devtodev is going to help you keep in touch with what’s happening in the game market. Every month we will publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel.

Table of Contents

-

Sensor Tower: Users mobile spendings reached $64.9 billion in H1 2021

-

App Annie: Gaming apps were earning $1.7 billion per week on average in Q2 2021

-

Newzoo: 3 billion gamers will be on the planet by the end of 2021

-

Sensor Tower: Mobile sports games in the US received $648.8 million in revenue in a year

-

IGEA: Australian gaming industry gained from the coronavirus

-

IDC & LoopMe: 75% of pandemic-driven gamers will continue playing games

-

Tenjin: Publishers started to buy more Android traffic after iOS 14.5 release

-

SocialPeta: The number of mobile gaming advertisers in some regions is decreasing

-

GlobalData: Mobile gaming market will reach $272 billion in 2030

-

Newzoo: 38% of Apex Legends PC players also playing CS: GO and Valorant

-

App Annie: City battle strategy games were accounted for $2.5 billion in Q1 2021

-

Newzoo: 51% of users in North America and Western Europe started playing more after COVID-19

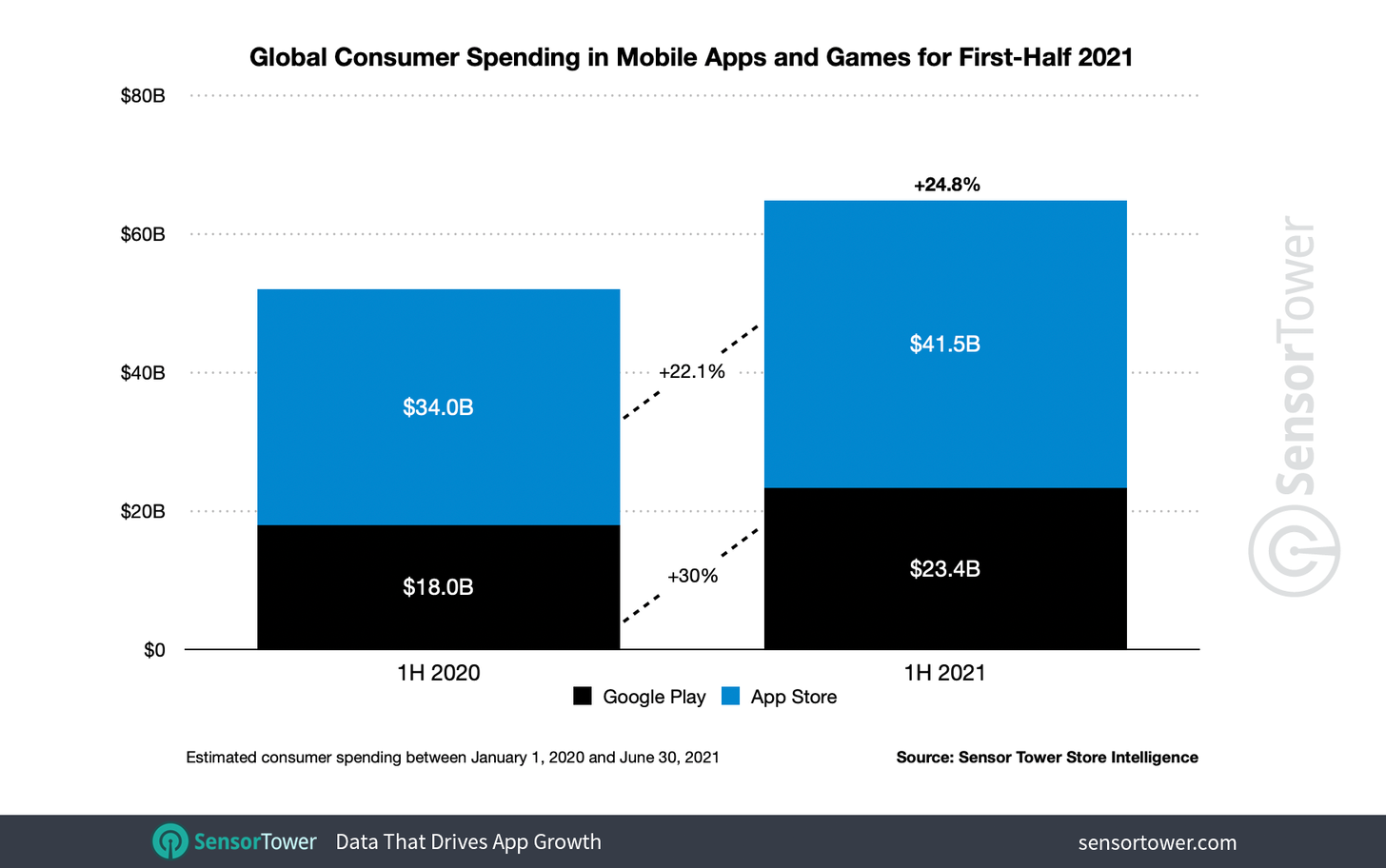

Sensor Tower: Users' mobile spendings reached $64.9 billion in H1 2021

- It’s 24.8% higher than in H1 2020.

-

Apple’s revenue reached $41.5 billion (+22.1% YoY). Google Play had $23.4 billion (+30% YoY).

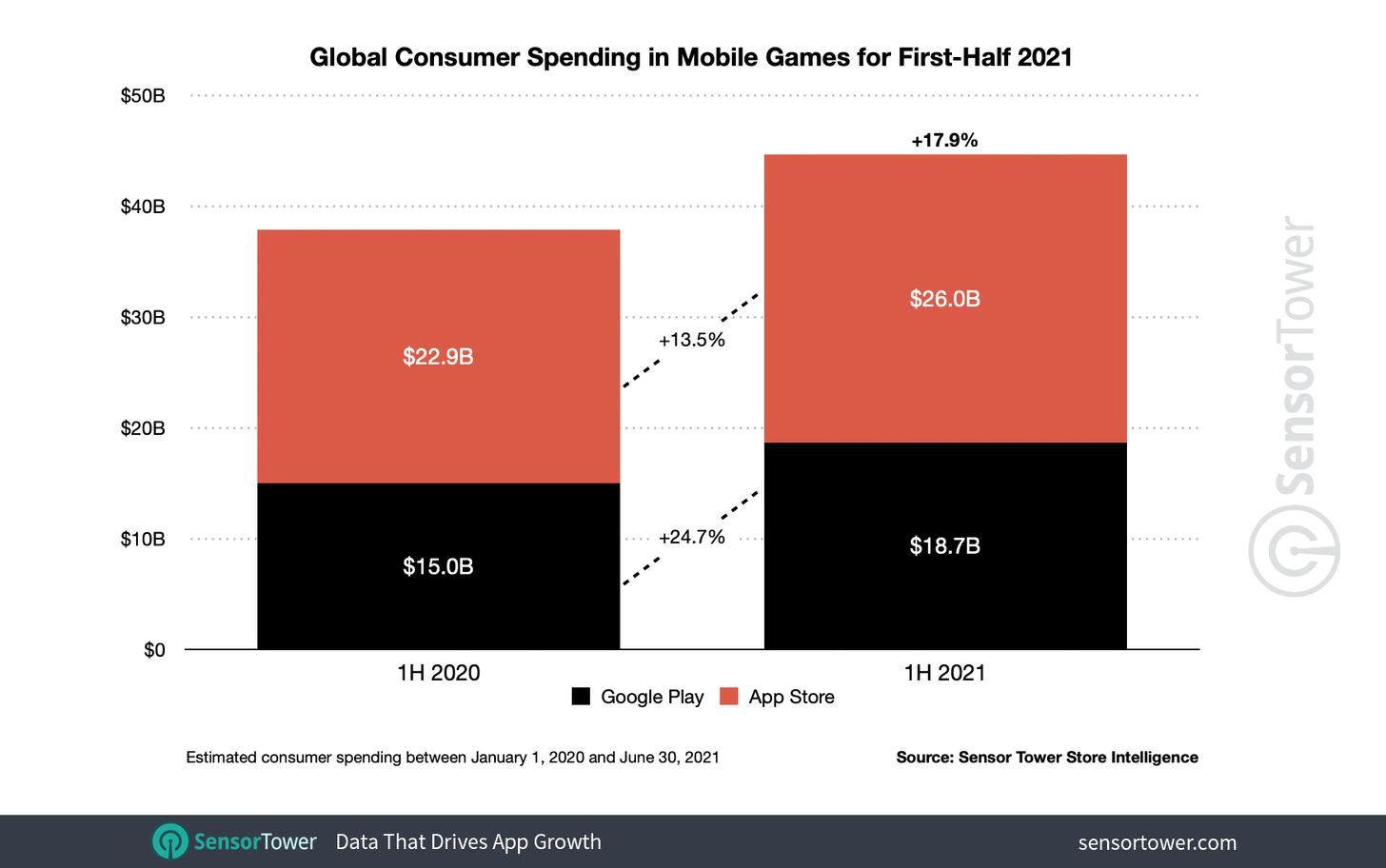

- The mobile gaming market in H1 2021 received $44.7 billion (+17.9% YoY). It’s 68.8% of the overall mobile market revenue.

-

Users spent $26 billion (+13.5% YoY) in App Store and $18.7 billion (+24.7% YoY) in Google Play.

-

The gaming market growth slowed down a little bit compared to H1 2020.

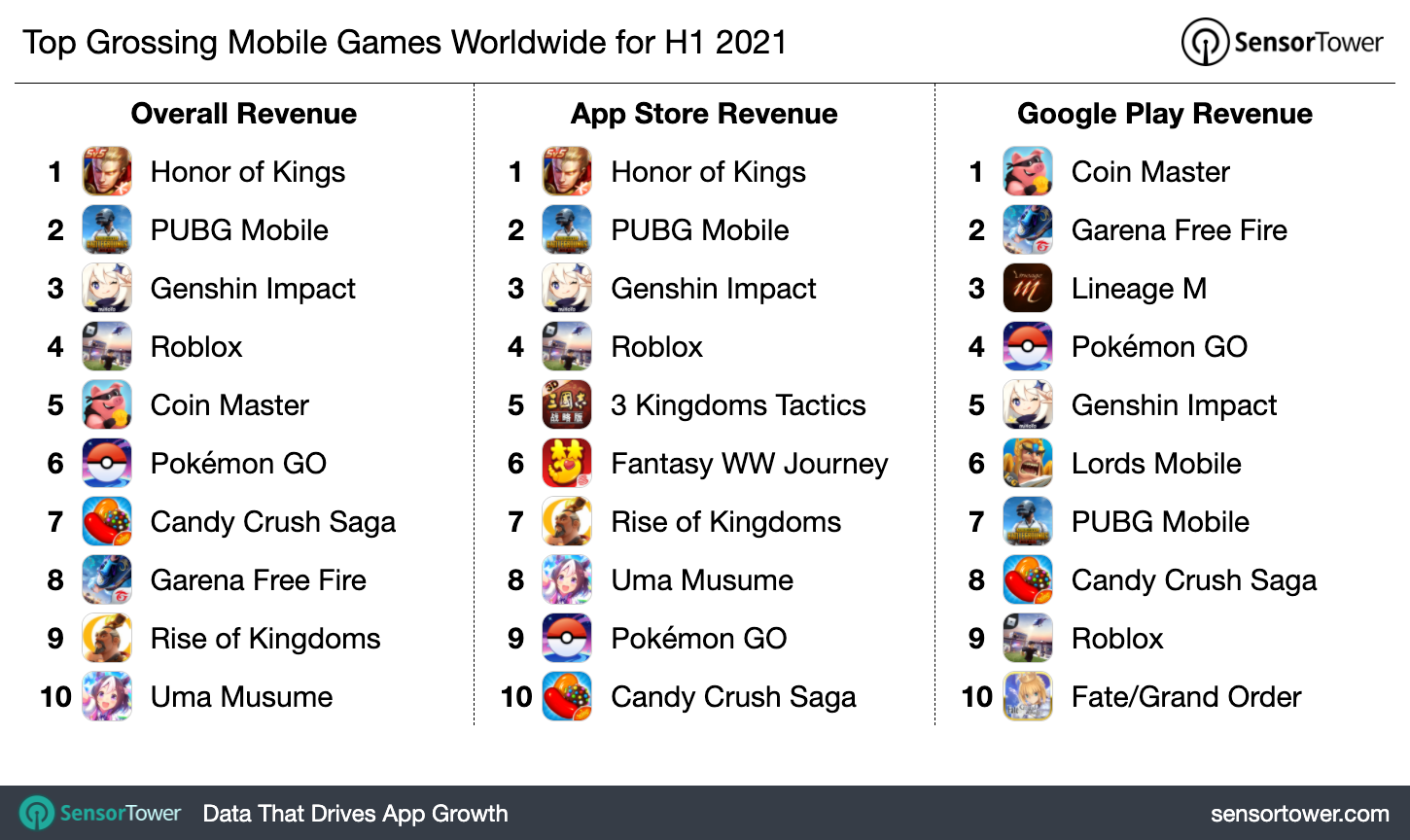

- The Honor of Kings was the top game by revenue in H1 2021. Developers earned more than $1.5 billion.

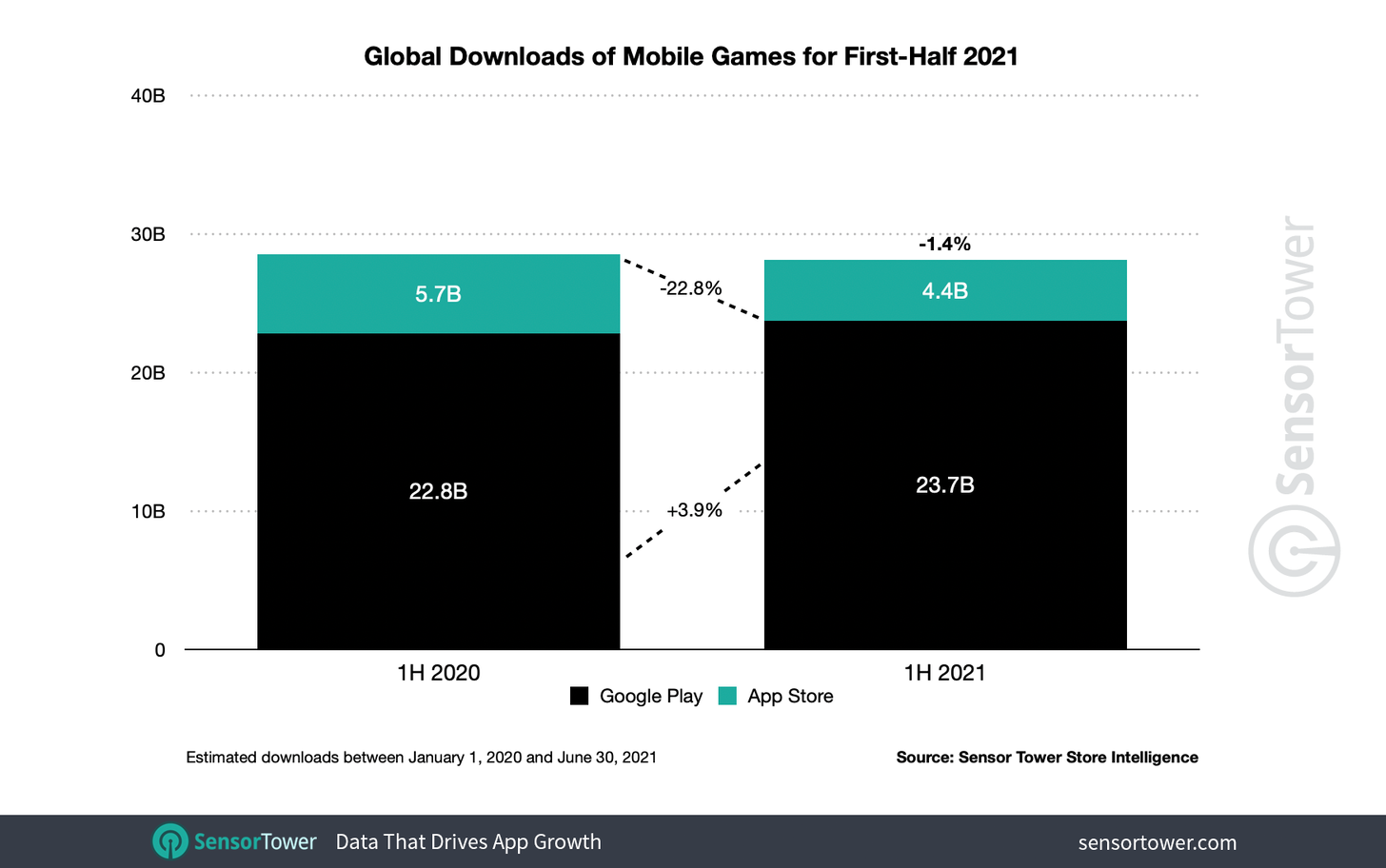

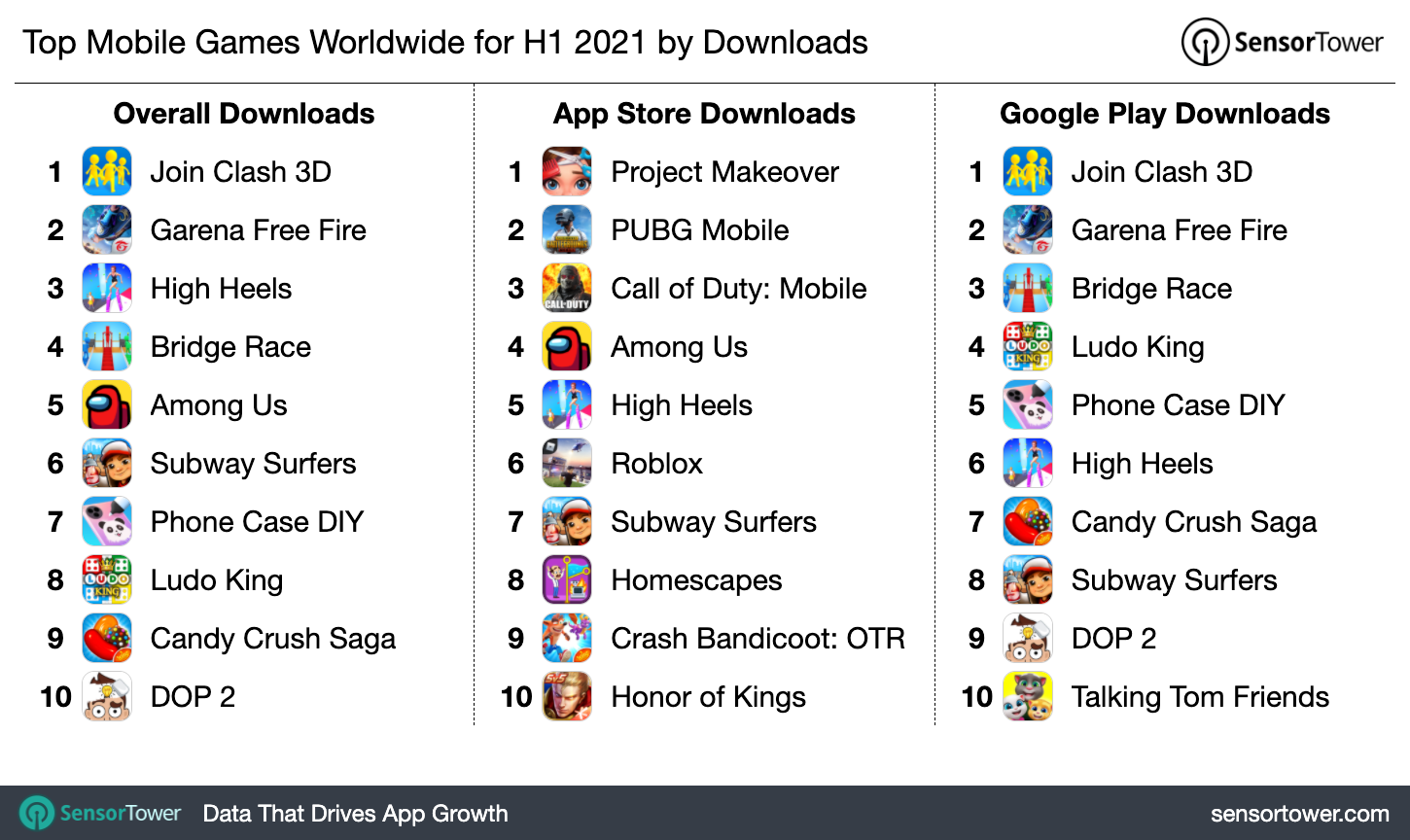

- The number of downloads in H1 2021 decreased compared to H1 2020 by 1.4%. It’s 28.1 billion downloads.

-

App Store downloads dropped by 22.8% YoY - to 4.4 billion. On contrary, Google Play showed 3.9% growth to 23.7 billion.

- Not counting Garena Free Fire, the most downloaded App Store & Google Play games were casual or hyper-casual titles.

App Annie: Gaming apps were earning $1.7 billion per week on average in Q2 2021

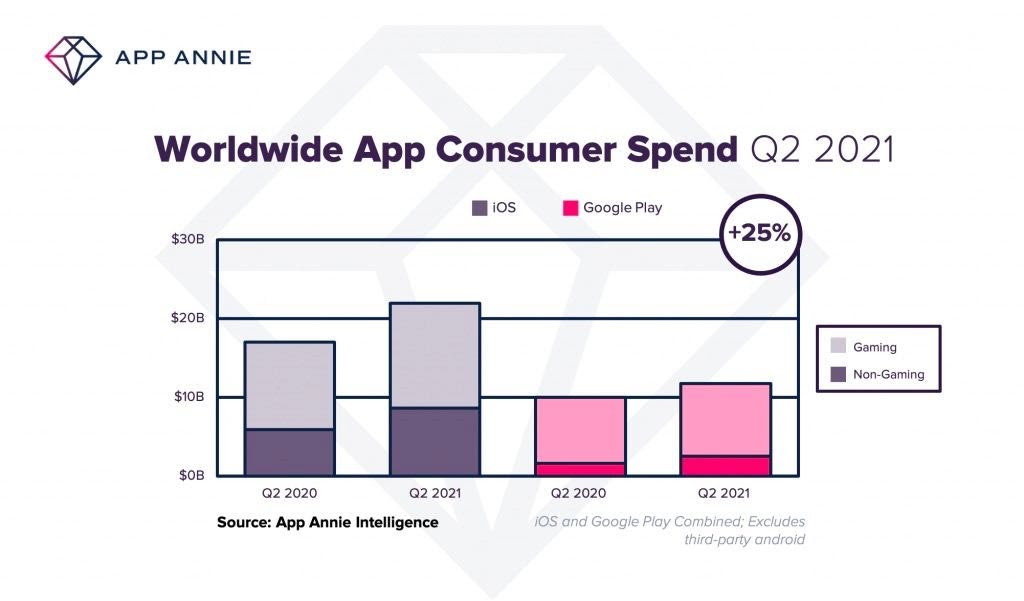

- Overall mobile market revenue in Q2 2021 was $34 billion - across all categories. It’s 25% higher than a year before.

-

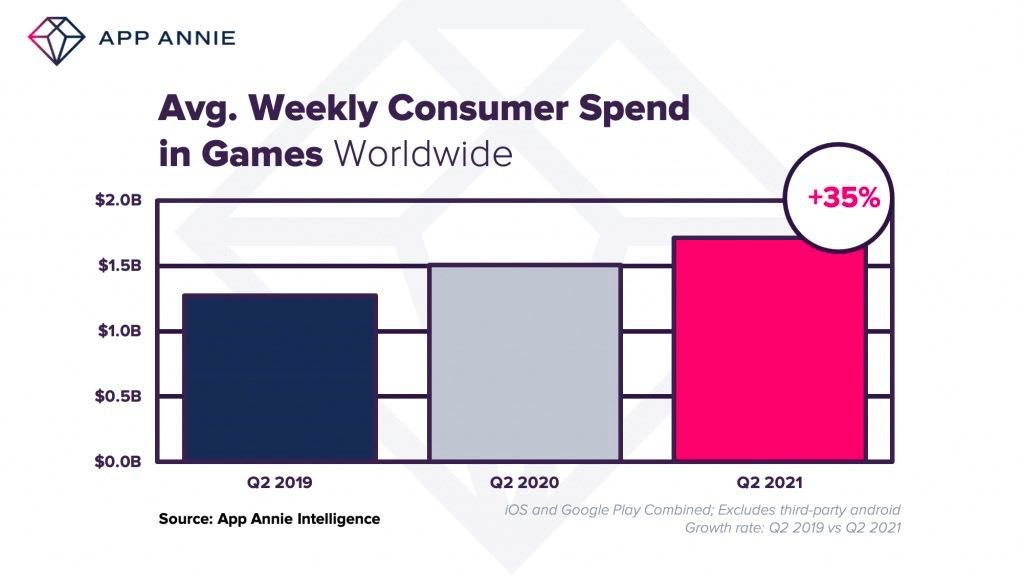

Games revenue increased by 35% compared to Q2 2019. Developers have been earning about $1.7 billion every week in Q2 2021.

-

The number of downloads exceeded 1 billion per quarter for the 5th quarter straight. Growth compared to 2019 - by 15%.

-

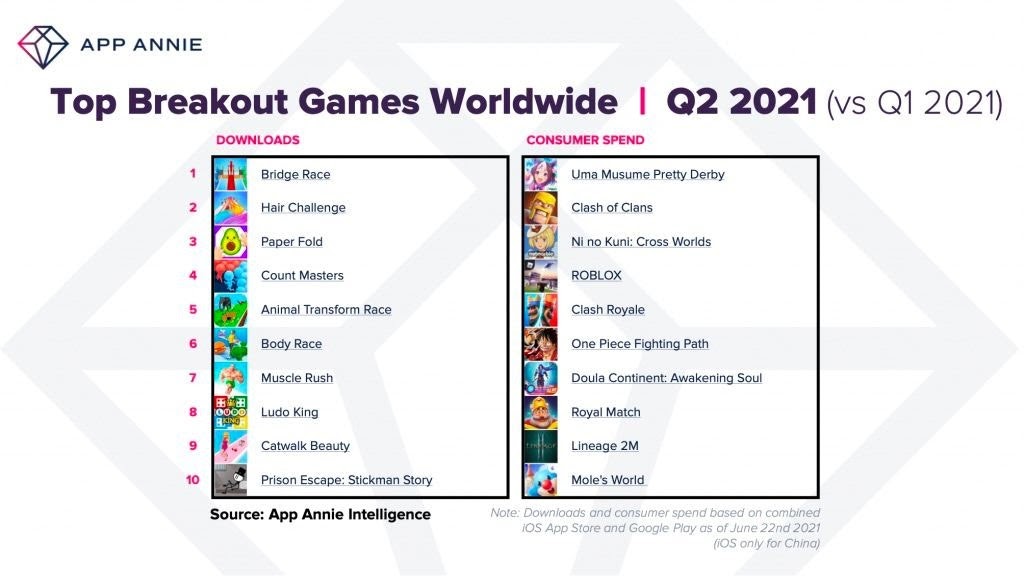

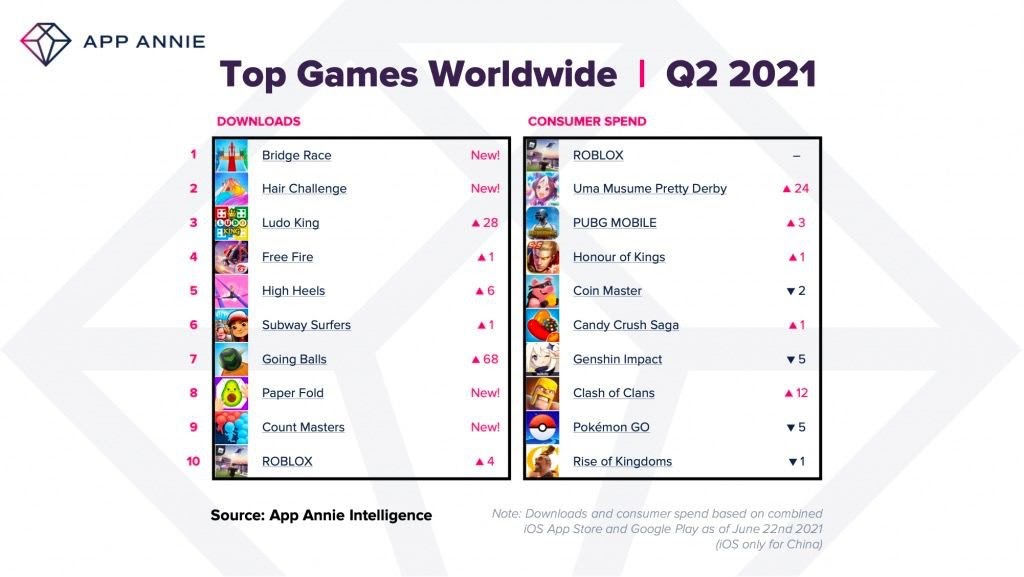

By consumer spend, ROBLOX was the top game in Q2 2021; Bridge Race had the most downloads. The most spectacular new game is Uma Musume Pretty Derby. Ni no Kuni: Cross Worlds is showing great results too.

Newzoo: There will be 3 billion gamers will be on the planet by the end of 2021

-

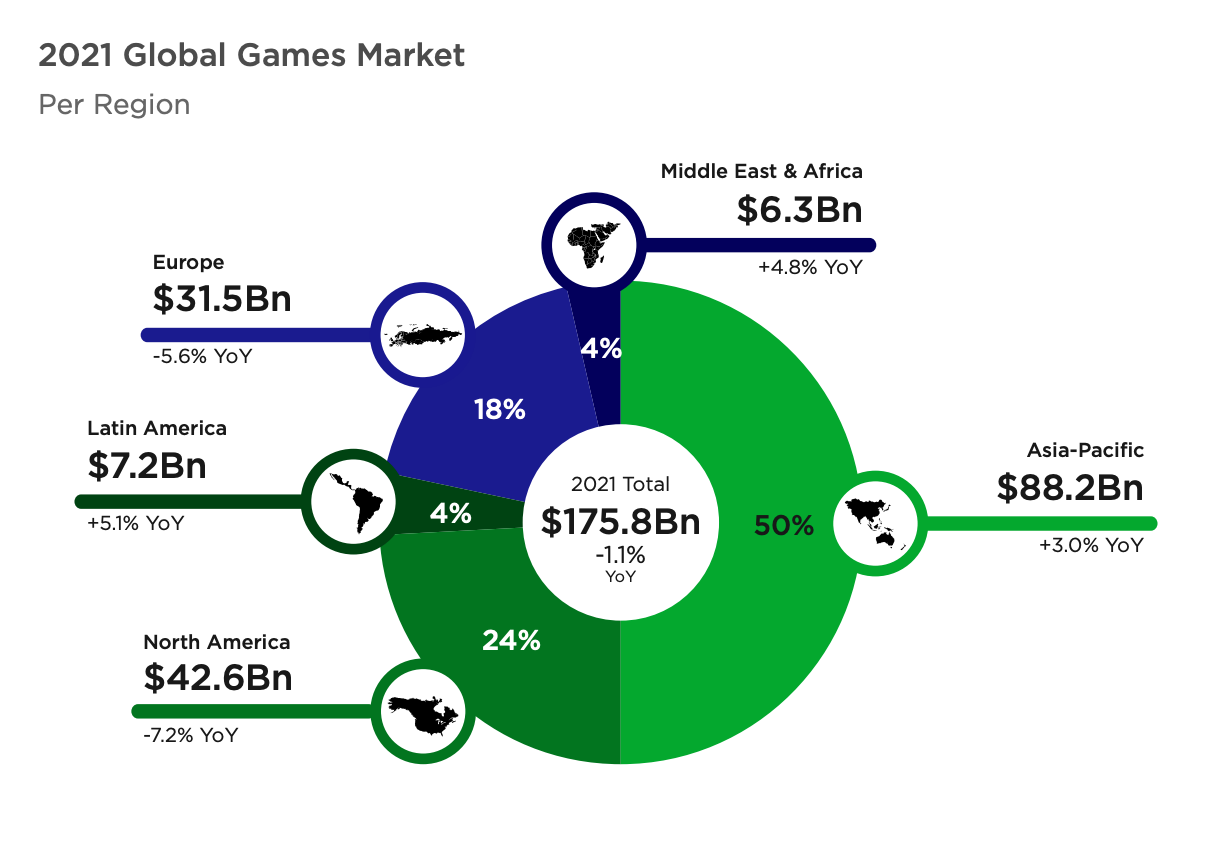

The gaming market will decrease by 1.1% compared to 2020 - to $175.88 billion. The highest shrink rate will be seen in the North American region at 7.2%.

-

The Mobile Gaming market in 2021 will reach $90.6 billion (+4.7% YoY). The Console market will shrink to $49.2 billion (-8.9% YoY), while the PC Market is predicted to be worth $35.9 billion (-1.7% YoY).

-

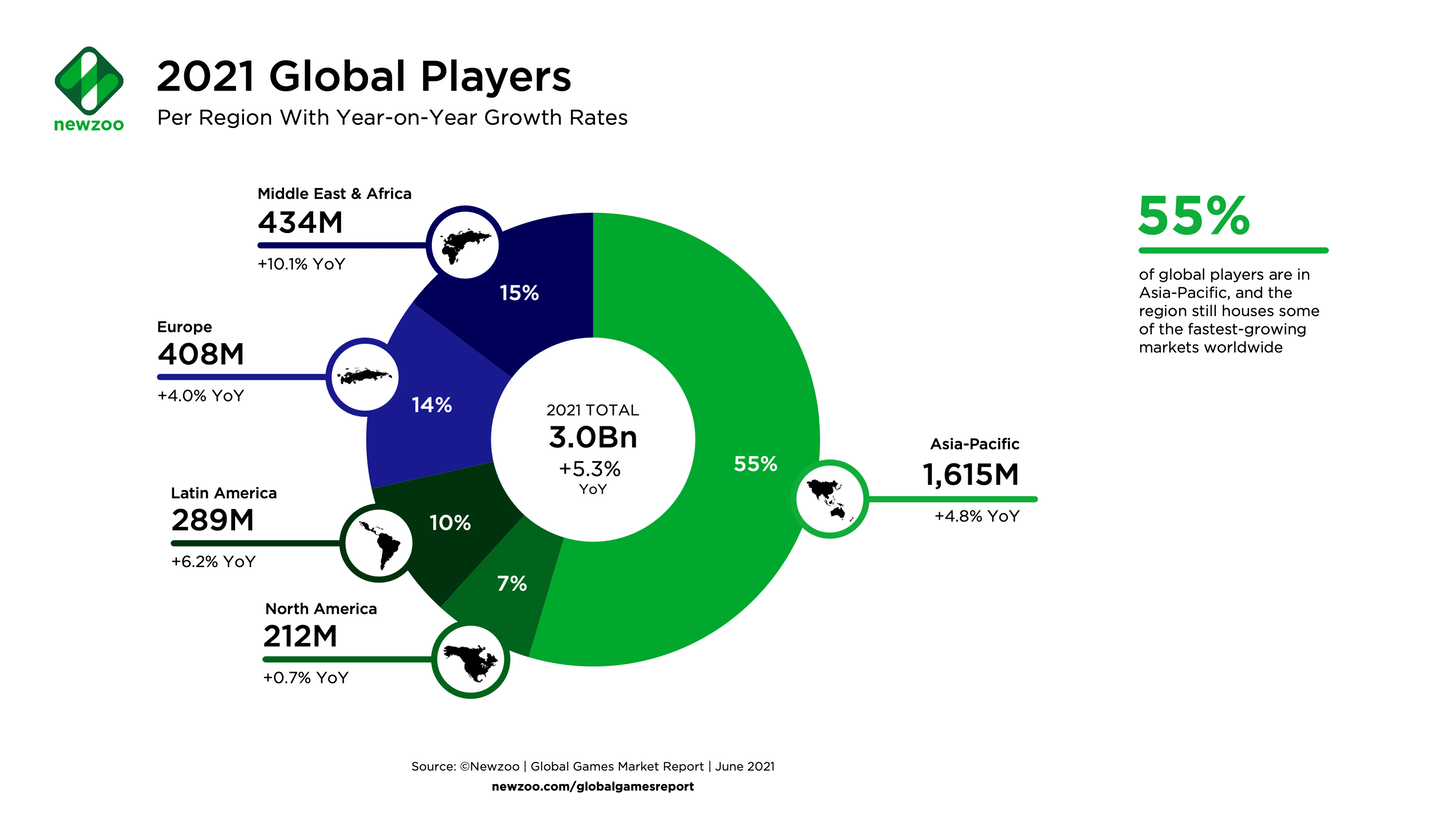

The number of gamers in 2021 will reach 3 billion users - it’s 5.3% more than in 2021. The majority of them comes from the Asian-Pacific region - 1.615 billion.

-

Newzoo points out, that the Gaming Market will amount to $218.7 billion by the end of 2024 with a CAGR of +8.7%.

-

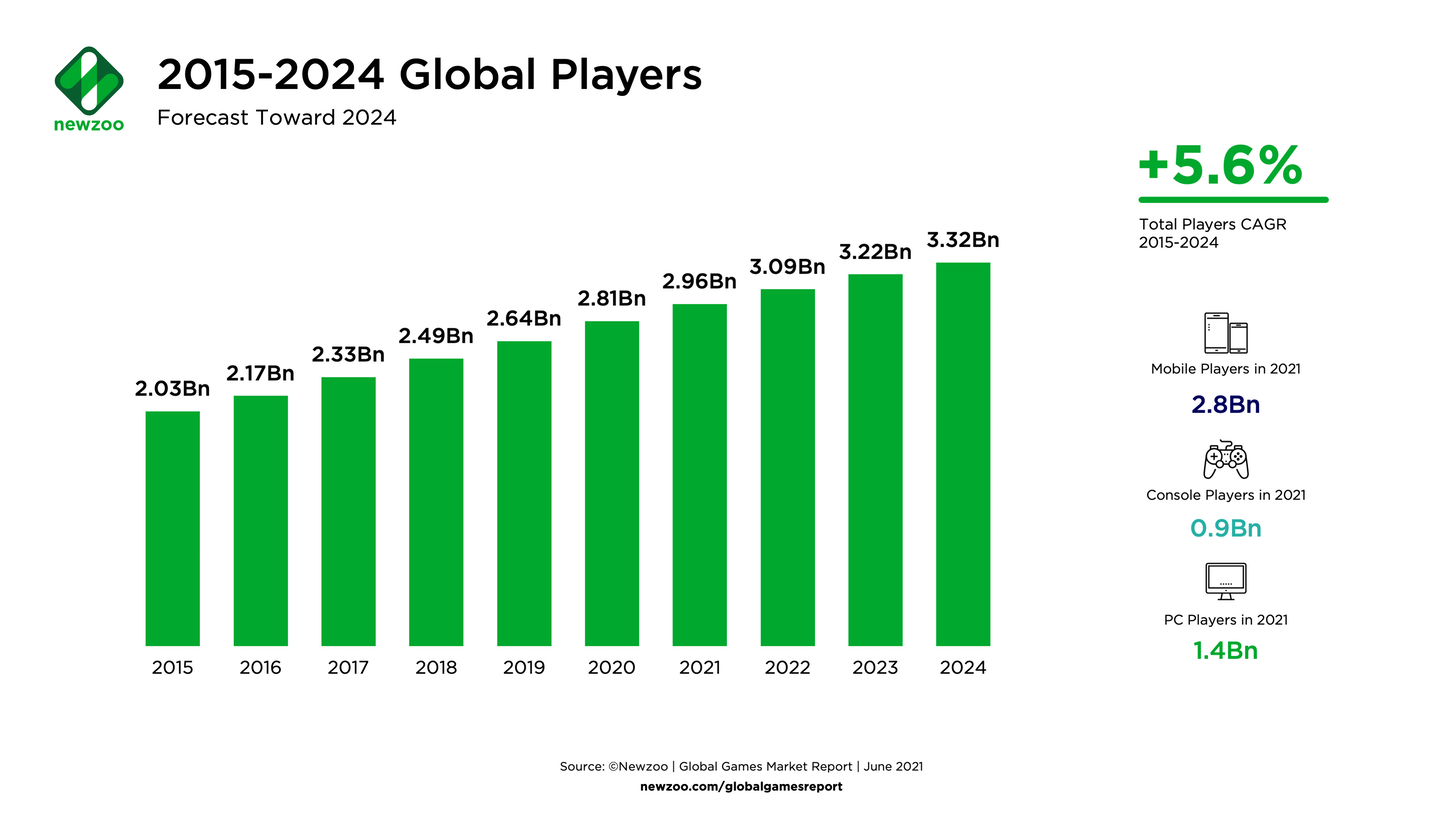

In 2021 2.8 billion out of 3 billion gamers will play on mobile devices. As for the PC, there will be 1.4 billion such users and 0.9 billion will play on consoles.

- By the end of 2024, the number of gamers will reach 3.32 billion, showing a CAGR of 5.6%.

Link to the full version of the report.

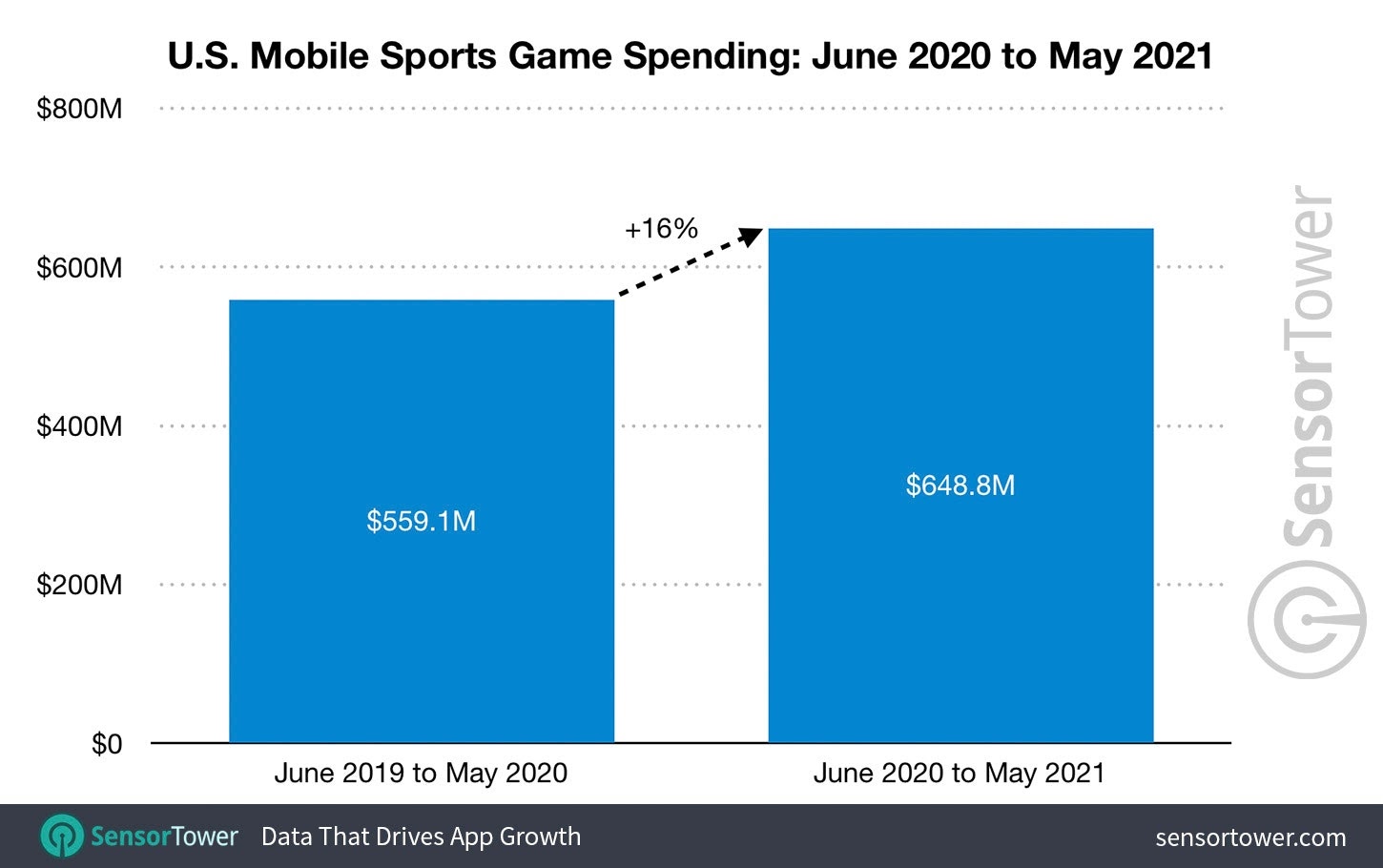

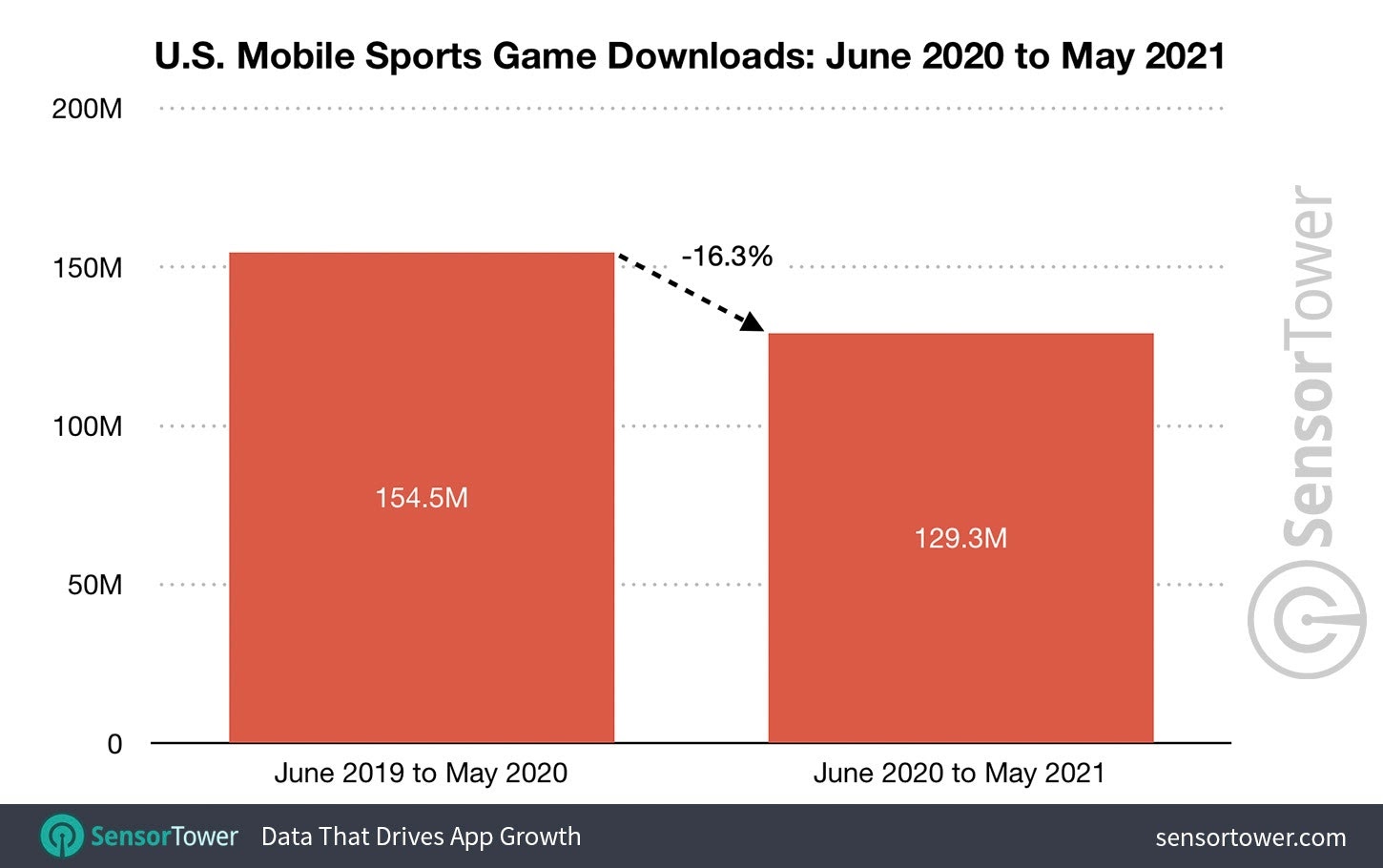

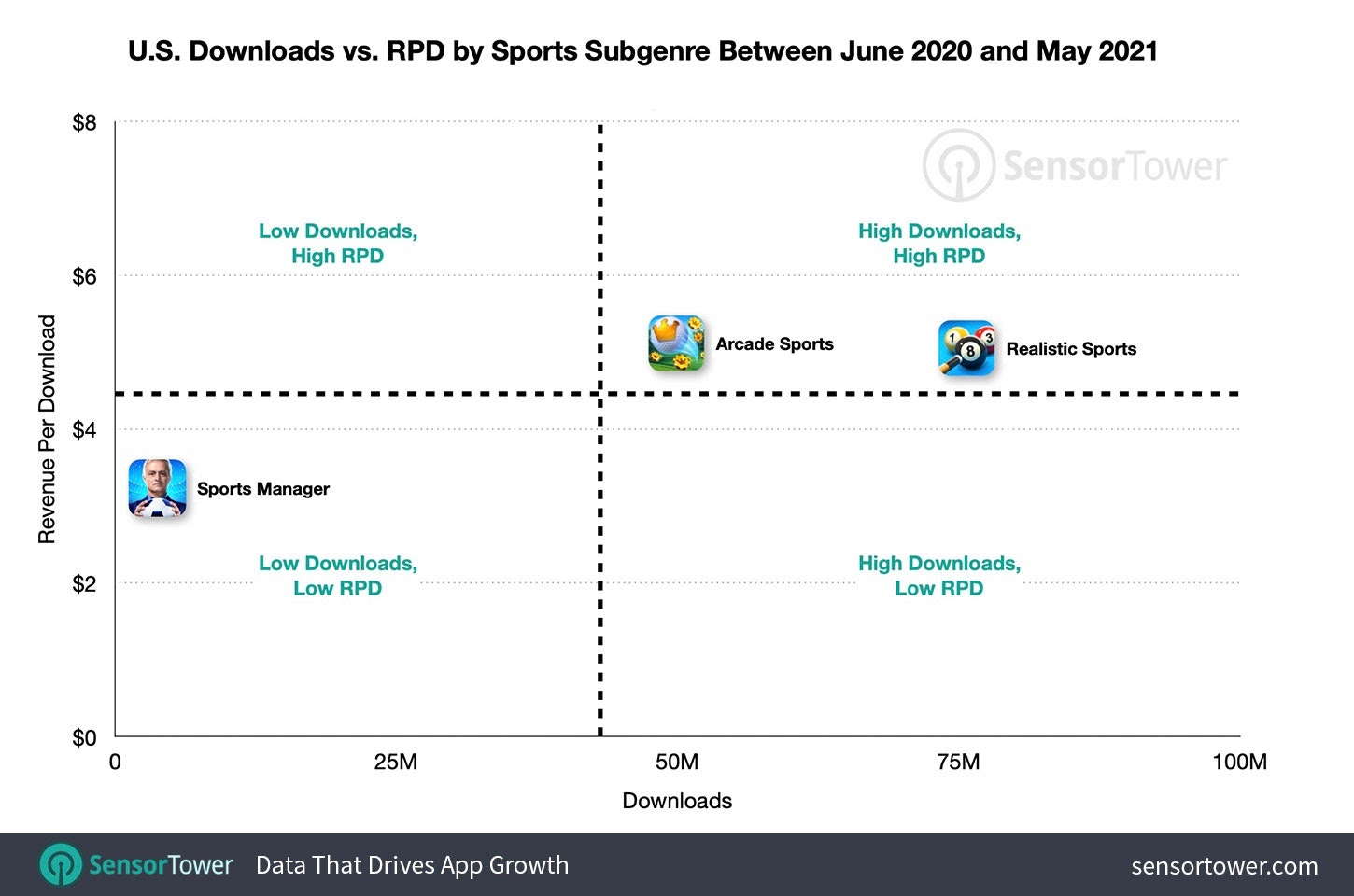

Sensor Tower: Mobile sports games in the US received $648.8 million in revenue in a year

- Sports games showed 16% growth YoY.

-

The highest-grossing game is Golf Clash with $132.8 million generated over the last year alone.

- From June 2020 to May 2021 Sports games were downloaded 129.3 million times. It’s a 16.3% decrease compared to the year before. The most downloaded game was 8 Ball Pool with 9.4 million downloads.

- The most profitable Sports games subcategory is Realistic Sports Games. Users spent $382 million in this subcategory, which is more than half of the entire Sports games' revenue.

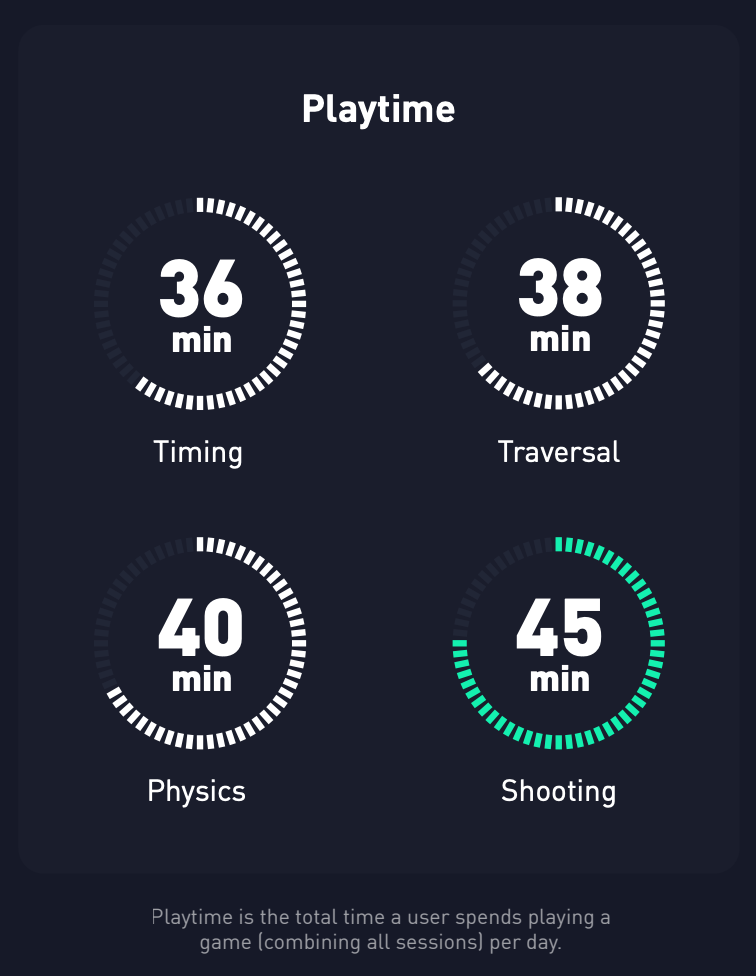

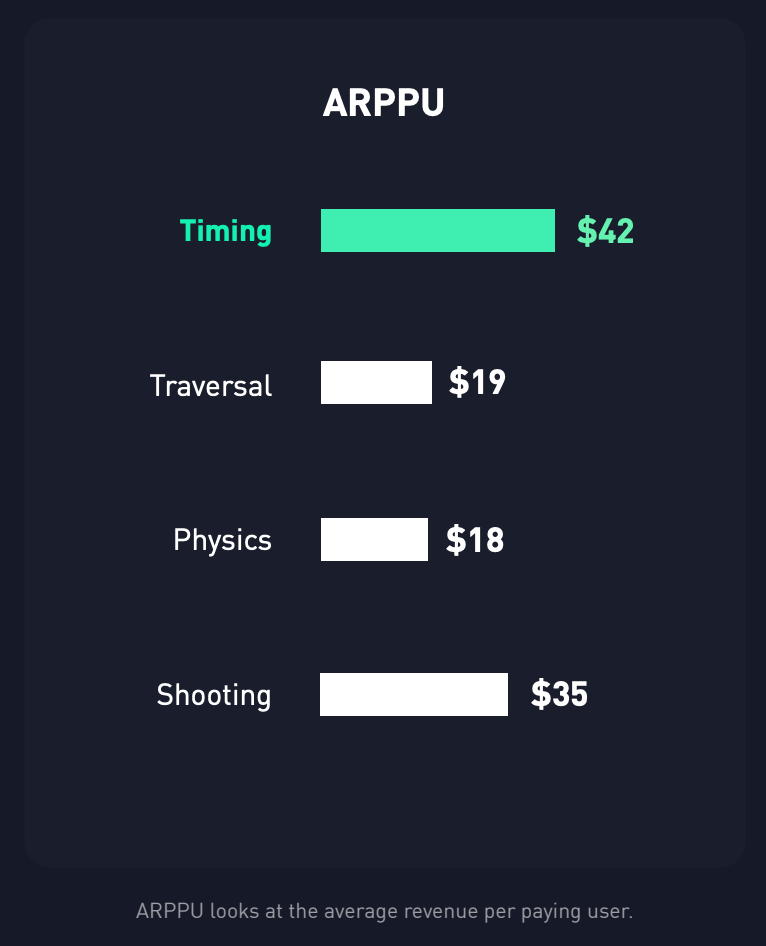

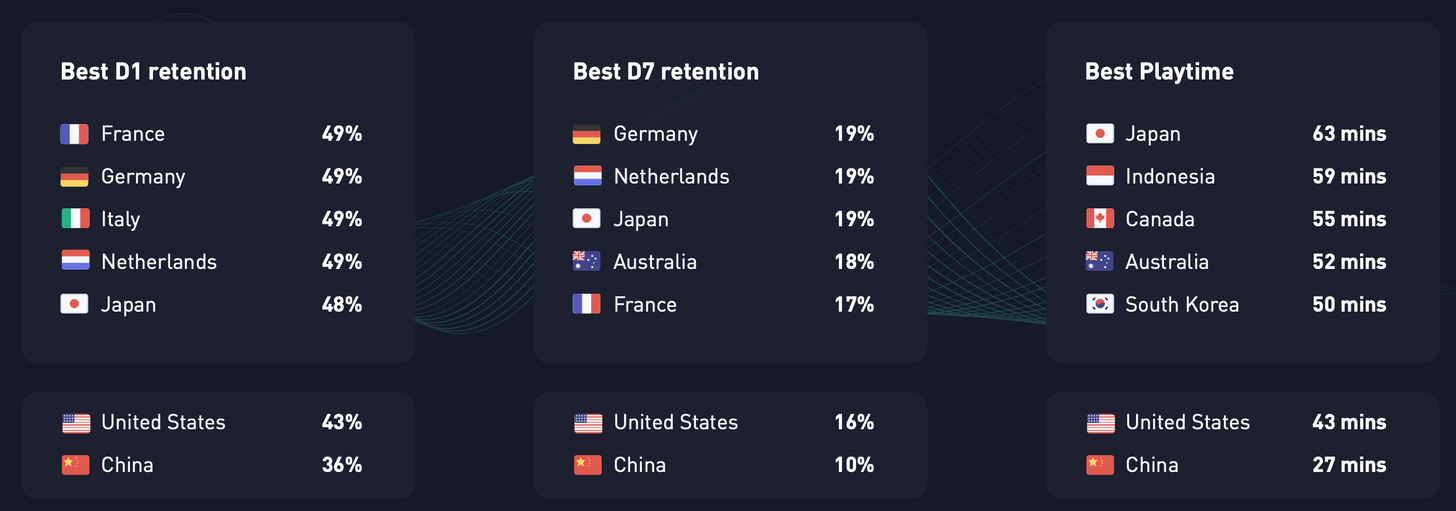

GameAnalytics: Hyper-casual games' metrics snapshot

For creating this report, GameAnalytics tracked only 5% of the best games.

-

Timing hyper-casual games show the best average D1 Retention - 44%.

-

Hyper-casual shooters show the best average D7 Retention - 17%.

- Hyper-casual shooters also have the best daily playtime - 45 minutes.

-

Timing-based Hyper-casual games have the best ARPPU - $42.

- Timing-based Hyper-casual Games also has the best ARPDAU - $0.15.

- They also have the best conversion into purchase rate (0.94%).

-

The best D1 Retention is in France (49%); D7 Retention - in Germany (19%); the longest playtime is in Japan (63 minutes).

The full report is available here.

KPMG: Indian gaming industry will grow by 113% by 2025

-

Money-wise it will reach $3.91 billion by 2025. Currently, it’s evaluated at $1.83 billion.

-

The number of players will increase by 52% from 2021 to 2025 - from 433 million to 657 million users.

- KPMG is segmenting games to “casual” (category includes all games - from Candy Crush to DOTA 2), real-money games (casino or card), and fantasy sports games.

- “Casual” games will show the highest growth - from $808 million in 2021 to $2.28 billion in 2025.

IGEA: Australian gaming industry gained from the coronavirus

-

62% of Australian studios started to earn more revenue in the past 12 months. A year ago only 33% of the companies could have said this.

-

63% of studios want to hire people in the short term. And only 4% are thinking about lay-offs.

-

60% of studios are using the hybrid working model.

-

31% of respondents said that they lost in contractual revenue in the past 12 months. 61% of them experienced the negative effect of the pandemic.

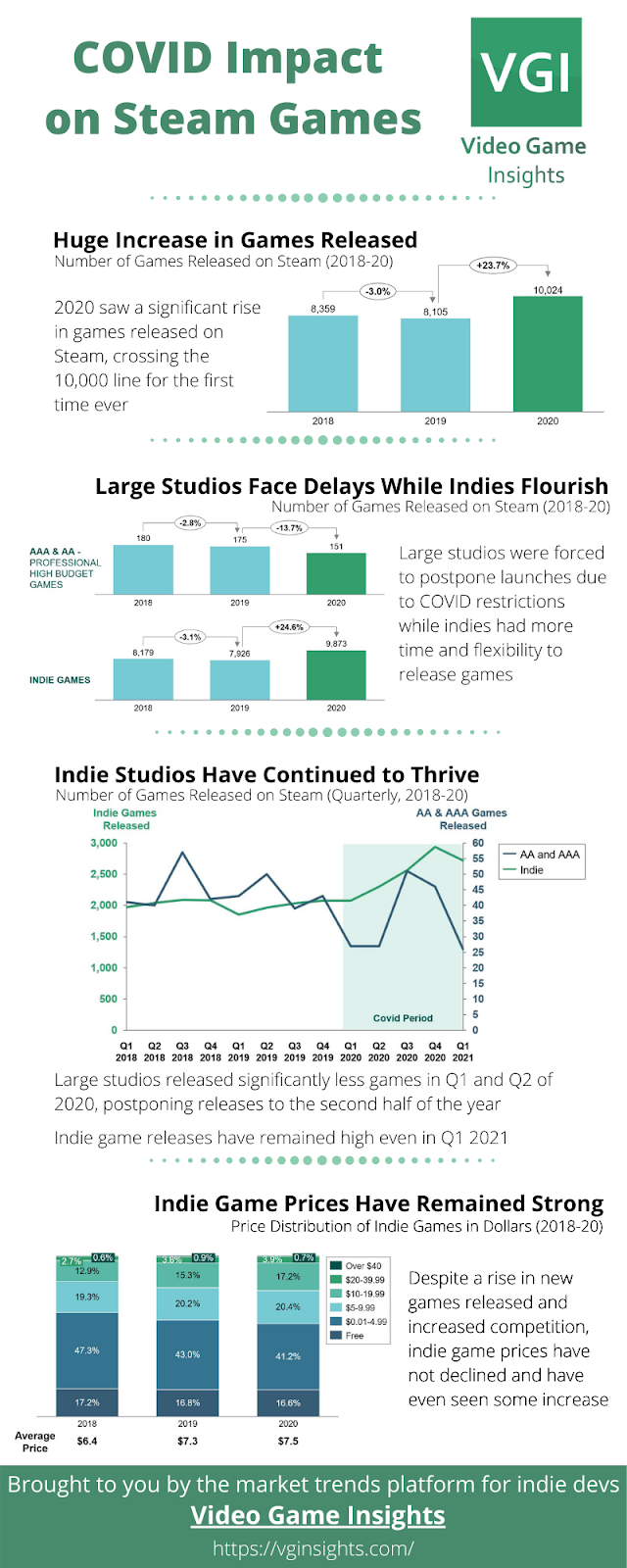

VG Insights: The COVID-19 effect on Steam releases in 2020

-

2020 became the record year in Steam in terms of releases. More than 10,000 games appeared on the platform - it’s 23.7% more than in 2019. It was the first year in history when Steam releases reached this plank.

-

The number of big (AAA/AA) releases decreased by 13.7% compared to 2019 (2019 - 175; 2020 - 151). In contrary, indie releases showed growth by 24.6% (2019 - 7,926; 2020 - 9,873).

-

The pandemic badly affected AAA/AA releases in Q1-Q2 2020 and forced developers to postpone them. Indie developers haven’t noticed any troubles.

-

The average indie-game price in 2020 increased to $7.5. In 2019 it was $7.3; in 2018 - $6.4.

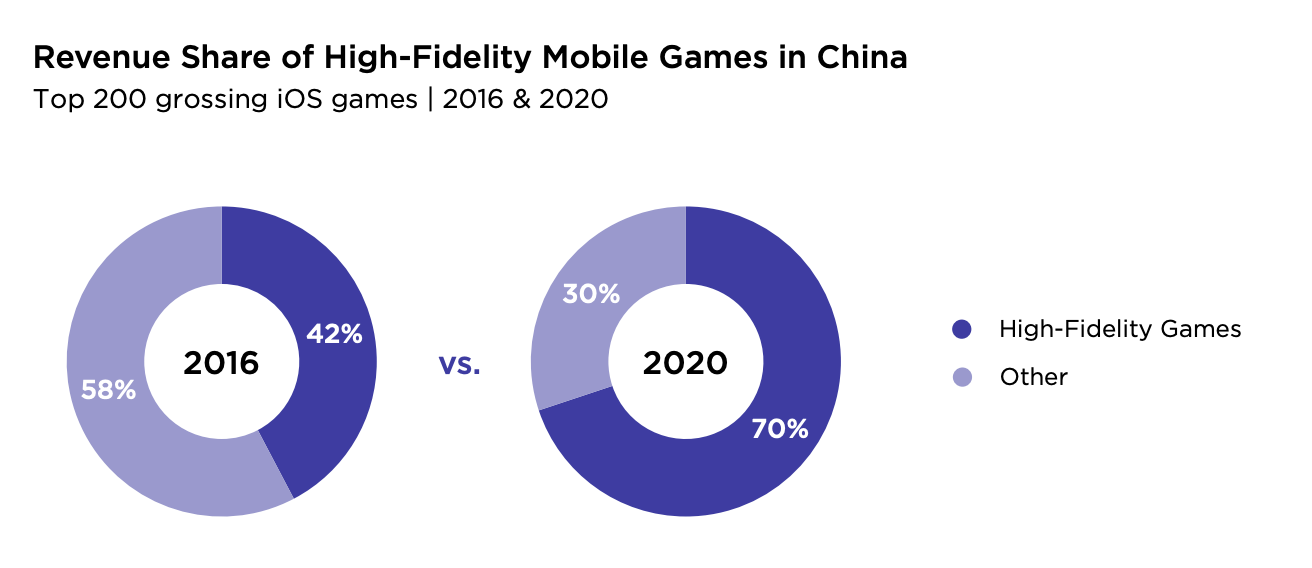

Newzoo&arm: High-fidelity mobile games report

-

It’s fair to say that high-fidelity mobile games, from the Newzoo expert’s perspective, are mobile AAA. They do have complex gameplay, high-quality graphic, and are mostly represented by hardcore genres.

- In 2020, Mobile AAA games were responsible for 70% of top-200 mobile games revenue in China. For comparison, in 2016 only 42% of mobile games' top-200 revenue belonged to them. Top high-fidelity games in China are Honor of Kings, Peacekeeper Elite, and CrossFire Mobile.

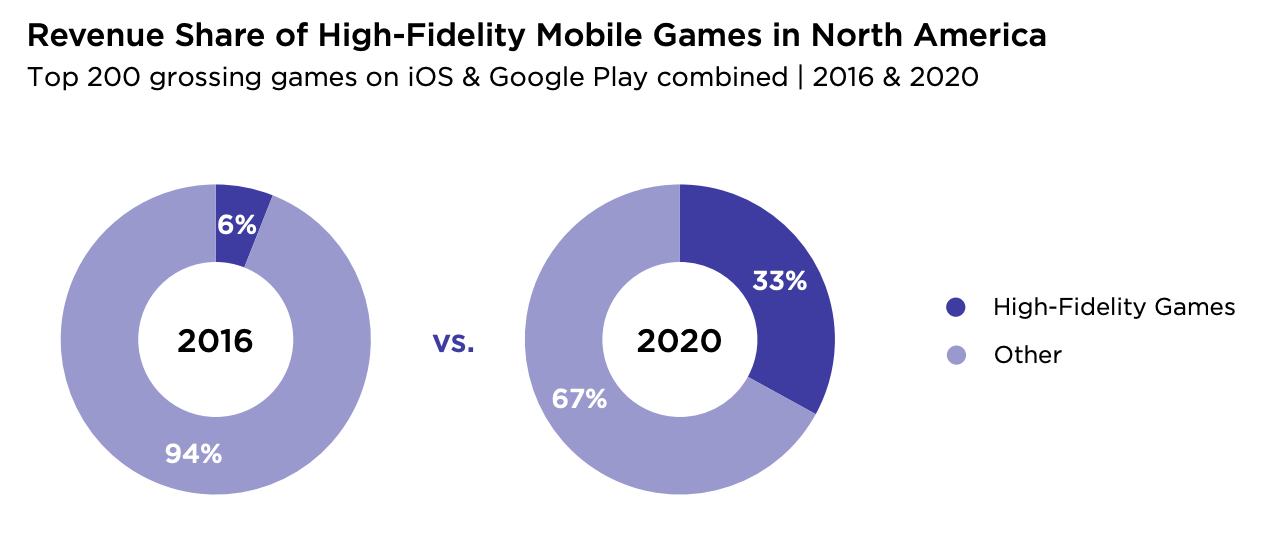

- In North America, the AAA games from the top-200 increased their revenue share from 6% in 2016 to 33% in 2020. Top high-fidelity games are ROBLOX, Pokemon Go, PUBG Mobile.

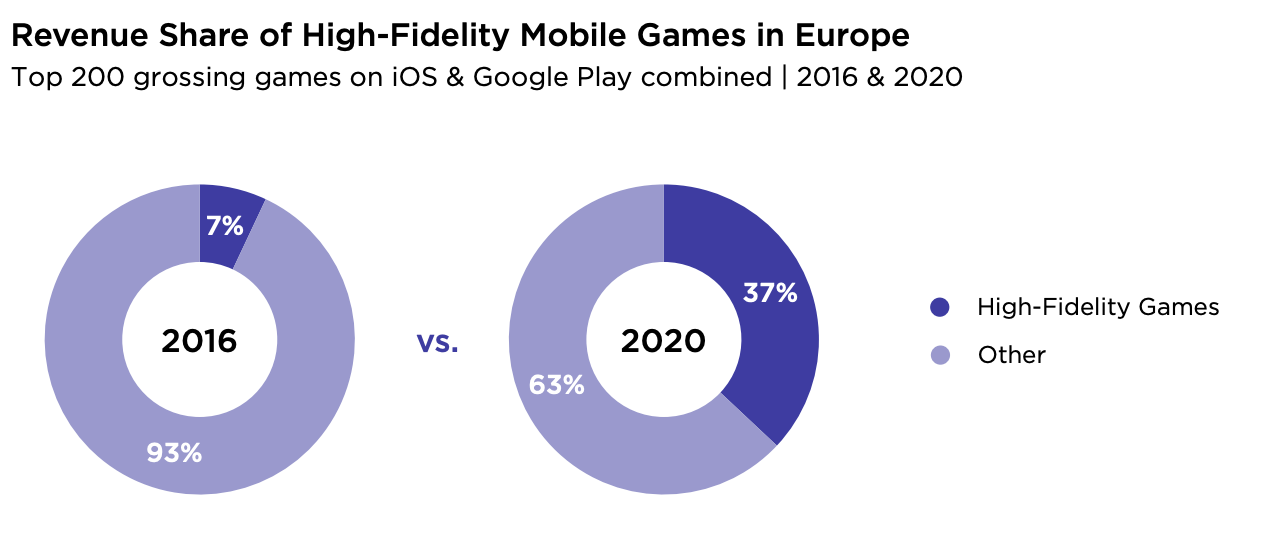

The situation is pretty similar in Europe. High-fidelity games showed growth from 7% of the top-200 mobile games revenue in 2016 to 37% of the revenue in 2020. In 2020 the top-grossing AAA mobile games were Pokemon Go, Brawl Stars, and ROBLOX.

-

From January 2019 to December 2020 number of high-end smartphones increased sufficiently - from 7.6% to 35.3% globally.

-

94% of all gamers are playing on mobile.

-

Newzoo experts are positive that the revenue of the high-fidelity games will continue to grow. PC/Console publishers moving to the mobile market will help it happen.

The full report is available here.

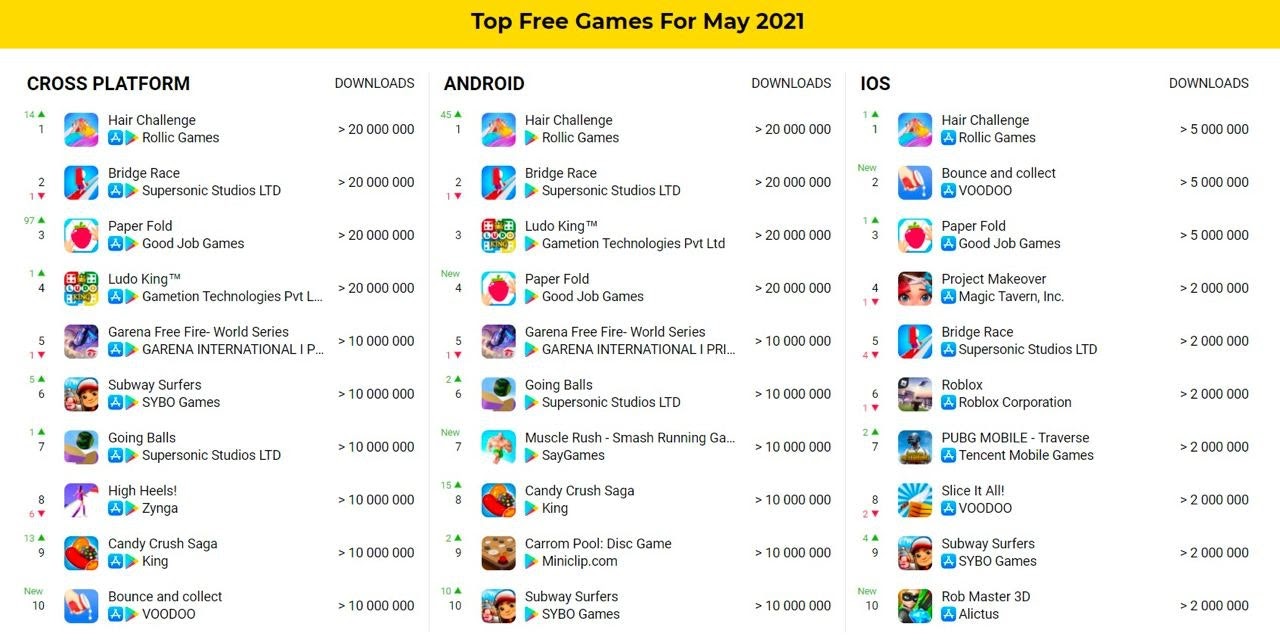

AppMagic: Top games by downloads and revenue in May 2021

Downloads

- The most popular game of the month is Hair Challenge from Rollic Games. It had 37 million downloads in Google Play and 6 million in App Store in May.

-

Bounce and Collect from Voodoo reached 10.3 million downloads (5.1 million came from iOS).

-

Muscle Rush from SayGames managed to get 13.9 million downloads in Google Play.

-

Turkish company Alictus with their Rob Master 3D received 3.2 million downloads on iOS.

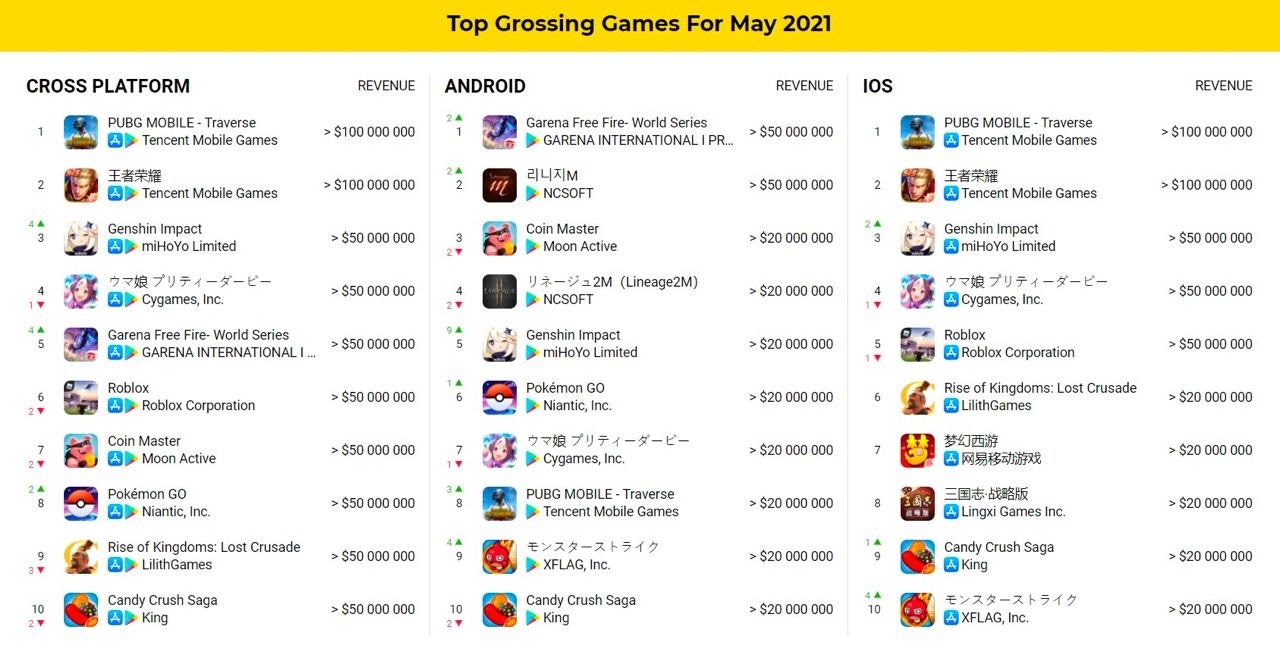

Revenue

- The most successful game of May was PUBG Mobile. It had $148 million of revenue, $119.5 million of which came from iOS.

-

The top Google Play game by revenue was Garena Free Fire with $59 million. iOS platform generated $22 million of revenue for the developers.

-

Coin Master had $44 million Android revenue and $29 iOS revenue in May 2021.

-

Genshin Impact reached $94 million of revenue ($57 million - from iOS; $37 million - from Android). It is worth mentioning, that Android game revenue increased by $13 million compared to the previous month.

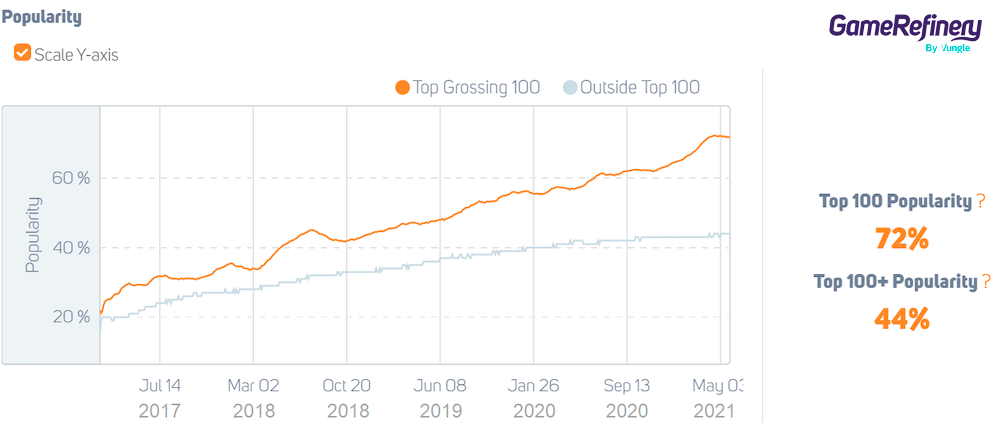

GameRefinery: Collection system in games

-

72% of the top-100 US games by Revenue this year has a collection mechanic. In February 2017 there were only 21% of projects with such a component.

-

GameRefinery reports that collection mechanics is a great way to increase user retention and monetize them more efficiently. Plus, many people just like to collect things, which changes the user experience with a game for the better.

In the full version you can find the best examples of collection mechanics: sticker album from Board Kings; weapon gallery from Pixel Gun 3D; heroes collection from Marvel Strike Force and many more with a description of how the collection mechanic implemented in each project.

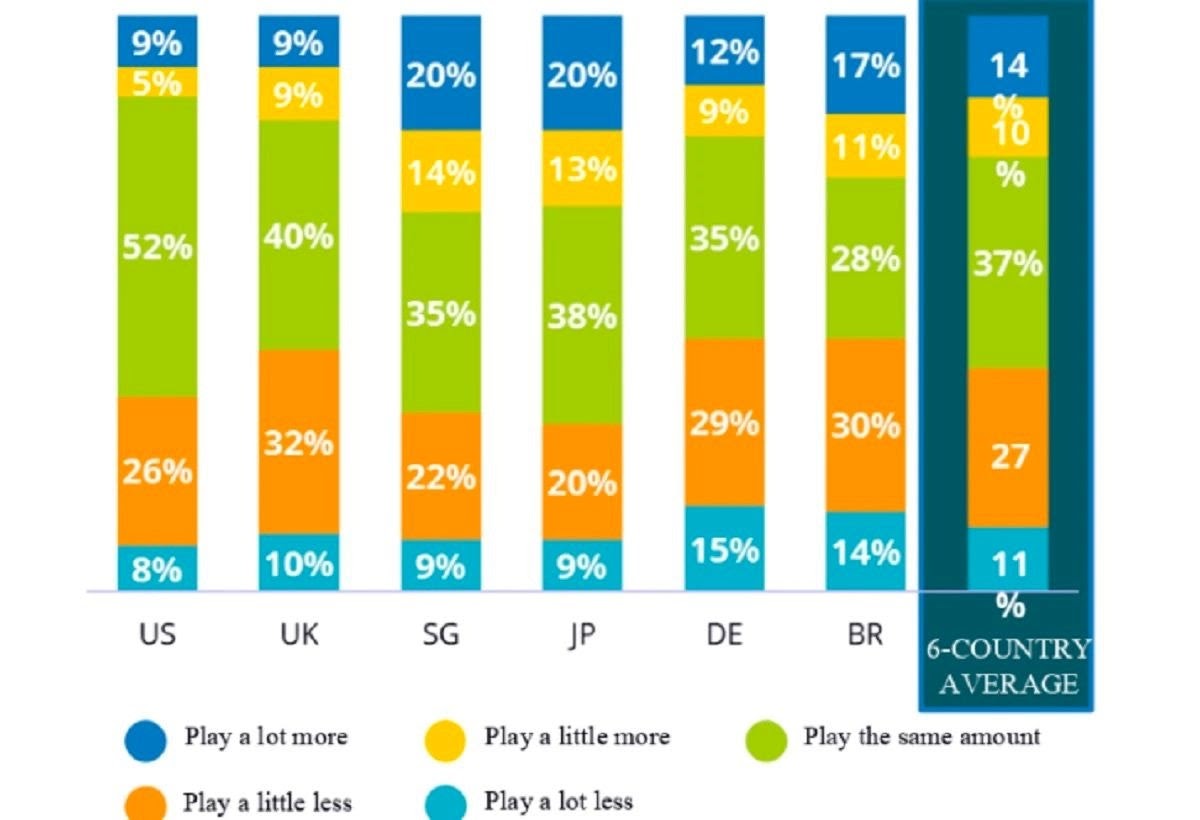

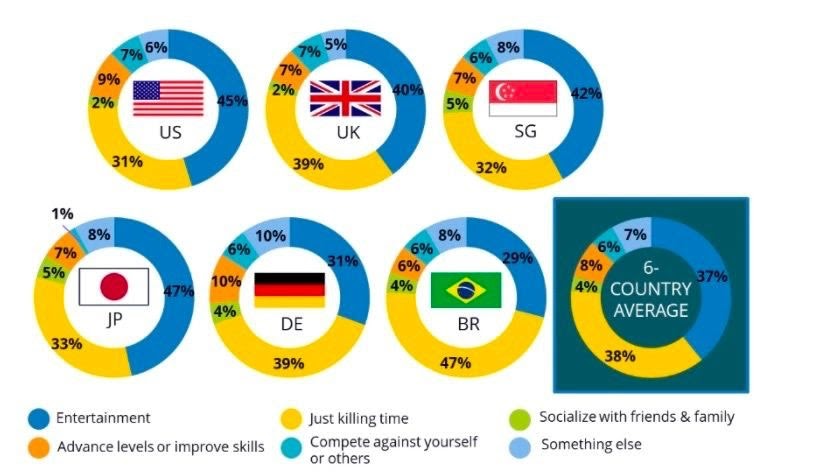

IDC & LoopMe: 75% of pandemic-driven gamers will continue playing games

The survey was made across 3,850 smartphone users in the US, UK, Japan, Germany, Brazil, and Singapore.

-

75% is an approximate number. It’s based on respondents' answers in the interview, where they were asked about how their gaming behavior will change after the pandemic.

-

38% of the interviewed said that they will play a little or a lot less after the pandemic. 24% of respondents, on the contrary, are planning to play more.

- 63% of all interviewed mentioned that they played more during the pandemic.

-

About 6% of current gamers haven’t played games before the pandemic.

-

The number of gamers in 2020 increased by 12% compared to 2019. It’s about 2.25 billion players.

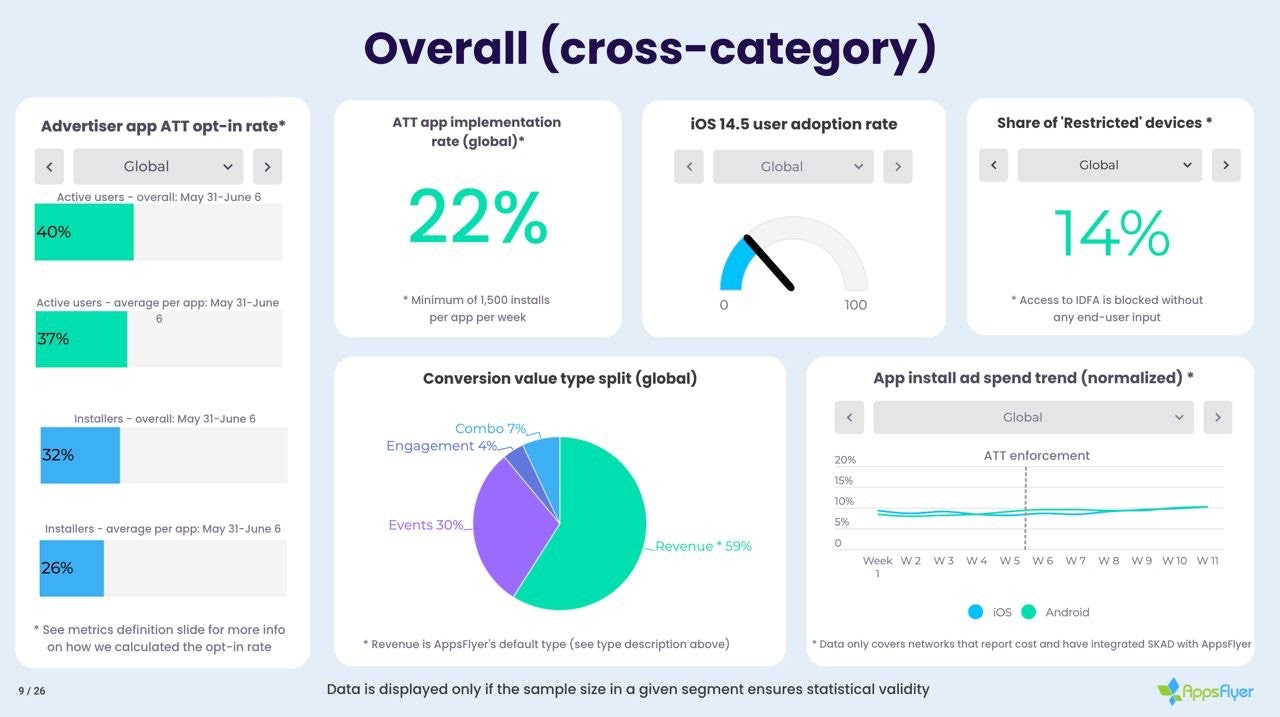

AppsFlyer: iOS 14 & ATT in gaming (June 8)

- Around 25% of all gaming apps have integrated the ATT framework. It’s an increase from 22% a week before.

-

As of 8 June, 27% of users have switched to iOS 14.5. A week before only 13% updated their system.

-

The best ATT framework penetration can be seen in hardcore and social casino games - 33%. Midcore titles are in between with 27% penetration. Casual and hyper-casual titles have the smallest share of apps with ATT - 20%.

-

It’s interesting, that the ad spending in the hardcore segment has increased since the IDFA policy update.

-

The only segment, where ad spending share has changed is the hyper-casual genre. Publishers started to buy more traffic on Android.

Sensor Tower: Top-grossing mobile games in May 2021

- Number one by revenue is Honor of Kings from Tencent with $264.5 million earned in May (+13% YoY growth). 95% of all money comes from China.

-

The second place belongs to PUBG Mobile from the very same Tencent with $258 million revenue (+5.2% YoY growth). In this case, China is accounted for 56.6% of all revenue, while has an 11% share.

-

Garena Free Fire had the very best month in history. The game revenue reached $107 million - it’s 29.4% more than in April and 19.4% more than in March of this year.

Tenjin: Publishers started to buy more Android traffic after iOS 14.5 release

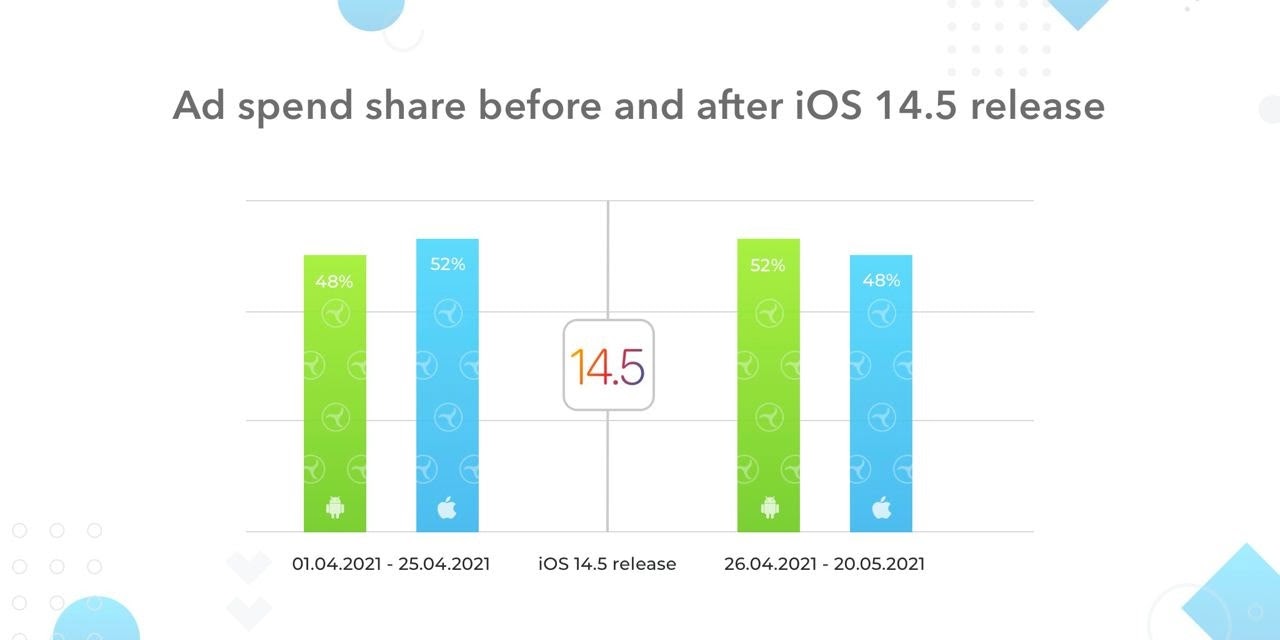

- After the iOS 14.5 release, the share of traffic purchased on iOS decreased from 52% to 48%. On Android, conversely, it raised from 48% to 52%.

-

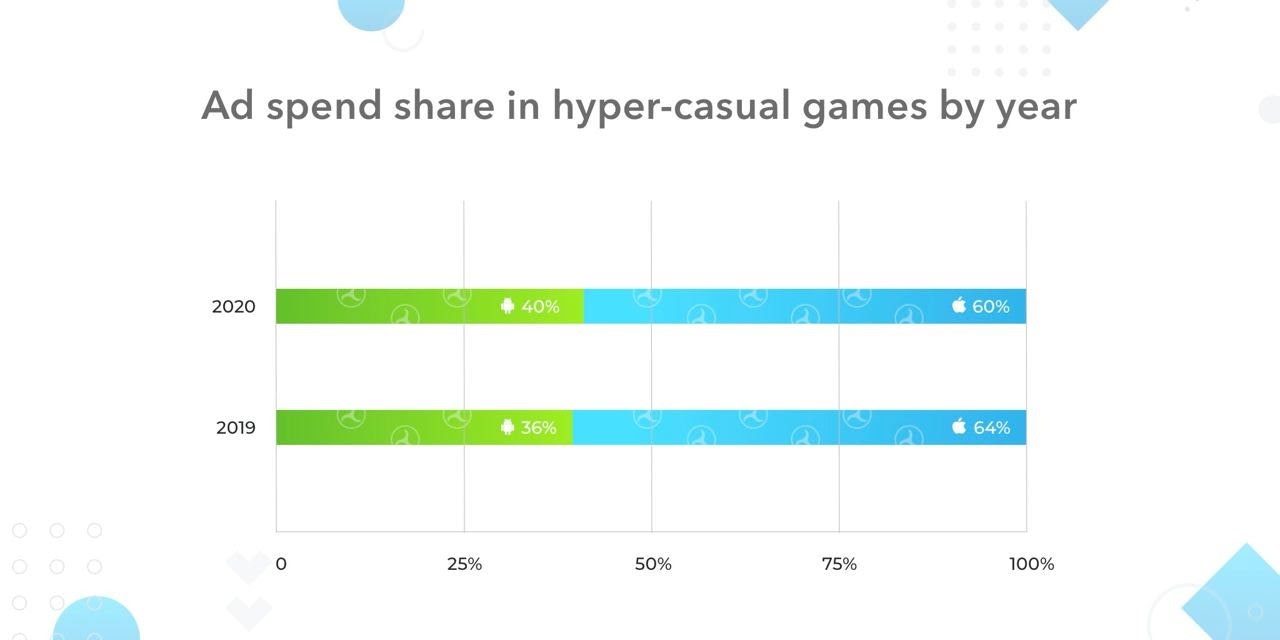

iOS 14.5 just speeded up the trend. In 2019 Android was responsible for 36% of paid traffic, in 2020 this number rose to 40%.

- Tenjin experts don’t see any reason for this trend to stop. By their assumptions, it will lead to a CPI increase on Android.

Ofcom: 62% of adults in the UK have played games in 2020

- In the age of 16 to 24, the vast majority - 92% - played games. Almost half of all gamers said that it helped them to cope with lockdown stress.

-

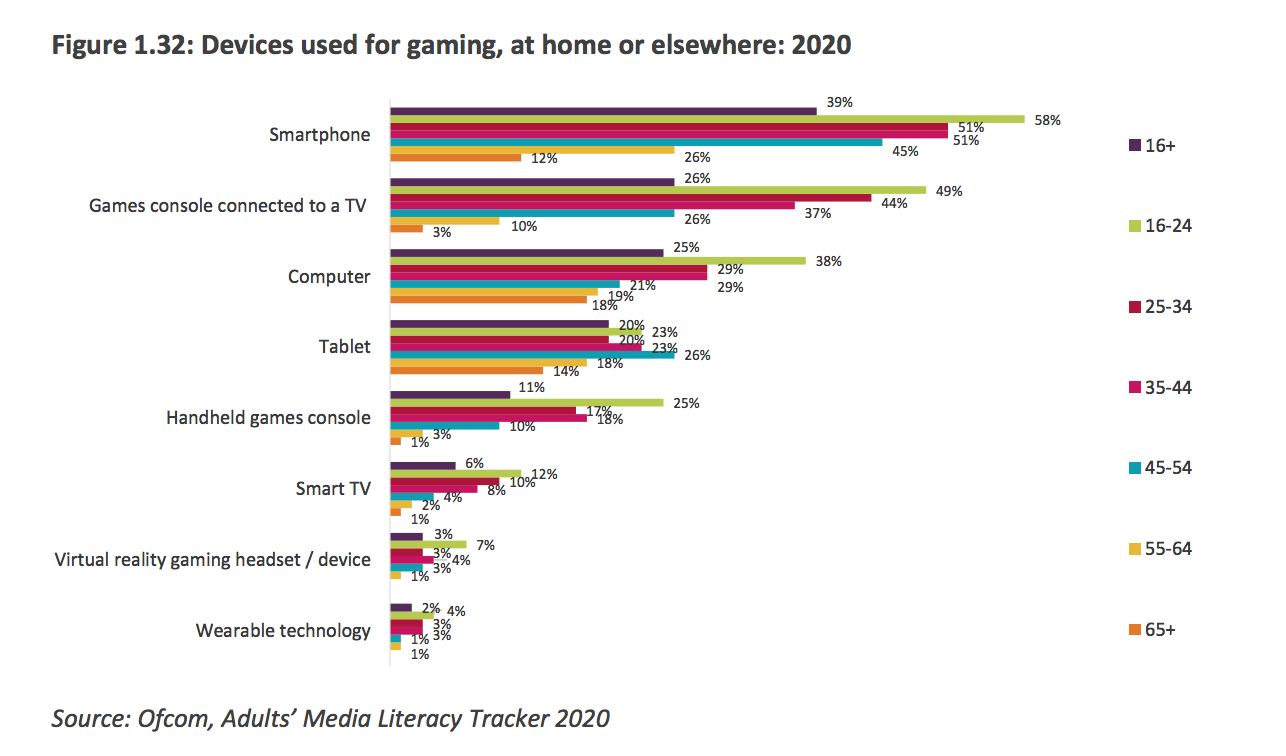

A smartphone is the most popular gaming device; it is used by 39% of adult gamers. PC & consoles are preferred by younger generations.

-

Men and women play games in more or less similar proportions. Women, however, more likely to play on smartphones (43% of respondents), while men are more likely to choose consoles (32% of respondents) or PCs (29% of respondents).

-

Half of UK gamers play F2P games only.

- 1/3 of all respondents paid for a game, in-app, or subscription for the last 30 days.

-

PS Plus is the most popular subscription in the UK with a 3M userbase. Xbox Live Gold has 1.9 million subscribers, Xbox Game Pass - 1.7 million, Nintendo Switch Online - 1.3 million.

-

46% of all online games revenue comes from mobile devices. 32% comes from consoles and 22% from PC.

-

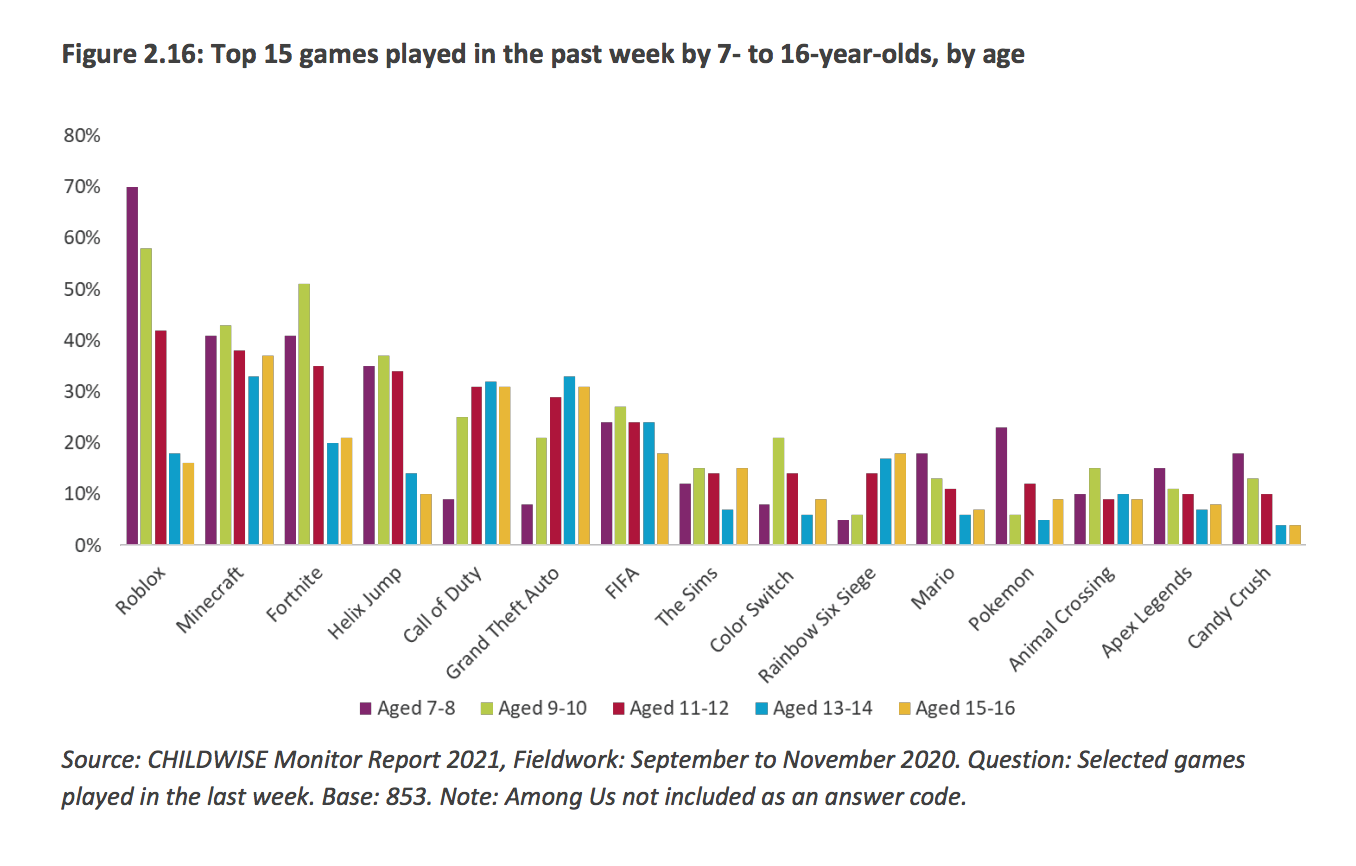

3/4 of adolescents between the age of 5 to 15 played online games in 2020.

-

70% of gamers age 8 to 11 used online chat. 48% of this segment experienced harassment actions.

Finnish game industry 2020 report

- Finnish gaming industry turnover reached €2.4 billion in 2020. It’s 9% growth compared to 2019.

-

There are more than 200 studios working in Finland. 46 of them have more than €1 million in revenue (it’s +35% compared to 2018).

-

More than 3,600 employees are currently working in the Finnish gaming industry. 28% of them are working remotely from other countries. 22% are women. In 2021 companies plan to hire 400-1,000 people.

Link to the full 152 pages report.

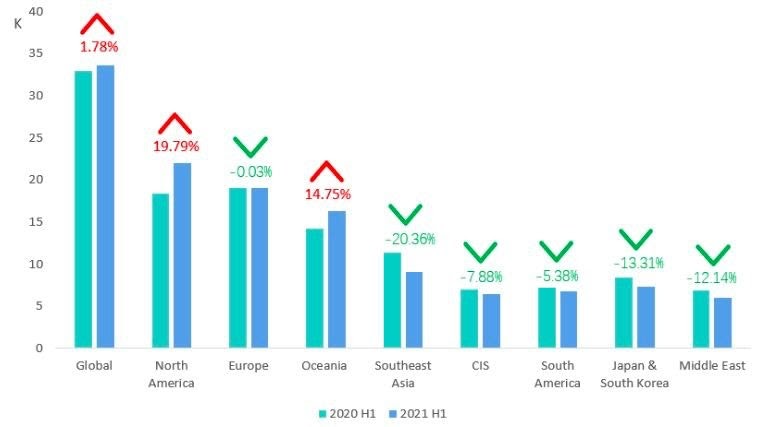

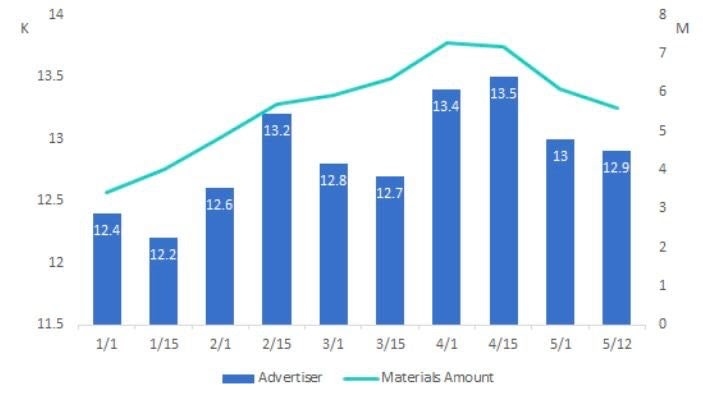

SocialPeta: The number of mobile gaming advertisers in some regions is decreasing

SocialPeta tracked numbers for the first five months of 2021.

-

The number of advertisers decreased in Europe, Southeast Asia, CIS, South America, Japan & South Korea, and the Middle East.

-

As for North America and Oceania, the number of advertisers increased. Which created an increasing trend in the global rating.

- All the graphics telling the same story - when Apple released iOS 14.5, the number of advertisers started to decrease.

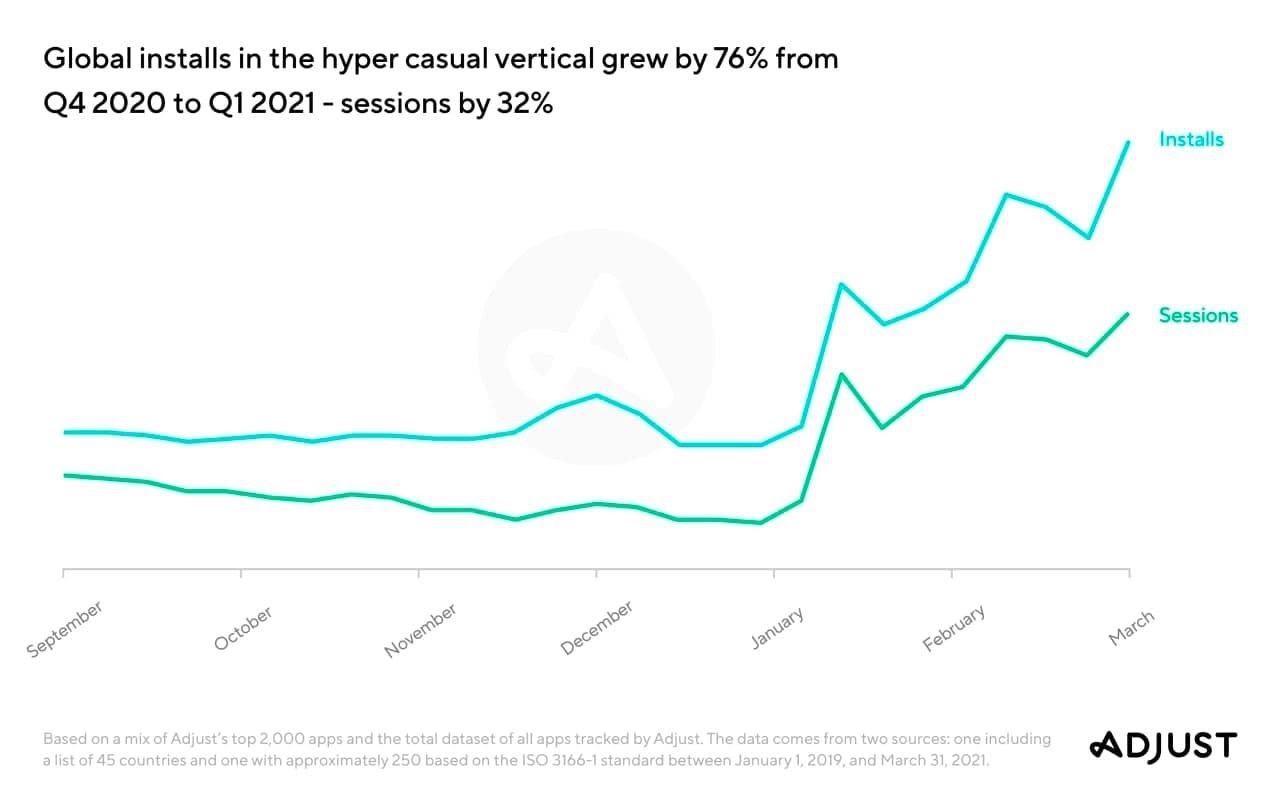

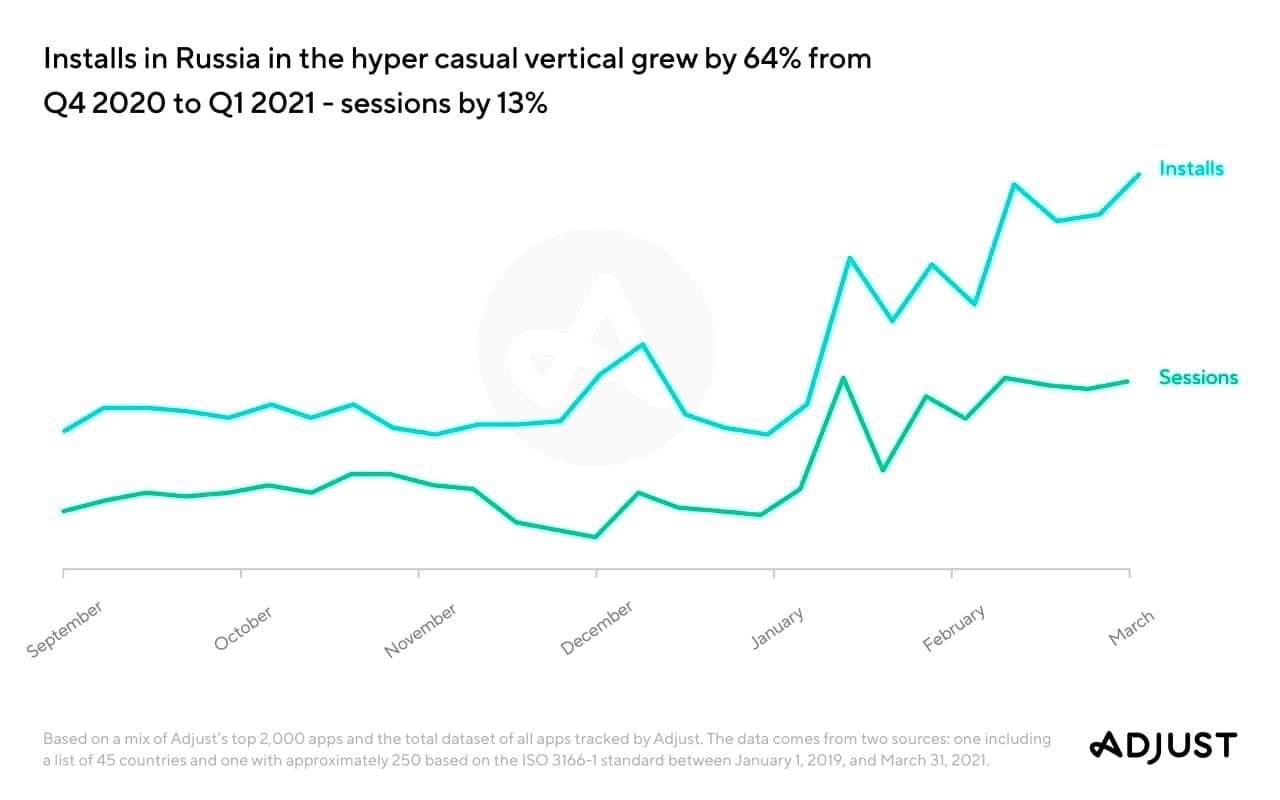

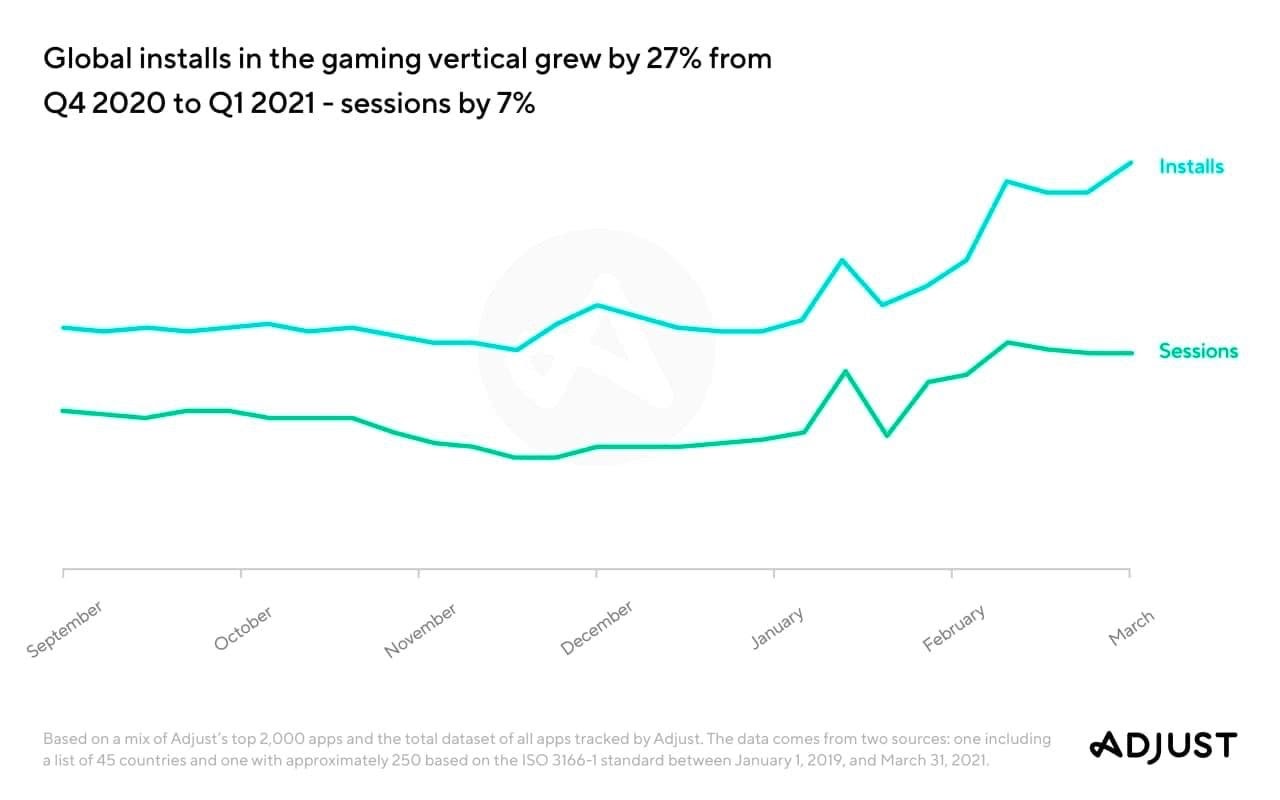

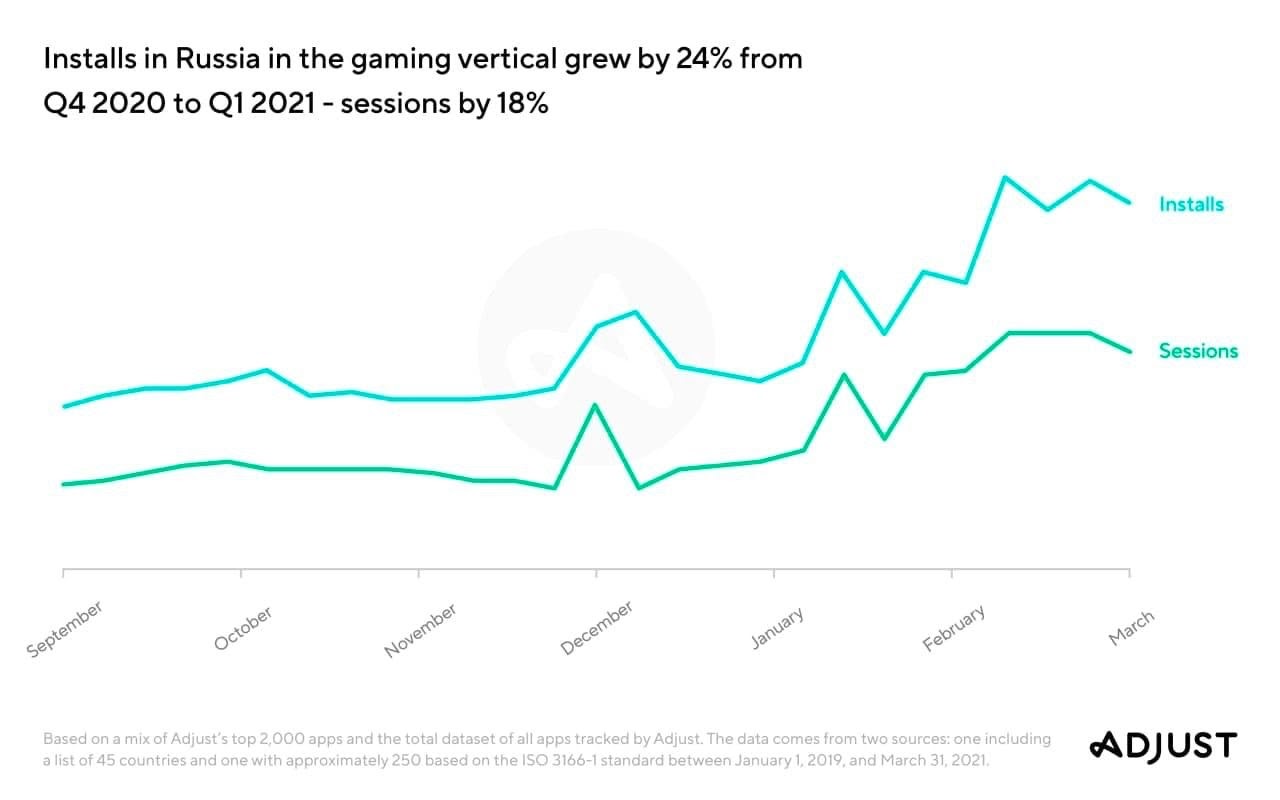

Adjust: Hyper-casual installs increased by 76% in Q1 2021

-

In Q1 2021 the number of sessions in hyper-casual games is 32% higher than in Q4 2020.

- In Russia, hyper-casual installs have increased by 64% in Q1 2021 compared to Q4 2020 with a 13% growth in the number of sessions.

- As for all gaming genres, installs grew by 27%, sessions - by 7%. It’s fair to assume that hyper-casual titles drove the growth globally.

- Russia is within the same growth trend - it had +24% in Q1 2021 compared to Q4 2020. Russian players, however, play more than twice more often compared to global averages. Sessions number increased by 18%.

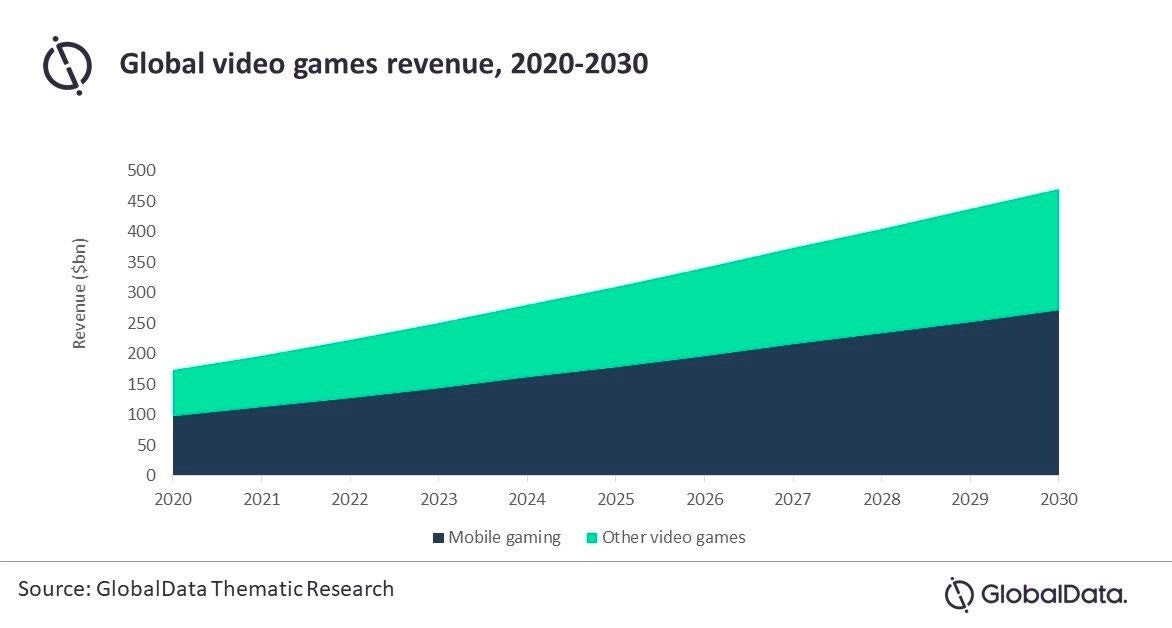

GlobalData: Mobile gaming market will reach $272 billion in 2030

- The compound annual growth rate is projected to be 11%.

-

Last year mobile games were accountable for 57% of all revenue of the gaming market.

-

GlobalData analytics names the 5G and cyber sport's increasing popularity, as well as increasing mobile platforms technical power (to be able to launch demanding games) as the main growth drivers.

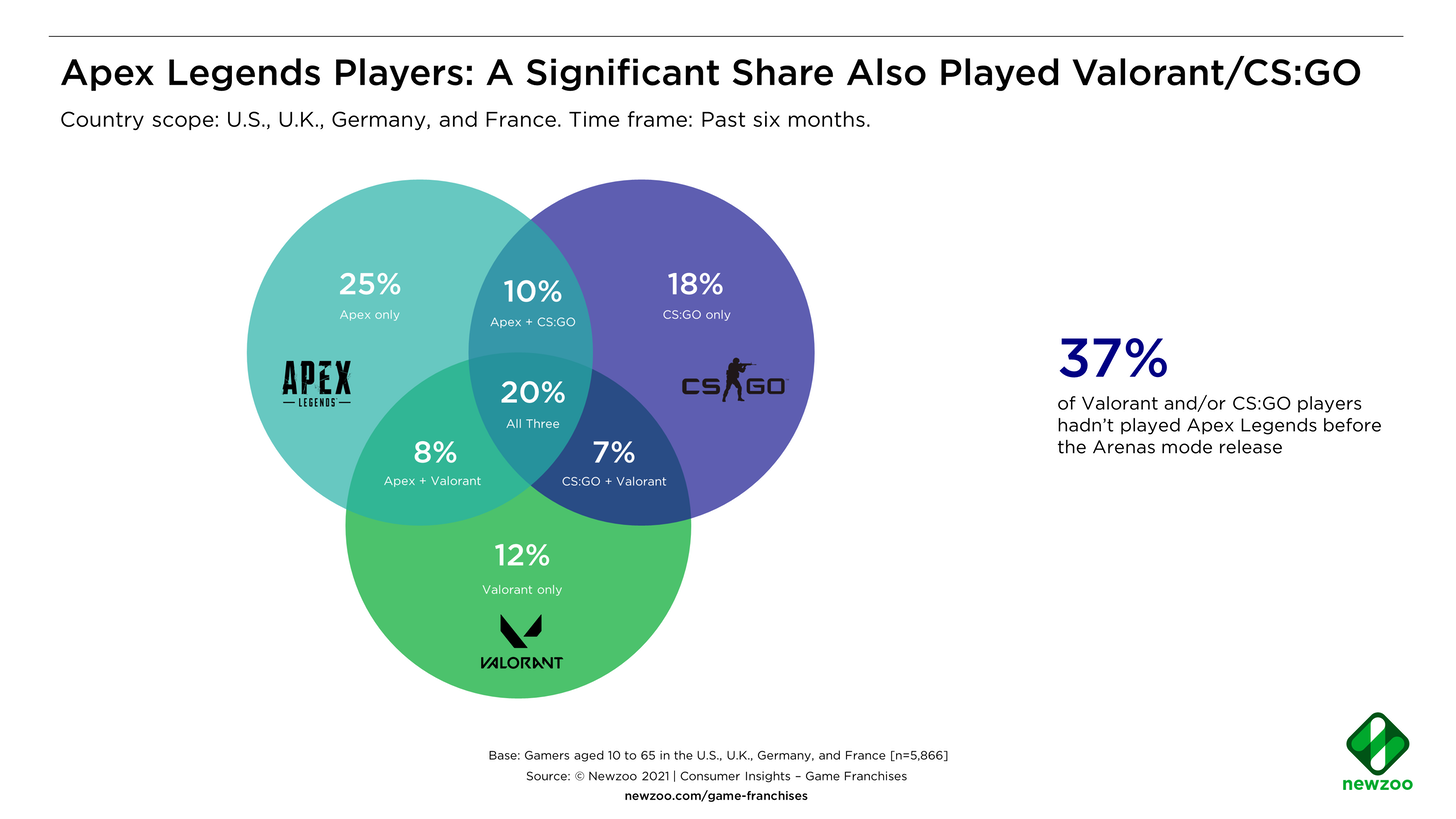

Newzoo: 38% of Apex Legends PC players also playing CS: GO and Valorant

Newzoo is using numbers to explain why Respawn Entertainment decided to add a new “Arena” mode with fast 3vs3 battles on small maps.

-

The reason is that 38% of Apex Legends PC audience also plays CS: GO and Valorant. Developers decided that they might want to see the mode which is similar to those games.

-

37% of the new Apex Legends audience, that is playing CS: GO and Valorant, came to the game only after the mode release.

-

Apex Legends had 22.6M MAU in May 2021 - 12.8M on consoles and 9.78 million on PC.

-

15% of Valorant PC audience churned to Apex Legends in May 2021. With the CS: GO 10.4% of the audience churned to Apex Legends.

-

Around half of Apex Legends players are male under the age of 35.

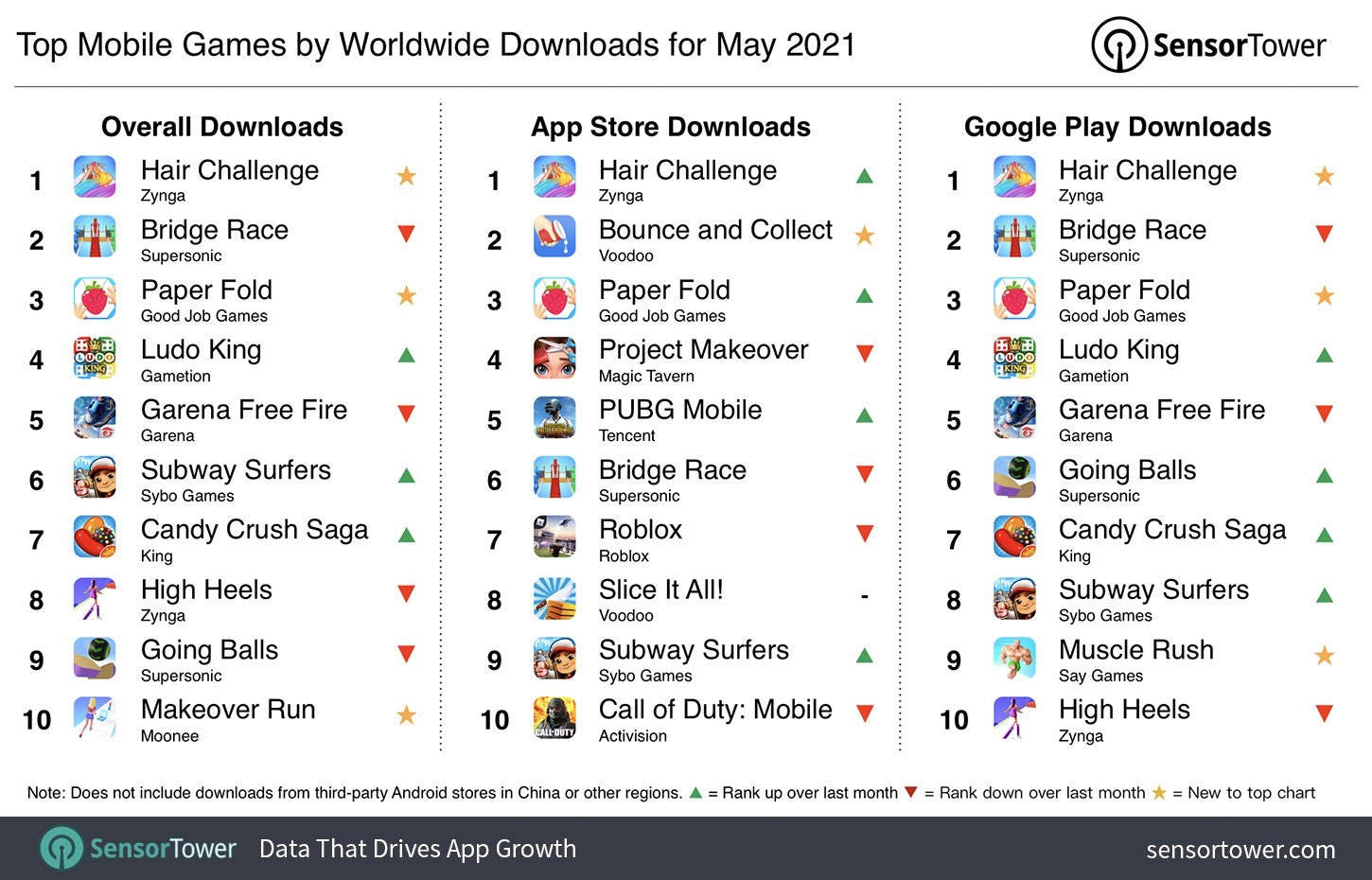

Sensor Tower: Top mobile games by downloads in May 2021

- Hair Challenge from Rollic Games (Zynga) was the most downloaded game with 36.5 million downloads. 22.4% of this number is attributed to India, 7.5% - to Brazil.

-

Bridge Race from Supersonic Studios with 32.3 million downloads took second place. India generated 18.5% of downloads, Brazil - 8%.

-

Fashion genre popularity is increasing. This month 3 games (High Heels, Makeover Run & Hair Challenge) were in the top-10 overall ranking. Cumulatively, they generated 65 million downloads. Plus, Project Makeover was number 4 on App Store downloads charts with 4 million.

-

There were 3 non-hyper-casual games in the overall ranking this month - Garena Free Fire, Subway Surfers, and Candy Crush Saga.

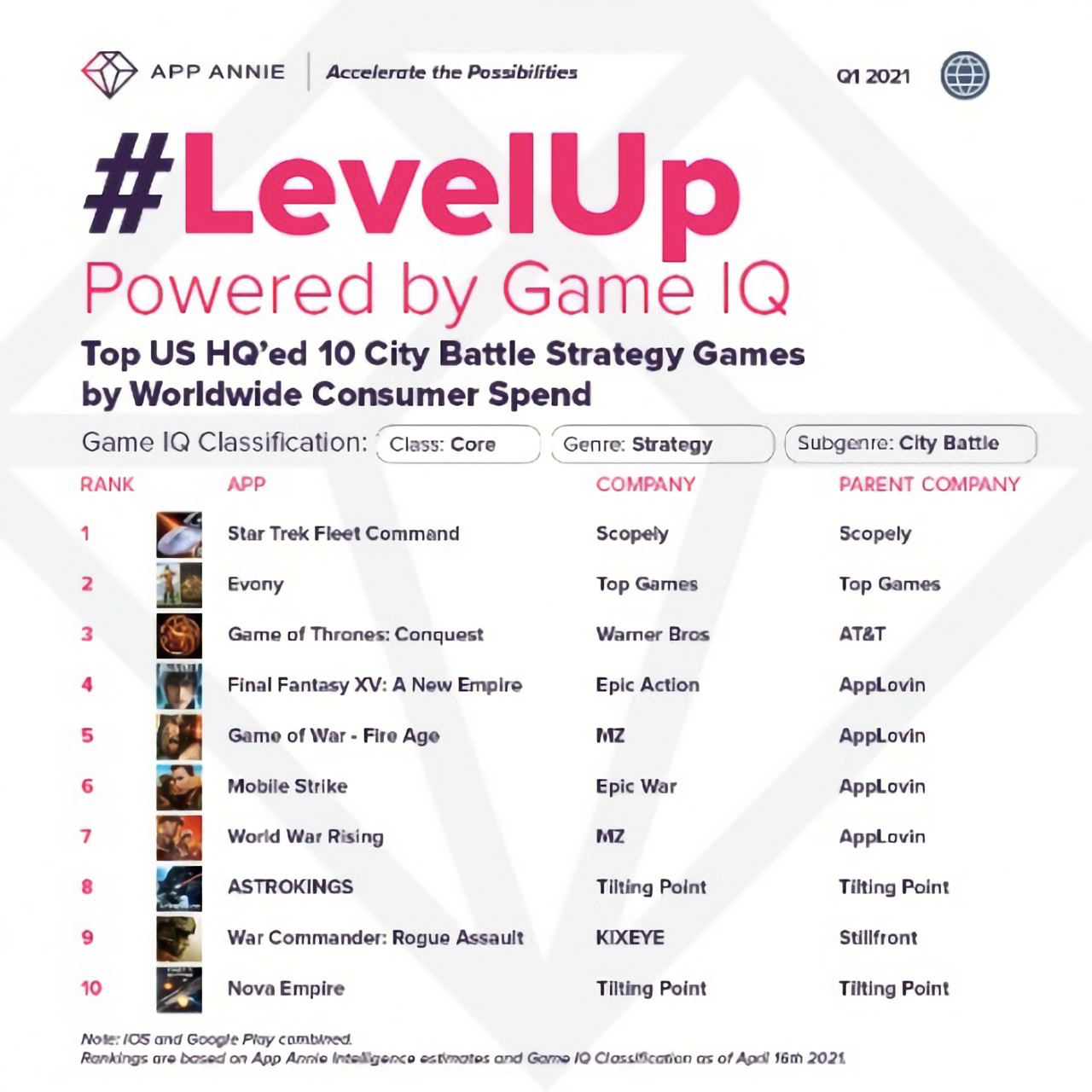

App Annie: City battle strategy games were accounted for $2.5 billion in Q1 2021

-

With $2.5 billion in revenue, the genre shows 60% growth in revenue YoY.

-

Overall genre downloads in Q1 2021 reached 135 million. It’s 30% more than a year before.

-

In the US the genre growth rate is exceeding the market average growth rate. It has +50% YoY in downloads and +90% YoY in revenue.

-

AppLovin (its Machine Zone, Epic Action & Epic War) is responsible for 4 out of 10 top games in the genre.

N.B: the top includes companies with US HQ only.

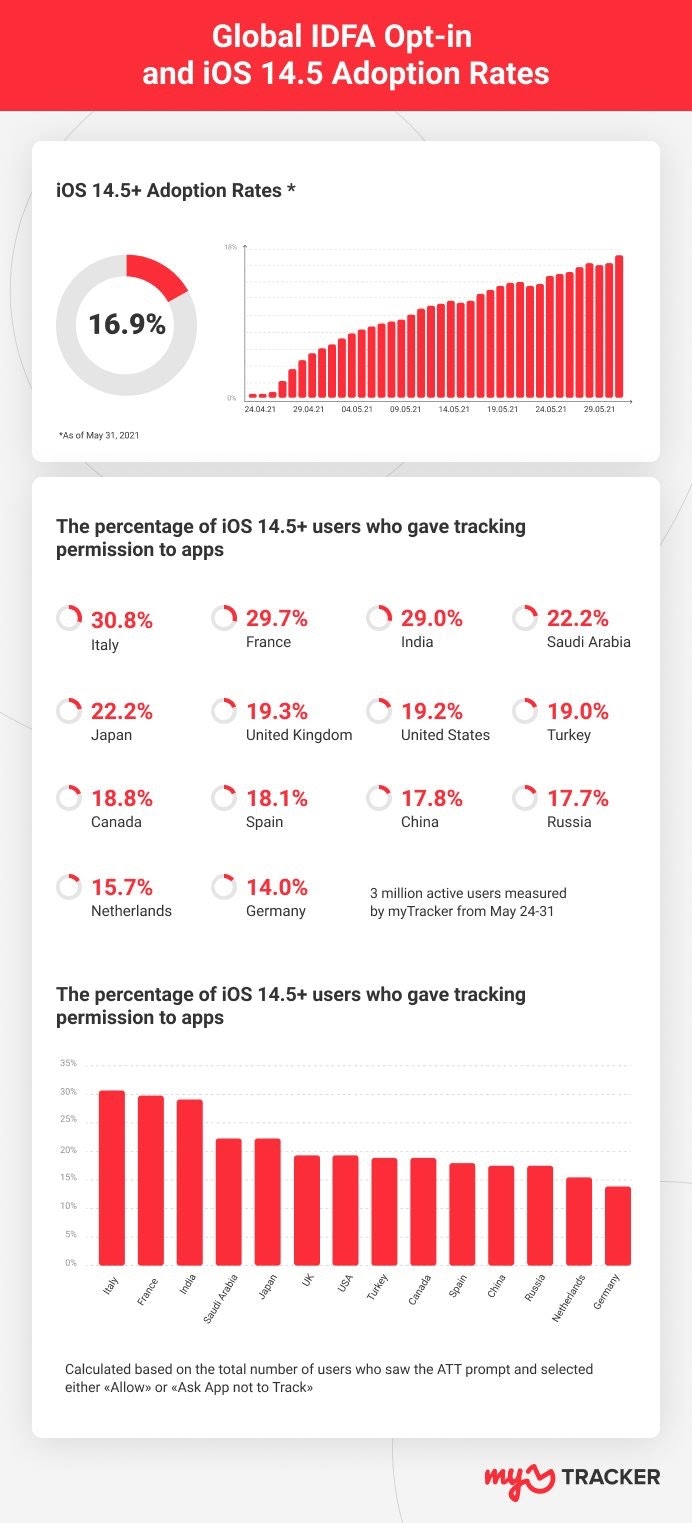

myTracker: iOS 14.5+ & IDFA benchmark on May 31

- 16,9% of users have updated their devices to iOS 14.5 or higher as of May 31.

-

The highest opt-in rate for games is 33%. The lowest - 9%. That means that in a perfect world you would be able to reach only 33% of the audience you were able to reach before (from those, who are using iOS 14.5+).

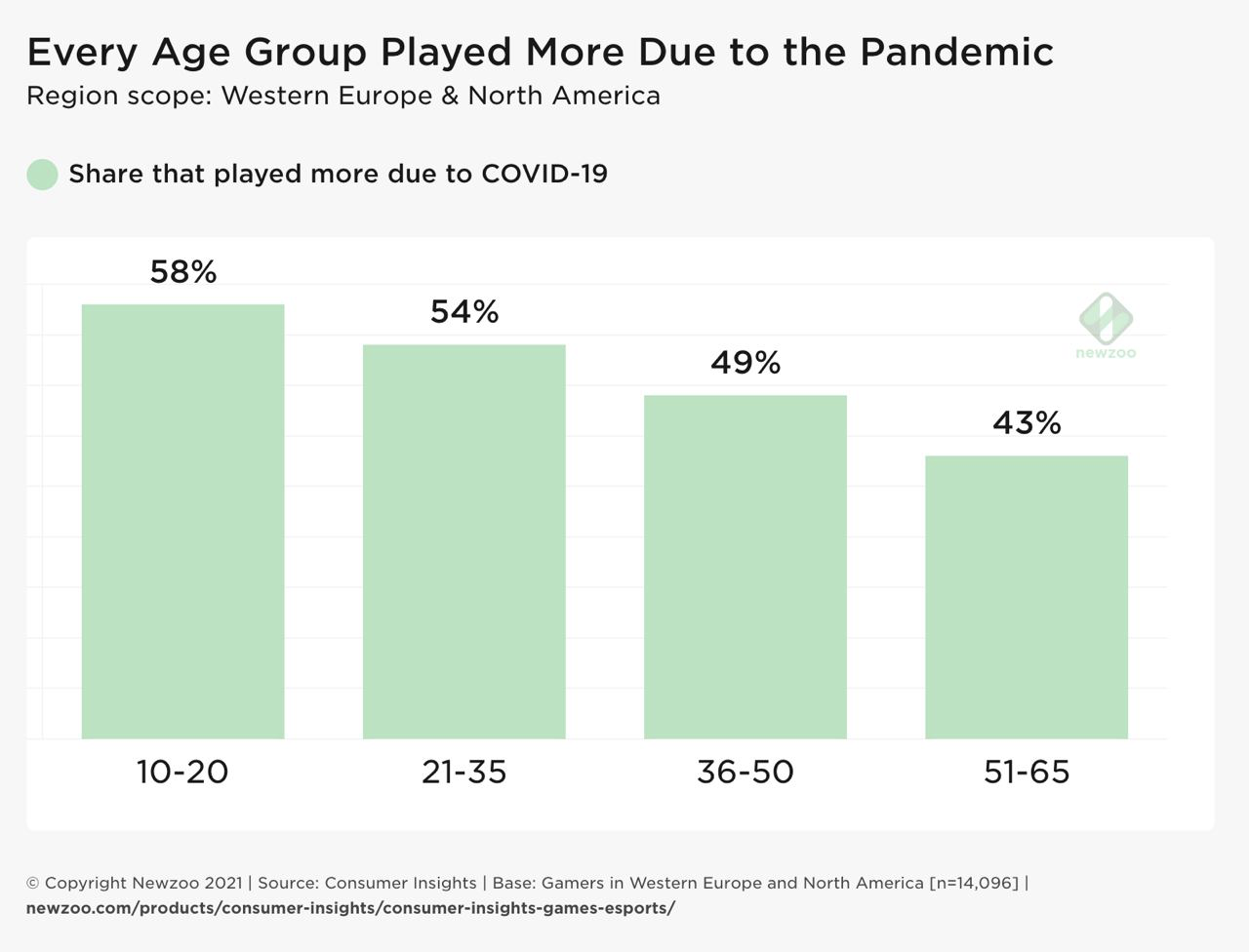

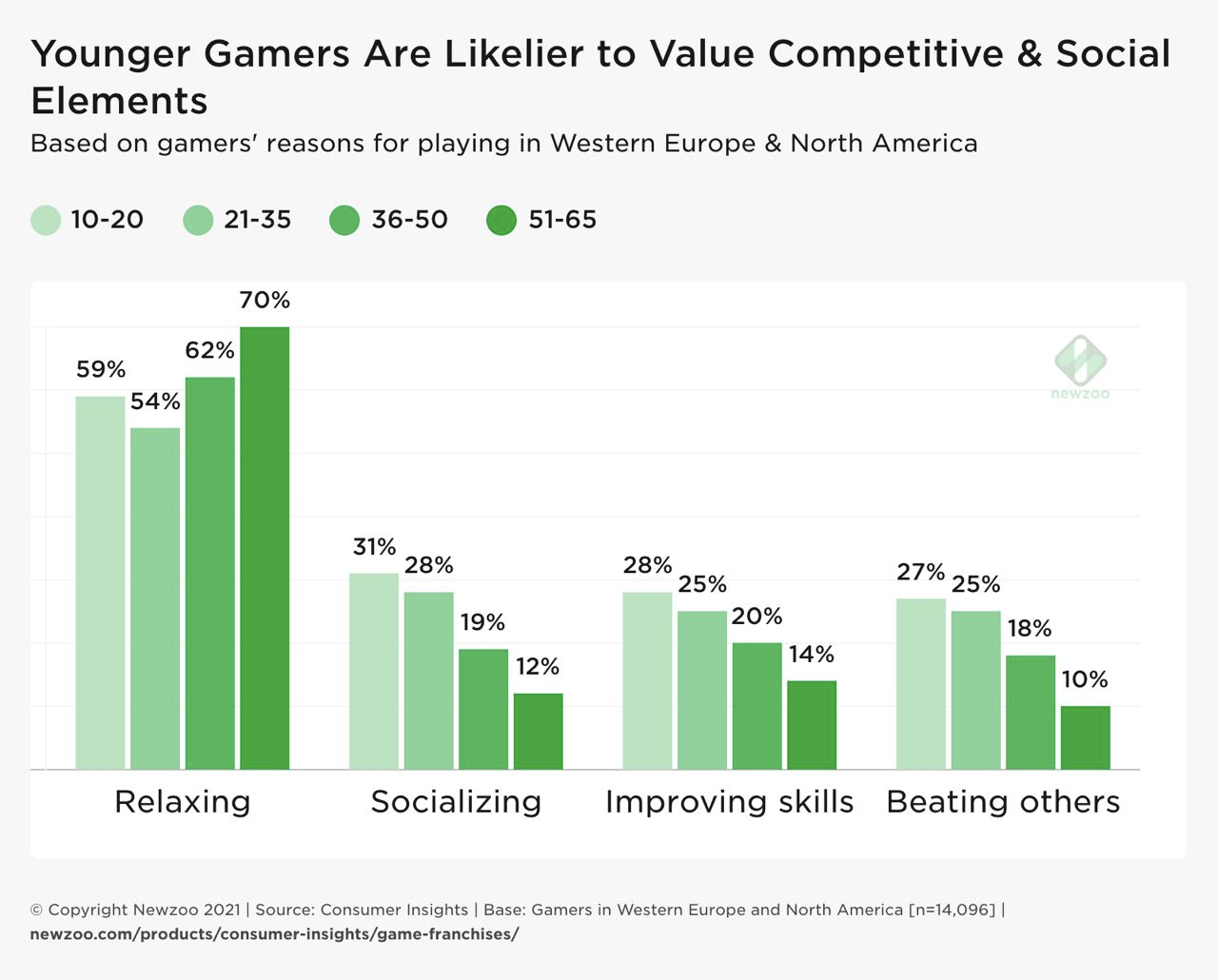

Newzoo: 51% of users in North America and Western Europe started playing more after COVID-19

- In North America and Western Europe, there is a straight correlation between age and time spent in games. Younger players spend more time in games.

-

For 1/3 of users in the age of 10 to 20 social features were the main reason to play.

- 61% of users of all age categories play games to relax.

-

Almost 50% of gamers between the age of 10 to 35 spend the majority of playtime in multiplayer modes. In the age of 36 to 50 years, there are 36% of “multiplayer” players.