devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the March and April reports.

Table of Content

- StreamHatchet: Video Games Streaming Market in Q1 2022

- AppMagic: Top Mobile Games by Revenue & Downloads in April 2022

- Sensor Tower: Genshin Impact passed the $3B Revenue plank on mobile devices

- Newzoo: Global Gaming Market will surpass $200B in 2022 - for the first tme in history

- Newzoo: Gaming Live Streaming Audience will reach 1.4B users in 2025

- Omdia: Consumers' awareness of Cloud Gaming increased, but it didn't help sales

- Tenjin & GameAnalytics: The Best Ad Networks for Hypercasual Titles and Retention benchmarks

- GfK & GSD: Lego Star Wars: The Skywalker Saga tops UK charts in April

- Sensor Tower: Mobile Gaming Market Revenue dropped for the first time in history

- Newzoo: 10 largest gaming companies generated 65% of overall revenue in 2021

- Gaming in Turkey: Turkish Gaming Market reached $1.2B in 2021

- Sensor Tower: PUBG Mobile overpassed $8B in Revenue

- TIGA: The number of full-time employees in the UK increased by 25% in the last year and a half

- Xinhua: Mobile Games Revenue in China in Q1 2022 reached $9.13B

- Niko Partners: Government regulations won't prevent the Chinese gaming market from growth

- Newzoo & Pangle: Hypercasual games in 2021

- StreamElements & Rainmaker.gg: Streams views went down in April 2022

- data.ai: Weekly mobile games revenue in Eastern Europe went down by 40% since March

- data.ai: The gaming market will reach $222B in 2022

- Sensor Tower: Apex Legends Mobile earned $4.8M during the first week

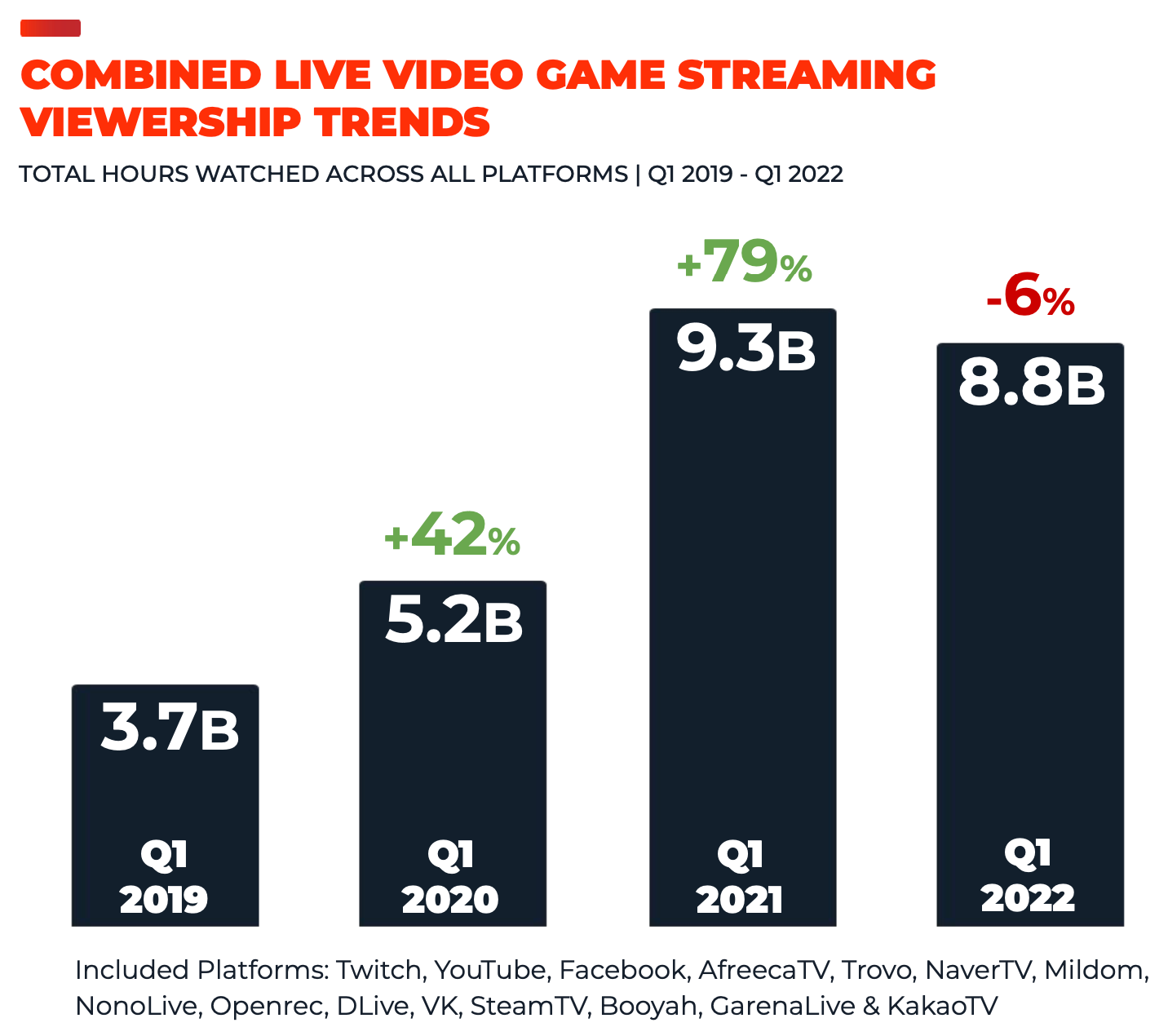

StreamHatchet: Video Games Streaming Market in Q1 2022

-

In Q1 2022 users watched 8.8B hours of gaming content. It’s 6% lower than a year before.

-

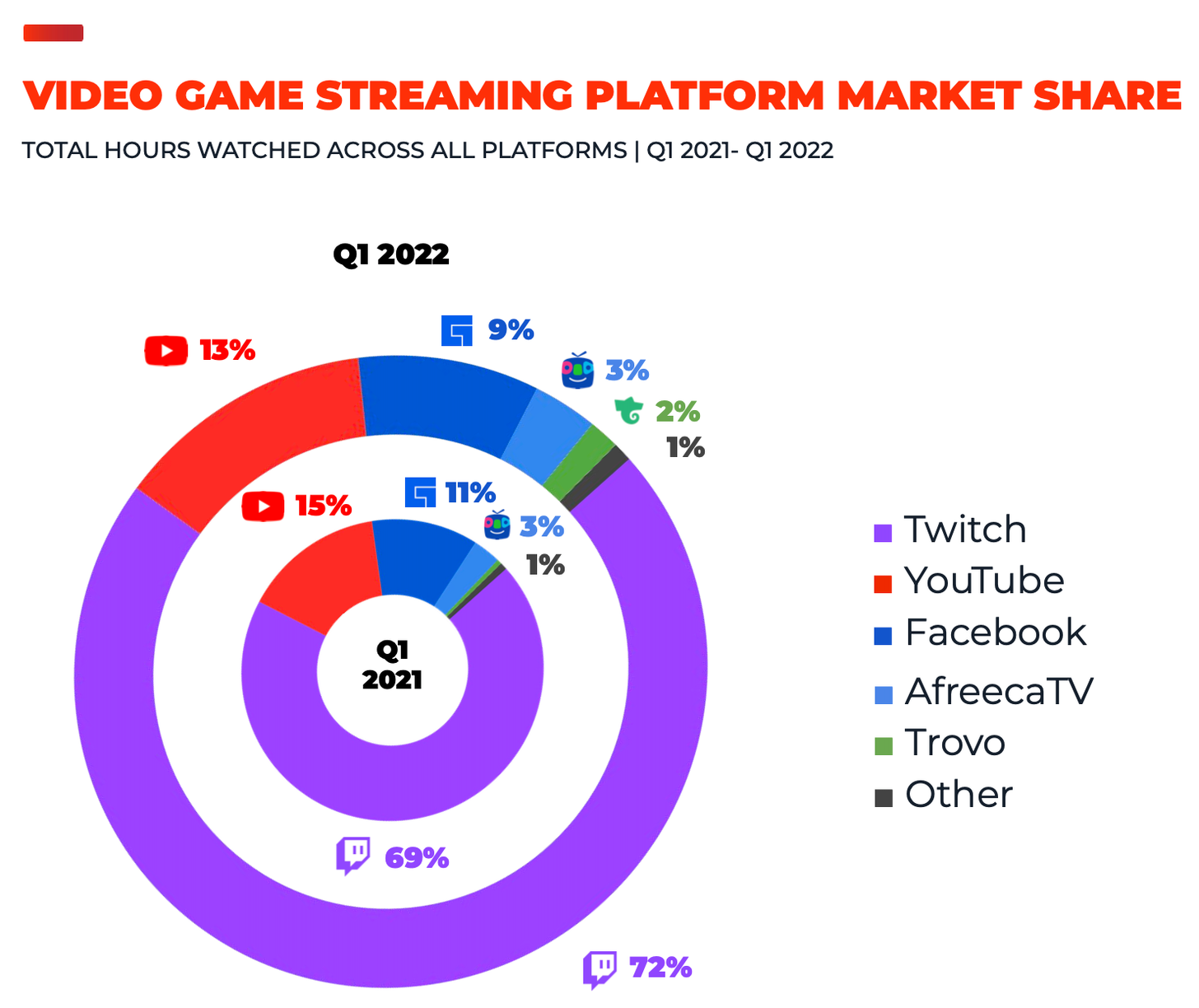

The Twitch market share in Q1 2022 reached 72%. A year before it was 69%. YouTube & Facebook Gaming experienced a decline - from 15% to 13% and from 11% to 9% respectively.

-

In Q1 2022 users watched 473M hours of E-Sports events. It’s a little bit smaller (-0.3%) than the year before.

-

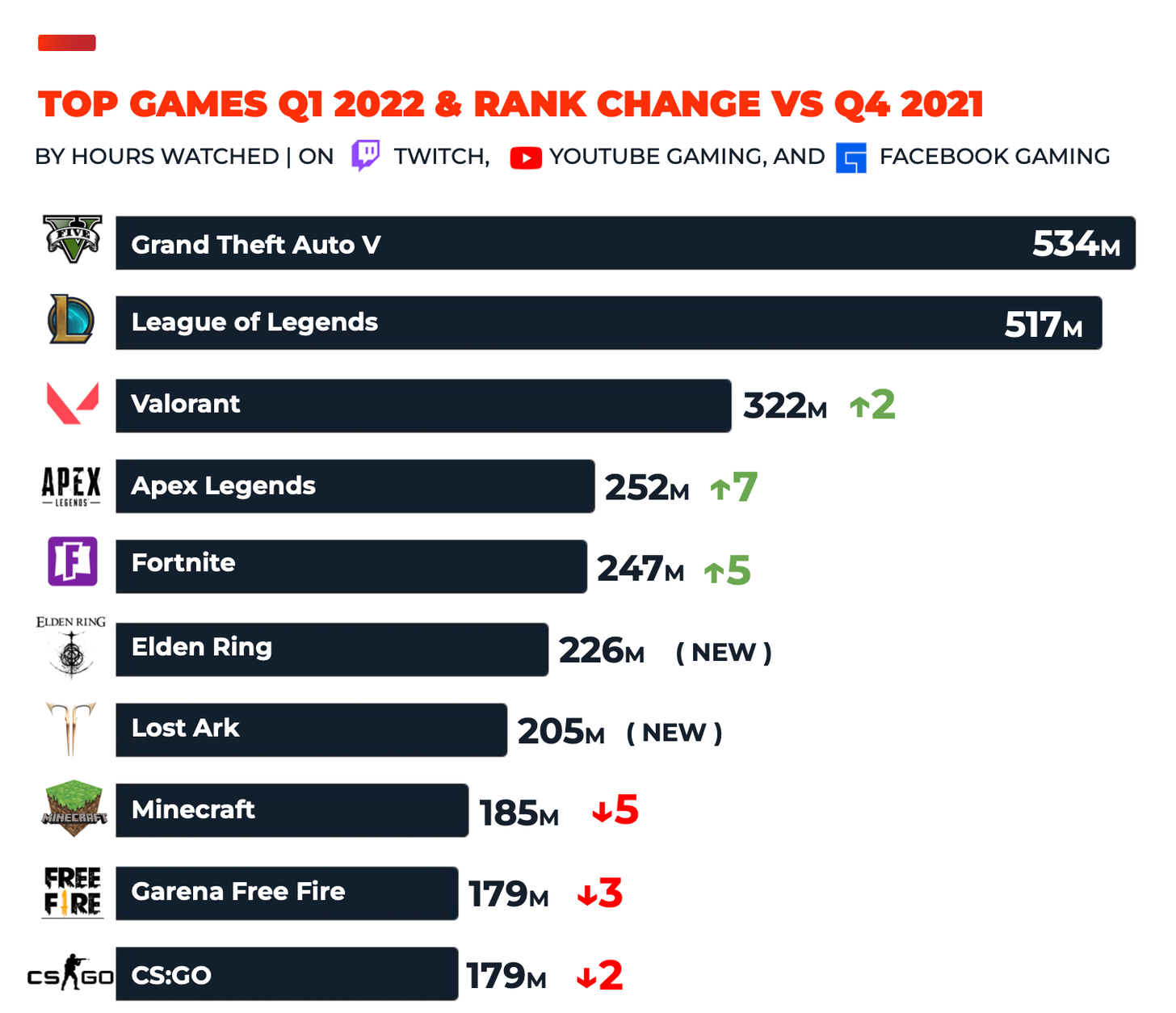

First place by hours watched in Q1 2022 won GTA V with 534M of hours. League of Legends & Valorant is next.

-

Elden Ring (226M hours watched) & Lost Ark (205M hours watched) entered the top for the first time.

-

7.75% of Twitch users (core audience) are generating 67% of all hours watched. On average, they’re spending 276M per day on streams.

AppMagic: Top Mobile Games by Revenue & Downloads in April 2022

Revenue:

-

Honor of Kings is on revenue top, traditionally.

-

Coin Master managed to reach first place by revenue on Android with $49M earned on this platform (with overall revenue of $72M).

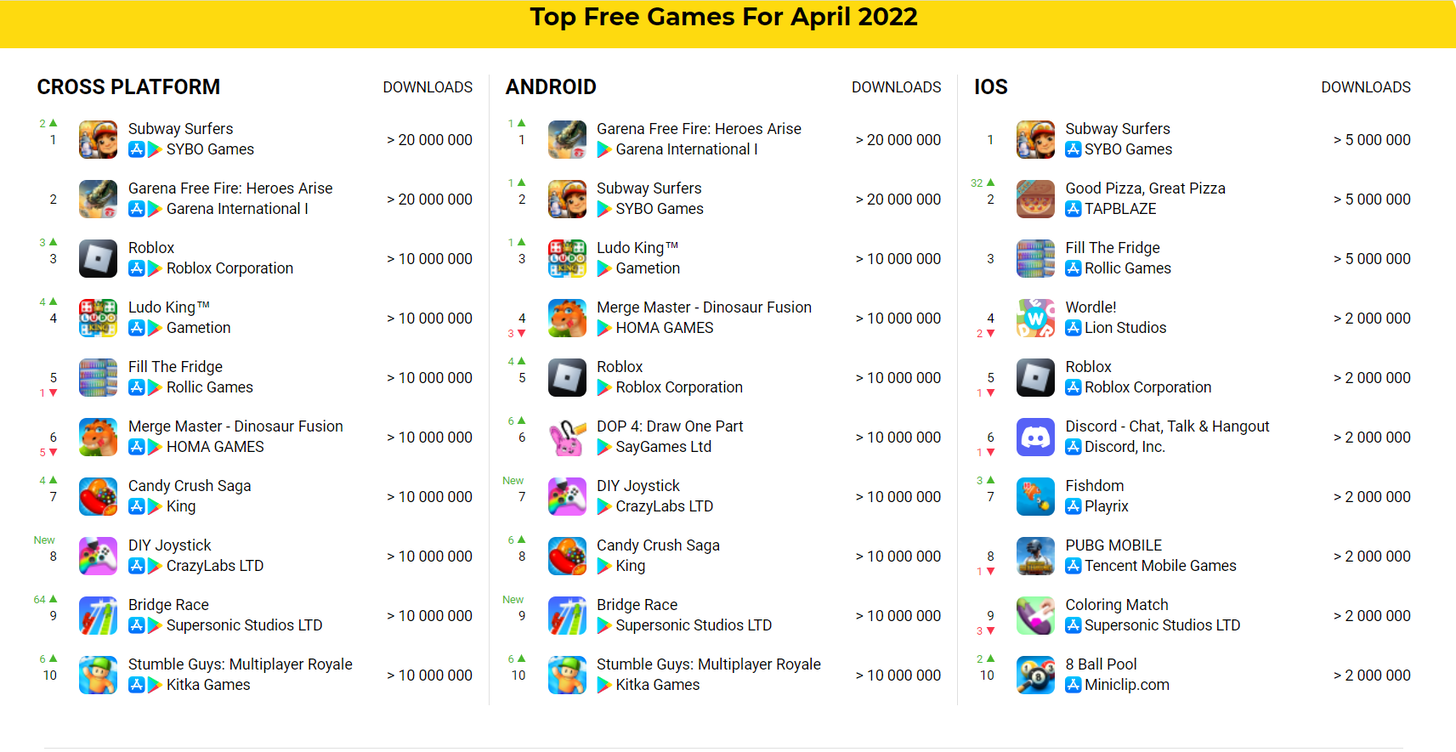

Downloads:

-

Subway Surfers is living its second youth - the game has been in downloads charts for several months. In April 2022 it was downloaded 28.5M times, from which 7.4M came from the App Store.

-

The first place on Android is occupied by Garena Free Fire: Heroes Arise. It has been downloaded in Google Play 23.3M times.

-

There are two new games in the April downloads chart. It's a DIY Joystick from Crazy Labs (13M downloads) and Bridge Race from Supersonic Studios (13M downloads).

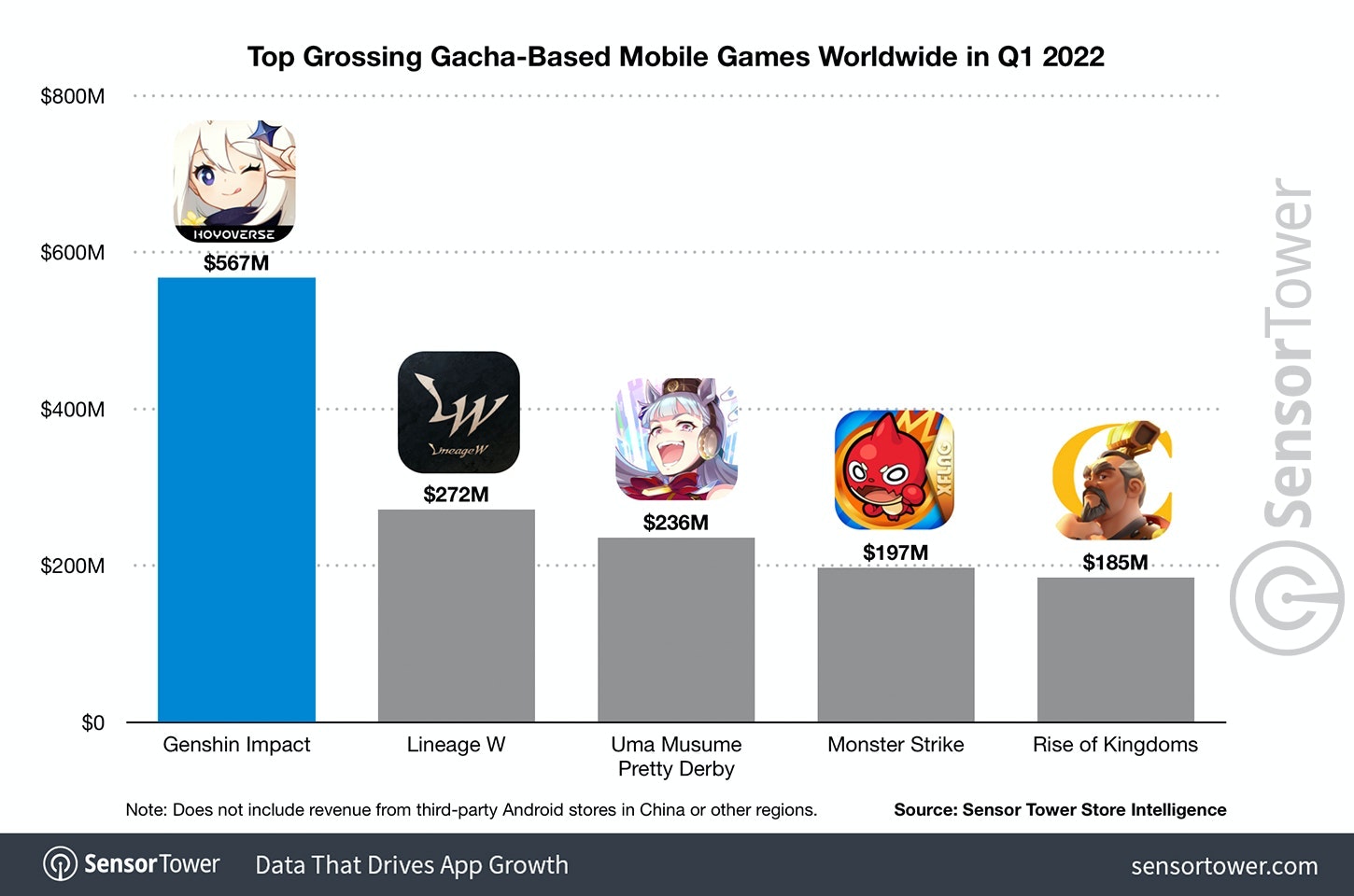

Sensor Tower: Genshin Impact passed the $3B Revenue plank on mobile devices

-

Genshin Impact was launched on 28 September 2020. This means that the game earns $1B every half a year.

-

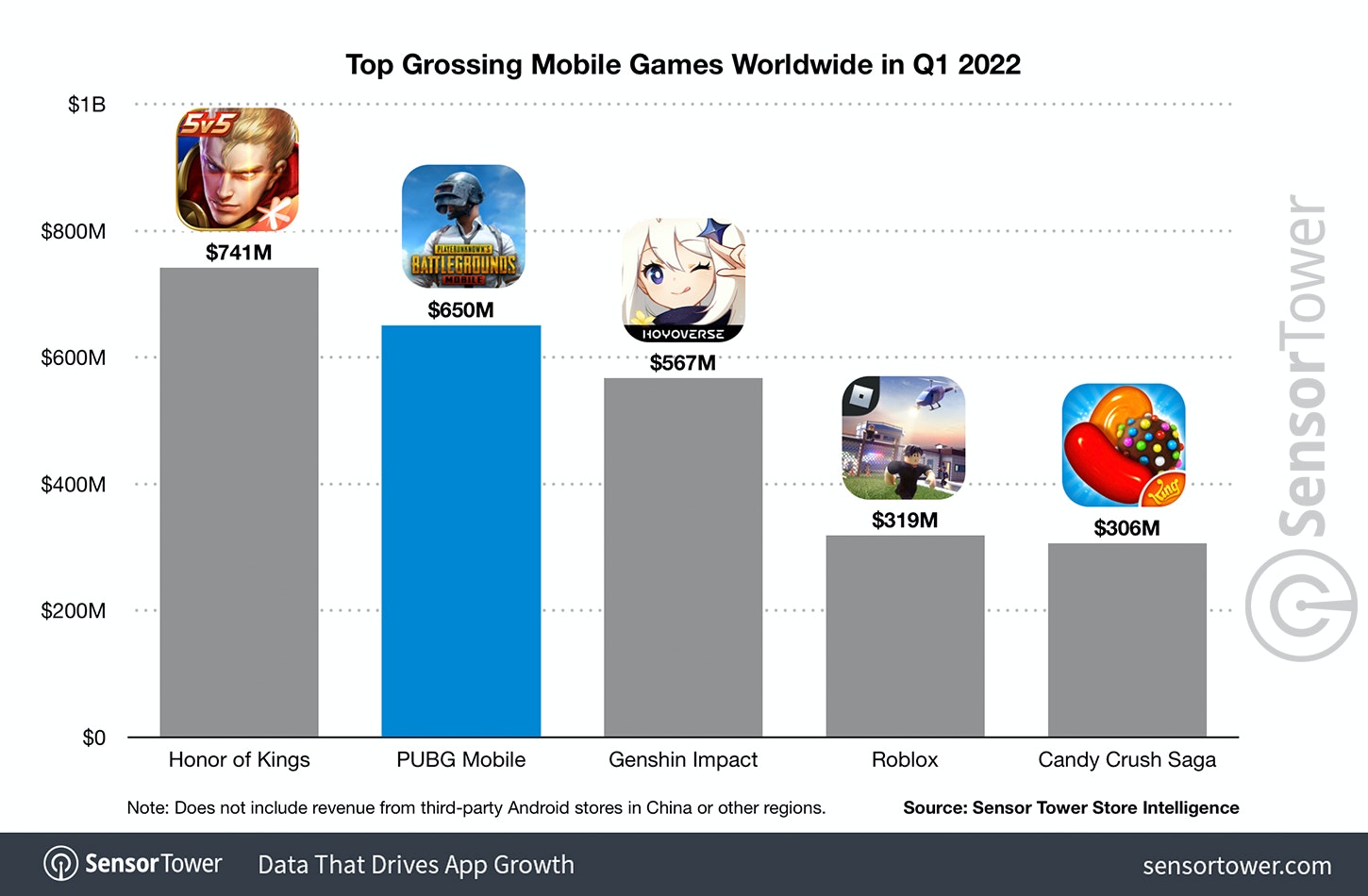

Genshin Impact is the most successful game among games with Gacha in Q1 2022. Genshin Impact earned $567M during this period, while the closest competitor - Lineage W - earned only $272M.

-

From the moment of launch, Genshin Impact is taking solid third place by overall revenue behind Honor of Kings & PUBG Mobile.

-

China is the main market for Genshin Impact, it’s responsible for 30.7% of revenue ($973.3M). And it’s only on iOS as Sensor Tower is not tracking alternative App Stores. Japan (23.7%), and the US (19,7%) are next.

-

About 70% of the overall Genshin Impact revenue comes from Asia.

-

App Store is responsible for 65.7% of overall revenue. But if we exclude China, the distribution is more equal - 50.5% on App Store and 49.5% on Google Play.

-

Genshin Impact’s MAU increased in Q1 2022 by 44%.

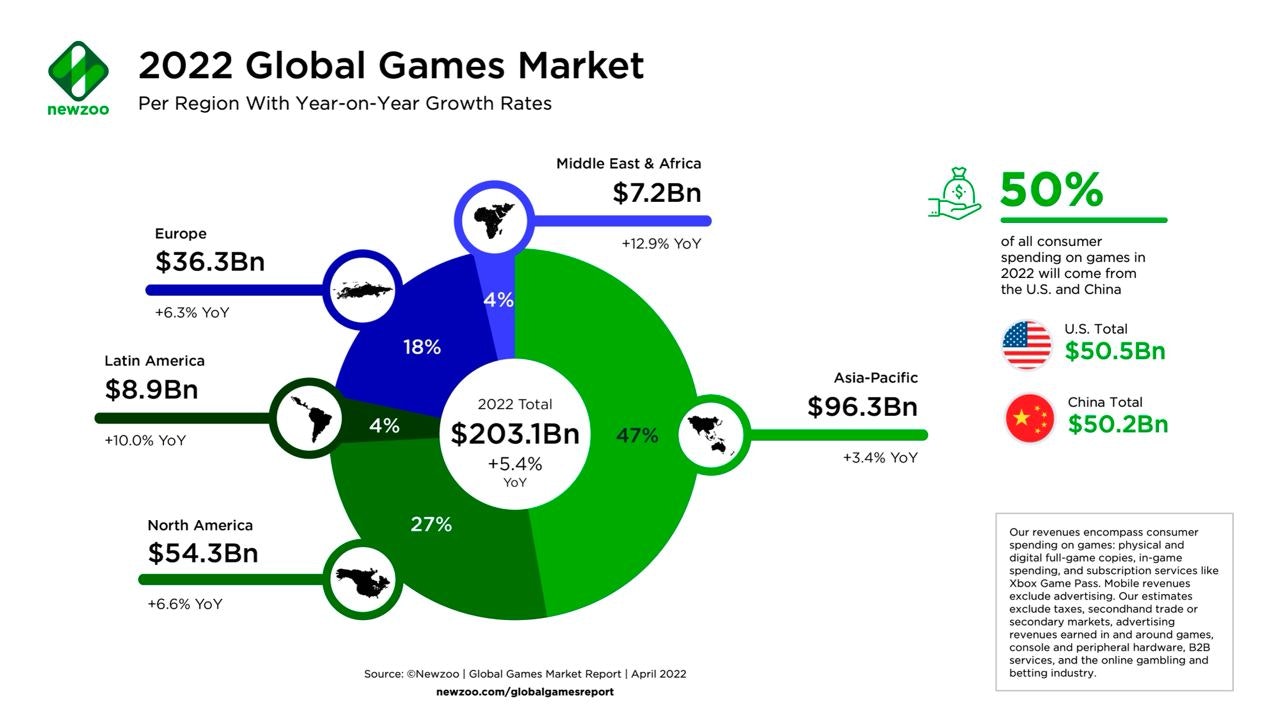

Newzoo: Global Gaming Market will surpass $200B in 2022 - for the first time in history

-

Newzoo forecasts that by the end of 2022 the global gaming market will reach $203.1B - 5.4% more than a year before.

-

The overall number of players will reach 3.09B by the end of the year.

-

The US ($50.5B) will overtake China ($50.2B) by revenue in 2022. It’s connected, mainly, to government regulations and the lack of new releases in China.

-

The market growth is slowing. Only emerging markets (LATAM, MENA) are showing double-digit percentages of growth.

-

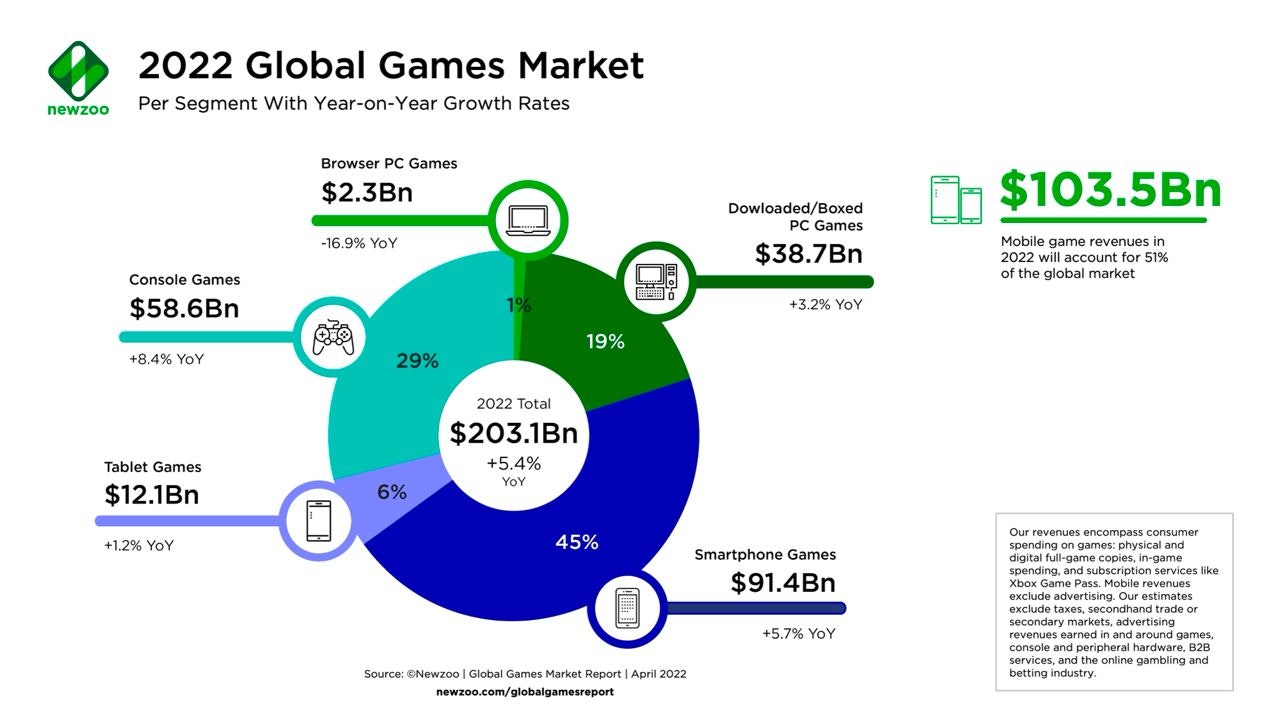

Mobile revenue in 2022 will reach $103.5B (+5.1% YoY) and for the first time in history will surpass the $100B plank.

-

Mobile market share, however, will decline from 52% in 2021 to 51% in 2022.

-

Developed mobile markets are showing a very small growth. China - by 2.8%; Japan - by 1.1%.

-

The console market revenue in 2022 will reach $56.9B, showing 8.4% growth YoY.

-

The PC market will grow by 1.9% and result in $41B of revenue. Browser games will continue to surge, while PC games sales will increase by 3.2%.

-

The Chinese PC market will go down in 2022.

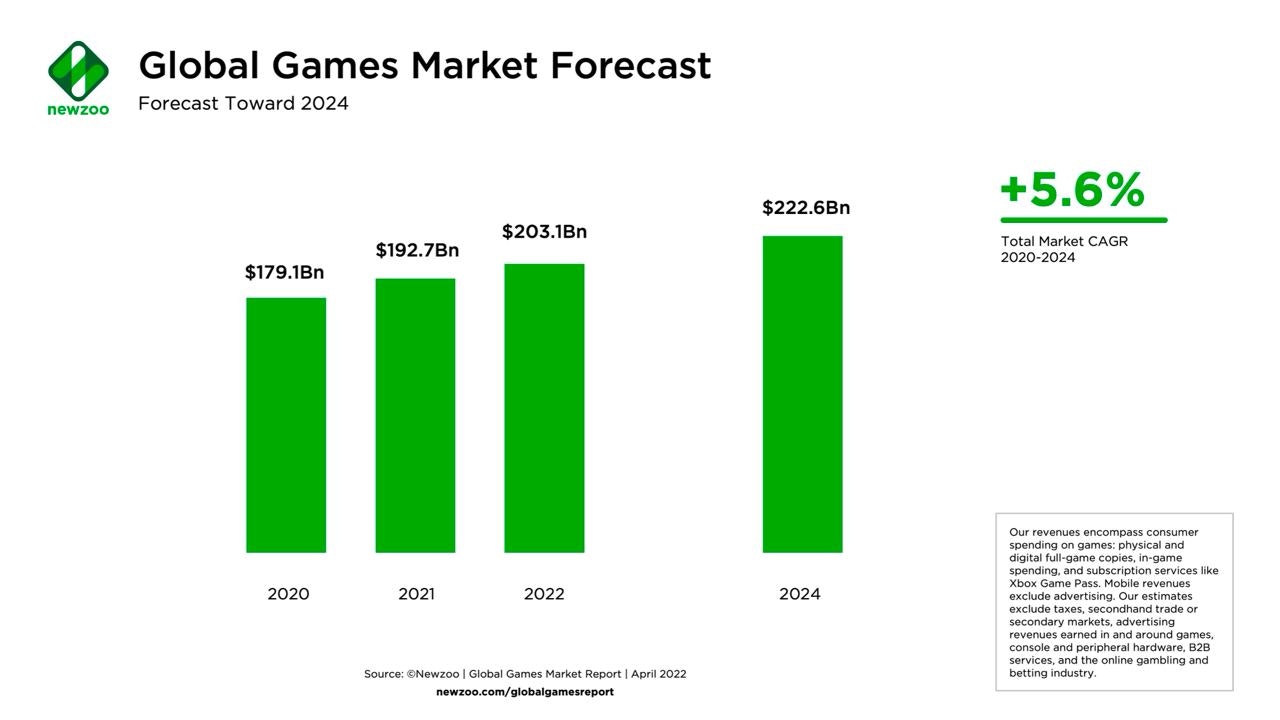

By 2024 the gaming market will reach $222.6B with a 5.6% CAGR 2020 to 2024.

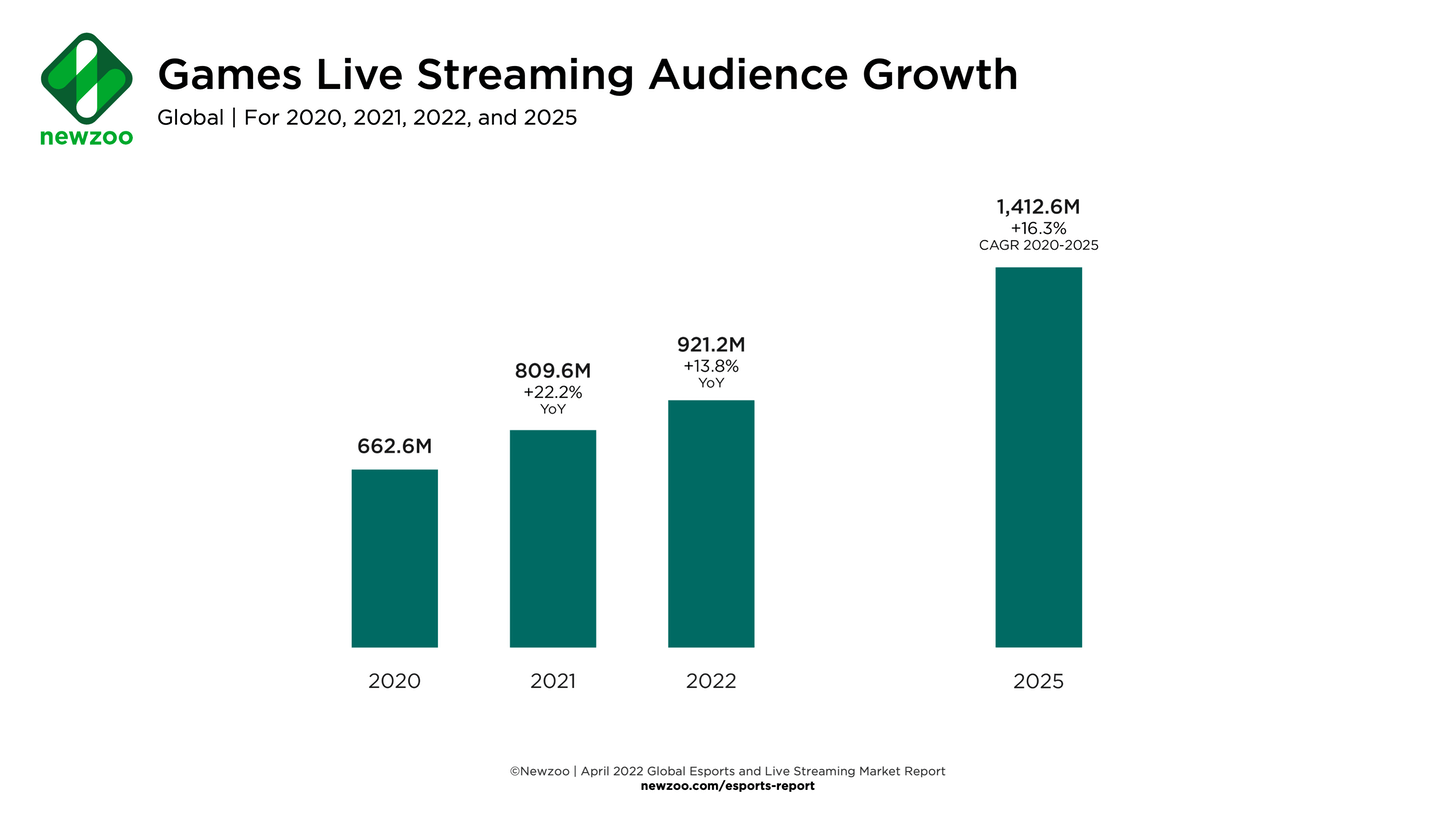

Newzoo: Gaming Live Streaming Audience will reach 1.4B users in 2025

-

921.2M users will watch gaming live streams this year. It’s 13.8% more than a year before.

-

In 2023 the number of users watching how others play will be more than a billion.

-

Twitch is the largest platform for live streaming. More than 20 billion hours of content were watched on the platform in 2021 (+26% YoY). More than 31M users are visiting the platform daily.

-

China is the country with the largest live streaming audience. By 2025 there will be 267.5M of gaming content watchers.

-

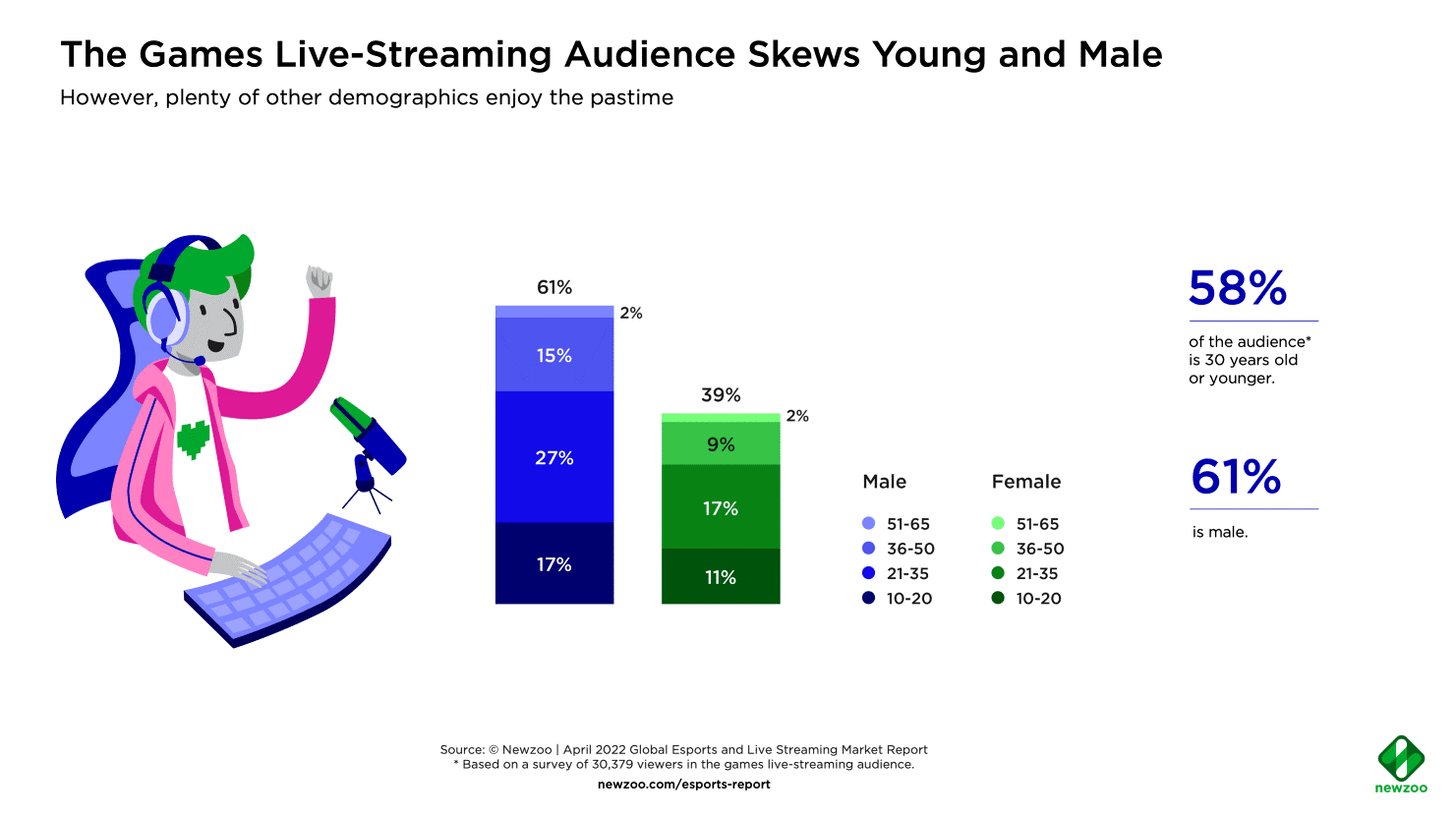

58% of live streaming fans are younger than 30. 61% are male.

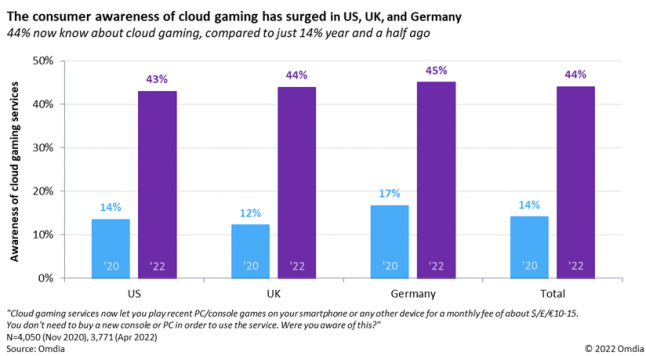

Omdia: Consumers' awareness of Cloud Gaming increased, but it didn't help sales

-

In April 2022 Omdia asked 3,700 users from the US, UK, and Germany about Cloud Gaming services. And compared results with a similar survey made in November 2020.

-

44% of respondents now know what Cloud Gaming is. A year and a half ago only 14% had such understanding.

-

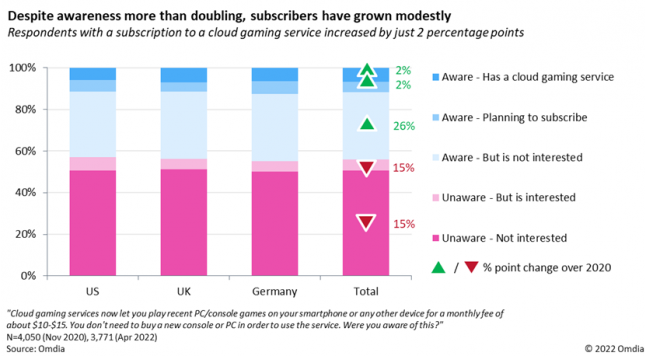

Despite the increase in awareness, it didn’t affect sales much. The number of Cloud Gaming services subscribers since November 2020 increased by 2%. A similar percentage increased the number of people who are planning to subscribe to any Cloud Gaming service.

-

By 26% - the largest increase - shows the category that knows about Cloud Gaming, but has no plans to use it.

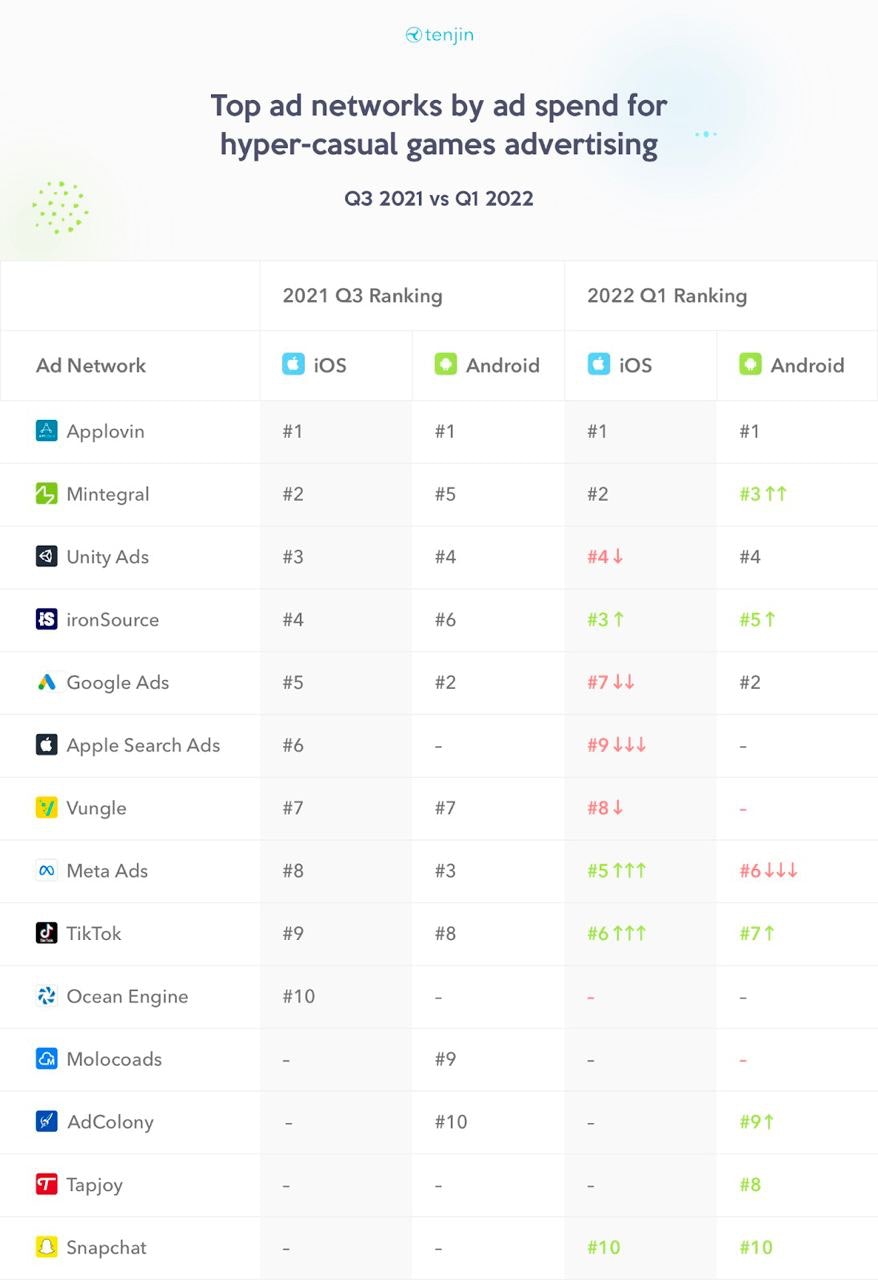

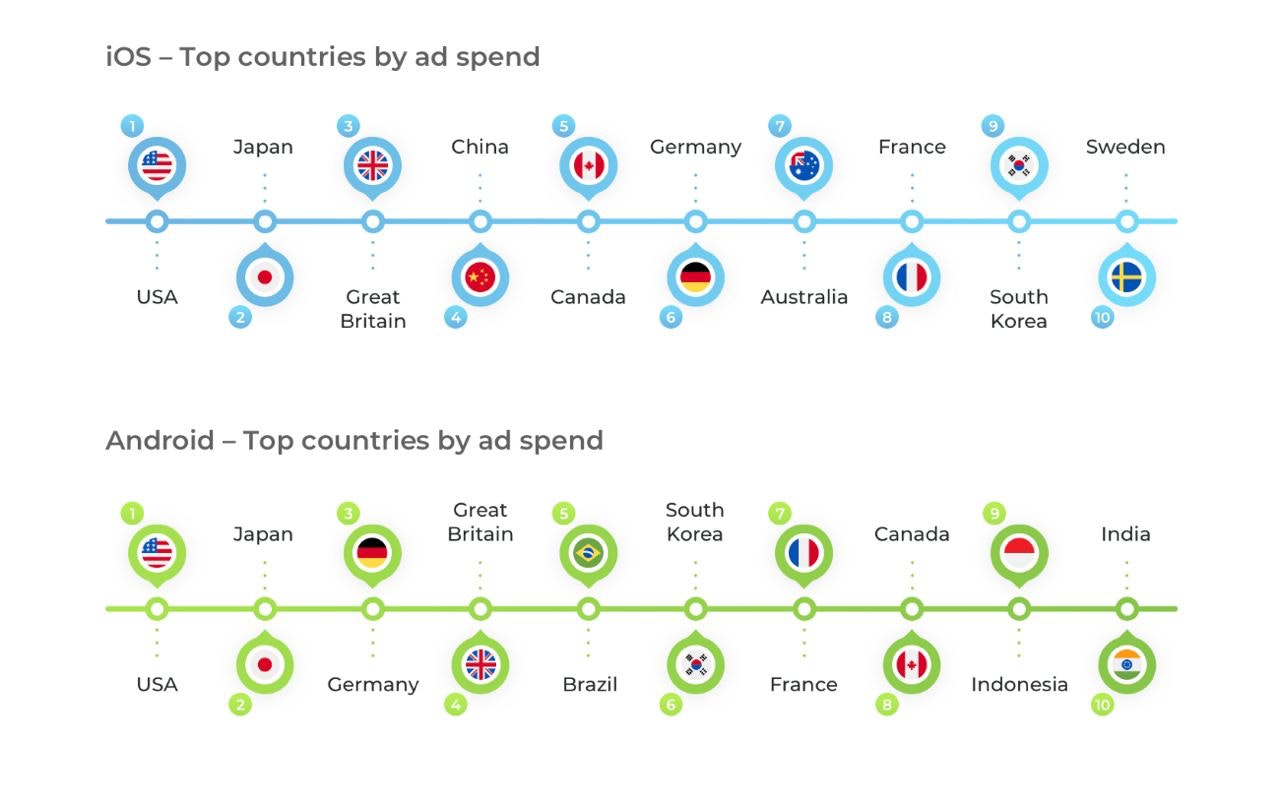

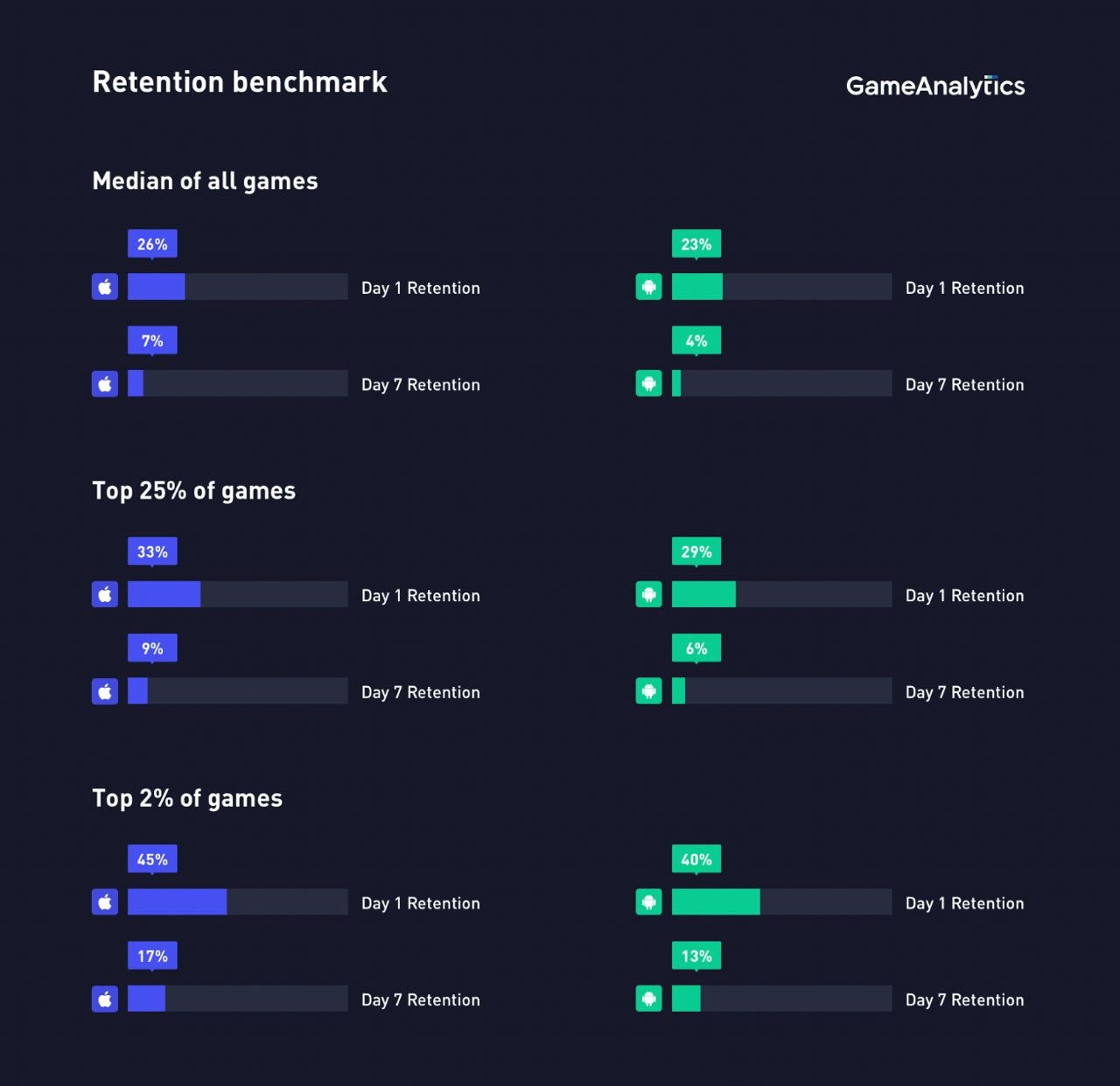

Tenjin & GameAnalytics: The Best Ad Networks for Hypercasual Titles and Retention benchmarks

-

Applovin, Mintegral, and Unity Ads are on top of the ad networks by money spent on hypercasual ads.

-

The US, Japan, and the UK are countries where advertisers spend the most money.

-

Top 2% hypercasual games median D1 Retention on iOS is 45%. On Android - 40%.

-

Top 2% hypercasual games median D7 Retention on iOS is 17%. On Android - 13%.

GfK & GSD: Lego Star Wars: The Skywalker Saga tops UK charts in April

-

Last month 92 thousand consoles were sold in the UK (-38% YoY). PlayStation 5 made it to the top with a 59% increase in sales compared to March. However, year-to-year dynamics are worse - in April 2021 sales were 51% higher.

-

Second place is taken by Nintendo Switch. Xbox Series S|X is third with a 59% decrease in sales MoM.

-

Accessory sales dynamic is decreasing too - by 19.2% to March 2022 and 13.7% to the previous year. The leader is a white DualSense.

-

In April 2.3M games were sold in the UK. It’s 18% less than in March 2022, but 12.5% more than in April 2021. 36.9% of sales are from physical copies.

-

Lego Star Wars: The Skywalker Saga is the first by sales, Elden Ring & Grand Theft Auto V are next.

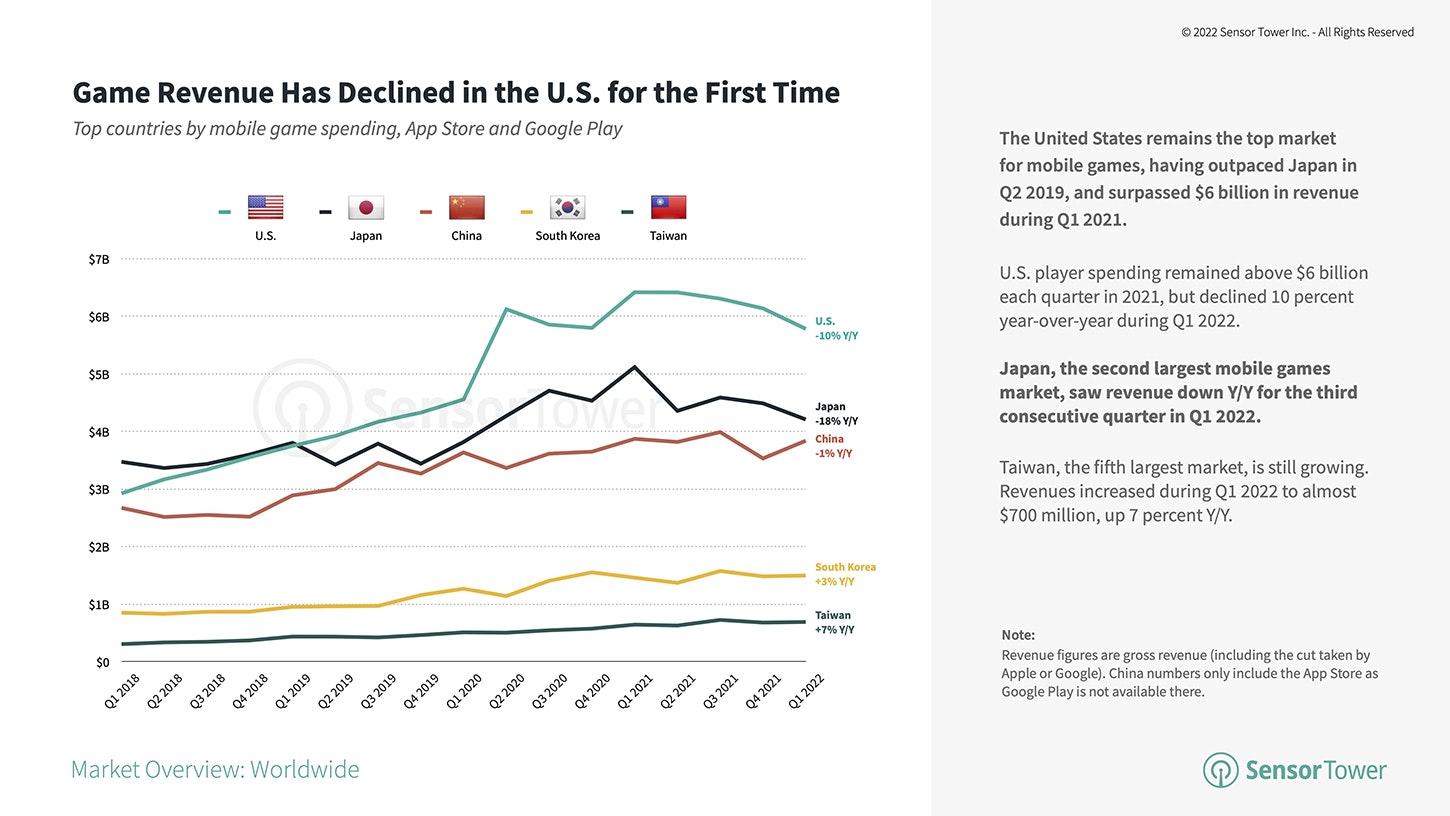

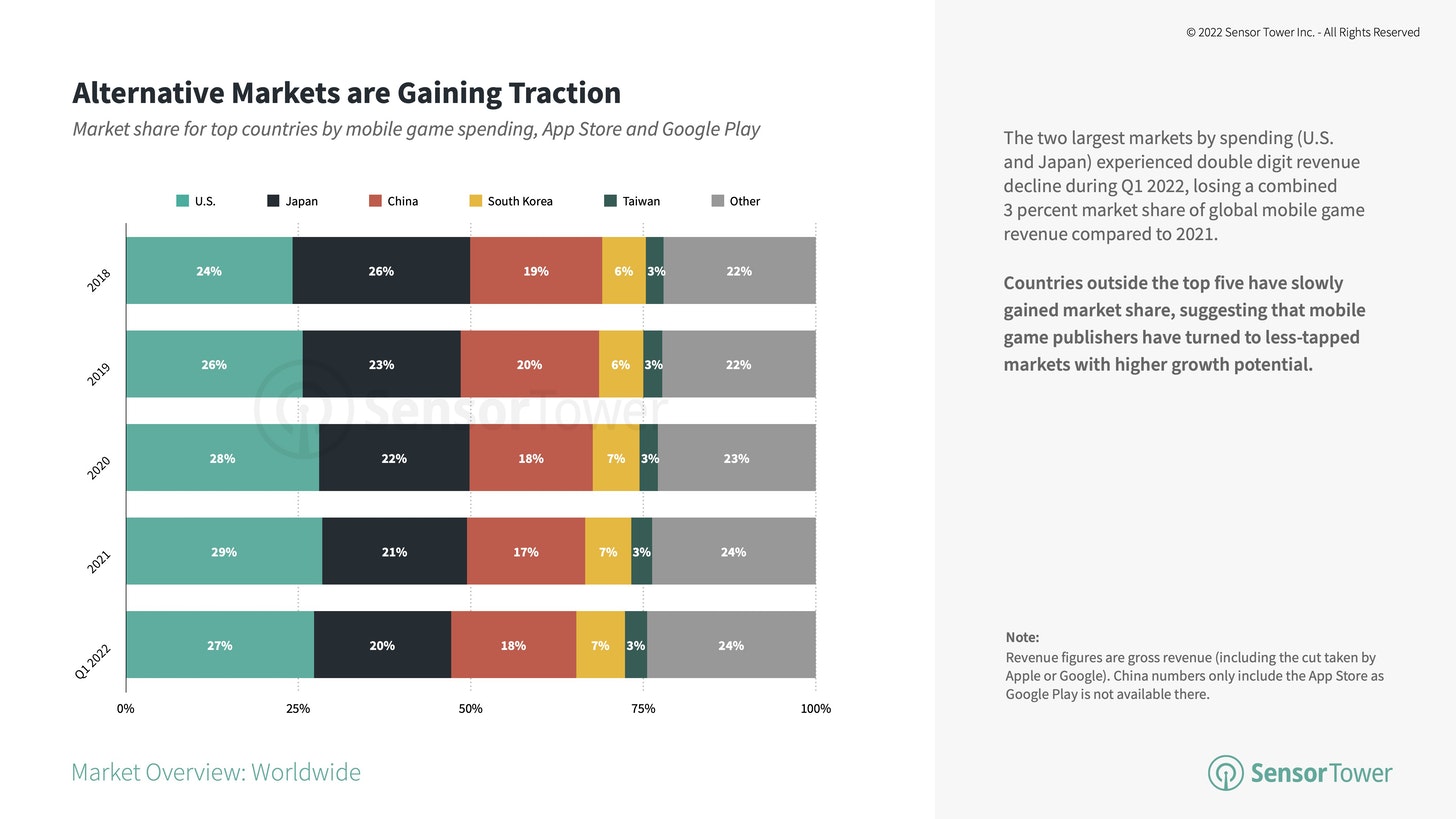

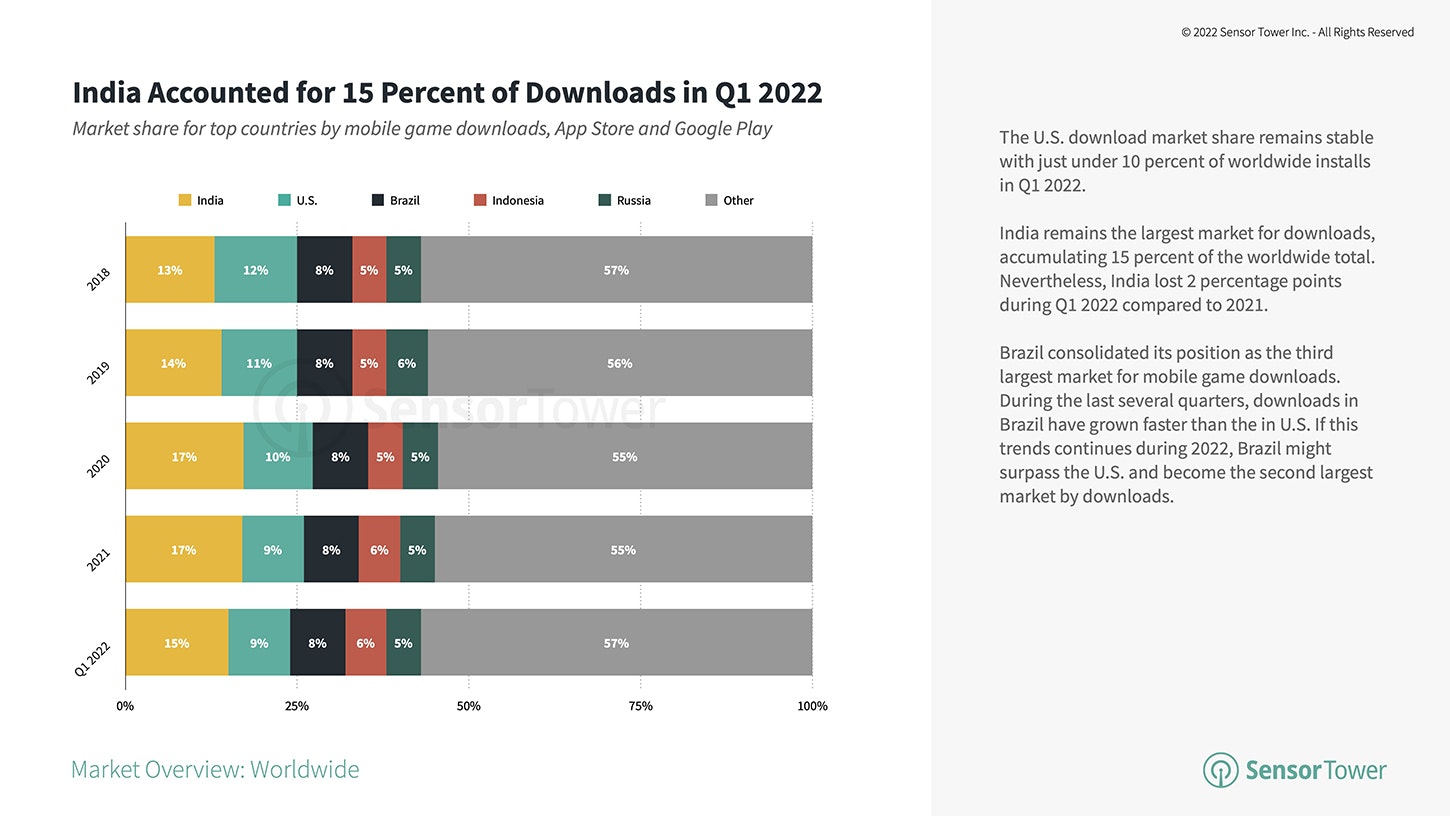

Sensor Tower: Mobile Gaming Market Revenue dropped for the first time in history

-

The decline happened in Q1 2022, in which users spent 6% less than in Q1 2021 - $21.2B. However, if we’ll compare results with Q1 2020 then growth will be 20%.

-

Lineage W is the only new game in the Q1 2022 chart by revenue.

-

Revenue from the largest markets declined in Q1 2022. In the US - by 10% YoY; in Japan - by 18%; in China - by 1%. Conversely, South Korea (+3% YoY), and Taiwan (+7% YoY) showed growth.

-

The share of alternative markets in the overall revenue structure increased by 2% in the last 5 years. Sensor Tower analytics are positive that it’s connected to the publishers’ interest in emerging markets.

-

Taiwan in Q1 2022 ousted Germany from fifth place in the largest mobile markets. India showed 74% growth in Q1 2022 by revenue.

-

The number of downloads continues to grow slowly. In Q1 2022 downloads increased by 2%.

-

Downloads charts are much more diverse than the revenue top. In Q1 2022 seven new titles appeared there.

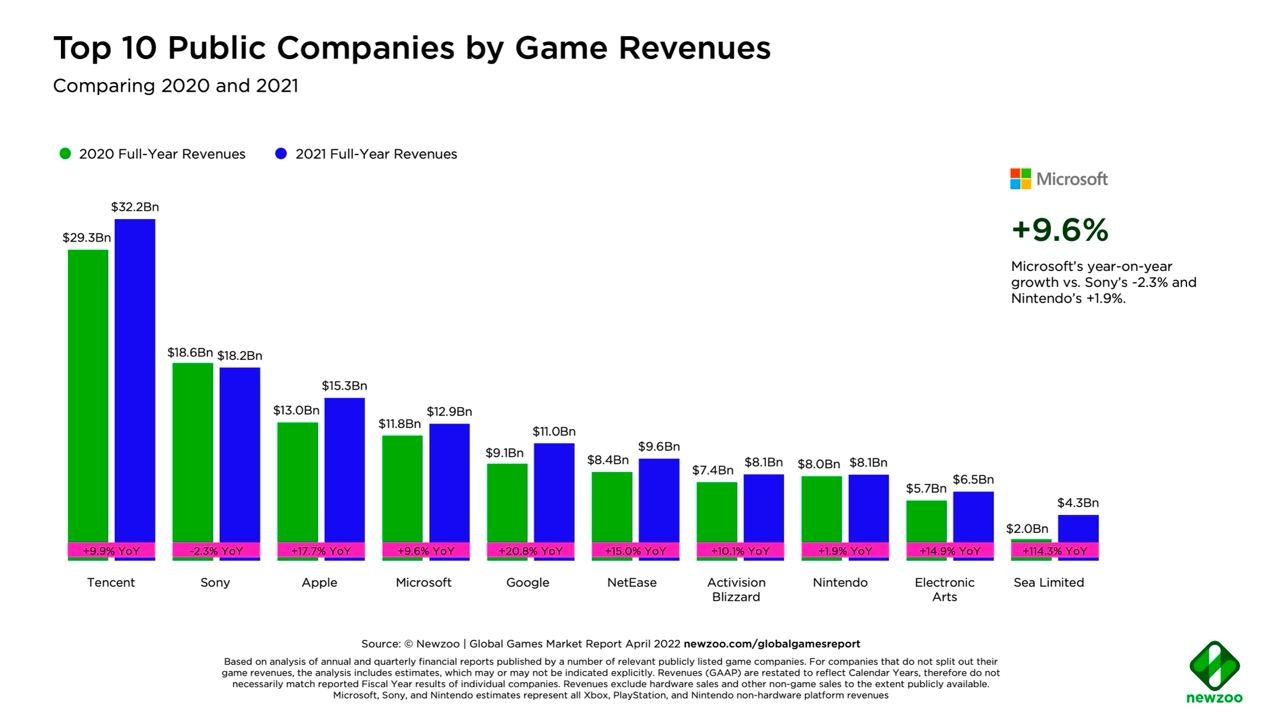

Newzoo: 10 largest gaming companies generated 65% of overall revenue in 2021

-

The 10 largest gaming companies earned $126B in 2021, which is 10.2% higher than in 2020.

-

Companies from 11 to 25 places increased their share by revenue as well.

-

Tencent earned $32.2B in 2021 (+9.9% YoY). It’s 16.7% of the overall gaming market ($192.7B according to Newzoo).

-

Sony is the only company in the top-10 that showed a decline in revenue (-2.3% YoY). The reason lies in console shortages. Meanwhile, the main competitors are showing growth - Nintendo by 1.9%; Microsoft - by 9.6%.

-

Sea Limited showed a 114.3% growth in revenue compared to 2020, which occurred thanks to Garena Free Fire.

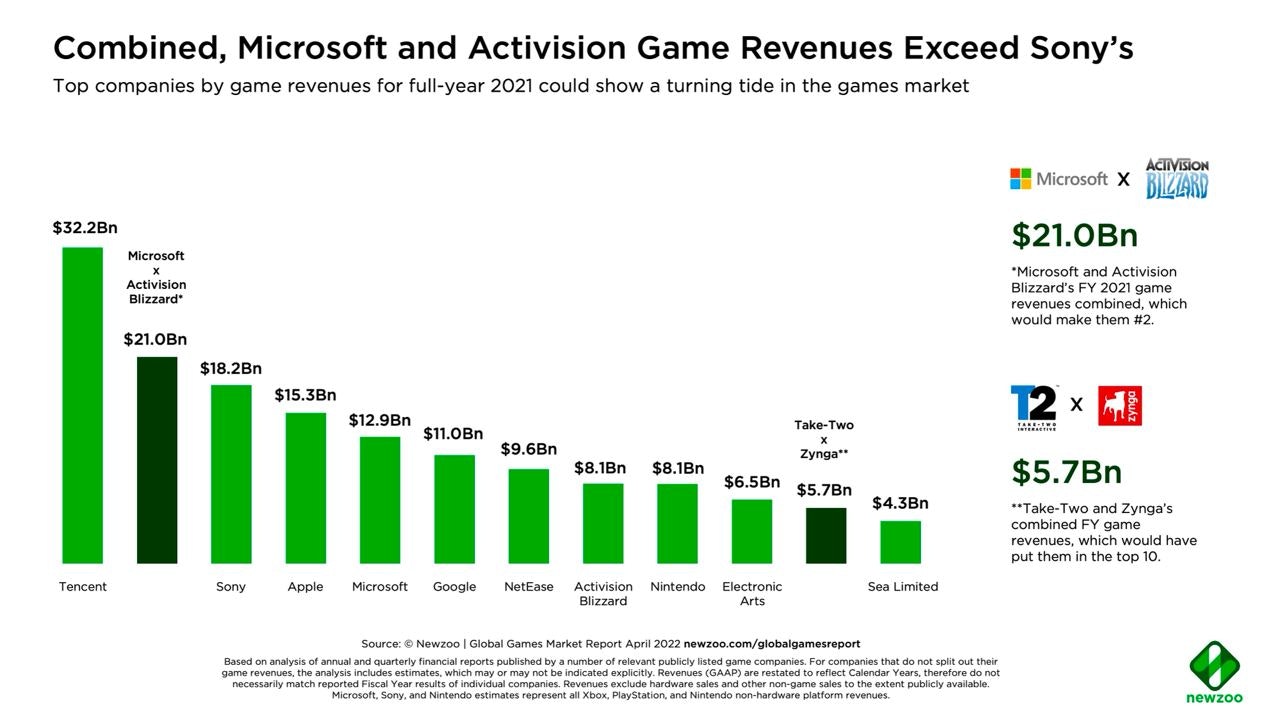

-

If the deal between Microsoft and Activision Blizzard happens, Microsoft will overcome Sony by revenue and will reach second place. Take-Two Interactive acquisition of Zynga will place them to the 9 place.

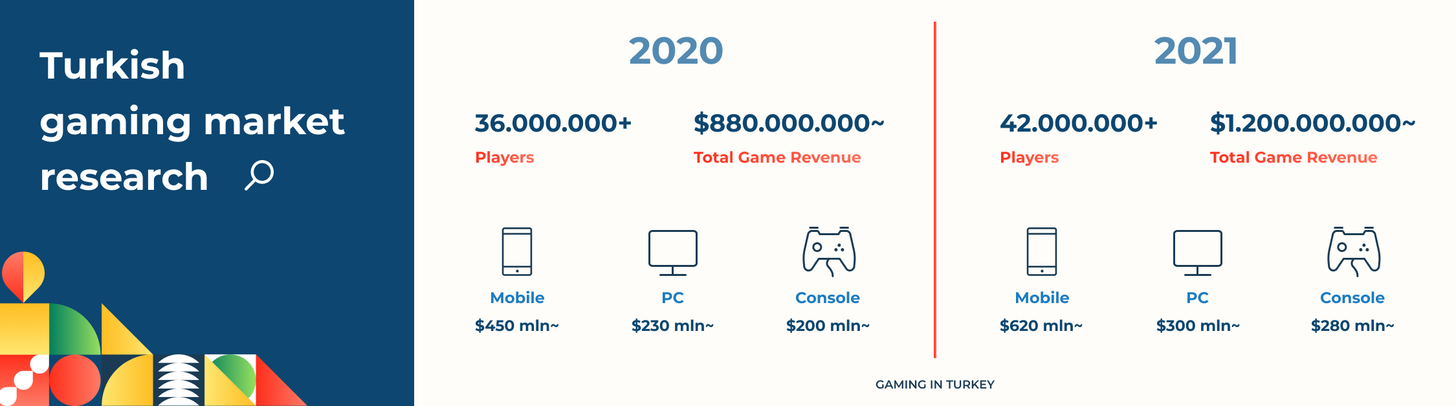

Gaming in Turkey: Turkish Gaming Market reached $1.2B in 2021

-

Growth to 2020 was 26%. The market hasn’t shown similar growth rates since 2017.

-

Mobile Market is responsible for $620M (+27% YoY). Turkish people spent $300M (+23.3% YoY) in PC games; $280M in console titles.

-

Turkish gaming companies received $266M of investment in 2021. During the last 5 years, if we exclude Zynga & Peak Games deals, the overall investment sum was about $600M. The number of deals in 2021 was 54, and nearly half of them are connected to the hypercasual market.

- 78% of the adult population in Turkey is playing mobile games. 52% of them are male. 46% of mobile gamers in Turkey are playing 10 or more hours per week.

Sensor Tower: PUBG Mobile overpassed $8B in Revenue

-

In Q1 2022, the game earned $650M. It’s the lowest revenue since Q4 2020.

-

57% of PUBG Mobile's revenue - $4.7B - came from China. The US is responsible for 11% of overall revenue; Turkey - for 4%.

-

App Store is responsible for 81% of overall revenue. But if we cut China, then the diversification is more normalized - only 56% are coming from the App Store.

TIGA: The number of full-time employees in the UK increased by 25% in the last year and a half

-

16,836 people worked full-time in the UK gaming industry in April 2020. As of December 2021, the number of full-time employees reached 20,975.

-

An average annual investment amount into the gaming industry reached £1.3B ($1.6B) at the end of 2021. It’s 30% higher than a year before.

-

Gaming companies paid £1.19B ($1.47B) in 2021 in taxes to the UK Treasury.

-

In 2021 overall UK GDP contribution by the game industry was £2.9B ($3.58B).

Xinhua: Mobile Games Revenue in China in Q1 2022 reached $9.13B

-

An increase from the previous year is 2.72%.

-

In Q1 2022 users spent 9.28% more than in Q4 2021.

-

Chinese-developed games earned $4.55B in the worldwide markets in Q1 2022, which is 0.54% lower than in Q4 2021.

Niko Partners: Government regulations won't prevent the Chinese gaming market from growth

-

By Niko Partners’ analysis, there were 706M gamers in 2021 in China (and there is a decrease from 2020). But by 2026 the number of gamers will increase to 730M.

-

ARPU will increase from $64.44 in 2021 to $75.6 in 2026.

-

Overall market revenue in 2021 reached $45.49B with projected growth in 2022 to $47.73B. By the end of 2026, it should reach $55.22B.

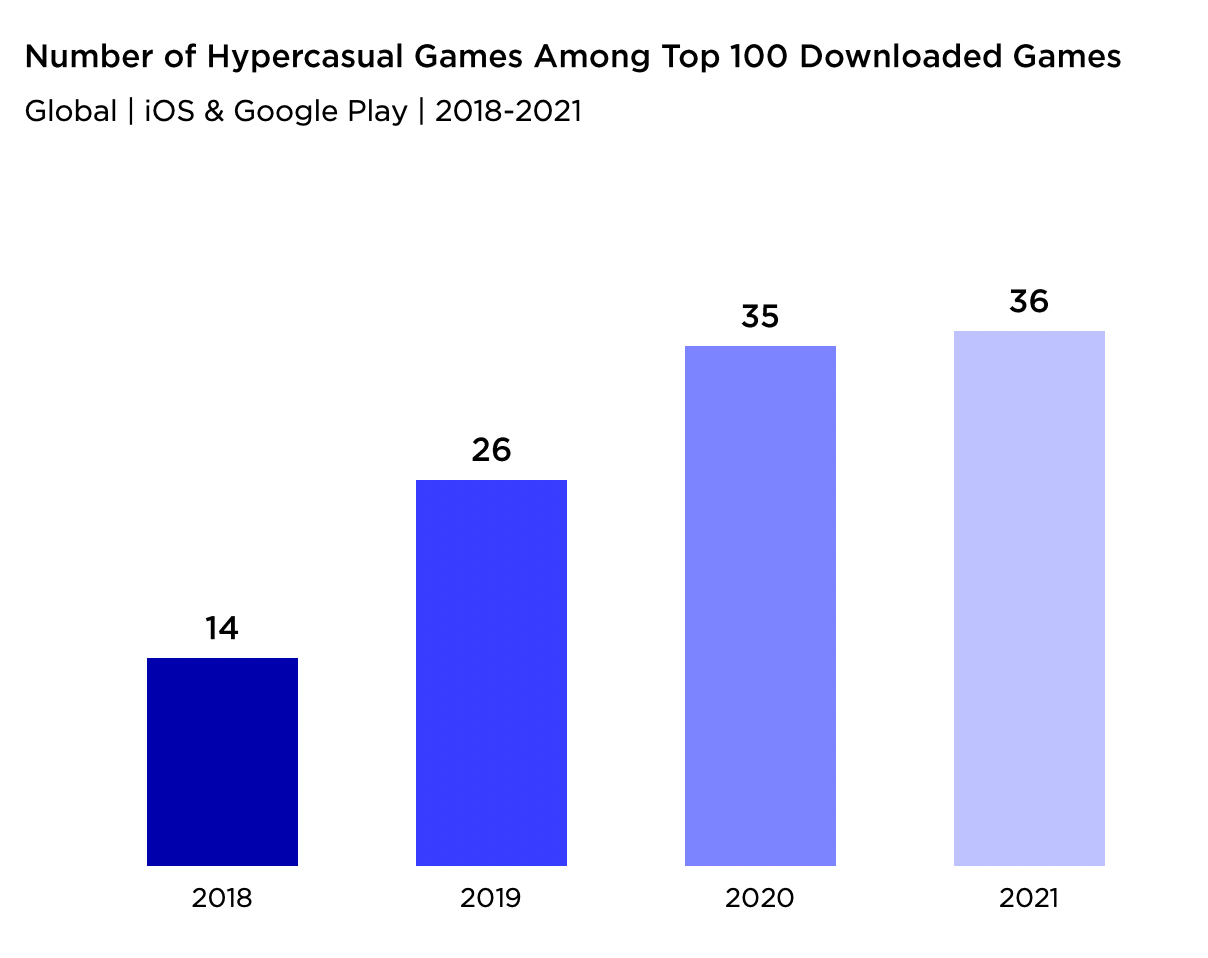

Newzoo & Pangle: Hypercasual games in 2021

-

36 games out of the top-100 in 2021 were hypercasual.

-

5 leading hypercasual publishers in 2021 by downloads were: Supersonic Studios, Zynga (Rollic), Azur Games, Crazy Labs, and SayGames.

-

Hypercasual games are getting more downloads in the West if we’re talking about tier-1 countries.

-

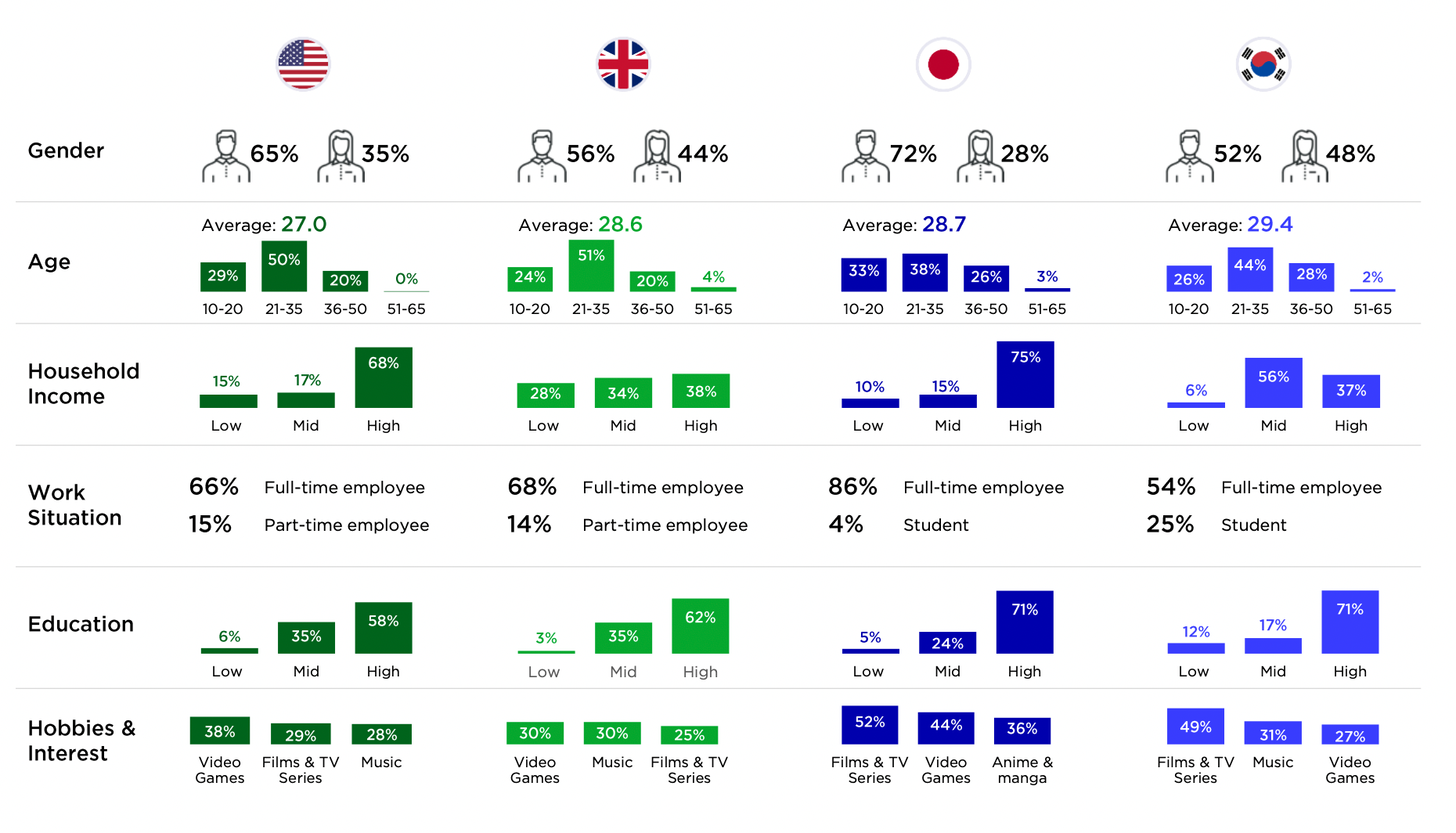

Newzoo & Pangle created the hypercasual gamer portrait in the US, the UK, Japan, and South Korean markets. More often it’s a man (61%) between the age of 27-30, with a mid to high level of income, and a high education who loves games.

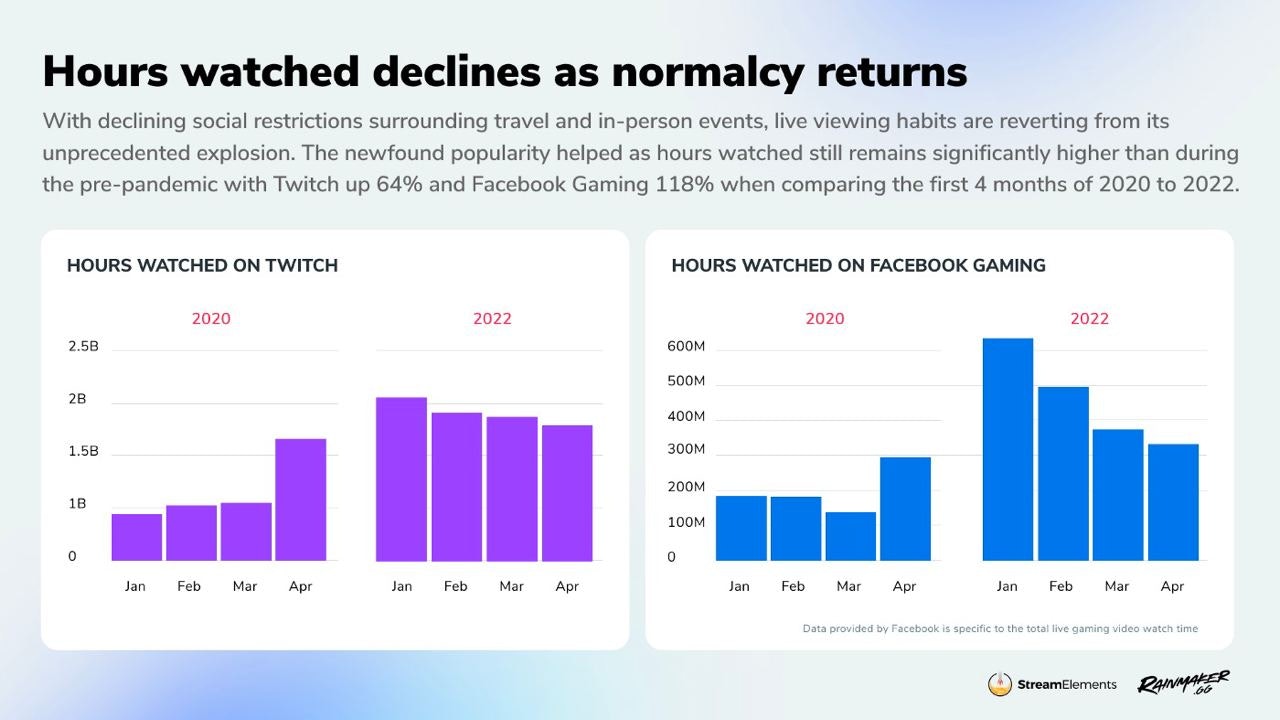

StreamElements & Rainmaker.gg: Streams views went down in April 2022

-

There is a declining trend in the number of views on Twitch & Facebook Gaming in 2022. However, cumulative views on Twitch during the first 4 months of 2022 are 64% higher than in 2020. A Facebook Gaming difference is even higher - 118%.

-

StreamElements & Rainmaker.gg analytics connect the drop of views with restoring social interactions and returning to everyday life.

-

Elden Ring made it to the top-10 third consecutive time in a row.

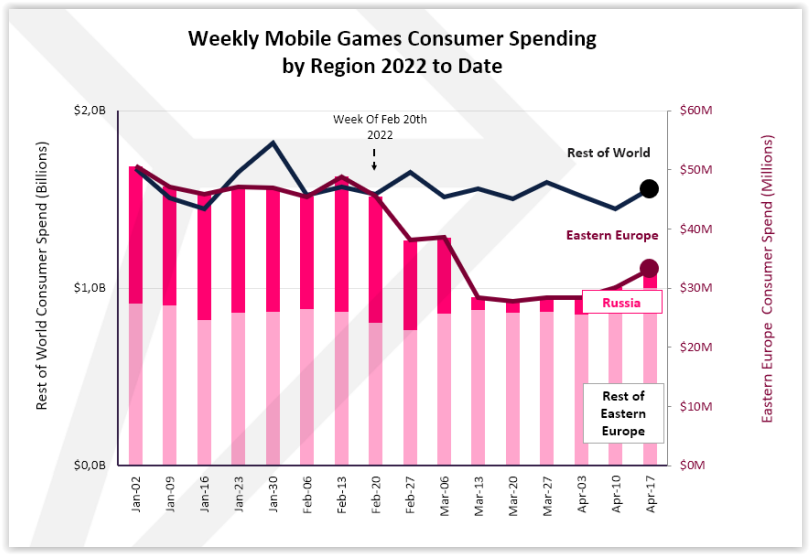

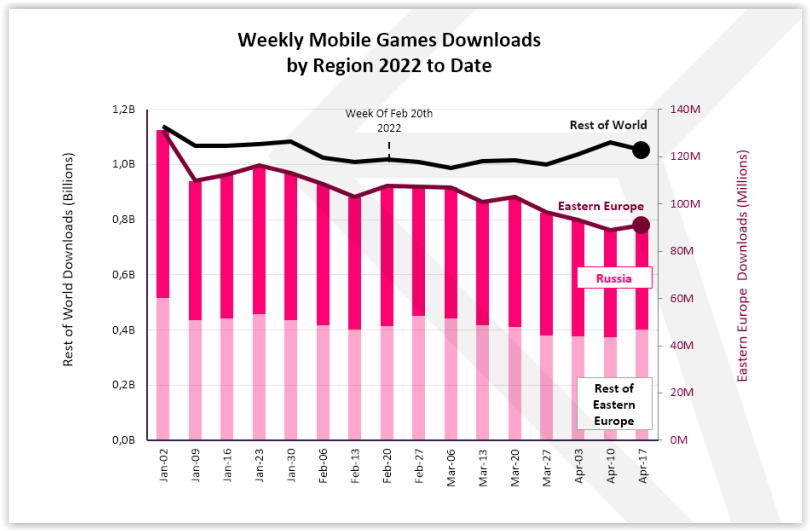

data.ai: Weekly mobile games revenue in Eastern Europe went down by 40% since March

-

Revenue went down from $50M weekly to $30M weekly. The main reason lies in the surging Russian market.

-

By graphic, in February Russian users were spending about $20M weekly on gaming apps. In April the amount of payments decreased to $3M weekly.

-

Before March 2022 the Russian gaming market was responsible for half of the Eastern European mobile revenue. Moreover, it was its main driver.

-

Downloads changed too, but not so dramatically. The number of installs went down from 110M weekly in early February to 90M weekly in mid-April. The majority of downloads are still coming from Russia.

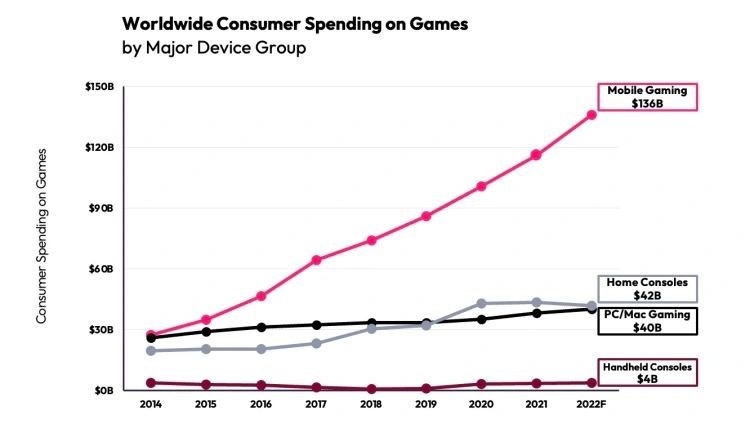

data.ai: The gaming market will reach $222B in 2022

-

The mobile segment will be responsible for $136B (61%) of the market.

-

The console market will go down slightly to $42B.

-

The PC market will stagnate at $40B.

-

data.ai analytics also reserved $4B of the market for handheld consoles. No additional information on what the “handheld consoles” are was provided.

Sensor Tower: Apex Legends Mobile earned $4.8M during the first week

-

The game reached #1 place by downloads on iOS in 60 countries. The US is first in downloads, India and Brazil are next.

-

The US is responsible for 44% of overall revenue - $2.1M. Japan is second, and Thailand is third.

-

Apex Legends Mobile's debut week revenue is much less than Call of Duty: Mobile had in its debut week ($14.8M). However, it’s much higher than PUBG Mobile earned in the first 7 days after monetization implementation ($600k).

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.