devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the November and December reports.

Table of Content

- UK Gaming Market was recession-resistant in 2022

- data.ai: State of Mobile 2023

- AppMagic: Top Mobile Games by Revenue & Downloads in December 2022

- GfK & GSD: The UK Game sales in December 2022 decreased by 8%

- Steam reached the 10M concurrent playing users

- ERA: Videogames remained the largest home entertainment format in the UK in 2022

- GSD: European PC/Console gaming market dropped by 7.1% in 2022

- Famitsu: Boxed games and consoles sales in Japan reached $2.9B in 2022

- Le Figaro: Nintendo Switch became the best-selling home console in France in history

- CNG: Chinese gaming market in 2022 dropped for the first time since the stats collection

- AppMagic: Hypercasual market in Q4 2022

- NPD: The US gaming market dropped by 5% in 2022

- GSD: European gaming market of PC & Consoles kept falling in December 2022

- AppsFlyer: Uninstall benchmarks on Android

- StreamElements & Rainmaker.gg: State of the streaming gaming market in December 2022

- Newzoo: 10 trends in Gaming of 2023

- GDC: Game Industry Report 2023

UK Gaming Market was recession-resistant in 2022

The material for Gamesindustry.biz was prepared by Sam Naji, the consultant at Sparkers.

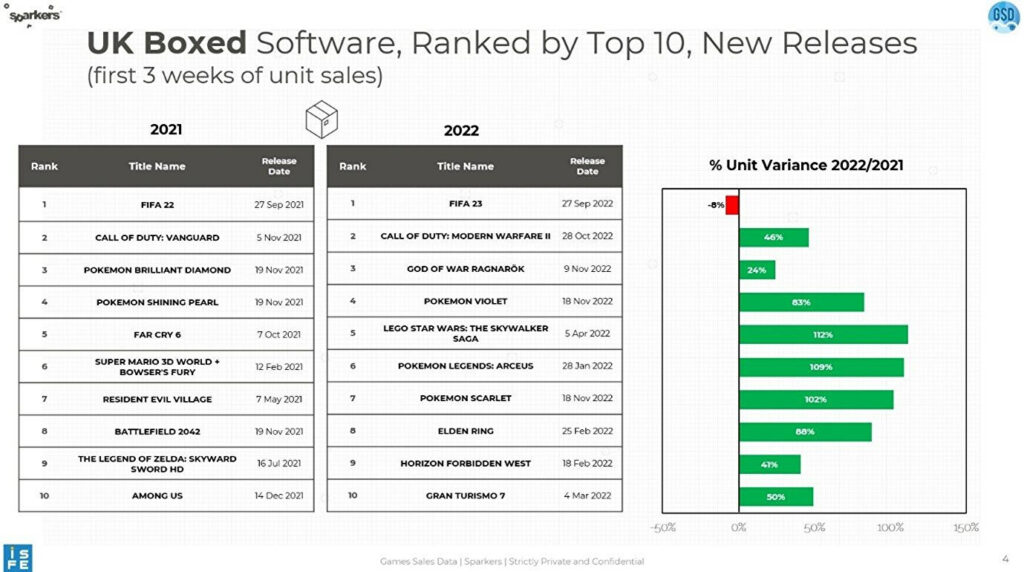

New releases in 2022 were selling better than in 2021

-

Comparison of boxed games sales from the top 10 shows that in 2022 hit games were sold 31% better than in 2021.

-

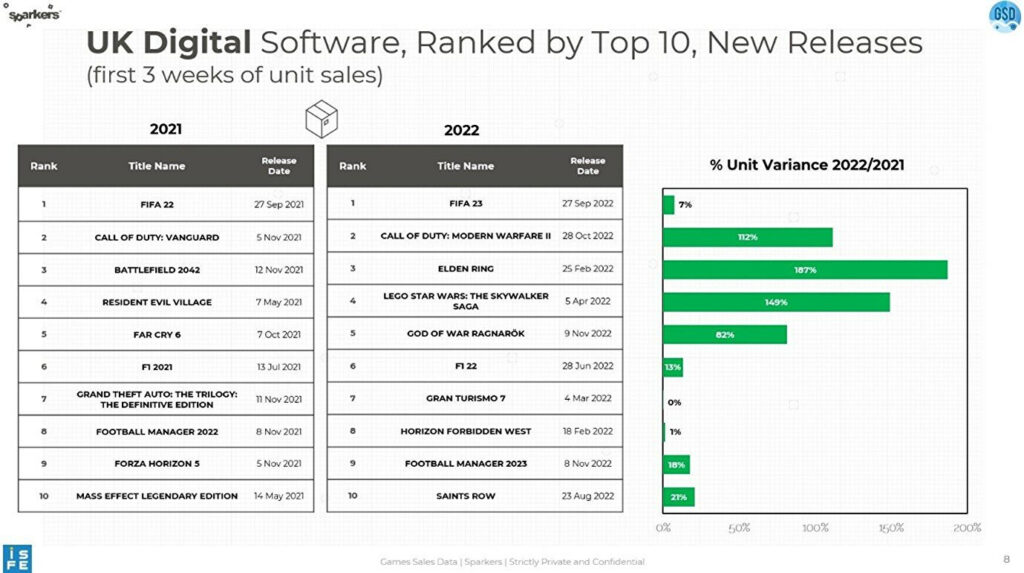

Digital sales of games from the top-10 in 2022 were 52% higher than in 2021.

-

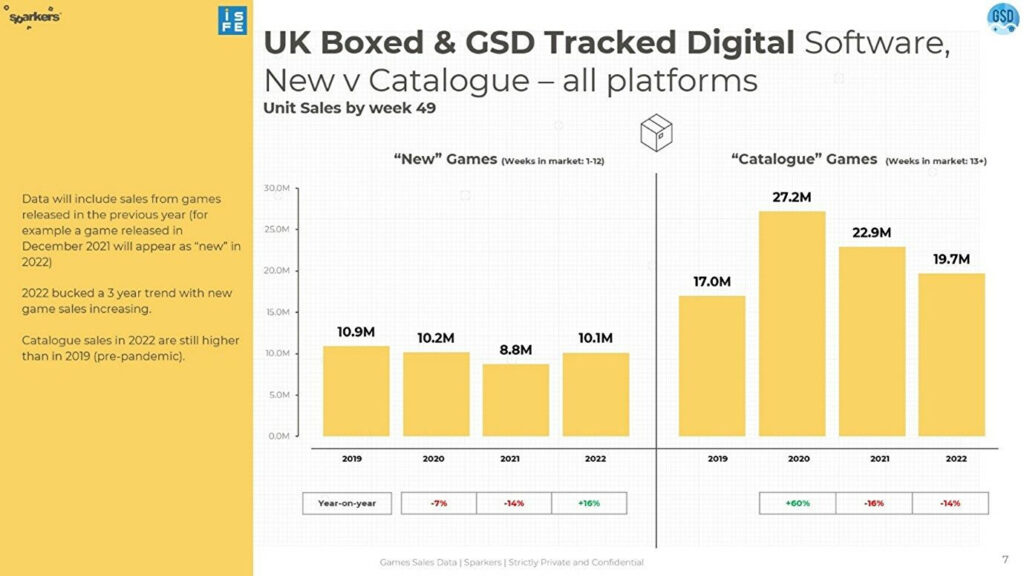

Overall sales of new games in 2022 were 16% better than in 2021.

Old games sales in 2022 went down

-

The overall number of game sales in 2022 declined. Boxed versions dropped by 10%, digital versions were 2% down compared to 2021.

-

It’s important to find reasons why it happened. The COVID-19 pandemic increased back-catalog sales in 2020 compared to 2019.

-

The overall decline in sales is connected with the decline in back-catalog sales. 19.7M copies were sold in 2022 - it’s 14% lower than in 2021, but 15% more than in pre-pandemic 2019.

Black Friday sales

-

Game sales during Black Friday in 2022 were down by 3% compared to 2021.

-

Sam Naji connected it not with a demand slowdown, but with fewer releases in 2022 and an even larger switch to the GAAS models.

data.ai: State of Mobile 2023

The report is generally dedicated to the mobile market, but we will focus on the gaming numbers.

Mobile market

-

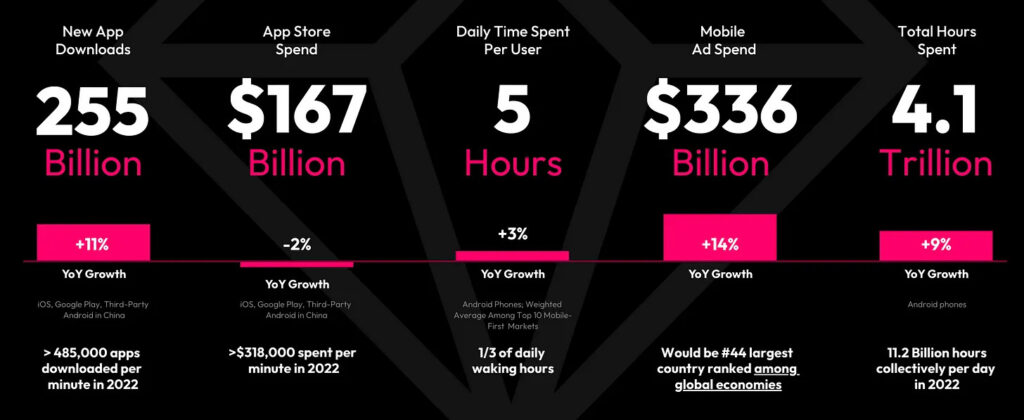

In 2022 the mobile market earned $167B. It’s 2% lower than in 2021.

-

In 2022 mobile apps were downloaded 255 billion times. An increase to 2021 is 11%.

-

Game marketing spending growth declined from 22.9% YoY in 2021 to 14% YoY in 2022. In 2023 the growth will be slower too - about 7.5% with the overall spending up to $362B.

-

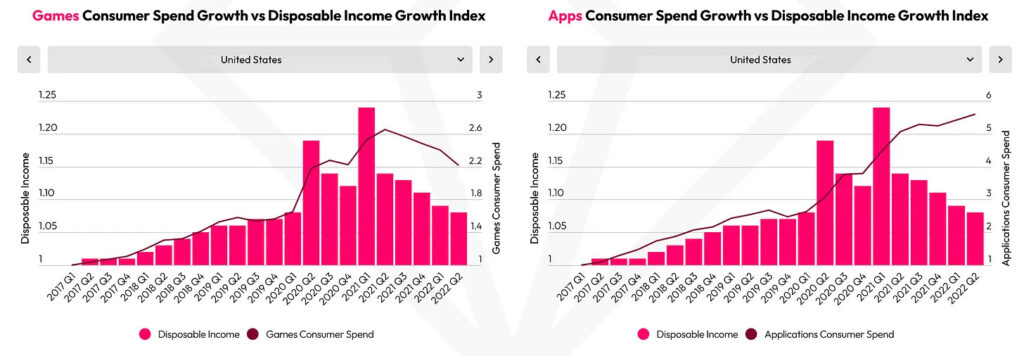

Games revenue has been declining in the majority of developed markets in 2022. In many countries (the US, the UK, and Germany) we can see a direct correlation with decreased disposable income. Spending on apps, on the opposite, has been growing despite the lower income.

Games - overall numbers

-

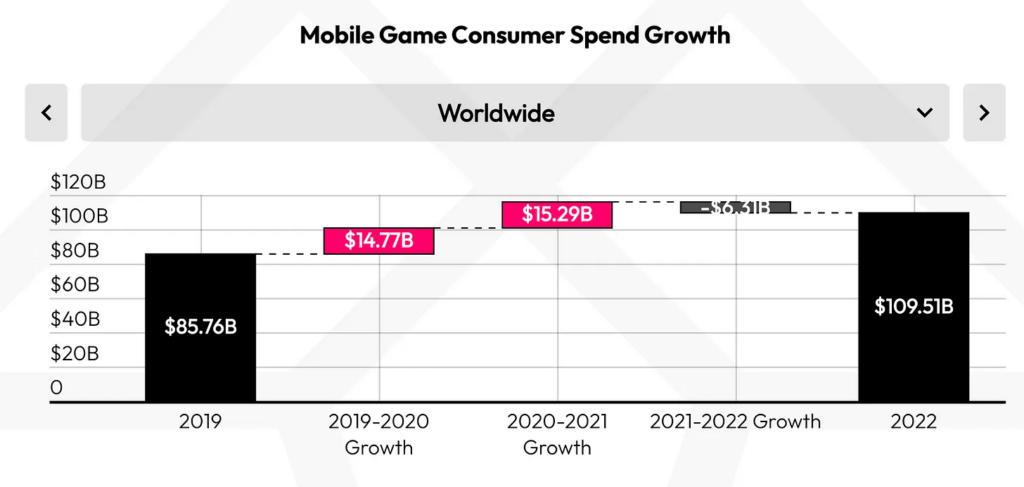

Mobile Games revenue in 2022 decreased by 5% to 2021 and was $110B.

-

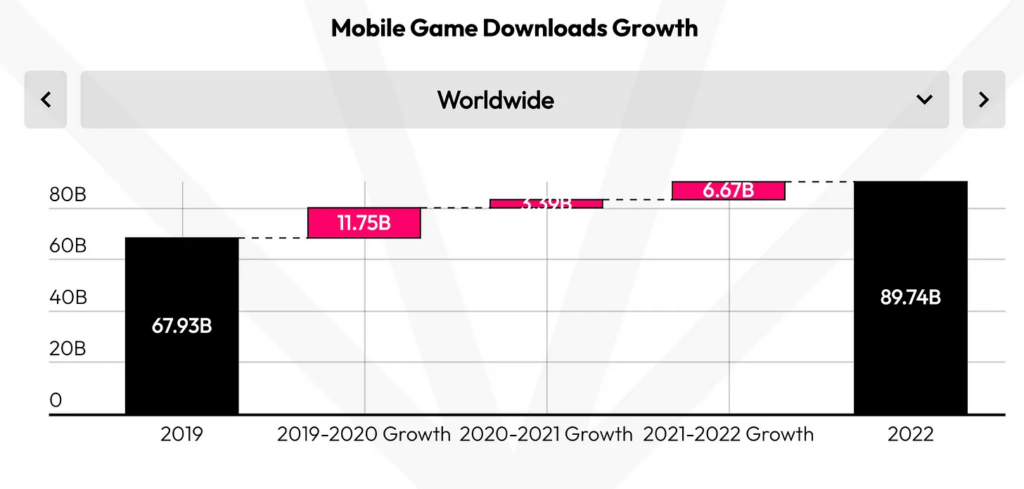

Downloads of mobile games continue to grow. In 2022 the pace of download growth increased twice compared to 2021.

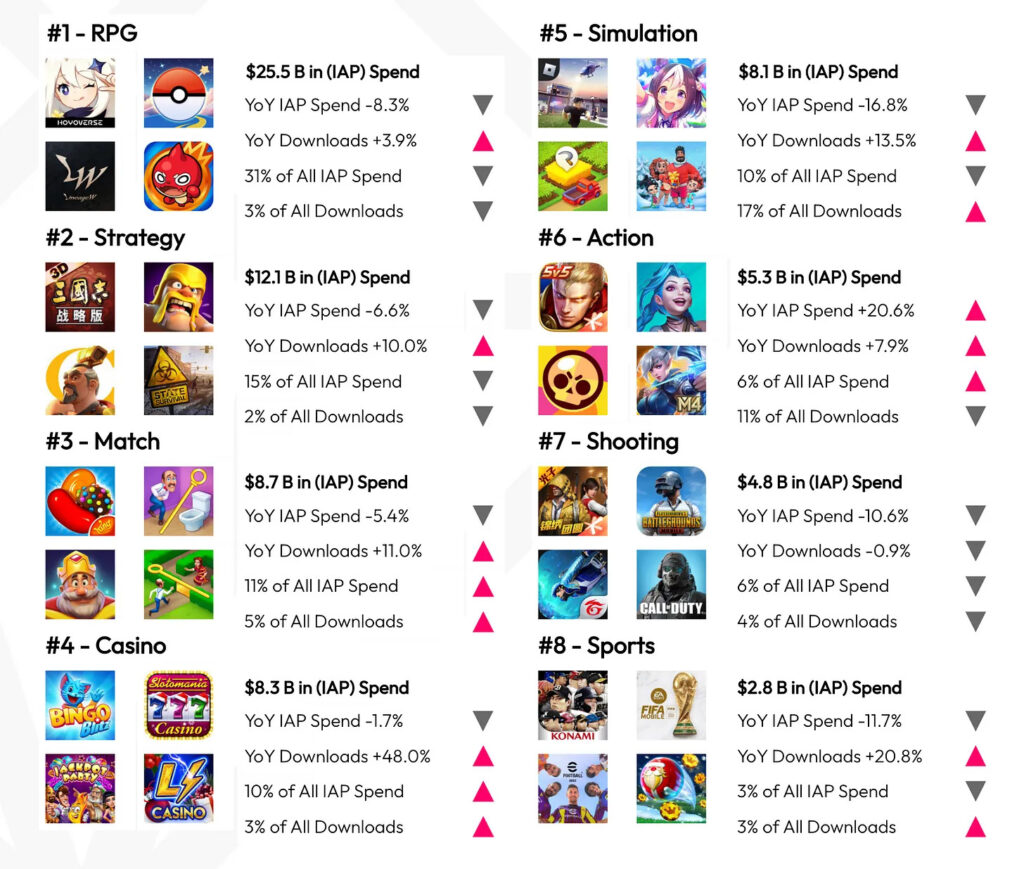

Top genres by revenue

-

RPG - $25.5B revenue (-8.3% YoY). Downloads increased by 3.9%. Genre is generating 31% of overall mobile gaming revenue and 3% of downloads.

-

Strategy - $12.1B revenue (-6.6% YoY). Downloads growth by 10%. Genre is responsible for 15% of mobile gaming revenue and 2% of downloads.

-

Match - $8.7B of revenue (-5.4% YoY). Downloads increased by 11% in 2022. Genre is generating 11% of overall gaming revenue and 5% of overall gaming downloads (2.8B).

-

Casino - $8.3B of revenue (-1.7% YoY). Growth by downloads in 2022 was a significant 48%. The casino is responsible for 10% of overall gaming revenue and 3% of overall downloads.

-

Simulation - $8.1B of revenue (-16.8% YoY). Growth by downloads - 13.5%. The genre is responsible for 10% of overall revenue and 17% of overall downloads (10.1B).

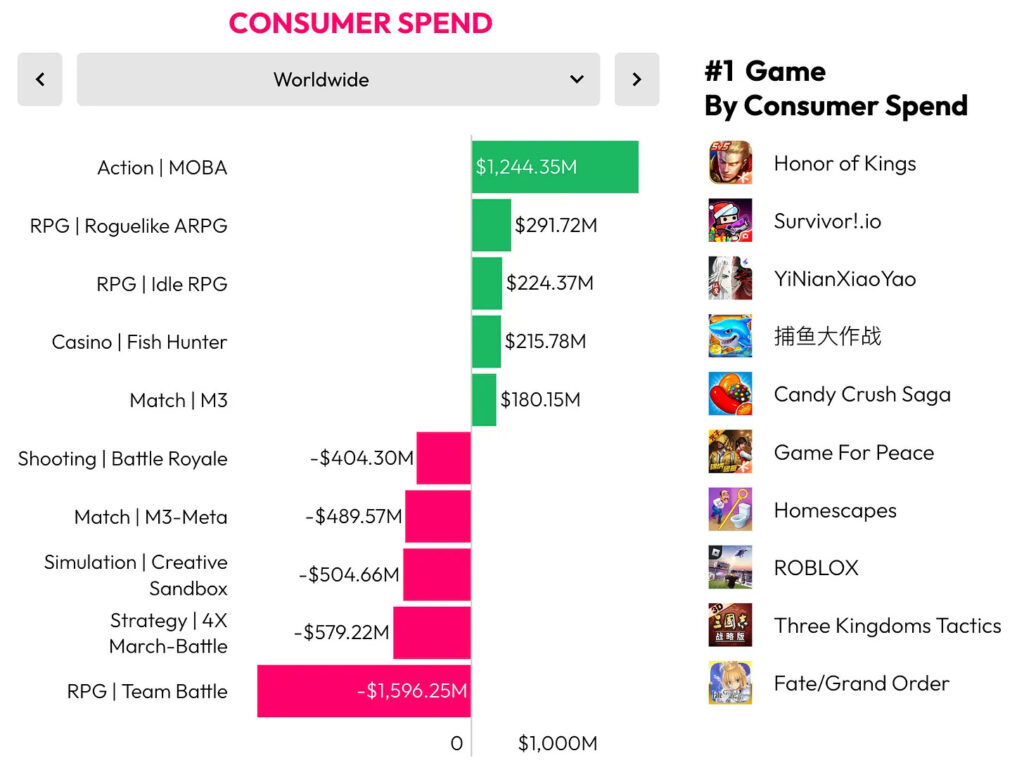

Trends

-

Positive growth dynamic by revenue in 2022 showed MOBA (Honor of Kings is the leader), Roguelike ARPG (Survivor.io), Idle RPG, casino, and Match 3.

-

Positive dynamic by downloads showed hypercasual games (Phone Case DIY), driving simulators (Offroad Truck Simulator), creative sandboxes (ROBLOX), sports simulators (8 Ball Pool), and Merge games (2248 Puzzle).

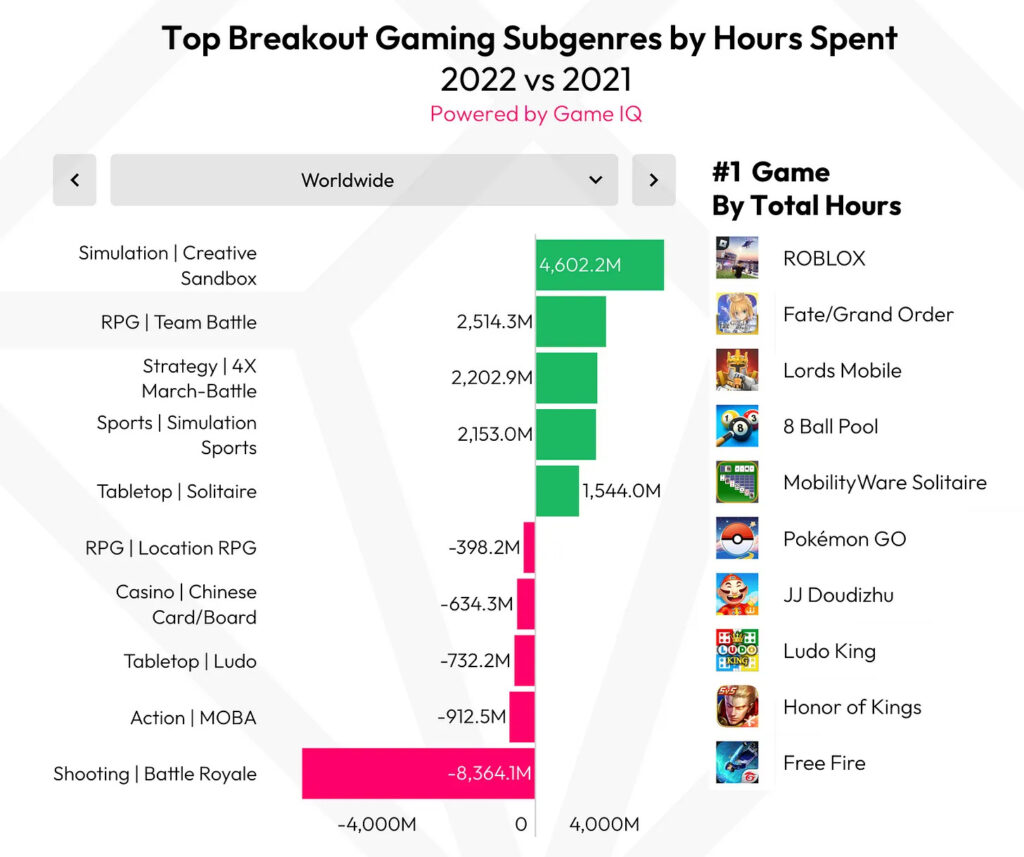

-

An increase in time spent was experienced by creative sandboxes, Team Battle RPGs, 4X-Strategies. A huge drop happened with Battle Royale games.

-

Younger audiences prefer party games, simulation, and shooters. A more mature audience is choosing Match 3, slots, puzzles.

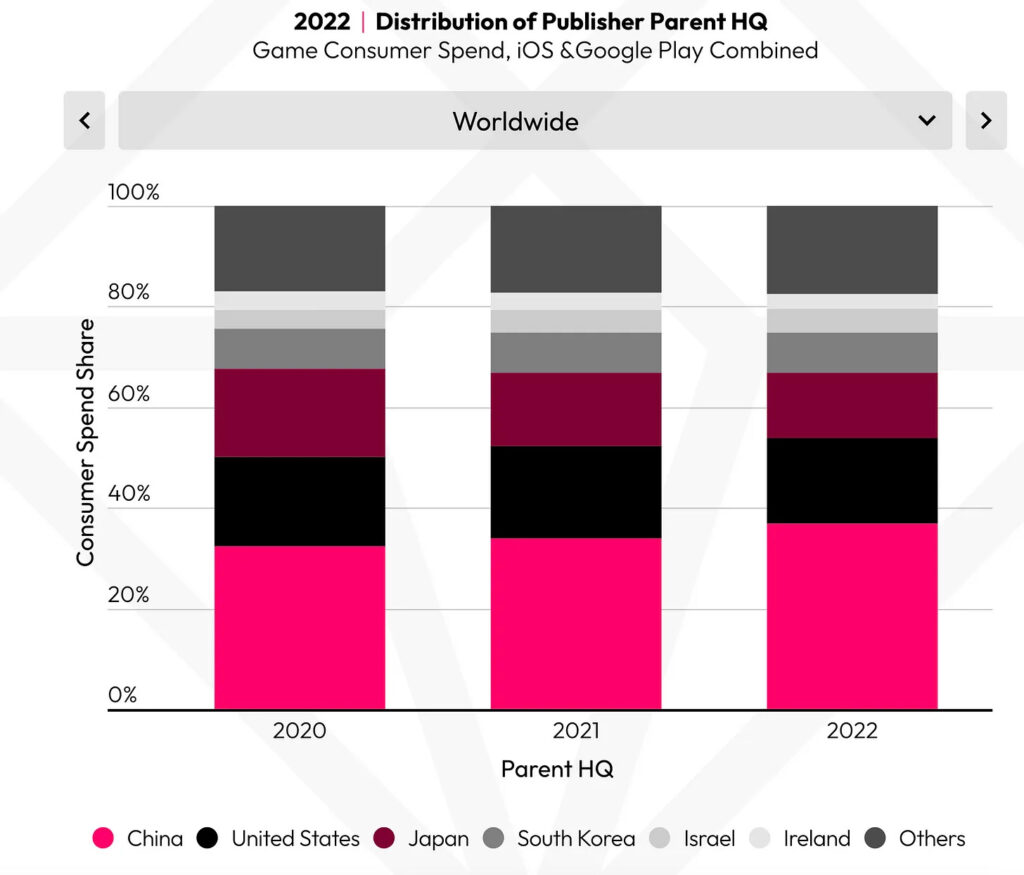

Countries-leaders

-

1/3 of gaming mobile revenue is generated by companies with HQ in China. Their impact since 2020 is growing. Positive dynamics are showing companies from Israel and South Korea.

-

Companies with HQ in the US have lost some percent of the market since 2021. Japanese companies are losing their positions since 2020 too.

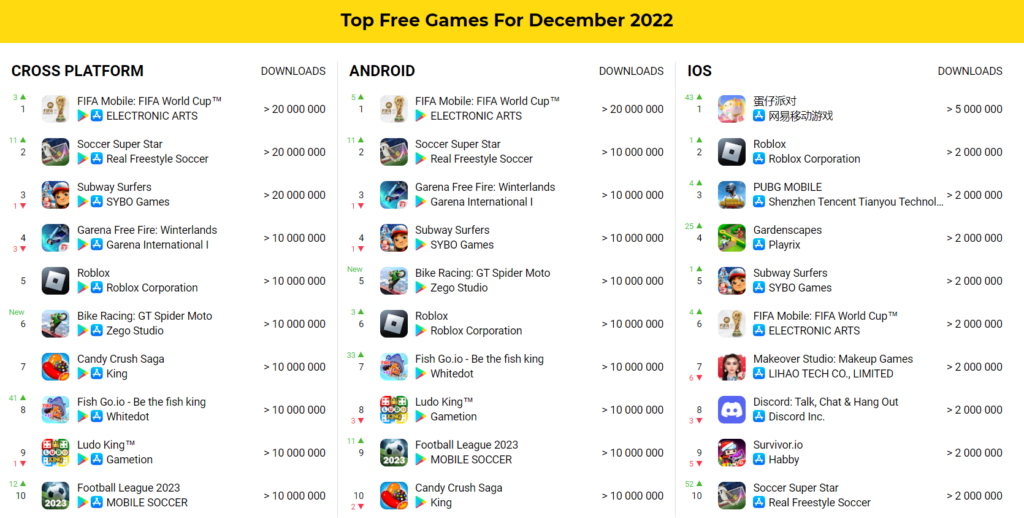

AppMagic: Top Mobile Games by Revenue & Downloads in December 2022

Revenue

-

Genshin Impact was the leader by revenue in December with $164.4M. Honor of Kings stepped down to the second place for the first time in many months, generating $162.5M in December.

-

Android leader by revenue was Lineage M with $51.26M (overall - $54,9M) on the platform.

-

Goddess of Victory: Nikke dropped to the 7 place on the Android chart. However, in December it earned $58.38M ($30.16M - via Google Play).

Downloads

-

FIFA Mobile benefitted from the World Cup that happened in Qatar. The game was #1 by downloads in December with 23.98M of downloads. In November it was downloaded 14.1M times, and in October - 7.7M times. Impressive growth. Indonesia (5.6M of downloads), Brazil (3.8M), and India (2.26M) are leaders by downloads.

-

Soccer Super Star - Score! Hero copycat - managed to reach 22.1M downloads. The majority (19.3M) came from Android.

GfK & GSD: The UK Game sales in December 2022 decreased by 8%

-

6.4M games were sold in the UK in December (-8% YoY). 2.85M have been bought in digital format, and more than 3.5M game copies have been sold in physical format.

-

FIFA 23, Call of Duty: Modern Warfare 2, and God of War Ragnarok are December leaders by sales. Good to mention that Call of Duty: Modern Warfare 2 sales split between PlayStation & Xbox is almost even - 54% against 46% respectively.

-

In December British people bought about 460 thousand consoles. It’s 17% lower than in December 2021 but 24% higher than in November 2022.

-

PlayStation 5 sales increased, while Xbox Series S and Nintendo Switch experienced a decline.

-

1.85M accessories have been sold in December (+44% to November 2022 and -11% to December 2021). DualSense is the most popular accessory.

Steam reached the 10M concurrent playing users

-

It happened on January 8 - this day 10.3M users played games on the platform simultaneously.

-

On the same day, Steam set a new record by concurrent online users - 33.1M.

-

CCU in Steam, according to SteamDB, has been growing in the last decade. Numbers increased sufficiently during the COVID-19 epidemic.

ERA: Videogames remained the largest home entertainment format in the UK in 2022

An ERA is studying buying behaviors of the UK people including their preferable ways of home entertainment.

-

The overall market size of home entertainment in the UK in 2022 was £11.1B. It includes music, video, and video games.

-

The largest growth showed the video segment with 14.4% growth YoY to £4,43B.

-

Games remained the largest home entertainment segment with £4.43B generated in 2022 (+2.3% YoY). Games are responsible for 42.1% of spending on home entertainment in the UK.

GSD: European PC/Console gaming market dropped by 7.1% in 2022

Game sales

-

159M copies were sold in Europe in 2022. It’s 7.1% lower than the previous year.

-

82.5M copies have been sold through digital channels; 76.5M in physical format.

-

Sales of new games (released in 2022) increased by 16% compared to 2021 (and sales of new games in 2021).

Markets

-

The UK is the largest European market (with a sales decline of 6% YoY).

-

Germany is second (-13% YoY). France is third (-3% YoY).

-

Game sales increased in Spain (+1% YoY) and Italy (+2% YoY).

Console and accessories

-

5.3M consoles were sold in Europe (not counting the UK and Germany) in 2022. There is a 25% drop compared to the previous year.

-

First place by sales is the Nintendo Switch (-15% YoY), PlayStation 5 is second (-35% YoY), and Xbox Series S|X is third (+4% YoY).

-

Game accessories sales declined by 10% to 18M products sold. The best accessory by sales was DualSense (+12% YoY). The best-selling non-controller was the Sony PS5 Pulse 3D Headset, which, however, showed a drop of 3.6% compared to 2021.

Famitsu: Boxed games and consoles sales in Japan reached $2.9B in 2022

Famitsu takes into account only physical sales of games and consoles.

-

Growth of Japanese gaming retail in 2022 was 4% - from $2.8B in 2021 to $2.9B in 2022.

-

Pokemon Scarlet and Violet became the best-selling game of the year. From November 18 to December 25 it was bought more than 4M times. And it’s only boxed versions.

-

Splatoon 3 is second with 3.7M boxed sales and release in September.

-

Nintendo Switch reached 4.8M sales in Japan in 2022. The overall sales in the region reached 27.7M.

-

9 out of 10 top-selling games were released for the Nintendo Switch. The only exception is the Elden Ring PS4 version.

-

PlayStation 5 sold 1.2M consoles in Japan in 2022 with an overall amount of sold consoles of 2.4M.

-

Users bought Xbox Series S|X 269.7k times in 2022. The overall system sales reached 398.3k.

Le Figaro: Nintendo Switch became the best-selling home console in France in history

Handheld consoles are not included in the competition.

-

Nintendo Switch sales in France reached 7.09M from the release date in 2017.

-

Console broke the record for Nintendo Wii (6.3M sold consoles).

-

987k Nintendo Switch consoles were sold in France in 2022. Every second console in the country now is Nintendo Switch. A quarter of households have it at home.

-

The best game by sales this year was Pokemon Scarlet & Violet (701k physical copies sold).

CNG: Chinese gaming market in 2022 dropped for the first time since the stats collection

Numbers have been published by the analytics agency CNG using data from Chinese governmental bodies.

-

Games sales decreased by 10.3% to $39.7B.

-

The mobile market is responsible for 70% of overall market revenue. In 2022 it declined by 14.4% to $28.4B.

-

In 2022 the Chinese government issued 512 licenses. In 2021 there were 755 of them.

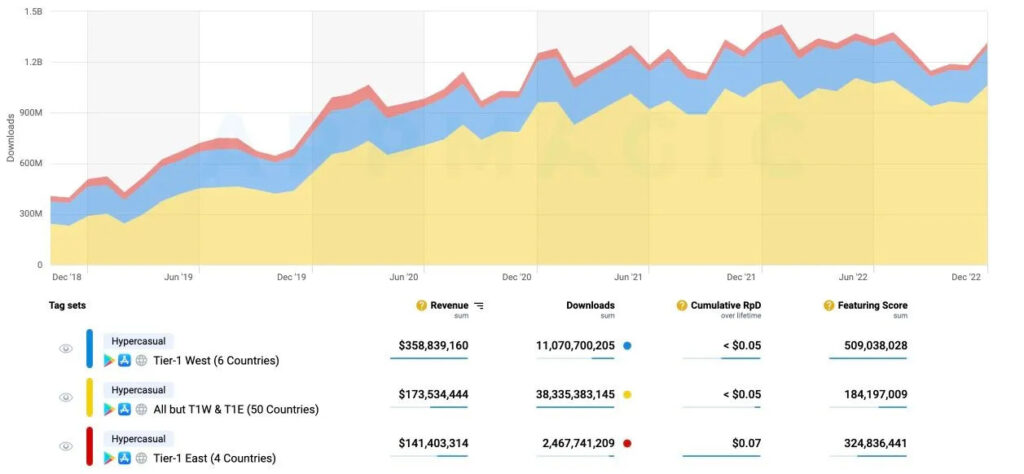

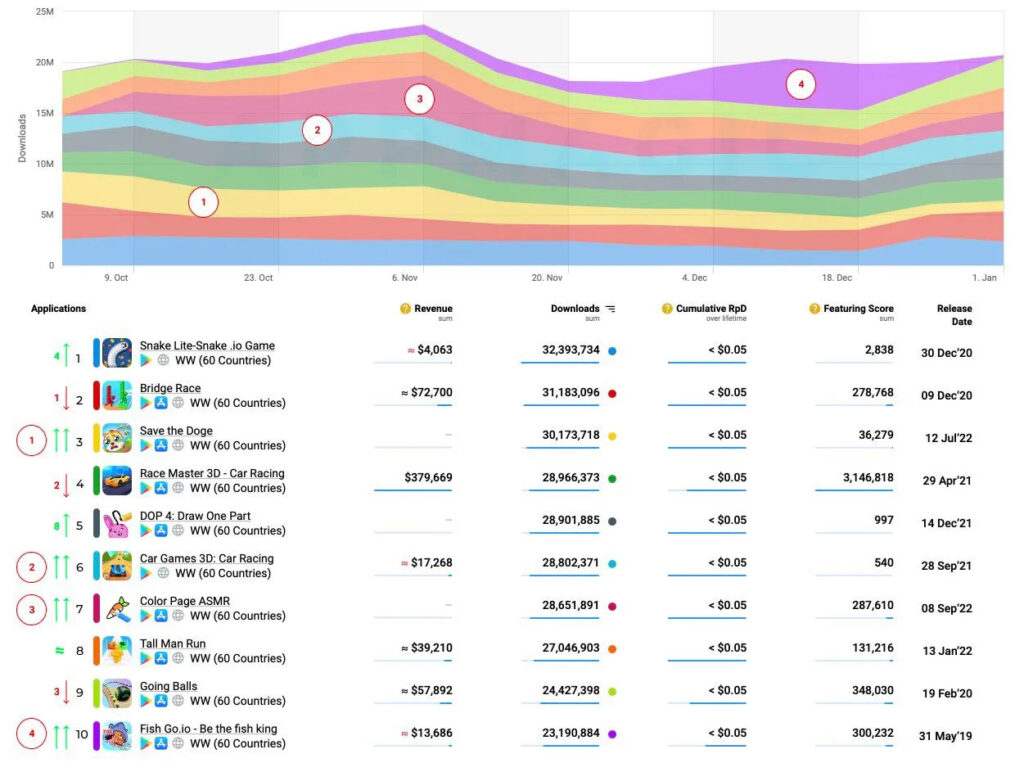

AppMagic: Hypercasual market in Q4 2022

-

Overall downloads of hypercasual games in 2022 increased by 5% and reached 15.5B.

-

Downloads in Q4 2021 were by 7% higher than in Q4 2022 (3.97B versus 3.68B).

-

There might be a downward trend that started in Q4 2022 as downloads were 2% lower than in Q3 2022.

-

Downloads were down in Tier-1 countries, while in less developed regions hypercasual games are still growing.

Successful games of Q4 2022

-

Snake Lite-Snake .io Game is the leader with 33M downloads.

-

Save the Doge is a new hit and a cultural phenomenon. The game reached 30M and its developers were inspired by viral videos in TikTok.

-

Another new game in the chart is the Car Games 3D: Car Racing. It’s a mix of GTA 5 and aquapari.io, and the growth of downloads happened because of the viral effect in TikTok & Twitter.

NPD: The US gaming market dropped by 5% in 2022

-

The US gaming market earned $57B in 2022. It’s 5% lower than in 2021 ($60B).

-

American spending on the content was $47.5B (84% of the overall amount). The loss to 2021 was 7%.

-

Call of Duty: Modern Warfare 2 is the best-selling game in the US. Elden Ring is second, and Madden NFL 23 is third.

-

Regarding exclusive titles, God of War: Ragnarok is the best-selling game on PlayStation; Pokemon: Scarlet and Violet is leading on Nintendo Switch, and Forza Horizon 5 is the best-seller on Microsoft platforms.

-

Gaming hardware sales increased in 2022 by 8% to $6.57B.

-

Nintendo Switch is first by units sold. PlayStation 5 became the most successful console from a revenue perspective.

-

Users spending on accessories increased by 8% to $2.5B. The leader by sales was Xbox Elite Series 2 Wireless Controller.

December numbers

-

Overall sales increased by 2% YoY to $7.6B.

-

Sales of gaming hardware increased by 16% to $1.53B. PlayStation 5 was the leader in December by both units and revenue.

GSD: European gaming market of PC & Consoles kept falling in December 2022

Games

-

27.4M games were sold in Europe in December 2022. It’s a 13% decline from the year before.

-

11.4M copies have been sold in digital format (-17% YoY); 16M copies - in physical (-10% YoY).

-

FIFA 23 became the best-selling game of the month. Call of Duty: Modern Warfare 2 was second.

-

New December releases didn’t show great results. Need for Speed: Unbound started at #12 in charts, Crisis Core: Final Fantasy VII Reunion was #21, and The Callisto Protocol was #22 (but without digital sales).

Consoles and accessories

-

1.33M consoles were sold in Europe (not counting Germany and the UK) in December 2022. The drop to the previous year is about 19%.

-

PlayStation 5 sales didn’t go down massively (drop was about 3.4%) while Nintendo Switch and Xbox Series S|X experienced a significant decline in sales.

-

Despite this, Nintendo Switch was the best-selling console in Europe in December 2022.

-

Users bought 3.66M accessories in Europe in December 2022. It’s 9% lower than a year before. DualSense remains the best seller with sales up by 5% compared to the previous year.

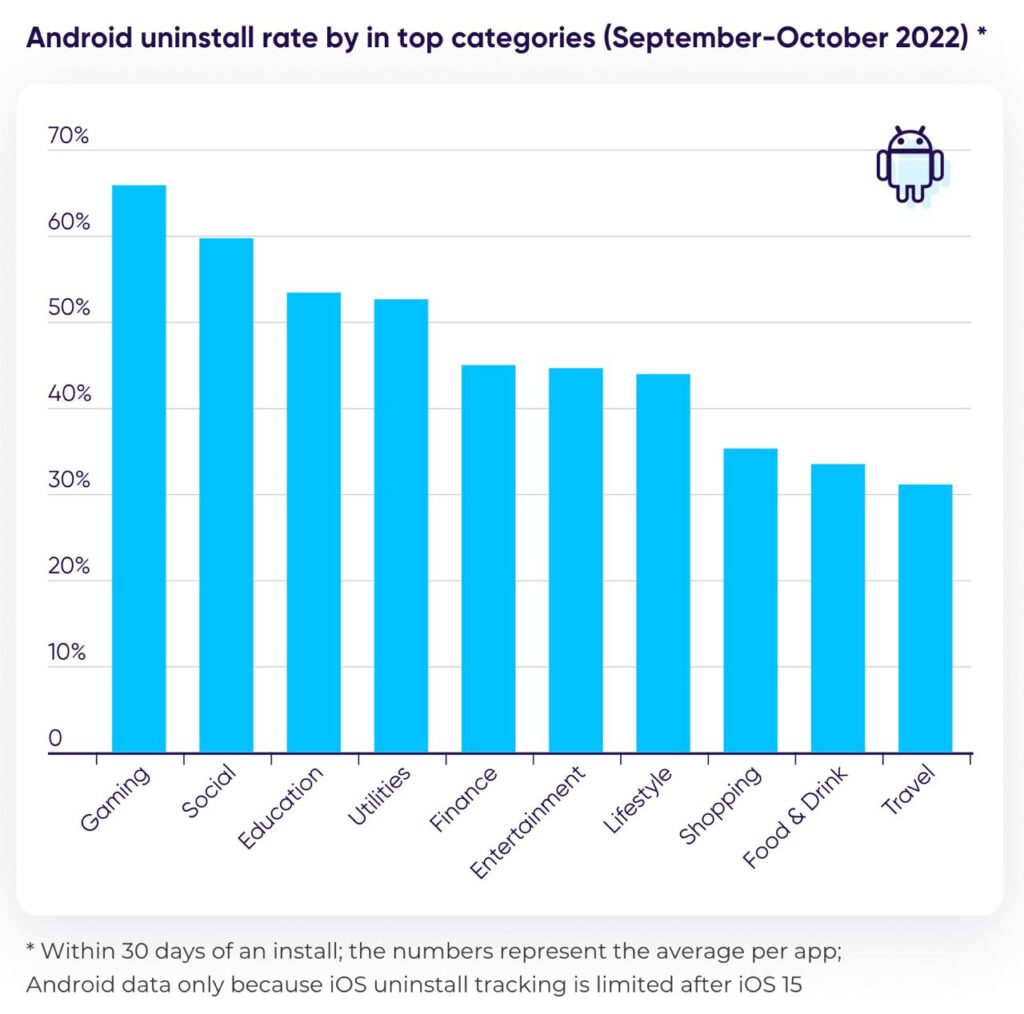

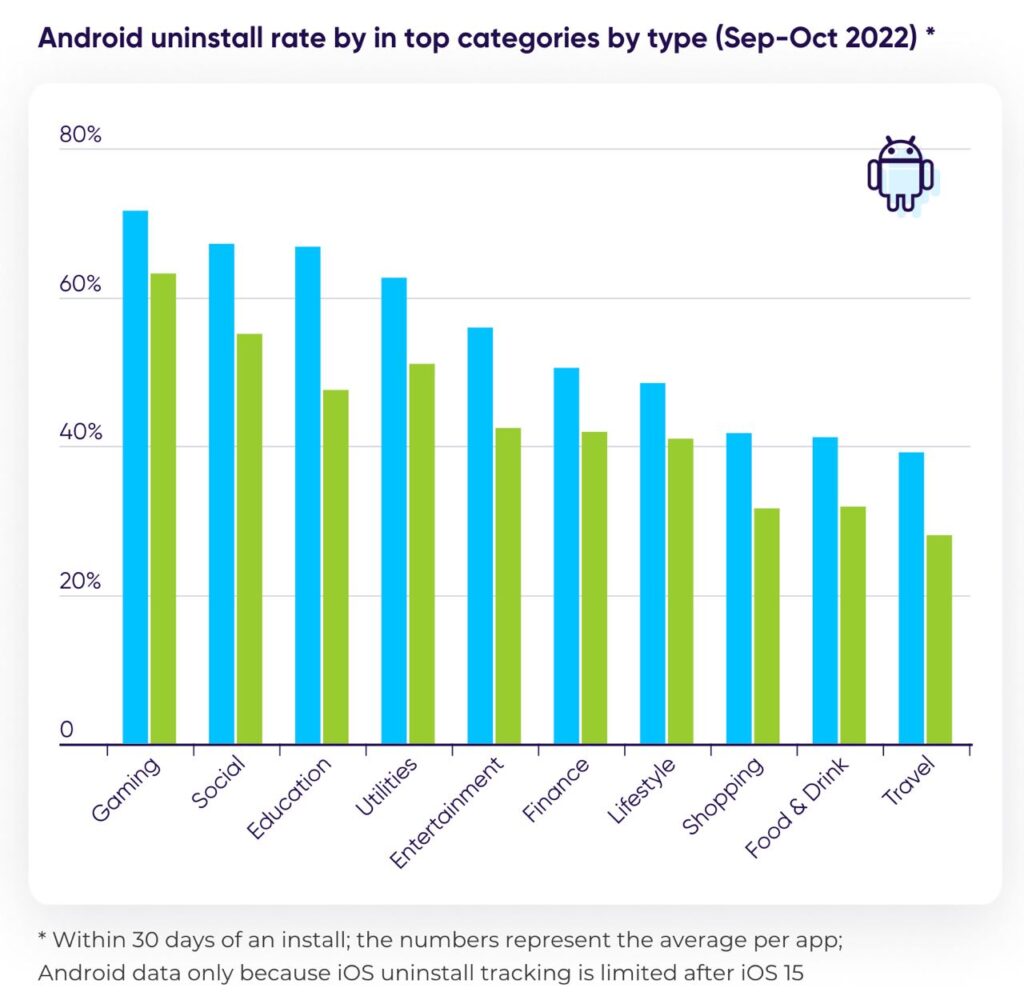

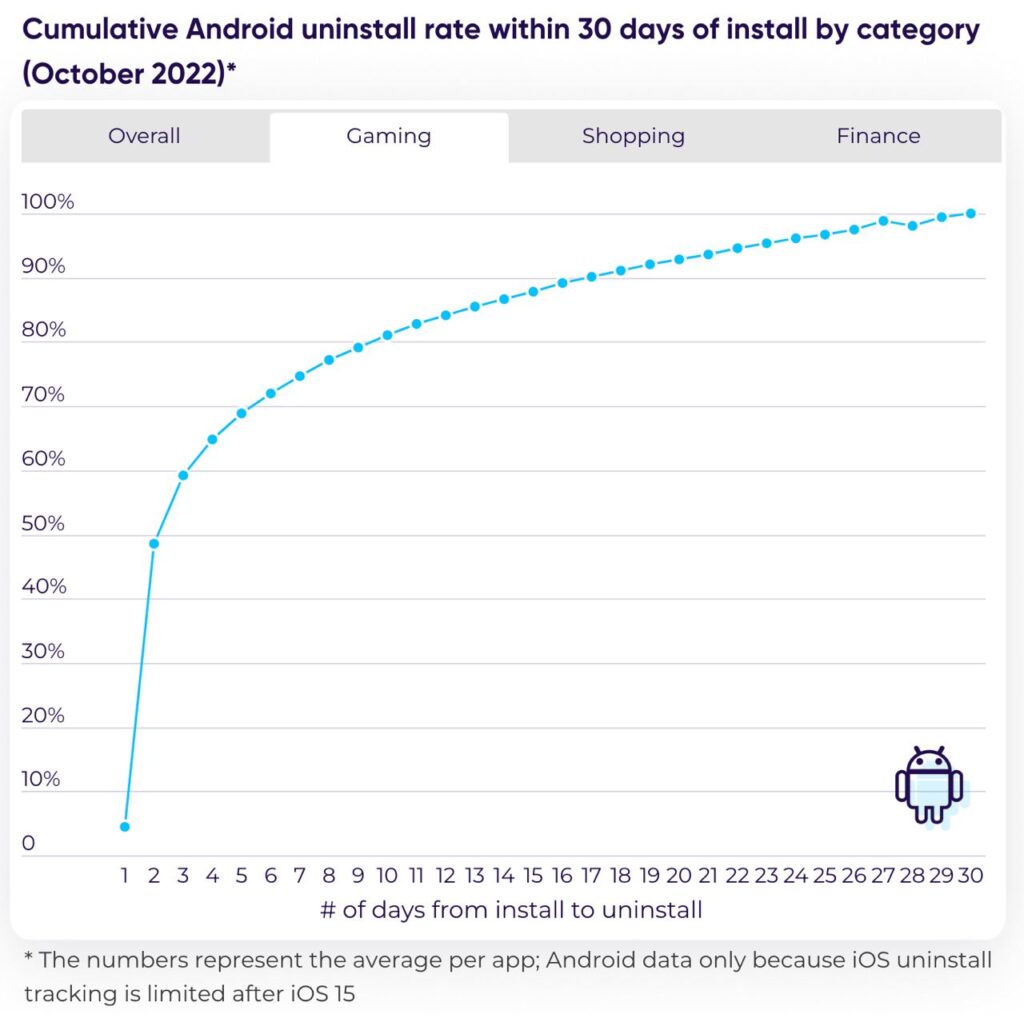

AppsFlyer: Uninstall benchmarks on Android

AppsFlyer published a report regarding uninstalling numbers. Only Android is counting because it’s rather hard to collect this data on iOS 15 and further. Dates are from July to October (inclusive).

-

49% of apps are deleted from the users’ phones after 30 days. There is an 8% improvement compared to the previous year (53%).

-

Games are the most uninstalled apps with a 66% uninstall rate in the first 30 days.

-

71.65% of paid users deleted games in the first month. In the organic case, this number drops to 63.19%.

-

On average, users in developing countries delete apps more often than in developed countries.

-

Almost 50% of game uninstalls are happening on the second day.

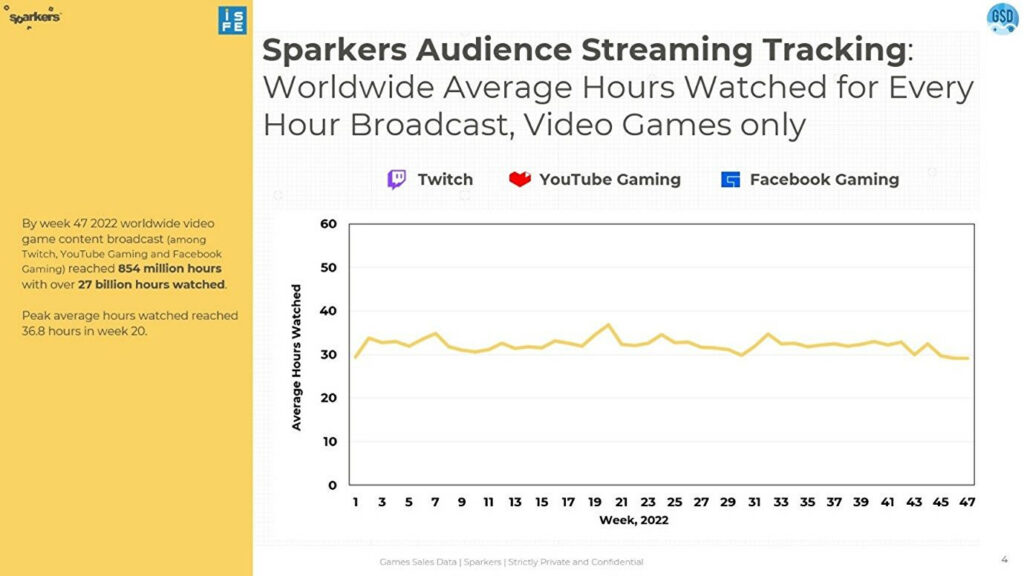

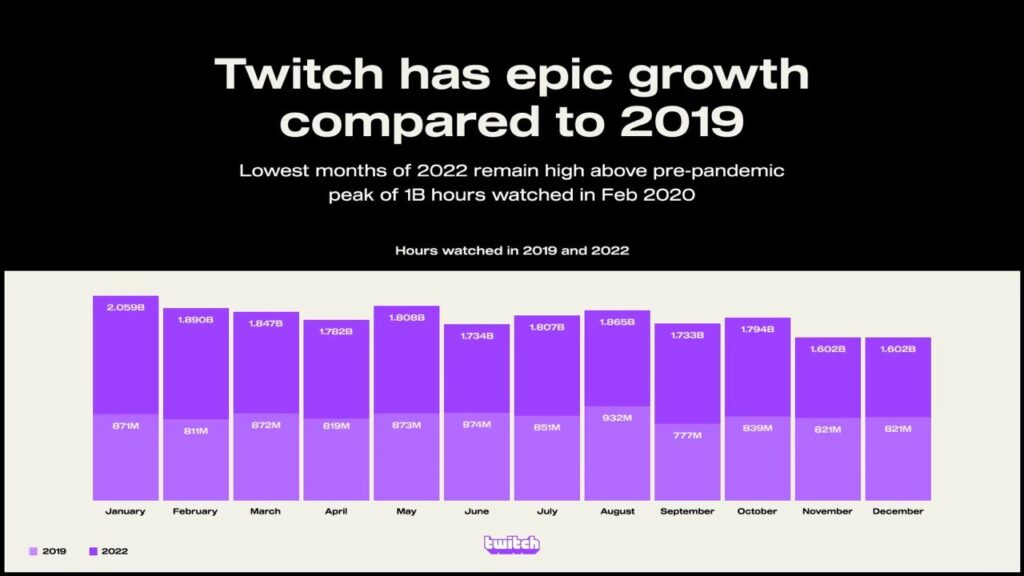

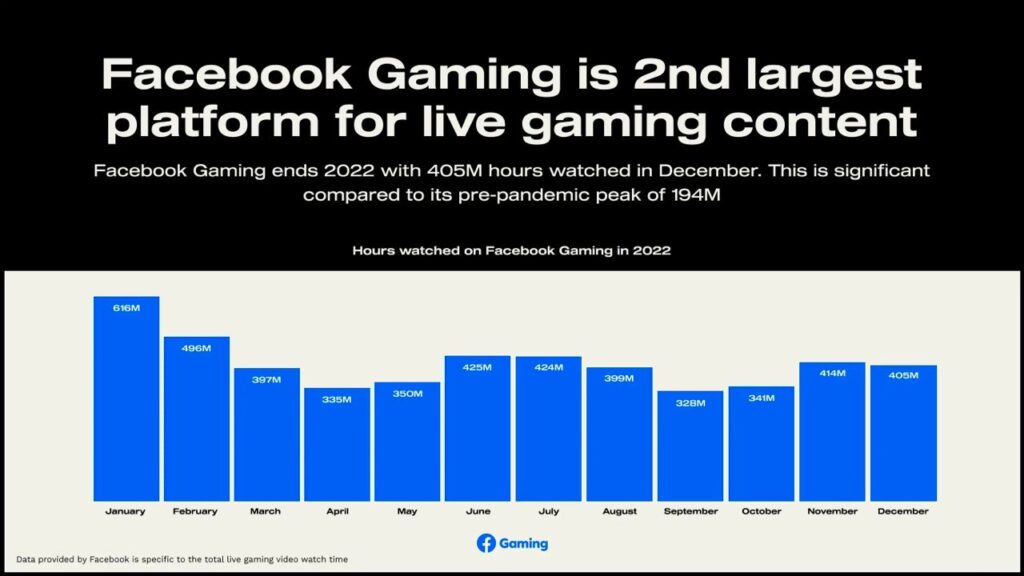

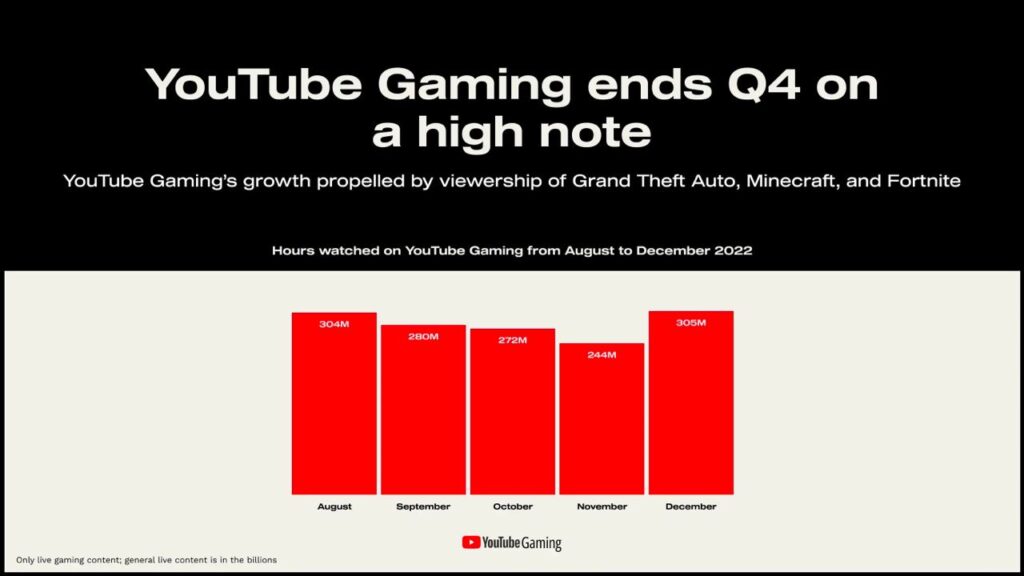

StreamElements & Rainmaker.gg: State of the streaming gaming market in December 2022

-

1.6B hours watched by users on Twitch in December 2022. It’s the worst result in 2022, but the worst result of 2022 is still better than the best result in pre-pandemic 2019.

Facebook Gaming managed to achieve 405M watched hours in December 2022. It’s the second platform by popularity.

-

YouTube Gaming in December received 305M watched hours.

-

Escape from Tarkov grew by 455% in hours watched because of the pre-wipe giveaways.

-

Users also had an interest in WoW: Dragonflight (+76% watched hours) and Fortnite (+75% watched hours).

Newzoo: 10 trends in Gaming of 2023

-

More AA/AAA developers will turn to the GAAS model.

-

Microsoft & Activision Blizzard deal will happen, but regulators’ supervision of gaming companies will increase.

-

Hybrid monetization options will come to the PC & Console market (including ads).

-

The number & size of M&A deals in 2023 will decline.

-

The semiconductor shortage will go off and consoles will be more available.

-

UA for Mobile will be more complex. Hypercasual games will experience the most challenging times.

-

Cloud Gaming companies will invest in PaaS (Platforms as a Service) - in this format, every device (TV or TV Box) may become a gaming console.

-

The gaming industry will start to apply AI instruments. However, full AI automation is far away.

-

VR gaming will continue to grow but will remain niche.

-

Gaming in cars might become a new segment. BMW announced a partnership with AirConsole; Tesla integrated Steam; GeForce Now announced an agreement with Hyundai, BYD, and Polestar.

GDC: Game Industry Report 2023

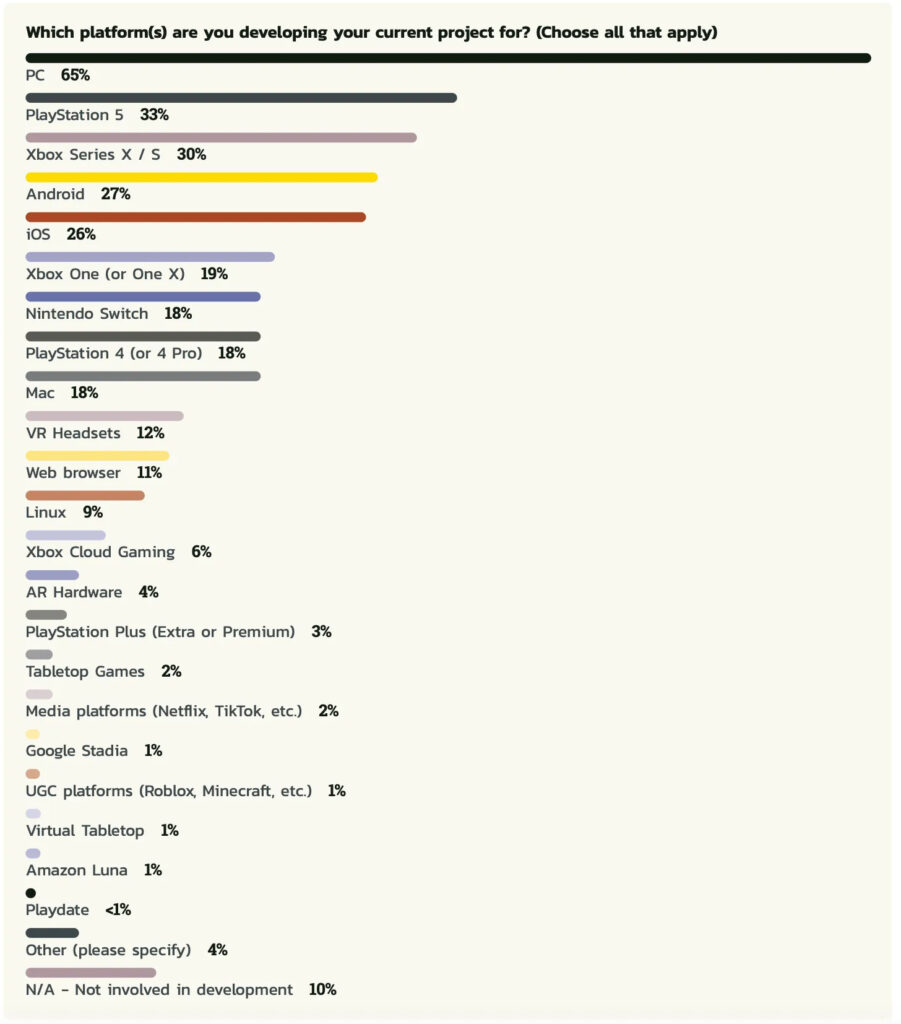

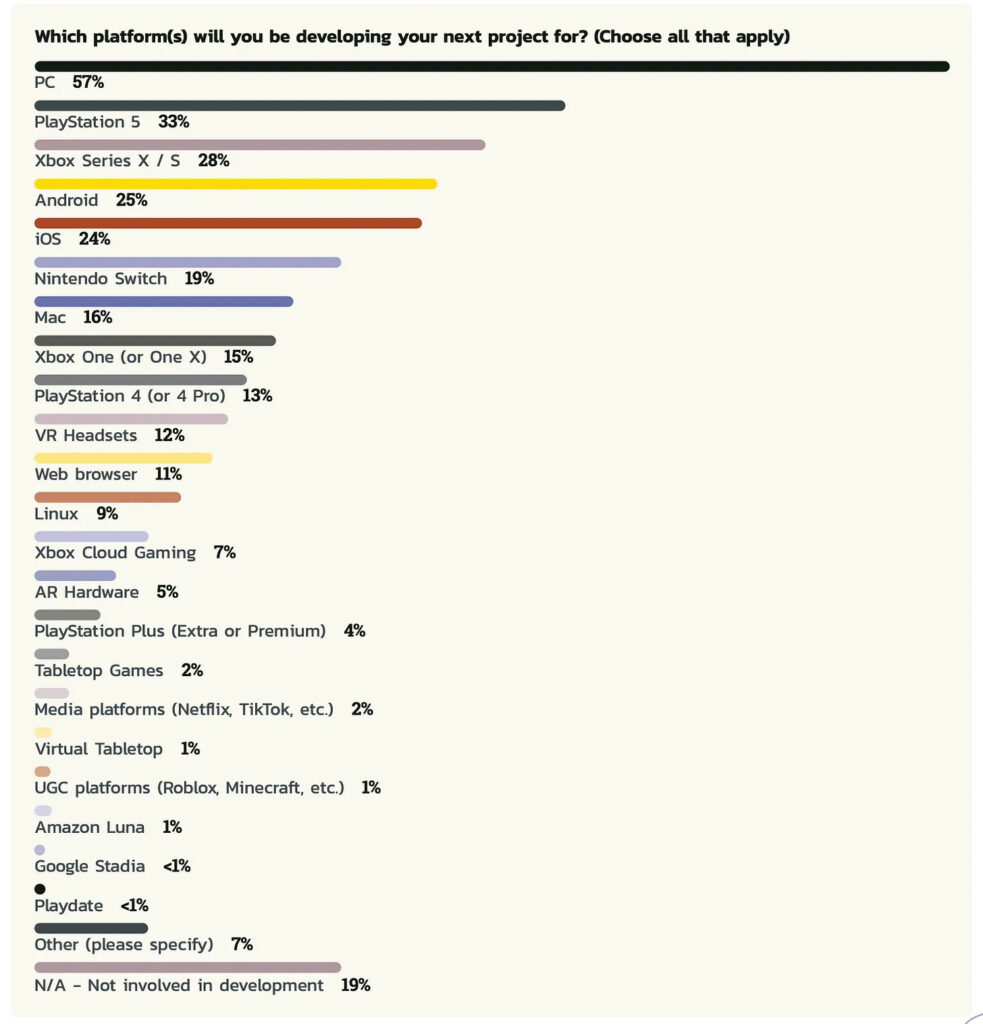

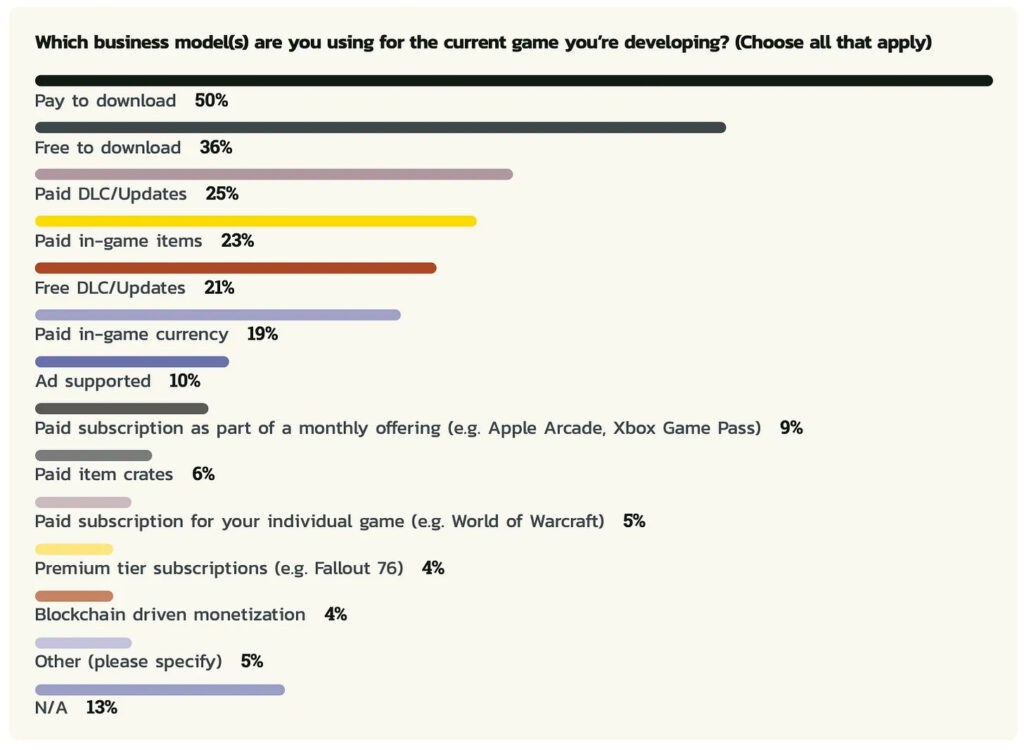

GDC is releasing the annual report to figure out the latest trends in the game industry. This year 2,300 people from the sector answered questions. 85% of respondents are from the US & Europe.

-

PC is a pure leader across platforms. 65% of developers are making the game on PC now, and 57% are planning to release the next project on PC. PlayStation 5 is second with 33% on both statuses.

-

Three platforms of developers’ interest are PC, PlayStation 5, and Nintendo Switch.

-

Half of the developers are working on Premium titles. 36% are creating F2P Games. Only 4% of companies are working on games with blockchain monetization.

-

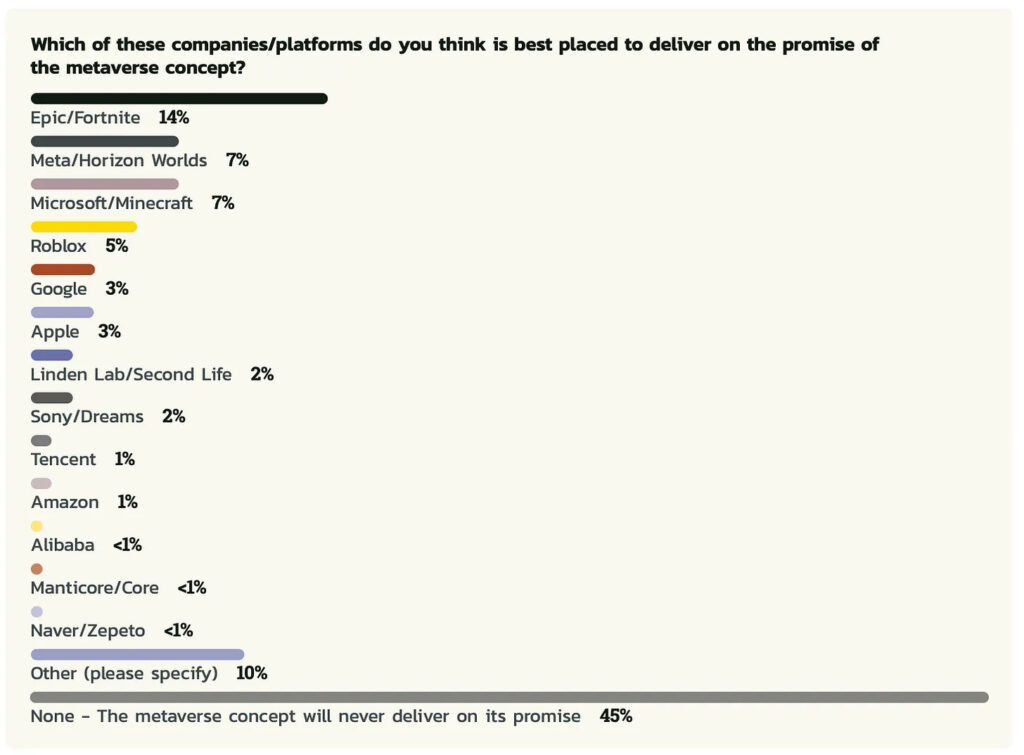

Developers believe more in the metaverse in Fortnite (14%), than in Horizon Worlds from Meta (7%). They also believe in Minecraft (7%) and Roblox (5%).

-

Interest in blockchain development hasn't grown since 2022. 75% are not interested at all, 16% are ready to review blockchain game opportunities, 7% are interested, and only 2% are working on the Web3 titles.

-

44% of respondents are sure that the game market consolidation is a bad thing. 17% are sure that it will bring only positive changes.

GDC: Game Industry Report 2023Download

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.