devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the May and June reports.

Contents

- GameRefinery & Liftoff: Mid-core games in 2023

- AppMagic: Top Games by Revenue & Downloads in June 2023

- data.ai: Tencent is the most successful publisher of 2022

- Square Enix: Final Fantasy XVI sold more than 3M copies in less than a week

- SGDA: Slovak game industry turnover dropped to €77.1M in 2022

- Microsoft reported about 21M+ sold Xbox Series S|X

- Rush Royale reached $230M in revenue

- Niko Partners: 37% of Asian gamers are female

- BattleBit Remastered reached 1.8M copies in two weeks since the launch

- Harry Potter: Magic Awakened worldwide release is worse than Chinese by times

- Abragames: Brazilian game industry in 2022

- Konvoy Ventures: VC funding in gaming dropped by 38% in Q2 2023

- data.ai: Mobile gaming market in H1 2023 showed a further decline in revenue

- Sensor Tower: Top Mobile Games by Revenue in June 2023

- GSD: The UK game sales in June 2023 increased by 7% YoY

- Niko Partners & AppMagic: 5 main mobile genres in Asia & MENA

- Famitsu: Japanese gaming market in H1 2023

- Polish Agency for Enterprise Development: Polish Gaming Industry in 2023

- GSD: European game sales increased by 20% in June 2023

- A new MMORPG from NetEase - Justice Online Mobile - is earning at least $1.5M daily since the release

- Carry1st & Newzoo: Sub-Saharan African countries gaming revenue reached $863M in 2022

- SEGA President: Games for a new console generation will cost $70M+ to develop

- How to Market a Game: 2022 became the worst year for indie developers on Steam

- GSD: Hogwarts Legacy & Diablo IV are leaders by sales in Europe in H1 2023

- Drake Star: Gaming investments in Q2 2023

- Niko Partners: Console game market in China in 2023

- Call of Duty: Mobile revenue exceeded $3B

GameRefinery & Liftoff: Mid-core games in 2023

CPI & ROI numbers have been collected from 1 May 2022 to 1 May 2023. Analysts covered 30B impressions, 1.1B clicks, and 5.5M installs.

- Liftoff considers shooting games, strategy titles, and RPGs as mid-core games.

- Midcore games earned 35% of overall mobile revenue on iOS in the US.

Overall numbers

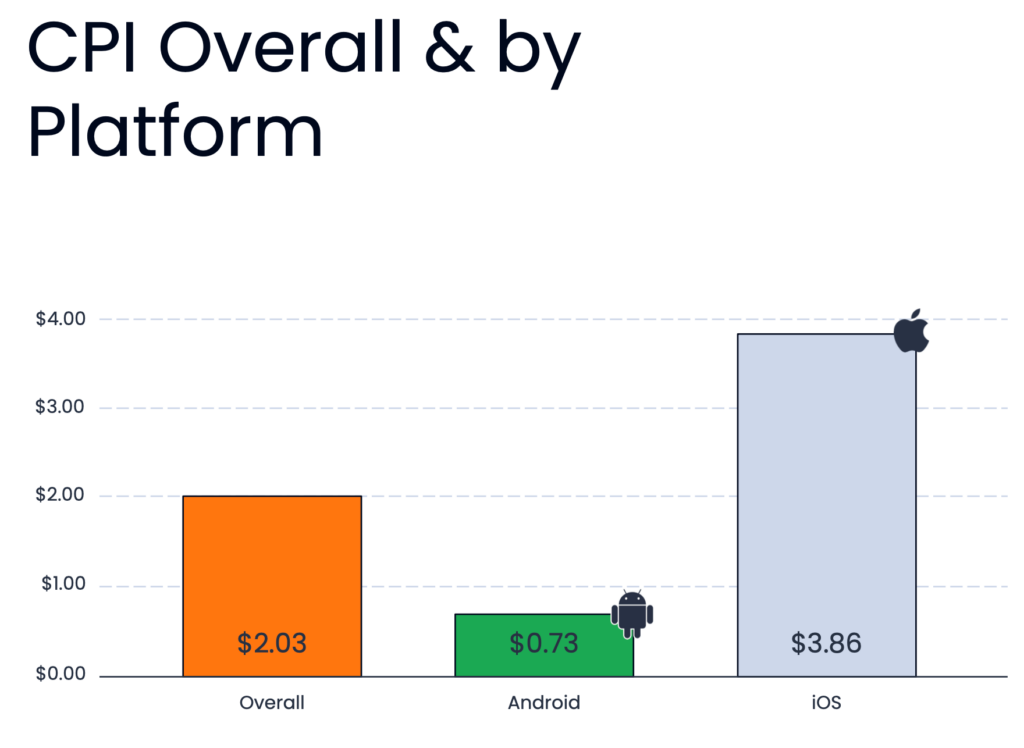

- The average CPI of mid-core titles is at the level of $2.03. On Android it’s $0.73; on iOS - $3.86. Analysts note that traffic for mid-core titles is twice as expensive compared to casual games.

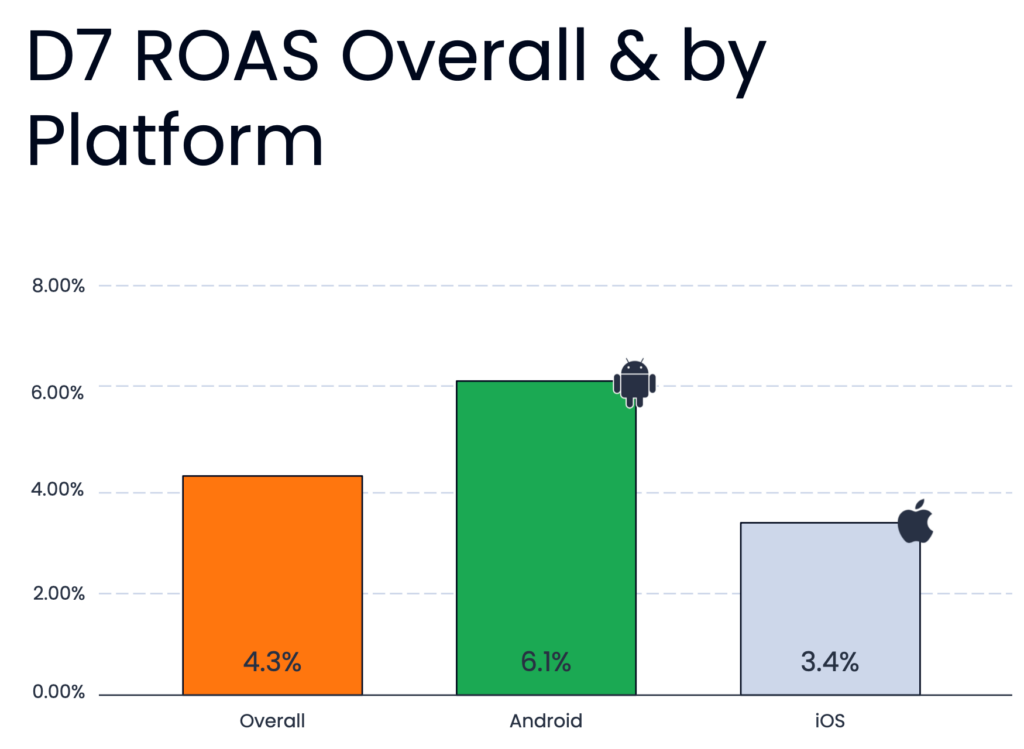

- An average D7 ROAS in mid-core games is 4.3%. On Android, it’s better - 6.1% while on iOS it’s lower - 3.4%.

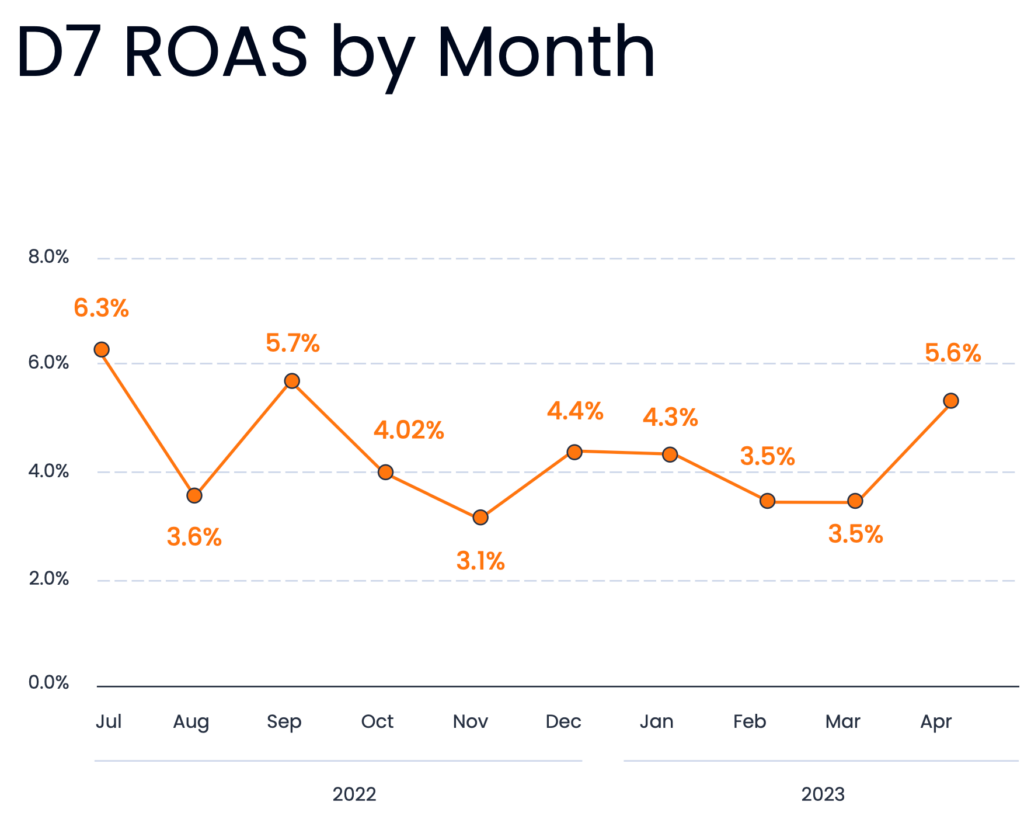

- D7 ROAS from July 2022 to May 2023 was between 3.1% and 6.3%.

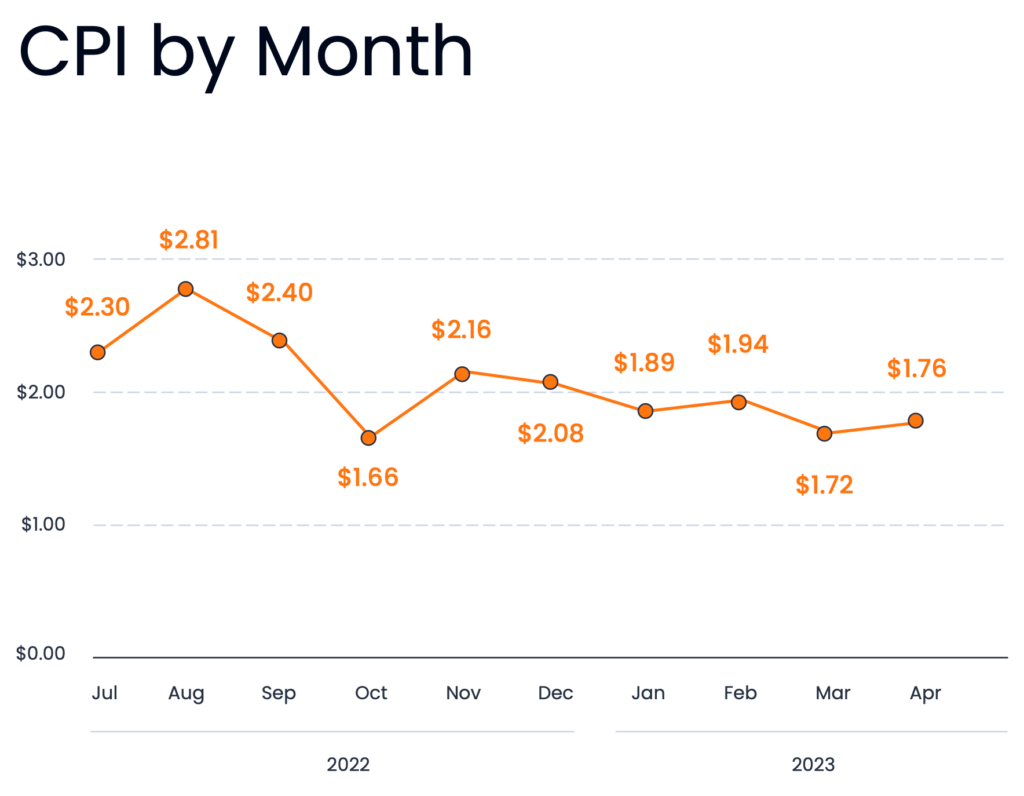

- In the last twelve months, the peak month by an average install price was in August 2022 - $2.81. The lowest one was in October 2022 - $1.66.

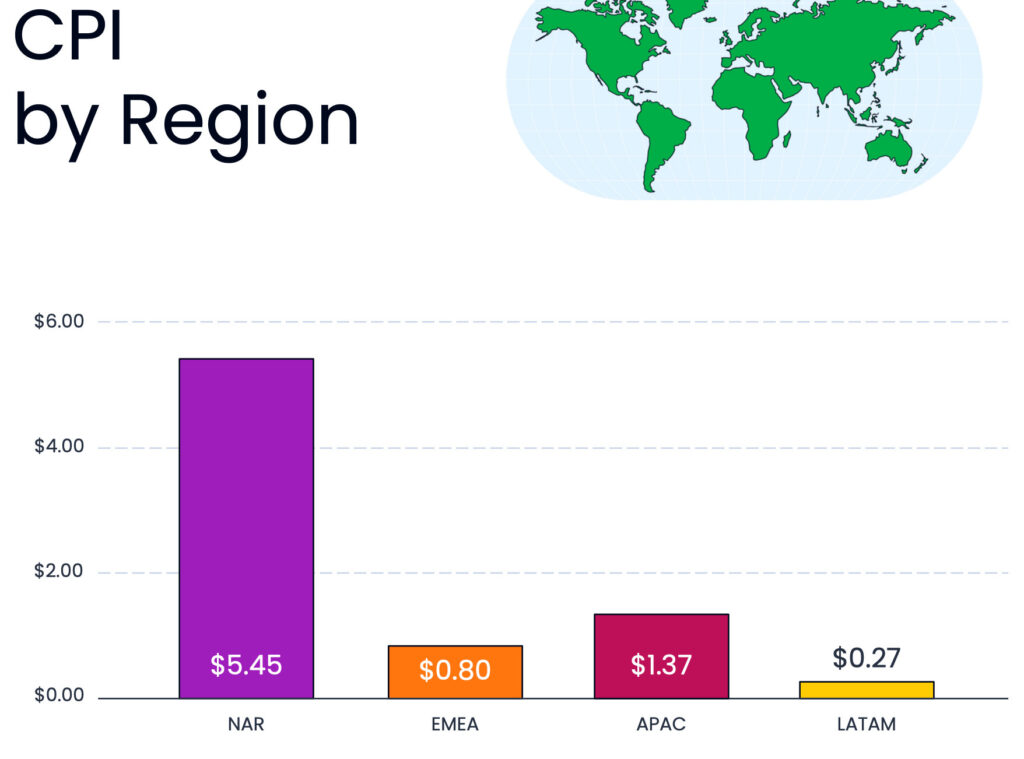

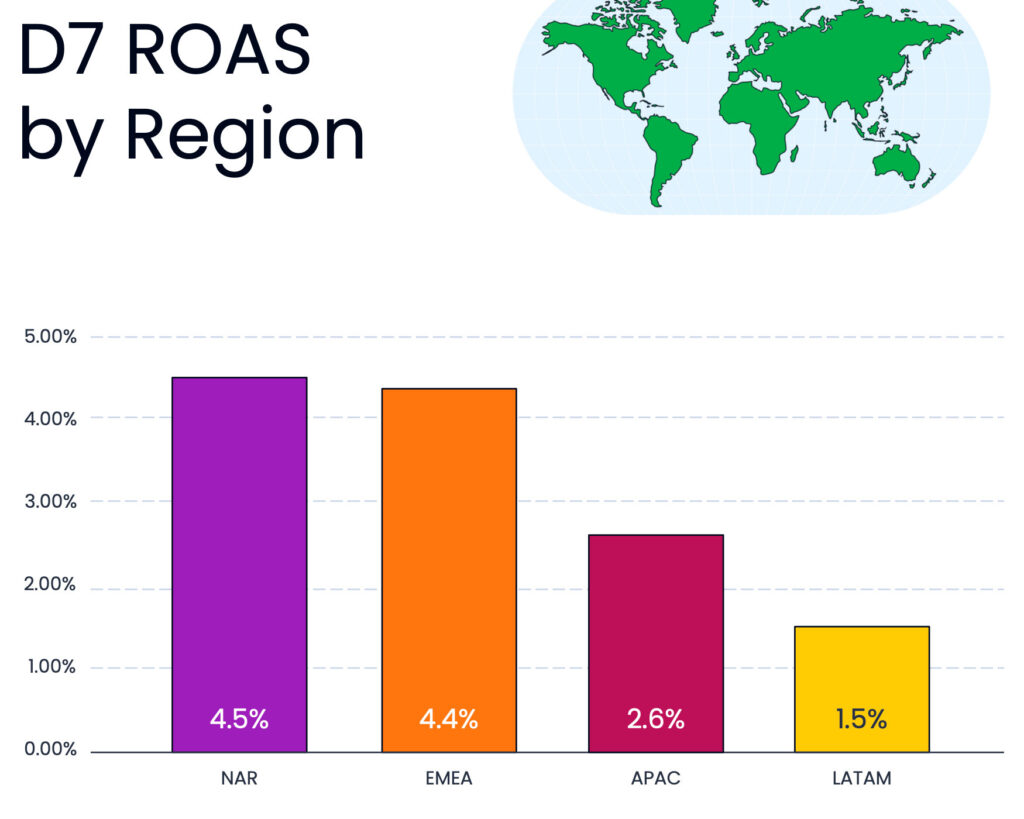

Benchmarks by markets

- The largest CPI is in North America - $5.45. In APAC it’s $1.37; in EMEA - $0.8; in LATAM - $0.27.

- However, D7 ROAS in North America is the best too - 4.5%. EMEA is next with 4.4%; APAC has 2.6%, and LATAM is behind with 1.5%. Based on the acquisition price and return ratio, EMEA is the best option to start marketing activities.

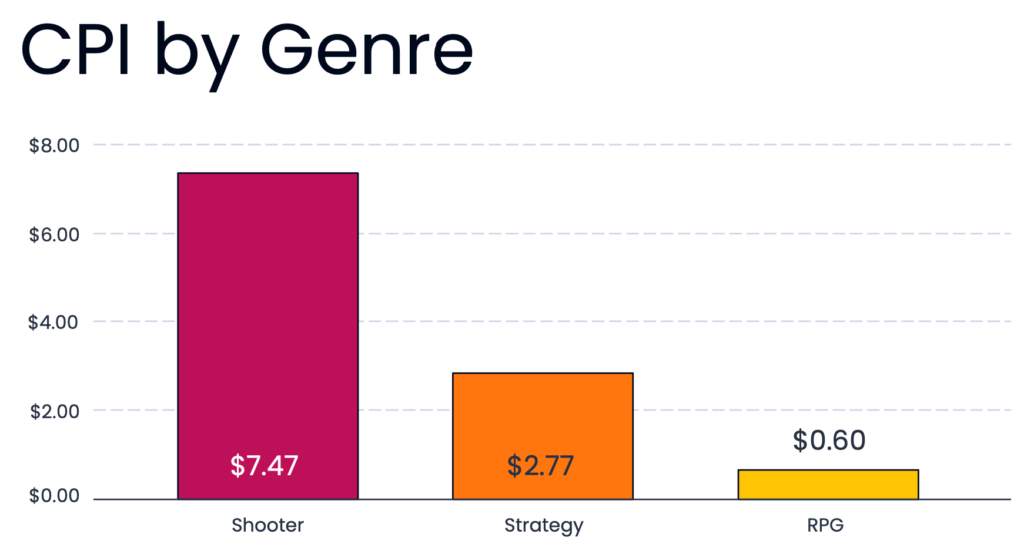

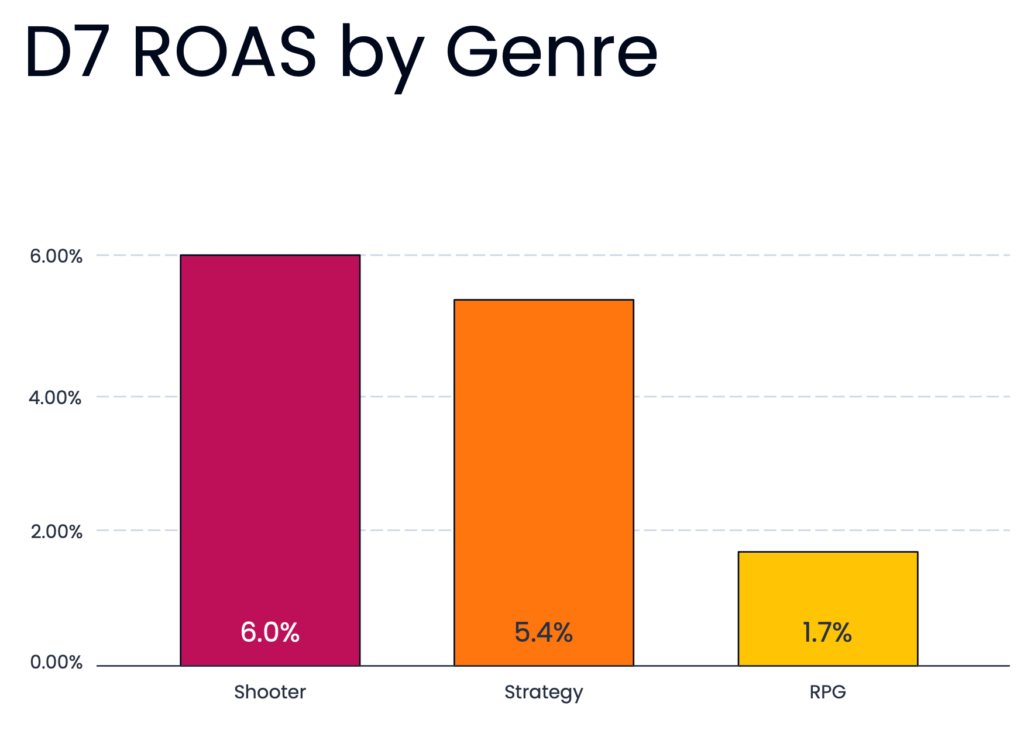

Benchmarks by genres

- CPI in shooters is $7.47. That’s a leader with a great margin. CPI in strategy titles is $2.77; in RPG - $0.6.

- D7 ROAS in shooters is 6%; in strategy titles - 5.4%; in RPG - 1.7%.

Trends

- Extraction shooters are becoming a new trend. Arena Breakout is the most popular new game and third among all shooters in China.

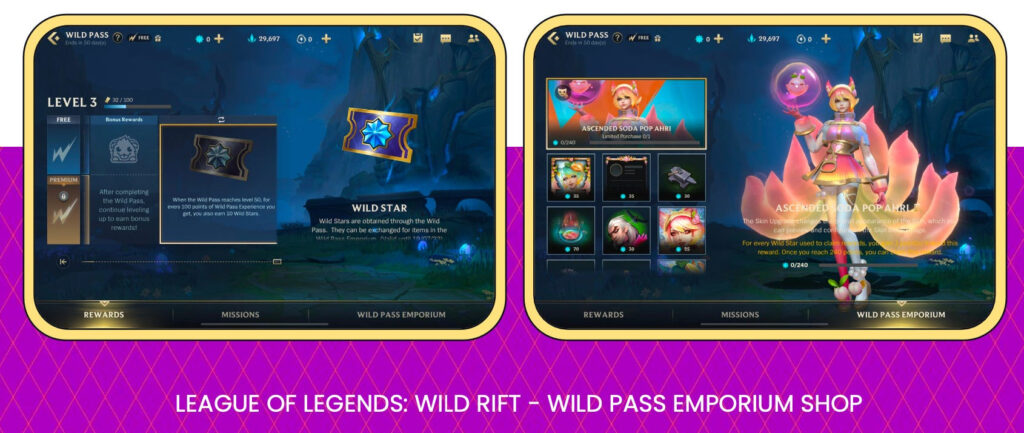

- More mid-core games are adding additional monetization layers in the form of event passes.

- Some mid-core games are adding a shop with a special currency inside the Battle Passes.

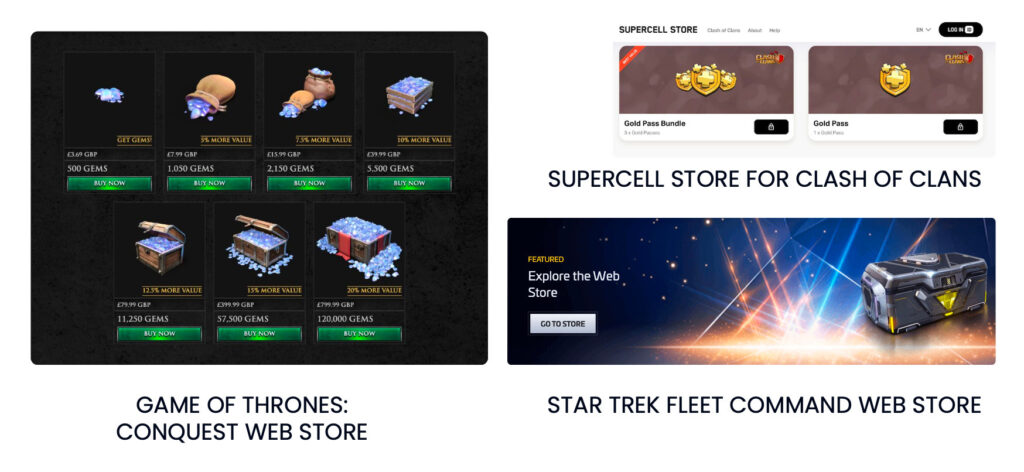

- A lot of mid-core titles opened off-store web shops to avoid paying commissions.

Source: 2023-Midcore-Gaming-Apps-Report (pdf)

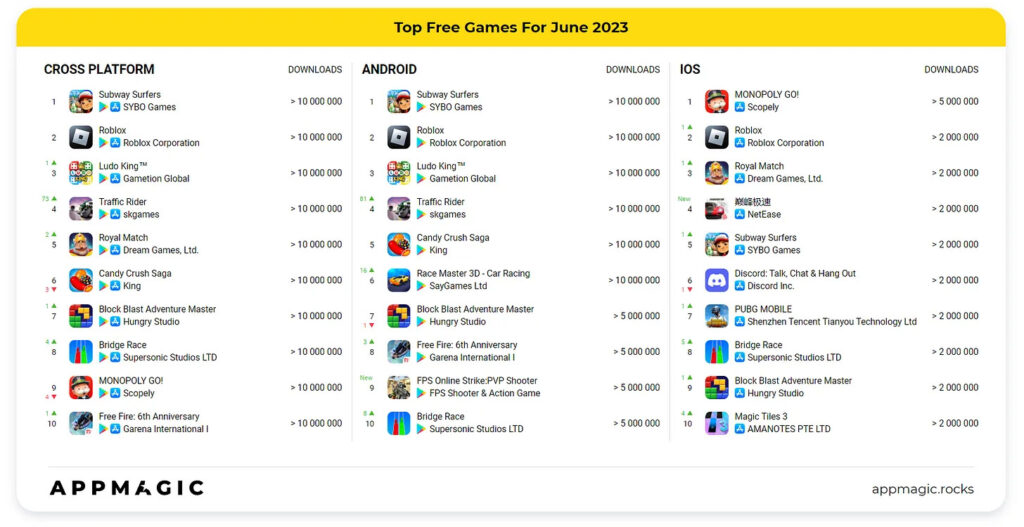

AppMagic: Top Games by Revenue & Downloads in June 2023

Revenue

- Honor of Kings is back on top. Honkai: Star Rail dropped to the second position.

- Monopoly GO! reached 9 places on the Android chart. The game earned $34.7M in June on both platforms. And revenue continues to increase despite declining installs.

Downloads

- FPS Online Strike: PVP Shooter made it 9th place on the Android chart by downloads. That’s a multiplayer shooter of… fair to say, mediocre quality by the current standards. However, the game reached 9.4M installs in June. How? Ask developers.

- Racing Master from NetEase in June reached 3.4M downloads on iOS with $7.2M in revenue.

data.ai: Tencent is the most successful publisher of 2022

- There are 5 gaming companies in the top 10 worldwide. Tencent is leading.

- Besides 5 gaming companies, Tencent, ByteDance, and Disney are in the top 10. They do have both gaming and non-gaming apps.

- Playrix, Playtika, and Moon Active are leaders of the EMEA region by revenue in 2022.

- Tencent, ByteDance, NetEase, and Netmarble are leaders in the APAC region by revenue.

- Activision Blizzard, Take-Two Interactive & Roblox are the most successful gaming publishers of 2022 by revenue from the AMER region.

Square Enix: Final Fantasy XVI sold more than 3M copies in less than a week

- The company is counting both digital and physical sales.

- The sales dynamics of a new title are lower than Final Fantasy XV's. The previous installment reached 5M copies on the first day. However, FF XV was released on PS4 and Xbox One, while FF XVI is now a console exclusive to PlayStation 5.

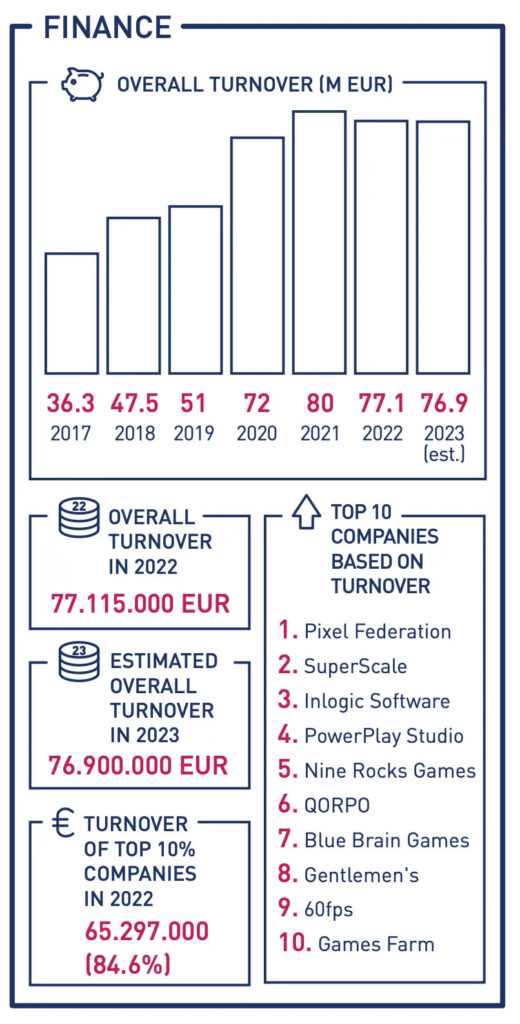

SGDA: Slovak game industry turnover dropped to €77.1M in 2022

- In 2021 Slovak gaming companies earned €80M.

- 10% of most successful companies earned €65.3M. Their share in overall revenue dropped by 2% compared to the previous year.

- By the end of 2022, there were 66 gaming companies and 1080 gaming professionals in Slovakia.

- Pixel Federation, QORPO, PowerPlay Studio, SuperScale, and Inlogic Software are leaders by number of employees.

- Slovak developers released 49 titles in 2022. 168 games were created in collaboration with partners.

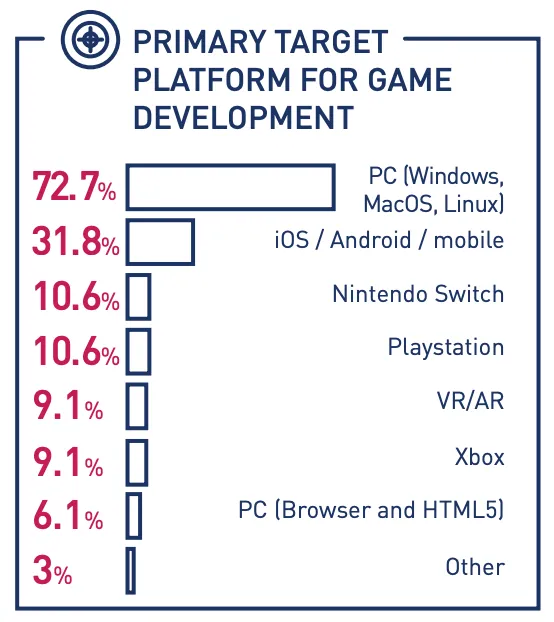

- 72.7% of developers are working on PC titles. 31.8% are developing games for mobile.

- Worth mentioning that 65.2% of Slovak gaming studios are self-funded.

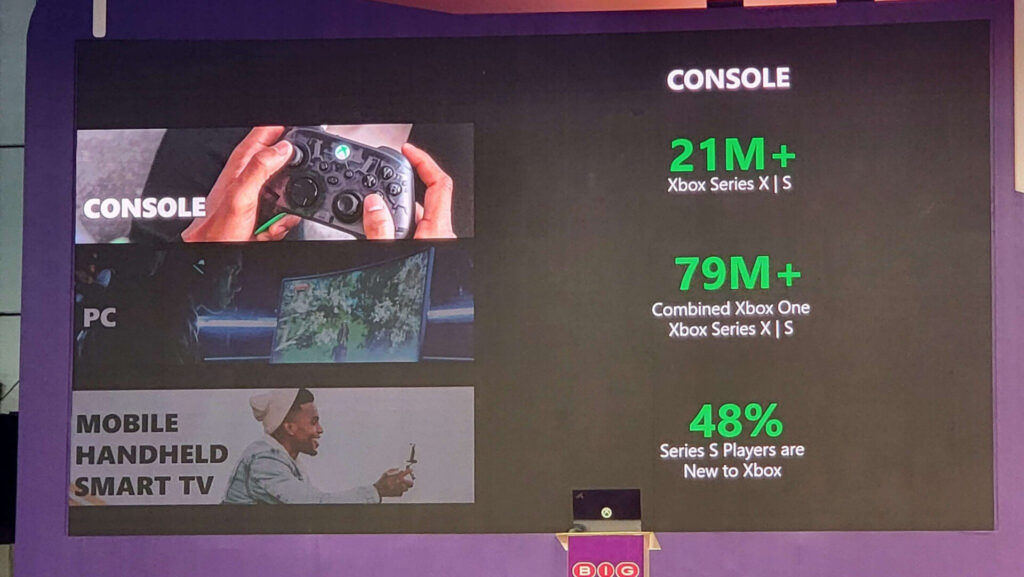

Microsoft reported about 21M+ sold Xbox Series S|X

The company showed new numbers during the BIG Festival in Brazil.

- Xbox One, Xbox Series S, and Xbox Series X sales reached 79M, which means that the company finished the previous generation with 58M in sales.

- For comparison, the main competitor - PlayStation 4 - had 117M sales last generation. This April Sony announced 38M sales of PlayStation 5.

- Microsoft marks that 48% of Xbox Series S users have bought the Xbox console for the first time.

Rush Royale reached $230M in revenue

- In June game had 6M MAU and 1.14M DAU.

- The game reached $230M revenue in 3 years after its release.

- The number of downloads surpassed 63 million since the release.

- A recent collaboration with Jake Paul, a famous American blogger, helped the game to boost metrics. On the date of the event launch, CCU in Rush Royale reached 76k users, and DAU in the US increased by 20%.

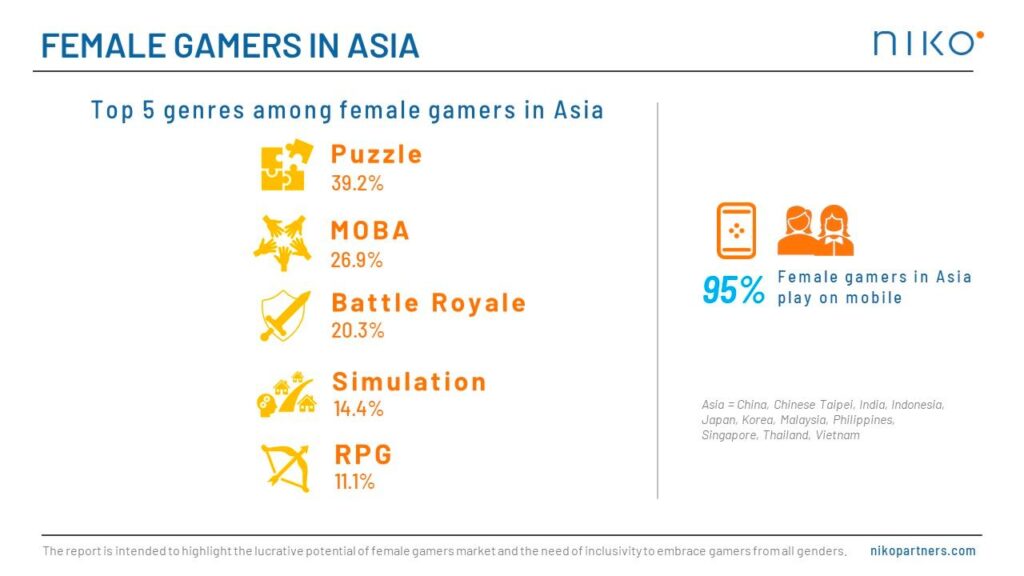

Niko Partners: 37% of Asian gamers are female

- The number of female gamers is increasing by 11% each year. It’s two times faster than growth among male gamers.

- Currently, the female audience in Asia is generating 23.5% of overall revenue. Niko Partners analysts are positive that this share will increase soon.

- The female gaming audience in Asia is playing predominantly on mobile devices. Its penetration is 95%.

- Puzzle (39.2%); MOBA (26.9%); Battle Royale (20.3%); Simulation (14.4%); RPG (11.1%) are the most popular genres among female gamers in Asia.

- While the majority of female gamers are casual players, the younger gamer is, the more complex and competitive genres female gamers prefer.

- eSports might become one of the main growth drivers among female audiences. Female gamers who are following eSports tournaments are paying more and spending more time in games.

- More than half of gamers are not satisfied with how females are pictured in games. Another large problem is gender discrimination in multiplayer titles.

BattleBit Remastered reached 1.8M copies in two weeks since the launch

BattleBit Remastered is a multiplayer online shooter inspired by classic Battlefield and created with a team of 3 people.

- Before the launch, the game had 800k wishlists on Steam.

- The peak CCU of the title reached 87k people.

- The development took more than 6 years. Initially, all 3 people from the development team had experience creating modes for other titles.

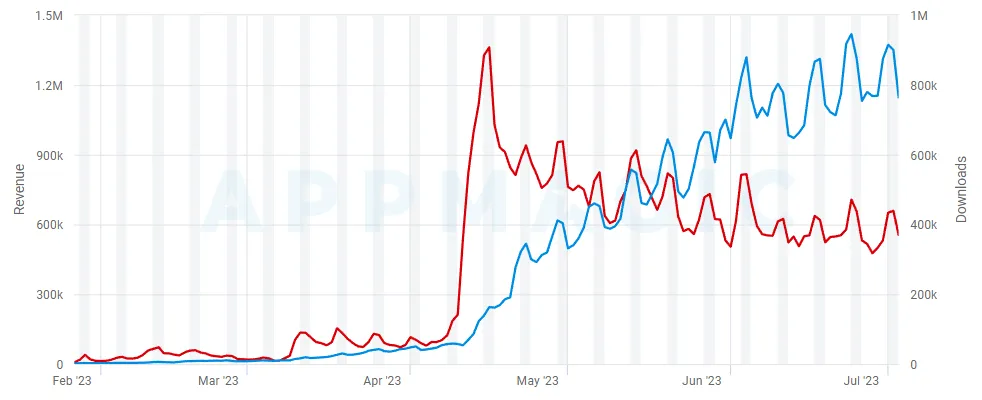

Harry Potter: Magic Awakened worldwide release is worse than Chinese by times

AppMagic was used as a data source.

- Harry Potter: Magic Awakened earned $5.17M in the first two weeks after its release.

- Japan ($1.94M); the US ($1.22M); South Korea ($436k) are leaders by revenue.

- The game was downloaded 5.345M times in two weeks.

- RpD on the Asian market reached $1.24. Western Tier-1 markets are showing $1.21 numbers.

- Harry Potter: Magic Awakened in China earned $26M in the first week after its release in 2021. The game earned $263.7M overall to date.

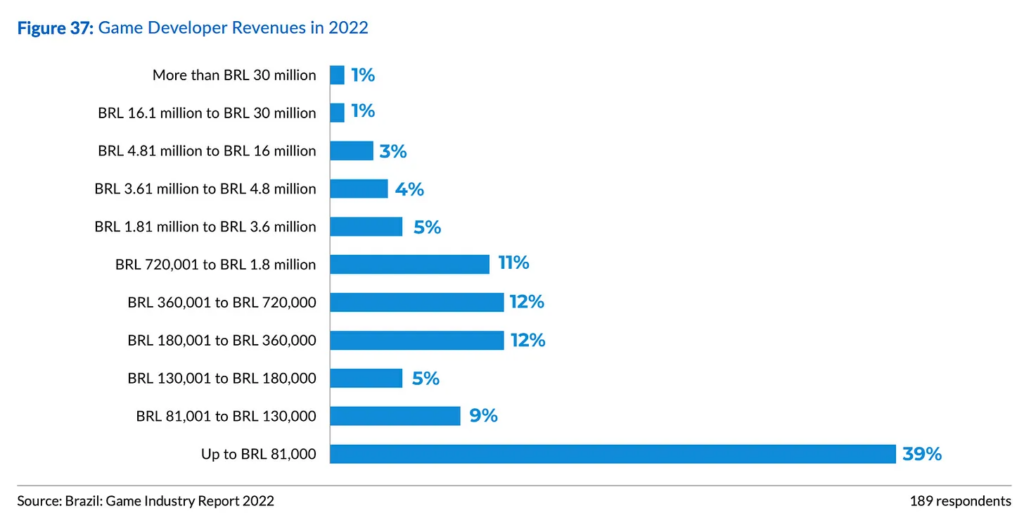

Abragames: Brazilian game industry in 2022

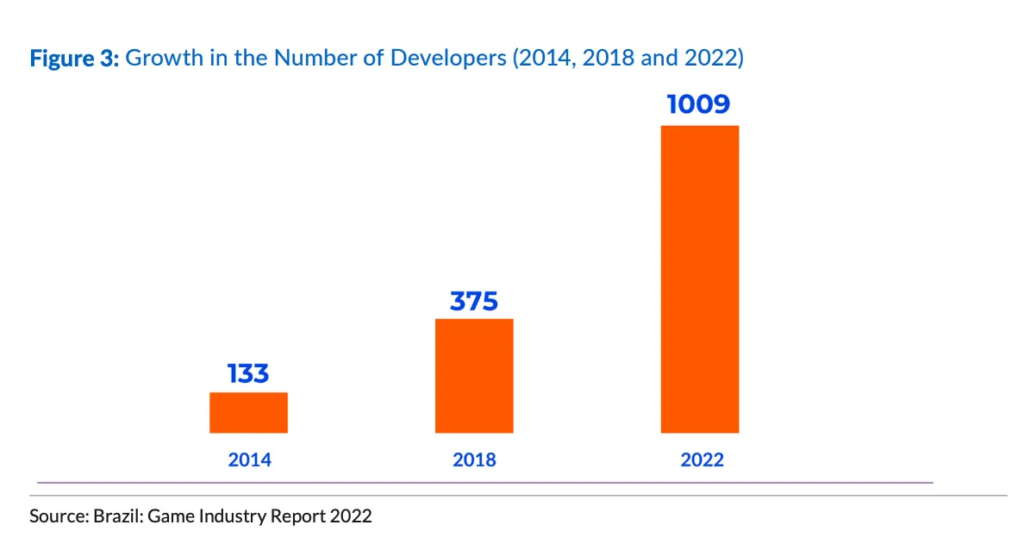

- 1,009 game studios were working in Brazil at the end of 2022. In 2018 there were only 375.

- In 2021 gaming studios from Brazil released 643 games.

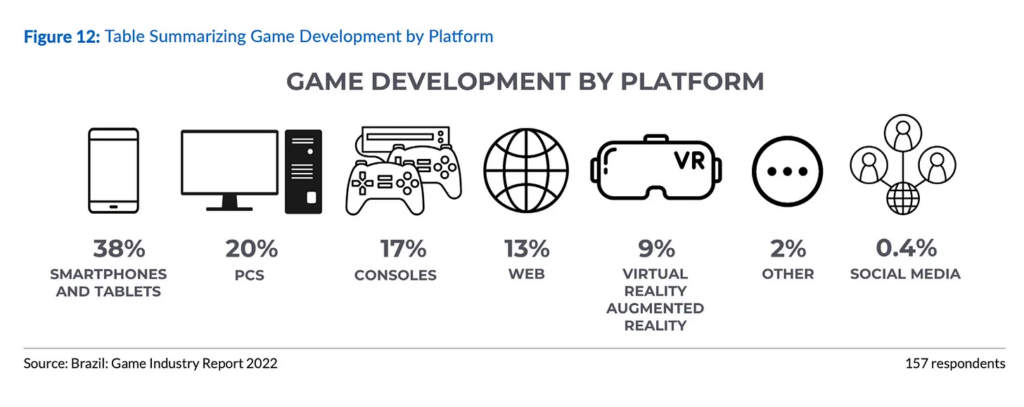

- 38% of developers are focusing on mobile titles; 20% on PC; 17% on Consoles; 13% on Web games; 9% on VR/AR; 2% - on other platforms. Less than 1% are working on games for social platforms.

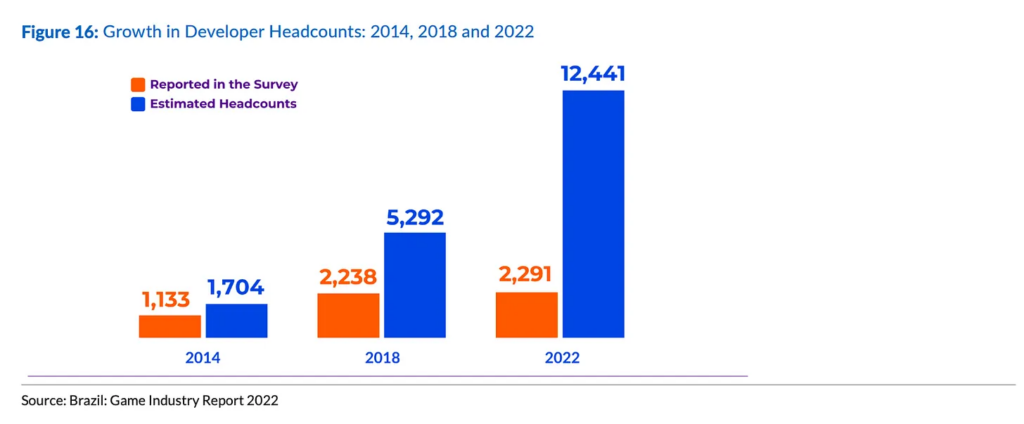

- More than 12 thousand people are estimated to work in Brazil at the end of 2022. 68.7% were male; 29.8% - female; and 1.5% were non-binary persons.

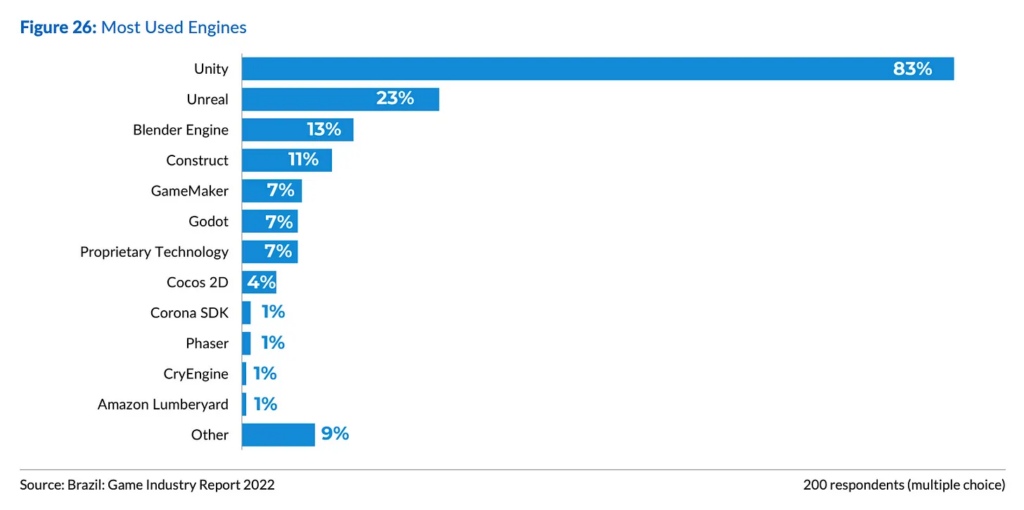

- Unity is by far the most popular engine in Brazil with a 83% penetration. Unreal Engine (23%) is second.

- Only 5% of Brazilian studios are earning more than $1M per year. 39% are getting less than $16k annually.

- Half of gaming companies are living on personal funding and F&F. 28% does not even have private funding sources.

- Main problems of Brazilian developers

- Access to the funding.

- Talent attraction & retention. More successful companies (especially from the US and Canada) are offering better conditions to workers.

- Increased competition.

- Taxes and bureaucracy. In particular, there is a double taxation problem in Brazil when a company is launching a title on international platforms. There is also a problem with hardware taxes needed for development.

Source: Abragames: Brazilian game industry in 2022 (pdf)

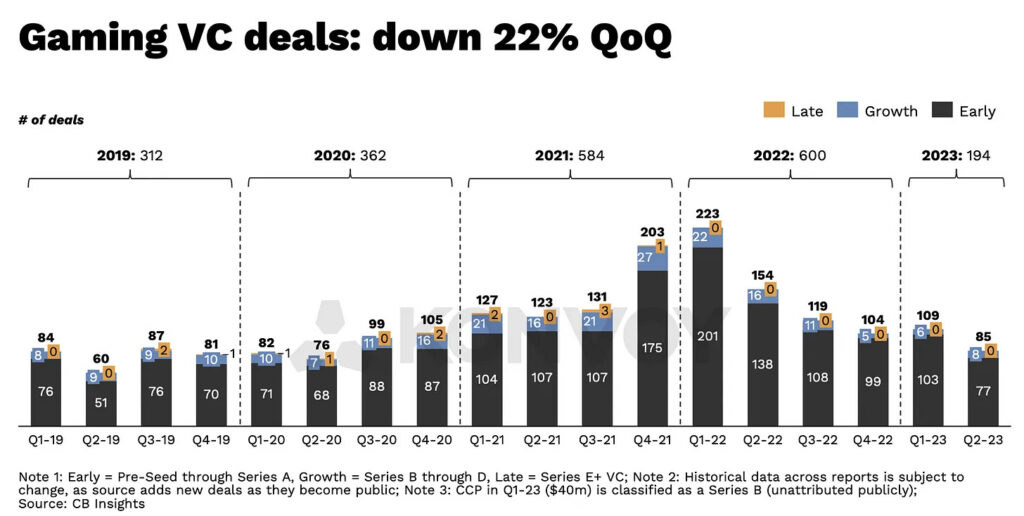

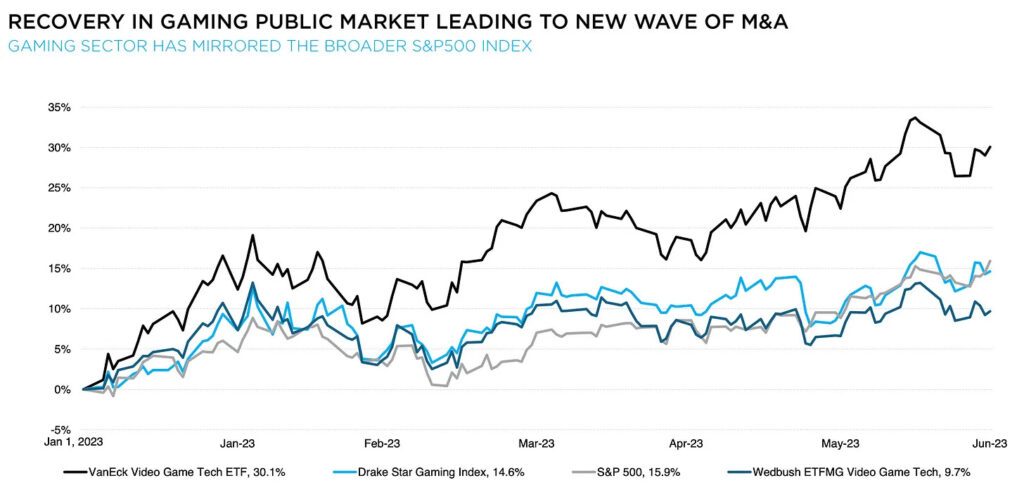

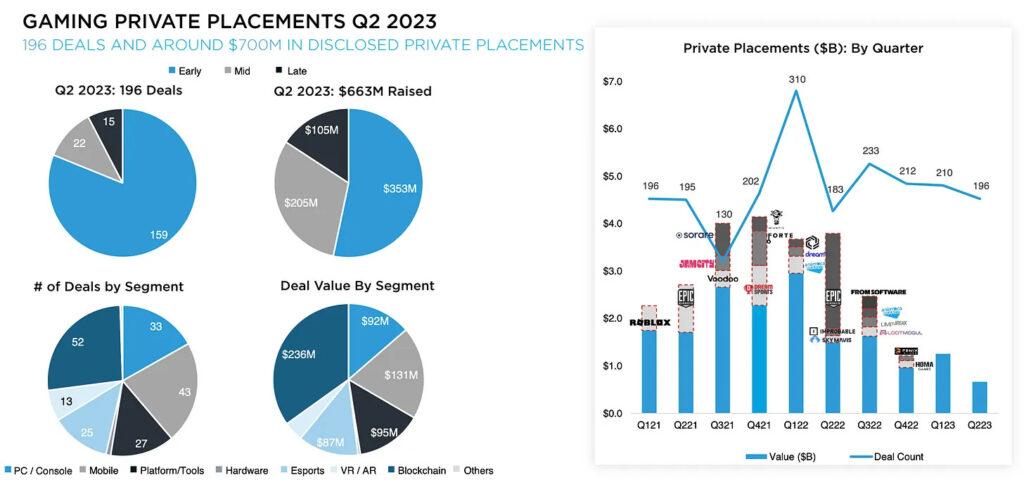

Konvoy Ventures: VC funding in gaming dropped by 38% in Q2 2023

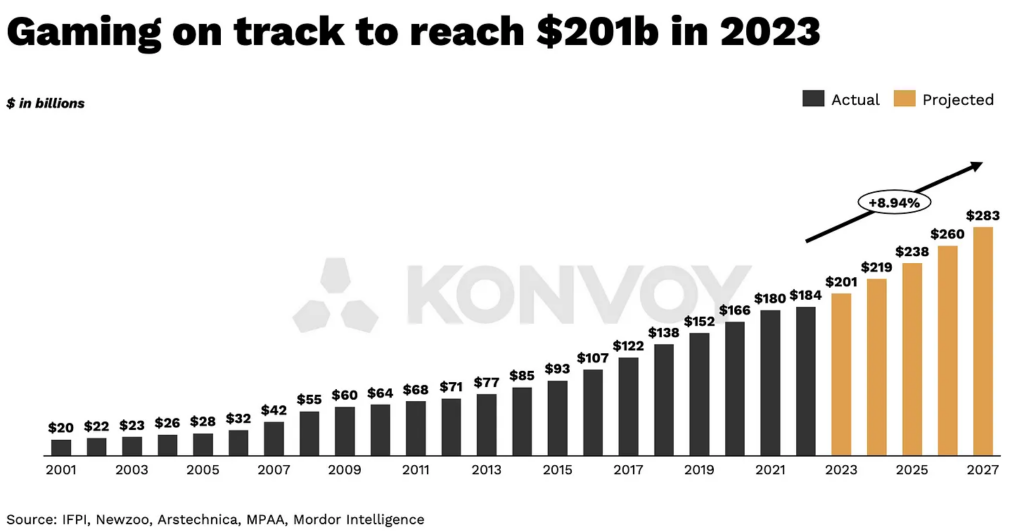

- The company believes that in 2023 the gaming market will grow to $201B and will continue growth with an 8.94% CAGR.

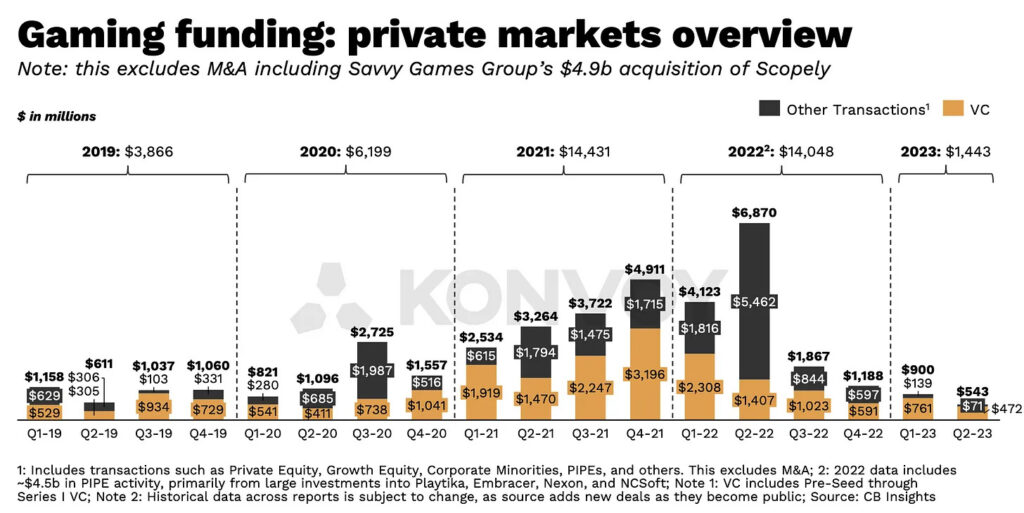

- Funding in different stages in 2022 (without M&A) in the gaming industry was $14.048B. In the first two quarters of 2023, funding only reached $1.443B.

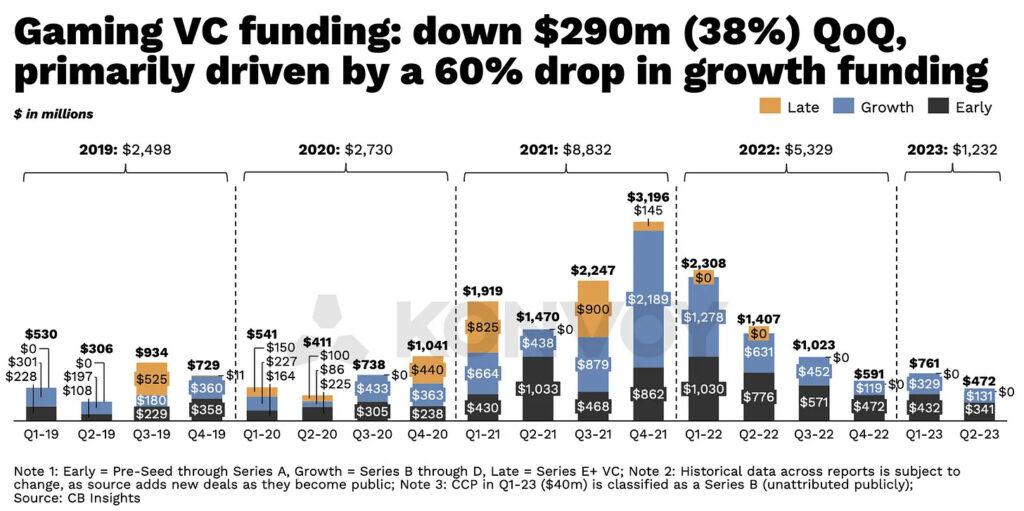

- VC funding dropped by 38% in Q2 2023 compared to the first quarter. The volume of early stages deals is dropping 5th quarter straight.

- The number of VC deals in Q2 2023 reached its minimum in 3 years. Less was only in Q2 2020.

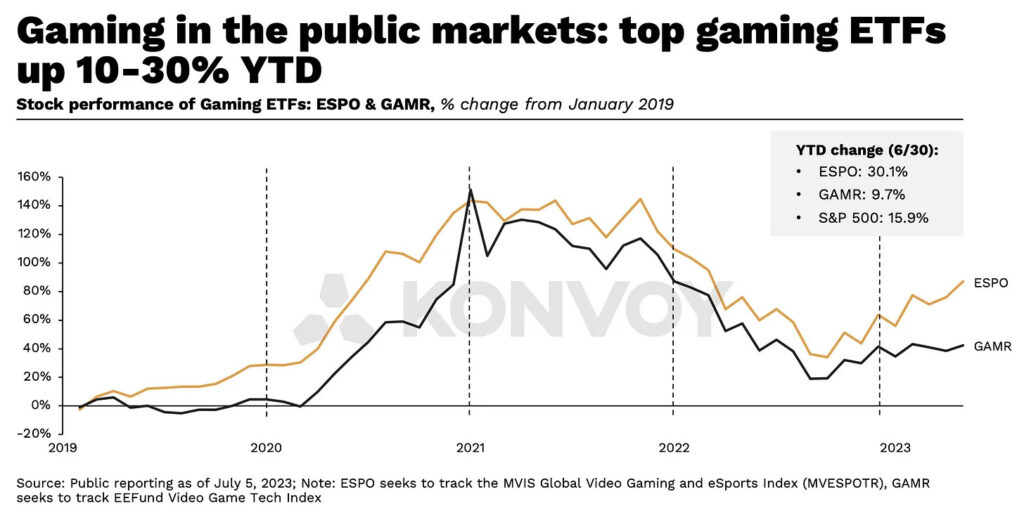

- Gaming ETF started to grow at the beginning of 2023. ESPO got +30.1%; GAMR - +9.7%. We can carefully presume that investors believe in companies’ adaptation to the new market cycle.

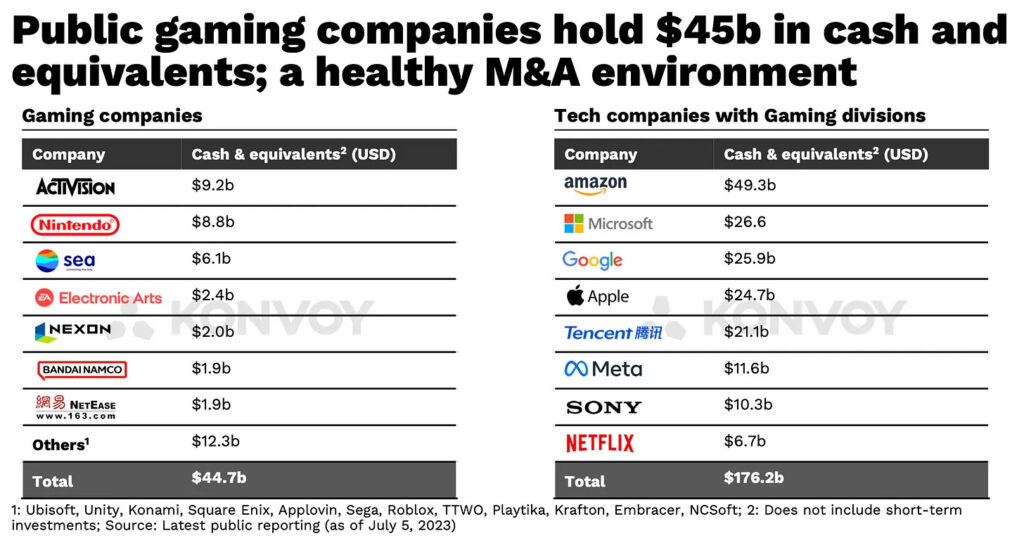

- Public companies have a significant amount in cash - more than $45B. Activision Blizzard is a leader by this parameter with $9.2B in cash.

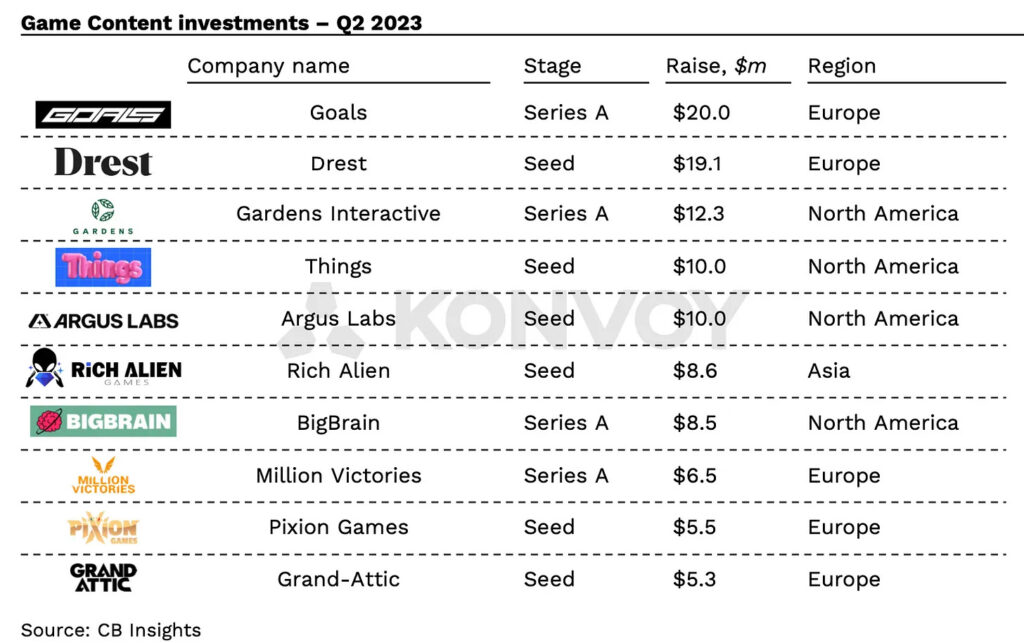

- The largest gaming VC deal of Q2 2023 is a Round A from Goals ($20M).

- Asia remains the leader in both the number and size of deals in the gaming industry.

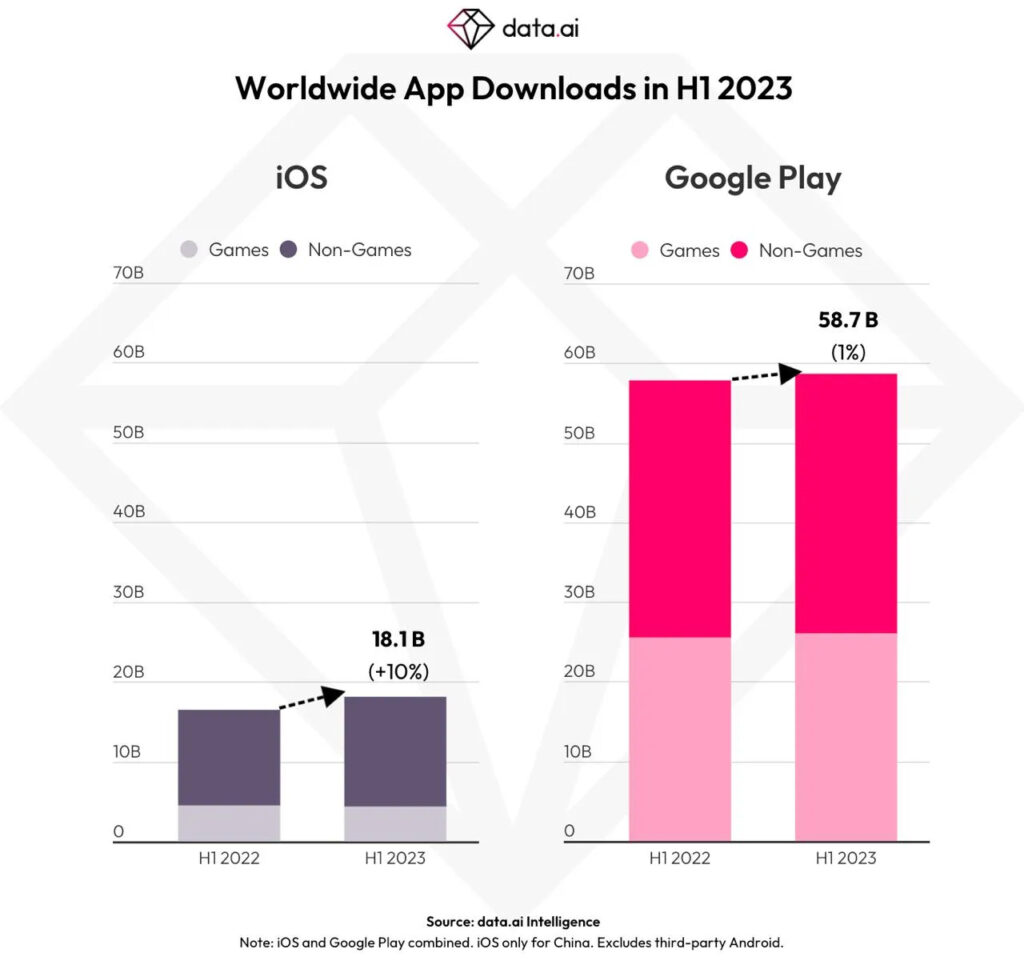

data.ai: Mobile gaming market in H1 2023 showed a further decline in revenue

Revenue

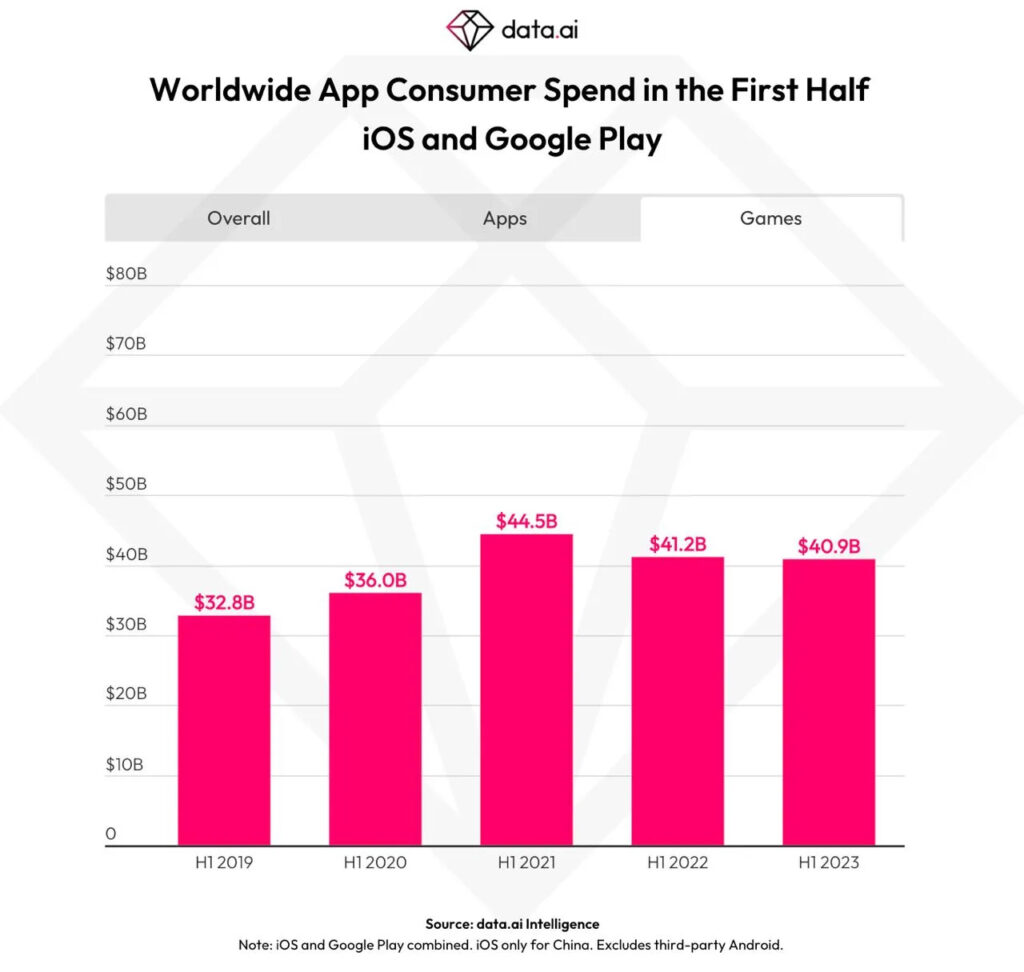

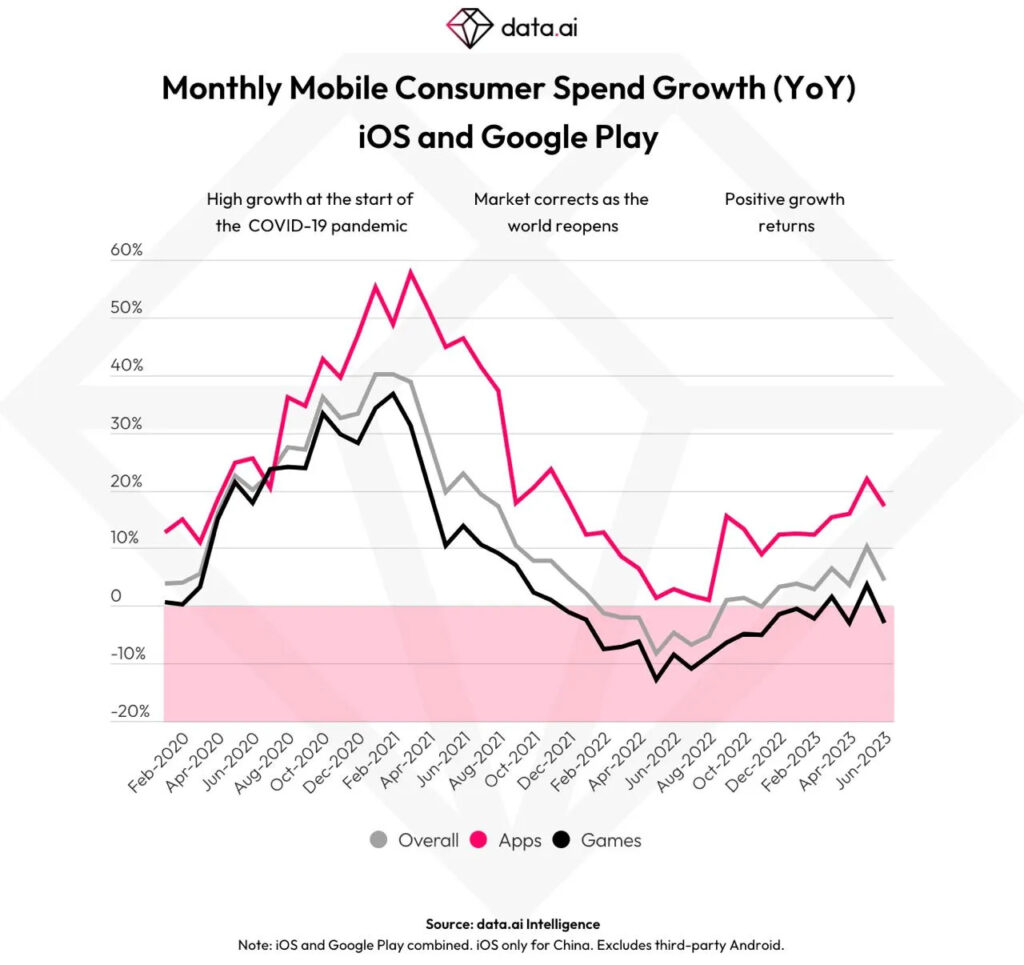

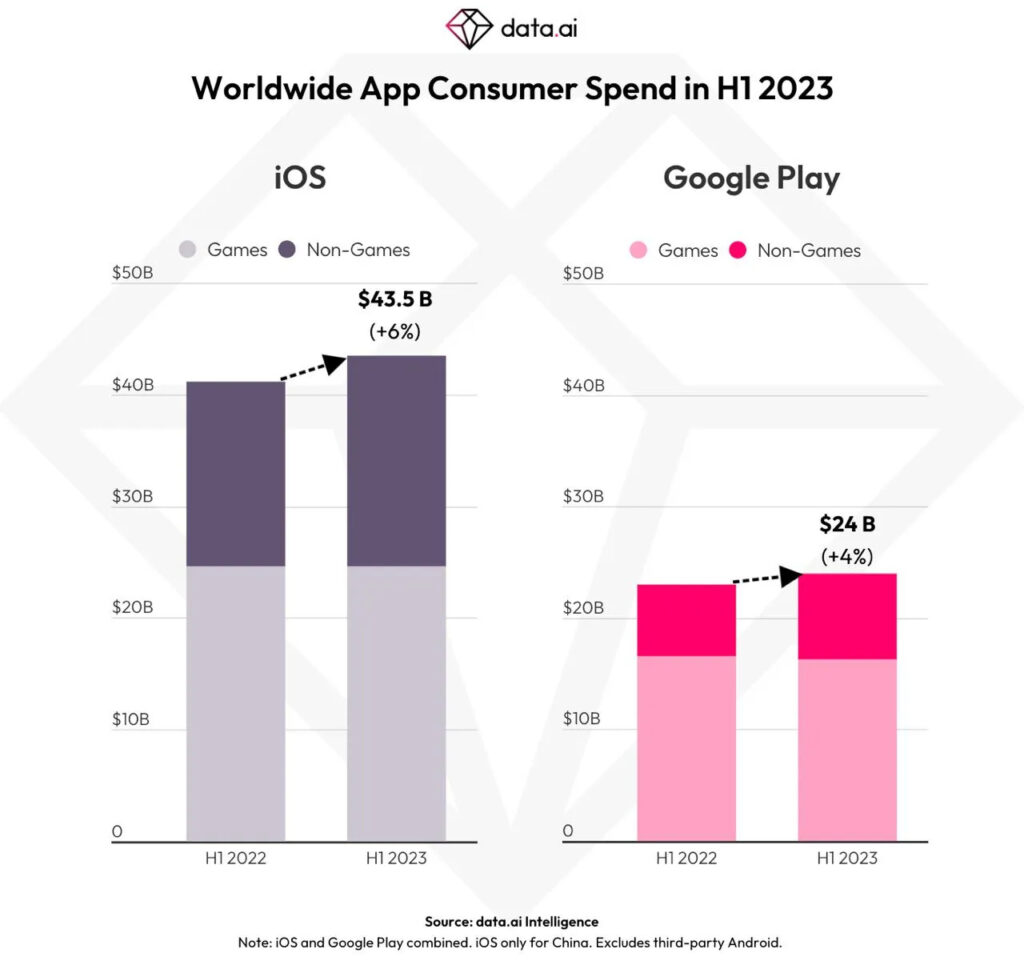

- $40.9B was spent by mobile gamers in H1 2023. It’s less than in H1 2022 ($41.2B) and H1 2021 ($44.5B) but more than in H1 2020 ($36B).

However, we should consider that data.ai can’t track some payments as more mobile companies are adopting alternative payment methods outside of app stores.

- The revenue dynamic from the lowest point in May 2022 started to climb up. It’s still in a minus zone, but March and May 2023 showed growth.

- data.ai analysts think that the worst in the mobile gaming market is behind. We can expect normalization and growth further.

- iOS was responsible for $24.6B of gaming revenue in H1 2023; Android - for $16.3B. Games are 56.5% of overall iOS apps revenue and 67.9% of Android overall revenue.

Downloads

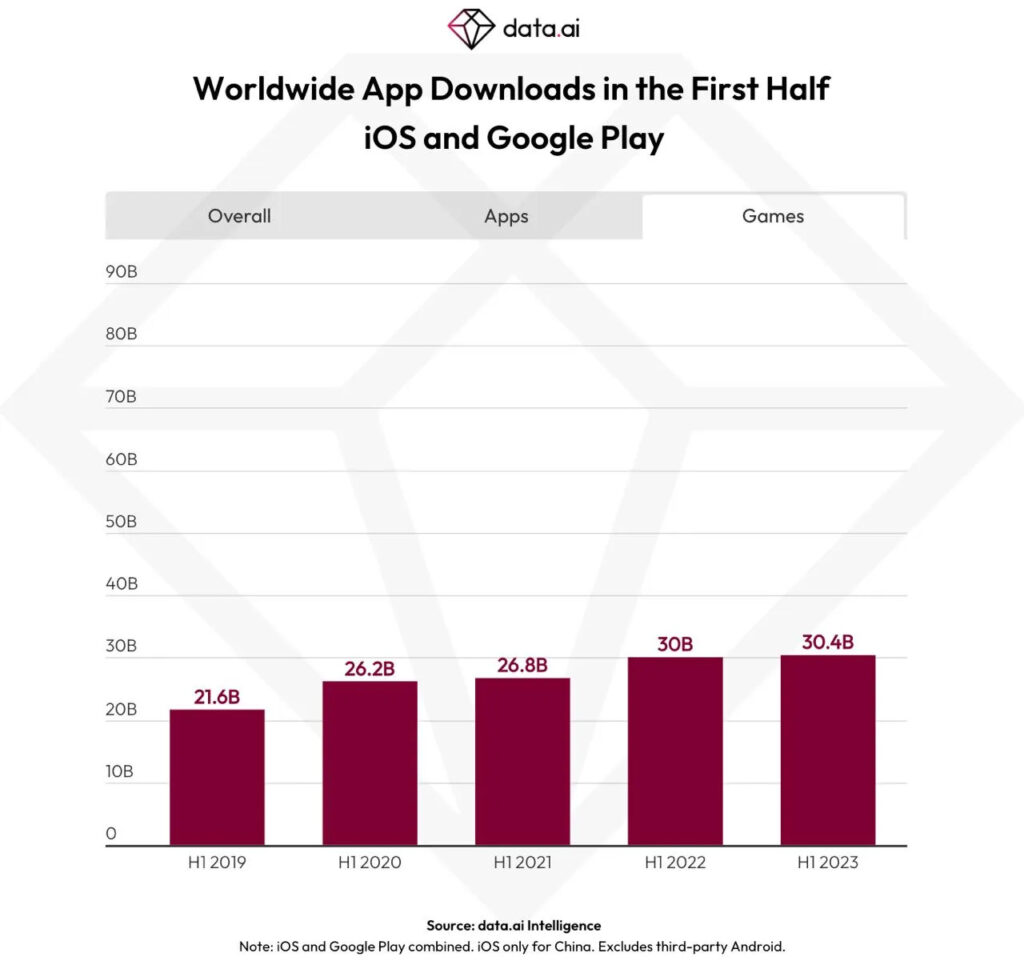

- Games downloads in H1 2023 reached 30.4B. It’s 0.4B higher than in H1 2022.

- 4.3B (23.7% of overall download volume) games have been downloaded in H1 2023 on iOS. 26.1B games have been downloaded on Android (it’s 44.5% of overall downloads).

Best games

- Downloads leaders in H1 2023 are Subway Surfers, Garena Free Fire, and ROBLOX. Two new games are on top - Block Blast Adventure Master and Attack Hole.

- Top-3 games by revenue are Honor of Kings, Candy Crush Saga, and ROBLOX. Gardenscapes returned to the top 10.

- The best MAU titles of H1 2023 are ROBLOX, Garena Free Fire, and Candy Crush Saga. FIFA Soccer showed significant growth and jumped to the top 10.

Sensor Tower: Top Mobile Games by Revenue in June 2023

- The 3 top-grossing games of June are Honor of Kings, Honkai: Star Rail, and PUBG Mobile. All of them are from Chinese developers.

- Honor of Kings earned $213M in June. The increase in revenue is connected to the release of an updated version of the game.

- 39.7% of Honkai: Star Rail revenue came from China (iOS only); 27.7% - from Japan, and 11.4% from the US.

- PUBG Mobile revenue in June reached $122M - 54.2% of which generated Chinese users. The US is accountable for 9%; India - for 7.5%.

- Dragon Quest Champions, a turn-based RPG from Square Enix, and Peak Spead, a new racing game from Netease Games & Codemasters, are among the prominent releases of the previous week.

- Users spent $6.15B in games in June 2023. There is no growth compared to the previous year, but no decline as well.

- The US is the largest mobile gaming market in June ($1.8B; 29.3% of the overall amount). China is second (19.3% - but only iOS is counted); Japan is third (16.7%).

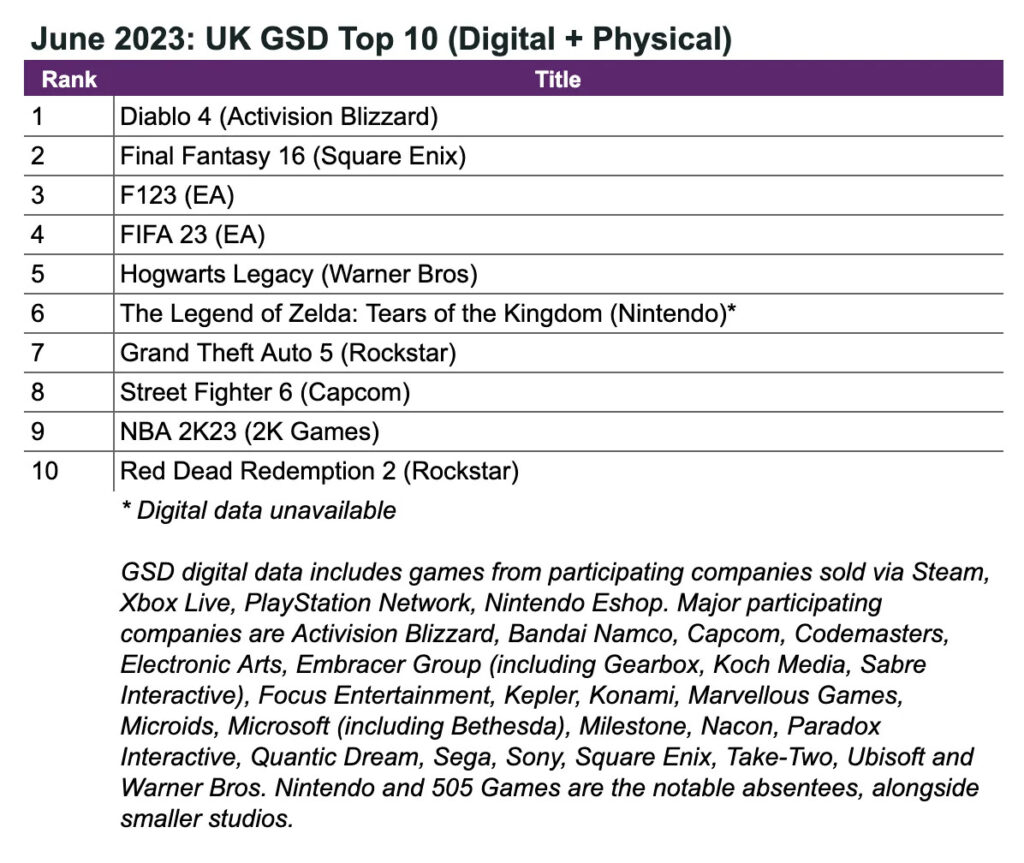

GSD: The UK game sales in June 2023 increased by 7% YoY

GSD is reporting only the fact sales numbers were received from partners. There are partners (like Nintendo), who are not sharing the digital sales numbers, which might affect the overall picture.

Games

- Game sales increased by 7% compared to June 2022. It’s happened because of a bunch of great releases this year.

- Diablo IV is the best-selling game of June in the UK. Currently, it’s the second title by sales dynamic after Hogwarts Legacy and, maybe, The Legend of Zelda: Tears of the Kingdom (but Nintendo is not sharing digital data).

- 57% of Diablo IV sales came from PCs.

- Final Fantasy XVI reached second place in sales. In the first two weeks sales numbers are 36% worse than Final Fantasy VII: Remake had. However, Square Enix seems to be satisfied with the results.

- F1 2023 is third. In the first 3 weeks of sales, it performed 49% worse than the previous installation. Interesting that 48.5% of sales came from the Xbox Series S|X - that’s a rare situation.

- Street Fighter 6 started from the 8 position in the chart. 52% of sales came from the PS5.

- 82% of all sales in June 2023 were digital.

Hardware

- Console sales in June 2023 increased by 15% and reached 110k.

- PlayStation 5 increased by 43% compared to May. Demand is partly connected with discounts.

- Nintendo Switch sales dropped by 20%. It seems that everyone, who wanted to play The Legend of Zelda: Tears of the Kingdom, already bought the console.

- Xbox Series S|X sales increased by 31% MoM.

- In June 2023, 722k consoles have been sold in the UK. It’s 11% more than a year before. PlayStation 5 sales increased by 66%. Nintendo Switch dropped by 10%; Xbox Series S|X - by 23%.

- DualSense, as almost always, is the best-selling accessory.

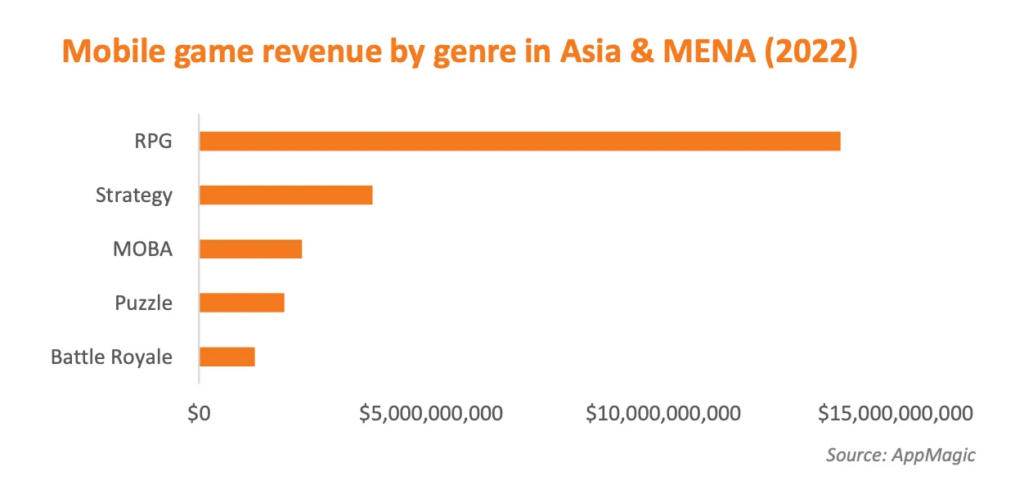

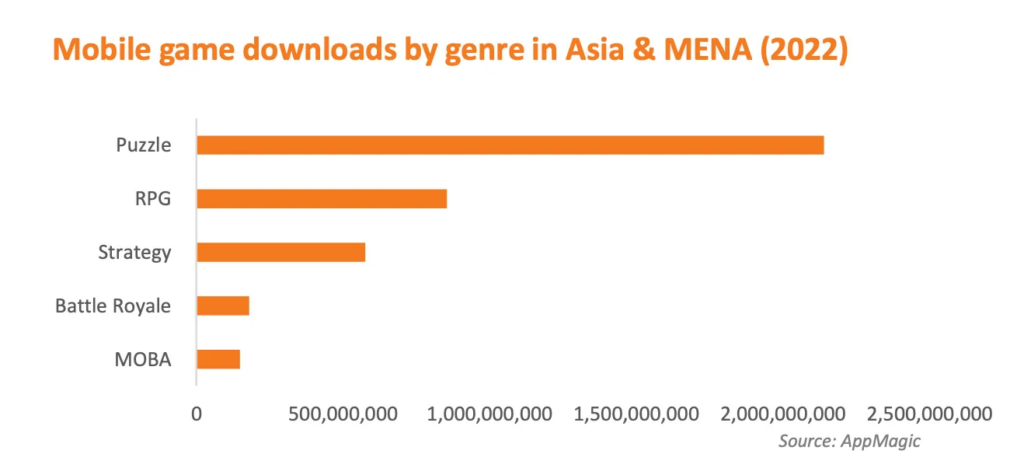

Niko Partners & AppMagic: 5 main mobile genres in Asia & MENA

- RPG, strategies, MOBA, Puzzles, and Battle Royale games generated more than 80% of revenue in Asia and MENA region in 2022.

- RPG is the largest genre with almost $15B in annual revenue. It’s 50% higher than combined strategies, MOBA, Puzzles, and Battle Royale revenues.

- Puzzles is the most downloaded genre in Asia & MENA region with more than 2B downloads in 2022.

- MOBA players are the most loyal. They rarely play other games in the genre and spend a lot of time with a chosen title.

- Battle Royale players are interested in eSports. They’re watching tournaments, attending offline events, and participating in them.

Source: Niko Partners & AppMagic: 5 main mobile genres in Asia & MENA (pdf)

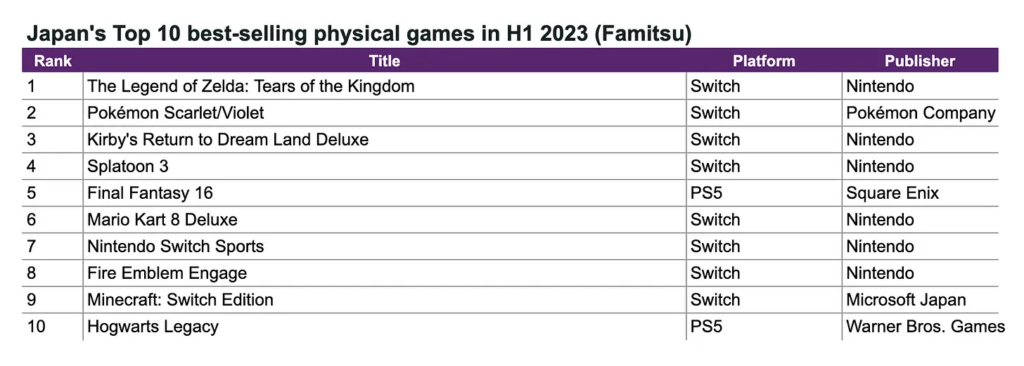

Famitsu: Japanese gaming market in H1 2023

Famitsu is tracking physical sales only.

Games

- Nintendo earned $203M in H1 2023 from boxed sales. It’s 44% of the overall market volume.

- Square Enix had 10.6% of the boxed market in Japan; Pokemon Company had 7% ($34M). But Nintendo owns the former, so it’s fair to say, that Nintendo owns more than 50% of the Japanese boxed market.

- The Legend of Zelda: Tears of the Kingdom is the best-selling game of the first half in Japan, its sales surpassed 1.7M copies. Pokemon Scarlet and Violet (719k copies) are second; Kirby’s Return to Dream Land Deluxe is third (451k copies).

Hardware

- Nintendo Switch in H1 2023 reached 1.94M sales.

- PlayStation 5 was bought 1.4M times.

June results

- Japanese gamers bought 380k Nintendo Switch and 215k PlayStation 5 in June.

- Despite the Final Fantasy XVI release, Nintendo (422k boxed sales) outpaced Square Enix (364k boxed sales). Capcom is third (83k).

- Final Fantasy XVI is the best-selling game of the month (336k copies sold). The Legend of Zelda: Tears of the Kingdom is second with 182k boxed copies.

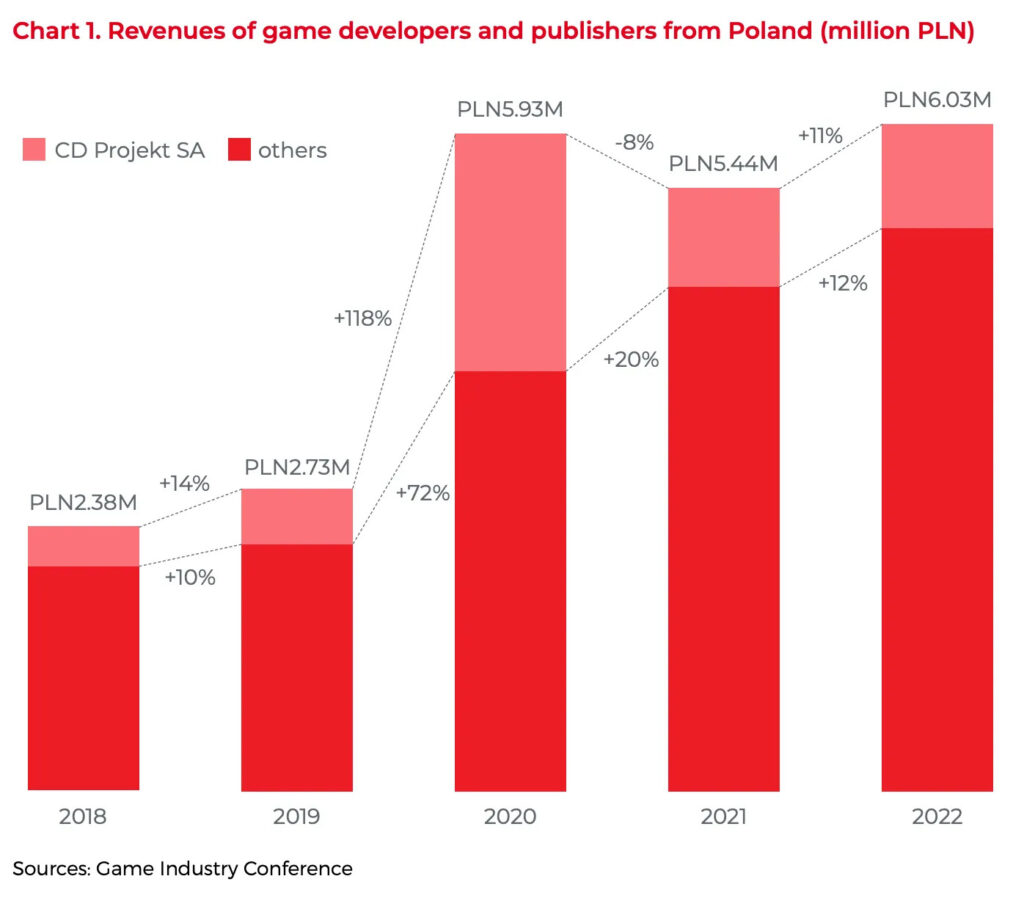

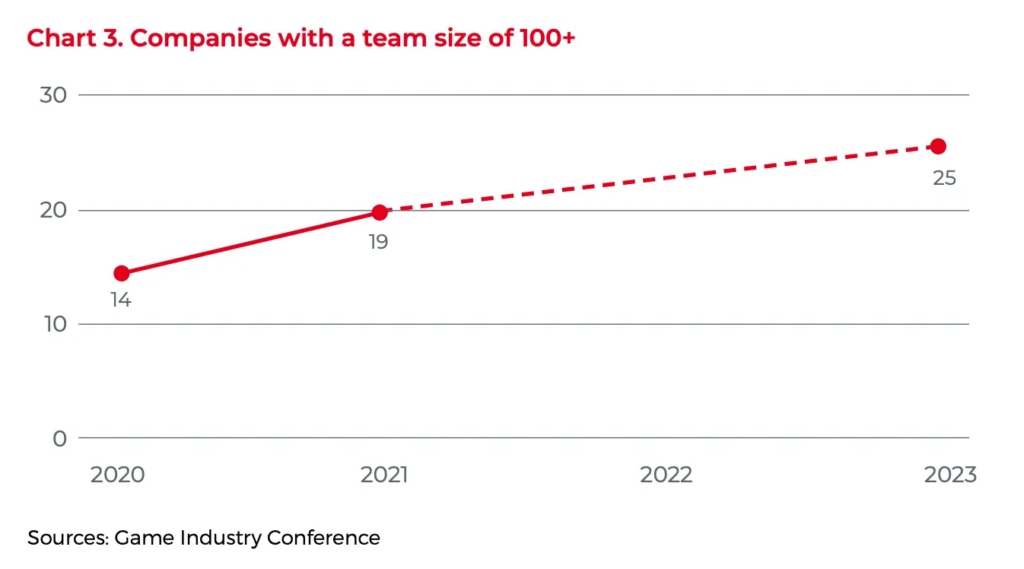

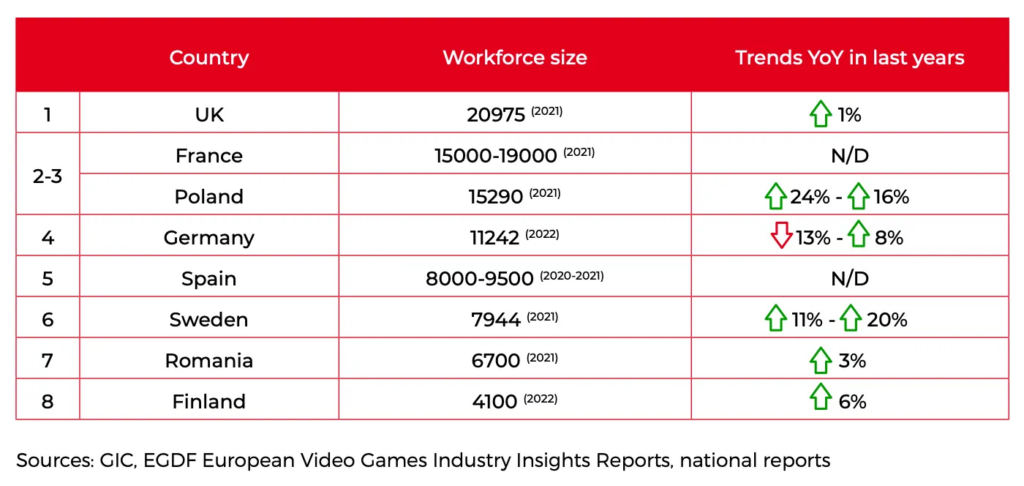

Polish Agency for Enterprise Development: Polish Gaming Industry in 2023

Gaming industry

- €1.286B gaming companies from Poland earned in 2022. They released more than 530 games.

- At the end of 2022, there were 494 companies in Poland involved in game development or publishing.

- 16 companies in the country have more than 200 people; 56 have more than 50. The average team size in Poland in 2023 will be 31.3 people per studio.

- The Polish industry had more than 15 290 gaming industry professionals at the end of 2021. The growth dynamics of people involved in gaming surpass all other European countries.

- 24% of the workforce are female. 2200 foreigners (14.5% of the overall amount) are working for companies located in Poland.

- There are 52 universities in Poland offering different gaming educational programs.

Gaming market

- In 2022 the Polish gaming market reached €1,225B. An increase from the previous year was 15%. This is the #19 market in the world.

- $68 is an ARPU for a gamer in Poland. It includes both mobile and PC/Console purchases.

- Physical distribution in Poland dropped by 14% in 2022.

- More than 20M gamers are living in Poland, 80% of them are adults. 47% are female.

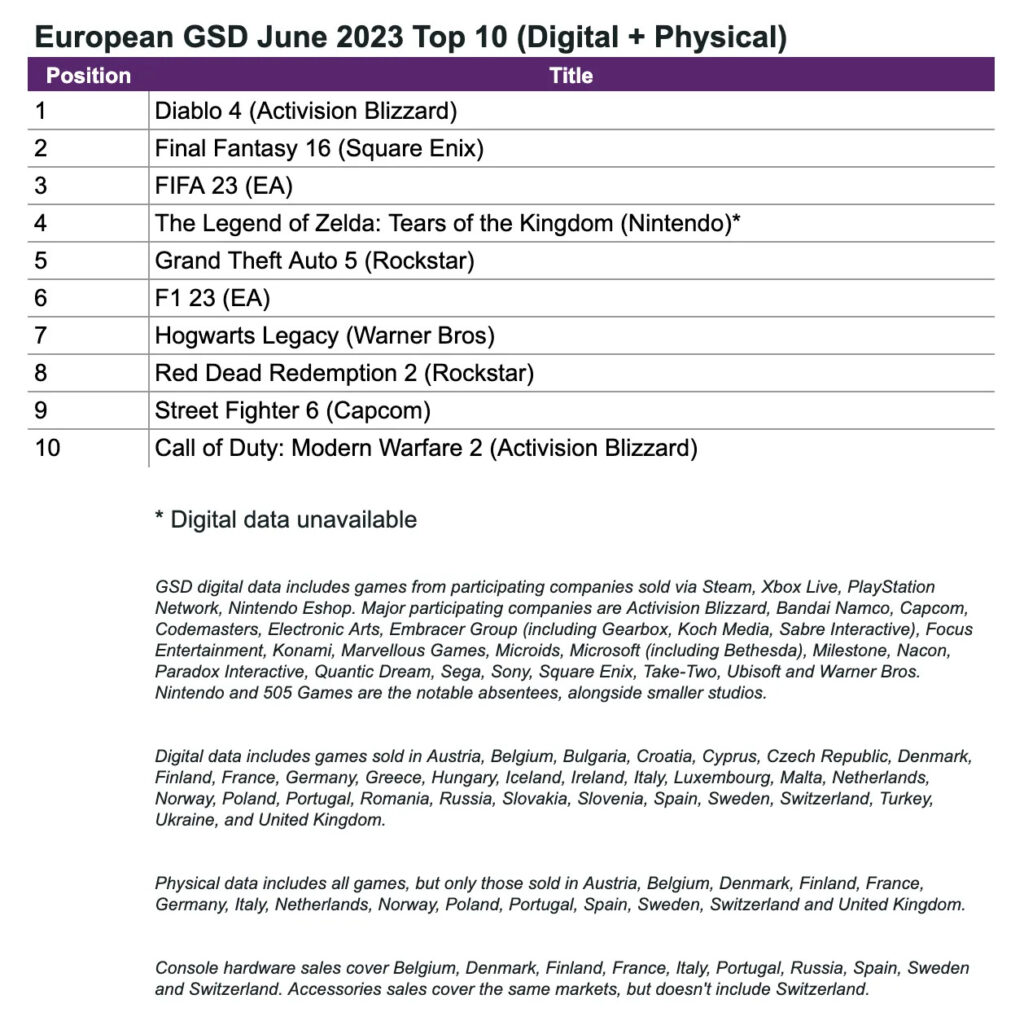

GSD: European game sales increased by 20% in June 2023

GSD is reporting only the fact sales numbers were received from partners. Some partners (like Nintendo) are not sharing the digital sales numbers, which might affect the overall picture.

Games

- 15.5M copies were sold in Europe last month. It’s 20% more than it was in June 2022, which is related to plenty of new game launches.

- Diablo IV is the best-selling game of June and second by sales dynamics after Hogwarts Legacy. However, if Nintendo were to share its digital sales it’s highly probable that The Legend of Zelda: Tears of the Kingdom was second.

- Diablo IV is the largest launch of June in the history of GSD records (since 2017). 66% of sales came from PC players; 21% - from PS5, and only 9% are playing on Xbox Series S|X. PlayStation 4 has 4% of the audience.

- Final Fantasy XVI is in second place by sales. The game launched in Europe 24% worse than Final Fantasy VII: Remake.

- F1 23 is third. The game started badly in the UK, in Europe the situation is the same - starting sales are 47% lower than the previous installation. 65% of sales came from PS5; 22.5% from Xbox Series S|X; 12.5% from PS4.

- 80% of all sales in June were digital.

- Counting only boxed sales, Diablo IV is first, but The Legend of Zelda: Tears of the Kingdom is only a little behind.

- GfK Entertainment also mentioned that The Legend of Zelda: Tears of the Kingdom is the best-selling retail game in Europe in the first half. Although Hogwarts Legacy was launched earlier and on 5 platforms instead of only Nintendo Switch.

Hardware

- 500.7k consoles were sold in Europe in June. It’s 33% more than in the previous year.

- PlayStation 5 sales increased by 116% YoY. That’s the top-selling console of the month.

- Xbox Series S|X sales dropped by 0.8%; Nintendo Switch experienced a 2.3% decline.

- DualSense is, as it often happens, a leader in sales among accessories. Gamepad sales increased by 6.6% YoY.

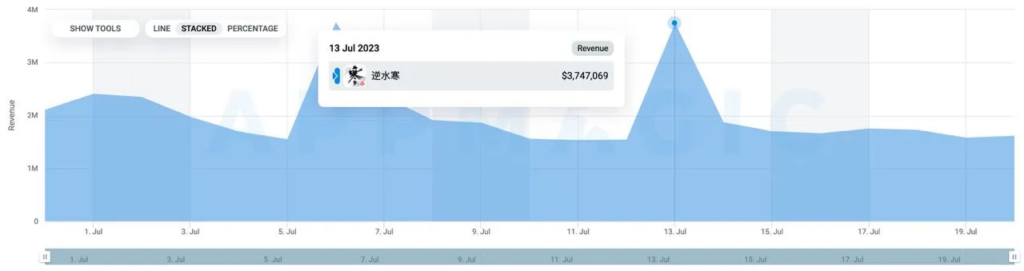

A new MMORPG from NetEase - Justice Online Mobile - is earning at least $1.5M daily since the release

- Yicai Global reported that the game earned $3.6M on the first day after its release (30 June). In 5 days it reached $23.3M.

- AppMagic numbers are a little lower. According to the platform, the game earned $2.1M on the first day. Since the release (30 June) and by 20 July, the game earned $42M.

- From 14 to 20 July, the game earns on average $1.6M daily.

- As far as the game is launched only in China, only iOS sales are counting. It’s fair to suggest that the real revenue might be 1.5-2x times higher due to 3rd-party stores.

- According to Yicai Global, by the release, the game had more than 40M pre-registrations. The number of downloads according to AppMagic is now 6.2M.

- Game development cost $139M. That’s one of the most expensive games NetEase ever created.

- Justice Online Mobile reportedly is using AI. It’s used for realistic bots and NPC dialogues.

Carry1st & Newzoo: Sub-Saharan African countries gaming revenue reached $863M in 2022

Sub-Saharan Africa is the part of Africa located south of the Sahara.

- The gaming market size increased by 8.7% YoY.

- Mobile games are generating 90% of overall region revenue ($778.6M).

- PC games are responsible for $49.4M; console titles for $34.8M.

- The most significant regions of the market are Nigeria ($249M) and South Africa ($236M).

- It’s expected that the overall value of the Sub-Saharan Africa region will surpass $1B in 2024.

SEGA President: Games for a new console generation will cost $70M+ to develop

- Yukio Sugino thinks that the development cost in Japan is increasing. The new normality with the next generation will be a $70M budgets.

- Considering this, SEGA is planning to increase its worldwide presence. 3.5k people are working in the company now, and 1.5k of them are overseas.

- Global markets generate 80% of SEGA’s PC & Console revenue. Mobile titles, in reverse, earn 90% of the revenue in Japan, the local market.

- The game development price increased sufficiently in the last few years. The Last of Us: Part II cost $220M. Shadow of the Tomb Raider development was somewhere between $75M and $100M. Forspoken, Callisto Protocol, and Saints Row budgets exceeded $100M - and all those projects haven’t found financial success.

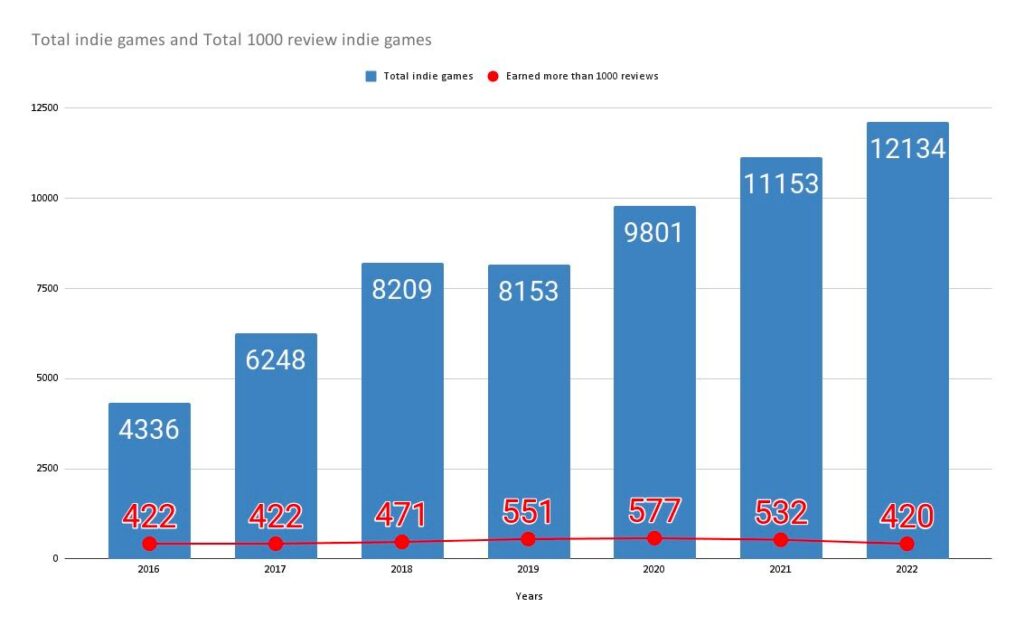

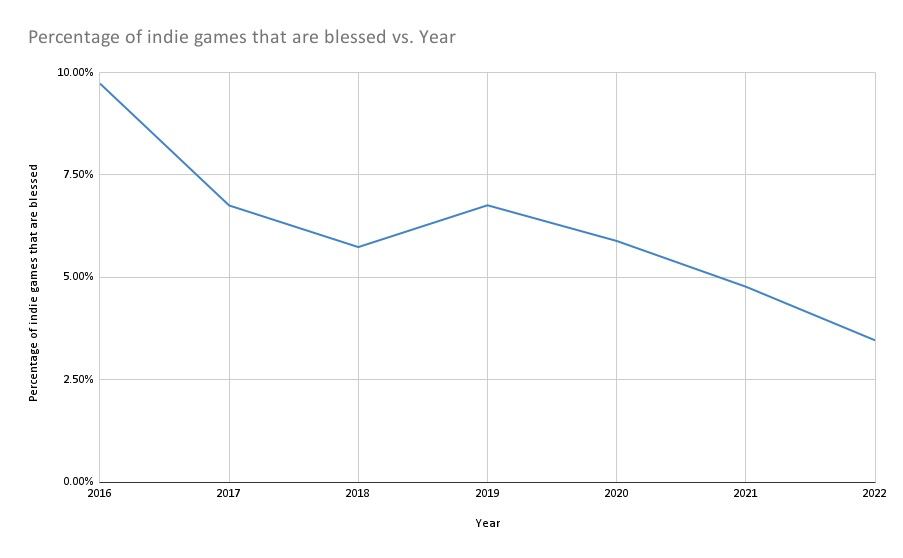

How to Market a Game: 2022 became the worst year for indie developers on Steam

As a benchmark, How to Market a Game considered titles that passed 1,000 reviews on the platform.

- In 2022 there were 420 such games. A year before - 532. In 2020 - 577. The smallest number of 1,000+ reviews games were in 2016 & 2017 - 422.

- Wherein, the number of new indie games on Steam is increasing every year. If in 2016 there were about 10% of successful indie releases, in 2022 this percentage dropped to 3.75%.

Interesting highlights

- There were no indie titles in 2022 that failed the release but made a comeback with great live-ops and community management.

- Vampire Survivor clones were popular even at the end of 2022.

- Horror games do have a stable audience and sell quite fine.

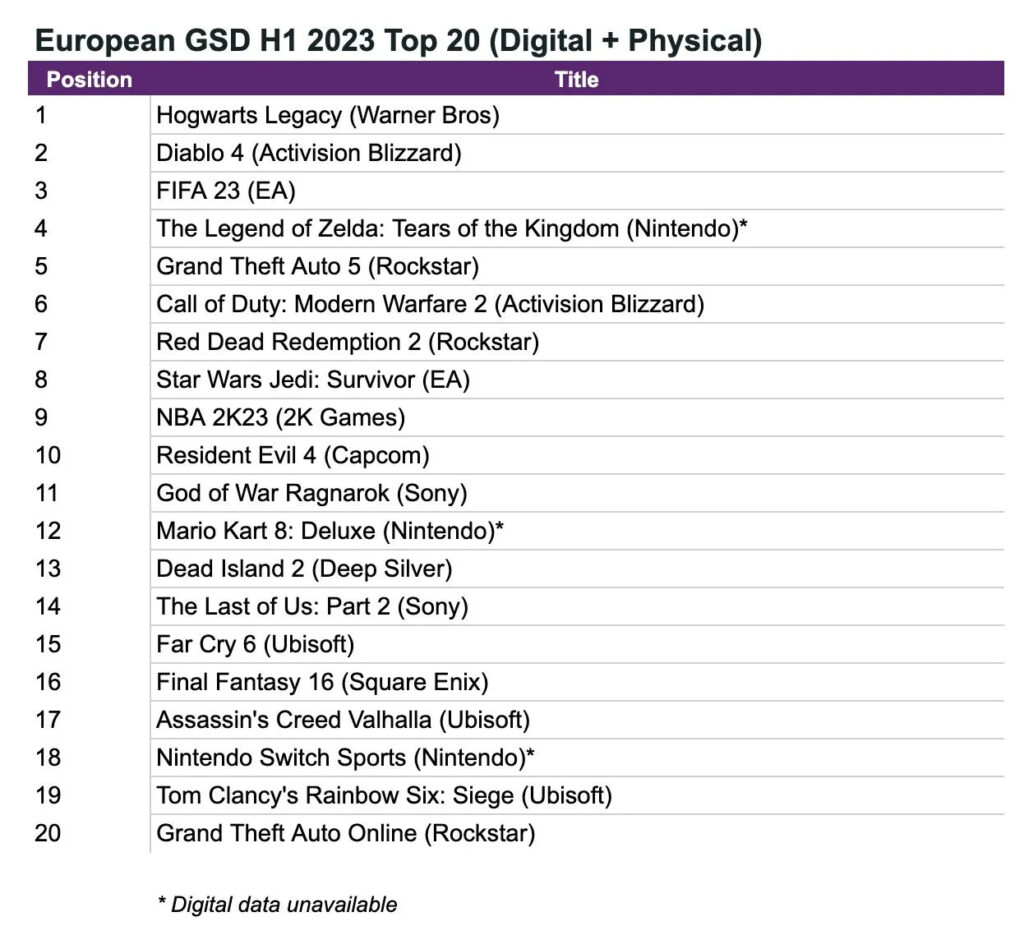

GSD: Hogwarts Legacy & Diablo IV are leaders by sales in Europe in H1 2023

- 76.1M games have been sold in Europe in H1 2023. It’s much bigger than in H1 2022.

- The UK is the largest European market. British gamers bought 15.3M games (+5.5% YoY). Germany is next - 14M (-11% YoY); then France - 11.1M (+8% YoY); Spain - 5.4M (+6.8% YoY); Italy - 4.9M (+2.7% YoY).

- Among all sales, 29.1M copies sold were boxed copies. It’s 9% less than a year before. The Legend of Zelda: Tears of the Kingdom is the most popular boxed game of the first half a year.

- Hogwarts Legacy is the best-selling game of H1 2023 in general. Its sales are 69% higher than Elden Ring’s, which topped the charts in H1 2022.

- Despite being on sale for just a couple of weeks, Diablo IV has already reached third place by sales. The Legend of Zelda: Tears of the Kingdom is in 4th place (but only physical copies are counted).

- FIFA 23 is selling 24% better than FIFA 22.

- Hogwarts Legacy sales in the UK in H1 2023 are 124% better than FIFA 23.

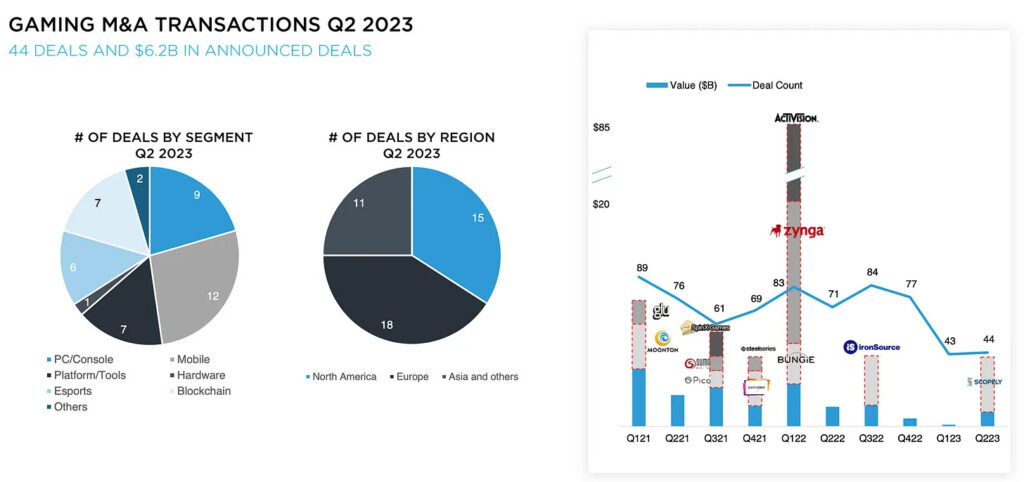

Drake Star: Gaming investments in Q2 2023

- The value of disclosed M&A deals in Q2 2023 surpassed $6B. The majority of this amount comes from the Scopely with Savvy Gaming & SEGA with Rovio deals. Overall, there were 44 M&A deals in Q2 2023.

- The public gaming companies index from Drake Star (includes top-25 public gaming companies with $1B+ capitalization) increased by 15% in H1 2023.

- AppLovin (+144.3%); SEGA (+53.8%), and Unity (+51.9%) are leaders of growth. Embracer (-43%), NCSoft (-34.2%); Keyword Studios (-33.6%) are companies whose stock prices dropped the most.

- 196 private investment deals happened in Q2 2023 - it’s less than in Q1 2023 (200). Amount of deals exceeded $700M. More than 80% were early stages.

- BITKRAFT is the leader in several deals in H1 2023. Andreessen Horowitz, Griffin Gaming, Makers Fund, and Play Ventures are next.

Source: Drake Star: Gaming investments in Q2 2023 (pdf)

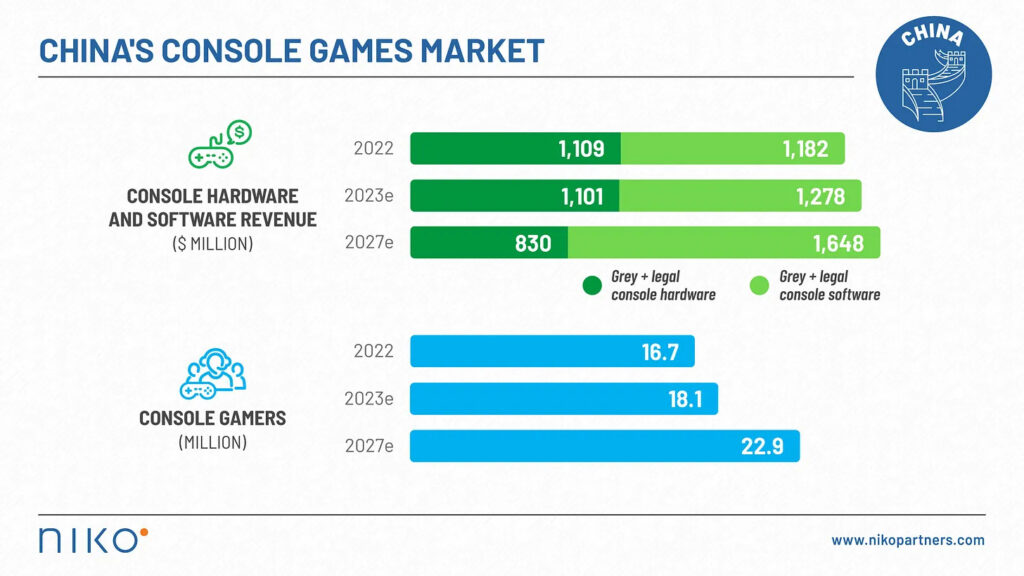

Niko Partners: Console game market in China in 2023

Niko Partners is covering both white and grey sales.

2022

- The volume of the console gaming market in China in 2022 reached $2.29B (+7.8% YoY). $1.1B from hardware sales; $1.19B - from game sales.

- The number of console gamers in 2022 reached 16.7M (+8.3% YoY).

2023 - estimation

- In 2023 the console gaming market will reach $2.37B. $1.1B will take hardware sales; $1.27B - game sales.

- The number of console gamers in the country is expected to reach up to 18.1M.

2027 - forecast

- The size of the console gaming market is expected to reach $2.48B (+1.6% CAGR). Hardware sales will be around $830M; games sales - $1.6B.

- The number of console gamers is supposed to increase to 22.9M.

Chinese console gaming market-specific feature

- China has its console versions with dedicated stores and complex content moderation. Many players prefer to buy imported consoles from other countries (grey import). Before 2015 there was a 15-year console ban in China.

Call of Duty: Mobile revenue exceeded $3B

- Activision Blizzard reported this in a Q2 2023 report.

- It took almost 4 years for a game to achieve this milestone. It was launched in October 2019.

- Activision Blizzard is currently working on a Call of Duty: Warzone Mobile release. It’s projected to happen this fall. The company states that both games will be operated as they’re offering different experiences for users.

Tune in next month for more updates!