devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the November and December reports.

Table of Content

- Newzoo & Pangle: RPG Genre Overview

- Sensor Tower: Europeans have spent on games in 2021 16.7% more than in 2020

- ERA: In 2021 the UK games market went down by 3.3% compared to 2020

- Research Dive: By 2028 the gaming ads market will reach $14B

- Niko Partners: Saudi Arabia, UAE and Egypt markets will reach $3,1B in 2025

- Sensor Tower: Mobile Industry Results in Q4 2021 by downloads

- Twitter: Users have made more than 2.4B tweets about games in 2021

- App Annie: Mobile Games earned $116.01B in 2021

- Sensor Tower: Top Grossing Mobile Games in December 2021

- Apple: App Store earned $60B in 2021

- Drake Star: 1,159 gaming deals happened in 2021

- AppMagic: Top Mobile Games Downloads & Revenue in December 2021

- GameAnalytics: 7 things to expect in 2022

- Sensor Tower: Mobile Action games in the US grew by 69% thanks to Genshin Impact

- Newzoo: What to expect in 2022

- GSD & GfK: Games, hardware, and accessory sales in the UK in 2021

- NPD: The US Gaming market earned $60.4B in 2021

- Newzoo: Who is playing Metaverses?

- Interpet: 57% of players are interested in NFTs

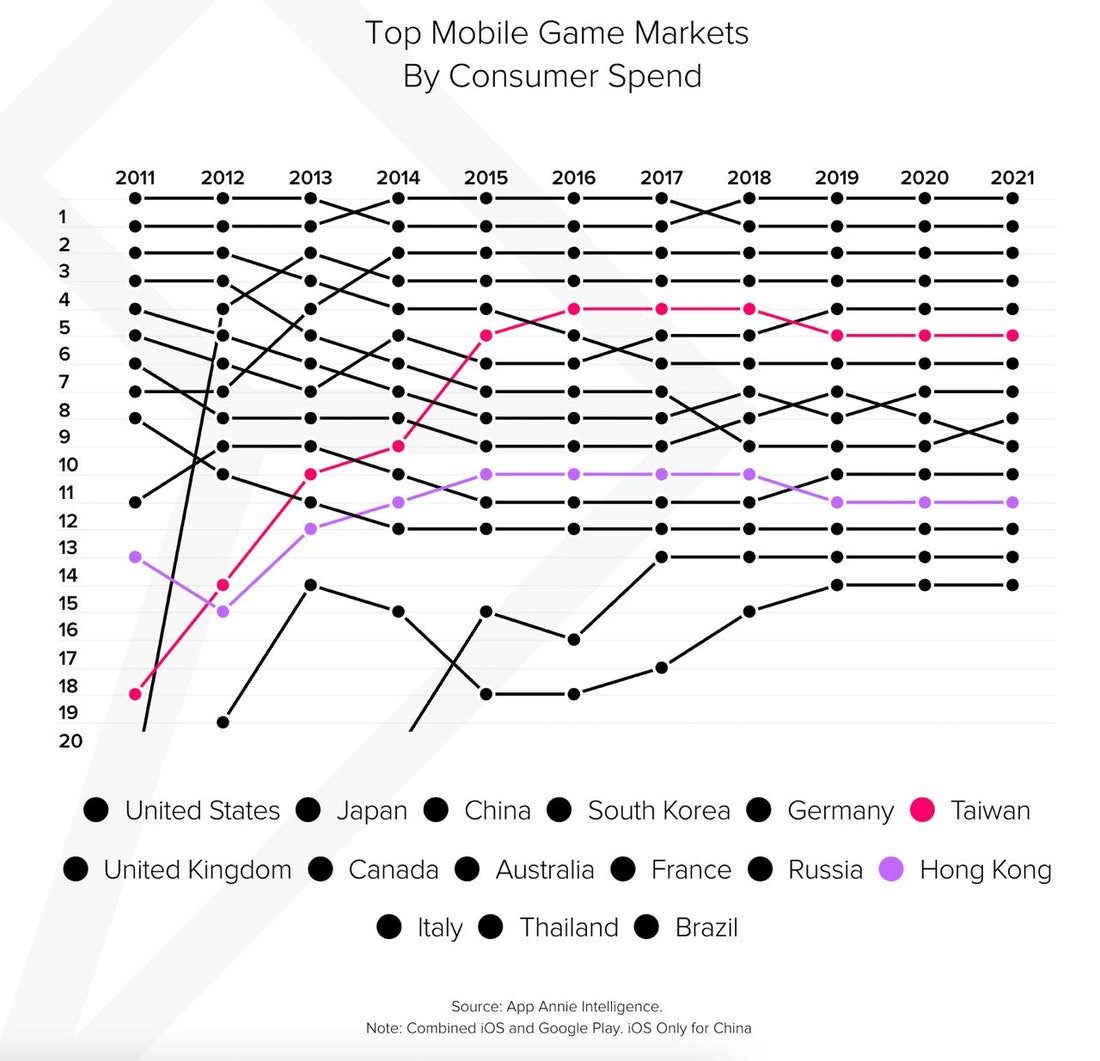

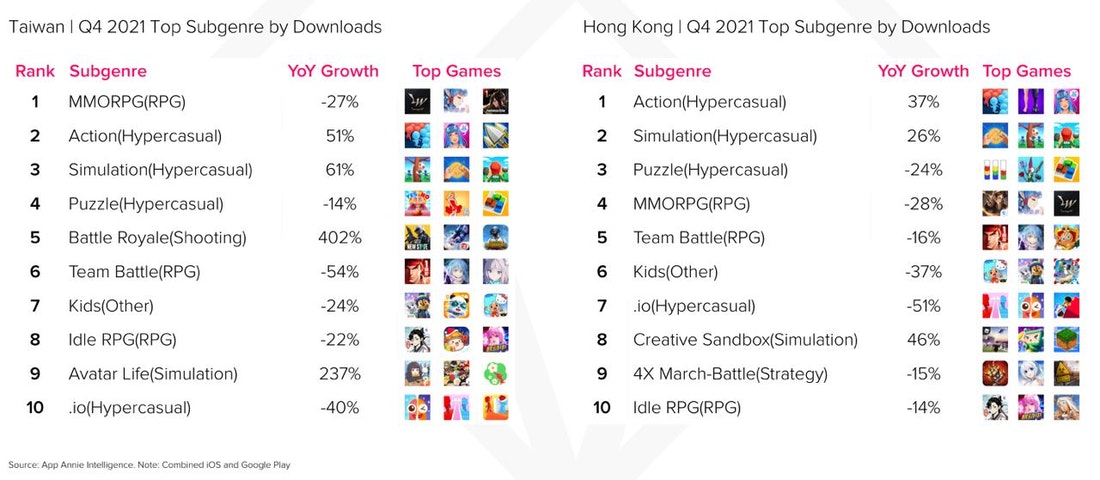

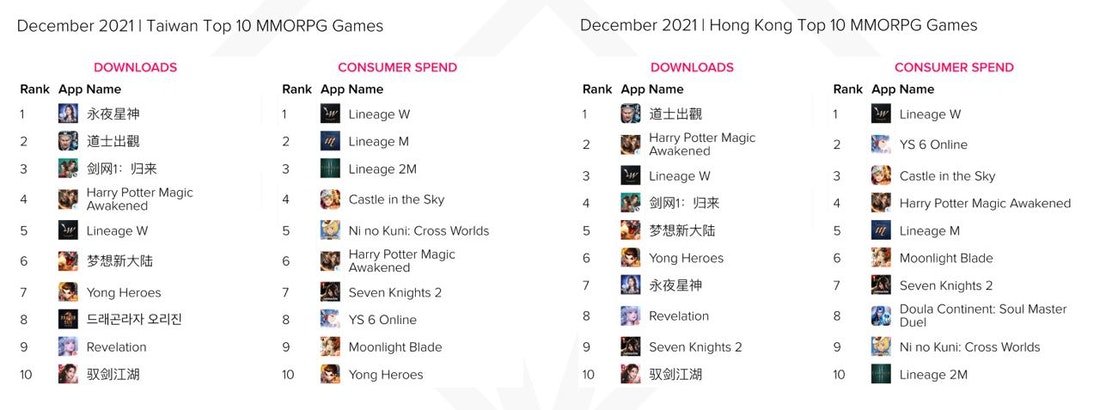

- App Annie: Taiwan & Hong Kong markets overview

Newzoo & Pangle: RPG Genre Overview

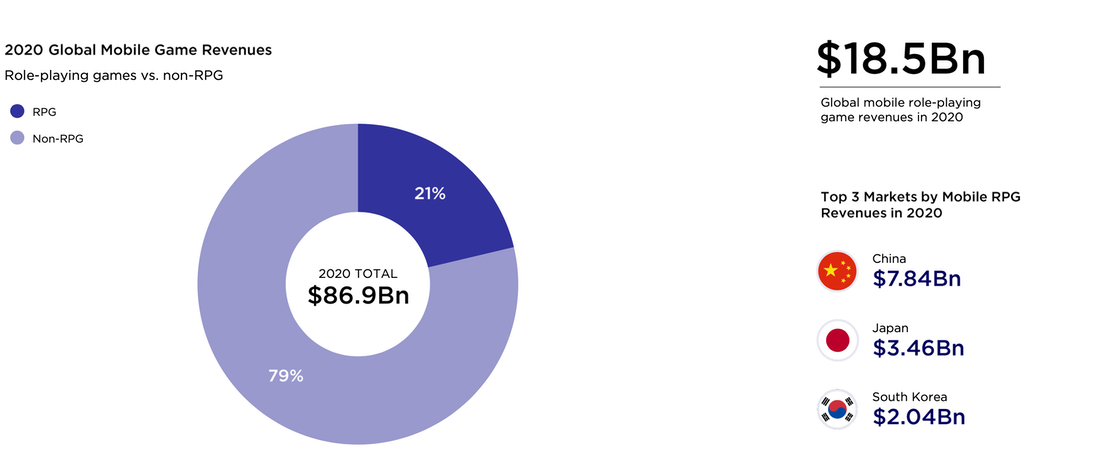

- In 2020, the genre was responsible for 21.2% of overall mobile games revenue. It’s $18.5B.

-

72% of this amount came from Eastern Asia users. China brought $7.84B, Japan - $3.46B, South Korea - $2,04B.

-

Eastern RPGs are using more game mechanics to monetize users more efficiently.

-

About half of the most successful RPG games are based on IP. It’s helping them to attract organic users effectively.

-

The majority of RPG revenue is still based on IAP. However, 83% of RPG players were positive about in-game ads, if it will bring them additional bonuses.

-

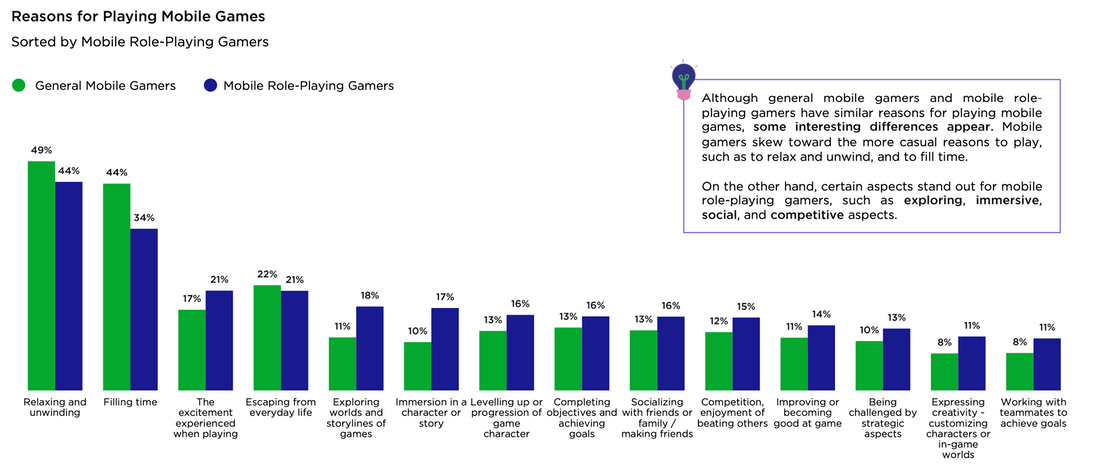

On average, people are playing RPG games to unwind and fill their free time.

-

The majority of RPG players are male (about 60%).

Sensor Tower: Europeans have spent on games in 2021 16.7% more than in 2020

-

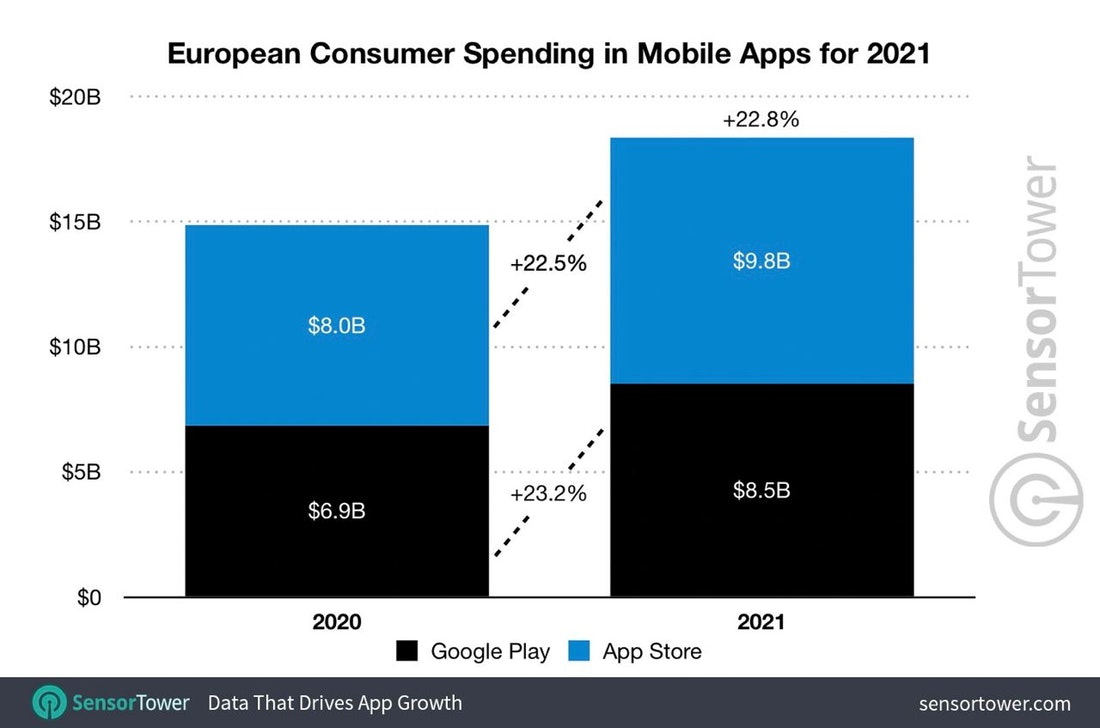

Overall spendings on apps increased by 22,8% and reached $18.3B.

-

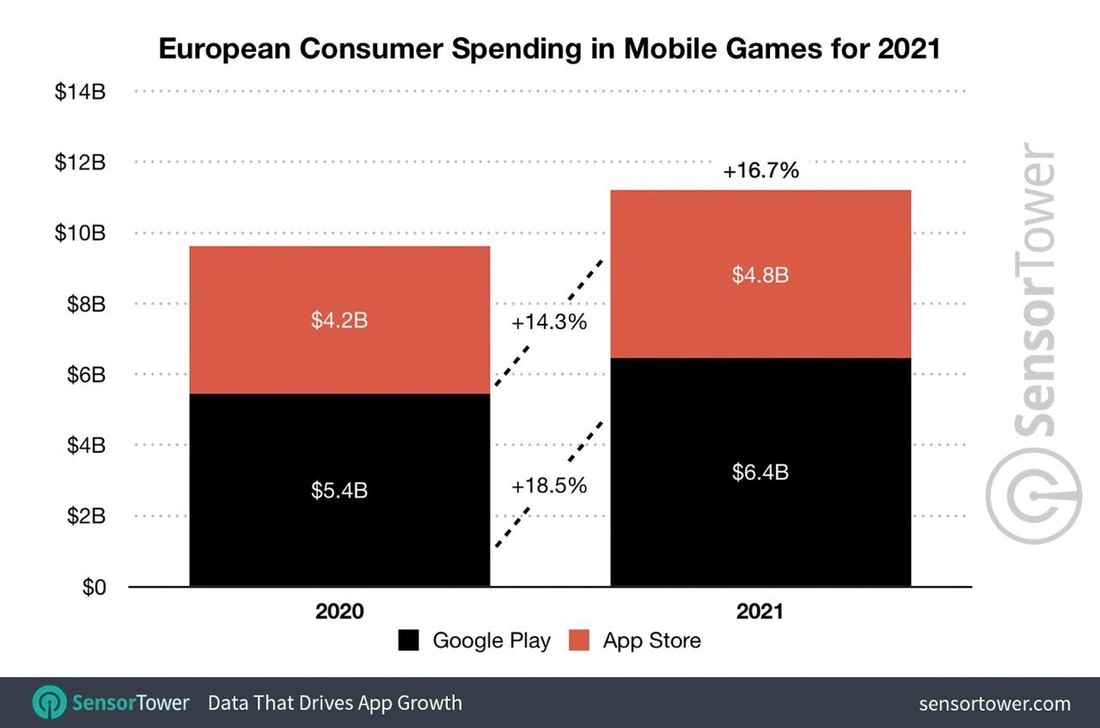

Games are responsible for about 61% of this sum - $11.2B. It’s 16,7% higher than in 2020. However, the revenue ratio decreased from 64.8% in 2020.

-

The European market in 2021 was counted as 12.7% of the world market.

-

Google Play in Europe earned more than App Store. $6.4B (+18.5% YoY) versus $4.8B (+14,3% YoY).

-

Germany ($1.3B), the UK, and France are the main regions for Google Play by revenue.

-

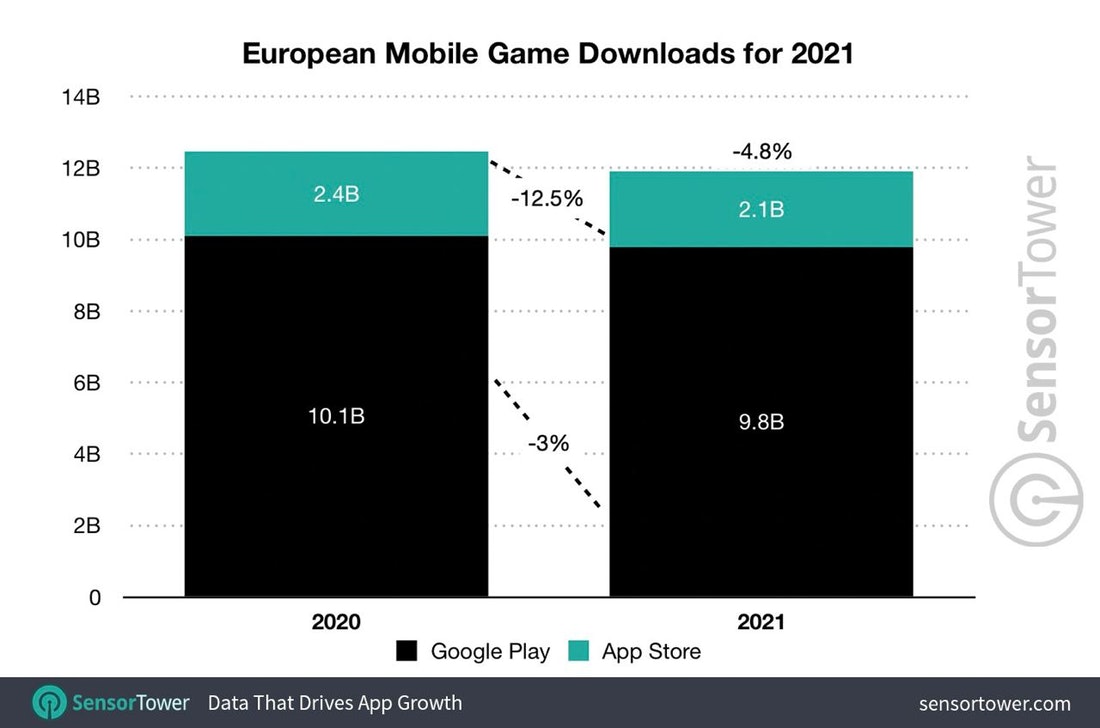

Downloads in Europe decreased from 12.5B in 2020 to 11.9B in 2021. It’s about 4.8% down.

-

PUBG Mobile is the most successful game in the region. It’s earned $404.2M per year (+58,3% YoY). Coin Master is second ($392M), Roblox is third ($264M).

-

By revenue growth, PUBG Mobile is first too. Second place belongs to State of Survival (+51.4% in revenue), Roblox is third again (+29.4%).

-

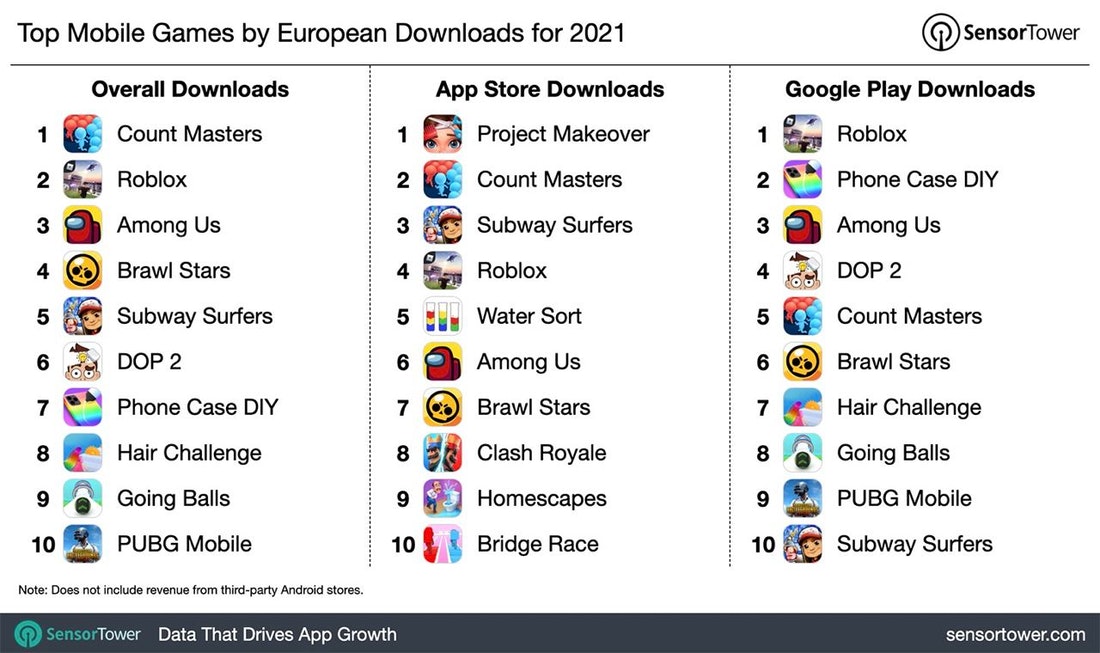

Count Masters with 38.2M downloads became the most downloaded game in Europe in 2021.

ERA: In 2021 the UK games market went down by 3.3% compared to 2020

-

The UK market valuation is £4.2B.

-

ERA analytics are mentioning, that the growth to 2019 is 13.9%. Abnormal growth of pandemic 2020 might not be counted.

-

Semi-conductors shortage caused a negative effect on the UK market with PS5 & Xbox Series sales below estimations.

-

Physical game copies sales decreased by 20.8% compared to 2020, and 15.1% compared to 2019. The volume is £511M.

-

Digital game copies sales increased by 19.4% compared to 2019 and declined only by 0.4% compared to 2020. The volume is £3.7B.

-

FIFA 22 became the best-selling game in the UK. It was sold about 2.2M times.

-

The only segment that showed growth in 2021 in the UK was Mobile with 8.1% up compared to 2020.

-

Games revenue are higher than Music (£1.6B) and Movies (£3.7B) sectors.

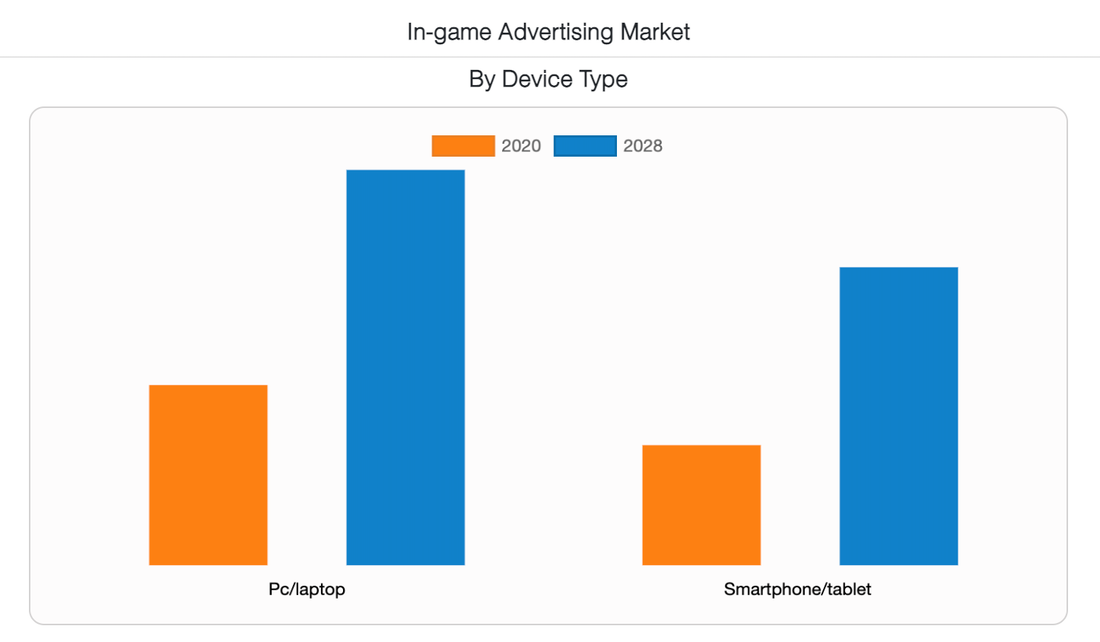

Research Dive: By 2028 the gaming ads market will reach $14B

-

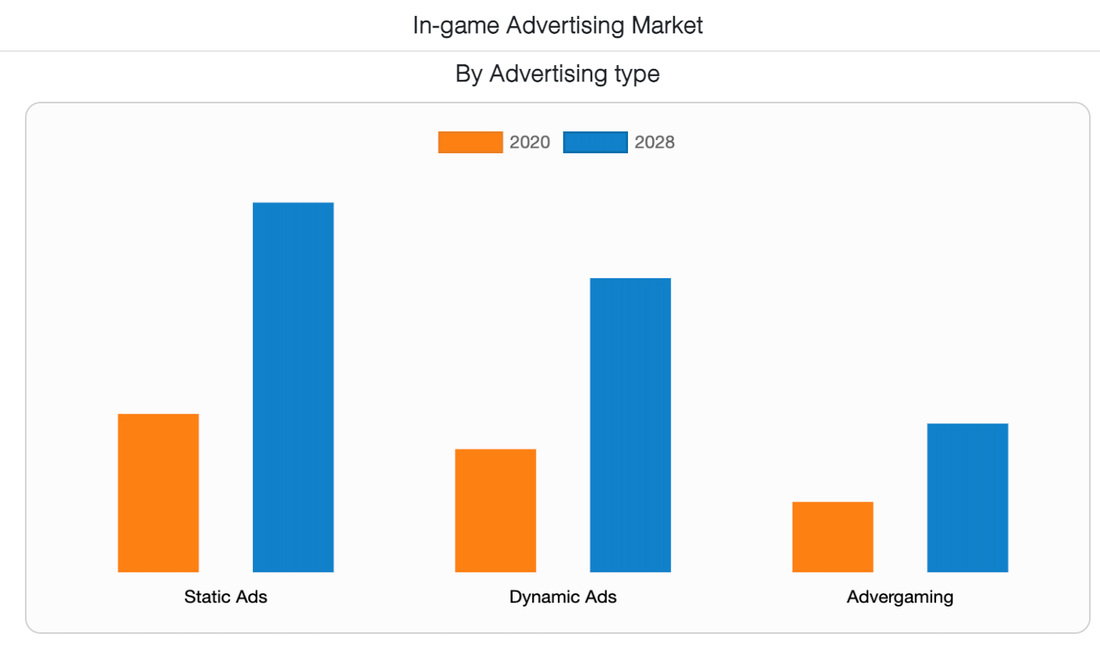

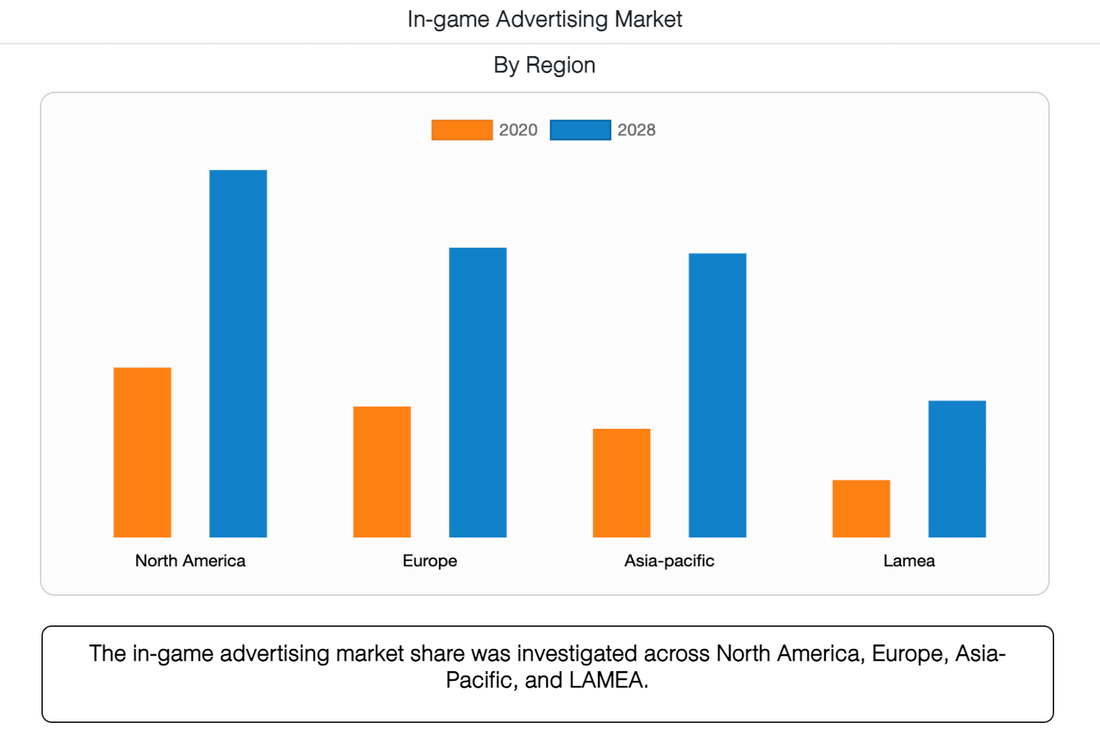

CAGR by 2028 will be about 11.2%, based on experts’ assumptions.

-

Analytics are foretelling, that the highest growth will show the Static Ads segment. By Research Dive classification, this is a category of in-game native ads, like Anzu is doing.

- Ten largest players of the segment by Research Dive: Alphabet, RapidFire, MediaSpike, Electronic Arts, IronSource, Motive Interactive, Blizzard Entertainment, Playwire, WPP, Anzu.

However, there are some questions to the research:

-

Why there are EA & Blizzard Entertainment in line with Alphabet & IronSource?

-

Where are AppLovin and Unity, the largest mobile ad companies?

So, I’d suggest taking the research with a grain of salt.

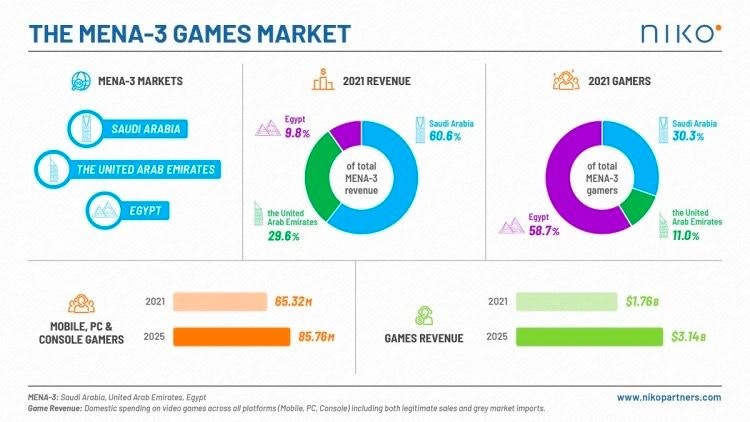

Niko Partners: Saudi Arabia, UAE and Egypt markets will reach $3,1B in 2025

-

In 2021, the Saudi Arabian market alone is valued at $1B. The cumulative valuation of the three top MENA markets is about $1,76B.

-

The number of players will increase from 65.3M to 85.76M.

-

More than half of MENA players are younger than 25 years.

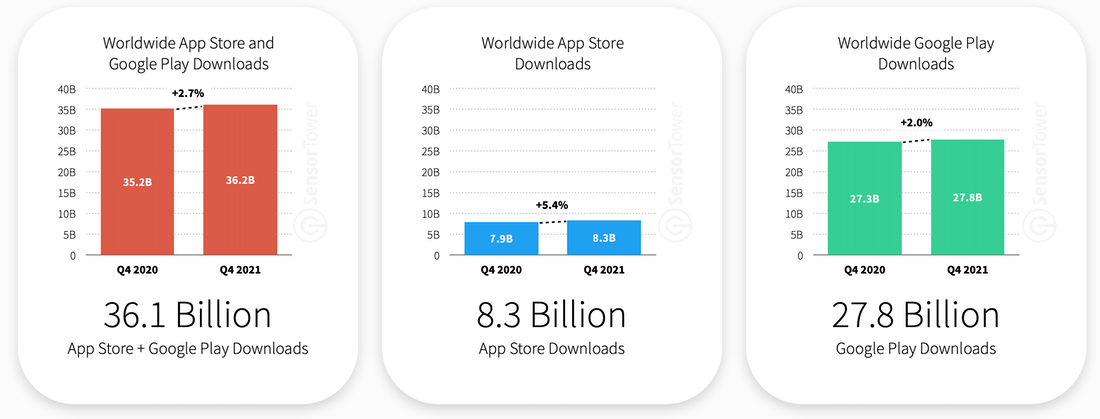

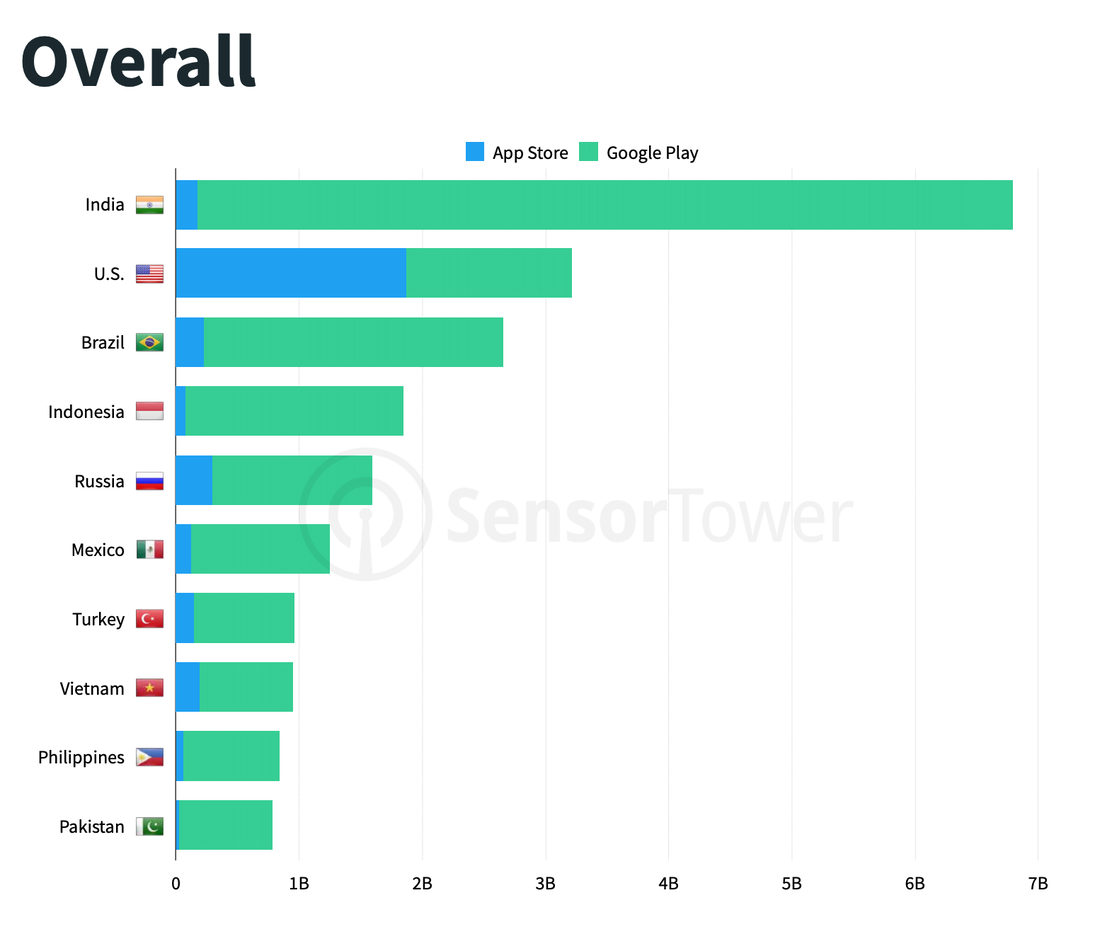

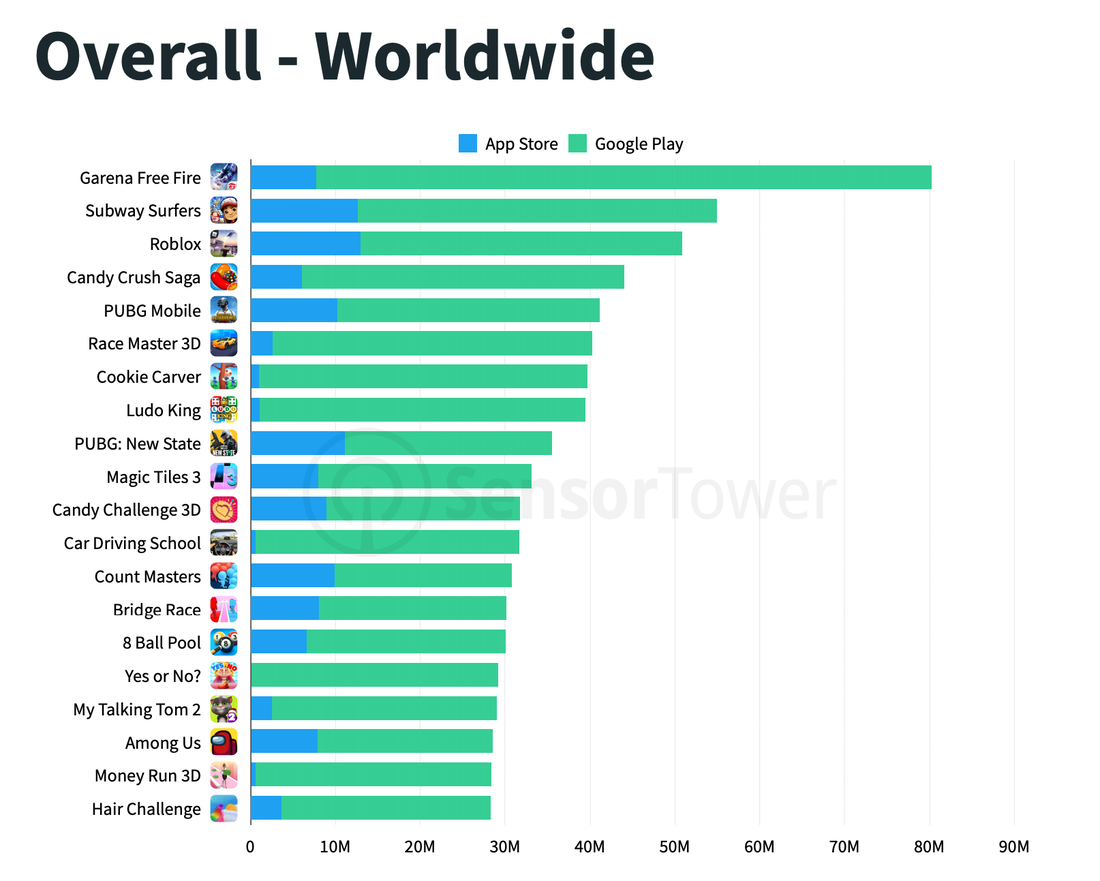

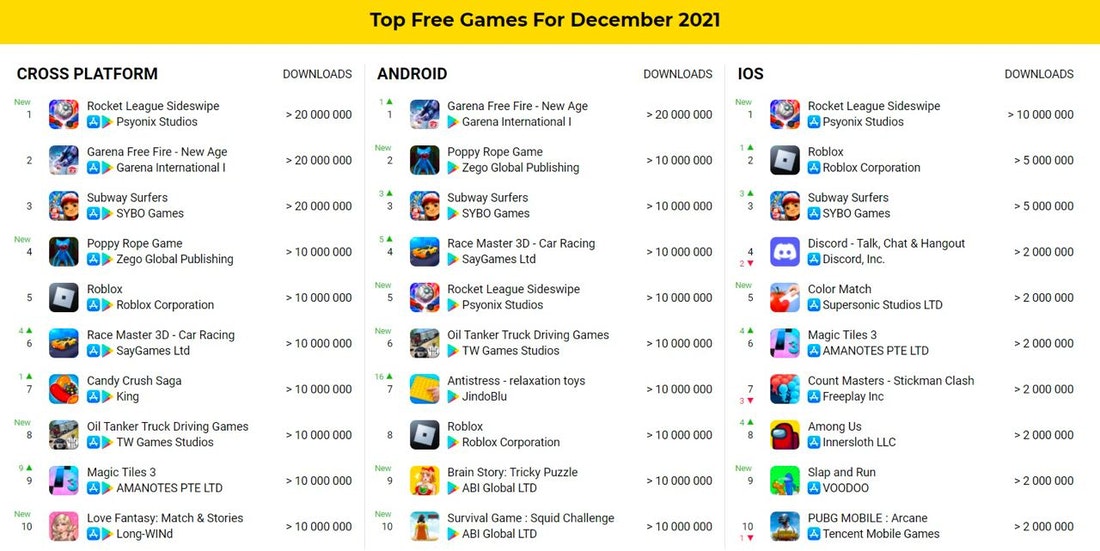

Sensor Tower: Mobile Industry Results in Q4 2021 by downloads

-

The overall amount of downloads increased from 35.2B in Q4 2020 to 36.2B in Q4 2021.

-

Games have been downloaded 13.87B times.

-

India (6.9B of downloads), the US (3.2B of downloads), and Brazil (2.7B of downloads) are leading charts. Russia is in 5th place and it’s the only country that showed positive YoY growth.

- Garena Free Fire had the second-best quarter in history. The game received more than 80M downloads.

-

There are 7 game companies among the top-10 mobile publishers. It’s AppLovin, Embracer Group, Say Games, Azur Interactive, Voodoo, OneSoft, and Supersonic Studios.

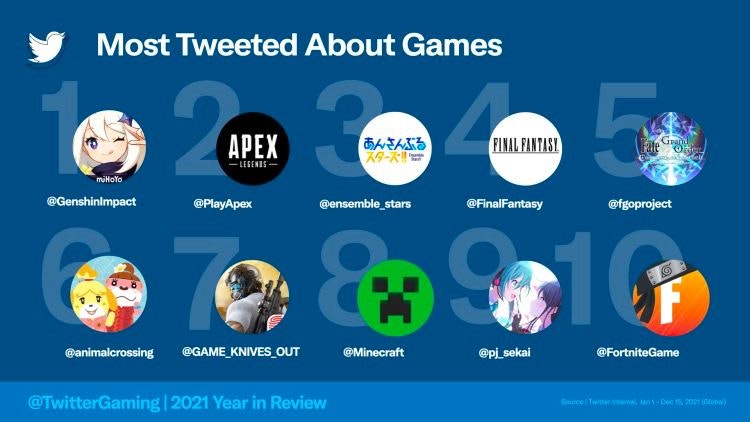

Twitter: Users have made more than 2.4B tweets about games in 2021

-

It’s 14% more than in 2020. But the most shocking results we’ll get if we compare 2021 results with 2017 - there is a 10x increase.

-

Genshin Impact, Apex Legends, and Ensemble Stars are the most popular games on Twitter. It might be surprising for somebody, but Final Fantasy is in fourth place.

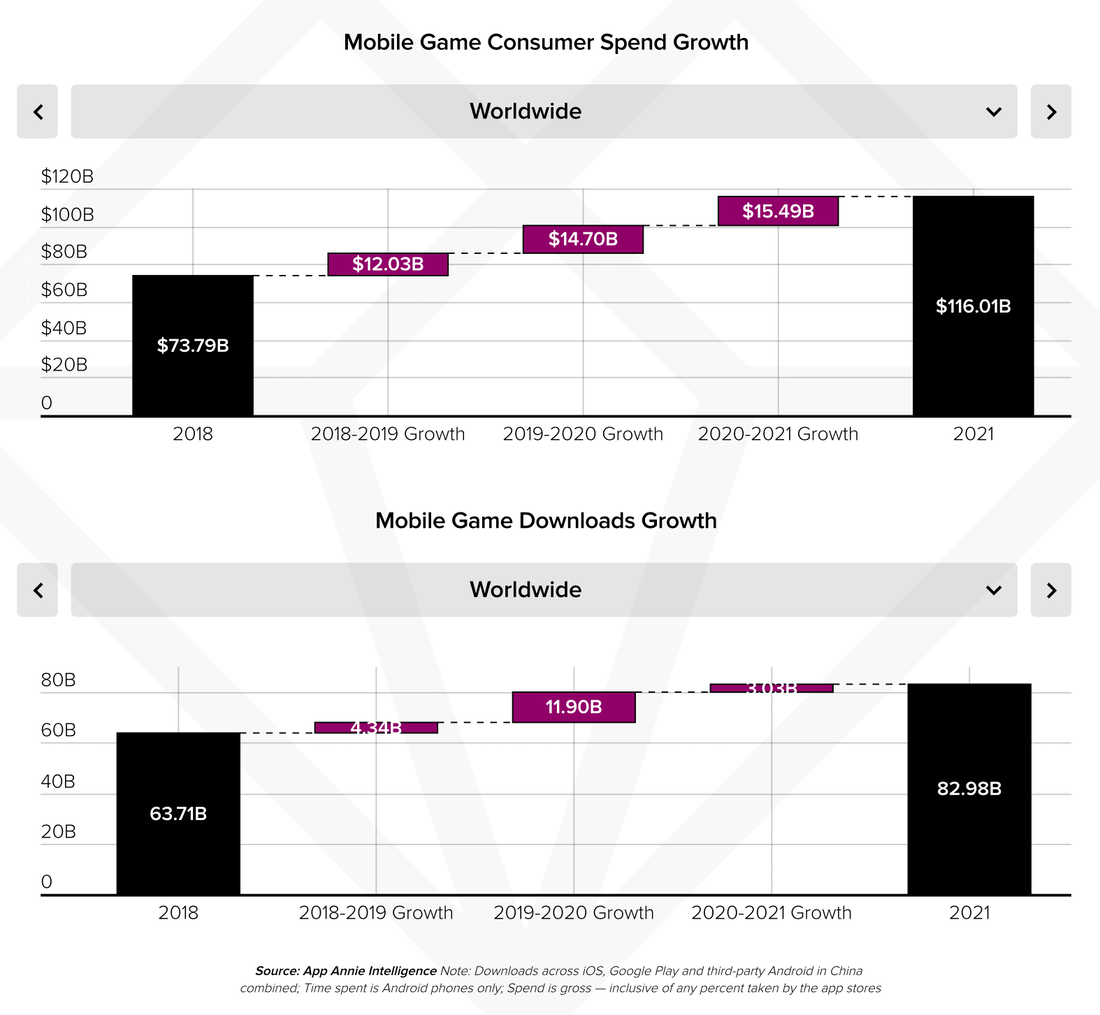

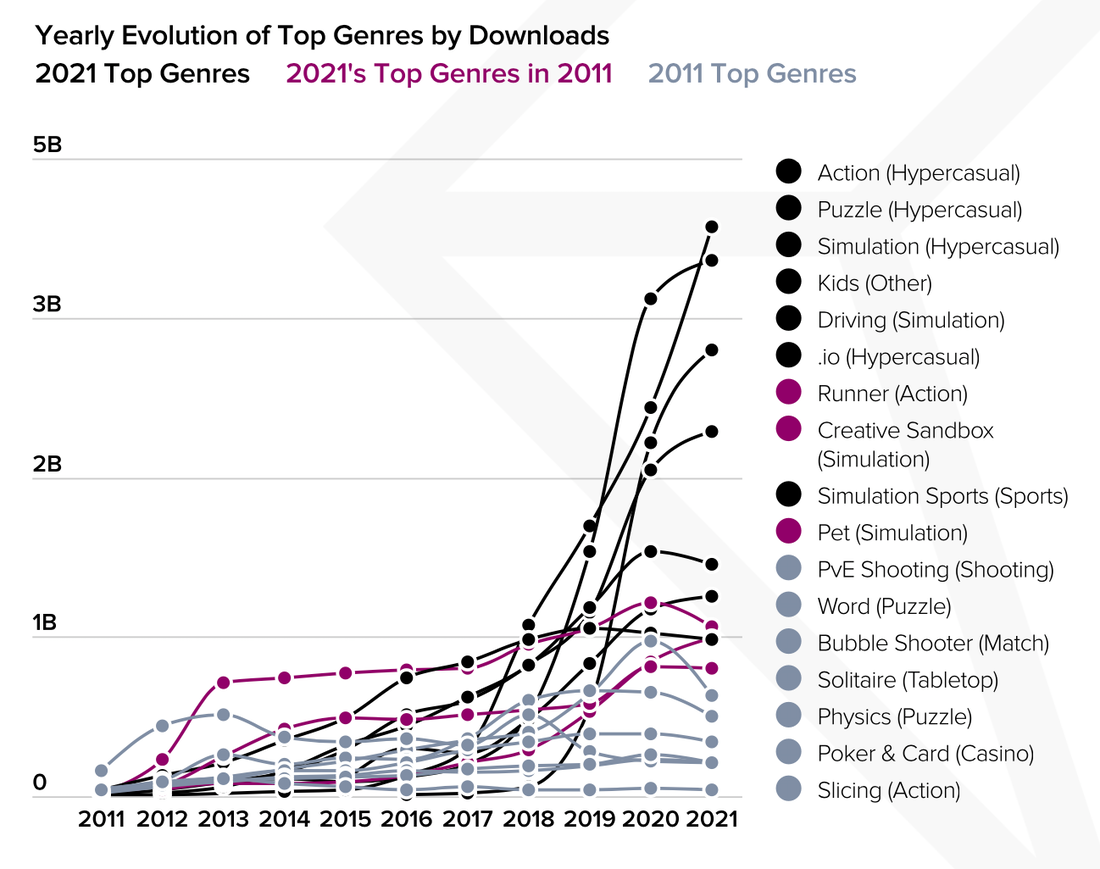

App Annie: Mobile Games earned $116.01B in 2021

-

In 2021 the mobile gaming market earned $15.49B more, than in 2020.

-

The number of downloads reached 82.98B. Plus 3.03B to the 2020 results.

-

Hypercasual titles are leading the top downloads charts. Interesting, that the Racing Simulation genre is in 5th place by downloads with 1.63B installs.

-

4X March Battle games are leaders by revenue. They earned $9.7B in 2021.

-

Battlers are played preliminary by males, while the Match 3 audience is mostly female. ROBLOX and the whole Creative Sandbox category have an ideal split of 50/50.

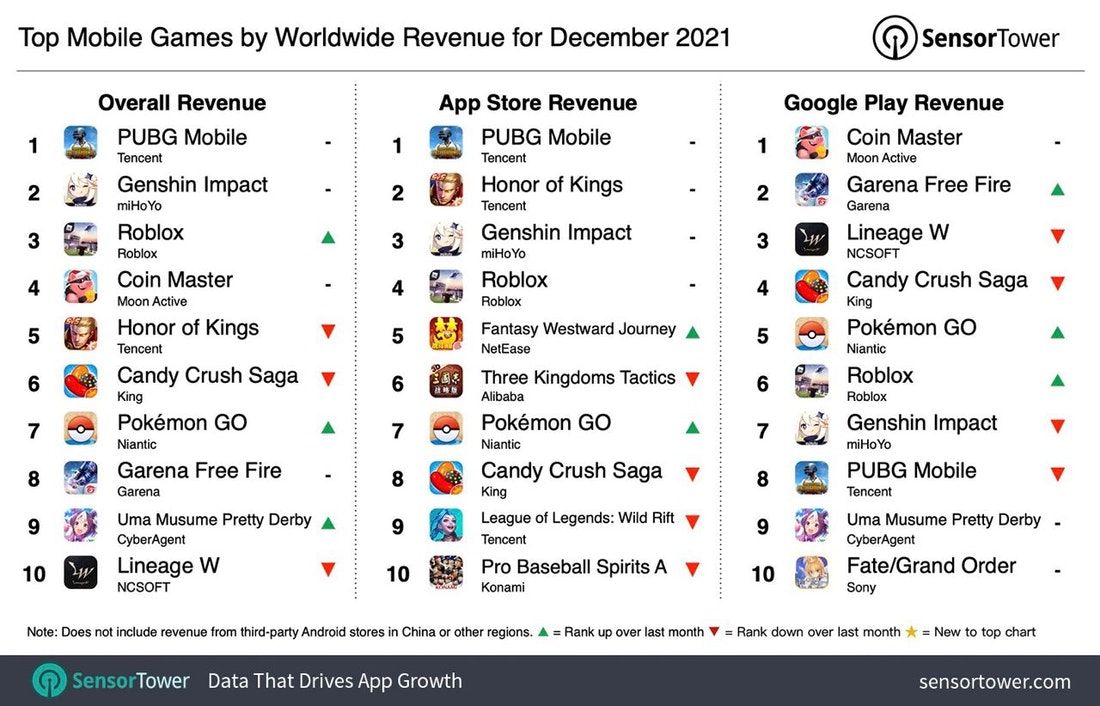

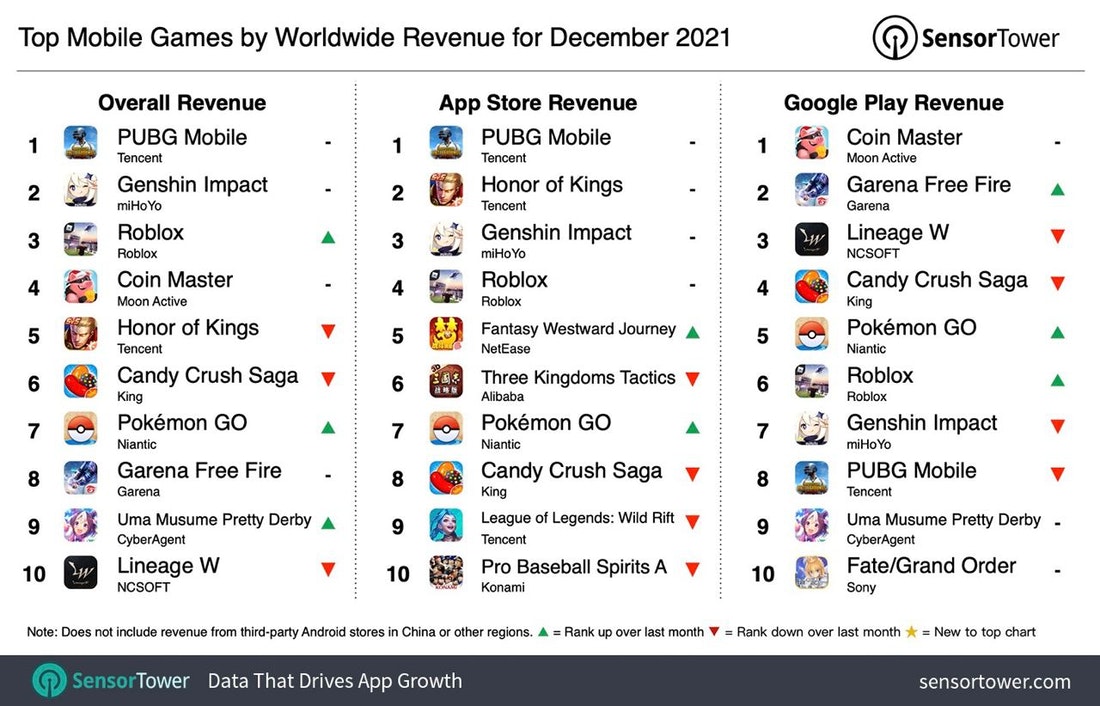

Sensor Tower: Top Grossing Mobile Games in December 2021

-

PUBG Mobile in December 2021 received $244M revenue. It’s 36.7% higher than a year before. 68.3% of the revenue came from China, 6.8% - from the US, another 5.5% - from Turkey.

-

Genshin Impact had a nice month too with $134.3M revenue. 28% of this sum belongs to China, 23.4% to the US.

-

In December users spent on games $7.4B. It’s 2% less, compared to December 2020.

-

The top market by revenue was the US ($2.2B; 29.6% of overall revenue); Japan got second place (20.3% of revenue), China is third (15.7% of revenue). But Sensor Tower is not tracking the alternative Android Stores, so Chinese numbers, in reality, are higher.

Apple: App Store earned $60B in 2021

-

Lifetime revenue for App Store is $260B. The result of this year is a new record.

-

Games, based on Daniel Akhmad's data, are responsible for not less than 60% of $60B. So, it’s $36B at least.

-

Apple named this holiday season the most successful in history and highlighted, that it was two times more successful than in 2020. 2020 holidays brought the company $1.8B, so in 2021 it must be $3.6B.

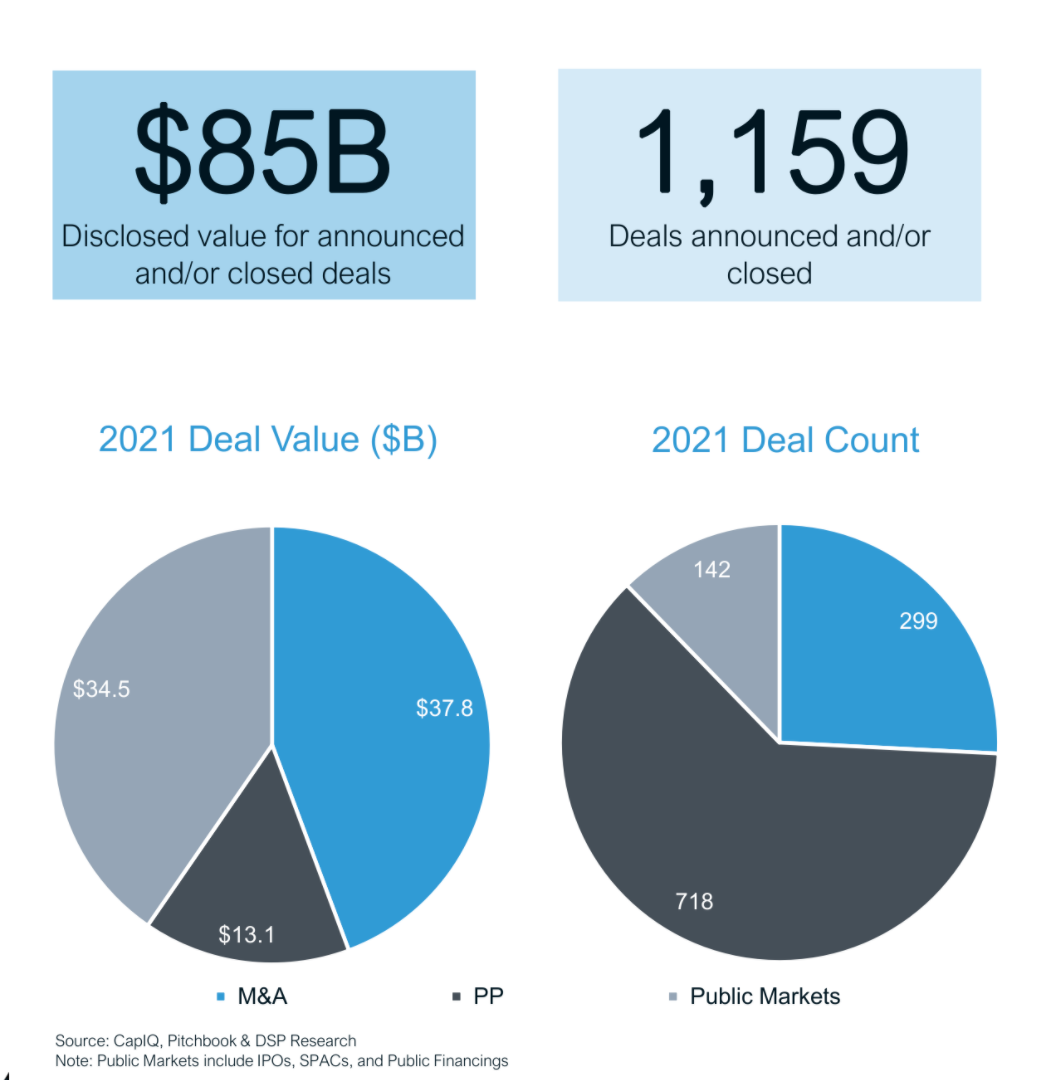

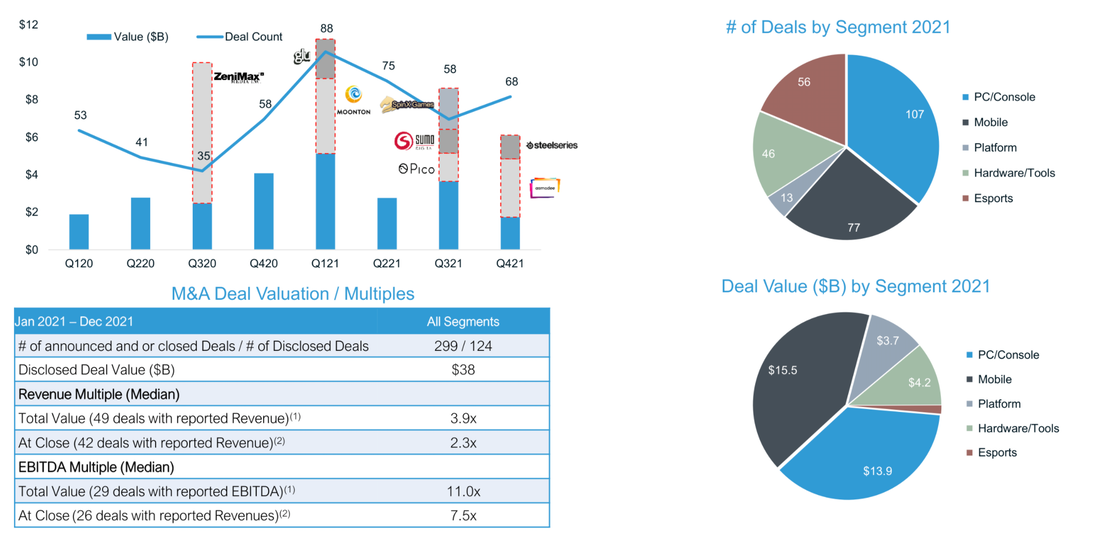

Drake Star: 1,159 gaming deals happened in 2021

-

The volume of deals exceeded $85B. $37.8B came from M&A activity. Another $34.5 - from Public Markets. The rest $13.1B - from PP.

-

Out of 1,159 deals, 718 were PP, 299 - M&A, and 142 - Public Markets.

-

It’s interesting, that most M&A deals happened in the PC\Console segment - 107. The volume is valued at $13.9B, which is just a little bit lower, than Mobile M&A 2021 valuation ($15.5B).

AppMagic: Top Mobile Games Downloads & Revenue in December 2021

Downloads

-

Rocket League Sideswipe (mobile version of Rocket League) reached first place with 25.7M of installs.

-

The most downloaded Android game was Garena Free Fire - 22M of downloads. Generally, the game got 24.8M new users in December.

-

Have a look at Poppy Rope Game. The game was downloaded 19.7M times in December - only on Google Play. It’s 4th place by downloads overall, which is crazy, given the quality of the product.

Revenue

-

PUBG Mobile is in the first place with $186.7M of revenue.

-

Lineage W performing great on Android. In December revenue from this platform alone was $81.7M.

GameAnalytics: 7 things to expect in 2022

-

AR games will grow. GA specialists think that recent Niantic investments will help with it.

-

Metaverse hype will slow down.

-

NFT will stay, but the technology needs a killer app. Currently, an ordinary gamer just can’t jump into blockchain gaming.

-

Privacy control will cause more restrictions. There is a high probability, that Google will show its own privacy-related solution similar to what Apple did in 2021.

-

There will be more social features in games.

-

More real-life brands will turn their faces to games.

-

Header-bidding will kill the Waterfall model in marketing.

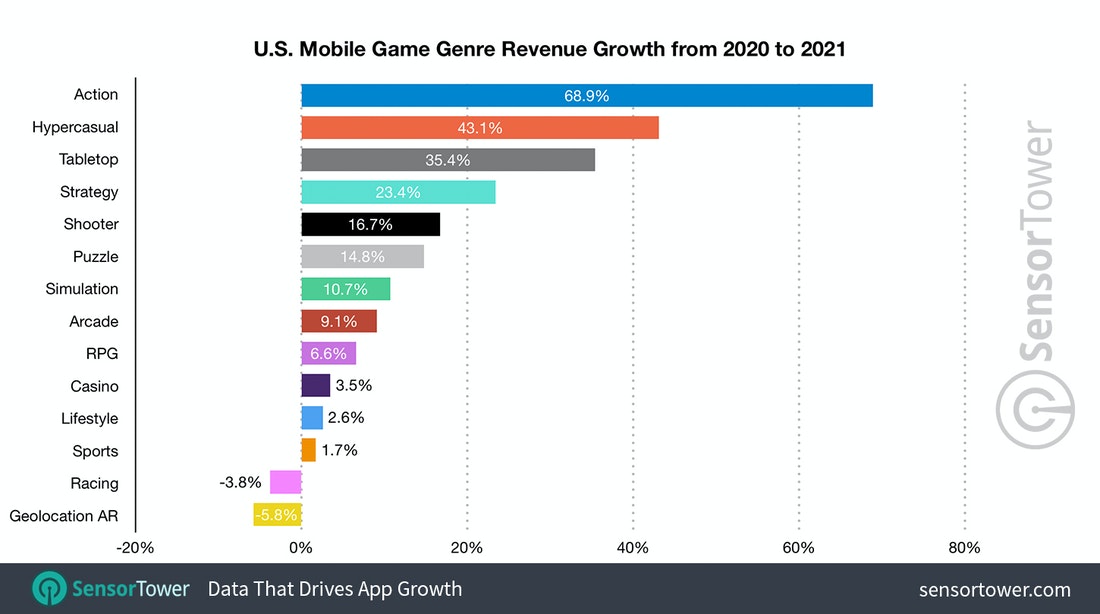

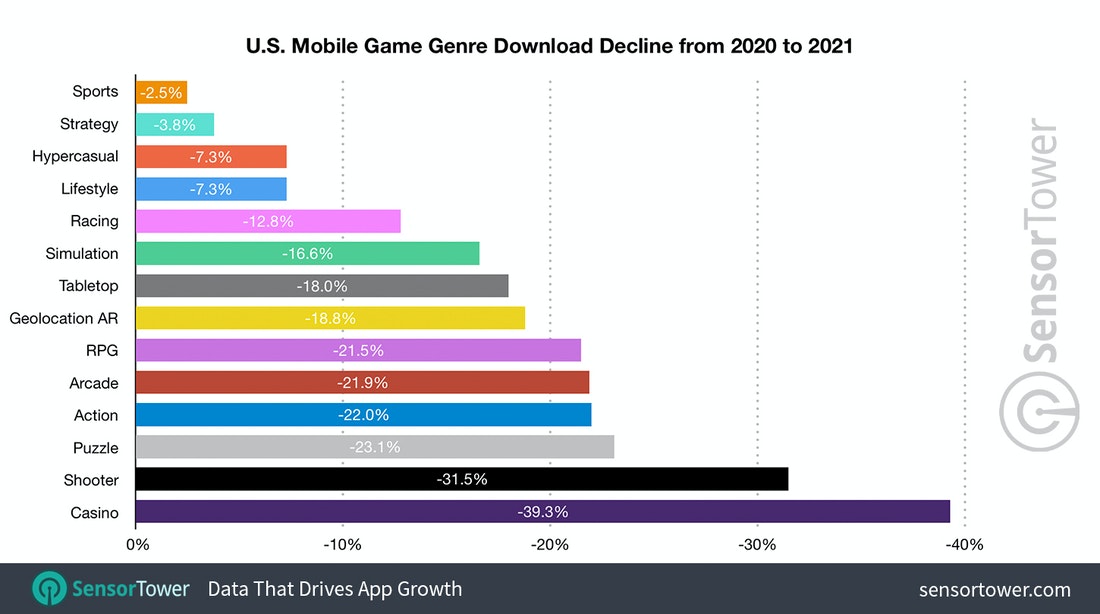

Sensor Tower: Mobile Action games in the US grew by 69% thanks to Genshin Impact

-

The genre revenue in the US reached $966.8M. It’s 68.9% higher than last year.

-

Growth dynamics is highest among all genres in the US last year.

-

The largest subgenre of Action game was Open World Adventure, which earned $418.3M and showed 3.5x times growth to 2020. However, the main game of this sub-genre is Genshin Impact, which revenue in 2021 in the US was $406.3M.

-

The second place by genres revenue growth belongs to Hypercasual titles. They grew by 43.1% (+$111M). Third place is owned by the Tabletop genre (+35.4% - $772.5M overall).

-

The puzzle genre become the top in terms of absolute revenues. The US users spent $5.1B in Puzzle games in 2021. Casino ($4.8B) and Strategy games ($4.3B) are next.

-

All genres have seen a decline in downloads in the US in 2021, but sports games experienced the smallest one.

Newzoo: What to expect in 2022

GSD & GfK: Games, hardware, and accessory sales in the UK in 2021

-

35.8M games (in both digital and physical formats), 3.36M consoles, and 10.6M accessories were sold in the UK in 2021.

-

Nintendo Switch overpassed PS5 in terms of sales. In November-December, it had about half a million consoles sold, which helped it to reach the top. Consoles sales in the UK in 2021 increased by 14% compared to 2020.

-

Software sales went down by 16% compared to 2020. But it showed 38% growth if we are talking about 2019. 20.5M copies were bought in digital format, 15.3M - in physical. And the digital share is gradually growing.

-

FIFA 22 was the most popular game in the UK in 2021. Third place is well-deserved by GTA V - even almost 9 years after launch.

-

Accessory sales decreased by 6%, reaching 10.6M. The top-selling accessory was DualSense.

NPD: The US Gaming market earned $60.4B in 2021

-

The new record is settled. It’s 8% more than in 2020.

-

Software (games, DLC, in-game purchases, subscriptions) revenue was $51.7B or 85% of the overall amount. Growth to the previous year - 7%.

-

Call of Duty: Vanguard became the top seller in the US. It’s 13 consecutive year when the Call of Duty game is leading the chart.

-

Marvel’s Spider-Man: Miles Morales webbed to the best exclusive selling game on PlayStation. Pokemon: Brilliant Diamond and Shining Pearl leading Nintendo exclusive charts. Forza Horizon 5 joins the company on Microsoft systems.

-

Consoles sales increased by 14% and reached $6B.

-

Audience spending on accessories didn’t grow dramatically - by 2% only - and reached $2.7B.

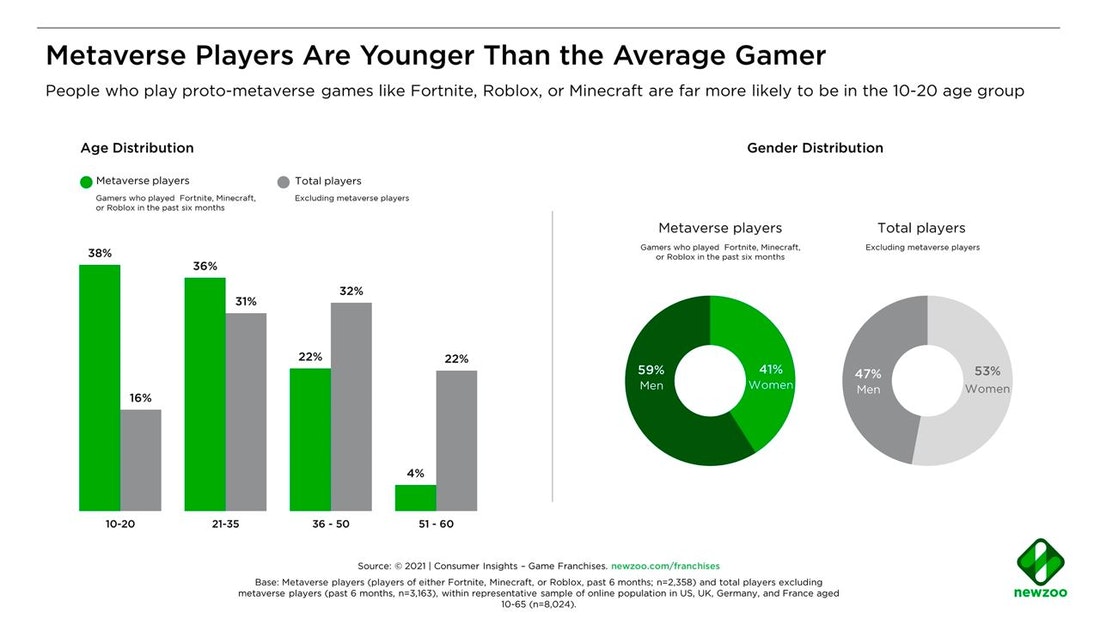

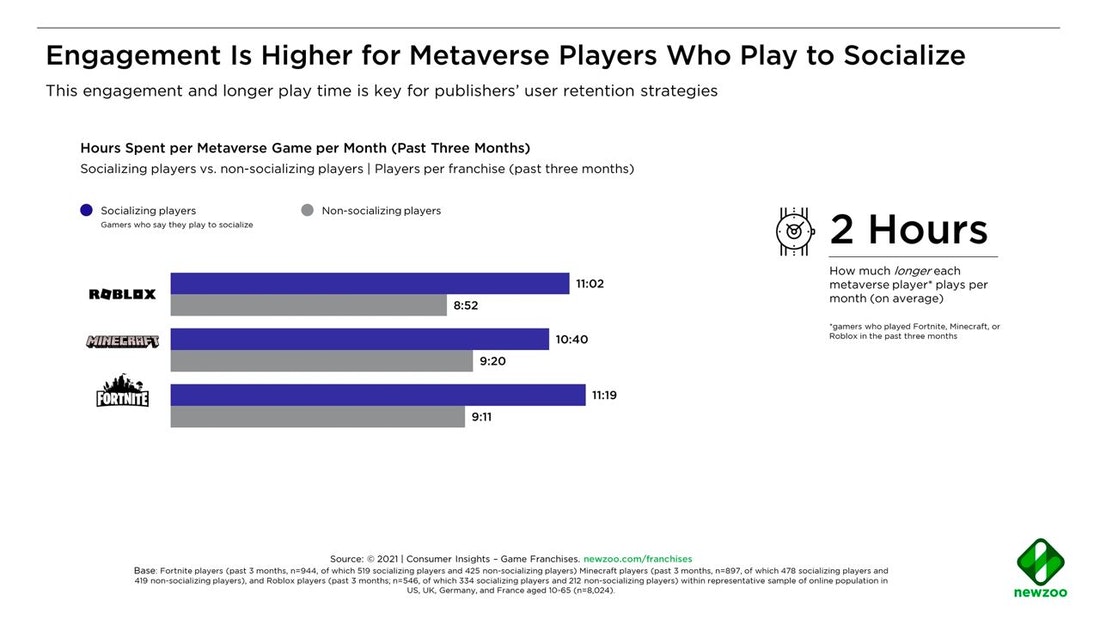

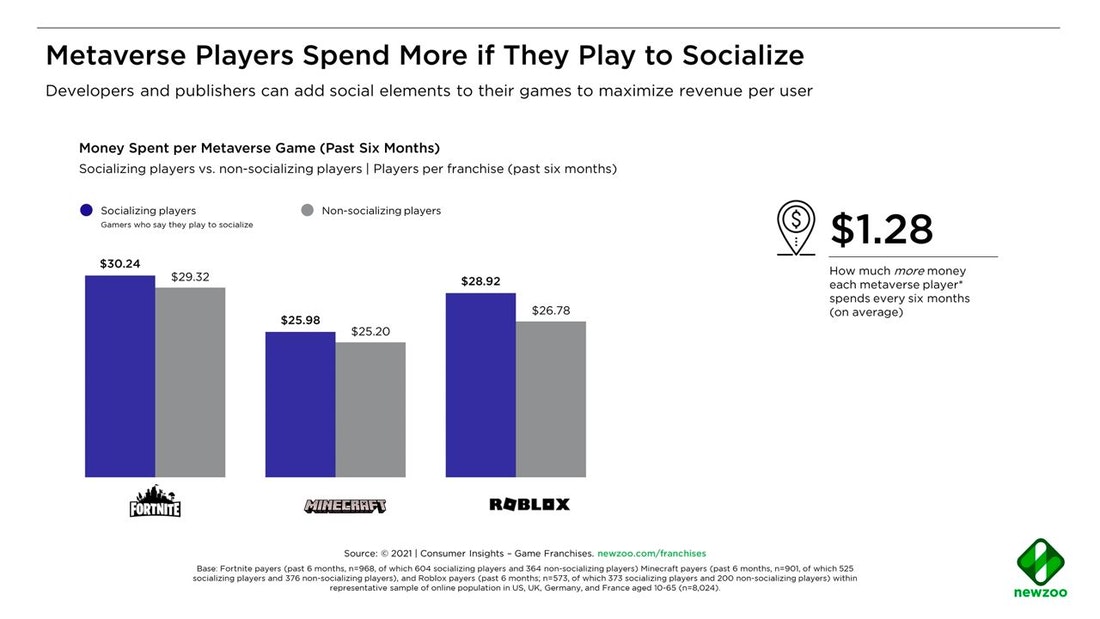

Newzoo: Who is playing Metaverses?

-

Metaverse players are much younger than the average gamer. 27 years vs. 38.

-

More than a half (59%) users mentioned, that they’re playing Metaverse games (Roblox, Fortnite, Minecraft) to socialize.

-

On average, users are spending around 11 hours per month in Metaverses.

-

Socialization-driven users are paying more - by 10%.

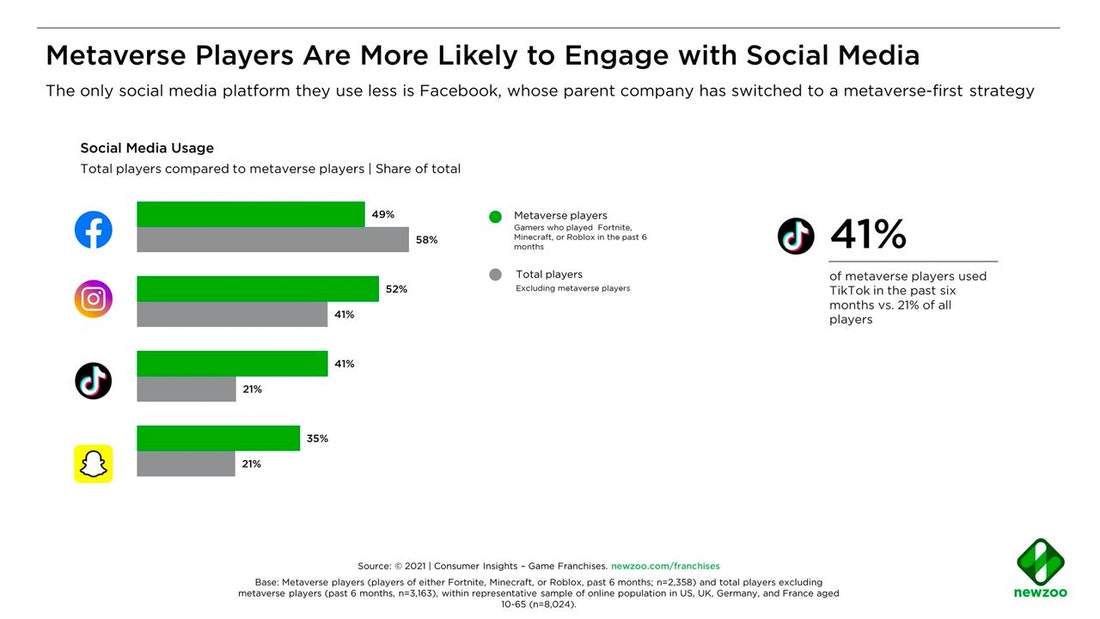

-

Metaverse players are spending less time on Facebook, but much more on other social networks - Instagram, Snap, and, of course, TikTok.

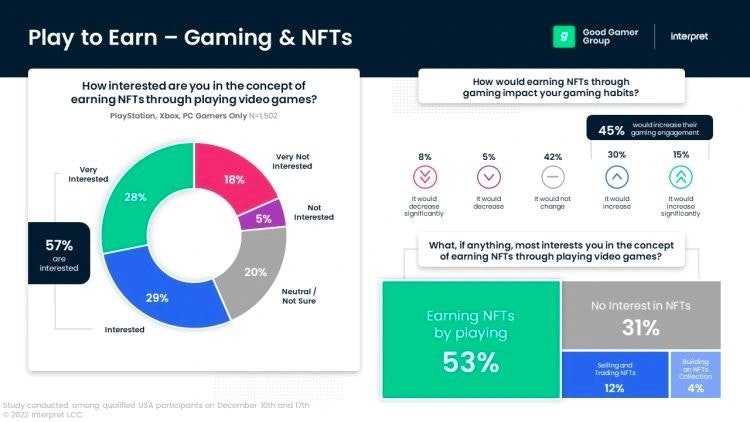

Interpet: 57% of players are interested in NFTs

-

A survey of 1,500 players on PC and Console showed, that the majority will be interested in collecting, buying, and selling in-game items for real money.

-

45% of respondents mentioned, that it will force them to spend more time playing games.

App Annie: Taiwan & Hong Kong markets overview

-

Taiwan is #6 in the global country top by revenue. In Q4 2021 users in this country have spent $597M on mobile games. Hong Kong is #12 with $193M revenue in the same period.

- MMORPG is the most popular genre in Taiwan by downloads. However, during the last year, its downloads went down by 27%. In Hong Kong, the first place reserved by hypercasual action games, downloads increased by 37% during last year.

-

As for the revenue, MMORPG is the top-grossing genre in both countries.

-

Among the most popular games in Taiwan, Harry Potter Magic Awakened has the best Retention metrics. D1 - 52.54%; D7 - 26.04%; D14 - 19.82%.

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.