

-

Only 40% of puzzle gamers are part of gaming communities.

-

78% of puzzle gamers think that localization is important.

Newzoo: Chinese Gaming Market Regulations in 2022

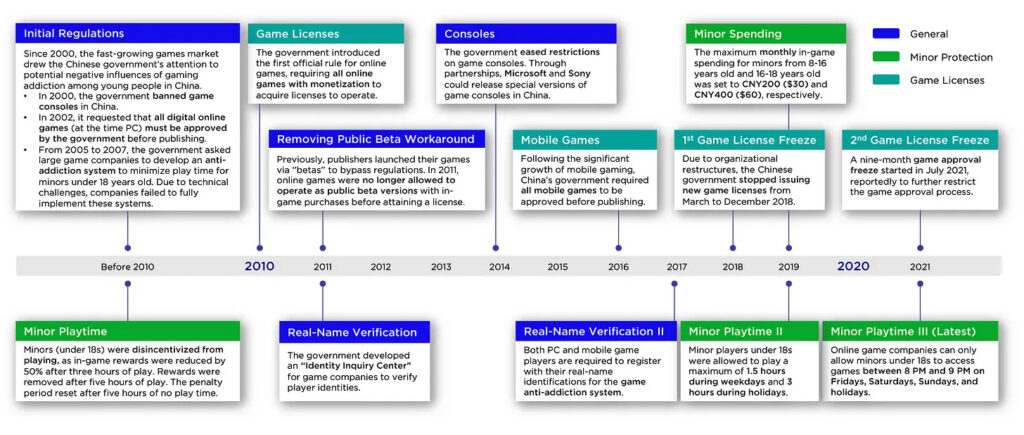

Child protection

-

China's regulation allows children and teenagers under 18 years to play only from 8 to 9 PM on Fridays, weekends, and holidays.

-

Children aged 8 to 16 years have a monthly game payment limit of $30. Teenagers from 16 to 18 years can spend twice as more - $60.

-

Gaming companies are obliged to identify the person under 18 years. ID is required to play the game.

-

Users under 18 years can’t spend their money on streaming platforms. Teenagers from 16 years old can stream but only under an adult person's control.

-

People under 18 years old can’t participate in any E-Sports events. They also can’t buy/rent gaming accounts.

Newzoo suggests that these regulations will negatively impact the Chinese gaming market in the long run. Chinese children won’t have a habit of playing games. However, in reality, a big chunk of those regulations is possible to pass with a help of adults.

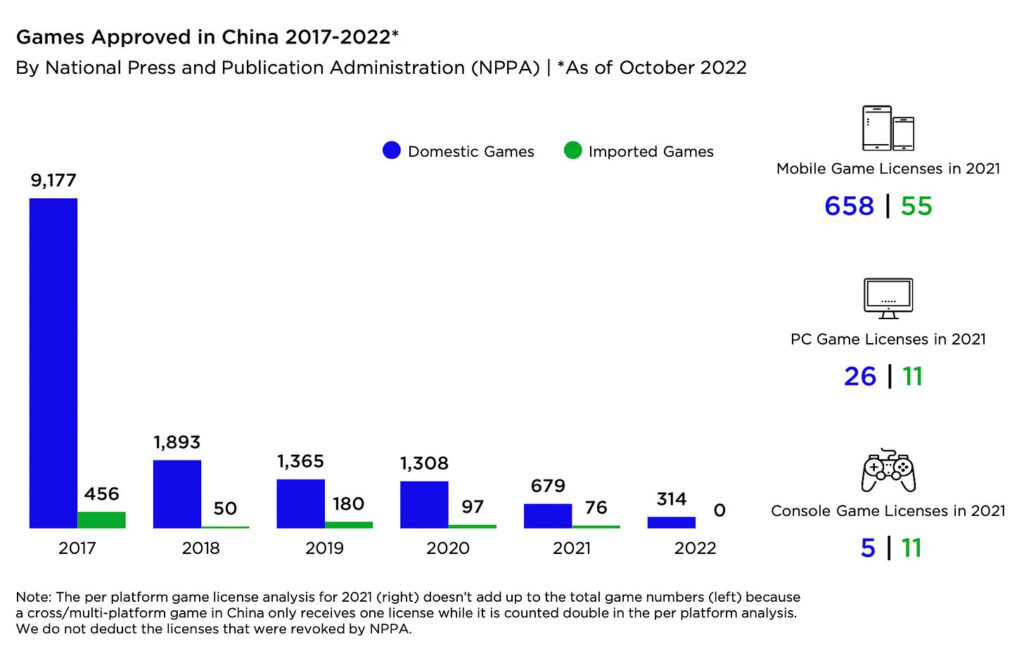

Licenses

-

All games with a feature of receiving money (Premium or IAP) are required to have a license to be published in China.

-

The Chinese government issued 9,177 licenses in 2017 for Chinese developers, and 456 licenses for foreign developers. In 2022 (valid for October 2022) the Chinese government provided only 314 licenses - all of them for local companies.

Grey zone

-

Steam is still available in China. There are rumors around for the last couple of years that it will be blocked, but it’s still alive. Now gamers are using Game Accelerator and VPN services to get access to it.

-

VR and Cloud Gaming platforms are not currently regulated by the government.

-

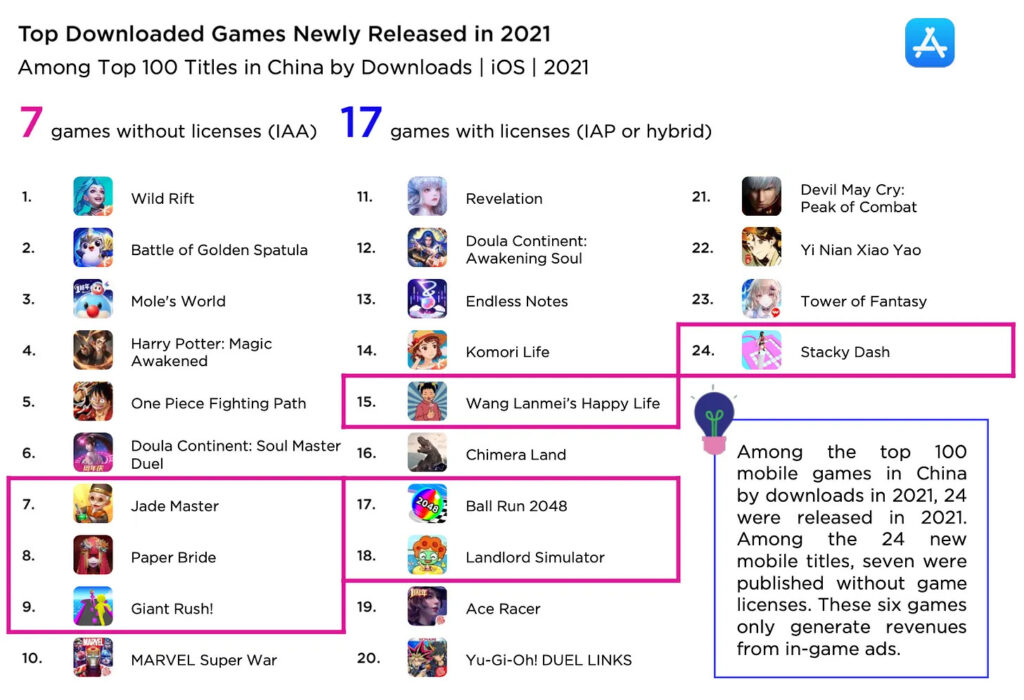

Mobile games with only ad monetization are not required to get a license. But in June 2022 three games with such monetization were fined by the Chinese government. It took their revenue and banned them from App Store.

-

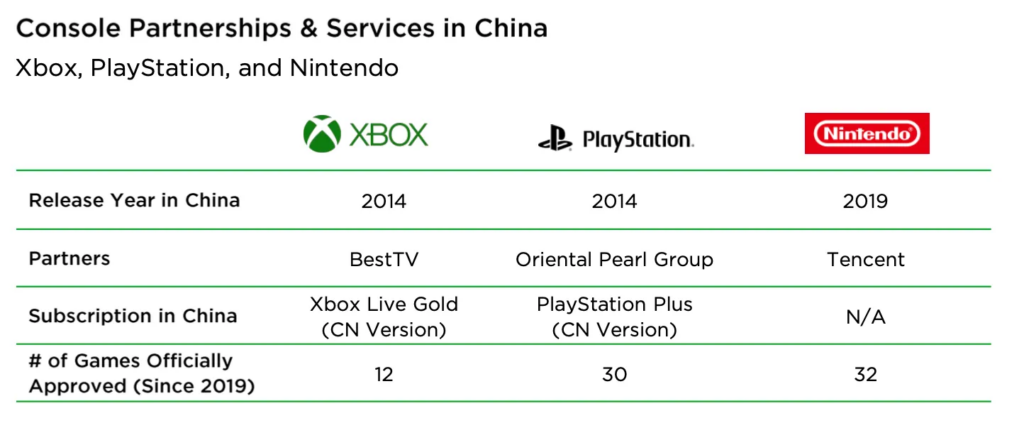

There is a huge grey console market in China. People are buying consoles from Japan & Hong Kong to play games that didn’t get a license to launch on the local market.

What Chinese companies are doing

-

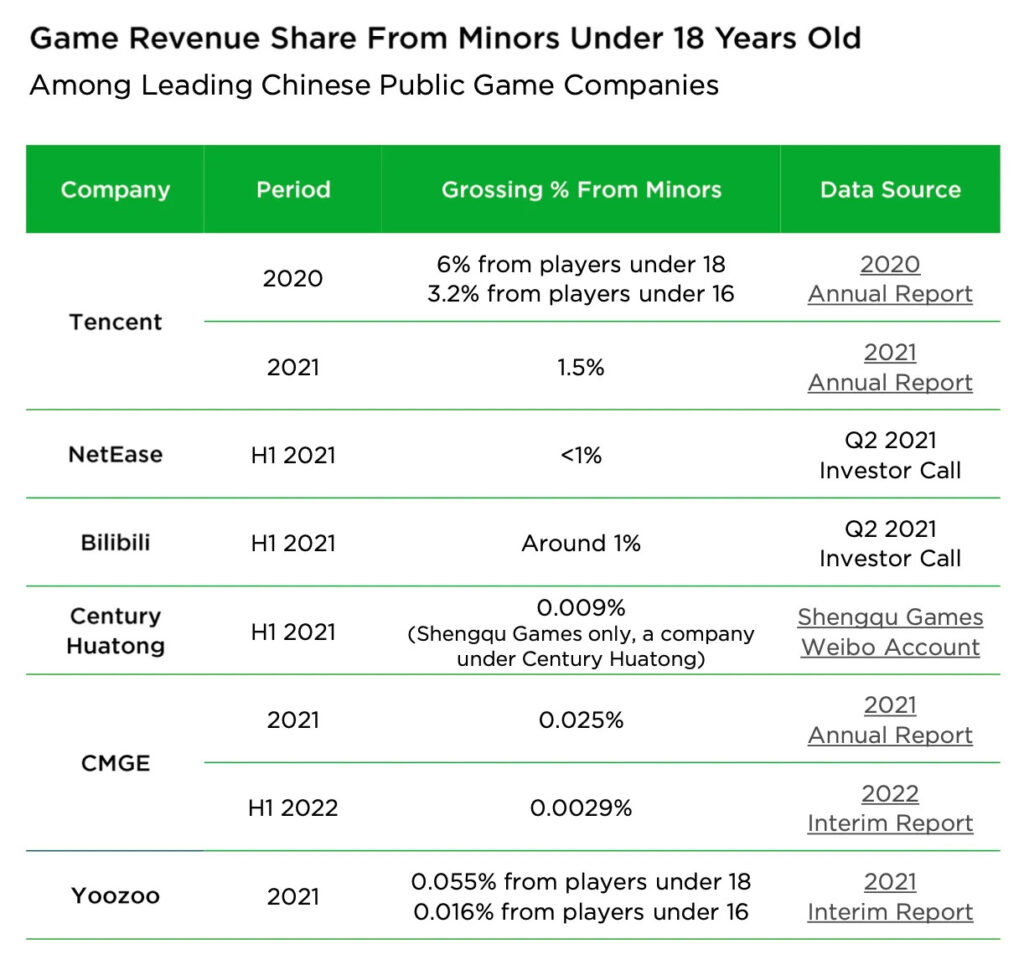

Big Chinese companies are working on self-regulation. Tencent, NetEase, and 37 Interactive have a technology of identification by the face. Tencent also registered a patent that helps to verify users by their location.

-

Chinese companies that want to launch in the local market, are focused in general on big F2P titles, which are launching on several platforms. Only one license is required for a multi-platform release.

-

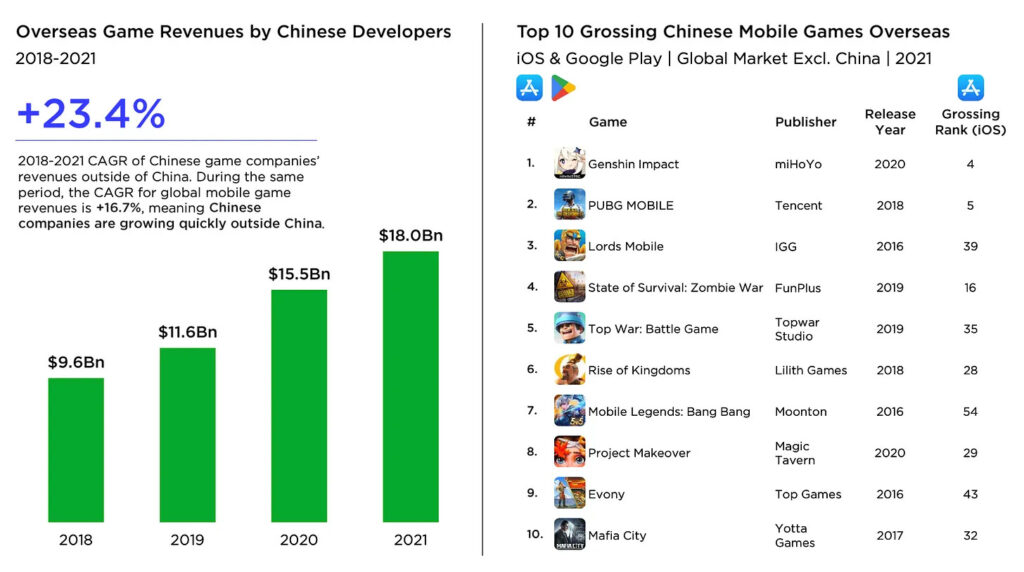

Chinese companies started to focus on overseas markets. Their revenue outside of China increased from $9.6B in 2018 to $18B in 2021.

-

Chinese companies are actively investing in foreign companies. Ubisoft, From Software, 1C Entertainment, and Quantic Dream - all of them have Chinese participation.

What should developers do?

-

Releasing a game in the Chinese market with a Premium/IAP game is a hard job. Even with a partner.

-

Even if you were extremely lucky and got the license, you need to compete with other projects. For this, you’ll need a world-known IP, that matches the Chinese audience's interests. 7 out of 10 foreign games in Chinese top charts were based on big IPs.

-

One of the few remaining relatively easy ways to enter the Chinese market now is to launch the game on Steam. But there is always a risk that the platform will be closed.

Newzoo: Chinese Gaming Market Regulations in 2022

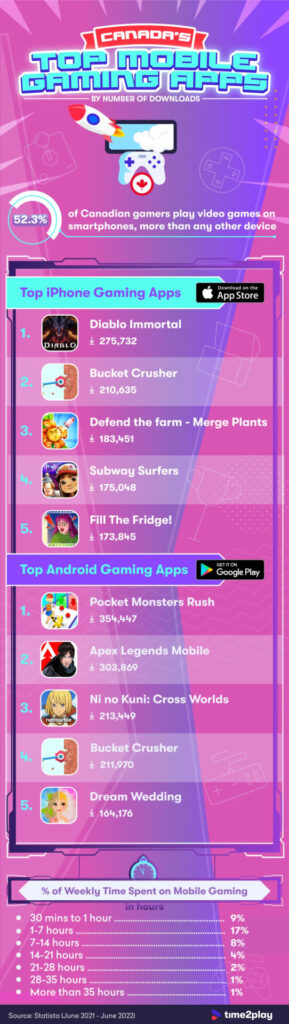

Time2Play: Canadian mobile gamers habits in 2022

-

52.3% of Canadian gamers are playing on mobile phones more than on other devices.

-

17% spent in games 1-7 hours weekly. 9% - from 30 minutes to 1 hour. 8% - from 7 to 14 hours.

-

Top-3 titles by downloads in App Store in 2022 in Canada are Diablo Immortal (275.7k downloads), Bucket Crusher (210.6k downloads), and Defend the Farm - Merge Plants (183.5k downloads).

-

Google Play leaders in 2022 are Pocket Monster Rush (354.4k downloads), Apex Legends Mobile (303.9k downloads), and Ni No Kuni: Cross Worlds (213.4k downloads).

Call of Duty: Modern Warfare II earned $1B in 10 days

-

The previous record was held by Call of Duty: Black Ops II. In 2012 the game reached the number in 15 days.

-

Call of Duty: Modern Warfare II is now the most successful entertainment product of 2022.

-

Second-week decrease in physical sales in the UK was only 42%. It’s an incredible number.

-

Physical copies of Call of Duty: Modern Warfare II in the UK is selling 40% better than Call of Duty Vanguard.

KantanGames: Japanese PC gaming market doubled in the last 3 years

-

Japanese PC gaming market by the end of 2021 reached $896M. It’s twice as more compared to 2018.

-

16 million PC gamers were living in Japan in 2021. It’s about 28.8% of the overall player base.

-

Of 16 million PC gamers, 4.5 million are playing exclusively on PC. In 2015 there were 2.2 million such players.

-

However, Japan is a mobile-first market. It’s 3x times larger than the console one. And PC gaming is still considered niche.

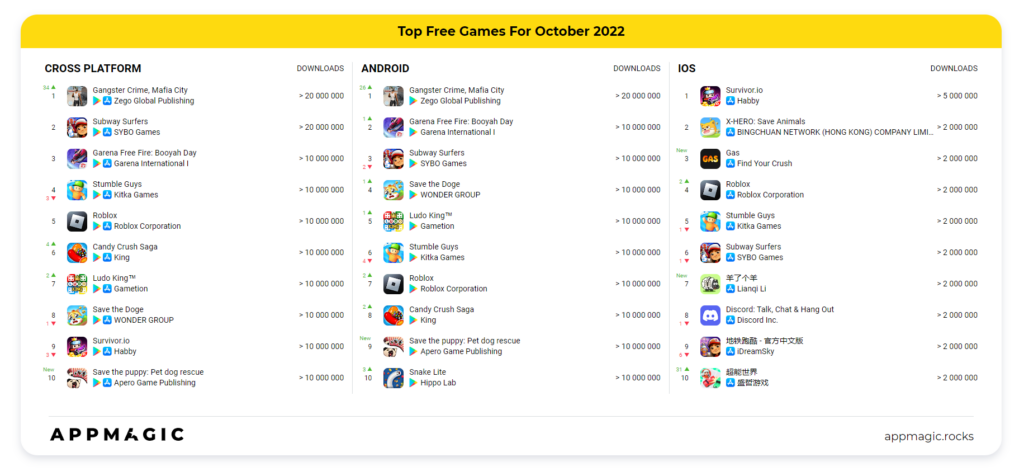

AppMagic: Top mobile games in October 2022 by Revenue and Downloads

Revenue

-

Honor of Kings earned $194M in October.

-

Players spent $141M on PUBG Mobile last month.

-

Genshin Impact reached the top 3 with $121M revenue in October.

Downloads

-

Gangster Crime, Mafia City became the leader by downloads with 27.1M users. The vast majority of installs (26.7M) came from Google Play. The game is actively using GTA: San Andreas references in ads. In reality, this is a budget GTA copycat, that is using fake materials (even in the app stores screenshots).

Huawei AppGallery reached 580M MAU

-

The number was reached in Q3 2022. It’s 16% more than it was in Q3 2020.

-

In 2021 people downloaded apps in AppGallery 432B times. It’s 96% more than in 2019.

-

There were 6M developers on the platform in Q3 2022. It’s twice as more compared to Q3 2020.

-

The number of apps in AppGallery reached 220k in Q3 2022. It’s 120% more than it was two years ago.

Sensor Tower: Top Mobile games in Southeast Asia by Downloads in September 2022

-

Save the Doge was the top-downloaded game in the region with 6.5M downloads. Indonesia is responsible for 49.4% of installs; Vietnam brought 25.7%.

-

Garena Free Fire is in second place with 3.9M downloads. Vietnam is responsible for 37.6%; Indonesia - for 35.4%.

Sensor Tower: Top Mobile games by Revenue in Southeast Asia in September 2022

-

Mobile Legends: Bang Bang from Moonton is first with almost $9M revenue (+6.9% YoY). 37.9% comes from Malaysia, 29.1% - from Indonesia, and 17.2% - from the Philippines.

-

Garena Free Fire is second with $8.1M monthly revenue, 39.3% of which comes from Thailand and 28.9% from Indonesia.

GSD: PC & Console gaming market in the UK grew in October 2022

Games

-

2.83M games were sold in the country in October 2022. It’s 11.2% more than a year before.

-

62% of sales are digital (+36% YoY). Retail sales dropped by 14% in 2021.

-

The increase in sales is connected to the Call of Duty: Modern Warfare 2 release. The game launched much better (by 92%) than Call of Duty Vanguard (which was released in November 2021).

-

57% of Call of Duty: Modern Warfare 2 has been made by PlayStation owners (42% are PS5); 33% is an Xbox part, and 10% - is a PC.

-

FIFA 23 is showing great results too. It’s performing 6% better in October than the previous installment.

Hardware

-

A little less than 175k consoles have been sold in October 2022. It’s a 1% decline from the previous year.

-

Compared to September 2022, PlayStation 5 sales went down by 6%. Despite this, the console is still in first place with a slight margin over Xbox Series.

-

Nintendo Switch sales increased by 5% to the previous month.

-

Time-to-date, there is only a 40k unit difference between the first and the last console in the UK.

-

669k accessories have been sold in the UK in October 2022. It’s 9% less than in September, and 7.5% less than in October 2021. Controllers for PlayStation 5 and Xbox Series are on top of the charts.

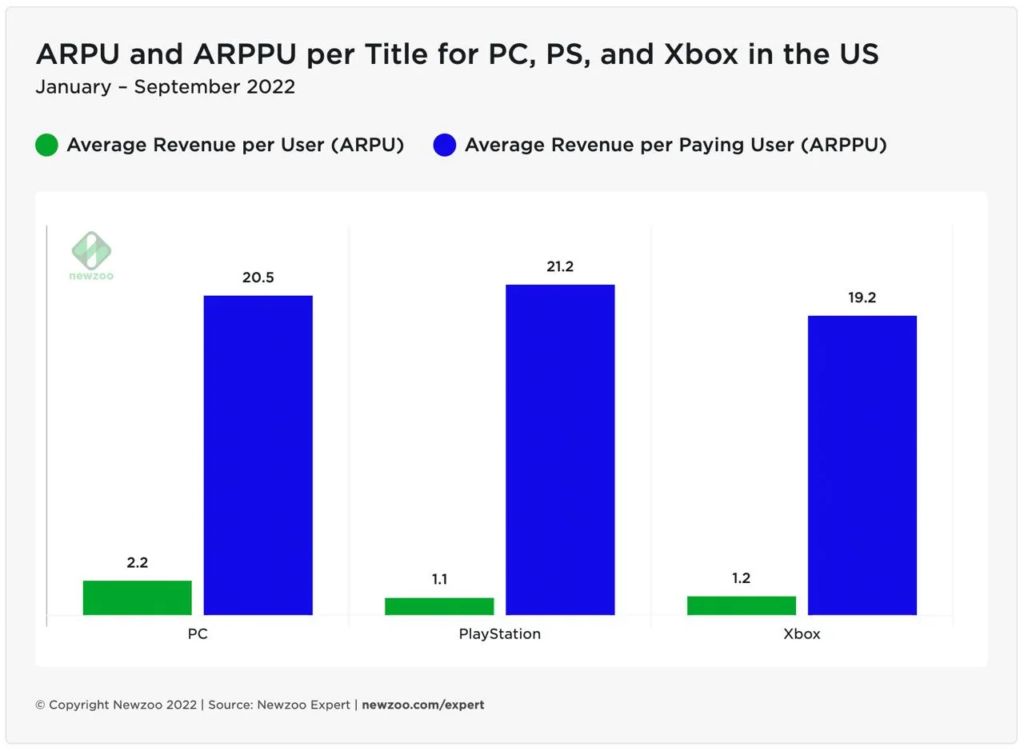

Newzoo: ARPU & ARPPU on PC & Consoles at the US market in 2022

-

ARPU on PC from January to September 2022 was $2.2. On Xbox - $1.2; on PlayStation - $1.1. According to Newzoo numbers, there are more people on consoles who are not paying for games.

-

During the same time period, the average ARPPU on PlayStation was $21.2; on PC - $20.5, and $19.2 on Xbox.

-

23% of console owners haven’t bought anything in the last half a year. There are only 18% of such users on PC.

-

Fortnite, Call of Duty: Modern Warfare/Warzone and Grand Theft Auto V are the US leaders by MAU from January to September this year.

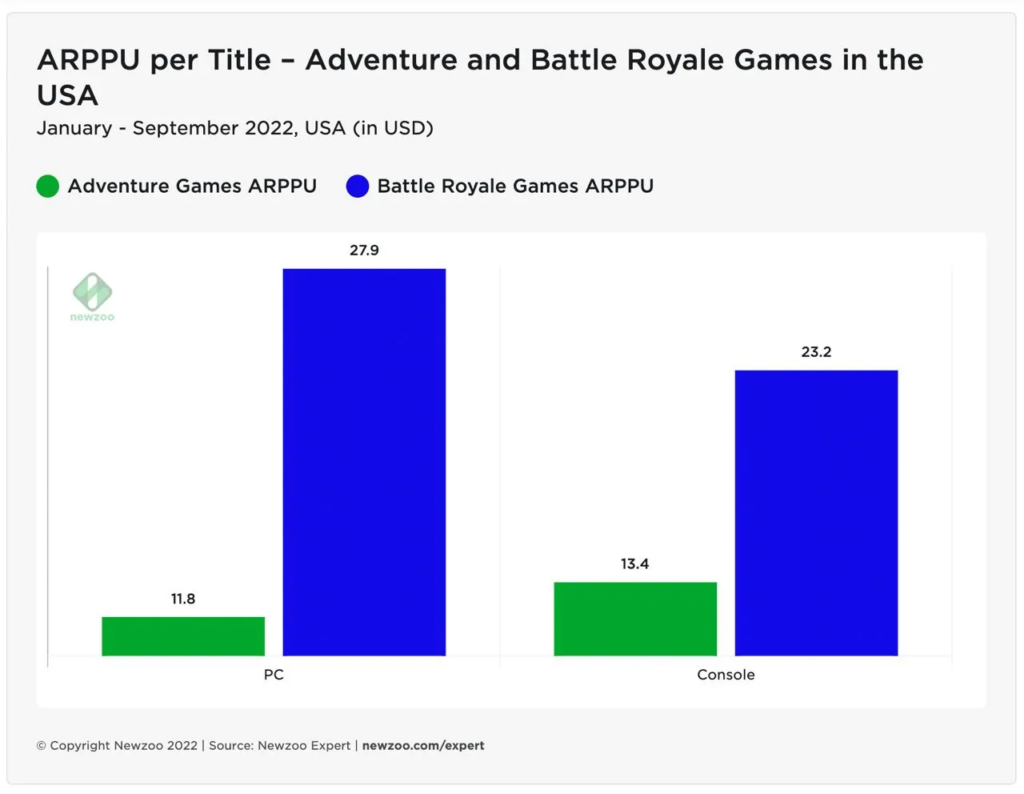

ARPPU in genres

-

ARPPU varies a lot from genre to genre. Adventure games on PC are showing an ARPPU of $11.8 while Battle Royale has $27.9.

-

On consoles the situation is similar. ARPPU of adventure games is $13.4; Battle Royale is showing the $23.2 number.

-

It’s important to mention that the majority of adventure games have a Premium distribution model. And IAP is an additional monetization tool.

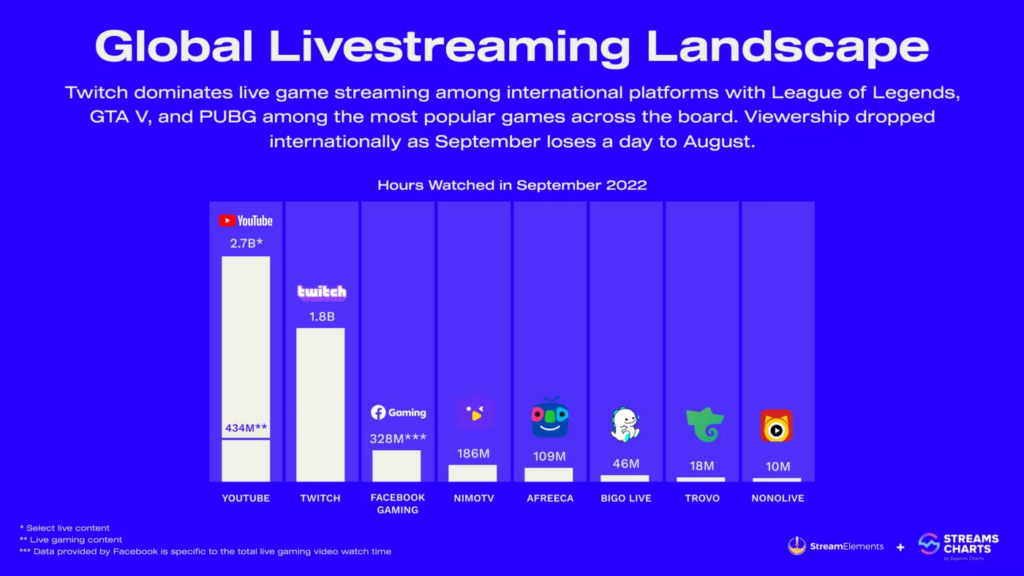

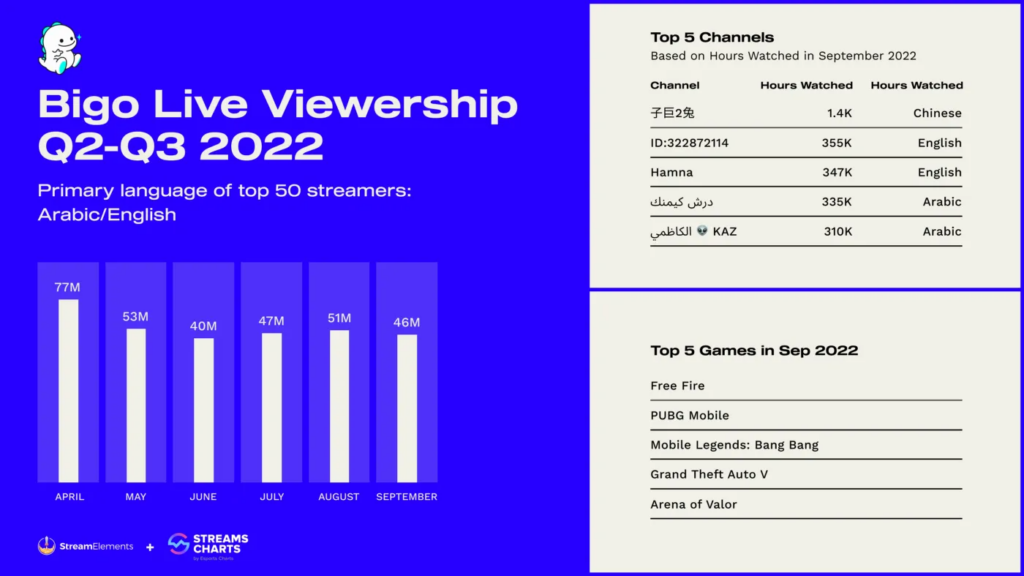

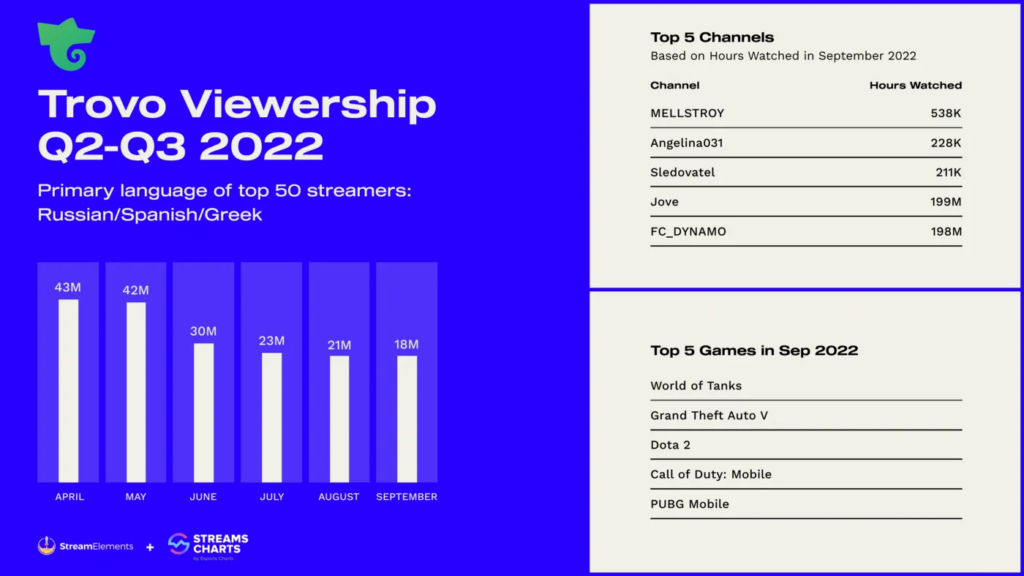

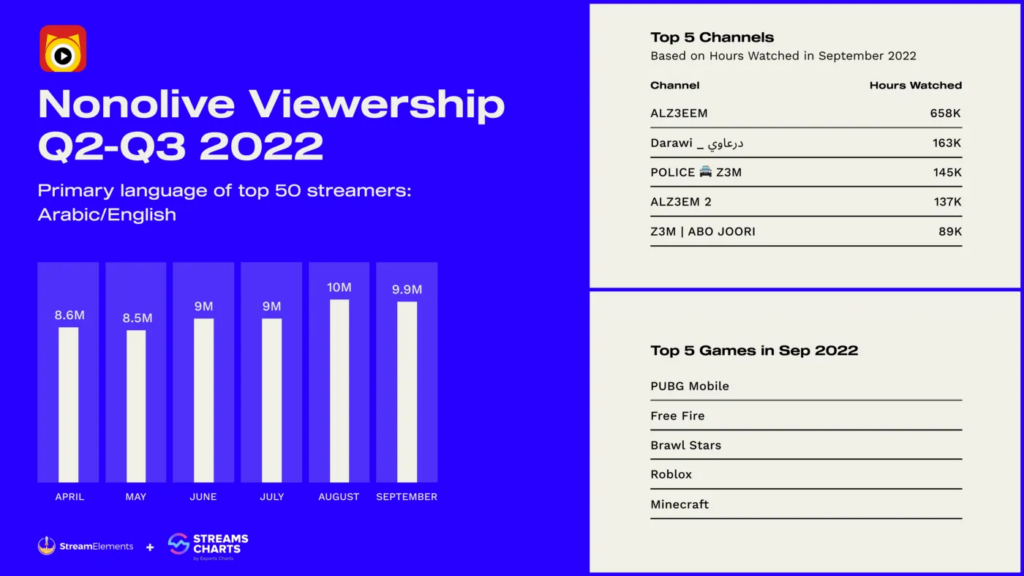

StreamElements & Stream Charts: Streaming Market Status in September 2022

-

Twitch is the solid leader with 1.8B hours watched. YouTube Gaming (434M hours), and Facebook Gaming (328M - but the data was provided by Facebook itself).

The report authors also shared some numbers of other popular platforms.

-

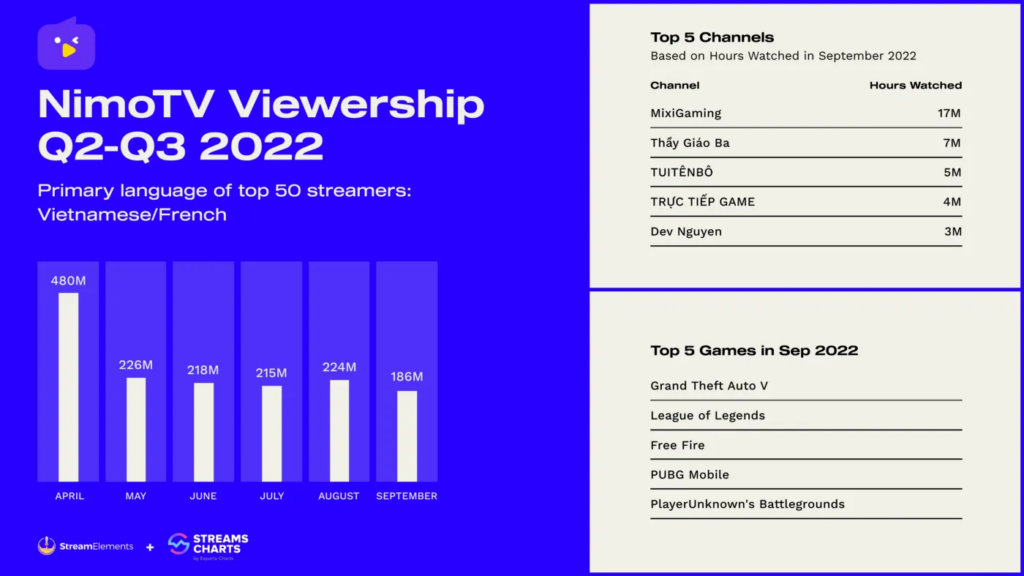

NimoTV reached 186M hours watched (main languages: Vietnamese and French).

-

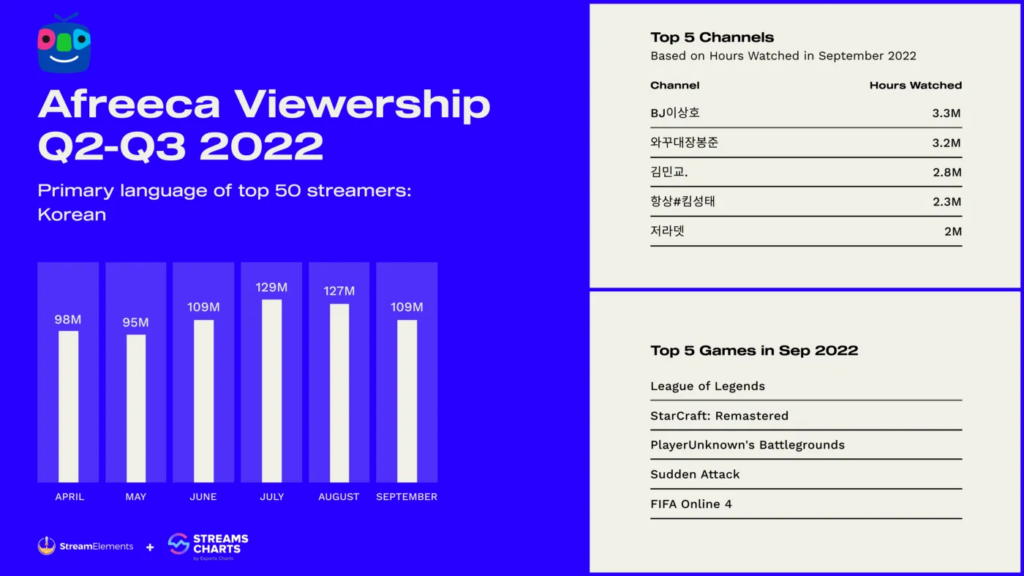

AfreecaTV had 109M hours (main language - Korean).

-

Bigo Live had 46M hours (main languages are Arabic and English).

-

Trovo had 18M hours (main languages are Russian, Spanish, and Greek).

-

Nonolive had 9.9M hours (main languages are Arabic and English).

Sonic The Hedgehog series surpassed 1.5B in sales

-

It’s the largest franchise of SEGA Sammy. In the 2022 report, the company also shared the results of its other franchises.

-

The Total War series launched in 2000 reached 40.4M copies sold.

-

Football Manager and Chain Chronicle have sold 25M copies each.

-

The Persona series has sold 15.5M copies since its debut in 1996. Persona 5 and its spin-offs are responsible for 7.22M copies. 77% of its sales were international.

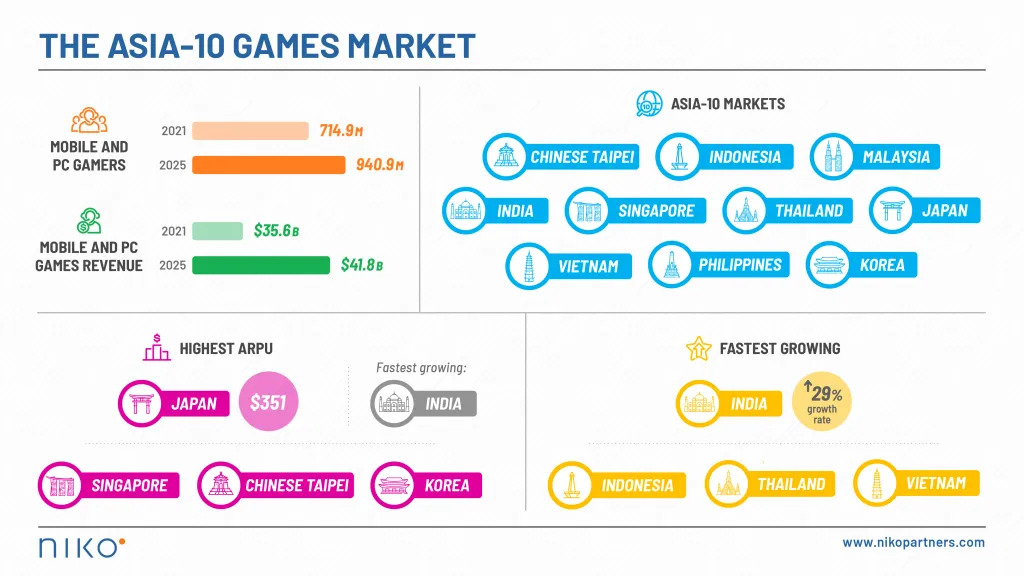

Niko Partners: Top-10 Asian markets and Female gamers in Asia

Top-10 Asian markets

Niko Partners excluded China from the list. It includes Chinese Taipei, Indonesia, Malaysia, India, Singapore, Thailand, Japan, Vietnam, Philippines, and South Korea.

-

The number of mobile & PC gamers will increase from 714.9M in 2022 to 940.9M in 2025.

-

Revenue from mobile & PC games will increase from $35.6B to $41.8B in 2025.

-

The highest ARPU is in Japan ($351). Singapore, Chinese Taipei, and South Korea are among the leaders too.

-

India is showing the highest growth rate from the revenue, and ARPU standpoint (+29%). Leaders by growth are also Indonesia, Thailand, and Vietnam.

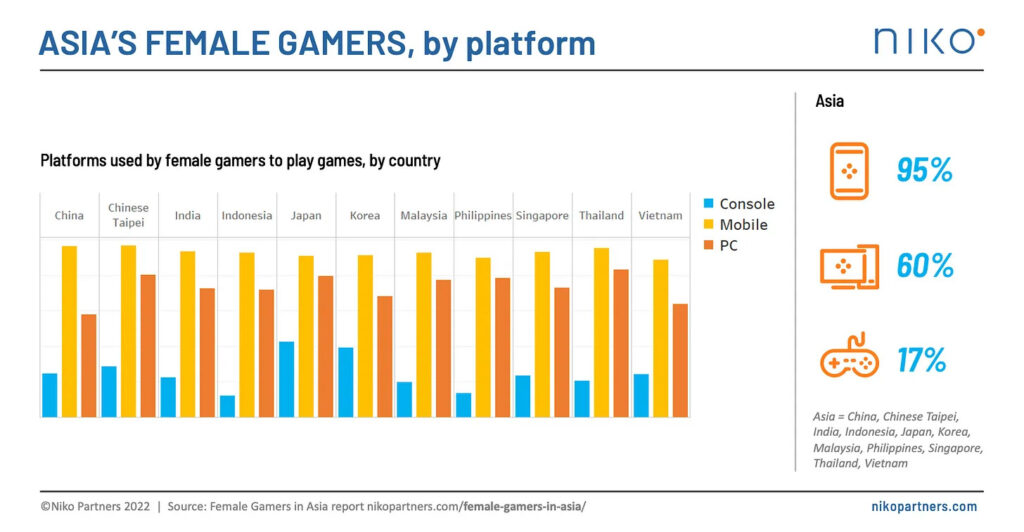

Female gamers in Asia

The numbers below include Chinese female gamers too.

-

35% of gamers in Asia are female.

-

The number of female gamers in Asia increased by 7.6% compared to last year.

-

95% of female gamers are playing on mobile devices; 60% on PC & Mobile Devices; 17% on Consoles.

-

According to Niko Partners, RPGs, Racing games and Strategies are the favorite genres of female Asian gamers. Tower Defence, MOBA, and CCG are next.

-

84% of female gamers in Asia are making IAP.

Call of Duty: Modern Warfare 2 (2022) showed the best launch in the series' history

-

The game earned $800M in the first three days after the launch.

-

The previous record was set in 2011 by Call of Duty: Modern Warfare 3. It reached comparable results in 5 days.

-

In the UK the boxed version of Call of Duty: Modern Warfare 2 (2022) sold 42% more copies during the launch than Call of Duty: Vanguard. It also started by 9% better than Call of Duty: Black Ops - Cold War. However, launch boxed sales dropped by 61% compared to the previous Call of Duty: Modern Warfare. But it was in 2019.

-

Among the other reasons to be proud: Call of Duty: Modern Warfare 2 (2022) reached the largest number of unique users and played hours in the first three days in the history of Call of Duty Premium releases. Not counting Warzone and Call of Duty: Mobile.

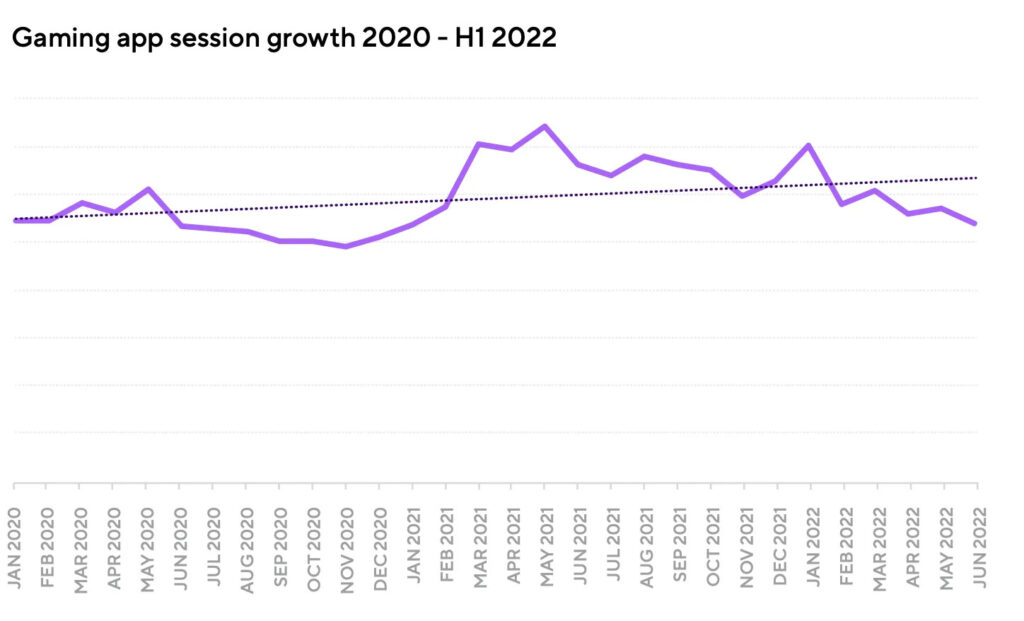

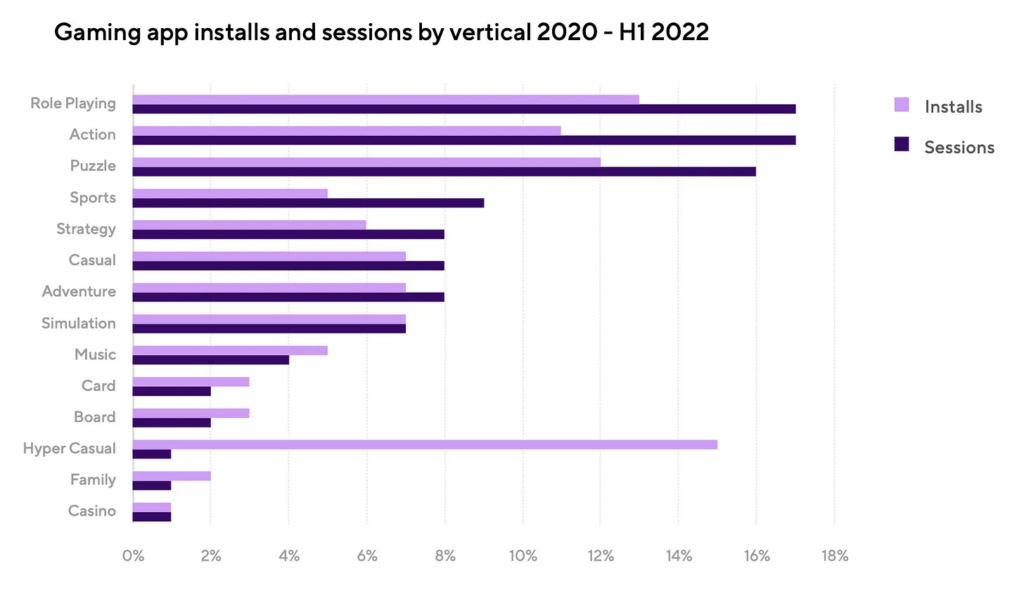

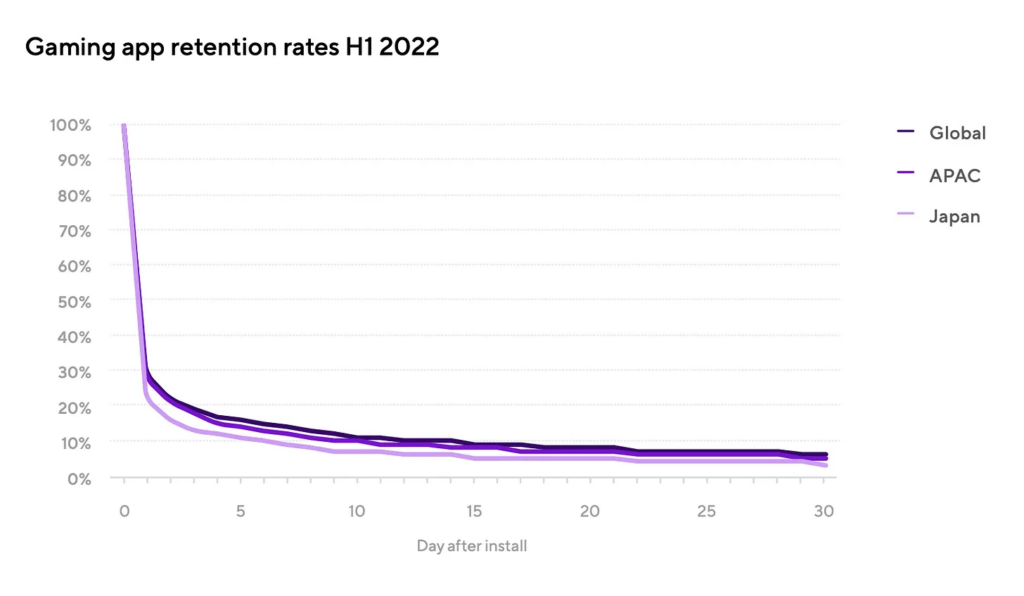

Adjust & Liftoff: Mobile gaming trends in Japan in 2022

-

15% of installs in Japan come from hypercasual games. It’s the most popular segment.

-

After the COVID burst in activity, Japanese gamers are returning to normal consuming patterns. The number of sessions in H1 2022 is 8% higher than in H1 2020.

-

RPG is the second after the hypercasual genre by popularity. It’s responsible for 13% of all installs from 2020 to H1 2022.

-

iOS in Japan is dominating with 67% of the revenue. Android, as you can assume, takes 33%.

-

An average D1 Retention in Japan for games in H1 2022 - 22%. D7 - 9%. D30 - 3%.

Marketing

-

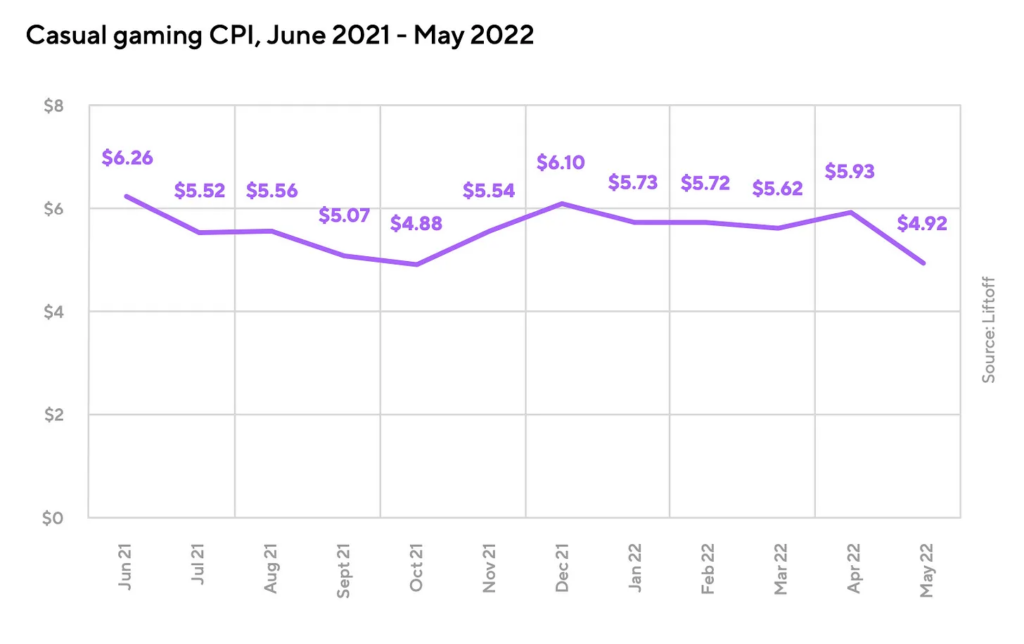

The average CPI in the casual segment in Japan - is $5.46 from June 2021 to May 2022.

-

There is no big difference in CPI between iOS and Android in Japan.

-

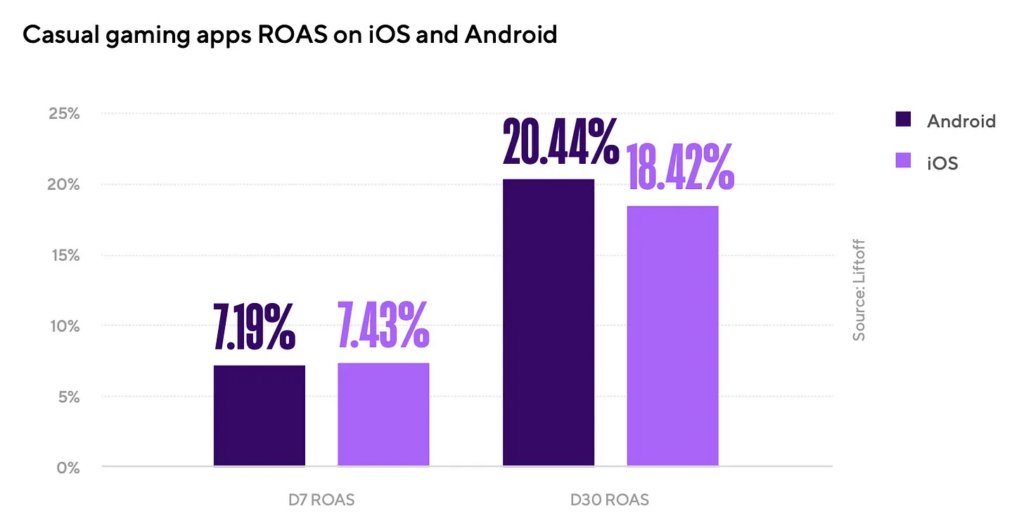

Average D7 ROAS - 7%; D30 ROAS - 19.1%.

Adjust & Liftoff: Mobile gaming trends in Japan in 2022Download

Niko Partners: The Chinese gaming market will decline in 2022 for the first time in 20 years

-

Chinese gaming market revenue will reach $45.44B in 2022.

-

It’s 2.5% lower than it was last year. And it’s the first decline in 20 years that Niko Partners is tracking the market.

-

The drop is connected with several factors: macroeconomy situation, administrative regulations, lack of new licenses, and underperformance of released games.

-

Mobile games are responsible for 66% of the market’s revenue. This segment will decline by 5.1% YoY. An additional negative factor here was the ATT implementation from Apple.

-

The PC segment will increase by 2.1% after the long 4-years recession. It’s responsible for 30% of the whole revenue in China.

-

The console market is relatively small but growing fast - +14.7% to the previous year.

-

There will be 701.8M gamers in China in 2022. And it’s the second consecutive year when this number is dropping. By Niko Partners’ assumptions, 39M young Chinese people stopped playing games in 2022.

-

Despite all difficulties, Niko Partners expects that by 2026 the number of gamers will increase to 754.5M; and revenue will reach $53B.

Superjoost: Top-10 companies by revenue in the gaming industry in 2021

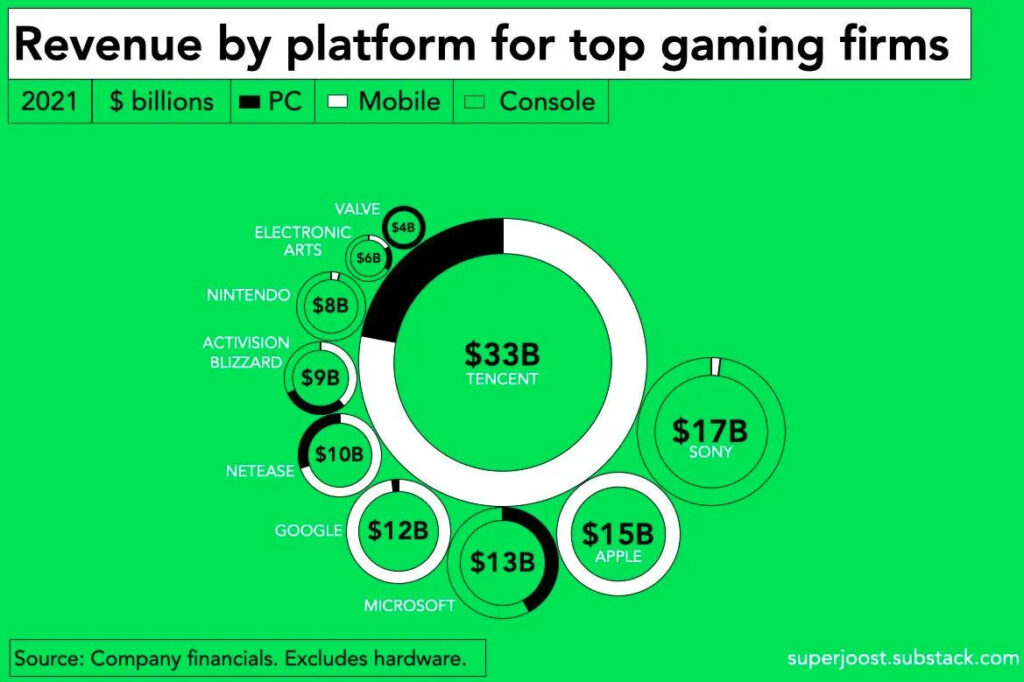

The information was collected from company financial reports. The graphic doesn’t cover the hardware sales.

-

The top ten gaming companies earned $126B in 2021. It’s about 60% of the whole industry revenue.

-

Tencent earned $33B - a quarter of the top revenues. And this number doesn’t include the income of companies where Tencent is a shareholder. 3/4 (about $24.75B) of revenue comes from Mobile games.

-

Apple & Google are earning well on games. Apple received $15B in 2021, and Google - $12B.

-

The majority of top-10 gaming companies’ revenue comes from Mobile. That’s one of the reasons why big companies like Sony want to move to the mobile entertainment direction.

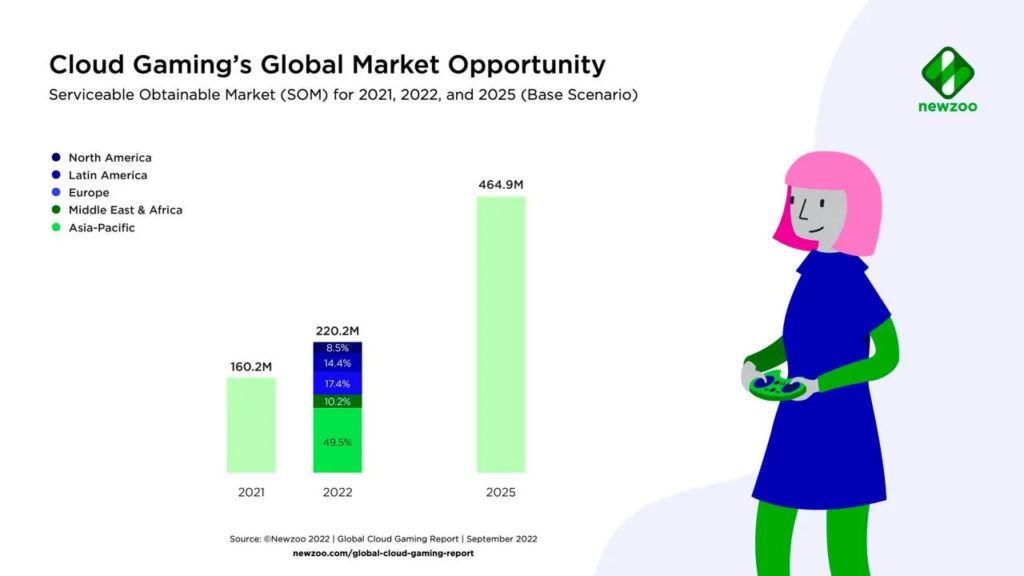

Newzoo: Fortnite helped Xbox Cloud Gaming to twice the audience this year

-

In April, before the Fortnite launch, the number of users in Xbox Cloud Gaming was around 10 million. Now it exceeds 20M users.

-

The fast growth started in May when Xbox announced the Fortnite addition to the Xbox Cloud Gaming.

-

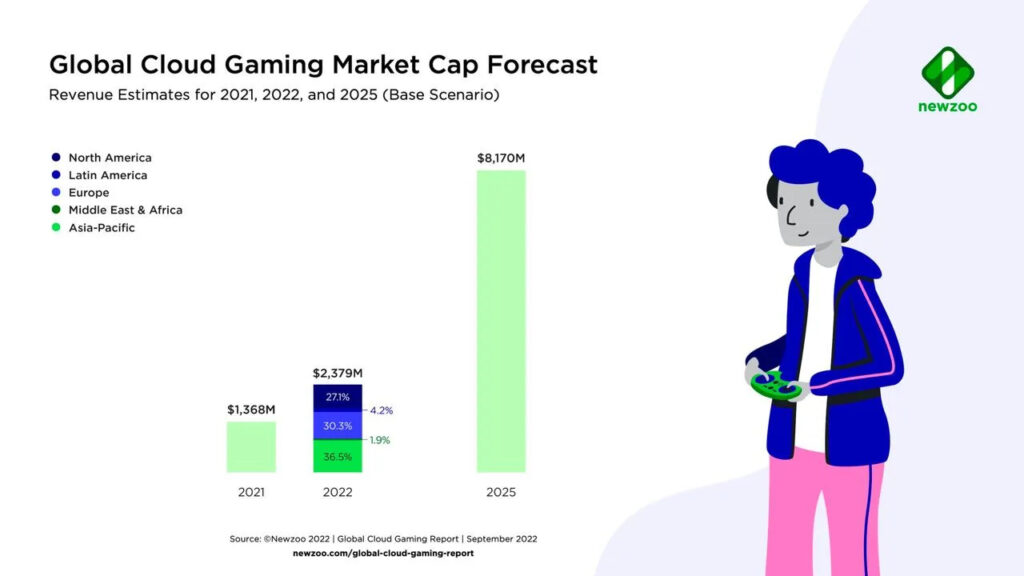

Newzoo expects that the Cloud Gaming market will reach $8.1B in 2025. Now it’s at the level of $2.379B.

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.