This article is about LTV (lifetime value) - one of the most important financial metrics, which allows you to optimize the costs for user acquisition campaigns, to plan revenue for a long time forward, to gauge the effectiveness of acquisition channels, to select the most financially attractive user segments and many other things.

Lifetime value, or Customer lifetime value (CLV), is the average amount of money from one user during all his “life” in a project.

Read more: devtodev’s Map of Key Analytics Metrics in Games

No other indicator can arguably be compared to the lifetime value in terms of the number of ways to calculate it and its importance in assessing the financial performance of an app.

In fact, LTV is a Cumulative ARPU that has reached a certain stable value.

In other words, LTV is the average revenue gradually brought to an app by one user.

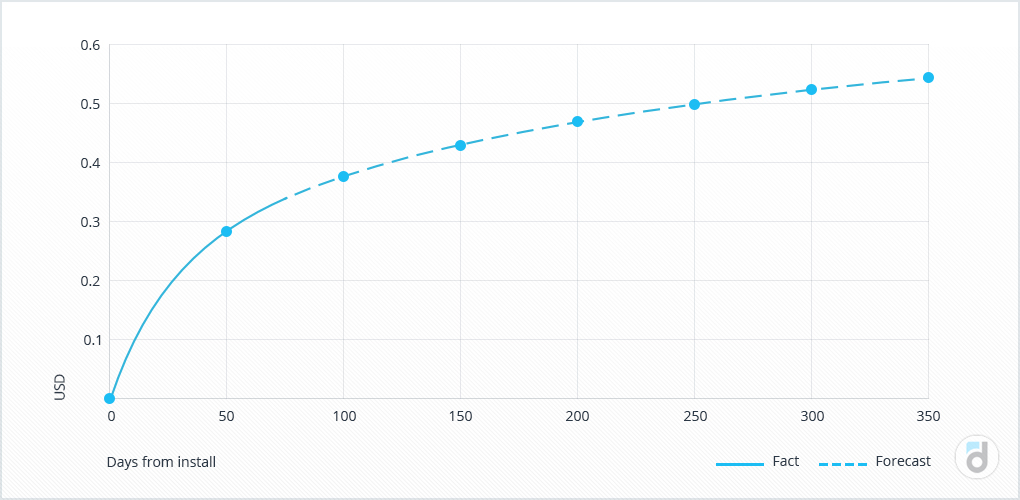

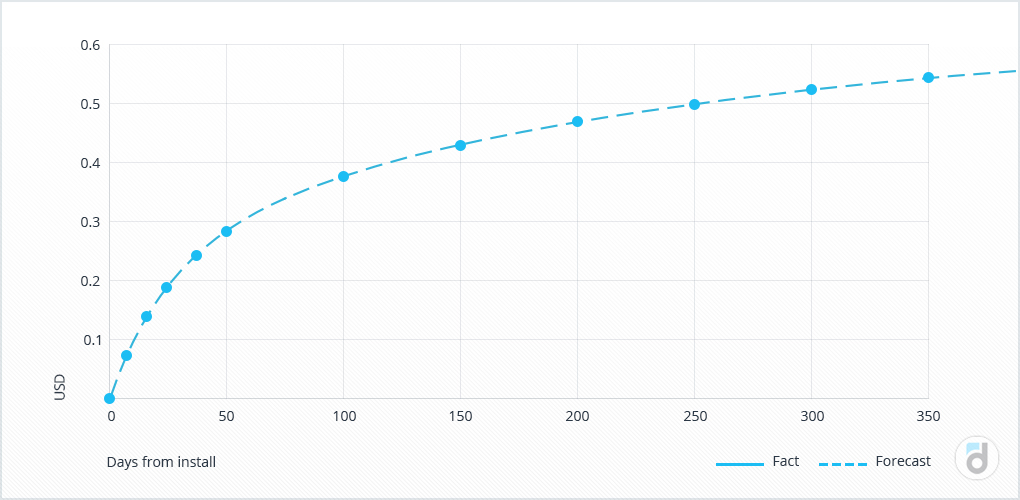

The LTV chart looks the same as the chart of cumulative ARPU and it is calculated for cohorts. Its value only increases over time.

Notably, the chart grows rather quickly at the beginning and then its growth slows down and stops completely after a while.

Such trend is associated with the churn of users in the game - initially, there are a lot of people in a cohort who actively make purchases, and then gradually most of the users leave the project and revenue growth decreases by their quitting.

LTV directly affects revenue which is obvious since the more money a single user brings to a project, the higher the total revenue is.

Revenue = Lifetime value * Active users

LTV is worth analyzing by different segments, as all the users behave and pay differently. For example, segments can be sorted by country, traffic source, or can be action-based, e.g. by completing the tutorial. LTV of all these segments will most likely vary.

Read more: How to Integrate an Analytics System into your Game

Why do we need LTV?

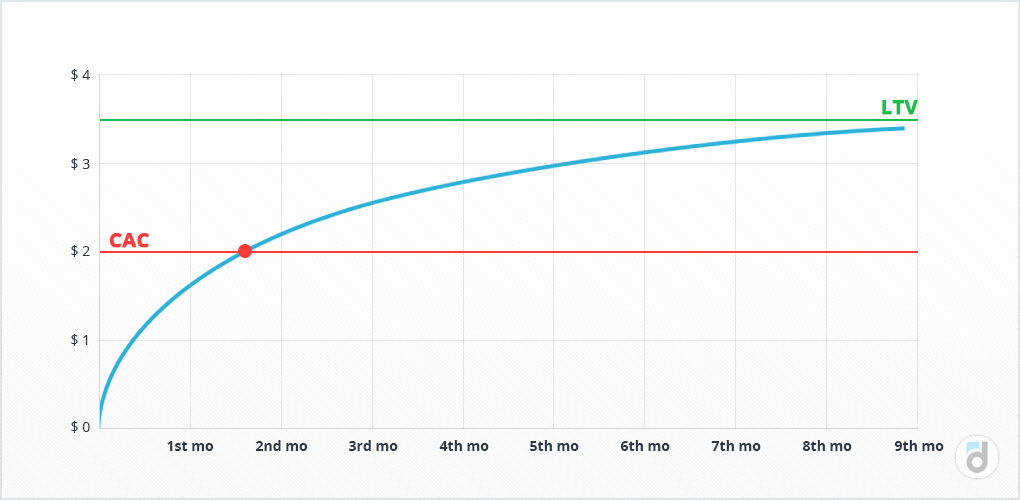

Evaluating the quality of traffic is one of the most frequent uses of this metric. LTV provides insight into the number of payments made by one user during their entire life in a project. Therefore, when purchasing traffic, it should be considered that the customer acquisition cost (CAC) must be less than its LTV, otherwise purchasing such traffic will only inflict losses.

You can find the exact point when the acquisition cost pays back by calculating lifetime value. It will happen when LTV becomes equal to CAC.

However, if the lines cross, let’s say, after two years of a user's presence in the project, it is also worth evaluating if buying such traffic makes sense.

We may regard LTV as the upper limit of the cost of purchased traffic, but still, it is quite risky to buy it at a price that’s equal to the lifetime value itself.

That’s why the recommendation of holding on to the following ratio is widely spread:

LTV > 3*CAC

Its realization indicates the viability and success rate of a product.

The revenue forecast is one more option of using LTV, especially if you pre-estimate this indicator for different segments. In this case, if you know the audience structure and the lifetime value of each segment, it is possible to count the revenue that each of them can bring after a certain period of time.

Read more: How to Create a Mobile App Push Notification

Let’s assume that we know the LTV of the users who were acquired for money and organically, therefore we can review how traffic experiments affect the revenue: what may happen if we increase the number of organic installs by launching the app in a new country, or how the total revenue will change if we reduce paid traffic.

|

Current situation |

Option 1 |

Option 2 |

|

|

Paid traffic |

1000 |

1000 |

500 |

|

Organic traffic |

500 |

700 |

500 |

|

Payers' LTV |

$24,5 |

$24,5 |

$24,5 |

|

Organic LTV |

$ 29,1 |

$29,1 |

$29,1 |

|

Revenue in N month |

$39,050 |

$44,870 (+15%) |

$26,800 (-31%) |

How to Increase LTV?

It is difficult to affect the lifetime value directly since it is a complex metric. So, in order to maximize it, it's worth paying attention to the indicators that influence it the most - the lifetime, which shows how much time a user “lives” in a project, and ARPU, which shows how much they pay.

On the other hand, a user’s lifetime in a project is affected by the retention, and ARPU is made up of the proportion of payers and their average check.

Lifetime value = Lifetime * ARPU

Lifetime can be calculated as an integral of retention, and ARPU - as a product of the Paying share and ARPPU.

As a result, we can distinguish five metrics that influence the LTV:

- Lifetime;

- ARPU;

- Retention;

- Paying share;

- ARPPU.

These are exactly those levers of influence over lifetime value. It is possible to increase LTV by raising these metrics.

How to Calculate Lifetime Value?

There are a great many methods of calculating LTV and that is due to plenty of factors, which we’ll discuss below.

In theory, in order to calculate LTV, we need to take a cohort of users who installed the app during a certain period of time and observe the way they will pay monthly. Hereafter, when there are no more users left in the cohort due to the inevitable churn, all the revenue they generated should be divided by the number of users in the cohort.

This method has a certain problem. It involves spending pretty much time on such calculation since users can “live” inside the app for half a year, a year, or even longer. Usually, no one has so much time for calculating LTV.

Read more: Senior and Lead Game Designer: Key Skills, Mistakes, and KPIs

Moreover, a lot of changes are likely to occur inside the app in this interval of time, and new users may behave differently from the users of the cohort we are observing. This means that their lifetime value has all the chances to change as well.

Thus, the whole complexity of the calculation is based on the fact that it takes a small amount of data that is available for the short period of time that the user spent in the app.

That’s why all the calculation methods that are used in real life are not quite accurate and have their advantages and disadvantages (by the way, devtodev uses ML for predicting LTV with 95% of accuracy).

Nevertheless, let’s look at several approaches.

Let's start with the formula mentioned above:

Lifetime value = Lifetime * ARPU

It’s not perfect. Firstly, lifetime itself does not have a decisive and exact method of count and, the same as lifetime value is calculated in advance on the basis of a small amount of data.

Secondly, whilst ARPU is also constantly changing, the formula contains only one conservative value.

Another way to calculate LTV is through the cumulative ARPU.

If we know the cumulative ARPU values for a certain period of time, for example, for the 1st, 7th, 14th, 30th days, then by using mathematical approximation, we can complete the curve for a longer period, the limit of which the LTV will exactly be.

These are by no means all methods of calculating the lifetime value and probably they are not the simplest ones, but this is an indicator that still needs to be estimated, as it combines the most important metrics, takes into account both paying and free users, and is regarded to be one of the most important financial indicators.

Read more: App Cohort Analysis

When we know the LTV of our project, it becomes possible to understand which customers type is of the greatest value, how soon the costs of their acquisition will hit breakeven, how much revenue new users will bring us in six months or in a year, how this revenue will change if we increase retention, and so on. Now we can see that lifetime value inspires us to work on the most important financial and customer metrics and plan our business for a longer time.