devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the June and July reports.

Table of Content

- NPD: Gaming Sales in the US in H1 2022 dropped by 10%

- Sensor Tower: League of Legends: Wild Rift reached $500M plank

- GSD Market Data: Game Sales in Europe increased in H1 2022

- The Chinese Gaming Market decreased for the first time in 14 years

- AppMagic: Top-10 hypercasual titles of Q2 2022

- Newzoo: IP usage in Mobile Games

- StreamElements & Rainmaker.gg: Twitch views dropped in June 2022

- Sensor Tower: Mobile version of Diablo Immortal reached $100M

- Sensor Tower: RAID: Shadow Legends earned its first $1B on mobile devices

- game: 93% of PC titles on PC in 2021 were bought digitally

- Apptica: Top Grossing iOS & Android games of Q2 2022

- Ofcom: The number of Mobile gamers in the UK increased by 4.5M since the pandemic

- SocialPeta: Mobile Gaming Marketing Market in H1 2022

- Sensor Tower: Mobile revenue of the majority of genres in the US dropped in H1 2022

- Newzoo: Spanish Gaming Market in 2022

- AppMagic: Top Mobile Games of July 2022 by Revenue and Downloads

- Niko Partners: How regulations changed the young gamers landscape in China

- GfK UK: The UK gaming market continued to decline in July 2022

- Hitmarker: Only 5% of gaming industry vacancies in H1 2022 were entry level

- game: German gaming market in 2021

- Newzoo: RPG in 2022

- Tenjin: Games on Android got more ad revenue in Q2 2022 than games on iOS

- NPD: The US Gaming industry fell by 9% in July 2022

- StreamElements & Rainmaker.gg: People didn't watch more streams in July 2022 than in June

- ISFE & EGDF: European Gaming Market in 2021

NPD: Gaming Sales in the US in H1 2022 dropped by 10%

- The negative dynamic that started in May continued in June. In the first summer month sales went down by 11% to $4.3B.

-

In H1 2022 the gaming industry in the US earned $26.3B. It’s 10% lower than a year before.

-

Elden Ring became the best game by dollar revenue in the US in H1 2022.

-

Hardware sales in June dropped by 8% to $371M. In H1 2022 they declined by 9% to $2.1B. The first place by dollar revenue in both June and H1 2022 is taken by PlayStation 5. The unit sales leader is Nintendo Switch.

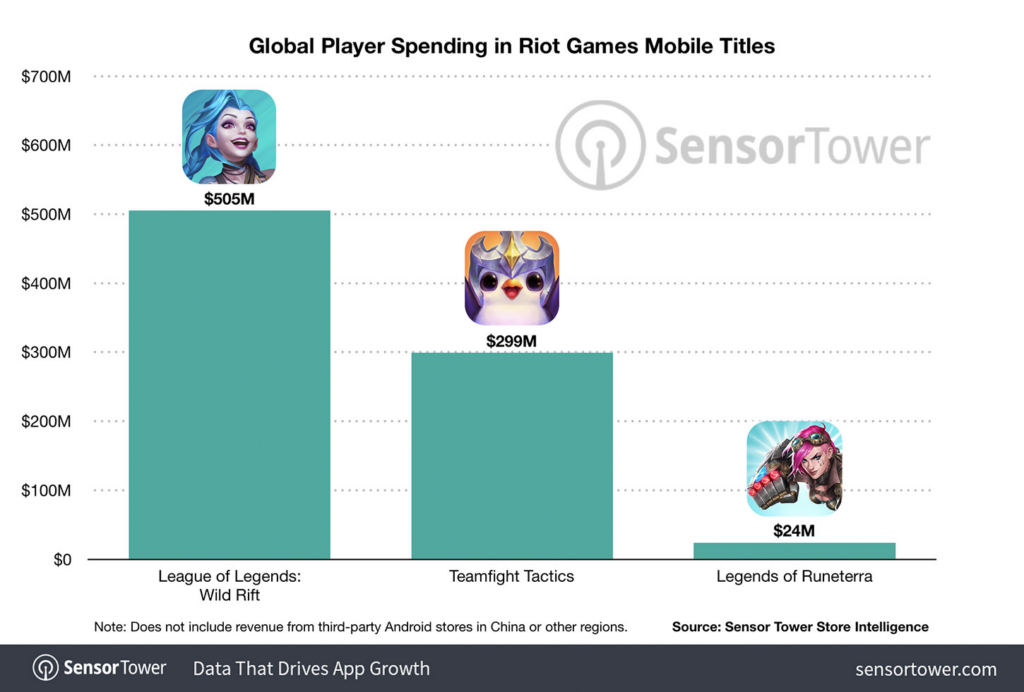

Sensor Tower: League of Legends: Wild Rift reached $500M plank

-

In H1 2022 the game generated $218M, which made it the second MOBA title after the Honor of Kings ($1.4B during the same period). Brawl Stars is third ($149.5M).

-

League of Legends: Wild Rift is the third Riot Games title on mobile devices and the most successful so far. Teamfight Tactics earned $299M, and Legends of Runeterra - earned $24M.

-

Riot Games’ overall revenue from the mobile market after 16 months is $828M.

-

The main region for League of Legends: Wild Rift is China, where the game earned $364.6M only on the App Store, which is 72.2% of overall revenue. In China, the game was released on 8 October 2021 with Tencent’s help. The US is in second place by revenue (6.8%), and South Korea is third (3.7%).

-

App Store is responsible for 84.2% of overall game revenue ($425.2M); Google Play - for 15.8% (about $80M). But outside of China, the balance is different, App Store generating 43% of revenue while 57% is coming from Google Play.

-

Riot Games is one of the few examples of western developers’ success in the eastern markets.

GSD Market Data: Game Sales in Europe increased in H1 2022

-

76.1M game copies were sold in Europe in H1 2022. It’s a 13.5% increase from the same period in 2021.

-

Germany became the largest European game market with 15.4M game sales (+13.6% YoY). The UK is next - 14.3M (+2% YoY), France is third - 10.2M sales (+12.1% YoY).

-

Elden Ring is the most popular game in Europe. However, the first place in physical sales is taken by Pokémon Legends: Arceus. It helped it to reach third place in overall charts, without the digital version taken into account (Nintendo is not sharing digital sales of its titles).

-

About 2M consoles were sold in Europe in H1 2022, the drop is 21%.

-

PlayStation 5 sales went down by 44%, but it still became the second most popular console in the region.

-

Nintendo Switch is first by sales with a 7% YoY increase. Xbox Series S|X is also showing a positive dynamic with a 9% YoY increase in H1 2022.

-

8.6M accessories were sold in H1 2022, 4.2% lower than a year before.

-

The most popular accessory is DualSense with a sales increase of 53%. DualShock 4 is second.

The Chinese Gaming Market decreased for the first time in 14 years

Numbers were reported by the semi-official Game Publishing Committee of the China Audio-Video and Digital Publishing Association.

-

In H1 2022 the gaming market in China fell by 1.8%.

-

The number of gamers dropped from 666.5M in December 2021 to 665.7M at the end of June.

-

Chinese gaming companies’ revenue from the local market decreased by 4.25% in H1 2022. For comparison, in H1 2020 the industry showed 30.4% growth; in H1 2021 - 8.3% growth.

-

However, Chinese gaming companies’ revenue from foreign markets increased by 6.2% to $9B in H1 2022.

Experts are naming game licenses regulation and children's restrictions as the main factors of the Chinese gaming market troubles.

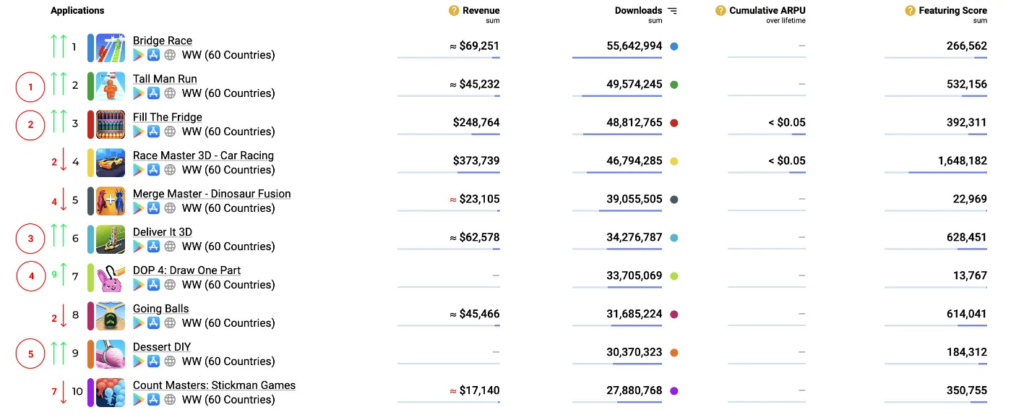

AppMagic: Top-10 hypercasual titles of Q2 2022

-

Hypercasual titles were downloaded 4.4B times via App Store and Google Play in Q2 2022. It’s a 10% increase from Q2 2021.

-

Two titles from Supersonic Studios are leading the chart. It’s Bridge Race (55.6M downloads) and Tall Man Run (49.5M downloads).

-

Fill the Fridge from Rollic Games is third with 48.8M downloads. The game also managed to receive $248.7k after store commission and taxes through IAP, which is the second result in the hypercasual segment in Q2 2022.

-

Count Masters is closing the top 10. Gamers downloaded it 27.8M times in April-June.

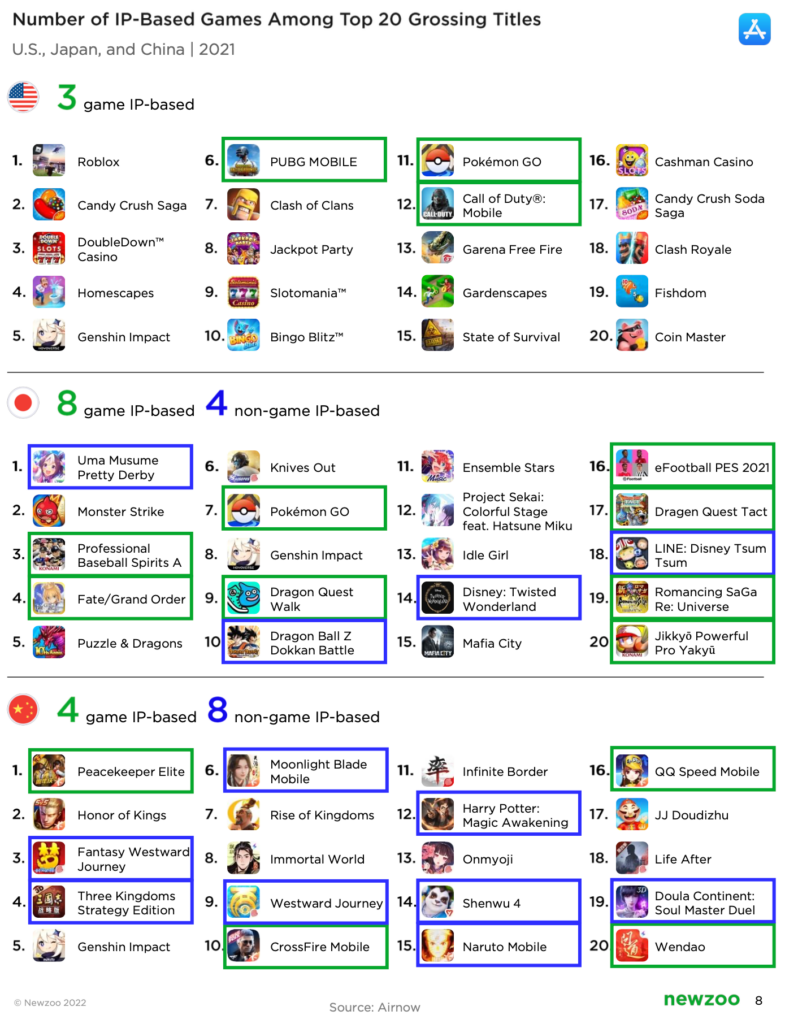

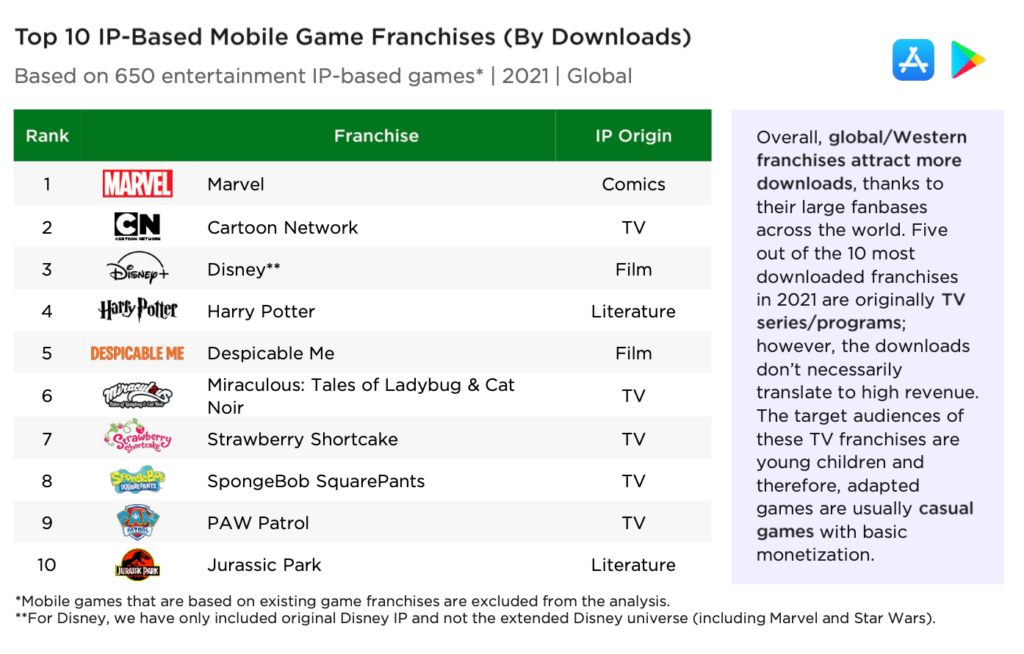

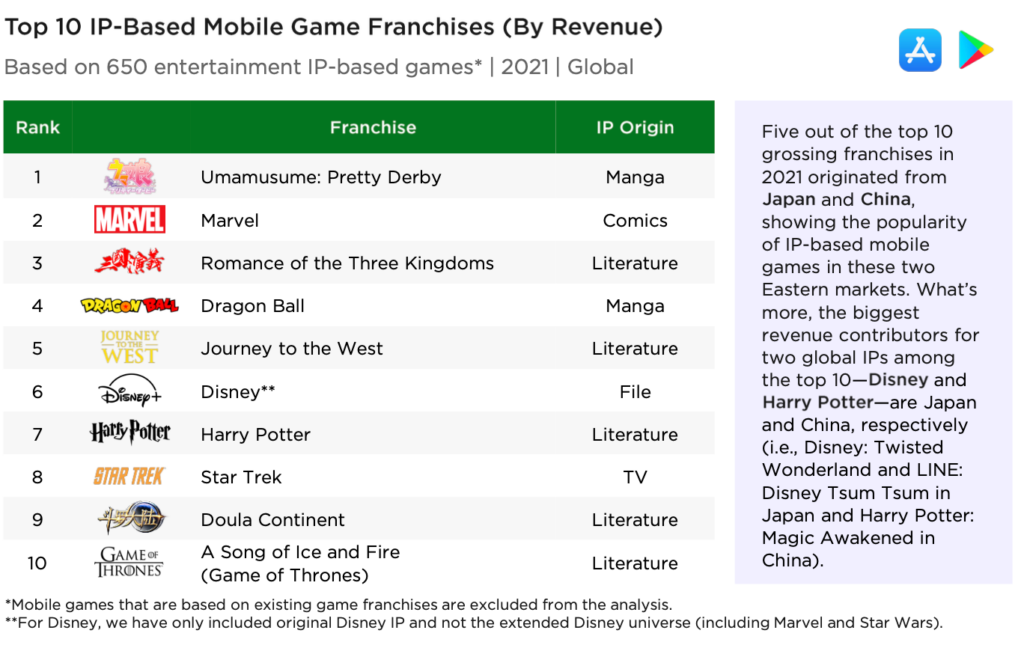

Newzoo: IP usage in Mobile Games

-

9 out of 10 top-downloaded mobile games in 2021 on the App Store were based on IP. The only title that is not is Soccer Super Star.

-

Paying users are downloading IP-based titles 2.84 times more than games based on original IP.

-

In the US 3 mobile games in 2021 from the top 20 by revenue (App Store) were based on game IPs.

-

In Japan, 12 mobile games in 2021 from the top 20 by revenue (App Store) have been using IP. 4 of them used non-gaming IPs, 8 - gaming IPs.

-

In China, the same amount of mobile games in 2021 from the top 20 by revenue (App Store) used IPs - 12. But 4 of them were gaming and 8 - were non-gaming.

-

The three IPs that bring the most downloads are from Marvel, Cartoon Network, and Disney original IPs.

-

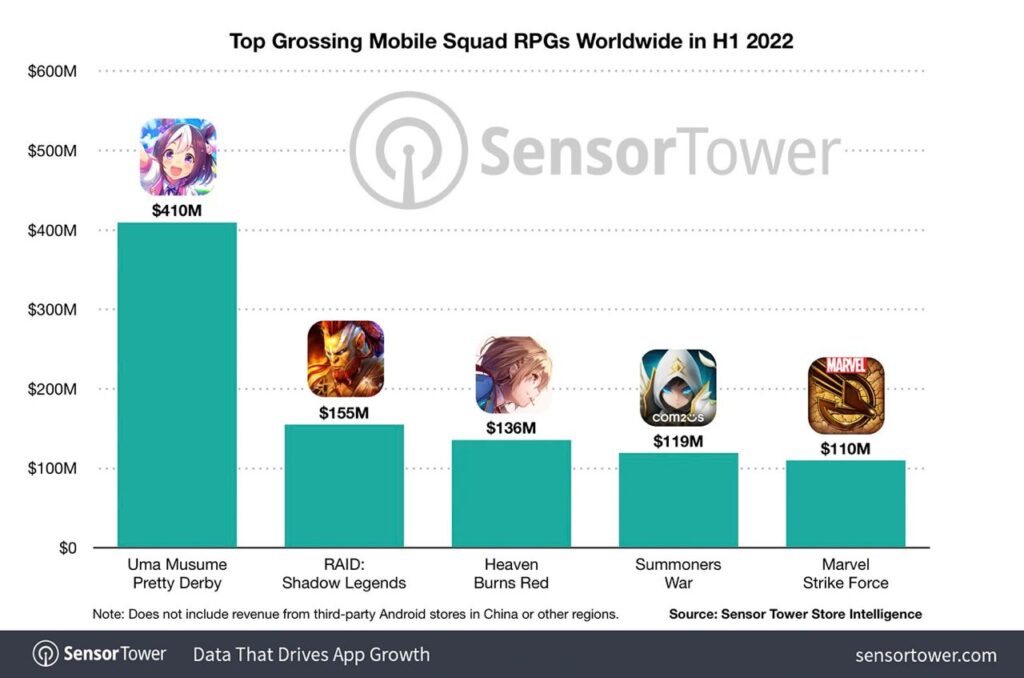

Most revenue-generating IPs are Umamusume: Pretty Derby, Marvel, and Romance of the Three Kingdoms.

Newzoo covers Marvel Strike Force and Umamusume: Pretty Derby case studies and the material; also showing Tilting Point, Bandai Namco Entertainment & GREE Entertainment's approach to the IP-based titles.

Newzoo: IP usage in Mobile Games Download

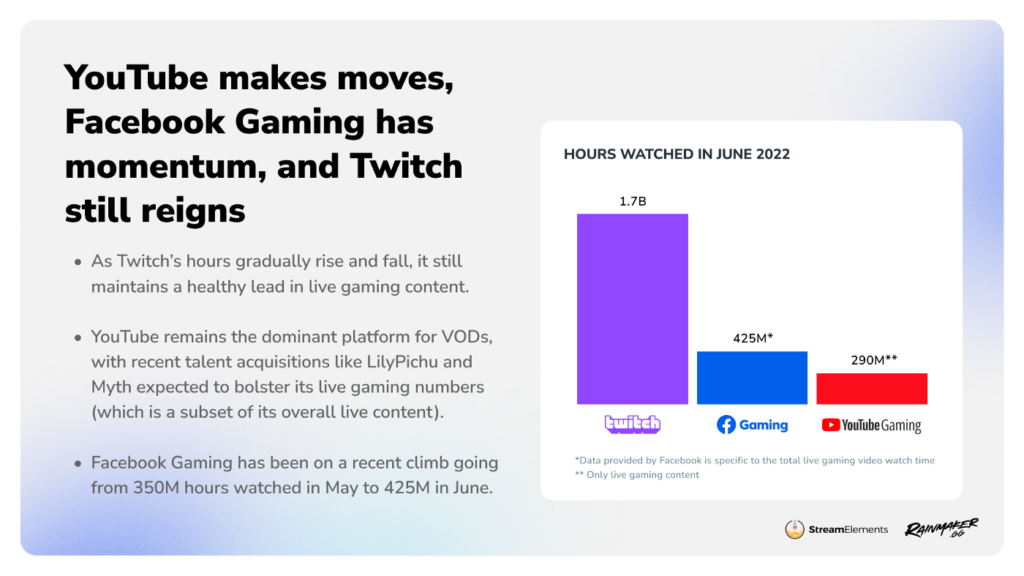

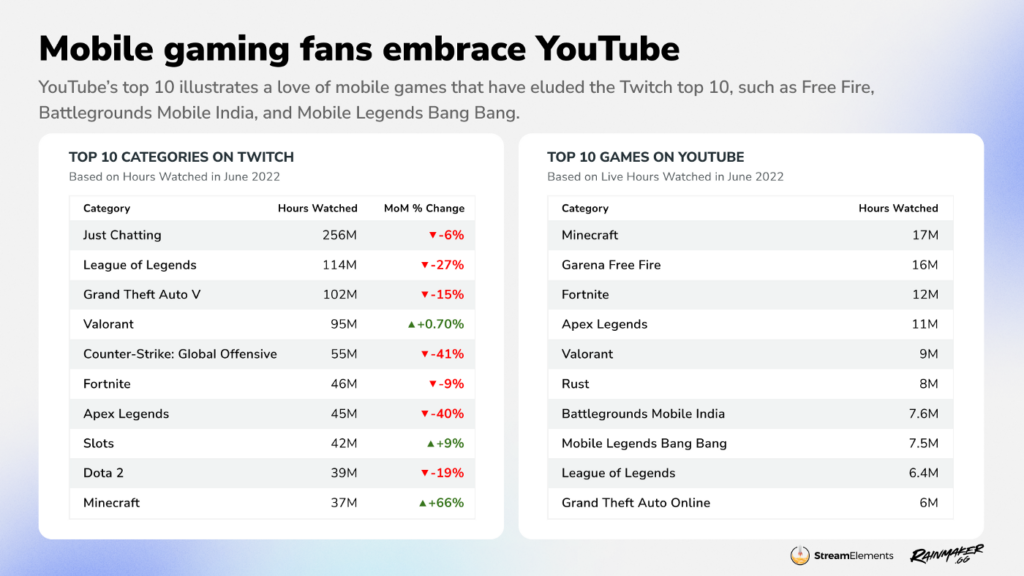

StreamElements & Rainmaker.gg: Twitch views dropped in June 2022

-

Despite the dominant position, in June 2022 Twitch views dropped by 4% - from 1.8B hours to 1.7B.

-

Facebook Gaming showed solid growth of 21% from 350M watched hours to 425M.

-

YouTube Gaming in June reached 290M watched hours on live streams.

-

Three top games on Twitch are League of Legends (114M hours), GTA V (102M hours), and Valorant (95M hours).

-

The situation is different on YouTube Gaming. Minecraft is first (17M hours), Garena Free Fire is second (16M hours), and Fortnite is third (12M hours).

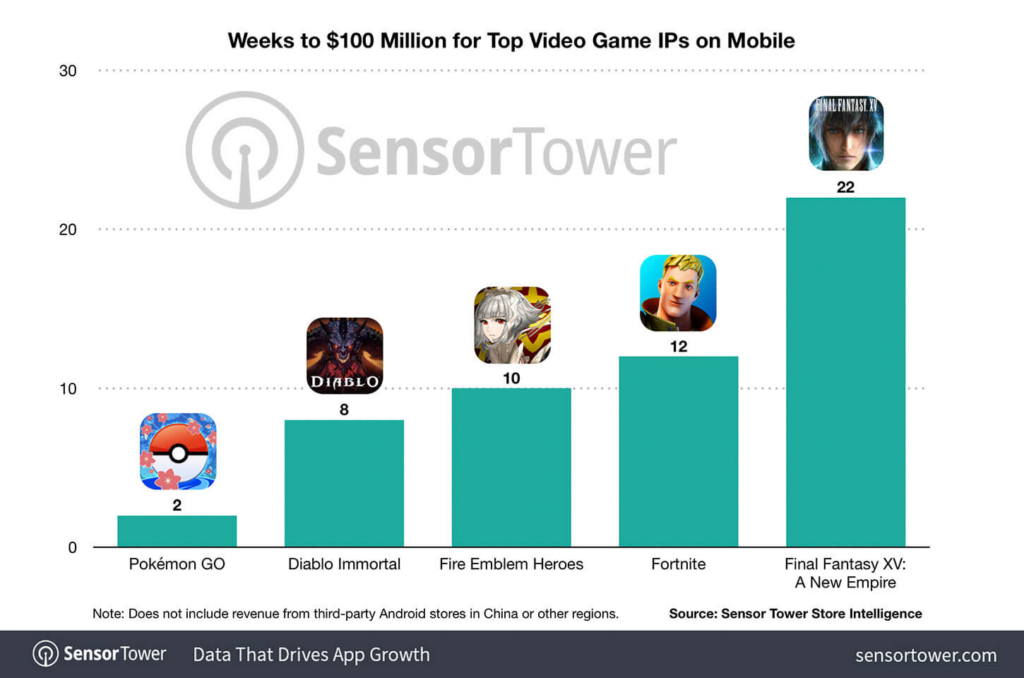

Sensor Tower: Mobile version of Diablo Immortal reached $100M

-

It took a little bit less than 2 months to reach this plank.

-

Only Pokemon GO earned $100M faster, in just 2 weeks after the release.

Sensor Tower: RAID: Shadow Legends earned its first $1B on mobile devices

-

It took RAID: Shadow Legends a bit less than 3.5 years to hit the goal.

-

In H1 2022 the game earned $155M.

-

The majority of revenue comes from the US ($595.5M - 59.4% of the overall amount). Germany is second (5.8%), and the UK is third (4.5%).

-

$594.6M (59.3% of the overall amount) came from Google Play, App Store is responsible for the remaining 40.7%. But the game is also available on PC via Plarium Play, so the real revenue numbers are higher.

-

The US is the leader in downloads (15.3M - 24.7% of the overall amount). Russia is second (10.8%), and France is third (4.3%).

-

Google Play is responsible for 45.5M of downloads (or 73.4%).

-

The most successful game of Plarium before RAID: Shadow Legends was Vikings: War of Clans which made $541M of revenue.

game: 93% of PC titles on PC in 2021 were bought digitally

-

The popularity of digital versions in Germany increased in 2021. Talking of both PC & Consoles, digital games sales are taking 59% of all sales.

-

93% of PC titles were sold digitally.

-

On consoles, however, the situation is different. In Germany, only 36% of console titles were sold digitally. Representative of the Germany Game Industry Association thinks that it is connected with a tradition of collection.

-

The German market in 2021 increased by 17% to 9.8B euros.

Apptica: Top Grossing iOS & Android games of Q2 2022

The data comes from 3 segments (casual games, casino, and mid-core games) from 37 countries.

-

Android top grossing leaders are Candy Crush Saga (>$122M); Coin Master (>$99.2M), and Roblox (>$68.1M).

-

Apptica analysts checked the organic to paid traffic ratio. In Candy Crush Saga for each paid install, there are 3 organic. In Roblox on Android, based on the Apptica study, 99% of installs are organic.

-

iOS revenue leaders are Rise of Kingdoms (>$179.5M), Candy Crush Saga (>$85.2M), and Clash of Clans (>$57.7M).

-

In the Rise of Kingdoms, 89% of traffic is organic. In Clash of Clans, 99% of traffic is labeled organic.

-

Playrix and Playtika are two companies that were on the top charts more often (6 times).

Apptica: Top Grossing iOS & Android games of Q2 2022 Download

Ofcom: The number of Mobile gamers in the UK increased by 4.5M since the pandemic

-

In 2019 there were 7.3M adult mobile gamers.

-

In 2020 due to the pandemic, this number increased to 12.48M. Now - after some restrictions cancellation - people started playing less and the current size of the adult mobile gamer audience in the UK is about 11.8M.

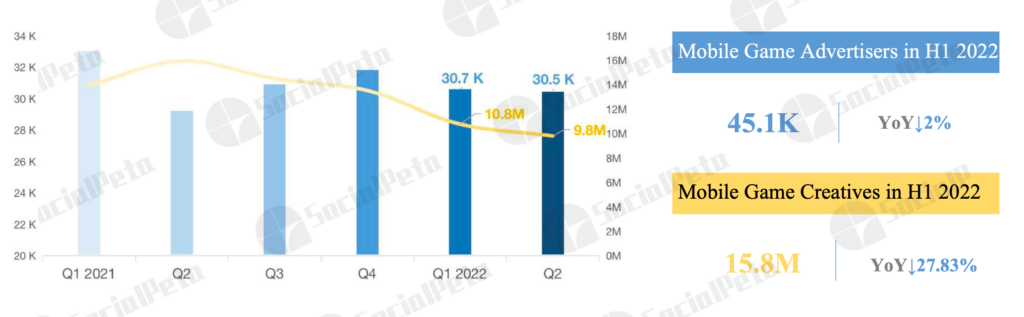

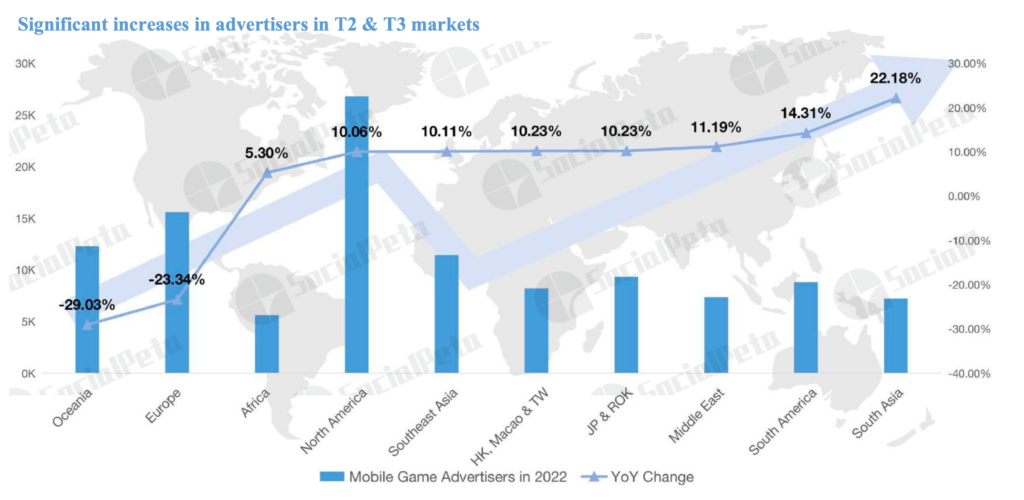

SocialPeta: Mobile Gaming Marketing Market in H1 2022

The company released the report on 191 pages, which analyzed 1.2B creatives in 72 countries in more than 90 channels.

-

The number of creatives in H1 2022 decreased by 27.83% YoY. The number of advertisers also dropped by 2%.

-

Advertisers paid more attention to the T2 and T3 markets - all of them are growing.

-

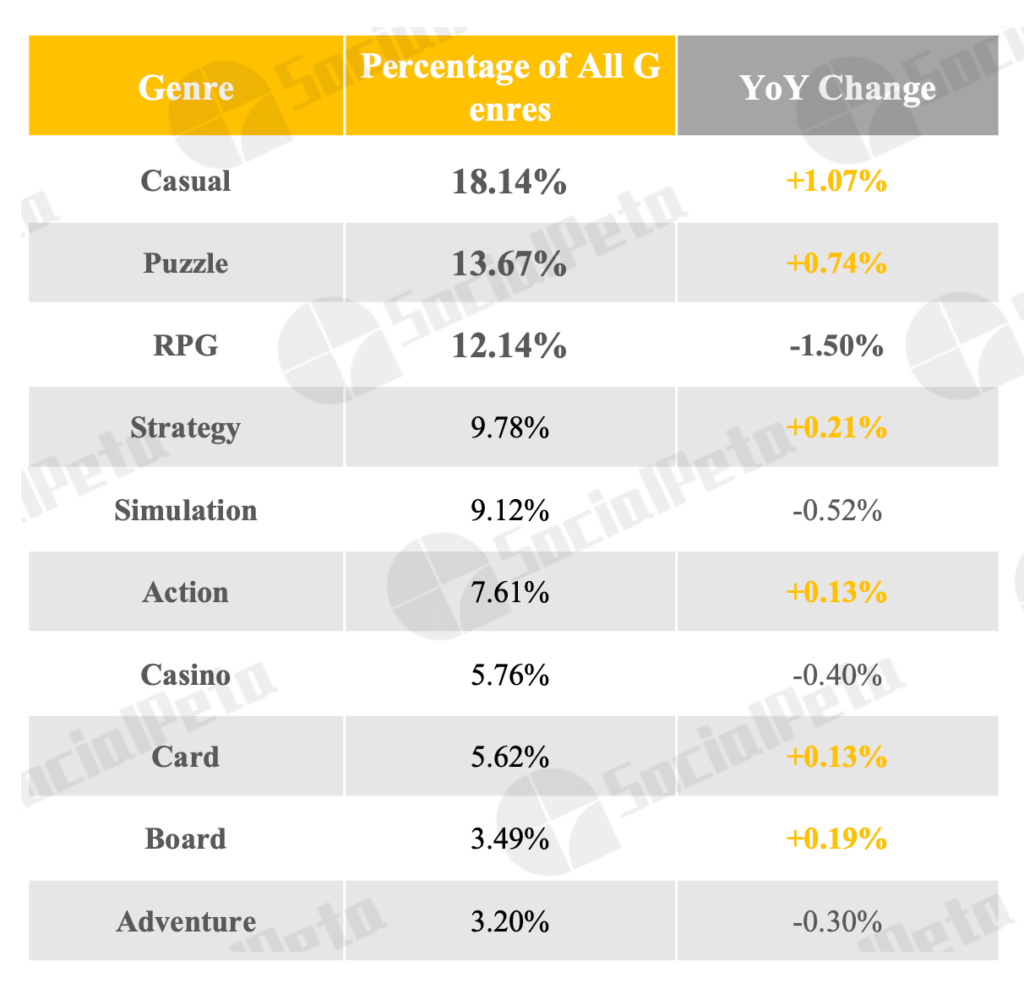

The majority of advertisers (26.03%) are working in the casual gaming space. The competition is growing, in H1 2022 the number of advertisers increased by 4.7%.

-

A lot of creatives are created for casual games (18.14% of the overall amount), puzzles (13.67%), and RPGs (12.14%).

-

86% of creatives are videos.

-

Android in H1 2022 was responsible for about 70% of all creatives and advertisers.

-

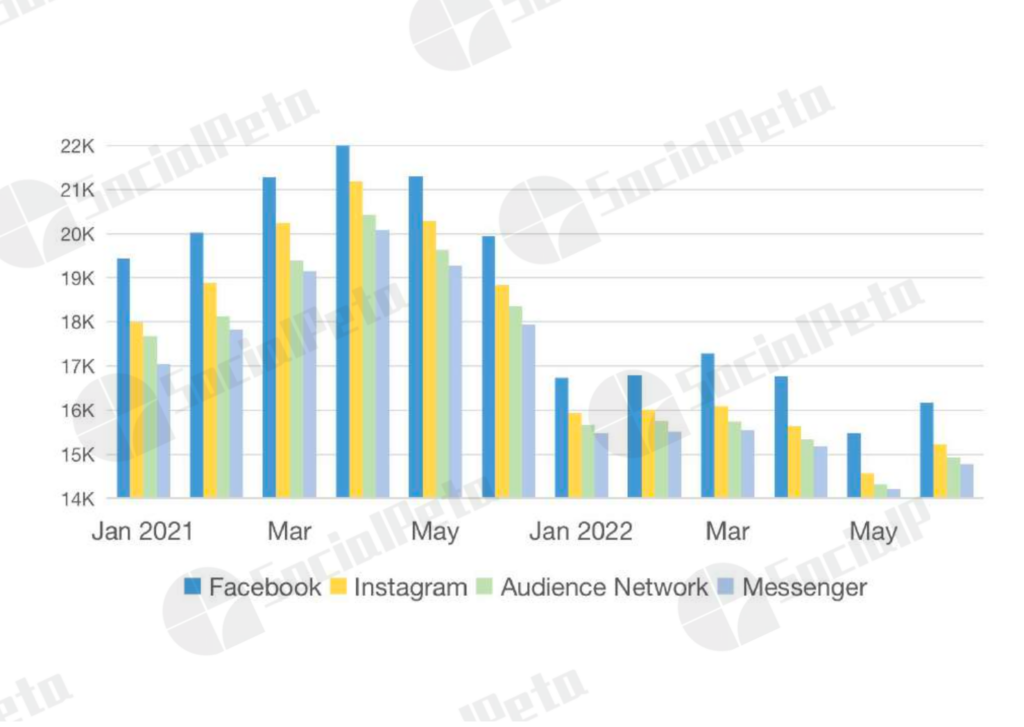

The number of advertisers in H1 2022 on Meta platforms (Facebook, Instagram, Audience Network, Messenger) experienced a serious decline.

-

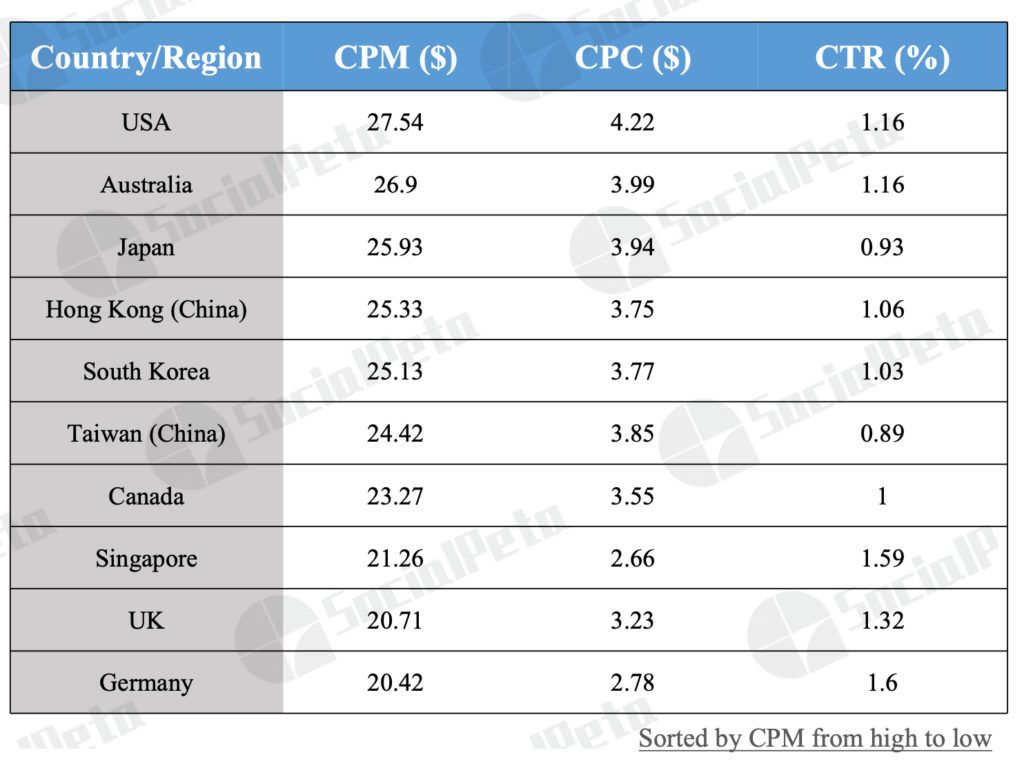

The average CPM in gaming ads is $19.31 in H1 2022. The average CPC is $2.57. The average creative CTR is 1.48%.

-

The most expensive traffic is in the US (CPM - $27.54). The most expensive platform is iOS (CPM - $20.08). The most expensive genre is a strategy (CPM - $21.58). Women cost more than a man (CPM - $20.5 versus $18.11).

-

Countries with the most expensive CPI are South Korea ($13.9), Japan ($12.69), and Hong Kong ($11.66).

-

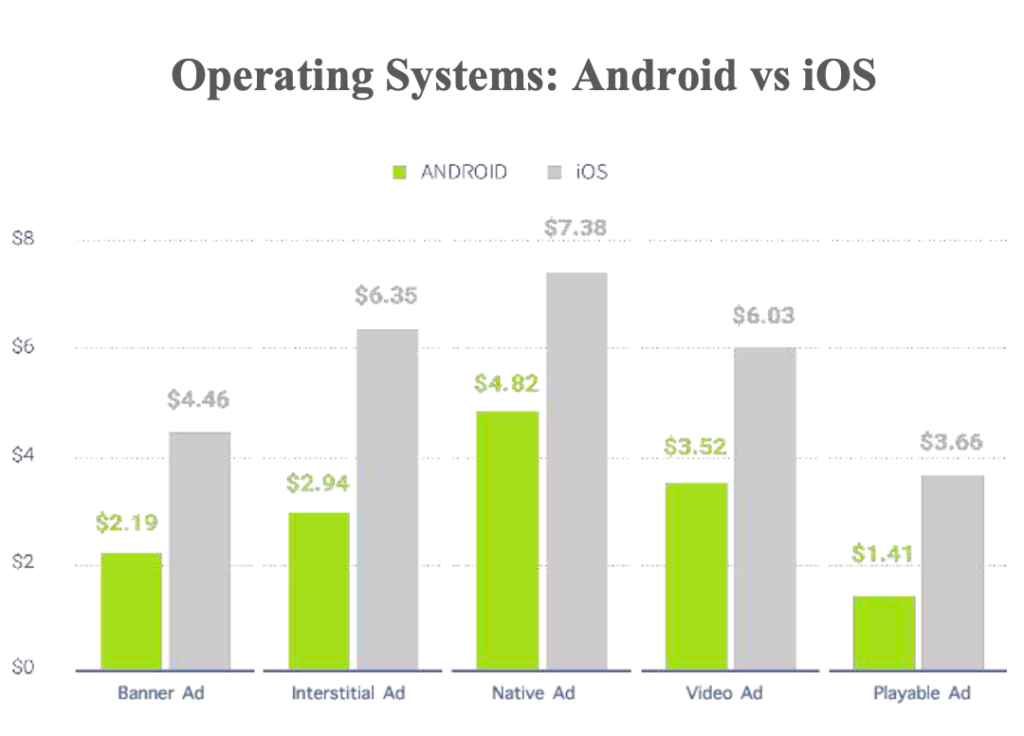

Playable Ads are the most effective from the CPI standpoint ad format. The average CPI in H1 2022 on Android was $1.41 and on iOS - $3.66.

-

In 2021 CPI of video ads increased from $3.44 to $6.09.

-

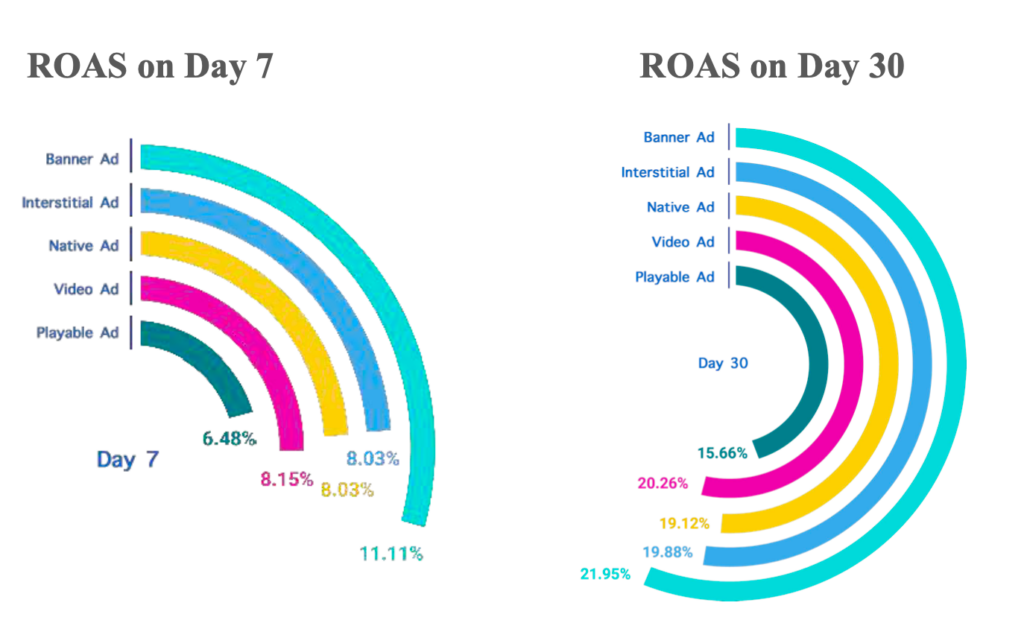

Banner ads have the second cheapest CPI, but the highest ROAS (11.11% - D7 and 21.95% - D30). Native ads (CPI - $5.22) are more expensive than Interstitial ads ($4.67), but they have almost similar ROAS D7 and ROAS D30. Playable Ad has the lowest CPI, but also the lowest ROAS.

SocialPeta: Mobile Gaming Marketing Market in H1 2022Download

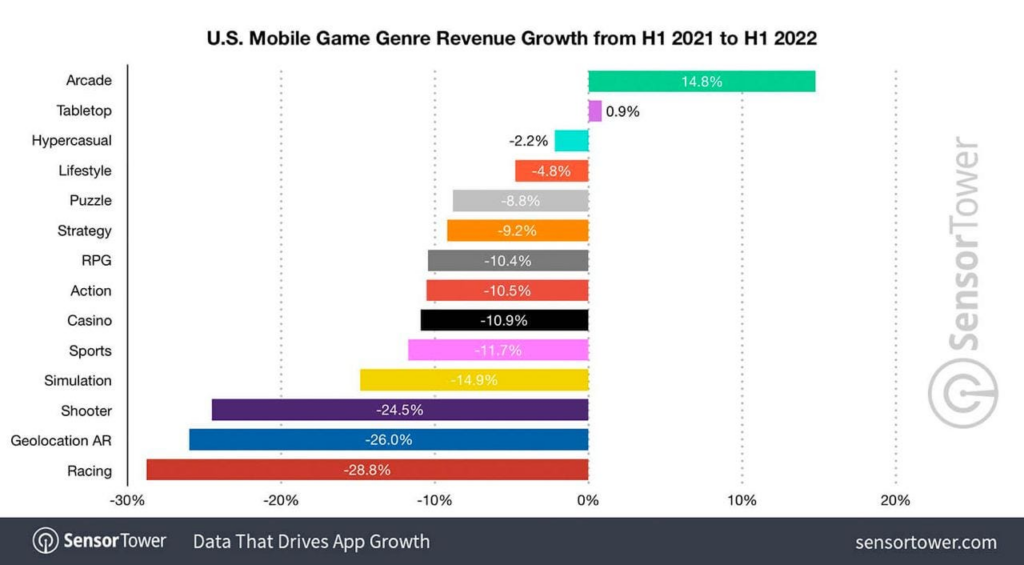

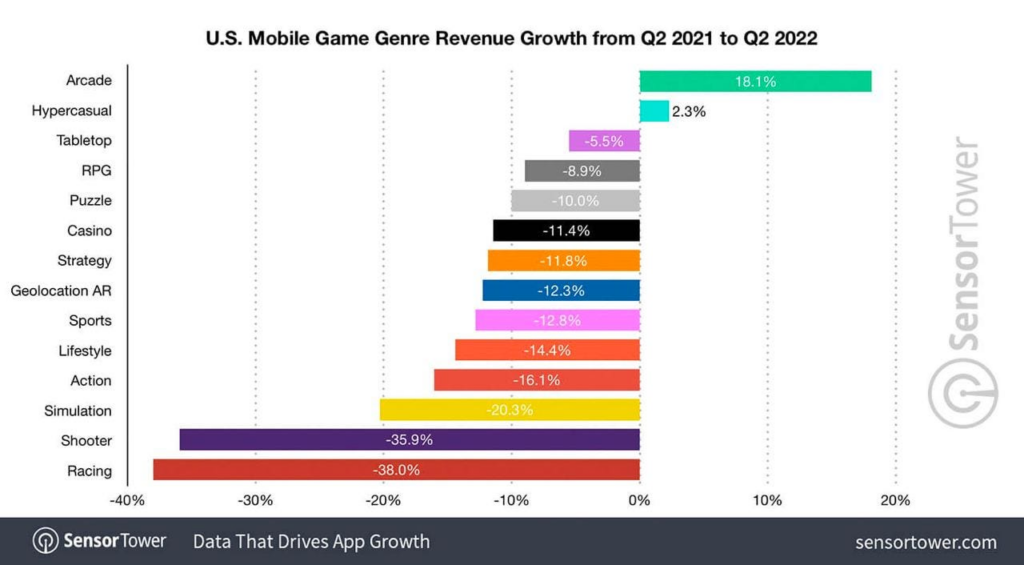

Sensor Tower: Mobile revenue of the majority of genres in the US dropped in H1 2022

-

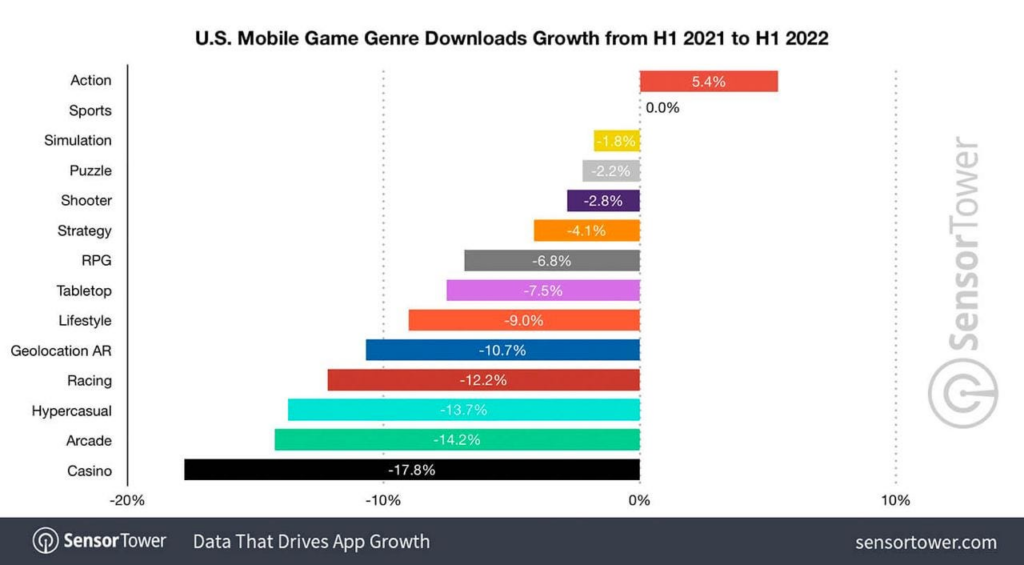

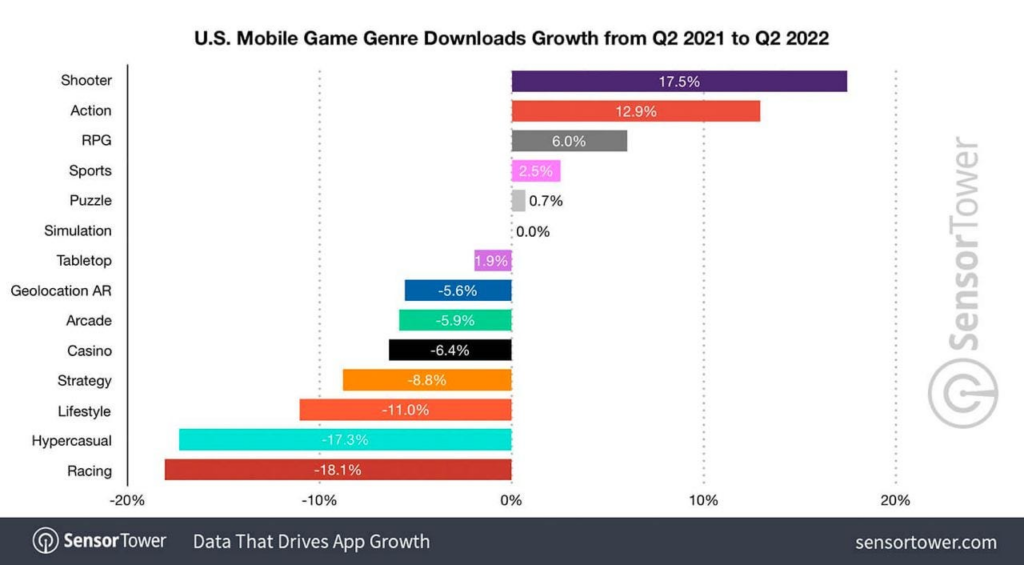

The overall size of the US mobile gaming market in H1 2022 was $11.4B. It’s 9.6% smaller than it was in H1 2021. Downloads dropped by 2.5% to 2.4B. In Q2 2022 the revenue decline fastened to 11.4% YoY.

-

In H1 2022 the revenue growth showed only Arcade and Tabletop genres.

-

Arcades grew by 14.8% to $176M. Idle games were the largest sub-genre, earning $88M (+35.3% YoY). Sub-genre leaders are Clawee ($16.5M), Gold & Goblins, and Idle Mafia.

-

The Tabletop genre grew by 0.9% in the first half of 2022 to $388.8M.

-

The largest revenue decline showed Racing games - by 28.8%.

-

Puzzle games remained to lead the revenue top despite the 8.8% fall. Games of this genre already earned $2.3B in H1 2022. Casino games ($2.2B) and Strategy ($2B) games are next.

-

As for Q2 2022, Arcade revenue grew by 18% to $89.4M. Hypercasual games showed 2.3% growth to $27.3M. Racing games downfall increased to 38% YoY.

-

Only Action games showed an increase in downloads in H1 2022 - by 5.4% to 54.7M. Leaders are Genshin Impact (2.3M downloads), Galaxy Attack: Space Shooter, and Galaxy Attack: Alien Shooter.

-

Hypercasual titles led the top of downloaded genres in H1 2022 - they’ve been downloaded 718.2M times (-13.7% YoY).

-

In Q2 2022 six genres showed increase (or at least not fall) downloads dynamic - Shooters (+17.5), Actions (+12.9%), RPG (+6%), Sport games (+2.5%), Puzzle (+0.7%), and Simulation (+0%).

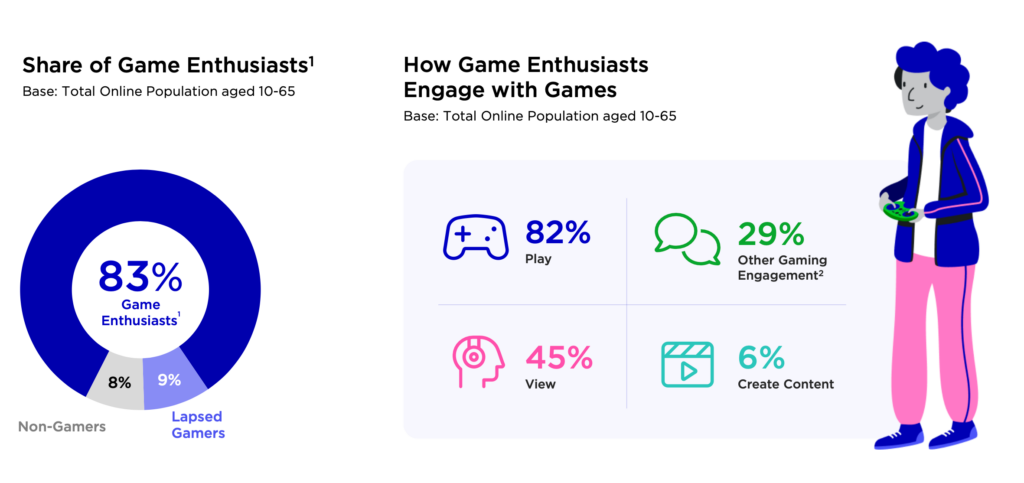

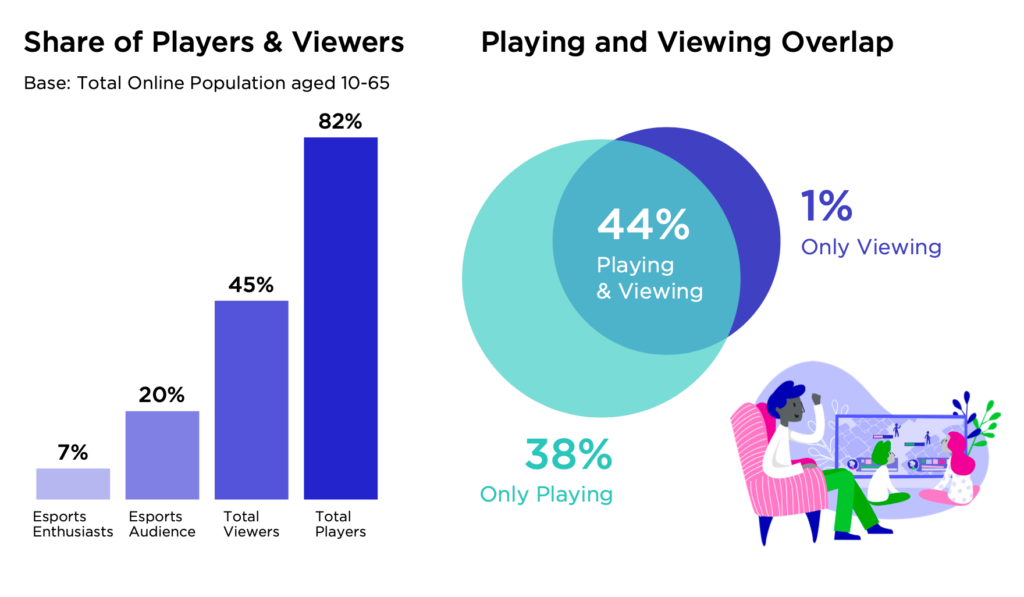

Newzoo: Spanish Gaming Market in 2022

-

Spanish gaming market in 2022 will reach $2.38B - it’s #13 place in the world.

-

31.7M gamers are living in Spain. It’s the 23rd result in the world.

-

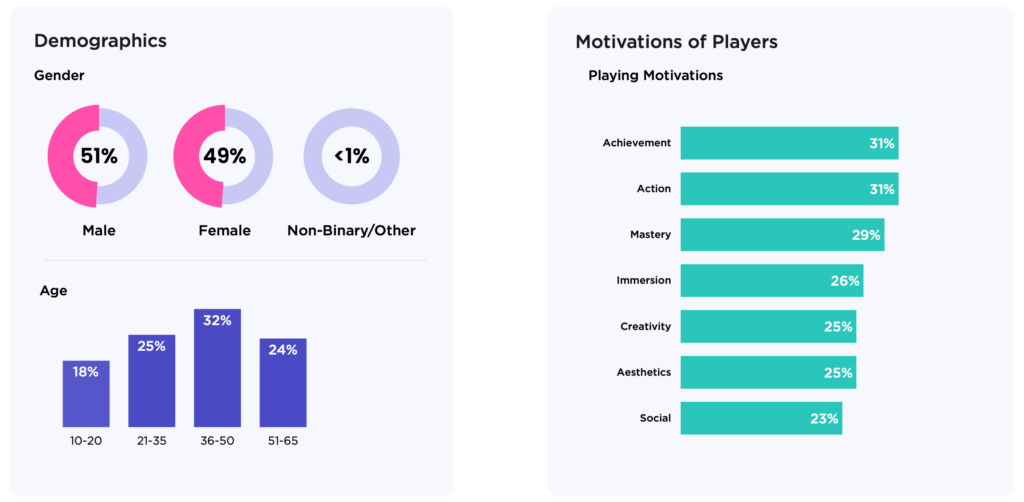

83% of people in Spain play games often.

-

51% of Spanish gamers are men, and 49% are women.

-

The largest gamers segment by age is from 36 to 50, covering 32% of all gaming audiences. The segment of 21-35 years is next (25%); 24% of gamers are 51-65 years old. Interesting that the smallest segment is a young one - there are only 18% of gamers in the age of 10-20 years.

-

The main motivation for Spanish people is achieving results (31%).

-

The majority of Spanish gamers are playing on smartphones (60%). 48% are playing on consoles, 41% - on PC. On average, playtime on PC & Consoles is 4 hours per week, while on smartphones only 3 hours.

-

Fall Guys, Fortnite, and FIFA 22 are top-3 games by MAU on PC and Consoles in Spain.

-

48% of Spanish gamers paid in games in the last half a year. 33% did it because of the sales or special offers.

Newzoo: Spanish Gaming Market in 2022 Download

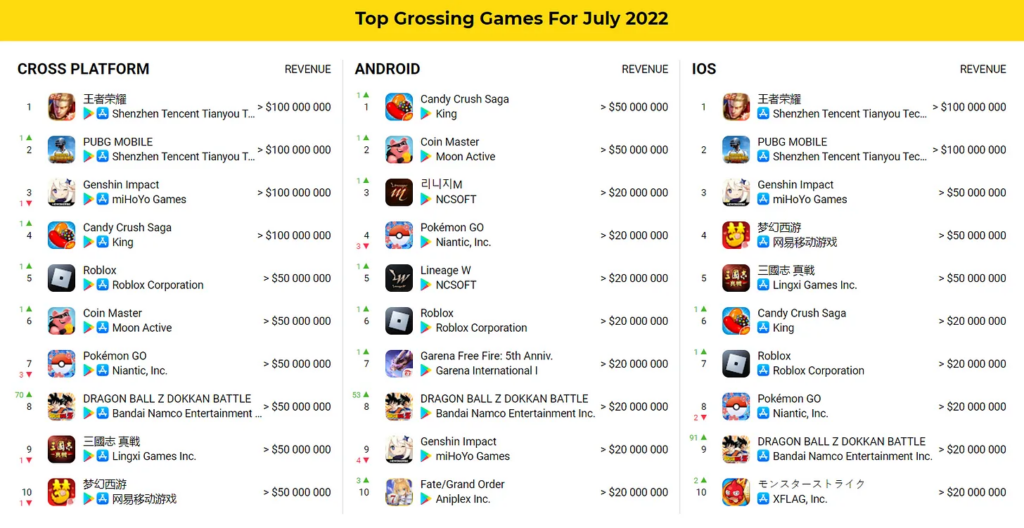

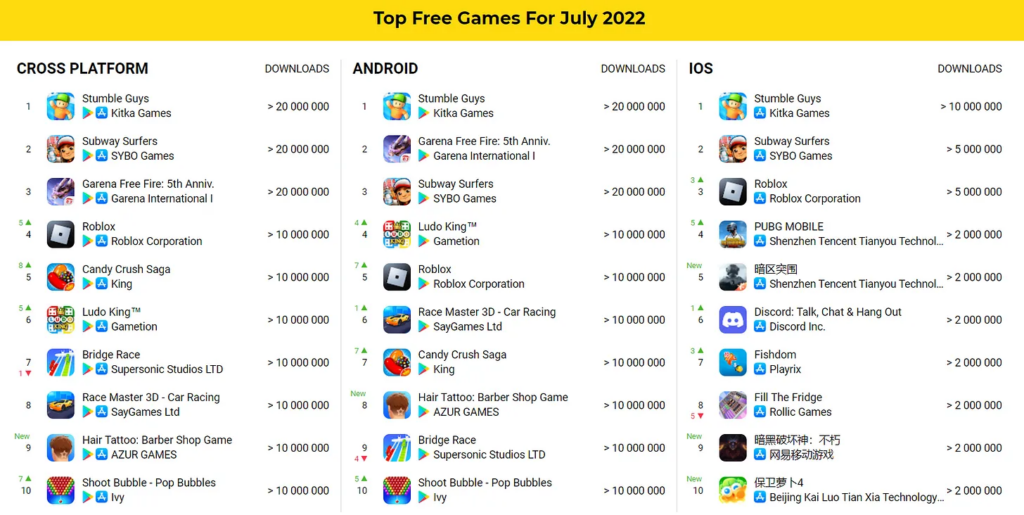

AppMagic: Top Mobile Games of July 2022 by Revenue and Downloads

Revenue

-

The Honor of Kings, as always, was the top-grossing title and earned $168.3M.

-

Candy Crush Saga became the most successful game of July on Android with $58.3M revenue. Overall revenue across all platforms was $106.9M.

-

Dragon Ball Z Dokkan Battle surprisingly managed to reach the #8 overall revenue chart with $59.89M of revenue. The game was released in 2015, last month it was at #78 place.

Downloads

-

Stumble Guys - a mobile clone of Fall Guys: Ultimate Knockout - was first with 45.6M of downloads.

-

Arena Breakout - mobile Escape from Tarkov from Tencent - reached 3.9M of installs.

-

Diablo Immortal in July reached #9 place by downloads on iOS with 2.68M installs. Release in China happened only at the end of the month.

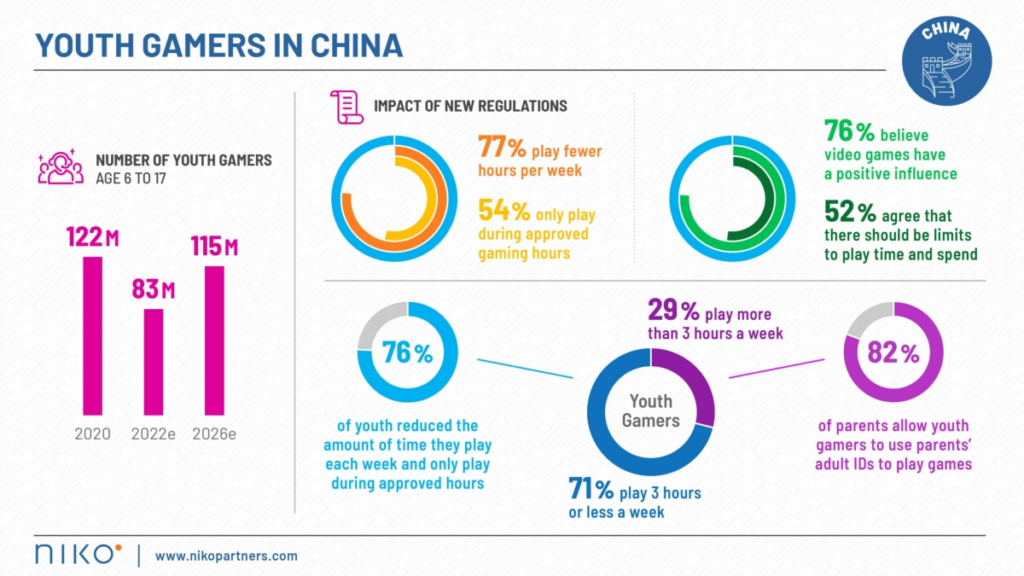

Niko Partners: How regulations changed the young gamers landscape in China

Niko Partners studied how the regulations of September 2021 affected young gamers in China between the ages of 6-17.

-

The number of gamers between the ages of 6-17 decreased from 122M (2020) to 83M in 2022. Wherein Niko Partners analysts are sure that the number of young gamers will increase to 115M in 2026.

-

Before regulations, about 60% of young gamers named themselves gamers. Now only 40% are gamers.

-

77% of children and teenagers started to play less. 54% are playing only in allowed hours.

-

Only 29% of young Chinese gamers are playing more than 3 hours per week. Parents are helping them - 82% providing their children with their adult IDs.

-

However, 52% of young gamers in China agree that time spent with games should be controlled. 76% of young gamers are sure, that video games have a positive impact.

-

86% of young Chinese gamers are playing on mobile devices, 30% - on PC, and only 6% on consoles.

GfK UK: The UK gaming market continued to decline in July 2022

-

About 104k consoles were sold in the UK in July, it’s 16% lower than in June. Console games sales decreased by 38% from the previous year.

-

PS5 sales dropped in July the least (only by 14%), which helped it to become the second most popular console in the UK in 2022. Nintendo Switch is first.

-

1.79M games were sold in the UK in July. It’s 17% less than last year and 32% less than in the previous month. F1 2022 became the leader of the chart.

-

About 50% of PS5 sales in the last 3 months were in the form of bundles with Horizon: Forbidden West.

-

551,038 accessories were sold in the UK the previous month. It’s 5.7% less than in June and 4.8% less than in July 2021.

-

Accessory chart leaders are white DualSense (first), and black DualSense (second).

Hitmarker: Only 5% of gaming industry vacancies in H1 2022 were entry level

Job platform Hitmarker analyzed 19,458 game industry vacancies in January-July 2022.

-

One-two year of work experience was required in 8.6% of vacancies.

-

The majority of employees prefer more experienced employers. 44.5% of vacancies asked for 2-5 years of relevant experience.

-

41% of vacancies were for senior employees with more than 5 years of experience.

-

In the UK the situation is slightly better. 5.9% of positions were entry-level. 9.4% of vacancies were for junior employees with 1-2 years of experience.

-

In the US everything is worse. Only 3.4% of job openings were looking for people without experience. And only 6.8% were looking for employees with little experience.

-

However, the situation with a career start in the gaming industry hasn’t changed. In H1 2021 the number of entry-level vacancies was the same. But have decreased the number of Junior positions (in H1 2021 there were 11% of the overall amount).

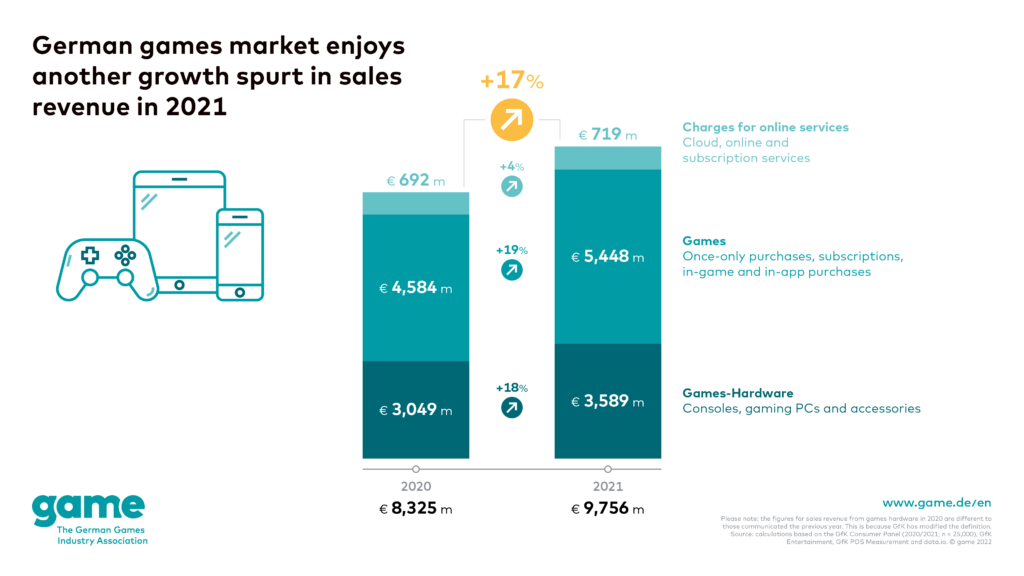

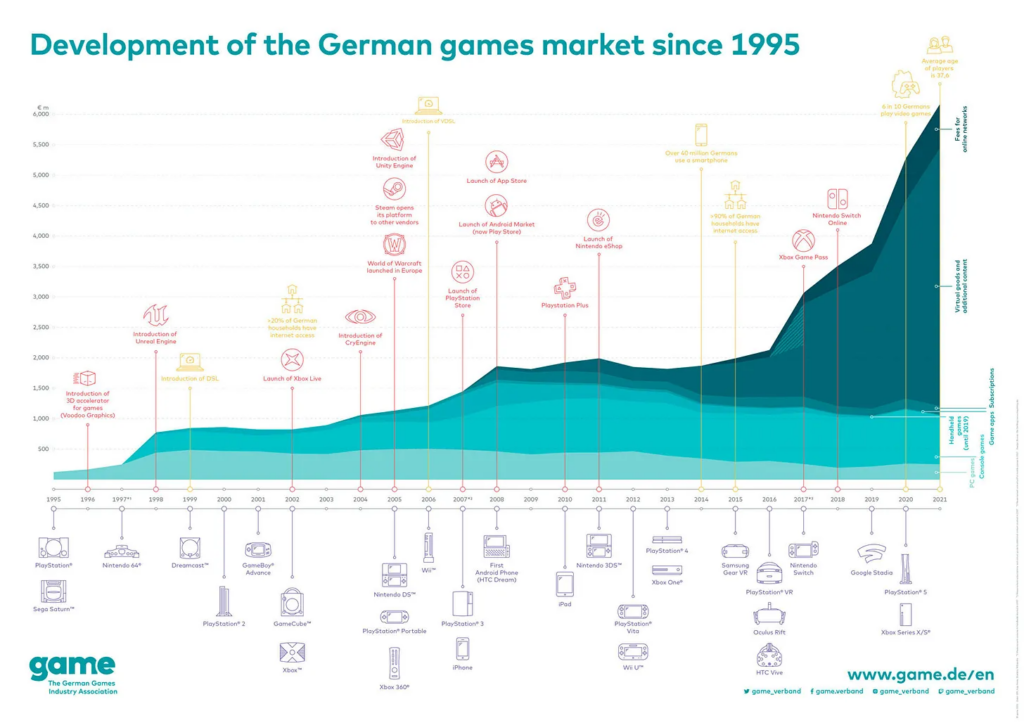

game: German gaming market in 2021

German Gaming Market

-

The overall gaming size in 2021 was €9.8B. It’s the largest gaming market in Europe.

-

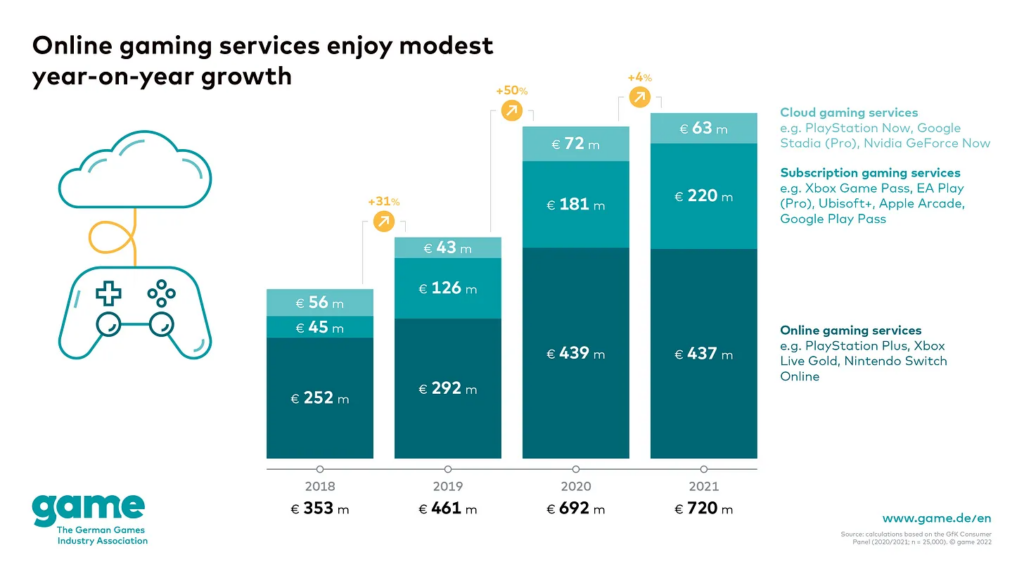

€5.4B came from game sales and IAPs (+19% YoY); €3.6B - from hardware (+18% YoY); €719M - from subscription services (+4% YoY).

-

Mobile games generated the majority of software revenues - €2.76B from IAPs alone. PC & Console titles earned only €1.5B from IAPs.

-

The overall mobile revenue grew by 22% and reached €2.78B.

-

Revenue from traditional subscription services like Xbox Live Gold & Nintendo Switch Online fell from €439M in 2020 to €437M in 2021. But 21% growth showed subscription services offering game catalogs like Xbox Game Pass, Apple Arcade, and Google Play Pass.

-

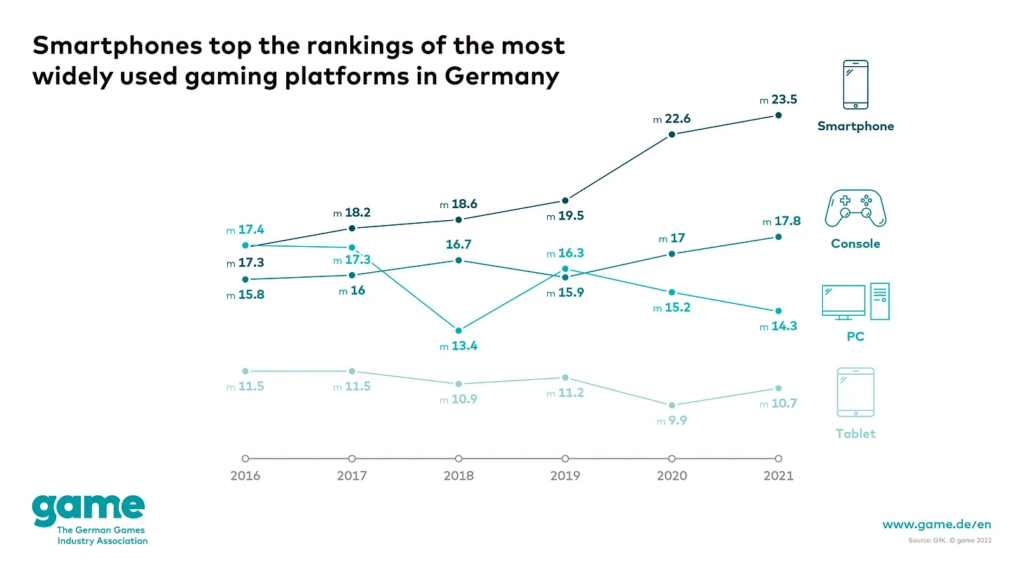

Here is the audience distribution: smartphone - 23.5M users (+4% YoY); consoles - 17.8M (+4.7% YoY); PC - 14.3M (-5.9% YoY); tablets - 10.7M users (+8% YoY).

-

The top games of 2021 by sales are FIFA 22, GTA V, and Mario Kart 8 Deluxe.

German Gaming Industry

-

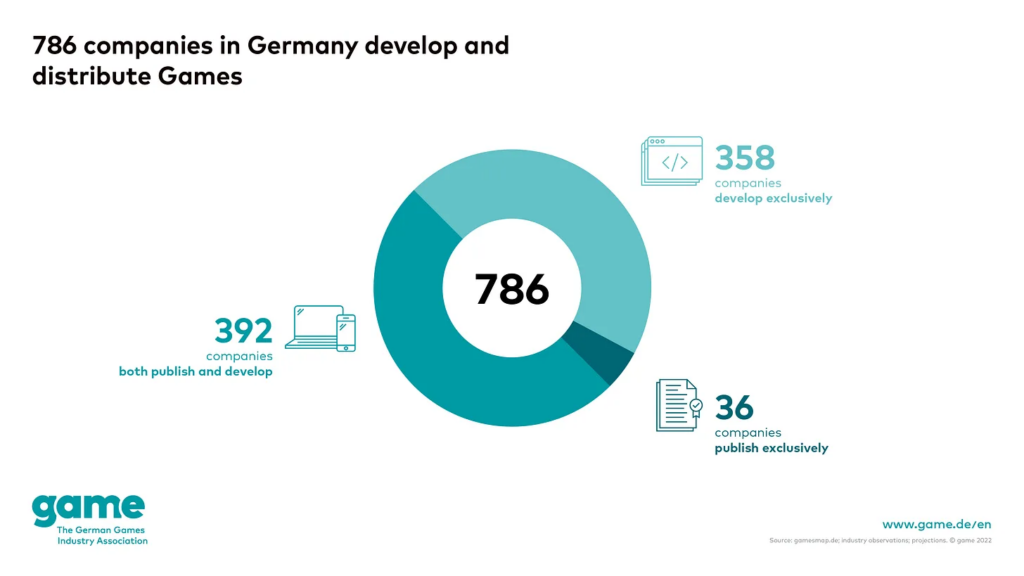

There were 786 gaming companies (+5% YoY) in Germany in 2021.

-

The number of employees increased by 5% from 2020 to 28,650 people.

-

70% of german gaming companies were less than 10 people.

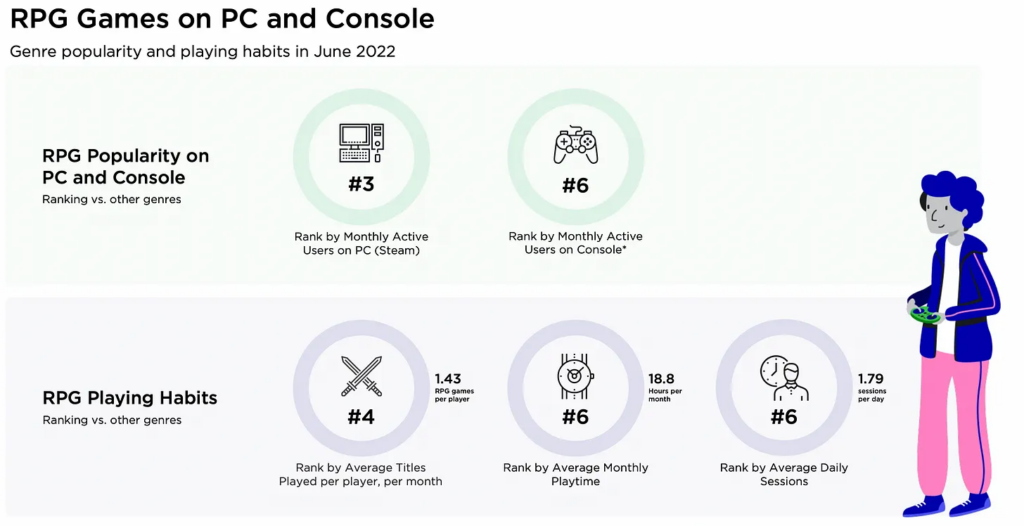

Newzoo: RPG in 2022

-

RPG genre, by experts’ assumptions, will be the first by revenue in 2022.

-

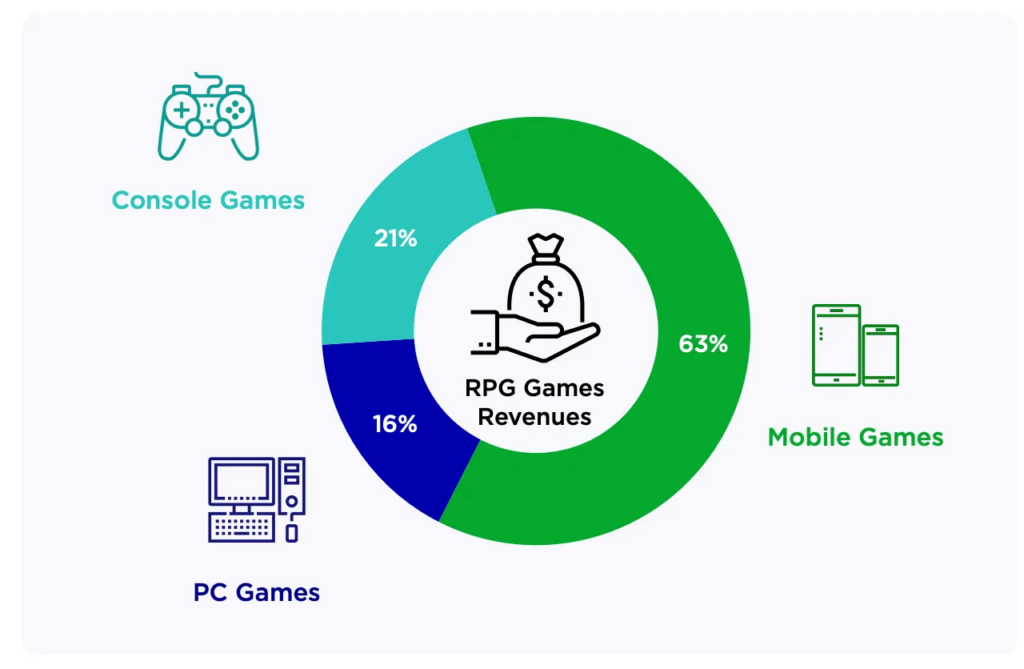

63% of genre revenue will come from mobile devices; 21% - from consoles; 16% - from PC.

-

RPG games are in 3rd place by MAU on Steam, and in 6th place on consoles.

-

58% of RPG gamers are male.

-

The largest age segment of RPG players is from 10 to 20 years (30%). The 21-30 years segment is next (29%); 31-40 is third (24%), and 17% of players are between the ages of 41 to 65.

-

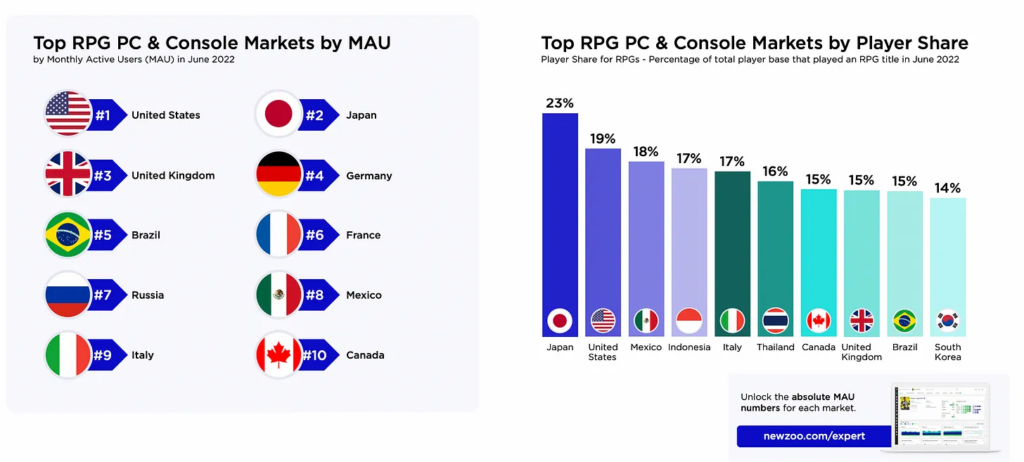

The largest RPG markets by MAU are the US, Japan, and the UK. By RPG player share - Japan, the US, and Mexico.

-

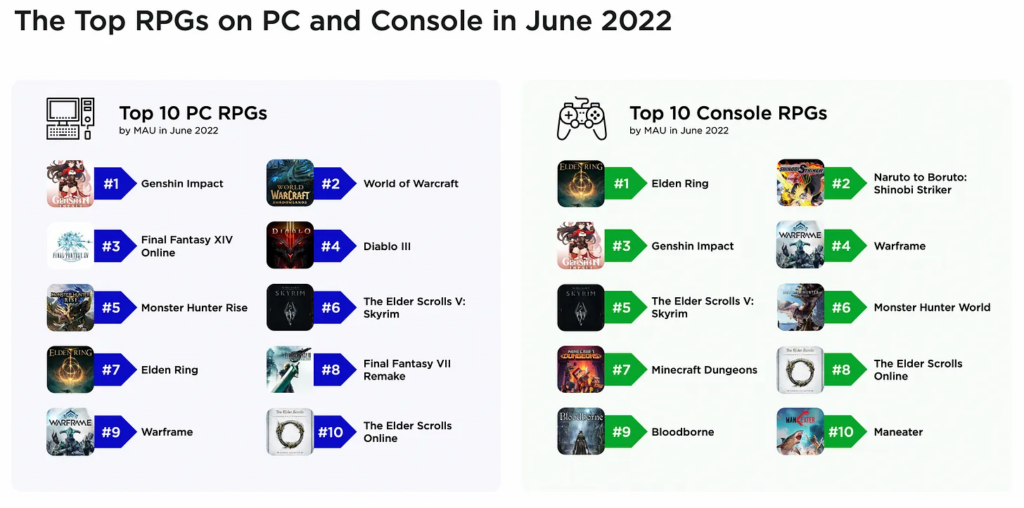

Three top PC RPGs by MAU in June 2022 are Genshin Impact, World of Warcraft & Final Fantasy XIV Online. On consoles: Elden Ring, Naruto to Boruto: Shinobi Striker & Genshin Impact.

-

People watched 205M hours of RPG in June 2022. World of Warcraft, Lost Ark, and Diablo Immortal were top-watched titles.

-

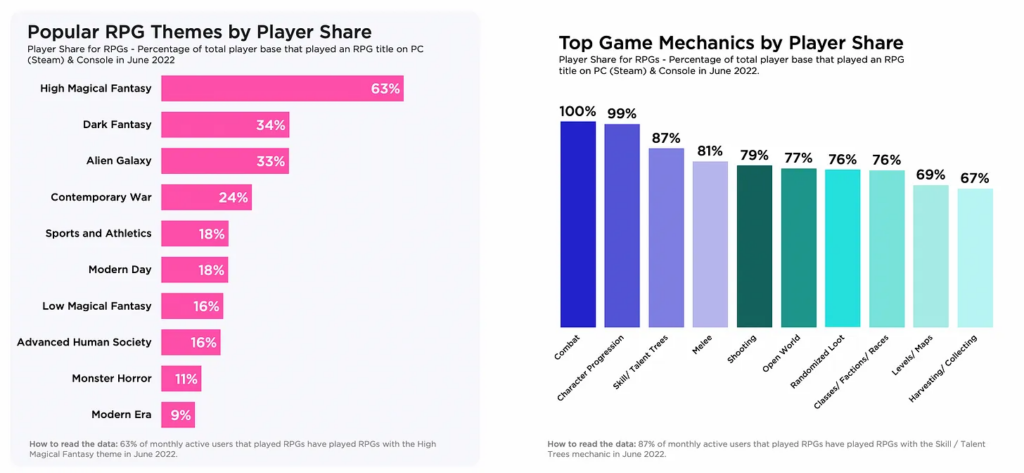

63% of RPG players played RPGs in High Magic Fantasy. It’s the most popular setting. Dark Fantasy (34%) and Alien Galaxy (33%) settings are next by popularity. This works for RPGs on PC & Consoles.

-

99% of RPG titles have the character progression system. 87% of them have skill/talent trees. And 79% - surprisingly - have shooting mechanics.

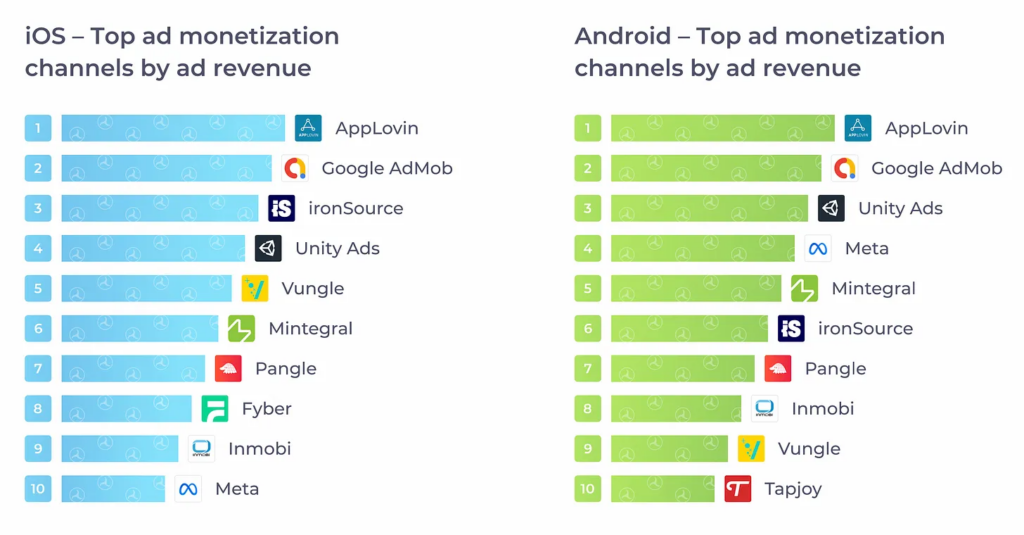

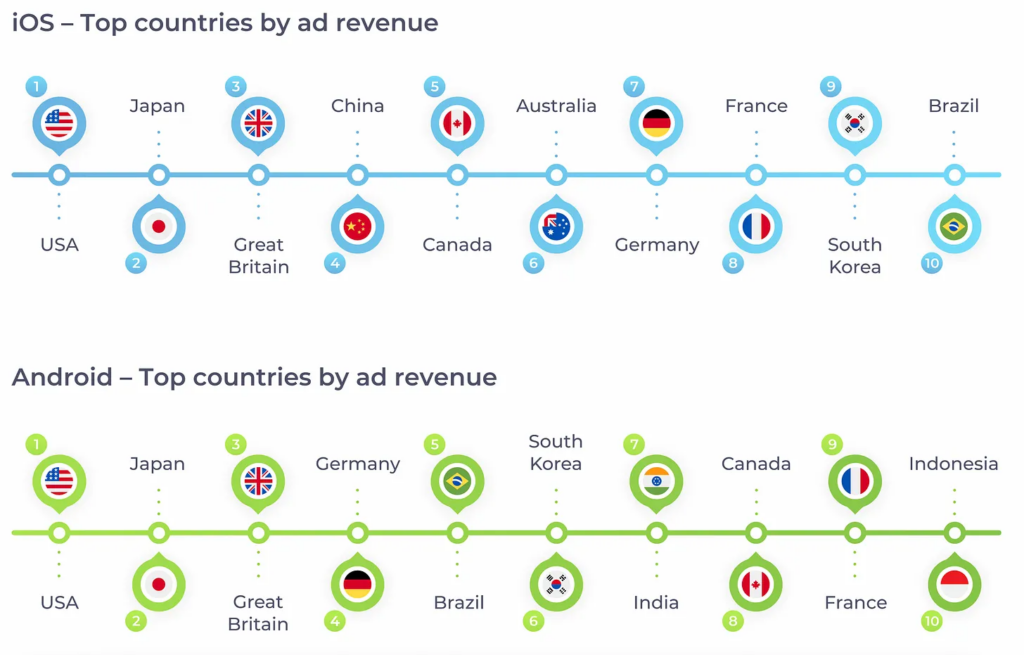

Tenjin: Games on Android got more ad revenue in Q2 2022 than games on iOS

-

Android received 54% of the quarter's ad revenue.

-

AppLovin, Google AdMob & ironSource are the best ad channels on iOS. On Android, the first two places are the same, but the third is taken by Unity Ads.

-

The US, Japan, and the UK are leaders in ad revenue on both iOS and Android.

NPD: The US Gaming industry fell by 9% in July 2022

-

Overall gaming market revenue in July 2022 was $4.2B - it’s 9% smaller than a year before.

-

Hardware sales increased by 12% and reached $362M. PlayStation 5 was the first by dollar revenue, and Nintendo Switch led by unit sales.

-

Gaming software sales dropped by 10% YoY to $3.7B.

-

MultiVersus from Warner Bros. Interactive Entertainment reached first place in the chart, and Elden Ring finished second.

-

Accessory sales went down by 22% to $148M. But the leader is the same - black DualSense.

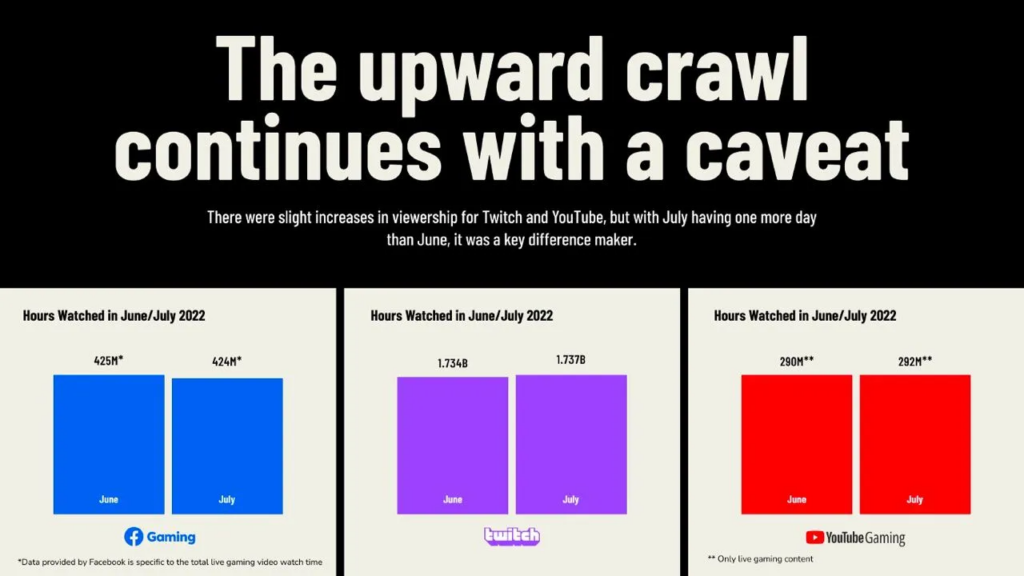

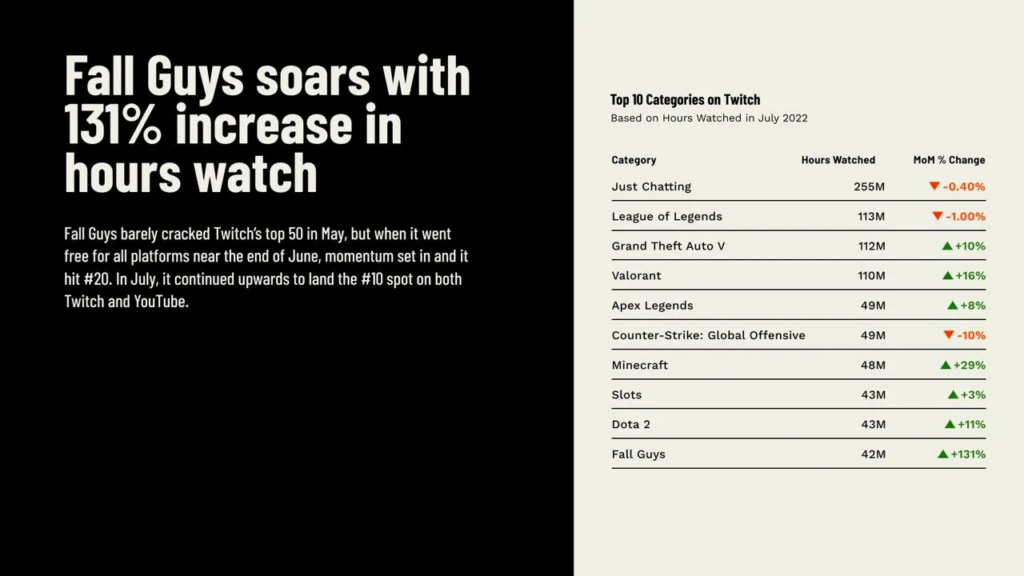

StreamElements & Rainmaker.gg: People didn't watch more streams in July 2022 than in June

-

The overall number of watched hours increased on Twitch and YouTube Gaming. But there were 31 days in July, so the actual difference to June disappears.

-

Streaming platforms are on the plateau by streaming hours from March 2022.

-

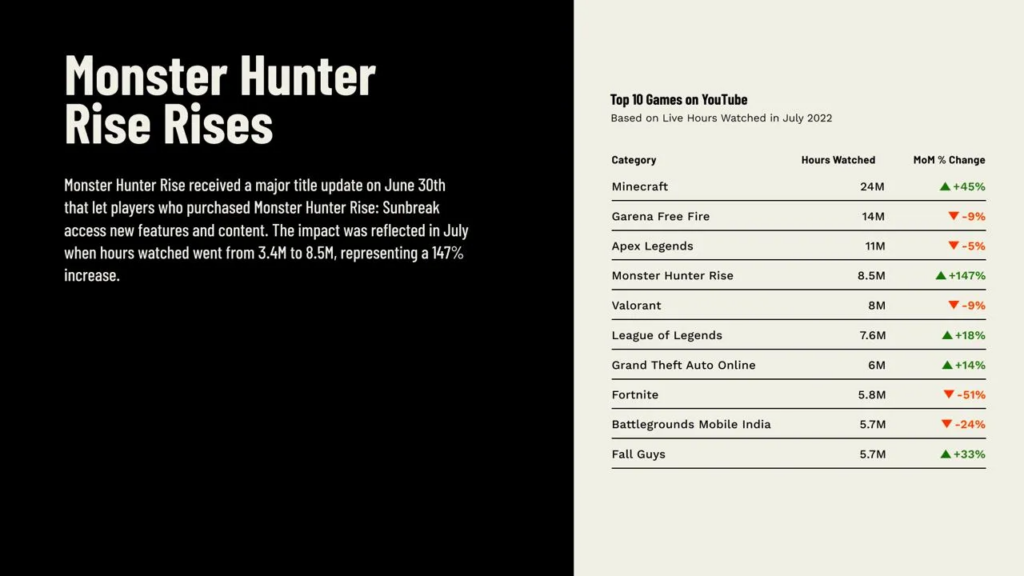

Fall Guys managed back to top-10 after the transition to F2P. The game received 131% more viewed hours in July 2022.

-

Monster Hunter Rise did even better with +147% of watched hours in July 2022 compared to June. A new content update helped the game.

-

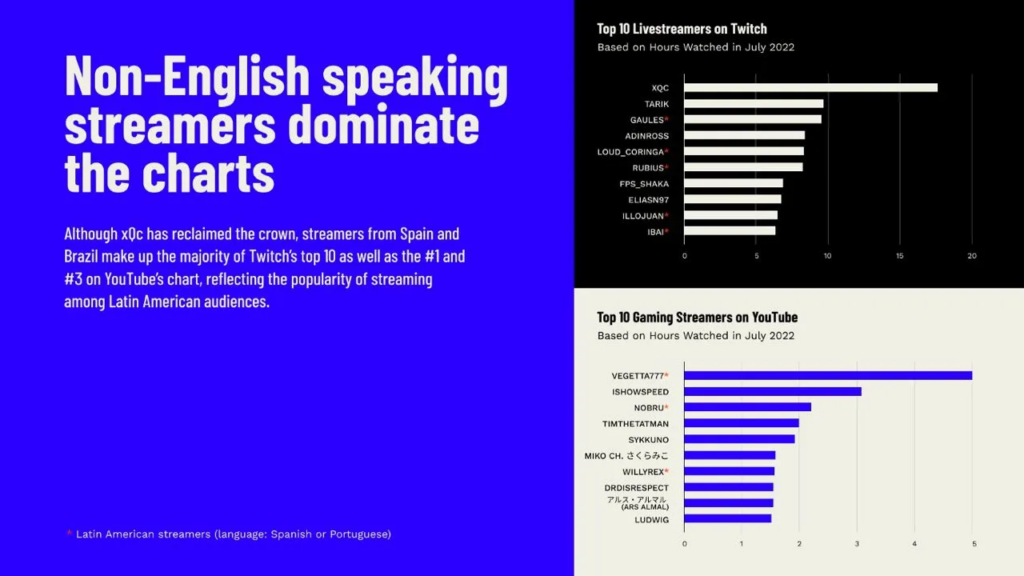

In July 2022 half of the top-10 streamers were from Latin America (speaking Spanish or Portuguese languages). It’s the first time in a long time that English-speaking streamers are the minority. There is also one German-speaking, and one Japanese-speaking streamer at the top.

ISFE & EGDF: European Gaming Market in 2021

-

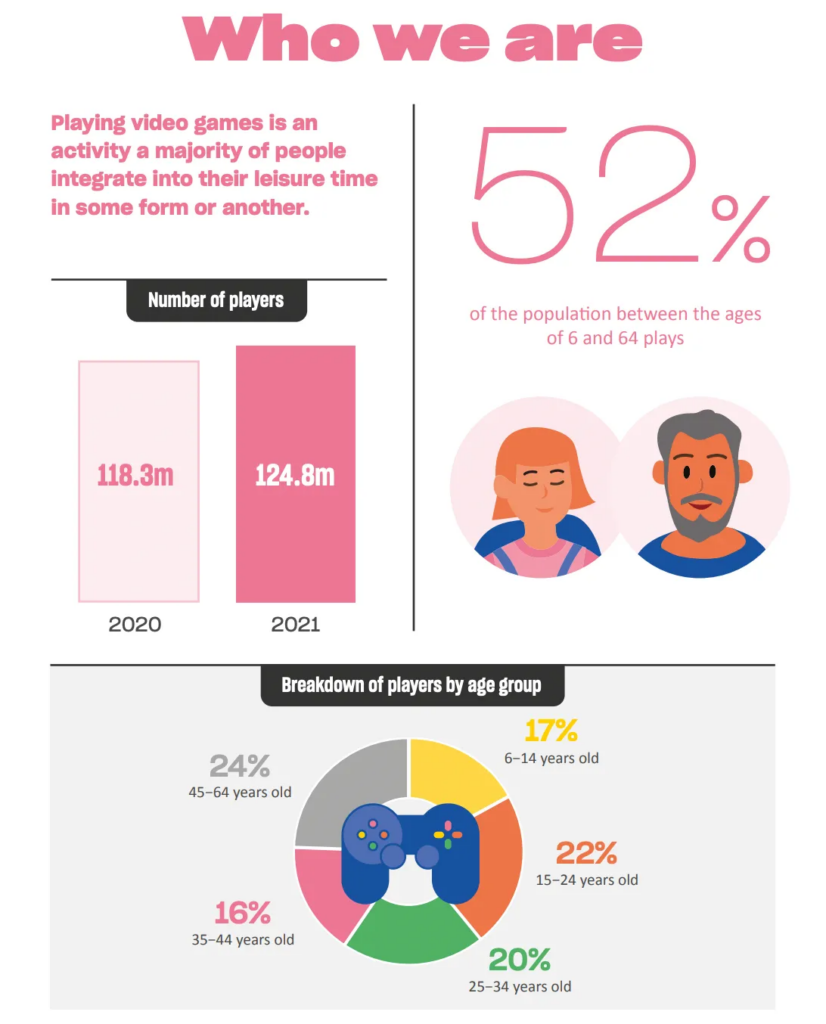

124.8M players were in Europe by the end of 2021. 52% of the population between 6 to 64 years play games.

-

45% of European gaming revenue in 2021 was generated by mobile games (40% in 2020); 42% was generated by console market (44% in 2020); 6% by PC (14% in 2020), and 2% by streaming services (2% in 2020).

-

Digital goods were responsible for 81% of overall revenue. 69% of this amount were IAP purchases.

-

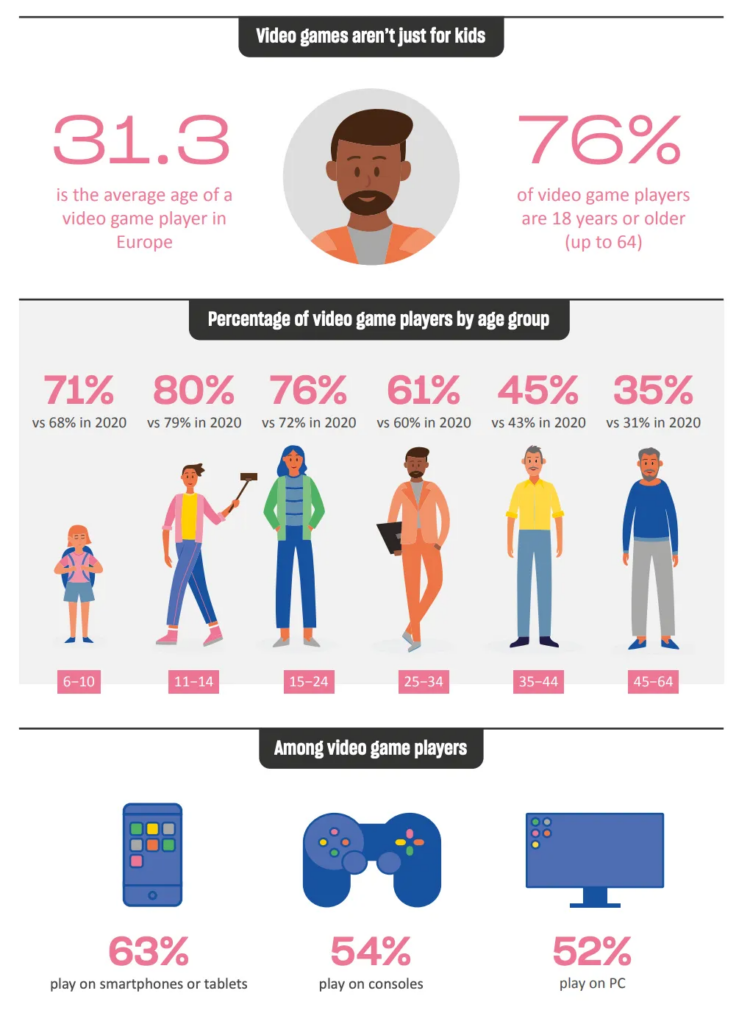

The average European gamer age is 31.3 years. 76% of people older than 18 years (and younger than 64) are playing games.

-

63% of users are playing on smartphones; 54% on consoles, and 52% on PC.

-

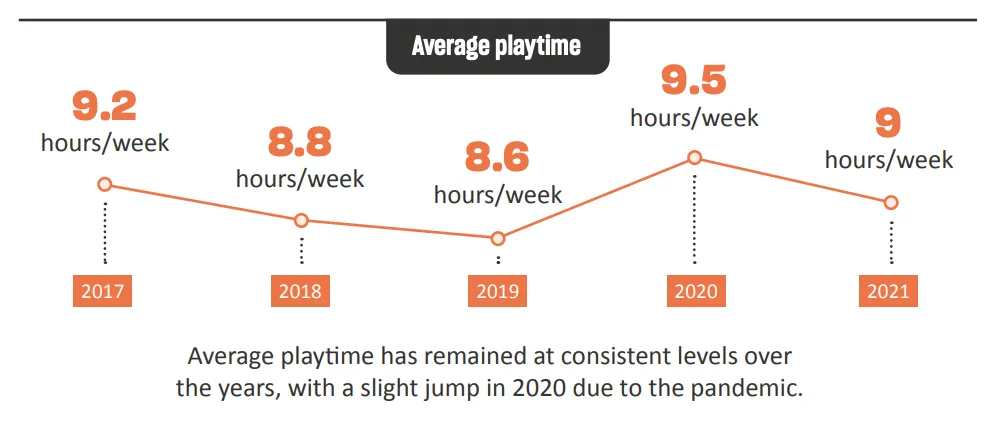

78% of European gamers are playing at least 1-hour weekly. On average, European gamers spend about 9 hours on games per week.

- Only 19% of children make in-app purchases in Europe. It’s a large decrease from 42% in 2018.

ISFE & EGDF: European Gaming Market in 2021 Download

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.