devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the June and July reports.

Contents

- Apptica: Mobile gaming market in H1 2023

- AppMagic: miHoYo mobile titles surpassed $8B in revenue

- Sensor Tower: Top Mobile Games by Downloads in June 2023

- Sensor Tower: Japanese mobile market in H1 2023

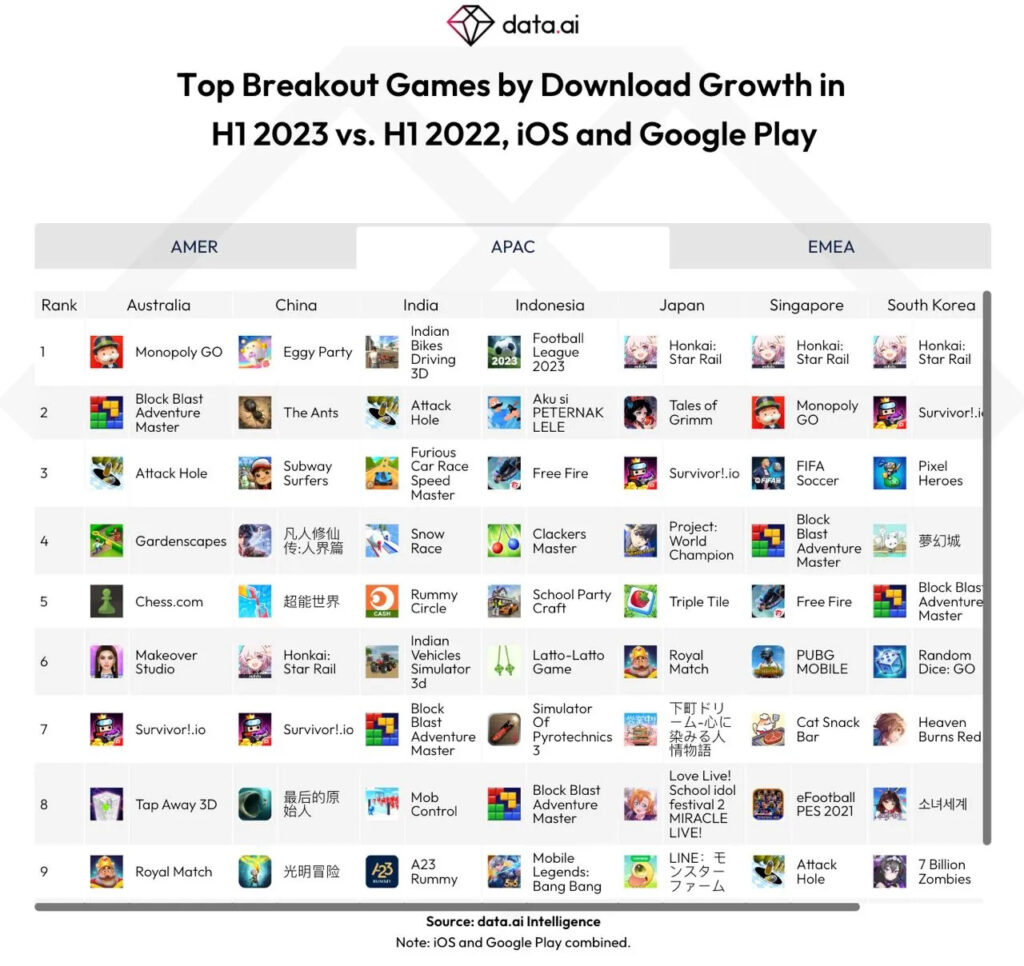

- data.ai: Users spent 2.5T hours in front of their mobile screens in H1 2023

- PlayStation 5 surpassed 40M sales

- game: The German gaming industry is back to active growth in 2023

- Circana: The US Gaming market in June 2023 grew by 9%

- StreamElements & Rainmaker.gg: State of the Streaming market in June 2023

- Newzoo: The Gaming Market in 2023

- CADPA: The Chinese Gaming Industry Revenue in H1 2023 dropped

- Adjust & data.ai: The Mobile Gaming market in Japan in 2023

- Sensor Tower: Odin: Valhalla Rising has been the top-grossing title in South Korea for the last two years

- Ampere Analysis: The Console gaming market in June 2023

- GameDiscoverCo: The Most Important Games for PlayStation Owners

- Circana: On August 6th, Baldur’s Gate III accounted for 27.5% of the total gameplay time on Steam in the US

- AppMagic: Top Games by Revenue & Downloads in July 2023

- Newzoo: Diversity and representation are becoming increasingly important for the gaming audience

- The Super Mario Bros. Movie is the highest-grossing among game adaptations

- Famitsu: Game and Console Sales in Japan in July 2023

- StreamElements & Rainmaker.gg: State of the Streaming Market in July 2023

- Sensor Tower: Royal Match! has reached $1.2 billion in global revenue

- Circana: American players spent over 5 hours a day playing Baldur’s Gate III on weekends

- Game Data Library: PlayStation 5 sales trend in Japan outpaces PS4 and PS3

- GamesIndustry.biz & IIDEA: The Video Game Industry and Market of Italy in 2022

- War Robots surpass 250 million users

- AppMagic: Melsoft Games' titles surpass $1 billion

- Simon Carless (GameDiscoverCo): Study of the share of top games on PC and consoles

- data.ai: Pokemon GO is #4 in the list of the most downloaded mobile games in the USA

- Belgian Embassy in China: Baldur's Gate III sales reached 5.2M copies

- DDM: Gaming investment market overview in Q2 2023 & H1 2023

- GSD: Sales of PC and console games in Europe grew by 34% in July

- Circana: Remnant II tops the US game sales in July 2023

- InvestGame: The gaming investment market in H1 2023

- Sensor Tower: Honkai: Star Rail reaches $500 million in revenue on Mobile

Apptica: Mobile gaming market in H1 2023

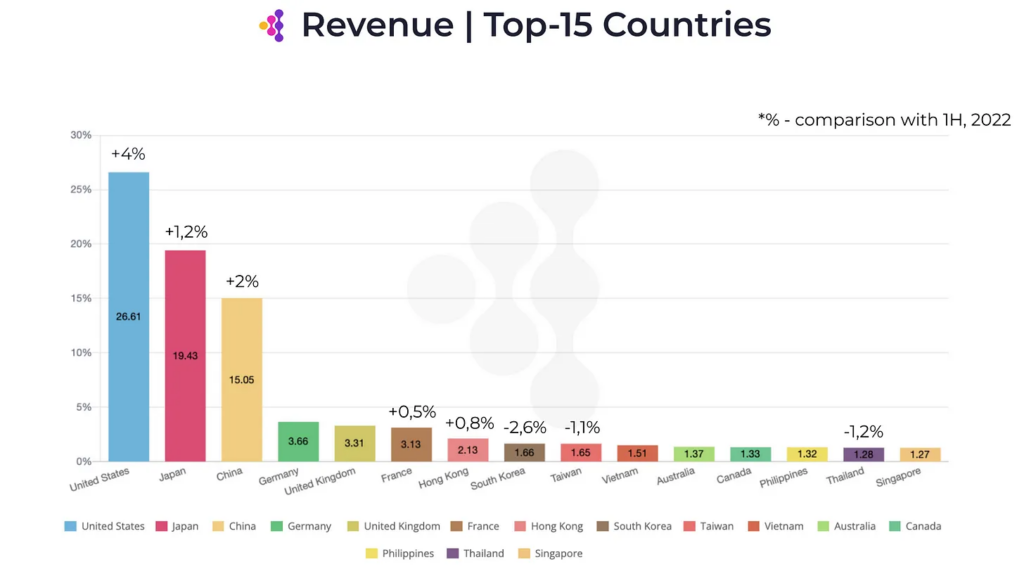

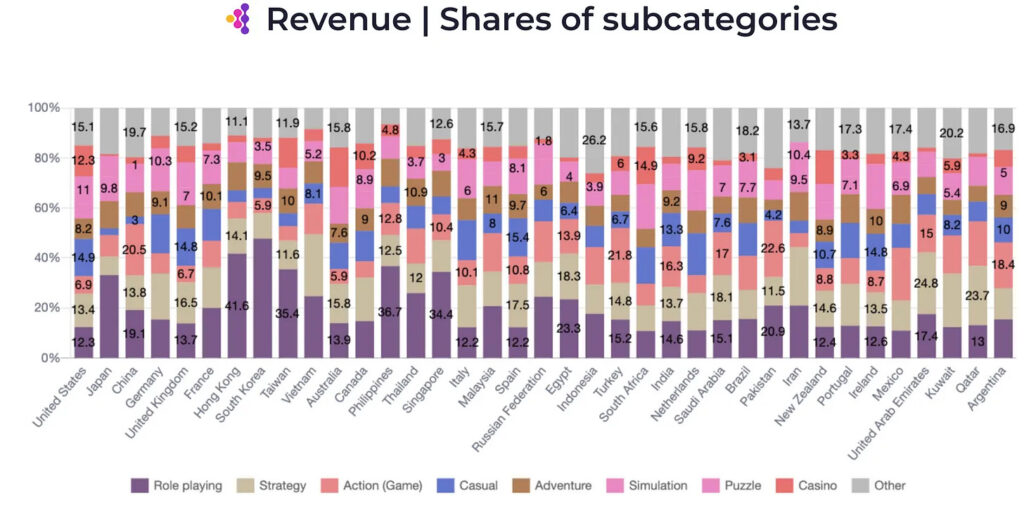

Revenue

- The US ($5.71B) is the largest market with a 26.61% share. In H1 2023 it increased by 4% by this component compared to H1 2022. Japan is second with $4.17B and 19.43% of the market (+1.2% market share YoY growth). China is third with $3.23B and 15.05% of the market (+2% market share YoY growth). But we traditionally do want to highlight that numbers about China don’t include 3rd-party Android stores.

- Distribution by revenue between iOS and Android - 56.26% to 43,74%.

- RPG suffered the most from the revenue drop. Genre had $5.9B revenue in H1 2022 and received only $4.4B in H1 2023.

- Honor of Kings ($766M); PUBG Mobile ($344M); Genshin Impact ($209M) are leaders by revenue on iOS in H1 2023. Android's top-grossing titles in H1 2023 were Coin Master ($228M); Candy Crush Saga ($220M), and Roblox ($167M).

- In H1 2023 games were responsible for 51% of overall Stores revenue.

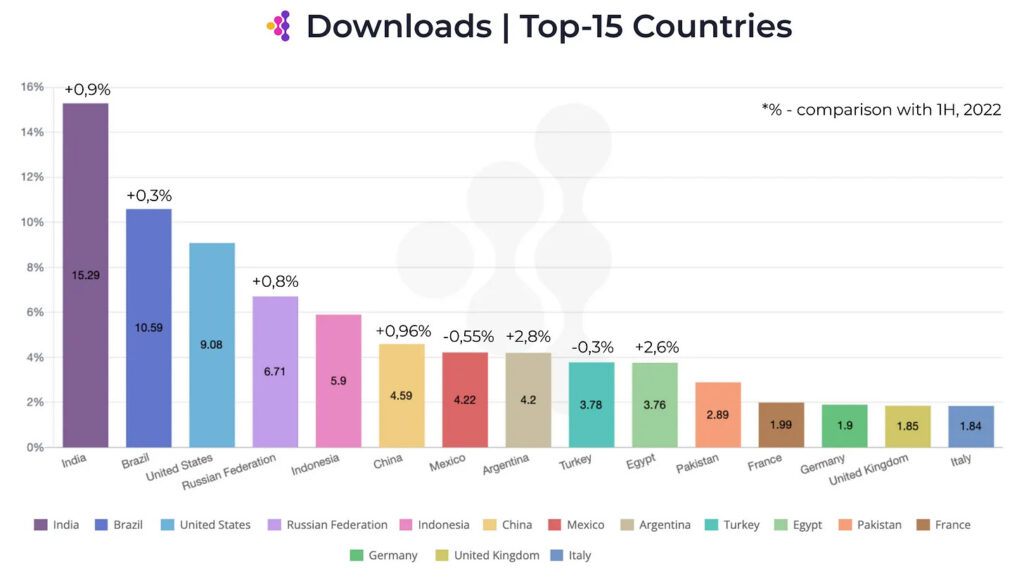

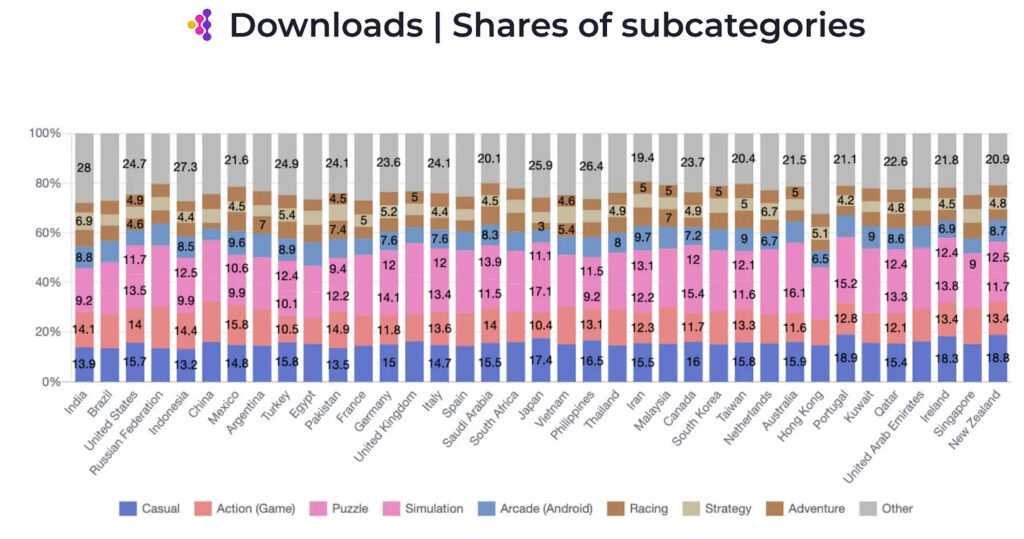

Downloads

- India (4.32B downloads - 15.29% of the overall amount) is the largest market by downloads, whose share in H1 2023 increased by 0.9%. Next is Brazil (10.59% - +0.3% YoY growth by market share), the US (9.08%), Russia (6.71% - +0.8% YoY growth by market share), and Indonesia.

- The distribution of downloads between iOS and Android is far from equal - 11.37% to 88.63%.

- In H1 2023 almost all genres dropped in downloads compared to H1 2022.

- Eggy Party (32.2M); Royal Match (20.2M); Roblox (19.5M) are top-downloaded games of H1 2023 on iOS. Subway Surfers (116.5M); Candy Crush Saga (106.3M); Garena Free Fire (88M) are Android leaders.

- Games are responsible for 29.6% of overall downloads on iOS and Android.

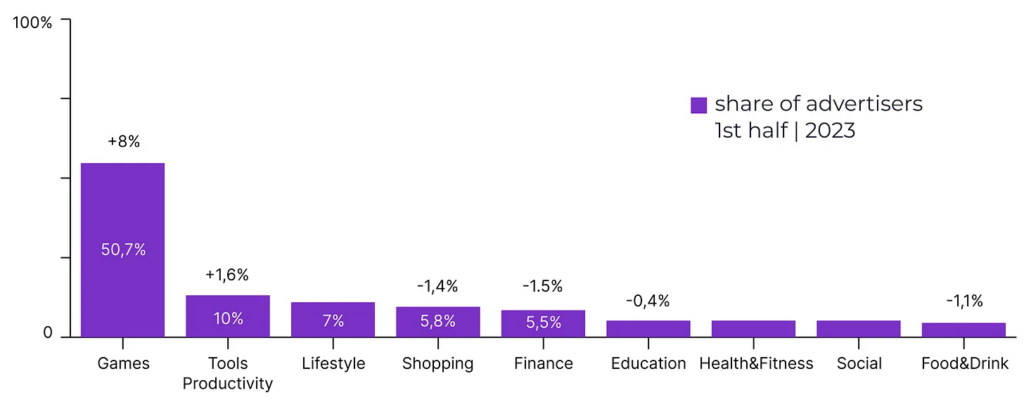

Advertising

- The number of advertisers in games increased by 22% in a year.

- 8.9M creatives have been created for games - it’s 56% of the overall amount.

You can download the report here (pdf)

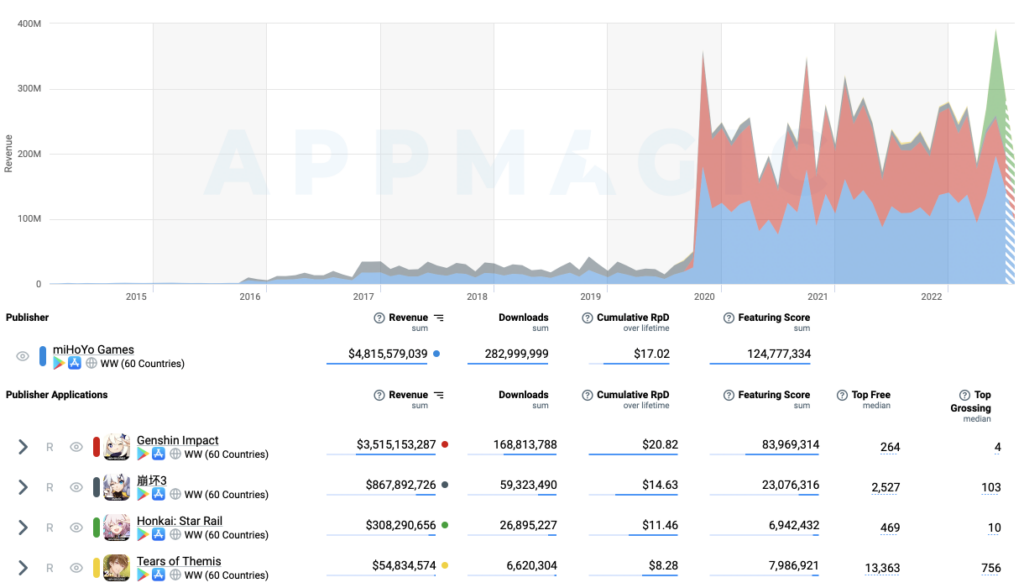

AppMagic: miHoYo mobile titles surpassed $8B in revenue

- Genshin Impact generated 73% of the overall revenue for the company on mobile.

- Honkai Impact 3rd brought the company 18% of revenue; Honkai: Star Rail just launched but already generated 6%. The remaining % belongs to Tears of Themis - the most unknown title of miHoYo.

- China (39% of overall revenue); Japan (21%), and the US (15%) are the main markets for miHoYo.

- App Store accounted for 69% of users’ spending; Google Play - for 31%. That’s without 3rd-party Android stores in China.

- miHoYo started its journey in 2011.

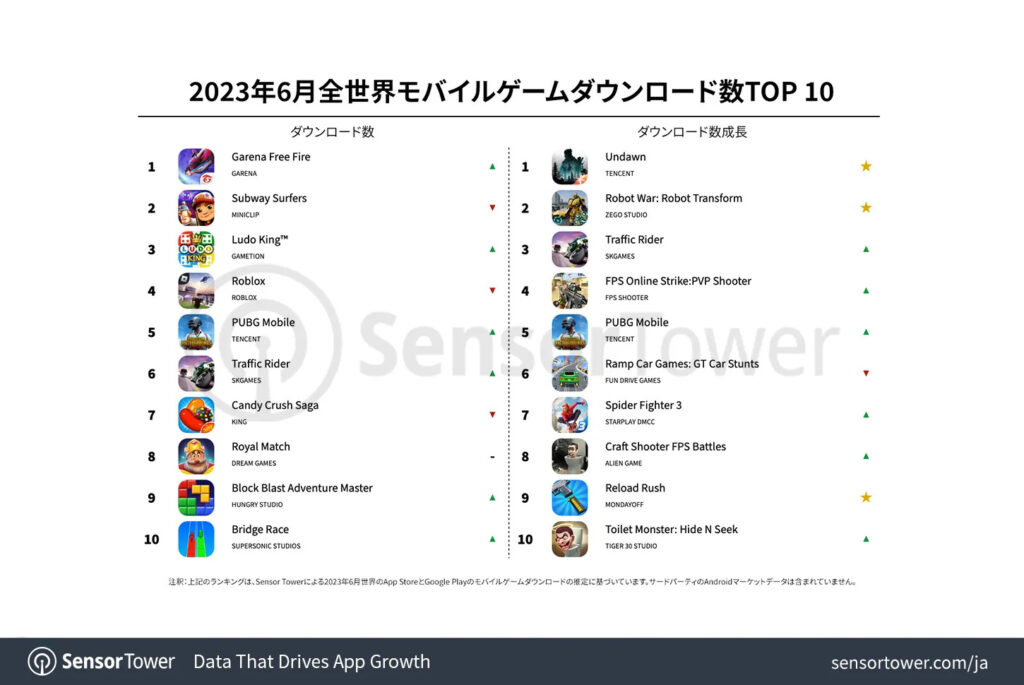

Sensor Tower: Top Mobile Games by Downloads in June 2023

- Garena Free Fire is the leader of the month. It’s been downloaded 19M times - 27.9% of them came from India; 12.7% - from Indonesia; and 8.1% from Vietnam.

- Subway Surfers is second with 18.5M downloads. Players from India made up 24.2%; from the US - 7.8%; from Brazil - 7.3%.

- Ludo King is a third game by downloads with 18.4M installs. India is by far first with 83% of overall downloads; Indonesia had 4.9%; Pakistan - 3.1%.

- Undawn from Tencent was the leader in the growth dynamic in June.

- In June 2023 users downloaded 4.44B games. It’s flat compared to the previous month.

- India is the first by overall number of downloads (862M - 19.4% of overall amount); the US is second (8.4%); Brazil is third (8.3%).

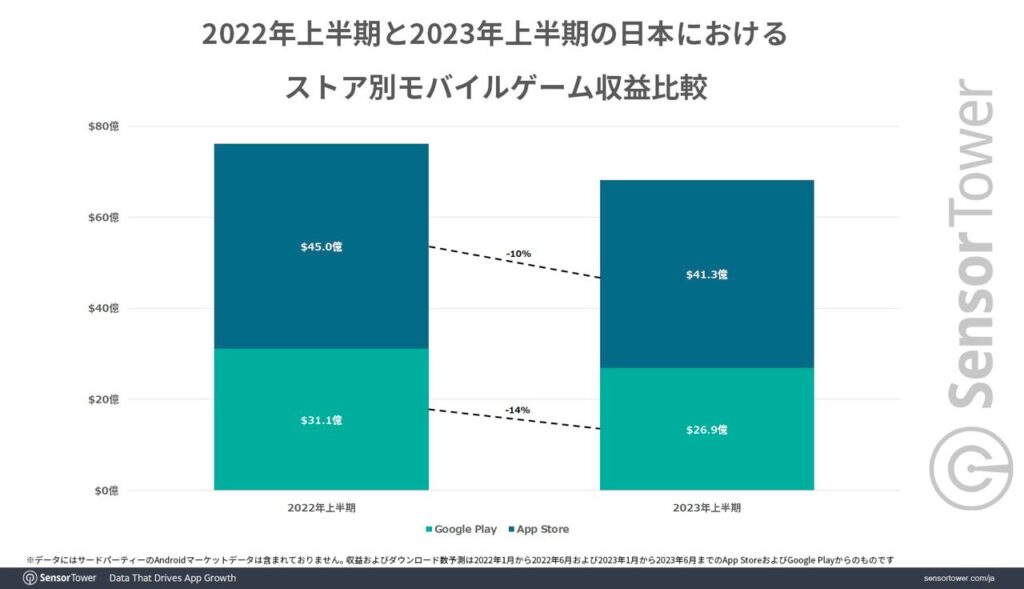

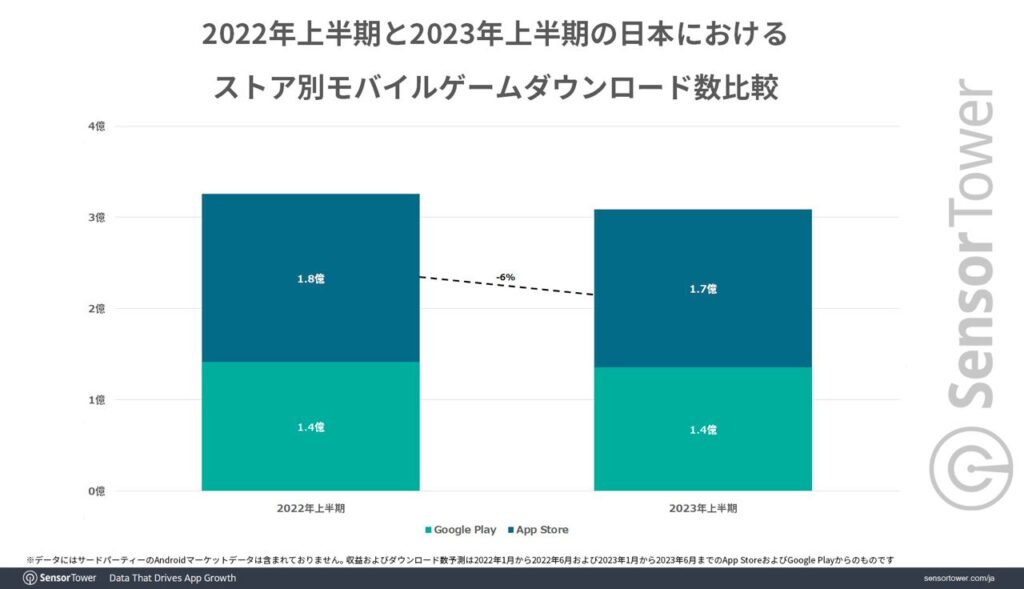

Sensor Tower: Japanese mobile market in H1 2023

General numbers

- Mobile games in Japan earned $6.8B in the first half of 2023. It’s 11% lower than a year before.

- iOS revenue dropped by 10%; Android decreased by 14%.

- Downloads went down too - to 300M (-6% YoY). The decline is solely due to iOS's underperformance as Android stayed flat.

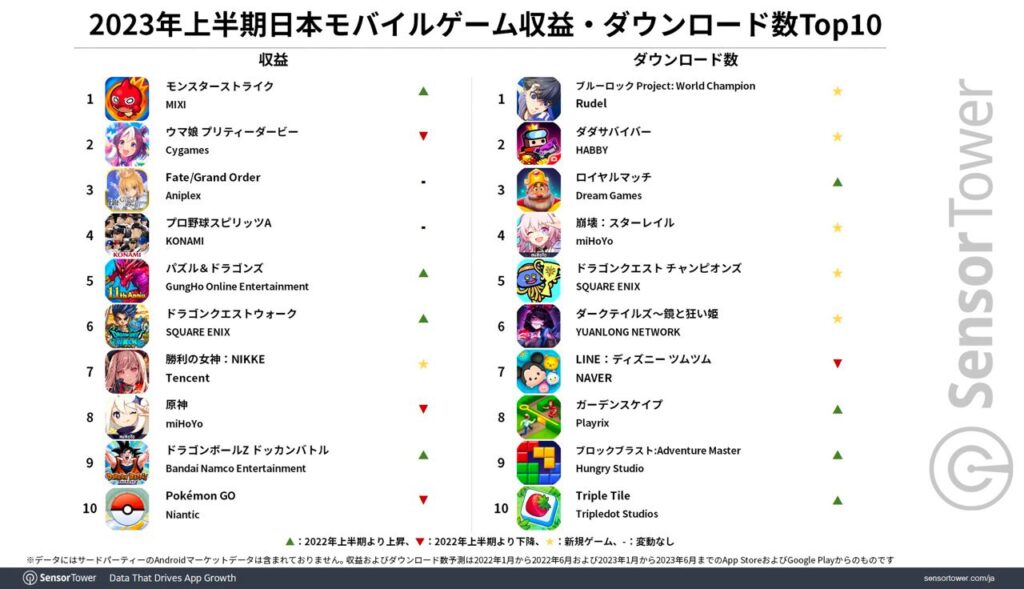

The most successful titles

- Monster Strike from MIXI is the leader in H1 2023 by revenue. The game earned $350M during this period.

- Uma Musume Pretty Derby was second; its worldwide revenue in March 2023 exceeded $2B.

- 6 games in the top 10 have been released more than 5 years before.

- 7 games in the top 10 are from Japanese publishers.

- Blue Rock Project: World Champion is the best title by downloads in Japan in H1 2023. It’s based on the soccer manga Blue Rock.

Growing projects

- Honkai: Star Rail is the leader in revenue and downloads.

- Victory Goddess: Nikke is second by this parameter.

Most successful publishers

- CyberAgent, Bandai Namco Entertainment, and Square Enix are leaders in the Japanese market by revenue.

- Tencent stepped to the top-10 rating in H1 2023; miHoYo went up by two positions thanks to the great release of Honkai: Star Rail.

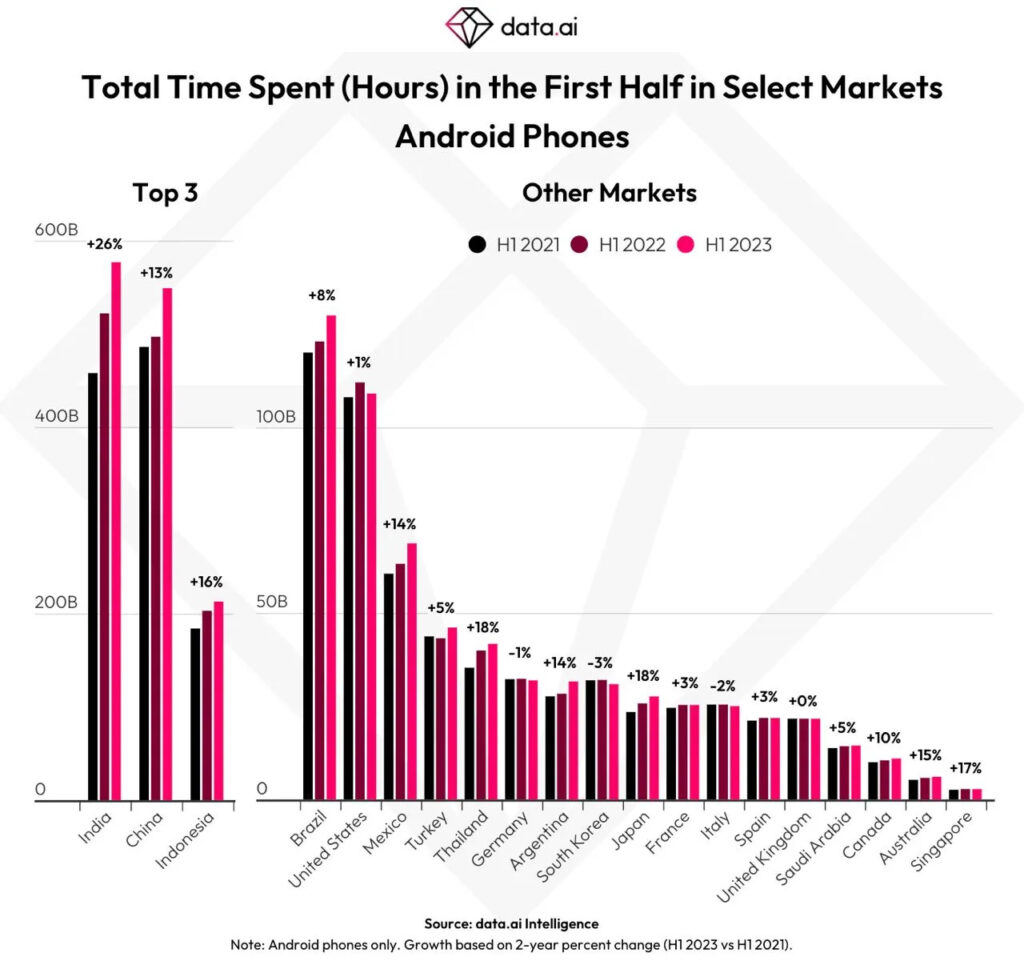

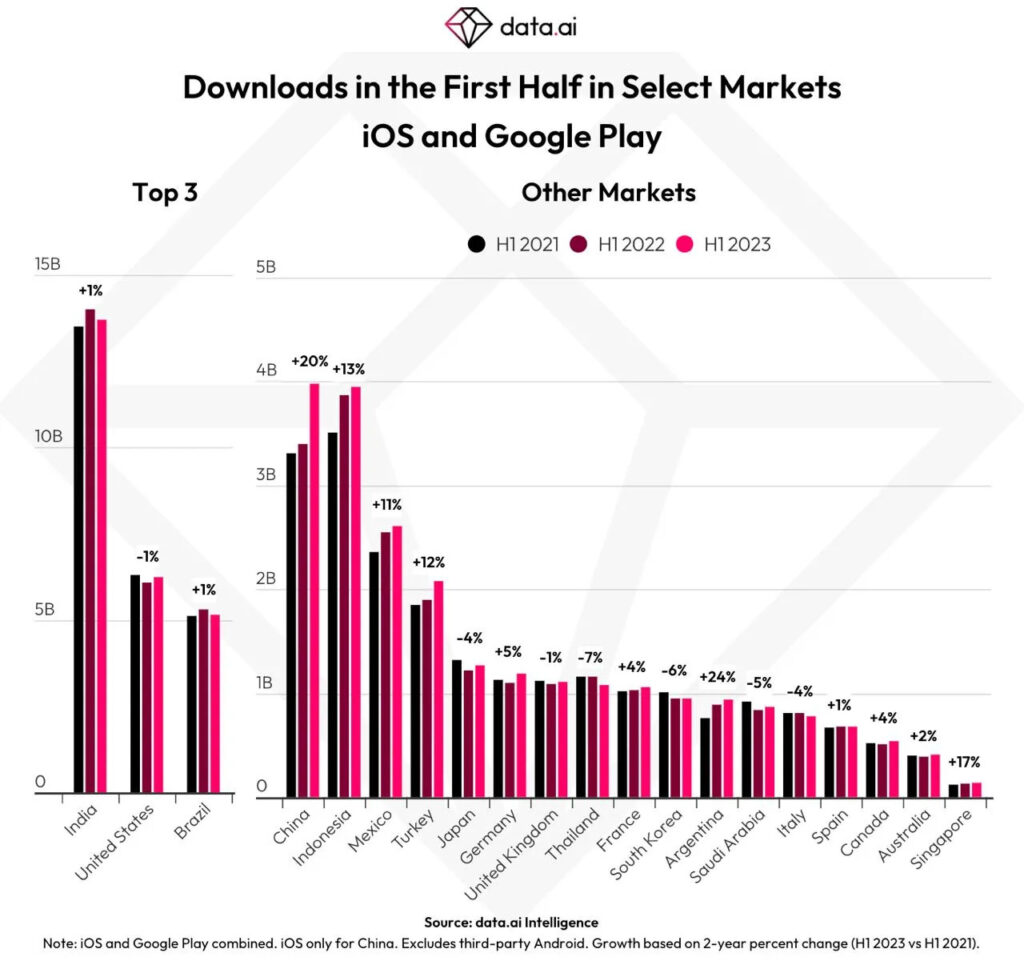

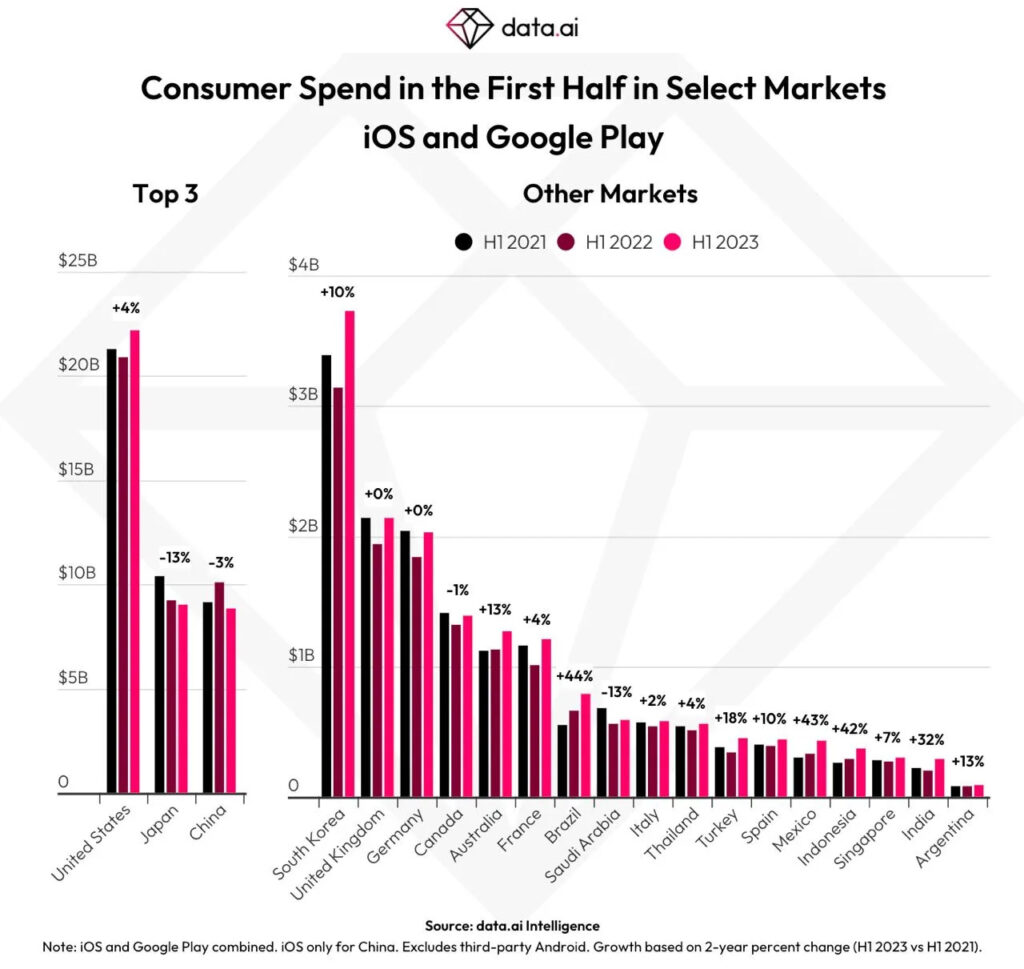

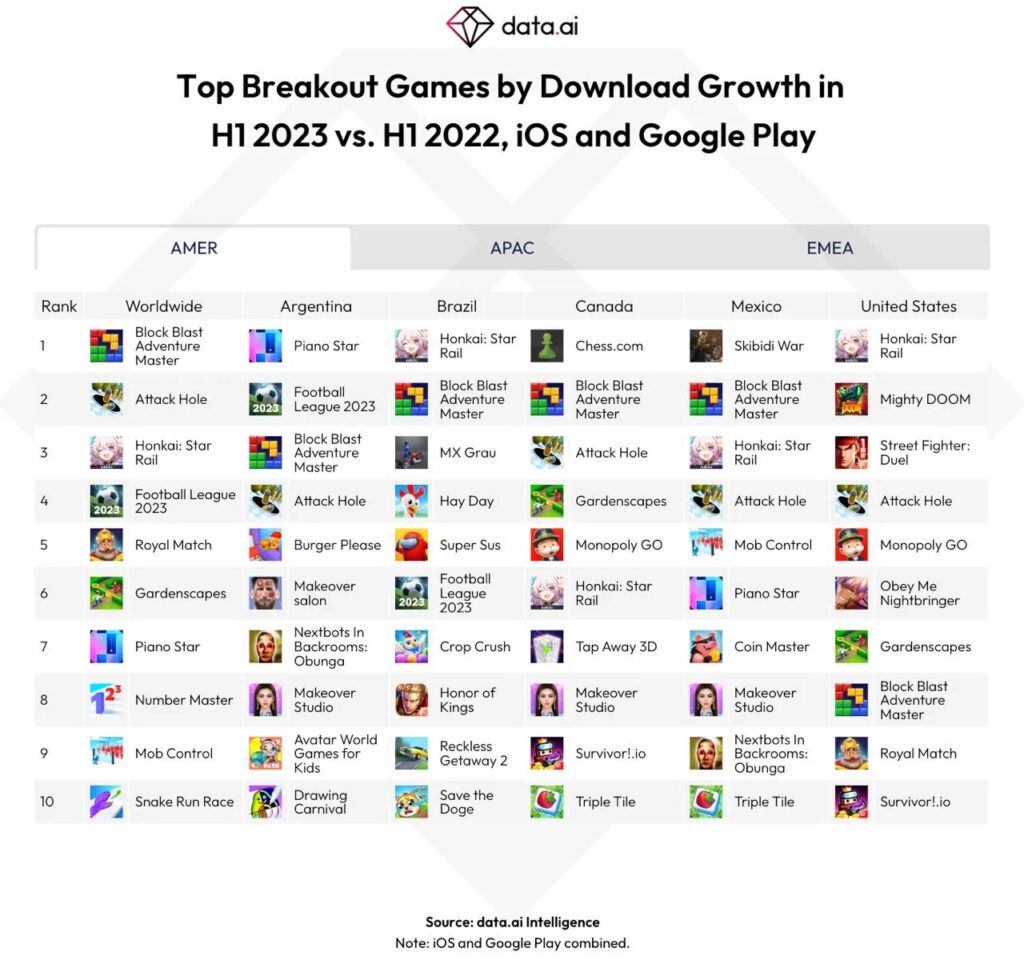

data.ai: Users spent 2.5T hours in front of their mobile screens in H1 2023

General numbers

- Leaders by mobile content consumption in H1 2023 on Android are India (580B hours; +26% YoY); China (560B hours; +13% YoY); Indonesia (210B hours; +16% YoY).

- The largest download markets - India, the US, and Brazil - are stagnating. It might be a sign of an excessive amount of offers in the market.

- Downloads in China in H1 2023 increased by 20% while gaming downloads decreased. People haven’t stopped searching for new content, but making choices not in the gaming favor.

- Overall app revenue in H1 2023 on the largest markets is more pessimistic. The US market grew by 4% (to $22B), but the Japanese dropped by 13% (to $8.5B); the Chinese declined by 3% (to $8.4B but without 3rd-party Android stores).

- TikTok outpaced the most significant mobile games by IAP revenue.

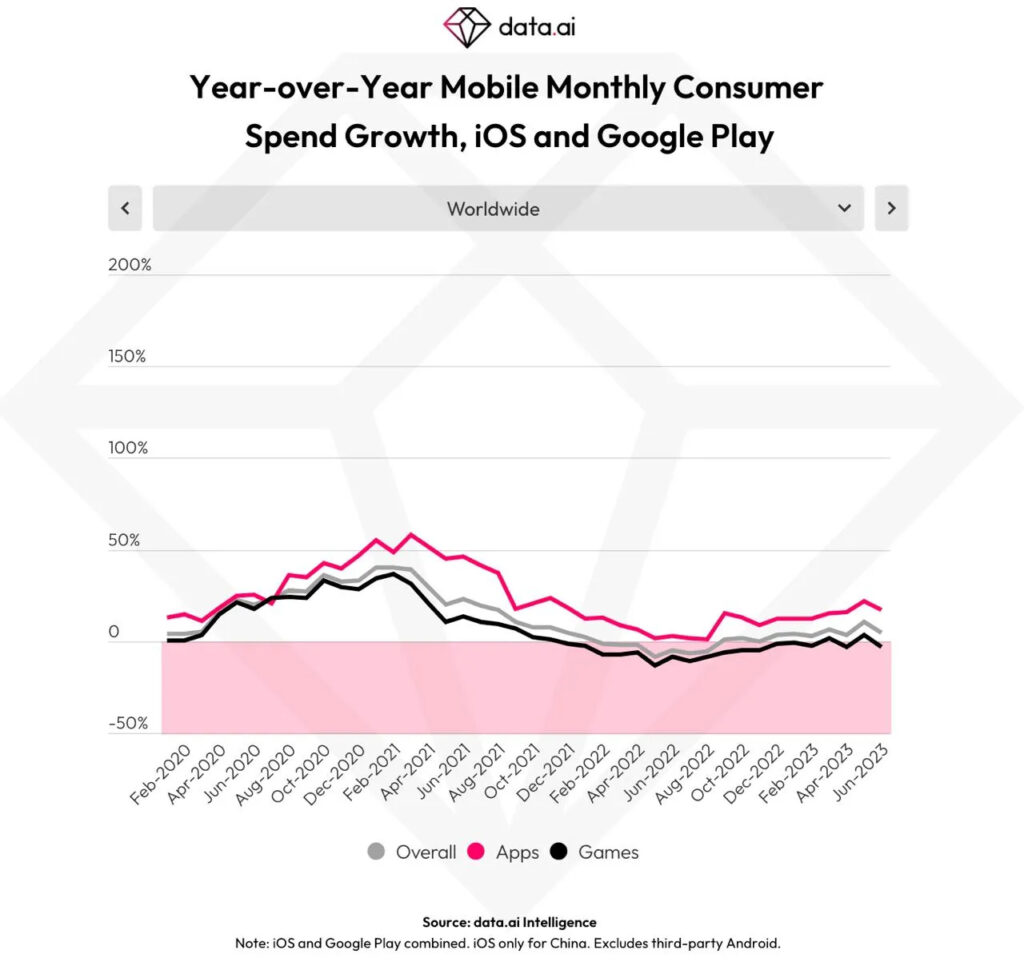

Games

- March 2023 is the first year since December 2021, when games showed positive dynamics by revenue growth (+1.5%). Another growing month was May (+3.6%). It’s a bit early to say about the market recovery, but the signs are great.

- Honkai: Star Rail made a huge impact on the games market and expected restoration with $230M of revenue in 30 days and 50M downloads in the first 15 days.

- Monopoly GO is another example of a successful launch. 40% of game downloads came from Europe.

PlayStation 5 surpassed 40M sales

- Sony officially announced that PlayStation 5 sales reached the 40M mark since the release.

- The console’s library has more than 2.5k games.

- In a financial report from April, Sony stated that 38M consoles were sold.

- PlayStation 5 sales dynamics are currently 3% above PS4 and 83% better than PS3.

- In the last financial report, Sony stated that software sales declined by 3.5%.

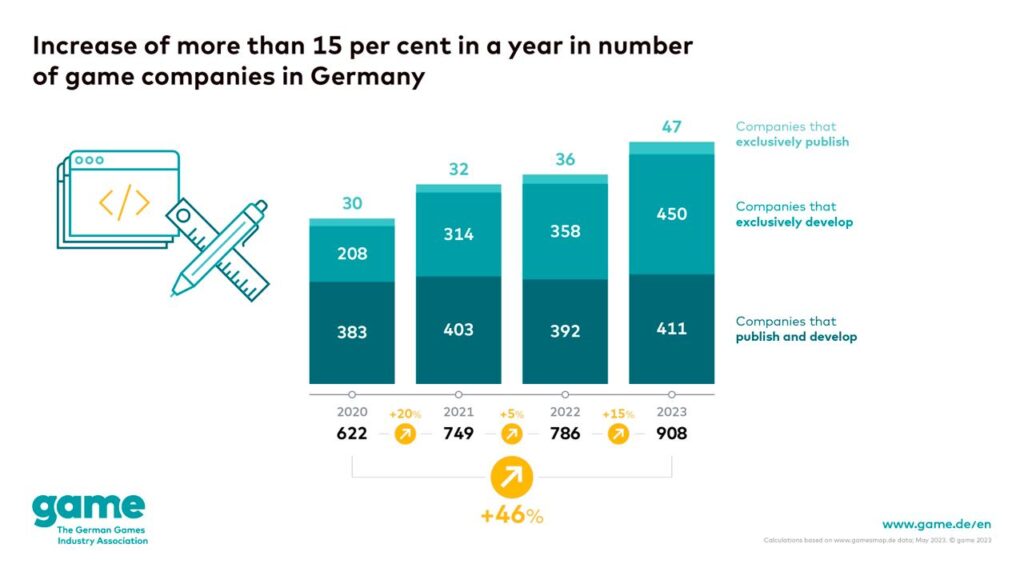

game: The German gaming industry is back to active growth in 2023

- The number of gaming companies in the country increased to 908. It’s 15% more than it was in 2022.

- The growth in the number of companies since 2020 is 46%.

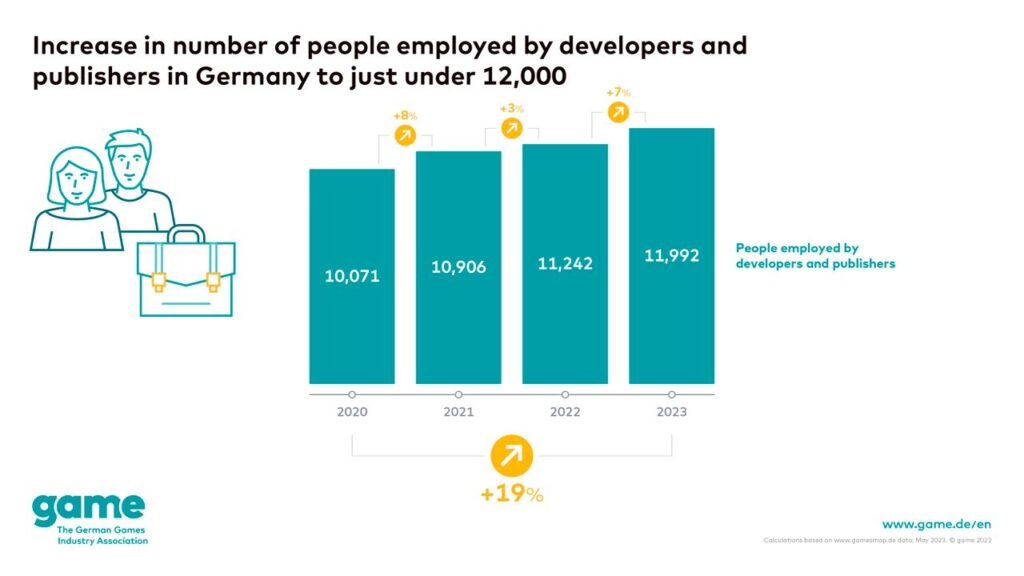

- Amount of people working in the industry is increasing too. In 2023 the number almost reached 12k which is 7% more than a year before.

- Compared to 2020, the number of game industry employees in Germany increased by 19%.

- Association representatives are pointing out the fact that the number of people employed in the related gaming industry jobs is significantly higher and is reaching 30k people. We’re speaking of workers at media outlets, retail shops, education, and other fields.

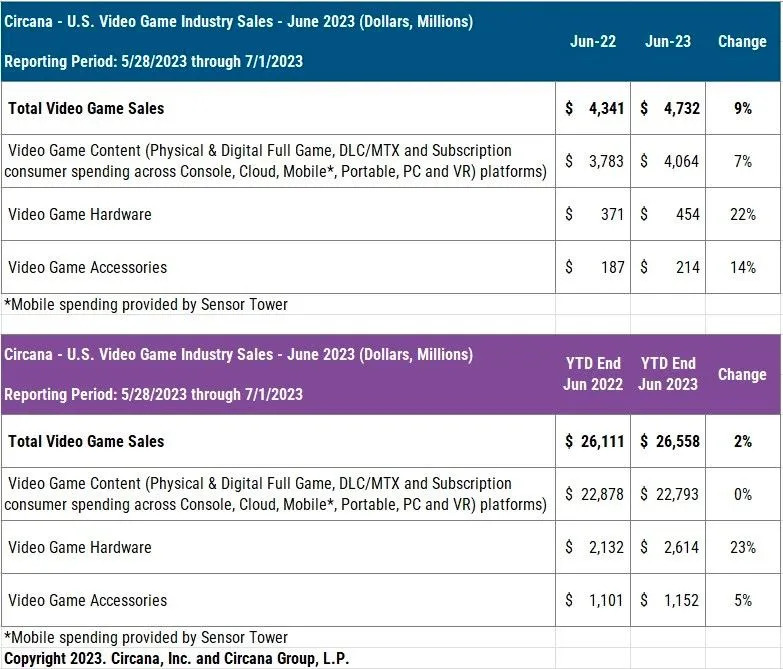

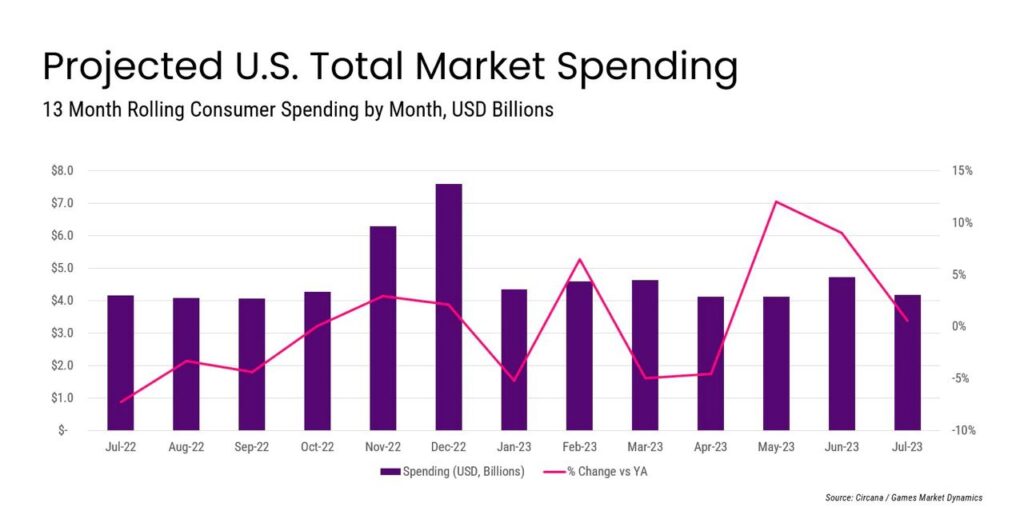

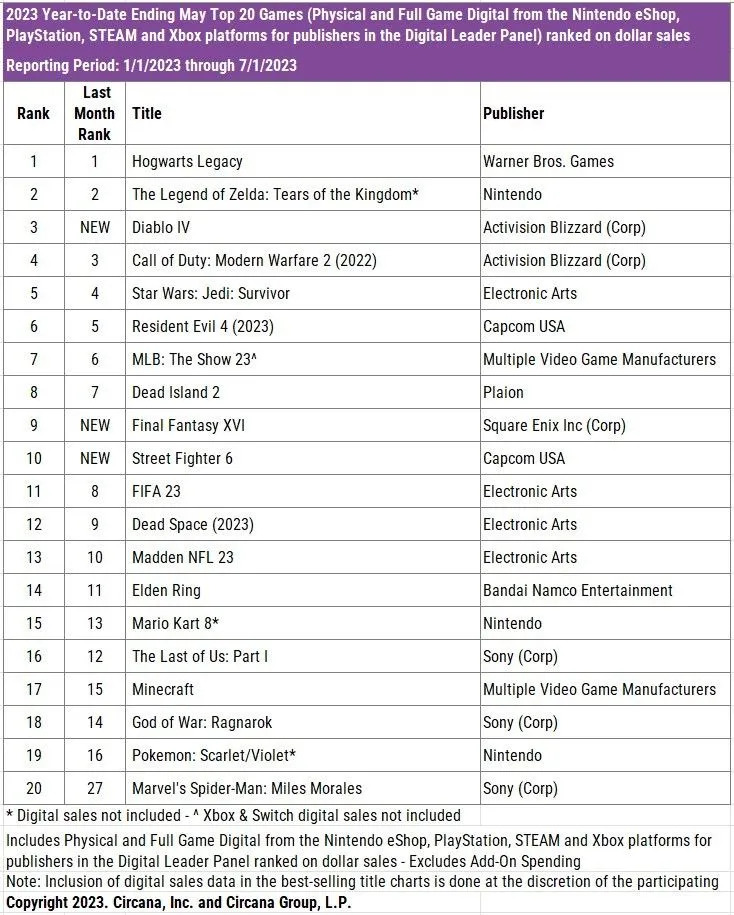

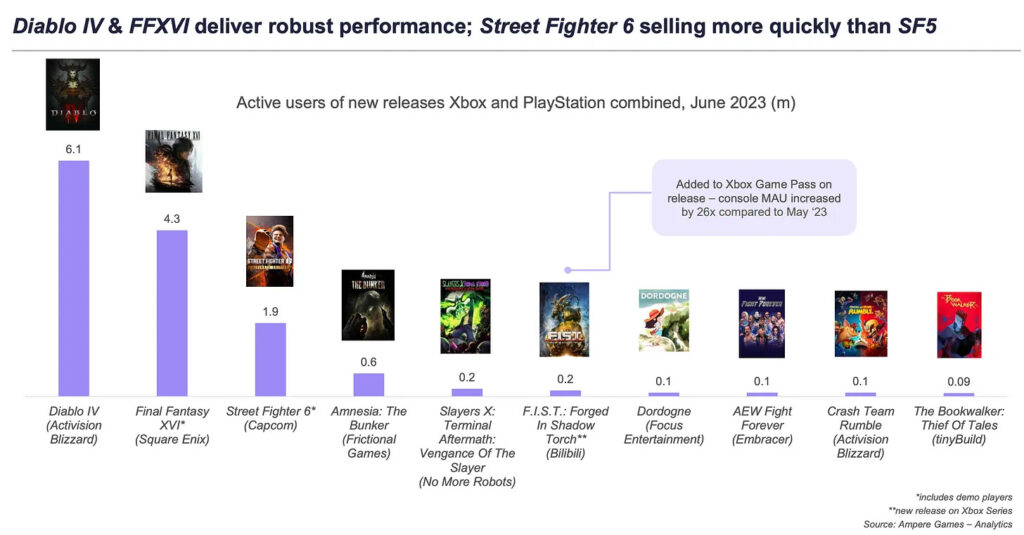

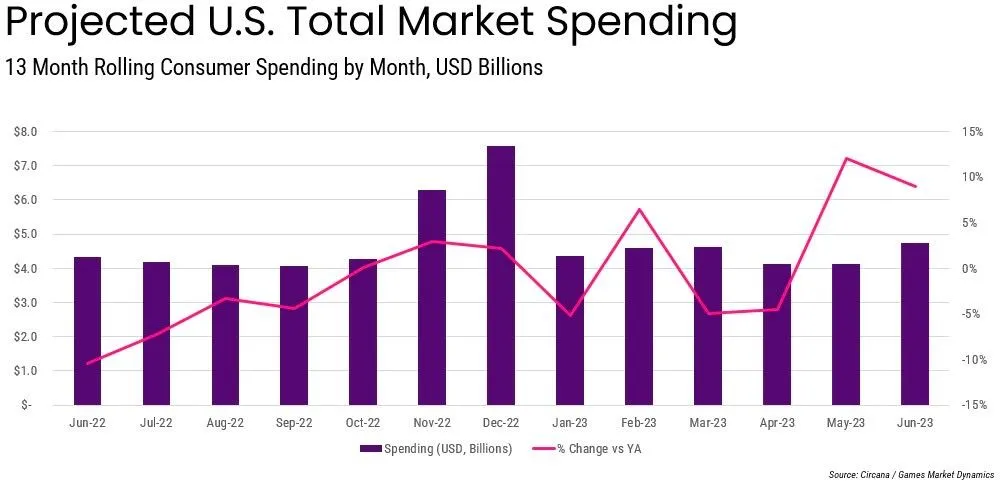

Circana: The US Gaming market in June 2023 grew by 9%

- American gamers spent $4.7B on games in June 2023. It’s 9% more than a year before.

- That’s the second-largest June in history. More American users spent only in June 2021 - $4.8B.

Games

- $4.1B are software sales. Growth to the previous year is 7%.

- Diablo IV is the leader by sales in the US; Final Fantasy XVI reached second place; Street Fighter 6 is third.

- Launch sales of Street Fighter 6 are doubling Street Fighter’s V sales.

Hardware

- Hardware spending in the US increased by 22% and surpassed $454M. It’s the highest June mark since June 2008 ($617M).

- PlayStation 5 is a leader in both unit & dollar sales.

- June 2023 sales of PlayStation 5 are impressive: PlayStation performed better in dollar sales in June 2008; and by number of units - in June 2010.

- Accessory sales increased by 14% and reached $214M. DualSense is leading.

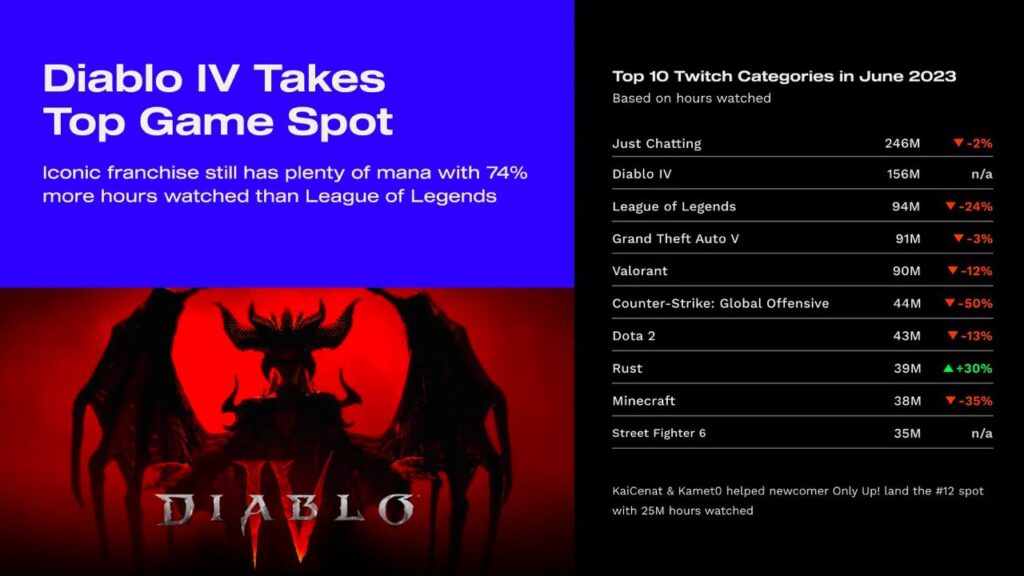

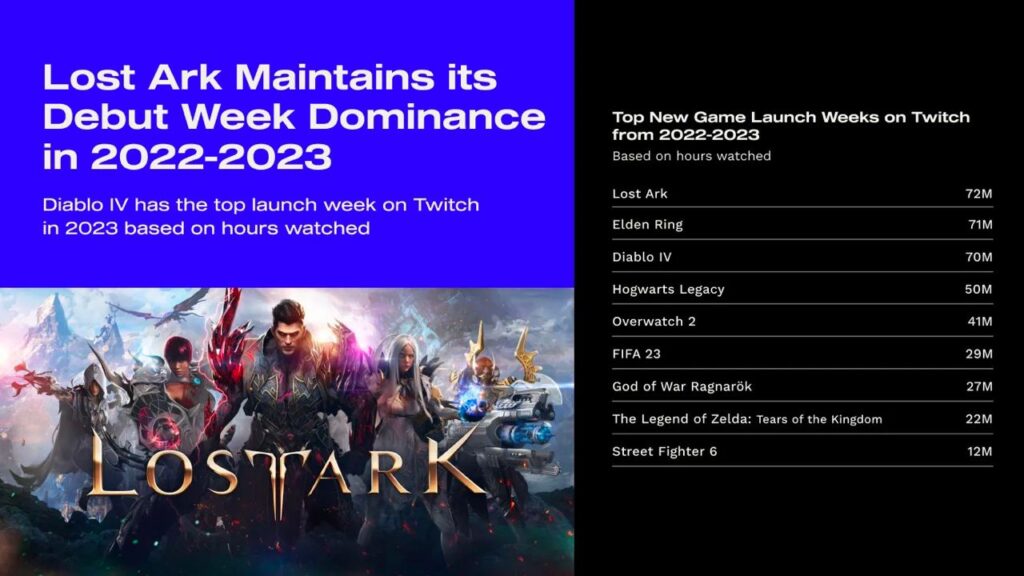

StreamElements & Rainmaker.gg: State of the Streaming market in June 2023

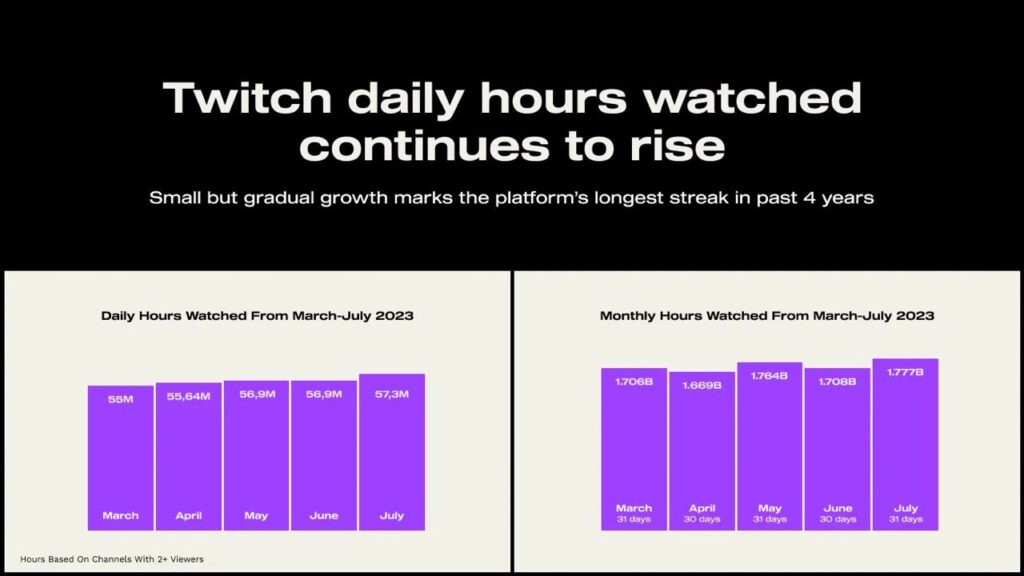

- Twitch is growing a little by daily views - in June daily average was 56.919M hours versus 56.901M in May. The difference in the overall amount of hours is because of the fewer days in June.

- In 2020-2022 the number of watched hours dropped from March to June. Growth this year is atypical.

- 76% of watched hours on Twitch in June accounted for leading 10k streamers. It’s 5% of the overall amount of content makers on the platform.

- Diablo IV (first place) and Street Fighter 6 (last place) debuted in the top 10 in June 2023.

- League of Legends (94M watched hours); Grand Theft Auto V (91M watched hours) and Valorant (90M hours) are on top too.

- Diablo IV is one of the most successful launches on Twitch in the last year and a half. The game received 70M watched hours in a launch week. Only Lost Ark (72M hours) and Elden Ring (71M) had better results in 2022-2023.

Newzoo: The Gaming Market in 2023

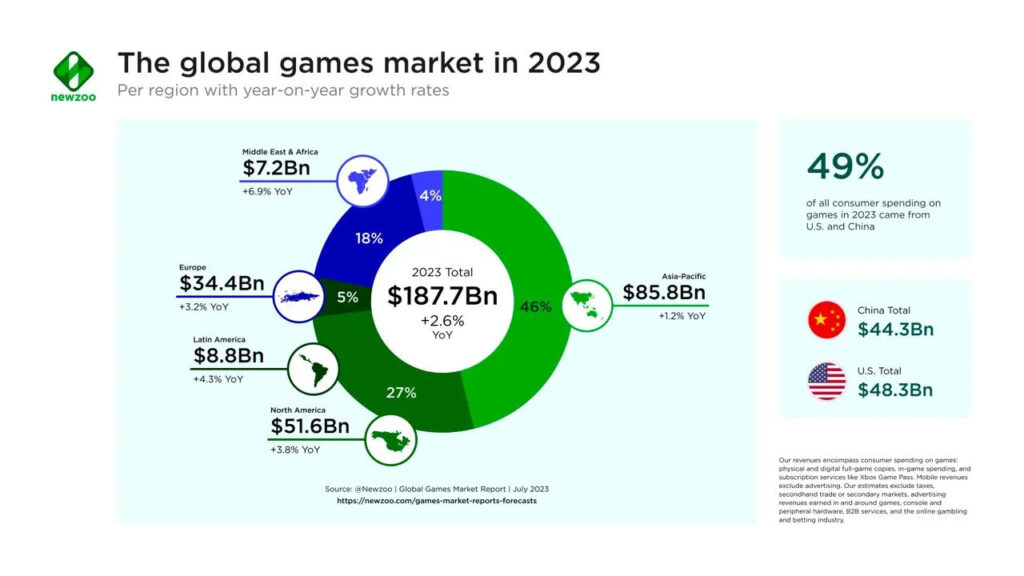

Revenue - general numbers

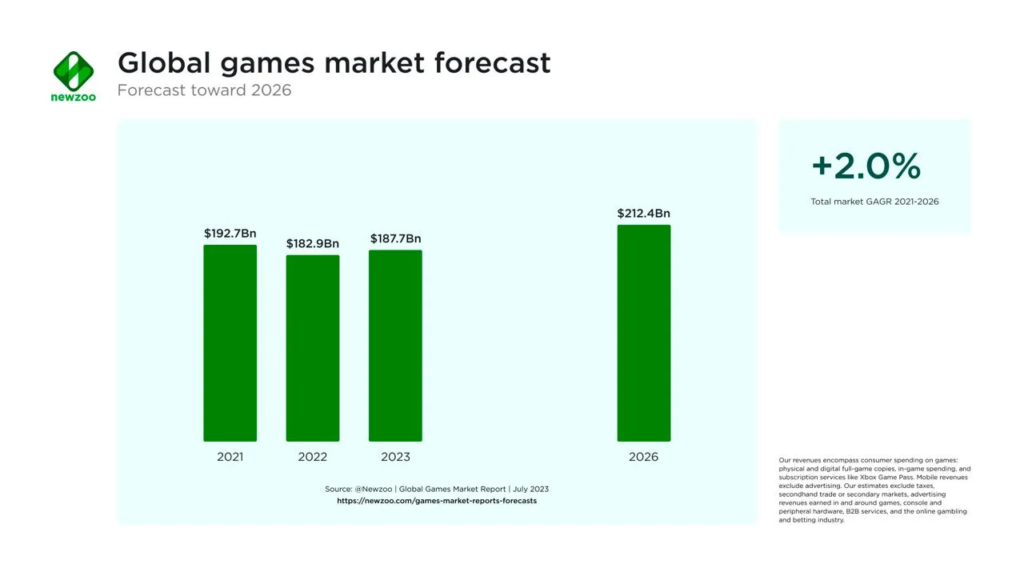

- The gaming market in 2023 will earn $187.7B. It’s 2.6% more than last year despite all the troubles the market experienced (and continues to handle).

- Newzoo is optimistic that the gaming market stabilized after the post-pandemic crisis. By 2026 its size will reach $212.4B.

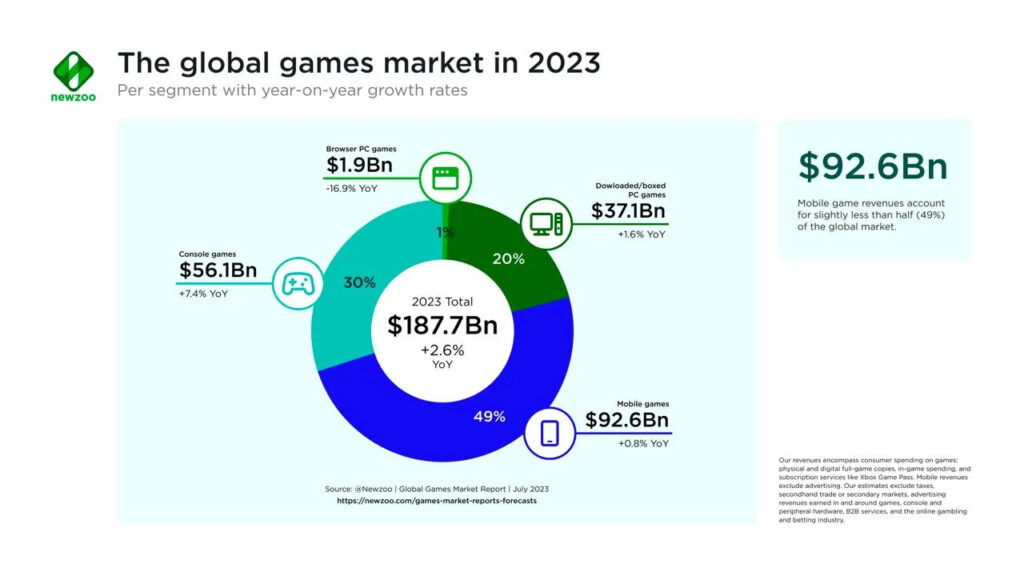

Revenue - platforms

- Most revenue is still coming from the mobile market ($92.6B), but in 2023 this segment will grow only by 0.8%. Newzoo analysts suggest that mobile gaming growth will be limited at least by 2026.

- The console games segment in 2023 will show the highest growth numbers - by 7.4% to $56.1B. There are 3 success factors: release of postponed titles; some hits arrived; and new console shipping returned back to normal.

- The PC games market will grow by 1.6% and reach $37.1B. Browser PC games have been on a declining trend for years, in 2023 they’ll decrease by 16.9% YoY to $1.9B.

- The number of paying users of Cloud Gaming will reach 43.1M by the end of 2023. By 2025 this number will reach 80.4M.

Regions

- The Asia-Pacific region is the largest by revenue in the world. It’s responsible for 46% of the overall revenue ($85.8B - +1.2% YoY). Next are North America (27% of the market; $51.6B - 3.8% YoY growth); Europe (18% of the market; $34.4B - 3.2% YoY growth); Latin America (5% of the market; $8.8B - 4.3% YoY growth), and MENA (4% of the market; $7.2B - 6.9% YoY growth).

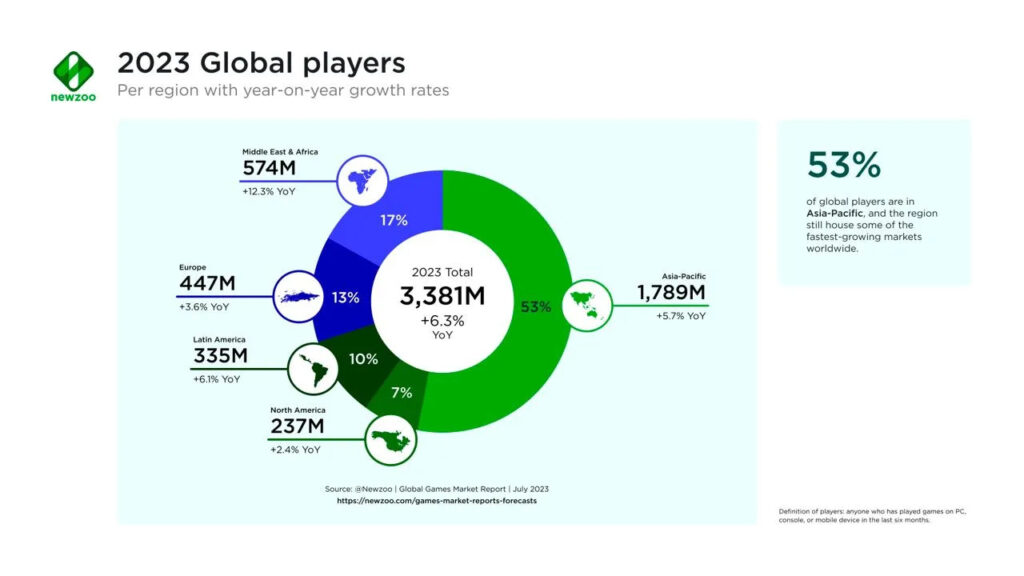

- The Asia-Pacific region is also the largest in terms of audience (53% of the worldwide audience lives there; 1.79B gamers; in 2023 it will increase by 5.7%). It might be a surprise for someone, but the MENA market is the second largest by audience (17% of gamers live there; 574M people; +12.3% YoY). Next are Europe (13% of the audience; 447M; +3.6% YoY); Latin America (10% of the audience; 335M; +6.1% YoY), and North America (7% of the audience; 237M; +2.4% YoY).

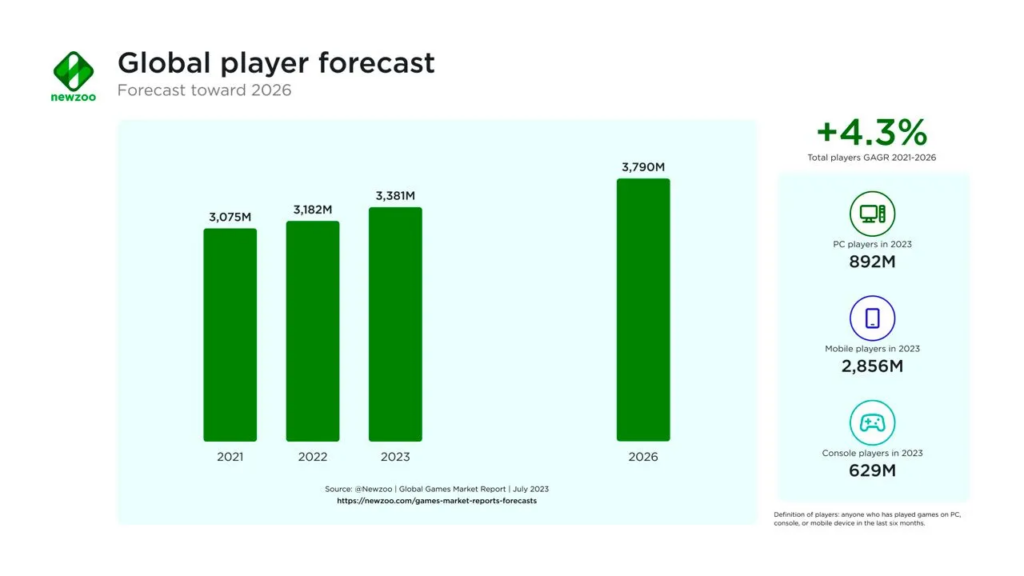

The gaming audience worldwide

- The number of players in 2023 will increase by 6.3% and reach 3.38B. By 2026 it will surge to 3.79B.

- 84.4% of this amount in 2023 will play on mobile devices; 26.3% - on a PC; 18.6% - on consoles.

- The number of paying users will increase by 7.3% in 2023 with 1.47B people in total. By the end of 2026, the number of paying gamers will increase to 1.66B with a +4.7% CAGR.

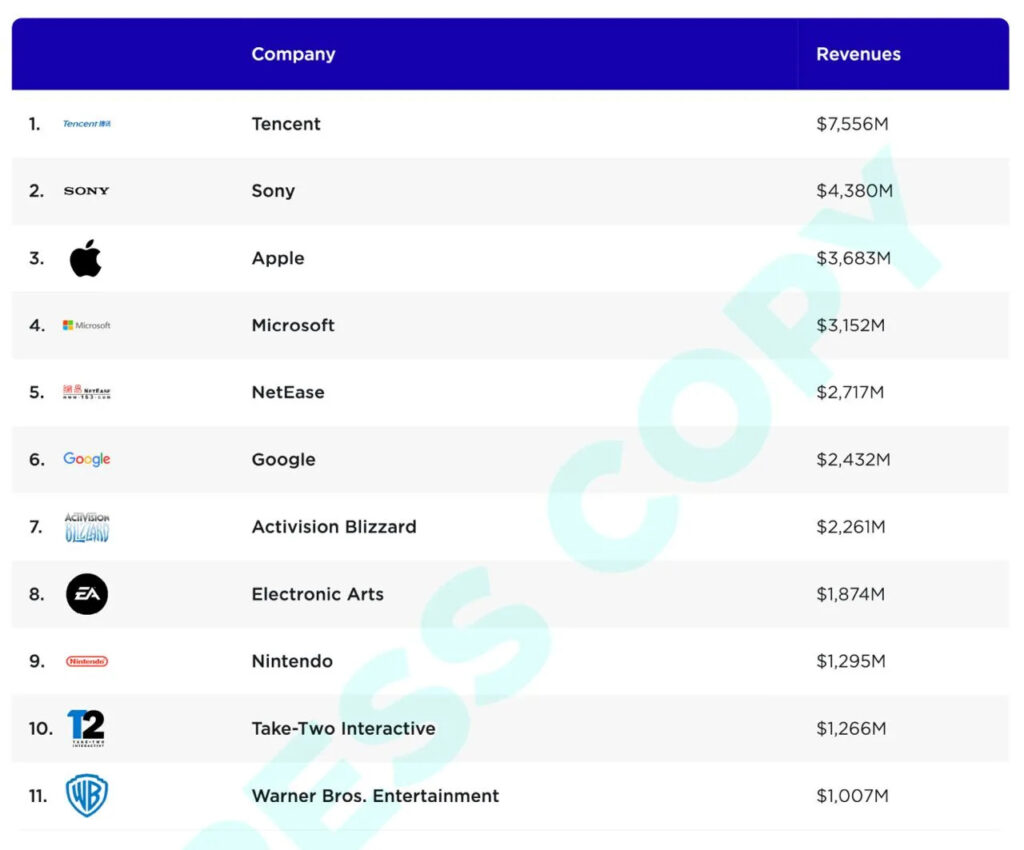

Companies

- Tencent ($7.56B), Sony ($4.38B), and Apple ($3.68B) are leaders in gaming revenue among public companies.

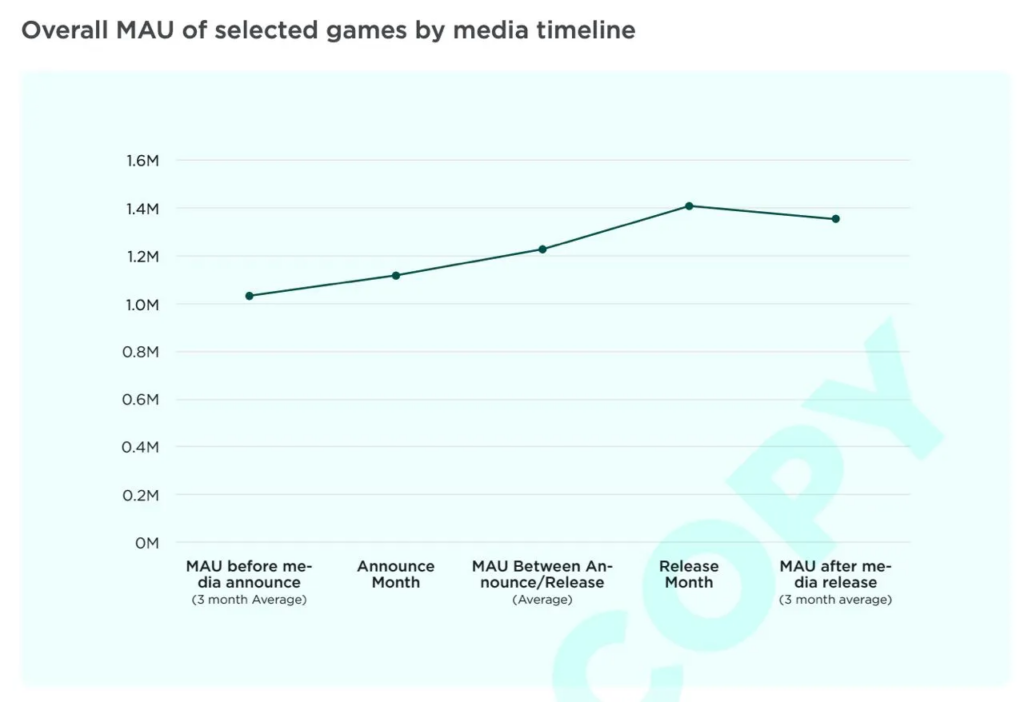

Transmedia

- Transmedia releases are positively affecting games MAU. In cases that the Newzoo team reviewed, the MAU of titles that received transmedia attention was increased by 40% on its peak. After stabilization, MAU growth was about 33-38%.

Trends

- The live-service games are huge on PC and Consoles. The competition for the user’s time is cut-throat.

- AI is stepping into the industry. Now its effect on the final product and production processes is low, but almost all market players are sure that the AI implementation will grow.

- The role of complementary consoles - like Steam Deck - probably will increase.

- Mobile developers are forced to find new ways to generate revenue because of platform regulations. PC/Console releases are a part of those moves.

- UGC and the creative economy continue to grow. Influencers’ influence (hehe) is on the rise, and they started to open their gaming studios.

- VR/AR is expected to boost after the Apple announcement of Apple Vision Pro.

- Saudi Arabia is one of the gaming industry growth leaders with Savvy Gaming Group being an investment leader in 2023.

CADPA: The Chinese Gaming Industry Revenue in H1 2023 dropped

- The gaming revenue in China in the first half of 2023 generated $20B revenue. It’s 2.39% lower than a year before.

- However, CADPA does expect fast growth in H2 2023, which will help to end the year with positive dynamics. They’re relying on quarter-to-quarter numbers, which shows that in Q2 the market was up by 22% compared to Q1.

- The number of gamers reached 668M. It means that every second Chinese person is a gamer.

- The PC gaming market is rapidly growing in China. In the first half of 2023, it grew by 7.2% and reached $4.56B.

- The Chinese gaming industry is making a bet on eSports. Event organizers do see both revenue and interest growth.

- Chinese companies earned $8.21B on overseas markets in H1 2023 which is a decline of 8.72% compared with H1 2022. The main overseas markets for Chinese developers are the US, Japan, and South Korea.

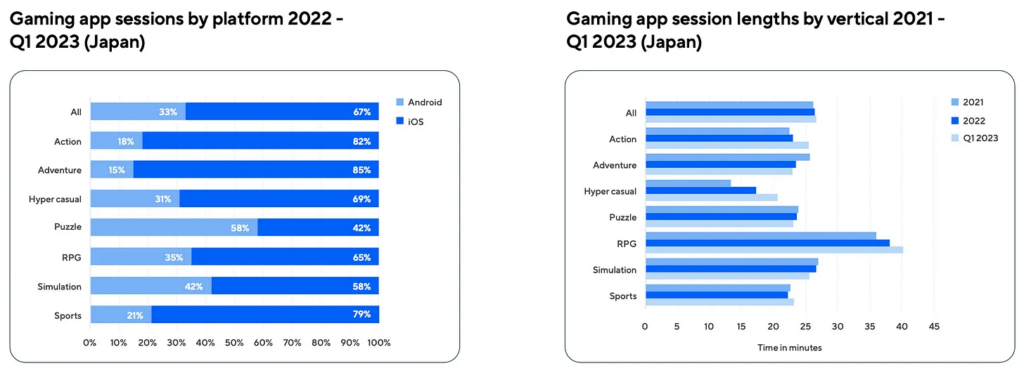

Adjust & data.ai: The Mobile Gaming market in Japan in 2023

General numbers

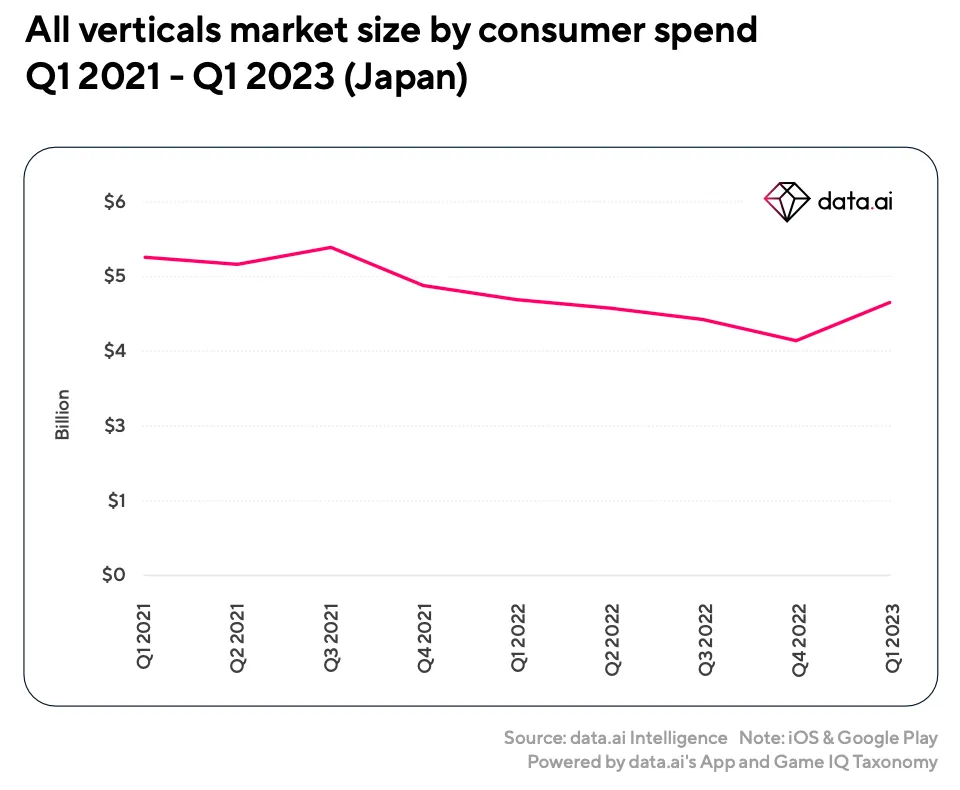

- The revenue from mobile apps in Q1 2023 in Japan was $4.65B. It’s a 13% increase compared to Q4 2022.

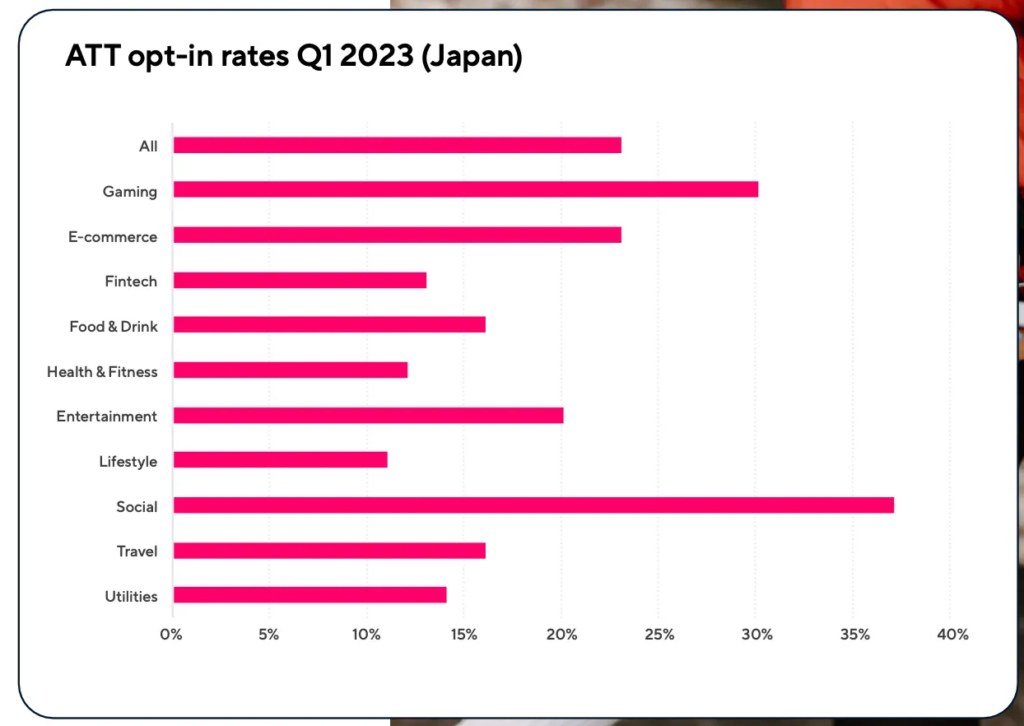

- ATT Opt-in in Japan is lower than the world benchmark. In games, 30% of people agree with their personal data usage.

Mobile games revenue

- It’s expected that Japanese gamers will spend $12.6B on mobile games in 2023.

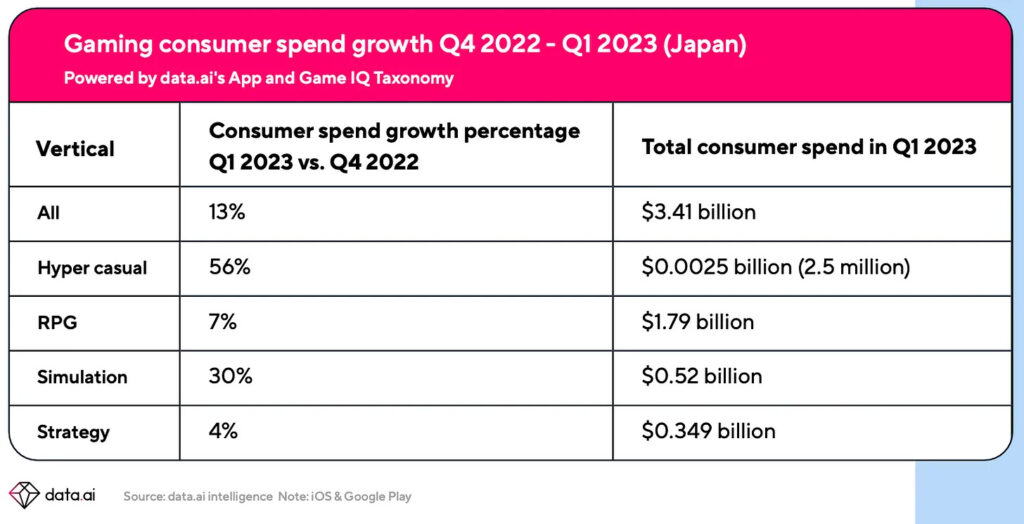

- In Q1 2023, the people of Japan already spent $3.41B on mobile games. 13% more than in Q4 2022. Games revenue growth is equal to the overall app revenue growth.

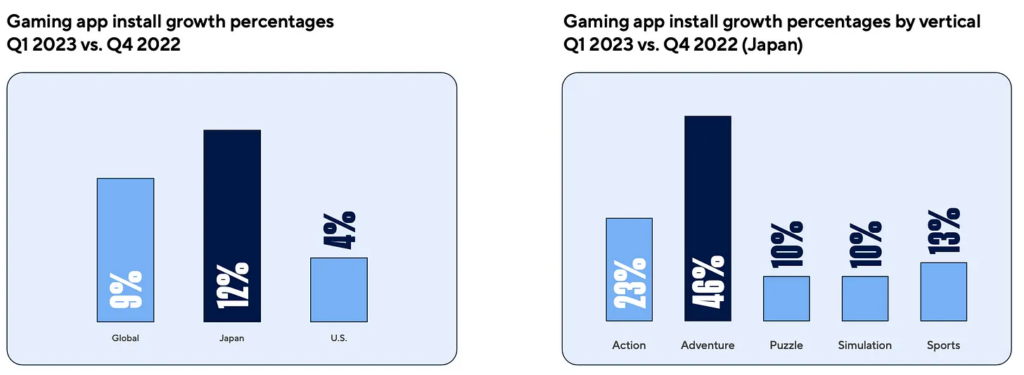

- Hypercasual games (+56% QoQ) and Simulation genre (+30% QoQ) are the fastest-growing revenue segments.

- Japanese gamers are the leader in the world of paying users. On average, one iOS user spends $10.3 per month (first place in the world); a Japanese Android user spends about $9.8 monthly (second place in the world).

Mobile games downloads

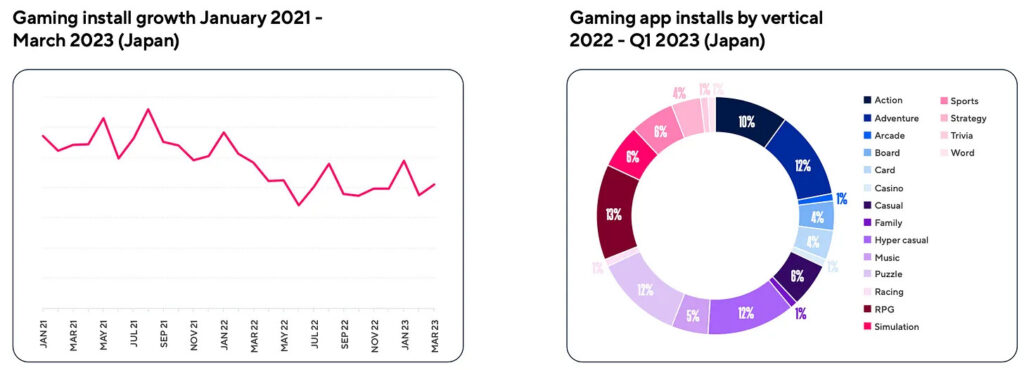

- Downloads in Q1 2023 increased by 12% compared to the previous quarter. The growth dynamics are higher than the market average by 3 percentage points.

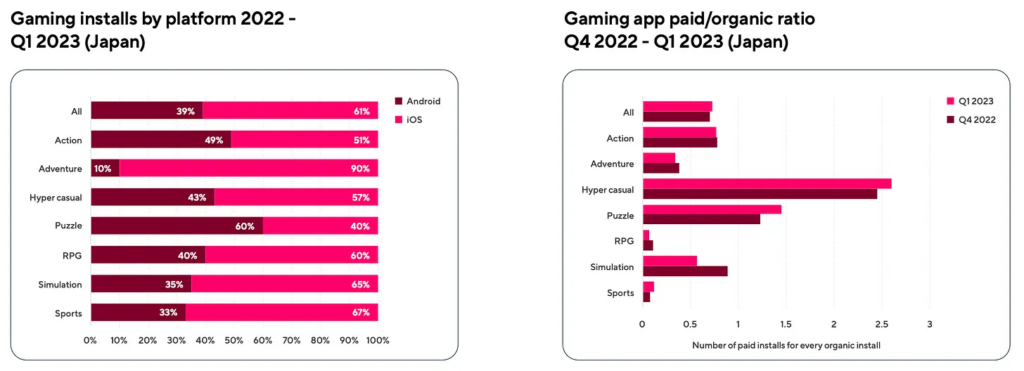

- Japan is one of the few markets where iOS is dominating by downloads (61% of the overall amount). Android is responsible for 39%.

- Organic traffic in Japan in Q1 2023 decreased. The average by all genres ratio between paid to organic traffic dropped from 0.73 to 0.7.

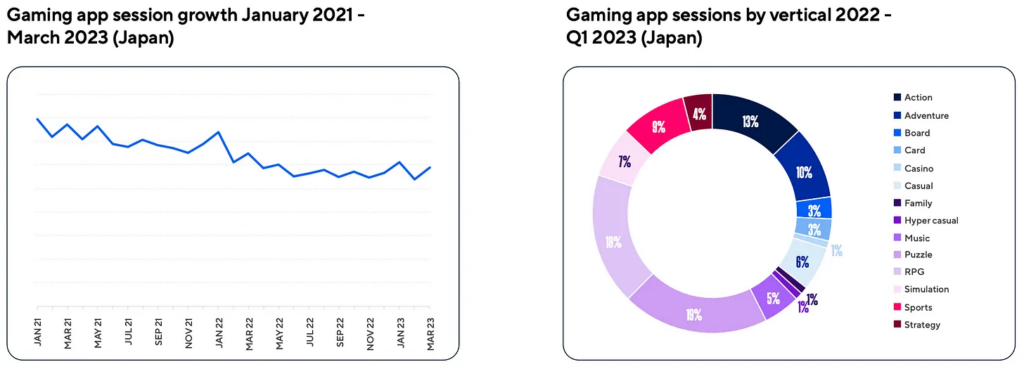

- RPG is the most popular genre in the country. It’s responsible for 13% of all downloads.

User behavior in mobile games

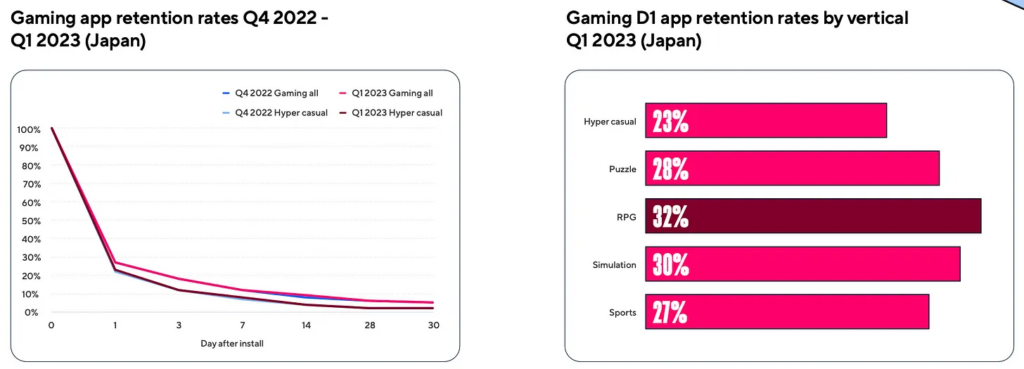

- Median D1 Retention in Q1 2023 was 27%; D3 Retention - 18%; D7 Retention - 12%; D30 Retention - 5%.

- RPG titles have the highest D1 Retention - 32%. Simulation (30%) and Puzzles (28%) are next.

- The number of sessions in Q1 2023 increased by 6% compared to the previous quarter. It’s 3 percentage points lower than the market’s average.

- 33% of all sessions in Q1 2023 were on Android; 67% - on iOS.

- The overall length of sessions in games has been growing in Japan since 2021. Now it’s about 26.59 minutes.

Mobile games audience

- There are about 70M mobile gamers in Japan now. It’s one of the largest markets in the world.

- 65% of smartphone users in Japan play games daily. 92% are playing at least once a week.

- Generation Z is 233% more likely to choose Party Royale; younger millennials tend to choose MOBA (52% more likely). Older millennials are more likely to choose puzzles. Generation X and baby boomers are spending 42% more time in card games than other generations.

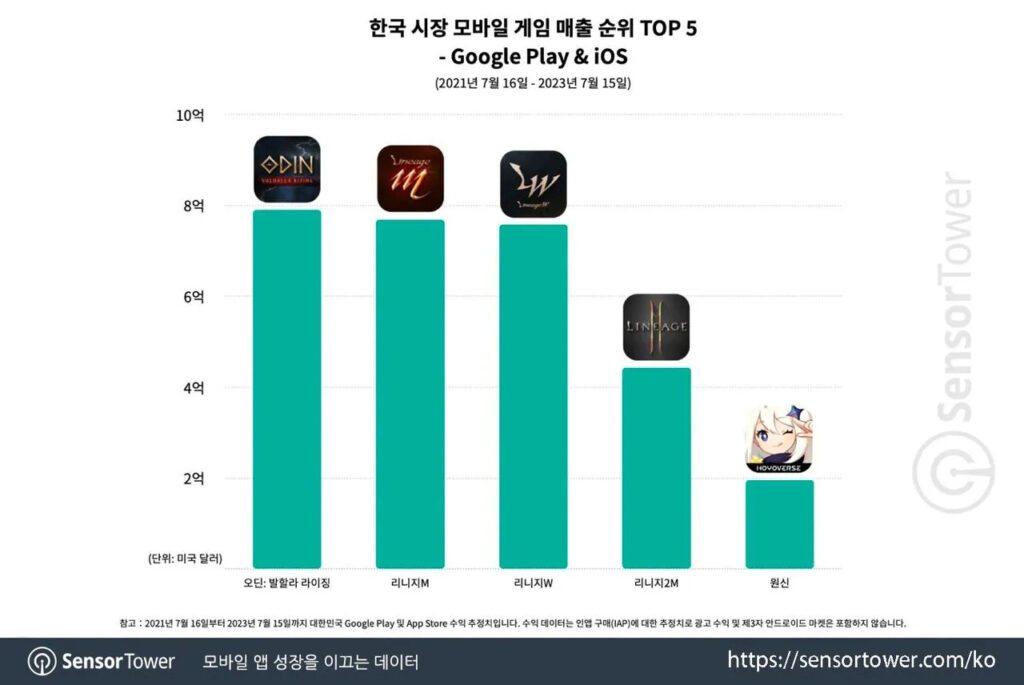

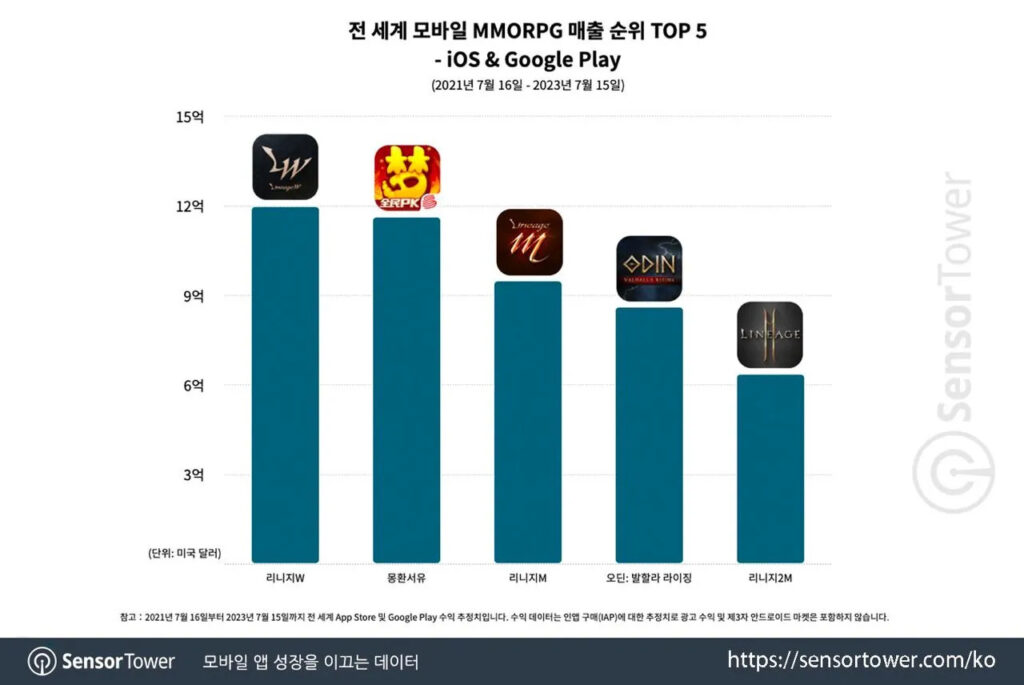

Sensor Tower: Odin: Valhalla Rising has been the top-grossing title in South Korea for the last two years

- The game came out on June 29, 2021, and ever since it has raked in over $900 million in earnings.

- An impressive 91.4% of this revenue has flowed in from South Korea, with Taiwan (5.1%), Hong Kong (2.6%), and Japan (0.9%) following suit.

- No game since the release of Odin: Valhalla Rising in South Korea has managed to outdo its earnings. The title that comes closest in terms of revenue is Lineage M.

- Since its launch, Odin: Valhalla Rising has claimed the spot as the fourth most successful MMORPG in the global market. Only Lineage W, Fantasy Westward Journey, and Lineage M have earned more.

- In terms of gender distribution, Odin: Valhalla Rising boasts a nearly equal player base, with 55% identifying as male and 45% as female.

Ampere Analysis: The Console gaming market in June 2023

- Fortnite takes the lead in MAU (Monthly Active Users) on both PlayStation (26 million players) and Xbox (10.1 million).

- Gamers collectively spent 612 million hours in Fortnite during June 2023, across PlayStation and Xbox. FIFA 23 comes in second (430 million hours), followed by Call of Duty: Modern Warfare II (Warzone 2.0) with 391 million hours.

- Grand Theft Auto V ranks second in total MAU, boasting 17.1 million on PlayStation consoles and 7.2 million on Xbox.

- For user engagement in June, Diablo IV (11 days per month), Final Fantasy XIV Online (8.9 days per month), and FIFA 23 (8.9 days per month) take the lead on consoles.

- Shooters, action-adventures, and sports games dominate in MAU during the first half of 2023 on consoles.

New Releases

- Diablo IV accumulated 6.1 million MAU on consoles in June. Following closely is Final Fantasy XVI with 4.3 million (including the demo version). Street Fighter VI holds the third spot with 1.9 million (also considering the demo version).

Impact of Subscription Services and Trans-media on MAU

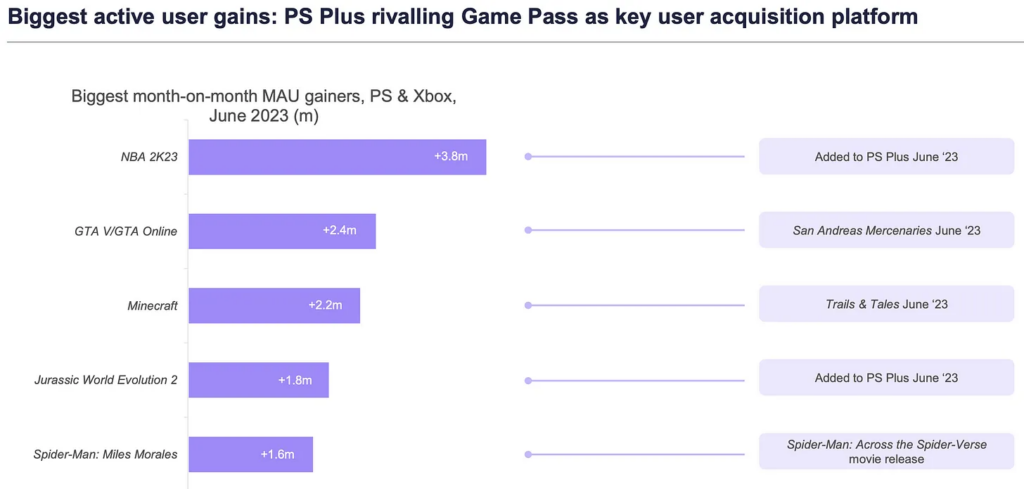

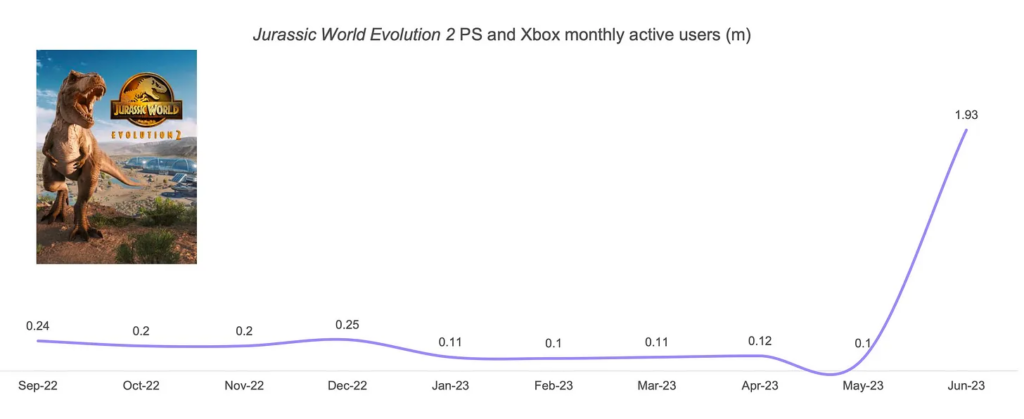

- PS Plus stands as a key driver for MAU growth. In June, the addition of NBA 2K23 (+3.8 million MAU) and Jurassic World Evolution 2 (+1.8 million MAU) to the catalog boosted numbers. Xbox Game Pass does not yield similar growth.

- Adding Jurassic World Evolution 2 to PS Plus Essential increased the game's MAU by 19 times.

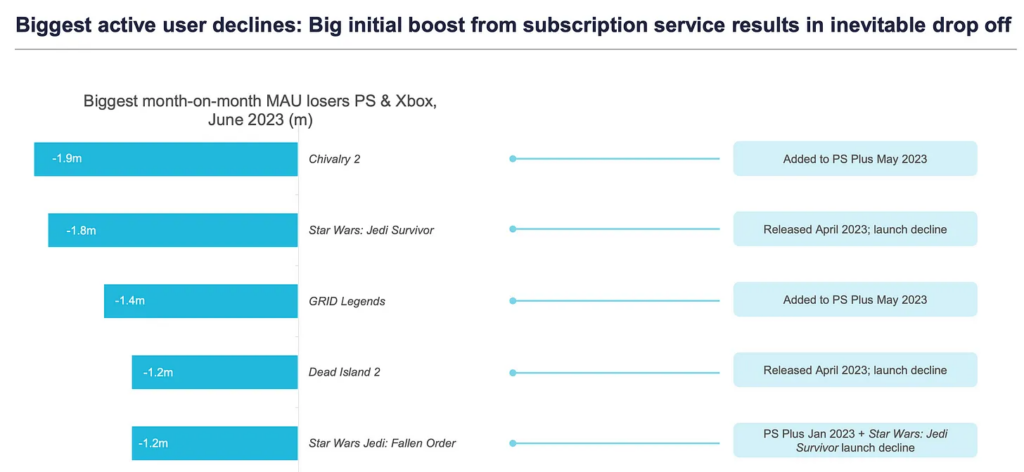

- However, there's a downside to subscription additions; it consistently leads to decreased MAU. This was seen with Chivalry 2 (leading in decline with -1.9 million MAU) and GRID Legends (-1.4 million MAU).

- The release of Spider-Man: Across the Spider-Verse boosted MAU for Spider-Man: Miles Morales by 1.6 million in June.

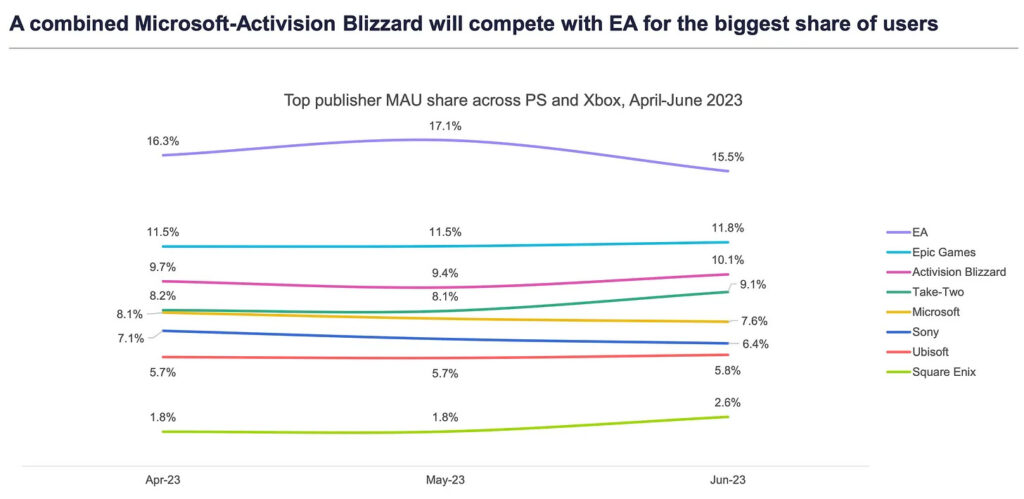

Companies

- EA leads in MAU for Q2 2023 on consoles (15.5%). Epic Games comes in second (11.8%), followed by Activision Blizzard (10.1%). Microsoft holds 7.6%, while Sony has 6.4%.

Diablo IV Profile

- MAU: 6.1 million

- Average playtime: 55 hours

- Audience overlap: Final Fantasy XVI (13.8%); Call of Duty: Modern Warfare II (8%); Fortnite (6.9%)

- Top markets: USA (44.9%); Germany (8.5%); Japan (6.5%)

Final Fantasy XVI Profile

- MAU: 4.3 million (including demo version)

- Average playtime: 18.7 hours

- Audience overlap: Diablo IV (19.7%); Street Fighter 6 (12.6%); Fortnite (9.4%)

- Top markets: USA (33.5%); Japan (24.3%); UK (6.6%)

You can download the report here (pdf)

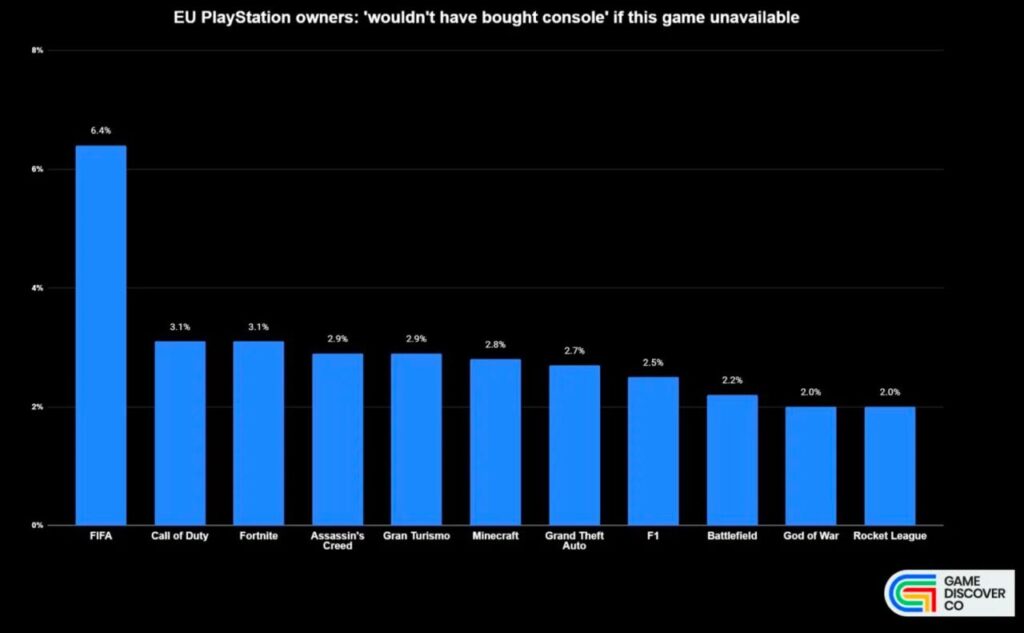

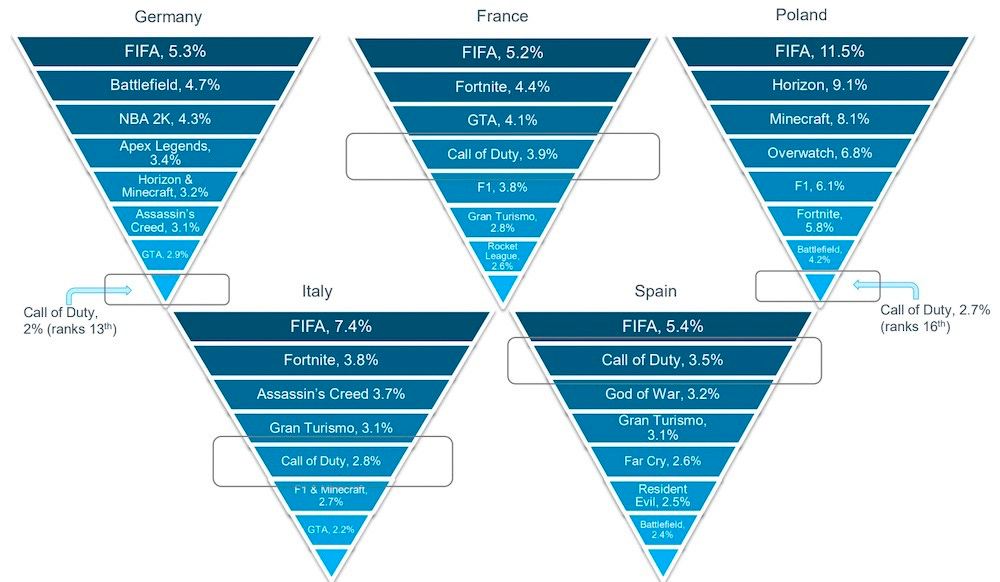

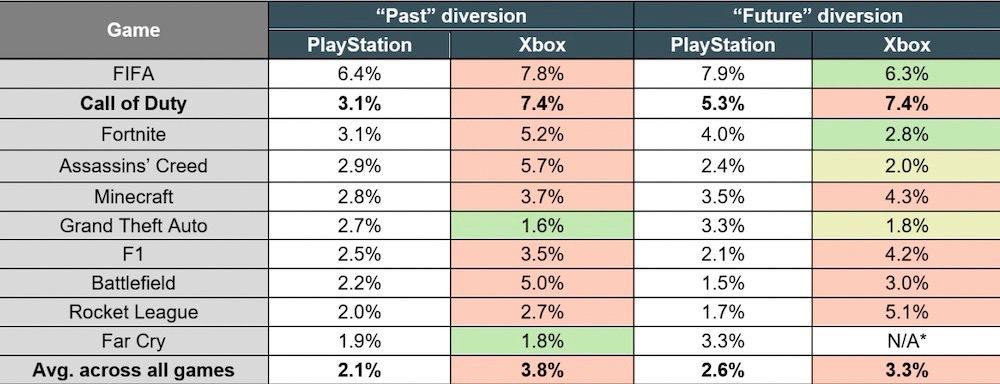

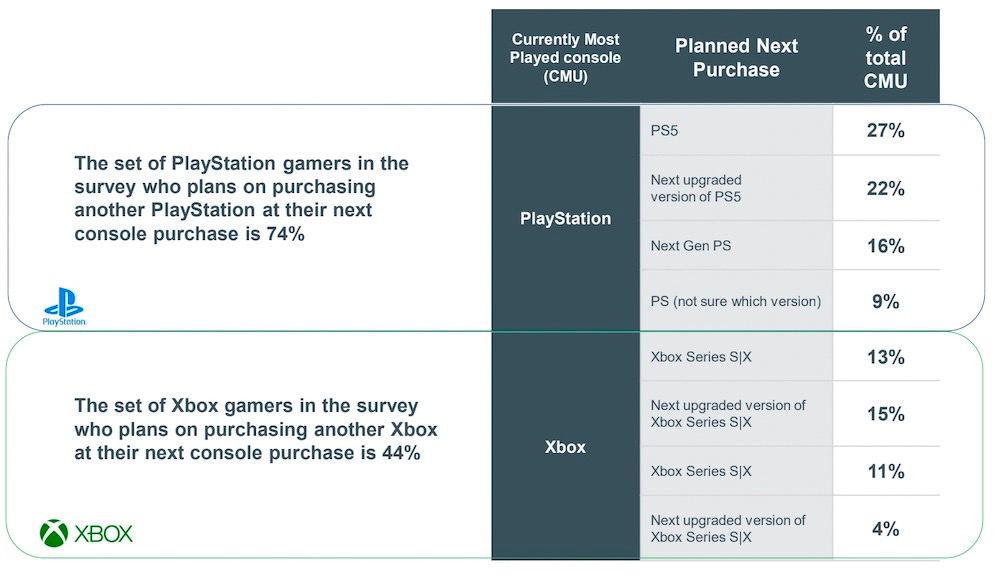

GameDiscoverCo: The Most Important Games for PlayStation Owners

YouGov surveyed 7,640 adult console gamers in Germany, Spain, France, Italy, and Poland in January 2023.

- FIFA - a crucial series for PlayStation enthusiasts. 6.4% of players would refrain from purchasing the console if the football simulator ceased to be released on it.

- Next in line are Call of Duty (3.1%), Fortnite (3.1%), Assassin’s Creed (2.9%), Gran Turismo (2.9%), and Minecraft (2.8%). Interestingly, two series out of the top 5 belong to Microsoft. Theoretically, the American company could capture 5% of players from Sony - 10 years from now, when the exclusive agreement concludes.

- 74% of PlayStation owners express their desire to acquire the next generation. For Xbox, this figure stands at 44%.

Microsoft employed this research during a legal dispute regarding the deal with Activision Blizzard, hence its potential bias.

Source

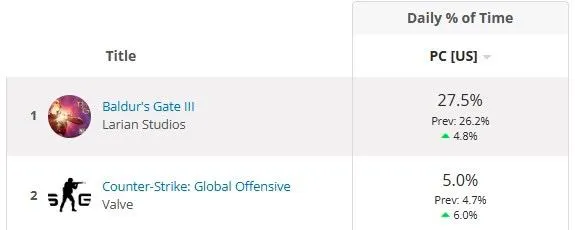

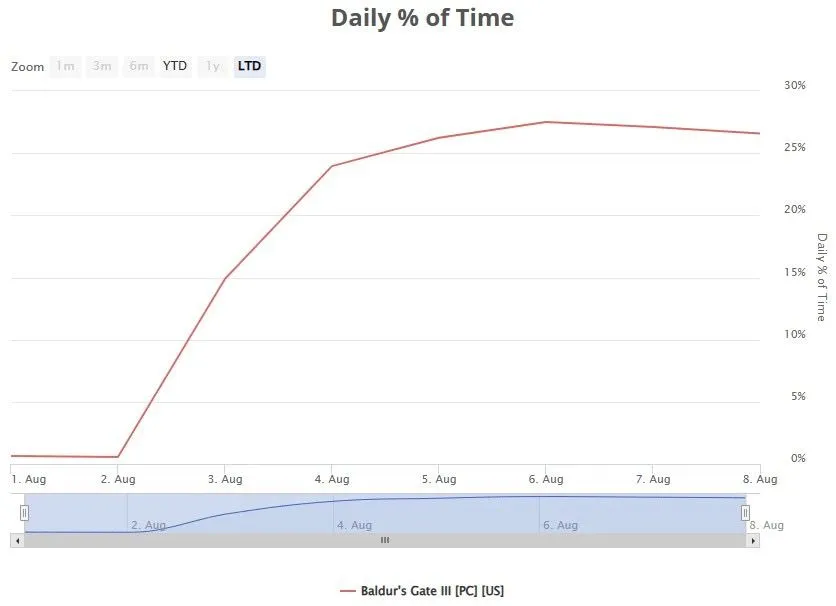

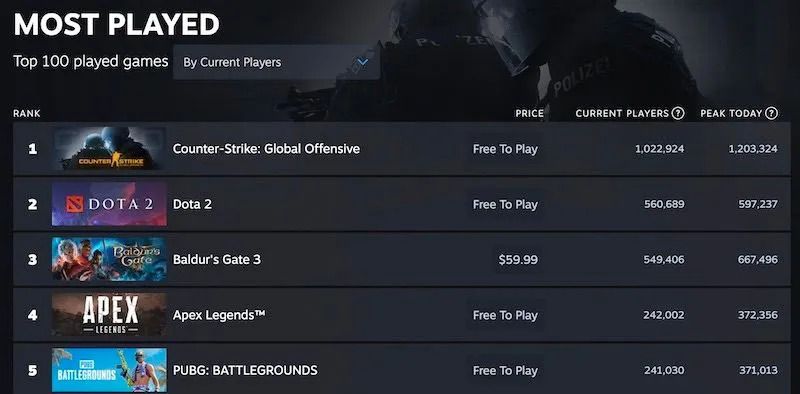

Circana: On August 6th, Baldur’s Gate III accounted for 27.5% of the total gameplay time on Steam in the US

- The game by Larian Studios took first place with a significant lead. In second place was Counter-Strike: Global Offensive (5% of the time).

- It took three days for Baldur’s Gate III to reach its peak of popularity.

- Currently, Baldur’s Gate III is one of the highest-rated games of the year.

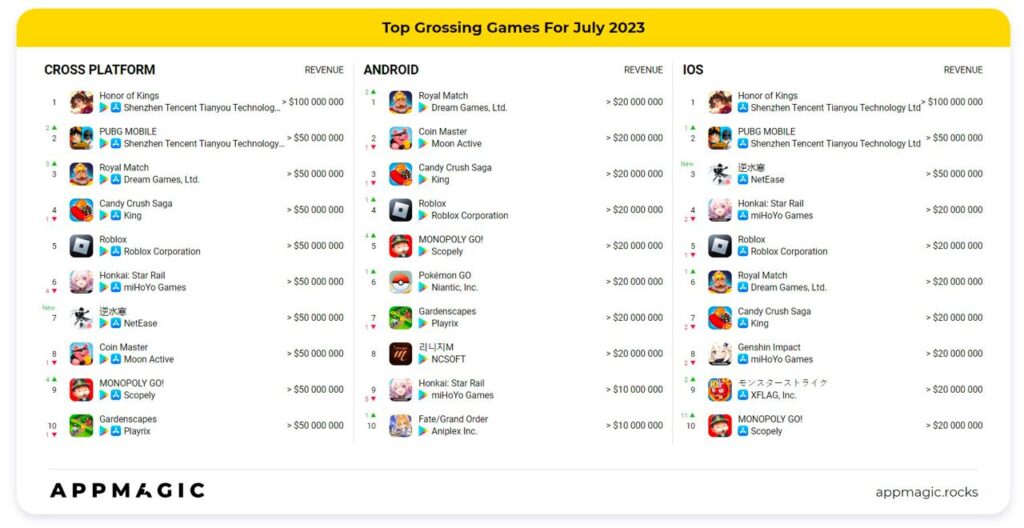

AppMagic: Top Games by Revenue & Downloads in July 2023

Revenue

- Honor of Kings, PUBG Mobile, and Royal Match are leaders in global revenue.

- Justice Mobile by NetEase jumped to 7th in the global ranking. The game earned $63.3 million in July, exclusively on iOS and only in China (meaning the actual revenue figure is higher due to alternative Android stores). Justice Mobile utilizes AI to generate unique NPC reactions to player actions.

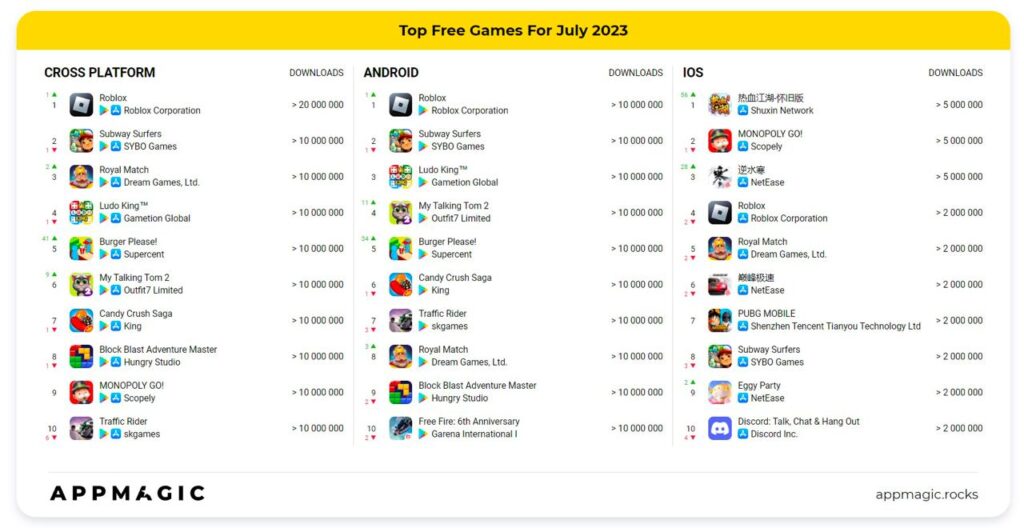

Downloads

- Roblox, Subway Surfers, and Royal Match took the lead in July for downloads.

- Burger Please! entered the top 10 charts despite its release in February of this year. The game was downloaded 13.9 million times in July (with 11.7 million downloads on Google Play and 1.1 million on the App Store).

- Noteworthy is also the release of Yulgang (Scions of Fate). In July, the game was downloaded 7.9 million times (only in China) - securing first place. Interestingly, the game is a port of a Korean MMORPG from 2004.

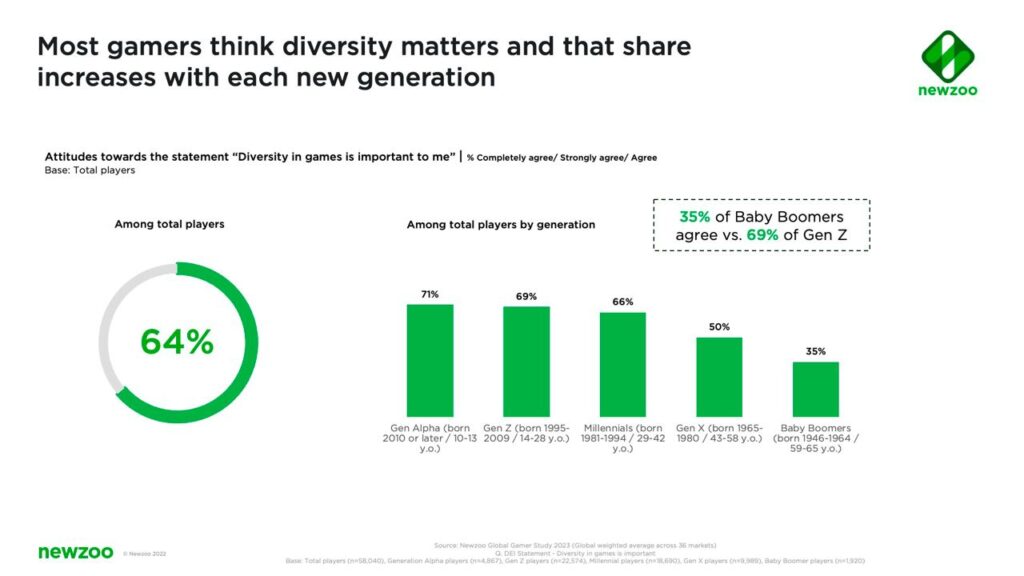

Newzoo: Diversity and representation are becoming increasingly important for the gaming audience

- 64% of players are certain that diversity in games matters. The younger the players, the more prevalent this opinion is.

- 62% of players believe that they (their gender, race, age, etc.) are well represented in games. However, older generations face challenges in this aspect – for example, only 35% of baby boomers feel that there are characters in games resembling them.

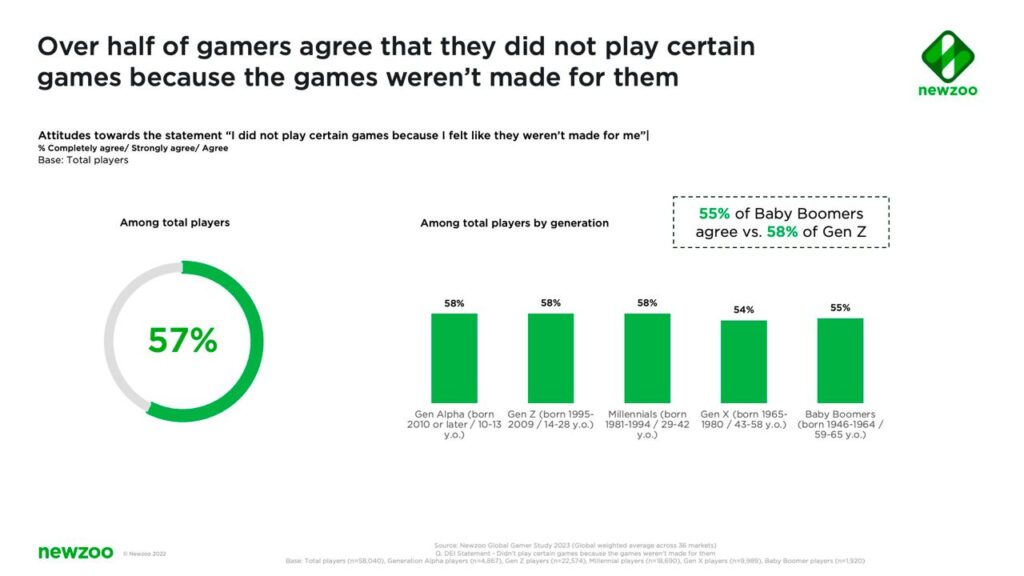

- 57% of players do not engage in games that are "not meant for them." Considering the vague wording of the question, this might relate to both representation in these games and genre preferences.

The Super Mario Bros. Movie is the highest-grossing among game adaptations

- And it's second among all animated movies in general.

- The animated movie "The Super Mario Bros." earned $1.35 billion. It was watched by 168.1 million people.

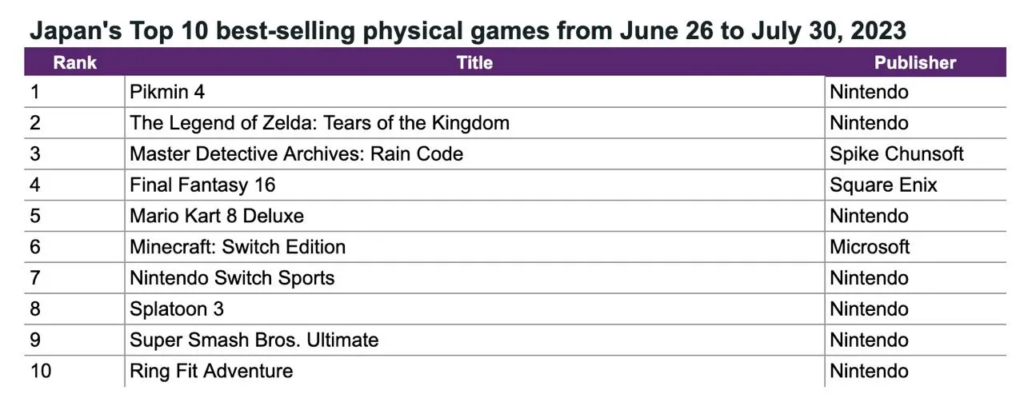

Famitsu: Game and Console Sales in Japan in July 2023

Famitsu only takes into account retail sales.

Games

- Nintendo - the leader in game sales at retail in Japan. In July, the company sold 947 thousand copies of games.

- The sales leader - Pikmin 4, the game sold 518 thousand copies in July. Within 10 days of its release, the game had already reached 80% of all Pikmin 3 sales.

- In second place is Square Enix (109 thousand copies); in third place is Spike Chunsoft (101 thousand).

- Nintendo owns 55% of the Japanese gaming retail market. Square Enix - 6.4%; Spike Chunsoft in July - 6%.

Hardware

- In July 2023, Nintendo Switch crossed the 30 million mark for consoles sold in the local market. 407 thousand consoles were sold in July.

- For the PlayStation 5, the results for July are more modest - 243 thousand consoles. Sony's system has a total of 4 million sales in the domestic market.

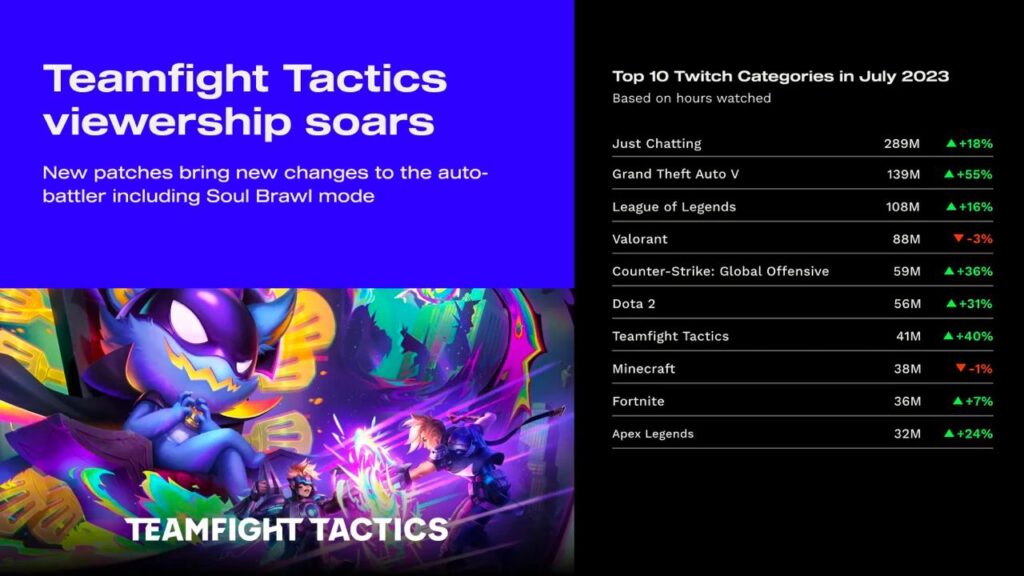

StreamElements & Rainmaker.gg: State of the Streaming Market in July 2023

- Twitch has been growing in daily views for 5 consecutive months - the best performance in 4 years of observation.

- In July, the platform had 57.312 million hours of content viewed daily; and overall for the month, the total viewing hours reached 1.777 billion.

- Teamfight Tactics reached the 7th position on the viewing chart. The game accumulated 41 million hours of views in July.

- The leaders remain the same - Grand Theft Auto V (139 million hours); League of Legends (108 million hours); Valorant (88 million hours).

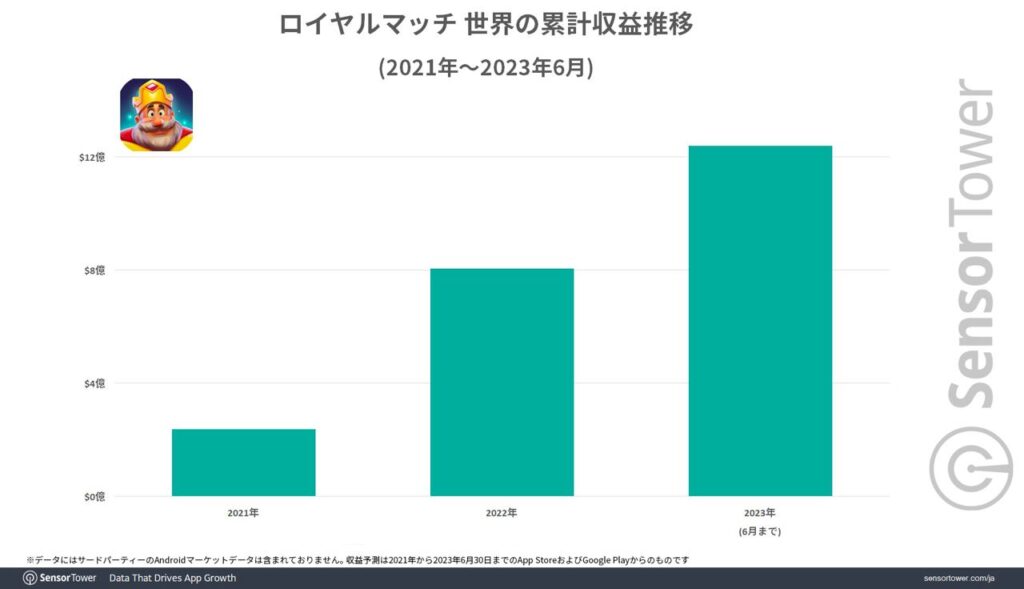

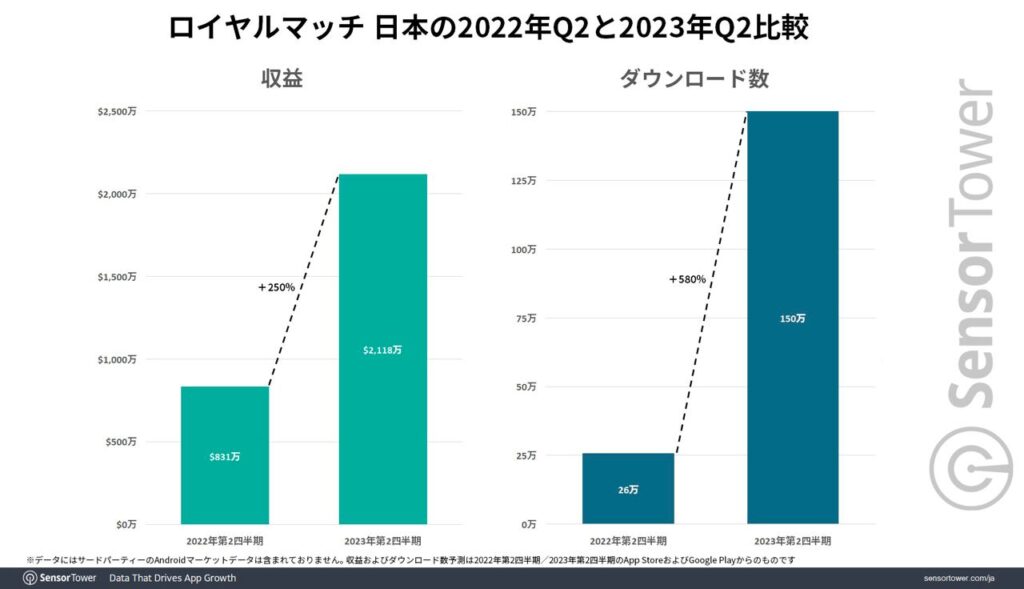

Sensor Tower: Royal Match! has reached $1.2 billion in global revenue

- The USA is the primary market for the game (58%); Japan is in second place (6%); the United Kingdom is third (5%).

- In Japan, Royal Match experienced sharp growth in the second quarter of 2023 in terms of both downloads (+580%) and revenue (+250%).

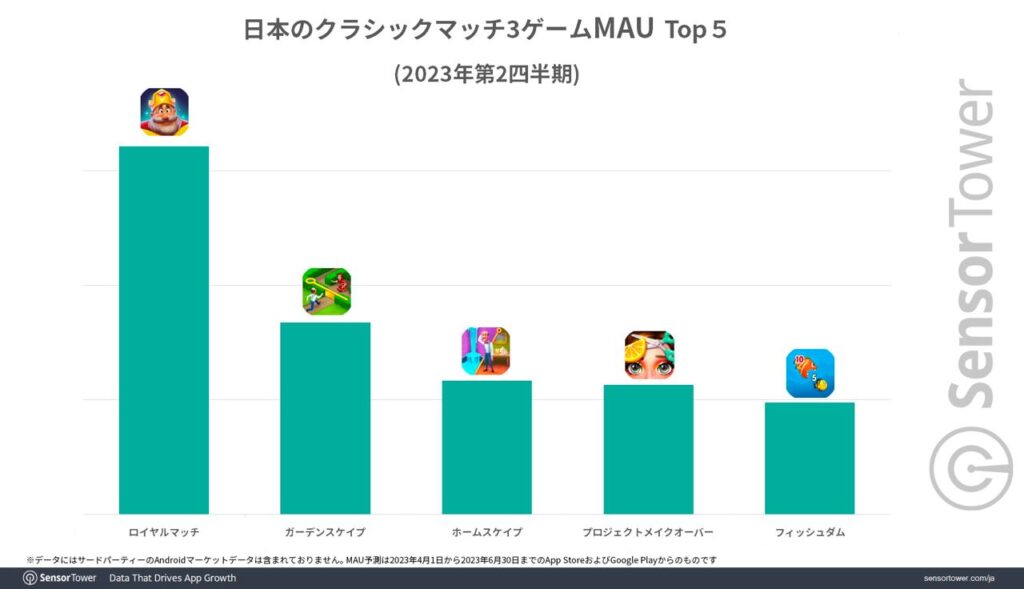

- Royal Match is the most successful puzzle game in Japan, surpassing Gardenscapes, Homescapes, and other hits several times. In terms of Monthly Active Users (MAU), the game outperforms Gardenscapes by two times.

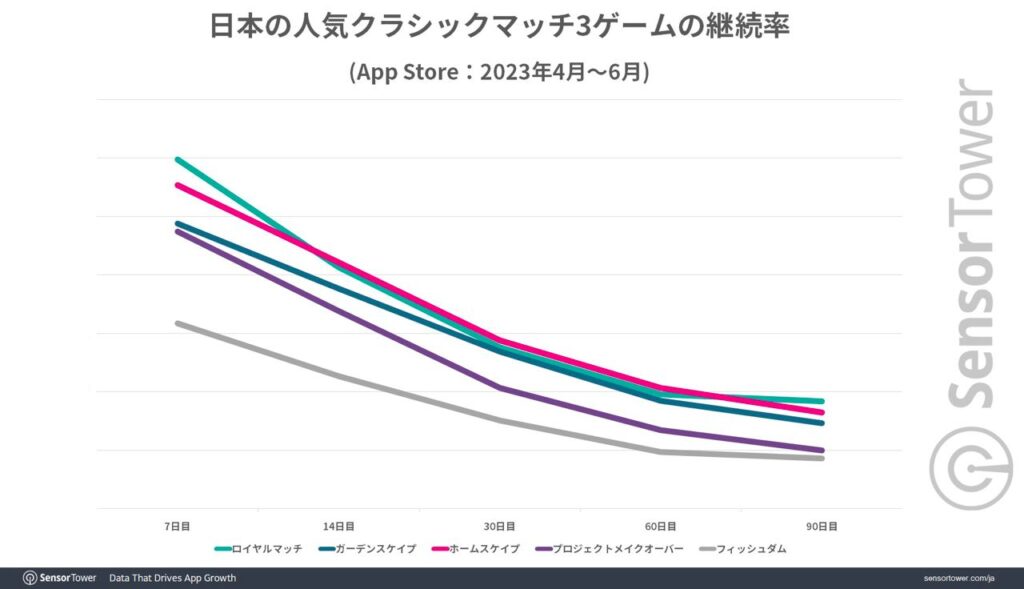

- Royal Match has better retention rates than its competitors at 7 and 90 days. Between days 14 and 60, its retention is only surpassed by Homescapes.

Circana: American players spent over 5 hours a day playing Baldur’s Gate III on weekends

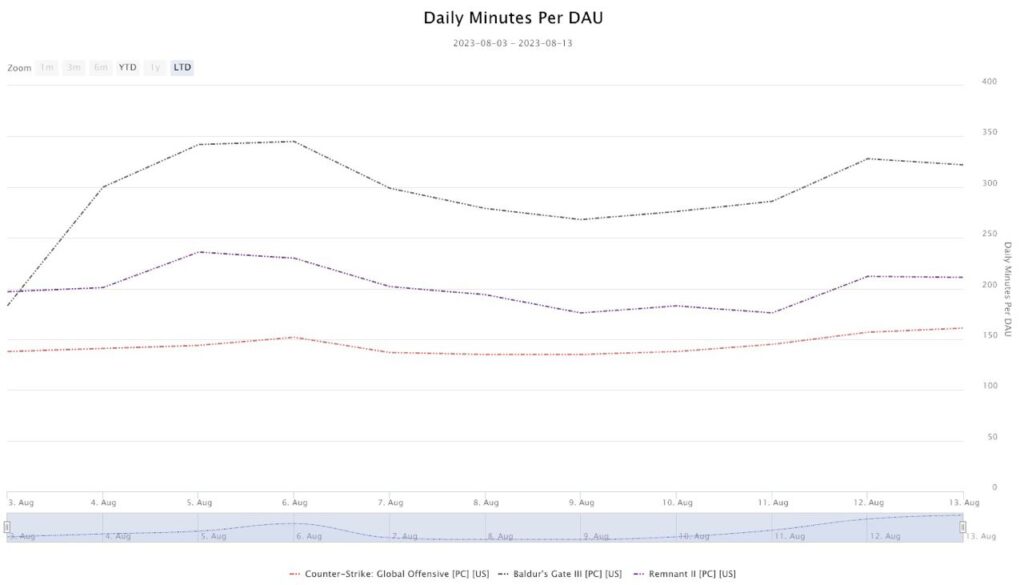

The calculation methodology takes into account the total number of minutes played by users and divides it by the number of active users on a specific day.

- During the weekends, Americans played Baldur’s Gate III for nearly 350 minutes per day. On weekdays, players spent 260-280 minutes per day in the game.

- For comparison, Remnant II's engagement rate in the USA on weekends stands at around 200 minutes per day. Counter-Strike: Global Offensive's metrics are at 150 minutes per day.

- Baldur’s Gate III is currently the best-selling game on Steam in the past couple of weeks. The game has also managed to become the highest-rated game of this year.

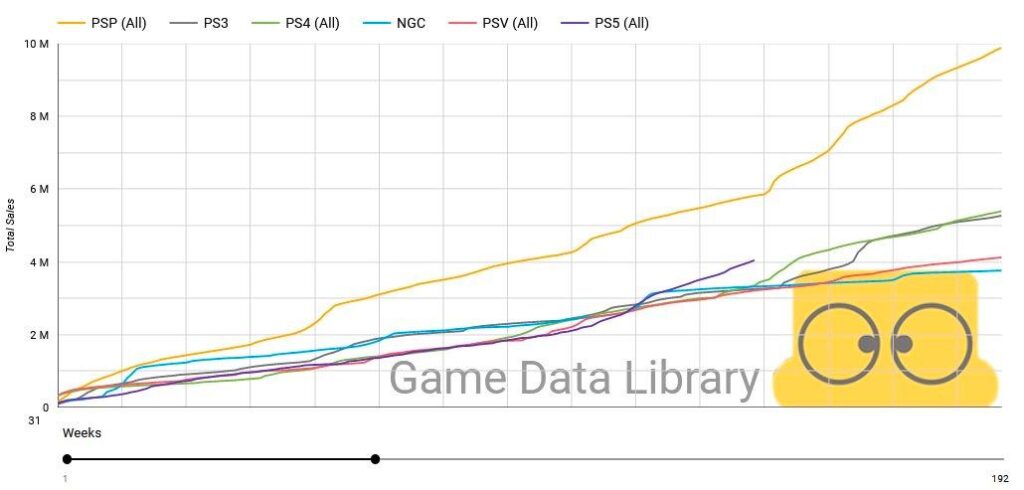

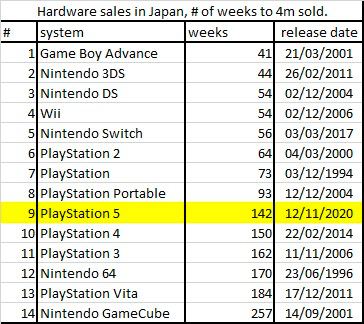

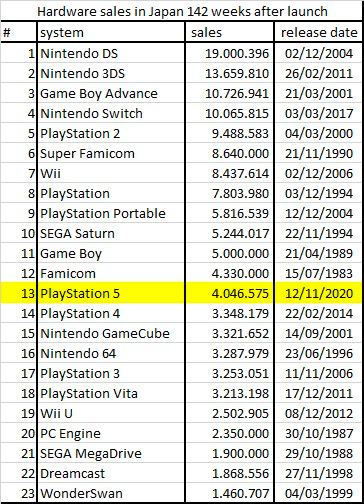

Game Data Library: PlayStation 5 sales trend in Japan outpaces PS4 and PS3

- PS5 reached the milestone of 4 million sales in Japan within 142 weeks. It took PS4 150 weeks to achieve this result, and the PS3 took 162 weeks.

- However, the sales trend significantly lags behind PlayStation 2 (which took 64 weeks to reach 4 million) and the original PlayStation (73 weeks).

- The fastest to reach the 4 million mark in Japan was Game Boy Advance, which accomplished it in 41 weeks.

- Currently, PlayStation 5 ranks 13th in terms of sales trends in Japan, being surpassed by systems like Famicom and SEGA Saturn.

- The indisputable sales leader in Japan is the Nintendo DS, with 19 million consoles sold within 142 weeks.

GamesIndustry.biz & IIDEA: The video game industry and market of italy in 2022

Industry

- 84% of companies are working on games for PC; 54% - on mobile projects; 38% - on console games.

- In Italy, only 22% of gaming companies earn more than €500,000 per year. 26% fall within the range of €100,000 to €500,000. The rest earn less.

- In 2022, Italy had over 2,400 employees in the gaming industry. This is a 50% increase compared to 2021.

- 24% of the workforce in Italy's gaming industry are women.

Market

- 11.5 million games were sold in Italy on PC and consoles in 2022. There was no growth compared to 2021.

- As of July 2023, the Italian market shows a 4% growth compared to the previous year. Already, 5.8 million games have been sold.

- €287 million was spent on consoles in 2022, 10% less than in 2021.

- In 2023, the situation looks much better - console sales have grown by 104%. PS5 sales have soared by 283% compared to the previous year. However, Nintendo Switch sales have fallen by 8%, and Xbox Series S|X sales by 23%.

Audience

- 14.2 million Italians (32% of the population) played games in 2022. 81% of them were over 18 years old.

- The average age of gamers in Italy is 30 years.

- 42% of Italian gamers are women.

Top Games

- FIFA 23 - the leading game in Italy in 2022. It remains in second place in 2023, slightly behind Hogwarts Legacy. FIFA 22 takes the third spot.

- In between them in 2022, on the second spot, was Call of Duty: Modern Warfare II.

War Robots surpass 250 million users

- In April 2023, the game reached a milestone of $750 million in revenue.

- In 2022, over 30 million new players joined the game, marking a 40% growth compared to 2021.

- A significant portion of downloads comes from the USA. The game is also growing in India and Mexico (almost 7.5% of the total Android revenue comes from this country).

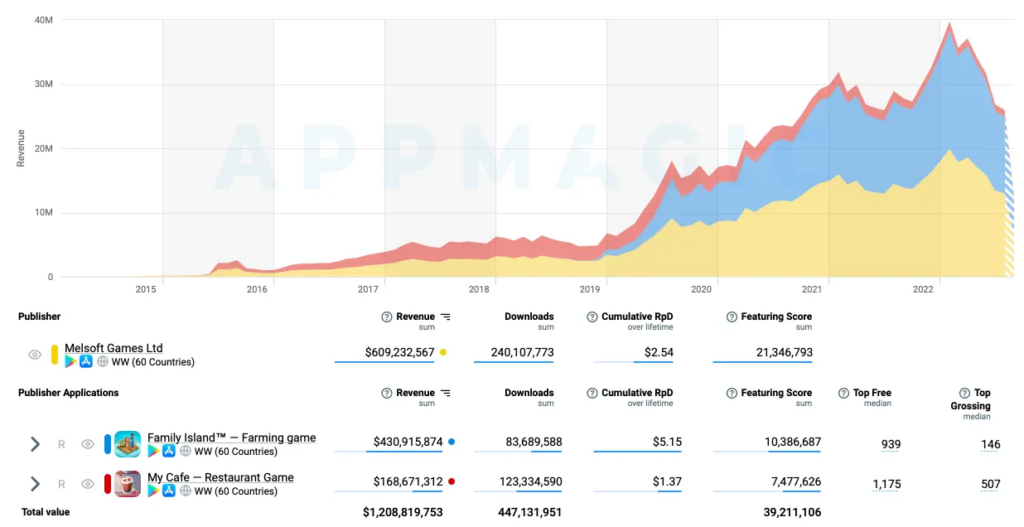

AppMagic: Melsoft Games' titles surpass $1 billion

- Family Island contributes to 70% of the total revenue. My Cafe accounts for 28%. The remaining 2% of revenue is distributed among the studio's other 14 games.

- 39% of the revenue comes from the United States. Germany and Japan account for 6% each. Following closely are the United Kingdom and France (5% each).

- 58% of the company's total revenue comes from Google Play; App Store is responsible for 42% of all earnings.

Simon Carless (GameDiscoverCo): Study of the share of top games on PC and consoles

Data from August 11, 2023.

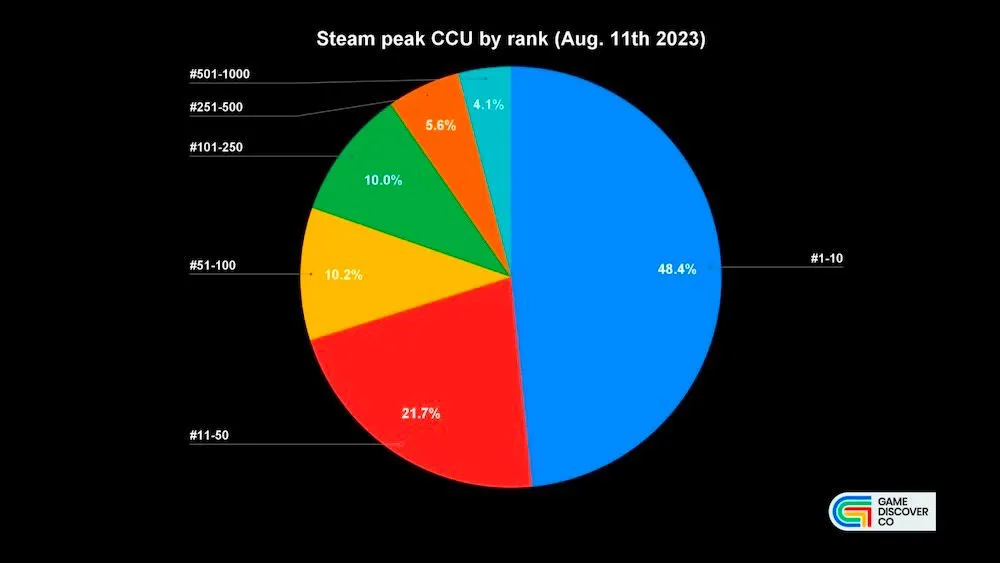

Steam

- 48.4% of the daily CCU (Concurrent Current Users) is attributed to the top 10 games on Steam.

- The top 10 at the time of writing looks like this: CS: GO, DOTA 2, Baldur’s Gate 3, PUBG: Battlegrounds, Apex Legends, Grand Theft Auto V, Rust, Team Fortress 2, Naraka: Bladepoint, and War Thunder. 70% are free-to-play games.

- The top 50 games account for 70% of the total CCU. And the top 1000 games cover 94.7% of the platform's total CCU.

There is no open information about CCU on consoles, so Simon used his estimation based on DAU (Daily Active Users).

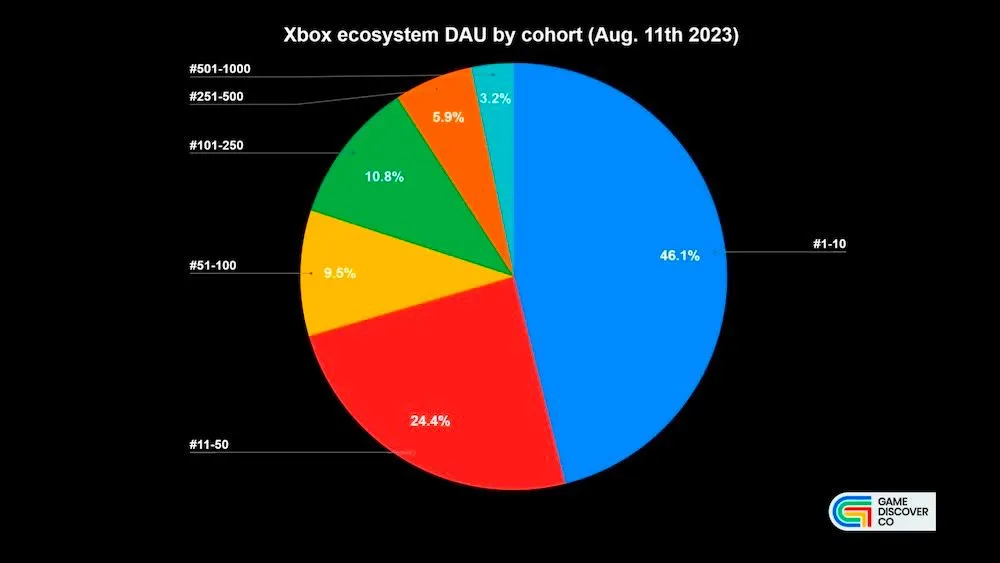

Xbox

- The situation on Xbox is similar. The top 10 projects account for 46.1% of the DAU; for the top 50, it's 70.5%.

- The top 10 games on Xbox by DAU are Minecraft (including the PC version's DAU), Fortnite, Call of Duty: Modern Warfare II (including Warzone), FIFA 23, Roblox, GTA V, Rocket League, Tom Clancy’s Rainbow Six Siege, Forza Horizon 5, and Apex Legends.

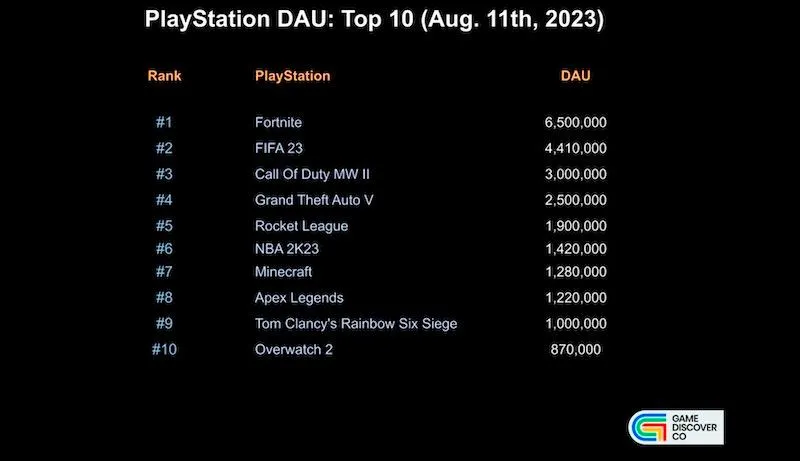

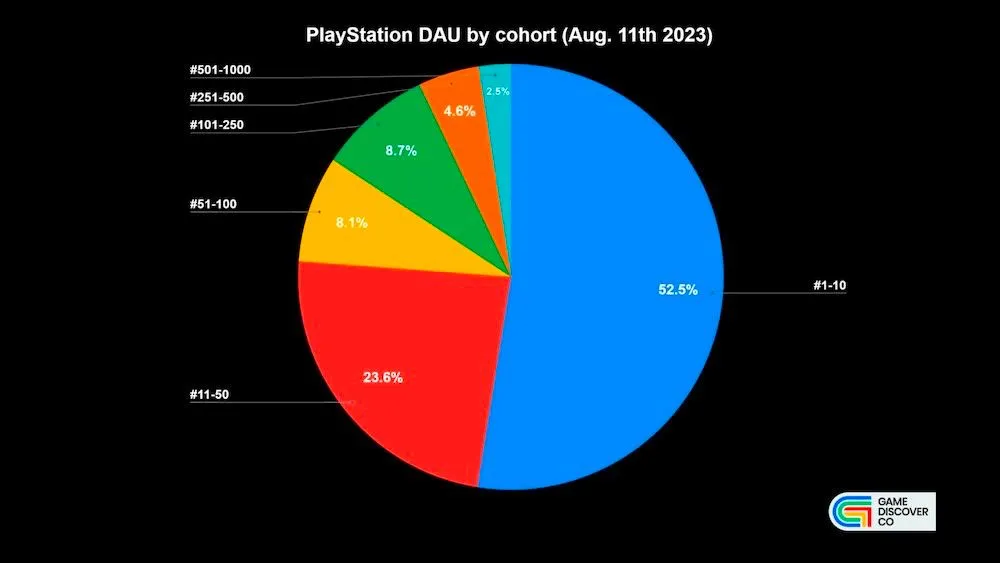

PlayStation

- On PlayStation, the "heavyweights" have a slight advantage, with the top 10 games accounting for 52.5% of the DAU. For the top 50, it's 76.1%.

- The top 10 on the platform includes Fortnite, FIFA 23, Call of Duty: Modern Warfare II (including Warzone), Grand Theft Auto V, Rocket League, NBA 2K23, Minecraft, Apex Legends, Tom Clancy’s Rainbow Six Siege, and Overwatch 2.

- The DAU of leaders on PlayStation is higher. For example, the Fortnite audience is more than 3 times larger, and FIFA 23 is 4.4 times larger.

- Overall, the competition for players on PlayStation is slightly tougher than on Xbox, despite having a larger audience.

data.ai: Pokemon GO is #4 in the list of the most downloaded mobile games in the USA

- The game has been downloaded 678 million times worldwide. This is the 18th-highest figure in history.

- Currently, the game is ranked 16th worldwide by Monthly Active Users (MAU).

- In the USA, the game has been downloaded by 164 million people. Only three games in history have more downloads - Subway Surfers, Candy Crush Saga, and Roblox. In terms of MAU, Pokemon GO is third in the USA.

- However, since 2019, the game has lost 52% of its user engagement time. In the first half of 2019, on average, people played it for 13 hours and 30 minutes each month; in the first half of 2023, this figure dropped to 6 hours and 27 minutes.

- There are several reasons for this decline: the end of the pandemic, and increased competition (especially from Roblox). Some updates may have also impacted user engagement as they forced backlash from the community.

Belgian Embassy in China: Baldur's Gate III sales reached 5.2M copies

- The embassy disclosed the total sales of the game - as of August 16, 2023, they reached 5.2 million copies. This refers to Steam sales only.

- Previously, Bloomberg reported that early access sales of the game amounted to 2.5 million copies. Thus, within two weeks after the release, Larian Studios sold 2.7 million copies of Baldur's Gate III.

❗️Larian Studios itself, however, has not yet confirmed this information.

- Baldur's Gate III is currently the highest-rated game of this year; a bestseller on Steam; a leader on Steam in terms of engagement, and it ranks in the top 10 for peak CCU (875 thousand concurrent users) in history.

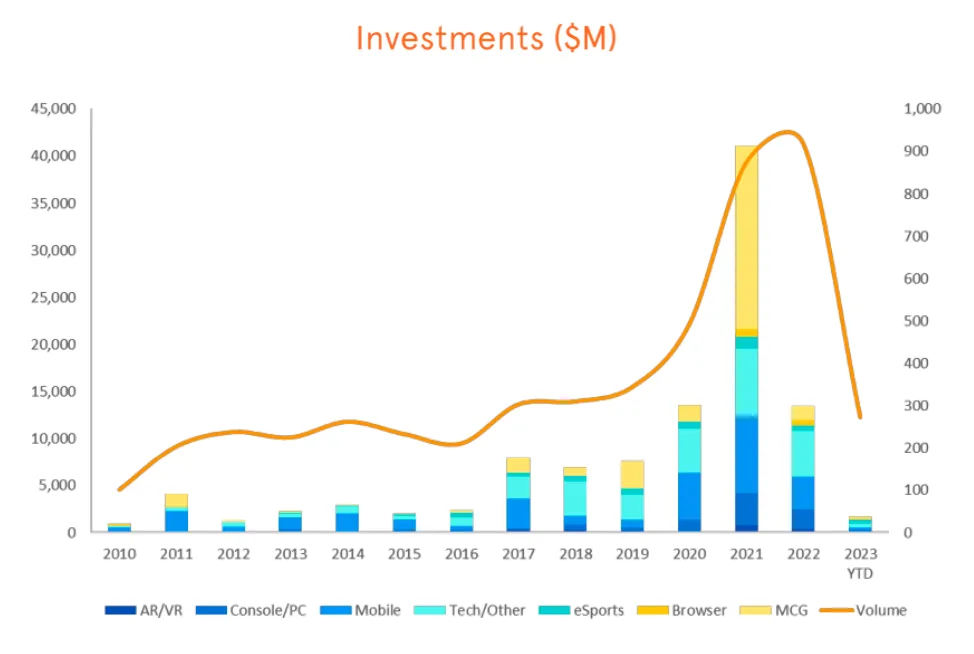

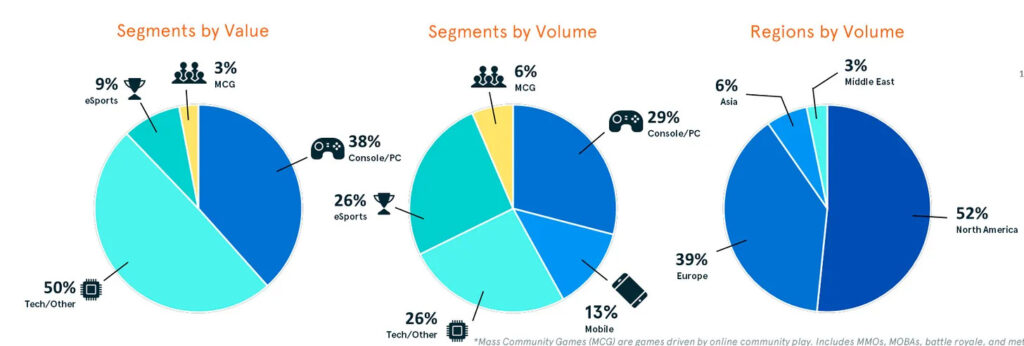

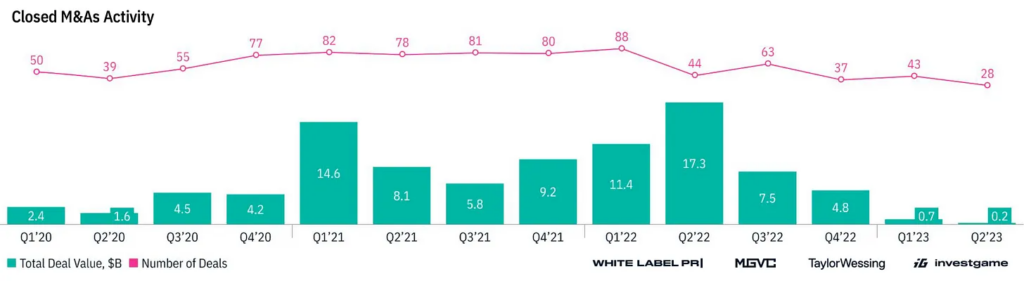

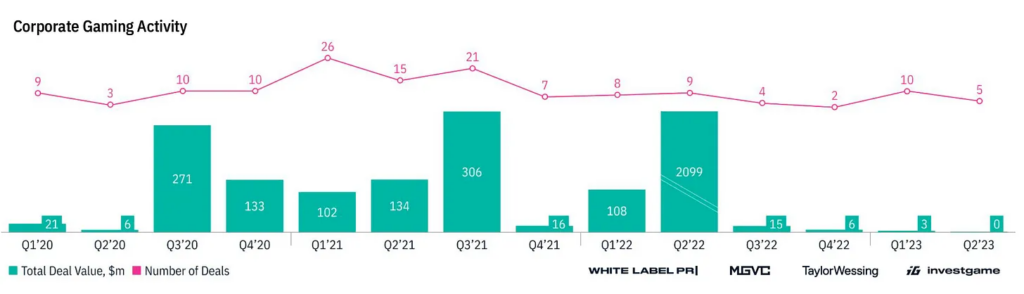

DDM: Gaming investment market overview in Q2 2023 & H1 2023

General data

- The most money in Q2 2023 was invested in technology gaming companies (24%); eSports (19%); mobile (19%).

- The largest private investment deals in Q2 2023 were Everdome ($50M - blockchain game and metaverse development); Anzu ($48M - in-game native advertising); and Mythical Games ($37M - blockchain-powered MMO development).

❗️However, there's a nuance - Everdome raised funds through token sales for $50M. This isn't a traditional fundraiser in exchange for company equity.

- By the number of transactions in Q2 2023, mobile games lead (30 transactions); technology companies (22 transactions); and PC/console games (11 transactions).

- Polygon (6 investments); BITKRAFT Ventures (5 investments); Animoca Brands (4 investments) are the most active in Q2 2023.

- VRFabric had the only IPO of the quarter. It was listed on the Polish NewConnect exchange with a market capitalization of $11.4 million.

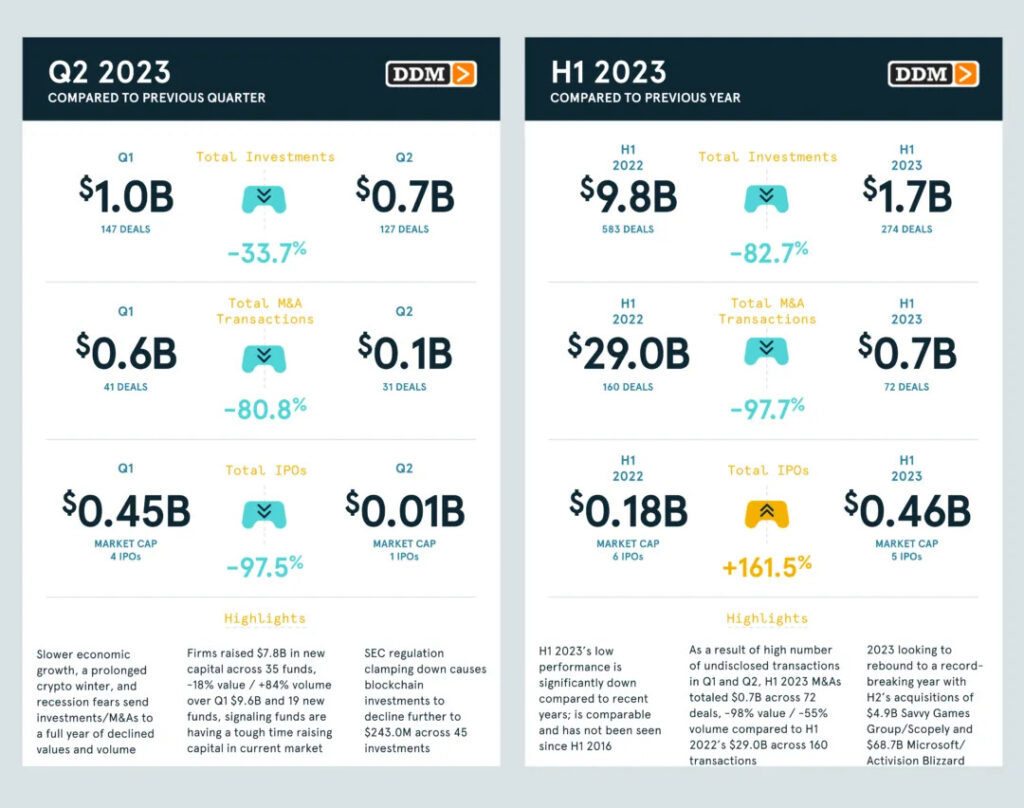

Comparison with Q1 2023

- In the second quarter of 2023, there were 127 deals totaling $676 million. This is 33.7% less in volume compared to the first quarter (147 deals totaling $1 billion).

- The number of M&A deals in the second quarter decreased from 41 (Q1 2023) to 31. The volume dropped from $565 million (Q1 2023) to $108.4 million.

- Only one gaming IPO of $10 million happened in the second quarter of 2023. In the first quarter, there were 4, totaling $450 million.

Comparison with H1 2022

- In the first half of 2023, there were 274 investment deals totaling $1.7 billion. This is 83% less in volume ($9.8 billion) and 53% less in number (583 deals) compared to the first half of 2022.

- In H1 2023, the total volume of M&A deals was $673.4M with 72 transactions. This is 98% less in volume ($29 billion) and 55% less in number (160 transactions) compared to H1 2022.

❗️Deals involving SEGA and Rovio; Scopely and Savvy Games Group (Steer Studios); Microsoft and Activision Blizzard are expected in the second half of 2023, barring unforeseen events.

Mergers and Acquisitions (M&A)

- The second quarter of 2023 ranks third from the bottom in terms of volume. Only the second quarters of 2010 and 2013 were weaker.

- DDM notes that companies tend to "hold back" money.

- The largest disclosed deals of the quarter were the acquisition of Wargraphs ($53.6 million - analytical service); Night Dive Studios ($19.5 million - developer); and Hardsuit Labs (developer and service provider).

Blockchain and web3

- Investments in crypto projects continue to decline. In Q2 2023, they decreased by 38% in volume (from $390.7 million to $243 million) and 34% in number (from 68 transactions to 45).

- 46% of transactions by volume were from the USA; 25% from the Middle East; 19% from Europe.

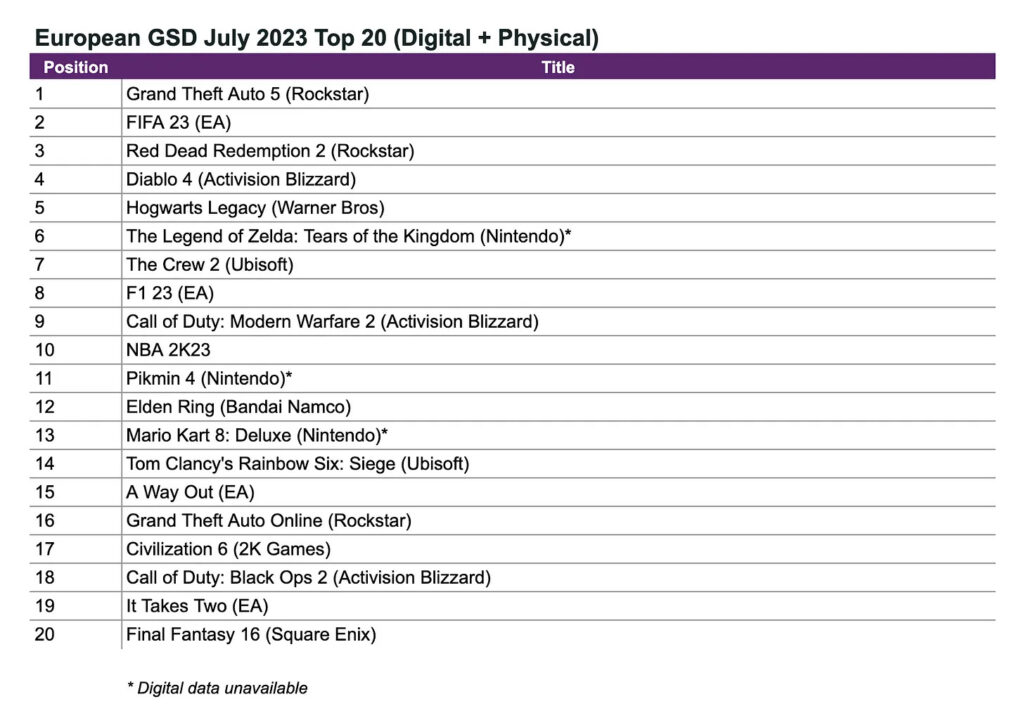

GSD: Sales of PC and console games in Europe grew by 34% in July

GSD reports only on actual sales figures obtained directly from partners. Major publishers like Nintendo do not share information about digital copy sales, for example.

Games

- 11.6 million console and PC games were sold in Europe in July. This is 34% more than in July 2022.

- 7.9 million copies were digital (a growth of 60% YoY). 3.75 million were physical copies (also a growth of 0.2%).

- Grand Theft Auto V was the best-selling game of July in Europe. FIFA 23 was in second place, and Red Dead Redemption 2 was in third. Rockstar Games titles were heavily discounted through the whole of July, which helped them to reach top positions.

- Among new games, the highest position was achieved by Pikmin 4, a Nintendo exclusive, which reached the 11th spot.

Hardware and Accessories

- 493,000 consoles were sold in Europe in July. This is 62.5% more than in 2022, but 2% less than in June 2023. GSD does not account for sales in Germany.

- PS5 led the sales. The number of systems sold increased by 244% compared to July of the previous year. Thanks to discounts, PS5 sold 24% better in July than in June of this year.

- At the current point in 2023, PlayStation 5 sales are 203% higher than the same period last year.

- Nintendo Switch sales fell by 9% in July when compared to the previous year. However, the sales figures in 2023 so far are on par with the results of 2022.

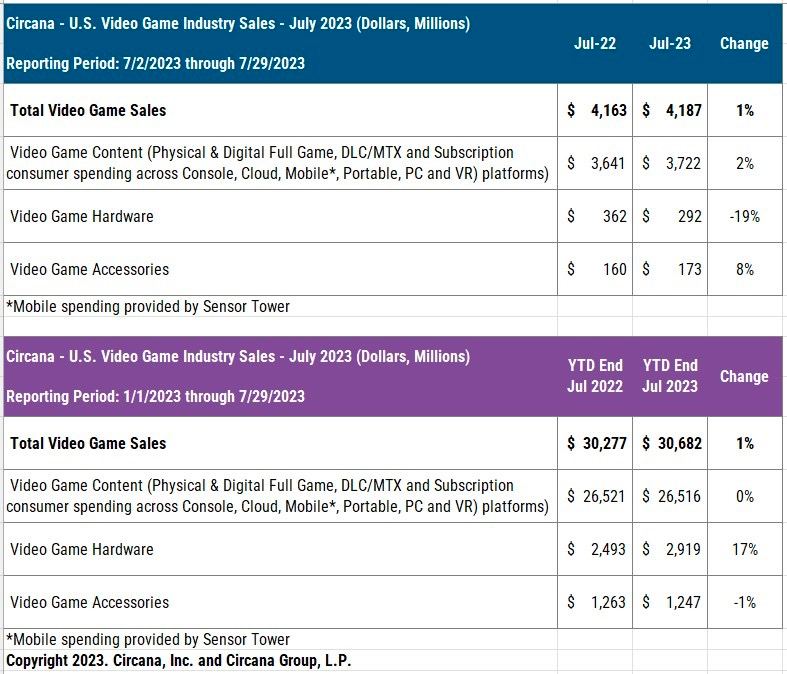

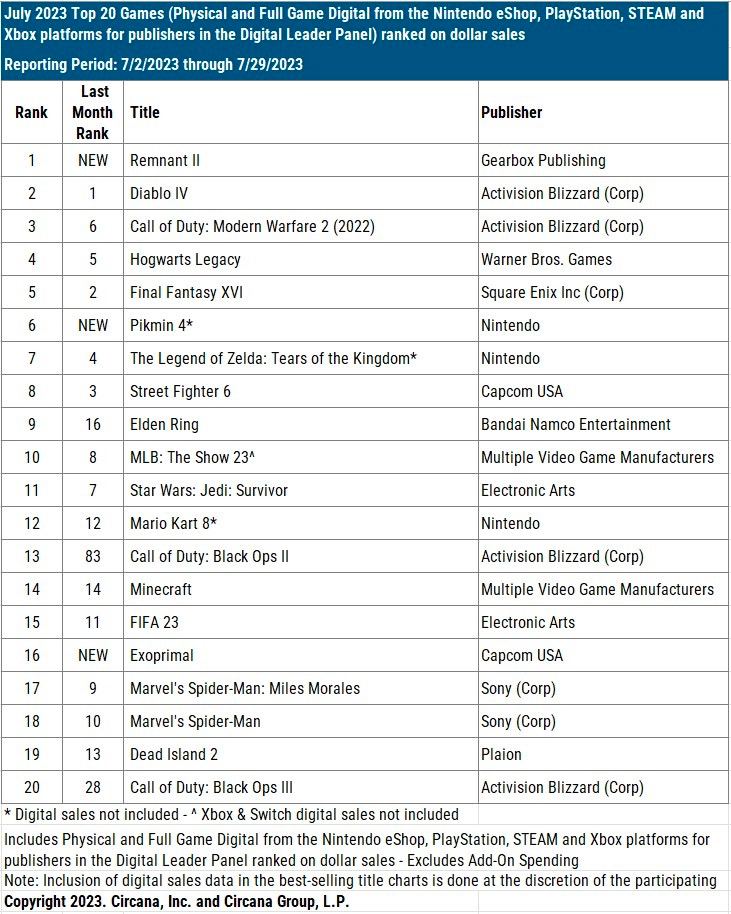

Circana: Remnant II tops the US game sales in July 2023

Games

- The total revenue of the gaming industry in the U.S. reached $4.187 billion in July, marking a 1% increase compared to the previous year.

- U.S. residents spent $3.722 billion on games, showing a 2% increase from the previous year.

- Gearbox Publishing's Remnant II emerged as the best-selling game of July in the U.S. It also secured the 18th position on the chart of the best-selling games of the year.

- Among other newcomers in the July chart, Pikmin 4 ranked 6th, and Exoprimal secured the 16th spot.

- Due to the restoration of multiplayer in older CoD games on Xbox, Call of Duty: Black Ops II returned to the top 20 in sales for the first time since April 2017. Sales of Call of Duty: Black Ops III also increased.

- Royal Match, MONOPOLY GO!, and Roblox led the American mobile market in revenue for July 2023.

- Royal Match managed to increase revenue by 21% compared to June 2023. The results for MONOPOLY GO! were even more impressive, with the game's revenue growing by 83% MoM in July 2023.

Hardware and Accessories

- Sales of gaming hardware dropped by 19% in July 2023, totaling $292 million. This decline affected all platforms.

- PlayStation 5 continued to be the most successful system in 2023, both in terms of sales volume and revenue.

- Gaming console sales in the U.S. for 2023 have reached $2.9 billion, a 17% increase from the previous year.

- Accessories sales grew by 8% in July, reaching $173 million.

2023 results so far

- As of the end of July, the total revenue of the U.S. gaming industry reached $30.682 billion, representing a 1% increase compared to the same period in 2022.

- Game sales remained at the same level, totaling $26.516 billion.

- Console sales increased by 17% to $2.919 billion.

- Accessories sales were 1% lower than in 2022, with a combined sales volume of $1.247 billion by the end of July.

- Hogwarts Legacy, The Legend of Zelda: Tears of the Kingdom (excluding digital sales), and Diablo IV are the best-selling games of 2023 up to the current moment.

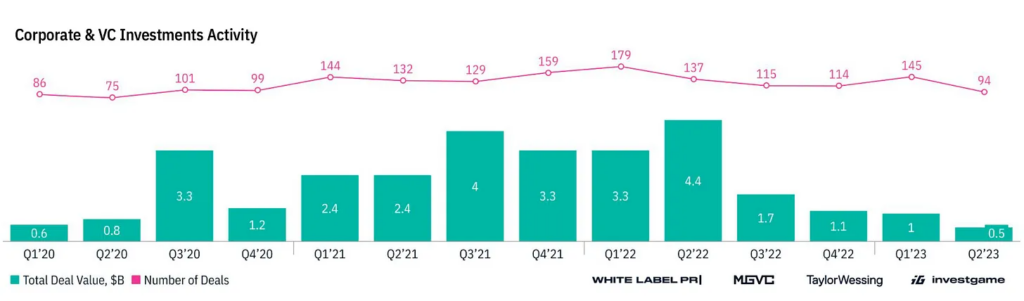

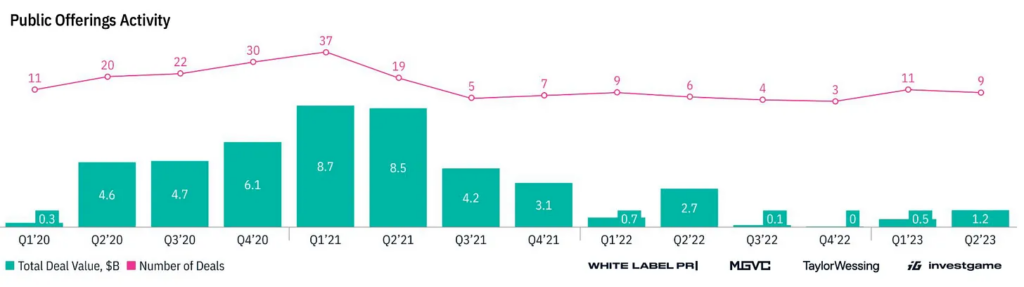

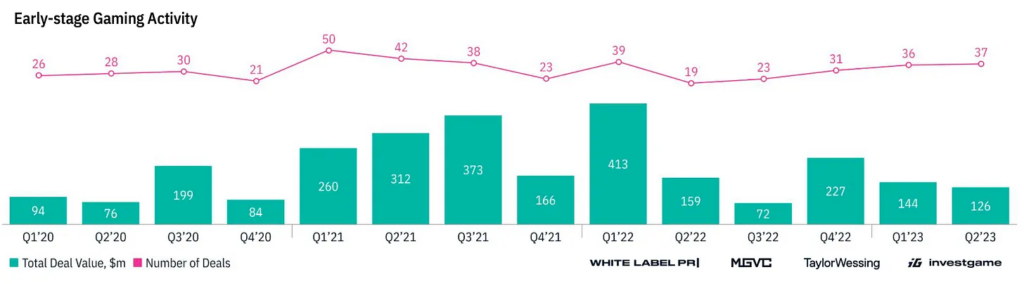

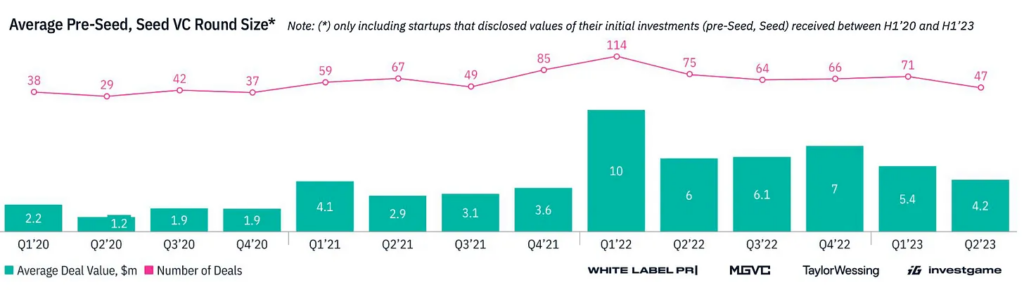

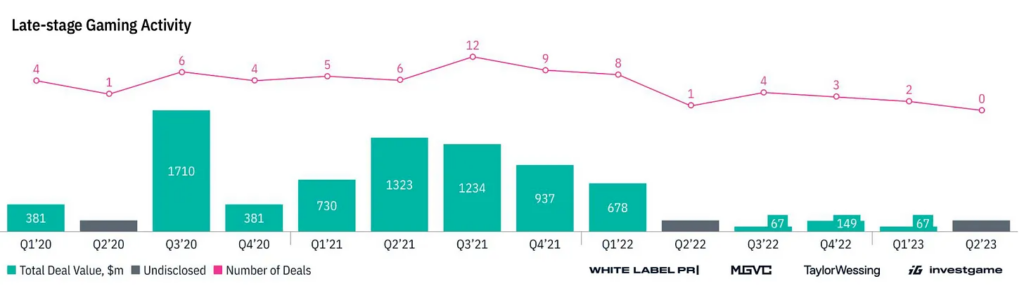

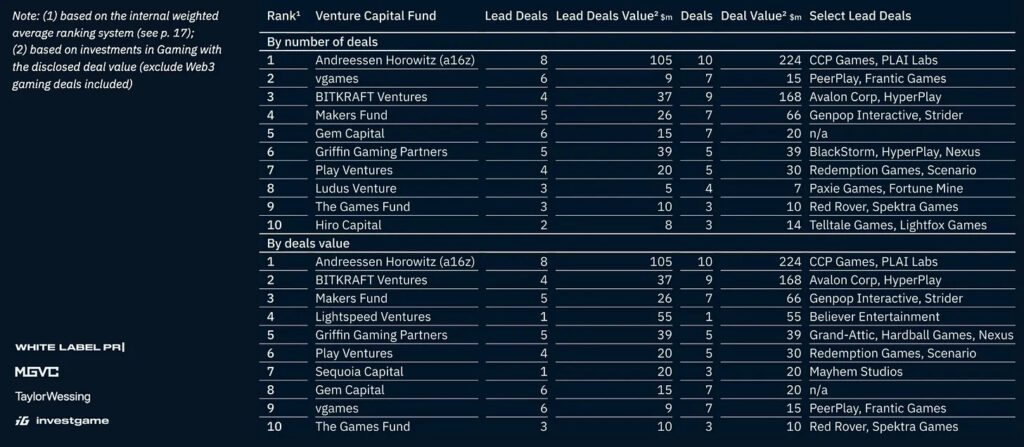

InvestGame: The gaming investment market in H1 2023

Key Figures

- The volume of private investments decreased by 81% compared to the previous year, from $7.6 billion to $1.5 billion. The number of deals decreased from 316 in the first half of 2022 to 239.

- M&A deals dropped by 97%, from $28.7 billion to $0.9 billion. It's worth noting that neither the deal with Scopely, nor the deal with Rovio, nor the deal with Activision Blizzard (if it ever closes) are included in the first half of this year.

- The size of IPO deals decreased by 49%, from $3.4 billion in the first half of 2022 to $1.7 billion.

Private Investments

- In the first half of 2023, 90 deals were made with gaming companies or publishers totaling $300 million. This is 90% less than the previous year.

- The volume of early-stage deals (pre-seed or seed) decreased threefold compared to the first half of 2022 (from $2.7 billion to $904 million). The number of these deals also decreased by 22%.

- Investors are increasingly preferring to support additional rounds for their existing portfolio companies rather than investing in new ventures.

- The situation with deals at later stages is even more challenging. In the first half of 2023, 12 deals were closed, totaling $500 million. In a similar period in 2022, there were 27 deals totaling $2.6 billion.

- Despite venture funds having capital, obtaining investments has become more difficult. Experienced managers have better chances.

- a16z, games, BITKRAFT Ventures, Makers Fund, and Gem Capital are the leaders in the number of deals in the first half of 2023.

- a16z, BITKRAFT Ventures, Makers Fund, Lightspeed Ventures, and Griffin Gaming Partners lead in deal volume for the first half of 2023.

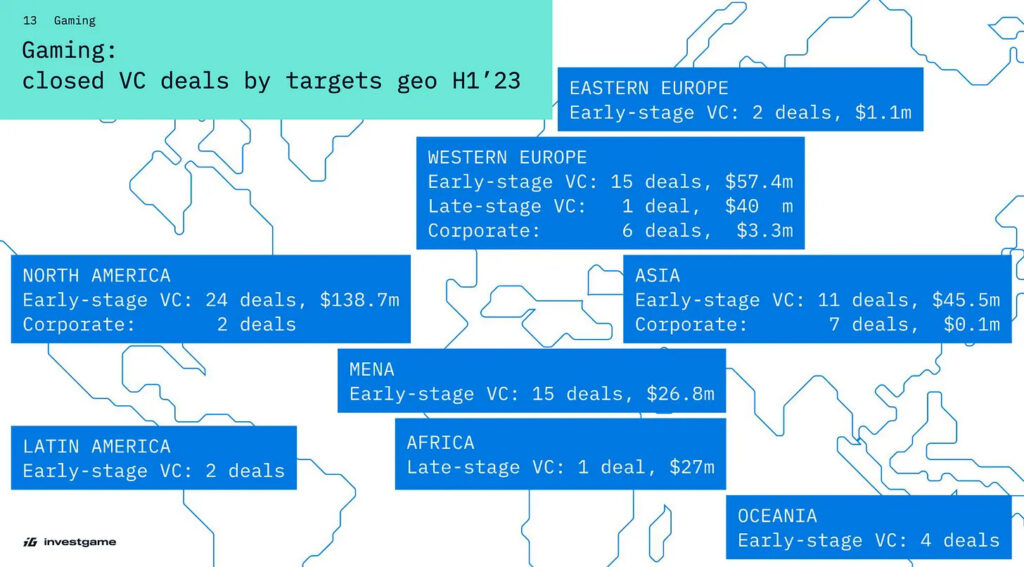

- North America, Western Europe, Asia, and the Middle East are leaders in business investment activity in gaming.

M&A

- The first half of 2023 resulted in $300 million and 46 deals when it comes to gaming companies and publishers. This represents a 99% decrease compared to the previous year.

- InvestGame notes that in volatile economic conditions, strategic investors prefer internal investments over external ones.

- Companies are also reevaluating their portfolios and optimizing their workforce (as seen with Embracer Group).

IPO

- Gaming product companies accounted for 13 deals and $1.3 billion. This is 57% worse than the previous year.

- Private companies are delaying listings due to the unfavorable market climate. Those already on the market are implementing stock buyback programs.

- The American stock market shows early signs of recovery, but Europe is struggling.

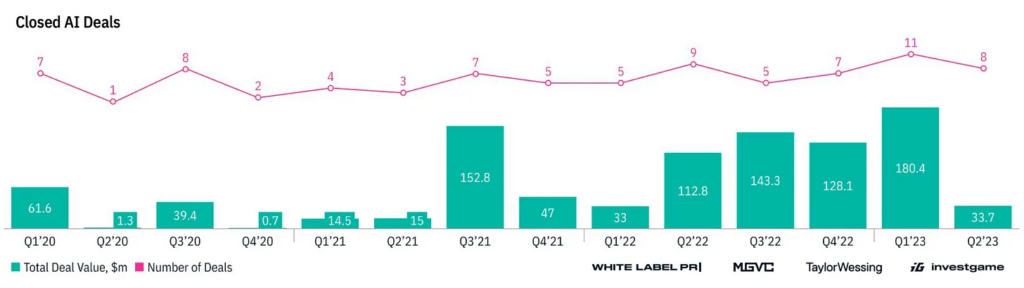

Investments in AI in Gaming

- In the first half of 2023, 19 deals were made totaling $214.1 million.

- The same demand that once existed for Web3 is not observed.

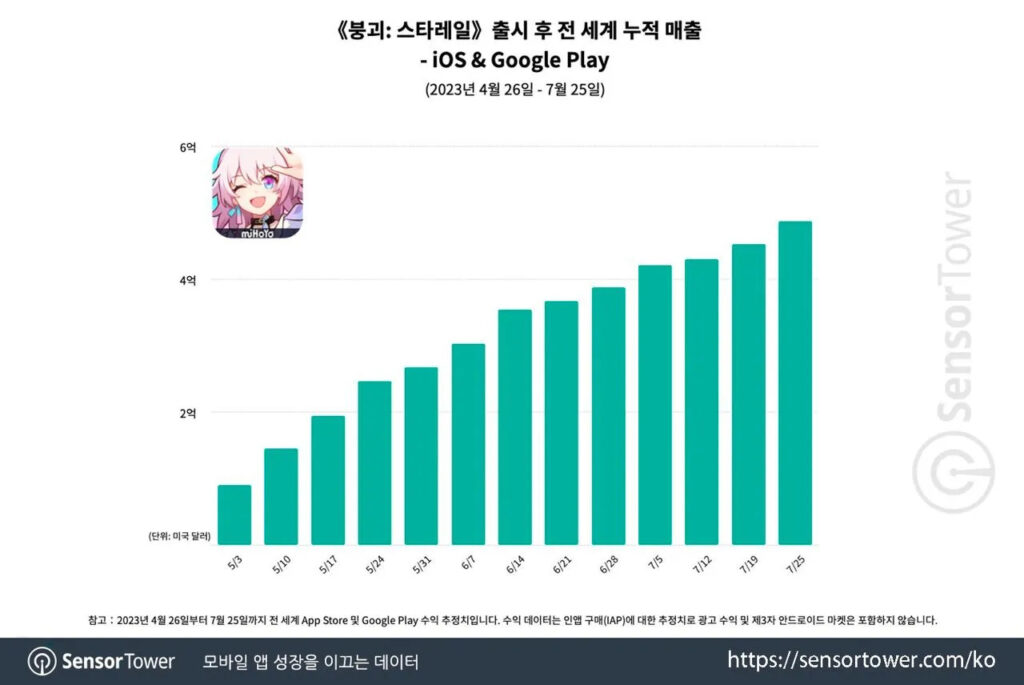

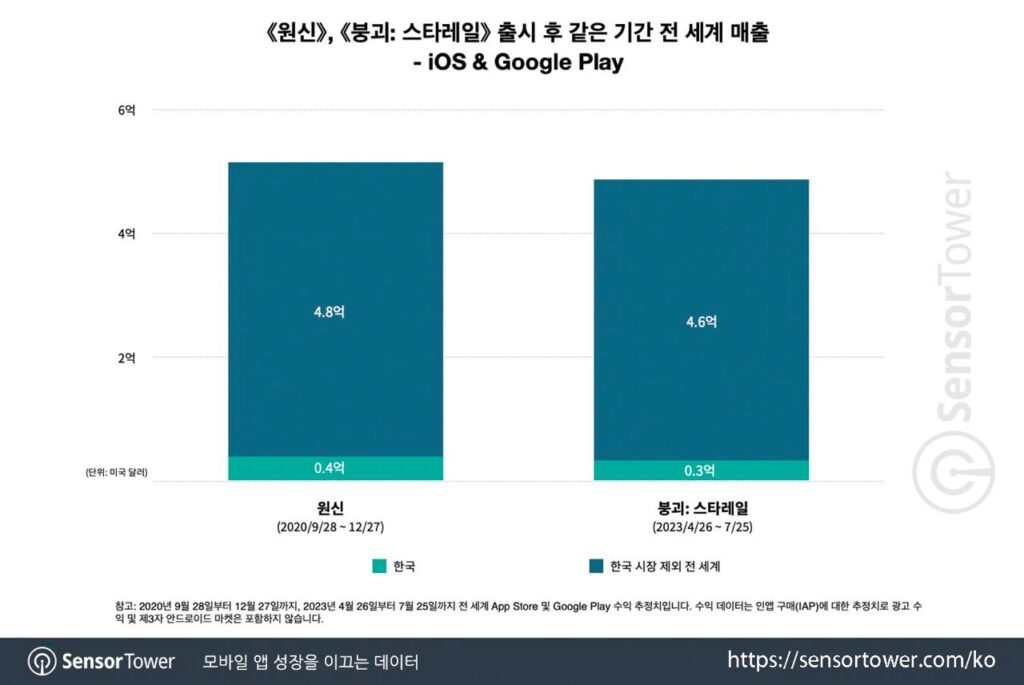

Sensor Tower: Honkai: Star Rail reaches $500 million in revenue on Mobile

- This impressive milestone was achieved on July 25th. It took the game 3 months to reach $500 million in revenue.

- The majority of the revenue came from China (41.1%); Japan (23.9%); the United States (12%); and South Korea (7%).

- Japan leads in RPD (Revenue per Download) with $60. In China, it's $41; in South Korea, $37; in the United States, $17.

- During this time, the game has been downloaded over 19 million times.

- Honkai: Star Rail is the only non-MMORPG in the top 5 for revenue in the South Korean market. The game earned around $34 million in the country in 3 months.

- In terms of revenue dynamics, Honkai: Star Rail is only 5% weaker than Genshin Impact.

- After its release, Honkai: Star Rail captured a significant share of miHoYo's revenue - 65.3%. Genshin Impact accounted for 30.6%, while Honkai Impact 3rd had 2.8%.

Tune in next month for more updates!