devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the September and October reports.

Table of Content

- State of Survival collaboration with The Walking Dead brought 20M new users

- App Annie: League of Legends: Wild Rift Earned $150M in first 370 days

- AppMagic: Top Mobile Games in October by Revenue and Downloads

- Sensor Tower: ROBLOX servers outage led users to Twitch, Among Us, and Minecraft

- Genshin Impact might be the most successful game ever in the first year after launch

- Sensor Tower: Harry Potter: Magic Awakened earned $228M in less than 2 months

- Star Wars: Galaxy of Heroes earned $1.4B since the release

- App Annie: Garena Free Fire became the most popular Battle Royale game of the first half of 2021

- Nintendo Switch will receive the record amount of games this year

- GlobalData: The VR market will reach $51B valuation in 2030

- Sensor Tower: Animal Crossing: Pocket Camp reached $250M since the release

- Dataspelsbranschen: Swedish Gaming Companies earned $3.8B in 2020

- Moloco: Post-IDFA Mobile Game Advertising Costs

- App Annie: Indian Mobile Market Report

- Sensor Tower: Top Grossing Mobile Games of October

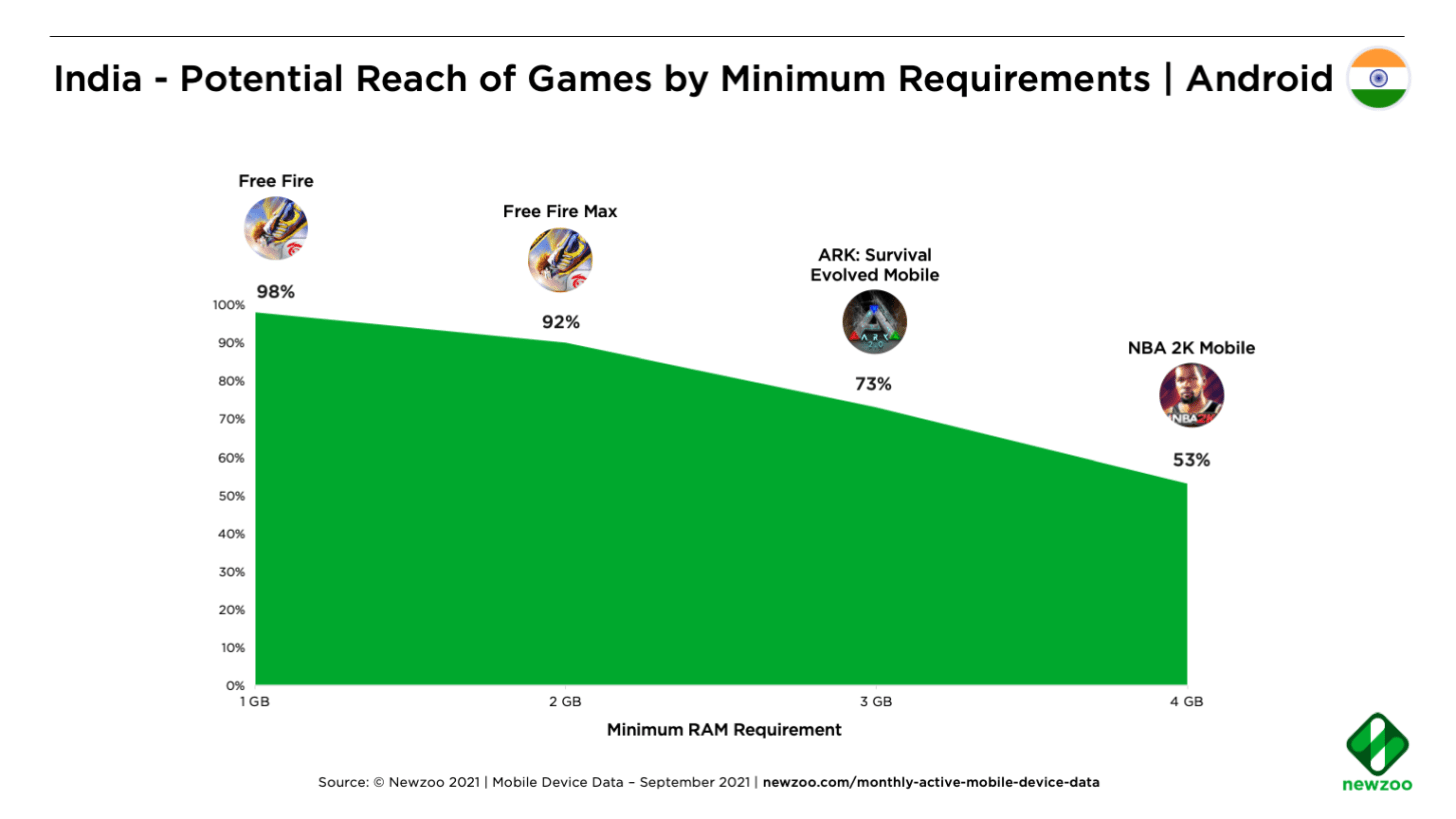

- Newzoo: Only 53% of Indian players have an Android device with 4GB RAM

- MY.GAMES: Russian Gaming Market will grow in 2021 only by 1% - in roubles

- Sensor Tower: Top Downloaded Mobile Games of October 2021

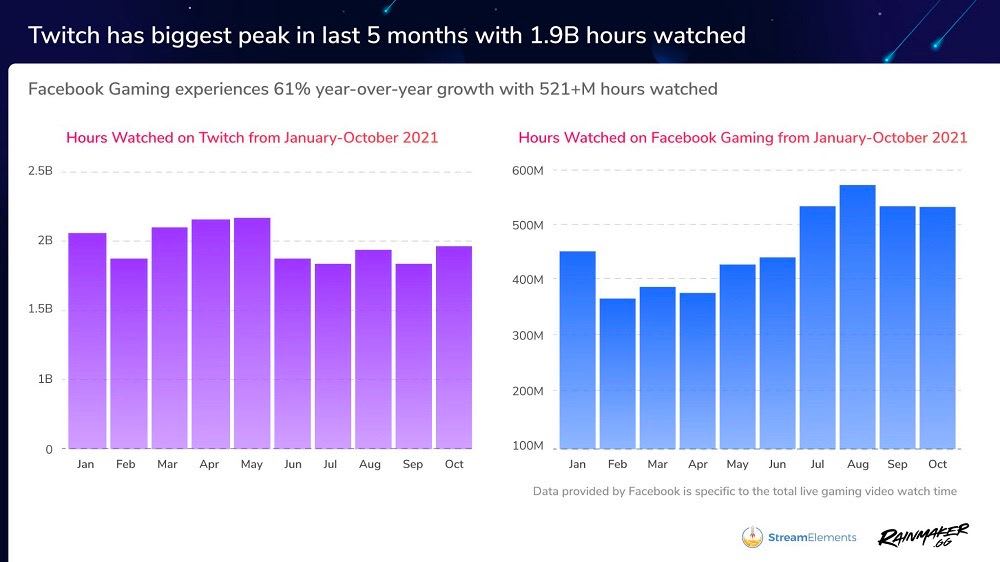

- StreamElements & Rainmaker.gg: Twitch grew in viewership by 19% YoY in October

- DFC Intelligence: Cloud Gaming Market will reach $13.5B by 2026

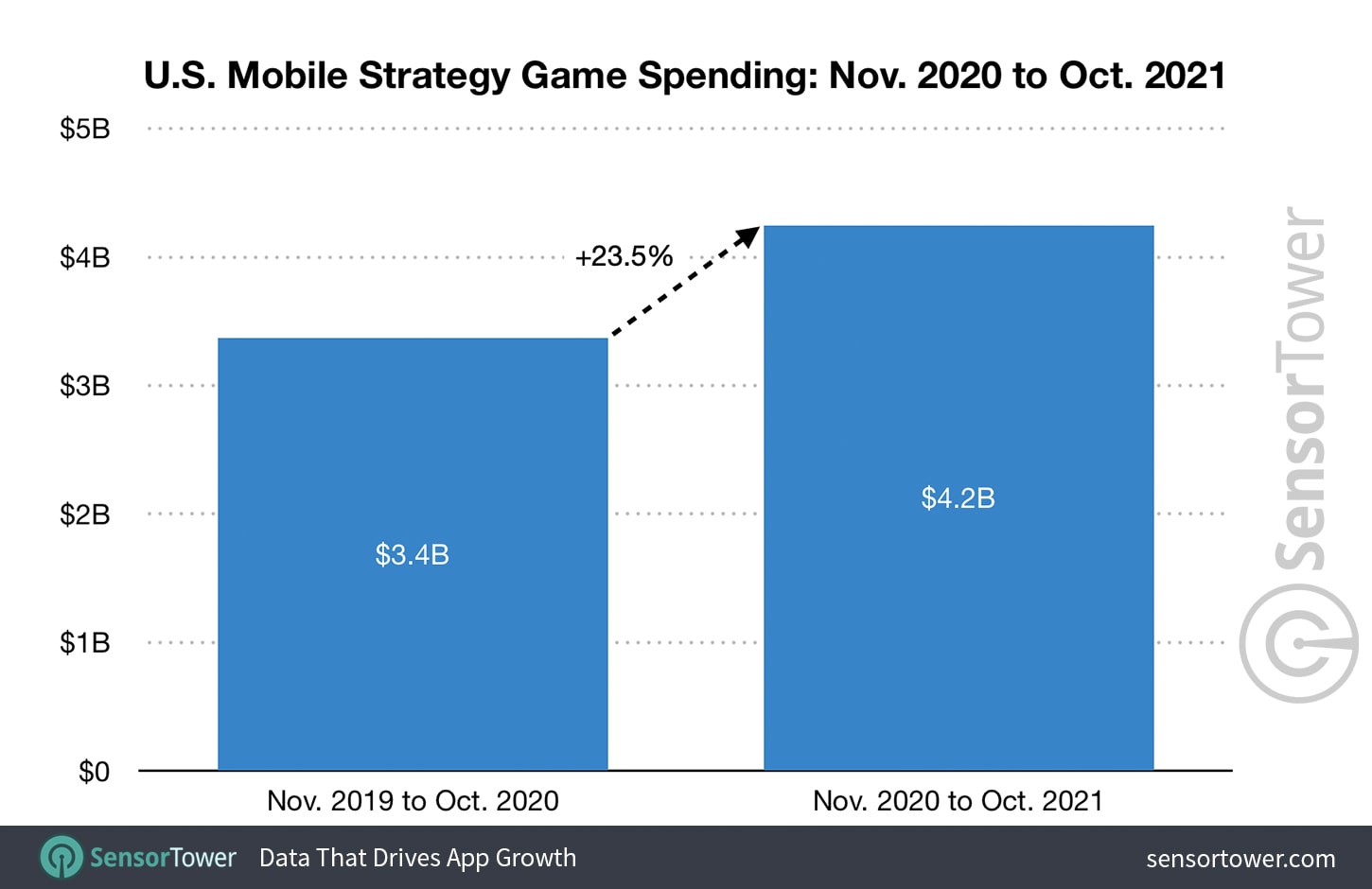

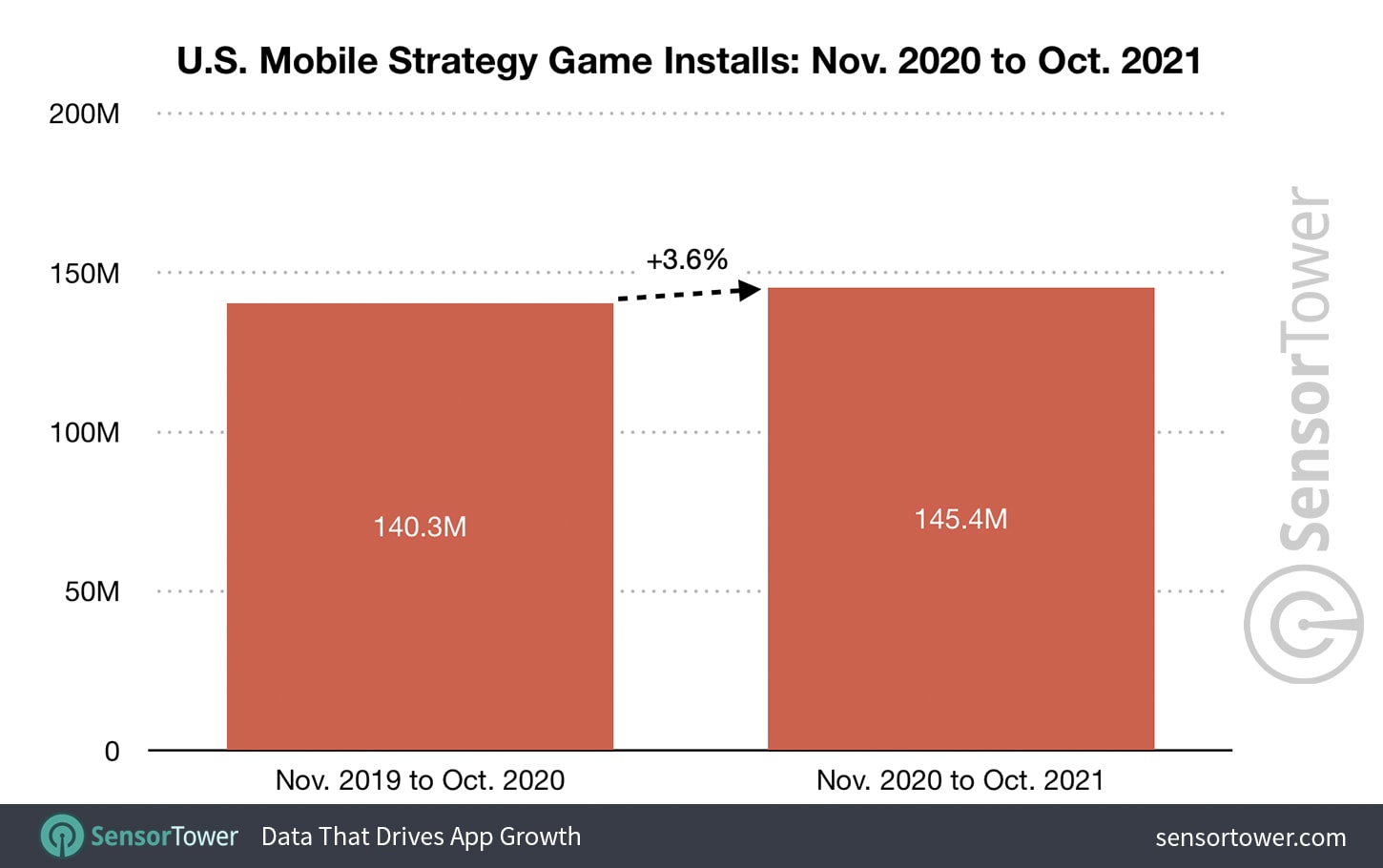

- Sensor Tower: The Strategy genre in the US grew by a quarter last 12 months

- PUBG: New State surpassed 20M downloads in 5 days

- Tenjin & Espresso Publishing: Hyper-casual market in Q3 2021

- App Annie: Sports Sims has been downloaded 23M times in Q3 2021 in the US

- Sensor Tower: South Korean gamers have spent almost $1.5B on games in Q3 2021

- Google & Newzoo: Gaming industry in 2021 and beyond

- Global Sales Data: PlayStation 5 owners prefer buying boxed games

- Newzoo: 20% of the Xbox audience played Call of Duty: Warzone & Fortnite last month

- Niko Partners: Chinese gaming market will earn less in 2021 than expected

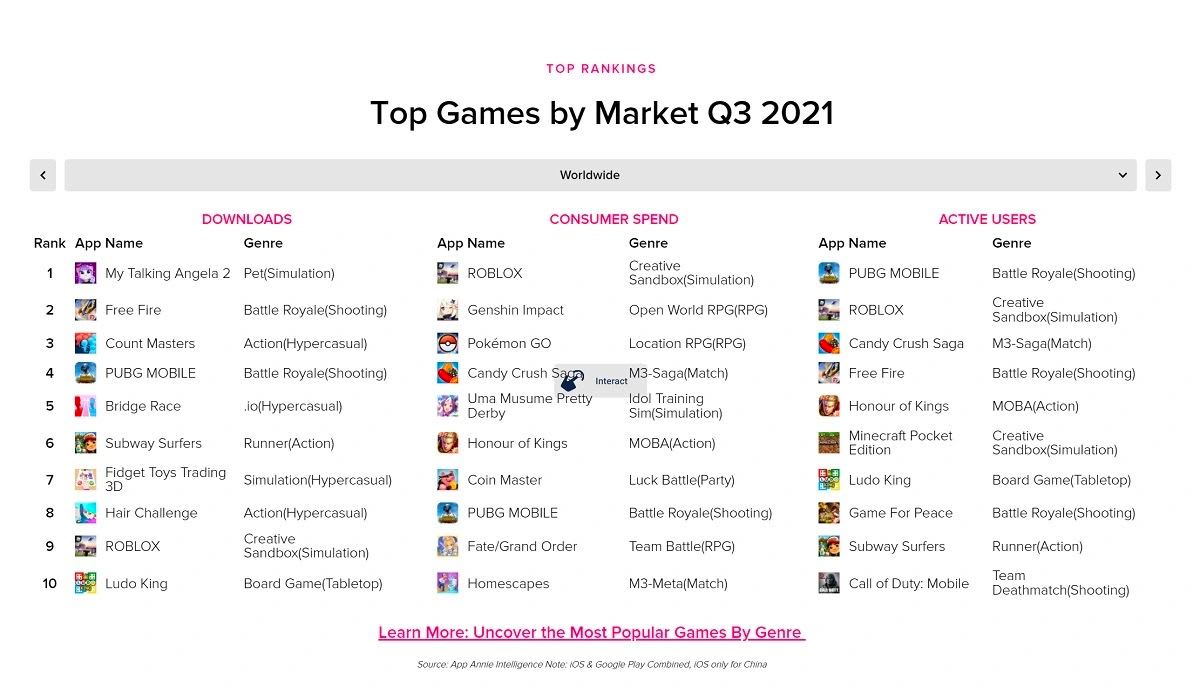

- App Annie: Players downloaded games 14.3B times in Q3 2021

- DFC Intelligence: Users will spend $135B on gaming hardware by 2026

- App Annie: Mobile Gaming Market of Australia & New Zealand in 2021

- Newzoo & Carry1st: The number of Sub-Saharian Africa users increased by 2.4x times in 6 years

- Sensor Tower: PUBG Mobile daily revenue in 2021 is $8.1M

- App Annie: EMEA-based Match-3 developers earned almost a billion $ in Q3 2021

- Sensor Tower: PUBG: New State reached $2.6M of revenue first week

State of Survival collaboration with The Walking Dead brought 20M new users

- The partnership started in March. New items, in-game events were added to the State of Survival. Also, Daryl Dixon, one of The Walking Dead characters, was presented as a playable character.

- This September the game passed 100M downloads plank.

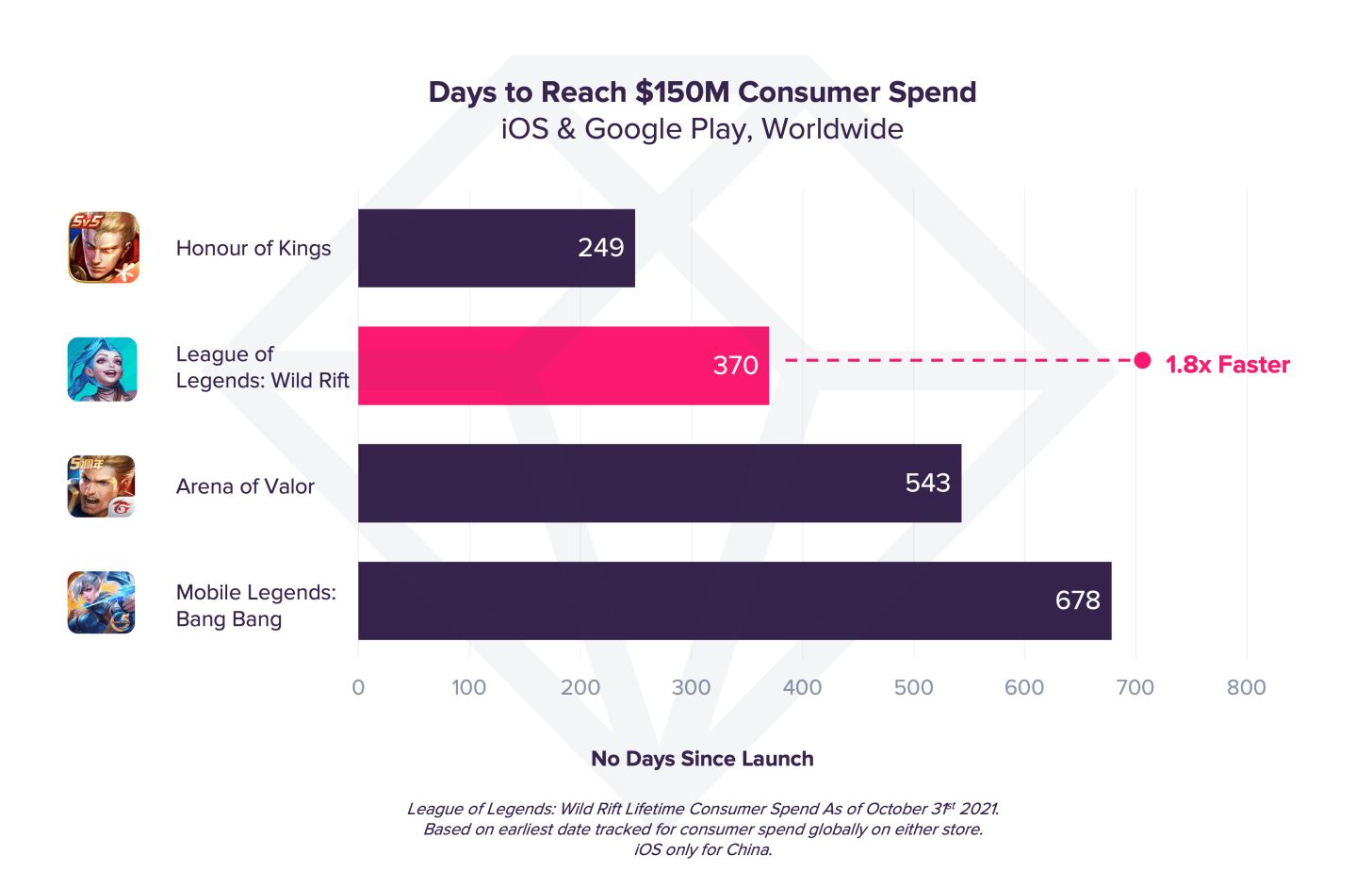

App Annie: League of Legends: Wild Rift Earned $150M in first 370 days

-

Only Honour of Kings among competitors achieved this sum faster - it took Tencent’s game only 249 days.

- The US and Brazil are top regions in players spendings at League of Legends: Wild Rift.

-

League of Legends: Wild Rift is the most successful Riot Games title now. Its revenue is higher than Teamfight’s Tactics and Legends of Runeterra’s combined.

AppMagic: Top Mobile Games in October by Revenue and Downloads

Revenue

-

PUBG Mobile is back to the throne - in October project received $107.7M of revenue.

-

The most profitable iOS game was Honor of Kings ($87.7M); on Android ODIN: Valhalla Rising led the chart ($53.1M).

-

Only one new game - the Chinese version of League of Legends: Wild Rift - entered the chart with $43.5M of revenue.

-

Monster Strike released in 2013 received $71.8M of revenue in October.

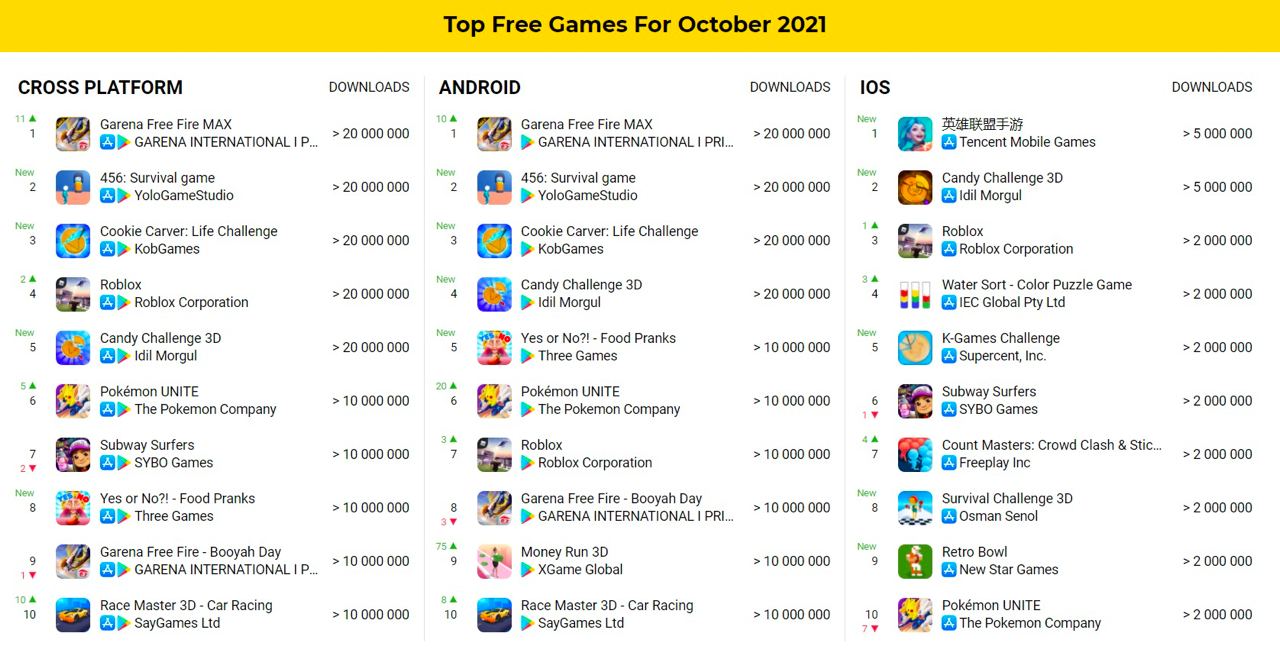

Downloads

-

Garena Free Fire MAX won the overall downloads chart with 41.5M of downloads, 39.7M of which came from Android.

-

The most downloaded game on iOS was the Chinese version of League of Legends: Wild Rift - it received 6.8M of downloads.

-

On 2, 3, and 5 places of overall downloads chart landed games inspired by Squid Game. 456: Survival Game (second place) managed to get 36.3M downloads.

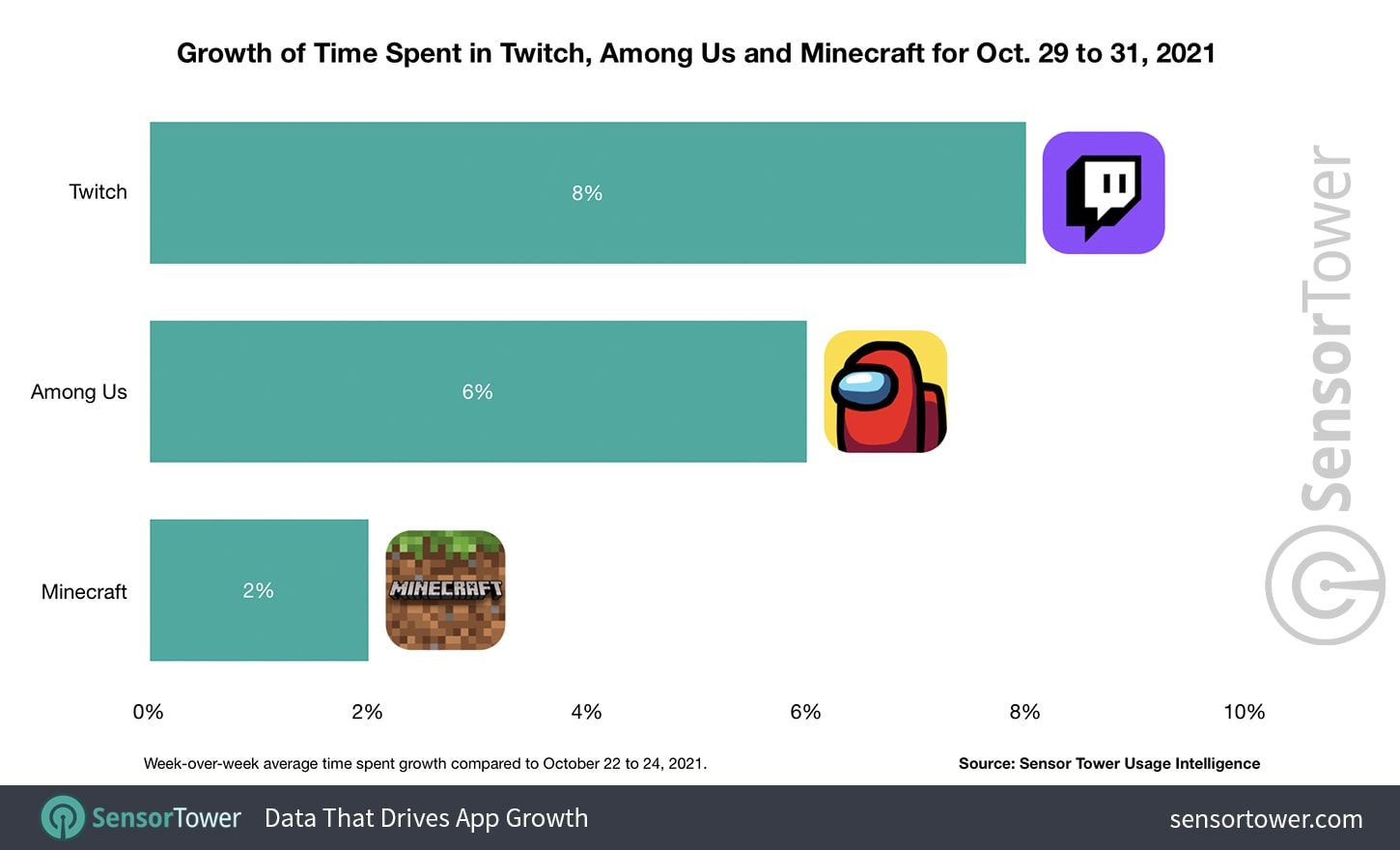

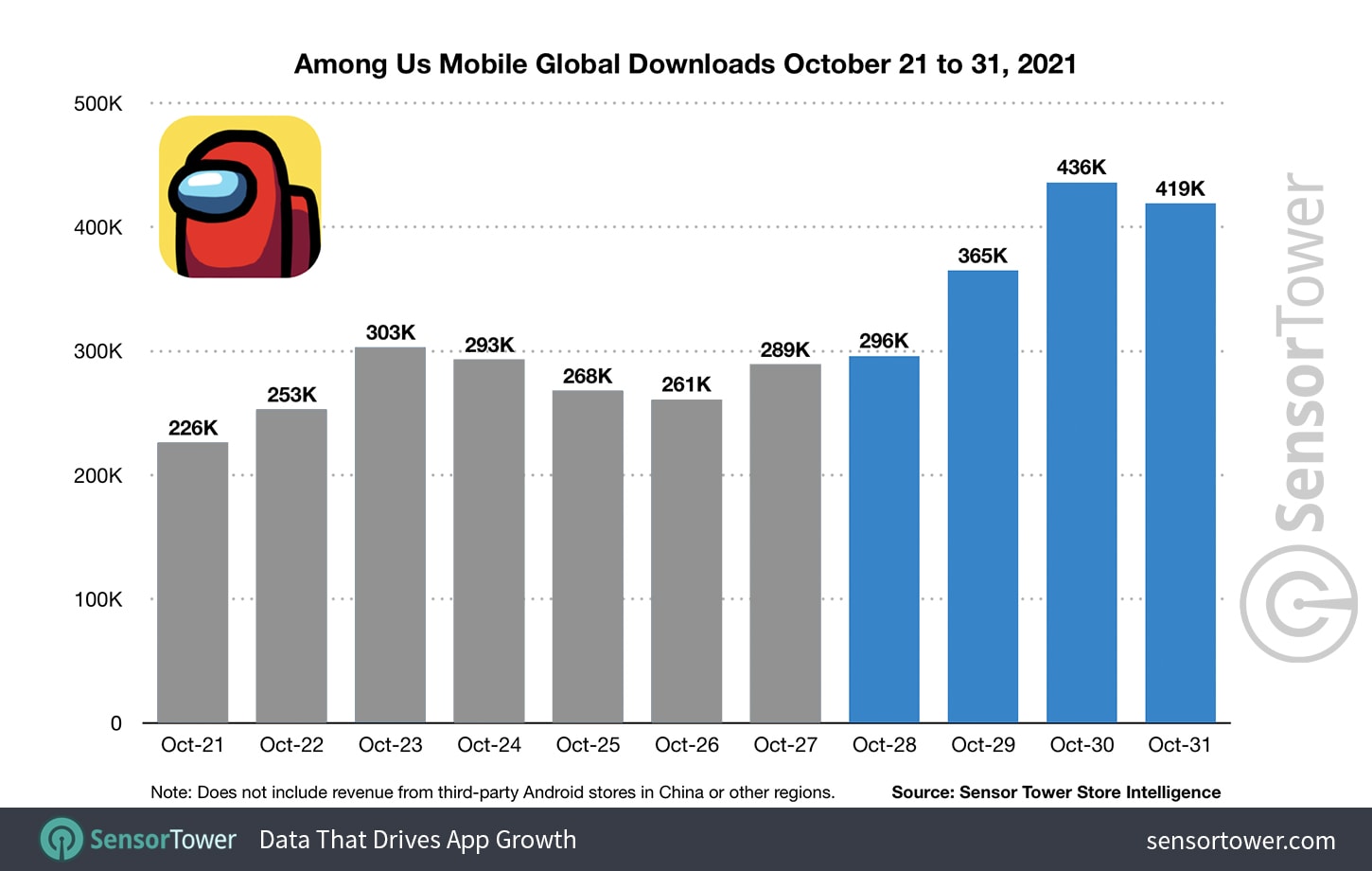

Sensor Tower: ROBLOX servers outage led users to Twitch, Among Us, and Minecraft

-

From 29 to 31 October, the time, spent by users in Twitch, increased by 8%, compared to previous days. Among Us, time spending increased by 6%, Minecraft - by 2%.

-

By the outage time (from 29 to 31 October), ROBLOX lost only 33% in sessions. People were still trying to enter the game.

-

Among Us experienced on October 30 the best day by downloads from 4 April 2021 and the best day in revenue since 17 July 2021.

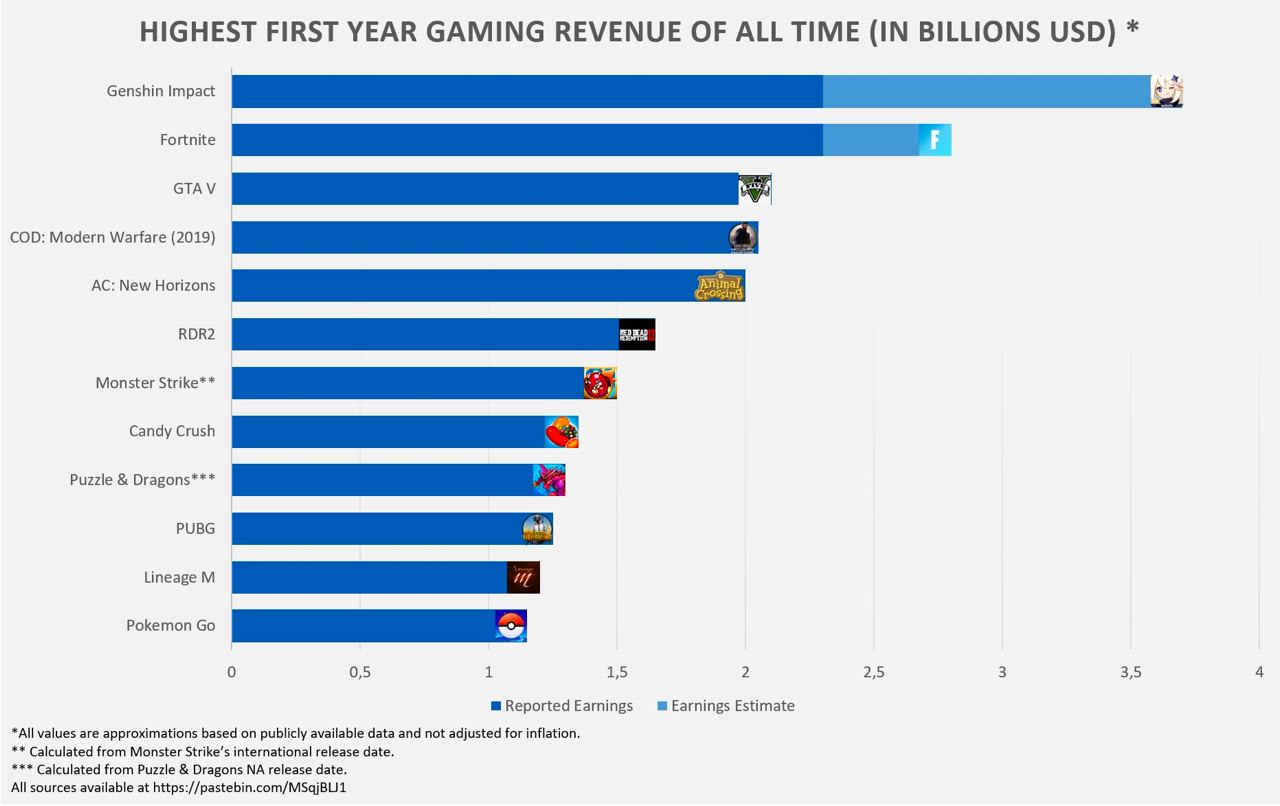

Genshin Impact might be the most successful game ever in the first year after launch

-

The first 365 days brought the game $2.1B of revenue only on Mobile devices.

-

If we count all platforms, the overall revenue might be from $2.3B to $3.7B, based on different sources.

-

Only Fortnite has shown comparable results the first year.

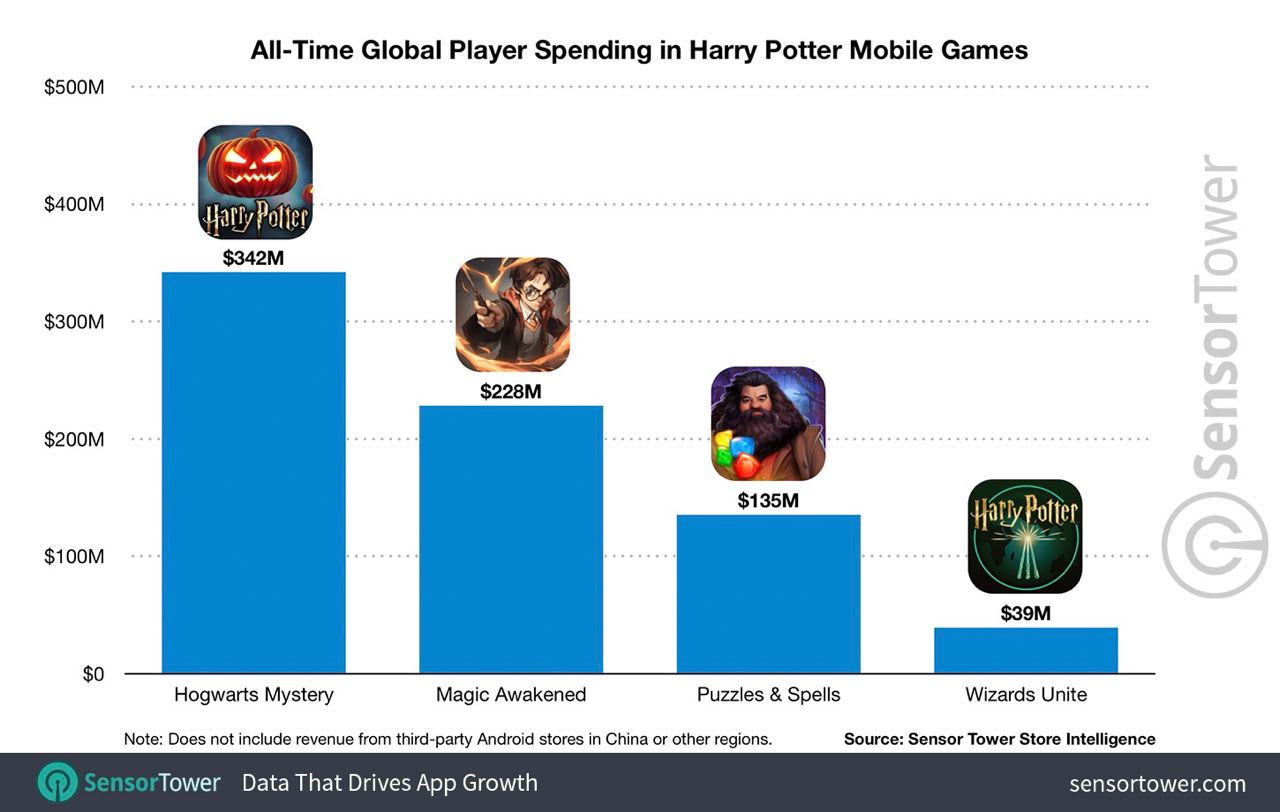

Sensor Tower: Harry Potter: Magic Awakened earned $228M in less than 2 months

-

The game managed to reach second place among the most profitable mobile games based on Harry Potter IP. The first place is held by Hogwarts Mystery - the game’s lifetime revenue is $342M.

-

Harry Potter: Wizards Unite, which soon will be closed, received $39M in a lifetime.

-

If we’ll compare the first month after launch, then Harry Potter: Magic Awakened will heavily outperform other franchise projects. The game has earned $180.7M during the first month, while the nearest competitor - Hogwarts Mystery - received $32.6M.

-

The majority of Harry Potter mobile games revenue comes from the US - $285.6M (38,4% of the overall amount). The second place belongs to China - 28% - but only because of the Harry Potter: Magic Awakened launch. The third country, which likes Harry, is Germany - 5.4% of revenue.

-

The total revenue of mobile games using Harry Potter IP is $743M.

Star Wars: Galaxy of Heroes earned $1.4B since the release

-

The game that launched in 2015, has been downloaded more than 100M times.

-

The majority of revenue ($850M) comes from the US. Germany and the UK are next.

-

From Q1 to Q3 of 2021 the game received more than $170M, which shows consistent interest in the project even years after.

-

Star Wars: Galaxy of Heroes is the most successful mobile game based on the Star Wars IP. It’s responsible for 98% of all last 5 Star Wars-based mobile games.

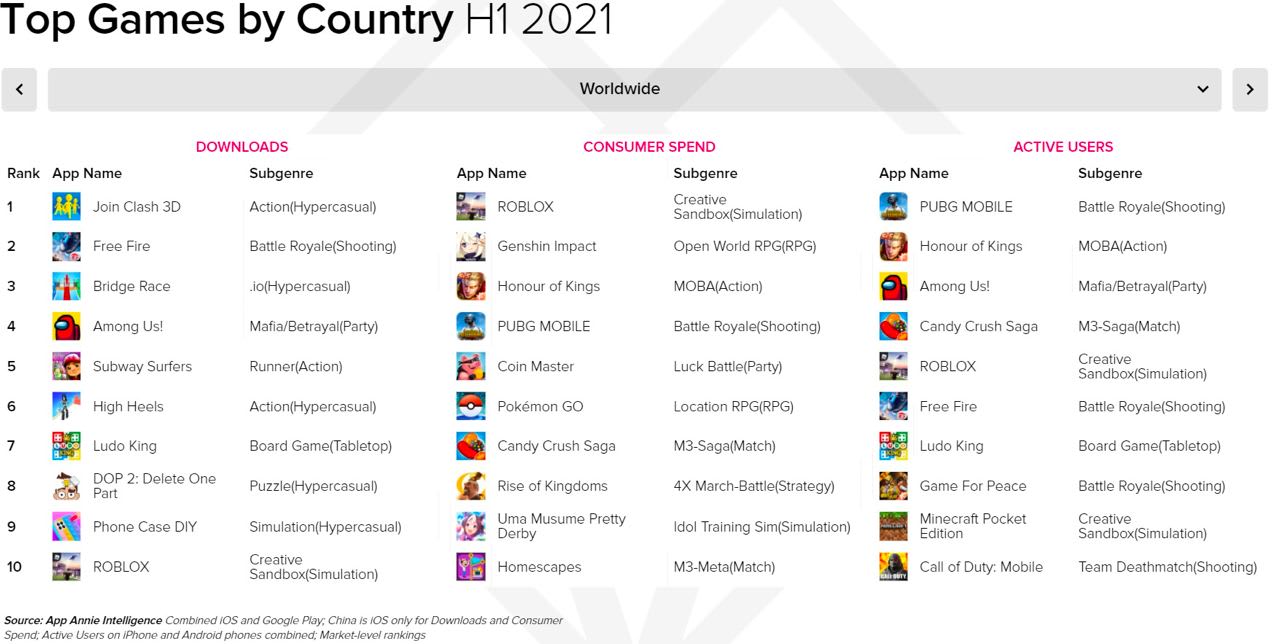

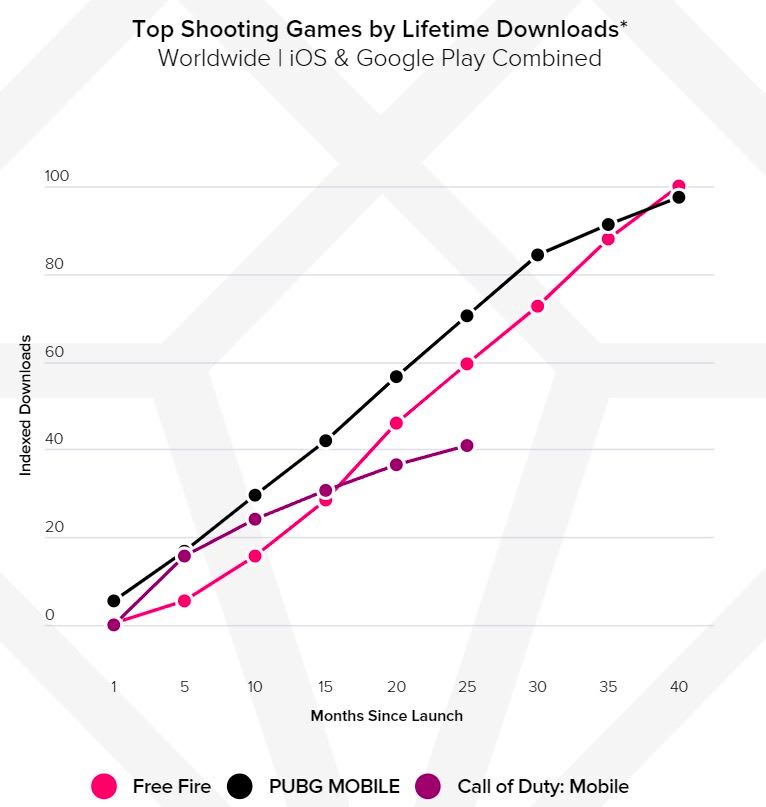

App Annie: Garena Free Fire became the most popular Battle Royale game of the first half of 2021

-

From January to July 2021 the game was downloaded 104.5M times. Garena Free Fire lost only to Join Clash from FreePlay.

-

Competitors performed much worse. PUBG Mobile had 71.6M installs during the same period; Call of Duty: Mobile - only 38.3M.

-

However, the number of active users in PUBG Mobile is still higher. But engagement is better in Garena Free Fire - its users playing 35% more sessions.

-

Comparing downloads from the launch moment, Garena Free Fire accumulated more than a billion downloads; PUBG Mobile - 974M, and Call of Duty: Mobile - 409M. Worth to mention, that latter was released 2 years later than competitors.

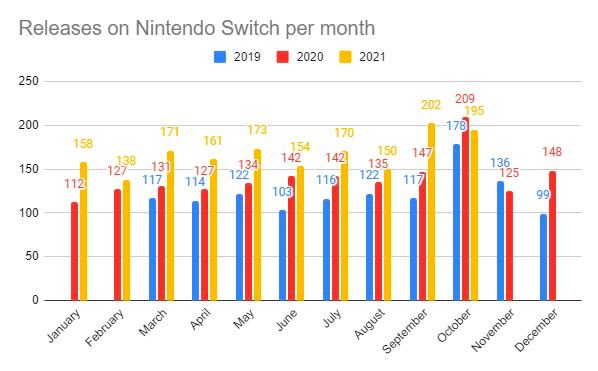

Nintendo Switch will receive the record amount of games this year

-

In the first ten months of 2021, Nintendo Switch got 1672 new projects. It’s only 7 games less than during the whole of 2020.

-

In September 2021 202 games were released on Switch - in 2020 there were only 147.

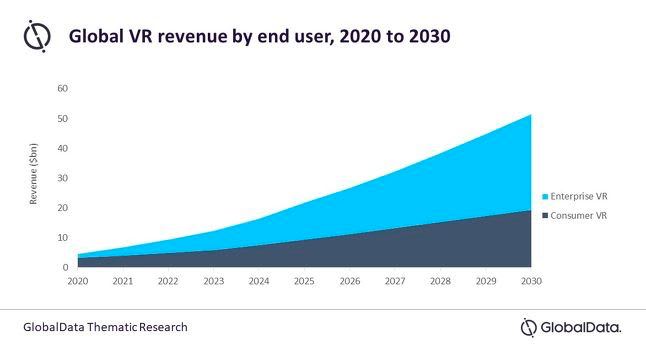

GlobalData: The VR market will reach $51B valuation in 2030

-

The analytic company highlighted, that in 2020 the valuation of the VR market was only $5B.

-

In 2030, about 75% of the valuation will come from the Enterprise segment. GlobalData analytics are sure, that the VR technology will find customers in professional domains.

-

Analytics are sure, that 5G integration, Cloud Services, and Motion Tracking enhancements, will positively affect the VR technology.

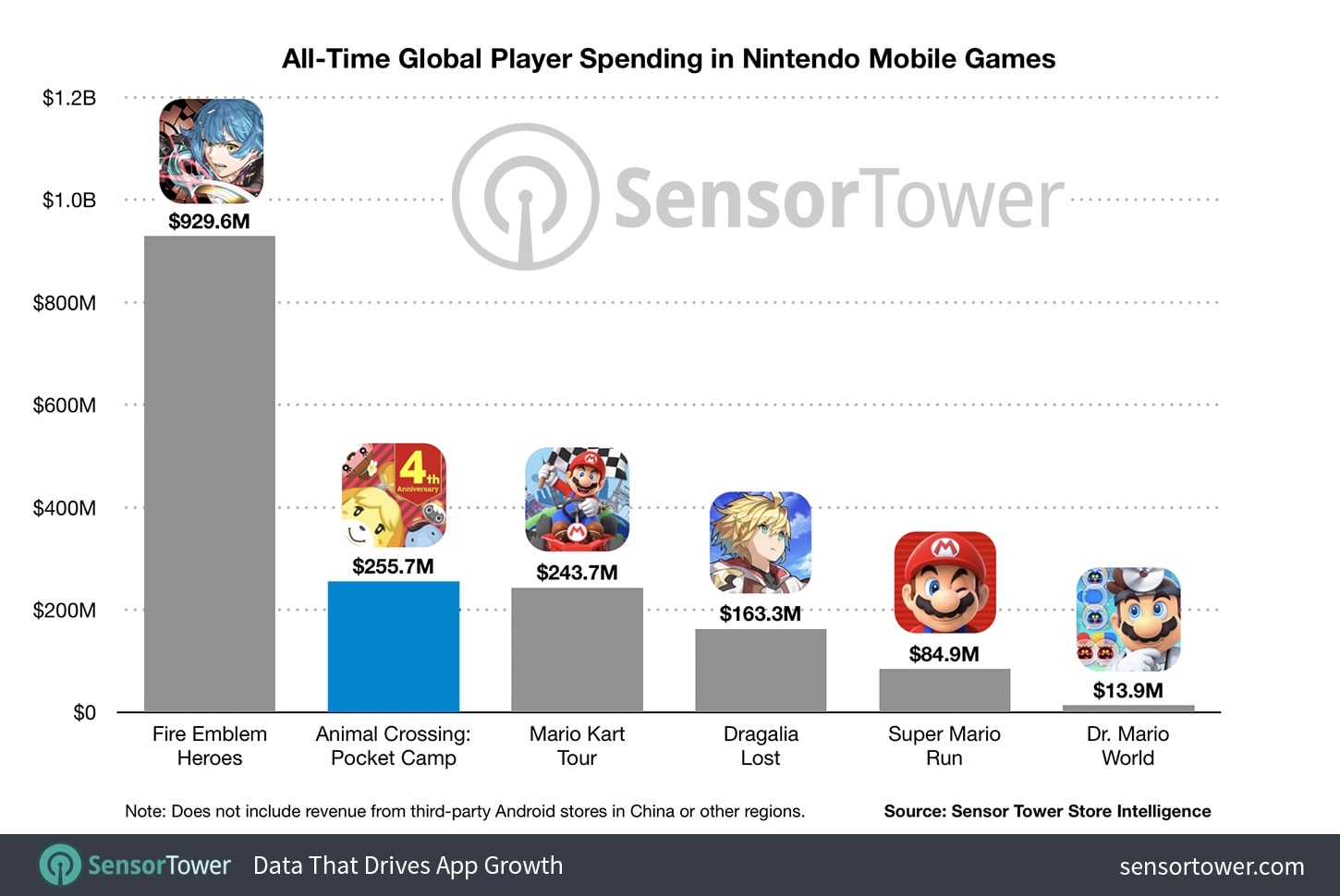

Sensor Tower: Animal Crossing: Pocket Camp reached $250M since the release

-

The game was launched in 2017, and the best year happened in 2020, thanks to coronavirus. Last year the game earned $77.5M - it’s 23.6% higher than in 2019.

-

In May 2020 Animal Crossing: Pocket Camp had the best month by revenue - $8.4M.

-

As for the current moment, in 2021 the game has earned $51.5M.

-

Animal Crossing: Pocket Camp is the second Nintendo game by revenue. It’s losing only to Fire Emblem Heroes ($929.6M).

-

Japan is the primary market for Animal Crossing: Pocket Camp ($172M of revenue, 67.3% of the whole volume). The US is next (21% of all revenue), South Korea is third (1.8%).

-

App Store is responsible for 61% of revenue, Google Play covers the remaining 39%.

-

Animal Crossing: Pocket Camp was downloaded 61.8M times. 20.4M (33%) came from the US; 7.8% from Japan, and 6.3% from France.

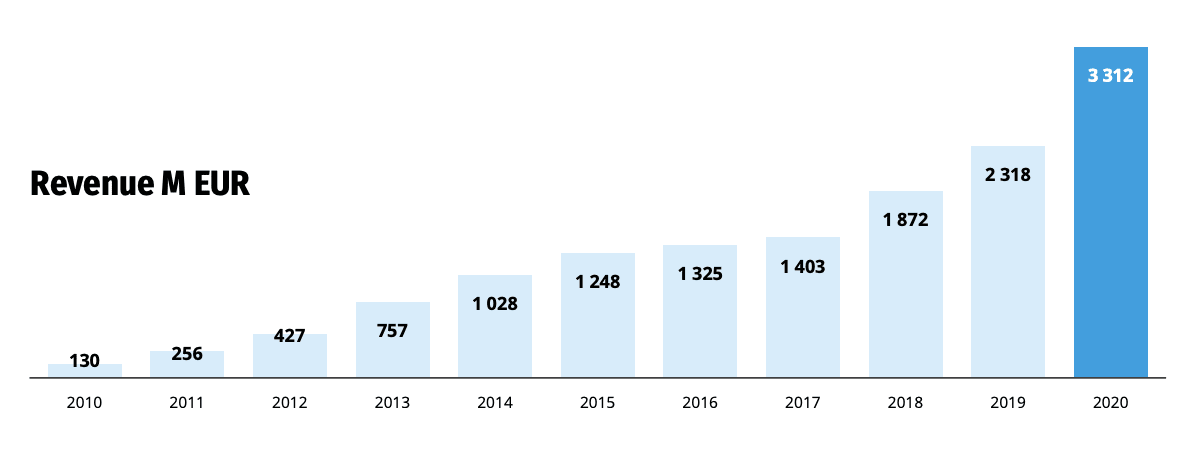

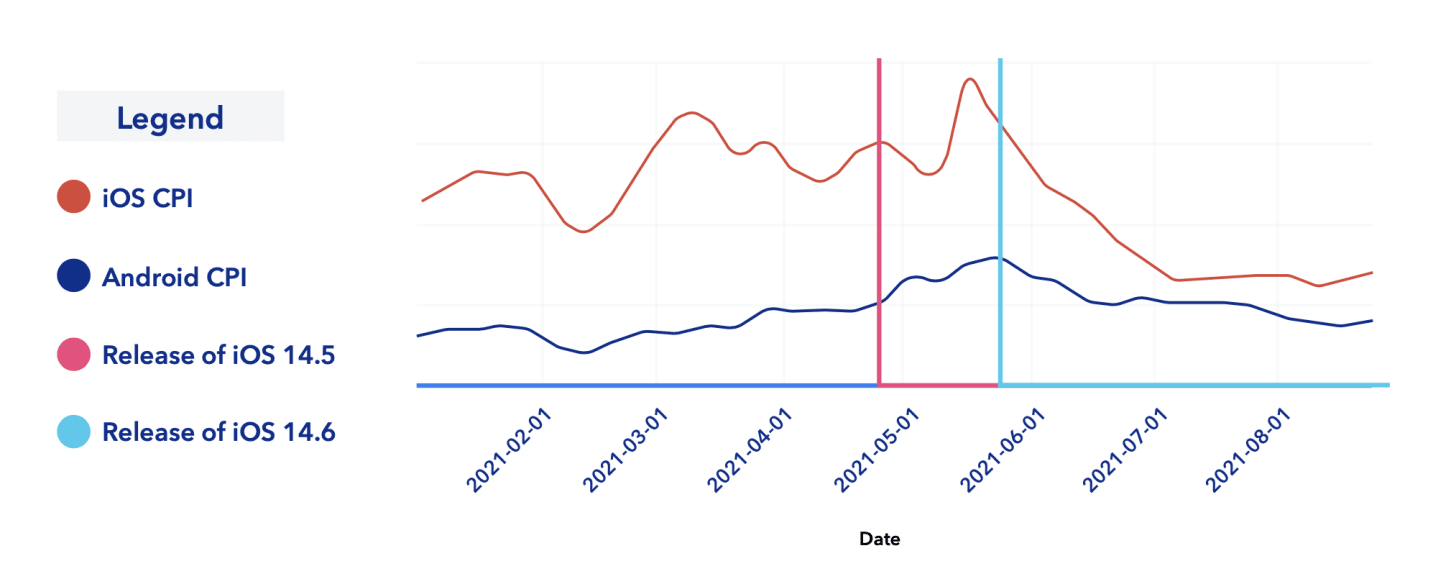

Dataspelsbranschen: Swedish Gaming Companies earned $3.8B in 2020

-

It’s 43% higher than in 2019. $3.8B of revenue was split between 667 gaming companies working in the country.

-

The gaming industry income resulted in $834M - it’s 46% higher than in 2019.

-

81 new gaming companies were settled in Sweden in 2020. And for the past 10 years, the industry grew from $150.5M of revenue to $3.8B.

-

6,596 employees are working in the Swedish gaming industry. 78.6% of this amount are male.

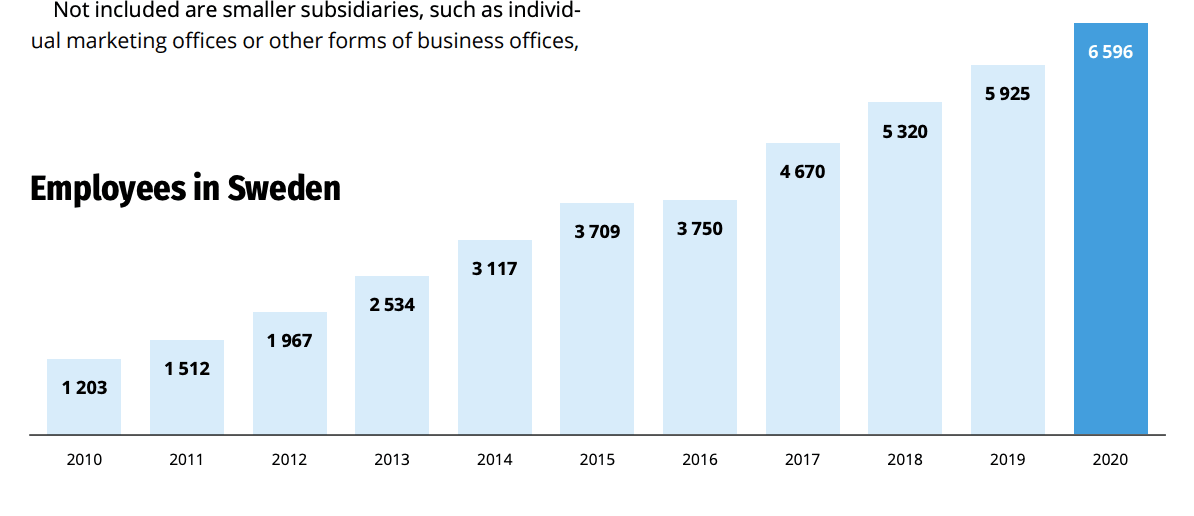

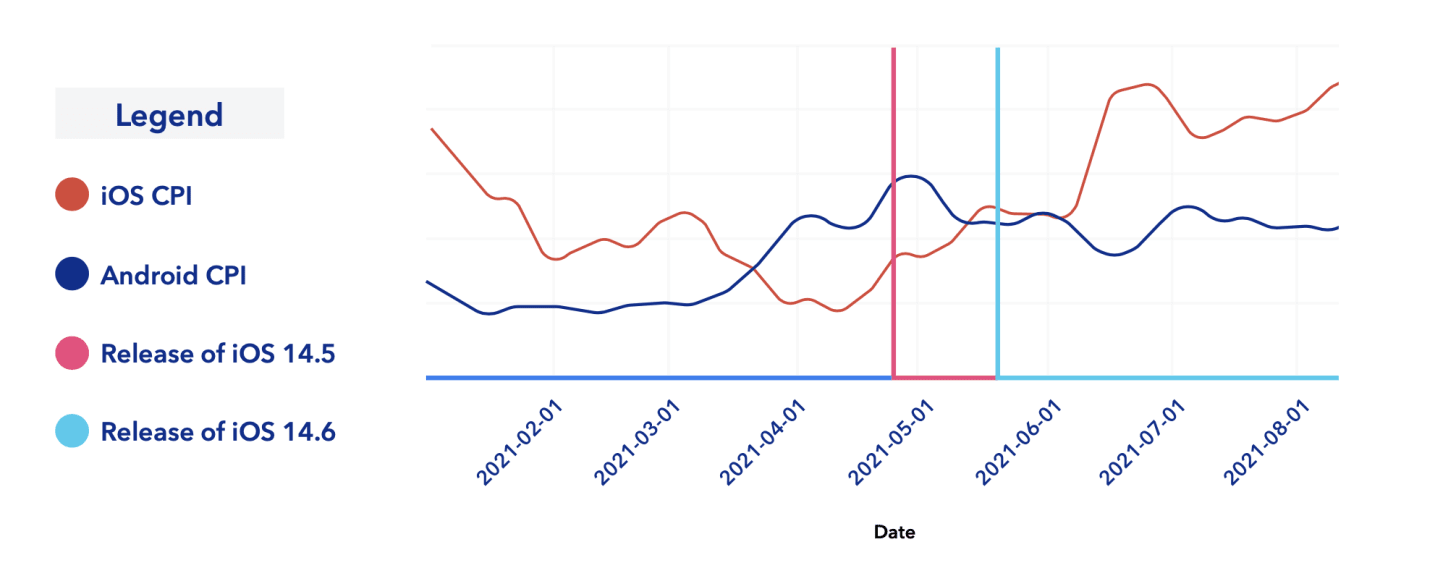

Moloco: Post-IDFA Mobile Game Advertising Costs

Casual Games

-

The average CPI in casual games on iOS fell down by 38% since the iOS 14.6 release. On Android, it increased by 16%.

-

Important to mention, that from the release of iOS 14.5 to iOS 14.6, CPI in casual games on iOS increased by 20%, and by 97% on Android.

Dynamics (Casual Games):

-

iOS: CPI increased by 20% after the iOS 14.5 release. Felt down by 38% after the iOS 14.6 release.

-

Android: CPI increased by 97% after the iOS 14.5 release. Increased additionally by 16% after the iOS 14.6 release.

Core Games

-

CPI in core games on iOS increased by 78% since the iOS 14.6 release. On Android, there is also a growth - by 36%.

-

From the release of iOS 14.5 upon to iOS 14.6 release, there was an increase in CPI too. On iOS - by 10%, on Android - by 67%.

Dynamics (Core Games):

-

iOS: CPI increased by 10% after the iOS 14.5 release. Additionally increased by 78% after the iOS 14.6 release.

-

Android: CPI increased by 67% after the iOS 14.5 release. Additionally increased by 36% after the iOS 14.6 release.

The full version of the report is available here.

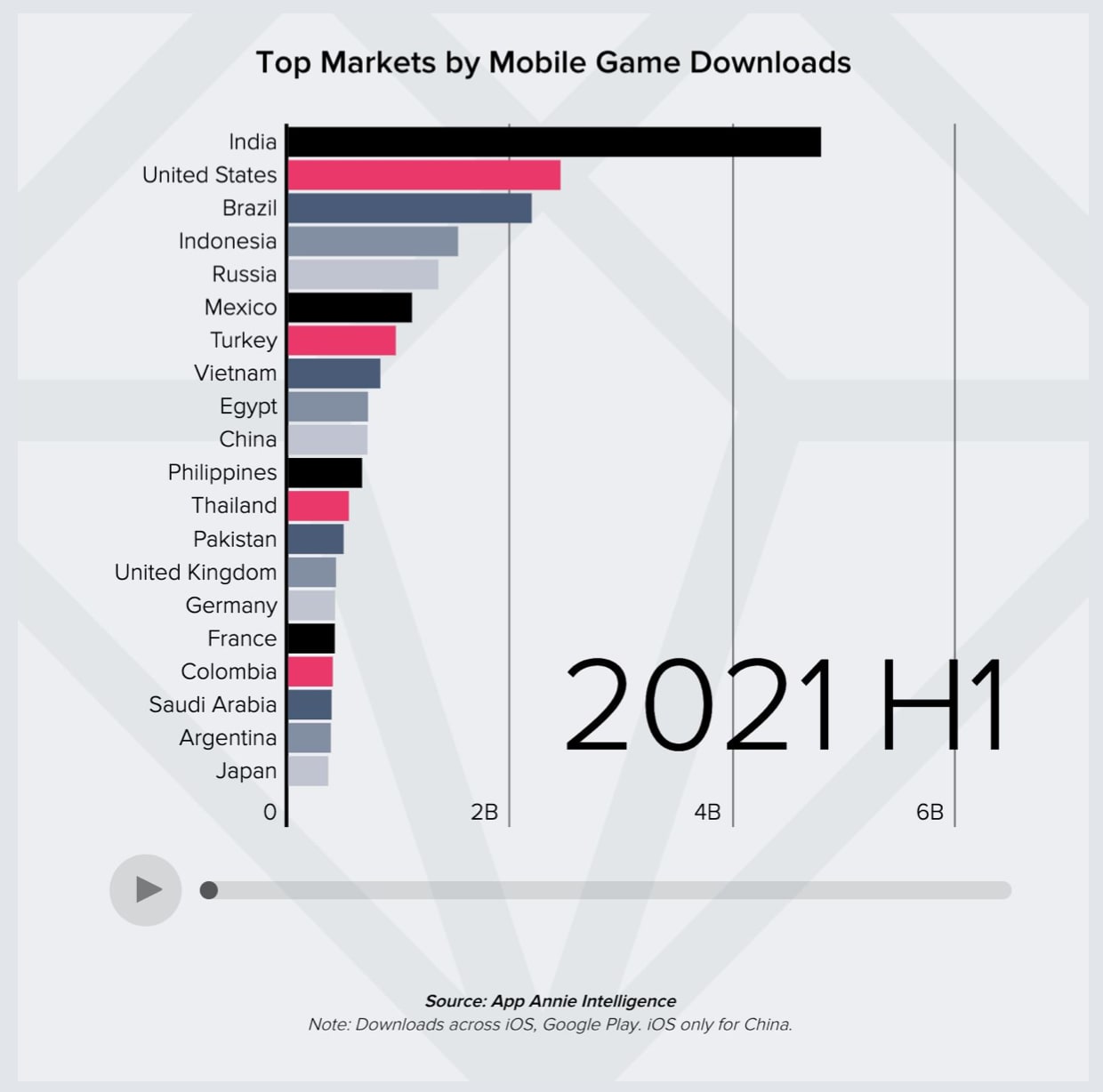

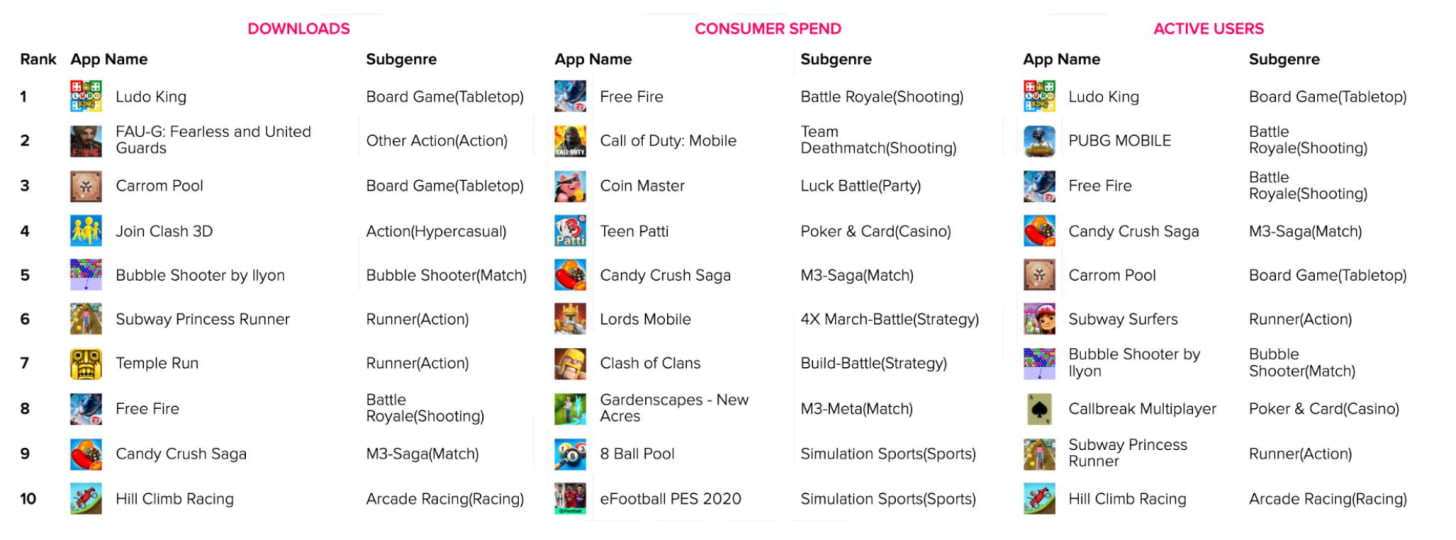

App Annie: Indian Mobile Market Report

-

India became the leader in H1 2021 by mobile games downloads. Users have downloaded games 4.8B times. Around 1/5 of world game downloads came from India.

-

The most popular game by downloads and MAU in H1 2021 was Ludo King. From the revenue perspective - Garena Free Fire.

-

In India, the Battle Royale genre is pretty popular (like in other regions).

-

However, there are no financial results of the market. App Annie is telling that the market is “booming”, but the downloads/revenue ratio, probably, doesn’t look good.

The full version of the report might be found here (with more verticals).

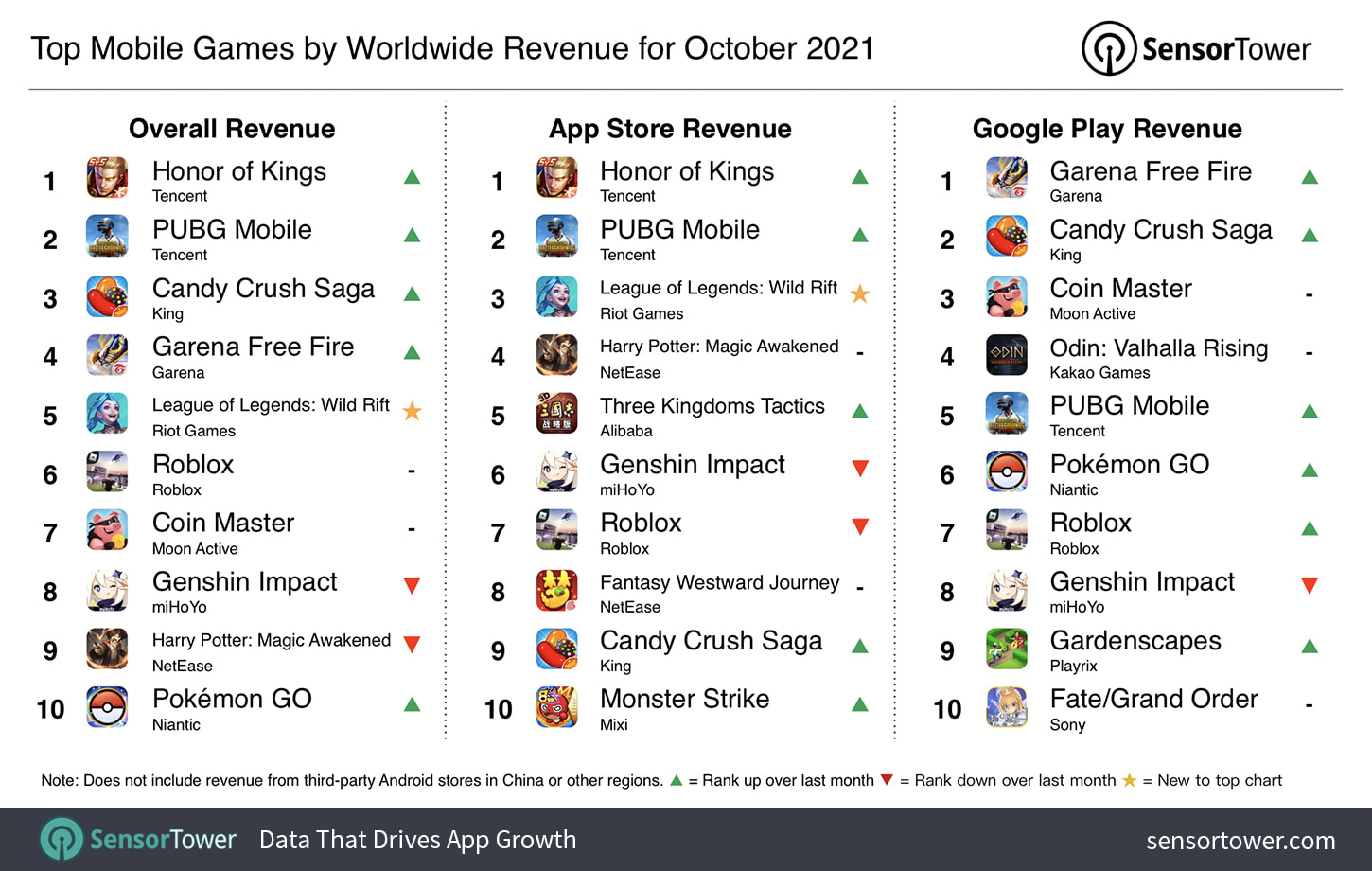

Sensor Tower: Top Grossing Mobile Games of October

-

Honor of Kings (as usual) was first, earned $329M last month. The increase YoY is 46.2%. 96.7 of overall revenue comes from China, and this is without alternative stores.

-

PUBG Mobile is second with $197M of revenue. 51% of revenue came from China, 11.5% - from the US.

-

League of Legends: Wild Rift managed to top-10 the first time, due to its launch in China, which was responsible for 93% of all revenue. The game earned $108M last month.

-

Good month for Candy Crush Saga, which YoY revenue growth was about 50%.

-

In October the mobile gaming market earned $7.5B - it’s 10.5% more than a year before.

-

The first place by revenue belongs to the US ($2.1B), Japan is second (about 20% of overall revenue), China is third (18.7%). But with the last case, Sensor Tower is not counting alternative stores, which might put China in the leading position.

Newzoo: Only 53% of Indian players have an Android device with 4GB RAM

-

Newzoo analytics tried to find out what RAM size must have the game to reach the max audience in India.

-

It happens, that 1GB RAM has 98% of Android users - it’s enough to run Garena Free Fire.

92% has smartphones with 2GB RAM - it will be enough to launch Garena Free Fire MAX.

Devices to launch ARK: Survival Evolved, which requires 3GB RAM, will find only 73% of India's population.

Finally, only 53% of gamers in India have access to NBA 2K Mobile, which requires 4GB RAM.

MY.GAMES: Russian Gaming Market will grow in 2021 only by 1% - in roubles

-

Russians will spend on games 165.6B of roubles ($2.25B) in 2021 - it’s 1% higher than in 2020 (163.4B roubles).

-

In dollars, the market will even fall down from $2.26B of revenue to $2.25B of revenue due to the course correction.

-

The reason for such numbers covers in previous coronavirus year when the market grew by 35%. The global tendency (due to Newzoo) is that in 2021 the gaming market will show a 1.1% decline.

-

It’s expected, that in 2022 the Russian market growth will get back to double-digit numbers.

-

The PC market in Russia in 2021 will earn 78.1B of roubles - about $1,09B (-4.6%).

-

The mobile market in Russia in 2021 will earn 73.8B of roubles - about $1,03B (+10%)

-

The console market in Russia in 2021 will earn 13.6B of roubles - about $190M (-5%).

- F2P is responsible for about 85% of all revenues.

From an inside source.

Sensor Tower: Top Downloaded Mobile Games of October 2021

- Garena Free Fire became the most popular game of the previous month with 34M downloads. It’s 72% higher than the year before. Most downloads came from Brazil, the country is responsible for 12% of the overall amount.

-

Candy Challenge 3D from Idil Morgul earned second place with 19M of downloads. 12.2% of traffic came from the US, 9.3% from Brazil.

-

Games based on the Squid Game in October received 53.2M of downloads collectively. Three of them reached top-10 (Candy Challenge 3D, Cookie Carver, and 456).

-

In October users downloaded games 4.5B times - it’s 1.3% higher, than in 2020. India is responsible for 16.8% of all downloads (762.6M). The US is second (8.6%), Brazil is third (8.3%).

StreamElements & Rainmaker.gg: Twitch grew in viewership by 19% YoY in October

-

The users have watched 1.9B hours of streams in Twitch in October. It’s 19% higher than in October of 2020.

-

Facebook Gaming showed 61% growth. Users have watched 512M of videos in October.

-

The most-watched game of Twitch became League of Legends (98% growth MoM). The highest increase experienced DOTA 2 (+189% MoM), due to The International.

DFC Intelligence: Cloud Gaming Market will reach $13.5B by 2026

-

As of today, the market valuation is $1.23B.

-

More than $10B will come from those, who are owning the high-end PC right now.

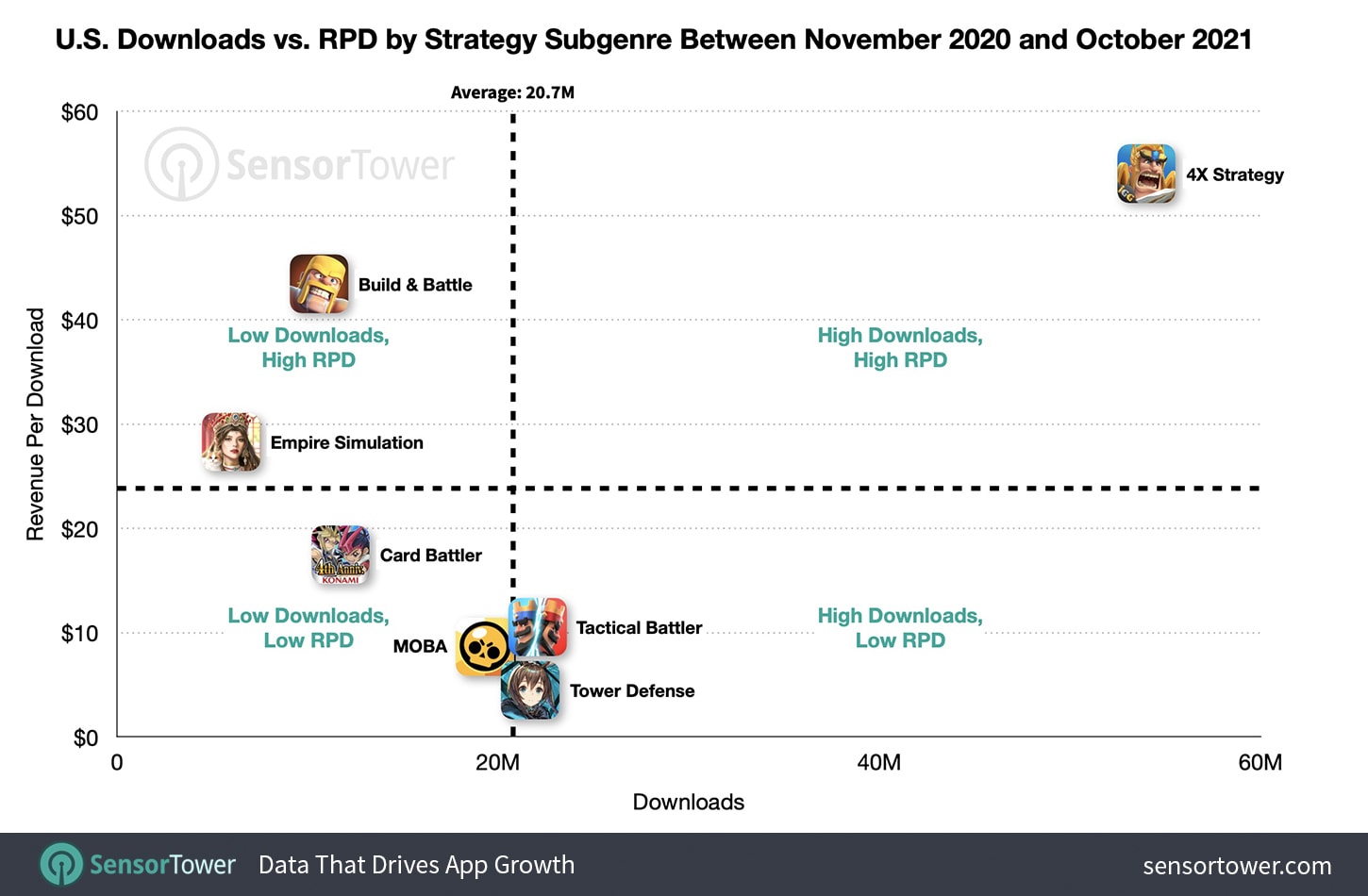

Sensor Tower: The Strategy genre in the US grew by a quarter last 12 months

-

Revenue in the last 12 months was $4.2B, which is a 23.5% increase since the previous year.

-

Lords Mobile earned the most ($330.3M), Clash of Clans and State of Survival are following.

-

Strategy games have been downloaded 145.4M times.

-

The first place by downloads belongs to Pokemon Unite (8.3M), Top War is next, the third place went to State of Survival.

-

4X Strategies are responsible for 32.5% of overall genre revenue ($2.9B).

-

MOBA subgenre is the fastest-growing with 50% YoY growth. Its revenue, however, is relatively small ($168.4M).

-

4X Strategies became the top downloaded subgenre too (53.3M).

-

MOBA games showed the highest growth dynamic (+133.3% YoY to 19.4M of downloads).

-

ARPD in 4X Strategies is $54.

PUBG: New State surpassed 20M downloads in 5 days

-

The game reached the top place in 160 countries, including the US, Japan, South Korea, Saudi Arabia, and Germany.

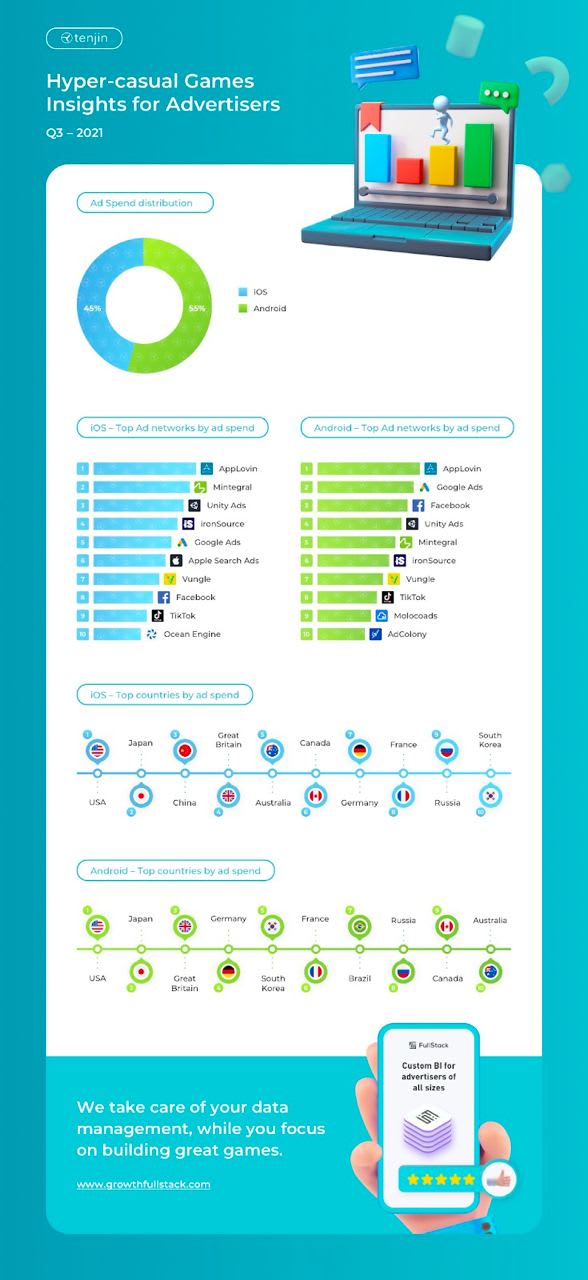

Tenjin & Espresso Publishing: Hyper-casual market in Q3 2021

-

55% of marketing budgets are spent on Android, 45% - on iOS. In 2019, the Apple platform had a 64% share.

-

AppLovin, Mintegral & Unity Ads are top-3 popular ad networks on iOS. AppLovin, Google Ads & Facebook are leading on Android.

-

The majority of marketing budgets are spent on the US, Japan, and China. On Android Great Britain replaced China.

Source: Tenjin and Espresso Publishing

App Annie: Sports Sims has been downloaded 23M times in Q3 2021 in the US

-

23M were about 78% of overall downloads of sports genre in the country in Q3 2021.

-

Madden NFL 22 Mobile is in the first place by far in the US.

Sensor Tower: South Korean gamers have spent almost $1.5B on games in Q3 2021

-

The exact amount of gaming revenue in Q3 2021 - $1.47B, showing 5% growth YoY.

-

80,3% of the revenue came from Google Play, the rest - from the App Store. But it is worth to mention, that Sensor Tower is not tracking alternative stores, which are relatively big in South Korea.

-

In Q3 2021 games have been downloaded 139M times, which is 16% lower, than a year before.

-

RPG became the main revenue driver, they were responsible for 66% of overall revenues. 8 out of 10 games in the top-10 are RPGs.

-

Odin: Valhalla Rising is the top game of Q3 2021. It has earned $230M (54% of the overall revenue of the top-10) and reached 4 place by downloads.

-

Genshin Impact managed to earn $45M.

-

Out of 100 top-grossing games, 35 were released by Chinese developers. Cumulatively, they’ve earned $280M, which is about 24% of overall mobile revenue in South Korea.

-

Pokemon Unite is the top downloaded game with 1.5M of downloads.

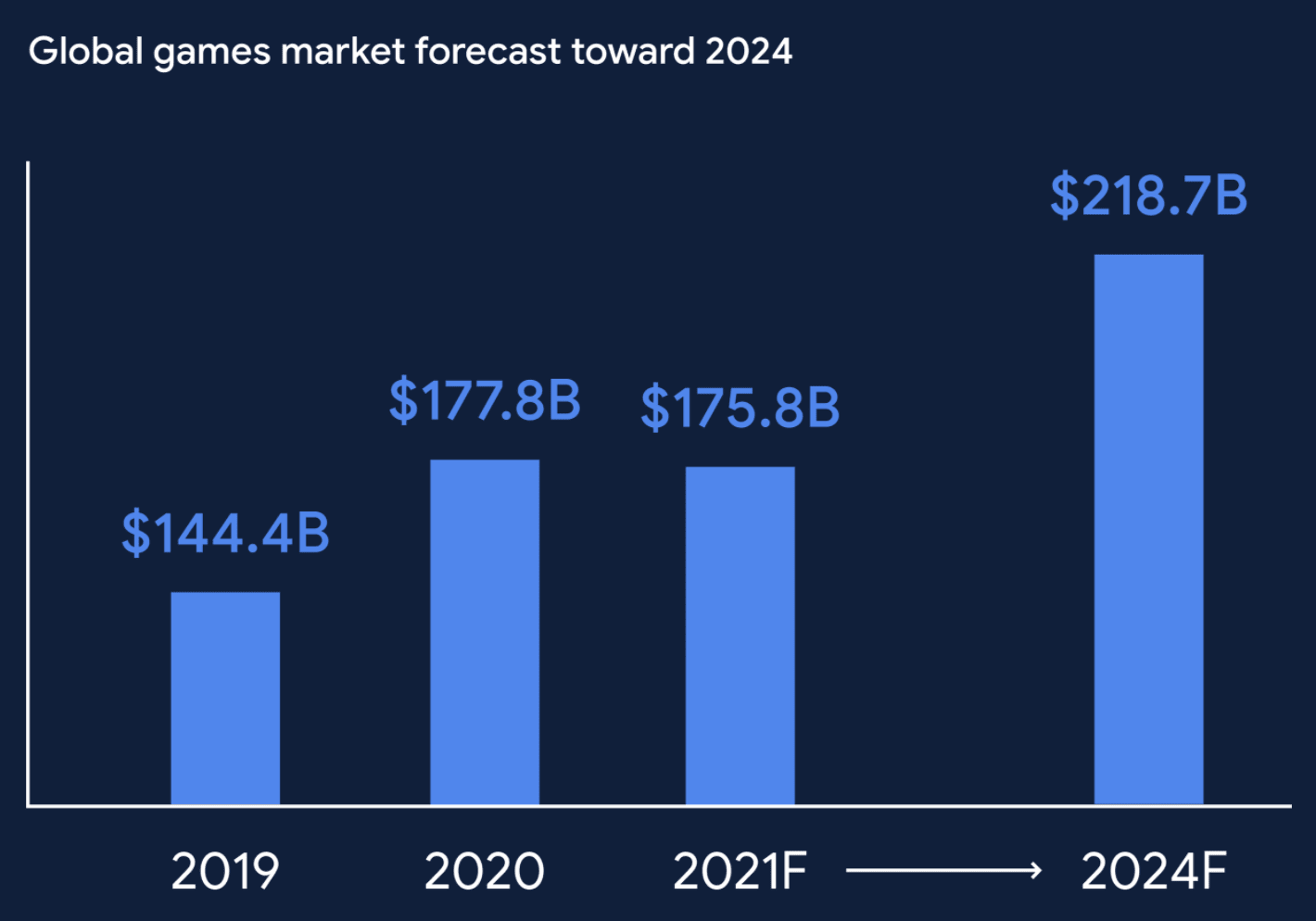

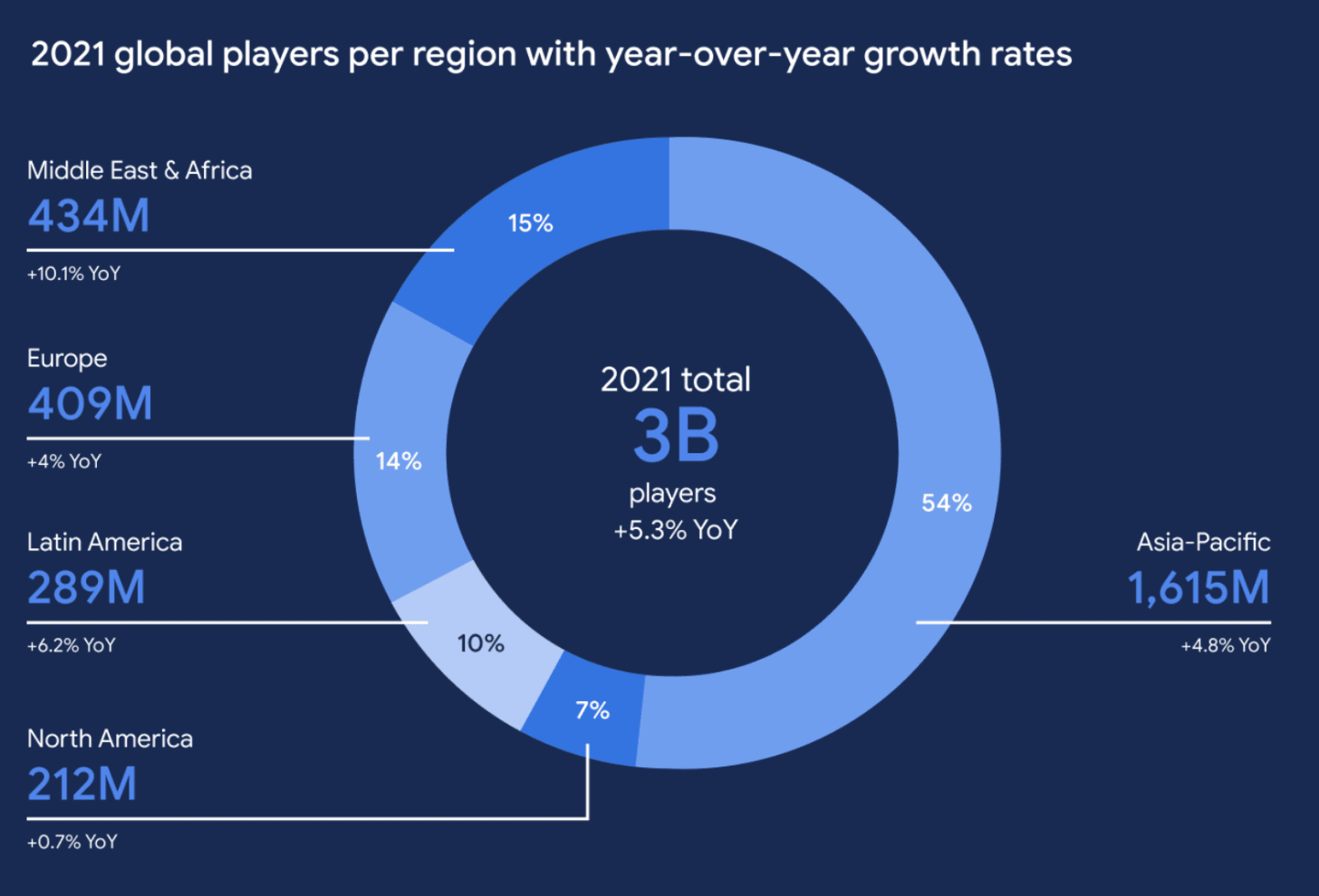

Google & Newzoo: Gaming industry in 2021 and beyond

-

In 2021 the gaming first time in history will show a decline from the record $177.8B in 2020 to $175.8B this year. However, by 2024 it’s expected to grow to $218.7B.

-

By the end of 2021, there will be 3B players in the world. Middle East & Africa are showing the highest growth rates with +10,1% YoY.

Trends:

-

Gaming subscriptions are making easier access to the content. At least, on PC and consoles.

-

Games are used as a socialization tool.

-

Increasing gaming content consumption (streams, videos, tournaments).

-

Cross-platform playing.

-

Cloud Gaming.

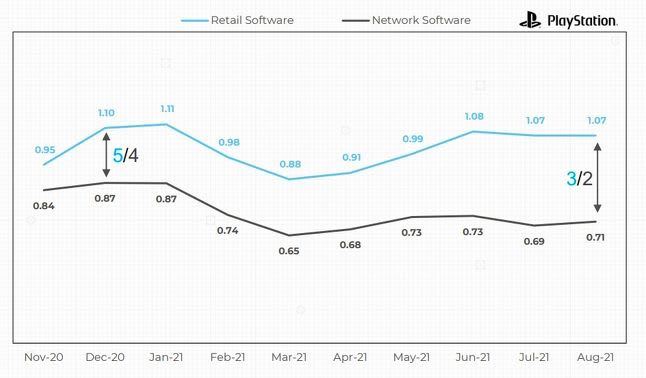

Global Sales Data: PlayStation 5 owners prefer buying boxed games

-

At the moment, for each 3 bought boxed copies 2 digital copies are sold.

-

Analytics are pointing out two factors. Firstly, for $70 users do want to own something physical. Secondly, boxed copies might be exchanged, or sold to other users.

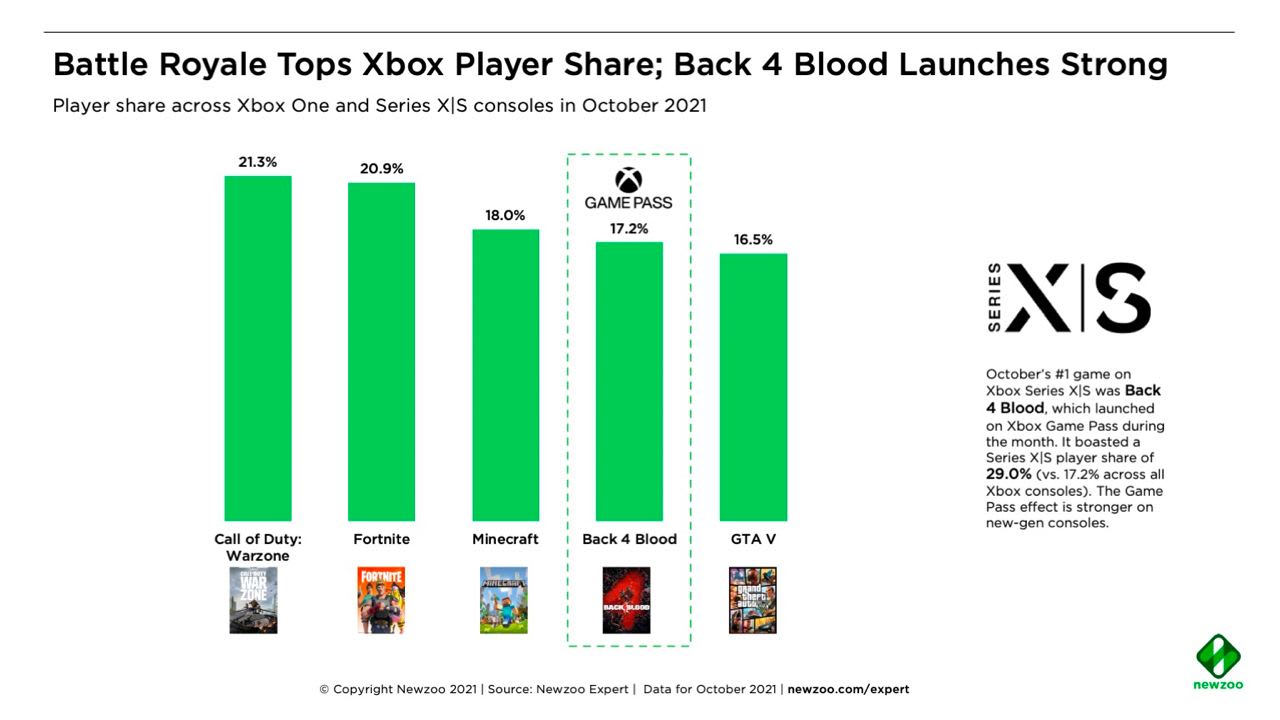

Newzoo: 20% of the Xbox audience played Call of Duty: Warzone & Fortnite last month

-

Call of Duty: Warzone was played by 21.3% of the whole Xbox audience. Fortnite has a little bit less - 20.9%. But if we’re talking about retention, the latter is best every day (from D1 to D28).

-

18% of Xbox users have played Minecraft last month; Back 4 Blood has 17.2% of the audience (thanks to Xbox Game Pass), GTA V has 16.5%.

-

Xbox Game Pass really helps to boost the audience that is playing your game. After adding Bethesda games to the catalog, numbers changed in the following way:

-

Skyrim's audience increased from 2.4% in February to 4.1% in March.

-

Fallout 4 audience increased from 0.9% in February to 3% in March.

-

DOOM Eternal audience increased from 1.4% in February to 3% in March.

-

Prey's audience increased from 0.1% in February to 1.8% in March.

-

-

It’s worth to mention, that new users have shown great retention and long gaming sessions.

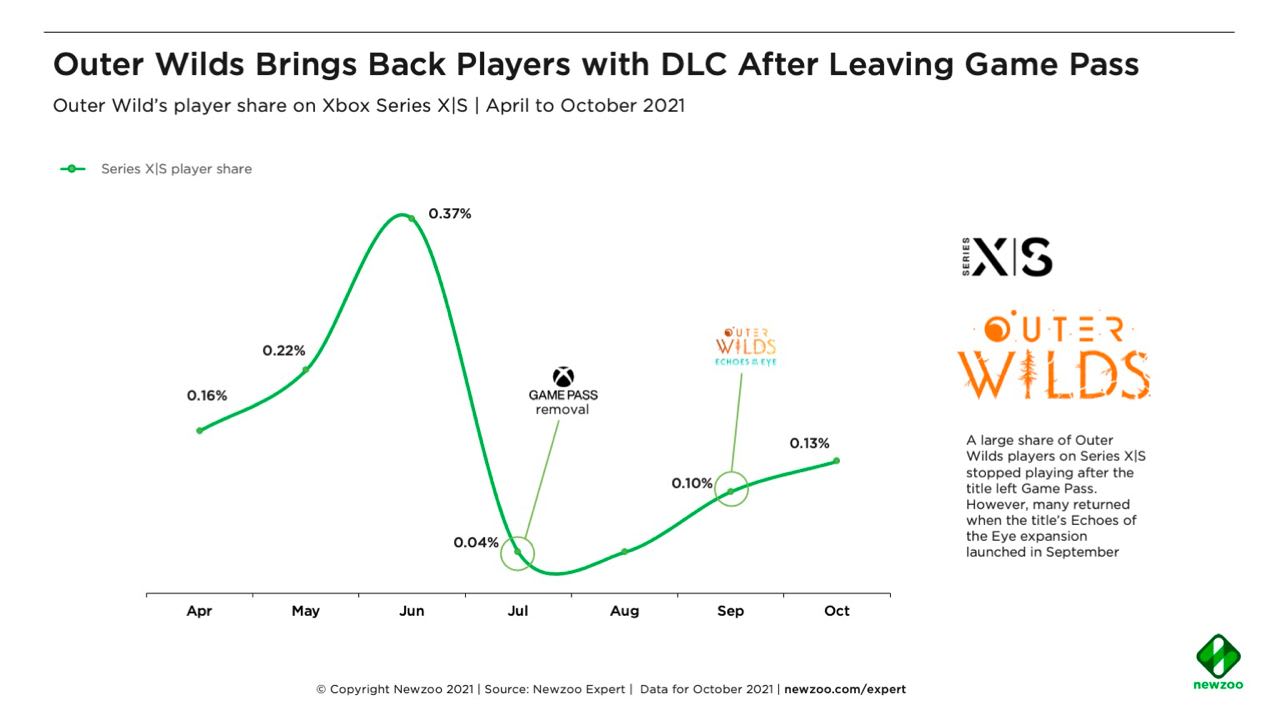

- Outer Wilds developers managed to invite a huge audience to the game thanks to Xbox Game Pass. They even managed to return it with the release of the DLC, reaching almost the same numbers they had when the game was launched in the Xbox Game Pass.

Niko Partners: Chinese gaming market will earn less in 2021 than expected

-

Its forecasted revenue in 2021 will slightly fall down from $47.52B to $46.98B.

-

There are several reasons for it: government regulations, slow opening of internet cafes (COVID-19 affect), lack of new online game licenses.

-

$32.3B of the overall sum will come from mobile games. Growth to the previous year will be 10.5%, but analytics expected 11,9%.

-

PC gaming market will generate $13.6B, which is 2.1% less than in 2020. It was expected, that decline will be just 1.2%.

-

The console market will bring $2.19B. The forecast here didn’t change.

-

The number of Chinese gamers is expected to decrease too. Currently, there are more than 700M players - part of young gamers will drop games because of time limitations for them.

-

Daniel Ahmad, Niko Partners analytics, is expecting that the Chinese government will affect the market. It will cause more Chinese companies to look at the Western markets, which are not suffering from regulations.

App Annie: Players downloaded games 14.3B times in Q3 2021

-

3.6B of downloads from the overall amount came from the hypercasual games.

DFC Intelligence: Users will spend $135B on gaming hardware by 2026

-

Currently, the market of gaming hardware is valuated at $82B. This sum consists of console, PC, accessories sales.

-

DFC Intelligence analytics thinks, that growth will be driven by PC, PlayStation 5, Nintendo Switch, Xbox Series S|X. In this order.

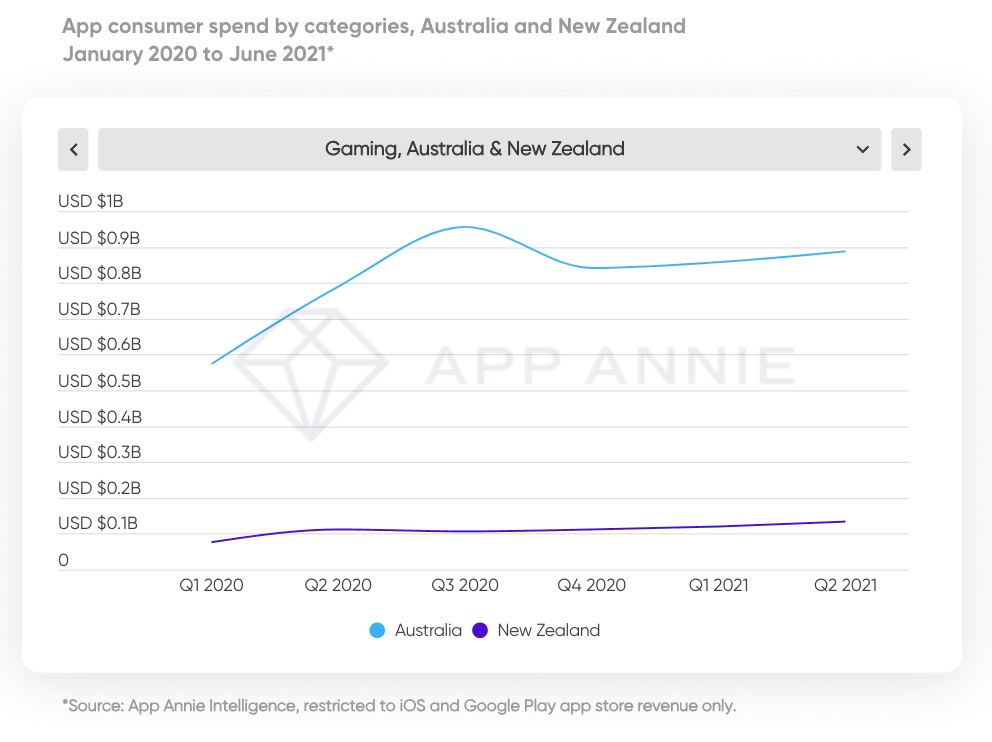

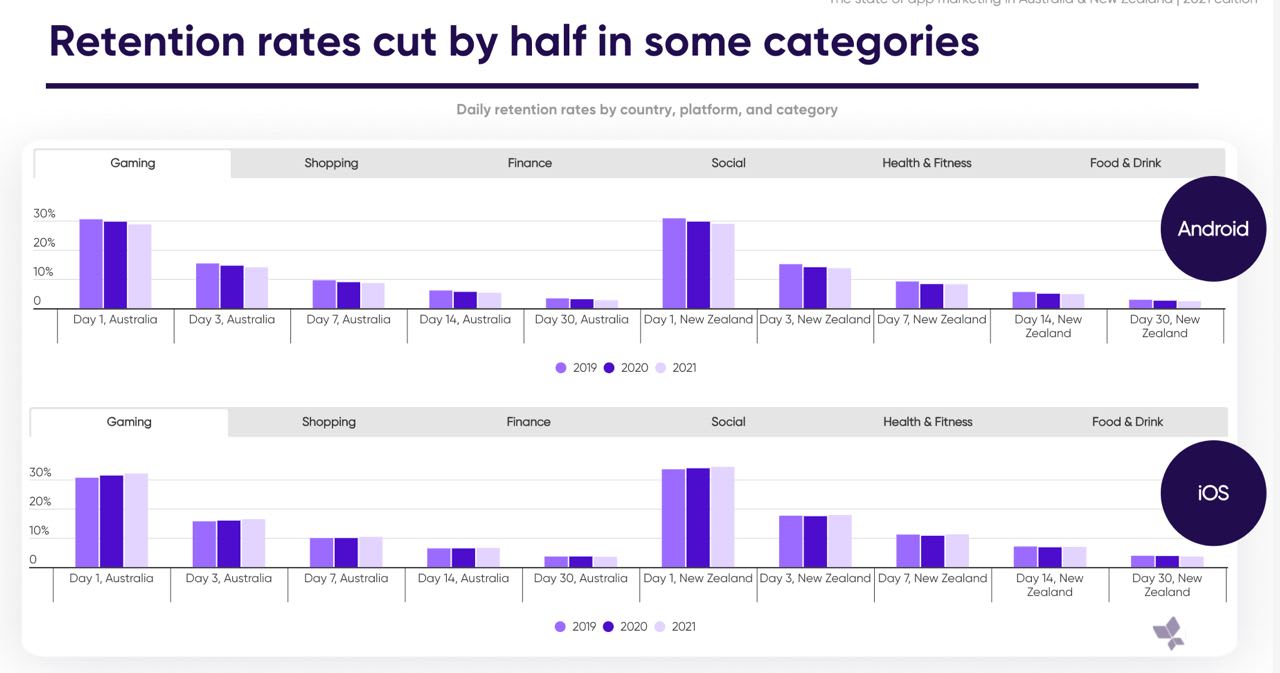

App Annie: Mobile Gaming Market of Australia & New Zealand in 2021

-

In Q2 2021 Australian users spent $888.7M in games. New Zealand users added $134.8M to the revenue.

-

In both countries, Android users retention is decreasing. In average, D1 Retention decreased from 30.5% in 2019 to 28.6% in 2021; D3 Retention - from 3% in 2019 to 2.5% in 2021.

-

The picture is a little bit different on iOS. D1 Retention there increased from 31.9% in 2019 to 32.8% in 2021. But D30 Retention is still decreasing - from 3.7% to 3.55%.

-

The percentage of fraud downloads in the gaming segment in both countries is lower than 0.75%.

Newzoo & Carry1st: The number of Sub-Saharan Africa users increased by 2.4x times in 6 years

-

South Africa is the largest Sub-Saharan Africa market by gaming revenue with $290M.

-

Nigeria is responsible for $185M; Ghana - for $42M; Kenya - for $38M; Ethiopia - for $35M.

-

In South Africa, about 40% of the overall population plays games. In Ghana (27%), Nigeria (23%), Kenya (22%), and Ethiopia (13%) this percentage is much lower.

-

From 2017 the number of gamers in Sub-Saharan Africa increased from 77M to 186M in 2021.

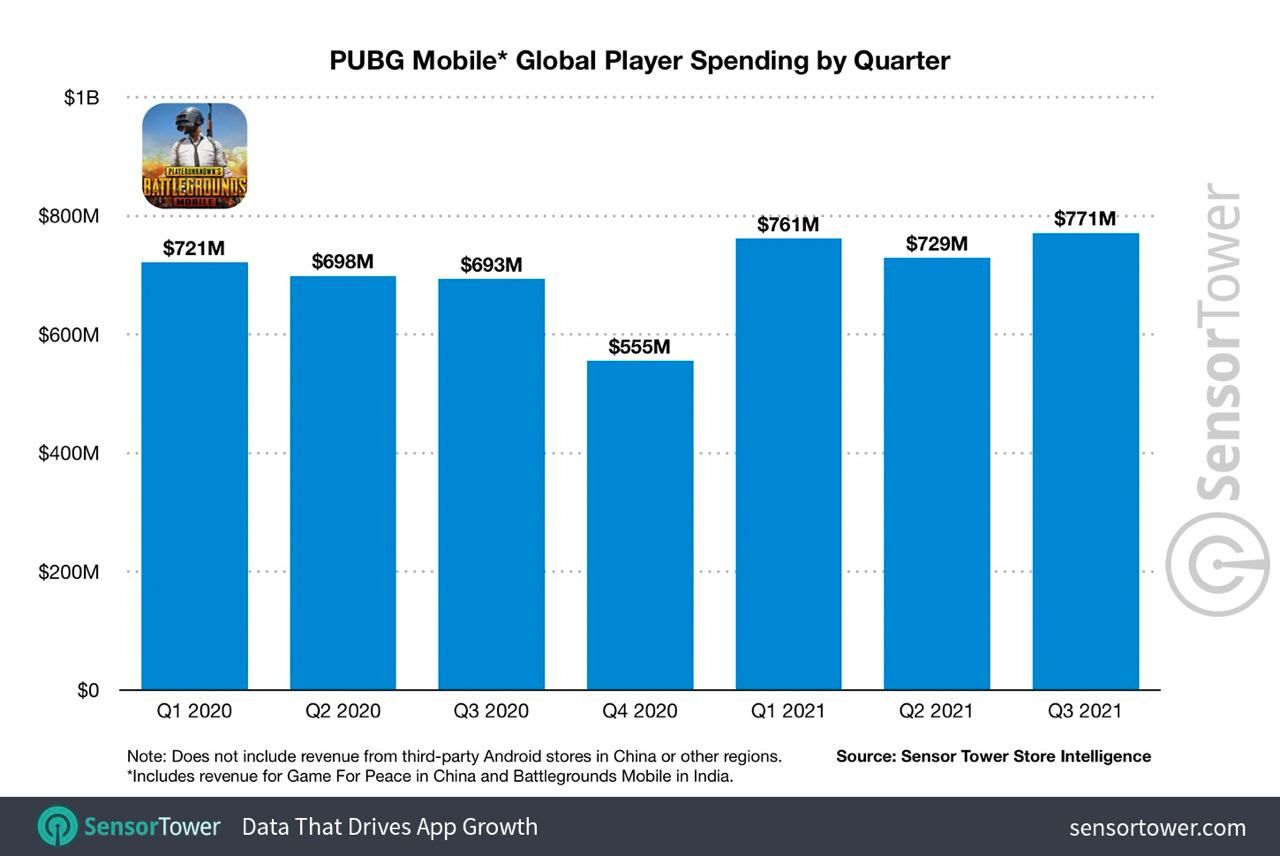

Sensor Tower: PUBG Mobile daily revenue in 2021 is $8.1M

-

PUBG Mobile surpassed the $7B mark after the record Q3 2021.

-

This year's game has earned $2.6B so far. It’s more than Genshin Impact has but less than Honor of Kings.

-

In the record Q3 2021, revenue reached $771M. No quarter this year it was lower than $700M, which means, that PUBG Mobile's daily revenue was about $8.1M.

-

The Chinese version of PUBG Mobile (Game For Peace) is responsible for $4B (57% of overall revenue, not counting third-party Android stores). The US is accountable for 11.8%, and Japan is third with 4.2%.

App Annie: EMEA-based Match-3 developers earned almost a billion $ in Q3 2021

-

Royal Match is first by revenue, Took Life: World - second, Homescapes is third.

-

There is only one shooter on the list - Mech Arena: Robot Showdown.

Sensor Tower: PUBG: New State reached $2.6M of revenue first week

-

The game was downloaded more than 23M times.

-

India is responsible for 30% (7M) of overall revenues, the US and South Korea are next.

-

The US, Japan, and Turkey are leading by revenue.

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.