Devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the November and December reports.

Contents

- Game Industry Layoffs: 10,526 people lost their jobs in the gaming industry in 2023

- TIGA: The UK game studios lack qualified employees

- AppMagic: Top Mobile games of December 2023 by Revenue and Downloads

- Visual Capitalist: 50 Years of Video Game Revenue

- SteamDB: In 2023, 14,533 games were released on Steam

- GfK: For the first time in a decade, FIFA (EA Sports FC) did not become the largest physical release in the UK

- Video Game Insights: State of the PC games (Steam) market in 2023

- Steam has set a new record for peak concurrent users (CCU)

- Sensor Tower: Top mobile games and publishers in the US by Revenue in 2023

- GSD & GfK: The UK gaming market grew by 2% in December

- Hogwarts Legacy sold 22 million copies in 2023

- Crunchbase: Investments in gaming startups at venture stages in 2023 reached a minimum since 2018

- TheGameDiscoverCo: Game Catalogs on PC and Gaming Consoles in 2023

- data.ai: Mobile Gaming Market in 2023 (State of Mobile 2024)

- GSD & GfK: Game sales on PC and consoles in the UK grew by 2.6% in 2023

- Game sales Round-up (01.01.2024 - 16.01.2024)

- GSD: The European gaming market (PC & consoles) slightly grew in December 2023

- Sensor Tower: Mobile Publisher Ranking in South Korea in 2023

- GSD: European PC and Console Market in 2023

- PlayStation set an MAU record in December 2023

- Circana: The US gaming market - December and 2023 Results

- Newzoo: Forecasts and Gaming Trends for 2024

- GDC & Game Developer: The State of the Gaming Industry in 2024

- Video Games are no longer the largest entertainment segment in the UK

Game Industry Layoffs: 10,526 people lost their jobs in the gaming industry in 2023

Game Industry Layoffs provide approximate figures. The information is gathered from open sources, and the numbers are likely even higher.

-

The highest number of people were laid off in November 2023 - 2,775 individuals.

-

The leaders in layoffs in 2023 were Unity (1,165 people), ByteDance (1,000 people), Embracer Group (962 people), Epic Games (830 people), and Amazon (715 people).

-

A total of 162 rounds of layoffs were publicly announced throughout the year.

TIGA: The UK game studios lack qualified employees

The report was released in mid-November 2023.

-

68% of British studios faced hiring problems in the last year. The most significant issues were with programmers (24%), but there were also difficulties in finding artists (22%) and game designers (22%).

-

Among the studios that encountered hiring problems, 93% noted that there is simply a shortage of people with the required qualifications in the market. 47% mentioned that they suffer from the headhunting of their best employees.

-

The shortage of employees affects productivity. 59% of studios noted that it hinders their growth. The same percentage said that the lack of personnel forces them to postpone project releases. 73% mentioned that the workload on the existing staff has increased. 64% were compelled to outsource more work.

-

British companies are trying to address the challenge. 91% have made internal promotions to fill necessary vacancies. 90% have tried new hiring methods. 81% have increased salaries. The same percentage of companies improved training programs for current employees.

-

All British game companies reported providing training programs for their employees.

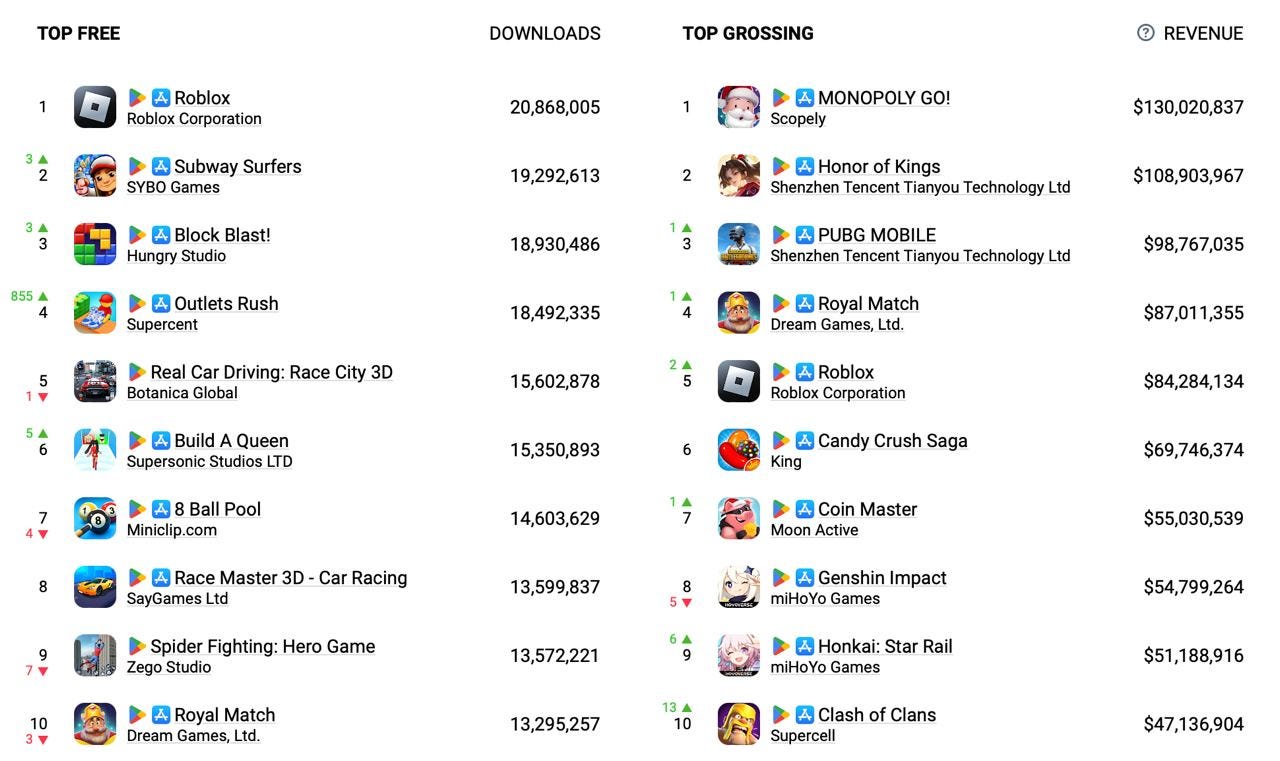

AppMagic: Top Mobile games of December 2023 by Revenue and Downloads

AppMagic provides data on revenue excluding store commissions and taxes.

Revenue

-

Monopoly GO! took the top spot in revenue. The game earned $130M in December after deductions.

-

Honor of Kings secured the second position with $108.9M, followed by PUBG Mobile in third place with $98.8M.

-

Honkai: Star Rail claimed the 9th position in the December chart with revenue of $51.2M. The game rose by 6 positions compared to November.

-

Impressive results also for Clash of Clans. The Supercell game closes the top ten highest-earning projects of December with revenue of $47.1M. In November, the game was in the 23rd position.

Downloads

-

Outlets Rush - a new hit from Supercent. The game received 18.5 million downloads in December. It is a tycoon game where players manage a clothing store.

-

Otherwise, there are no changes. Roblox is in the first position (20.8 million downloads); Subway Surfers is in the second position (19.3 million); Block Blast! is in the third position (18.9 million downloads).

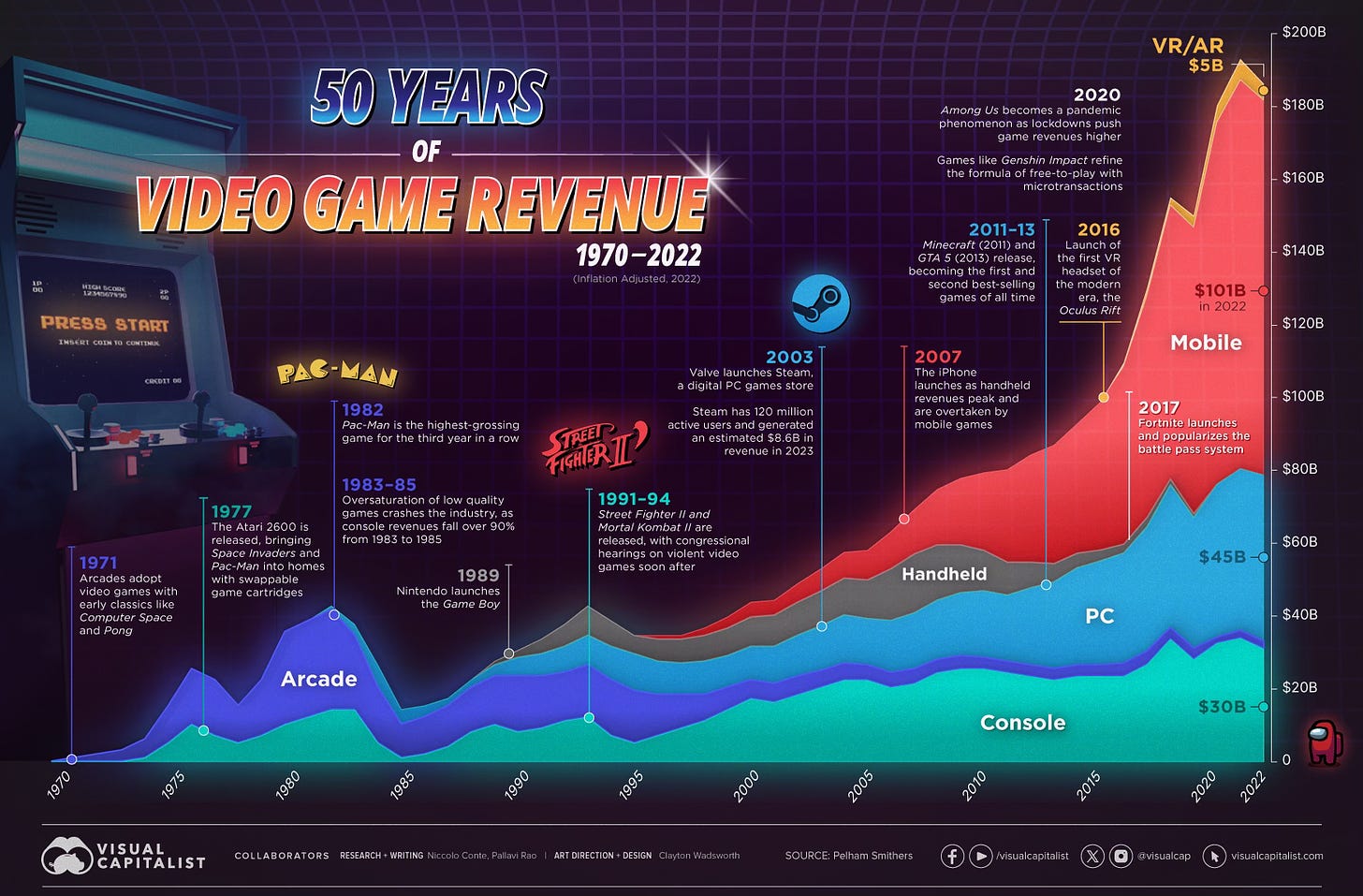

Visual Capitalist: 50 Years of Video Game Revenue

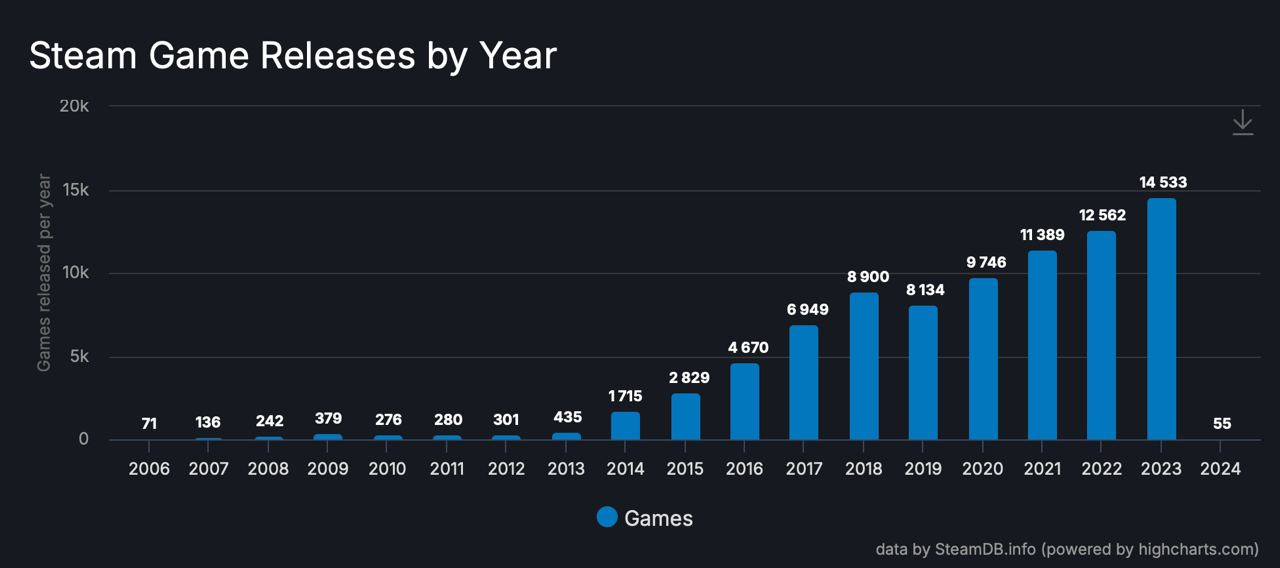

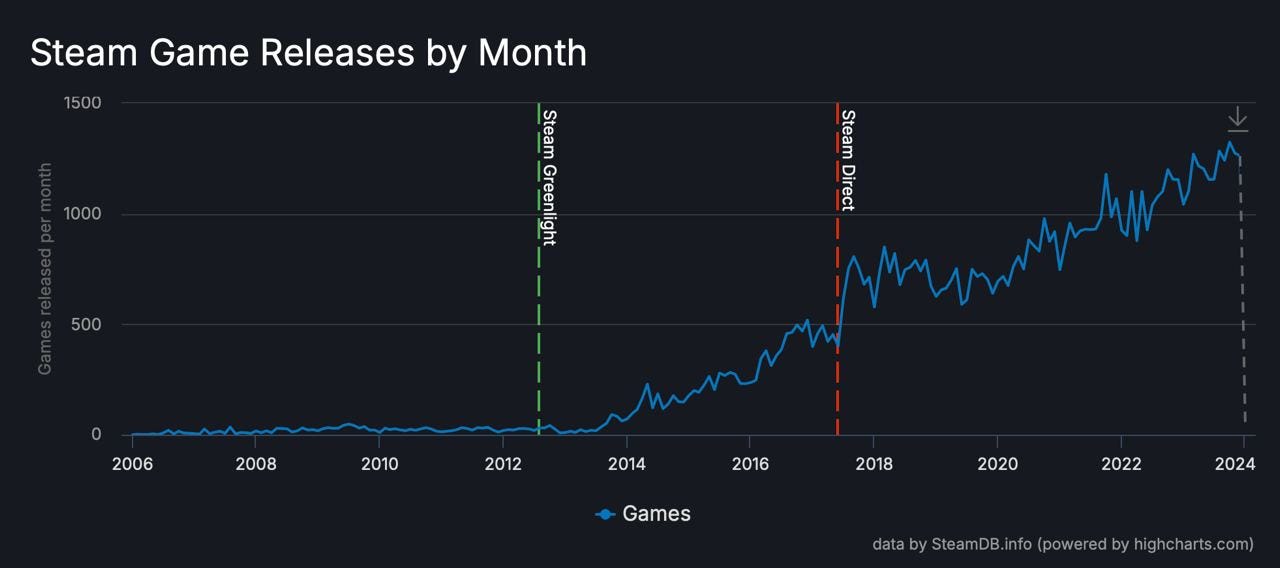

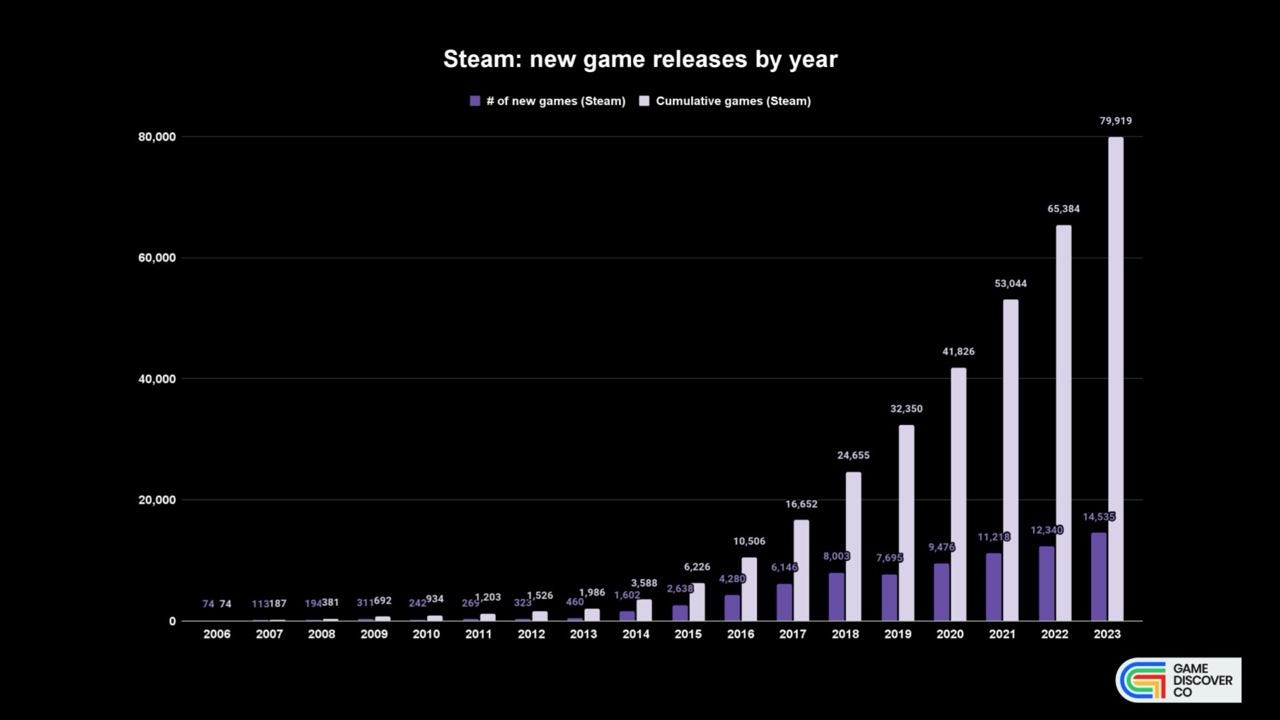

SteamDB: In 2023, 14,533 games were released on Steam

-

This is the record-breaking year for the entire observation period.

-

In October 2023, 1,324 games were released. This is a record-breaking month for the entire observation period.

-

In 2023, 12,562 games were released, compared to 11,389 in 2021.

-

The number of new games on Steam started to increase after the introduction of Steam Greenlight. Steam Direct further accelerated the growth by allowing developers to simply purchase a slot for releasing a game.

GfK: For the first time in a decade, FIFA (EA Sports FC) did not become the largest physical release in the UK

-

Hogwarts Legacy is the best-selling boxed game in the UK in 2023. More than half of the sales were for the PS5 version, with the second most popular platform being the PS4.

-

The last time FIFA was surpassed in retail sales was by Grand Theft Auto V in 2013.

-

In 2023, 12.76 million copies of games were sold at retail in the UK. This is 5% less compared to 2022, but it doesn't necessarily indicate a market decline. It's more likely that more people were purchasing digital versions.

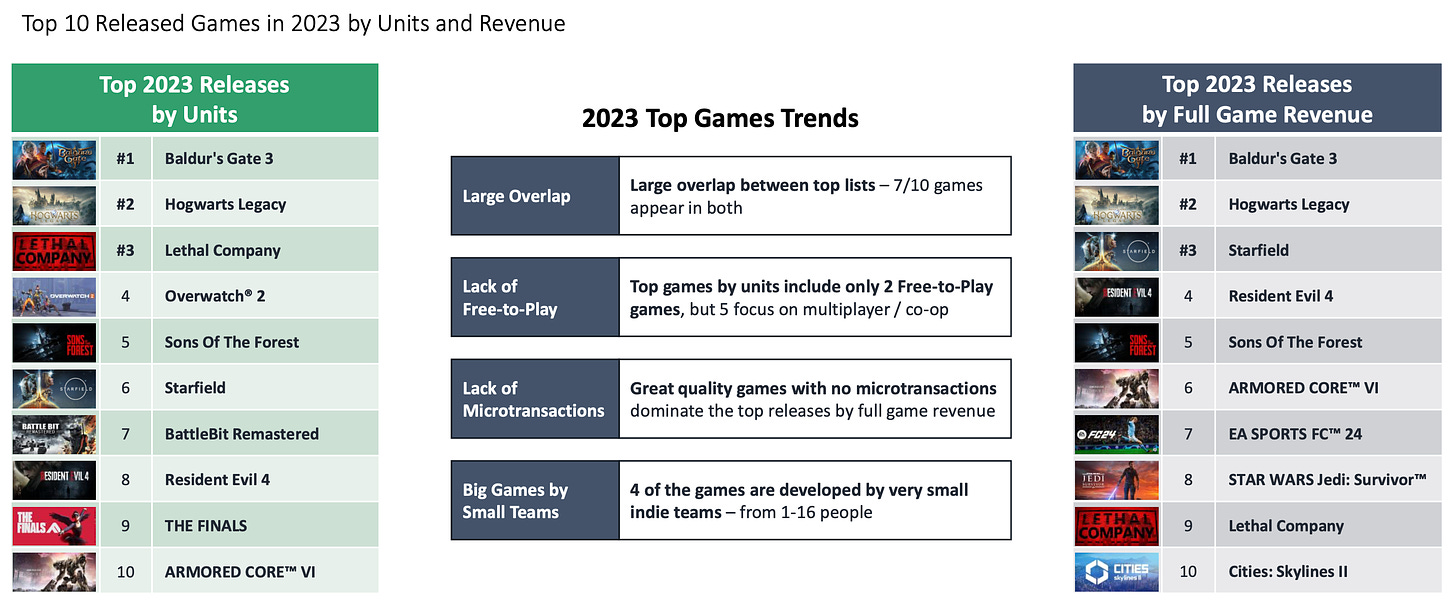

Video Game Insights: State of the PC games (Steam) market in 2023

-

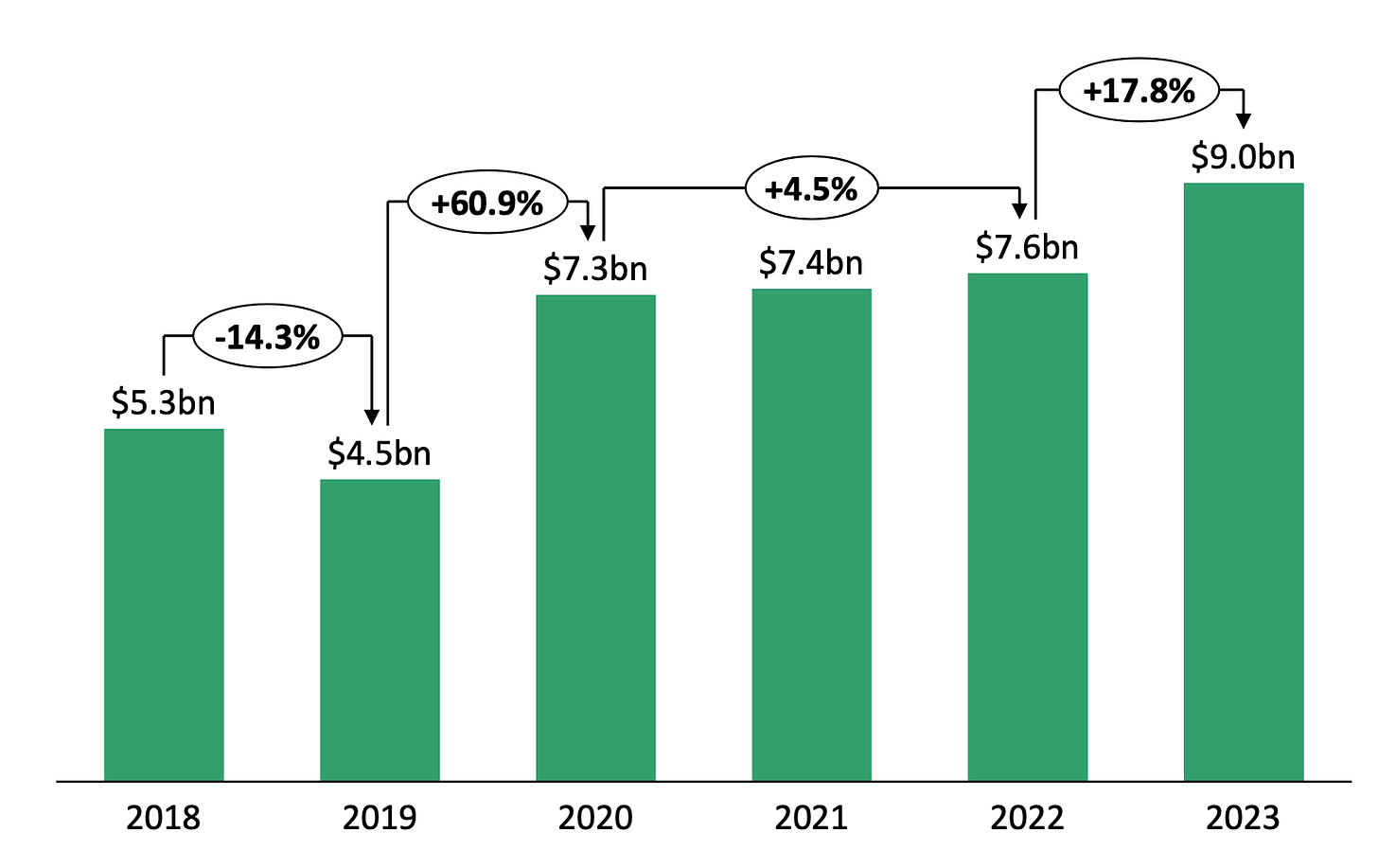

2023 was a record year for Steam. Games worth $9 billion were sold (excluding microtransactions). This accounts for more than 580 million copies, with almost 14 thousand games released. The platform's peak concurrent users (CCU) exceeded 33.6 million.

-

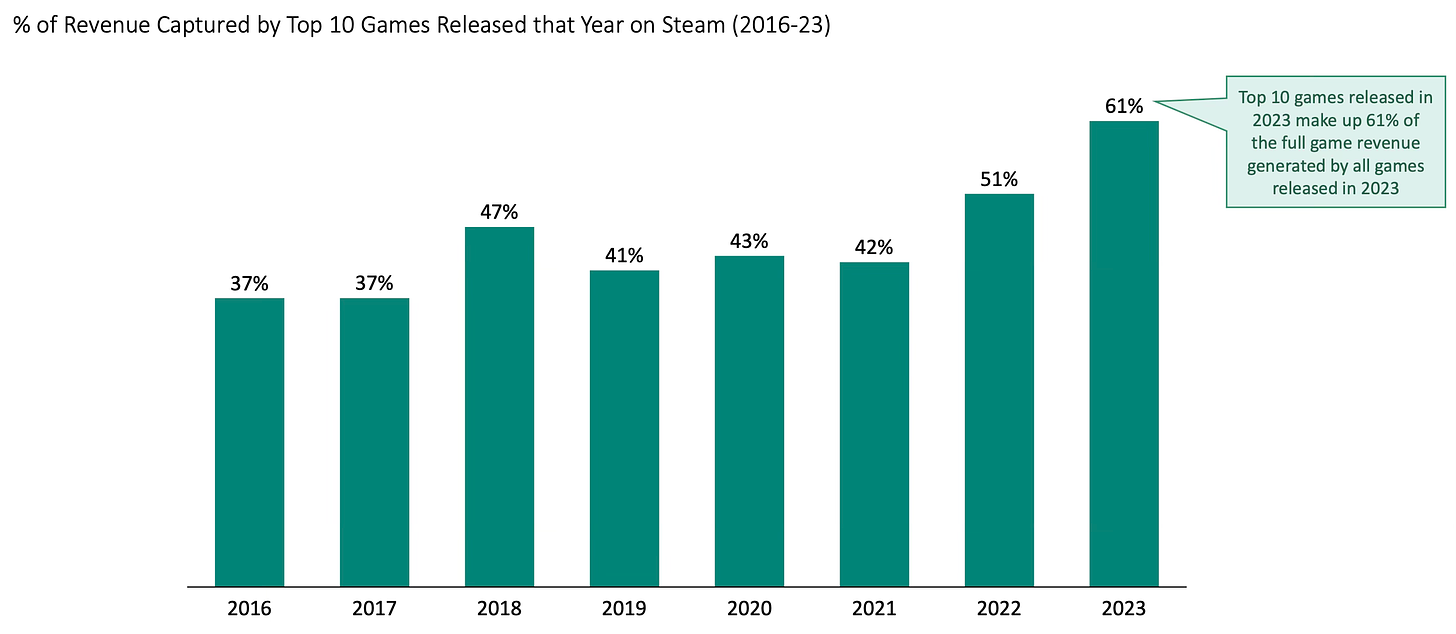

In 2023, 61% of Steam's total revenue from sales was distributed among the top 10 games (that were released in 2023). This is the highest figure since 2016.

-

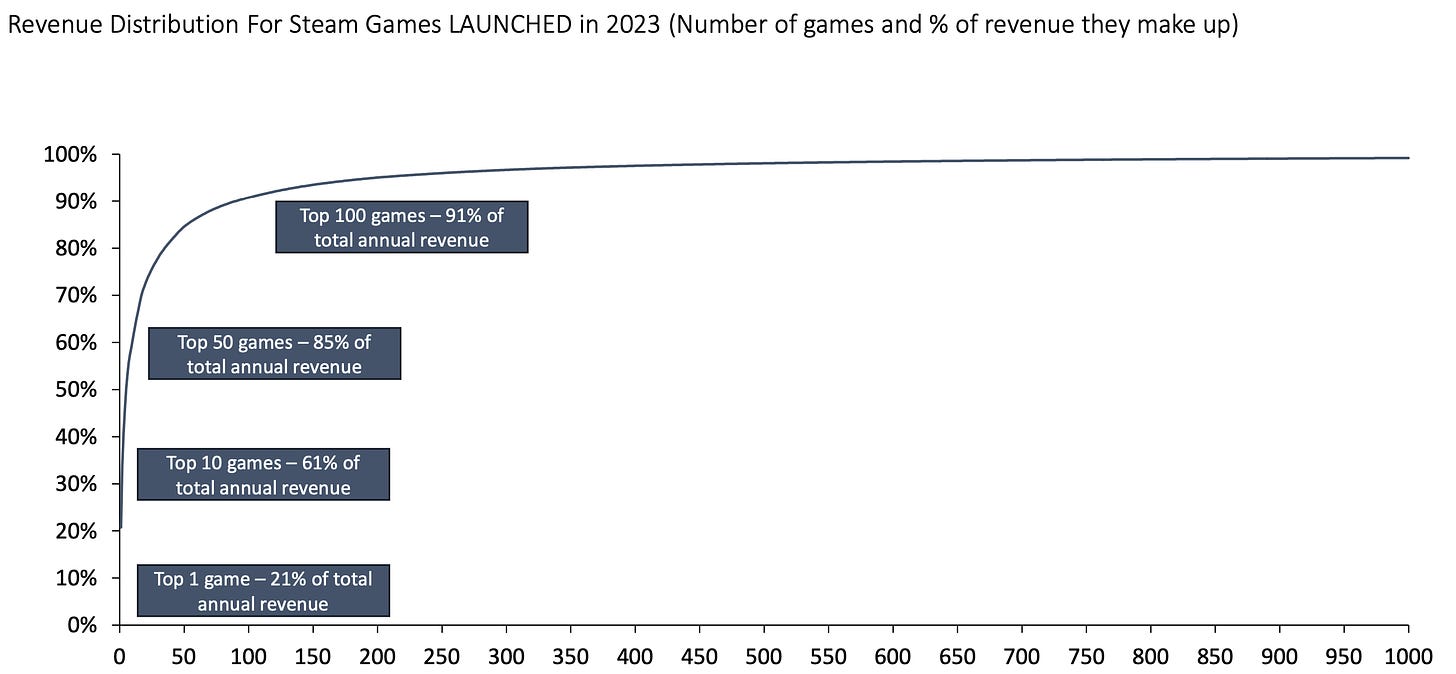

In 2023, the top 100 launched games on Steam (in 2023) generated 91% of the total revenue (from games released in 2023).

-

Game sales on Steam grew by 17.8% in 2023 compared to the previous year. The platform size in 2023 is twice as large as it was in 2019.

-

Baldur’s Gate 3, Hogwarts Legacy, Lethal Company, Sons of the Forest, and Starfield - leaders on Steam in terms of the number of copies sold (I’ve excluded free games).

-

Baldur’s Gate 3 ($657M), Hogwarts Legacy ($341M), Starfield ($235M), Resident Evil 4 ($159M), and Sons of the Forest ($116M) - leaders on Steam in terms of revenue from sales.

-

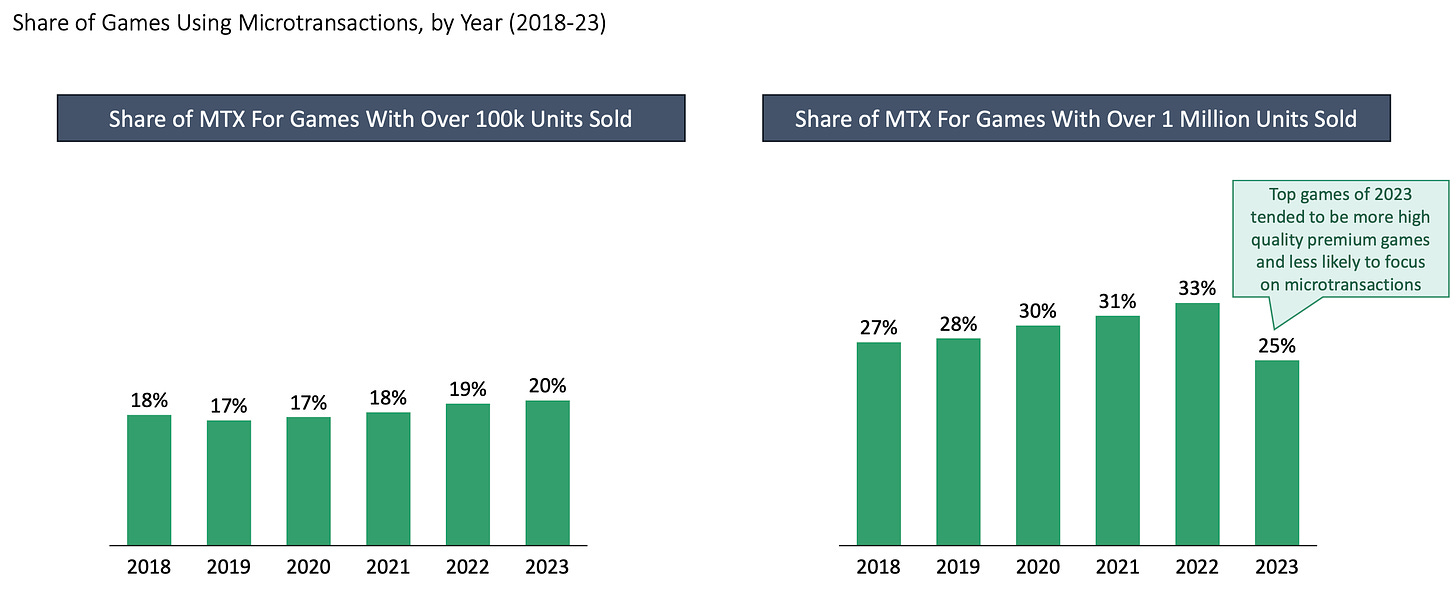

Interestingly, only 2 free games are in the top list on Steam in terms of the number of copies - Overwatch 2 and The Finals.

-

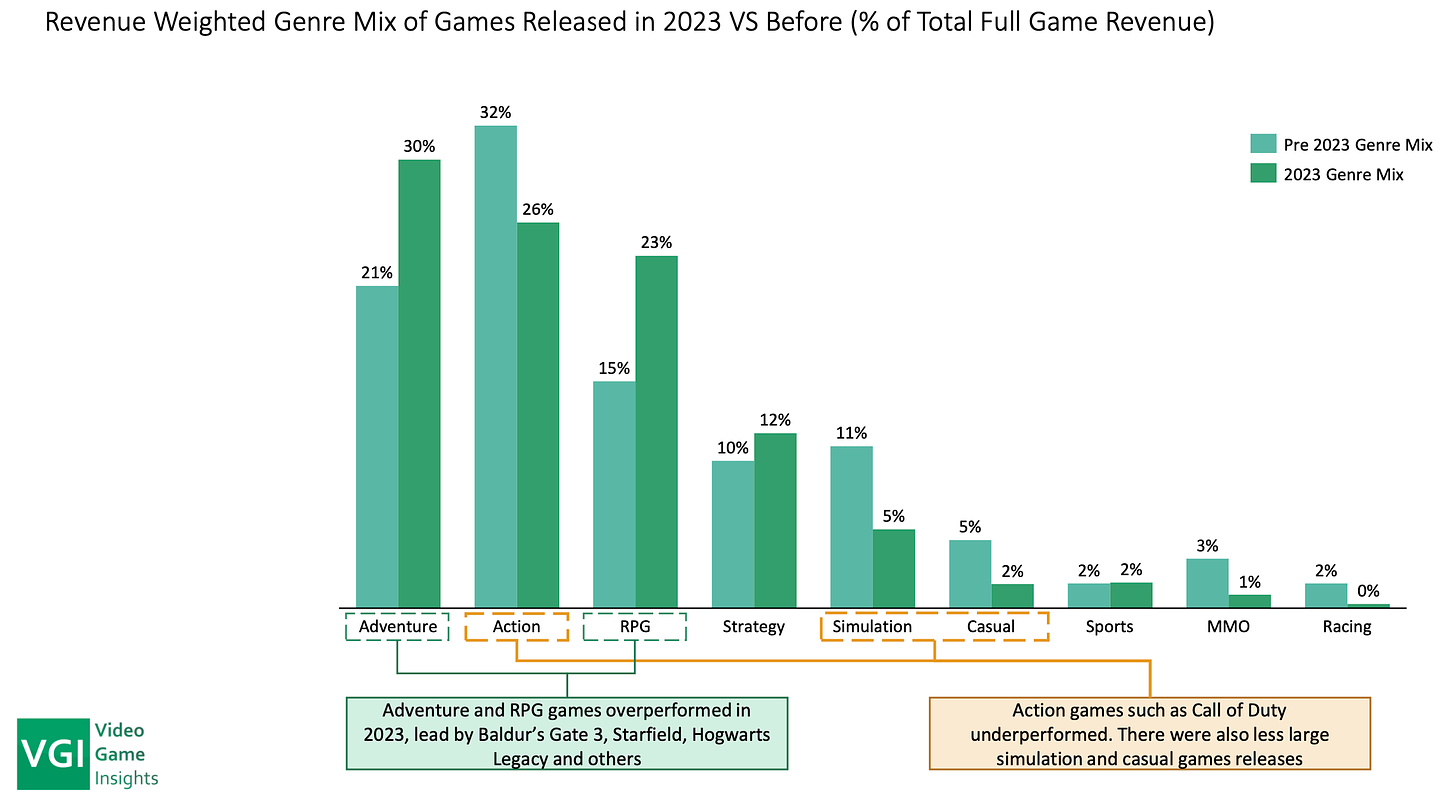

In 2023, only 6 out of the top 24 games on Steam had microtransactions. This is the lowest figure since 2018. Although the share of microtransactions in games with sales exceeding $100 thousand is growing - in 2023, they were present in 20% of projects.

-

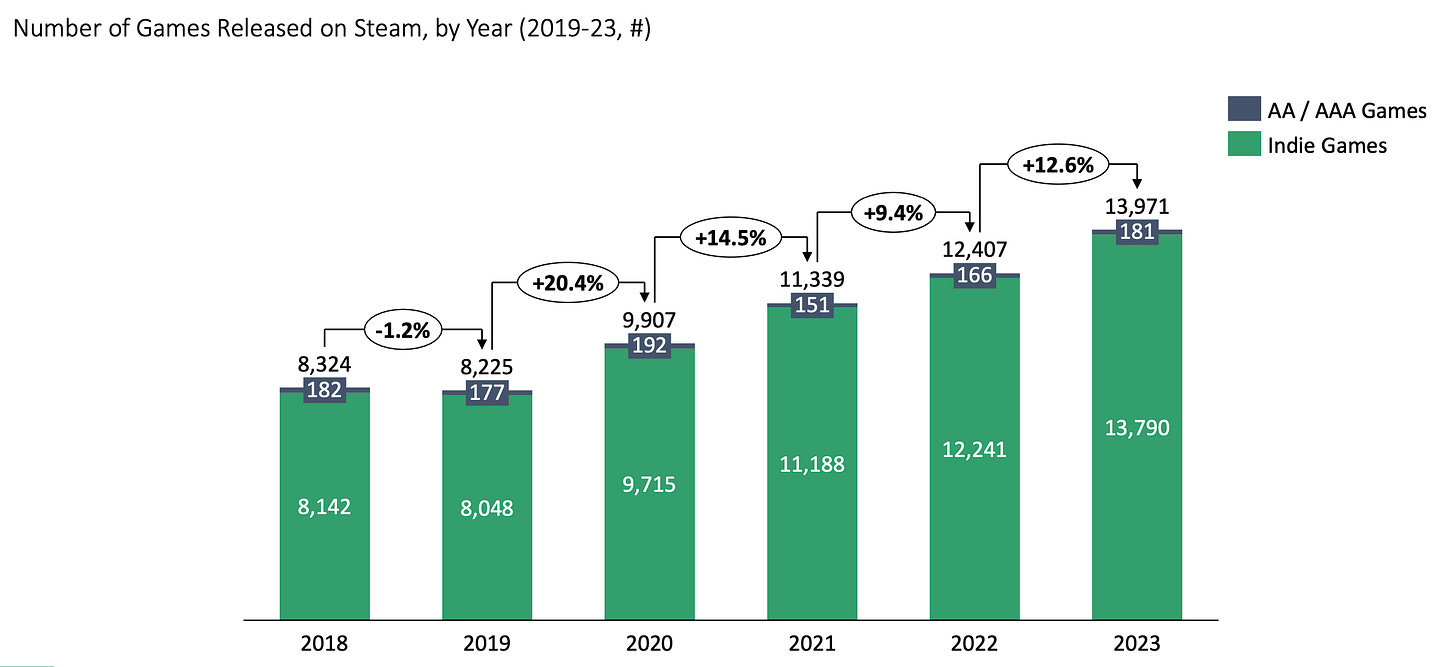

RPG and adventure games grew on Steam in 2023, while MMOs, simulators, and casual projects lost their positions.

-

The number of games on Steam continues to grow each year. In 2023, 12.6% more games were released than in 2022.

-

Out of almost 14 thousand released games, only 930 earned more than $1 million in sales. 157 games earned more than $10 million, and only 20 surpassed the $50 million mark.

-

Out of 14 thousand projects, 309 are free.

-

The average price per copy of a game sold on Steam in 2023 was $15.5. And it is increasing every year.

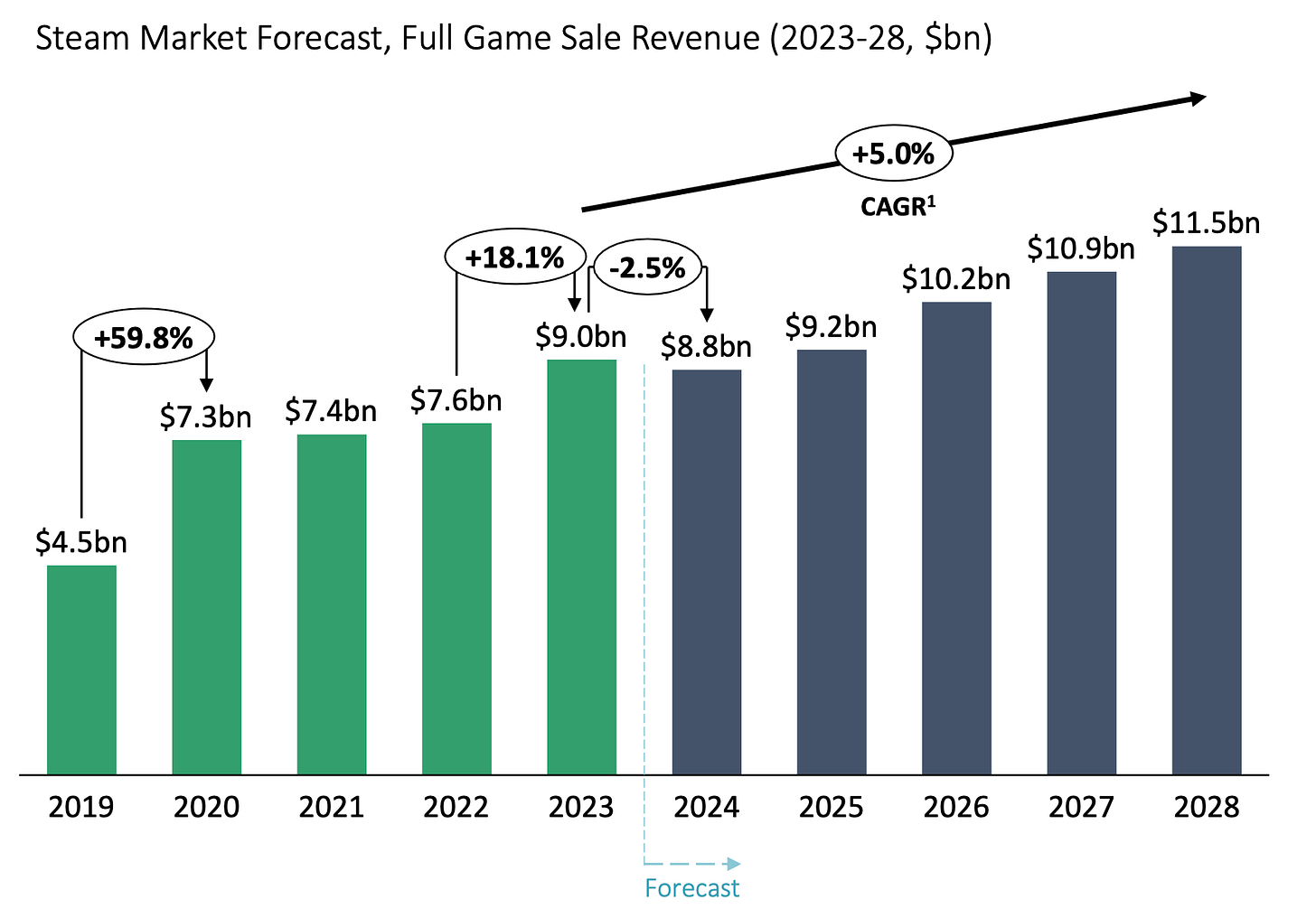

Future Forecast

-

VGI predicts that in 2024, revenue on Steam will decrease by 2.5% to $8.8 billion. This is due to fewer releases, an increase in the share of consoles, and the growing presence of subscription services in the market.

-

It is expected that the number of copies sold on Steam will reach the 2023 results only in 2026. There will be a slight decline in 2024 and 2025.

-

The average price per sold copy on Steam will increase to $18.1 by 2028.

-

VGI expects that revenue from game sales on Steam will grow to $11.5 billion by 2028.

Steam has set a new record for peak concurrent users (CCU)

- On January 7th, 33.68 million people were on the platform simultaneously. Of them, only 10.6 million were playing games; the rest were engaged in something else.

-

The previous record was recorded at 33.6 million, which happened in March 2023.

Sensor Tower: Top mobile games and publishers in the US by Revenue in 2023

Mobile Games in the US - Revenue

-

MONOPOLY GO! - a breakthrough hit in the US market in 2023. According to Sensor Tower, the game was downloaded 33 million times and earned $632 million.

-

Traditionally strong results are shown by Candy Crush Saga ($472 million in revenue), Roblox ($408 million), and Royal Match ($389 million).

-

In the revenue charts, it's worth noting Gardenscapes, which rose 16 positions in 2023. The game earned $202 million in the USA.

Mobile Games in the US - Downloads

-

In the download charts, there are 4 newcomers. In addition to MONOPOLY GO!, good results were achieved by Block Blast! (14 million downloads - 26% of which are organic), Attack Hole - Black Hole Games (11 million downloads), and My Perfect Hotel (11 million).

-

It's also important to note the growth of Royal Match in downloads - the game rose 23 positions compared to the previous year and gained 20 million new users.

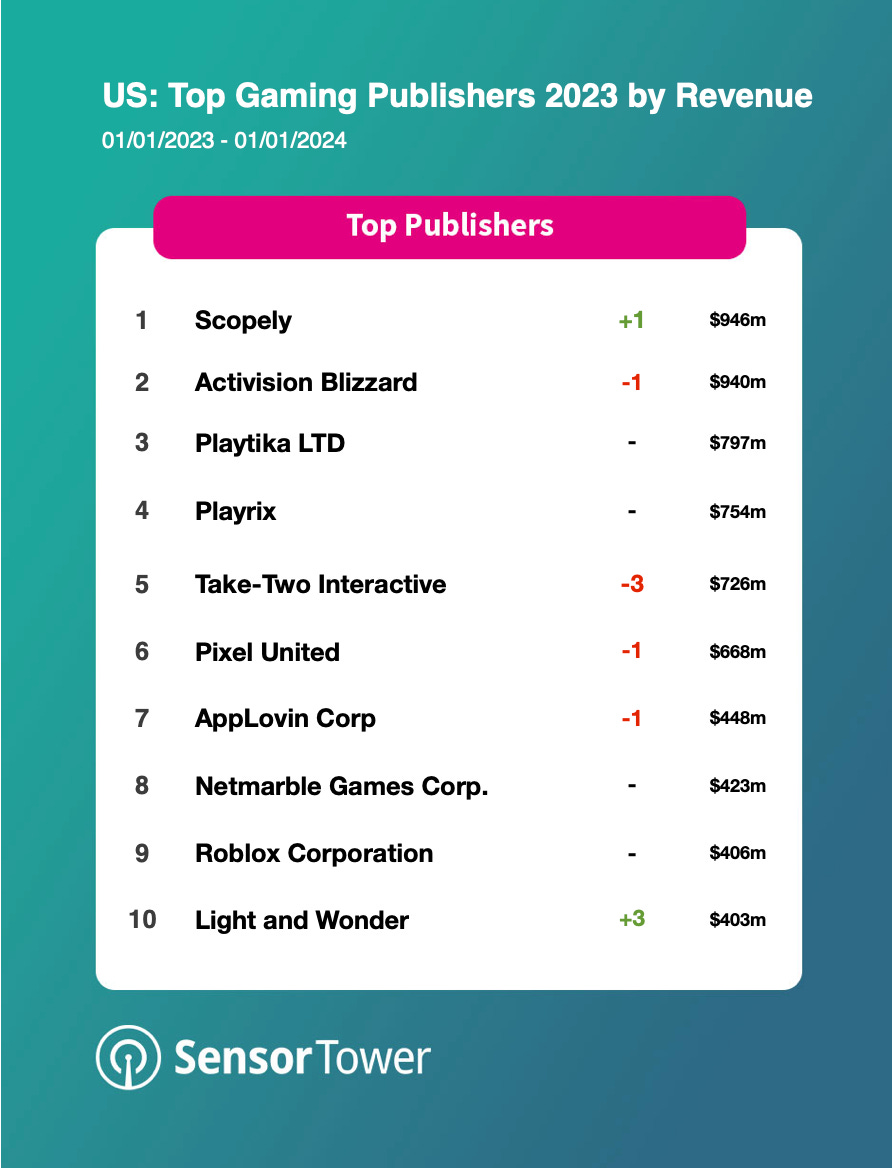

Top Mobile Publishers in the USA

-

Scopely moved up from the first position on the list of publishers, surpassing Activision Blizzard, earning $946 million against $940 million.

-

Among lesser-known companies, Light & Wonder ranked tenth in the USA by revenue ($403 million). The company specializes in casino releases.

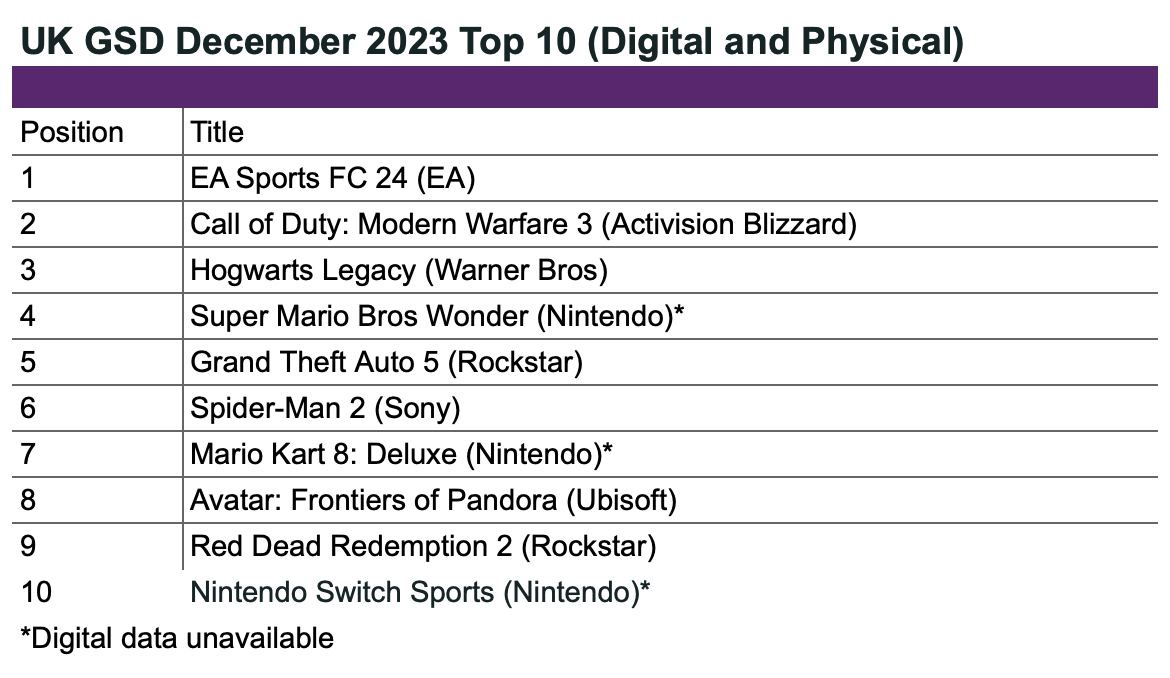

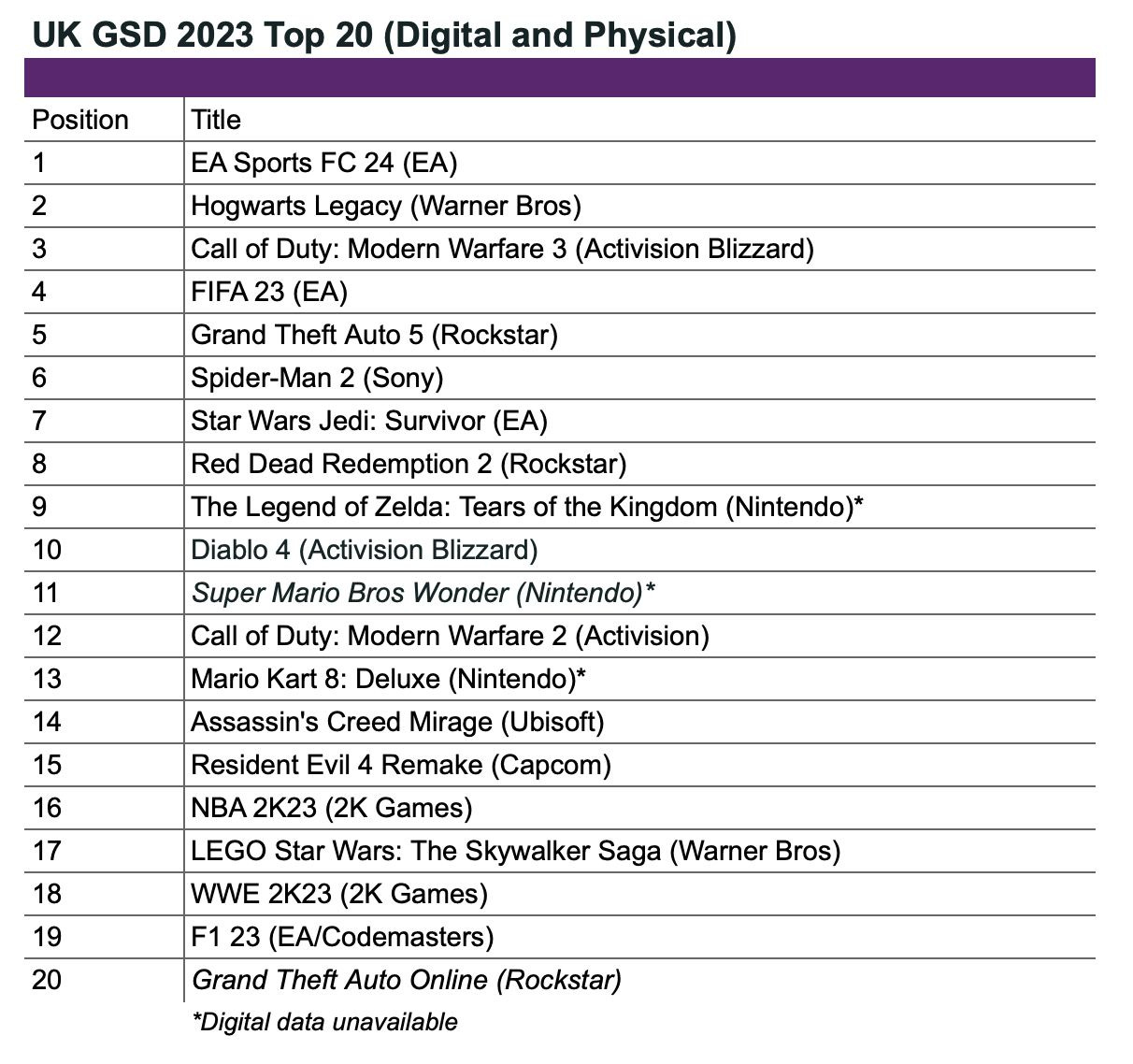

GSD & GfK: The UK gaming market grew by 2% in December

Analytical platforms report only actual sales figures obtained directly from partners. Major publishers, such as Nintendo, do not share information on digital copy sales. The mobile segment is also not taken into account.

Game Sales

-

6.9 million copies of games for PC and consoles were sold in the UK in December 2023. This is 2% more than the previous year.

-

EA Sports FC 24 became the sales leader; Call of Duty: Modern Warfare III dropped to the second position; Hogwarts Legacy and Super Mario Bros. Wonder ranked third and fourth, respectively.

-

Avatar: Frontiers of Pandora debuted at the 8th position in the charts, despite receiving relatively weak reviews from critics and players.

Console and Accessory Sales

-

Nearly 500 thousand consoles were sold in the UK in December. This is 2% more than in November and 7% more than in December of the previous year.

-

PlayStation 5 continues to lead confidently, but system sales fell by 19% compared to the previous month.

-

Meanwhile, Nintendo Switch saw a sales increase of 39%; Xbox Series S|X showed a growth of 6%.

-

2.07 million accessories were sold in December. This is 63% more than in November (thanks to the holiday season) and 10% more than the previous year. DualSense, as always, is the sales leader.

Hogwarts Legacy sold 22 million copies in 2023

-

Approximately 2 million copies were sold during the New Year holidays.

-

It was previously reported that by the end of March, the game had already sold 15 million copies. The first 12 million were sold within the first 2 weeks.

-

It turns out that between April and the end of November, 5 million copies of the game were sold. Not bad.

It would be correct to compare Hogwarts Legacy with other large launches. GTA V sold 34 million copies in its first year. The Legend of Zelda: Tears of the Kingdom, released in May of this year, sold 19.5 million copies by the end of September. Therefore, despite impressive figures for the year, Hogwarts Legacy did not set any records.

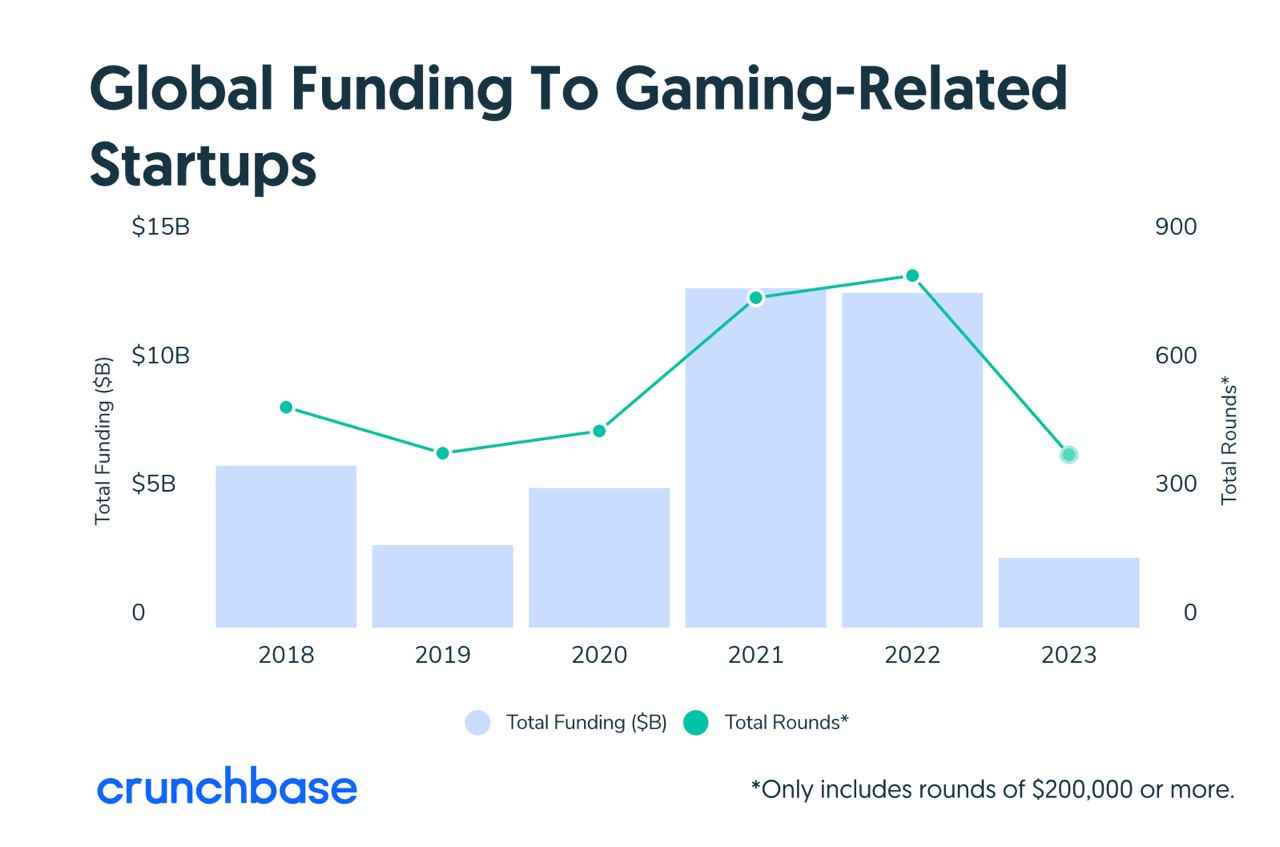

Crunchbase: Investments in gaming startups at venture stages in 2023 reached a minimum since 2018

Crunchbase considered all stages in the statistics until the company went public or was acquired by a strategic investor.

-

The total funding volume in 2023 at the early stages amounted to $2.71 billion, compared to $13.03 billion in 2022. This is a 79% decrease.

-

The number of deals decreased by half, from 824 in 2022 to 403 in 2023. Rounds larger than $200 thousand were taken into account.

-

In 2023, there were no deals with venture investors exceeding $100 million. In 2022, for example, there was a $2 billion round from Epic Games. Additionally, thatgamecompany raised $160 million in a Series D round.

The situation in the US market

-

The investment volume decreased to $0.93 billion from $6.86 billion in 2022, an 86% drop.

-

The number of deals fell from 281 in 2022 to 146 in 2023.

Overall market situation

-

Crunchbase notes that the year was not bad for the entire industry. Take-Two Interactive Software, Electronic Arts, Nintendo, and Sony ended the year with stock values higher than at the beginning of the year. Microsoft completed a deal with Activision Blizzard. It is more accurate to describe the situation not as a market crisis but as a market entry crisis—it is challenging to compete with big players.

-

There is a slight consolation in all of this. According to Crunchbase, 2023 was so bad that it will not be difficult to surpass it in 2024.

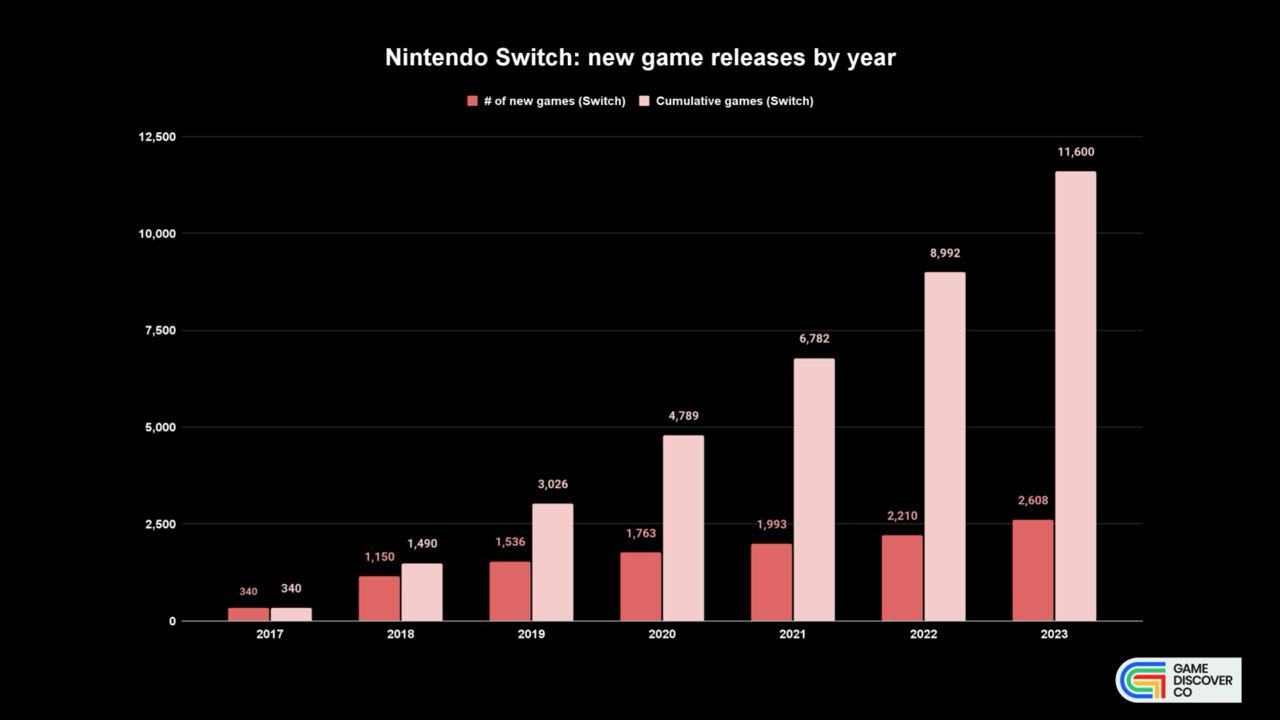

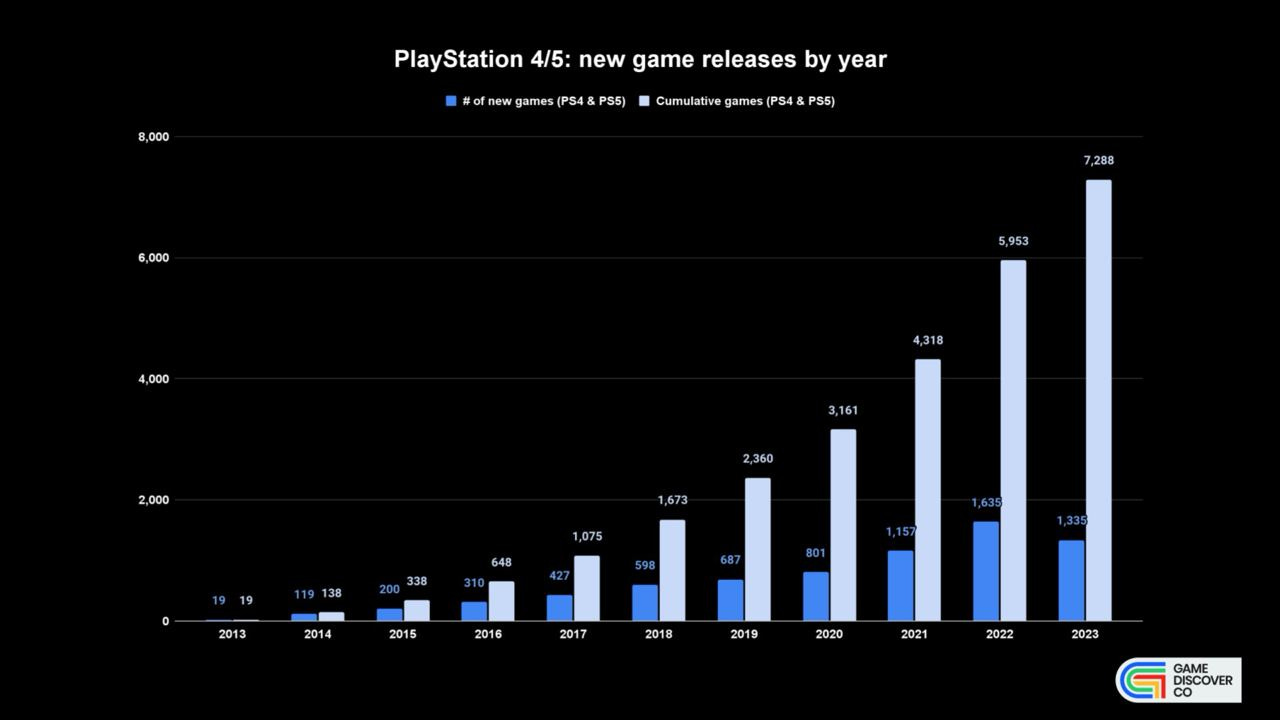

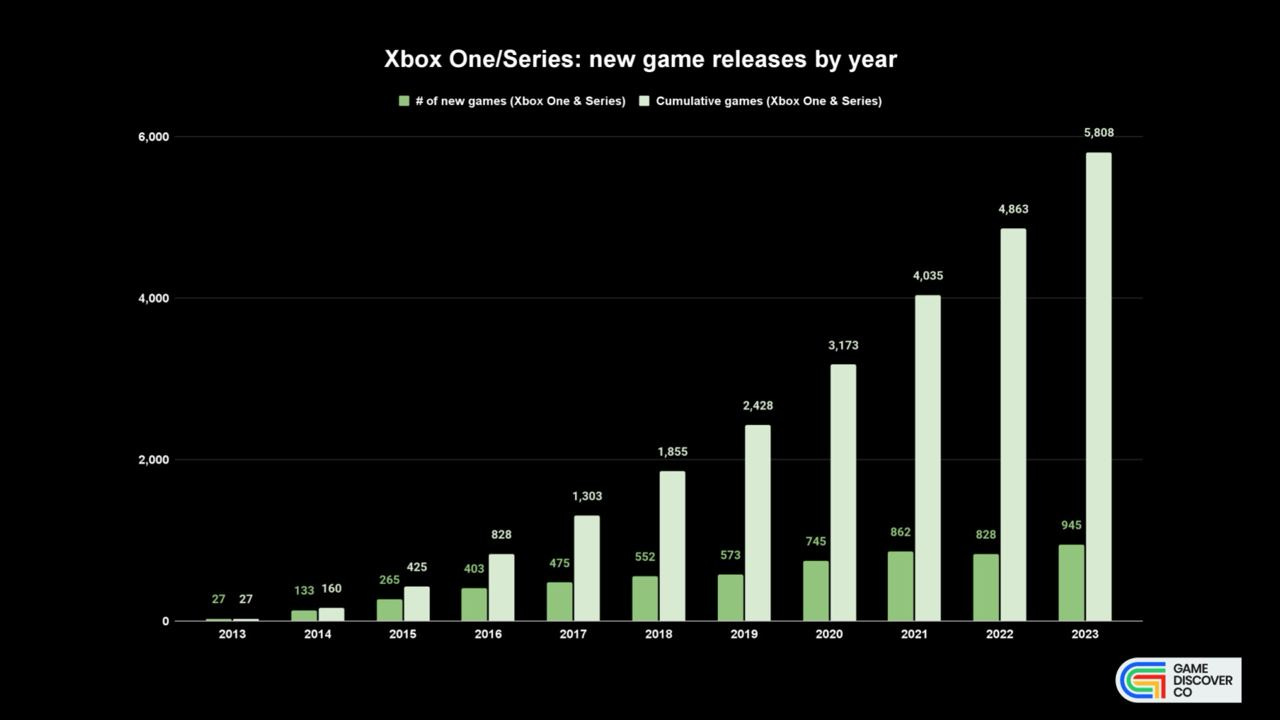

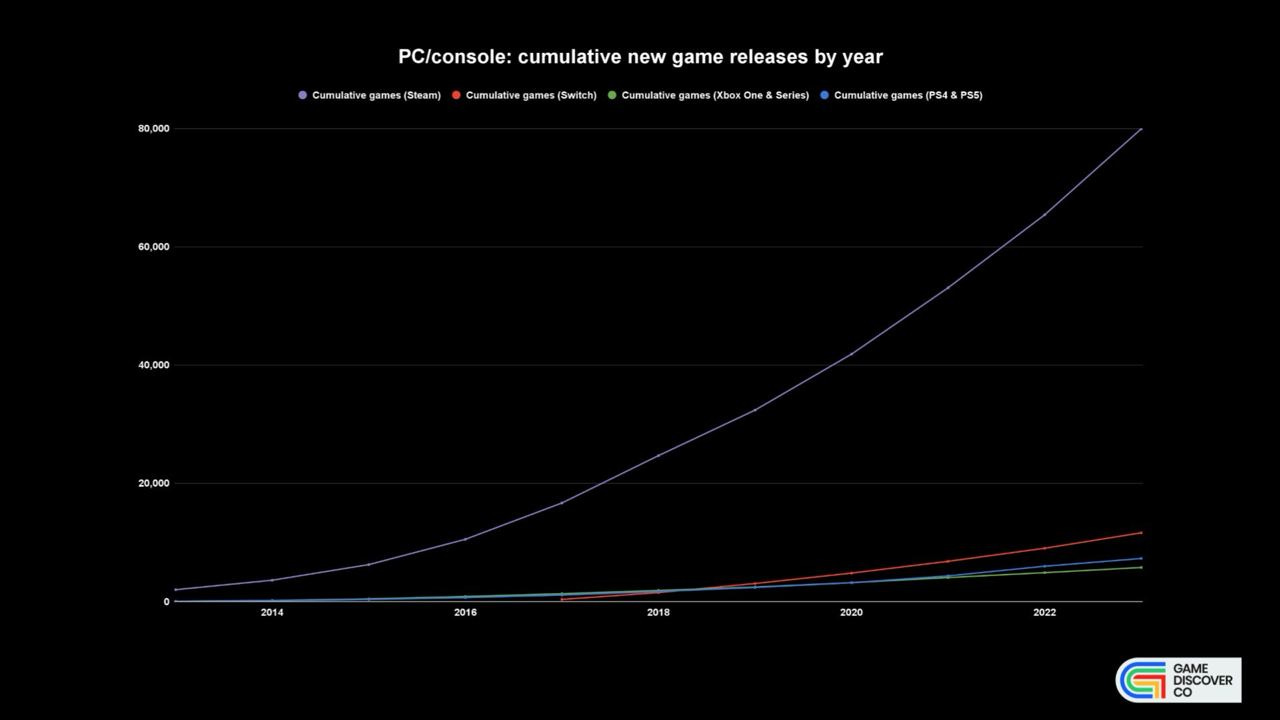

TheGameDiscoverCo: Game Catalogs on PC and Gaming Consoles in 2023

Simon Carles from GameDiscoverCo analyzed the number of games available to players on different platforms at the end of 2023.

-

The current game catalog on Steam counts 79,919 games. In 2023, 14,535 new projects were released - a new record for the platform.

-

The number of games on Nintendo Switch is 11,600. Of these, 2,608 projects were released in 2023.

-

On PlayStation 4 and 5 at the end of 2023, there were 7,288 games, 1,335 of which were released in 2023. Sony's platform is the only one where fewer games were released in 2023 than in 2022 (1,335 compared to 1,635).

-

Owners of Xbox One and Xbox Series S|X had access to 5,808 games at the end of 2023. 945 of them were released in 2023.

-

As seen from the graph, Steam is far ahead of all platforms in terms of the number of games. This is explained by the fact that releasing a game on Steam is the easiest.

Several conclusions

-

More games mean more competition. By releasing a new game, you compete not only with new projects but also with all other games released on the platform. Many of them already have a lot of content and public recognition.

-

Nintendo Switch gained popularity among indie developers in 2018-2019. Looking at the graphs, it can be seen that the number of games on the platform was small, making it much easier to stand out (and earn). Those times have passed. The console's audience still loves indie games, but available marketing channels need to be utilized.

-

The back catalog of large and medium-sized companies is growing, and revenue from it is increasing, but the average sales volume per project is decreasing. I assume this is due to increased competition and the need to offer significant discounts on games.

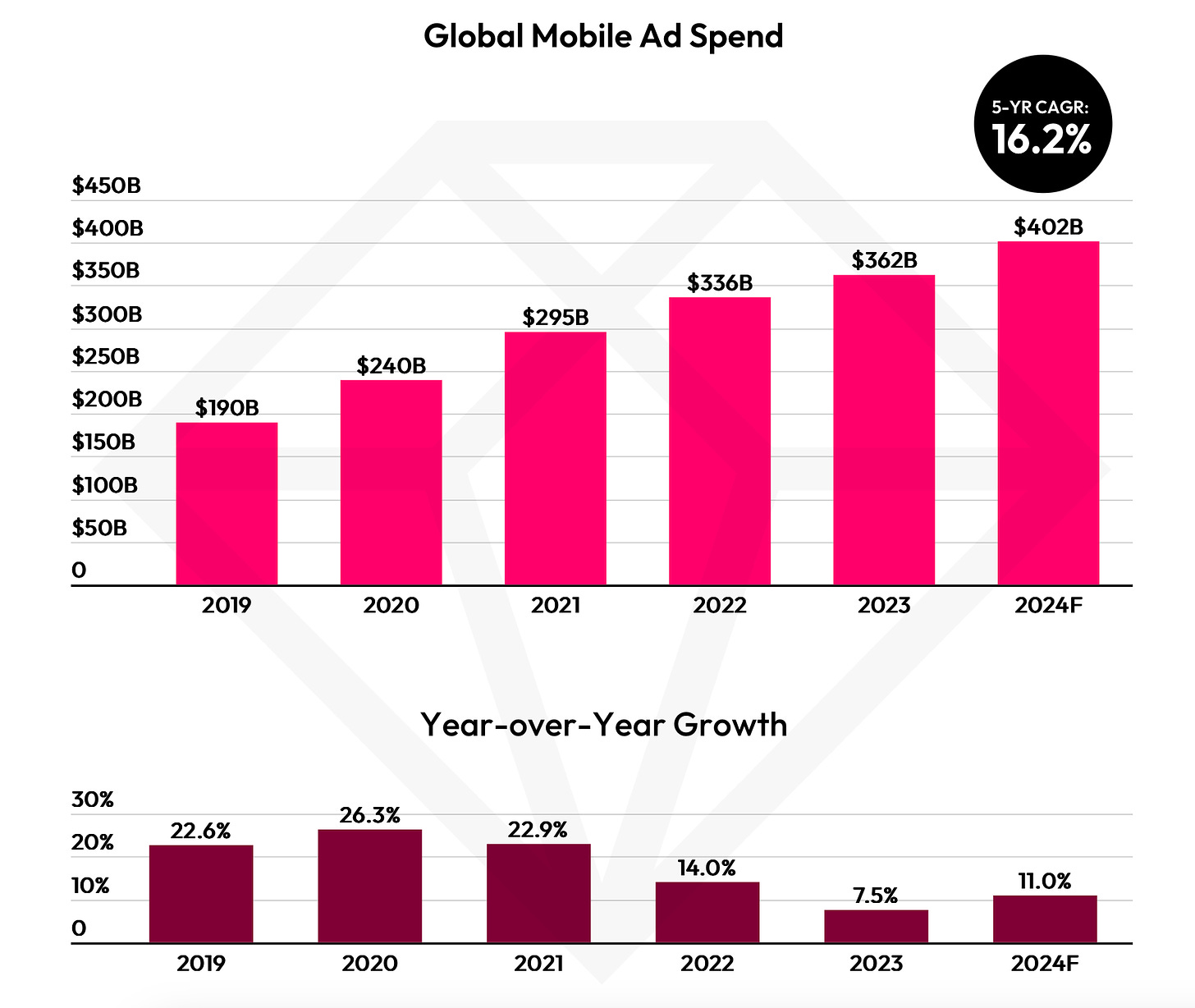

data.ai: Mobile Gaming Market in 2023 (State of Mobile 2024)

Overall Mobile Market state

-

In 2023, users spent $171 billion on mobile applications, which is 3% more than the previous year.

-

Apps were downloaded 257 billion times, a 1% increase compared to 2022.

-

Spending on mobile advertising reached $362 billion, an 8% increase from the previous year.

-

Users spent 5.1 trillion hours in mobile apps on Android alone, marking a 6% increase from the previous year.

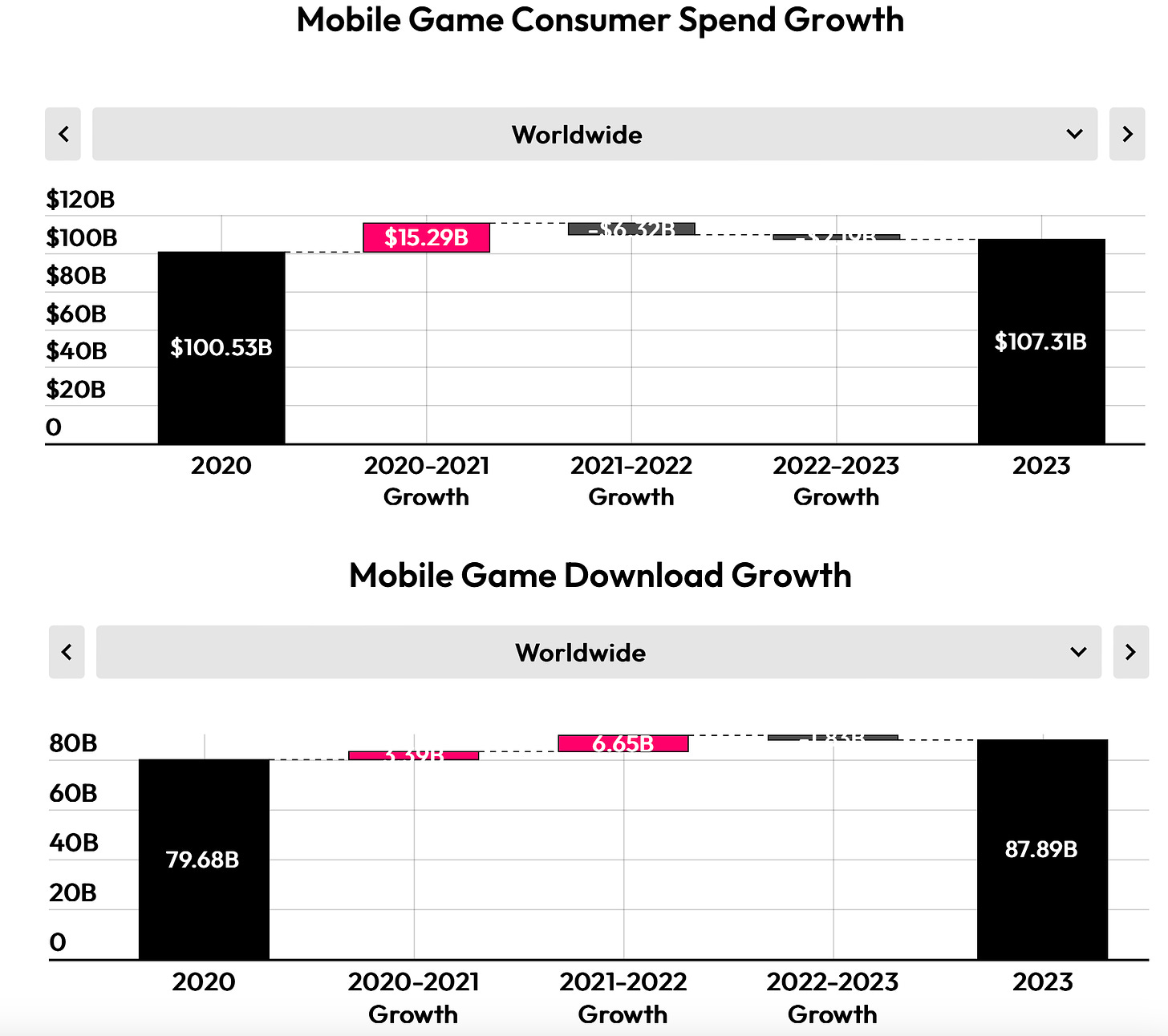

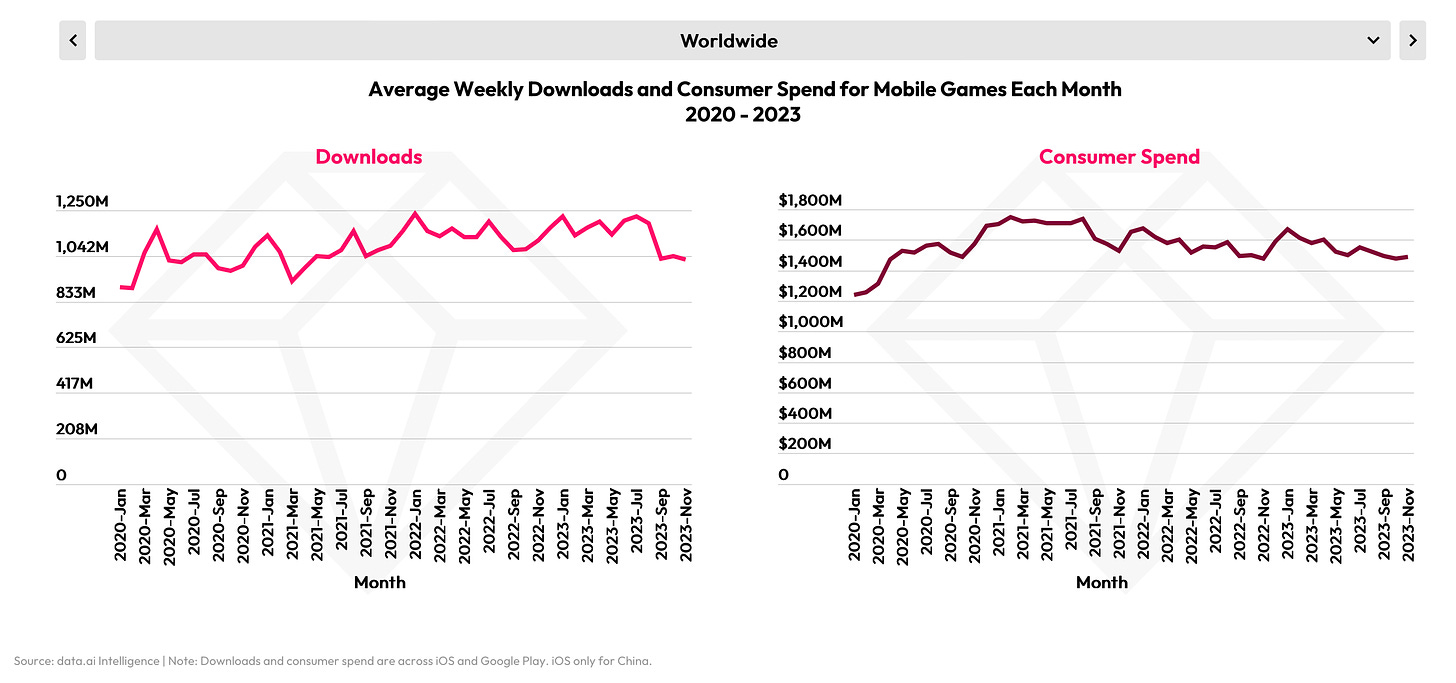

State of the Mobile Gaming market

-

Revenue from mobile games in 2023 decreased by 2% to $107.3 billion.

-

The overall decline is strongly tied to a decrease in the Chinese market by $4.62 billion. Revenue in the U.S. remained stable, with a slight decrease in Japan. There was growth in the South Korean markets, Latin American markets, and several Western European countries (United Kingdom, France, Germany).

While it is common to talk about a crisis in the mobile market, it's important to consider a few things. Firstly, part of the revenue has shifted from mobile stores to alternative payment methods. Secondly, an increasing number of games are being released on the web and PC. Thirdly, the decline reported by data.ai is primarily due to the Chinese market, represented only by iOS within the scope of the data.ai research. This does not mean there are no challenges, but examples from miHoYo, Scopely, Century Games show that great results can be achieved.

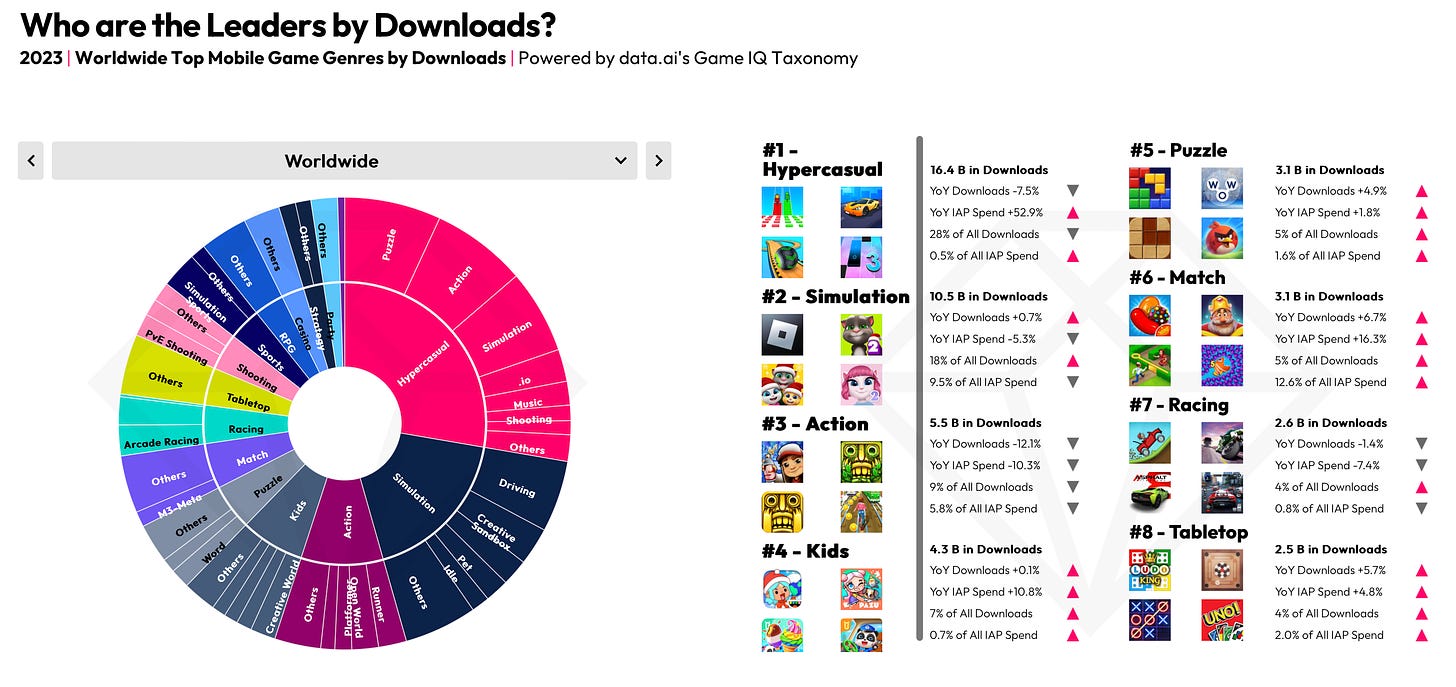

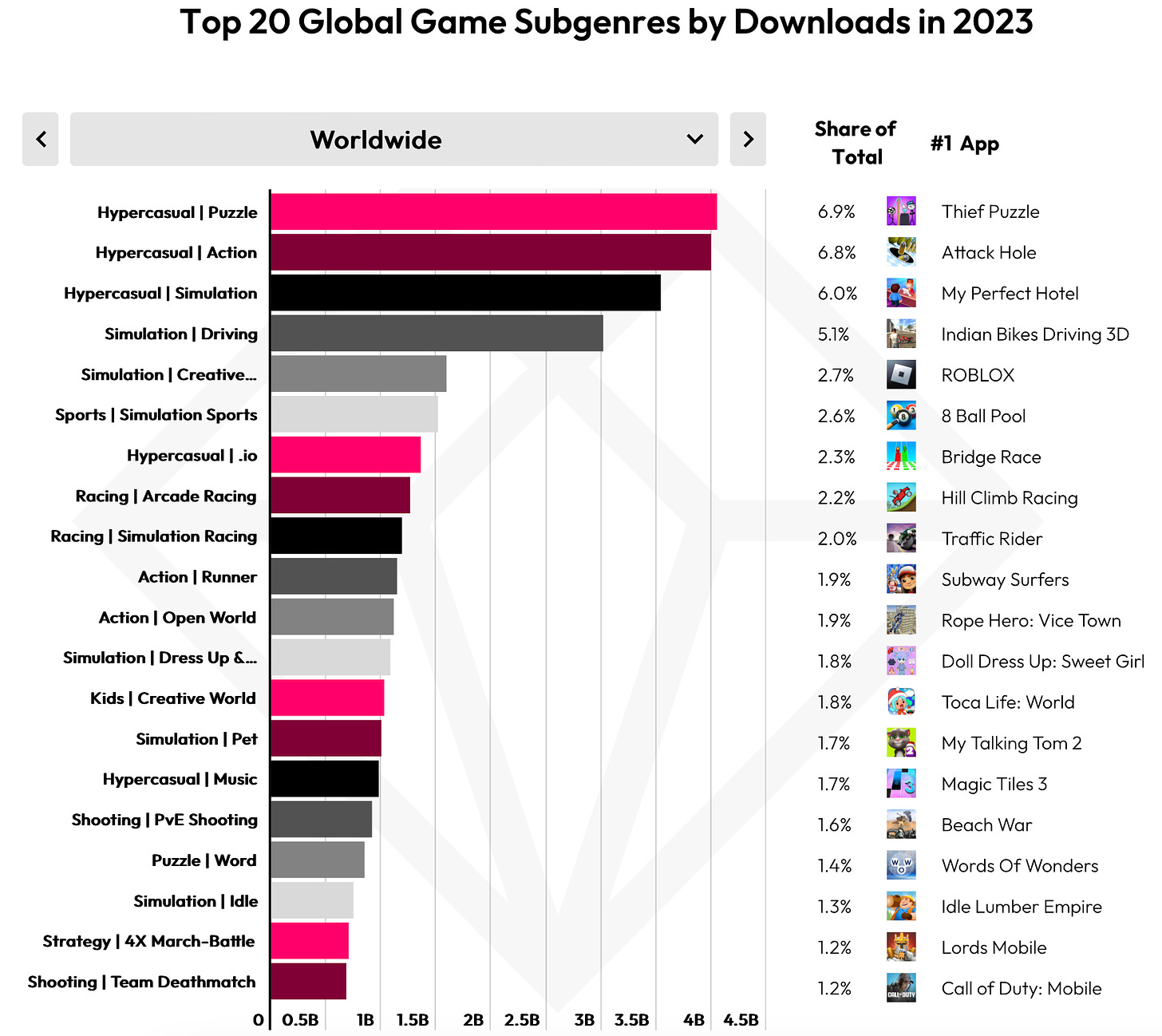

Gaming Mobile Market - Downloads

-

Hyper-casual projects lead in downloads, accounting for 28% of the total volume. In 2023, 16.4 billion hyper-casual projects were downloaded, which is 7.5% less than the previous year. However, the genre saw a 52.9% growth in In-App Purchase (IAP) revenue (now contributing 0.5% of the total IAP market).

-

Simulators rank second with 10.5 billion downloads (18% of the total - a 0.7% increase from 2022). This category includes games like Roblox and My Talking Tom. Simulators account for 9.5% of the total IAP payments, a decrease of 5.3% from 2022.

-

Action games are in third place with 5.5 billion downloads (9% of the total - a 12.1% decrease from 2022). In terms of IAP payments, the genre declined by 10.3% in 2023, now representing 5.8% of the total IAP market with games like Subway Surfers.

-

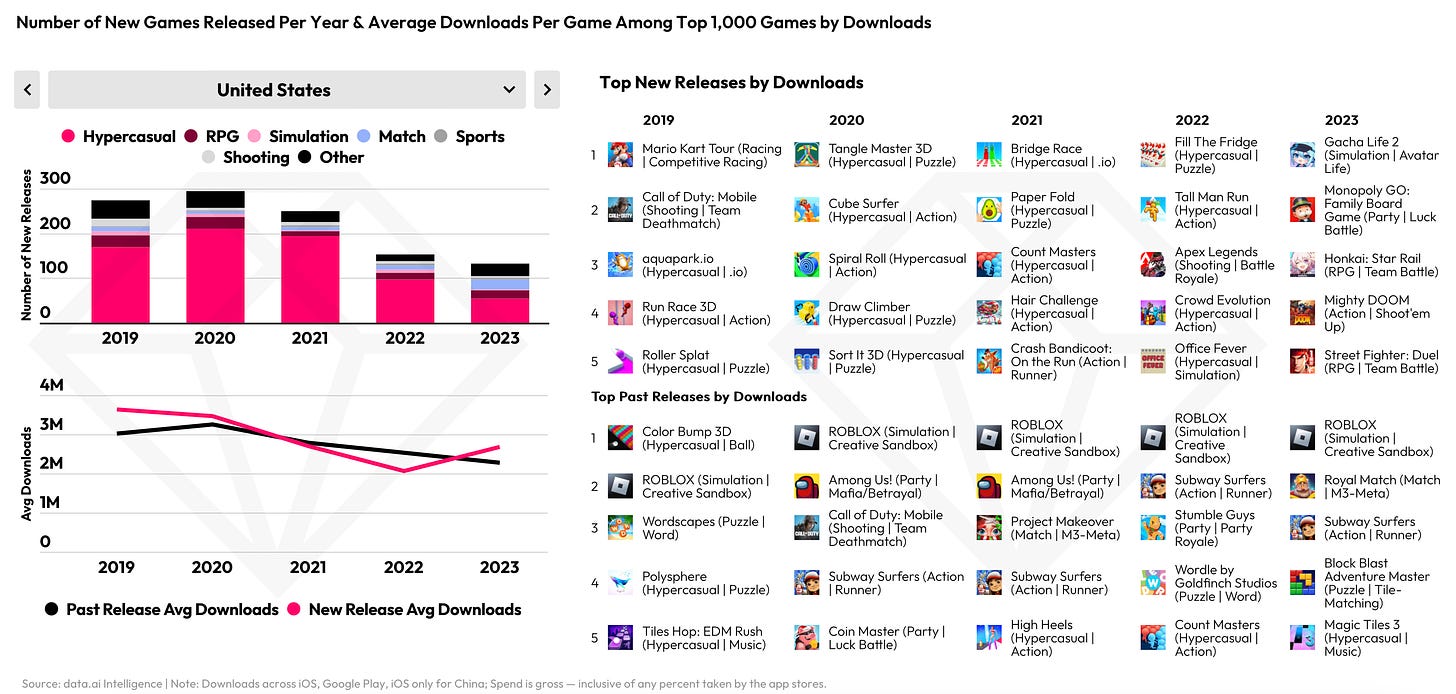

Thief Puzzle, Attack Hole, and My Perfect Hotel were leaders in 2023 in their subgenres.

-

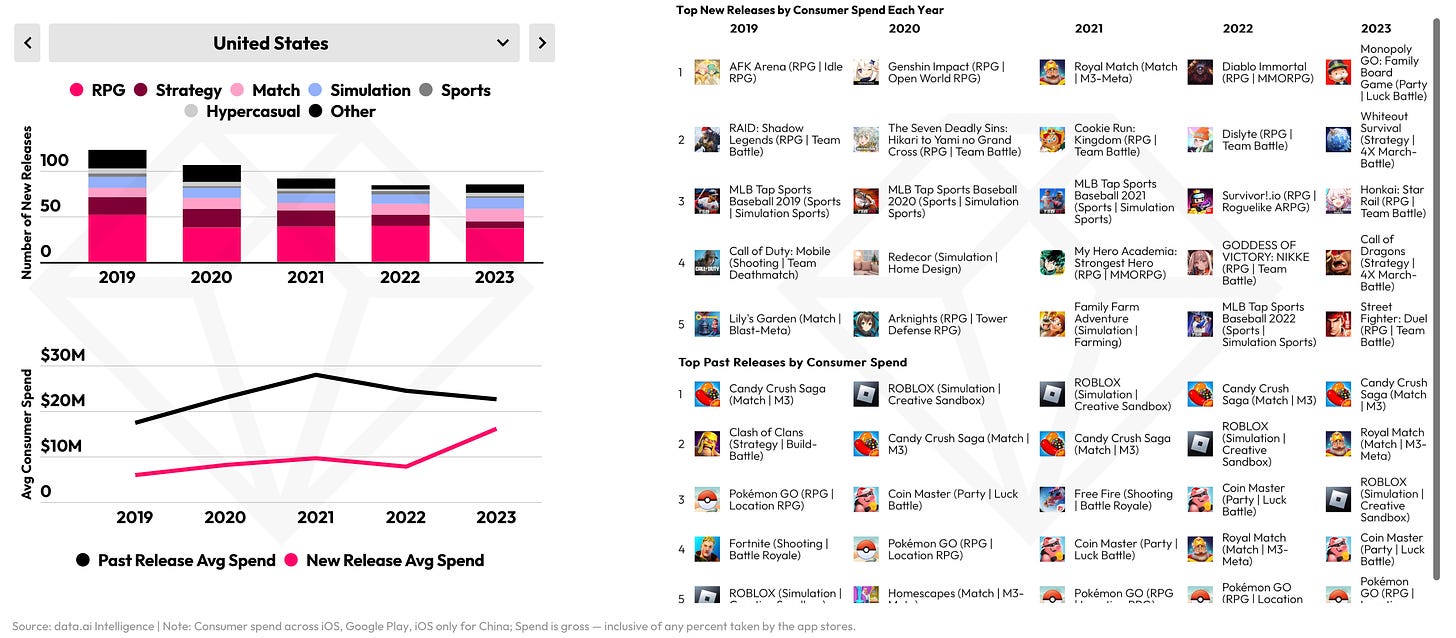

data.ai notes that in 2023, the number of new projects in the top 1000 by downloads was the lowest since 2019.

-

However, until 2020, the average download volume of new games exceeded that of existing projects. In 2021-2022, the situation changed, with older projects generating more downloads on average. But in 2023, the situation has reversed again, and new games are attracting installations.

While a more detailed view is necessary, the fact that new games, on average, are getting more downloads than old ones is a positive sign, indicating people are willing to try new products.

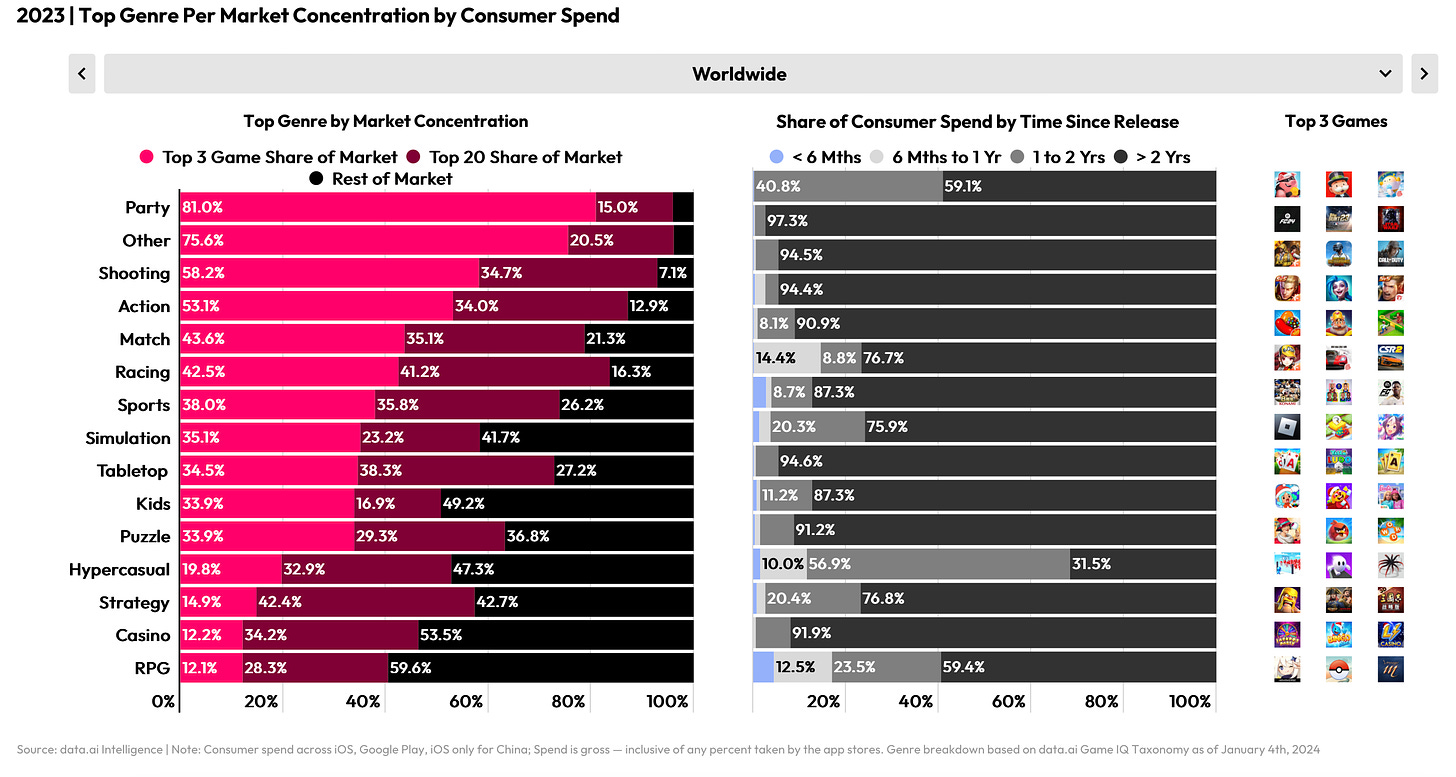

-

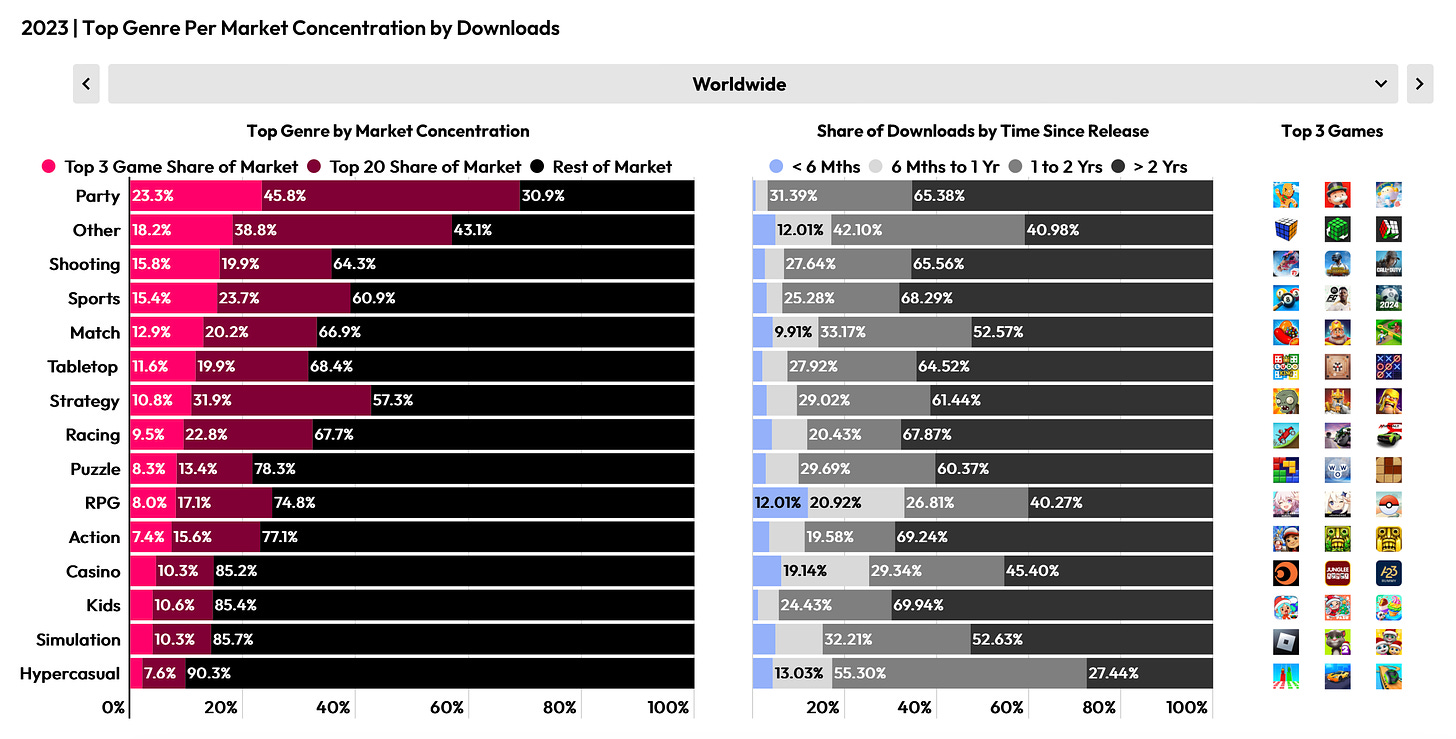

Party games (23.3% of top 3 downloads), shooters (15.8% of top 3 downloads), and sports games (15.8% of top 3 downloads) are the most challenging genres in terms of competition, if we consider only downloads. Interestingly, in all three genres, 65%+ of downloads are from users who installed games 2 or more years ago.

-

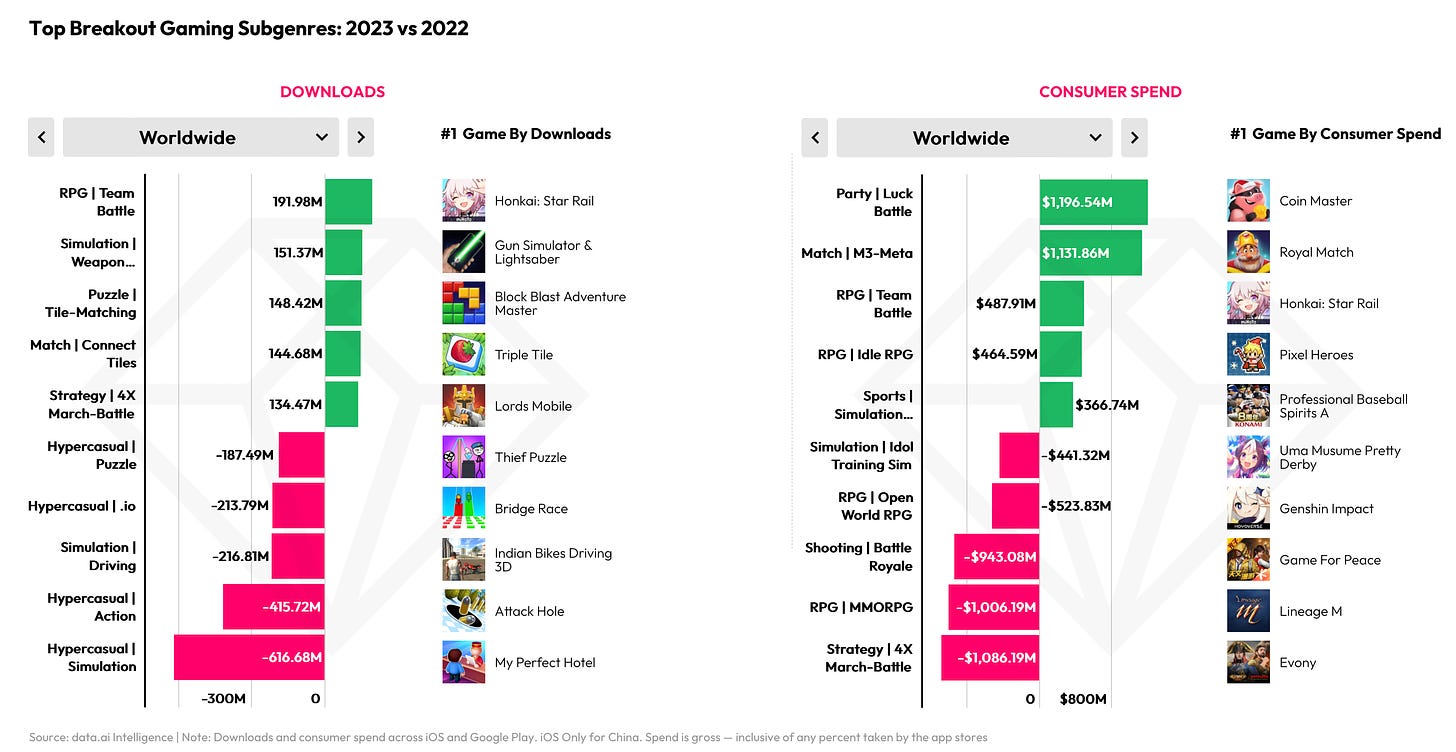

In 2023, RPGs (Team Battle) showed the strongest growth in downloads, thanks to Honkai: Star Rail (+191.98 million downloads).

Gaming Mobile Market - Revenue

-

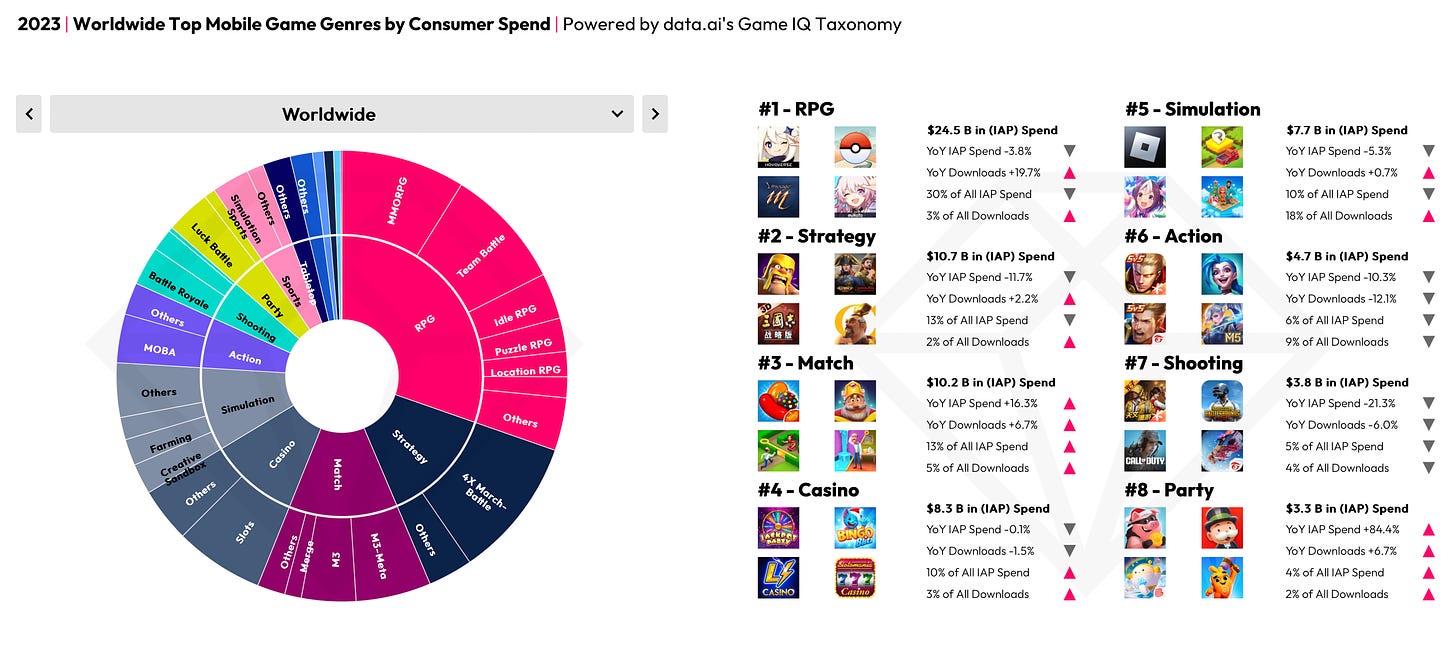

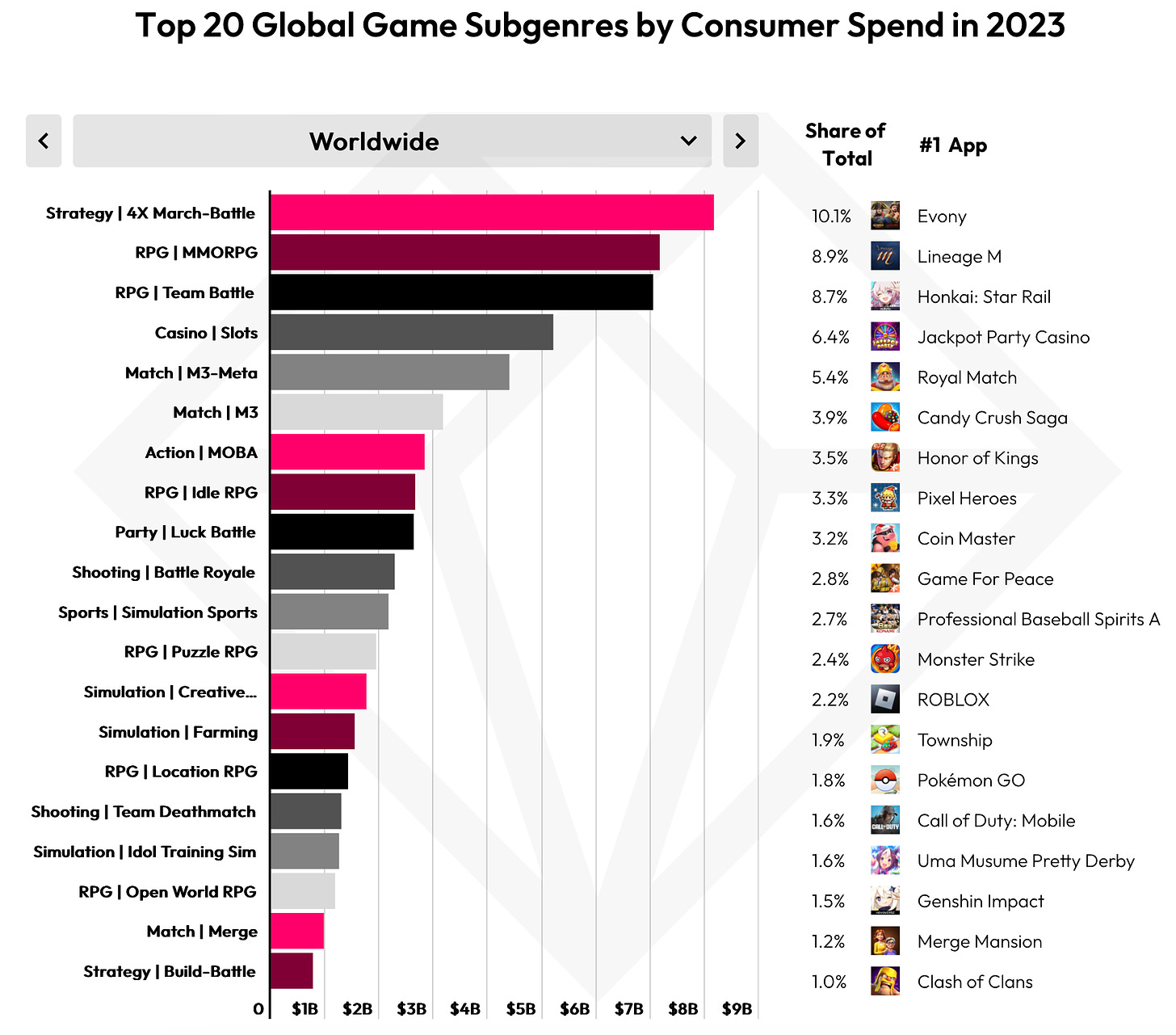

RPG is the most profitable genre globally, bringing in $24.5 billion in 2023. It represents 30% of the entire IAP market, but it experienced a 3.8% decline from the previous year. However, in terms of downloads, the genre grew by 19.7%, accounting for 3% of the market share.

-

In 2023, strategies earned $10.7 billion, securing the second position. The genre accounts for 13% of the total IAP market, with a 11.7% decline in revenue in 2023. Nevertheless, in terms of downloads, the genre grew by 2.2%, holding a 2% market share.

-

Match projects secured the third position with $10.2 billion. The genre is growing in all aspects; IAP revenue increased by 16.3% (13% of the total volume), and downloads grew by 6.7% (5% of the total volume).

-

Evony, Lineage M, and Honkai: Star Rail were leaders in 2023 in their respective categories.

-

The number of new games entering the top 1000 by revenue in 2023 reached the minimum since 2019, with a slight decline compared to 2022 (and in some markets, no decline at all).

-

However, the average revenue of new projects compared to old ones shows growth in many markets - the U.S., Canada, the UK, South Korea. This indicates that new projects entering the top 1000 are approaching revenue figures of old projects with more content and active Live-ops.

In 2023, many high-earning projects were released, including Monopoly GO!, Whiteout Survival, Honkai: Star Rail, and more. Importantly, new games are managing to collect both audience and revenue. Comparing this with the download data provided by data.ai earlier, it can be concluded that users are ready for new projects.

- The most challenging genres in terms of revenue competition are party-games (81% of revenue shared among the top 3), shooters (58.2% of money going to the top 3 products), and action games (53.1% for the top 3). In the latter two, more than 94% of users are "old" (installed games more than 2 years ago).

An interesting situation emerges. At the time of the release of Monopoly GO!, the party games genre was a "red ocean." Almost all revenue was accumulated by old projects. However, Scopely, through an excellent game, strong IP, and large budgets, entered a very competitive category and found success. The question is, in fact, complex. Many teams, when choosing a genre for a new project, are afraid to compete with "heavyweights" - and this risk is justified. But the graph above shows that in the mobile market, there are currently no genres without serious competition. Therefore, it is essential to pay attention to the expertise of the team and what they can, love, and want to do. I believe that quality products - in any niche - even the most crowded - have good chances.

-

The revenue growth leaders in 2023 were party-games (Luck Battle) with +$1.2 billion. Coin Master is the revenue leader in this segment, but the growth is attributed to Monopoly GO!. Match 3 also saw growth with +$1.1 billion (Royal Match being the largest game in the genre).

GSD & GfK: Game sales on PC and consoles in the UK grew by 2.6% in 2023

Analytical platforms report only the actual sales figures obtained directly from partners. The mobile segment is also not taken into account.

Game sales

-

38 million copies of games were sold in the UK in 2023. This is 2.6% more than in 2022.

-

EA Sports FC 24 surpassed Hogwarts Legacy and became the best-selling game of the year in the country. Its sales reached 2.39 million copies (8.4% less than FIFA 23 during the same period). Call Of Duty: Modern Warfare 3 took the third place.

-

The physical copy of Hogwarts Legacy became the best-selling in the UK. Many people surely bought it as a gift (I bought it too).

-

Call of Duty: Modern Warfare 3 sales were 39% worse than the previous installment. Partially, this is due to Modern Warfare 2 being launched in October.

-

All three sales leaders had marketing agreements with PlayStation. More than half of the sales of all three games were on this platform.

-

The biggest new IP of the year (excluding EA Sports FC) is Starfield, ranking 31st on the chart. Last year it was Elden Ring.

-

Disney performed well in 2023. Marvel’s Spider-Man 2 is at the 6th position on the British chart; Star Wars Jedi: Survivor follows immediately.

-

We don't mention Baldur’s Gate III because Larian Games does not share sales information. But the game is definitely in the top 10.

Console and accessory sales

-

2.38 million consoles were sold in the UK in 2023. This is 9.4% more than the previous year.

-

PlayStation 5 sales soared by 55.2% compared to the previous year. This is the best year for PS on the market since 2014.

-

Interestingly, PS4 sales also grew by 633% compared to 2022.

-

Nintendo Switch is the second console in the UK. Its sales in 2023 decreased by 16.7%.

-

Xbox Series S|X is in third place. System sales fell by 14.2%.

-

Over 9 million accessories were sold in the UK in 2023. This is 4.5% less than the previous year.

Game sales Round-up (01.01.2024 - 16.01.2024)

-

Cyberpunk 2077: Phantom Liberty has surpassed the 5 million copies mark. The main game has over 25 million sales.

-

Football Manager 2024 reached 6 million players in less than 2 months after launch. The previous game took 284 days for this achievement. However, the new installment is available on Apple Arcade, Netflix, and Xbox Game Pass.

-

Dave the Diver has sold over 3 million copies. The developers are currently working on versions of the game for PlayStation and Xbox.

-

Worldwide sales of Monster Hunter: World has reached 23 million copies. In 2021, the game had 17.1 million copies.

-

According to Simon Carless, Warhammer 40,000: Rogue Trader earned $12.6 million in December only on Steam. The game is also available on the Epic Games Store, PlayStation 5, and Xbox Series S|X.

-

Deep Rock Galactic has been purchased over 8 million times since 2018. 2.5 million sales were in 2023. DAU (Daily Active Users) is around 150 thousand; MAU (Monthly Active Users) is around a million. These figures are for the year.

-

House Flipper 2 recouped development costs in 72 hours. The game sold 131 thousand copies, generating $4.3 million in Gross. Developers will receive approximately $2.6 million, considering a 4% refund rate. $2 million was spent on development, and an additional $330 thousand on marketing. At the time of release, the game had 850 thousand wishlists.

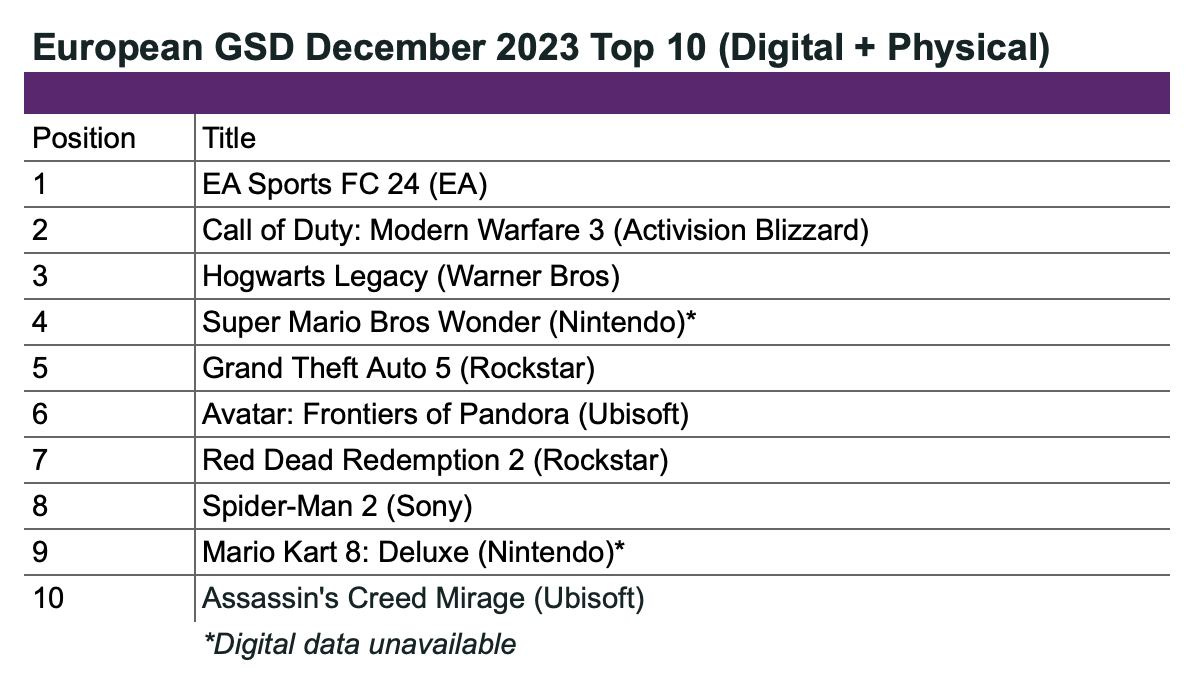

GSD: The European gaming market (PC & consoles) slightly grew in December 2023

GSD reports only the actual sales figures obtained directly from partners. Large publishers, such as Nintendo, do not share sales information for digital copies. The mobile segment is also not taken into account.

Game sales

-

26.6 million games for PC and consoles were sold in December in Europe. Sales increased by 3.6% compared to the previous year.

-

EA Sports FC 24 - with a significant lead, it was the best-selling game in Europe in December. However, the sales of the project were 11.5% worse than those of FIFA 23. However, last year, during this period, the FIFA World Cup took place - and this affected the sales.

-

Call of Duty: Modern Warfare III - ranked second in sales. In third place is Hogwarts Legacy.

-

Avatar: Frontiers of Pandora started from the 6th position. Its sales are half of Assassin’s Creed Mirage, released in October. Considering the production cost, the project's success depends on its performance in the long term.

Console and Accessory sales

-

1.27 million consoles were sold in Europe (excluding Germany). This is 16% more than the previous year.

-

PlayStation 5 sales increased by 66% compared to the previous year. Sony's console is a confident leader in sales.

-

Nintendo Switch is in second place with a 7% decline from the previous year; Xbox Series S|X is in third place with a 19% decline.

-

3.5 million accessories were sold in December in Europe. This is 11% more than in December 2022.

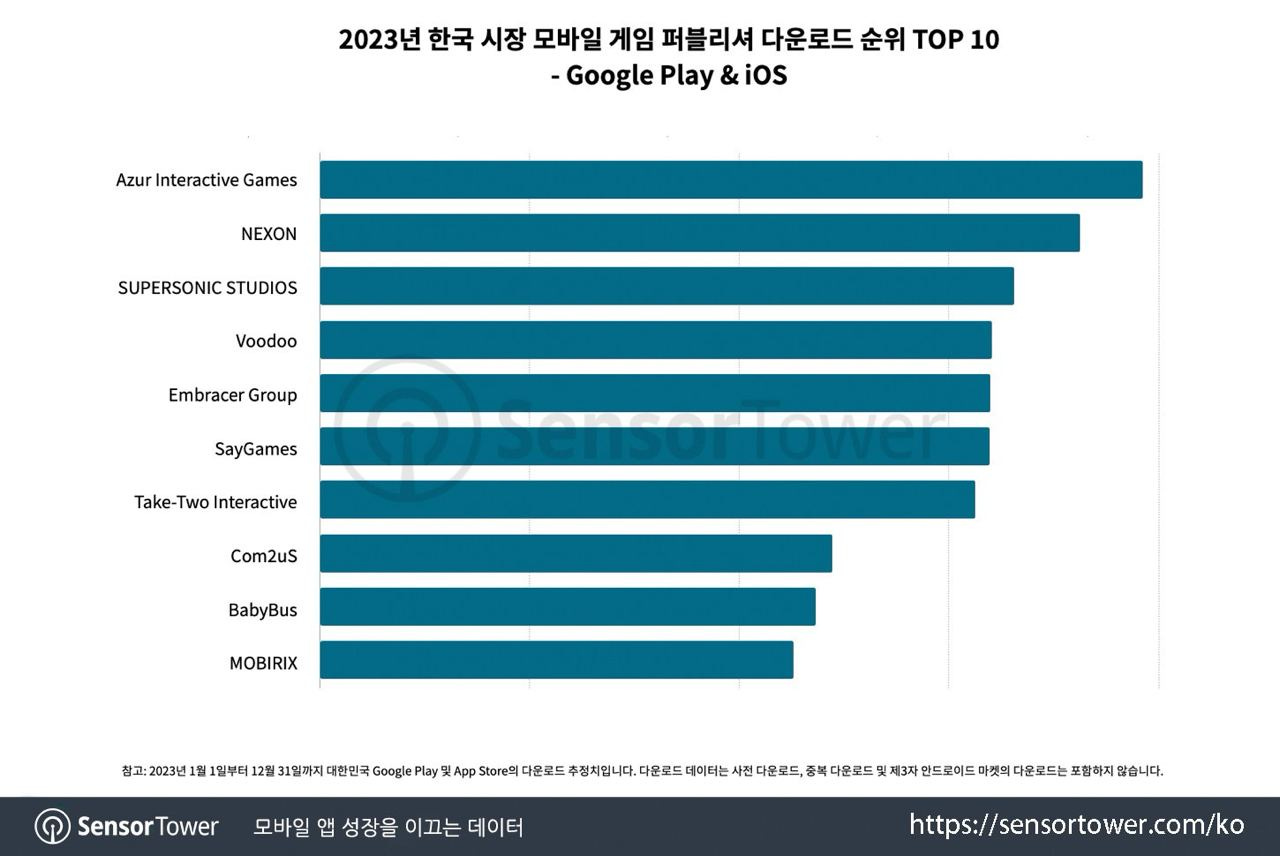

Sensor Tower: Mobile Publisher Ranking in South Korea in 2023

Download Ranking

-

Azur Interactive Games, NEXON, Supersonic Studios - the top three publishers by downloads in South Korea.

-

Half of the publishers in the top 10 focuses on hyper-casual and hybrid-casual games.

-

In 2022, there was only one Korean publisher in the download ranking - NEXON. In 2023, Com2uS and MOBIRIX joined them.

-

NEXON showed significant growth in 2023, rising from 8th place in 2022 to 2nd in 2023. FC Mobile and Cart Rider: Drift made the difference.

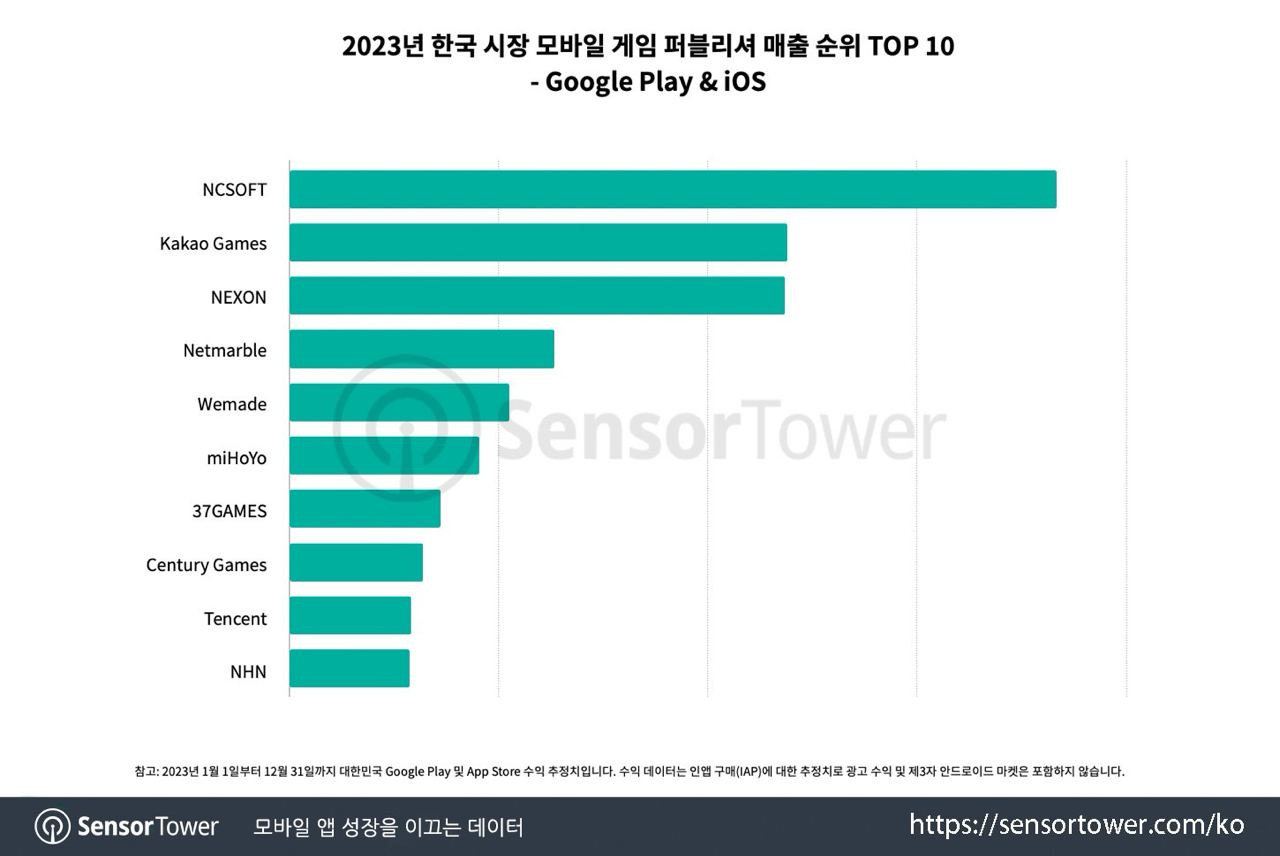

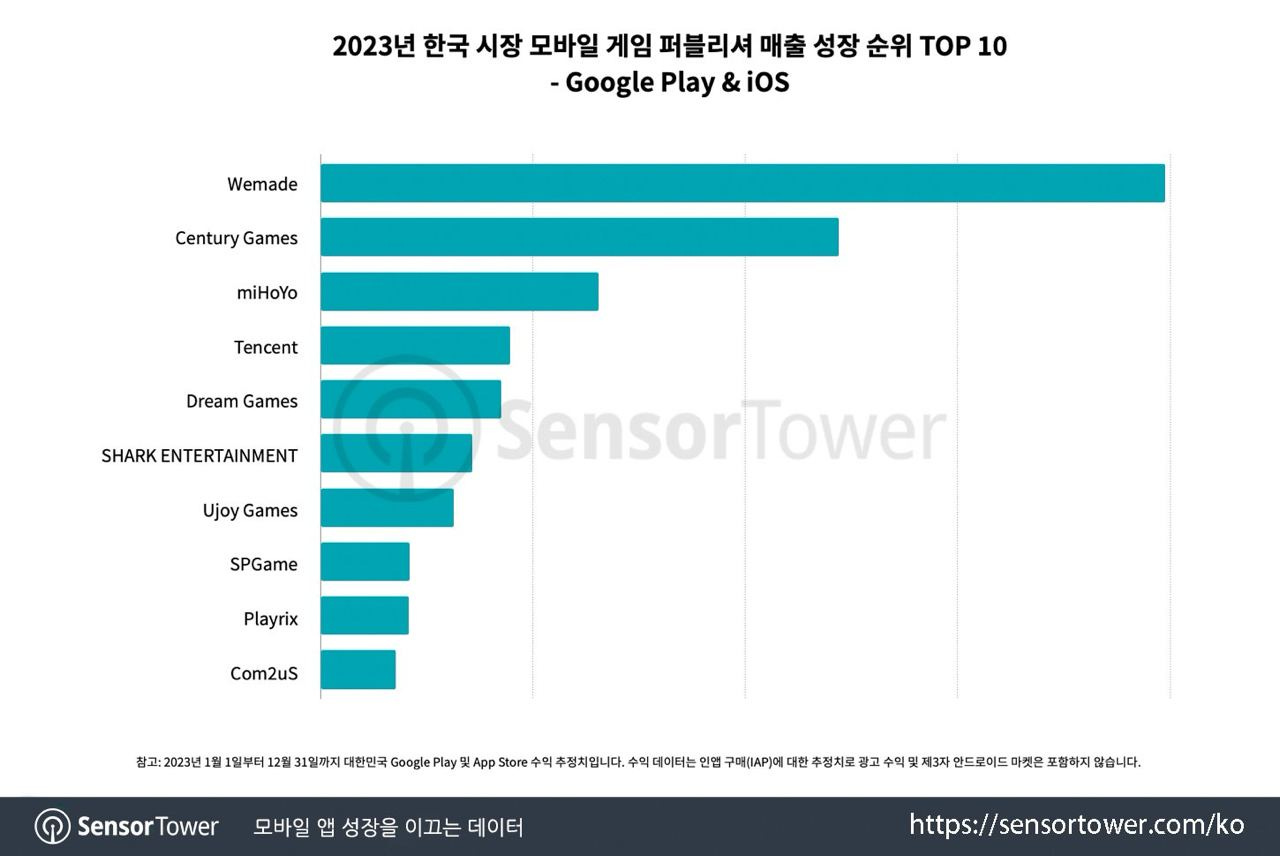

Revenue Ranking

-

NCSOFT, Kakao Games, and NEXON - leaders in revenue in the South Korean market with a significant lead.

-

NCSOFT, thanks to Lineage, has held the first position since 2018.

-

The success of Night Crows allowed Wemade to rise from 25th place in 2022 to 5th in 2023. The game will launch in the West in 2024 and will support Web3 elements.

-

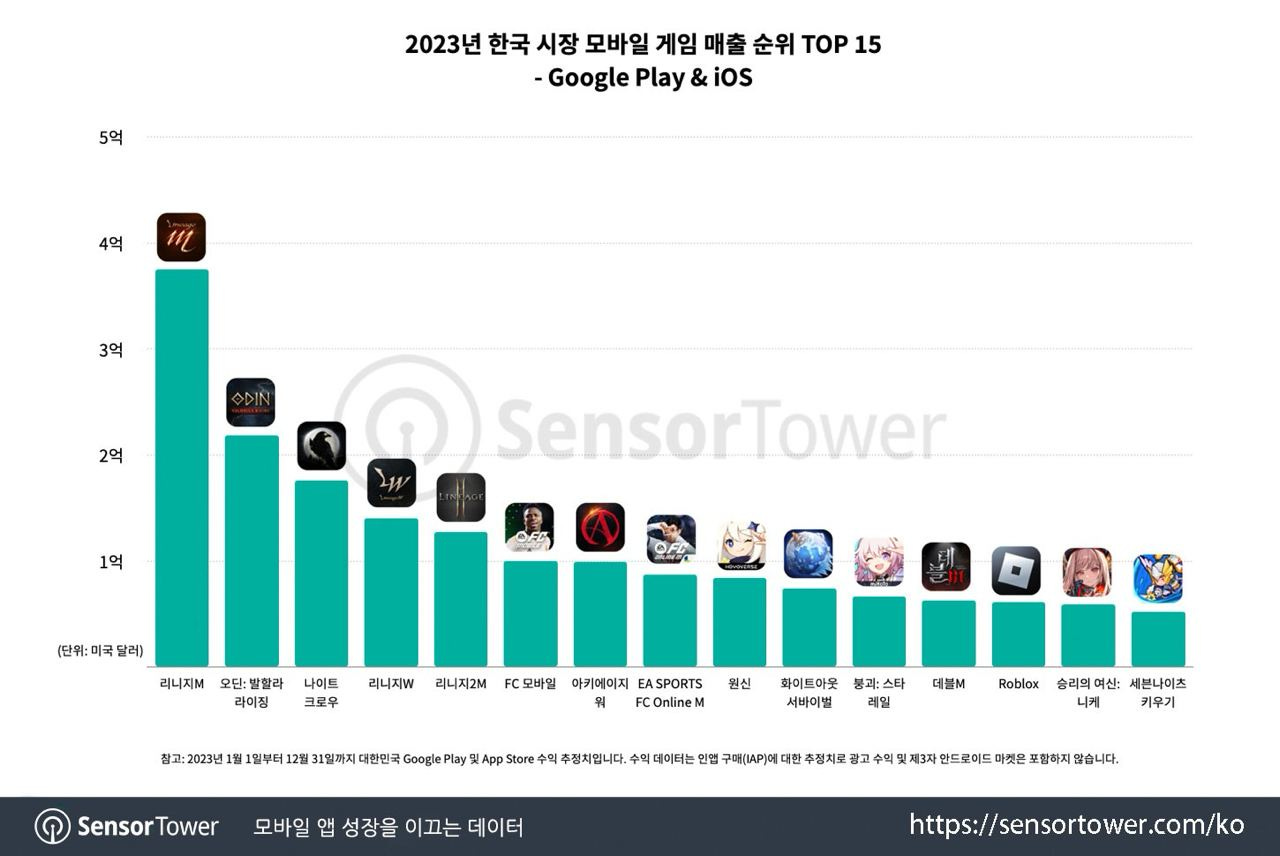

Lineage M; Odin: Valhalla Rising; Night Crows; Lineage W; and Lineage 2M - the top 5 mobile games by revenue in South Korea.

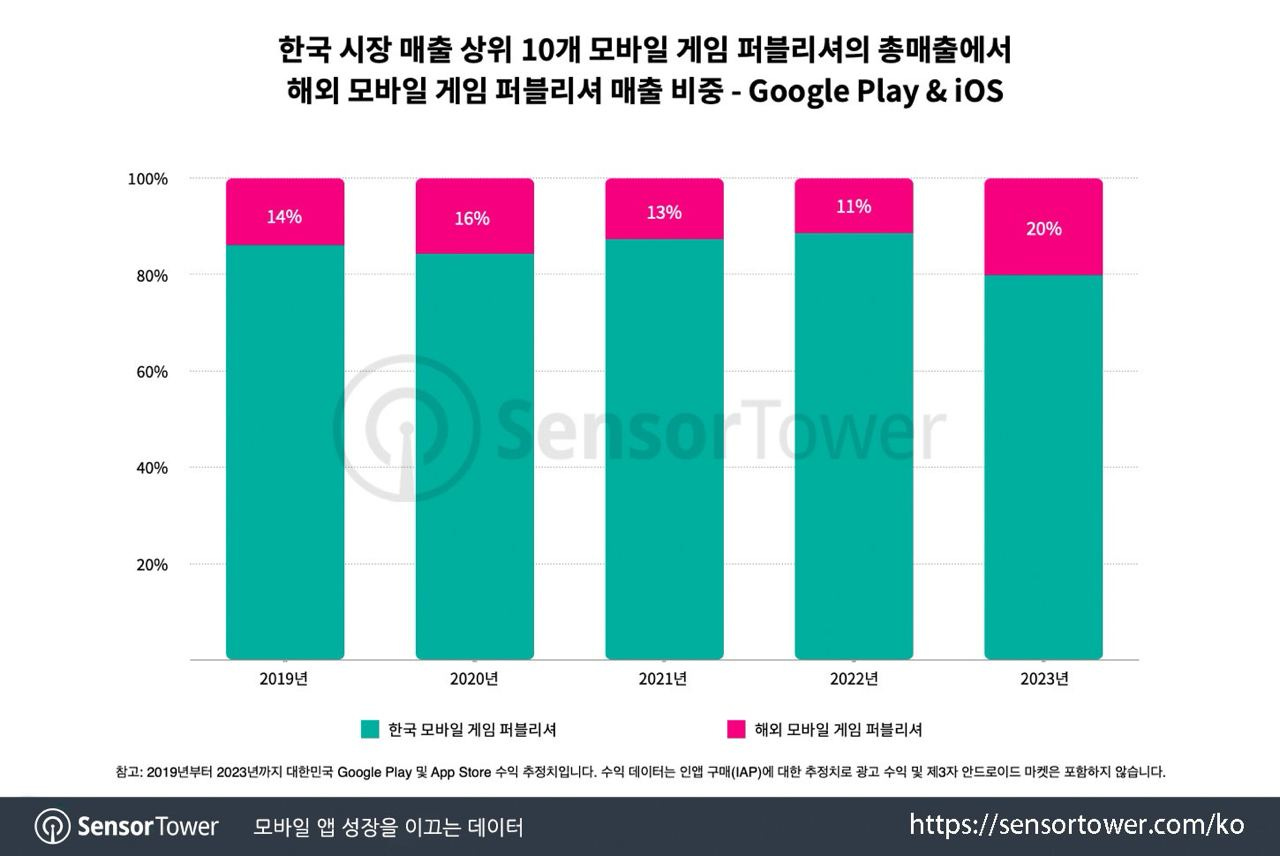

Overseas Publishers in South Korea

-

Four non-South Korean publishers made it to the top 10 by revenue in the country - miHoYo, 37GAMES, Century Games, and Tencent.

-

The share of foreign publishers in the top 10 by revenue in 2023 increased to 20% - the highest since 2019.

- Moreover, considering the growth dynamics, 8 out of the top 10 are foreign publishers. It can be assumed that if this trend continues, they will continue to capture a share of the South Korean market.

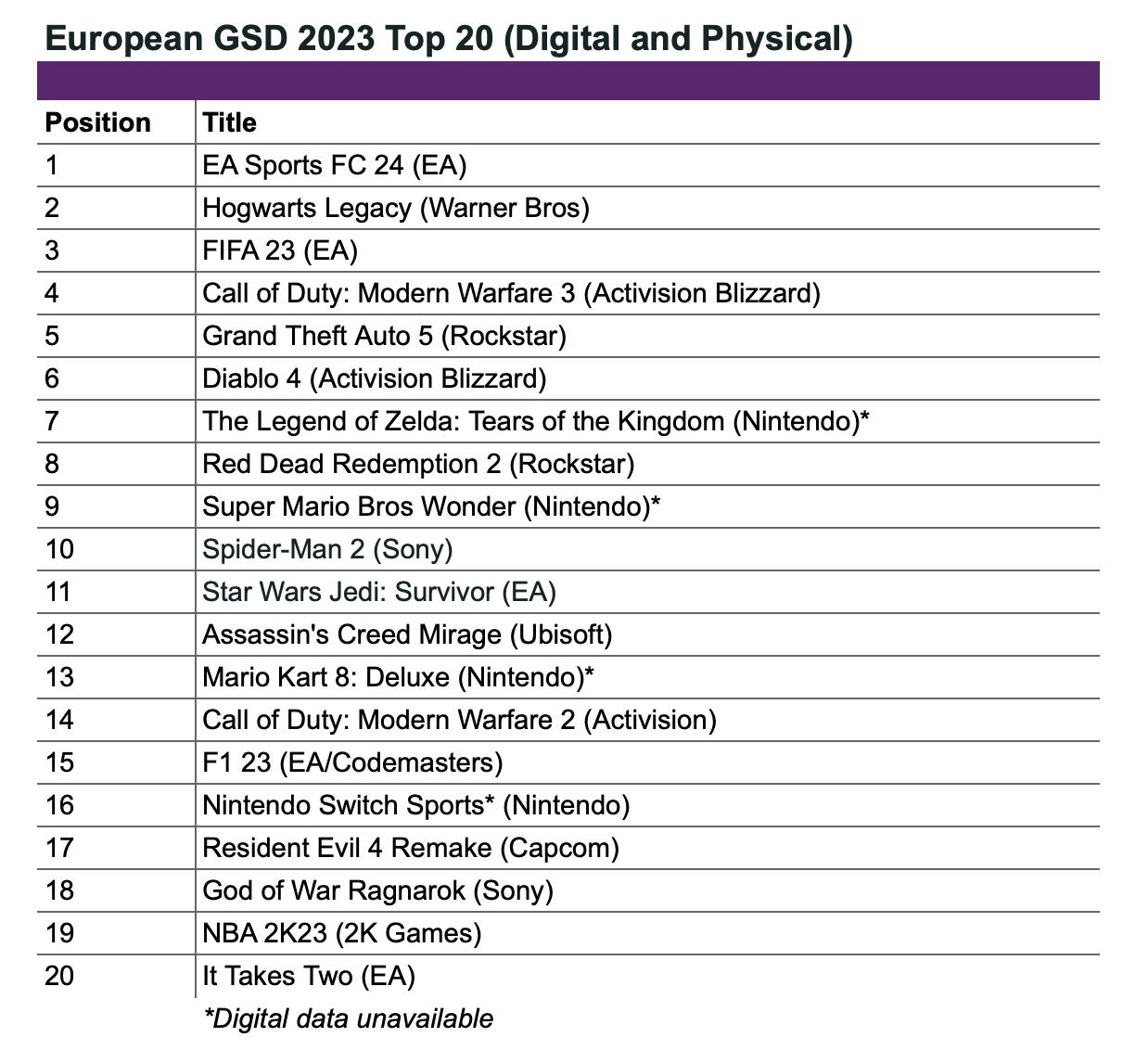

GSD: European PC and Console Market in 2023

GSD reports only on the actual sales figures obtained directly from partners. The mobile segment is not taken into account.

Game sales

-

182 million games for PC and consoles were sold in Europe in 2023. This is 1.7% more than the previous year.

-

EA Sports FC 24 - the sales leader in Europe in 2023. The number of copies sold for the project dropped by 9% compared to FIFA 23 (by the way, the third in sales in 2023); but this is explained by the World Cup held at the end of 2022.

-

Hogwarts Legacy - second in sales in Europe. If you exclude the EA football simulator series, Hogwarts Legacy has sold the most copies in a calendar year since 2017.

-

For the first time in a long time, Call of Duty did not make it to the top 3. Call of Duty: Modern Warfare III ended the year in fourth place, with sales of the new part in Europe being 32% worse than Modern Warfare II.

-

GTA V continues to sell well, with sales figures in 2023 only 1% lower than last year - the game is in fifth place. Red Dead Redemption II showed a 19% growth by 2022 (8th place).

-

34% of all games sold in 2023 were new releases. In 2022, this figure was 35%.

-

In terms of platforms, most games were sold on PC; followed by PlayStation 5, Nintendo Switch, PlayStation 4, and Xbox Series S|X.

-

The largest European markets are the United Kingdom, Germany, France, Spain, and Italy.

Hardware sales

-

7.4 million consoles were sold in Europe in 2023 (excluding Germany). This is 42% more than in 2022.

-

The main reason for the growth is PlayStation 5, with system sales growing by 177% compared to the previous year. It far outpaces competitors.

-

Nintendo Switch sales fell by 10%, making it the second-highest-selling console. Sales of Xbox Series S|X fell by 18% compared to 2022.

-

PlayStation 4 sales in 2023 increased by 671%.

-

20.5 million accessories were sold in Europe in 2023 - a 9% increase—DualSense - the accessory of the year in sales.

PlayStation set an MAU record in December 2023

-

The number of MAUs on PlayStation platforms reached 123 million users. The company announced this at CES 2024.

-

Earlier, PlayStation reported 107 million MAU in September 2023. At that time, they also noted that PS5 owners had higher engagement, constituting just over 40% of the stated quantity.

-

Sony also surpassed the milestone of 50 million PlayStation 5 units sold. The company's goal is to sell 25 million consoles within this fiscal year.

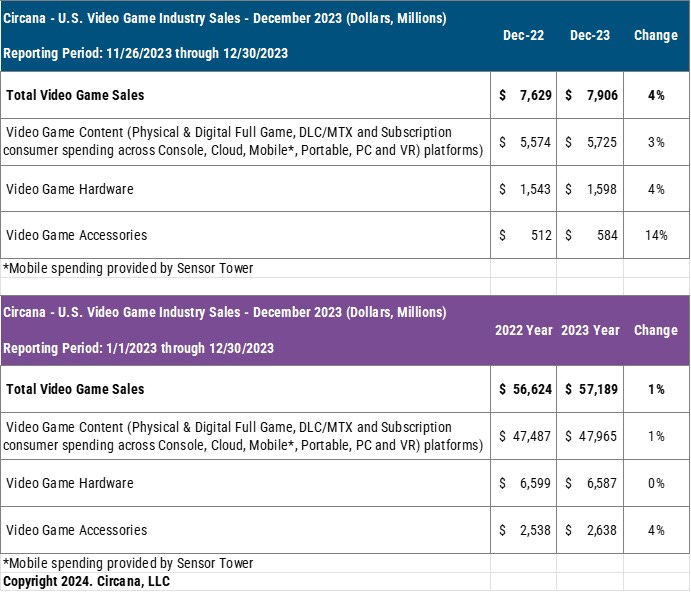

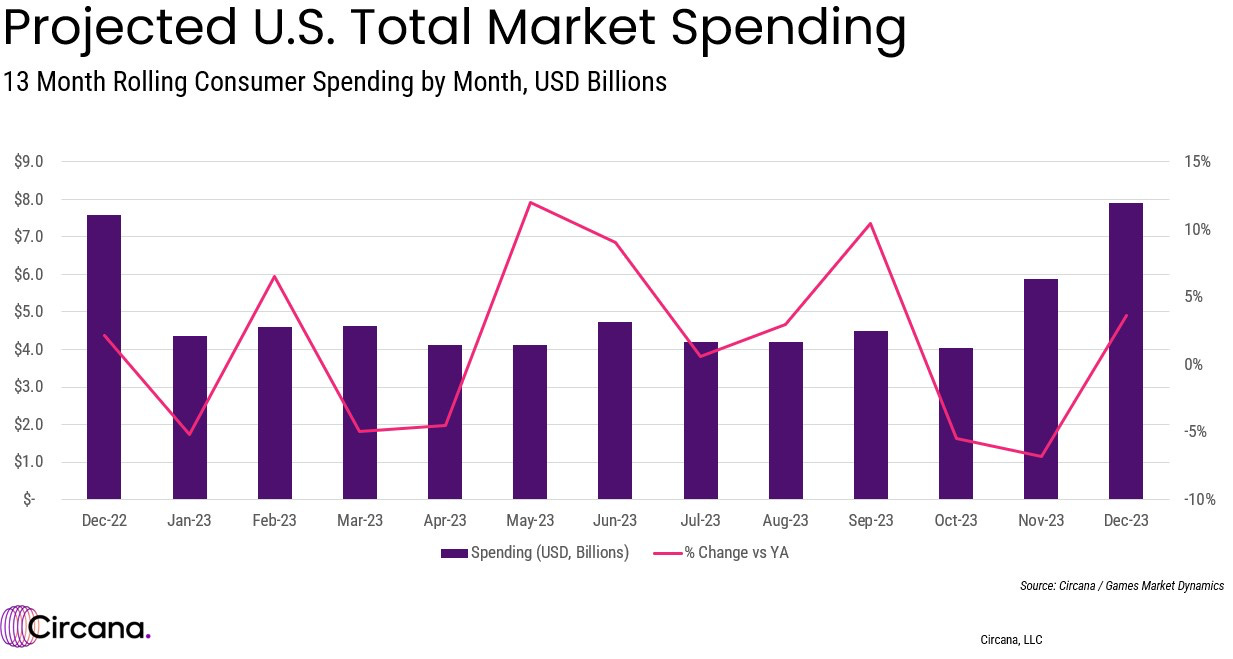

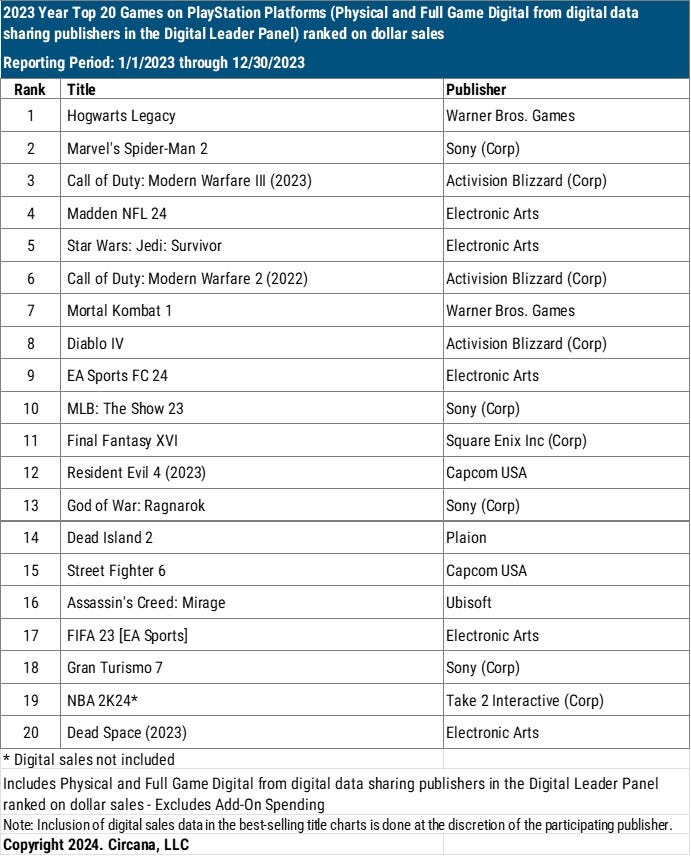

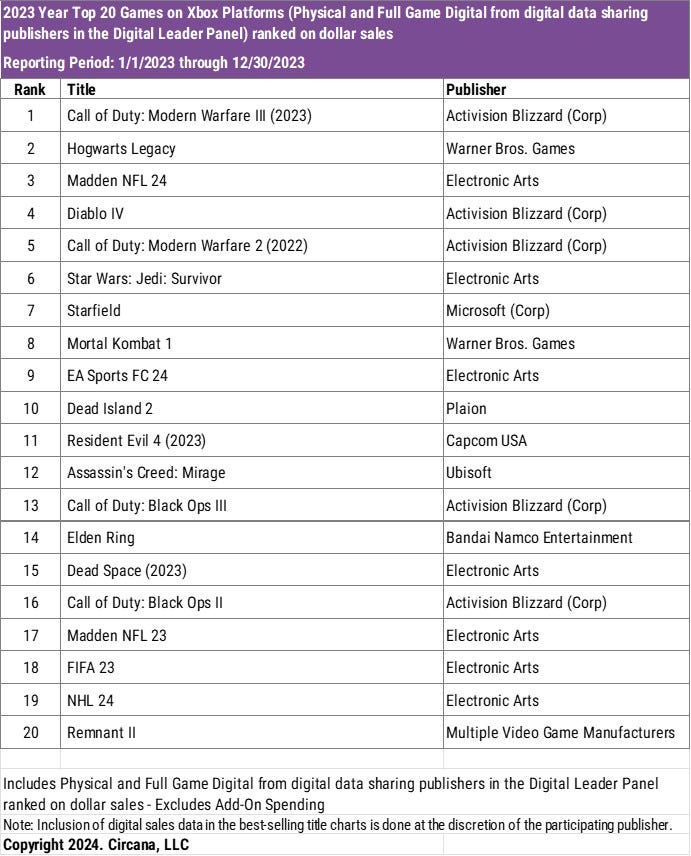

Circana: The US gaming market - December and 2023 Results

Market Overview

-

The American gaming market, as of December 2023, grew by 4% and reached $7.9 billion compared to December 2022.

-

The total volume of the American gaming market in 2023 amounted to $57.2 billion, which is 1% more than in 2022.

-

In 2023, users in the USA spent $6.6 billion on gaming hardware, the same amount as in 2022. The sales growth of PlayStation 5 offset the decline of Xbox Series S|X and Nintendo Switch.

-

PlayStation 5 was the best-selling console in 2023 in terms of both the number of systems sold and revenue.

-

The growth of subscriptions for consoles and PC in the USA almost came to a halt. In 2023, subscriptions accounted for approximately 10% of the total content spending. Matt Piscatella (Video Game Industry Analyst & Executive Director at Circana) does not believe that subscriptions cannibalize game sales.

-

Hogwarts Legacy, Call of Duty: Modern Warfare III and Madden NFL 24 were the top-selling games in the USA in 2023.

-

Accessory sales in the USA in 2023 amounted to $2.6 billion, 4% more than the previous year. Gamepad sales increased by 7%, with PS5 being the accessory of the year.

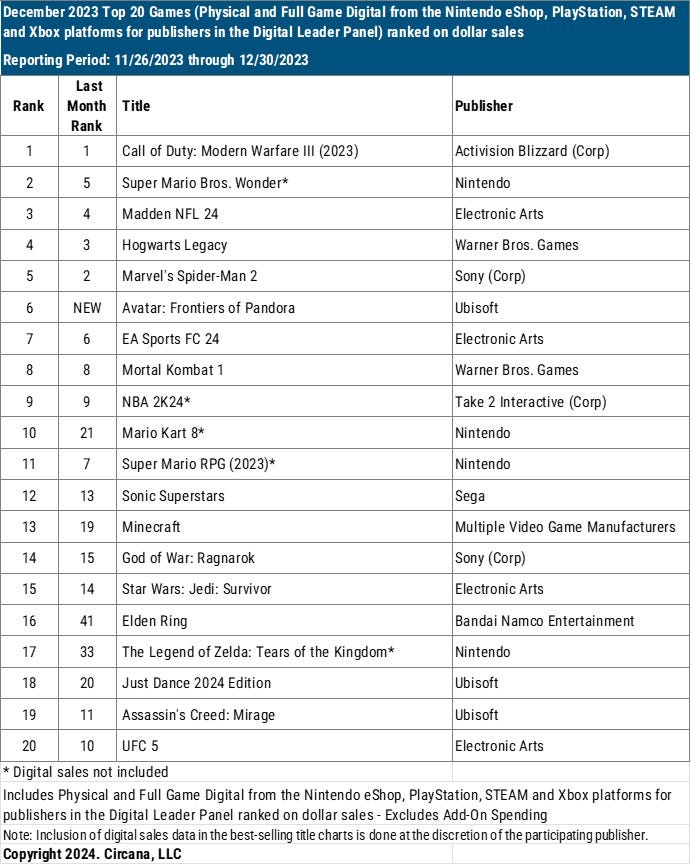

Game Sales - December 2023

-

Call of Duty: Modern Warfare III, Super Mario Bros. Wonder, and Madden NFL 24 were the top-selling games in December.

-

Hogwarts Legacy became the leader in the USA in terms of sales in dollar equivalent, the first non-Call of Duty and non-Rockstar game to achieve this since 2008. The game was the top-selling on PlayStation, second on Xbox, and fifth on Nintendo Switch in terms of sales.

-

MONOPOLY GO!, Royal Match, and Roblox led the American mobile market in revenue. Clash of Clans also entered the top 10, rising 9 positions.

-

The American mobile gaming market grew by 2.7% in December 2023 compared to December 2022.

Engagement - December 2023

-

Fortnite, Call of Duty (all parts), and Grand Theft Auto V led on PlayStation in terms of Monthly Active Users (MAU). Roblox was in fourth place. Xbox had an identical situation in the top four positions.

-

In December, 36% of active users on PlayStation and 31% on Xbox played Fortnite. In November, these figures were 31% on PlayStation and 28% on Xbox.

-

Including games in subscriptions helped PowerWash Simulator rise from 318th place by MAU in November to 9th place in December on PlayStation. Goat Simulator on Xbox jumped from 245th position to 7th by MAU in the USA.

-

Hogwarts Legacy, Marvel’s Spider-Man 2, and Call of Duty: Modern Warfare III were the top-selling games in 2023 on PlayStation.

-

Call of Duty: Modern Warfare III, Hogwarts Legacy, and Madden NFL 24 were the top-selling games in the USA in 2023 on Xbox.

-

Lethal Company, The Finals, and Counter-Strike 2 were the most popular games by MAU in the USA in December on Steam. Baldur’s Gate III was fourth, and Ready or Not significantly rose to fifth place in December.

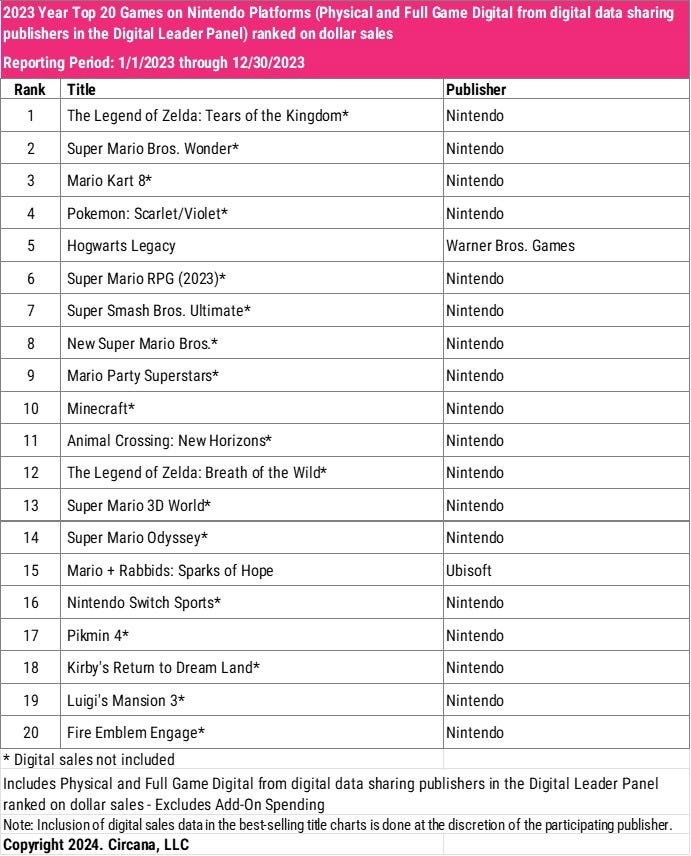

-

The Legend of Zelda: Tears of the Kingdom, Super Mario Bros. Wonder, and Mario Kart 8 were the sales leaders in the USA on Nintendo Switch in 2023.

-

Interestingly, in the top 20 for Nintendo Switch, only 2 games were not from Nintendo. These were Hogwarts Legacy (Warner Bros.) and Mario + Rabbids: Sparks of Hope.

Hardware Sales

-

In December, gaming hardware sales in the USA amounted to $1.6 billion, 4% more than in 2022.

-

PlayStation 5 became the best-selling system of the month in the USA. Sony set a new sales record for a single month, with the previous record dated back to December 2022.

-

Xbox Series S|X also set a sales record in the USA, with the previous one occurring in December 2021.

-

PlayStation Portal was fifth in sales in the USA in December. Matt Piscatella noted that the console was sold out almost everywhere throughout the fourth quarter, but the sales volume is not considered significant.

-

In December 2023, accessory sales amounted to $584 million, 14% more than in December 2022.

A few comments on the year-end results by Mat Piscatella

-

The results for 2023 turned out to be below expectations, as Circana was anticipating a 3% growth.

-

Fortnite, Minecraft, Roblox, GTA, and Call of Duty dominate the gaming market in the USA in terms of audience and engagement.

-

The concept of "average success" is disappearing. New games are either hits or disappointments.

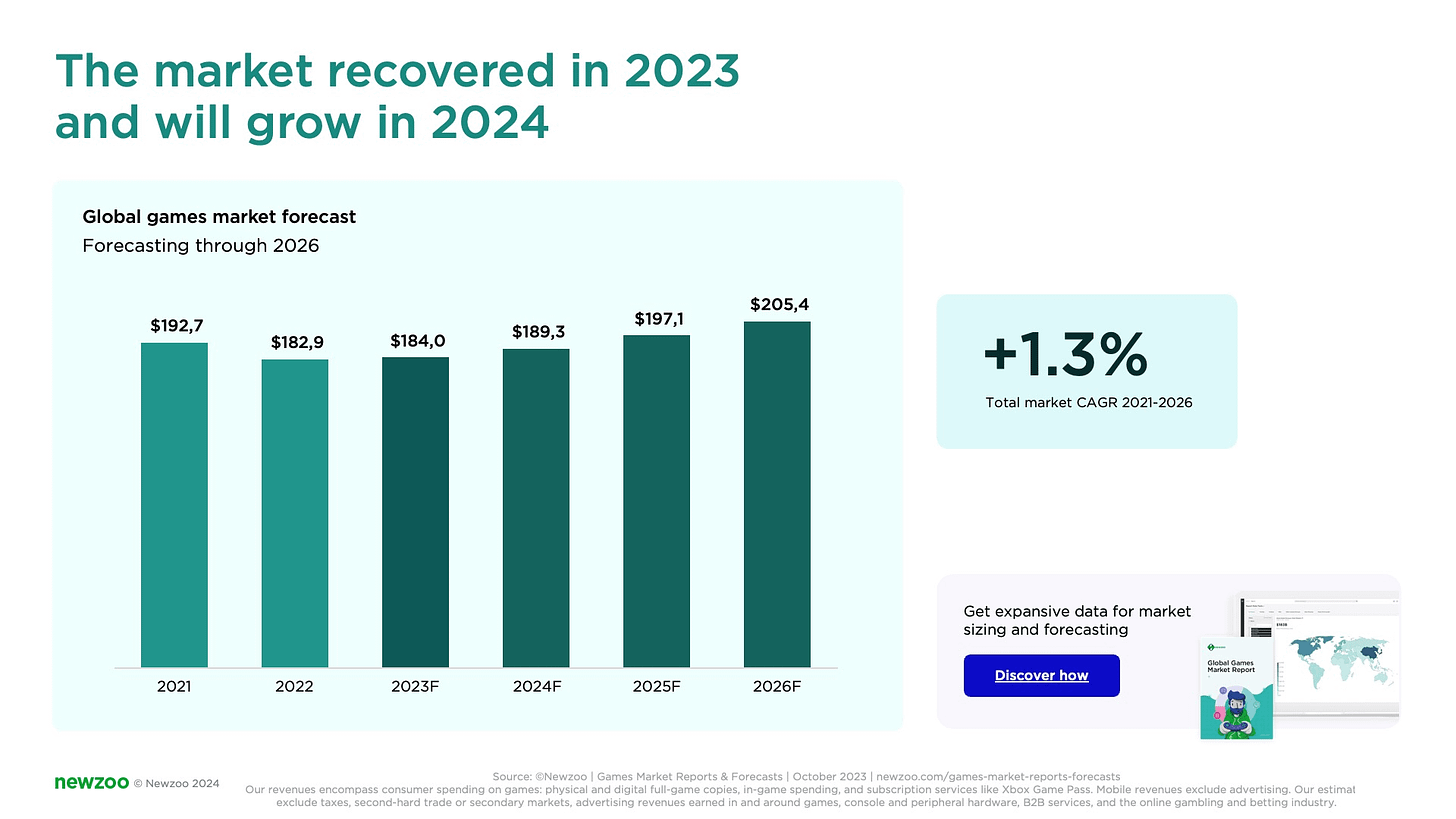

Newzoo: Forecasts and Gaming Trends for 2024

Trend 1. The gaming market has recovered and will continue its growth.

-

Newzoo notes that the gaming market reached $184 billion in 2023. By 2026, the company expects a cumulative annual growth rate of 1.3%, reaching $205.4 billion.

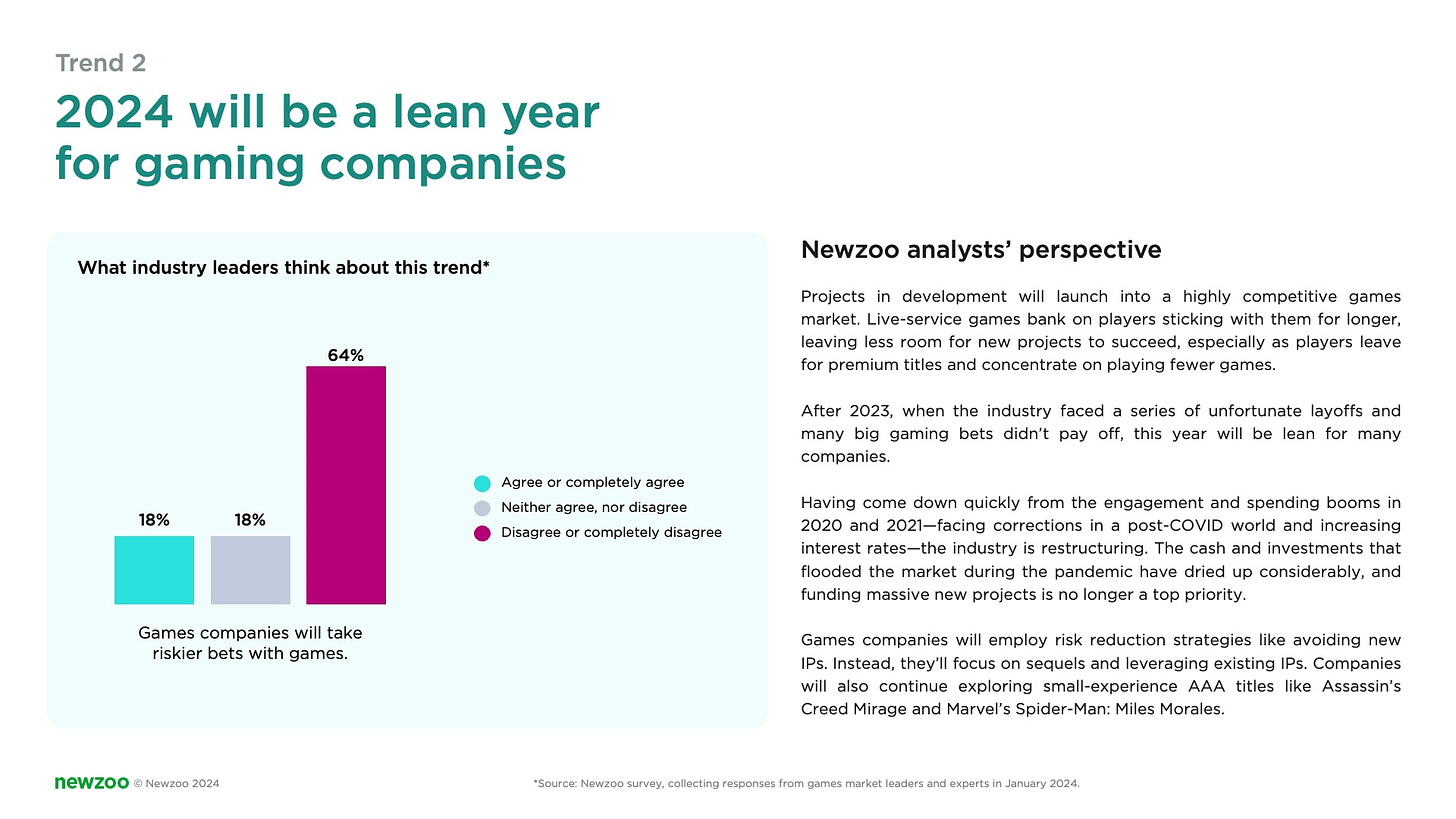

Trend 2. Companies will take fewer risks in 2024.

-

64% of representatives in the gaming industry agree with Newzoo's forecast.

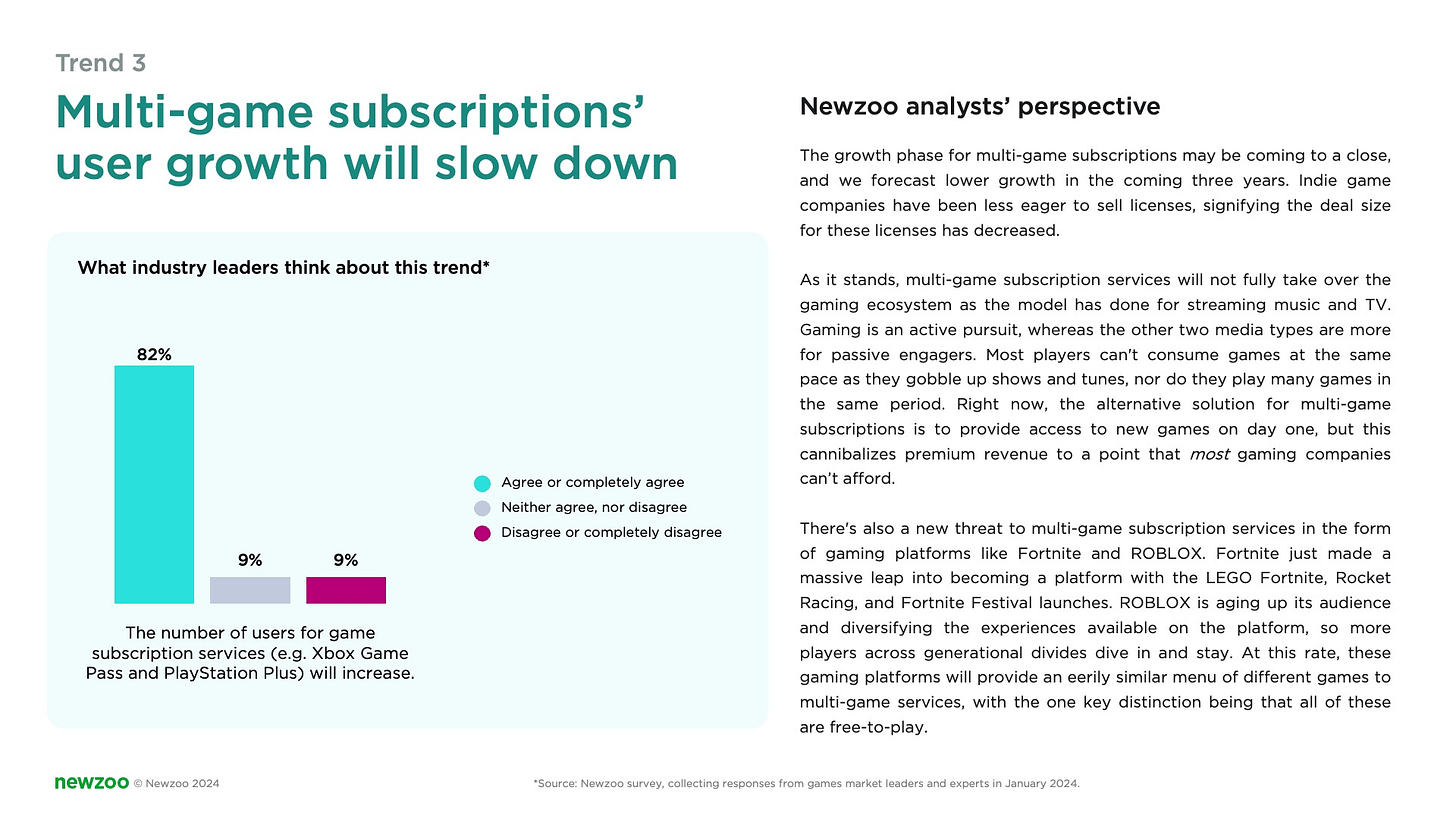

Trend 3. Growth in subscribers to subscription services will slow down.

-

82% of surveyed gaming industry employees agree with this trend.

This trend began earlier in my view. For example, Sony removed information about the number of PS Plus subscribers from its quarterly reports because the service's audience stopped growing. This happened a little over a year ago.

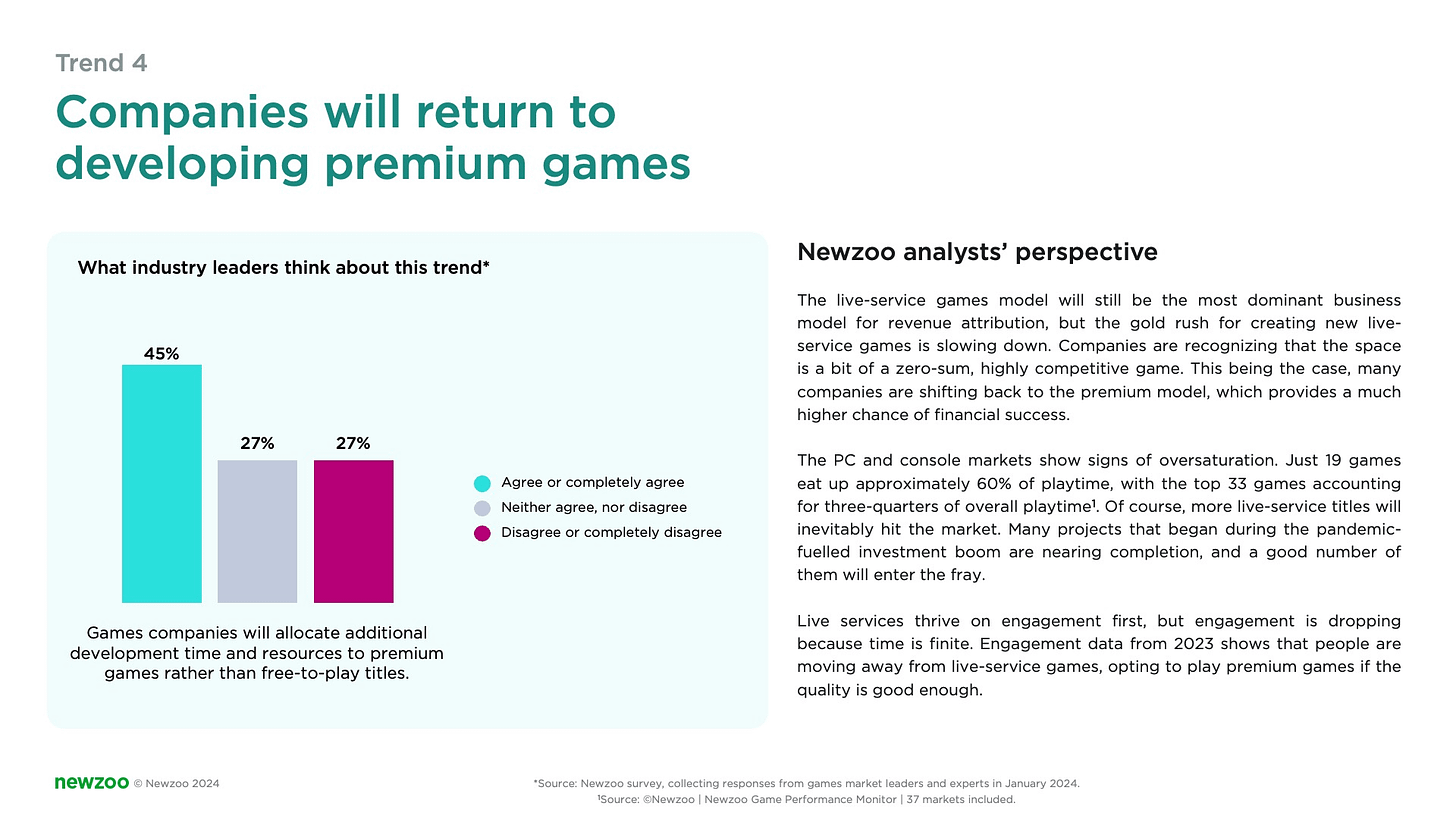

Trend 4. Gaming companies are returning to the development of Premium (buy-to-play) games.

-

High competition (19 games accounting for 60% of total user gaming time) is prompting a return from service games to traditional ones. 45% of industry representatives agree with this trend.

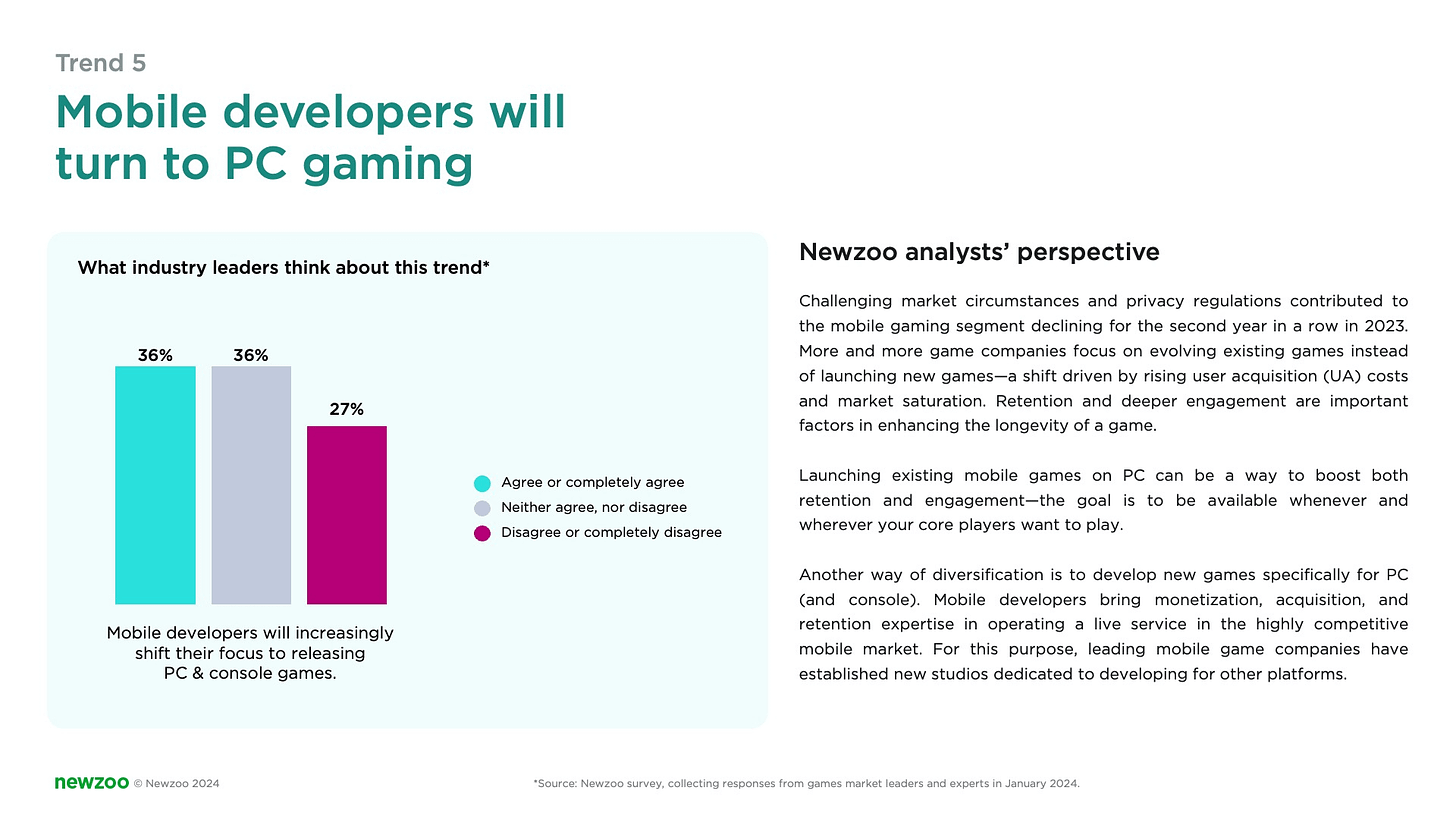

Trend 5. Mobile developers are moving towards developing for PC and consoles.

-

Newzoo analysts believe that issues with user acquisition on mobile devices are driving developers toward new platforms. 36% of surveyed individuals from the gaming industry agree with this.

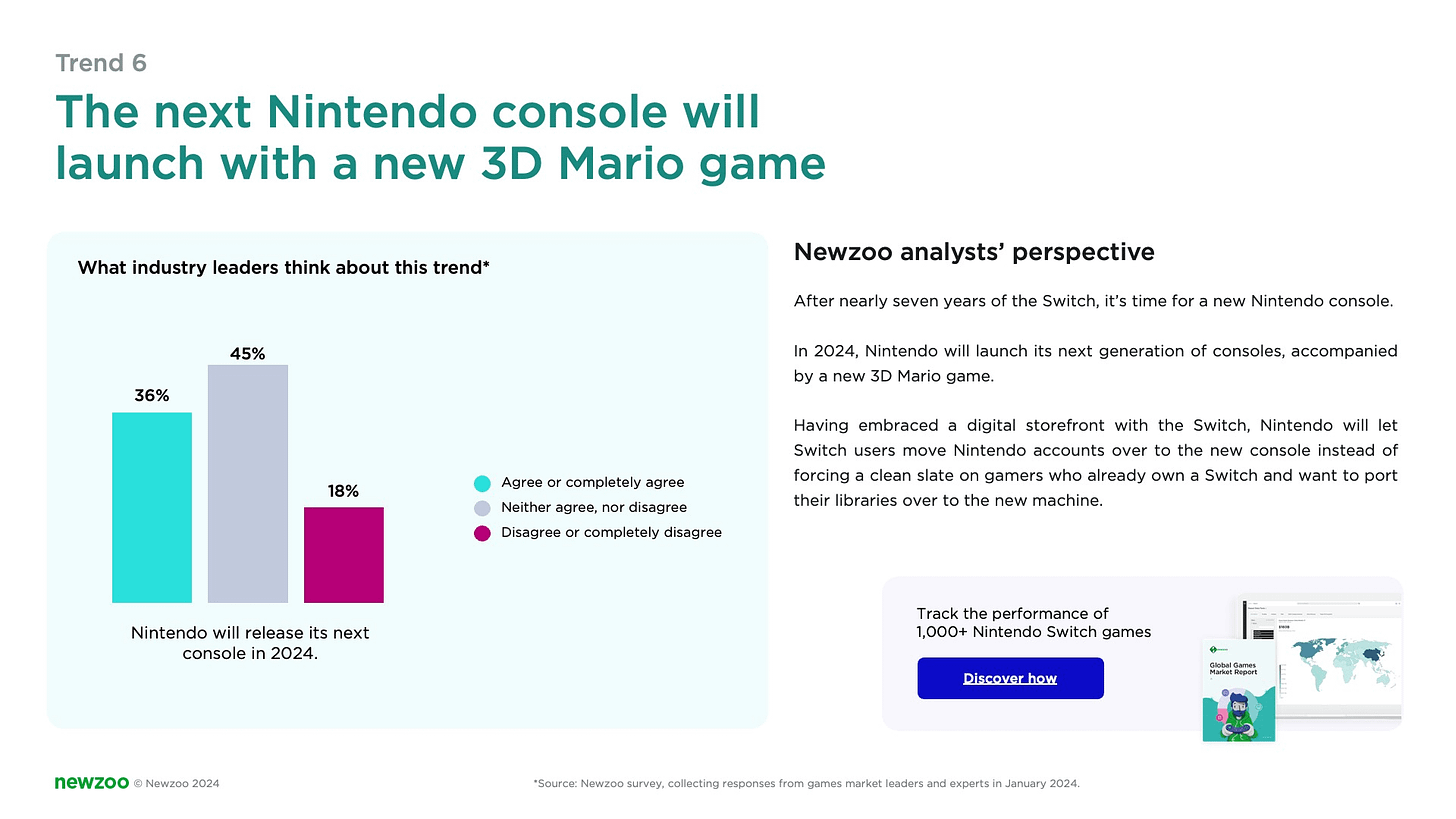

Trend? Forecast? 6. Nintendo will release its new console alongside 3D Mario.

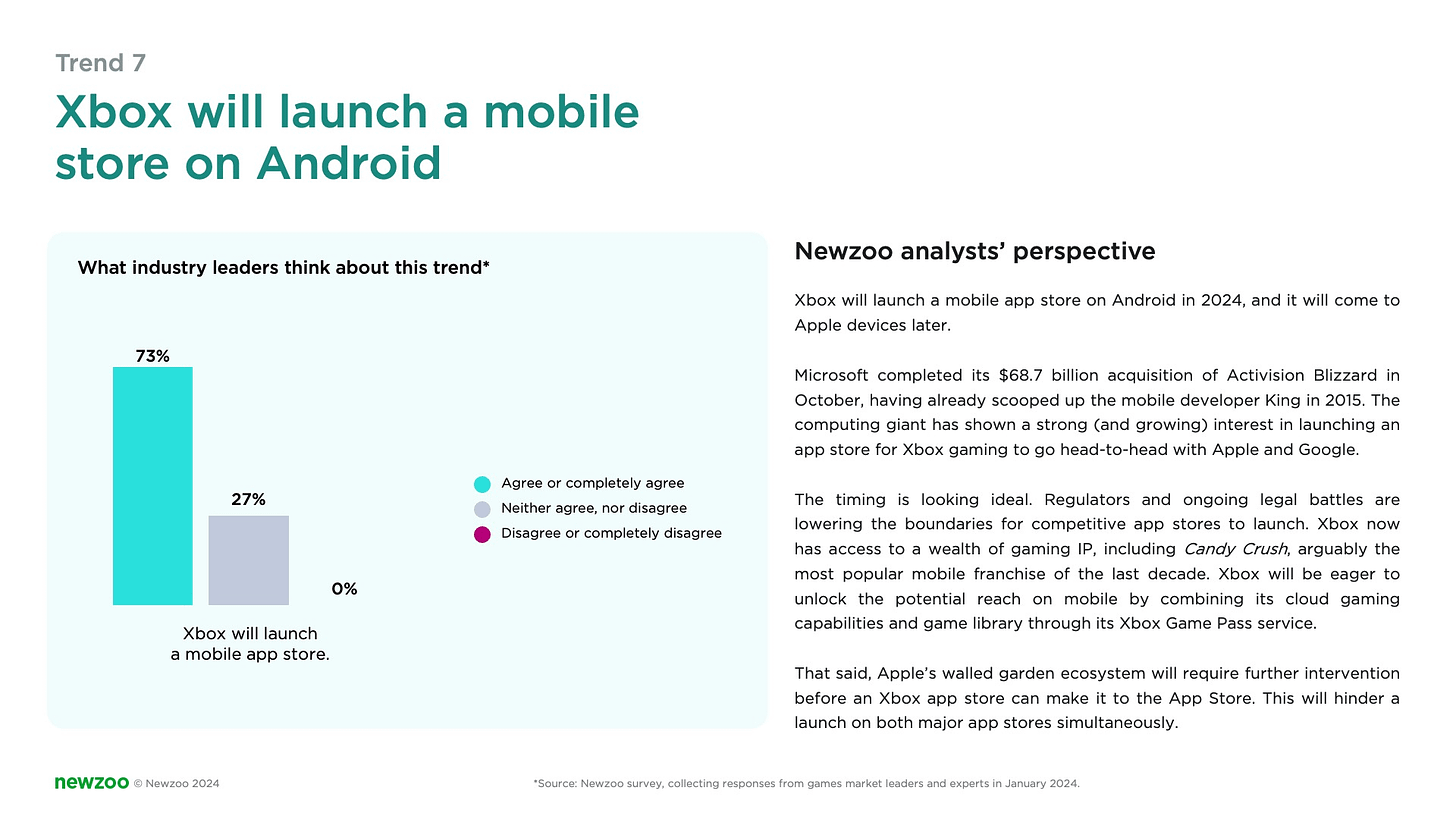

Trend 7. Xbox will launch its mobile gaming store on Android. 73% of the gaming industry agrees with this.

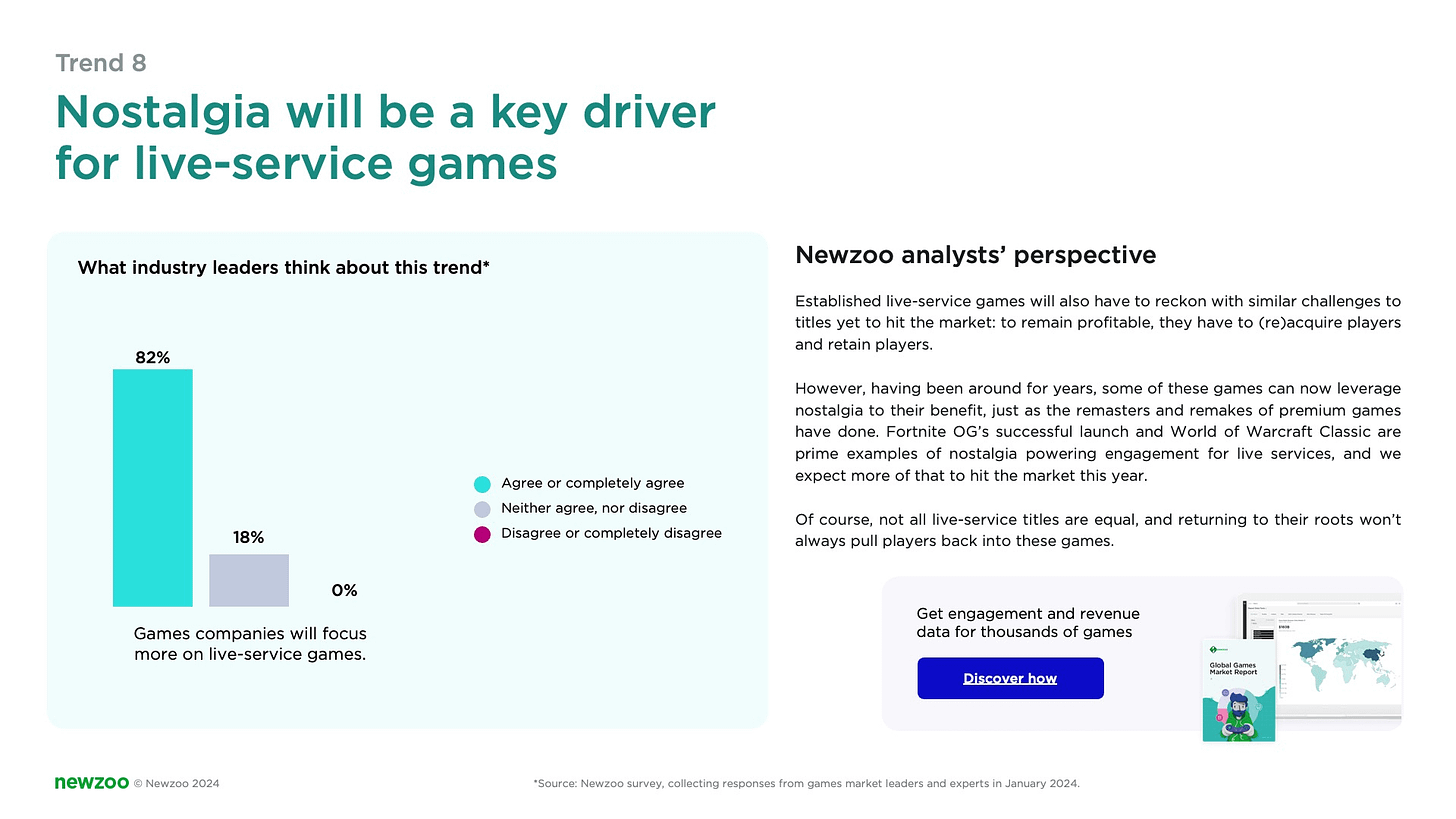

Trend 8. Nostalgia will become a key factor in the success of service games.

-

Fortnite OG and World of Warcraft Classic are prime examples. 82% of the industry agrees with this. But what about mobile games?

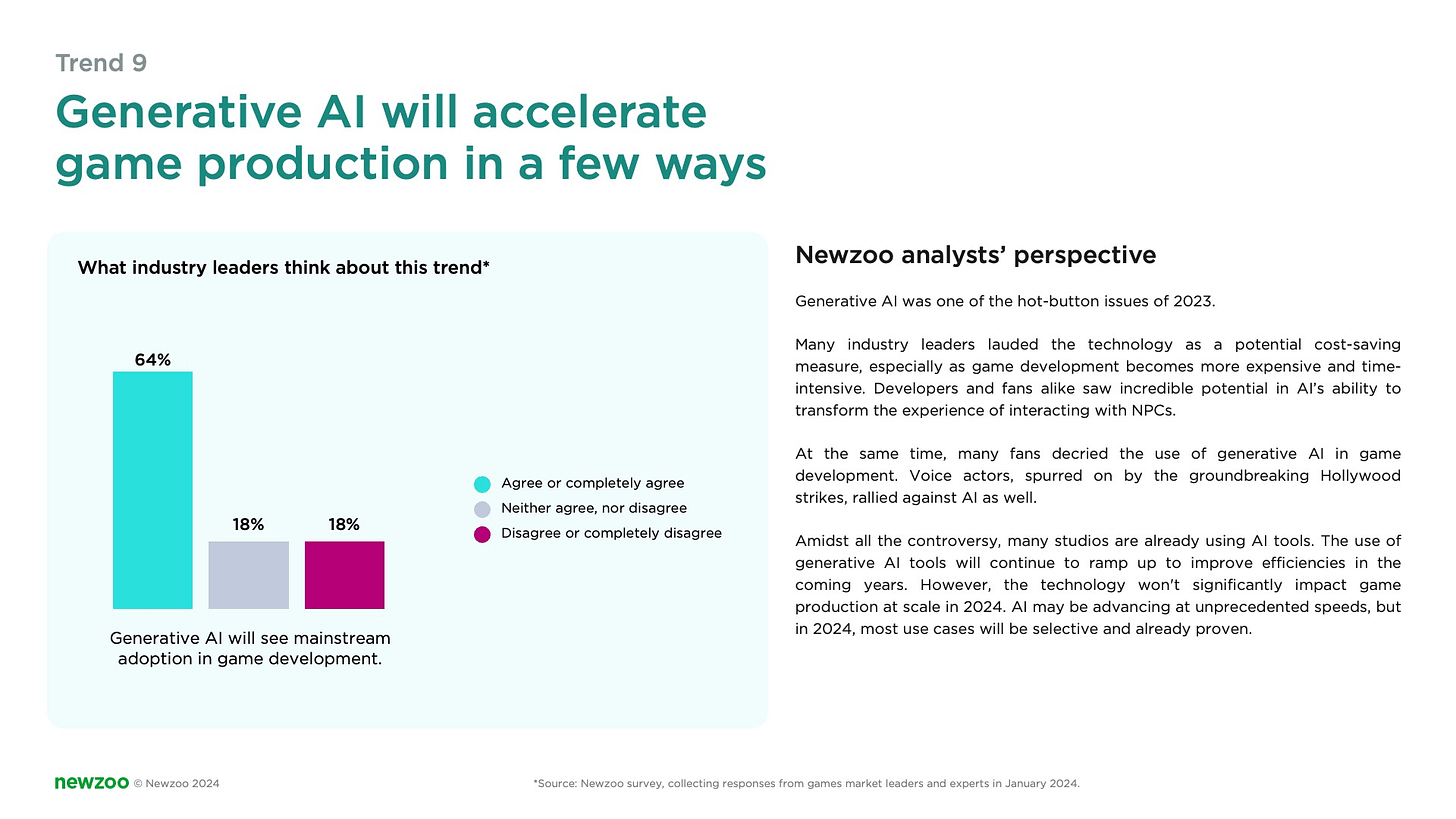

Trend 9. Generative AI will accelerate game development.

-

64% of the industry concurs that this will happen.

Trend 10. In 2024, many Souls-like games with open worlds will be released.

-

Among the already announced are Another Crab’s Treasure; Rise of the Ronin; Black Myth: Waking; Enotria: The Last Song; Flintlock: The Siege of Dawn. And this is not counting the additions to Elden Ring.

Great job, Newzoo. Haven’t seen this trend anywhere - better to have a closer look.

GDC & Game Developer: The State of the Gaming Industry in 2024

Companies surveyed over 3000 employees in the gaming industry.

Platforms and Engines

-

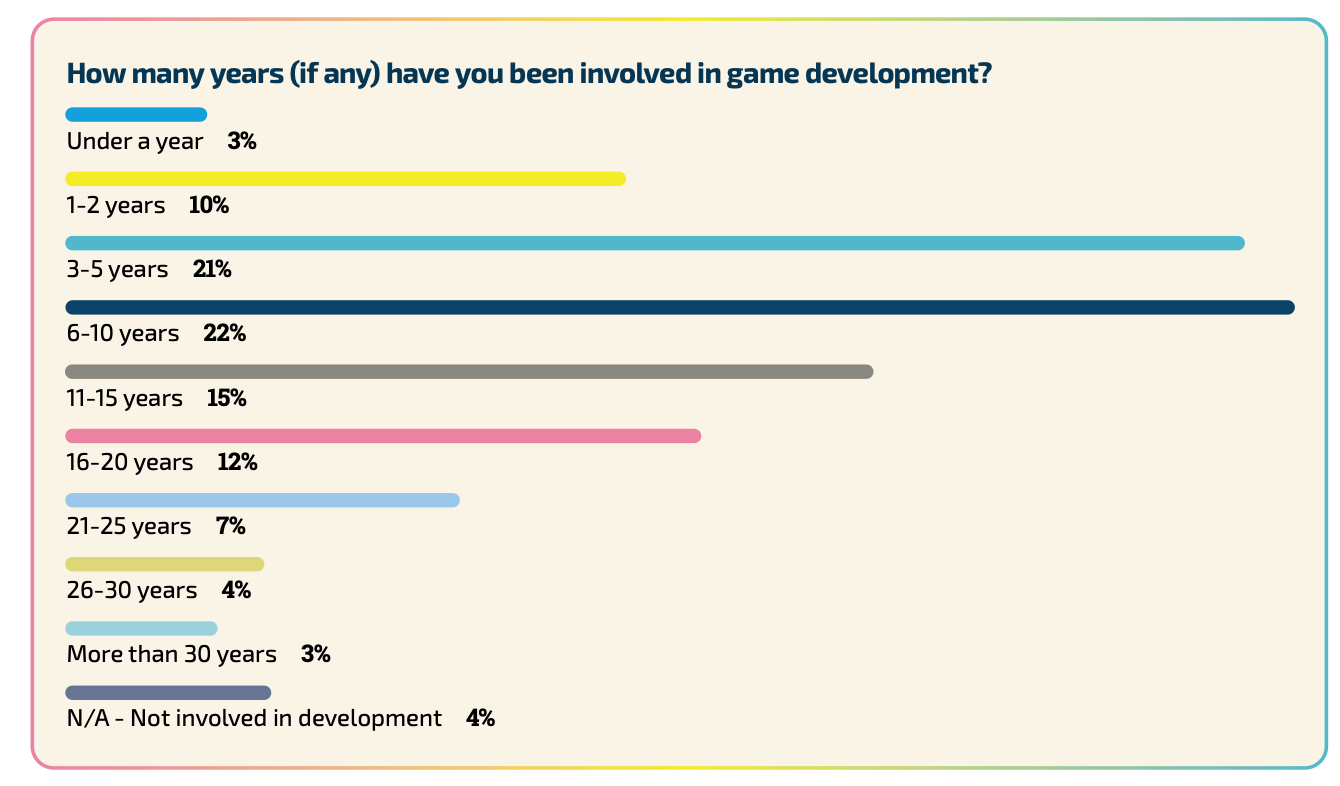

56% of developers have been working in the gaming industry for less than 10 years. Among those in the industry the longest, the majority are men - 87%.

-

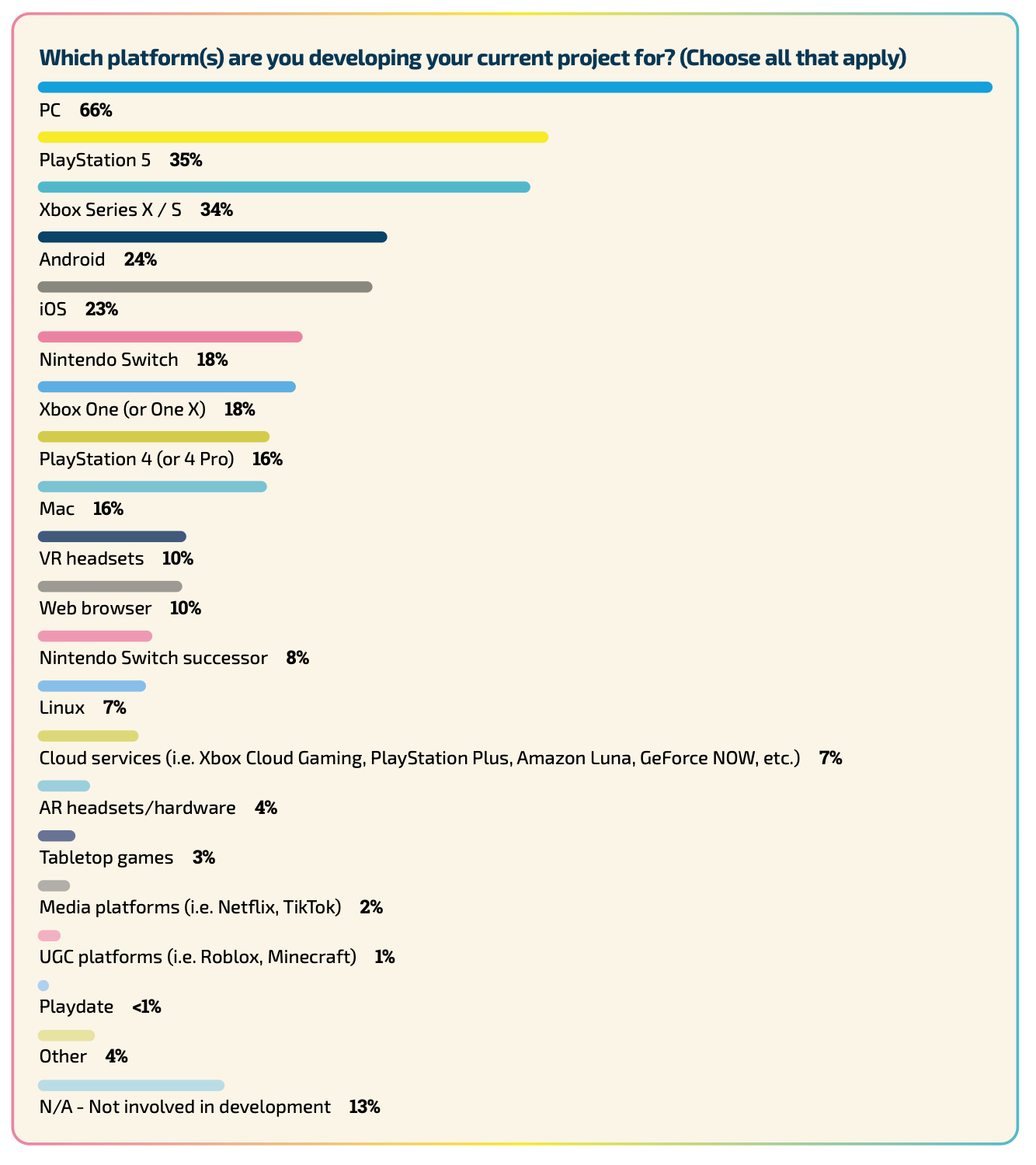

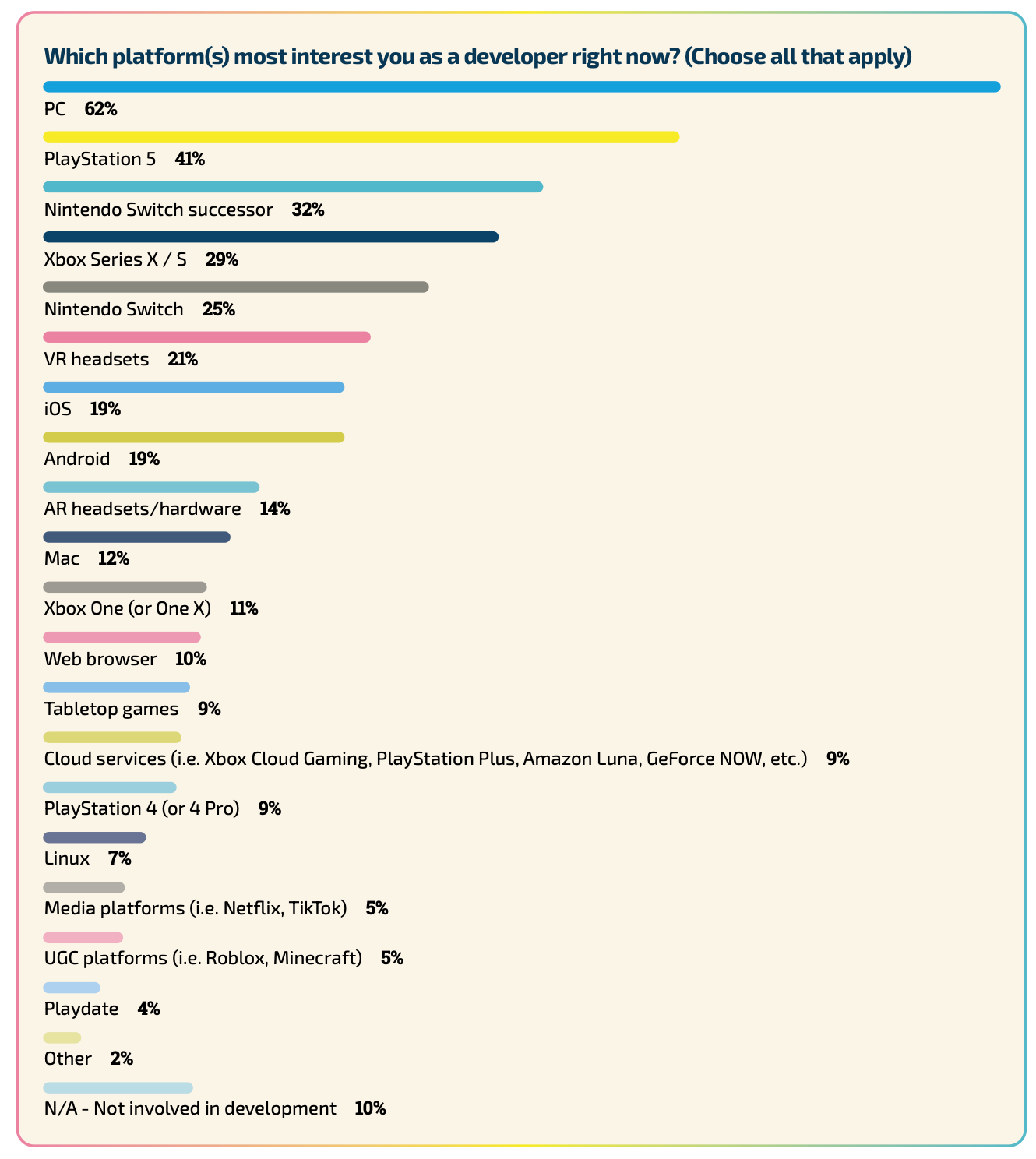

Currently, 66% of developers are making games for PC, and 57% plan to continue making games for this platform in the future. 33% are working on projects for PlayStation 5, and 30% plan to release games for Xbox Series S|X. Mobile platforms are planned for 23-24%. Only 1% is currently working on games for UGC platforms (Roblox, Fortnite, Minecraft).

-

The popularity of mobile device development has decreased by 16% compared to 2023. PC and consoles are the most popular platforms.

-

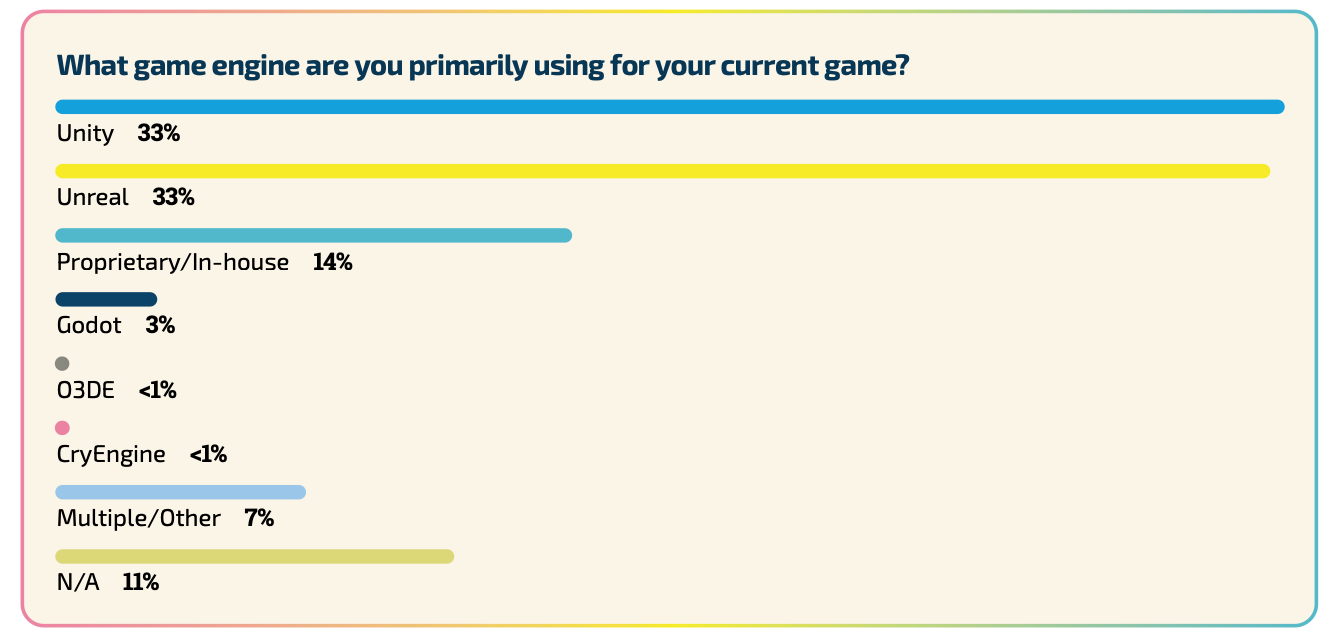

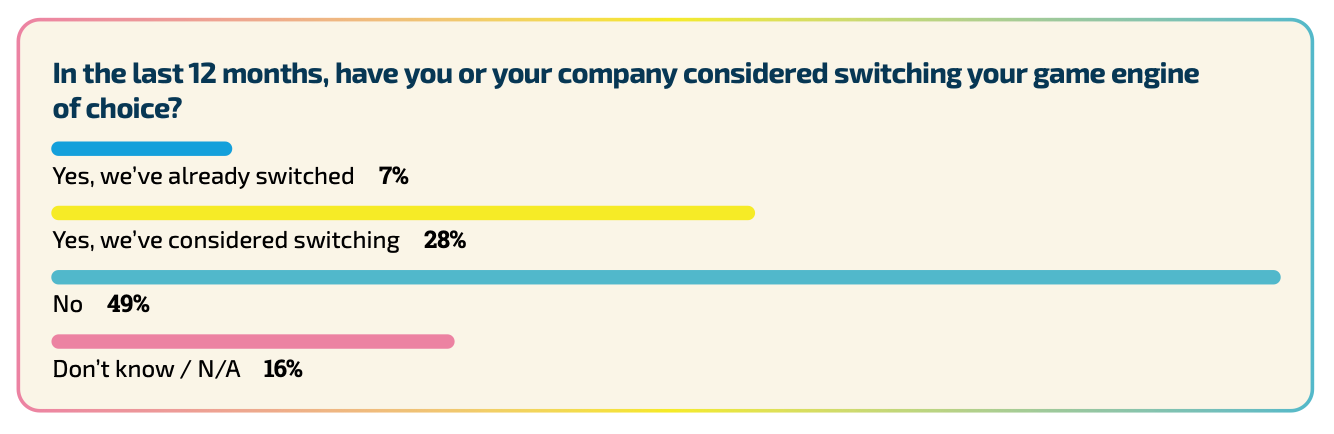

33% of surveyed developers use Unity; 33% use Unreal Engine; 14% have their engine. In the last 12 months, 7% of companies changed their game engine, 28% plan to do so, and 16% have not yet decided. High numbers are related to Unity's Runtime Fee announcement.

-

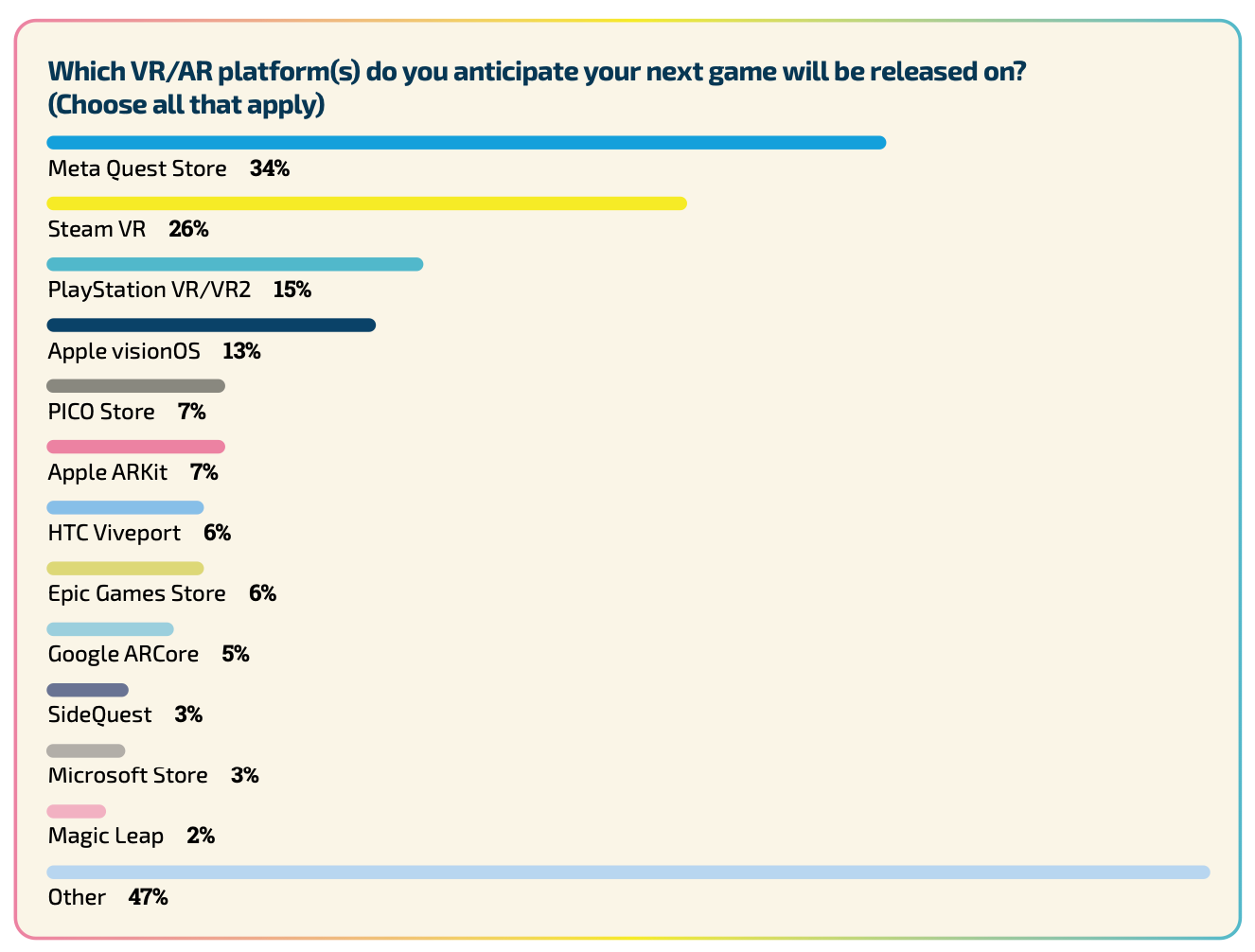

Interest in VR/AR continues to slightly decline. Meta Quest (34%), Steam VR (26%), PlayStation VR2 (15%), Apple visionOS are the most popular platforms for future releases.

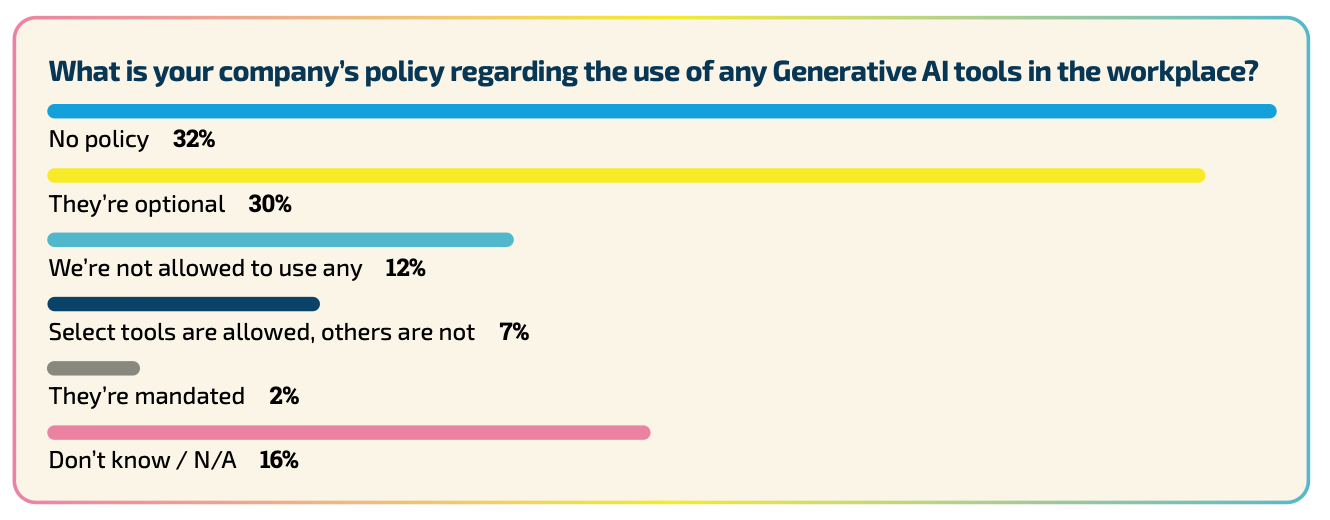

Generative AI

-

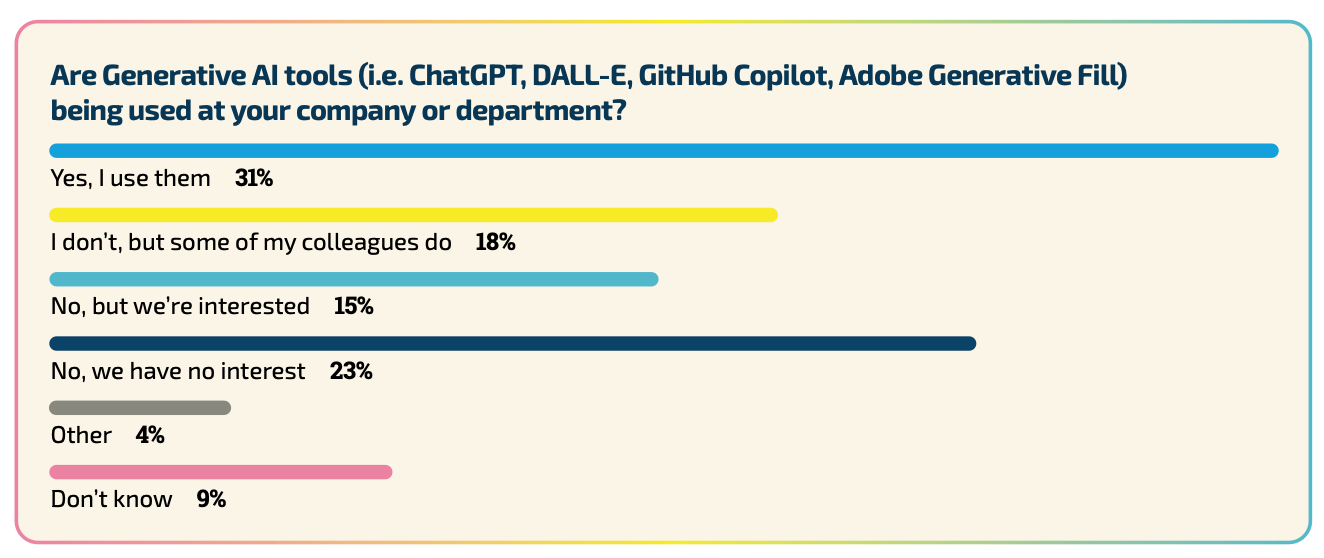

31% of developers use generative AI; 18% do not use it but see colleagues using it; 15% are interested but have not applied it yet. Only 23% are not interested.

-

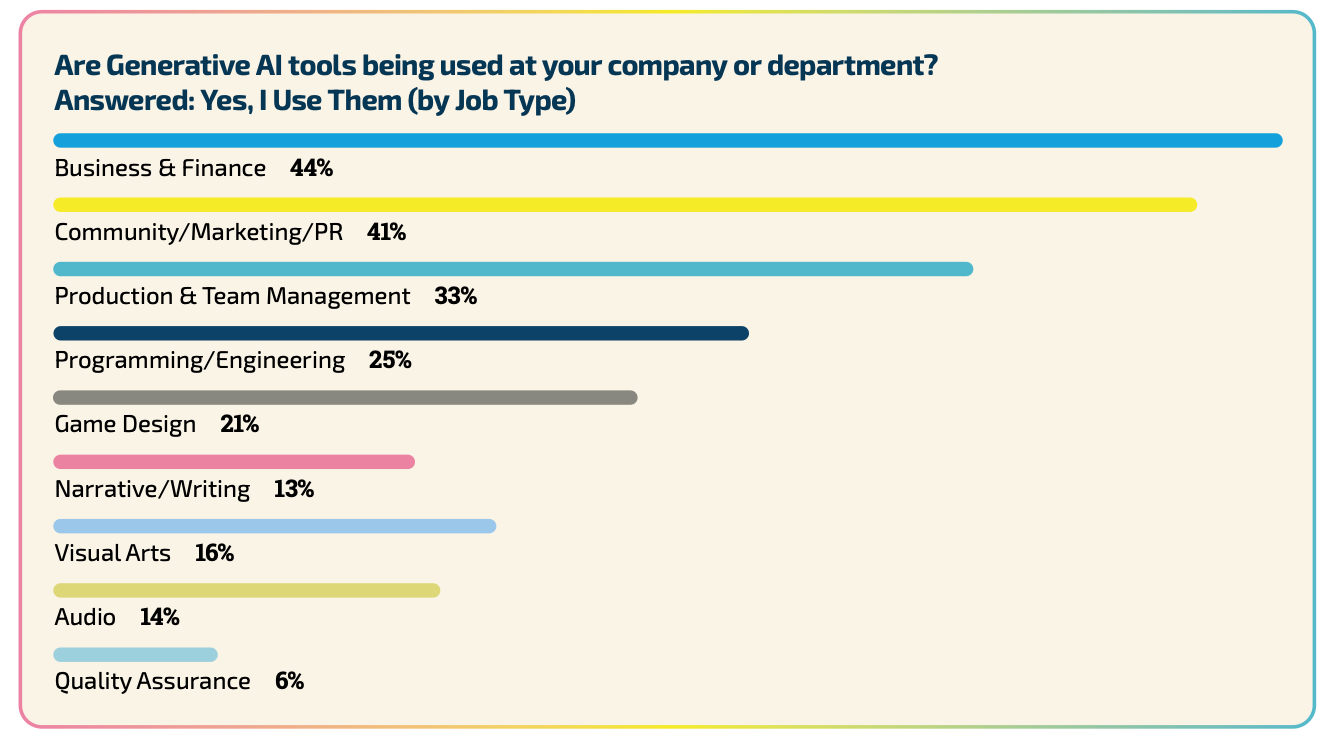

AI is mostly applied in business and finance (44%), marketing and PR (41%), production and team management (33%). The least is in QA (6%) and audio (14%).

-

Generative AI is prohibited in 12% of companies, mandatory in 2%, and the rest are undecided.

-

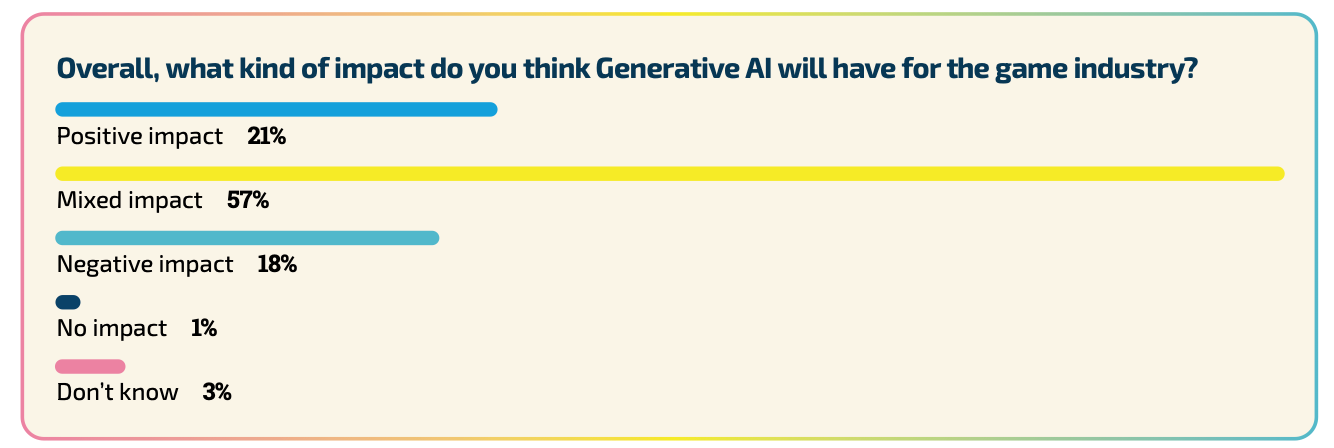

Attitudes toward AI vary. 21% believe tools based on AI positively impact the industry, 18% negatively, and 57% think the effect is mixed.

-

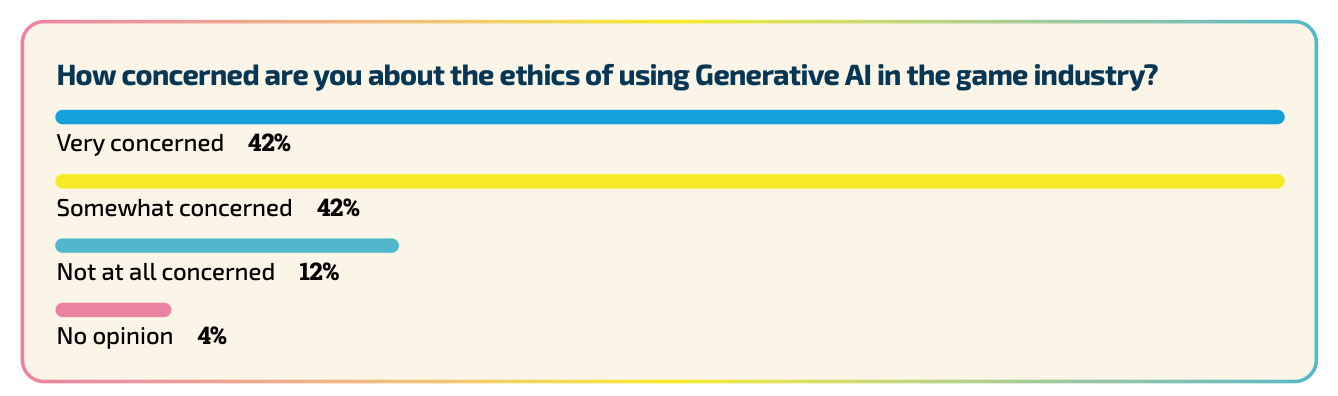

84% are concerned to some extent about the ethics of using AI in the gaming industry. The biggest concern is that AI tools will lead to more layoffs.

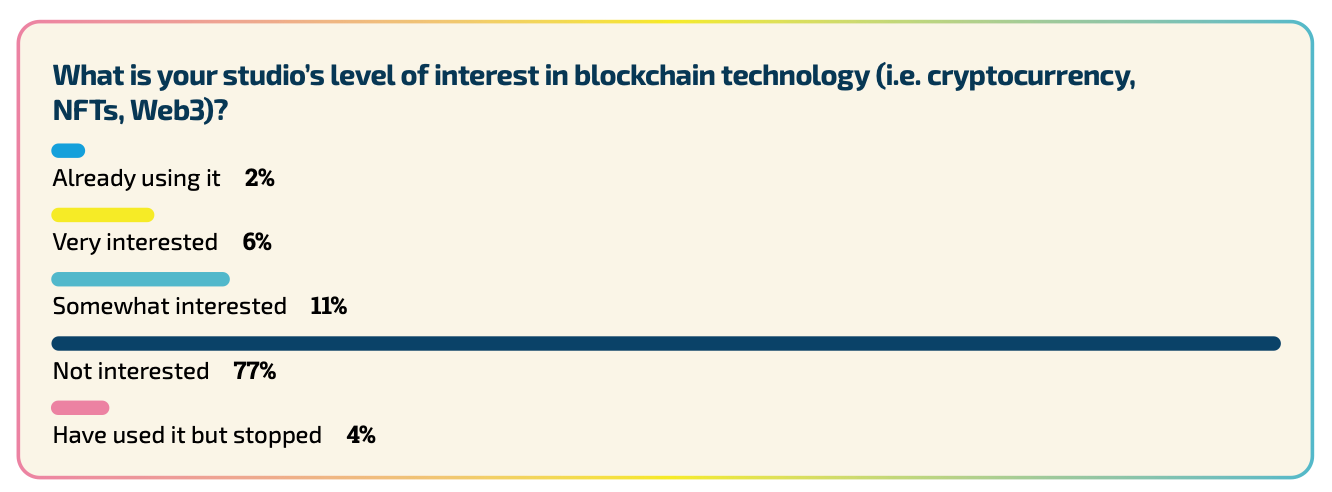

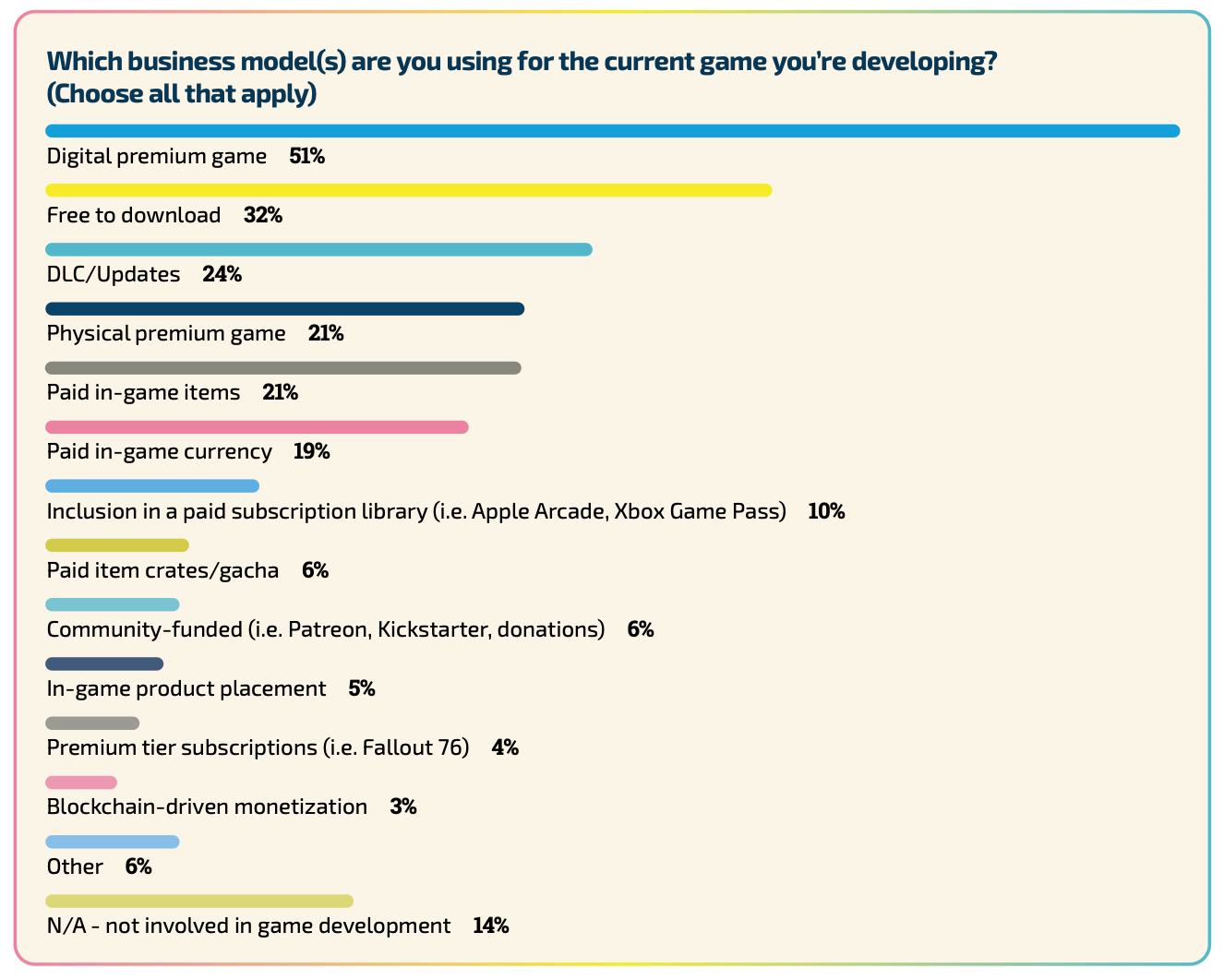

Blockchain; Monetization Methods

-

Interest in blockchain games continues to decline. 77% of developers are not interested, a 27% increase compared to 2023. Only 2% of companies use blockchain technologies.

-

Most developers create premium games (51%), followed by the F2P model (32%).

-

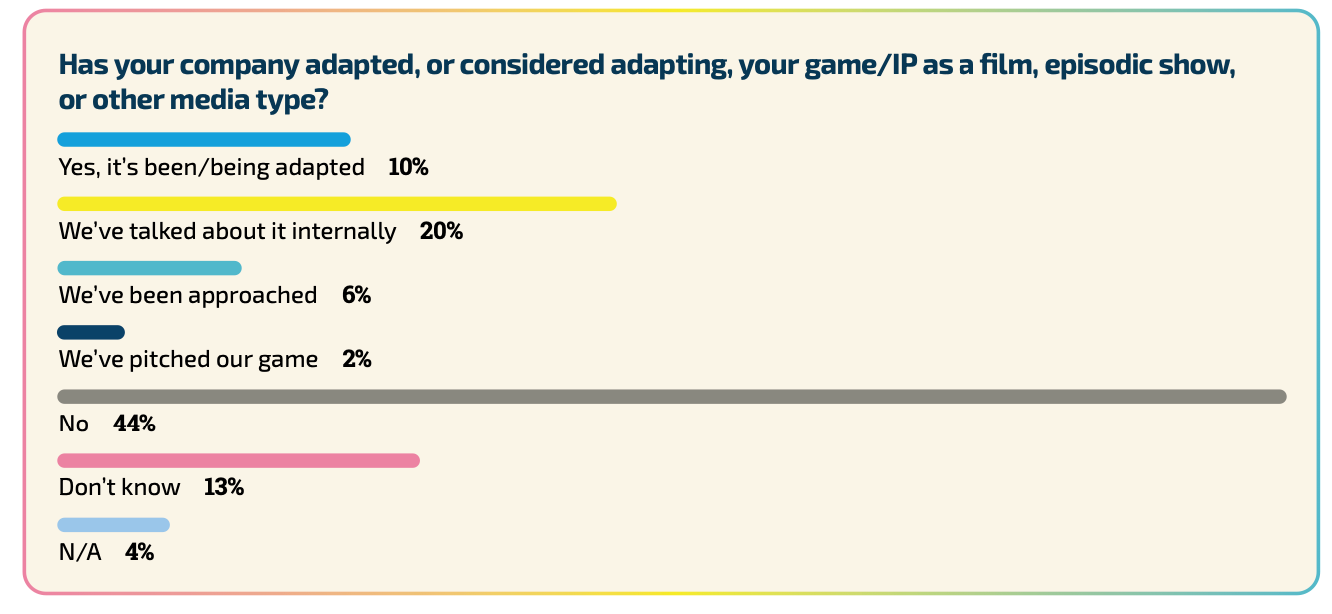

38% of developers (mostly major ones) have either made or discussed television adaptations of their IP. The majority of the industry (89%) agrees that expanding gaming IP beyond platforms is beneficial.

-

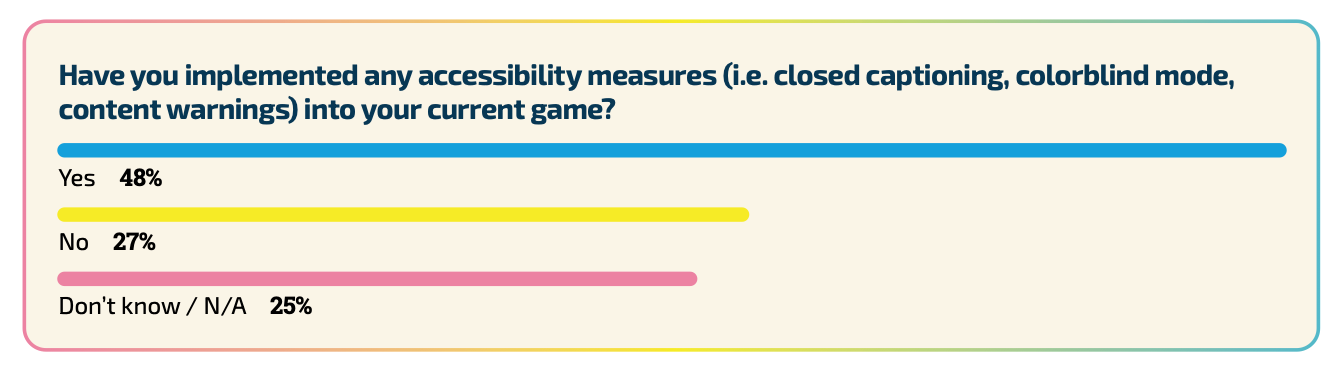

48% integrate various accessibility tools into their games.

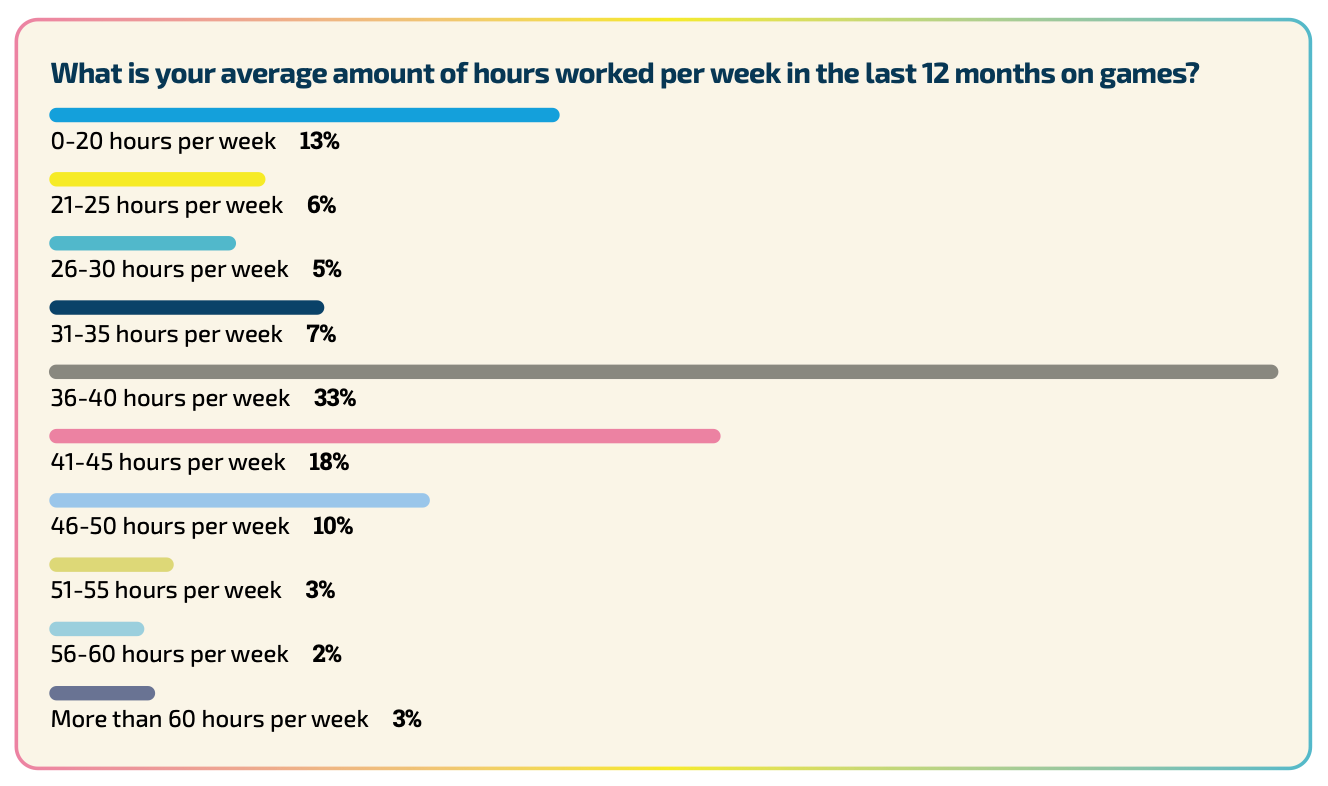

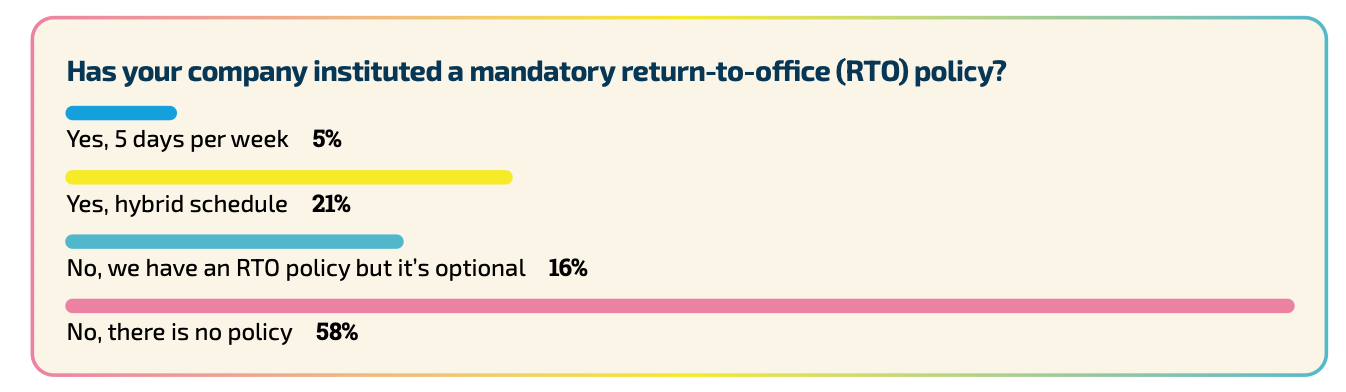

How people are working

-

The majority of game developers (64%) work 40 hours per week or less.

-

58% of game companies have decided not to force employees back to the office. Among those who want employees back, AAA companies (40% of them) are the majority.

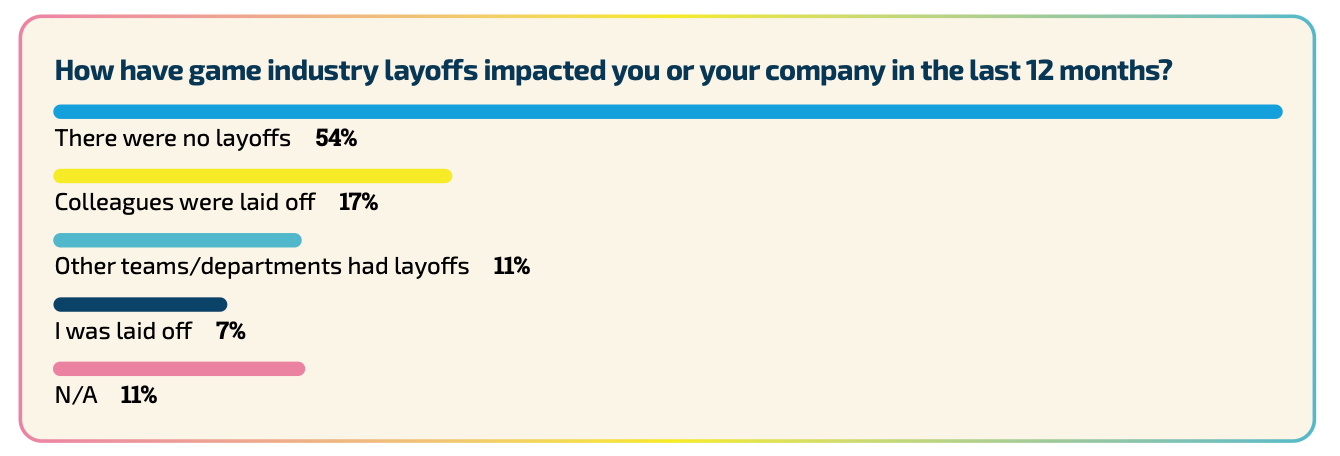

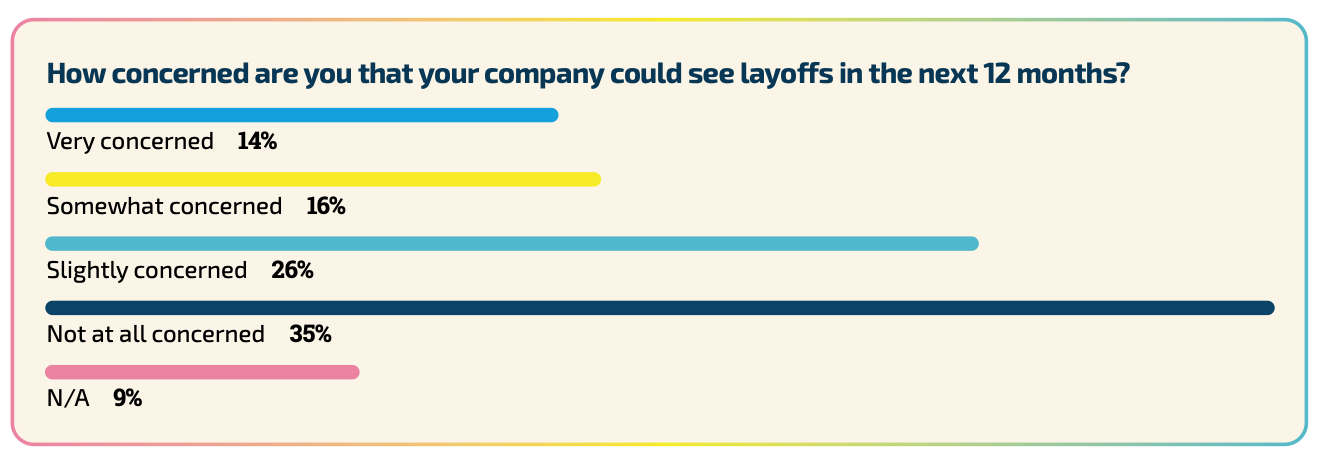

Layoffs

-

35% of gaming industry workers have faced layoffs - either themselves, their acquaintances, or colleagues.

-

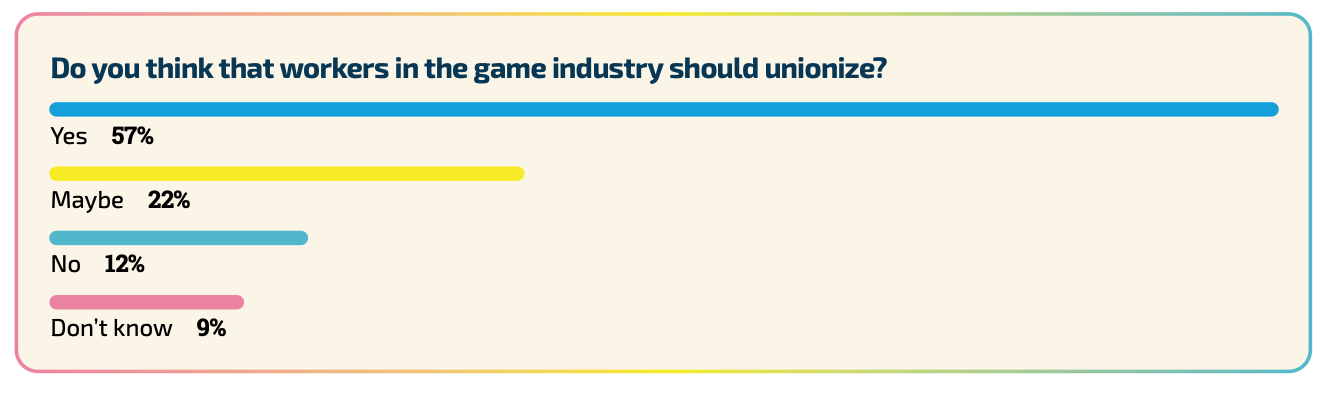

56% of those surveyed are concerned about the situation in the industry. Creating unions to protect their rights is seen as one solution.

-

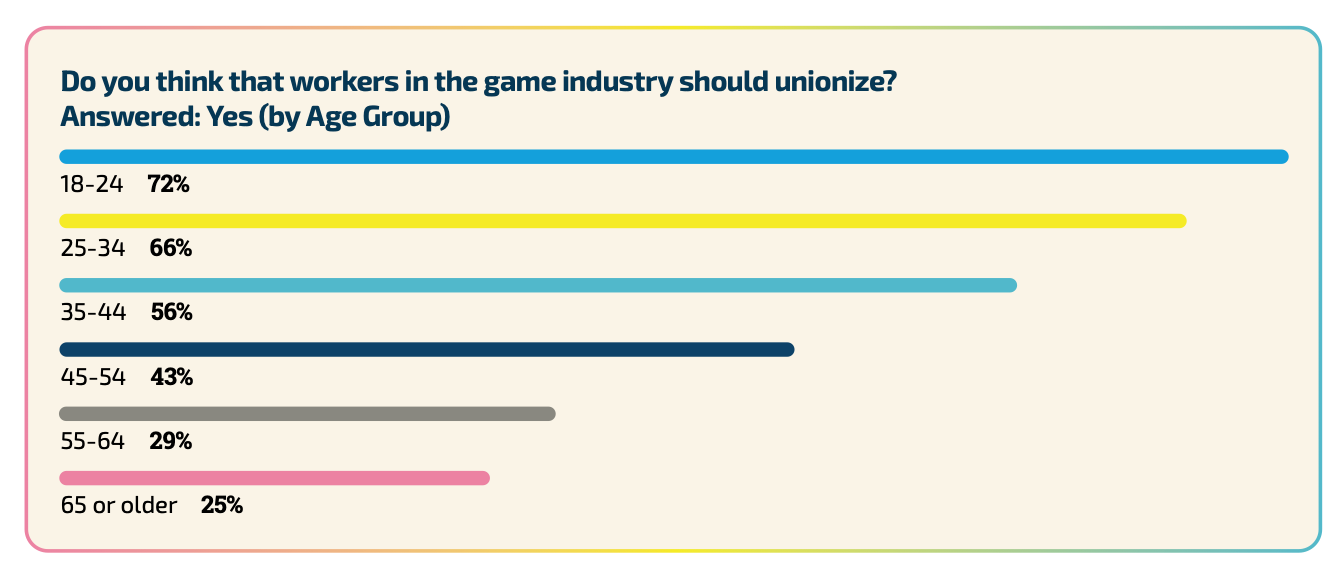

79% of gaming industry representatives believe that unions are needed in the gaming industry.

-

5% of respondents are members, and 18% have discussed this issue. There is a direct correlation between the age of respondents and the desire to create unions (more desire among younger respondents).

Demographics

-

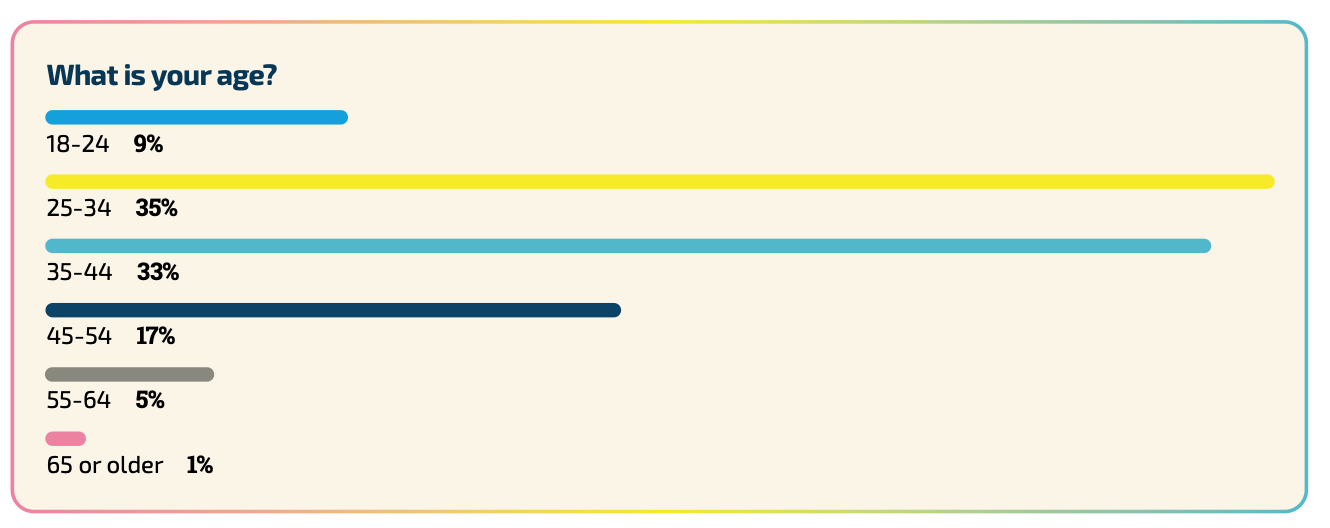

68% of gaming industry workers are aged between 25 and 44.

-

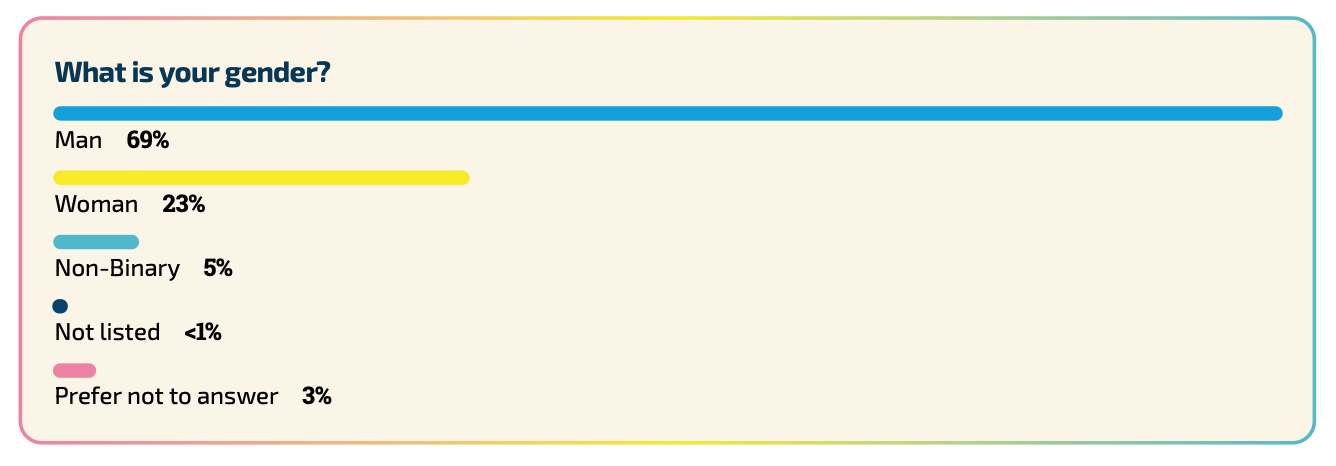

69% are men, 23% are women, and 5% are non-binary individuals.

Video Games are no longer the largest entertainment segment in the UK

-

For the first time in the last 11 years, video games have yielded their place as the highest-earning entertainment industry in the UK. Games earned £4.74 billion, showing a growth of 2.9% compared to the previous year.

-

Surpassing video games is the video content industry, more precisely, subscriptions to services like Netflix, Disney Plus, and Apple TV. This segment earned £4.9 billion in 2023, a 10% increase from 2022. Subscriptions account for 89% of the entire video content market.

-

The music industry in the UK earned £2.2 billion in 2023, a 9.6% increase from the previous year. The year turned out to be almost record-breaking in terms of performance (close to 2001).

-

Comparing the figures from 2019 to the results of 2023, the gaming industry grew by 29.2%, video by 88.3%, and music by 38.8%.

Tune in next month for more updates!